Maritime Satellite Communication Market by Component (Solutions and Services), Solution (VSAT and MSS), Service (Tracking and Monitoring, Voice, Video, Data), End User (Merchant Shipping, Offshore, Government), and Region - Global Forecast to 2025

Maritime Satellite Communication Market Overview, Share and Forecast

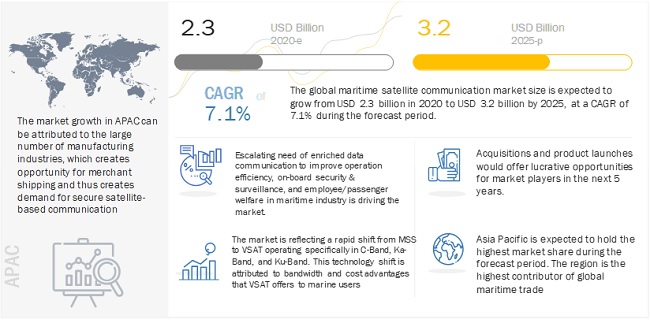

The global Maritime Satellite Communication Market size is anticipated to generate revenue around $3.2 billion by the end of 2025, Growing at a CAGR of around 7.1% between 2020 to 2025.

Escalating need for enriched data communication to improve operation efficiency, on-board security and surveillance, and employee/passenger welfare in the maritime industry is driving the market. Furthermore, The major factor driving the maritime satellite communication market is the need to attain improved connectivity between the land and sea operations and realizing benefits in faster repair times, preventative maintenance, fuel-saving, and real-time navigation.

Maritime Satellite Communication Market Dynamics

Driver: Increased technology advancements and less expensive technology solutions

The technology innovation in the maritime industry is flourishing market growth. High-Throughput Satellites (HTS) using Ku-band are being launched in the market. Technology developments are advancing at a fast pace. These developments include gyro-stabilized ground terminals, high-speed broadband modems, multi-frequency dish antennas, and an all-plastic design that would be more resilient to harsh environmental conditions offshore. The oil and gas sector has been using C-band services, while the shipping and maritime industry has leaned more towards Ku-band for its specific needs.

Restraint: Lack of awareness about advanced maritime satellite services

The maritime satellite communication market comprises a range of communication service offerings provided mainly through L-band, Ku-band, and Ka-band frequency-based satellite communication services, which support communication across the globe. Satellite services are the enabler of voice and data communications at sea. Knowing a vessel’s route and operating area is one of the key factors in choosing the type of communication band and services. However, customers do not understand the technical aspects of the frequency bands used in satellite communication and may tend to choose wrong frequency bands, which can lower productivity.

Opportunity: Increasing demand for broadband connections and VSAT connectivity

With the rising availability of satellite services offering Ku-band or Ka-band for VSAT, the demand for broadband connections and greater bandwidth is increasing. Demand growth is driven by crew welfare, seafarers, and passengers using their own devices on ships, and the increasing appetite for operational data processing and analysis. Lower satellite capacity pricing is paving the way for the adoption of broadband VSAT. The demand for data is continuously growing as satellite operators are increasing their capacity for maritime markets. With more supply pushing bandwidth costs lower, end users are responding by ramping up their demand for VSAT connectivity across all segments, including merchant, passenger, offshore (oil and gas), and fishing.

Challenge: lack of reliability and flexibility of satellite communication

To serve the evolving demands of the overall maritime sector, wherein end-users have vast differences in their communications needs, service providers would need even more capacity, coverage, performance, and flexibility. Moreover, they must have the ability to scale networks to meet customer demands quickly. With the increasing usage of technologies in maritime satellite, customers are finding difficulties in operating satellite solutions. Sometimes, maritime satellite vendors fail to provide reliable communication solutions; as a result, communication equipment and services do not perform effectively under unfavorable weather conditions. Therefore, there is a challenge for satellite communication service providers to provide reliable communication to their customers irrespective of the weather conditions.

Merchant Shipping segment to hold the largest market size during the forecast period

In recent years, satellite communication technology has become advanced, which enables ships to communicate through satellite links from anywhere globally without the help of a specialist radio officer. This technological advancement helps merchants gain higher profit through reliable communication services that maintain operational efficiency. The recent developments in satellite communication, such as Ka-band and Ku-band in VSAT, facilitate the marine industry to communicate at a lower cost, and provide access to weather information, position reports, and safety messages without incurring higher communication cost.

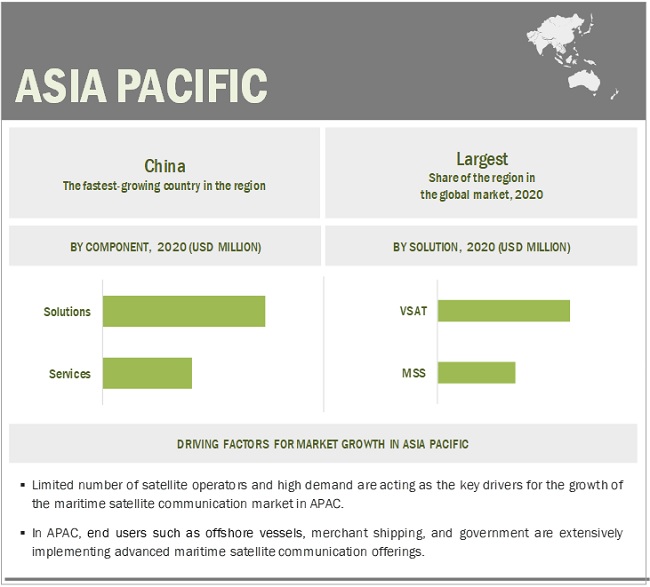

APAC to hold the largest market size during the forecast period

Many countries in the APAC region are likely to adopt maritime satellite communication solutions owing to high demands, specifically in the oil and gas, merchant shipping, mining, and passenger shipping verticals. The APAC region is implementing maritime satellite communication solutions significantly. The maritime satellite technology has been adopted in this region to incorporate advanced communication networks to communicate with employees, such as crew working at remote offshore locations. At present, end-users such as offshore vessels, merchant shipping, and government are extensively implementing advanced maritime satellite communication offerings.

Key Market Players

The global maritime satellite communication market includes players, such as Inmarsat (UK), Iridium Communications (US), Thuraya (UAE), Hughes Network Systems (US), and KVH Industries (US).

Scope of the report:

|

Report Metric |

Details |

|

Market size available for years |

2016–2025 |

|

Base year considered |

2019 |

|

Forecast period |

2020–2025 |

|

Forecast units |

Value (USD) |

|

Segments covered |

Component (solutions and services), solutions (VSAT and MSS), services (Tracking and monitoring, voice, video, and data), end-user (merchant shipping, fishing, passenger ships, leisure vessel, offshore, government, and others (manufacturing and construction)) |

|

Geographies covered |

North America, APAC, MEA, and Latin America |

|

Companies covered |

Inmarsat (UK), Iridium Communications (US), Thuraya (UAE), Hughes Network Systems (US), KVH Industries (US), Viasat (US), Speedcast (Australia), ST Engineering (Singapore), NSSLGlobal (England), Marlink (France), ORBOCOMM (US), Navarino (Greece), Network Innovations (Canada), GTMaritime (England), AST Group (UK), Isotropic Networks (Wisconsin), Norsat International (Ontario), Satcom Global (Canada), Intelsat (US), and Orbit Communication Systems (Israel) |

The research report categorizes the maritime satellite communication market based on the component, solution, service, end user, and region.

