Nanosatellite and Microsatellite Market by Component (Hardware, Software), Application, Type (Nanosatellite, Microsatellite), Organization Size, Vertical (Government, Civil, Commercial), Orbit, Frequency and Region - Global Forecast to 2027

The global Nanosatellite and Microsatellite Market size is expected to register a CAGR of 19.3% over the forecast period and in terms of revenue it is expected to increase from $2.8 billion in 2022 to rise more than $6.7 billion by the end of 2027.

To know about the assumptions considered for the study, Request for Free Sample Report

Nanosatellite and microsatellite Market Dynamics

Driver: Rising demand of Earth Observation related applications

Earth observation services cover monitoring agricultural fields, weather forecasting, disaster mitigation, meteorology, mining, and several other resources. The requirement for high-resolution Earth imaging has increased across verticals, as images can be used for various purposes, such as precise management of land, water, and forest resources. The images also help fulfill the country's developmental and security needs. Space-based inputs can be extremely useful for disaster forewarning and post-disaster management. The demand for more data and insights will be driven by upcoming constellations, high-volume data pipelines, and subscriptions for insight services. Nanosatellites and microsatellites have a smaller development cycle and better orbital maneuverability than conventional satellites. Hence, miniature satellites can provide data continuity and facilitate long-term and systematic measurement of key climate variables. Data continuity helps researchers better understand the global climate and ongoing weather patterns.

Restraint: Limited access to space

There are limited options for small satellite launches as small satellites are often considered secondary payloads on rockets launching large satellites or carrying cargo to the International Space Station (ISS). These limited options impose restrictions regarding the integration and launch schedules, orbit destinations, and loss of flexibility concerning subsystems in small satellites. The process of procuring the launch is complex enough for small satellite operators. Thus companies such as Spaceflight Industries (US), ECM Space (Germany), TriSept (US), Tyvak (US), and Innovative Solutions in Space (Netherlands) have developed technologies to safely include large numbers of small satellites such as secondary payloads on large launchers. Only a few small launchers are expected to succeed due to the challenges such as the inability to compete price-wise (per kg cost) with large launchers, the failure of technology, the inability to raise the funding needed for development and operations, or an oversaturated market, leading to the inability to compete.

Opportunity: Rising demand for satellite imagery from non-governmental players

The demand for satellite imagery is expected to come from non-governmental actors that could use images and image-based analytics for agriculture, economic forecasting, urban planning, resource management, disaster monitoring, retail, maritime, and other applications. SpaceWorks 2020 report estimates the growth in market share of commercial operators' use of satellites to increase from 55% in 2020 to 70% by 2024. Although non-governmental demands appear poised to grow, these demands currently are too small to point to a clear trajectory. The success will depend on whether commercial small satellite organizations can convert images and metadata into useful information for end-users. According to SpaceWorks, 2,000–2,800 microsatellites and nanosatellites will be launched into space over the next five years, accounting for Earth observation and communication applications.

Challenge: Concerns related to space debris

Small satellites may threaten the space environment as they are often launched in densely populated orbits. This is because small satellites are subsidiary payloads that are piggybacked on launches dedicated to much larger and more expensive satellites. They are generally deployed near or with other large satellites. These large satellites are positioned with space debris in sun-synchronous orbits or geostationary transfer orbits. Nanosatellites and microsatellites lack the maneuverability required to move around in such orbits. The native radar signatures of these satellites are typically small and often below the threshold of the perception for space surveillance sensors. Space debris may prove to be a hazard for small satellites, which may, in turn, increase the number of debris due to collisions or system failures. This is a significant challenge in this field and is under research by various space agencies.

By Component, the software and data processing segment to have a higher CAGR during the forecast period

The Component segment includes revenues from software packages and data processing suites required for accepting and extracting actionable information from raw satellite data at the ground station. It has revenues from onboard nanosatellite and microsatellite software. The software performs commands and data handling, attitude determination and control, and satellite space protocol. This segment contributes to a small portion of the total nanosatellite and microsatellite market, accounting for approximately six percent during the forecast period. However, the software and data processing segment is expected to grow at the highest CAGR during the forecast period. In November 2019, ISRO launched CARTOSAT-3, 13 US nanosatellites. With this launch, ISRO crossed the 300 foreign satellite launch mark. In July 2022, Carnegie Mellon University (CMU) launched an initiative to transform nanosatellite capabilities in low-earth orbit. Cyber-Physical Systems (CPS) Frontiers Program by National Science Foundation (NSF) granted USD 7 million for the program. Factors such as advanced data processing in space can now monitor agriculture, environmental protection, and geology down on earth. This, in turn, can significantly expand the knowledge of what damages the environment, how this change occurs, and at what pace this devastation takes place.

By Organization Size, the larger enterprises segment accounts for a larger market size during the forecast period

Organizations with more than 1,000 employees are considered large enterprises. The adoption of nanosatellites and microsatellites among large enterprises is expected to increase in the coming years. Nanosatellite constellations provide situational awareness and fulfill various needs, such as collecting very short data bursts from remote areas, detecting and monitoring sea and meteorological conditions, and remote sensing and surveillance. Constant innovation and technological advances in the miniaturization of electronics are expected to significantly boost the growth of large enterprises in the proportion of nanosatellite launches.

Europe to grow at the highest CAGR during the forecast period

The European region has a considerable market share due to increased demand for remote sensing, Earth observation, and scientific exploration activities. The UK, Russia, Germany, Italy, Finland, and the Rest of Europe have been covered under this region for market analysis. In March 2022, Tenali-based Sai Divya designed and developed a 1U CubeSat nanosatellite named LakshyaSAT, which successfully launched into the stratosphere from the United Kingdom. The European Space Agency (ESA) and other regional, national space agencies are expected to launch several small satellites to gather data for climate monitoring, disaster management, navigation, and surveillance. For instance, In October 2022, Sateliot received the endorsement of the European Space Agency (ESA) through the Future Preparation Generic Programme line of the ARTES program for launching the first constellation of low-orbit nanosatellites to provide 5G coverage for IoT. Technological innovations in the nanosatellite and microsatellite ecosystem and their increased deployment are expected to fuel European market growth.

To know about the assumptions considered for the study, download the pdf brochure

Key Market Players

The report includes a study of key players nanosatellite and microsatellite market. It profiles major vendors in the nanosatellite and microsatellite market. The major vendors in the nanosatellite and microsatellite market GomSpace (Denmark), Lockheed Martin (US), L3Harris (US), Sierra Nevada Corporation (US), AAC Clyde Space (Scotland), Planet Labs (US), Surrey Satellite Technology (UK), Northrop Grumman (US), OHB SE (Germany), Tyvak (US), Raytheon Intelligence and Space (US), Pumpkin Space Systems (US), Beyond Gravity (Switzerland), Millennium Space Systems (US), Exolaunch (Germany), Axelspace (US), Nanoavionics (US), GAUSS (Italy), Spire Global (US), Dauria Space (Russia), C3S (Hungary), Swarm (US), Alen Space (Spain), Satlantis (Spain), Dhruva Space (India), Astrocast (Switzerland), Kepler Aerospace (India). These players have adopted various strategies to grow in the global offering nanosatellite and microsatellite market. The study includes an in-depth competitive analysis of these key players in the offering nanosatellite and microsatellite market with their company profiles, recent developments, and key market strategies.

Scope of the Report

|

Report Metrics |

Details |

|

Market size value in 2022 |

USD 2.8 Billion |

|

Revenue forecast in 2027 |

USD 6.7 Billion |

|

Growth rate |

CAGR of 19.3% |

|

Market size available for years |

2016–2027 |

|

Base year considered |

2020 |

|

Forecast period |

2022–2027 |

|

Segments covered |

Component (Hardware, Software), Application, Type (Nanosatellite, Microsatellite), Organization Size, Vertical (Government, Civil, Commercial), Orbit, Frequency and Region |

|

Geographies covered |

North America, Europe, APAC, Latin America, and MEA |

|

Companies covered |

GomSpace (Denmark), Lockheed Martin (US), L3Harris (US), Sierra Nevada Corporation (US), AAC Clyde Space (Scotland), Planet Labs (US), Surrey Satellite Technology (UK), Northrop Grumman (US), OHB SE (Germany), Tyvak (US), Raytheon Intelligence and Space (US), Pumpkin Space Systems (US), Beyond Gravity (Switzerland), Millennium Space Systems (US), Exolaunch (Germany), Axelspace (US), Nanoavionics (US), GAUSS (Italy), Spire Global (US), Dauria Space (Russia), C3S (Hungary), Swarm (US), Alen Space (Spain), Satlantis (Spain), Dhruva Space (India), Astrocast (Switzerland), Kepler Aerospace (India). |

The study categorizes the nanosatellite and microsatellite market based on component, application type, organization size, vertical, orbit, frequency at the regional and global level.

