Microbiological Testing of Water Market Size, Share, Industry Growth, Trends Report by Pathogen type (Legionella, Coliform, Salmonella, Clostridium, Vibrio), Type (Instruments, Reagents & Test Kits), Water Type (Drinking & Bottle, Industrial water), Industry and Region - Global Forecast to 2027

Microbiological Water Testing Market Insights

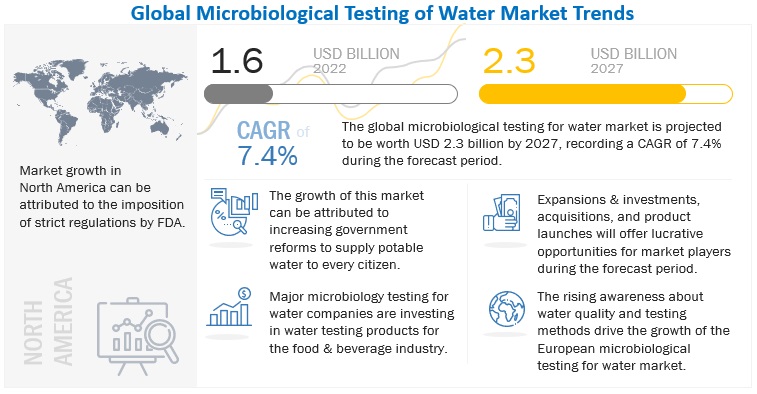

The global microbiological testing of water market is estimated to reach $2.3 billion by 2027, growing at a 7.4% compound annual growth rate (CAGR). The global market size was valued $1.6 billion in 2022. The latest research study includes an analysis of industry trends in the market, covering aspects such as pricing, patents, conference and webinar materials, key stakeholders, and consumer purchasing behavior.

Consumer awareness regarding consuming water to be safe, nutritious water as well as an increase in the consumption of water that is free of bacteria and chemicals are the main factors driving market growth. The pharmaceutical, biopharmaceutical, and food industries utilize testing of drinking and industrial water. Increasing water-borne diseases like typhoid, dysentery, and cholera play a significant role in market growth.

To know about the assumptions considered for the study, Request for Free Sample Report

Microbiological Testing of Water Market Dynamics

Driver: Increasing need for water quality analysis

The need for water microbiological testing is rising in response to the rise in microbial contamination at various water bodies for a variety of industrial applications. The market for microbiological water testing solutions is rapidly expanding, in large part due to the expansion of end-user industries like oil & gas, semiconductor, pharmaceutical, chemical, and food & beverage. All around the world, most people rely on private water supplies. This includes wells, dugouts, and ponds. The accessibility of high-quality water has a significant impact on the population's economic, physical, and social well-being. Government institutions and research laboratories continue to be the main customers for microbial water analytical instruments as part of their various health safety activities. Regular testing and monitoring of the quality of water is necessary to maintain reliable and safe water sources and to eliminate any potential health hazards associated with water contamination.

The quality of the water is the most crucial factor in any process used to produce food. The water's source and actual use in food production have an impact on its quality. Water contamination can occur at any time and in a wide variety of ways. When food is produced safely, physical, chemical, or biological agents pose serious health risks. Numerous pathological microorganisms can contaminate water, which is hazardous for both human and animal health and poses serious issues for food safety. Water must be free of pathogenic organisms and other pollutants that could endanger consumers and the quality of the finished product when used as an ingredient in food. The quality of the water must fulfil the safe drinking water standard. A crucial factor in the preservation and storage of food is "water activity." This important property is used to predict the stability and safety of food in relation to microbial growth, rates of deteriorative reactions, and chemical/physical changes in the food products. Innovative food formulators use water activity values to make shelf-stable foods. By maintaining a product below a certain water activity level, mould growth is inhibited. As a result, the shelf life is extended.

