Glass Substrate Market by Type (Borosilicate, Silicon, Ceramic, And Fused Silica/Quartz-Based Glass Substrates), End-Use Industry (Electronics, Automotive, Medical, Aerospace & Defense, Solar), and Region - Global Forecast to 2028

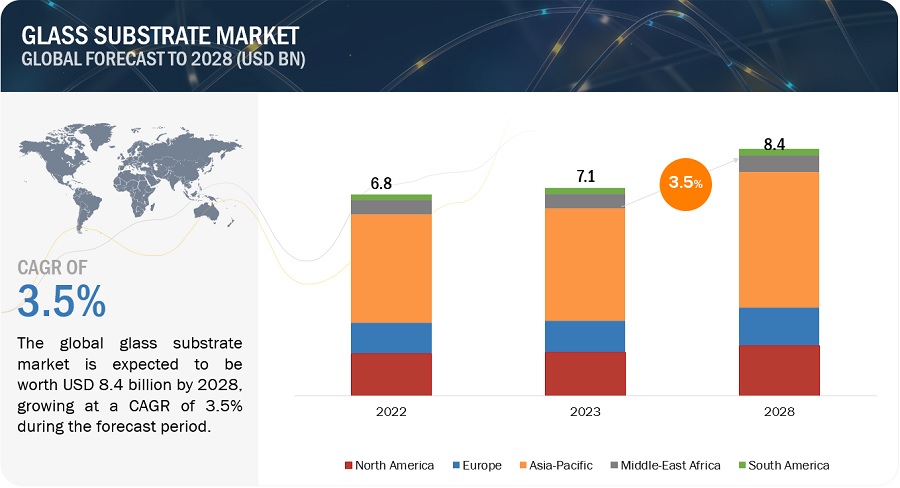

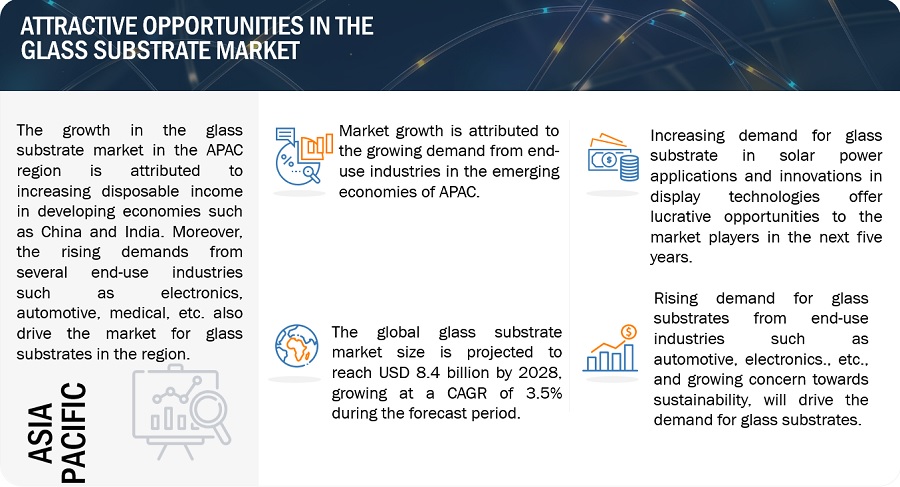

The glass substrate market size is estimated to be USD 7.1 billion in 2023, and it is projected to reach USD 8.4 billion by 2028 at a CAGR of 3.5%. One of the key factors expected to propel the growth of the glass substrate market is the expanding utilization of LCDs in consumer durables, smart handheld devices, and automotive applications. Additionally, the increasing demand for glass substrates is foreseen to be driven by the growth in the semiconductor and electronics industries.

Global Glass Substrate Market Trends

To know about the assumptions considered for the study, Request for Free Sample Report

Glass substrate Market Dynamics

Driver: Rising usage of LCDs in consumer electronics and automotive application

The surging demand for LCDs in consumer electronics and automotive applications is a pivotal driver behind the growth of the glass substrate market. LCDs, with their sleek designs and high-resolution displays, have become integral components in devices like smartphones, televisions, and laptops, elevating the visual experience for consumers. In the automotive sector, LCDs are increasingly incorporated into digital dashboards, infotainment systems, and heads-up displays, contributing to enhanced driver interfaces and passenger entertainment. As these industries continue to expand and innovate, the need for high-quality glass substrates to support the production of advanced LCDs becomes paramount. The glass substrate market is thus propelled by the growing usage of LCD technology across these dynamic sectors, reflecting the broader trend toward sophisticated and visually immersive electronic displays.

Restraint: High manufacturing and technology costs

The growth of the glass substrate market faces challenges due to the constraints imposed by high technology and manufacturing costs. The intricate processes involved in producing advanced glass substrates for applications such as electronics, displays, and semiconductors often require sophisticated technologies, leading to elevated development costs. Additionally, the manufacturing processes demand precision and specialized equipment, contributing to higher production costs. These elevated costs act as a deterrent for some market players, impacting their ability to invest and innovate. As a result, the glass substrate market encounters obstacles in achieving broader adoption and market expansion, especially as the industry strives to strike a balance between advancing technology and managing the associated economic considerations. Addressing these cost-related challenges becomes imperative for fostering sustainable growth and widespread accessibility within the glass substrate market.

Opportunity: Growing use of glass substrate in solar power application

The burgeoning use of glass substrates in solar applications presents a significant opportunity for the growth of the glass substrate market. As the solar energy sector continues to expand, glass substrates find extensive application in the manufacturing of photovoltaic cells and solar panels. The transparency, durability, and thermal stability of glass make it an ideal substrate for encapsulating and protecting photovoltaic components, ensuring efficient energy conversion and extended lifespan of solar modules. The escalating demand for sustainable energy solutions, coupled with advancements in solar technologies, propels the need for high-performance glass substrates. This trend opens up avenues for innovation and market growth as the solar industry increasingly relies on robust and technologically advanced materials, positioning glass substrates at the forefront of opportunities within the evolving renewable energy landscape.

Challenges: LCD glass to meet strict quality requirements

A formidable challenge faced by the glass substrate market is the imperative to meet stringent quality restrictions in the production of LCD (Liquid Crystal Display) glass. LCDs, ubiquitous in consumer electronics and other industries, demand precise manufacturing processes to ensure flawless displays. Meeting high-quality standards involves minimizing defects, ensuring uniform thickness, and achieving optimal optical clarity in the glass substrate. The intricate nature of these requirements necessitates sophisticated production techniques, which, in turn, can escalate manufacturing costs. Striking a delicate balance between meeting stringent quality standards and managing production expenses poses a significant challenge for industry players. As the demand for impeccable display quality persists, the glass substrate market navigates the complex task of upholding rigorous quality restrictions while maintaining competitiveness in the dynamic landscape of display technologies.

Ecosystem of Glass Substrate Market

“Dominance of electronic industry in the Glass substrate end-use industry segment.”