By Component

- Software

-

Service

-

Professional Services

- Consulting

- Implementation

- Support & Maintenance

- Managed Services

-

Professional Services

By Organization Size

- SMEs

- Large Enterprises

By Deployment Type

- On-Premises

- Cloud

By Operator

- B2B

- B2C

By Vertical

- BFSI

- Aviation

- Automotive

- Media and Entertainment

- Retail and Consumer Goods

- Hospitality

- Others (education, healthcare and telecom)

By Region

- North America

- Europe

- APAC

- Latin America

- MEA

Recent Developments:

- In December 2021, GomSpace partnered with Unseen Labs to establish the next-generation satellite platform. The new platform will be an upgrade in size and performance compared to the satellites previously built by GomSpace for Unseen Labs.

- In November 2021, Lockheed Martin and the US Space Force conducted the system-level Critical Design Review (CDR) for the Next Generation Overhead Persistent Infrared Geosynchronous Earth Orbit (NGG) Block 0 space program. This marks another significant step toward the first NGG satellite launch in 2025.

- In September 2021, OHB Sweden was the prime mission contractor for the Arctic Weather Satellite, providing the satellite platform and system integration. AAC Clyde Space has been contracted to deliver the Starbuck power system with mission-specific customization.

- In May 2021, L3Harris partnered with Air Tractor. Both companies partnered to create an affordable, production-ready ISR strike system that will combine Air Tractor's rugged platform with L3Harris' mature mission solutions.

Frequently Asked Questions (FAQ):

How is the nanosatellite and microsatellite market expected to grow in the next five years?

According to MarketsandMarkets, the nanosatellite and microsatellite market size is expected to grow USD 2.8 billion in 2022 to USD 6.7 billion by 2027 at a Compound Annual Growth Rate (CAGR) of 19.3% during the forecast period.

Which region has the largest market share in the nanosatellite and microsatellite market?

North America is estimated to hold the largest market share in the nanosatellite and microsatellite market in 2022. North America is one of the most technologically advanced markets in the world.

What are the major factors driving the nanosatellite and microsatellite market?

The major nanosatellite and microsatellite market drivers are the proliferation of LEO-based services to connect better remote and inaccessible regions and the Increasing demand for CubeSats.

Who are the major vendors in the nanosatellite and microsatellite market?

Major vendors in the nanosatellite and microsatellite market include GomSpace (Denmark), Lockheed Martin (US), L3Harris (US), Sierra Nevada Corporation (US), AAC Clyde Space (Scotland), Planet Labs (US), Surrey Satellite Technology (UK), Northrop Grumman (US), OHB SE (Germany), Tyvak (US), Raytheon Intelligence and Space (US), Pumpkin Space Systems (US), Beyond Gravity (Switzerland), Millennium Space Systems (US), Exolaunch (Germany), Axelspace (US), Nanoavionics (US), GAUSS (Italy), Spire Global (US), Dauria Space (Russia), C3S (Hungary), Swarm (US), Alen Space (Spain), Satlantis (Spain), Dhruva Space (India), Astrocast (Switzerland), Kepler Aerospace (India). .

To speak to our analyst for a discussion on the above findings, click Speak to Analyst

TABLE OF CONTENTS

1 INTRODUCTION (Page No. - 25)

1.1 STUDY OBJECTIVES

1.2 MARKET DEFINITION

1.2.1 INCLUSIONS AND EXCLUSIONS

1.3 MARKET SCOPE

1.3.1 MARKET SEGMENTATION

1.3.2 YEARS CONSIDERED

1.4 CURRENCY CONSIDERED

TABLE 1 UNITED STATES DOLLAR, EXCHANGE RATES, 2018–2021

1.5 STAKEHOLDERS

1.6 SUMMARY OF CHANGES

2 RESEARCH METHODOLOGY (Page No. - 30)

2.1 RESEARCH DATA

FIGURE 1 GLOBAL NANOSATELLITE AND MICROSATELLITE MARKET: RESEARCH DESIGN

2.1.1 SECONDARY DATA

2.1.2 PRIMARY DATA

2.1.2.1 Breakup of primary profiles

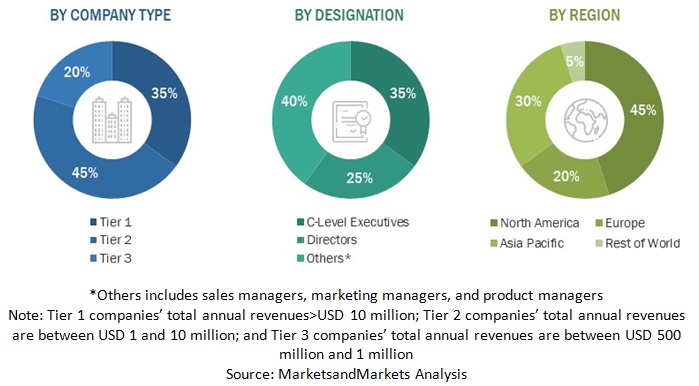

FIGURE 2 BREAKUP OF PROFILES OF PRIMARY PARTICIPANTS: BY COMPANY TYPE, DESIGNATION, AND REGION

2.1.2.2 Key industry insights

2.2 MARKET BREAKUP AND DATA TRIANGULATION

FIGURE 3 DATA TRIANGULATION

2.3 MARKET SIZE ESTIMATION

FIGURE 4 MARKET SIZE ESTIMATION METHODOLOGY: APPROACH 1 (SUPPLY-SIDE): REVENUE OF HARDWARE/SOFTWARE/SERVICES OF MARKET

FIGURE 5 MARKET SIZE ESTIMATION METHODOLOGY: APPROACH 1 BOTTOM-UP (SUPPLY-SIDE): COLLECTIVE REVENUE OF SOFTWARE/HARDWARE/SERVICES OF NANOSATELLITE AND MICROSATELLITE MARKET

