Space SATCOM Equipment Market by Component (Transponders, Transceivers, Converters, Amplifiers, Antennas), Satellite Type (CubeSat, Small, Medium, Large), End User (Commercial, Government & Military), Application, and Region - Global Forecast to 2035

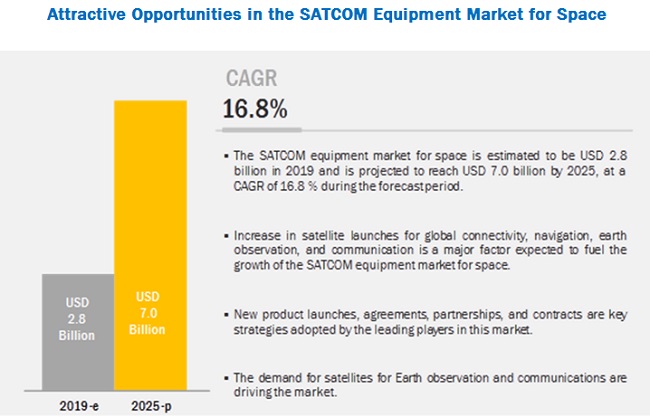

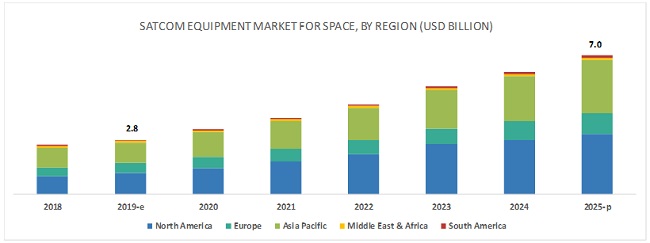

[143 Pages Report] The SATCOM equipment market for space is projected to grow from USD 2.8 billion in 2019 to USD 7.0 billion by 2025, at a CAGR of 16.8% from 2019 to 2025. One of the major factors expected to fuel the market growth includes the increasing launch of satellites for a variety of applications, such as navigation, communication, Earth observation, and remote sensing.

MnM helped a global manufacturer of high-value printed circuit boards to identify ~USD 40 million market potential by tapping into the SATCOM Equipment Market for Space across the globe.

Client’s Problem Statement

The client, an eminent manufacturer of high-value printed circuit boards, was keen to build a substantive business from SATCOM Equipment Market for Space. The senior management needed to take few crucial decisions such as: which SATCOM Equipment Market for Space to focus on, which countries to prioritize across the planet. The client was interested in crucial information such as data of regional level satellite launches and top suppliers for satellite communication equipment. It needed this information for a superior understanding of revenue vs. price costs.

MnM Approach

MnM identified key disruptive technology trends with regards to SATCOM Equipment such as 3D Printing RF Equipment and Gallium Nitride (GaN) that changed the revenue mix of our client’s clients in end-use industries such as space satellite operations, scientific research & development, media and entertainment, and defense & intelligence. The client was provided with the volume analysis of satellites, which included volumes of information on CubeSats, Small Satellites, Medium Satellites, and Large Satellites in regions such as North America, Europe, the Middle East and the Asia Pacific. MnM also provided the global list of top suppliers for satellites.

This helped the client to assess the market potential and identify high-impact use cases for tapping into the SATCOM Equipment Market for Space. Further, MnM also supported the client to understand the competitive landscape, varying business models and strategies of different players in the SATCOM Equipment Market for Space. The client could devise a differentiated product offering and forge suitable alliances to help it win in this market.

Revenue Impact (RI)

The client could tap into an approximate USD 1.0 billion market, with projected revenue of USD 40 million in three years, based on MnM’s expert recommendations.

By satellite type, the CubeSat (0.25U–27U) segment is projected to grow at the highest CAGR during the forecast period.

By satellite type, the CubeSat (0.25U—27U) segment of the SATCOM equipment market for space is projected to grow at the highest CAGR from 2019 to 2025. CubeSats are used for a variety of applications, including testing new technologies for space missions. A majority of the CubeSats launched is used for Earth observation and remote sensing applications. A rise in the demand for Earth observation applications is expected to drive the growth of the CubeSat (0.25U–27U) segment during the forecast period.

By end user, the commercial segment is expected to lead the market from 2019 to 2025.

Based on end user, the SATCOM equipment market for space has been segmented into commercial, government & military, and commercial, government, & military. The commercial segment is expected to lead the Satellite Terminals Market due to the increasing launch of satellites for communication, Earth observation, and navigation.

By application, the Earth observation & remote sensing segment is projected to grow at the highest CAGR from 2019 to 2025.

