Bottled Water Testing Equipment Market by Technology (Traditional, and Rapid), Component (Instruments, Consumables & Reagents, and Reference Material), Test Type (Microbiological, Chemical, Physical, Radiological), and Region - Global Forecast to 2021

The bottled water testing equipment market, in terms of value, is projected to reach USD 6.46 Billion by 2021, at a CAGR of 5.3% from 2016. Rapid increase in consumption of bottled water, rise in disposable income, awareness about the effects of health due to contaminated water, increase in regulations regarding bottled water quality, and technological developments in the water testing industry are some of the factors driving this market.

The years considered for the study are as follows:

- Base year – 2015

- Estimated year – 2016

- Projected year – 2021

- Forecast period – 2016 to 2021

The objectives of the report

- To define, segment, and project the global market size for bottled water testing equipment

- To understand the structure of the market by identifying its various subsegments

- To provide detailed information about the key factors influencing the growth of the market (drivers, restraints, opportunities, and challenges)

- To analyze the opportunities in the market for stakeholders and provide a competitive landscape of market trends

- To analyze the macro and microindicators of this market to provide a factor analysis

- To project the size of the bottled water testing equipment market and its submarkets, in terms of value

- To strategically profile key players of the globe and comprehensively analyze their market shares and core competencies*

- To project the market size, in terms of value, of all the segments; by technology, by component, by test type, and by region

- To analyze the competitive developments such as acquisitions, expansions, partnerships, agreements, and new product launches in the bottled water testing equipment market

- To provide a detailed competitive landscape of this market, along with an analysis of the business of key players

Research Methodology:

- Major regions were identified, along with countries contributing the maximum share

- Secondary research was done from various sources such as International Bottled Water Association (IBWA), Beverage Marketing Corporation (BMC), and key players’ data to find the market of bottled water testing equipments for regions such as North America, Europe, Asia-Pacific, and RoW; trends for food safety testing industry, and their contribution

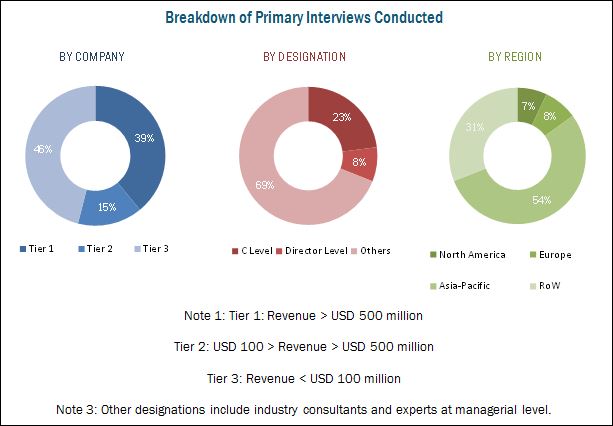

The key players were identified through secondary sources such as Agilent Technologies Inc. (U.S.), Bio-Rad Laboratories, Inc. (U.S.), Waters Corporation (U.S.), ThermoFisher Scientific, Inc. (U.S.), PerkinElmer Inc. (U.S.), Shimadzu Corporation (Japan), Restek (U.S.), Accepta (U.K.), and LaMotte Company (U.S.)., while their market share in respective regions have been determined through both, primary and secondary research. The research methodology includes the study of annual and financial reports of top market players, as well as interviews with industry experts (such as CEOs, VPs, directors, and marketing executives) for key insights (both, quantitative and qualitative) for the bottled water testing equipments market.

To know about the assumptions considered for the study, download the pdf brochure

Target Audience

The stakeholders for the report are as follows:

-

Suppliers

- R&D institutes

- Technology providers

- Bottled water testing equipment manufacturers/suppliers

- Bottled water manufacturers/suppliers/processors

- Reagents and reference material manufacturers/suppliers

-

Regulatory bodies

- Food safety agencies such as FDA

- Government agencies & NGOs

-

Intermediary suppliers

- Wholesalers

- Dealers

-

Consumers

- End users

- Retailers

Scope of the Report:

This research report categorizes the global market based on on the basis of technology, componant, test type, and region.

Based on Technology, the market has been segmented as follows:

- Traditional

-

Raid

- Chromatography

- Spectroscopy

- Testing Kits

- Other Instruments (PCR, Immunoassay, and others)

Based on Componant, the market has been segmented as follows:

- Instruments

- Consumables & Reagents

- Reference Materials

Based on Test Type, the market has been segmented as follows:

- Microbiological

- Physical

- Chemical

- Radiological

Based on Region, the market has been segmented as follows:

- North America

- Europe

- Asia-Pacific

- RoW (Latin America, the Middle East, and Africa)

Available Customizations

With the given market data, MarketsandMarkets offers customizations according to client-specific scientific needs.