FIGURE 6 MARKET SIZE ESTIMATION METHODOLOGY: APPROACH 2— BOTTOM-UP (DEMAND-SIDE): SOFTWARE/SERVICES

2.4 MARKET FORECAST

FIGURE 7 FACTOR ANALYSIS

2.5 ASSUMPTIONS

TABLE 2 ASSUMPTIONS

2.6 LIMITATIONS

3 EXECUTIVE SUMMARY (Page No. - 39)

FIGURE 8 NANOSATELLITE AND MICROSATELLITE MARKET, 2020-2027

FIGURE 9 LEADING SEGMENTS IN MARKET IN 2022

FIGURE 10 MARKET, REGIONAL AND COUNTRY-WISE SHARE, 2022

FIGURE 11 EUROPE TO BE BEST MARKET FOR INVESTMENTS DURING FORECAST PERIOD

4 PREMIUM INSIGHTS (Page No. - 44)

4.1 ATTRACTIVE OPPORTUNITIES FOR PLAYERS IN NANOSATELLITE AND MICROSATELLITE MARKET

FIGURE 12 RISING TECHNOLOGICAL ADVANCEMENTS TO DRIVE MARKET

4.2 MARKET, BY ORGANIZATION SIZE

FIGURE 13 LARGE ENTERPRISES TO LEAD MARKET DURING FORECAST PERIOD

4.3 NORTH AMERICAN MARKET, 2022

FIGURE 14 SPACE SERVICES SEGMENT AND US TO ACCOUNT FOR HIGH MARKET SHARES IN NORTH AMERICA IN 2022

4.4 ASIA PACIFIC MARKET, 2022

FIGURE 15 HARDWARE AND CHINA TO ACCOUNT FOR HIGH MARKET SHARES IN ASIA PACIFIC IN 2022

4.5 MARKET, BY COUNTRY

FIGURE 16 UK TO GROW AT HIGHEST CAGR DURING FORECAST PERIOD

5 MARKET OVERVIEW AND INDUSTRY TRENDS (Page No. - 48)

5.1 INTRODUCTION

5.2 MARKET DYNAMICS

FIGURE 17 NANOSATELLITE AND MICROSATELLITE MARKET: DRIVERS, RESTRAINTS, OPPORTUNITIES, AND CHALLENGES

5.2.1 DRIVERS

5.2.1.1 Proliferation of LEO-based services to connect remote regions

5.2.1.2 Rapid escalation of production and launch of small satellites to revolutionize space industry

TABLE 3 NUMBER OF NANOSATELLITES LAUNCHED IN APRIL 2021

5.2.1.3 Rising demand for Earth observation-related applications

5.2.1.4 Development of satellite networks to provide internet access to remote areas

TABLE 4 KEY INFORMATION ON SATELLITE AND TERRESTRIAL CONNECTIVITY

5.2.1.5 Increasing demand for CubeSats

5.2.2 RESTRAINTS

5.2.2.1 Limited access to space

5.2.2.2 Stringent government regulations

5.2.3 OPPORTUNITIES

5.2.3.1 Rise in demand for satellite imagery from non-governmental players

5.2.3.2 Increase in number of application areas

5.2.3.3 Increase in space exploration missions

5.2.3.4 Growing technological advancements to transform space exploration

5.2.3.5 Use of flexible software-defined technology to alter space missions

5.2.3.6 Technological advancements in antennas, ground stations, and other areas

5.2.4 CHALLENGES

5.2.4.1 Raising capital and funding satellite manufacturing

5.2.4.2 Concerns related to space debris

5.3 INDUSTRY TRENDS

5.3.1 VALUE CHAIN

FIGURE 18 VALUE CHAIN ANALYSIS FOR NANOSATELLITE AND MICROSATELLITE MARKET

5.3.2 ECOSYSTEM

5.3.2.1 MARKET: ECOSYSTEM

TABLE 5 MARKET: ECOSYSTEM

5.3.3 PORTER’S FIVE FORCES MODEL

TABLE 6 MARKET: PORTER’S FIVE FORCES MODEL

FIGURE 19 MARKET: PORTER’S FIVE FORCES MODEL

5.3.3.1 Threat of new entrants

5.3.3.2 Threat of substitutes

5.3.3.3 Bargaining power of buyers

5.3.3.4 Bargaining power of suppliers

5.3.3.5 Intensity of competitive rivalry

5.3.4 KEY STAKEHOLDERS AND BUYING CRITERIA

5.3.4.1 Key stakeholders in buying process

FIGURE 20 INFLUENCE OF STAKEHOLDERS IN BUYING PROCESS FOR TOP THREE APPLICATIONS

TABLE 7 INFLUENCE OF STAKEHOLDERS IN BUYING PROCESS FOR TOP THREE APPLICATIONS (%)

5.3.4.2 Buying criteria

FIGURE 21 KEY BUYING CRITERIA FOR TOP THREE APPLICATIONS

TABLE 8 KEY BUYING CRITERIA FOR TOP THREE APPLICATIONS

5.3.5 TECHNOLOGY ANALYSIS

5.3.5.1 Artificial Intelligence

5.3.5.2 Internet of Things

5.3.5.3 Dynamic Spectrum Access Technologies

5.3.5.4 Ultra-High Frequency

5.3.5.5 Very High Frequency

5.3.6 TRENDS AND DISRUPTIONS IMPACTING BUYERS

FIGURE 22 REVENUE SHIFT FOR NANOSATELLITE AND MICROSATELLITE MARKET

5.3.7 PATENT ANALYSIS

FIGURE 23 TOP 10 COMPANIES WITH HIGHEST NUMBER OF PATENT APPLICATIONS

TABLE 9 TOP 20 PATENT OWNERS

FIGURE 24 NUMBER OF PATENTS GRANTED IN 2012-2021

5.3.8 PRICING ANALYSIS

5.3.8.1 Average selling price trends based on type

TABLE 10 PRICING RANGE FOR SATELLITES

5.3.9 USE CASES

5.3.9.1 CASE STUDY 1: RACE(Rendezvous Autonomous CubeSats Experiment), is ESA’s latest in-orbit demonstration CubeSat mission

5.3.9.2 CASE STUDY 2: Blink gets a space lift

5.3.10 KEY CONFERENCES & EVENTS IN 2022

TABLE 11 MARKET: DETAILED LIST OF CONFERENCES & EVENTS

5.3.11 TARIFF AND REGULATORY IMPACT

5.3.11.1 North America

5.3.11.2 Europe

5.3.11.3 Asia Pacific

5.3.11.4 Rest of the World

6 NANOSATELLITE AND MICROSATELLITE MARKET, BY COMPONENT (Page No. - 72)

6.1 INTRODUCTION

6.1.1 COMPONENTS: MARKET DRIVERS

FIGURE 25 SOFTWARE AND DATA PROCESSING SEGMENT TO GROW AT HIGHEST CAGR DURING FORECAST PERIOD

TABLE 12 MARKET, BY COMPONENT, 2017–2021 (USD MILLION)

TABLE 13 MARKET, BY COMPONENT, 2022–2027 (USD MILLION)

6.2 HARDWARE

TABLE 14 HARDWARE: MARKET, BY REGION, 2017–2021 (USD MILLION)

TABLE 15 HARDWARE: MARKET, BY REGION, 2022–2027 (USD MILLION)

6.2.1 STRUCTURE

6.2.2 PAYLOAD

6.2.3 COMMUNICATION SYSTEM

6.2.4 ONBOARD COMPUTER

6.2.5 POWER SYSTEMS

6.2.6 PROPULSION SYSTEM

6.3 SOFTWARE AND DATA PROCESSING

TABLE 16 SOFTWARE AND DATA PROCESSING: NANOSATELLITE AND MICROSATELLITE MARKET, BY REGION, 2017–2021 (USD MILLION)

TABLE 17 SOFTWARE AND DATA PROCESSING: MARKET, BY REGION, 2022–2027 (USD MILLION)

6.3.1 COMMANDS AND DATA HANDLING

6.3.2 ATTITUDE DETERMINATION AND CONTROL SYSTEM

6.4 SPACE SERVICES

TABLE 18 SPACE SERVICES: MARKET, BY REGION, 2017–2021 (USD MILLION)

TABLE 19 SPACE SERVICES: MARKET, BY REGION, 2022–2027(USD MILLION)

6.5 LAUNCH SERVICES

TABLE 20 LAUNCH SERVICES: MARKET, BY REGION, 2017–2021 (USD MILLION)

TABLE 21 LAUNCH SERVICES: MARKET, BY REGION, 2022–2027 (USD MILLION)

7 NANOSATELLITE AND MICROSATELLITE MARKET, BY TYPE (Page No. - 81)

7.1 INTRODUCTION

7.1.1 TYPES: MARKET DRIVERS

FIGURE 26 NANOSATELLITE SEGMENT TO GROW AT HIGHER CAGR DURING FORECAST PERIOD

TABLE 22 MARKET, BY TYPE, 2017–2021 (USD MILLION)

TABLE 23 MARKET, BY TYPE, 2022–2027, (USD MILLION)

7.2 NANOSATELLITE

TABLE 24 NANOSATELLITE: MARKET, BY REGION, 2017–2021 (USD MILLION)

TABLE 25 NANOSATELLITE: MARKET, BY REGION, 2022–2027 (USD MILLION)

7.3 MICROSATELLITE

TABLE 26 MICROSATELLITE: MARKET, BY REGION, 2017–2021 (USD MILLION)

TABLE 27 MICROSATELLITE: MARKET, BY REGION, 2022–2027 (USD MILLION)

8 NANOSATELLITE AND MICROSATELLITE MARKET, BY ORGANIZATION SIZE (Page No. - 86)

8.1 INTRODUCTION

FIGURE 27 SMALL AND MEDIUM-SIZED ENTERPRISES SEGMENT TO GROW AT HIGHER CAGR DURING FORECAST PERIOD

8.1.1 ORGANIZATION SIZE: MARKET DRIVERS

TABLE 28 MARKET, BY APPLICATION, 2017–2021 (USD MILLION)

TABLE 29 MARKET, BY ORGANIZATION SIZE, 2022–2027 (USD MILLION)

8.2 LARGE ENTERPRISES

TABLE 30 LARGE ENTERPRISES: MARKET, BY REGION, 2017–2021 (USD MILLION)

TABLE 31 LARGE ENTERPRISES: MARKET, BY REGION, 2022–2027 (USD MILLION)

8.3 SMALL AND MEDIUM-SIZED ENTERPRISES

TABLE 32 SMALL AND MEDIUM-SIZED ENTERPRISES: MARKET, BY REGION, 2017–2021 (USD MILLION)

TABLE 33 SMALL AND MEDIUM-SIZED ENTERPRISES: MARKET, BY REGION, 2022–2027 (USD MILLION)

9 NANOSATELLITE AND MICROSATELLITE MARKET, BY APPLICATION (Page No. - 90)

9.1 INTRODUCTION

9.1.1 APPLICATIONS: MARKET DRIVERS

FIGURE 28 EARTH OBSERVATION AND REMOTE SENSING SEGMENT TO GROW AT HIGHEST CAGR DURING FORECAST PERIOD

TABLE 34 MARKET, BY APPLICATION, 2017–2021 (USD MILLION)

TABLE 35 MARKET, BY APPLICATION, 2022–2027 (USD MILLION)

9.2 COMMUNICATION

TABLE 36 COMMUNICATION: MARKET, BY REGION, 2017–2021 (USD MILLION)

