Satellite Transponder Market by Bandwidth (C-Band, Ku-Band, Ka-Band), by Application (Commercial Communications, Government, Remote Sensing, Navigation, R&D), by Service (Leasing, Maintenance & Support, Others), and by Region - Global Forecast to 2020

[149 Pages Report] The global satellite transponder market is estimated to be USD 15.55 Billion in 2015, and is projected to reach USD 20.10 Billion by 2020 at a CAGR 5.3% from 2015 to 2020.

Request for Customization to get the global Satellite Transponder market forecasts to 2023

Factors such as increase in demand for new TV platforms and technologies, rise in demand for consumer broadband and corporate enterprise networks, and Growth in KU-band and Ka-band services are expected to drive the market. The report aims at estimating the market size and future growth potential of the market across different segments based on bandwidth, service, application, and region. In this report, 2014 is considered as base year, and 2015-2020 as the forecast period.

Both top-down approach and bottom-up approaches were used to estimate and validate the market size of the satellite transponder market. The process of research started with the collection of secondary data related to key vendors and other markets. The product portfolio of different vendors was also considered to determine market segmentation. The geographical presence of top players in varied regions was traced to understand the geographical market segmentation. To derive the global market numbers, bottom-up approach was employed, whereas, the top-down approach was used to verify and validate these global numbers.

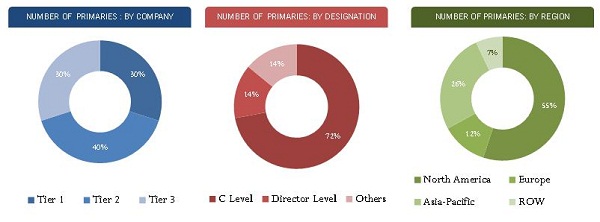

Primary interviews were conducted with market experts, including CEOs, VPs, directors, and executives of top companies. Primary research helped us to understand the market dynamics and strategies governing the decision-making process in top five companies. To complete the overall market engineering process and arrive at the exact statistics for all segments and subsegments, data triangulation and breakdown procedure were applied. The breakdown of profiles of primaries conducted for this research is depicted in the figure given below:

To know about the assumptions considered for the study, download the pdf brochure

The satellite transponder ecosystem comprises of satellite transponder service providers and manufacturers Eutelsat Communications S.A., SES S.A., Intelsat S.A., and others, and support and maintenance service providers such as Hispasat, Arabsat, Thaicom Public Company Limited, and many more who provide satellite transponder services such as leasing, support & maintenance, consulting, and others to end users to cater to their unique business requirements and needs.

Target Audience

- Satellite transponders manufacturers

- End users/consumers/enterprise users

- Government organizations

- Consultants/advisory firms

- System integrators and resellers

- Military

- Support and maintenance service providers

Scope of the Report

This research report categorizes the global satellite transponder market into the following segments and subsegments:

- Global Market Size and Forecast, By Bandwidth

- C Band

- Ku Band

- Ka Band

- K Band

- Others

- Global Satellite Transponder Market Size and Forecast, By Service

- Leasing

- Maintenance & Support

- Others

- Global Market Size and Forecast, By Application

- Commercial Communications

- Government Communications

- Navigation

- Remote Sensing

- R&D

- Others

- Global Market Size and Forecast, By Region

- North America

- Europe

- Asia-Pacific

- Middle East & Africa

- Latin America

Available Customizations

With the given market data, MarketsandMarkets offers customizations as per the companys specific needs. The following customization options are available for the Satellite Transponder Market research report:

Product Analysis

- Product matrix, which gives a detailed comparison of the product portfolio of each company

Geographic Analysis

- Further breakdown of the North American Satellite Transponder market

- Further breakdown of the Europe market

- Further breakdown of the Asia-Pacific market

- Further breakdown of the Middle East & Africa market

- Further breakdown of the Latin American market

Company Information

- Detailed analysis and profiling of additional market players

The satellite transponder market is expected to grow from USD 15.55 Billion in 2015 to USD 20.10 Billion by 2020, at a CAGR of 5.3% from 2015 to 2020. Satellite operators have shifted their focus towards supplying high capacity satellite transponders in terms of bandwidth that are capable of greater transponder throughput thereby reducing costs, in turn providing extra value to the customer.