The following customization options are available for the report:

Product Analysis

- Product matrix, which gives a detailed comparison of the product portfolio of each company

Company Information

- Detailed analysis and profiling of additional market players (up to five)

The bottled water testing equipment market is projected to reach USD 6.46 Billion by 2021, at a CAGR of 5.3% from 2016. The market is driven by technological advancements in testing equipment, increasing need for quality testing of water, stringent regulatory requirements, and increased bottled water consumption.

The global market, based on the technology, has been segmented into rapid and traditional, wherein the rapid technology is further segmented as chromatography, spectroscopy, testing kits, and other technologies. The market based on component, is segmented as reference materials, consumables & reagents, and instruments, where consumables &v reagents are the fasest growing. The equipment market, by test type is segmented as physical, chemical, microbiological, and radiological test markets.

The chemical test type is the largest and the fastest growing sub-segment among the test types. This is due to the high valued equipment associated with the chemical testing, such as chromatography. The increased usage of pesticides in the agriculture is depsited in the water which inturn is processed as bottled water. Also there has been a gradual increase of heavy metal testing in bottled water which is driving the spectroscopic equipment market. The frequency in purchase of consumables & reagents is much higher than the equipment.

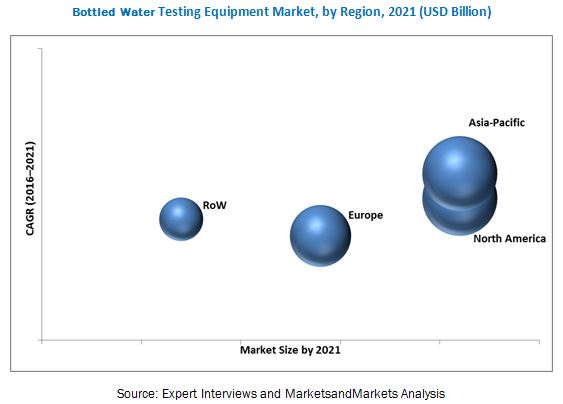

The global market was dominated by the North American region in 2015. In the U.S., bottled water is outselling other packaged beverages on retail shelf in cities such as New York, Boston, Los Angeles, San Francisco, Las Vegas, Houston, Miami, and Washington D.C. With increase in FDA regulations governing the safety & quality of bottled water, there is a surge in demand for bottled water testing. The presence of most of the global players in the bottled water testing equipment market in the region has led to higher product availability in this region.

Asia-Pacific is the fastest-growing region for bottled water testing equipment due to the significant increase in the demand for bottled water The region is emerging as a huge market for bottled water testing due to increasing awareness towards water contaminant s and their impact on health. The boom in the bottled water market has resulted in an emergence of unregulated and unauthorized companies that source water from improper sources and have been selling them without proper treatment. This has stimulated the need for bottled water testing and in turn the growth of the testing equipment market.

The high cost of testing equipment is one of the greatest challenges in the equipment market. Also the adoption of advanced testing methods is proportional to the price of the sample testing. the water testing laboratories and bottled water manufacturers find it challenging to adapt to the varying methods and principles of upgraded technology. Negative environmental impacts such as uncontrolled usage and littering of PET containers is one of the bigger challenges in the growth of bottled water industry.

Some of the key players of the bottled water testing equipment are Agilent Technologies Inc. (U.S.), Waters Corporation (U.S.), Thermofisher Scientific (U.S.), (Perkin Elmer Inc. (U.S.), Sigma-Aldrich Corporation (U.S.), Bio-Rad Laboratories (U.S.), Shimadzu Corporation (Japan), Restek Corporation (U.S.), Danaher Corporation (U.S.), Hitachi High-Technologies Corporation (Japan), Accepta (U.K.), Lamotte Company (U.S.), and Idexx Laboratories (U.S.) in 2015.