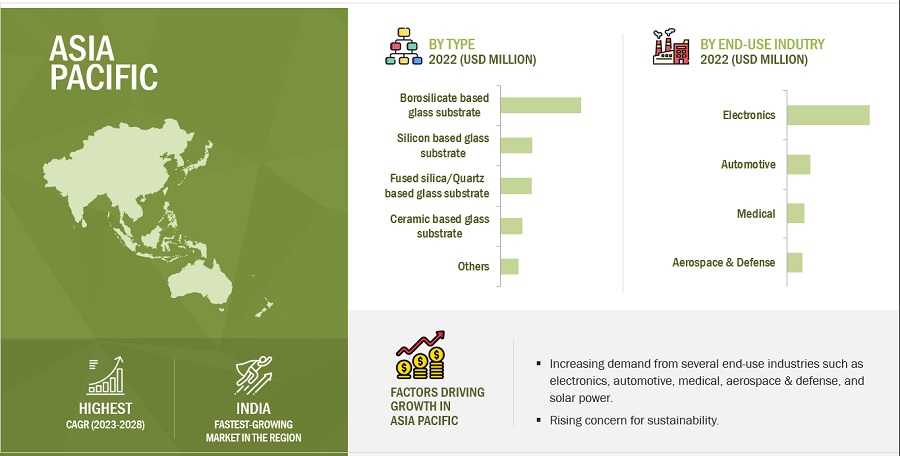

Categorized by end-use industry, the glass substrate market includes segments such as electronics, automotive, medical, aerospace & defense, and solar. Notably, the electronics industry stands out as the largest segment within this market. The significant surge in the production of display devices, electronic components, semiconductors, MEMS devices, and information, computing, and telecommunication devices is anticipated to be a primary driver propelling the growth of the glass substrate market in the electronics sector.

“Borosilicate-based glass substrate is the most usable by type substrate in the glass substrate market.”

Categorized by type, the glass substrate market exhibits segmentation into borosilicate-based glass substrates, silicon-based glass substrates, ceramic-based glass substrates, fused silica/quartz-based glass substrates, and other variants. Among these, borosilicate-based glass substrates emerge as the most extensively employed type. This prevalence is attributed to their exceptional attributes, including a low coefficient of thermal expansion, high chemical resistivity, and superior surface strength, making them highly favored for various applications.

“APAC is the speediest-growing market for glass substrate market.”

In terms of value, the Asia Pacific will be the fastest-growing region in the overall glass substrate market.

This growth is attributed to rapid urbanization, increasing disposable income, and improving living standards, which drive the demands from several end-use industries such as electronics, automotive, medical, aerospace & defense, and solar power. Apart from this, the growing adoption of electronics gadgets such as consumer wearbales, smart watches, etc. This fuelled the market of glass substrates in the region during the forecast period.

To know about the assumptions considered for the study, download the pdf brochure

Key Market Players

Key stakeholders steering the trajectory of the glass substrate market include AGC Inc. (Japan), Schott (Germany), Corning, Incorporated (US), Nippon Sheet Glass Co., Ltd. (Japan), Plan Optik AG (Germany), HOYA Corporation (Japan), Ohara Inc. (Japan), IRICO Group New Energy Company Limited (China), Toppan Inc. (Japan), Tunghsu Group Co. Ltd. (China). To solidify their positions in this competitive market, these industry frontrunners have judiciously employed a range of growth strategies. This encompasses acquisitions, diversifying their product lineup, geographical expansions, and forging productive partnerships, collaborations, and agreements. Through these strategic maneuvers, they aim to cater to the escalating demand for glass substrates, particularly from dynamic emerging markets.

Read More: Glass Substrate Companies

Scope of the report:

|

Report Metric |

Details |

|

Years Considered |

2019–2028 |

|

Base year |

2022 |

|

Forecast period |

2023–2028 |

|

Unit considered |

Value (USD Million/Billion) |

|

Segments |

Type, End-Use Industry, and Region |

|

Regions |

Asia-Pacific, North America, Europe, South America, and Middle East & Africa. |

|

Companies |

The major players are AGC Inc. (Japan), Schott (Germany), Corning Incorporated (US), Nippon Sheet Glass Co., Ltd. (Japan), HOYA Corporation (Japan) and others are covered in the Glass substrate market. |

This research report categorizes the global Glass substrate market on the basis of Type, End-use Industries, and Region.

Glass substrate Market, By Type

- Borosilicate-based glass substrates

- Silicon-based glass substrates

- Ceramic-based glass substrates

- Fused silica-/quartz-based glass substrates

- Other Types

Glass substrate Market, By End-Use Industries

- Automotive

- Electronics

- Medical

- Aerospace & Defense

- Solar Power

Glass substrate Market, By Region

- Asia Pacific (APAC)

- North America

- Europe

- South America

- Middle East & Africa

The market has been further analyzed for the key countries in each of these regions.

Recent Developments

- In December 2023, Schott (Germany) has invested in expanding the research and development site, in Landshut.

- In November 2023, Nippon Sheet Glass Co., Ltd. (Japan) has announced its plans to invest in additional TCO (transparent conductive oxide) glass production capacity in the United States. to support the growing solar market.

- In November 2023, Nippon Sheet Glass Co., Ltd. (Japan) has announced the opening of new production plant of solar glass in Malaysia

- In September 2023, Schott (Germany) has announced a three-point action plan to address the chip industry's needs for glass-substrate-based advanced chip packaging.

- In May 2023, Corning Incorporated (US) has announced a 20% increment in the prices of display glass substrate

- In February 2023, AGC Inc. (Japan) has partnered with Saint-Gobain, to design a pilot breakthrough flat glass line that is expected to reduce very significantly direct CO2 emissions.

- In January 2023, AGC Inc. (Japan) has developed a CADTANK Online Computation and Optimization Assistant (a digital twin technology), used for the glass melting process.

- In January 2022, Schott (Germany) has introduced, FLEXINITY connect, an ultra-fine structured glass that brings a game-changing element to semiconductor manufacturing, which has traditionally used printed circuit boards (PCB) and silicon interposers for advanced chip packaging solutions.

- In June 2022, Schott (Germany) has inaugurated a new flat glass, state-of-the-art production plant in Bolu, Turkey

- In December 2022, Nippon Sheet Glass Co., Ltd. (Japan) has announced the establishment of the Second Research Building, in its Technical Research Laboratory of Japan.

Frequently Asked Questions (FAQ):

What growth prospects does the glass substrate market present?

Rising urbanization, improving living standards, and increasing disposable income, led to the adoption of electronic products, which drives the market of glass substrate. Apart from this, increasing demands from several end-use industries such as automotive, medical, aerospace & defense, and solar power also drive the glass substrate market.

How do product type choices influence the glass substrate market dynamics?

The market is categorized based on by type segments like borosilicate-based glass substrates, silicon-based glass substrates, ceramic-based glass substrates, fused silica-/quartz-based glass substrates, and others. Borosilicate glass substrates are widely used for various applications due to their unique properties and advantages such as low coefficient of thermal expansion, good chemical resistance, excellent optical clarity, good mechanical strength, good resistance to water and moisture, and others. These benefits help to influence the market of the glass substrate.

Which application predominantly utilizes glass substrate?

On the basis of end-use industry, the market is segmented into the following end-use industries such as electronics, automotive, medical, aerospace & defense, and solar power. The electronics industry holds the largest market share, where glass substrates are used in making LCDs, OLEDs, touchscreens, sensors, semiconductor manufacturing, etc.

Which companies are at the forefront of the glass substrate market?