Commercial communication applications are projected to dominate the global satellite transponder market over the forecast period. This high share of commercial communication applications in the overall market is driven by the development of new cost effective satellite technologies and increasing demand for telecommunication services across the globe. The majority of application of satellites are attributed to commercial communications. Commercial communication includes video distribution, DTH, legacy telephone and carrier services, commercial mobility services, OUTV, enterprise data service, broadband satellite access services, and others satellite based services which offer commercial use in air, maritime and land based communication.

In 2015, the C-band segment registered the largest market share, followed by the Ku-band and Ka-band segment in the satellite transponder bandwidth market. This large share is mainly attributed to the increasing usage of transponders of working on these bandwidths in weather forecasting, broadcasting, mapping, and many more applications. Moreover, C Band is the original frequency allocation for communications satellites. C-band satellite service is better suited for subscribers with large bandwidth requirements. This is because it easily supports enterprise level connectivity featuring dedicated CIR bandwidth with an SLA that guarantees uptime. This band is very dependable and less susceptible to weather related service outages. Also, the adoption of higher frequency bands typically give access to wider bandwidths, but are also more susceptible to signal degradation due to rain fade (the absorption of radio signals by atmospheric rain, snow or ice).

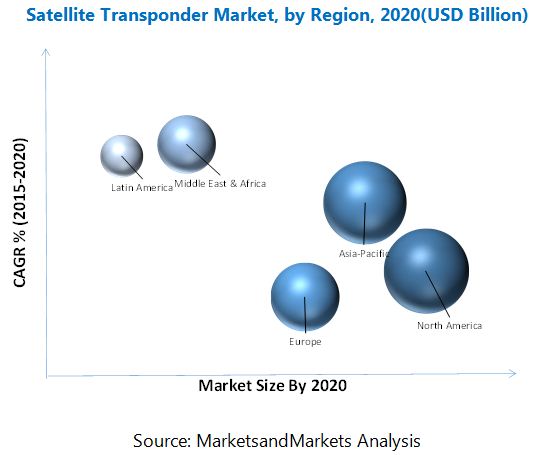

The North American region holds the maximum market share in the satellite transponder market due to extensive necessity for secure and reliable satellite-based communication that is being used in video distribution, DTH, broadband accesses, and others, followed by Asia-Pacific. However, major growth will be witnessed in the Middle East & Africa and Latin America due to rise in demand for direct-to-home (DTH) satellite TV, high definition (HD) to replace standard definition (SD) offerings, need for secure communications for military and defense, and the vibrant broadcast industry in the region.

On the other hand, major restraints hampering the growth of the satellite transponder market include competition from fiber-optic transmission cable networks and requirement of huge capital investment.

Key market players such as Eutelsat Communications S.A., Intelsat S.A., and SES S.A. have adopted acquisition, as an eminent growth strategy to expand their client base and enter new markets with their improved solution capabilities.

To speak to our analyst for a discussion on the above findings, click Speak to Analyst

