Food Pathogen Testing Market Size, Share, Industry Growth, Trends Report by Type (E.coli, Salmonella, Campylobacter, Listeria), Technology (Traditional, Rapid), Food Type (Meat & poultry, Dairy, Processed food, Fruits & Vegetables, Cereals & Grains), & by Region - Global Forecasts to 2028

Global Food Pathogen Testing Market Report, 2023 - 2028

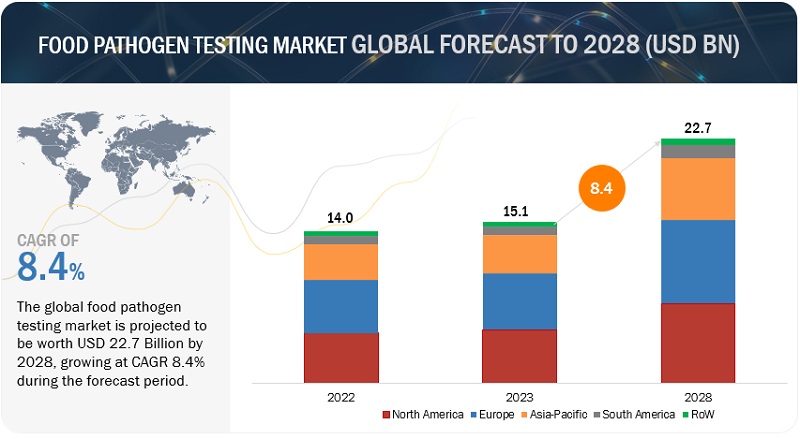

The food pathogen testing market is predicted to reach a value of US$ 15.1 billion in 2023. Further, the food pathogen testing market is predicted to be worth US$ 22.7 billion by 2028. The overall market valuation is estimated to secure a CAGR of 8.4% during the forecast period.

Food pathogen testing has been witnessing an increasing trend on a global level due to the rising incidences of foodborne disease outbreaks, globalization of food trade, consumer awareness, implementation of food safety regulations, and advancement in modern testing technology. The market in North America has been growing consistently due to many foodborne disease outbreaks in the region, owing to salmonella and campylobacter occurrence. The market has been witnessing dynamic growth due to increasing concerns about food contamination, spoilage, and foodborne illnesses. The market has been experiencing growth driven by increasing consumer awareness of food safety and media influence related to food safety issues.

To know about the assumptions considered for the study, Request for Free Sample Report

Food Pathogen Testing Market Dynamics:

Drivers: Cross-contamination of food products due to complex processes

The unintentional transmission of microorganisms, chemical pollutants (including allergies), or any foreign substance from food, people, or objects to another food product is known as cross-contamination of food. It generally occurs between products that contain allergens and allergen-free products or between raw foods and ready-to-eat (RTE) foods. Cross-contamination can result in food poisoning when harmful bacteria are transmitted to RTE products that do not go through additional processing to remove bacteria. Cross-contamination can occur at any point in the food supply chain. It begins with poorly handling raw food, which typically has a high bacteria count. Then, by skipping food hygiene practices like handwashing in between touching raw food, equipment, cooked products, or from a different food worker, these harmful microorganisms are transferred from one person, object, or place to another. In the production area, contaminants can also come from the water, air, unclean equipment, clothing, soil, workers, and food contact surfaces.

There have been several outbreaks of foodborne illnesses over the years. Most of them are reportedly brought on by improper food handling. Cross-contamination is one of the biggest factors related to foodborne illnesses. Foodborne disease is a major international health issue that is caused by the transfer of harmful bacteria through cross-contamination. The World Health Organization (WHO) revealed that six hundred million people worldwide are affected by foodborne diseases every year. Further, a rise in trade globalization has led to an increased risk of food cross-contamination in inter-country trade and exports.

A notable outbreak caused by Salmonella in 2016 is the Multistate Outbreak of Salmonella Poona linked to cucumbers. At least 720 people were impacted by this outbreak, and 204 of them were hospitalized. According to reports from the FDA, the bacterium was spread by contact between the cucumbers and the shipping crates. Salmonella was also the culprit for an incident in China linked to an outbreak related to egg fried rice. At least 220 people became ill in January 2022 with diarrhea, fever, stomach pain, nausea, and vomiting. Authorities explained that the outbreak was caused by the cooked egg fried rice being placed in previously used basins that contained residual egg fluids.

Restraints of the Food Pathogen Testing Market: Complexity in testing techniques

Existing technologies for food safety testing involve various difficulties in providing valid test results. The difficulties involved are in terms of the demerits of technologies failing to provide relevant results and shortcomings of Technology with regard to analyzing complex products such as processed food, among others. A poorly designed food safety testing technique may yield false-negative results, releasing finished goods that may be contaminated. As a result, food safety tests need to be standardized and have a specific set of characteristics for the application to be considered effective.

The use of chemical and microbiological testing in food safety testing also presents a number of challenges. For instance, in the field of chemical testing, it has been found that some environmental toxins that enter the food chain, such as dioxin and PCBs, are harmful at levels as low as one part per trillion (ppt), which is comparable to looking for a needle in a haystack. The existing methods for the detection of these compounds are labor-intensive and expensive due to the sensitivity required to detect such minute levels.

Opportunities in the Food Pathogen Testing Market: Technological advancements in the testing industry

The COVID-19 pandemic has had an impact on the field of food safety testing technology because it has stressed out many workforces. As a result, businesses have had staffing issues, particularly in areas requiring specialized knowledge and training, such as lab technicians. The techniques needed to assure food safety increasingly depend heavily on accuracy and efficiency. Nucleic acids can be found using a variety of methods, including PCR, qPCR, RT-PCR, LAMP, and others, most notably ELISA, ELFA, and lateral flow, for antibody-based detection. When it comes to identifying strains, food safety technology uses sequencing and NGS. Traditional serotyping, MLST, PFGE, DNA arrays, and bead-based arrays are further technological tools.

To know about the assumptions considered for the study, download the pdf brochure

Foodborne illness is a major concern around the world that affects thousands of people each year. The Typhimurium variant has been responsible for about a quarter of Salmonella outbreaks since the 1960s. Researchers trained a machine-learning algorithm on more than 1,300 Typhimurium genomes with known origins. Finally, the algorithm was able to identify the origin of foodborne illness by correctly predicting which animal sources—primarily poultry and swine—would have the Typhimurium genome. AI is also used to reduce food waste. Researchers in Singapore have developed a meat-freshness "nose" powered by AI. It operates by responding to the gases released as the meat starts to spoil. As food can be tested to determine whether it is safe to consume regardless of the "best before" date, this could help reduce food waste.

Challenges in the Food Pathogen Testing Market: Lack of harmonization of food safety standards

There are different meanings of the term "standard." It could refer to a set of requirements that apply to a particular food, such as the identification standards in the US and quality standards in the EU. It could refer to any legal requirements outlined in Codex Alimentarius. These private food safety standards are largely concerned with the criteria for food safety processes, like Hazard Analysis and Critical Control Points (HACCP). One more private standard similar to the auditing schemes (e.g., BRC, IFS, SQF) is ISO 22000 (in connection with FSSC 22000). ISO is mainly used by food producers, whereas the others are typically used by retailers.

A significant barrier to harmonizing food safety regulations is represented by the inefficient communication and collaboration between scientists and lawmakers, and vice versa, without an established, transparent method between the two entities. It is crucial to underline the necessity of incorporating generally agreed [upon] science facts into the legislation as they emerge to keep food regulations updated with scientific advancements, discoveries, and changes. The lack of standardized legal terms is another factor that is delaying the possibility of having worldwide unified food safety standards. It is critical to comprehend that terms can have varied meanings and applications across different countries and languages. Such misunderstandings might create barriers in the food trade; despite the fact that the actions taken are the same, they are only presented in a different way, which is the major challenge in the food pathogen testing market.

The growing number of national standards for food safety management has led to ambiguity. There is a need to harmonize these food safety standards. Leading industries in the food sector have increasingly recognized the cost and inefficiencies created by developing multiple food safety standards. Audits are conducted to ensure compliance with government regulatory legislation. Neither ingredient suppliers nor retailers, nor food service companies are well served when duplicative standards and audits raise total costs for food certification without enhancing or ensuring the overall safety of food. Industrial experts have often suggested uniform and harmonized food safety standards reduce the multiplicity of food laws for better efficiency. To eliminate the duplication and overlap among the multiple standards, government and private-sector stakeholders should work together to create transparent and uniform food certification standards.

Harmonization will eliminate trade restrictions and stop the unnecessary destruction of healthy food. To make it work, food safety education, training, and communication must all be improved; in particular, information regarding food safety must be written in a way that is easy for politicians and the public to understand while also being accurate, arming them against misinformation.

Food Pathogen Testing Market Ecosystem

Based on type, the salmonella sub-segment is estimated to account for the largest market share of the food pathogen testing market.

Gram-negative, rod-shaped, and mobile enterobacteria, Salmonella is. It has been named as one of the main pathogens in charge of tainted food. The main sources of it are meat, poultry, milk, and eggs. Salmonella epidemics of great proportion have been brought on by raw dairy products, undercooked meat, and eggs. As an illustration, a Salmonella outbreak in August 2022 that was related to Kinder chocolate, a well-known brand of chocolate bars made by the multinational Italian confectionery business Ferrero, infected more than 450 people. Additionally, Natural Grocers Brand 1-pound Organic Amaranth Grain was recalled in July 2022 by Lakewood, Colorado-based Vitamin Cottage Natural Food Markets, Inc. of the US due to possible Salmonella contamination.