To speak to our analyst for a discussion on the above findings, click Speak to Analyst

Table of Contents

1 Introduction (Page No. - 15)

1.1 Objectives of the Study

1.2 Market Definition

1.3 Study Scope

1.3.1 Markets Covered

1.3.2 Periodization Considered for the Study

1.4 Currency

1.5 Limitations

1.6 Stakeholders

2 Research Methodology (Page No. - 19)

2.1 Research Data

2.1.1 Secondary Data

2.1.1.1 Key Data From Secondary Sources

2.1.2 Primary Data

2.1.2.1 Key Data From Primary Sources

2.1.2.2 Key Industry Insights

2.1.2.3 Breakdown of Primaries

2.2 Factor Analysis

2.2.1 Introduction

2.2.2 Demand-Side Analysis

2.2.2.1 Rising Population

2.2.2.1.1 Increase in Middle-Class Population, 2009–2030

2.2.2.2 Developing Economies and Increasing Gdp

2.2.2.3 Growth in the Consumption of Bottled Water

2.2.3 Supply-Side Analysis

2.2.3.1 Regular Developments in Technologies Used for Bottled Water Testing

2.2.3.2 Regulations for Bottled Water Content

2.3 Market Size Estimation

2.4 Market Breakdown & Data Triangulation

2.5 Research Assumptions

3 Executive Summary (Page No. - 32)

4 Premium Insights (Page No. - 37)

4.1 Opportunities in this Market

4.2 Key Bottled Water Testing Equipment Markets, 2016

4.3 Life Cycle Analysis: Bottled Water Testing Equipment Market, By Region

4.4 Bottled Water Testing Equipment Market, By Technology, 2016 vs 2021

4.5 Europe Bottled Water Testing Equipment Market, By Test Type & Region

4.6 Market Size, By Component & Region

4.7 Developed vs Emerging Bottled Water Testing Equipment Markets, 2016 vs 2021

5 Market Overview (Page No. - 43)

5.1 Introduction

5.2 Market Segmentation

5.2.1 By Technology

5.2.2 By Component

5.2.3 By Test Type

5.2.4 By Region

5.3 Market Dynamics

5.3.1 Drivers

5.3.1.1 Technological Advancements in Testing Equipment

5.3.1.1.1 Solid Phase Extraction (Spe) Tubes

5.3.1.1.2 Stable Isotope Labeling and High Resolution Mass Spectrometry

5.3.1.1.3 Government Funding for Technological Developments

5.3.1.2 Increasing Need for Quality Testing of Water

5.3.1.2.1 Emerging Water-Borne Diseases Driving the Testing Market

5.3.1.3 Stringent Regulatory Requirement

5.3.1.4 Increased Bottled Water Consumption

5.3.2 Restraints

5.3.2.1 High Cost of Testing Equipment

5.3.2.1.1 Adoption of Advanced Testing Methods Proportional to the Price of Sample Testing

5.3.3 Opportunities

5.3.3.1 Growing Market in Emerging Economies

5.3.3.2 Testing Laboratories’ Demand for After-Sales Service to Enhance Operational Efficiency

5.3.4 Challenges

5.3.4.1 High Capital Investment

5.3.4.2 Negative Environmental Impact

5.3.4.2.1 Increase in Disposable Containers Leads to Pollution, Restricting Growth of the Bottled Water Industry

6 Market for Bottled Water Testing Equipment, By Technology (Page No. - 53)

6.1 Introduction

6.2 Traditional

6.3 Rapid

6.3.1 Chromatography

6.3.2 Spectroscopy

6.3.3 Testing Kits

6.3.4 Other Technologies

7 Market for Bottled Water Testing Equipment, By Component (Page No. - 62)

7.1 Introduction

7.2 Instruments

7.3 Consumables & Reagents

7.4 Reference Materials

8 Market for Bottled Water Testing Equipment, By Test Type (Page No. - 67)

8.1 Introduction

8.2 Microbiological

8.3 Physical

8.4 Chemical

8.5 Radiological

9 Bottled Water Testing Equipment Market, By Region (Page No. - 76)

9.1 Introduction

9.2 North America

9.2.1 U.S.

9.2.2 Canada

9.2.3 Mexico

9.3 Europe

9.3.1 Germany

9.3.2 France

9.3.3 U.K.

9.3.4 Rest of Europe

9.4 Asia-Pacific

9.4.1 China

9.4.2 India

9.4.3 Japan

9.4.4 Rest of Asia-Pacific

9.5 Rest of the World (RoW)

9.5.1 Latin America

9.5.2 Middle East & Africa

10 Competitive Landscape (Page No. - 111)

10.1 Overview

10.2 Competitive Situation & Trends

10.2.1 New Product Launches

10.2.2 Acquisitions

10.2.3 Expansions

10.2.4 Agreements, Collaborations & Partnerships

11 Company Profiles (Page No. - 118)

(Company at A Glance, Business Overview, Products Offered, Key Strategy, Recent Developments, SWOT Analysis & MnM View)*