By Component

- Solutions

- Services

By Solution

-

VSAT

- Ku-band

- Ka-band

- C-band

- Mobile Satellite Service (MSS)

By Service

- Tracking and monitoring

- Voice

- Video

- Data

By End User:

- Merchant Shipping

- Fishing

- Passenger Ships

- Leisure Vessel

- Offshore

- Government

- Others (manufacturing and construction)

By region:

- North America

- Europe

- APAC

- MEA

- Latin America

Recent Developments:

- In February 2020, Inmarsat launched connectivity services in Saudi Arabia across land, sea, and air.

- In January 2020, Inmarsat and ITC Global have announced a five-year strategic collaboration. The partnership enables the organizations to combine their highly complementary, market-leading services to offer broadband connectivity, paired with high-value connectivity solutions to customers in the maritime, yachting, and offshore energy sectors.

Frequently Asked Questions (FAQ):

What is maritime satellite communication?

What is the projected market value of the global maritime satellite communication market?

What is the estimated growth rate of the global maritime satellite communication market?

Which end user of the global maritime satellite communication market expected to witness the highest growth?

Who are the key players operative in the global market?

To speak to our analyst for a discussion on the above findings, click Speak to Analyst

TABLE OF CONTENTS

1 INTRODUCTION (Page No. - 21)

1.1 INTRODUCTION TO COVID-19

1.2 COVID-19 HEALTH ASSESSMENT

FIGURE 1 COVID-19: THE GLOBAL PROPAGATION

FIGURE 2 COVID-19 PROPAGATION: SELECT COUNTRIES

1.3 COVID-19 ECONOMIC ASSESSMENT

FIGURE 3 REVISED GROSS DOMESTIC PRODUCT FORECASTS FOR SELECT G20 COUNTRIES IN 2020

1.3.1 COVID-19 ECONOMIC IMPACT—SCENARIO ASSESSMENT

FIGURE 4 CRITERIA IMPACTING THE GLOBAL ECONOMY

FIGURE 5 SCENARIOS IN TERMS OF RECOVERY OF THE GLOBAL ECONOMY

1.4 OBJECTIVES OF THE STUDY

1.5 MARKET DEFINITION

1.5.1 INCLUSIONS AND EXCLUSIONS

1.6 MARKET SCOPE

1.6.1 MARKET SEGMENTATION

1.6.2 YEARS CONSIDERED FOR THE STUDY

1.7 CURRENCY CONSIDERED

TABLE 1 UNITED STATES DOLLAR EXCHANGE RATE, 2017-2019

1.8 STAKEHOLDERS

2 RESEARCH METHODOLOGY (Page No. - 30)

2.1 RESEARCH DATA

FIGURE 6 MARITIME SATELLITE COMMUNICATION MARKET: RESEARCH DESIGN

2.1.1 SECONDARY DATA

2.1.2 PRIMARY DATA

2.1.2.1 Breakup of primary profiles

2.2 MARKET BREAKUP AND DATA TRIANGULATION

2.3 MARKET SIZE ESTIMATION

FIGURE 7 MARKET SIZE ESTIMATION METHODOLOGY—APPROACH 1 (SUPPLY SIDE): REVENUE OF COMPONENTS OF THE MARKET

FIGURE 8 MARKET SIZE ESTIMATION METHODOLOGY—APPROACH 1—BOTTOM-UP (SUPPLY SIDE): COLLECTIVE REVENUE OF ALL OFFERINGS OF THE MARKET

FIGURE 9 MARKET SIZE ESTIMATION METHODOLOGY—APPROACH 2—TOP-DOWN (DEMAND SIDE): SHARE OF THE MARITIME SATELLITE COMMUNICATION MARKET THROUGH VENDOR OFFERINGS

2.4 MARKET FORECAST

TABLE 2 FACTOR ANALYSIS

2.5 COMPETITIVE LEADERSHIP MAPPING METHODOLOGY

FIGURE 10 COMPETITIVE LEADERSHIP MAPPING: CRITERIA WEIGHTAGE

2.6 ASSUMPTIONS FOR THE STUDY

2.7 LIMITATIONS OF THE STUDY

3 EXECUTIVE SUMMARY (Page No. - 38)

FIGURE 11 MARITIME SATELLITE COMMUNICATION MARKET TO WITNESS STEADY GROWTH DURING THE FORECAST PERIOD

FIGURE 12 LEADING SEGMENTS IN THE MARKET IN 2020

FIGURE 13 MARKET: REGIONAL SCENARIO

FIGURE 14 MARKET, TOP THREE SEGMENTS, 2020

FIGURE 15 SOLUTIONS SEGMENT TO HOLD A HIGHER MARKET SHARE IN 2020

4 PREMIUM INSIGHTS (Page No. - 42)

4.1 ATTRACTIVE OPPORTUNITIES IN THE MARITIME SATELLITE COMMUNICATION MARKET

FIGURE 16 INTRODUCTION OF LESS EXPENSIVE TECHNOLOGIES AND NEED FOR ENRICHED DATA COMMUNICATION DRIVING THE MARKET GROWTH

4.2 MARKET, BY COMPONENT AND REGION

FIGURE 17 SOLUTIONS SEGMENT AND ASIA PACIFIC TO HOLD HIGH MARKET SHARES IN 2020

4.3 MARKET, BY REGION

FIGURE 18 ASIA PACIFIC TO GROW AT THE HIGHEST CAGR DURING THE FORECAST PERIOD

4.4 MARKET: INVESTMENT SCENARIO

FIGURE 19 NORTH AMERICA AND ASIA PACIFIC TO EMERGE AS THE BEST MARKETS FOR INVESTMENTS OVER THE NEXT FIVE YEARS

5 MARKET OVERVIEW AND INDUSTRY TRENDS (Page No. - 45)

5.1 MARKET DYNAMICS

FIGURE 20 DRIVERS, RESTRAINTS, OPPORTUNITIES, AND CHALLENGES: MARITIME SATELLITE COMMUNICATION MARKET

5.1.1 DRIVERS

5.1.1.1 New satellite systems and data-intensive applications to drive the growth of the market

5.1.1.2 Increased technology advancements and less expensive technology solutions

5.1.1.3 Growth in bandwidth requirements and communication needs

5.1.2 RESTRAINTS

5.1.2.1 Lack of awareness about advanced maritime satellite services

5.1.2.2 Reliance on high-cost satellite equipment

5.1.3 OPPORTUNITIES

5.1.3.1 Increasing demand for broadband connections and VSAT connectivity

5.1.3.2 High-throughput satellites to unlock cloud and IoT services

5.1.3.3 Unification of satellites and cellular communication technology

5.1.4 CHALLENGES

5.1.4.1 Increasing cybersecurity attacks

5.1.4.2 Lack of reliability and flexibility of satellite communication

5.1.4.3 Coping up with rapidly changing technologies

5.2 INDUSTRY USE CASES

5.2.1 USE CASE 1: INMARSAT GLOBAL XPRESS HELPED EUKOR CAR CARRIERS FOR ITS FLEET OF 27 VESSELS

5.2.2 USE CASE 2: THURAYA HELPED DEVOR TECHNOLOGIES TO BRING RELIABLE, HIGH-SPEED INTERNET CONNECTION TO OFFSHORE MARITIME OPERATOR