Based on application, the SATCOM equipment market for space has been segmented into Earth observation & remote sensing, communication, scientific research & exploration, navigation, and others. The Earth observation & remote sensing segment is projected to grow at the highest CAGR during the forecast period. There is an increase in demand for Earth observation, global connectivity, navigation, and communication, among others. This demand is expected to have a significant impact on the market for SATCOM equipment for space.

By region, the market in North America is projected to grow at the highest CAGR from 2019 to 2025.

By region, the SATCOM equipment market for space in North America is projected to grow at the highest CAGR during the forecast period due to the increasing launch of satellites in the region for communications, scientific research & development, and Earth observation. Private companies such as OneWeb (US), SpaceX (US), and Amazon (US) are heavily invested in the launch of small satellites into Low Earth Orbit for communications. According to an article published by Via Satellite in November 2018, SpaceX has received approval from the Federal Communications Commission (FCC) to launch over 7,000 satellites for its Starlink constellation. Such launches are driving the SATCOM equipment market for space in North America.

Key Market Players

The major players in the SATCOM equipment market for space include Airbus SE (Netherlands), Maxar Technologies (US), Mitsubishi Electric Corporation (Japan), General Dynamics Corporation (US), Honeywell International Inc. (US), Harris Corporation (US), ISIS - Innovative Solutions in Space B.V. (Netherlands), and Oxford Space Systems (UK). These players have adopted various growth strategies, such as contracts, acquisitions, expansions, new product launches, and partnerships & agreements, to further expand their presence in the market.

Scope of the Report

|

Report Metric |

Details |

|

Market size available for years |

2017–2025 |

|

Base year considered |

2018 |

|

Forecast period |

2019–2025 |

|

Forecast monetary unit |

Value (USD) |

|

Segments covered |

Satellite Type, Application, Component, End User, and Region |

|

Regions covered |

North America, Europe, Asia Pacific, Middle East & Africa, and South America |

|

Companies covered |

Airbus SE (Netherlands), Maxar Technologies (US), Mitsubishi Electric Corporation (Japan), General Dynamics Corporation (US), Honeywell International Inc. (US), and Harris Corporation (US), among others. |

This research report categorizes the SATCOM equipment market for space based on satellite type, application, component, end user, and region.

Based on Satellite Type, the SATCOM equipment market for space has been segmented as follows:

- CubeSat (0.25U–27U)

-

Small Satellite (1–500 KG)

- Nanosatellite (1–10 KG)

- Microsatellite (11–100 KG)

- Minisatellite (101–500 KG)

- Medium Satellite (501–2,500 KG)

- Large Satellite (>2,500 KG)

Based on Application, the SATCOM equipment market for space has been segmented as follows:

- Earth Observation & Remote Sensing

- Communication

- Scientific Research & Exploration

- Navigation

- Others

Based on Component, the SATCOM equipment market for space has been segmented as follows:

- Transponders

- Transceivers

- Converters

- Amplifiers

- Space Antennas

- Others

Based on End User, the SATCOM equipment market for space has been segmented as follows:

-

Commercial

- Satellite Operators/Owners

- Scientific Research & Development

- Energy Industry

- Air Traffic & Navigation Service Providers

- Media & Entertainment

-

Government & Military

- Space Agencies

- Department of Defense & Intelligence Agencies

- Search & Rescue Entities

- Academic Research Institutions

- Commercial, Government, & Military

Based on Region, the SATCOM equipment market for space has been segmented as follows:

- North America

- Europe

- Asia Pacific

- Middle East & Africa

- South America

Recent Developments

- In January 2019, Ball Aerospace and Telesat (Canada) collaborated to develop a fully electronically-steered flat panel antenna.

- In May 2018, GomSpace secured a contract from the ESA worth USD 4 million for the development of improved smallsat systems and subsystems for a science mission to deep space.

- In January 2019, Harris Corporation introduced its new 3D printed Radio Frequency (RF) Antenna at the 2019 IEEE Radio & Wireless Week in Orlando, US.

- In November 2018, MDA, a Maxar Technologies company, secured two contracts worth USD 11 million from OHB System AG and Tesat-Spacecom GmbH & Co. KG for the supply of multiple advanced communication subsystems.

Key Questions Addressed by the Report

- What are the key dynamics, such as drivers, opportunities, and trends, governing the SATCOM equipment market for space?

- What are the key sustainability strategies adopted by the leading players operating in the SATCOM equipment market for space?

- What are the new emerging technologies and use cases disrupting the satellite industry?

- Which are the applications wherein SATCOM equipment for space plays a significant role?

- What are the key trends and opportunities in the SATCOM equipment market for space across different regions and their respective countries?

- Who are the key players and innovators in the ecosystem of the SATCOM equipment market for space?

- Which supplier of SATCOM equipment for space had the maximum share in the market in 2018?