Major market players include AGC Inc. (Japan), Schott (Germany), Corning, Incorporated (US), Nippon Sheet Glass Co., Ltd. (Japan), Plan Optik AG (Germany), HOYA Corporation (Japan), Ohara Inc. (Japan), IRICO Group New Energy Company Limited (China), Toppan Inc. (Japan), Tunghsu Group Co. Ltd. (China), and others.

What are the prime factors that are poised to influence the market in the forecast period?

Burgeoning demand for advanced electronic devices, including smartphones, tablets, and high-resolution displays, a continuous evolution of display technologies, such as OLED and flexible displays, increasing use of glass in solar panels, etc. propels the market of glass substrate. .

To speak to our analyst for a discussion on the above findings, click Speak to Analyst

- 5.1 INTRODUCTION

-

5.2 MARKET DYNAMICSDRIVERS- Rising use of LCDs in consumer electronics and automotive applications- Growing semiconductor industryRESTRAINTS- High technology development and manufacturing costOPPORTUNITIES- Innovations in display technologies- Growing use of glass substrates in solar power applicationCHALLENGES- LCD glass to meet strict quality requirements

-

6.1 PORTER’S FIVE FORCES ANALYSISTHREAT OF NEW ENTRANTSTHREAT OF SUBSTITUTESBARGAINING POWER OF SUPPLIERSBARGAINING POWER OF BUYERSINTENSITY OF COMPETITIVE RIVALRY

- 6.2 SUPPLY CHAIN ANALYSIS

- 6.3 VALUE CHAIN ANALYSIS

-

6.4 KEY MARKETS FOR IMPORT AND EXPORT (TRADE ANALYSIS)EXPORT SCENARIO OF GLASS SUBSTRATESIMPORT SCENARIO OF GLASS SUBSTRATES

-

6.5 MACROECONOMIC OVERVIEWGLOBAL GDP OUTLOOK

-

6.6 PRICING ANALYSISINDICATIVE PRICING ANALYSIS FOR GLASS SUBSTRATES, BY REGION

- 6.7 TECHNOLOGY ANALYSIS

-

6.8 TRENDS/DISRUPTIONS IMPACTING CUSTOMER’S BUSINESS

-

6.9 TARIFF AND REGULATORY LANDSCAPETARIFF RELATED TO GLASS SUBSTRATE MARKETREGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

-

6.10 CASE STUDY ANALYSISSAFE TRANSPORT CONTAINERS FOR SCHOTT TELESCOPE MIRROR SUBSTRATE- Introduction- Challenge- Solution

- 6.11 KEY CONFERENCES & EVENTS, 2022–2023

-

6.12 ECOSYSTEM/MARKET MAP

-

6.13 KEY STAKEHOLDERS & BUYING CRITERIAKEY STAKEHOLDERS IN BUYING PROCESSBUYING CRITERIA

-

6.14 PATENT ANALYSISINTRODUCTION

- 7.1 INTRODUCTION

-

7.2 BOROSILICATE-BASED GLASS SUBSTRATESADVANTAGEOUS PROPERTIES OF GLASS SUBSTRATES TO DRIVE DEMAND

-

7.3 SILICON-BASED GLASS SUBSTRATESMECHANICAL SUPPORT FOR INTEGRATED CIRCUITS TO SUPPORT GROWTH

-

7.4 CERAMIC-BASED GLASS SUBSTRATESABILITY TO WITHSTAND THERMAL SHOCKS TO DRIVE DEMAND

-

7.5 FUSED SILICA-/QUARTZ-BASED GLASS SUBSTRATESGOOD THERMAL SHOCK RESISTANCE TO DRIVE DEMAND

- 7.6 OTHER TYPES

- 8.1 INTRODUCTION

-

8.2 ELECTRONICSINCREASING DEMAND FOR ELECTRONICS PRODUCTS TO DRIVE DEMAND

-

8.3 AUTOMOTIVERISING DEMAND FOR ELECTRIC VEHICLES TO DRIVE DEMAND

-

8.4 MEDICALGROWING MEDICAL DEVICE INDUSTRY TO DRIVE DEMAND

-

8.5 AEROSPACE & DEFENSEHIGH OPTICAL CLARITY AND RESISTANCE TO ENVIRONMENTAL FACTORS TO DRIVE DEMAND

-

8.6 SOLAR POWERRAISING CONCERN FOR CLIMATE CHANGE AND ENVIRONMENTAL ISSUES TO DRIVE DEMAND

- 9.1 INTRODUCTION

-

9.2 NORTH AMERICARECESSION IMPACTUS- Growing semiconductor and automotive industries to drive demandCANADA- Rising solar and automotive industries to drive demandMEXICO- Increasing automotive industry to grow market

-

9.3 ASIA PACIFICRECESSION IMPACTCHINA- Government subsidies for semiconductor manufacturers to drive marketINDIA- Rising medical device and automotive industry to increase demandJAPAN- Growing automotive and semiconductor industries to support marketSOUTH KOREA- Growing electric vehicle market and government initiatives to drive demandTAIWAN- Growing semiconductor industry to drive marketREST OF ASIA PACIFIC

-

9.4 EUROPERECESSION IMPACTGERMANY- Growing end-use industries to drive demandUK- Government initiatives to provide growth opportunitiesFRANCE- Government initiatives and growing automotive industry to drive demandITALY- Growing solar power industry to drive marketRUSSIA- Government investment to generate demandREST OF EUROPE

-

9.5 SOUTH AMERICARECESSION IMPACTBRAZIL- Growing automotive industry and government initiatives to drive marketARGENTINA- Renewable energy initiatives and growing automotive industry to boost marketREST OF SOUTH AMERICA

- 10.1 OVERVIEW

- 10.2 OVERVIEW OF STRATEGIES ADOPTED BY KEY GLASS SUBSTRATE PLAYERS

- 10.3 MARKET SHARE ANALYSIS

- 10.4 REVENUE ANALYSIS OF TOP MARKET PLAYERS

-

10.5 COMPANY EVALUATION MATRIXSTARSEMERGING LEADERSPERVASIVE PLAYERSPARTICIPANTS

- 10.6 COMPANY FOOTPRINT

-

10.7 START-UPS/SMES EVALUATION MATRIX, 2022PROGRESSIVE COMPANIESRESPONSIVE COMPANIESDYNAMIC COMPANIESSTARTING BLOCKS

- 10.8 COMPETITIVE BENCHMARKING

-

10.9 COMPETITIVE SCENARIO AND TRENDSPRODUCT LAUNCHESDEALS

-

11.1 KEY PLAYERSAGC INC.- Business overview- Products/Solutions/Services offered- Recent developments- MNM viewSCHOTT AG- Business overview- Products/Solutions/Services offered- Recent developments- MNM viewCORNING INCORPORATED- Business overview- Products/Solutions/Services offered- Recent developments- MNM viewNIPPON SHEET GLASS CO., LTD.- Business overview- Products/Solutions/Services offered- Recent developments- MNM viewPLAN OPTIK AG- Business overview- Products/Solutions/Services offered- Recent developments- MNM viewHOYA CORPORATION- Business overview- Products/Solutions/Services offered- MNM viewOHARA INC.- Business overview- Products/Solutions/Services offered- MNM viewIRICO GROUP NEW ENERGY COMPANY LIMITED- Business overview- Products/Solutions/Services offered- MNM viewTOPPAN INC.- Business overview- Products/Solutions/Services offered- MNM viewTUNGHSU GROUP CO. LTD.- Business overview- Products/Solutions/Services offered- MNM viewNIPPON ELECTRIC GLASS CO., LTD.- Business overview- Products/Solutions/Services offered- Recent developments- MNM view