5.2.3 USE CASE 3: VIASAT HELPED M/Y STARFIRE IN DELIVERING HIGH-SPEED CONNECTIVITY TO SUPPORT LUXURY GUEST EXPERIENCE

5.2.4 USE CASE 4: NSSLGLOBAL HELPED MOL LNG BY PROVIDING RELIABLE SERVICES FOR MANAGING FLEET OF 15 LNG CARRIERS

5.3 IMPACT OF DISRUPTIVE TECHNOLOGIES

5.3.1 INTERNET OF THINGS

5.3.2 5G

6 COVID-19 IMPACT ON MARITIME SATELLITE COMMUNICATION MARKET (Page No. - 53)

6.1 COVID-19 IMPACT—MARITIME SATELLITE COMMUNICATION

7 MARITIME SATELLITE COMMUNICATION MARKET, BY COMPONENT (Page No. - 54)

7.1 INTRODUCTION

7.1.1 COMPONENT: MARKET DRIVERS

7.1.2 COMPONENT: MARITIME SATELLITE COMMUNICATION VENDOR INITIATIVES AND DEVELOPMENTS

FIGURE 21 SOLUTIONS SEGMENT TO GROW AT A HIGHER CAGR DURING THE FORECAST PERIOD

TABLE 3 MARKET SIZE, BY COMPONENT, 2016–2018 (USD MILLION)

TABLE 4 MARKET SIZE, BY COMPONENT, 2019–2025 (USD MILLION)

7.2 SOLUTIONS

TABLE 5 SOLUTIONS: MARKET SIZE, BY REGION, 2016–2018 (USD MILLION)

TABLE 6 SOLUTIONS: MARKET SIZE, BY REGION, 2019–2025 (USD MILLION)

TABLE 7 SOLUTIONS: NORTH AMERICA MARKET SIZE, BY COUNTRY, 2019–2025 (USD MILLION)

TABLE 8 SOLUTIONS: ASIA PACIFIC MARKET SIZE, BY COUNTRY, 2019–2025 (USD MILLION)

7.3 SERVICES

TABLE 9 SERVICES: MARKET SIZE, BY REGION, 2016–2018 (USD MILLION)

TABLE 10 SERVICES: MARKET SIZE, BY REGION, 2019–2025 (USD MILLION)

TABLE 11 SERVICES: NORTH AMERICA MARKET SIZE, BY COUNTRY, 2019–2025 (USD MILLION)

TABLE 12 SERVICES: ASIA PACIFIC MARKET SIZE, BY COUNTRY, 2019–2025 (USD MILLION)

8 MARITIME SATELLITE COMMUNICATION MARKET, BY SOLUTION (Page No. - 61)

8.1 INTRODUCTION

8.1.1 SOLUTIONS: MARKET DRIVERS

8.1.2 SOLUTIONS: MARITIME SATELLITE COMMUNICATION VENDOR INITIATIVES AND DEVELOPMENTS

FIGURE 22 VSAT SEGMENT TO GROW AT A HIGHER CAGR DURING THE FORECAST PERIOD

TABLE 13 MARKET SIZE, BY SOLUTION, 2016–2018 (USD MILLION)

TABLE 14 MARKET SIZE, BY SOLUTION, 2019–2025 (USD MILLION)

8.2 VERY SMALL APERTURE TERMINAL

TABLE 15 VERY SMALL APERTURE TERMINAL: MARITIME SATELLITE COMMUNICATION SOLUTIONS MARKET SIZE, BY REGION, 2016–2018 (USD MILLION)

TABLE 16 VERY SMALL APERTURE TERMINAL: MARITIME SATELLITE COMMUNICATION SOLUTIONS MARKET SIZE, BY REGION, 2019–2025 (USD MILLION)

TABLE 17 VERY SMALL APERTURE TERMINAL: NORTH AMERICA MARITIME SATELLITE COMMUNICATION SOLUTIONS MARKET SIZE, BY COUNTRY, 2019–2025 (USD MILLION)

TABLE 18 VERY SMALL APERTURE TERMINAL: ASIA PACIFIC MARITIME SATELLITE COMMUNICATION SOLUTIONS MARKET SIZE, BY COUNTRY, 2019–2025 (USD MILLION)

8.2.1 VERY SMALL APERTURE TERMINAL, BY FREQUENCY BAND

TABLE 19 VERY SMALL APERTURE TERMINAL MARKET SIZE, BY FREQUENCY BAND, 2016–2018 (USD MILLION)

TABLE 20 VERY SMALL APERTURE TERMINAL MARKET SIZE, BY FREQUENCY BAND, 2019–2025 (USD MILLION)

8.2.1.1 Ka-band

TABLE 21 KA-BAND MARKET SIZE, BY REGION, 2016–2018 (USD MILLION)

TABLE 22 KA-BAND MARKET SIZE, BY REGION, 2019–2025 (USD MILLION)

8.2.1.2 Ku-band

TABLE 23 KU-BAND MARKET SIZE, BY REGION, 2016–2018 (USD MILLION)

TABLE 24 KU-BAND MARKET SIZE, BY REGION, 2019–2025 (USD MILLION)

8.2.1.3 C-band

TABLE 25 C-BAND MARKET SIZE, BY REGION, 2016–2018 (USD MILLION)

TABLE 26 C-BAND MARKET SIZE, BY REGION, 2019–2025 (USD MILLION)

8.3 MOBILE SATELLITE SERVICES

TABLE 27 MOBILE SATELLITE SERVICES: MARITIME SATELLITE COMMUNICATION SOLUTIONS MARKET SIZE, BY REGION, 2016–2018 (USD MILLION)

TABLE 28 MOBILE SATELLITE SERVICES: MARITIME SATELLITE COMMUNICATION SOLUTIONS MARKET SIZE, BY REGION, 2019–2025 (USD MILLION)

TABLE 29 MOBILE SATELLITE SERVICES: NORTH AMERICA MARITIME SATELLITE COMMUNICATION SOLUTIONS MARKET SIZE, BY COUNTRY, 2019–2025 (USD MILLION)

TABLE 30 MOBILE SATELLITE SERVICES: MARITIME SATELLITE COMMUNICATION SOLUTIONS MARKET SIZE, BY COUNTRY, 2019–2025 (USD MILLION)

9 MARITIME SATELLITE COMMUNICATION MARKET, BY SERVICE (Page No. - 72)

9.1 INTRODUCTION

9.1.1 SERVICES: MARKET DRIVERS

9.1.2 SERVICES: MARITIME SATELLITE COMMUNICATION VENDOR INITIATIVES AND DEVELOPMENTS

FIGURE 23 TRACKER AND MONITORING SEGMENT TO GROW AT THE HIGHEST CAGR DURING THE FORECAST PERIOD

TABLE 31 MARKET SIZE, BY SERVICE, 2016–2018 (USD MILLION)

TABLE 32 MARKET SIZE, BY SERVICE, 2019–2025 (USD MILLION)

9.2 TRACKING AND MONITORING

TABLE 33 TRACKING AND MONITORING: MARITIME SATELLITE COMMUNICATION SERVICES MARKET SIZE, BY REGION, 2016–2018 (USD MILLION)

TABLE 34 TRACKING AND MONITORING: MARITIME SATELLITE COMMUNICATION SERVICES MARKET SIZE, BY REGION, 2019–2025 (USD MILLION)