The mandatory requirement for water hygiene standards during processing and disposal is expected to contribute to a rapid growth in the water quality analysis market in the healthcare, environmental, and food and beverage sectors. The development of microbiological water testing and analysis instruments depends heavily on these regulations, accreditations, and standards. UNICEF works with governments and communities to test household and public water sources for faecal contamination, which is determined by testing for E. coli bacteria in water samples, in accordance with World Health Organization recommendations. The microbiological testing of water market and analysis instruments is expanding globally, with developed European and North American markets accounting for leading positions in the market.

Restraint: High Capital Investment

Manufacturing of food & beverage products consumes a tremendous amount of energy and power, especially where large and automated equipment is involved. The entire manufacturing of food & beverage products is concluded in the following stages: agriculture, processing, handling, and transporting. The handling and processing stages involve diverse types of machinery and technology, which consume massive energy and power.

Setting up any testing laboratory requires a lot of time and investment. Especially when it comes to the water testing lab. Water testing lab is a highly regulated area; therefore, when setting up the lab, one must meet all the necessary government regulations defined by the local authorities. The Central Pollution Control Board (CPCB), for instance, has established guidelines for the Recognition of Environmental Laboratories Under the Environment (Protection) Act of 1986 to help India's water testing laboratory get started and recognized.

Additionally, there are several investment-related factors to consider when setting up the lab. Infrastructure needs, laboratory design and furnishings, and laboratory equipment make up most of the components. Numerous technologies must be considered while setting up a lab, in addition to the need for skilled workers. An extensive investment is required for each of these components. An article from the National Library of Medicine from 2017 states that the average cost of a microbiological water quality test is 21.0 + 11.3 USD, including consumables, equipment, labour, and logistics.

A complete microbiological water testing laboratory requires a significant capital investment from companies, institutions, organisations, or governmental authorities. In addition to having high installation costs, testing equipment also needs to be maintained on time, which adds costs and reduces operating margins for manufacturers or processors. Water processors are searching for less expensive options, like renting equipment. Outsourcing the microbial water quality testing from third-party laboratories requires reduces capital expenditure and operating costs.

Opportunity: Growing Market in emerging economies

The microbiological testing of water market solutions is expected to grow most rapidly in the emerging economies. Compared to Europe and North America, the Asia Pacific, Middle East, and Latin American countries are untapped markets for companies that provide solutions for microbiological water testing, and they have enormous growth potential.

The microbiological water testing sector has expanded because of rising population, globalisation, and awareness of the importance of clean water in developing countries. Additionally, the necessity for microbiological water testing emerges in some countries, such as India and Indonesia, due to inadequate sanitation and water supply. Most manufacturers of testing equipment, including Agilent Technologies, Shimadzu Corporation, and Thermo Fisher Scientific, have a presence in these developing nations. Increasing industrialization in developing nations has raised consumer awareness of water pollution and degradation.

Over the past few years, industrialization has increased in developing regions like Africa and Asia. Especially Asia, China, Japan, and India have made significant advancements in industrial growth. Hong Kong Korea, and Taiwan have become major exporters of textiles and other goods. The governments of several countries have launched several programmes, including "Make in India" by the Indian government and "Made in China 2025" by the Chinese government, to encourage the expansion of the manufacturing sector. These countries were able to advance their industrial development and raise public awareness of the importance of industrialisation for the economy due to these initiatives. This has led to the adoption of various water protection act, creating a significant market opportunity for microbiological water testing technologies.

Challenge: Lack of basic supporting Infrastructure

Testing & certification practices in several developing countries lack organization, sophistication, and technology. A significant challenge to the expansion of the microbiological testing of water market is the absence of necessary infrastructure for setting up testing labs. Testing services in some developing regions also challenge obtaining samples from manufacturing companies, as they are fragmented and dominated by small enterprises. Inadequate provision of necessary water testing services in urban India is frequently caused by a lack of funds (as well as the growth of illegal/unplanned urban colonies). While developed nations have more than adequate infrastructure for providing water testing services, it is crucial to invest capital in developing nations like India to improve the infrastructure.