-

11.2 OTHER PLAYERSSPECIALTY GLASS PRODUCTSABSOLICS INC.BIOTAIN CRYSTAL CO., LIMITEDYATEKSVALLEY DESIGN CORP.AVANSTRATE INC.KYODO INTERNATIONAL, INC.TAIWAN GLASS IND. CORP.GUARDIAN INDUSTRIESTECNISCO, LTD.ARRYAIT CORPORATIONPRÄZISIONS GLAS & OPTIK GMBHJIANGSU SUCHUAN TECHNOLOGY CO., LTD.BUWON PRECISION SCIENCES CO., LTD.VIRACON

- 12.1 INTRODUCTION

- 12.2 DISPLAY MARKET

- 13.1 DISCUSSION GUIDE

- 13.2 KNOWLEDGESTORE: MARKETSANDMARKETS’ SUBSCRIPTION PORTAL

- 13.3 AVAILABLE CUSTOMIZATIONS

- 13.4 RELATED REPORTS

- 13.5 AUTHOR DETAILS

- TABLE 1 LIMITATIONS & ASSOCIATED RISKS

- TABLE 2 GLASS SUBSTRATE MARKET: PORTER’S FIVE FORCES ANALYSIS

- TABLE 3 WORLD GDP GROWTH PROJECTION, 2019–2026 (USD BILLION)

- TABLE 4 INDICATIVE PRICING ANALYSIS OF GLASS SUBSTRATES, BY REGION, 2021–2028 (USD/UNIT)

- TABLE 5 NORTH AMERICA: LIST OF REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- TABLE 6 EUROPE: LIST OF REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- TABLE 7 ASIA PACIFIC: LIST OF REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- TABLE 8 MIDDLE EAST AND AFRICA: LIST OF REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- TABLE 9 SOUTH AMERICA: LIST OF REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- TABLE 10 GLASS SUBSTRATE MARKET: DETAILED LIST OF CONFERENCES & EVENTS

- TABLE 11 GLASS SUBSTRATE MARKET: ECOSYSTEM

- TABLE 12 INFLUENCE OF STAKEHOLDERS IN BUYING PROCESS FOR END-USE INDUSTRIES (%)

- TABLE 13 KEY BUYING CRITERIA FOR GLASS SUBSTRATE FOR END-USE INDUSTRIES

- TABLE 14 LIST OF A FEW PATENTS IN GLASS SUBSTRATE MARKET, 2022–2023

- TABLE 15 GLASS SUBSTRATE MARKET, BY TYPE, 2019–2021 (USD MILLION)

- TABLE 16 GLASS SUBSTRATE MARKET, BY TYPE, 2022–2028 (USD MILLION)

- TABLE 17 BOROSILICATE-BASED GLASS SUBSTRATE MARKET, BY REGION, 2019–2021 (USD MILLION)

- TABLE 18 BOROSILICATE-BASED GLASS SUBSTRATE MARKET, BY REGION, 2022–2028 (USD MILLION)

- TABLE 19 SILICON-BASED GLASS SUBSTRATE MARKET, BY REGION, 2019–2021 (USD MILLION)

- TABLE 20 SILICON-BASED GLASS SUBSTRATE MARKET, BY REGION, 2022–2028 (USD MILLION)

- TABLE 21 CERAMIC-BASED GLASS SUBSTRATE MARKET, BY REGION, 2019–2021 (USD MILLION)

- TABLE 22 CERAMIC-BASED GLASS SUBSTRATE MARKET, BY REGION, 2022–2028 (USD MILLION)

- TABLE 23 FUSED SILICA/QUARTZ-BASED GLASS SUBSTRATE MARKET, BY REGION, 2019–2021 (USD MILLION)

- TABLE 24 FUSED SILICA/QUARTZ -BASED GLASS SUBSTRATE MARKET, BY REGION, 2022–2028 (USD MILLION)

- TABLE 25 OTHER GLASS SUBSTRATES MARKET, BY REGION, 2019–2021 (USD MILLION)

- TABLE 26 OTHER GLASS SUBSTRATES MARKET, BY REGION, 2022–2028 (USD MILLION)

- TABLE 27 GLASS SUBSTRATE MARKET, BY END-USE INDUSTRY, 2019–2021 (USD MILLION)

- TABLE 28 GLASS SUBSTRATE MARKET, BY END-USE INDUSTRY, 2022–2028 (USD MILLION)

- TABLE 29 GLASS SUBSTRATE MARKET IN ELECTRONICS END-USE INDUSTRY, BY REGION, 2019–2021 (USD MILLION)

- TABLE 30 GLASS SUBSTRATE MARKET IN ELECTRONICS END-USE INDUSTRY, BY REGION, 2022–2028 (USD MILLION)

- TABLE 31 GLASS SUBSTRATE MARKET IN AUTOMOTIVE END-USE INDUSTRY, BY REGION, 2019–2021 (USD MILLION)

- TABLE 32 GLASS SUBSTRATE MARKET IN AUTOMOTIVE END-USE INDUSTRY, BY REGION, 2022–2028 (USD MILLION)

- TABLE 33 GLASS SUBSTRATE MARKET IN MEDICAL END-USE INDUSTRY, BY REGION, 2019–2021 (USD MILLION)

- TABLE 34 GLASS SUBSTRATE MARKET IN MEDICAL END-USE INDUSTRY, BY REGION, 2022–2028 (USD MILLION)

- TABLE 35 GLASS SUBSTRATE MARKET IN AEROSPACE AND DEFENSE END-USE INDUSTRY, BY REGION, 2019–2021 (USD MILLION)

- TABLE 36 GLASS SUBSTRATE MARKET IN AEROSPACE AND DEFENSE END-USE INDUSTRY, BY REGION, 2022–2028 (USD MILLION)

- TABLE 37 GLASS SUBSTRATE MARKET IN SOLAR POWER END-USE INDUSTRY, BY REGION, 2019–2021 (USD MILLION)

- TABLE 38 GLASS SUBSTRATE MARKET IN SOLAR POWER END-USE INDUSTRY, BY REGION, 2022–2028 (USD MILLION)

- TABLE 39 GLASS SUBSTRATE MARKET, BY REGION, 2019–2021 (USD MILLION)

- TABLE 40 GLASS SUBSTRATE MARKET, BY REGION, 2022–2028 (USD MILLION)

- TABLE 41 NORTH AMERICA: GLASS SUBSTRATE MARKET, BY COUNTRY, 2019–2021 (USD MILLION)

- TABLE 42 NORTH AMERICA: GLASS SUBSTRATE MARKET, BY COUNTRY, 2022–2028 (USD MILLION)

- TABLE 43 NORTH AMERICA: GLASS SUBSTRATE MARKET, BY TYPE, 2019–2021 (USD MILLION)

