Satellite Bus Market by Subsystem (Structures & Mechanisms, Thermal Control, Electric Power, Attitude Control, Propulsion, Telemetry Tracking and Command (TT&C), Flight Software), Satellite Size, Application, and Region - Global Forecast to 2022

[142 Pages Report] The Satellite Bus Market was USD 9.28 Billion in 2016 and is projected to reach USD 13.64 Billion by 2022, at a CAGR of 5.97% during the forecast period. The base year considered for the study is 2016 and the forecast period is from 2017 to 2022.

Objective of the Study:

The objective of this study is to analyze the satellite bus market, along with statistics from 2016 to 2022 as well as to define, describe, and forecast the market and map the segments and subsegments across major regions, namely, North America, Europe, Asia Pacific, and RoW. On the basis of satellite size, the satellite bus market has been segmented into small (1-500kg), medium (501-2,500kg) and large (>2,500kg). On the basis of subsystem, the satellite bus market has been segmented into structures & mechanisms, thermal control, electric power system, attitude control system, propulsion, Telemetry Tracking and Command (TT&C), and flight software. On the basis of application, the market has been segmented into earth observation & meteorology, communication, scientific research & exploration, surveillance & security, and mapping & navigation.

The report provides in-depth market intelligence regarding the market dynamics and major factors, such as drivers, restraints, opportunities, and industry-specific challenges influencing the growth of the satellite bus market, along with an analysis of micromarkets with respect to individual growth trends, future prospects, and their contribution to the satellite bus market.

The report also covers competitive developments, such as long-term contracts, joint ventures, mergers, new product launches and developments, and research & development activities in the satellite bus market, in addition to business and corporate strategies adopted by key market players.

The satellite bus market is estimated at USD 10.21 Billion in 2017 and is projected to reach USD 13.64 Billion by 2022, at a CAGR of 5.97% during the forecast period. Factors such as increased deployment of small satellites, increasing space exploration missions, and rising demand for earth observation related applications are expected to fuel the growth of the satellite bus market.

Based on satellite size, the small (1-500kg) segment of the satellite bus market is projected to grow at the highest CAGR during the forecast period. Various countries are focusing on developing small satellites owing to their low-cost and short development time, which has been made possible due to the use of proven standard equipment and off-the-shelf components. This pushes the market for satellite bus in small satellites.

Based on subsystem, electrical power system segment of the satellite bus market is projected to grow at the highest CAGR during the forecast period. The electric power system is responsible for the generation, storage, conditioning control, and distribution of power within the satellite. The EPS manages the power input from solar cells, charges onboard batteries, and distributes electric power, at the required voltage to all other subsystems of the satellite.

Based on application, the earth observation & meteorology segment in the satellite bus market is projected to grow at the highest CAGR during the forecast period. These satellites are capable of monitoring situations, such as cyclones, storms, floods, fires, volcanic activities, earthquakes, landslides, oil slicks, environmental pollution, and industrial and power plant disasters, among others.

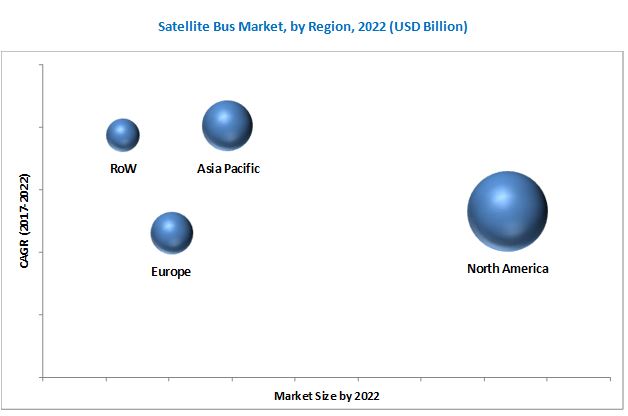

North America led the satellite bus market in 2016. The US government is increasingly investing in the satellite bus industry to enhance the capabilities and efficiency of satellite bus and launch vehicles. However, the satellite bus market in the Asia Pacific region is expected to grow at the highest CAGR during the forecast period. The Asia Pacific is considered a lucrative market for domestic and regional satellite bus manufacturers, and thus, the increase in the development of satellites is expected to propel the growth of the satellite bus market in this region.