According to research conducted by the Indian Council for Research on International Economic Relations, the provision of environmental infrastructure services in India is hindered most by a lack of funding, followed by insufficient management systems (problem of attitude noted by Supreme Court Committee on Municipal Waste Management in India).

Many water-testing laboratories face with technical issues such a lack of specialised equipment, an inability to plan for the calibration and maintenance of analytical instruments, and the use of standard operating procedures (SOPs). Sometimes, the equipment stops functioning and getting them repaired becomes a challenge for laboratories. The availability of a suitable and reliable source of electricity, which must be maintained, is another essential factor for a laboratory. To restock the chemical reagents used in the water testing procedure, a suitable, functional supply chain is required. A system must be put up in water laboratories to notify management before the calibration date or if an analyst departs from standard practices. To ensure cooperation between manufacturing enterprises and government testing services, good manufacturing procedures (GMP) are necessary. Lack of these has been acting as a bottleneck in the growth of the microbial water testing market. In developing countries like Asia Pacific and Africa, there may be some growth in the microbiological water testing market with significant government support.

Microbiological Testing of Water Market Segment Insights:

By type, the Instruments subsegment is estimated to account for the largest share of the market.

In the global microbiological water testing market, the instruments sector held the largest market share. These testing tools are simple to use and have undergone significant improvement as a result of field research activities.

By industry, the food segment is projected to achieve the highest CAGR in the microbiological water testing market during the forecast period.

The market is driven by the compliance of FDA regulations for the food & beverage industry. Due to various regulations, including the Food Safety Modernization Act of 2011 and the Juice HACCP (Hazard Analysis and Critical Control Points) regulations, as well as the introduction of scientific instruments and innovative technologies for food safety, the quality assurance and quality control programs in this industry have become more stringent.

Microbiological Testing of Water Market Regional Insights:

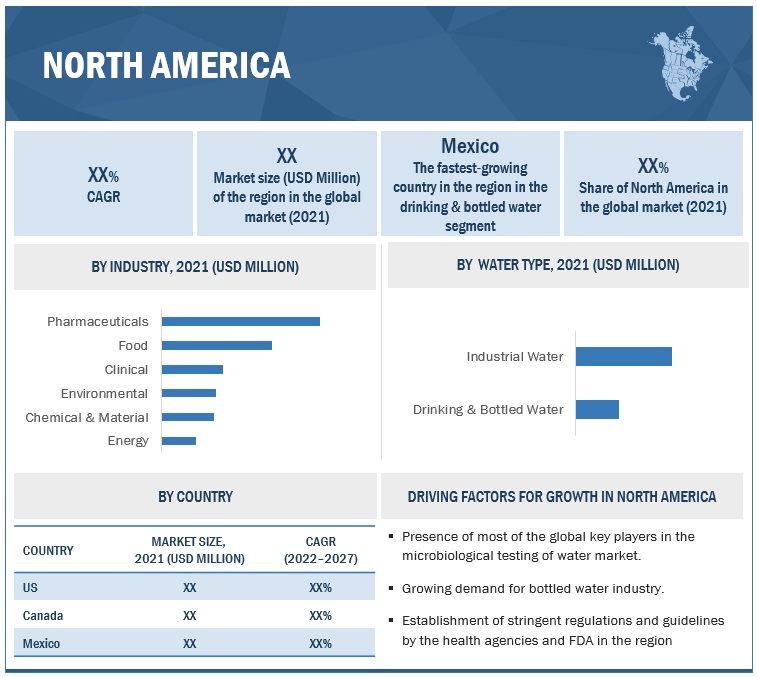

North America is projected to account for the largest market share of the microbiological water testing market during the forecast period.

In North America, multiple cases of waterborne disease outbreaks such as cryptosporidiosis and giardiasis have been found due to protozoan contamination. According to a journal published by National Center for Biotechnology Information (NCBI), the microbial waterborne diseases affected the developed countries such as US, where it has been estimated that each year 560,000 people suffer from severe waterborne diseases, and 7.1 million suffer from a mild to moderate infections, resulting in estimated 12,000 deaths a year. These contaminations grow due to an increase in microbial numbers in water reservoirs because of heavy rains or floods, lack of water treatment due to a substantial number of pathogens, and breakdown in the water treatment process.