TABLE 37 COMMUNICATION: MARKET, BY REGION, 2022–2027 (USD MILLION)

9.3 EARTH OBSERVATION AND REMOTE SENSING

TABLE 38 EARTH OBSERVATION AND REMOTE SENSING: MARKET, BY REGION, 2017–2021 (USD MILLION)

TABLE 39 EARTH OBSERVATION AND REMOTE SENSING: MARKET, BY REGION, 2022–2027 (USD MILLION)

9.4 SCIENTIFIC RESEARCH

TABLE 40 SCIENTIFIC RESEARCH: MARKET, BY REGION, 2017–2021 (USD MILLION)

TABLE 41 SCIENTIFIC RESEARCH: NANOSATELLITE AND MICROSATELLITE MARKET, BY REGION, 2022–2027 (USD MILLION)

9.5 BIOLOGICAL EXPERIMENTS

TABLE 42 BIOLOGICAL EXPERIMENTS: MARKET, BY REGION, 2017–2021 (USD MILLION)

TABLE 43 BIOLOGICAL EXPERIMENTS: MARKET, BY REGION, 2022–2027 (USD MILLION)

9.6 TECHNOLOGY DEMONSTRATION AND VERIFICATION

TABLE 44 TECHNOLOGY DEMONSTRATION AND VERIFICATION: MARKET, BY REGION, 2017–2021 (USD MILLION)

TABLE 45 TECHNOLOGY DEMONSTRATION AND VERIFICATION: MARKET, BY REGION, 2022–2027 (USD MILLION)

9.7 ACADEMIC TRAINING

TABLE 46 ACADEMIC TRAINING: MARKET, BY REGION, 2017–2021 (USD MILLION)

TABLE 47 ACADEMIC TRAINING: MARKET, BY REGION, 2022–2027 (USD MILLION)

9.8 MAPPING AND NAVIGATION

TABLE 48 MAPPING AND NAVIGATION: MARKET, BY REGION, 2017–2021 (USD MILLION)

TABLE 49 MAPPING AND NAVIGATION: MARKET, BY REGION, 2022–2027 (USD MILLION)

9.9 RECONNAISSANCE

TABLE 50 RECONNAISSANCE: MARKET, BY REGION, 2017–2021 (USD MILLION)

TABLE 51 RECONNAISSANCE: MARKET, BY REGION, 2022–2027 (USD MILLION)

10 NANOSATELLITE AND MICROSATELLITE MARKET, BY ORBIT (Page No. - 101)

10.1 INTRODUCTION

10.2 NON-POLAR INCLINED

10.3 SUN-SYNCHRONOUS ORBIT

10.4 POLAR ORBIT

11 NANOSATELLITE AND MICROSATELLITE MARKET, BY VERTICAL (Page No. - 102)

11.1 INTRODUCTION

11.1.1 VERTICAL: MARKET DRIVERS

FIGURE 29 COMMERCIAL SEGMENT TO GROW AT HIGHEST CAGR DURING FORECAST PERIOD

TABLE 52 MARKET, BY VERTICAL, 2017–2021 (USD MILLION)

TABLE 53 MARKET, BY VERTICAL, 2022–2027 (USD MILLION)

11.2 GOVERNMENT

TABLE 54 GOVERNMENT: MARKET, BY REGION, 2017–2021 (USD MILLION)

TABLE 55 GOVERNMENT: MARKET, BY REGION, 2022–2027 (USD MILLION)

11.3 CIVIL

TABLE 56 CIVIL: MARKET, BY REGION, 2017–2021 (USD MILLION)

TABLE 57 CIVIL: MARKET, BY REGION, 2022–2027 (USD MILLION)

11.4 COMMERCIAL

TABLE 58 COMMERCIAL: MARKET, BY REGION, 2017–2021 (USD MILLION)

TABLE 59 COMMERICAL: MARKET, BY REGION, 2022–2027 (USD MILLION)

11.5 DEFENSE

TABLE 60 DEFENSE: NANOSATELLITE AND MICROSATELLITE MARKET, BY REGION, 2017–2021 (USD MILLION)

TABLE 61 DEFENSE: MARKET, BY REGION, 2022–2027 (USD MILLION)

11.6 ENERGY AND INFRASTRUCTURE

TABLE 62 ENERGY AND INFRASTRUCTURE: MARKET, BY REGION, 2017–2021 (USD MILLION)

TABLE 63 ENERGY AND INFRASTRUCTURE: MARKET, BY REGION, 2022–2027 (USD MILLION)

11.7 MARITIME AND TRANSPORTATION

TABLE 64 MARITIME AND TRANSPORTATION: MARKET, BY REGION, 2017–2021 (USD MILLION)

TABLE 65 MARITIME AND TRANSPORTATION: MARKET, BY REGION, 2022–2027 (USD MILLION)

12 NANOSATELLITE AND MICROSATELLITE MARKET, BY FREQUENCY (Page No. - 111)

12.1 INTRODUCTION

12.1.1 FREQUENCY: MARKET DRIVERS

FIGURE 30 S-BAND TO GROW AT HIGHEST CAGR DURING FORECAST PERIOD

TABLE 66 MARKET, BY FREQUENCY, 2017–2021 (USD MILLION)

TABLE 67 MARKET, BY FREQUENCY, 2022–2027 (USD MILLION)

12.2 UHF-BAND

TABLE 68 UHF-BAND: MARKET, BY REGION, 2017–2021 (USD MILLION)

TABLE 69 UHF-BAND: MARKET, BY REGION, 2022–2027 (USD MILLION)

12.3 VHF-BAND

TABLE 70 VHF-BAND: MARKET, BY REGION, 2017–2021 (USD MILLION)

TABLE 71 VHF-BAND: MARKET, BY REGION, 2022–2027 (USD MILLION)

12.4 S-BAND

TABLE 72 S-BAND: NANOSATELLITE AND MICROSATELLITE MARKET, BY REGION, 2017–2021 (USD MILLION)

TABLE 73 S-BAND: MARKET, BY REGION, 2022–2027 (USD MILLION)

12.5 X-BAND

TABLE 74 X-BAND: MARKET, BY REGION, 2017–2021 (USD MILLION)

TABLE 75 X-BAND: MARKET, BY REGION, 2022–2027 (USD MILLION)

12.6 KA-BAND

TABLE 76 KA-BAND: MARKET, BY REGION, 2017–2021 (USD MILLION)

TABLE 77 KA-BAND: MARKET, BY REGION, 2022–2027 (USD MILLION)

12.7 OTHERS

TABLE 78 OTHERS: MARKET, BY REGION, 2017–2021 (USD MILLION)

TABLE 79 OTHERS: MARKET, BY REGION, 2022–2027 (USD MILLION)

13 NANOSATELLITE AND MICROSATELLITE MARKET, BY REGION (Page No. - 120)

13.1 INTRODUCTION

FIGURE 31 EUROPE TO GROW AT HIGHEST CAGR DURING FORECAST PERIOD

TABLE 80 MARKET, BY REGION, 2017–2021 (USD MILLION)

TABLE 81 LLITE MARKET, BY REGION, 2022–2027 (USD MILLION)

13.2 NORTH AMERICA

13.2.1 NORTH AMERICA: PESTLE ANALYSIS

FIGURE 32 NORTH AMERICA: MARKET SNAPSHOT

TABLE 82 NORTH AMERICA: NANOSATELLITE AND MICROSATELLITE MARKET, BY COMPONENT, 2017–2021 (USD MILLION)

TABLE 83 NORTH AMERICA: MARKET, BY COMPONENT, 2022–2027 (USD MILLION)

TABLE 84 NORTH AMERICA: MARKET, BY TYPE, 2017–2021 (USD MILLION)

TABLE 85 NORTH AMERICA: MARKET, BY TYPE, 2022–2027 (USD MILLION)

TABLE 86 NORTH AMERICA: MARKET, BY ORGANIZATION SIZE, 2017–2021 (USD MILLION)

TABLE 87 NORTH AMERICA: MARKET, BY ORGANIZATION SIZE, 2022–2027 (USD MILLION)

TABLE 88 NORTH AMERICA: MARKET, BY APPLICATION, 2017–2021 (USD MILLION)

TABLE 89 NORTH AMERICA: MARKET, BY APPLICATION, 2022–2027 (USD MILLION)

TABLE 90 NORTH AMERICA: MARKET, BY VERTICAL, 2017–2021 (USD MILLION)

TABLE 91 NORTH AMERICA: MARKET, BY VERTICAL, 2022–2027 (USD MILLION)

TABLE 92 NORTH AMERICA: MARKET, BY FREQUENCY, 2017–2021 (USD MILLION)

TABLE 93 NORTH AMERICA: MARKET, BY FREQUENCY, 2022–2027 (USD MILLION)