11.1 Introduction

11.2 Bio-Rad Laboratories, Inc.

11.3 Agilent Technologies, Inc.

11.4 Waters Corporation

11.5 Thermo Fisher Scientific, Inc.

11.6 Perkinelmer, Inc.

11.7 Shimadzu Corporation

11.8 Sigma-Aldrich Corporation

11.9 Restek

11.10 Accepta

11.11 Lamotte Company

*Details on Company at A Glance, Recent Financials, Products Offered, Strategies & Insights, & Recent Developments Might Not Be Captured in Case of Unlisted Companies.

12 Appendix (Page No. - 149)

12.1 Discussion Guide

12.2 Knowledge Store: Marketsandmarkets’ Subscription Portal

12.3 More Company Developments

12.3.1 Acquisitions

12.3.2 Expansions

12.3.3 Agreements, Collaborations & Partnerships

12.4 Introducing RT: Real Time Market Intelligence

12.5 Available Customizations

12.6 Related Reports

List of Tables (83 Tables)

Table 1 Growing Middle-Class Population in Asia-Pacific

Table 2 Reported Outbreaks Associated With Bottled Water

Table 3 Market Size, By Technology, 2014–2021 (USD Million)

Table 4 Traditional Bottled Water Testing Technology Market Size, By Region, 2014–2021 (USD Million)

Table 5 Bottled Water Testing Equipment Market Size, By Rapid Technology, 2014–2021 (USD Million)

Table 6 Rapid Bottled Water Testing Technology Market Size, By Region, 2014–2021 (USD Million)

Table 7 Bottled Water Chromatography Market Size, By Region, 2014–2021 (USD Million)

Table 8 Bottled Water Spectroscopy Market Size, By Region, 2014–2021 (USD Million)

Table 9 Bottled Water Testing Kits Market Size, By Region, 2014–2021 (USD Million)

Table 10 Other Rapid Bottled Water Testing Technologies Market Size, By Region, 2014–2021 (USD Million)

Table 11 Market Size, By Component, 2014–2021 (USD Million)

Table 12 Bottled Water Testing Instruments Market Size, By Region, 2014–2021 (USD Million)

Table 13 Bottled Water Testing Consumables & Reagents Market Size, By Region, 2014–2021 (USD Million)

Table 14 Bottled Water Testing Reference Materials Market Size, By Region, 2014–2021 (USD Million)

Table 15 Bottled Water Testing Equipment Market Size, By Test Type, 2014–2021 (USD Million)

Table 16 Bottled Water Microbiological Testing Equipment Market Size, By Region, 2014–2021 (USD Million)

Table 17 Bottled Water Physical Testing Equipment Market Size, By Region, 2014–2021 (USD Million)

Table 18 Permissible Levels for Inorganic Substances

Table 19 The Permissible Levels for Volatile Organic Chemicals (VOC) are as Follows:

Table 20 Permissible Levels for Pesticides & Other Synthetic Organic Chemicals (SOC)

Table 21 Permissible Levels for Certain Chemicals

Table 22 Bottled Water Chemical Testing Equipment Market Size, By Region, 2014–2021 (USD Million)

Table 23 Bottled Water Radiological Testing Market Equipment Size, By Region, 2014–2021 (USD Million)

Table 24 Market Size, By Region, 2014–2021 (USD Million)

Table 25 North America: Bottled Water Testing Equipment Market Size, By Country, 2014–2021 (USD Million)

Table 26 North America: Market Size, By Technology, 2014–2021 (USD Million)

Table 27 U.S.: Bottled Water Testing Equipment Market Size, By Technology, 2014–2021 (USD Million)

Table 28 U.S.: Bottled Water Testing Size, By Rapid Technology, 2014–2021 (USD Million)

Table 29 U.S.: Market Size, By Component, 2014–2021 (USD Million)

Table 30 Canada: Bottled Water Testing Equipment Market Size, By Technology, 2014–2021 (USD Million)

Table 31 Canada: Bottled Water Testing Size, By Rapid Technology, 2014–2021 (USD Million)

Table 32 Canada: Market Size, By Component, 2014–2021 (USD Million)

Table 33 Mexico: Bottled Water Testing Equipment Market Size, By Technology, 2014–2021 (USD Million)