Table of Contents

1 Introduction (Page No. - 14)

1.1 Objectives of the Study

1.2 Market Definition

1.3 Market Scope

1.3.1 Markets Covered

1.3.2 Years Considered for the Study

1.4 Currency

1.5 Limitations

1.6 Stakeholders

2 Research Methodology (Page No. - 17)

2.1 Research Data

2.1.1 Secondary Data

2.1.1.1 Key Data From Secondary Sources

2.1.2 Primary Data

2.1.2.1 Key Data From Primary Sources

2.1.2.2 Key Industry Insights

2.2 Market Size Estimation

2.2.1 Bottom-Up Approach

2.2.2 Top-Down Approach

2.3 Market Breakdown and Data Triangulation

2.3.1 Assumptions

3 Executive Summary (Page No. - 25)

4 Premium Insights (Page No. - 29)

4.1 Attractive Market Opportunities in the Satellite Transponder Market

4.2 Satellite Transponder Market, Top Application, By Region

4.3 Global Satellite Transponder Market

4.4 Satellite Transponder Market Potential

4.5 Satellite Transponder Market, Top Band, By Region

4.6 Lifecycle Analysis, By Region (2015)

5 Market Overview (Page No. - 33)

5.1 Introduction

5.2 Market Segmentation

5.2.1 By Bandwidth

5.2.2 By Service

5.2.3 By Application

5.2.4 By Region

5.3 Market Dynamics

5.3.1 Drivers

5.3.1.1 Increase in Demand for New TV Platforms and Technologies

5.3.1.2 Growth in KU-Band and KA-Band Services

5.3.1.3 Increased Demand for Consumer Broadband and Corporate Enterprise Networks

5.3.2 Restraints

5.3.2.1 Competition From Fiber-Optic Transmission Cable Networks

5.3.2.2 Requirement of High Capital Investment

5.3.3 Opportunity

5.3.3.1 Increased Use of Hts for Broadband Connectivity

5.3.3.2 Increase in Customer Demand for High Data Rate Applications

5.3.4 Challenges

5.3.4.1 Slowdown in Capacity Demand and Large Supply Additions

6 Industry Trends (Page No. - 40)

6.1 Introduction

6.2 Value Chain Analysis

6.2.1 Satellite Manufacturers

6.2.2 Satellite Launch Services

6.2.3 Satellite Operators

6.2.4 Service Providers/Resellers

6.2.5 End Users

6.2.6 Ground Equipment Vendors

6.3 Innovation Spotlight (Analysis of Competing Technology)

6.3.1 Focus on Vsat Technology

6.3.2 Focus on Hts

6.4 Porters Five Forces Analysis

6.4.1 Threat From New Entrants

6.4.1.1 Limited Orbital Location

6.4.1.2 High Entry Cost

6.4.2 Threat From Substitutes

6.4.2.1 Growth in Fiber-Optic Cable Capacity

6.4.3 Bargaining Power of Suppliers

6.4.3.1 Flexible Pricing

6.4.3.2 Multiyear Contracts

6.4.4 Bargaining Power of Buyers

6.4.4.1 Buyers Controlling the Market

6.4.5 Intensity of Competitive Rivalry

6.4.5.1 Impact on Revenue Margins

6.4.5.2 Increased Competition in High Growth Emerging Regions

7 Global Satellite Transponder Market Analysis, By Bandwidth (Page No. - 46)

7.1 Introduction

7.2 C-Band

7.3 KU-Band

7.4 KA-Band

7.5 K-Band

7.6 Others

8 Global Satellite Transponder Market, By Application (Page No. - 54)

8.1 Introduction

8.2 Commercial Communications

8.3 Government Communications

8.4 NAvigation

8.5 Remote Sensing

8.6 R&D

8.7 Others

9 Global Satellite Transponder Market, By Service (Page No. - 61)

9.1 Introduction

9.2 Leasing

9.3 Maintenance and Support

9.4 Others

10 Geographic Analysis (Page No. - 65)

10.1 Introduction

10.2 NA

10.2.1 Overview

10.3 Europe

10.3.1 Overview

10.4 APAC

10.4.1 Overview

10.5 MEA

10.5.1 Overview

10.6 LA

10.6.1 Overview

11 Competitive Landscape (Page No. - 96)

11.1 Overview

11.2 Competitive Situation and Trends

11.3 Partnerships, Agreements, Joint Ventures, and Collaborations

11.4 New Product Launches

11.5 Mergers and Acquisitions

11.6 Expansions

12 Company Profiles (Page No. - 101)

(Company at A Glance, Recent Financials, Products & Services, Strategies & Insights, & Recent Developments)*

12.1 Introduction

12.2 Eutelsat Communications S.A.

12.3 Intesat S.A.

12.4 SES S.A.

12.5 Thaicom Public Company Limited

12.6 SKY Perfect JSAT Corporation

12.7 Embratel Star One

12.8 SingAPOre Telecommunication Limited (Singtel)

12.9 Telesat Canada

12.10 Hispasat

12.11 Arabsat

*Details on Company at A Glance, Recent Financials, Products & Services, Strategies & Insights, & Recent Developments Might Not Be Captured in Case of Unlisted Companies.