- TABLE 44 NORTH AMERICA: GLASS SUBSTRATE MARKET, BY TYPE, 2022–2028 (USD MILLION)

- TABLE 45 NORTH AMERICA: GLASS SUBSTRATE MARKET, BY END-USE INDUSTRY, 2019–2021 (USD MILLION)

- TABLE 46 NORTH AMERICA: GLASS SUBSTRATE MARKET, BY END-USE INDUSTRY, 2022–2028 (USD MILLION)

- TABLE 47 US: GLASS SUBSTRATE MARKET, BY TYPE, 2019–2021 (USD MILLION)

- TABLE 48 US: GLASS SUBSTRATE MARKET, BY TYPE, 2022–2028 (USD MILLION)

- TABLE 49 US: GLASS SUBSTRATE MARKET, BY END-USE INDUSTRY, 2019–2021 (USD MILLION)

- TABLE 50 US: GLASS SUBSTRATE MARKET, BY END-USE INDUSTRY, 2022–2028 (USD MILLION)

- TABLE 51 CANADA: GLASS SUBSTRATE MARKET, BY TYPE, 2019–2021 (USD MILLION)

- TABLE 52 CANADA: GLASS SUBSTRATE MARKET, BY TYPE, 2022–2028 (USD MILLION)

- TABLE 53 CANADA: GLASS SUBSTRATE MARKET, BY END-USE INDUSTRY, 2019–2021 (USD MILLION)

- TABLE 54 CANADA: GLASS SUBSTRATE MARKET, BY END-USE INDUSTRY, 2022–2028 (USD MILLION)

- TABLE 55 MEXICO: GLASS SUBSTRATE MARKET, BY TYPE, 2019–2021 (USD MILLION)

- TABLE 56 MEXICO: GLASS SUBSTRATE MARKET, BY TYPE, 2022–2028 (USD MILLION)

- TABLE 57 MEXICO: GLASS SUBSTRATE MARKET, BY END-USE INDUSTRY, 2019–2021 (USD MILLION)

- TABLE 58 MEXICO: GLASS SUBSTRATE MARKET, BY END-USE INDUSTRY, 2022–2028 (USD MILLION)

- TABLE 59 ASIA PACIFIC: GLASS SUBSTRATE MARKET, BY COUNTRY, 2019–2021 (USD MILLION)

- TABLE 60 ASIA PACIFIC: GLASS SUBSTRATE MARKET, BY COUNTRY, 2022–2028 (USD MILLION)

- TABLE 61 ASIA PACIFIC: GLASS SUBSTRATE MARKET, BY TYPE, 2019–2021 (USD MILLION)

- TABLE 62 ASIA PACIFIC: GLASS SUBSTRATE MARKET, BY TYPE, 2022–2028 (USD MILLION)

- TABLE 63 ASIA PACIFIC: GLASS SUBSTRATE MARKET, BY END-USE INDUSTRY, 2019–2021 (USD MILLION)

- TABLE 64 ASIA PACIFIC: GLASS SUBSTRATE MARKET, BY END-USE INDUSTRY, 2022–2028 (USD MILLION)

- TABLE 65 INDIA: GLASS SUBSTRATE MARKET, BY TYPE, 2019–2021 (USD MILLION)

- TABLE 66 INDIA: GLASS SUBSTRATE MARKET, BY TYPE, 2022–2028 (USD MILLION)

- TABLE 67 INDIA: GLASS SUBSTRATE MARKET, BY END-USE INDUSTRY, 2019–2021 (USD MILLION)

- TABLE 68 INDIA: GLASS SUBSTRATE MARKET, BY END-USE INDUSTRY, 2022–2028 (USD MILLION)

- TABLE 69 JAPAN: GLASS SUBSTRATE MARKET, BY TYPE, 2019–2021 (USD MILLION)

- TABLE 70 JAPAN: GLASS SUBSTRATE MARKET, BY TYPE, 2022–2028 (USD MILLION)

- TABLE 71 JAPAN: GLASS SUBSTRATE MARKET, BY END-USE INDUSTRY, 2019–2021 (USD MILLION)

- TABLE 72 JAPAN: GLASS SUBSTRATE MARKET, BY END-USE INDUSTRY, 2022–2028 (USD MILLION)

- TABLE 73 SOUTH KOREA: GLASS SUBSTRATE MARKET, BY TYPE, 2019–2021 (USD MILLION)

- TABLE 74 SOUTH KOREA: GLASS SUBSTRATE MARKET, BY TYPE, 2022–2028 (USD MILLION)

- TABLE 75 SOUTH KOREA: GLASS SUBSTRATE MARKET, BY END-USE INDUSTRY, 2019–2021 (USD MILLION)

- TABLE 76 SOUTH KOREA: GLASS SUBSTRATE MARKET, BY END-USE INDUSTRY, 2022–2028 (USD MILLION)

- TABLE 77 TAIWAN: GLASS SUBSTRATE MARKET, BY TYPE, 2019–2021 (USD MILLION)

- TABLE 78 TAIWAN: GLASS SUBSTRATE MARKET, BY TYPE, 2022–2028 (USD MILLION)

- TABLE 79 TAIWAN: GLASS SUBSTRATE MARKET, BY END-USE INDUSTRY, 2019–2021 (USD MILLION)

- TABLE 80 TAIWAN: GLASS SUBSTRATE MARKET, BY END-USE INDUSTRY, 2022–2028 (USD MILLION)

- TABLE 81 REST OF ASIA PACIFIC: GLASS SUBSTRATE MARKET, BY TYPE, 2019–2021 (USD MILLION)

- TABLE 82 REST OF ASIA PACIFIC: GLASS SUBSTRATE MARKET, BY TYPE, 2022–2028 (USD MILLION)

- TABLE 83 REST OF ASIA PACIFIC: GLASS SUBSTRATE MARKET, BY END-USE INDUSTRY, 2019–2021 (USD MILLION)

- TABLE 84 REST OF ASIA PACIFIC: GLASS SUBSTRATE MARKET, BY END-USE INDUSTRY, 2022–2028 (USD MILLION)

- TABLE 85 EUROPE: GLASS SUBSTRATE MARKET, BY COUNTRY, 2019–2021 (USD MILLION)

- TABLE 86 EUROPE: GLASS SUBSTRATE MARKET, BY COUNTRY, 2022–2028 (USD MILLION)

- TABLE 87 EUROPE: GLASS SUBSTRATE MARKET, BY TYPE, 2019–2021 (USD MILLION)

- TABLE 88 EUROPE: GLASS SUBSTRATE MARKET, BY TYPE, 2022–2028 (USD MILLION)

- TABLE 89 EUROPE: GLASS SUBSTRATE MARKET, BY END-USE INDUSTRY, 2019–2021 (USD MILLION)

- TABLE 90 EUROPE: GLASS SUBSTRATE MARKET, BY END-USE INDUSTRY, 2022–2028 (USD MILLION)

- TABLE 91 GERMANY: GLASS SUBSTRATE MARKET, BY TYPE, 2019–2021 (USD MILLION)

- TABLE 92 GERMANY: GLASS SUBSTRATE MARKET, BY TYPE, 2022–2028 (USD MILLION)