Table 34 Mexico: Bottled Water Testing Size, By Rapid Technology, 2014–2021 (USD Million)

Table 35 Mexico: Market Size, By Component, 2014–2021 (USD Million)

Table 36 Parameters as Per Directive 98/83/Ec

Table 37 Regulatory Model in European Countries in the Water Industry

Table 38 Europe: Bottled Water Testing Size, By Country, 2014–2021 (USD Million)

Table 39 Europe: Bottled Water Testing Equipment Market Size, By Technology, 2014–2021 (USD Million)

Table 40 Germany: Bottled Water Testing Equipment Market Size, By Technology, 2014–2021 (USD Million)

Table 41 Germany: Market Size, By Rapid Technology, 2014–2021 (USD Million)

Table 42 Germany: Market Size, By Component, 2014–2021 (USD Million)

Table 43 France: Bottled Water Testing Equipment Market Size, By Technology, 2014–2021 (USD Million)

Table 44 France: Market Size, By Rapid Technology, 2014–2021 (USD Million)

Table 45 France: Market Size, By Component, 2014–2021 (USD Million)

Table 46 U.K.: Bottled Water Testing Size, By Technology, 2014–2021 (USD Million)

Table 47 U.K.: Market Size, By Rapid Technology, 2014–2021 (USD Million)

Table 48 U.K.: Market Size, By Component, 2014–2021 (USD Million)

Table 49 Rest of Europe: Bottled Water Testing Equipment Market Size, By Technology, 2014–2021 (USD Million)

Table 50 Rest of Europe: Market Size, By Rapid Technology, 2014–2021 (USD Million)

Table 51 Rest of Europe: Market Size, By Component, 2014–2021 (USD Million)

Table 52 Asia-Pacific: Bottled Water Testing Equipment Market Size, By Country, 2014-2021 (USD Million)

Table 53 Asia-Pacific: Market Size, By Technology, 2014-2021 (USD Million)

Table 54 China: Bottled Water Testing Equipment Market Size, By Technology, 2014-2021 (USD Million)

Table 55 China: Market Size, By Rapid Technology, 2014-2021 (USD Million)

Table 56 China: Market Size, By Component, 2014–2021 (USD Million)

Table 57 India: Bottled Water Testing Equipment Market Size, By Technology, 2014-2021 (USD Million)

Table 58 India: Market Size, By Rapid Technology, 2014-2021 (USD Million)

Table 59 India: Market Size, By Component, 2014–2021 (USD Million)

Table 60 Conferences, Symposia, and Seminars on Analytical Technologies Held in Japan

Table 61 Japan: Bottled Water Testing Equipment Market Size, By Technology, 2014-2021 (USD Million)

Table 62 Japan: Market Size, By Rapid Technology, 2014-2021 (USD Million)

Table 63 Japan: Market Size, By Component, 2014–2021 (USD Million)

Table 64 Rest of Asia-Pacific: Bottled Water Testing Equipment Market Size, By Technology, 2014-2021 (USD Million)

Table 65 Rest of Asia-Pacific: Market Size, By Rapid Technology, 2014-2021 (USD Million)

Table 66 Rest of Asia-Pacific: Market Size, By Component, 2014–2021 (USD Million)

Table 67 RoW: Bottled Water Testing Equipment Market Size, By Region, 2014-2021 (USD Million)

Table 68 RoW: Market Size, By Technology, 2014-2021 (USD Million)

Table 69 Latin America: Bottled Water Testing Equipment Market Size, By Technology, 2014-2021 (USD Million)

Table 70 Latin America: Market Size, By Rapid Technology, 2014-2021 (USD Million)

Table 71 Latin America: Market Size, By Component, 2014–2021 (USD Million)

Table 72 Middle East & Africa: Bottled Water Testing Equipment Market Size, By Technology, 2014-2021 (USD Million)

Table 73 Middle East & Africa: Market Size, By Rapid Technology, 2014-2021 (USD Million)

Table 74 Middle East & Africa: Market Size, By Component, 2014–2021 (USD Million)

Table 75 New Product Launches, 2013–2016

Table 76 Acquisitions, 2010–2014

Table 77 Expansions, 2010-2015

Table 78 Agreements , Collaborations & Partnerships, 2010–2015

Table 79 Bio-Rad Laboratories, Inc.: Products & Services

Table 80 Acquisitions, 2010–2016

Table 81 Expansions, 2010–2015

Table 82 New Product Launches, 2010–2015

Table 83 Agreements, Collaborations & Partnerships, 2010–2015

List of Figures (53 Figures)