TABLE 94 NORTH AMERICA: MARKET, BY COUNTRY, 2017–2021 (USD MILLION)

TABLE 95 NORTH AMERICA: ICROSATELLITE MARKET, BY COUNTRY, 2022–2027 (USD MILLION)

13.2.2 US

13.2.2.1 Use of nanosatellites and microsatellites in agriculture

TABLE 96 US: NANOSATELLITE AND MICROSATELLITE MARKET, BY COMPONENT, 2017–2021 (USD MILLION)

TABLE 97 US: MARKET, BY COMPONENT, 2022–2027 (USD MILLION)

TABLE 98 US: MARKET, BY TYPE, 2017–2021 (USD MILLION)

TABLE 99 US: MARKET, BY TYPE, 2022–2027 (USD MILLION)

TABLE 100 US: MARKET, BY ORGANIZATION SIZE, 2017–2021 (USD MILLION)

TABLE 101 US: MARKET, BY ORGANIZATION SIZE, 2022–2027 (USD MILLION)

TABLE 102 US: MARKET, BY APPLICATION, 2017–2021 (USD MILLION)

TABLE 103 US: MARKET, BY APPLICATION, 2022–2027 (USD MILLION)

TABLE 104 US: MARKET, BY VERTICAL, 2017–2021 (USD MILLION)

TABLE 105 US: MARKET, BY VERTICAL, 2022–2027 (USD MILLION)

TABLE 106 US: MARKET, BY FREQUENCY, 2017–2021 (USD MILLION)

TABLE 107 US: MARKET, BY FREQUENCY, 2022–2027 (USD MILLION)

13.2.3 CANADA

13.2.3.1 Government initiatives to drive market

13.3 EUROPE

13.3.1 EUROPE: PESTLE ANALYSIS

FIGURE 33 EUROPE: MARKET SNAPSHOT

TABLE 108 EUROPE: NANOSATELLITE AND MICROSATELLITE MARKET, BY COMPONENT, 2017–2021 (USD MILLION)

TABLE 109 EUROPE: MARKET, BY COMPONENT, 2022–2027 (USD MILLION)

TABLE 110 EUROPE: MARKET, BY TYPE, 2017–2021 (USD MILLION)

TABLE 111 EUROPE: MARKET, BY TYPE, 2022–2027 (USD MILLION)

TABLE 112 EUROPE: MARKET, BY ORGANIZATION SIZE, 2017–2021 (USD MILLION)

TABLE 113 EUROPE: MARKET, BY ORGANIZATION SIZE, 2022–2027 (USD MILLION)

TABLE 114 EUROPE: MARKET, BY APPLICATION, 2017–2021 (USD MILLION)

TABLE 115 EUROPE: MARKET, BY APPLICATION, 2022–2027 (USD MILLION)

TABLE 116 EUROPE: MARKET, BY VERTICAL, 2017–2021 (USD MILLION)

TABLE 117 EUROPE: MARKET, BY VERTICAL, 2022–2027 (USD MILLION)

TABLE 118 EUROPE: MARKET, BY FREQUENCY, 2017–2021 (USD MILLION)

TABLE 119 EUROPE: MARKET, BY FREQUENCY, 2022–2027 (USD MILLION)

TABLE 120 EUROPE: MARKET, BY COUNTRY, 2017–2021 (USD MILLION)

TABLE 121 EUROPE: MARKET, BY COUNTRY, 2022–2027 (USD MILLION)

13.3.2 UK

13.3.2.1 Innovations in satellite technologies to drive market

TABLE 122 UK: NANOSATELLITE AND MICROSATELLITE MARKET, BY COMPONENT, 2017–2021 (USD MILLION)

TABLE 123 UK: MARKET, BY COMPONENT, 2022–2027 (USD MILLION)

TABLE 124 UK: MARKET, BY TYPE, 2017–2021 (USD MILLION)

TABLE 125 UK: MARKET, BY TYPE, 2022–2027 (USD MILLION)

TABLE 126 UK: MARKET, BY ORGANIZATION SIZE, 2017–2021 (USD MILLION)

TABLE 127 UK: MARKET, BY ORGANIZATION SIZE, 2022–2027 (USD MILLION)

TABLE 128 UK: MARKET, BY APPLICATION, 2017–2021 (USD MILLION)

TABLE 129 UK: MARKET, BY APPLICATION, 2022–2027 (USD MILLION)

TABLE 130 UK: MARKET, BY VERTICAL, 2017–2021 (USD MILLION)

TABLE 131 UK: MARKET, BY VERTICAL, 2022–2027 (USD MILLION)

TABLE 132 UK: MARKET, BY FREQUENCY, 2017–2021 (USD MILLION)

TABLE 133 UK: MARKET, BY FREQUENCY, 2022–2027 (USD MILLION)

13.3.3 RUSSIA

13.3.3.1 Reliance on self-developed space systems to drive market

TABLE 134 RUSSIA: NANOSATELLITE AND MICROSATELLITE MARKET, BY COMPONENT, 2017–2021 (USD MILLION)

TABLE 135 RUSSIA: MARKET, BY COMPONENT, 2022–2027 (USD MILLION)

TABLE 136 RUSSIA: MARKET, BY TYPE, 2017–2021 (USD MILLION)

TABLE 137 RUSSIA: MARKET, BY TYPE, 2022–2027 (USD MILLION)

TABLE 138 RUSSIA: MARKET, BY ORGANIZATION SIZE, 2017–2021 (USD MILLION)

TABLE 139 RUSSIA: MARKET, BY ORGANIZATION SIZE, 2022–2027 (USD MILLION)

TABLE 140 RUSSIA: MARKET, BY APPLICATION, 2017–2021 (USD MILLION)

TABLE 141 RUSSIA: MARKET, BY APPLICATION, 2022–2027 (USD MILLION)

TABLE 142 RUSSIA: MARKET, BY VERTICAL, 2017–2021 (USD MILLION)

TABLE 143 RUSSIA: MARKET, BY VERTICAL, 2022–2027 (USD MILLION)

TABLE 144 RUSSIA: MARKET, BY FREQUENCY, 2017–2021 (USD MILLION)

TABLE 145 RUSSIA: MARKET, BY FREQUENCY, 2022–2027 (USD MILLION)

13.3.4 FRANCE

13.3.4.1 Government encourages to use nanosatellites and microsatellites

13.3.5 REST OF EUROPE

13.4 ASIA PACIFIC

13.4.1 ASIA PACIFIC: PESTLE ANALYSIS

TABLE 146 ASIA PACIFIC: NANOSATELLITE AND MICROSATELLITE MARKET, BY COMPONENT, 2017–2021 (USD MILLION)

TABLE 147 ASIA PACIFIC: MARKET, BY COMPONENT, 2022–2027 (USD MILLION)

TABLE 148 ASIA PACIFIC: MARKET, BY TYPE, 2017–2021 (USD MILLION)

TABLE 149 ASIA PACIFIC: MARKET, BY TYPE, 2022–2027 (USD MILLION)

TABLE 150 ASIA PACIFIC: MARKET, BY ORGANIZATION SIZE, 2017–2021 (USD MILLION)

TABLE 151 ASIA PACIFIC: MARKET, BY ORGANIZATION SIZE, 2022–2027 (USD MILLION)

TABLE 152 ASIA PACIFIC: MARKET, BY APPLICATION, 2017–2021 (USD MILLION)

TABLE 153 ASIA PACIFIC: MARKET, BY APPLICATION, 2022–2027 (USD MILLION)

TABLE 154 ASIA PACIFIC: MARKET, BY VERTICAL, 2017–2021 (USD MILLION)

TABLE 155 ASIA PACIFIC: MARKET, BY VERTICAL, 2022–2027 (USD MILLION)

TABLE 156 ASIA PACIFIC: MARKET, BY FREQUENCY, 2017–2021 (USD MILLION)

TABLE 157 ASIA PACIFIC: MARKET, BY FREQUENCY, 2022–2027 (USD MILLION)

TABLE 158 ASIA PACIFIC: MARKET, BY COUNTRY, 2017–2021 (USD MILLION)

TABLE 159 ASIA PACIFIC: MARKET, BY COUNTRY, 2022–2027 (USD MILLION)

13.4.2 CHINA

13.4.2.1 Dependence on self-made space technology to increase satellite launches

TABLE 160 CHINA: NANOSATELLITE AND MICROSATELLITE MARKET, BY COMPONENT, 2017–2021 (USD MILLION)

TABLE 161 CHINA: MARKET, BY COMPONENT, 2022–2027 (USD MILLION)

TABLE 162 CHINA: MARKET, BY TYPE, 2017–2021 (USD MILLION)