- TABLE 93 GERMANY: GLASS SUBSTRATE MARKET, BY END-USE INDUSTRY, 2019–2021 (USD MILLION)

- TABLE 94 GERMANY: GLASS SUBSTRATE MARKET, BY END-USE INDUSTRY, 2022–2028 (USD MILLION)

- TABLE 95 UK: GLASS SUBSTRATE MARKET, BY TYPE, 2019–2021 (USD MILLION)

- TABLE 96 UK: GLASS SUBSTRATE MARKET, BY TYPE, 2022–2028 (USD MILLION)

- TABLE 97 UK: GLASS SUBSTRATE MARKET, BY END-USE INDUSTRY, 2019–2021 (USD MILLION)

- TABLE 98 UK: GLASS SUBSTRATE MARKET, BY END-USE INDUSTRY, 2022–2028 (USD MILLION)

- TABLE 99 FRANCE: GLASS SUBSTRATE MARKET, BY TYPE, 2019–2021 (USD MILLION)

- TABLE 100 FRANCE: GLASS SUBSTRATE MARKET, BY TYPE, 2022–2028 (USD MILLION)

- TABLE 101 FRANCE: GLASS SUBSTRATE MARKET, BY END-USE INDUSTRY, 2019–2021 (USD MILLION)

- TABLE 102 FRANCE: GLASS SUBSTRATE MARKET, BY END-USE INDUSTRY, 2022–2028 (USD MILLION)

- TABLE 103 ITALY: GLASS SUBSTRATE MARKET, BY TYPE, 2019–2021 (USD MILLION)

- TABLE 104 ITALY: GLASS SUBSTRATE MARKET, BY TYPE, 2022–2028 (USD MILLION)

- TABLE 105 ITALY: GLASS SUBSTRATE MARKET, BY END-USE INDUSTRY, 2019–2021 (USD MILLION)

- TABLE 106 ITALY: GLASS SUBSTRATE MARKET, BY END-USE INDUSTRY, 2022–2028 (USD MILLION)

- TABLE 107 RUSSIA: GLASS SUBSTRATE MARKET, BY TYPE, 2019–2021 (USD MILLION)

- TABLE 108 RUSSIA: GLASS SUBSTRATE MARKET, BY TYPE, 2022–2028 (USD MILLION)

- TABLE 109 RUSSIA: GLASS SUBSTRATE MARKET, BY END-USE INDUSTRY, 2019–2021 (USD MILLION)

- TABLE 110 RUSSIA: GLASS SUBSTRATE MARKET, BY END-USE INDUSTRY, 2022–2028 (USD MILLION)

- TABLE 111 REST OF EUROPE: GLASS SUBSTRATE MARKET, BY TYPE, 2019–2021 (USD MILLION)

- TABLE 112 REST OF EUROPE: GLASS SUBSTRATE MARKET, BY TYPE, 2022–2028 (USD MILLION)

- TABLE 113 REST OF EUROPE: GLASS SUBSTRATE MARKET, BY END-USE INDUSTRY, 2019–2021 (USD MILLION)

- TABLE 114 REST OF EUROPE: GLASS SUBSTRATE MARKET, BY END-USE INDUSTRY, 2022–2028 (USD MILLION)

- TABLE 115 SOUTH AMERICA: GLASS SUBSTRATE MARKET, BY COUNTRY, 2019–2021 (USD MILLION)

- TABLE 116 SOUTH AMERICA: GLASS SUBSTRATE MARKET, BY COUNTRY, 2022–2028 (USD MILLION)

- TABLE 117 SOUTH AMERICA: GLASS SUBSTRATE MARKET, BY TYPE, 2019–2021 (USD MILLION)

- TABLE 118 SOUTH AMERICA: GLASS SUBSTRATE MARKET, BY TYPE, 2022–2028 (USD MILLION)

- TABLE 119 SOUTH AMERICA: GLASS SUBSTRATE MARKET, BY END-USE INDUSTRY, 2019–2021 (USD MILLION)

- TABLE 120 SOUTH AMERICA: GLASS SUBSTRATE MARKET, BY END-USE INDUSTRY, 2022–2028 (USD MILLION)

- TABLE 121 BRAZIL: GLASS SUBSTRATE MARKET, BY TYPE, 2019–2021 (USD MILLION)

- TABLE 122 BRAZIL: GLASS SUBSTRATE MARKET, BY TYPE, 2022–2028 (USD MILLION)

- TABLE 123 BRAZIL: GLASS SUBSTRATE MARKET, BY END-USE INDUSTRY, 2019–2021 (USD MILLION)

- TABLE 124 BRAZIL: GLASS SUBSTRATE MARKET, BY END-USE INDUSTRY, 2022–2028 (USD MILLION)

- TABLE 125 ARGENTINA: GLASS SUBSTRATE MARKET, BY TYPE, 2019–2021 (USD MILLION)

- TABLE 126 ARGENTINA: GLASS SUBSTRATE MARKET, BY TYPE, 2022–2028 (USD MILLION)

- TABLE 127 ARGENTINA: GLASS SUBSTRATE MARKET, BY END-USE INDUSTRY, 2019–2021 (USD MILLION)

- TABLE 128 ARGENTINA: GLASS SUBSTRATE MARKET, BY END-USE INDUSTRY, 2022–2028 (USD MILLION)

- TABLE 129 REST OF SOUTH AMERICA: GLASS SUBSTRATE MARKET, BY TYPE, 2019–2021 (USD MILLION)

- TABLE 130 REST OF SOUTH AMERICA: GLASS SUBSTRATE MARKET, BY TYPE, 2022–2028 (USD MILLION)

- TABLE 131 REST OF SOUTH AMERICA: GLASS SUBSTRATE MARKET, B Y END-USE INDUSTRY, 2019–2021 (USD MILLION)

- TABLE 132 REST OF SOUTH AMERICA: GLASS SUBSTRATE MARKET, BY END-USE INDUSTRY, 2022–2028 (USD MILLION)

- TABLE 133 GLASS SUBSTRATE MARKET: DEGREE OF COMPETITION

- TABLE 134 GLASS SUBSTRATE MARKET: END-USE INDUSTRY FOOTPRINT (25 COMPANIES)

- TABLE 135 GLASS SUBSTRATE MARKET: REGIONAL FOOTPRINT (25 COMPANIES)

- TABLE 136 GLASS SUBSTRATE MARKET: COMPANY FOOTPRINT (25 COMPANIES)