Food manufacturers are now being extra cautious before releasing food products to international markets and adopting food safety testing services as a result of these types of recalls, which have put them under financial and legislative pressure. In the long run, this is expected to fuel growth in the global food pathogen testing industry.

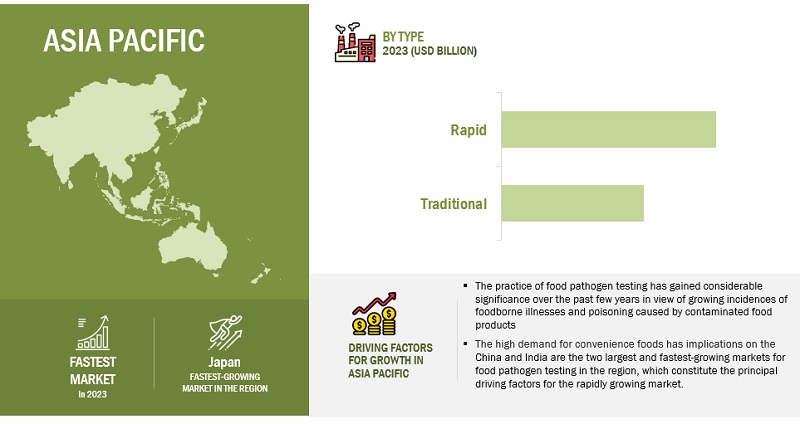

Based on Technology, the rapid technology sub-segment of the market is anticipated to dominate the market.

Food producers are increasingly requesting rapid testing technology to speed up results and speed up supply chain operations. Additionally, compared to conventional technology, quick procedures have improved accuracy, sensitivity, and the capacity to test a wide range of pollutants while concurrently generating accurate results. For instance, a new technology that can create and instantly dispense culture media for use in microbiological food testing was introduced by Millipore Sigma, a US, and Canadian-based Life Science business unit of the chemical corporation Merck KGaA, in April 2022. The newly developed technology, known as the ReadyStream system, offers producers increased testing effectiveness and does away with the standard microbiological testing process' five steps.

Regional Insights:

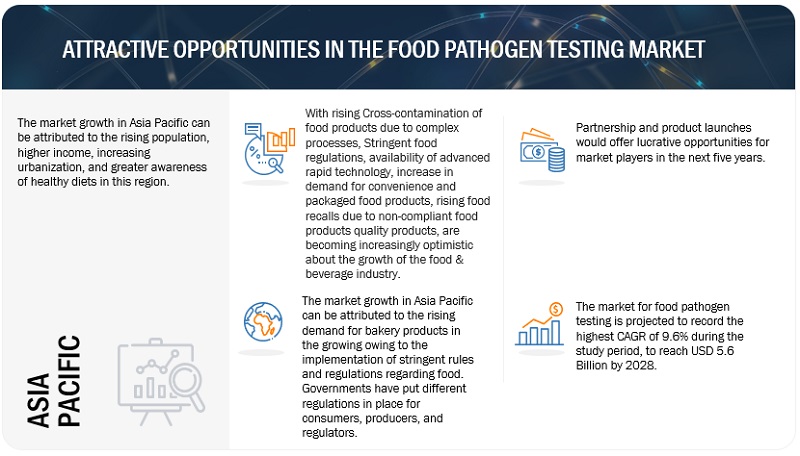

The Asia Pacific market is projected to dominate the food pathogen testing market.

Japan is one of the largest markets for food pathogen testing in the Asia-Pacific region. It is also estimated to be a mature market with a steady growth rate; however, concerns for food safety are still important to the country, owing to which the enforcement of stringent food sanitation laws has become mandatory. The Japanese scrutiny system has revealed food poisoning through pathogens to be the largest outbreak across Japan. E. coli was the major pathogen that caused severe foodborne diseases in Japan.

In Australia, food pathogen testing has gained a significant level of importance owing to frequent increases in the number of foodborne disease outbreaks, increasingly stringent regulations on food safety, a growing level of trade between Australia and other countries, and a sustained number of food recalls, among other reasons. The implementation of a food safety system has reduced the incidences of foodborne diseases in Australia. The development in technologies and the increasing number of regulatory norms have fuelled the growth of this market. The Australian food industry is using strict quality control standards and verifies.

Key Market Players in the Food Pathogen Testing Market

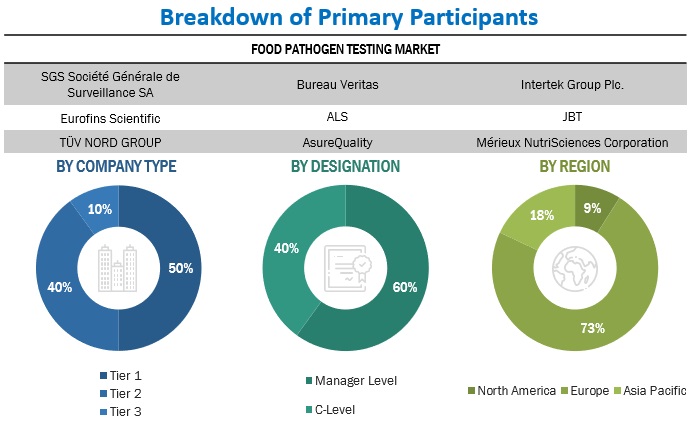

SGS Société Générale de Surveillance SA (Switzerland), Bureau Veritas (France), Intertek Group Plc. (UK), Eurofins Scientific (Europe), ALS (Australia), JBT(US), and TÜV NORD GROUP (Germany) are among the key players in the global market. To increase their company's revenues and market shares, companies are focusing on launching new services, developing partnerships, and expanding their laboratory facilities. The key strategies used by companies in the market include geographical expansion to tap the potential of emerging economies, strategic acquisitions to gain a foothold over the extensive supply chain, and new service launches as a result of extensive research and development (R&D) initiatives.

Food Pathogen Testing Market Report Scope

|

Report Metric |

Details |

|

Market Valuation in 2023 |

USD 15.1 billion |

|

Revenue Prediction by 2028 |

USD 22.7 billion |

|

Growth Rate |

CAGR of 8.4% from 2023 to 2028 |

|

Segments Covered |

By Type, By Technology, By Food Tested, By Site, and By Region |

|

Regions covered |

North America, Europe, Asia Pacific, South America, and RoW |

|

Market Drivers |

Rising Demand for Healthy Tested and Certified Foods |

|

Opportunities |

Technological Advancements in the Testing Industry |

|

Largest Growing Region |

Asia Pacific |

|

Companies studied |

|

Food Pathogen Testing Market Segmentation:

|

Aspect |

Details |

|

Market By Type |

|

|

Market By Food Tested |

|

|

Market By Technology |

|

|

Market By Site |

|

|

Market By Region |

|

Recent Developments in the Food Pathogen Testing Market

- In April 2023, Eurofins USA acquired Rheonix. This partnership enables Eurofins to include the Rheonix Listeria PatternAlert Assay in their microbiology laboratory network.

- In August 2022, ALS expanded its food testing services in Chile by acquiring Corthorn Quality. ALS aims to meet the growing demand for quality and safety assurance in the food industry. This expansion allows ALS to provide comprehensive testing solutions to businesses in Chile, ensuring that food products meet regulatory standards and consumer expectations.

- In November 2021, Mérieux NutriSciences Corporation expanded with the establishment of a state-of-the-art food testing laboratory in Lima, Peru. The lab will perform microbiological and chemical analyses, encompassing different agricultural and industrial food products. This expansion will support in increasing the company's share in the food safety testing market.

Frequently Asked Questions (FAQ):

Which regional market has the highest growth potential in the food pathogen testing market?

The Europe region accounted for the largest share, in terms of value, of USD 4.9 billion, of the global food pathogen testing market in 2022 and is expected to grow at a CAGR of 7.9%. The growing consumer base and rising demand for processed foods are expected to drive the growth of the food pathogen testing market in emerging counties such as China, India, and Thailand, to name a few.

What is the current size of the global food pathogen testing market?

The food pathogen testing market is estimated at USD 15.1 billion in 2023 and is projected to reach USD 22.7 billion by 2028, at a CAGR of 8.4% from 2023 to 2028.

Which are the key players in the market?

The key players in this market include SGS Société Générale de Surveillance SA (Switzerland), Bureau Veritas (France), and Intertek Group Plc. (UK), Eurofins Scientific (Europe), ALS (Australia), JBT (US), TÜV NORD GROUP (Germany), AsureQuality (New Zealand).

What are the factors driving the food pathogen testing market?

Rising food recalls due to non-compliant food products and Cross-contamination of food products due to complex processes.

Which segment by food tested accounted for the largest food pathogen testing market share?

The meat & poultry segment dominated the market for food pathogen testing market and was valued at USD 5.4 billion in 2022. The global increase in meat consumption and related food products is what is fueling the expansion. Meat and poultry are regarded as excellent sources of proteins hence, the rising need for food pathogen testing.