Factors such as complexity issues related to bus subsystems, scarce intellectual assets, and regulatory challenges may act as restraints for the growth of the satellite bus market.

Key players profiled in the satellite bus market report include Orbital ATK (US), Inc., Lockheed Martin Corporation (US), Thales Alenia Space (France), Airbus Group (Netherlands), and China Academy of Space Technology (China), among others. Contracts was the key strategy adopted by leading players to sustain their positions in the satellite bus market. This strategy was adopted by companies to increase their reach, and enhance their revenues and service offerings.

To speak to our analyst for a discussion on the above findings, click Speak to Analyst

Table of Contents

1 Introduction (Page No. - 15)

1.1 Objectives of the Study

1.2 Market Definition

1.3 Study Scope

1.3.1 Markets Covered

1.3.2 Regional Scope

1.3.3 Years Considered for the Study

1.4 Currency & Pricing

1.5 Study Limitations

1.6 Stakeholders

2 Research Methodology (Page No. - 19)

2.1 Research Data

2.1.1 Secondary Data

2.1.1.1 Key Data From Secondary Sources

2.1.2 Primary Data

2.1.2.1 Key Data From Primary Sources

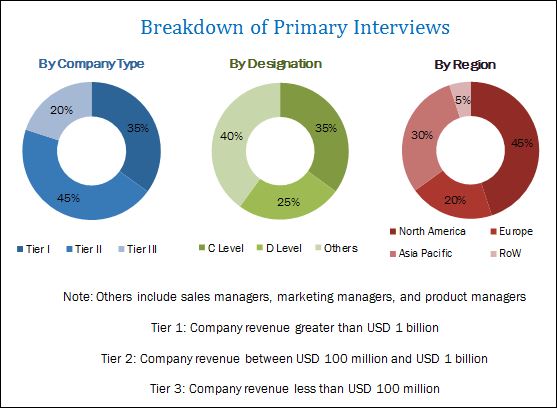

2.1.2.2 Breakdown of Primaries

2.2 Demand and Supply-Side Analysis

2.2.1 Introduction

2.2.2 Demand-Side Indicators

2.2.2.1 Rise in Demand for Nano and Micro Satellites Across All Applications

2.2.2.2 Increasing Demand for Satellite Aided Warfare

2.2.3 Supply-Side Indicators

2.2.3.1 Reducing Cost of Satellite Launch

2.2.3.2 Advancements in Technology Enable Reuse of Launch Systems and Orbital Launch Vehicles

2.3 Market Size Estimation

2.3.1 Bottom-Up Approach

2.3.2 Top-Down Approach

2.4 Market Breakdown & Data Triangulation

2.5 Research Assumptions

3 Executive Summary (Page No. - 29)

4 Premium Insights (Page No. - 32)

4.1 Increasing Investments in the Market to Offer Several Untapped and Unexplored Opportunities

4.2 Satellite Bus Market, By Satellite Size

4.3 Market, By Subsystem

4.4 Market, By Application

4.5 Market, By Region

5 Market Overview (Page No. - 35)

5.1 Introduction

5.2 Market Segmentation

5.2.1 By Satellite Size

5.2.2 By Subsystem

5.2.3 By Application

5.2.4 By Region

5.3 Market Dynamics

5.3.1 Drivers

5.3.1.1 Increased Deployment of Small Satellites Boosting the Growth of Satellite Bus and Its Components

5.3.1.2 Migration of Satellites to Geostationary Orbits (GEO)

5.3.1.3 Increase in Number of Space Exploration Missions

5.3.2 Restraints

5.3.2.1 Complexity Issues Related to Bus Subsystems

5.3.3 Opportunities

5.3.3.1 Technological Advancements in Bus Components

5.3.4 Challenges

5.3.4.1 Scarce Intellectual Assets

5.3.4.2 Regulatory Challenges

5.3.4.3 Highly Dynamic Technological Environment

6 Industry Trends (Page No. - 42)

6.1 Introduction

6.2 Value Chain

6.3 Supply Chain

6.4 Technology Trends

6.4.1 Evolutionary Change in Satellite Structure

6.4.2 State-Of-The-Art Electrical Power Systems (EPS)

6.4.3 Evolutionary Change in Attitude Control Systems (ACS)

6.4.4 Revolutionary Change in Command and Data Handling Systems

6.4.5 Technologies for Change in Thermal Control

6.4.6 State-Of-The-Art Propulsion Systems

6.4.7 Increased Demand for Hosted Payloads

6.5 Satellite Constellation