- TABLE 137 GLASS SUBSTRATE MARKET: DETAILED LIST OF KEY START-UP/SMES

- TABLE 138 GLASS SUBSTRATE MARKET: COMPETITIVE BENCHMARKING OF KEY START-UP/SMES

- TABLE 139 PRODUCT LAUNCHES, 2019–2023

- TABLE 140 DEALS, 2019–2023

- TABLE 141 AGC INC.: COMPANY OVERVIEW

- TABLE 142 AGC INC.: DEALS

- TABLE 143 AGC INC.: PRODUCT LAUNCHES

- TABLE 144 AGC INC.: OTHERS

- TABLE 145 SCHOTT AG: COMPANY OVERVIEW

- TABLE 146 SCHOTT AG: DEALS

- TABLE 147 SCHOTT AG: PRODUCT LAUNCHES

- TABLE 148 SCHOTT AG: OTHERS

- TABLE 149 CORNING INCORPORATED: COMPANY OVERVIEW

- TABLE 150 CORNING INCORPORATED: DEALS

- TABLE 151 CORNING INCORPORATED: PRODUCT LAUNCHES

- TABLE 152 CORNING INCORPORATED: OTHERS

- TABLE 153 NIPPON SHEET GLASS CO., LTD.: COMPANY OVERVIEW

- TABLE 154 NIPPON SHEET GLASS CO., LTD.: DEALS

- TABLE 155 NIPPON SHEET GLASS CO., LTD.: PRODUCT LAUNCHES

- TABLE 156 NIPPON SHEET GLASS CO., LTD.: OTHERS

- TABLE 157 PLAN OPTIK AG: COMPANY OVERVIEW

- TABLE 158 PLAN OPTIK AG: DEALS

- TABLE 159 HOYA CORPORATION: COMPANY OVERVIEW

- TABLE 160 OHARA INC.: COMPANY OVERVIEW

- TABLE 161 IRICO GROUP NEW ENERGY COMPANY LIMITED: COMPANY OVERVIEW

- TABLE 162 TOPPAN INC.: COMPANY OVERVIEW

- TABLE 163 TUNGHSU GROUP CO. LTD.: COMPANY OVERVIEW

- TABLE 164 NIPPON ELECTRIC GLASS CO., LTD.: COMPANY OVERVIEW

- TABLE 165 NIPPON ELECTRIC GLASS CO., LTD.: DEALS

- TABLE 166 NIPPON ELECTRIC GLASS CO., LTD.: PRODUCT LAUNCHES

- TABLE 167 SPECIALTY GLASS PRODUCTS: COMPANY OVERVIEW

- TABLE 168 ABSOLICS INC.: COMPANY OVERVIEW

- TABLE 169 BIOTAIN CRYSTAL CO., LIMITED: COMPANY OVERVIEW

- TABLE 170 YATEKS: COMPANY OVERVIEW

- TABLE 171 VALLEY DESIGN CORP.: COMPANY OVERVIEW

- TABLE 172 AVANSTRATE INC.: COMPANY OVERVIEW

- TABLE 173 KYODO INTERNATIONAL, INC.: COMPANY OVERVIEW

- TABLE 174 TAIWAN GLASS IND. CORP.: COMPANY OVERVIEW

- TABLE 175 GUARDIAN INDUSTRIES: COMPANY OVERVIEW

- TABLE 176 TECNISCO, LTD.: COMPANY OVERVIEW

- TABLE 177 ARRYAIT CORPORATION: COMPANY OVERVIEW

- TABLE 178 PRÄZISIONS GLAS & OPTIK GMBH: COMPANY OVERVIEW

- TABLE 179 JIANGSU SUCHUAN TECHNOLOGY CO., LTD.: COMPANY OVERVIEW

- TABLE 180 BUWON PRECISION SCIENCES CO., LTD.: COMPANY OVERVIEW

- TABLE 181 VIRACON: COMPANY OVERVIEW

- TABLE 182 DISPLAY MARKET, BY REGION, 2019–2022 (USD BILLION)

- TABLE 183 DISPLAY MARKET, BY REGION, 2023–2028 (USD BILLION)

- FIGURE 1 GLASS SUBSTRATE MARKET SEGMENTATION

- FIGURE 2 GLASS SUBSTRATE MARKET: RESEARCH DESIGN

- FIGURE 3 MARKET SIZE ESTIMATION: SUPPLY-SIDE ANALYSIS

- FIGURE 4 GLASS SUBSTRATE MARKET: SECOND APPROACH

- FIGURE 5 DATA TRIANGULATION

- FIGURE 6 LIST OF STAKEHOLDERS INVOLVED AND BREAKDOWN OF INTERVIEWS WITH EXPERTS

- FIGURE 7 LIMITATIONS

- FIGURE 8 BOROSILICATE-BASED GLASS SUBSTRATE TO LEAD MARKET DURING FORECAST PERIOD

- FIGURE 9 ELECTRONICS TO BE LARGER END-USE SEGMENT THROUGH 2028

- FIGURE 10 ASIA PACIFIC TO BE FASTEST-GROWING REGION IN FORECAST PERIOD

- FIGURE 11 DEVELOPING COUNTRIES OFFER ATTRACTIVE OPPORTUNITIES IN GLASS SUBSTRATE MARKET

- FIGURE 12 ASIA PACIFIC: CHINA WAS LARGEST GLASS SUBSTRATE MARKET IN 2022

- FIGURE 13 BOROSILICATE-BASED GLASS SUBSTRATE SEGMENT TO LEAD MARKET DURING FORECAST PERIOD

- FIGURE 14 ELECTRONICS TO LEAD MARKET DURING FORECAST PERIOD

- FIGURE 15 INDIA GLASS SUBSTRATE MARKET TO RECORD HIGHEST CAGR FROM 2023 TO 2028

- FIGURE 16 DRIVERS, RESTRAINTS, OPPORTUNITIES, AND CHALLENGES IN GLASS SUBSTRATE MARKET

- FIGURE 17 GLOBAL SEMICONDUCTOR SALES, 2018–2022

- FIGURE 18 COUNTRY-WISE SOLAR ENERGY SHARE, 2022

- FIGURE 19 PORTER’S FIVE FORCES ANALYSIS

- FIGURE 20 GLASS SUBSTRATE: VALUE CHAIN ANALYSIS

- FIGURE 21 FLOAT GLASS AND SURFACE GROUND OR POLISHED GLASS, IN SHEETS (7005) EXPORTS, BY KEY COUNTRY, 2018–2022 (USD BILLION)

- FIGURE 22 FLOAT GLASS AND SURFACE GROUND OR POLISHED GLASS, IN SHEETS (7005) EXPORTS, BY KEY COUNTRY, 2018–2022 (USD BILLION)

- FIGURE 23 GROWING CONCERN FOR SUSTAINABILITY, TECHNOLOGICAL ADVANCEMENTS TO BRING IN CHANGE IN FUTURE REVENUE MIX

- FIGURE 24 ECOSYSTEM MAP

- FIGURE 25 INFLUENCE OF STAKEHOLDERS ON BUYING PROCESS FOR APPLICATIONS

- FIGURE 26 KEY BUYING CRITERIA FOR END-USE INDUSTRIES

- FIGURE 27 NUMBER OF PATENTS GRANTED FOR GLASS SUBSTRATES (2013–2023)

- FIGURE 28 REGIONAL ANALYSIS OF PATENT GRANTED FOR GLASS SUBSTRATES, 2013–2023

- FIGURE 29 BOROSILICATE-BASED GLASS SUBSTRATE TO DOMINATE MARKET IN 2023

- FIGURE 30 ELECTRONICS TO ACCOUNT FOR LARGEST MARKET SHARE IN 2023

- FIGURE 31 GLASS SUBSTRATE MARKET GROWTH RATE, BY COUNTRY, 2023–2028

- FIGURE 32 ASIA PACIFIC: MARKET SNAPSHOT

- FIGURE 33 EUROPE: MARKET SNAPSHOT

- FIGURE 34 GLASS SUBSTRATE MARKET: MARKET SHARE ANALYSIS

- FIGURE 35 REVENUE ANALYSIS FOR KEY COMPANIES IN GLASS SUBSTRATE MARKET IN PAST FIVE YEARS

- FIGURE 36 COMPANY EVALUATION MATRIX, 2022

- FIGURE 37 GLASS SUBSTRATE MARKET: PRODUCT FOOTPRINT (25 COMPANIES)