To speak to our analyst for a discussion on the above findings, click Speak to Analyst

- 5.1 INTRODUCTION

-

5.2 MACROECONOMIC INDICATORSINCREASING GLOBAL OUTBREAKS OF FOODBORNE ILLNESSESINCREASED GLOBAL FOOD TRADE

-

5.3 MARKET DYNAMICSDRIVERS- Cross-contamination of food products due to complex processes- Availability of advanced rapid technology- Increasing demand for convenience and packaged food products- Rising food recalls due to non-compliant food products- Rising consumer awareness about food safetyRESTRAINTS- Improper enforcement of regulatory laws and supporting infrastructure- Complexity in testing techniquesOPPORTUNITIES- Technological advancements in testing industry- Spike in food safety concerns after COVID-19CHALLENGES- Inflated cost associated with procurement of food pathogen testing equipment

- 6.1 INTRODUCTION

-

6.2 TARIFFS AND REGULATORY LANDSCAPEREGULATORY FRAMEWORKNORTH AMERICA- US- Canada- MexicoEUROPE- European Union- Germany- UK- France- Italy- PolandASIA PACIFIC- China- Japan- India- Australia and New ZealandSOUTH AMERICA- Brazil- ArgentinaROW- South Africa

- 6.3 REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

-

6.4 PATENT ANALYSIS

- 6.5 TRADE ANALYSIS

-

6.6 PRICING ANALYSISINDICATIVE PRICING ANALYSIS, BY REGIONINDICATIVE PRICING ANALYSIS, BY FOOD TESTED, 2022 (USD/TEST)

- 6.7 BUYING CRITERIA

-

6.8 TRENDS/DISRUPTIONS IMPACTING CUSTOMERS’ BUSINESSES

-

6.9 VALUE CHAIN ANALYSISSAMPLE COLLECTIONTRANSPORTATION AND HANDLINGLABORATORY TESTINGDATA ANALYSIS AND INTERPRETATIONREGULATORY COMPLIANCECONSULTATION AND ADVISORY SERVICESCOLLABORATION AND NETWORKING

-

6.10 SUPPLY CHAIN ANALYSISUPSTREAM PROCESS- Research and development in industries and farms- ProductionMIDSTREAM PROCESS- Processing & transforming- TransportationDOWNSTREAM PROCESS- Final preparation- Distribution

-

6.11 ECOSYSTEM/MARKET MAP

-

6.12 CASE STUDIES

-

6.13 PORTER’S FIVE FORCES ANALYSISINTENSITY OF COMPETITIVE RIVALRYBARGAINING POWER OF SUPPLIERSBARGAINING POWER OF BUYERSTHREAT OF SUBSTITUTESTHREAT OF NEW ENTRANTS

-

6.14 TECHNOLOGY ANALYSISBIOSENSORLANTHANIDE-BASED ASSAYLECTIN-BASED BIOSENSOR TECHNOLOGY

- 6.15 KEY CONFERENCES & EVENTS, 2022–2023

- 7.1 INTRODUCTION

-

7.2 MEAT & POULTRYCONCERNS ABOUT PATHOGEN CONTAMINATION IN MEAT, POULTRY, AND SEAFOOD TO DRIVE DEMAND FOR FOOD PATHOGEN TESTING

-

7.3 FISH & SEAFOODVULNERABILITY OF FISH AND SEAFOOD TO MICROBIAL GROWTH AND CONTAMINATION TO FUEL GROWTH OF FOOD PATHOGEN TESTING

-

7.4 DAIRYCONSUMPTION OF UNPASTEURIZED MILK AND UNSANITARY HANDLING OF DAIRY PRODUCTS TO FUEL DEMAND FOR DAIRY PRODUCT TESTING

-

7.5 PROCESSED FOODCONSUMPTION OF READY-TO-EAT OR MINIMALLY PROCESSED FOODSTUFFS AND ADDITION OF FOOD ADDITIVES TO DRIVE MARKET

-

7.6 FRUITS & VEGETABLESCONTAMINATION DUE TO SEWAGE WATER, ORGANIC MANURE, AND INAPPROPRIATE STORAGE TEMPERATURE TO DRIVE MARKET

-

7.7 CEREALS & GRAINSCONSUMER DEMAND FOR SAFE CEREAL & GRAIN PRODUCTS TO DRIVE MARKET FOR PATHOGEN TESTING

- 7.8 OTHER FOOD TESTED

- 8.1 INTRODUCTION

-

8.2 IN-HOUSE (FACTORY LABS)NEED FOR INCREASED CONTROL, FLEXIBILITY, AND FASTER TURNAROUND TIMES TO FUEL DEMAND FOR IN-HOUSE PATHOGEN TESTING SERVICES

-

8.3 OUTSOURCING FACILITY (SERVICE LABS)NEED FOR SPECIALIZED EXPERTISE AND COST-EFFECTIVENESS TO DRIVE DEMAND FOR OUTSOURCED FOOD PATHOGEN TESTING SERVICES

-

8.4 GOVERNMENT LABSNEED TO DETECT AND PREVENT HARMFUL PATHOGENS TO DRIVE DEMAND FOR GOVERNMENT LABS

- 9.1 INTRODUCTION

-

9.2 TRADITIONAL TECHNOLOGYAGAR CULTURING- Versatility, reliability, and cost-effectiveness to fuel demand for agar culturing in pathogen testing

-

9.3 RAPID TECHNOLOGYCONVENIENCE-BASED- Quick results and enhanced food safety to drive demand for convenience-based technologiesPCR- Need for high sensitivity, specificity, and rapid results to drive demand for PCR in food pathogen testingIMMUNOASSAY- Minimizing false results, rapid results, timely decision-making, and efficient control measures to drive marketOTHER MOLECULAR-BASED TESTS

- 10.1 INTRODUCTION

-

10.2 E. COLIIMPLEMENTATION OF FOOD PATHOGEN TESTING PROCEDURES AND STRICT HYGIENE STANDARDS TO REDUCE E. COLI-RELATED FOODBORNE ILLNESSES

-

10.3 SALMONELLAMAJOR FOOD PRODUCT RECALLS AND FOOD CONTAMINATION DUE TO SALMONELLA TO DRIVE MARKET

-

10.4 CAMPYLOBACTEREFFECTIVE PATHOGEN TESTING TO CONTRIBUTE TO LOWERING ECONOMIC BURDEN OF CAMPYLOBACTER-RELATED ILLNESSES

-

10.5 LISTERIAINCREASED AWARENESS ASSOCIATED WITH LISTERIA CONTAMINATION TO DRIVE DEMAND FOR COMPREHENSIVE FOOD PATHOGEN TESTING

-

10.6 CRONOBACTERNEED TO REDUCE OCCURRENCE OF CRONOBACTER INFECTIONS IN INFANTS TO DRIVE DEMAND FOR PATHOGEN TESTING

- 10.7 OTHER TYPES

- 11.1 INTRODUCTION

- 11.2 MACRO INDICATORS OF RECESSION

-

11.3 NORTH AMERICANORTH AMERICA: RECESSION IMPACT ANALYSISUS- Evolving consumer preferences, foodborne illness outbreaks, technological advancements, and risk identification to drive marketCANADA- High incidences of foodborne illnesses and initiatives from CFIA to maintain food safety to drive marketMEXICO- Implementation of NAFTA and increasing number of foodborne disease cases to propel market

-

11.4 EUROPEEUROPE: RECESSION IMPACT ANALYSISGERMANY- Rising foodborne outbreaks and focus on healthy food choices to propel marketFRANCE- Stringent adherence to food safety measures and increased availability of convenient food choices to drive marketUK- Rising number of food poisoning cases and demand for good manufacturing practices and hygiene standards to drive marketSPAIN- Diversified food sector and country’s position as major food exporter to propel marketITALY- Focus on food safety by chocolate manufacturers and implementation of stringent food safety regulations to propel marketPOLAND- Poland's position as major food producer to spur focus on food pathogen testingREST OF EUROPE

-

11.5 ASIA PACIFICASIA PACIFIC: RECESSION IMPACT ANALYSISCHINA- Increasing concerns about safety of agricultural food products and rising food exports to Europe to drive marketJAPAN- Increasing foodborne illnesses to fuel demand for food pathogen testingINDIA- Diverse food supply chain and emergence of foodborne illnesses and pathogen outbreaks to drive marketAUSTRALIA & NEW ZEALAND- Increasing foodborne disease outbreaks, stringent regulations on food safety, and sustained number of food recalls to drive marketSOUTHEAST ASIA- Rising food poisoning cases to spur need for pathogen testing servicesREST OF ASIA PACIFIC

-

11.6 SOUTH AMERICASOUTH AMERICA: RECESSION IMPACT ANALYSISBRAZIL- Need to ensure food safety and protect public health and growing concern about the dangers of foodborne illnesses to drive marketARGENTINA- Need to protect public health and ensure safety of food supply chain to propel marketREST OF SOUTH AMERICA

-

11.7 ROWROW: RECESSION IMPACT ANALYSISMIDDLE EAST- Inadequate food safety management and wastewater disposal facilities and increasing foodborne illnesses to propel marketAFRICA- Rising foodborne-related cases to spur demand for food pathogen testing

- 12.1 OVERVIEW

- 12.2 MARKET SHARE ANALYSIS, 2022

- 12.3 SEGMENTAL REVENUE ANALYSIS OF KEY PLAYERS

- 12.4 ANNUAL REVENUE VS. GROWTH OF KEY PLAYERS

- 12.5 KEY PLAYERS IN EBITDA

- 12.6 STRATEGIES ADOPTED BY KEY PLAYERS

- 12.7 GLOBAL SNAPSHOT OF KEY MARKET PARTICIPANTS

-

12.8 COMPANY EVALUATION MATRIX FOR KEY PLAYERSSTARSEMERGING LEADERSPERVASIVE PLAYERSPARTICIPANTSCOMPANY OVERALL FOOTPRINT

-

12.9 COMPANY EVALUATION MATRIX FOR STARTUPS/SMESPROGRESSIVE COMPANIESSTARTING BLOCKSRESPONSIVE COMPANIESDYNAMIC COMPANIESCOMPETITIVE BENCHMARKING OF KEY STARTUPS/SMES