- How is the competitive landscape changing in the client ecosystem, and how is this change impacting the revenues of companies?

To speak to our analyst for a discussion on the above findings, click Speak to Analyst

Table of Contents

1 Introduction (Page No. - 19)

1.1 Objectives of the Study

1.2 Market Definition

1.3 Currency & Pricing

1.4 Limitations

1.5 Market Stakeholders

2 Research Methodology (Page No. - 23)

2.1 Research Data

2.2 Market Definition & Scope

2.2.1 Segment Definitions

2.2.1.1 SATCOM Equipments Market for Space, By Satellite Type

2.2.1.2 SATCOM Equipments Market for Space, By Application

2.2.1.3 SATCOM Equipments Market for Space, By Component

2.2.1.4 SATCOM Equipments Market for Space, By End User

2.2.2 Exclusions

2.2.3 Secondary Data

2.2.3.1 Key Data From Secondary Sources

2.2.4 Primary Data

2.2.4.1 Key Data From Primary Sources

2.2.4.2 Breakdown of Primaries

2.3 Research Approach & Methodology

2.3.1 Bottom-Up Approach

2.3.1.1 Regional SATCOM Equipment Market for Space

2.3.1.2 SATCOM Equipments Market for Space for Satellite Type Segments

2.3.1.3 SATCOM Equipments Market for Space for Application Segments

2.3.1.4 SATCOM Equipments Market for Space for End User Segments

2.3.1.5 SATCOM Equipments Market for Space for Component Segments

2.3.2 Top-Down Approach

2.4 Triangulation & Validation

2.5 Research Assumptions

2.5.1 Market Sizing

2.5.2 Market Forecasting

2.6 Risks

2.7 Grey Areas

3 Executive Summary (Page No. - 34)

4 Premium Insights (Page No. - 38)

4.1 Attractive Growth Opportunities in SATCOM Equipments Market for Space

4.2 Small Satellite (1–500 Kg) SATCOM Equipments Market for Space, By Type

4.3 Commercial End User– SATCOM Equipments Market for Space, By Type

4.4 Government & Military End User–SATCOM Equipments Market for Space, By Type

4.5 SATCOM Equipments Market for Space, By Country

5 Market Overview (Page No. - 41)

5.1 Introduction

5.2 Market Dynamics

5.2.1 Drivers

5.2.1.1 Increase in Satellite Launches Globally

5.2.1.1.1 Increase in the Launch of Small Satellites

5.2.1.1.2 Growing Demand for Ku- and Ka-Band Satellites

5.2.1.1.3 Demand for Satellite Networks to Provide Internet Access

5.2.1.1.4 Increase in Demand for Earth Observation and Communications

5.2.2 Opportunities

5.2.2.1 High Data Rate Communication Equipment

5.2.2.2 New 3D-Printed RF Components

5.2.2.3 New Optical Technology for Inter-Satellite Communication

5.2.3 Challenges

5.2.3.1 Regulatory Challenges Related to Component Design

5.2.3.2 Regulatory Challenges Due to the Increasing Number of Proposed Small Satellite Launches

6 Industry Trends (Page No. - 45)

6.1 Introduction

6.2 Technology Trends

6.2.1 Gradual Shift From LEO Satellites to GEO Satellites

6.2.2 Increasing Use of Phased Array Antennas for Broadband Communications in Space

6.2.3 Design of New Antennas Could Boost Satellite Communications

6.2.4 3D Printing RF Equipment Will Change Manufacturing Processes

6.2.5 Increasing Use of Gan in the SATCOM Equipment Market for Space

6.2.6 Increasing Use of Modular SSPA

6.3 Innovations & Patent Registrations

7 SATCOM Equipment Market for Space, By Component (Page No. - 49)

7.1 Introduction

7.2 Transponders

7.2.1 Rise in Demand for 5G Communication Satellites Will Drive the Market for Transponders

7.3 Transceivers

7.3.1 Transmitters

7.3.1.1 Increased Use of Hts for Broadband Connectivity

7.3.2 Receivers

7.3.2.1 Increase in Customer Demand for High Data Rate Applications

7.4 Converters

7.4.1 Increase in Launch of Satellites in LEO for Earth Observation Will Drive the Market for Converters

7.5 Amplifiers

7.5.1 Increase in Launch of Satellites in GEO for Deep Space Missions Will Drive the Market for Amplifiers

7.6 Space Antennas

7.6.1 Increased Use of Phased Array Antennas for Communications Will Drive the Market for Space Antennas

7.6.1.1 Wire Antennas

7.6.1.2 Horn Antennas

7.6.1.3 Array Antennas

7.6.1.4 Reflector Antennas

7.7 Others

8 SATCOM Equipment Market for Space, By Satellite Type (Page No. - 57)

8.1 Introduction

8.2 CubeSat (0.25u–27u)