6.5.1 Innovations & Patent Registrations

7 Satellite Bus Market, By Satellite Size (Page No. - 49)

7.1 Introduction

7.2 Small (1-500kg)

7.2.1 Nanosatellite

7.2.2 Microsatellite

7.2.3 Minisatellite

7.3 Medium (501-2,500kg)

7.4 Large (>2,500kg)

8 Satellite Bus Market, By Subsystem (Page No. - 54)

8.1 Introduction

8.1.1 Structures and Mechanisms

8.1.2 Thermal Control

8.1.3 Electric Power System(EPS)

8.1.4 Attitude Control System

8.1.5 Propulsion

8.1.6 Telemetry Tracking and Command (TT&C)

8.1.7 Flight Software

9 Satellite Bus Market, By Application (Page No. - 61)

9.1 Introduction

9.2 Earth Observation & Meteorology

9.3 Communication

9.4 Scientific Research & Exploration

9.5 Surveillance & Security

9.6 Mapping & Navigation

10 Regional Analysis (Page No. - 67)

10.1 Introduction

10.2 North America

10.2.1 By Subsystem

10.2.2 By Satellite Size

10.2.3 By Application

10.2.4 By Country

10.2.4.1 US

10.2.4.1.1 By Satellite Size

10.2.4.1.2 By Application

10.2.4.2 Canada

10.2.4.2.1 By Satellite Size

10.2.4.2.2 By Application

10.3 Europe

10.3.1 By Subsystem

10.3.2 By Satellite Size

10.3.3 By Application

10.3.4 By Country

10.3.4.1 Russia

10.3.4.1.1 By Satellite Size

10.3.4.1.2 By Application

10.3.4.2 France

10.3.4.2.1 By Satellite Size

10.3.4.2.2 By Application

10.3.4.3 Germany

10.3.4.3.1 By Satellite Size

10.3.4.3.2 By Application

10.3.4.4 UK

10.3.4.4.1 By Satellite Size

10.3.4.4.2 By Application

10.3.4.5 Rest of Europe

10.3.4.5.1 By Satellite Size

10.3.4.5.2 By Application

10.4 Asia Pacific

10.4.1 By Subsystem

10.4.2 By Satellite Size

10.4.3 By Application

10.4.4 By Country

10.4.4.1 China

10.4.4.1.1 By Satellite Size

10.4.4.1.2 By Application

10.4.4.2 Japan

10.4.4.2.1 By Satellite Size

10.4.4.2.2 By Application

10.4.4.3 India

10.4.4.3.1 By Satellite Size

10.4.4.3.2 By Application

10.4.4.4 South Korea

10.4.4.4.1 By Satellite Size

10.4.4.4.2 By Application

10.4.4.5 Rest of Asia Pacific

10.4.4.5.1 By Satellite Size

10.4.4.5.2 By Application

10.5 Rest of the World

10.5.1 By Satellite Size

10.5.2 By Application

10.5.3 Rest of the World, By Region

10.5.3.1 Middle East

10.5.3.1.1 By Satellite Size

10.5.3.1.2 By Application

10.5.3.2 Latin America

10.5.3.2.1 By Satellite Size

10.5.3.2.2 By Application

10.5.3.3 Africa

10.5.3.3.1 By Satellite Size

10.5.3.3.2 By Application

11 Competitive Landscape (Page No. - 98)

11.1 Overview

11.2 Market Ranking Analysis

11.3 Competitive Leadership Mapping

11.3.1 Visionary Leaders

11.3.2 Innovators

11.3.3 Dynamic Differentiators

11.3.4 Emerging Companies

11.4 Competitive Benchmarking

11.4.1 Sterength of Product Portfolio (23 Companies)

11.4.2 Business Strategy Excellence (23 Companies)

*Top 23 companies analyzed for this study are – Lockheed Martin Corporation, Thales Alenia Space, Airbus Group, Honeywell International Inc, Israel Aerospace Industries Ltd, Orbital ATK, Inc, Ball Corporation, ISRO, OHB SE, SpaceQuest Ltd., NEC Corporation, Applied Aerospace Structures Corp., York Space Systems, Axon' Cable, Centum, Spaceflight Industries, Sierra Nevada Corporation, China Academy Of Space Technology, Mitsubishi Electric Corporation, The Boeing Company, Surrey Satellite Technology Limited, MacDonald, Dettwiler and Associates Ltd., Millennium Space Systems, Inc.