TABLE 35 TRACKING AND MONITORING: NORTH AMERICA MARITIME SATELLITE COMMUNICATION SERVICES MARKET SIZE, BY COUNTRY, 2019–2025 (USD MILLION)

TABLE 36 TRACKING AND MONITORING: ASIA PACIFIC MARITIME SATELLITE COMMUNICATION SERVICES MARKET SIZE, BY COUNTRY, 2019–2025 (USD MILLION)

9.3 VOICE

TABLE 37 VOICE: MARITIME SATELLITE COMMUNICATION SERVICES MARKET SIZE, BY REGION, 2016–2018 (USD MILLION)

TABLE 38 VOICE: MARITIME SATELLITE COMMUNICATION SERVICES MARKET SIZE, BY REGION, 2019–2025 (USD MILLION)

TABLE 39 VOICE: NORTH AMERICA MARITIME SATELLITE COMMUNICATION SERVICES MARKET SIZE, BY COUNTRY, 2019–2025 (USD MILLION)

TABLE 40 VOICE: ASIA PACIFIC MARITIME SATELLITE COMMUNICATION SERVICES MARKET SIZE, BY COUNTRY, 2019–2025 (USD MILLION)

9.4 VIDEO

TABLE 41 VIDEO: MARITIME SATELLITE COMMUNICATION SERVICES MARKET SIZE, BY REGION, 2016–2018 (USD MILLION)

TABLE 42 VIDEO: MARITIME SATELLITE COMMUNICATION SERVICES MARKET SIZE, BY REGION, 2019–2025 (USD MILLION)

TABLE 43 VIDEO: NORTH AMERICA MARITIME SATELLITE COMMUNICATION SERVICES MARKET SIZE, BY COUNTRY, 2019–2025 (USD MILLION)

TABLE 44 VIDEO: ASIA PACIFIC MARITIME SATELLITE COMMUNICATION SERVICES MARKET SIZE, BY COUNTRY, 2019–2025 (USD MILLION)

9.5 DATA

TABLE 45 DATA: MARITIME SATELLITE COMMUNICATION SERVICES MARKET SIZE, BY REGION, 2016–2018 (USD MILLION)

TABLE 46 DATA: MARITIME SATELLITE COMMUNICATION SERVICES MARKET SIZE, BY REGION, 2019–2025 (USD MILLION)

TABLE 47 DATA: NORTH AMERICA MARITIME SATELLITE COMMUNICATION SERVICES MARKET SIZE, BY COUNTRY, 2019–2025 (USD MILLION)

TABLE 48 DATA: ASIA PACIFIC MARITIME SATELLITE COMMUNICATION SERVICES MARKET SIZE, BY COUNTRY, 2019–2025 (USD MILLION)

10 MARITIME SATELLITE COMMUNICATION MARKET, BY END USER (Page No. - 83)

10.1 INTRODUCTION

FIGURE 24 MERCHANT SHIPPING SEGMENT TO HOLD THE HIGHEST MARKET SHARE DURING THE FORECAST PERIOD

10.1.1 END USER: MARKET DRIVERS

10.1.2 END USER: MARITIME SATELLITE COMMUNICATION VENDOR INITIATIVES AND DEVELOPMENTS

TABLE 49 MARKET SIZE, BY END USER, 2016–2018 (USD MILLION)

TABLE 50 MARKET SIZE, BY END USER, 2019–2025 (USD MILLION)

10.2 MERCHANT SHIPPING

TABLE 51 MERCHANT SHIPPING: MARKET SIZE, BY REGION, 2016–2018 (USD MILLION)

TABLE 52 MERCHANT SHIPPING: MARKET SIZE, BY REGION, 2019–2025 (USD MILLION)

TABLE 53 MERCHANT SHIPPING: NORTH AMERICA MARKET SIZE, BY COUNTRY, 2019–2025 (USD MILLION)

TABLE 54 MERCHANT SHIPPING: ASIA PACIFIC MARKET SIZE, BY COUNTRY, 2019–2025 (USD MILLION)

10.3 FISHING

TABLE 55 FISHING: MARITIME SATELLITE COMMUNICATION MARKET SIZE, BY REGION, 2016–2018 (USD MILLION)

TABLE 56 FISHING: MARKET SIZE, BY REGION, 2019–2025 (USD MILLION)

TABLE 57 FISHING: NORTH AMERICA MARKET SIZE, BY COUNTRY, 2019–2025 (USD MILLION)

TABLE 58 FISHING: ASIA PACIFIC MARKET SIZE, BY COUNTRY, 2019–2025 (USD MILLION)

10.4 PASSENGER SHIPS

TABLE 59 PASSENGER SHIPS: MARKET SIZE, BY REGION, 2016–2018 (USD MILLION)

TABLE 60 PASSENGER SHIPS: MARKET SIZE, BY REGION, 2019–2025 (USD MILLION)

TABLE 61 PASSENGER SHIPS: NORTH AMERICA MARKET SIZE, BY COUNTRY, 2019–2025 (USD MILLION)

TABLE 62 PASSENGER SHIPS: ASIA PACIFIC MARKET SIZE, BY COUNTRY, 2019–2025 (USD MILLION)

10.5 LEISURE VESSEL

TABLE 63 LEISURE VESSEL: MARKET SIZE, BY REGION, 2016–2018 (USD MILLION)

TABLE 64 LEISURE VESSEL: MARKET SIZE, BY REGION, 2019–2025 (USD MILLION)

TABLE 65 LEISURE VESSEL: NORTH AMERICA MARITIME SATELLITE COMMUNICATION MARKET SIZE, BY COUNTRY, 2019–2025 (USD MILLION)

TABLE 66 LEISURE VESSEL: ASIA PACIFIC MARKET SIZE, BY COUNTRY, 2019–2025 (USD MILLION)

10.6 OFFSHORE

TABLE 67 OFFSHORE: MARKET SIZE, BY REGION, 2016–2018 (USD MILLION)

TABLE 68 OFFSHORE: MARKET SIZE, BY REGION, 2019–2025 (USD MILLION)

TABLE 69 OFFSHORE: NORTH AMERICA MARKET SIZE, BY COUNTRY, 2019–2025 (USD MILLION)

TABLE 70 OFFSHORE: ASIA PACIFIC MARKET SIZE, BY COUNTRY, 2019–2025 (USD MILLION)

10.7 GOVERNMENT

TABLE 71 GOVERNMENT: MARKET SIZE, BY REGION, 2016–2018 (USD MILLION)

TABLE 72 GOVERNMENT: MARKET SIZE, BY REGION, 2019–2025 (USD MILLION)

TABLE 73 GOVERNMENT: NORTH AMERICA MARITIME SATELLITE COMMUNICATION MARKET SIZE, BY COUNTRY, 2019–2025 (USD MILLION)

TABLE 74 GOVERNMENT: ASIA PACIFIC MARKET SIZE, BY COUNTRY, 2019–2025 (USD MILLION)

10.8 OTHERS

TABLE 75 OTHERS: MARKET SIZE, BY REGION, 2016–2018 (USD MILLION)

TABLE 76 OTHERS: MARKET SIZE, BY REGION, 2019–2025 (USD MILLION)

TABLE 77 OTHERS: NORTH AMERICA MARKET SIZE, BY COUNTRY, 2019–2025 (USD MILLION)