- FIGURE 38 START-UPS/SMES EVALUATION MATRIX: GLASS SUBSTRATE MARKET, 2022

- FIGURE 39 AGC INC.: COMPANY SNAPSHOT

- FIGURE 40 SCHOTT AG: COMPANY SNAPSHOT

- FIGURE 41 CORNING INCORPORATED: COMPANY SNAPSHOT

- FIGURE 42 NIPPON SHEET GLASS CO., LTD.: COMPANY SNAPSHOT

- FIGURE 43 PLAN OPTIK AG: COMPANY SNAPSHOT

- FIGURE 44 HOYA CORPORATION: COMPANY SNAPSHOT

- FIGURE 45 OHARA INC.: COMPANY SNAPSHOT

- FIGURE 46 IRICO GROUP NEW ENERGY COMPANY LIMITED: COMPANY SNAPSHOT

- FIGURE 47 TOPPAN INC.: COMPANY SNAPSHOT

- FIGURE 48 NIPPON ELECTRIC GLASS CO., LTD.: COMPANY SNAPSHOT

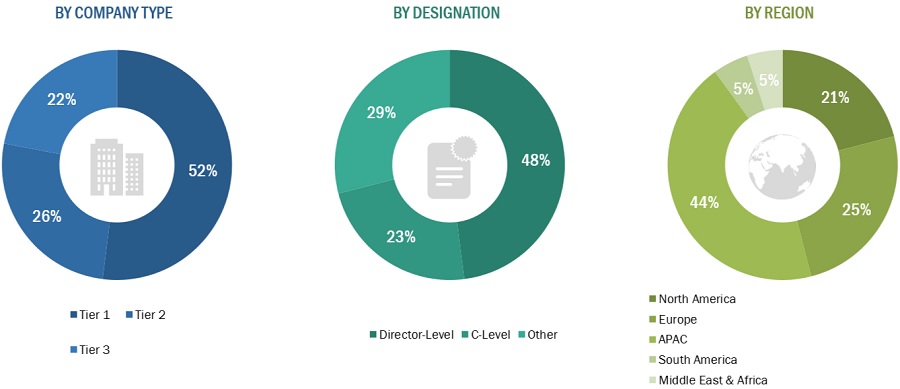

This research involved the use of extensive secondary sources and databases, such as Factiva and Bloomberg, to identify and collect information useful for a technical and market-oriented study of the Glass substrate market. Primary sources included industry experts from related industries and preferred suppliers, manufacturers, distributors, technologists, standards & certification organizations, and organizations related to all segments of the value chain of this industry. In-depth interviews have been conducted with various primary respondents, such as key industry participants, subject matter experts (SMEs), executives of key companies, and industry consultants, to obtain and verify critical qualitative and quantitative information as well as to assess growth prospects.

Secondary Research

In the secondary research process, various sources such as annual reports, press releases, and investor presentations of companies; white papers; and publications from recognized websites and databases have been referred to for identifying and collecting information. Secondary research has been used to obtain key information about the industry's supply chain, the total pool of key players, market classification and segmentation according to the industry trends to the bottom-most level, regional markets, and key developments from both market- and technology-oriented perspectives.

Primary Research

The Glass substrate market comprises several stakeholders in the supply chain, which include suppliers, processors, and end-product users. Various primary sources from the supply and demand sides of the markets have been interviewed to obtain qualitative and quantitative information. The primary participants from the demand side include key opinion leaders, executives, managers, directors, and CEOs of companies in the Glass substrate market. Primary sources from the supply side include associations and institutions involved in the Glass substrate industry, key opinion leaders, and processing players.

Following is the breakdown of primary respondents

To know about the assumptions considered for the study, download the pdf brochure

Market Size Estimation

Both top-down and bottom-up approaches were used to estimate and validate the size of the global Glass substrate market. The research methodology used to estimate the market size includes the following:

- The key players in the industry were identified through extensive secondary research.

- The supply chain of the industry and market size, in terms of value, were determined through primary and secondary research.

- All percentage shares split, and breakdowns were determined using secondary sources and verified through primary sources.

- All possible parameters that affect the markets covered in this research study were accounted for, viewed in extensive detail, verified through primary research, and analyzed to obtain the final quantitative and qualitative data.

- The research includes the study of reports, reviews, and newsletters of key industry players along with extensive interviews with key officials, such as directors and marketing executives.

Market Size Estimation: Bottom-Up Approach

To know about the assumptions considered for the study, Request for Free Sample Report

Market Size Estimation: Top-Down Approach

Data Triangulation

After arriving at the total market size from the estimation process explained above, the overall market was split into several segments and subsegments. To complete the overall market size estimation process and arrive at the exact statistics for all segments and subsegments, the data triangulation and market breakdown procedures have been employed, wherever applicable. The data have been triangulated by studying various factors and trends from both the demand and supply sides. In addition, the market size has been validated by using both the top-down and bottom-up approaches.

Market Definition

Glass substrates serve as thin, flat boards onto which a precise thin circuit is deposited. These substrates are crafted from various raw materials, including borosilicate, silicon, ceramic, fused silica/quartz, soda-lime, and aluminosilicate. They come in the form of disks and panels. Disk-shaped glass substrates, referred to as wafers, find primary applications in semiconductor manufacturing, while panel-shaped glass substrates are predominantly used in LCD manufacturing. The characteristics of glass substrates, such as shape, size, thickness, sharpness, and flexibility, are tailored to meet the specific requirements of their end-use industries, dictating their manufacturing processes accordingly.

Key Stakeholders

- Material Suppliers and Producers

- Regulatory Bodies

- End User

- Research and Development Organizations

- Industrial Associations

- Glass substrate manufacturers, dealers, traders, and suppliers.

Report Objectives

- To define, describe, and forecast the global Glass substrate market in terms of value.

- To provide insights regarding the significant factors influencing the growth of the market (drivers, restraints, opportunities, and challenges)

- To analyze and forecast the market based on type, end-use industries, and region

- To forecast the market size, in terms of value, with respect to five main regions: North America, Europe, Asia Pacific, South America, and Middle East & Africa.

- To analyze the opportunities in the market for stakeholders and provide details of the competitive landscape.

- To strategically profile key players in the market.

- To analyze competitive developments in the market, such as new product launches, capacity expansions, and mergers & acquisitions.

- To strategically profile the leading players and comprehensively analyze their key developments in the market.

Available Customizations:

Along with the given market data, MarketsandMarkets offers customizations as per the specific needs of the companies. The following customization options are available for the report:

Product Analysis:

- Product Matrix which gives a detailed comparison of the product portfolio of each company

Regional Analysis:

- Further breakdown of the Rest of the APAC Glass substrate market

- Further breakdown of the Rest of Europe’s Glass substrate market

Company Information:

- Detailed analysis and profiling of additional market players (up to 5)

Growth opportunities and latent adjacency in Glass Substrate Market