13 Key Innovators (Page No. - 133)

13.1 Nec Corporation

13.1.1 Business Overview

13.1.2 Push for Satellite Transponder

13.2 Apt Satellite Holdings Ltd.

13.2.1 Business Overview

13.2.2 Push for Satellite Transponder

13.3 Indian Space Research Organization (ISRO)

13.3.1 Business Overview

13.3.2 Push for Satellite Transponder

14 Appendix (Page No. - 135)

14.1 Insights of Industry Experts

14.2 Other Developments

14.2.1 New Product Launches

14.2.2 Partnerships, Agreements, Joint Ventures, and Collaborations

14.3 Discussion Guide

14.4 Knowledge Store: Marketsandmarkets Subscription Portal

14.5 Related Reports

List of Tables (70 Tables)

Table 1 Global Satellite Transponder Market Size and Growth Rate, 20132020 (USD Billion, Y-O-Y %)

Table 2 Global Satellite Transponder Market Size, By Bandwidth, 20132020 (USD Million)

Table 3 C-Band Market Size, By Region, 20132020 (USD Million)

Table 4 C-Band Market Size, By Application, 20132020 (USD Million)

Table 5 KU-Band Market Size, By Region, 20132020 (USD Million)

Table 6 KU-Band Market Size, By Application, 20132020 (USD Million)

Table 7 KA-Band Market Size, By Region, 20132020 (USD Million)

Table 8 KA-Band Market Size, By Application, 20132020 (USD Million)

Table 9 K-Band Market Size, By Region, 20132020 (USD Million)

Table 10 K-Band Market Size, By Application, 20132020 (USD Million)

Table 11 Other Band Market Size, By Region, 20132020 (USD Million)

Table 12 Other Band Market Size, By Application, 20132020 (USD Million)

Table 13 Global Satellite Transponder Market Size, By Application, 20132020 (USD Billion)

Table 14 Commercial Communications Market Size, By Region, 20132020 (USD Million)

Table 15 Government Communications Market Size, By Region, 20132020 (USD Million)

Table 16 Navigation Market Size, By Region, 20132020 (USD Million)

Table 17 Remote Sensing Market Size, By Region, 20132020 (USD Million)

Table 18 R&D Market Size, By Region, 20132020 (USD Million)

Table 19 Others Market Size, By Region, 20132020 (USD Million)

Table 20 Global Satellite Transponder Market Size, By Service, 20132020 (USD Billion)

Table 21 Leasing Market Size, By Region, 20132020 (USD Million)

Table 22 Maintenance and Support Market Size, By Region, 20132020 (USD Million)

Table 23 Others Market Size, By Region, 20132020 (USD Million)

Table 24 Satellite Transponder Market Size, By Region, 20132020 (USD Billion)

Table 25 NA Satellite Transponder Market Size, By Bandwidth, 20132020 (USD Million)

Table 26 NA Satellite Transponder Market Size, By Application, 20132020 (USD Million)

Table 27 NA Satellite Transponder Market Size, By Service, 20132020 (USD Million)

Table 28 NA Satellite Transponder Market Size, C-Band, By Application, 20132020 (USD Million)

Table 29 NA Satellite Transponder Market Size, KU-Band, By Application, 20132020 (USD Million)

Table 30 NA Satellite Transponder Market Size, KA-Band, By Application, 20132020 (USD Million)

Table 31 NA Satellite Transponder Market Size, K-Band, By Application, 20132020 (USD Million)

Table 32 NA Satellite Transponder Market Size, Others, By Application, 20132020 (USD Million)

Table 33 European Satellite Transponder Market Size, By Bandwidth, 20132020 (USD Million)

Table 34 European Satellite Transponder Market Size, By Application, 20132020 (USD Million)

Table 35 European Satellite Transponder Market Size, By Service, 20132020 (USD Million)

Table 36 European Satellite Transponder Market Size, C-Band, By Application, 20132020 (USD Million)