TABLE 78 OTHERS: ASIA PACIFIC MARKET SIZE, BY COUNTRY, 2019–2025 (USD MILLION)

11 MARITIME SATELLITE COMMUNICATION MARKET, BY REGION (Page No. - 100)

11.1 INTRODUCTION

FIGURE 25 ASIA PACIFIC TO GROW AT THE HIGHEST CAGR DURING THE FORECAST PERIOD

TABLE 79 MARKET SIZE, BY REGION, 2016–2018 (USD MILLION)

TABLE 80 MARKET SIZE, BY REGION, 2019–2025 (USD MILLION)

11.2 NORTH AMERICA

11.2.1 NORTH AMERICA: MARITIME SATELLITE COMMUNICATION MARKET DRIVERS

11.2.2 NORTH AMERICA: MARITIME SATELLITE COMMUNICATION VENDOR INITIATIVES AND DEVELOPMENTS

11.2.3 NORTH AMERICA: MARITIME SATELLITE COMMUNICATION COVID-19 IMPACT

TABLE 81 NORTH AMERICA: MARKET SIZE, BY COMPONENT, 2016–2018 (USD MILLION)

TABLE 82 NORTH AMERICA: MARKET SIZE, BY COMPONENT, 2019–2025 (USD MILLION)

TABLE 83 NORTH AMERICA: MARKET SIZE, BY SOLUTION, 2016–2018 (USD MILLION)

TABLE 84 NORTH AMERICA: MARKET SIZE, BY SOLUTION, 2019–2025 (USD MILLION)

TABLE 85 NORTH AMERICA: VSAT MARKET SIZE, BY FREQUENCY BAND, 2016–2018 (USD MILLION)

TABLE 86 NORTH AMERICA: VSAT MARKET SIZE, BY FREQUENCY BAND, 2019–2025 (USD MILLION)

TABLE 87 NORTH AMERICA: MARKET SIZE, BY SERVICE, 2016–2018 (USD MILLION)

TABLE 88 NORTH AMERICA: MARKET SIZE, BY SERVICE, 2019–2025 (USD MILLION)

TABLE 89 NORTH AMERICA: MARKET SIZE, BY END USER, 2016–2018 (USD MILLION)

TABLE 90 NORTH AMERICA: MARKET SIZE, BY END USER, 2019–2025 (USD MILLION)

TABLE 91 NORTH AMERICA: MARKET SIZE, BY COUNTRY, 2016–2018 (USD MILLION)

TABLE 92 NORTH AMERICA: MARKET SIZE, BY COUNTRY, 2019–2025 (USD MILLION)

11.2.4 UNITED STATES

TABLE 93 UNITED STATES: MARITIME SATELLITE COMMUNICATION MARKET SIZE, BY COMPONENT, 2016–2018 (USD MILLION)

TABLE 94 UNITED STATES: MARKET SIZE, BY COMPONENT, 2019–2025 (USD MILLION)

TABLE 95 UNITED STATES: MARKET SIZE, BY SOLUTION, 2016–2018 (USD MILLION)

TABLE 96 UNITED STATES: MARKET SIZE, BY SOLUTION, 2019–2025 (USD MILLION)

TABLE 97 UNITED STATES: VSAT MARKET SIZE, BY FREQUENCY BAND, 2016–2018 (USD MILLION)

TABLE 98 UNITED STATES: VSAT MARKET SIZE, BY FREQUENCY BAND, 2019–2025 (USD MILLION)

TABLE 99 UNITED STATES: MARKET SIZE, BY SERVICE, 2016–2018 (USD MILLION)

TABLE 100 UNITED STATES: MARKET SIZE, BY SERVICE, 2019–2025 (USD MILLION)

TABLE 101 UNITED STATES: MARKET SIZE, BY END USER, 2016–2018 (USD MILLION)

TABLE 102 UNITED STATES: MARKET SIZE, BY END USER, 2019–2025 (USD MILLION)

11.2.5 CANADA

TABLE 103 CANADA: MARITIME SATELLITE COMMUNICATION MARKET SIZE, BY COMPONENT, 2016–2018 (USD MILLION)

TABLE 104 CANADA: MARKET SIZE, BY COMPONENT, 2019–2025 (USD MILLION)

TABLE 105 CANADA: MARKET SIZE, BY SOLUTION, 2016–2018 (USD MILLION)

TABLE 106 CANADA: MARKET SIZE, BY SOLUTION, 2019–2025 (USD MILLION)

TABLE 107 CANADA: VSAT MARKET SIZE, BY FREQUENCY BAND, 2016–2018 (USD MILLION)

TABLE 108 CANADA: VSAT MARKET SIZE, BY FREQUENCY BAND, 2019–2025 (USD MILLION)

TABLE 109 CANADA: MARKET SIZE, BY SERVICE, 2016–2018 (USD MILLION)

TABLE 110 CANADA: MARKET SIZE, BY SERVICE, 2019–2025 (USD MILLION)

TABLE 111 CANADA: MARKET SIZE, BY END USER, 2016–2018 (USD MILLION)

TABLE 112 CANADA: MARKET SIZE, BY END USER, 2019–2025 (USD MILLION)

11.3 EUROPE

11.3.1 EUROPE: MARITIME SATELLITE COMMUNICATION MARKET DRIVERS

11.3.2 EUROPE: MARITIME SATELLITE COMMUNICATION VENDOR INITIATIVES AND DEVELOPMENTS

11.3.3 EUROPE: MARITIME SATELLITE COMMUNICATION COVID-19 IMPACT

FIGURE 26 EUROPE: MARKET SNAPSHOT

TABLE 113 EUROPE: MARKET SIZE, BY COMPONENT, 2016–2018 (USD MILLION)

TABLE 114 EUROPE: MARKET SIZE, BY COMPONENT, 2019–2025 (USD MILLION)

TABLE 115 EUROPE: MARKET SIZE, BY SOLUTION, 2016–2018 (USD MILLION)

TABLE 116 EUROPE: MARKET SIZE, BY SOLUTION, 2019–2025 (USD MILLION)

TABLE 117 EUROPE: VSAT MARKET SIZE, BY FREQUENCY BAND, 2016–2018 (USD MILLION)

TABLE 118 EUROPE: VSAT MARKET SIZE, BY FREQUENCY BAND, 2019–2025 (USD MILLION)

TABLE 119 EUROPE: MARKET SIZE, BY SERVICE, 2016–2018 (USD MILLION)

TABLE 120 EUROPE: MARKET SIZE, BY SERVICE, 2019–2025 (USD MILLION)

TABLE 121 EUROPE: MARKET SIZE, BY END USER, 2016–2018 (USD MILLION)

TABLE 122 EUROPE: MARKET SIZE, BY END USER, 2019–2025 (USD MILLION)

TABLE 123 EUROPE: MARKET SIZE, BY COUNTRY, 2016–2018 (USD MILLION)

TABLE 124 EUROPE: MARKET SIZE, BY COUNTRY, 2019–2025 (USD MILLION)

11.3.4 UNITED KINGDOM

TABLE 125 UNITED KINGDOM: MARITIME SATELLITE COMMUNICATION MARKET SIZE, BY COMPONENT, 2016–2018 (USD MILLION)

TABLE 126 UNITED KINGDOM: MARKET SIZE, BY COMPONENT, 2019–2025 (USD MILLION)