Figure 1 Market Segmentation

Figure 2 Bottled Water Testing Equipment: Research Design

Figure 3 Global Population, 2011-2015

Figure 4 Top Bottled Water Consuming Countries, 2014 (Million Gallons)

Figure 5 Market Size Estimation Methodology: Bottom-Up Approach

Figure 6 Market Size Estimation Methodology: Top-Down Approach

Figure 7 Data Triangulation Methodology

Figure 8 Market, By Technology, 2016 vs 2021 (USD Million)

Figure 9 Market, By Rapid Technology, 2016 vs 2021 (USD Million)

Figure 10 Market Snapshot (2016 vs 2021): Market for Chemical Test Type is Projected to Grow at the Highest CAGR

Figure 11 Bottled Water Testing Equipment Market, By Component, 2016 vs 2021 (USD Million)

Figure 12 Market, By Region, 2016-2021 (USD Million)

Figure 13 Asia-Pacific to Be the Fastest-Growing Regional Market (2016-2021)

Figure 14 Trend in Bottled Water Testing Equipment Market, 2016-2021 (USD Million)

Figure 15 Asia-Pacific Poised for High Growth From 2016

Figure 16 Asia-Pacifc Market Poised for Robust Growth, 2016 to 2021

Figure 17 The Market for Rapid-Based Bottled Water Testing Equipment is Projected to Record High Growth Between 2016 & 2021

Figure 18 Chemicals Segment Dominated the Europe Market in 2015

Figure 19 Consumables & Reagents Segment Projected to Grow at the Highest Rate From 2016 to 2021

Figure 20 Mexico & China are Expected to Be the Most Attractive Markets for Bottled Water Testing Equipment, 2016 to 2021

Figure 21 Market, By Technology

Figure 22 Market, By Component

Figure 23 Market, By Test Type

Figure 24 Market, By Region

Figure 25 Stringent Regulatory Environment to Drive Growth of Bottled Water Testing Equipment

Figure 26 Rapid Technology Dominated the Global Market in 2015 (USD Million)

Figure 27 Chromatography to Witness the Fastest Growth From 2016 to 2021 (USD Million)

Figure 28 Instruments to Be the Largest Segment in the Bottled Water Testing Through 2021 (USD Million)

Figure 29 Chemical Segment to Be the Largest Market in the Bottled Water Testing Equipment Through 2021 (USD Million)

Figure 30 Europe to Witness the Fastest Growth Between 2016 & 2021

Figure 31 North America is Projected to Dominate the Global Market By 2021 (USD Million)

Figure 32 The U.S. to Dominate the Market Through 2021 (USD Million)

Figure 33 Mexico to Witness the Fastest Growth in the North American Bottled Water Testing Equipment Market Through 2021

Figure 34 Germany to Lead the European Bottled Water Testing Equipment Market Through 2021

Figure 35 Germany to Dominate the Market in Europe in 2016 (USD Million)

Figure 36 India is Projected to Witness the Fastest Growth From 2016 to 2021 (USD Million)

Figure 37 Latin America is Projected to Witness the Fastest Growth From 2016 to 2021 (USD Million)

Figure 38 New Product Launches: Leading Strategy of Key Companies

Figure 39 Expanding Revenue Base Through New Product Launches, 2012–2015

Figure 40 New Product Launches: the Key Strategy, 2010–2016

Figure 41 Geographical Revenue Mix of Top Five Market Players

Figure 42 Bio-Rad Laboratories, Inc.: Company Snapshot

Figure 43 Bio-Rad Laboratories, Inc.: SWOT Analysis

Figure 44 Agilent Technologies, Inc.: Company Snapshot

Figure 45 Agilent Technologies, Inc.: SWOT Analysis

Figure 46 Waters Corporation: Company Snapshot

Figure 47 Waters Corporation: SWOT Analysis

Figure 48 Thermo Fisher Scientific, Inc.: Company Snapshot

Figure 49 Thermo Fisher Scientific, Inc.: SWOT Analysis

Figure 50 Perkinelmer, Inc.: Company Snapshot

Figure 51 Perkinelmer, Inc.:: SWOT Analysis

Figure 52 Shimadzu Corporation: Company Snapshot

Figure 53 Sigma-Aldrich Corporation : Company Snapshot

Growth opportunities and latent adjacency in Bottled Water Testing Equipment Market