Table 37 European Satellite Transponder Market Size, KU-Band, By Application, 20132020 (USD Million)

Table 38 European Satellite Transponder Market Size, KA-Band, By Application, 20132020 (USD Million)

Table 39 European Satellite Transponder Market Size, K-Band, By Application, 20132020 (USD Million)

Table 40 European Satellite Transponder Market Size, Others, By Application, 20132020 (USD Million)

Table 41 APAC Satellite Transponder Market Size, By Bandwidth, 20132020 (USD Million)

Table 42 APAC Satellite Transponder Market Size, By Application, 20132020 (USD Million)

Table 43 APAC Satellite Transponder Market Size, By Service, 20132020 (USD Million)

Table 44 APAC Satellite Transponder Market Size, C-Band, By Application, 20132020 (USD Million)

Table 45 APAC Satellite Transponder Market Size, KU-Band, By Application, 20132020 (USD Million)

Table 46 APAC Satellite Transponder Market Size, KA-Band, By Application, 20132020 (USD Million)

Table 47 APAC Satellite Transponder Market Size, K-Band, By Application, 20132020 (USD Million)

Table 48 APAC Satellite Transponder Market Size, Others, By Application, 20132020 (USD Million)

Table 49 MEA Satellite Transponder Market Size, By Bandwidth, 20132020 (USD Million)

Table 50 MEA Satellite Transponder Market Size, By Application, 20132020 (USD Million)

Table 51 MEA Satellite Transponder Market Size, By Service, 20132020 (USD Million)

Table 52 MEA Satellite Transponder Market Size, C-Band, By Application, 20132020 (USD Million)

Table 53 MEA Satellite Transponder Market Size, KU-Band, By Application, 20132020 (USD Million)

Table 54 MEA Satellite Transponder Market Size, KA-Band, By Application, 20132020 (USD Million)

Table 55 MEA Satellite Transponder Market Size, K-Band, By Application, 20132020 (USD Million)

Table 56 MEA Satellite Transponder Market Size, Others, By Application, 20132020 (USD Million)

Table 57 LA Satellite Transponder Market Size, By Bandwidth, 20132020 (USD Million)

Table 58 LA Satellite Transponder Market Size, By Application, 20132020 (USD Million)

Table 59 LA Satellite Transponder Market Size, By Service, 20132020 (USD Million)

Table 60 LA Satellite Transponder Market Size, C-Band, By Application, 20132020 (USD Million)

Table 61 LA Satellite Transponder Market Size, KU-Band, By Application, 20132020 (USD Million)

Table 62 LA Satellite Transponder Market Size, KA-Band, By Application, 20132020 (USD Million)

Table 63 LA Satellite Transponder Market Size, K-Band, By Application, 20132020 (USD Million)

Table 64 LA Satellite Transponder Market Size, Others, By Application, 20132020 (USD Million)

Table 65 Partnerships, Agreements, Joint Ventures, and Collaborations, 2015

Table 66 New Product Launches, 20132015

Table 67 Mergers and Acquisitions, 2013 and 2014

Table 68 Expansion, 20142015

Table 69 New Product Launches, 20122015

Table 70 Partnerships, Agreements, Joint Ventures, and Collaborations, 20122016

List of Figures (49 Figures)

Figure 1 Research Design

Figure 2 Market Size Estimation Methodology: Bottom-Up Approach

Figure 3 Market Size Estimation Methodology: Top-Down Approach

Figure 4 Market Breakdown Data Triangulation Approach

Figure 5 Satellite Transponder Market Size, Regional Snapshot (20152020): Market in the MEA is Expected to Grow at the Highest CAGR

Figure 6 Satellite Transponder Market Size, Bandwidth Snapshot (20152020): C-Band is Expected to Dominate the Global Satellite Transponder Market

Figure 7 Satellite Transponder Market Size, Application Snapshot (20152020): Remote Sensing is Expected to Grow at the Highest CAGR in the Global Satellite Transponder Market