TABLE 127 UNITED KINGDOM: MARKET SIZE, BY SOLUTION, 2016–2018 (USD MILLION)

TABLE 128 UNITED KINGDOM: MARKET SIZE, BY SOLUTION, 2019–2025 (USD MILLION)

TABLE 129 UNITED KINGDOM: VSAT MARKET SIZE, BY FREQUENCY BAND, 2016–2018 (USD MILLION)

TABLE 130 UNITED KINGDOM: VSAT MARKET SIZE, BY FREQUENCY BAND, 2019–2025 (USD MILLION)

TABLE 131 UNITED KINGDOM: MARKET SIZE, BY SERVICE, 2016–2018 (USD MILLION)

TABLE 132 UNITED KINGDOM: MARKET SIZE, BY SERVICE, 2019–2025 (USD MILLION)

TABLE 133 UNITED KINGDOM: MARKET SIZE, BY END USER, 2016–2018 (USD MILLION)

TABLE 134 UNITED KINGDOM: MARKET SIZE, BY END USER, 2019–2025 (USD MILLION)

11.3.5 GERMANY

TABLE 135 GERMANY: MARITIME SATELLITE COMMUNICATION MARKET SIZE, BY COMPONENT, 2016–2018 (USD MILLION)

TABLE 136 GERMANY: MARKET SIZE, BY COMPONENT, 2019–2025 (USD MILLION)

TABLE 137 GERMANY: MARKET SIZE, BY SOLUTION, 2016–2018 (USD MILLION)

TABLE 138 GERMANY: MARKET SIZE, BY SOLUTION, 2019–2025 (USD MILLION)

TABLE 139 GERMANY: VSAT MARKET SIZE, BY FREQUENCY BAND, 2016–2018 (USD MILLION)

TABLE 140 GERMANY: VSAT MARKET SIZE, BY FREQUENCY BAND, 2019–2025 (USD MILLION)

TABLE 141 GERMANY: MARKET SIZE, BY SERVICE, 2016–2018 (USD MILLION)

TABLE 142 GERMANY: MARKET SIZE, BY SERVICE, 2019–2025 (USD MILLION)

TABLE 143 GERMANY: MARKET SIZE, BY END USER, 2016–2018 (USD MILLION)

TABLE 144 GERMANY: MARKET SIZE, BY END USER, 2019–2025 (USD MILLION)

11.3.6 REST OF EUROPE

TABLE 145 REST OF EUROPE: MARITIME SATELLITE COMMUNICATION MARKET SIZE, BY COMPONENT, 2016–2018 (USD MILLION)

TABLE 146 REST OF EUROPE: MARKET SIZE, BY COMPONENT, 2019–2025 (USD MILLION)

TABLE 147 REST OF EUROPE: MARKET SIZE, BY SOLUTION, 2016–2018 (USD MILLION)

TABLE 148 REST OF EUROPE: MARKET SIZE, BY SOLUTION, 2019–2025 (USD MILLION)

TABLE 149 REST OF EUROPE: VSAT MARKET SIZE, BY FREQUENCY BAND, 2016–2018 (USD MILLION)

TABLE 150 REST OF EUROPE: VSAT MARKET SIZE, BY FREQUENCY BAND, 2019–2025 (USD MILLION)

TABLE 151 REST OF EUROPE: MARKET SIZE, BY SERVICE, 2016–2018 (USD MILLION)

TABLE 152 REST OF EUROPE: MARKET SIZE, BY SERVICE, 2019–2025 (USD MILLION)

TABLE 153 REST OF EUROPE: MARKET SIZE, BY END USER, 2016–2018 (USD MILLION)

TABLE 154 REST OF EUROPE: MARKET SIZE, BY END USER, 2019–2025 (USD MILLION)

11.4 ASIA PACIFIC

11.4.1 ASIA PACIFIC: MARITIME SATELLITE COMMUNICATION MARKET DRIVERS

11.4.2 ASIA PACIFIC: MARITIME SATELLITE COMMUNICATION VENDOR INITIATIVES AND DEVELOPMENTS

11.4.3 ASIA PACIFIC: MARITIME SATELLITE COMMUNICATION COVID-19 IMPACT

FIGURE 27 ASIA PACIFIC: MARKET SNAPSHOT

TABLE 155 ASIA PACIFIC: MARKET SIZE, BY COMPONENT, 2016–2018 (USD MILLION)

TABLE 156 ASIA PACIFIC: MARKET SIZE, BY COMPONENT, 2019–2025 (USD MILLION)

TABLE 157 ASIA PACIFIC: MARKET SIZE, BY SOLUTION, 2016–2018 (USD MILLION)

TABLE 158 ASIA PACIFIC: MARKET SIZE, BY SOLUTION, 2019–2025 (USD MILLION)

TABLE 159 ASIA PACIFIC: VSAT MARKET SIZE, BY FREQUENCY BAND, 2016–2018 (USD MILLION)

TABLE 160 ASIA PACIFIC: VSAT MARKET SIZE, BY FREQUENCY BAND, 2019–2025 (USD MILLION)

TABLE 161 ASIA PACIFIC: MARKET SIZE, BY SERVICE, 2016–2018 (USD MILLION)

TABLE 162 ASIA PACIFIC: MARKET SIZE, BY SERVICE, 2019–2025 (USD MILLION)

TABLE 163 ASIA PACIFIC: MARKET SIZE, BY END USER, 2016–2018 (USD MILLION)

TABLE 164 ASIA PACIFIC: MARKET SIZE, BY END USER, 2019–2025 (USD MILLION)

TABLE 165 ASIA PACIFIC: MARKET SIZE, BY COUNTRY, 2016–2018 (USD MILLION)

TABLE 166 ASIA PACIFIC: MARKET SIZE, BY COUNTRY, 2019–2025 (USD MILLION)

11.4.4 CHINA

TABLE 167 CHINA: MARITIME SATELLITE COMMUNICATION MARKET SIZE, BY COMPONENT, 2016–2018 (USD MILLION)

TABLE 168 CHINA: MARKET SIZE, BY COMPONENT, 2019–2025 (USD MILLION)

TABLE 169 CHINA: MARKET SIZE, BY SOLUTION, 2016–2018 (USD MILLION)

TABLE 170 CHINA: MARKET SIZE, BY SOLUTION, 2019–2025 (USD MILLION)

TABLE 171 CHINA: VSAT MARKET SIZE, BY FREQUENCY BAND, 2016–2018 (USD MILLION)

TABLE 172 CHINA: VSAT MARKET SIZE, BY FREQUENCY BAND, 2019–2025 (USD MILLION)

TABLE 173 CHINA: MARKET SIZE, BY SERVICE, 2016–2018 (USD MILLION)

TABLE 174 CHINA: MARKET SIZE, BY SERVICE, 2019–2025 (USD MILLION)

TABLE 175 CHINA: MARKET SIZE, BY END USER, 2016–2018 (USD MILLION)

TABLE 176 CHINA: MARKET SIZE, BY END USER, 2019–2025 (USD MILLION)

11.4.5 JAPAN

TABLE 177 JAPAN: MARITIME SATELLITE COMMUNICATION MARKET SIZE, BY COMPONENT, 2016–2018 (USD MILLION)

TABLE 178 JAPAN: MARKET SIZE, BY COMPONENT, 2019–2025 (USD MILLION)

TABLE 179 JAPAN: MARKET SIZE, BY SOLUTION, 2016–2018 (USD MILLION)