To know about the assumptions considered for the study, download the pdf brochure

Top Companies in the Microbiological Testing of Water Market

The key players in this market include 3M (US), Thermo Fisher Scientific Inc. (US), Danaher Corporation (US), Döhler Group (Germany), Agilent Technologies, Inc. (US), Shimadzu Corporation (Japan), Merck (Germany), PerkinElmer, Inc. (US), Bio-Rad Laboratories, Inc. (US), IDEXX Laboratories, Inc. (US), Avantor Inc. (US), Hardy Diagnostics (US), LaMotte Company (US), Accepta Ltd (UK), General Laboratory Products (US). To strengthen their market position in the global Microbiological water testing market, these players focus on strategies such as recent developments, acquisitions, collaborations, and partnerships.

Microbiological Testing of Water Market Report Scope

|

Report Metric |

Details |

|

Market size value in 2022 |

USD 1.6 billion |

|

Market revenue estimate in 2027 |

USD 2.3 billion |

|

Market progress rate |

CAGR of 7.4% |

|

Units considered |

Value (USD) |

|

Segments covered |

By pathogen type, water type, type, industry, and region |

|

Regions covered |

North America, South America, Europe, Asia Pacific, and MEA |

|

Companies studied |

|

Microbiological Testing of Water Market Segmentation

|

ByType |

By Pathogen Type |

By Water Type |

By Industry |

By Region |

|

|

|

|

|

Microbiological Water Testing Market: Industry News & Recent Developments

- In July 2021, Perkinelmer Inc company acquires BioLegend, a leading, global provider of life science antibodies and reagents. This acquisition will expand the company’s network and manufacturing capacity of the company.

- In October 2021, Bio-Rad Laboratories, Inc. acquires Dropworks, Inc. Dropworks is a development stage company focused on developing a digital PCR product. This strategic acquisition was to address opportunities in the testing market and supporting existing product portfolios.

Frequently Asked Questions (FAQ):

How big is the market for microbiologicalt testing of water?

The microbiological testing of water market in terms of revenue is estimated at USD 1.6 billion in 2022. It is projected to grow at a CAGR of 7.4% to reach USD 2.3 billion by 2027.

Is there Oceania (New Zealand and Australia) specific information (market size, players, growth rate) for microbiological testing of water market?

On request, We will provide details on market size, key players, and growth rate of this industry in the Oceania region. Also, you can let us know if there are any other countries of your interest.

What is the future growth potential of microbiological testing of water market?

The future growth potential of the microbiological testing of water market appears promising due to several key factors. Firstly, increasing concerns regarding water safety and quality, driven by factors such as population growth, urbanization, industrialization, and environmental pollution, are likely to drive demand for microbiological testing services. Additionally, stringent regulatory requirements and standards for water quality monitoring, particularly in industries such as healthcare, food and beverage, and municipal water treatment, are expected to contribute to market growth.

Which players are involved in manufacturing of microbiological testing of water? What key development strategies do the players undertake?

The key players in this market include 3M (US), Thermo Fisher Scientific Inc. (US), Danaher Corporation (US), Döhler Group (Germany), Agilent Technologies, Inc. (US), Shimadzu Corporation (Japan), Merck (Germany), PerkinElmer, Inc. (US), Bio-Rad Laboratories, Inc. (US), IDEXX Laboratories, Inc. (US), Avantor Inc. (US), Hardy Diagnostics (US), LaMotte Company (US), Accepta Ltd (UK), General Laboratory Products (US). Some of the strategies undertaken by players include acquisitions, investments, expansions and developments, and research initiatives.