-

12.10 COMPETITIVE SCENARIOPRODUCT LAUNCHESDEALSOTHERS

-

13.1 KEY PLAYERSSGS SOCIÉTÉ GÉNÉRALE DE SURVEILLANCE SA- Business overview- Products/Solutions/Services offered- Recent developments- MnM viewBUREAU VERITAS- Business overview- Products/Solutions/Services offered- Recent developments- MnM viewINTERTEK GROUP PLC.- Business overview- Products/Solutions/Services offered- Recent developments- MnM viewEUROFINS SCIENTIFIC- Business overview- Products/Solutions/Services offered- Recent developments- MnM viewALS- Business overview- Products/Solutions/Services offered- Recent developments- MnM viewJBT- Business overview- Products/Solutions/Services offered- MnM viewTÜV NORD GROUP- Business overview- Products/Solutions/Services offered- Recent developments- MnM viewASUREQUALITY- Business overview- Products/Solutions/Services offered- Recent developments- MnM viewMÉRIEUX NUTRISCIENCES CORPORATION- Business overview- Products/Solutions/Services offered- Recent developments- MnM viewMICROBAC LABORATORIES, INC.- Business overview- Products/Solutions/Services offered- Recent developments- MnM viewIFP INSTITUTE FOR PRODUCT QUALITY GMBH- Business overview- Products/Solutions/Services offered- Recent developments- MnM viewEMSL ANALYTICAL, INC.- Business overview- Products/Solutions/Services offered- Recent developments- MnM viewQ LABORATORIES- Business overview- Products/Solutions/Services offered- Recent developments- MnM viewSYMBIO LABORATORIES- Business overview- Products/Solutions/Services offered- Recent developments- MnM viewHILL LABORATORIES- Business overview- Products/Solutions/Services offered- Recent developments- MnM view

-

13.2 STARTUPS/SMESDAILY LABORATORIES- Business overview- Products/Solutions/Services offered- Recent developments- MnM viewCERTIFIED LABORATORIES- Business overview- Products/Solutions/Services offered- Recent developments- MnM viewIEH INC.- Business overview- Products/Solutions/Services offered- Recent developments- MnM viewPRIMUSLABS- Business overview- Products/Solutions/Services offered- Recent developments- MnM viewNOVA BIOLOGICALS- Business overview- Products/Solutions/Services offered- Recent developments- MnM viewDAANE LABSPT SEAFOOD INSPECTION LABORATORYEUREKA ANALYTICAL SERVICES PRIVATE LIMITEDBIOMEDALELEMENT MATERIALS TECHNOLOGY

- 14.1 INTRODUCTION

- 14.2 RESEARCH LIMITATIONS

-

14.3 FOOD SAFETY TESTING MARKETMARKET DEFINITIONMARKET OVERVIEW

-

14.4 NORTH AMERICAN FOOD SAFETY MARKETMARKET DEFINITIONMARKET OVERVIEW

-

14.5 EUROPEAN FOOD SAFETY TESTING MARKETMARKET OVERVIEW

- 15.1 DISCUSSION GUIDE

- 15.2 KNOWLEDGESTORE: MARKETSANDMARKETS’ SUBSCRIPTION PORTAL

- 15.3 CUSTOMIZATION OPTIONS

- 15.4 RELATED REPORTS

- 15.5 AUTHOR DETAILS

- TABLE 1 US DOLLAR EXCHANGE RATES CONSIDERED, 2018–2022

- TABLE 2 GLOBAL FOOD PATHOGEN TESTING MARKET SNAPSHOT, 2023 VS. 2028

- TABLE 3 FOOD RECALLS AND REASONS IN US, 2021

- TABLE 4 LIST OF FOOD RECALLS, 2020–2021

- TABLE 5 TOP FOOD TESTING TECHNOLOGY INNOVATIONS

- TABLE 6 NORTH AMERICA: LIST OF REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- TABLE 7 EUROPE: LIST OF REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- TABLE 8 ASIA PACIFIC: LIST OF REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- TABLE 9 SOUTH AMERICA: LIST OF REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- TABLE 10 LIST OF MAJOR PATENTS PERTAINING TO FOOD PATHOGEN TESTING MARKET, 2013–2022

- TABLE 11 IMPORT VALUE OF PREPARED CULTURE MEDIA, 2022 (USD THOUSAND)

- TABLE 12 EXPORT VALUE OF PREPARED CULTURE MEDIA, 2022 (USD THOUSAND)

- TABLE 13 INDICATIVE PRICING ANALYSIS, BY REGION, 2022 (USD/TEST)

- TABLE 14 INDICATIVE PRICING ANALYSIS, BY FOOD TESTED, 2022 (USD/TEST)

- TABLE 15 KEY CRITERIA FOR SELECTING SUPPLIER/VENDOR

- TABLE 16 USE CASE: EUROFINS MICROBIOLOGY LABORATORY NETWORK REDUCED TIME NEEDED FOR LISTERIA TESTING WITH RHEONIX LISTERIA PATTERNALERT ASSAY

- TABLE 17 FOOD PATHOGEN TESTING MARKET: PORTER’S FIVE FORCES ANALYSIS

- TABLE 18 FOOD PATHOGEN TESTING MARKET: DETAILED LIST OF CONFERENCES & EVENTS, 2022–2023

- TABLE 19 FOOD SAFETY TESTING MARKET: FOODBORNE PATHOGENS, BY FOOD SOURCE

- TABLE 20 FOOD PATHOGEN TESTING MARKET, BY FOOD TESTED, 2018–2022 (USD MILLION)

- TABLE 21 FOOD PATHOGEN TESTING MARKET, BY FOOD TESTED, 2023–2028 (USD MILLION)

- TABLE 22 MEAT & POULTRY: FOOD PATHOGEN TESTING MARKET, BY REGION, 2018–2022 (USD MILLION)

- TABLE 23 MEAT & POULTRY: FOOD PATHOGEN TESTING MARKET, BY REGION, 2023–2028 (USD MILLION)

- TABLE 24 FISH & SEAFOOD: FOOD PATHOGEN TESTING MARKET, BY REGION, 2018–2022 (USD MILLION)

- TABLE 25 FISH & SEAFOOD: FOOD PATHOGEN TESTING MARKET, BY REGION, 2023–2028 (USD MILLION)

- TABLE 26 DAIRY: FOOD PATHOGEN TESTING MARKET, BY REGION, 2018–2022 (USD MILLION)

- TABLE 27 DAIRY: FOOD PATHOGEN TESTING MARKET, BY REGION, 2023–2028 (USD MILLION)

- TABLE 28 PROCESSED FOODS: FOOD PATHOGEN TESTING MARKET, BY REGION, 2018–2022 (USD MILLION)

- TABLE 29 PROCESSED FOODS: FOOD PATHOGEN TESTING MARKET, BY REGION, 2023–2028 (USD MILLION)

- TABLE 30 FRUITS & VEGETABLES: FOOD PATHOGEN TESTING MARKET, BY REGION, 2018–2022 (USD MILLION)

- TABLE 31 FRUITS & VEGETABLES: FOOD PATHOGEN TESTING MARKET, BY REGION, 2023–2028 (USD MILLION)

- TABLE 32 CEREALS & GRAINS: FOOD PATHOGEN TESTING MARKET, BY REGION, 2018–2022 (USD MILLION)

- TABLE 33 CEREALS & GRAINS: FOOD PATHOGEN TESTING MARKET, BY REGION, 2023–2028 (USD MILLION)

- TABLE 34 OTHER FOOD TESTED: FOOD PATHOGEN TESTING MARKET, BY REGION, 2018–2022 (USD MILLION)

- TABLE 35 OTHER FOOD TESTED: FOOD PATHOGEN TESTING MARKET, BY REGION, 2023–2028 (USD MILLION)

- TABLE 36 FOOD PATHOGEN TESTING MARKET, BY SITE, 2023–2028 (% SHARE, 2022)

- TABLE 37 FOOD PATHOGEN TESTING MARKET, BY TECHNOLOGY, 2018–2022 (USD MILLION)

- TABLE 38 FOOD PATHOGEN TESTING MARKET, BY TECHNOLOGY, 2023–2028 (USD MILLION)

- TABLE 39 TRADITIONAL TECHNOLOGY: FOOD PATHOGEN TESTING MARKET, BY REGION, 2018–2022 (USD MILLION)

- TABLE 40 TRADITIONAL TECHNOLOGY: FOOD PATHOGEN TESTING MARKET, BY REGION, 2023–2028 (USD MILLION)

- TABLE 41 FOOD PATHOGEN TESTING MARKET, BY RAPID TECHNOLOGY, 2018–2022 (USD MILLION)

- TABLE 42 FOOD PATHOGEN TESTING MARKET, BY RAPID TECHNOLOGY, 2023–2028 (USD MILLION)

- TABLE 43 RAPID TECHNOLOGY: FOOD PATHOGEN TESTING MARKET, BY REGION, 2018–2022 (USD MILLION)

- TABLE 44 RAPID TECHNOLOGY: FOOD PATHOGEN TESTING MARKET, BY REGION, 2023–2028 (USD MILLION)

- TABLE 45 PATHOGENESIS OF COMMON PATHOGENS

- TABLE 46 FOOD PATHOGEN TESTING MARKET, BY TYPE, 2018–2022 (USD MILLION)

- TABLE 47 FOOD PATHOGEN TESTING MARKET, BY TYPE, 2023–2028 (USD MILLION)

- TABLE 48 E. COLI: FOOD PATHOGEN TESTING MARKET, BY REGION, 2018–2022 (USD MILLION)

- TABLE 49 E. COLI: FOOD PATHOGEN TESTING MARKET, BY REGION, 2023–2028 (USD MILLION)

- TABLE 50 E. COLI: FOOD PATHOGEN TESTING MARKET, BY FOOD TESTED, 2018–2022 (USD MILLION)