TABLE 180 JAPAN: MARKET SIZE, BY SOLUTION, 2019–2025 (USD MILLION)

TABLE 181 JAPAN: VSAT MARKET SIZE, BY FREQUENCY BAND, 2016–2018 (USD MILLION)

TABLE 182 JAPAN: VSAT MARKET SIZE, BY FREQUENCY BAND, 2019–2025 (USD MILLION)

TABLE 183 JAPAN: MARKET SIZE, BY SERVICE, 2016–2018 (USD MILLION)

TABLE 184 JAPAN: MARKET SIZE, BY SERVICE, 2019–2025 (USD MILLION)

TABLE 185 JAPAN: MARKET SIZE, BY END USER, 2016–2018 (USD MILLION)

TABLE 186 JAPAN: MARKET SIZE, BY END USER, 2019–2025 (USD MILLION)

11.4.6 REST OF ASIA PACIFIC

TABLE 187 REST OF ASIA PACIFIC: MARITIME SATELLITE COMMUNICATION MARKET SIZE, BY COMPONENT, 2016–2018 (USD MILLION)

TABLE 188 REST OF ASIA PACIFIC: MARKET SIZE, BY COMPONENT, 2019–2025 (USD MILLION)

TABLE 189 REST OF ASIA PACIFIC: MARKET SIZE, BY SOLUTION, 2016–2018 (USD MILLION)

TABLE 190 REST OF ASIA PACIFIC: MARKET SIZE, BY SOLUTION, 2019–2025 (USD MILLION)

TABLE 191 REST OF ASIA PACIFIC: VSAT MARKET SIZE, BY FREQUENCY BAND, 2016–2018 (USD MILLION)

TABLE 192 REST OF ASIA PACIFIC: VSAT MARKET SIZE, BY FREQUENCY BAND, 2019–2025 (USD MILLION)

TABLE 193 REST OF ASIA PACIFIC: MARKET SIZE, BY SERVICE, 2016–2018 (USD MILLION)

TABLE 194 REST OF ASIA PACIFIC: MARKET SIZE, BY SERVICE, 2019–2025 (USD MILLION)

TABLE 195 REST OF ASIA PACIFIC: MARKET SIZE, BY END USER, 2016–2018 (USD MILLION)

TABLE 196 REST OF ASIA PACIFIC: MARKET SIZE, BY END USER, 2019–2025 (USD MILLION)

11.5 MIDDLE EAST AND AFRICA

11.5.1 MIDDLE EAST AND AFRICA: MARITIME SATELLITE COMMUNICATION MARKET DRIVERS

11.5.2 MIDDLE EAST AND AFRICA: MARITIME SATELLITE COMMUNICATION VENDOR INITIATIVES AND DEVELOPMENTS

11.5.3 MIDDLE EAST AND AFRICA: MARITIME SATELLITE COMMUNICATION COVID-19 IMPACT

TABLE 197 MIDDLE EAST AND AFRICA: MARKET SIZE, BY COMPONENT, 2016–2018 (USD MILLION)

TABLE 198 MIDDLE EAST AND AFRICA: MARKET SIZE, BY COMPONENT, 2019–2025 (USD MILLION)

TABLE 199 MIDDLE EAST AND AFRICA: MARKET SIZE, BY SOLUTION, 2016–2018 (USD MILLION)

TABLE 200 MIDDLE EAST AND AFRICA: MARKET SIZE, BY SOLUTION, 2019–2025 (USD MILLION)

TABLE 201 MIDDLE EAST AND AFRICA: VSAT MARKET SIZE, BY FREQUENCY BAND, 2016–2018 (USD MILLION)

TABLE 202 MIDDLE EAST AND AFRICA: VSAT MARKET SIZE, BY FREQUENCY BAND, 2019–2025 (USD MILLION)

TABLE 203 MIDDLE EAST AND AFRICA: MARITIME SATELLITE COMMUNICATION MARKET SIZE, BY SERVICE, 2016–2018 (USD MILLION)

TABLE 204 MIDDLE EAST AND AFRICA: MARKET SIZE, BY SERVICE, 2019–2025 (USD MILLION)

TABLE 205 MIDDLE EAST AND AFRICA: MARKET SIZE, BY END USER, 2016–2018 (USD MILLION)

TABLE 206 MIDDLE EAST AND AFRICA: MARKET SIZE, BY END USER, 2019–2025 (USD MILLION)

TABLE 207 MIDDLE EAST AND AFRICA: MARKET SIZE, BY COUNTRY, 2016–2018 (USD MILLION)

TABLE 208 MIDDLE EAST AND AFRICA: MARKET SIZE, BY COUNTRY, 2019–2025 (USD MILLION)

11.5.4 UNITED ARAB EMIRATES

11.5.5 KINGDOM OF SAUDI ARABIA

11.5.6 REST OF MIDDLE EAST AND AFRICA

11.6 LATIN AMERICA

11.6.1 LATIN AMERICA: MARITIME SATELLITE COMMUNICATION MARKET DRIVERS

11.6.2 LATIN AMERICA: MARITIME SATELLITE COMMUNICATION VENDOR INITIATIVES AND DEVELOPMENTS

11.6.3 LATIN AMERICA: MARITIME SATELLITE COMMUNICATION COVID-19 IMPACT

TABLE 209 LATIN AMERICA: MARKET SIZE, BY COMPONENT, 2016–2018 (USD MILLION)

TABLE 210 LATIN AMERICA: MARKET SIZE, BY COMPONENT, 2019–2025 (USD MILLION)

TABLE 211 LATIN AMERICA: MARKET SIZE, BY SOLUTION, 2016–2018 (USD MILLION)

TABLE 212 LATIN AMERICA: MARKET SIZE, BY SOLUTION, 2019–2025 (USD MILLION)

TABLE 213 LATIN AMERICA: VSAT MARKET SIZE, BY FREQUENCY BAND, 2016–2018 (USD MILLION)

TABLE 214 LATIN AMERICA: VSAT MARKET SIZE, BY FREQUENCY BAND, 2019–2025 (USD MILLION)

TABLE 215 LATIN AMERICA: MARKET SIZE, BY SERVICE, 2016–2018 (USD MILLION)

TABLE 216 LATIN AMERICA: MARKET SIZE, BY SERVICE, 2019–2025 (USD MILLION)

TABLE 217 LATIN AMERICA: MARKET SIZE, BY END USER, 2016–2018 (USD MILLION)

TABLE 218 LATIN AMERICA: MARKET SIZE, BY END USER, 2019–2025 (USD MILLION)

TABLE 219 LATIN AMERICA: MARKET SIZE, BY COUNTRY, 2016–2018 (USD MILLION)

TABLE 220 LATIN AMERICA: MARKET SIZE, BY COUNTRY, 2019–2025 (USD MILLION)