12 Company Profiles (Page No. - 103)

(Business Overview, Product Offering Scorecard, Business Strategy Scorecard, Recent Developments,)*

12.1 Orbital ATK, Inc

12.2 Lockheed Martin Corporation

12.3 Thales Alenia Space

12.4 Airbus Group

12.5 China Academy of Space Technology

12.6 Israel Aerospace Industries Ltd

12.7 The Boeing Company

12.8 Honeywell International Inc.

12.9 Mitsubishi Electric Corporation

12.10 Ball Corporation

12.11 Macdonald, Dettwiler and Associates Ltd.

12.12 Sierra Nevada Corporation

*Details on Business Overview, Product Offering Scorecard, Business Strategy Scorecard, Recent Developments, Might Not Be Captured in Case of Unlisted Companies.

13 Appendix (Page No. - 135)

13.1 Discussion Guide

13.2 Knowledge Store: Marketsandmarkets’ Subscription Portal

13.3 Introducing RT: Real Time Market Intelligence

13.4 Available Customization

13.5 Related Reports

13.6 Author Details

List of Tables (67 Tables)

Table 1 Recent Space Exploration Missions

Table 2 Innovations & Patent Registrations, 2012-2016

Table 3 Satellite Bus Market Size, By Satellite Size, 2015-2022 (USD Million)

Table 4 Small Satellite (1-500kg) Segment, By Region, 2015-2022 (USD Million)

Table 5 Small Satellite (1-500kg) Segment, By Type, 2015-2022 (USD Million)

Table 6 Medium Satellite (501-2,500kg) Segment, By Region, 2015-2022 (USD Million)

Table 7 Large Satellite (>2,500kg) Segment, By Region, 2015-2022 (USD Million)

Table 8 Market Size, By Subsystem, 2015-2022 (USD Million)

Table 9 Structure and Mechanisms Segment, By Region, 2015-2022 (USD Million)

Table 10 Thermal Control Segment, By Region, 2015-2022 (USD Million)

Table 11 Electric Power System Segment, By Region, 2015-2022 (USD Million)

Table 12 Attitude Control System Segment, By Region, 2015-2022 (USD Million)

Table 13 Propulsion Segment, By Region, 2015-2022 (USD Million)

Table 14 Telemetry Tracking and Command (TT&C) Segment, By Region, 2015-2022 (USD Million)

Table 15 Flight Software Segment, By Region, 2015-2022 (USD Million)

Table 16 Market Size, By Application, 2015-2022 (USD Million)

Table 17 Earth Observation & Meteorology Market Size, By Region, 2015-2022 (USD Million)

Table 18 Communication Market Size, By Region, 2015-2022 (USD Million)

Table 19 Scientific Research & Exploration Market Size, By Region, 2015-2022 (USD Million)

Table 20 Surveillance & Security Market Size, By Region, 2015-2022 (USD Million)

Table 21 Mapping & Navigation Market Size, By Region, 2015-2022 (USD Million)

Table 22 Satellite Bus Market Size, By Region, 2015-2022 (USD Million)

Table 23 North America: Market Size, By Subsystem, 2015-2022 (USD Million)

Table 24 North America: Market Size, By Satellite Size, 2015-2022 (USD Million)

Table 25 North America: Market Size, By Application, 2015-2022 (USD Million)

Table 26 North America: Market Size, By Country, 2015-2022 (USD Million)

Table 27 US: Market Size, By Satellite Size, 2015-2022 (USD Million)

Table 28 US: Market Size, By Application, 2015-2022 (USD Million)

Table 29 Canada: Market Size, By Satellite Size, 2015-2022 (USD Million)

Table 30 Canada: Market Size, By Application, 2015-2022 (USD Million)

Table 31 Europe: Market Size, By Subsystem, 2015-2022 (USD Million)

Table 32 Europe: Market Size, By Satellite Size, 2015-2022 (USD Million)

Table 33 Europe: Market Size, By Application, 2015-2022 (USD Million)