TABLE 163 CHINA: MARKET, BY TYPE, 2022–2027 (USD MILLION)

TABLE 164 CHINA: MARKET, BY ORGANIZATION SIZE, 2017–2021 (USD MILLION)

TABLE 165 CHINA: MARKET, BY ORGANIZATION SIZE, 2022–2027 (USD MILLION)

TABLE 166 CHINA: MARKET, BY APPLICATION, 2017–2021 (USD MILLION)

TABLE 167 CHINA: MARKET, BY APPLICATION, 2022–2027 (USD MILLION)

TABLE 168 CHINA: MARKET, BY VERTICAL, 2017–2021 (USD MILLION)

TABLE 169 CHINA: MARKET, BY VERTICAL, 2022–2027 (USD MILLION)

TABLE 170 CHINA: MARKET, BY FREQUENCY, 2017–2021 (USD MILLION)

TABLE 171 CHINA: MARKET, BY FREQUENCY, 2022–2027 (USD MILLION)

13.4.3 JAPAN

13.4.3.1 Involvement of private space companies in government space programs to drive market

13.4.4 INDIA

13.4.4.1 Upcoming space initiatives to drive market

13.4.5 REST OF ASIA PACIFIC

13.5 REST OF WORLD

13.5.1 REST OF WORLD: PESTLE ANALYSIS

TABLE 172 REST OF THE WORLD: NANOSATELLITE AND MICROSATELLITE MARKET, BY COMPONENT, 2017–2021 (USD MILLION)

TABLE 173 REST OF THE WORLD: MARKET, BY COMPONENT, 2022–2027 (USD MILLION)

TABLE 174 REST OF THE WORLD: MARKET, BY TYPE, 2017–2021 (USD MILLION)

TABLE 175 REST OF THE WORLD: MARKET, BY TYPE, 2022–2027 (USD MILLION)

TABLE 176 REST OF THE WORLD: MARKET, BY ORGANIZATION SIZE, 2017–2021 (USD MILLION)

TABLE 177 REST OF THE WORLD: MARKET, BY ORGANIZATION SIZE, 2022–2027 (USD MILLION)

TABLE 178 REST OF THE WORLD: MARKET, BY APPLICATION, 2017–2021 (USD MILLION)

TABLE 179 REST OF THE WORLD: MARKET, BY APPLICATION, 2022–2027 (USD MILLION)

TABLE 180 REST OF THE WORLD: MARKET, BY VERTICAL, 2017–2021 (USD MILLION)

TABLE 181 REST OF THE WORLD: MARKET, BY VERTICAL, 2022–2027 (USD MILLION)

TABLE 182 REST OF THE WORLD: MARKET, BY FREQUENCY, 2017–2021 (USD MILLION)

TABLE 183 REST OF THE WORLD: MARKET, BY FREQUENCY, 2022–2027 (USD MILLION)

TABLE 184 REST OF THE WORLD: MARKET, BY COUNTRY, 2017–2021 (USD MILLION)

TABLE 185 REST OF THE WORLD: MARKET, BY COUNTRY, 2022–2027 (USD MILLION)

13.5.2 MIDDLE EAST

13.5.2.1 Increased private investments in space technology

13.5.3 AFRICA

13.5.3.1 Countries joining African satellite owners club to drive market

13.5.4 LATIN AMERICA

13.5.4.1 Low-cost solutions for defense and intelligence to drive market

14 COMPETITIVE LANDSCAPE (Page No. - 170)

14.1 OVERVIEW

14.2 MARKET EVALUATION FRAMEWORK

FIGURE 34 MARKET EVALUATION FRAMEWORK, 2019–2021

14.3 COMPETITIVE SCENARIO AND TRENDS

14.3.1 PRODUCT LAUNCHES

TABLE 186 NANOSATELLITE AND MICROSATELLITE MARKET: PRODUCT LAUNCHES, 2019-2021

14.3.2 DEALS

TABLE 187 DEALS, 2019-2021

14.4 MARKET SHARE ANALYSIS OF TOP PLAYERS

TABLE 188 MARKET: DEGREE OF COMPETITION

FIGURE 35 MARKET SHARE ANALYSIS OF COMPANIES

14.5 HISTORICAL REVENUE ANALYSIS

FIGURE 36 HISTORICAL REVENUE ANALYSIS, 2017-2021

14.6 COMPANY EVALUATION MATRIX OVERVIEW

14.6.1 COMPANY EVALUATION MATRIX METHODOLOGY AND DEFINITIONS

TABLE 189 PRODUCT FOOTPRINT WEIGHTAGE

14.6.2 STARS

14.6.3 EMERGING LEADERS

14.6.4 PERVASIVE PLAYERS

14.6.5 PARTICIPANTS

FIGURE 37 NANOSATELLITE AND MICROSATELLITE MARKET: COMPANY EVALUATION MATRIX (2022)

14.7 COMPANY PRODUCT FOOTPRINT ANALYSIS

TABLE 190 COMPANY PRODUCT FOOTPRINT

TABLE 191 COMPANY COMPONENT FOOTPRINT

TABLE 192 VERTICAL FOOTPRINT

TABLE 193 COMPANY REGION FOOTPRINT

14.8 COMPANY MARKET RANKING ANALYSIS

FIGURE 38 RANKING OF KEY PLAYERS IN THE MARKET (2022)

14.9 START-UP/SME EVALUATION MATRIX METHODOLOGY AND DEFINITIONS

FIGURE 39 START-UPS/SME EVALUATION MATRIX: CRITERIA WEIGHTAGE

TABLE 194 START-UP/SME EVALUATION MATRIX: CRITERIA WEIGHTAGE

14.9.1 PROGRESSIVE COMPANIES

14.9.2 RESPONSIVE COMPANIES

14.9.3 DYNAMIC COMPANIES

14.9.4 STARTING BLOCKS

FIGURE 40 NANOSATELLITE AND MICROSATELLITE MARKET: STARTUP EVALUATION MATRIX (2022)

14.10 COMPETITIVE BENCHMARKING FOR SME/START-UPS

TABLE 195 MARKET: DETAILED LIST OF KEY START-UP/SMES

TABLE 196 MARKET: COMPETITIVE BENCHMARKING OF KEY PLAYERS (START-UPS/SMES)

TABLE 197 MARKET: COMPETITIVE BENCHMARKING OF KEY PLAYERS (START-UPS/SMES)

15 COMPANY PROFILES (Page No. - 188)

15.1 KEY PLAYERS

(Business Overview, Products, Solutions & Services, Recent Developments, MnM View)*