11.6.4 BRAZIL

11.6.5 MEXICO

11.6.6 REST OF LATIN AMERICA

12 COMPETITIVE LANDSCAPE (Page No. - 165)

12.1 INTRODUCTION

12.2 COMPETITIVE LEADERSHIP MAPPING

TABLE 221 EVALUATION CRITERIA

12.2.1 VISIONARY LEADERS

12.2.2 DYNAMIC DIFFERENTIATORS

12.2.3 INNOVATORS

12.2.4 EMERGING COMPANIES

FIGURE 28 MARITIME SATELLITE COMMUNICATION MARKET (GLOBAL), COMPETITIVE LEADERSHIP MAPPING, 2020

12.3 STRENGTH OF PRODUCT PORTFOLIO

FIGURE 29 PRODUCT PORTFOLIO ANALYSIS OF TOP PLAYERS IN THE MARKET

12.4 BUSINESS STRATEGY EXCELLENCE

FIGURE 30 BUSINESS STRATEGY EXCELLENCE OF TOP PLAYERS IN THE MARKET

12.5 RANKING OF KEY PLAYERS

FIGURE 31 RANKING OF KEY PLAYERS IN THE MARITIME SATELLITE COMMUNICATION MARKET, 2020

13 COMPANY PROFILES (Page No. - 171)

13.1 INTRODUCTION

(Business Overview, Solutions & Services, Key Insights, Recent Developments, SWOT Analysis)*

13.2 INMARSAT

FIGURE 32 INMARSAT: COMPANY SNAPSHOT

FIGURE 33 INMARSAT: SWOT ANALYSIS

13.3 IRIDIUM COMMUNICATIONS

FIGURE 34 IRIDIUM COMMUNICATIONS: COMPANY SNAPSHOT

FIGURE 35 IRIDIUM COMMUNICATIONS: SWOT ANALYSIS

13.4 THURAYA

FIGURE 36 THURAYA: SWOT ANALYSIS

13.5 HUGHES NETWORK SYSTEMS

FIGURE 37 HUGHES NETWORK SYSTEMS: SWOT ANALYSIS

13.6 KHV INDUSTRIES

FIGURE 38 KVH INDUSTRIES: COMPANY SNAPSHOT

FIGURE 39 KVH INDUSTRIES: SWOT ANALYSIS

13.7 VIASAT

FIGURE 40 VIASAT: COMPANY SNAPSHOT

13.8 SPEEDCAST

FIGURE 41 SPEEDCAST: COMPANY SNAPSHOT

13.9 ST ENGINEERING

FIGURE 42 ST ENGINEERING: COMPANY SNAPSHOT

13.10 NSSLGLOBAL

13.11 MARLINK

13.12 ORBCOMM

13.13 NAVARINO

13.14 NETWORK INNOVATIONS

13.15 GTMARITIME

13.16 AST GROUP

13.17 ISOTROPIC NETWORKS

13.18 NORSAT INTERNATIONAL

13.19 SATCOM GLOBAL

13.20 INTELSAT

13.21 ORBIT COMMUNICATION SYSTEMS

*Details on Business Overview, Solutions & Services, Key Insights, Recent Developments, SWOT Analysis might not be captured in case of unlisted companies.

13.22 RIGHT-TO-WIN

14 APPENDIX (Page No. - 211)

14.1 DISCUSSION GUIDE

14.2 KNOWLEDGE STORE: MARKETSANDMARKETS’ SUBSCRIPTION PORTAL

14.3 AVAILABLE CUSTOMIZATIONS

14.4 RELATED REPORTS

14.5 AUTHOR DETAILS

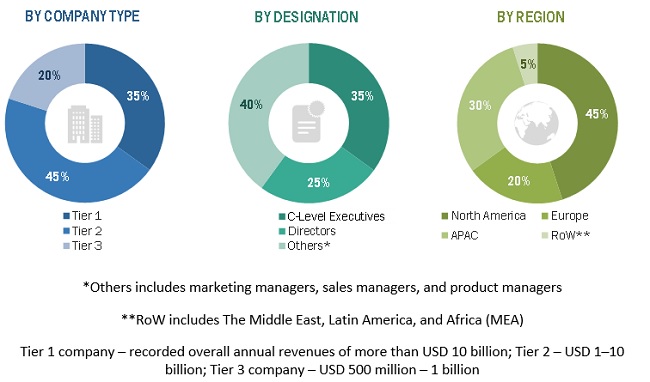

The study involved four major steps in estimating the current market size for the maritime satellite communication market. Exhaustive secondary research was done to collect information on the market, the peer market, and the parent market. The next step was to validate these findings, assumptions, and sizing with industry experts across the value chain through primary research. Both top-down and bottom-up approaches were employed to estimate the complete market size. Thereafter, the market breakup and data triangulation methods were used to estimate the market size of segments and subsegments.

Secondary Research

In the secondary research process, various secondary sources, such as Hoovers, Bloomberg BusinessWeek, and Dun & Bradstreet, have been referred to, to identify and collect information for the study. The secondary sources included companies’ annual reports, press releases, and investor presentations, and white papers; certified publications, such as the UK Finance Limited, Forexbonuses.org, Payment Systems Regulator, and ResearchGate were referred to; and articles from recognized associations and government publishing sources.

Primary Research

The maritime satellite communication market comprises several stakeholders, such as solutions and service providers, manufacturing enterprises, technology consultants, system design and development vendors, and logistics and supply chain management providers. The extensive primary research was conducted to gather information, and verify and validate the critical numbers arrived at. Primary research was further conducted to identify the segmentation types; industry trends; key players; the competitive landscape of different market players; and key market dynamics, such as drivers, restraints, opportunities, challenges, industry trends, and key strategies. Following is the breakup of the primary respondents:

To know about the assumptions considered for the study, download the pdf brochure

Market Size Estimation

Both top-down and bottom-up approaches were used to estimate and validate the overall size of the maritime satellite communication market. These methods were used extensively to estimate the size of various subsegments in the market. The research methodology used to estimate the market size includes the following:

- Key players in the industry and markets have been identified through extensive secondary research.

- The maritime satellite communication market expenditure across regions, along with the geographic split in various segments, have been considered to arrive at the overall market size.

- All percentage shares, splits, and breakups have been determined using secondary sources and verified through primary sources.

Data Triangulation

After arriving at the overall market size, using the market size estimation processes as explained above, the market was split into several segments and subsegments. To complete the overall market engineering process and arrive at the exact statistics of each market segment and subsegment, data triangulation, and market breakup procedures were employed, wherever applicable. The data was triangulated by studying various factors and trends from both the demand side and supply side in the maritime satellite communication market.

Report Objectives:

- To define, describe, and forecast the maritime satellite communication market by component (Solutions and Services), Very Small Aperture Terminal (VSAT), end user, and region

- To provide detailed information about the major factors (drivers, restraints, opportunities, and industry-specific challenges) influencing the market growth

- To analyze the opportunities in the market and provide details about the competitive landscape for stakeholders and market leaders

- To forecast the market size of the market segments with respect to four main regions, namely, North America, Europe, Asia Pacific (APAC), Middle East and Africa (MEA), and Latin America

- To profile the key players and comprehensively analyze their market rankings and core competencies1

- To analyze competitive developments, such as partnerships, new product launches, and mergers and acquisitions, in the maritime satellite communication market

1Core competencies of the companies have been captured in terms of their key developments and key strategies adopted by them to sustain their positions in the market.

- Detailed analysis and profiling of additional market players (up to 5)

Growth opportunities and latent adjacency in Maritime Satellite Communication Market

Gather insights into Maritime Satellite Communication Market

Interested in Market Usage of various VSAT systems in Maritime Industry

Interested in Market Usage of various VSAT systems in Maritime Industry

Understand the dynamics of Maritime Satellite Communication Market

Need analysis on the Maritime trends on Merchant Cargo Shipping; especially Container lines