Table 34 Europe: Market Size, By Country, 2015-2022 (USD Million)

Table 35 Russia: Market Size, By Satellite Size, 2015-2022 (USD Million)

Table 36 Russia: Market Size, By Application, 2015-2022 (USD Million)

Table 37 France: Market Size, By Satellite Size, 2015-2022 (USD Million)

Table 38 France: Market Size, By Application, 2015-2022 (USD Million)

Table 39 Germany: Market Size, By Satellite Size, 2015-2022 (USD Million)

Table 40 Germany: Market Size, By Application, 2015-2022 (USD Million)

Table 41 UK: Market Size, By Satellite Size, 2015-2022 (USD Million)

Table 42 UK: Market Size, By Application, 2015-2022 (USD Million)

Table 43 Rest of Europe: Market Size, By Satellite Size, 2015-2022 (USD Million)

Table 44 Rest of Europe: Market Size, By Application, 2015-2022 (USD Million)

Table 45 Asia Pacific: Market Size, By Subsystem, 2015-2022 (USD Million)

Table 46 Asia Pacific: Market Size, By Satellite Size, 2015-2022 (USD Million)

Table 47 Asia Pacific: Market Size, By Application, 2015-2022 (USD Million)

Table 48 Asia Pacific: Market Size, By Country, 2015-2022 (USD Million)

Table 49 China: Market Size, By Satellite Size, 2015-2022 (USD Million)

Table 50 China: Market Size, By Application, 2015-2022 (USD Million)

Table 51 Japan: Market Size, By Satellite Size, 2015-2022 (USD Million)

Table 52 Japan: Market Size, By Application, 2015-2022 (USD Million)

Table 53 India: Market Size, By Satellite Size, 2015-2022 (USD Million)

Table 54 India: Market Size, By Application, 2015-2022 (USD Million)

Table 55 South Korea: Market Size, By Satellite Size, 2015-2022 (USD Million)

Table 56 South Korea: Market Size, By Application, 2015-2022 (USD Million)

Table 57 Rest of Asia Pacific: Market Size, By Satellite Size, 2015-2022 (USD Million)

Table 58 Rest of Asia Pacific: Market Size, By Application, 2015-2022 (USD Million)

Table 59 Rest of the World: Market Size, By Satellite Size, 2015-2022 (USD Million)

Table 60 Rest of the World: Market Size, By Application, 2015-2022 (USD Million)

Table 61 Rest of the World: Market, By Region, 2015-2022 (USD Million)

Table 62 Middle East: Market Size, By Satellite Size, 2015-2022 (USD Million)

Table 63 Middle East: Market Size, By Application, 2015-2022 (USD Million)

Table 64 Latin America: Market Size, By Satellite Size, 2015-2022 (USD Million)

Table 65 Latin America: Market Size, By Application, 2015-2022 (USD Million)

Table 66 Africa: Market Size, By Satellite Size, 2015-2022 (USD Million)

Table 67 Africa: Market Size, By Application, 2015-2022 (USD Million)

List of Figures (43 Figures)

Figure 1 Satellite Bus Market Segmentation

Figure 2 Study Years

Figure 3 Research Flow

Figure 4 Research Design

Figure 5 Breakdown of Primary Interviews: By Company Type, Designation, & Region

Figure 6 Nano and Micro Satellites Trends By Purpose (1 – 50 Kg)

Figure 7 Market Size Estimation Methodology: Bottom-Up Approach

Figure 8 Market Size Estimation Methodology: Top-Down Approach

Figure 9 Data Triangulation

Figure 10 The Earth Observation & Meteorology Segment is Projected to Grow at the Highest CAGR During the Forecast Period

Figure 11 The Small Satellite Segment is Projected to Grow at the Highest CAGR During the Forecast Period

Figure 12 The Electric Power System Segment is Projected to Grow at the Highest CAGR During the Forecast Period

Figure 13 North America is Estimated to Account for the Largest Share of the Satellite Bus Market in 2017

Figure 14 Attractive Market Opportunities in the Market, 2017-2022

Figure 15 Large Satellite (>2,500kg) Segment Estimated to Be the Largest in the Market in 2017

Figure 16 Electric Power System Segment Projected to Be the Largest in the Market During the Forecast Period