15.1.1 GOMSPACE

TABLE 198 GOMSPACE: BUSINESS OVERVIEW

FIGURE 41 GOMSPACE: COMPANY SNAPSHOT

TABLE 199 GOMSPACE: PRODUCT/SOLUTIONS/SERVICES OFFERED

TABLE 200 GOMSPACE: PRODUCT LAUNCHES

TABLE 201 GOMSPACE: DEALS

15.1.2 LOCKHEED MARTIN

TABLE 202 LOCKHEED MARTIN: BUSINESS OVERVIEW

FIGURE 42 LOCKHEED MARTIN: COMPANY SNAPSHOT

TABLE 203 LOCKHEED MARTIN: PRODUCTS/SOLUTIONS/SERVICES OFFERED

TABLE 204 LOCKHEED MARTIN: PRODUCT LAUNCHES

TABLE 205 LOCKHEED MARTIN: DEALS

15.1.3 L3HARRIS

TABLE 206 L3HARRIS: BUSINESS OVERVIEW

FIGURE 43 L3HARRIS: COMPANY SNAPSHOT

TABLE 207 L3HARRIS: PRODUCTS/SOLUTIONS/SERVICES OFFERED

TABLE 208 L3HARRIS: PRODUCT LAUNCHES

TABLE 209 L3HARRIS: DEALS

15.1.4 SIERRA NEVADA CORPORATION

TABLE 210 SIERRA NEVADA CORPORATION: BUSINESS OVERVIEW

TABLE 211 SIERRA NEVADA CORPORATION: PRODUCTS/SOLUTIONS/SERVICES OFFERED

TABLE 212 SIERRA NEVADA CORPORATION: PRODUCT LAUNCHES

TABLE 213 SIERRA NEVADA CORPORATION: DEALS

15.1.5 AAC CLYDE SPACE

TABLE 214 AAC CLYDE SPACE: BUSINESS OVERVIEW

FIGURE 44 AAC CLYDE SPACE: COMPANY SNAPSHOT

TABLE 215 AAC CLYDE SPACE: PRODUCTS/SOLUTIONS/SERVICES OFFERED

TABLE 216 AAC CLYDE SPACE: PRODUCT LAUNCHES

TABLE 217 AAC CLYDE SPACE: DEALS

15.1.6 PLANET LABS

TABLE 218 PLANET LABS: BUSINESS OVERVIEW

FIGURE 45 PLANET LABS: COMPANY SNAPSHOT

TABLE 219 PLANET LABS: PRODUCTS/SOLUTIONS/SERVICES OFFERED

TABLE 220 PLANET LABS: PRODUCT LAUNCHES

TABLE 221 PLANET LABS: DEALS

15.1.7 SURREY SATELLITE TECHNOLOGY

TABLE 222 SURREY SATELLITE TECHNOLOGY: BUSINESS OVERVIEW

TABLE 223 SURREY SATELLITE TECHNOLOGY: PRODUCTS/SOLUTIONS/SERVICES OFFERED

TABLE 224 SURREY SATELLITE TECHNOLOGY: PRODUCT LAUNCHES

TABLE 225 SURREY SATELLITE TECHNOLOGY: DEALS

15.1.8 NORTHROP GRUMMAN

TABLE 226 NORTHROP GRUMMAN: BUSINESS OVERVIEW

FIGURE 46 NORTHROP GRUMMAN: COMPANY SNAPSHOT

TABLE 227 NORTHROP GRUMMAN: PRODUCT/SOLUTIONS/SERVICES OFFERED

15.1.8.3 Recent developments

TABLE 228 NORTHROP GRUMMAN: DEALS

15.1.9 OHB SE

TABLE 229 OHB SE: BUSINESS OVERVIEW

FIGURE 47 OHB SE: COMPANY SNAPSHOT

TABLE 230 OHB SE: PRODUCTS/SOLUTIONS/SERVICES OFFERED

TABLE 231 OHB SE: PRODUCT LAUNCHES

TABLE 232 OHB SE: DEALS

15.1.10 TYVAK

TABLE 233 TYVAK: BUSINESS OVERVIEW

TABLE 234 TYVAK: PRODUCTS/SOLUTIONS/SERVICES OFFERED

TABLE 235 TYVAK: PRODUCT LAUNCHES

15.1.11 RAYTHEON INTELLIGENCE & SPACE

15.1.12 PUMPKIN

15.1.13 BEYOND GRAVITY

15.1.14 MILLENNIUM SPACE SYSTEMS

15.1.15 EXOLAUNCH

15.1.16 NANOAVIONICS

15.1.17 GAUSS

15.1.18 AXELSPACE

15.1.19 SPIRE GLOBAL

*Details on Business Overview, Products, Solutions & Services, Recent Developments, MnM View might not be captured in case of unlisted companies.

15.2 STARTUP AND SMES

15.2.1 C3S

15.2.2 SWARM

15.2.3 ALEN SPACE

15.2.4 DAURIA AEROSPACE

15.2.5 SATLANTIS

15.2.6 DHRUVA SPACE

15.2.7 ASTROCAST

15.2.8 KEPLER AEROSPACE

16 ADJACENT AND RELATED MARKETS (Page No. - 234)

16.1 INTRODUCTION

16.1.1 LIMITATIONS

16.2 SMALL SATELLITE MARKET

16.2.1 MARKET DEFINITION

16.2.2 MARKET OVERVIEW

16.2.2.1 Small Satellite Market, By Subsystem

TABLE 236 SMALL SATELLITE MARKET, BY SUBSYSTEM, 2021–2026 (USD MILLION)

16.2.2.2 Small Satellite Market, By End User

TABLE 237 SMALL SATELLITE MARKET, BY END-USE, 2021–2026 (USD MILLION)

TABLE 238 SMALL SATELLITE MARKET, BY COMMERCIAL END USER, 2021–2026 (USD MILLION)

16.2.2.3 Small Satellite Market, By Application

TABLE 239 SMALL SATELLITE MARKET, BY APPLICATION, 2021–2026 (USD MILLION)

16.2.2.4 Small Satellite Market, By Frequency

TABLE 240 SMALL SATELLITE MARKET, BY FREQUENCY, 2021–2026 (USD MILLION)

16.2.2.5 Small Satellite Market, By Region

TABLE 241 SMALL SATELLITE MARKET, BY REGION, 2021–2026 (USD MILLION)

TABLE 242 NORTH AMERICA: SMALL SATELLITE MARKET, BY MASS, 2021–2026 (USD MILLION)

TABLE 243 EUROPE: SMALL SATELLITE MARKET, BY MASS, 2021–2026 (USD MILLION)

16.2.3 LEO SATELLITE MARKET

16.2.3.1 Market definition

16.2.3.2 Market overview

16.2.3.3 LEO Satellite Market, By Type

TABLE 244 LEO SATELLITE MARKET SIZE, BY SATELLITE TYPE, 2021–2026 (USD MILLION)

TABLE 245 LEO SATELLITE MARKET SIZE, BY SMALL SATELLITE, 2021–2026 (USD MILLION)

16.2.3.4 LEO Satellite Market, By Subsystem

TABLE 246 LEO SATELLITE MARKET, BY SUBSYSTEM, 2021–2026 (USD MILLION)

TABLE 247 SATELLITE BUS MARKET, BY SUBTYPE, 2021–2026 (USD MILLION)

TABLE 248 PROPULSION SYSTEM MARKET, BY TYPE, 2021–2026 (USD MILLION)

16.2.3.5 LEO Satellite Market, By Application

TABLE 249 LEO SATELLITE MARKET, BY APPLICATION, 2021–2026 (USD MILLION)

16.2.3.6 LEO Satellite Market, By End User

TABLE 250 LEO SATELLITE MARKET, BY END USER, 2021–2026 (USD MILLION)

16.2.4 SATELLITE COMMUNICATION (SATCOM) EQUIPMENT MARKET

16.2.4.1 Market definition

16.2.4.2 Market overview

16.2.4.3 Satellite Communication (SATCOM) Equipment Market, By Solution

TABLE 251 SATCOM EQUIPMENT MARKET, BY SOLUTION, 2017–2020 (USD MILLION)

TABLE 252 SATCOM EQUIPMENT MARKET, BY SOLUTION, 2021–2026 (USD MILLION)

16.2.4.4 Satellite Communication (SATCOM) Equipment Market, By Platform

TABLE 253 SATCOM EQUIPMENT MARKET, BY PLATFORM, 2017–2020 (USD MILLION)

TABLE 254 SATCOM EQUIPMENT MARKET, BY PLATFORM, 2021–2026 (USD MILLION)

16.2.4.5 Satellite Communication (SATCOM) Equipment Market, By Technology

TABLE 255 SATELLITE COMMUNICATION EQUIPMENT MARKET, BY TECHNOLOGY, 2017–2020 (USD MILLION)

TABLE 256 SATELLITE COMMUNICATION EQUIPMENT MARKET, BY TECHNOLOGY, 2021–2026 (USD MILLION)

16.2.4.6 Satellite Communication (SATCOM) Equipment Market, By Vertical

TABLE 257 SATCOM EQUIPMENT MARKET, BY VERTICAL, 2017–2020 (USD MILLION)

TABLE 258 SATCOM EQUIPMENT MARKET, BY VERTICAL, 2021–2026 (USD MILLION)

17 APPENDIX (Page No. - 246)

17.1 DISCUSSION GUIDE

17.2 KNOWLEDGESTORE: MARKETSANDMARKETS’ SUBSCRIPTION PORTAL

17.3 AVAILABLE CUSTOMIZATIONS

17.4 RELATED REPORTS

17.5 AUTHOR DETAILS

The study involved four major activities in estimating the current size of the nanosatellite and microsatellite market. Exhaustive secondary research was done to collect information on the industry. The next step was to validate these findings, assumptions, and sizing with industry experts across the value chain using primary research. Both top-down and bottom-up approaches were employed to estimate the total market size. After that, the market breakup and data triangulation procedures were used to estimate the market size of the segments and sub segments of the nanosatellite and microsatellite market.

Secondary Research

In the secondary research process, various secondary sources were referred to for identifying and collecting information for the study. The secondary sources included companies’ annual reports, press releases, and investor presentations, and white papers; certified publications, such as Institute of Electrical and Electronics Engineers (IEEE), nanosatellite and microsatellite Journal, NASA, ESA, UCS Satellite Database, Committee on Earth Observation Satellites (CEOS), Nanosats Database (Erik Kulu); and articles from recognized associations and government publishing sources. Secondary research was mainly used to obtain key information about the industry’s value chain, the total pool of key players, market classification, and segmentation according to industry trends to the bottom-most level, regional markets, and key developments from both market- and technology-oriented perspectives.