To speak to our analyst for a discussion on the above findings, click Speak to Analyst

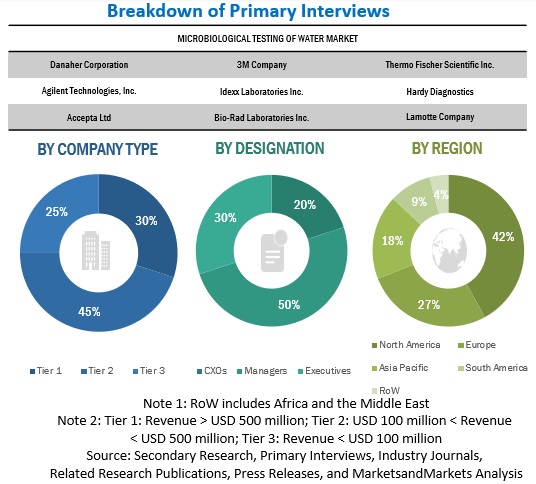

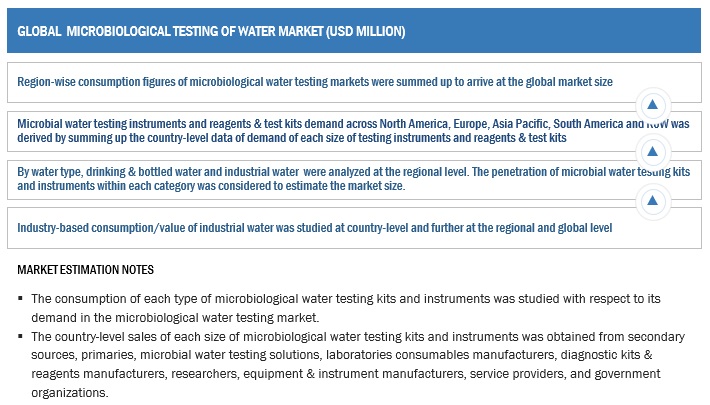

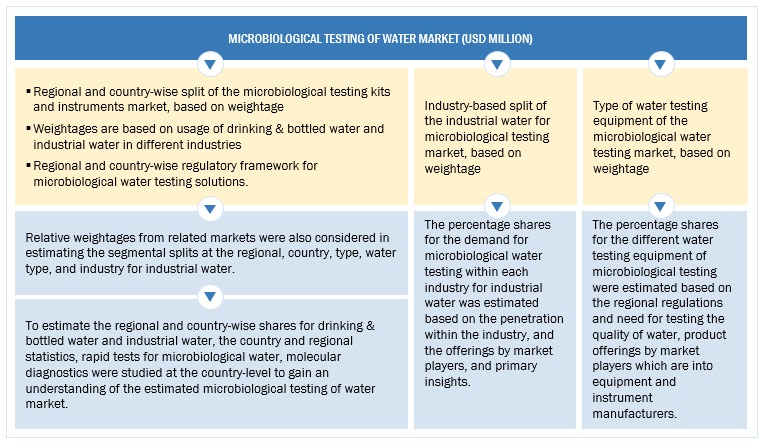

The study involved four major steps in estimating the size of the Microbiological testing of water market. Exhaustive secondary research was done to collect information on the market and the parent market. The next step was to validate these findings, assumptions, and sizing with industry experts across the value chain through primary research. The top-down and bottom-up approaches were employed to estimate the complete market size. After that, market breakdown and data triangulation were used to estimate the market size of segments and subsegments.

Secondary Research

In the secondary research process, various sources, such as the Food and Agriculture Organization (FAO), United States Department of Agriculture (USDA), World Health Organization (WHO), Environmental Protection Agency (EPA), Council on Environmental Quality (CEQ), Government institutes and R&D laboratories, and academic references pertaining to microbiological testing of water, were referred to identify and collect information for this study. The secondary sources also include water safety journals, press releases, investor presentations of companies, white papers, certified publications, articles by recognized authors and regulatory bodies, trade directories, and paid databases.

Secondary research was mainly conducted to obtain critical information about the industry’s supply chain, the total pool of key players, and market classification & segmentation according to the industry trends to the bottom-most level and geographical markets. It was also used to obtain information about the key developments from a market-oriented perspective.