- TABLE 51 E. COLI: FOOD PATHOGEN TESTING MARKET, BY FOOD TESTED, 2023–2028 (USD MILLION)

- TABLE 52 SALMONELLA: FOOD PATHOGEN TESTING MARKET, BY REGION, 2018–2022 (USD MILLION)

- TABLE 53 SALMONELLA: FOOD PATHOGEN TESTING MARKET, BY REGION, 2023–2028 (USD MILLION)

- TABLE 54 SALMONELLA: FOOD PATHOGEN TESTING MARKET, BY FOOD TESTED, 2018–2022 (USD MILLION)

- TABLE 55 SALMONELLA: FOOD PATHOGEN TESTING MARKET, BY FOOD TESTED, 2023–2028 (USD MILLION)

- TABLE 56 CAMPYLOBACTER: FOOD PATHOGEN TESTING MARKET, BY REGION, 2018–2022 (USD MILLION)

- TABLE 57 CAMPYLOBACTER: FOOD PATHOGEN TESTING MARKET, BY REGION, 2023–2028 (USD MILLION)

- TABLE 58 CAMPYLOBACTER: FOOD PATHOGEN TESTING MARKET, BY FOOD TESTED, 2018–2022 (USD MILLION)

- TABLE 59 CAMPYLOBACTER: FOOD PATHOGEN TESTING MARKET, BY FOOD TESTED, 2023–2028 (USD MILLION)

- TABLE 60 LISTERIA: FOOD PATHOGEN TESTING MARKET, BY REGION, 2018–2022 (USD MILLION)

- TABLE 61 LISTERIA: FOOD PATHOGEN TESTING MARKET, BY REGION, 2023–2028 (USD MILLION)

- TABLE 62 LISTERIA: FOOD PATHOGEN TESTING MARKET, BY FOOD TESTED, 2018–2022 (USD MILLION)

- TABLE 63 LISTERIA: FOOD PATHOGEN TESTING MARKET, BY FOOD TESTED, 2023–2028 (USD MILLION)

- TABLE 64 CRONOBACTER: FOOD PATHOGEN TESTING MARKET, BY REGION, 2018–2022 (USD MILLION)

- TABLE 65 CRONOBACTER: FOOD PATHOGEN TESTING MARKET, BY REGION, 2023–2028 (USD MILLION)

- TABLE 66 CRONOBACTER: FOOD PATHOGEN TESTING MARKET, BY FOOD TESTED, 2018–2022 (USD MILLION)

- TABLE 67 CRONOBACTER: FOOD PATHOGEN TESTING MARKET, BY FOOD TESTED, 2023–2028 (USD MILLION)

- TABLE 68 OTHER TYPES: FOOD PATHOGEN TESTING MARKET, BY REGION, 2018–2022 (USD MILLION)

- TABLE 69 OTHER TYPES: FOOD PATHOGEN TESTING MARKET, BY REGION, 2023–2028 (USD MILLION)

- TABLE 70 OTHER TYPES: FOOD PATHOGEN TESTING MARKET, BY FOOD TESTED, 2018–2022 (USD MILLION)

- TABLE 71 OTHER TYPES: FOOD PATHOGEN TESTING MARKET, BY FOOD TESTED, 2023–2028 (USD MILLION)

- TABLE 72 FOOD PATHOGEN TESTING MARKET, BY REGION, 2018–2022 (USD MILLION)

- TABLE 73 FOOD PATHOGEN TESTING MARKET, BY REGION, 2023–2028 (USD MILLION)

- TABLE 74 NORTH AMERICA: FOOD PATHOGEN TESTING MARKET, BY COUNTRY, 2018–2022 (USD MILLION)

- TABLE 75 NORTH AMERICA: FOOD PATHOGEN TESTING MARKET, BY COUNTRY, 2023–2028 (USD MILLION)

- TABLE 76 NORTH AMERICA: FOOD PATHOGEN TESTING MARKET, BY TYPE, 2018–2022 (USD MILLION)

- TABLE 77 NORTH AMERICA: FOOD PATHOGEN TESTING MARKET, BY TYPE, 2023–2028 (USD MILLION)

- TABLE 78 NORTH AMERICA: FOOD PATHOGEN TESTING MARKET, BY FOOD TESTED, 2018–2022 (USD MILLION)

- TABLE 79 NORTH AMERICA: FOOD PATHOGEN TESTING MARKET, BY FOOD TESTED, 2023–2028 (USD MILLION)

- TABLE 80 NORTH AMERICA: FOOD PATHOGEN TESTING MARKET, BY TECHNOLOGY, 2018–2022 (USD MILLION)

- TABLE 81 NORTH AMERICA: FOOD PATHOGEN TESTING MARKET, BY TECHNOLOGY, 2023–2028 (USD MILLION)

- TABLE 82 US: FOOD PATHOGEN TESTING MARKET, BY TYPE, 2018–2022 (USD MILLION)

- TABLE 83 US: FOOD PATHOGEN TESTING MARKET, BY TYPE, 2023–2028 (USD MILLION)

- TABLE 84 CANADA: FOOD PATHOGEN TESTING MARKET, BY TYPE, 2018–2022 (USD MILLION)

- TABLE 85 CANADA: FOOD PATHOGEN TESTING MARKET, BY TYPE, 2023–2028 (USD MILLION)

- TABLE 86 MEXICO: FOOD PATHOGEN TESTING MARKET, BY TYPE, 2018–2022 (USD MILLION)

- TABLE 87 MEXICO: FOOD PATHOGEN TESTING MARKET, BY TYPE, 2023–2028 (USD MILLION)

- TABLE 88 EUROPE: FOOD PATHOGEN TESTING MARKET, BY COUNTRY, 2018–2022 (USD MILLION)

- TABLE 89 EUROPE: FOOD PATHOGEN TESTING MARKET, BY COUNTRY, 2023–2028 (USD MILLION)

- TABLE 90 EUROPE: FOOD PATHOGEN TESTING MARKET, BY TYPE, 2018–2022 (USD MILLION)

- TABLE 91 EUROPE: FOOD PATHOGEN TESTING MARKET, BY TYPE, 2023–2028 (USD MILLION)

- TABLE 92 EUROPE: FOOD PATHOGEN TESTING MARKET, BY FOOD TESTED, 2018–2022 (USD MILLION)

- TABLE 93 EUROPE: FOOD PATHOGEN TESTING MARKET, BY FOOD TESTED, 2023–2028 (USD MILLION)

- TABLE 94 EUROPE: FOOD PATHOGEN TESTING MARKET, BY TECHNOLOGY, 2018–2022 (USD MILLION)

- TABLE 95 EUROPE: FOOD PATHOGEN TESTING MARKET, BY TECHNOLOGY, 2023–2028 (USD MILLION)

- TABLE 96 GERMANY: FOOD PATHOGEN TESTING MARKET, BY TYPE, 2018–2022 (USD MILLION)

- TABLE 97 GERMANY: FOOD PATHOGEN TESTING MARKET, BY TYPE, 2023–2028 (USD MILLION)

- TABLE 98 FRANCE: FOOD PATHOGEN TESTING MARKET, BY TYPE, 2018–2022 (USD MILLION)

- TABLE 99 FRANCE: FOOD PATHOGEN TESTING MARKET, BY TYPE, 2023–2028 (USD MILLION)

- TABLE 100 UK: FOOD PATHOGEN TESTING MARKET, BY TYPE, 2018–2022 (USD MILLION)

- TABLE 101 UK: FOOD PATHOGEN TESTING MARKET, BY TYPE, 2023–2028 (USD MILLION)

- TABLE 102 SPAIN: FOOD PATHOGEN TESTING MARKET, BY TYPE, 2018–2022 (USD MILLION)

- TABLE 103 SPAIN: FOOD PATHOGEN TESTING MARKET, BY TYPE, 2023–2028 (USD MILLION)

- TABLE 104 ITALY: FOOD PATHOGEN TESTING MARKET, BY TYPE, 2018–2022 (USD MILLION)

- TABLE 105 ITALY: FOOD PATHOGEN TESTING MARKET, BY TYPE, 2023–2028 (USD MILLION)

- TABLE 106 POLAND: FOOD PATHOGEN TESTING MARKET, BY TYPE, 2018–2022 (USD MILLION)

- TABLE 107 POLAND: FOOD PATHOGEN TESTING MARKET, BY TYPE, 2023–2028 (USD MILLION)

- TABLE 108 REST OF EUROPE: FOOD PATHOGEN TESTING MARKET, BY TYPE, 2018–2022 (USD MILLION)

- TABLE 109 REST OF EUROPE: FOOD PATHOGEN TESTING MARKET, BY TYPE, 2023–2028 (USD MILLION)

- TABLE 110 ASIA PACIFIC: FOOD PATHOGEN TESTING MARKET, BY COUNTRY, 2018–2022 (USD MILLION)

- TABLE 111 ASIA PACIFIC: FOOD PATHOGEN TESTING MARKET, BY COUNTRY, 2023–2028 (USD MILLION)

- TABLE 112 ASIA PACIFIC: FOOD PATHOGEN TESTING MARKET, BY TYPE, 2018–2022 (USD MILLION)

- TABLE 113 ASIA PACIFIC: FOOD PATHOGEN TESTING MARKET, BY TYPE, 2023–2028 (USD MILLION)

- TABLE 114 ASIA PACIFIC: FOOD PATHOGEN TESTING MARKET, BY FOOD TESTED, 2018–2022 (USD MILLION)

- TABLE 115 ASIA PACIFIC: FOOD PATHOGEN TESTING MARKET, BY FOOD TESTED, 2023–2028 (USD MILLION)

- TABLE 116 ASIA PACIFIC: FOOD PATHOGEN TESTING MARKET, BY TECHNOLOGY, 2018–2022 (USD MILLION)