Primary Research

In the primary research process, various primary sources from both supply and demand sides were interviewed to obtain qualitative and quantitative information for the report. The primary sources from the supply side included industry experts, such as Chief Executive Officers (CEOs), Vice Presidents (VPs), marketing directors, technology and innovation directors, and related key executives from various key companies and organizations providing nanosatellite and microsatellite software and solutions. The primary sources from the demand side included end users, such as Chief Information Officers (CIOs), consultants, service professionals, technicians and technologists, and managers at public and investor-owned utilities. In the market engineering process, both top-down and bottom-up approaches were extensively used, along with several data triangulation methods, to perform market estimation and market forecasting for the overall market segments and subsegments listed in the report. Extensive qualitative and quantitative analyses were performed on the complete market engineering process to list key information/insights throughout the report.

To know about the assumptions considered for the study, download the pdf brochure

Market Size Estimation

Multiple approaches were adopted for the estimation and forecasting of the nanosatellite and microsatellite market. The first approach involves the estimation of the market size through the summation of companies’ revenue generated through the sales of hardware, software, and services. This entire procedure has studied the annual and financial reports of top market players and extensive interviews of industry leaders, such as CEOs, VPs, directors, and marketing executives of leading companies, for key insights. All percentage splits and breakups have been determined using secondary sources and verified through primary sources. All possible parameters that affect the market covered in this research study have been accounted for, viewed in extensive detail, verified through primary research, and analyzed to arrive at the final quantitative and qualitative data. This data has been consolidated and enhanced with detailed inputs and analysis from MarketsandMarkets.

Data Triangulation

After arriving at the overall market size—using the market size estimation processes as explained above—the market was split into several segments and subsegments. In order to complete the overall market engineering process and arrive at the exact statistics of each market segment and subsegment, the data triangulation and market breakdown procedures were employed, wherever applicable.

Report Objectives

- To determine and forecast the global nanosatellite and microsatellite market based on component, type, organization size, deployment mode, application, vertical, orbit, frequency and region from 2017 to 2027, and analyze various macro and microeconomic factors that affect the market growth.

- To forecast the size of the market’s segments with respect to five main regions: North America, Europe, Asia Pacific (APAC), and Rest of the World (RoW).

- To provide detailed information about the major factors (drivers, opportunities, threats, and challenges) influencing the growth of the market

- To analyze each submarket with respect to individual growth trends, prospects, and contributions to the total market

- To analyze opportunities in the market for stakeholders by identifying the high-growth segments of the nanosatellite and microsatellite market

- To profile key market players (such as top vendors and startups); provide a comparative analysis based on their business overviews, regional presence, product offerings, business strategies, and key financials; and illustrate the market’s competitive landscape

- To track and analyze competitive developments, such as mergers and acquisitions (M&As), product developments, partnerships and collaborations, and Research and Development (R&D) activities, in the market

Artificial Satellites Market & Its Impact on the Nanosatellite and Microsatellite Market

The overall growth of the artificial satellite market has a significant impact on the nanosatellite and microsatellite market. The demand for artificial satellites in various sectors such as communication, earth observation, navigation, and scientific research is expected to continue growing in the coming years. This growth will create opportunities for the nanosatellite and microsatellite market as well, as these smaller satellites can provide a cost-effective solution for many of the same applications.

One of the key drivers for the growth of the nanosatellite and microsatellite market is the increasing demand for Earth observation and remote sensing applications. Nanosatellites and microsatellites can provide high-resolution imagery of the Earth's surface, which is useful for a variety of applications, including weather forecasting, disaster response, and resource management. As the demand for this type of data continues to grow, the market for nanosatellites and microsatellites is expected to grow as well.

Another driver for the nanosatellite and microsatellite market is the increasing demand for low-cost and flexible satellite solutions. Smaller satellites are generally cheaper to build and launch than larger satellites, making them an attractive option for many organizations. This is particularly true for startups and smaller companies that may not have the resources to build and launch traditional satellites.

Overall, the growth of the artificial satellite market is likely to create significant opportunities for the nanosatellite and microsatellite market in the coming years. As the demand for satellite applications continues to grow, the demand for smaller, more affordable satellites is expected to grow as well.

New Business Opportunities in Artificial Satellites Market:

The artificial satellite market offers a wide range of new business opportunities across various sectors. Here are a few examples:

- Satellite manufacturing: The demand for artificial satellites is growing rapidly, and many companies are now investing in satellite manufacturing. This includes traditional satellite manufacturers as well as new startups that are developing innovative satellite solutions.

- Launch services: The launch of artificial satellites requires specialized launch services, and there is a growing market for companies that provide these services.

- Satellite data services: Artificial satellites generate vast amounts of data, and there is a growing market for companies that provide data services based on satellite data.

- Earth observation: Artificial satellites are used extensively for Earth observation and remote sensing applications, and there is a growing market for companies that provide these services.

- Communication services: Artificial satellites are also used extensively for communication services, including television and radio broadcasting, internet connectivity, and mobile communication.

Overall, the artificial satellite market offers a wide range of new business opportunities across various sectors, and the market is expected to continue growing in the coming years.

Some of the top companies in the Artificial Satellites Market are Airbus Defence and Space, Boeing, Thales Alenia Space, Lockheed Martin, Northrop Grumman, SpaceX, OneWeb, Planet Labs, Orbital Sciences, and SES.

Industries Getting Impacted in the future by Artificial Satellites Market:

The artificial satellite market is expected to impact several industries in the future, including:

- Telecommunications: Artificial satellites are used extensively for telecommunications services, including satellite phones, satellite TV, and internet connectivity. The growth of the artificial satellite market is expected to further expand the availability and accessibility of these services.

- Agriculture: Artificial satellites are increasingly being used for agricultural applications, including crop monitoring, yield estimation, and soil mapping. This data can help farmers make more informed decisions and improve their crop yields.

- Environmental monitoring: Artificial satellites are used for environmental monitoring and climate research, including tracking weather patterns, monitoring changes in ice caps and sea levels, and studying natural disasters like hurricanes and wildfires. This data is critical for understanding and mitigating the impact of climate change.

- Defense and security: Artificial satellites are used extensively for defense and security applications, including intelligence gathering, surveillance, and navigation. The growth of the artificial satellite market is expected to further expand the capabilities of these applications.

- Transportation and logistics: Artificial satellites are used for navigation and tracking in transportation and logistics applications, including air traffic control, shipping, and vehicle tracking. The growth of the artificial satellite market is expected to further improve the accuracy and reliability of these systems.

Overall, the artificial satellite market is expected to impact a wide range of industries in the future, improving efficiency, expanding capabilities, and providing new opportunities for growth and innovation.

Artificial Satellites Market Trends:

The artificial satellite market is expected to experience several trends in the coming years. Here are some of the future artificial satellite market trends:

- Growth of Low Earth Orbit (LEO) constellations: The demand for internet connectivity and other communication services is driving the development of large LEO constellations, which consist of hundreds or thousands of small satellites in low Earth orbit. These constellations are being developed by companies like SpaceX, OneWeb, and Amazon.

- Advancements in satellite technology: Advances in satellite technology are expected to continue, leading to the development of more advanced and capable artificial satellites. This includes improvements in sensors, propulsion systems, and data processing capabilities.

- Increasing use of nanosatellites and microsatellites: Nanosatellites and microsatellites are becoming increasingly popular due to their low cost and versatility. They are being used for a wide range of applications, including Earth observation, communications, and scientific research.

- Growing demand for Earth observation services: The demand for Earth observation services is expected to continue growing, particularly in areas like agriculture, environmental monitoring, and disaster response. Artificial satellites provide a valuable source of data for these applications.

- Increasing interest in space tourism: The development of commercial space tourism is expected to grow in the coming years, with companies like Virgin Galactic and Blue Origin offering suborbital flights for paying customers. This trend is expected to drive the development of new spacecraft and launch systems.

- Space debris mitigation: The issue of space debris is becoming increasingly important, as the number of artificial satellites in orbit continues to grow. Efforts are being made to mitigate the impact of space debris on the artificial satellite market, including the development of debris removal systems and regulations to reduce the creation of new debris.

Overall, the artificial satellite market is expected to experience significant growth and innovation in the coming years, with new applications, technologies, and business models driving the industry forward.

Available Customizations

Along with the market data, MarketsandMarkets offers customizations as per the company’s specific needs. The following customization options are available for the report:

Product Analysis

- Product Matrix which gives a detailed comparison of the product portfolio of each company

Company Information

- Detailed analysis and profiling of additional market players (up to 5)

Generating Response ...

Generating Response ...

Growth opportunities and latent adjacency in Nanosatellite and Microsatellite Market

Gather insights into Nanosatellite and Microsatellite Market

Understanding of the nano and microsatellites.

Interested in the he market value subdivision relative to launch, components, telecommunication services between earth and satellites.

Deep understanding of the small satellite market, microgravity market, and future launchers of the orbital and suborbital markets.

Detailed understanding of the Space Commercialization