8.2.1 Increase in Launch of CubeSats for Earth Observation is Expected to Drive the SATCOM Equipment Market

8.3 Small Satellite (1-500 Kg)

8.3.1 Nanosatellite (1–10 Kg)

8.3.1.1 Use of Nanosatellites for A Variety of Commercial Applications

8.3.2 Microsatellite (11–100 Kg)

8.3.2.1 Testing New Technologies in A Realistic Orbital Environment

8.3.3 Minisatellite (101–500 Kg)

8.3.3.1 Widely Used for Earth Observation and Broadband Internet

8.4 Medium Satellite (501–2,500 Kg)

8.4.1 Increase in Launch of Medium Satellites for Scientific Research & Exploration is Expected to Drive the SATCOM Equipment Market

8.5 Large Satellite (Above 2,500 Kg)

8.5.1 Increase in Launch of Large Satellites for Navigation and Tracking is Expected to Drive the SATCOM Equipment Market

9 SATCOM Equipment Market for Space, By Application (Page No. - 63)

9.1 Introduction

9.2 Earth Observation & Remote Sensing

9.2.1 Increase in Launch of Satellites for Earth Observation and Remote Sensing Expected to Drive the SATCOM Equipment Market

9.3 Communication

9.3.1 Need for Global Network Coverage With High-Speed Data Transfer Expected to Positively Influence the Market

9.4 Scientific Research & Exploration

9.4.1 Use of CubeSats for Preliminary Scientific Missions and Testing New Technologies Expected to Drive the Scientific Research & Exploration Segment

9.5 Navigation

9.5.1 Launch of New Constellations of Satellites for Gnss Expected to Drive the SATCOM Equipment Market for Space

9.6 Others

10 SATCOM Equipment Market for Space, By End User (Page No. - 70)

10.1 Introduction

10.2 Commercial

10.2.1 Satellite Operators/Owners

10.2.1.1 Increased Demand for Satellite Communications Services

10.2.2 Scientific Research & Development

10.2.2.1 Increased Launch of Satellites for Deep Space Exploration

10.2.3 Energy Industry

10.2.3.1 Increased Demand for Satellite Communications Services

10.2.4 Media & Entertainment

10.2.4.1 Increasing Demand for On-Demand and Streaming Information and Entertainment

10.3 Government & Military

10.3.1 Space Agencies

10.3.1.1 Increased Demand for Strategic Satellites

10.3.2 Department of Defense & Intelligence Agencies

10.3.2.1 The Continuously Growing Demand for Bandwidth Within the Military

10.3.3 Search & Rescue Entities

10.3.3.1 Earth Observation Satellites Play A Vital Role in Search & Rescue Operations

10.3.4 Academic Research Institutions

10.3.4.1 Universities Collaborate With Space Agencies to Conduct Research and Launch Satellites

10.4 Commercial, Government, & Military

10.4.1 Increase in Launch of Satellites for Increased Connectivity and Provision of High-Speed Data is Expected to Drive the Market

11 Regional Analysis (Page No. - 77)

11.1 Introduction

11.2 North America

11.2.1 US

11.2.1.1 Increase in Launch of Satellites for 5G to Drive the SATCOM Equipment Market in the US

11.2.2 Canada

11.2.2.1 Increase in Launch of Satellites for Scientific Research & Development Expected to Drive the SATCOM Equipment Market in Canada

11.3 Europe

11.3.1 Russia

11.3.1.1 Increase in Launch of Satellites for Increased Connectivity is Expected to Drive the Market in Russia

11.3.2 Germany

11.3.2.1 Partnerships With Nasa and the Esa Will Impact the SATCOM Equipment Market in Germany

11.3.3 France

11.3.3.1 50-Year Partnership With the Isro Will Impact the Market for SATCOM Equipment in France

11.3.4 UK

11.3.4.1 Increase in Launch of Medium Satellites to Drive the SATCOM Equipment Market in the UK

11.3.5 Italy

11.3.5.1 Increase in Launch of Satellites for Communication to Drive the SATCOM Equipment Market in the Italy

11.4 Asia Pacific

11.4.1 China

11.4.1.1 Major Investments in Space Programs By the Chinese Government is Estimated to Drive the SATCOM Equipment Market in China

11.4.2 Japan

11.4.2.1 Increase in Spending on Space Science Missions Will Impact the SATCOM Equipment Market in Japan

11.4.3 India

11.4.3.1 Increased Demand for Earth Observation and Remote Sensing Applications Will Drive the SATCOM Equipment Market in India

11.4.4 South Korea

11.4.4.1 Investment in the Development of Satellites for Monitoring Agriculture Will Impact the SATCOM Equipment Market in South Korea