Figure 8 Satellite Transponder Market Size, Service Snapshot (20152020): Leasing Segment is Expected to Dominate the Global Satellite Transponder Market

Figure 9 Global Satellite Transponder Market Share, 2015: NA Dominated the Market in 2015

Figure 10 Increase in Demand for New Television Platform and Technologies and Growing Demand for KA-Band and KU-Band Services are Driving the Satellite Transponder Market

Figure 11 Commercial Communications Segment in NA is Expected to Dominate the Satellite Transponder Application Market From 2015 to 2020

Figure 12 C-Band is the Most Dominant Segment in the Satellite Transponder Market in 2015

Figure 13 MEA Expected to Grow at the Highest CAGR From 2015 to 2020

Figure 14 C-Band in MEA is Expected to Be the Fastest Growing Segment in the Global Satellite Transponder Market From 2015 to 2020

Figure 15 Regional Lifecycle The Satellite Transponder Market in the MEA Expected to Grow at the Highest CAGR From 2015 to 2020

Figure 16 Satellite Transponder Market Segmentation: By Bandwidth

Figure 17 Satellite Transponder Market Segmentation: By Service

Figure 18 Satellite Transponder Market Segmentation: By Application

Figure 19 Satellite Transponder Market Segmentation: By Region

Figure 20 Global Satellite Transponder Market: Drivers, Restraints, Opportunities, and Challenges

Figure 21 Value Chain Analysis: Satellite Transponder Market

Figure 22 Global Satellite Transponder Market: Porters Five Forces Analysis

Figure 23 C-Band Dominates the Satellite Transponder Market From 2015 to 2020

Figure 24 Commercial Communications Dominate the Global Satellite Transponder Market From 2015 to 2020

Figure 25 Leasing Services Dominate the Satellite Transponder Market From 2015 to 2020

Figure 26 MEA Will Exhibit the Highest Growth Rate in the Satellite Transponder Market From 2015 to 2020

Figure 27 Geographic Snapshot (20152020): MEA and LA are Attractive Destinations for the Overall Satellite Transponder Market

Figure 28 NA Satellite Transponder Market Snapshot: Commercial Government Communications, and Navigation to Contribute Maximum Share in 2015

Figure 29 European Satellite Transponder Market Snapshot: C-Band, KU-Band, and KA-Band are Expected to Contribute Maximum Share to the Market in 2015

Figure 30 APAC Satellite Transponder Market Snapshot: C-Band, KU-Band, and KA-Band are Expected to Contribute Maximum Share to the Market in 2015

Figure 31 MEA Satellite Transponder Market Snapshot: C-Band, KU-Band, and KA-Band are Expected to Contribute Maximum Share to the Market in 2015

Figure 32 LA Satellite Transponder Market Snapshot: C-Band, KU-Band, and KA-Band are Expected to Contribute Maximum Share to the Market in 2015

Figure 33 Companies Adopted Partnerships, Agreements, Joint Ventures, and Collaborations as the Key Growth Strategy to Expand Their Presence in the Market From 2012 to 2015

Figure 34 Market Evaluation Framework

Figure 35 Battle for Market Share: Partnerships, Agreements, Collaborations, and Joint Ventures Have Been the Key Strategies in the Satellite Transponder Market

Figure 36 Geographic Revenue Mix of Top Five Market Players

Figure 37 Eutelsat Communications S.A. : Business Overview

Figure 38 Eutelsat Communications S.A.: SWOT Analysis

Figure 39 Intelsat S.A: Business Overview

Figure 40 Intelsat S.A.: SWOT Analysis

Figure 41 SES S.A.: Business Overview

Figure 42 SES S.A.: SWOT Analysis

Figure 43 Thaicom Public Company Limited: Business Overview

Figure 44 Thaicom Public Company Limited: SWOT Analysis

Figure 45 SKY Perfect JSAT Corporation: Business Overview

Figure 46 SKY Perfect JSAT Corporation: SWOT Analysis

Figure 47 Singtel: Business Overview

Figure 48 Telesat Canada: Business Overview

Figure 49 Hispasat: Business Overview

Growth opportunities and latent adjacency in Satellite Transponder Market