- TABLE 117 ASIA PACIFIC: FOOD PATHOGEN TESTING MARKET, BY TECHNOLOGY, 2023–2028 (USD MILLION)

- TABLE 118 CHINA: FOOD PATHOGEN TESTING MARKET, BY TYPE, 2018–2022 (USD MILLION)

- TABLE 119 CHINA: FOOD PATHOGEN TESTING MARKET, BY TYPE, 2023–2028 (USD MILLION)

- TABLE 120 JAPAN: FOOD PATHOGEN TESTING MARKET, BY TYPE, 2018–2022 (USD MILLION)

- TABLE 121 JAPAN: FOOD PATHOGEN TESTING MARKET, BY TYPE, 2023–2028 (USD MILLION)

- TABLE 122 INDIA: FOOD PATHOGEN TESTING MARKET, BY TYPE, 2018–2022 (USD MILLION)

- TABLE 123 INDIA: FOOD PATHOGEN TESTING MARKET, BY TYPE, 2023–2028 (USD MILLION)

- TABLE 124 AUSTRALIA & NEW ZEALAND: FOOD PATHOGEN TESTING MARKET, BY TYPE, 2018–2022 (USD MILLION)

- TABLE 125 AUSTRALIA & NEW ZEALAND: FOOD PATHOGEN TESTING MARKET, BY TYPE, 2023–2028 (USD MILLION)

- TABLE 126 SOUTHEAST ASIA: FOOD PATHOGEN TESTING MARKET, BY TYPE, 2018–2022 (USD MILLION)

- TABLE 127 SOUTHEAST ASIA: FOOD PATHOGEN TESTING MARKET, BY TYPE, 2023–2028 (USD MILLION)

- TABLE 128 REST OF ASIA PACIFIC: FOOD PATHOGEN TESTING MARKET, BY TYPE, 2018–2022 (USD MILLION)

- TABLE 129 REST OF ASIA PACIFIC: FOOD PATHOGEN TESTING MARKET, BY TYPE, 2023–2028 (USD MILLION)

- TABLE 130 SOUTH AMERICA: FOOD PATHOGEN TESTING MARKET, BY COUNTRY, 2018–2022 (USD MILLION)

- TABLE 131 SOUTH AMERICA: FOOD PATHOGEN TESTING MARKET, BY COUNTRY, 2023–2028 (USD MILLION)

- TABLE 132 SOUTH AMERICA: FOOD PATHOGEN TESTING MARKET, BY TYPE, 2018–2022 (USD MILLION)

- TABLE 133 SOUTH AMERICA: FOOD PATHOGEN TESTING MARKET, BY TYPE, 2023–2028 (USD MILLION)

- TABLE 134 SOUTH AMERICA: FOOD PATHOGEN TESTING MARKET, BY FOOD TESTED, 2018–2022 (USD MILLION)

- TABLE 135 SOUTH AMERICA: FOOD PATHOGEN TESTING MARKET, BY FOOD TESTED, 2023–2028 (USD MILLION)

- TABLE 136 SOUTH AMERICA: FOOD PATHOGEN TESTING MARKET, BY TECHNOLOGY, 2018–2022 (USD MILLION)

- TABLE 137 SOUTH AMERICA: FOOD PATHOGEN TESTING MARKET, BY TECHNOLOGY, 2023–2028 (USD MILLION)

- TABLE 138 BRAZIL: FOOD PATHOGEN TESTING MARKET, BY TYPE, 2018–2022 (USD MILLION)

- TABLE 139 BRAZIL: FOOD PATHOGEN TESTING MARKET, BY TYPE, 2023–2028 (USD MILLION)

- TABLE 140 ARGENTINA: FOOD PATHOGEN TESTING MARKET, BY TYPE, 2018–2022 (USD MILLION)

- TABLE 141 ARGENTINA: FOOD PATHOGEN TESTING MARKET, BY TYPE, 2023–2028 (USD MILLION)

- TABLE 142 REST OF SOUTH AMERICA: FOOD PATHOGEN TESTING MARKET, BY TYPE, 2018–2022 (USD MILLION)

- TABLE 143 REST OF SOUTH AMERICA: FOOD PATHOGEN TESTING MARKET, BY TYPE, 2023–2028 (USD MILLION)

- TABLE 144 ROW: FOOD PATHOGEN TESTING MARKET, BY REGION, 2018–2022 (USD MILLION)

- TABLE 145 ROW: FOOD PATHOGEN TESTING MARKET, BY REGION, 2023–2028 (USD MILLION)

- TABLE 146 ROW: FOOD PATHOGEN TESTING MARKET, BY TYPE, 2018–2022 (USD MILLION)

- TABLE 147 ROW: FOOD PATHOGEN TESTING MARKET, BY TYPE, 2023–2028 (USD MILLION)

- TABLE 148 ROW: FOOD PATHOGEN TESTING MARKET, BY FOOD TESTED, 2018–2022 (USD MILLION)

- TABLE 149 ROW: FOOD PATHOGEN TESTING MARKET, BY FOOD TESTED, 2023–2028 (USD MILLION)

- TABLE 150 ROW: FOOD PATHOGEN TESTING MARKET, BY TECHNOLOGY, 2018–2022 (USD MILLION)

- TABLE 151 ROW: FOOD PATHOGEN TESTING MARKET, BY TECHNOLOGY, 2023–2028 (USD MILLION)

- TABLE 152 MIDDLE EAST: FOOD PATHOGEN TESTING MARKET, BY TYPE, 2018–2022 (USD MILLION)

- TABLE 153 MIDDLE EAST: FOOD PATHOGEN TESTING MARKET, BY TYPE, 2023–2028 (USD MILLION)

- TABLE 154 AFRICA: FOOD PATHOGEN TESTING MARKET, BY TYPE, 2018–2022 (USD MILLION)

- TABLE 155 AFRICA: FOOD PATHOGEN TESTING MARKET, BY TYPE, 2023–2028 (USD MILLION)

- TABLE 156 MARKET: DEGREE OF COMPETITION, 2022

- TABLE 157 STRATEGIES ADOPTED BY KEY PLAYERS

- TABLE 158 COMPANY TYPE FOOTPRINT

- TABLE 159 COMPANY REGIONAL FOOTPRINT

- TABLE 160 OVERALL COMPANY FOOTPRINT

- TABLE 161 FOOD PATHOGEN TESTING MARKET: DETAILED LIST OF KEY STARTUPS/SMES

- TABLE 162 PRODUCT LAUNCHES, 2019–2023

- TABLE 163 DEALS, 2019–2023

- TABLE 164 OTHERS, 2019–2023

- TABLE 165 SGS SOCIÉTÉ GÉNÉRALE DE SURVEILLANCE SA: COMPANY OVERVIEW

- TABLE 166 SGS SOCIÉTÉ GÉNÉRALE DE SURVEILLANCE SA: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 167 SGS SOCIÉTÉ GÉNÉRALE DE SURVEILLANCE SA: DEALS

- TABLE 168 SGS SOCIÉTÉ GÉNÉRALE DE SURVEILLANCE SA: OTHERS

- TABLE 169 BUREAU VERITAS: COMPANY OVERVIEW

- TABLE 170 BUREAU VERITAS: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 171 BUREAU VERITAS: DEALS

- TABLE 172 BUREAU VERITAS: OTHERS

- TABLE 173 INTERTEK GROUP PLC.: COMPANY OVERVIEW

- TABLE 174 INTERTEK GROUP PLC.: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 175 EUROFINS SCIENTIFIC: COMPANY OVERVIEW

- TABLE 176 EUROFINS SCIENTIFIC: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 177 EUROFINS SCIENTIFIC: SERVICE LAUNCHES

- TABLE 178 EUROFINS SCIENTIFIC: DEALS

- TABLE 179 ALS: COMPANY OVERVIEW

- TABLE 180 ALS: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 181 ALS: DEALS

- TABLE 182 JBT: COMPANY OVERVIEW

- TABLE 183 JBT: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 184 TÜV NORD GROUP: COMPANY OVERVIEW

- TABLE 185 TÜV NORD GROUP: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 186 TÜV NORD GROUP: SERVICE LAUNCHES

- TABLE 187 ASUREQUALITY: COMPANY OVERVIEW

- TABLE 188 ASUREQUALITY: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 189 MÉRIEUX NUTRISCIENCES CORPORATION: COMPANY OVERVIEW

- TABLE 190 MÉRIEUX NUTRISCIENCES CORPORATION: PRODUCTS/SOLUTIONS/ SERVICES OFFERED

- TABLE 191 MÉRIEUX NUTRISCIENCES CORPORATION: DEALS

- TABLE 192 MÉRIEUX NUTRISCIENCES CORPORATION: OTHERS

- TABLE 193 MICROBAC LABORATORIES, INC.: COMPANY OVERVIEW

- TABLE 194 MICROBAC LABORATORIES, INC.: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 195 IFP INSTITUTE FOR PRODUCT QUALITY GMBH: COMPANY OVERVIEW

- TABLE 196 IFP INSTITUTE FOR PRODUCT QUALITY GMBH: PRODUCTS/SOLUTIONS/ SERVICES OFFERED

- TABLE 197 EMSL ANALYTICAL, INC.: COMPANY OVERVIEW

- TABLE 198 EMSL ANALYTICAL, INC.: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 199 Q LABORATORIES: COMPANY OVERVIEW

- TABLE 200 Q LABORATORIES: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 201 SYMBIO LABORATORIES: COMPANY OVERVIEW

- TABLE 202 SYMBIO LABORATORIES: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 203 HILL LABORATORIES: COMPANY OVERVIEW