Figure 17 Communication Projected to Be the Largest Segment in the Market During the Forecast Period

Figure 18 North America Projected to Lead the Satellite Bus Market During the Forecast Period

Figure 19 Market, By Satellite Size

Figure 20 Market, By Subsystem

Figure 21 Market, By Application

Figure 22 Market, By Region

Figure 23 Market: Market Dynamics

Figure 24 Satellites Launched, By Application (2006-2016)

Figure 25 Factors Affecting ACS Configuration

Figure 26 Market Size, By Satellite Size, 2017-2022

Figure 27 Market, By Subsystem, 2017 & 2022 (USD Million)

Figure 28 Earth Observation & Meteorology Segment is Expected to Grow at the Highest Rate During the Forecast Period

Figure 29 Market: Regional Snapshot (2017-2022)

Figure 30 North America Market Snapshot (2017)

Figure 31 Europe Market Snapshot (2017)

Figure 32 Asia Pacific Market Snapshot (2017)

Figure 33 Market Share Ranking

Figure 34 Market (Global) Competitive Leadership Mapping, 2017

Figure 35 Orbital ATK, Inc.: Company Snapshot

Figure 36 Lockheed Martin Corporation: Company Snapshot

Figure 37 Airbus Group: Company Snapshot

Figure 38 Israel Aerospace Industries Ltd: Company Snapshot

Figure 39 The Boeing Company: Company Snapshot

Figure 40 Honeywell International Inc.: Company Snapshot

Figure 41 Mitsubishi Electric Corporation: Company Snapshot

Figure 42 Ball Corporation: Company Snapshot

Figure 43 Macdonald, Dettwiler and Associates Ltd: Company Snapshot

The research methodology used to estimate and forecast the satellite bus market begins with obtaining data on revenues of key satellite bus and its component providers through secondary sources, such as Hoovers, Bloomberg, Businessweek, Factiva, company websites, corporate filings, such as annual reports, investor presentations, and financial statements, among others. Satellite bus offerings are also taken into consideration to determine market segmentation. The bottom-up procedure was employed to arrive at the overall market size from the revenues of key players in the market. After arriving at the overall market size, the total market was split into several segments and subsegments, which were then verified through primary research by conducting extensive interviews with market experts, such as CEOs, VPs, directors, and executives. These data triangulation and market breakdown procedures were employed to complete the overall satellite bus market size engineering process, and arrive at the exact statistics for all segments and subsegments. A breakdown of the profiles of primaries is depicted in the figure below:

To know about the assumptions considered for the study, download the pdf brochure

The ecosystem of the satellite bus market comprises satellite bus and component manufacturers, suppliers, and technology support providers, such as Airbus Defense and Space SAS (France), Boeing (US), Thales Group (France), Lockheed Martin Corporation (US), and Mitsubishi Electric Corporation (Japan), among others. These companies offer advanced technology systems, products, and services. They also provide a broad range of management, engineering, technical, communications, and information service capabilities.

Target Audience

- Component Providers

- Original Equipment Manufacturers

- Subsystem Manufacturers

- Technology Support Providers

- Ministries of Defense

- Scientific Research Centers

- Forums, Alliances, and Associations

- End Users

“The study answers several questions for stakeholders, primarily which market segments they need to focus upon during the next two to five years to prioritize their efforts and investments”.

Scope of the Report

- This research report categorizes the satellite bus market into the following segments and subsegments:

-

Satellite Bus Market: By Satellite Size

- Small (1-500kg)

- Medium (501-2,500kg)

- Large (>2,500kg)

-

Satellite Bus Market: By Subsystem

- Structures & Mechanisms

- Thermal Control

- Electric Power System

- Attitude Control System

- Propulsion

- Telemetry Tracking and Command (TT&C)

- Flight Software

-

Satellite Bus Market: By Application

- Earth Observation & Meteorology

- Communication

- Scientific Research & Exploration

- Surveillance & Security

- Mapping & Navigation

- Navigation

-

Satellite Bus Market: By Region

- North America

- Europe

- Asia Pacific

- RoW

Available Customizations:

Along with market data, MarketsandMarkets offers customizations as per the specific needs of a company. The following customization options are available for the report:

-

Company Information

- Detailed analysis and profiles of additional market players (up to 5)

Growth opportunities and latent adjacency in Satellite Bus Market