11.4.5 Australia

11.4.5.1 International Partnerships With Canada, the UK, and the UAE Will Impact the SATCOM Equipment Market in Australia

11.5 Middle East & Africa

11.5.1 The Middle East

11.5.1.1 Increase in Launch of Small Satellite for Earth Observation is Expected to Drive the Market in the Middle East

11.5.2 Africa

11.5.2.1 Increase in Launch of Small Satellites for Communications is Expected to Drive the Market in Africa

11.6 South America

11.6.1 Increase in Launch of Large Satellites for Scientific Research is Expected to Drive the Market in South America

12 Competitive Landscape (Page No. - 106)

12.1 Introduction

12.2 Market Rank Analysis, 2018

12.3 Competitive Scenario

12.4 Competitive Leadership Mapping

12.4.1 Visionary Leaders

12.4.2 Innovators

12.4.3 Dynamic Differentiators

12.4.4 Emerging Companies

12.5 Competitive Scenario

12.5.1 New Product Launches

12.5.2 Contracts

12.5.3 Partnerships, Agreements, Mergers, Collaborations, and Acquisitions

13 Company Profiles (Page No. - 113)

(Business Overview, Products/Services/Solutions Offered, Recent Developments, SWOT Analysis, and MnM View)*

13.1 Airbus SE

13.2 Antwerp Space

13.3 Ball Aerospace and Technologies Corporation

13.4 Cobham PLC

13.5 General Dynamics Corporation

13.6 Gomspace A/S

13.7 Harris Corporation

13.8 Honeywell International Inc.

13.9 ISIS - Innovative Solutions in Space B.V.

13.10 Maxar Technologies

13.11 Mitsubishi Electric Corporation

13.12 NEC Space Technologies, Ltd.

13.13 Oxford Space Systems

13.14 Ruag Group

13.15 Tesat-Spacecom GmbH & Co. Kg

*Details on Business Overview, Products/Services/Solutions Offered, Recent Developments, SWOT Analysis, and MnM View Might Not Be Captured in Case of Unlisted Companies.

14 Appendix (Page No. - 139)

14.1 Discussion Guide

14.2 Knowledge Store: Marketsandmarkets’ Subscription Portal

14.3 Available Customizations

14.4 Related Reports

List of Tables (83 Tables)

Table 1 USD Exchange Rates

Table 2 Innovations & Patent Registrations, June 2015–June 2019

Table 3 SATCOM Equipment Market Size for Space, By Component, 2017–2025 (USD Million)

Table 4 Transponders Market Size, By Region, 2017–2025 (USD Million)

Table 5 Transceivers Market Size, By Type, 2017–2025 (USD Million)

Table 6 Transceivers Market Size, By Region, 2017–2025 (USD Million)

Table 7 Converters Market Size, By Region, 2017–2025 (USD Million)

Table 8 Amplifiers Market Size, By Region, 2017–2025 (USD Million)

Table 9 Space Antennas Market Size, By Region, 2017–2025 (USD Million)

Table 10 Other Components Market Size, By Region, 2017–2025 (USD Million)

Table 11 SATCOM Equipment Market Size for Space, By Satellite Type, 2017–2025 (USD Million)

Table 12 CubeSat SATCOM Equipment Market Size for Space, By Region, 2017–2025 (USD Million)

Table 13 Small Satellite (1–500 Kg) SATCOM Equipment Market Size for Space, By Type, 2017–2025 (USD Million)

Table 14 Small Satellite (1–500 Kg) SATCOM Equipment Market Size for Space, By Region, 2017–2025 (USD Million)

Table 15 Medium Satellite (501–2,500 Kg) SATCOM Equipment Market Size for Space, By Region, 2017–2025 (USD Million)

Table 16 Large Satellite (Above 2,500 Kg) SATCOM Equipment Market Size for Space, By Region, 2017–2025 (USD Million)

Table 17 SATCOM Equipments Industry Size for Space, By Application, 2017–2025 (USD Million)

Table 18 SATCOM Equipments Industry Size for Space in Earth Observation & Remote Sensing, By Region, 2017–2025 (USD Million)

Table 19 SATCOM Equipments Industry Size for Space in Communication, By Region, 2017–2025 (USD Million)

Table 20 SATCOM Equipments Industry Size for Space in Scientific Research & Exploration, By Region, 2017–2025 (USD Million)

Table 21 SATCOM Equipments Industry Size for Space in Navigation, By Region, 2017–2025 (USD Million)

Table 22 SATCOM Equipments Industry Size for Space in Other Applications, By Region, 2017–2025 (USD Million)

Table 23 SATCOM Equipments Market Size for Space, By End User, 2017–2025 (USD Million)

Table 24 Commercial End User–SATCOM Equipment Industry Size for Space, By Type, 2017–2025 (USD Million)