Primary Research

The market comprises several stakeholders in the supply chain, which include water testing equipment manufacturers, suppliers, processors, and end-product manufacturers. The demand side of the market is characterized by the presence of food processors, food importers/exporters, other industries, and manufacturers engaged in the production of various products, among other applications. The supply side is characterized by the presence of key technology providers for microbial water testing solutions, laboratories consumables manufacturers, diagnostic kits & reagents manufacturers, researchers, equipment & instrument manufacturers, and service providers. Various primary sources from the supply and demand sides have been interviewed to obtain qualitative & quantitative information.

The primary interviewees from the supply side include key opinion leaders and key industry players in the microbiological testing of water market. The primary sources from the demand side include key opinion leaders, executives, vice presidents, and CEOs from water testing and laboratories sector.

To know about the assumptions considered for the study, download the pdf brochure

Microbiological Testing of Water Market Size Estimation

To estimate and validate the total size of the microbiological water testing market, the bottom-up and top-down approaches are used. These approaches were also used extensively to determine the size of various subsegments in the market for the base year in terms of value. The research methodology used to estimate the market size includes the following details:

- The key players in the industry and the overall markets were identified through extensive secondary research.

- The revenues of the major players were determined through primary and secondary research, which were used as the basis for market sizing and estimation.

- All percentage shares, splits, and breakdowns were determined using secondary sources and verified through primary sources.

- All macroeconomic and microeconomic factors affecting the growth of the microbiological testing of water market were considered while estimating the market size.

- All possible parameters that affect the market covered in this research study were accounted for, viewed in extensive detail, verified through primary research, and analyzed to obtain final quantitative and qualitative data.

The following sections (bottom-up & top-down) depict the overall market size estimation process employed for the purpose of this study.

Bottom-Up

To know about the assumptions considered for the study, Request for Free Sample Report

Top-Down

Data Triangulation

After arriving at the overall market size from the estimation process explained above, the total market was split into several segments and subsegments. The data triangulation and market breakdown procedures were employed, wherever applicable, to estimate the overall microbiological water testing market and arrive at the exact statistics for all segments and subsegments. The data was triangulated by studying various factors and trends from the demand and supply sides. Along with this, the market size was validated using the top-down and bottom-up approaches.

Microbiological Testing of Water Market Report Objectives:

Market Intelligence

- Determining and projecting the size of the Microbiological testing of water based on pathogen type, water type, type, industry, and region over a five-year period ranging from 2022 to 2027

- Identifying the attractive opportunities in the market by determining the largest and fastest-growing segments across the key regions

- Analyzing the demand-side factors based on the following:

- Impact of macro- and micro-economic factors on the market

- Shifts in demand patterns across different subsegments and regions

- Providing detailed information about the key factors influencing the growth of the market (drivers, restraints, opportunities, and industry-specific challenges)

Competitive Intelligence

- Identifying and profiling the key market players in the Microbiological testing of water market

- Providing a comparative analysis of the market leaders based on the following:

- Product offerings

- Business strategies

- Strengths and weaknesses

- Key financials

- Understanding the competitive landscape and identifying the major growth strategies adopted by players across the key regions

- Analyzing the value chain and regulatory frameworks across regions and their impact on prominent market players

- Providing insights into the key investments in product innovations and technology in the Microbiological water testing market

Customization Options

With the given market data, MarketsandMarkets offers customizations according to the company’s specific scientific needs.

The following customization options are available for the report:

Geographic Analysis

- Further breakdown of the Rest of Asia-Pacific microbial water testing solutions market, by country

- Further breakdown of other countries in the Rest of the World microbiological testing of water market, by key country

Segmental Analysis

- Segmental analysis, which provides further breakdown of the reagents, instruments, and test kits in the application segment

Generating Response ...

Generating Response ...

Growth opportunities and latent adjacency in Microbiological Testing of Water Market