- TABLE 204 HILL LABORATORIES: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 205 HILL LABORATORIES: OTHERS

- TABLE 206 DAILY LABORATORIES: COMPANY OVERVIEW

- TABLE 207 DAILY LABORATORIES: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 208 CERTIFIED LABORATORIES: COMPANY OVERVIEW

- TABLE 209 CERTIFIED LABORATORIES: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 210 CERTIFIES LABORATORIES: DEALS

- TABLE 211 IEH INC.: COMPANY OVERVIEW

- TABLE 212 IEH INC.: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 213 PRIMUSLABS: COMPANY OVERVIEW

- TABLE 214 PRIMUSLABS: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 215 NOVA BIOLOGICALS: COMPANY OVERVIEW

- TABLE 216 NOVA BIOLOGICALS: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 217 NOVA BIOLOGICALS: OTHERS

- TABLE 218 DAANE LABS: BUSINESS OVERVIEW

- TABLE 219 PT SEAFOOD INSPECTION LABORATORY: BUSINESS OVERVIEW

- TABLE 220 EUREKA ANALYTICAL PRIVATE LIMITED: BUSINESS OVERVIEW

- TABLE 221 BIOMEDAL: BUSINESS OVERVIEW

- TABLE 222 ELEMENT MATERIALS TECHNOLOGY: BUSINESS OVERVIEW

- TABLE 223 ADJACENT MARKETS

- TABLE 224 FOOD SAFETY TESTING MARKET, BY TARGET TESTED, 2017–2021 (USD MILLION)

- TABLE 225 FOOD SAFETY TESTING MARKET, BY TARGET TESTED, 2022–2027 (USD MILLION)

- TABLE 226 FOOD SAFETY TESTING MARKET, BY CONTAMINANT, 2013–2020 (USD MILLION)

- TABLE 227 FOOD SAFETY TESTING MARKET, BY CONTAMINANT, 2011–2018 (USD MILLION)

- FIGURE 1 FOOD PATHOGEN TESTING MARKET SEGMENTATION

- FIGURE 2 FOOD PATHOGEN TESTING MARKET: RESEARCH DESIGN

- FIGURE 3 BREAKDOWN OF PRIMARY PROFILES: BY COMPANY TYPE, DESIGNATION, AND REGION

- FIGURE 4 DATA TRIANGULATION: SUPPLY SIDE

- FIGURE 5 DATA TRIANGULATION: DEMAND SIDE

- FIGURE 6 DATA TRIANGULATION METHODOLOGY

- FIGURE 7 FOOD PATHOGEN TESTING MARKET, BY TYPE, 2023 VS. 2028

- FIGURE 8 FOOD PATHOGEN TESTING MARKET, BY TECHNOLOGY, 2023 VS. 2028

- FIGURE 9 FOOD PATHOGEN TESTING MARKET, BY FOOD TESTED, 2023 VS. 2028 (USD MILLION)

- FIGURE 10 FOOD PATHOGEN TESTING MARKET, BY REGION

- FIGURE 11 RISING DEMAND FOR HEALTHY TESTED AND CERTIFIED FOODS TO PROPEL MARKET GROWTH

- FIGURE 12 RAPID SEGMENT AND GERMANY TO ACCOUNT FOR SIGNIFICANT SHARES IN 2023

- FIGURE 13 SALMONELLA SEGMENT TO ACCOUNT FOR LARGEST MARKET SHARE IN 2023

- FIGURE 14 US TO ACCOUNT FOR LARGEST MARKET SHARE IN 2023

- FIGURE 15 FIVE PATHOGENS TO ACCOUNT FOR MOST FOODBORNE ILLNESSES IN US

- FIGURE 16 BURDEN OF FOODBORNE ILLNESS ACROSS REGIONS, 2020

- FIGURE 17 GLOBAL AGRI-FOOD EXPORT, 2018–2020 (USD BILLION)

- FIGURE 18 COUNTRY-WISE PREPARED FOOD TRADE SCENARIOS, 2021 (USD THOUSAND)

- FIGURE 19 DRIVERS, RESTRAINTS, OPPORTUNITIES, AND CHALLENGES: FOOD PATHOGEN TESTING MARKET

- FIGURE 20 RECALLED PRODUCTS BY FISCAL YEAR, 2012–2022

- FIGURE 21 CATEGORY-WISE FDA FOOD RECALLS, 2019

- FIGURE 22 FOOD SAFETY AWARENESS AMONGST CONSUMERS IN US, 2019

- FIGURE 23 LEGISLATION PROCESS IN EU

- FIGURE 24 NUMBER OF PATENTS GRANTED FOR FOOD PATHOGEN TESTING PRODUCTS IN GLOBAL MARKET, 2013–2022

- FIGURE 25 REGIONAL ANALYSIS OF PATENTS GRANTED IN FOOD PATHOGEN TESTING MARKET

- FIGURE 26 IMPORT VALUE OF PREPARED CULTURE MEDIA, 2019–2022

- FIGURE 27 EXPORT VALUE OF PREPARED CULTURE MEDIA, 2019–2022

- FIGURE 28 KEY CRITERIA FOR SELECTING SUPPLIER/VENDOR

- FIGURE 29 FOOD PATHOGEN TESTING MARKET: TRENDS & DISRUPTIONS IMPACTING CUSTOMERS’ BUSINESSES

- FIGURE 30 FOOD PATHOGEN TESTING: VALUE CHAIN ANALYSIS

- FIGURE 31 FOOD PATHOGEN TESTING: SUPPLY CHAIN ANALYSIS

- FIGURE 32 FOOD PATHOGEN TESTING MARKET: MARKET MAP

- FIGURE 33 US: FOOD RECALLS, BY CONTAMINANT CATEGORY, 2021

- FIGURE 34 FOOD PATHOGEN TESTING, BY FOOD TYPE, 2023 VS. 2028 (USD MILLION)

- FIGURE 35 FOOD PATHOGEN TESTING MARKET, BY TECHNOLOGY, 2023 VS. 2028 (USD MILLION)

- FIGURE 36 FOOD PATHOGEN TESTING MARKET, BY TYPE, 2023 VS. 2028 (USD MILLION)

- FIGURE 37 GEOGRAPHIC SNAPSHOT: NEW HOTSPOTS EMERGING IN ASIA PACIFIC (2023–2028)

- FIGURE 38 INDICATORS OF RECESSION

- FIGURE 39 FOOD PATHOGEN TESTING MARKET: WORLD INFLATION RATE, 2011–2022

- FIGURE 40 FOOD PATHOGEN TESTING MARKET: GLOBAL GDP, 2011–2022 (USD TRILLION)

- FIGURE 41 RECESSION INDICATORS AND THEIR IMPACT ON FOOD PATHOGEN TESTING MARKET

- FIGURE 42 GLOBAL FOOD PATHOGEN TESTING MARKET: EARLIER FORECAST VS. RECESSION FORECAST

- FIGURE 43 FOOD PATHOGEN TESTING MARKET: COUNTRY-LEVEL DATA FOR INFLATION (2018–2022)

- FIGURE 44 NORTH AMERICAN FOOD PATHOGEN TESTING MARKET: RECESSION IMPACT ANALYSIS

- FIGURE 45 EUROPE: FOOD PATHOGEN TESTING MARKET SNAPSHOT

- FIGURE 46 FOOD PATHOGEN TESTING MARKET: COUNTRY-LEVEL DATA FOR INFLATION (2018–2022)

- FIGURE 47 EUROPEAN FOOD PATHOGEN TESTING MARKET: RECESSION IMPACT ANALYSIS

- FIGURE 48 ASIA PACIFIC: FOOD PATHOGEN TESTING MARKET SNAPSHOT

- FIGURE 49 ASIA PACIFIC: INFLATION RATES, BY KEY COUNTRY, 2017–2022

- FIGURE 50 ASIA PACIFIC FOOD PATHOGEN TESTING MARKET: RECESSION IMPACT ANALYSIS

- FIGURE 51 SOUTH AMERICA: INFLATION RATES, BY KEY COUNTRY, 2017–2022

- FIGURE 52 SOUTH AMERICAN FOOD PATHOGEN TESTING MARKET: RECESSION IMPACT ANALYSIS

- FIGURE 53 ROW: INFLATION RATES, BY KEY COUNTRY, 2018–2022

- FIGURE 54 ROW FOOD PATHOGEN TESTING MARKET: RECESSION IMPACT ANALYSIS

- FIGURE 55 SEGMENTAL REVENUE ANALYSIS OF KEY PLAYERS IN MARKET, 2018–2022 (USD BILLION)

- FIGURE 56 ANNUAL REVENUE, 2022 (USD BILLION) VS. REVENUE GROWTH, 2020–2022 (%)

- FIGURE 57 EBITDA, 2022 (USD BILLION)

- FIGURE 58 FOOD PATHOGEN TESTING MARKET: GLOBAL SNAPSHOT OF KEY PARTICIPANTS, 2022

- FIGURE 59 FOOD PATHOGEN TESTING MARKET: COMPANY EVALUATION MATRIX FOR KEY PLAYERS, 2022

- FIGURE 60 FOOD PATHOGEN TESTING MARKET: COMPANY EVALUATION MATRIX FOR STARTUP/SMES, 2022

- FIGURE 61 SGS SOCIÉTÉ GÉNÉRALE DE SURVEILLANCE SA: COMPANY SNAPSHOT

- FIGURE 62 BUREAU VERITAS: COMPANY SNAPSHOT

- FIGURE 63 INTERTEK GROUP PLC.: COMPANY SNAPSHOT

- FIGURE 64 EUROFINS SCIENTIFIC: COMPANY SNAPSHOT

- FIGURE 65 ALS: COMPANY SNAPSHOT

- FIGURE 66 JBT: COMPANY SNAPSHOT

- FIGURE 67 TÜV NORD GROUP: COMPANY SNAPSHOT

- FIGURE 68 ASUREQUALITY: COMPANY SNAPSHOT

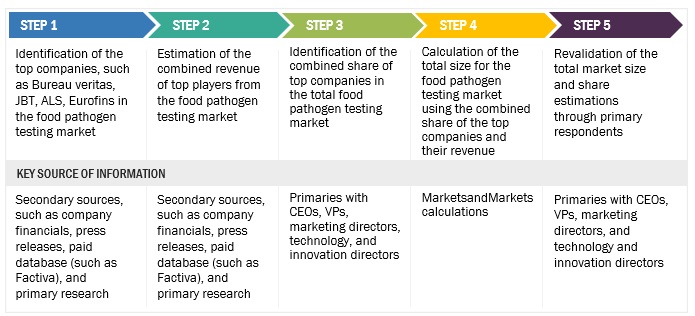

This research study involved the extensive use of secondary sources—directories and databases such as Bloomberg Businessweek and Factiva—to identify and collect information useful for a technical, market-oriented, and commercial study of the food pathogen testing market. In-depth interviews were conducted with various primary respondents—such as key industry participants, subject matter experts (SMEs), C-level executives of key market players, and industry consultants—to obtain and verify critical qualitative and quantitative information as well as to assess prospects.