Table 25 Commercial SATCOM Equipments Industry Size for Space, By Region, 2017–2025 (USD Million)

Table 26 Government & Military End User–SATCOM Equipment Industry Size for Space, By Type, 2017–2025 (USD Million)

Table 27 Government & Military SATCOM Equipments Industry Size for Space, By Region, 2017–2025 (USD Million)

Table 28 Commercial, Government, & Military SATCOM Equipment Industry Size for Space, By Region, 2017–2025 (USD Million)

Table 29 SATCOM Equipment Market Size for Space, By Region, 2017–2025 (USD Million)

Table 30 North America SATCOM Equipments Industry Size for Space, By Satellite Type, 2017–2025 (USD Million)

Table 31 North America SATCOM Equipments Industry Size for Space, By Application, 2017–2025 (USD Million)

Table 32 North America SATCOM Equipments Industry Size for Space, By End User, 2017–2025 (USD Million)

Table 33 North America SATCOM Equipments Industry Size for Space, By Component, 2017–2025 (USD Million)

Table 34 North America SATCOM Equipments Industry Size for Space, By Country, 2017–2025 (USD Million)

Table 35 US SATCOM Equipment Market Size for Space, By Satellite Type, 2017–2025 (USD Million)

Table 36 US SATCOM Equipment Market Size for Space, By Application, 2017–2025 (USD Million)

Table 37 Canada SATCOM Equipments Market Size for Space, By Satellite Type, 2017–2025 (USD Million)

Table 38 Canada SATCOM Equipments Market Size for Space, By Application, 2017–2025 (USD Million)

Table 39 Europe SATCOM Equipments Market Size for Space, By Satellite Type, 2017–2025 (USD Million)

Table 40 Europe SATCOM Equipments Market Size for Space, By Application, 2017–2025 (USD Million)

Table 41 Europe SATCOM Equipments Market Size for Space, By End User, 2017–2025 (USD Million)

Table 42 Europe SATCOM Equipments Market Size for Space, By Component, 2017–2025 (USD Million)

Table 43 Europe SATCOM Equipments Market Size for Space, By Country, 2017–2025 (USD Million)

Table 44 Russia SATCOM Equipments Market Size for Space, By Satellite Type, 2017–2025 (USD Million)

Table 45 Russia SATCOM Equipments Market Size for Space, By Application, 2017–2025 (USD Million)

Table 46 Germany SATCOM Equipment Market Size for Space, By Satellite Type, 2017–2025 (USD Million)

Table 47 Germany SATCOM Equipment Market Size for Space, By Application, 2017–2025 (USD Million)

Table 48 France SATCOM Equipment Industry Size for Space, By Satellite Type, 2017–2025 (USD Million)

Table 49 France SATCOM Equipment Industry Size for Space, By Application, 2017–2025 (USD Million)

Table 50 UK SATCOM Equipment Industry Size for Space, By Satellite Type, 2017–2025 (USD Million)

Table 51 UK SATCOM Equipment Industry Size for Space, By Application, 2017–2025 (USD Million)

Table 52 Italy SATCOM Equipment Industry Size for Space, By Satellite Type, 2017–2025 (USD Million)

Table 53 Italy SATCOM Equipment Market Size for Space, By Application, 2017–2025 (USD Million)

Table 54 Asia Pacific SATCOM Equipment Industry Size for Space, By Satellite Type, 2017–2025 (USD Million)

Table 55 Asia Pacific SATCOM Equipment Industry Size for Space, By Application, 2017–2025 (USD Million)

Table 56 Asia Pacific SATCOM Equipment Industry Size for Space, By End User, 2017–2025 (USD Million)

Table 57 Asia Pacific SATCOM Equipment Industry Size for Space, By Component, 2017–2025 (USD Million)

Table 58 Asia Pacific SATCOM Equipment Market Size for Space, By Country, 2017–2025 (USD Million)

Table 59 China SATCOM Equipment Industry Size for Space, By Satellite Type, 2017–2025 (USD Million)

Table 60 China SATCOM Equipment Industry Size for Space, By Application, 2017–2025 (USD Million)

Table 61 Japan SATCOM Equipment Industry Size for Space, By Satellite Type, 2017–2025 (USD Million)

Table 62 Japan SATCOM Equipment Industry Size for Space, By Application, 2017–2025 (USD Million)

Table 63 India SATCOM Equipment Industry Size for Space, By Satellite Type, 2017–2025 (USD Million)

Table 64 India SATCOM Equipment Industry Size for Space, By Application, 2017–2025 (USD Million)

Table 65 South Korea SATCOM Equipment Market Size for Space, By Satellite Type, 2017–2025 (USD Million)

Table 66 South Korea SATCOM Equipment Market Size for Space, By Application, 2017–2025 (USD Million)

Table 67 Australia SATCOM Equipment Market Size for Space, By Satellite Type, 2017–2025 (USD Million)

Table 68 Australia SATCOM Equipment Market Size for Space, By Application, 2017–2025 (USD Million)

Table 69 Middle East & Africa SATCOM Equipment Industry Size for Space, By Satellite Type, 2017–2025 (USD Million)

Table 70 Middle East & Africa SATCOM Equipment Industry Size for Space, By Application, 2017–2025 (USD Million)

Table 71 Middle East & Africa SATCOM Equipment Industry Size for Space, By End User, 2017–2025 (USD Million)

Table 72 Middle East & Africa SATCOM Equipment Industry Size for Space, By Component, 2017–2025 (USD Million)

Table 73 The Middle East SATCOM Equipment Industry Size for Space, By Satellite Type, 2017–2025 (USD Million)

Table 74 The Middle East SATCOM Equipment Industry Size for Space, By Application, 2017–2025 (USD Million)

Table 75 Africa SATCOM Equipments Market Size for Space, By Satellite Type, 2017–2025 (USD Million)

Table 76 Africa SATCOM Equipments Market Size for Space, By Application, 2017–2025 (USD Million)

Table 77 South America SATCOM Equipment Market Size for Space, By Satellite Type, 2017–2025 (USD Million)

Table 78 South America SATCOM Equipment Market Size for Space, By Application, 2017–2025 (USD Million)

Table 79 South America SATCOM Equipment Market Size for Space, By End User, 2017–2025 (USD Million)

Table 80 South America SATCOM Equipment Market Size for Space, By Component, 2017–2025 (USD Million)

Table 81 New Product Launches, December 2015– May 2019

Table 82 Contracts, December 2015–May 2019

Table 83 Partnerships, Agreements, Mergers, Collaborations, and Acquisitions December 2015–May 2019

List of Figures (40 Figures)

Figure 1 Markets Covered

Figure 2 Regional Scope

Figure 3 Years Considered for the Study

Figure 4 Research Process Flow

Figure 5 SATCOM Equipments Market for Space: Research Design

Figure 6 Breakdown of Primary Interviews: By Company Type, Designation, and Region

Figure 7 Market Size Estimation Methodology: Bottom-Up Approach

Figure 8 Market Size Estimation Methodology: Top-Down Approach

Figure 9 Data Triangulation

Figure 10 Assumptions for the Research Study

Figure 11 Medium Satellite (501–2,500 Kg) Segment Projected to Lead the SATCOM Equipments Market for Space From 2019 to 2025

Figure 12 Earth Observation & Remote Sensing Segment Projected to Lead the SATCOM Equipments Market for Space From 2019 to 2025

Figure 13 Transceivers Segment Projected to Lead the SATCOM Equipments Market for Space From 2019 to 2025

Figure 14 Commercial Segment Projected to Lead the SATCOM Equipments Market for Space From 2019 to 2025

Figure 15 North America Projected to Lead the SATCOM Equipments Market for Space From 2019 to 2025

Figure 16 Rising Demand for Earth Observation and Ongoing Expansion of Telecommunications Networks Drive SATCOM Equipments Market for Space

Figure 17 Minisatellite (101 – 500 Kg) Segment Expected to Lead Small Satellite Communication Equipment Market for Space From 2019 to 2025

Figure 18 Satellite Operators/Owners Segment Expected to Lead Commercial SATCOM Equipments Market for Space From 2019 to 2025

Figure 19 Space Agencies Segment Expected to Lead Government & Military SATCOM Equipments Market for Space During Forecast Period

Figure 20 China is Expected to Grow at the Highest CAGR During Forecast Period

Figure 21 SATCOM Equipments Market for Space: Drivers, Opportunities, & Challenges

Figure 22 Transponders Segment of SATCOM Equipments Market for Space Projected to Grow at Highest CAGR During Forecast Period

Figure 23 CubeSat (0.25u–27u) Segment of SATCOM Equipments Market for Space Projected to Grow at Highest CAGR During Forecast Period

Figure 24 Earth Observation & Remote Sensing Segment of SATCOM Equipments Market for Space Projected to Grow at Highest CAGR During Forecast Period

Figure 25 Commercial Segment of SATCOM Equipments Market for Space Projected to Grow at Highest CAGR During Forecast Period

Figure 26 SATCOM Equipment Market for Space, Regional Snapshot

Figure 27 North America SATCOM Equipment Market for Space Snapshot

Figure 28 Europe SATCOM Equipment Market for Space Snapshot

Figure 29 Asia Pacific SATCOM Market for Space Snapshot

Figure 30 Major Players in SATCOM Equipment Market for Space, 2018

Figure 31 Companies Adopted Contracts as Key Growth Strategy From April 2013 to May 2019