Secondary Research

The secondary sources referred for this research study include government sources, the EU Commission, the European Food Safety Authority, the German Federal Institute of Risk Assessment, the Food Safety and Standards Authority of India (FSSAI), and the Japanese Ministry of Health, Labor and Welfare have been referred to, to identify and collect information for this study. The secondary sources also included food pathogen testing annual reports, press releases & investor presentations of companies, white papers, food journals, certified publications, articles from recognized authors, gold & silver standard websites, regulatory bodies, trade directories, and paid databases.

Secondary research was used to obtain key information about the industry’s supply chain, the total pool of key players, and market classification and segmentation according to industry trends to the bottom-most level, regional markets, and key developments from both market and technology-oriented perspectives. The secondary data was collected and analyzed to arrive at the overall market size, which was further validated by primary research. It was also used to obtain information on the key developments from a market-oriented perspective.

Primary Research

The Food pathogen testing market comprises multiple stakeholders, including raw material suppliers, processed food suppliers, and regulatory organizations in the supply chain. Various primary sources from the supply and demand sides of the market were interviewed to obtain qualitative and quantitative information. Primary interviewees from the supply side include research institutions involved in R&D to introduce to the manufacturers and, importers & exporters of food pathogen testing from the demand side, including distributors, wholesalers, and key opinion leaders through questionnaires, emails, and telephonic interviews.

To know about the assumptions considered for the study, download the pdf brochure

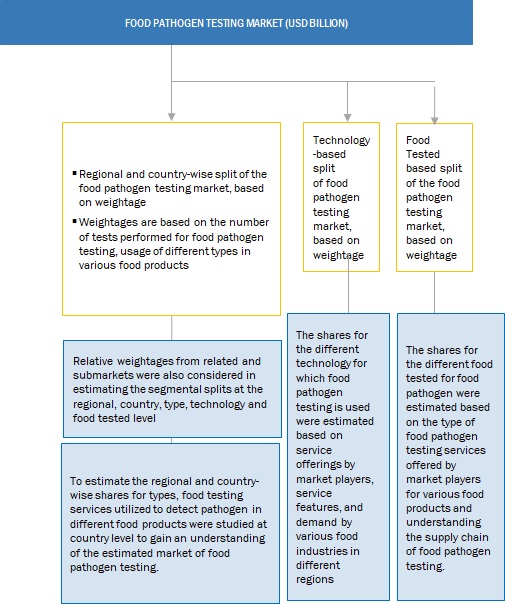

Food Pathogen Testing Market Size Estimation

The following approaches represent the overall market size estimation process employed for the purpose of this study.

Both top-down and bottom-up approaches were used to estimate and validate the total size of the market. These approaches were also used extensively to estimate the size of various dependent submarkets. The research methodology used to estimate the market size includes the following:

Top-down approach:

- The key players in the industry and the market were identified through extensive secondary research.

- The revenues of major food pathogen testing service providers were determined through primary and secondary research, such as paid databases, which were used as the basis for market estimation.

- Based on the market share analysis of key industry players from all regions, the final market size of the market has been arrived at.

Food Pathogen Testing Market Size Estimation, By Type (Supply Side)

To know about the assumptions considered for the study, Request for Free Sample Report

Bottom-up approach:

- Based on the share of food pathogen testing market for each application at regional and country levels, the market sizes were analyzed. Thus, with a bottom-up approach to the application at the country level, the global market for food pathogen testing was estimated.

- Based on the demand for food-tested, offerings of key players, and the region-wise market share of major players, the global market for food-tested was estimated.

- Other factors considered include the penetration rate of food pathogen testing, are the demand for consumer awareness, functional trends, the adoption rate, patents registered, and organic & inorganic growth attempts.

- From this, market sizes for each region were derived.

- All percentage shares, splits, and breakdowns were determined using secondary sources and verified through primary sources.

- All macroeconomic and microeconomic factors affecting the growth of the market were considered while estimating the market size.

- All parameters that affect the market covered in this research study were accounted for, viewed in extensive detail, verified through primary research, and analyzed to obtain final quantitative and qualitative data.

Food Pathogen Testing Market Size Estimation (Demand Side)

These sections (bottom-up & top-down) (supply-demand) depict the overall market size estimation process employed for this study.

Data Triangulation

After arriving at the global market size from the estimation process explained above, the total market was split into various segments and subsegments. The data triangulation and market breakdown procedures were employed, wherever applicable, to estimate the food pathogen testing market and arrive at the exact statistics for all segments and subsegments. The data was triangulated by studying a range of factors and trends from the demand and supply sides. Additionally, the market size was validated using both the top-down and bottom-up approaches.

Market Definition

Food safety is a scientific and technical method of handling, manufacturing, and storing food to prevent foodborne diseases. According to Food Safety and Standards Act, 2006, legislated by the Indian Ministry of Law and Justice, to support the establishment of the Food Safety and Standards Authority of India (FFSAI), the definitions are as follows:

Food safety” means assurance that food is acceptable for human consumption according to its intended use.

Food safety audit” means a systematic and functionally independent examination of food safety measures adopted by manufacturing units to determine whether such measures and related results meet the objectives of food safety and the claims made on that behalf.

Food Safety Management System (FSMS)” means adopting good manufacturing practices, good hygienic practices, hazard analysis, critical control points, and such other practices as may be specified by regulations for the food business.

Food pathogen testing is a part of food safety testing conducted to ensure food safety against pathogen contamination and compliance of food products to safety standards set by regulatory bodies across the globe.

Stakeholders in the food pathogen testing market

- Research & development (R&D) institutions and financial institutions

- Regulatory bodies

- Organizations such as the FDA, EFSA, USDA, and FSANZ

- Food safety agencies

- Government agencies and NGOs

- Manufacturers, importers & exporters, traders, distributors, and suppliers of food pathogens testing kits, equipment, reagents, chemicals, and other related consumables

- Food pathogens testing service providers

- Food pathogens testing laboratories

- Food manufacturers, food processors, food traders, and distributors

- Government organizations, research organizations, and consulting firms

- Trade associations and industry bodies

Food Pathogen Testing Market Report Objectives

Market Intelligence

- Determining and projecting the size of the market with respect to its type, food tested, site, technology, and regional presence, over a five-year period ranging from 2023 to 2028.

- Identifying the attractive opportunities in the market by determining the largest and fastest-growing segments across regions

- Providing detailed information about the key factors influencing the market growth (drivers, restraints, opportunities, and industry-specific challenges)

- Providing the regulatory framework for major countries related to the market.

- Analyzing the micro-markets with respect to individual growth trends, prospects, and their contribution to the total market

Competitive Intelligence

- Identifying and profiling the key players in the food pathogen testing market.

-

Providing a comparative analysis of market leaders based on the following:

- Service offerings

- Business strategies

- Strengths and weaknesses

- Key financials

- Understanding the competitive landscape and identifying the major growth strategies adopted by players across the key regions.

- Analyzing the value chain and services across the key regions and their impact on the prominent market players

- Providing insights on key service innovations and investments in the global market.

Available Customizations:

With the given market data, MarketsandMarkets offers customizations according to company-specific scientific needs.

The following customization options are available for the report:

Service Analysis

- Service Matrix, which gives a detailed comparison of the service portfolio of each company.

Geographic Analysis

With the given market data, MarketsandMarkets offers customizations according to company-specific scientific needs.

- Further breakdown of the Rest of Asia-Pacific food pathogen testing market into South Korea, Singapore, Mongolia, Tonga, Taiwan

- Further breakdown of the rest of Europe's market into Belgium, Netherlands, other EU, and non-EU countries.

- Further breakdown of the rest of the South American market into Chile, Venezuela, Peru, Columbia, Paraguay, and Uruguay.

Company Information

- Detailed analyses and profiling of additional market players (up to five)

Growth opportunities and latent adjacency in Food Pathogen Testing Market

I am interested in the Food Pathogen Testing Market. I would like to know if your report contains testing for both outsourced and insourced testing, i.e., does it include what is sent to contract labs only? Or does it include testing that food manufacturers do in their own labs?

I am interested in the Food Pathogen Testing Market. I would like to know if your report contains testing for both outsourced and insourced testing, i.e., does it include what is sent to contract labs only? Or does it include testing that food manufacturers do in their own labs?