Figure 32 SATCOM Equipment Market (Global) Space Competitive Leadership Mapping, 2018

Figure 33 Airbus Se: Company Snapshot

Figure 34 Cobham PLC: Company Snapshot

Figure 35 General Dynamics Corporation: Company Snapshot

Figure 36 Gomspace A/S: Company Snapshot

Figure 37 Harris Corporation: Company Snapshot

Figure 38 Honeywell International Inc.: Company Snapshot

Figure 39 Maxar Technologies: Company Snapshot

Figure 40 Mitsubishi Electric Corporation: Company Snapshot

Exhaustive secondary research was undertaken to collect information on the SATCOM equipment market for space, its adjacent markets, and its parent market. The next step involved the validation of these findings, assumptions, and sizing with the industry experts across the value chain through primary research. Both demand and supply side analyses were employed to estimate the overall size of the market. Thereafter, market breakdown and data triangulation procedures were used to estimate the market sizes of different segments and subsegments.

Secondary Research

In the secondary research process, various secondary sources such as Statista, National Aeronautics and Space Administration (NASA), Indian Space Research Organisation (ISRO), Gunter’s Space Page, Boeing Outlook, Airbus Outlook, Factiva, Bloomberg, BusinessWeek, SEC filings, annual reports, press releases & investor presentations of companies, certified publications, and articles by recognized authors were referred to for identifying and collecting information on the SATCOM equipment market for space.

Primary Research

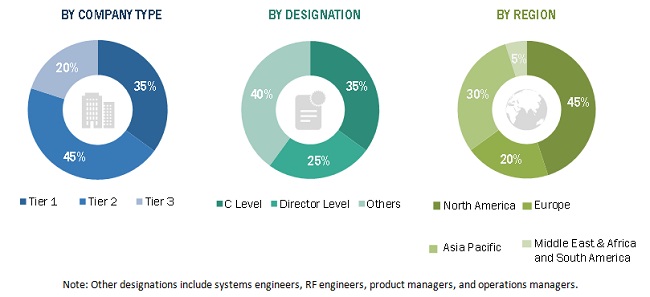

The SATCOM equipment market for space comprises several stakeholders, such as raw material suppliers, end-product manufacturers, and integratory and regulatory organizations in its supply chain. The demand side of this market is characterized by various end users, such as commercial organizations and military forces of different countries. The supply side is characterized by technological advancements in the SATCOM equipment and development of new communications subsystems. The following is the breakdown of primary respondents that were interviewed to obtain qualitative and quantitative information about the SATCOM equipment market for space.

To know about the assumptions considered for the study, download the pdf brochure

Market Size Estimation

Both top-down and bottom-up approaches were used to estimate and validate the total size of the SATCOM equipment market for space. These methods were also used extensively to estimate the size of various segments and subsegments of the market. The research methodology used to estimate the market size included the following:

- Key players in the industry and market were identified through extensive secondary research of their product matrix and geographical presence and developments undertaken by them.

- All percentage shares, splits, and breakdowns were determined using secondary sources and verified through primary sources.

Data Triangulation

After arriving at the overall size of the SATCOM equipment market for space using the market size estimation processes explained above, the market was split into several segments and subsegments. To complete the overall market engineering process and arrive at the exact statistics of each market segment and subsegment, data triangulation and market breakdown procedures were employed, wherever applicable. The data was triangulated by studying various factors and trends from the demand as well as supply sides of the SATCOM equipment market for space.

Report Objectives

- To define, describe, segment, and forecast the size of the SATCOM equipment market for space based on satellite type, end user, application, component, and region

- To understand the structure of the market by identifying its various segments and subsegments

- To forecast the size of various segments of the market with respect to 5 major regions, namely, North America, Europe, Asia Pacific, the Middle East & Africa, and South America, along with the major countries in each of these regions

- To identify and analyze key drivers, restraints, opportunities, and challenges influencing the growth of the SATCOM equipment market for space

- To strategically analyze the micromarkets with respect to individual growth trends, prospects, and their contribution to the overall market

- To analyze the opportunities in the market for stakeholders by identifying key market trends

- To analyze competitive developments such as contracts, acquisitions, expansions, new product launches, partnerships & agreements, and R&D activities in the market

- To provide a detailed competitive landscape of the SATCOM equipment market for space, along with an analysis of the business and corporate strategies adopted by leading players

Available Customizations

With the given market data, MarketsandMarkets offers customizations according to the specific requirements of companies.

Product Analysis

- Product matrix, which gives a detailed comparison of the product portfolio of each company

Company Information

- Detailed analysis and profiles of additional market players (up to 5)

Growth opportunities and latent adjacency in Space SATCOM Equipment Market