Glass Flake Coatings Market by Resin (Epoxy, Vinyl Ester, Polyester), Substrate (Steel, Concrete), End-Use Industry (Oil & Gas, Marine, Chemical & Petrochemical), and Region (APAC, Europe, North America, South America, MEA) - Global Forecast to 2022

[136 Pages Report] glass flake coatings market was valued at USD 1.38 Billion in 2016 and is projected to reach USD 1.80 Billion by 2022, at a CAGR of 4.48% during the forecast period. The forecast period considered is from 2017 to 2022, while the base year considered to estimate market size is 2016.

This report aims to estimate the size and growth of the glass flake coating market across different segments, such as resin, substrate, end-use industry, and region. It analyzes the opportunities in the market for stakeholders and presents a competitive landscape for market leaders. Factors such as drivers, restraints, opportunities, and industry-specific challenges influencing market growth have also been studied in this report.

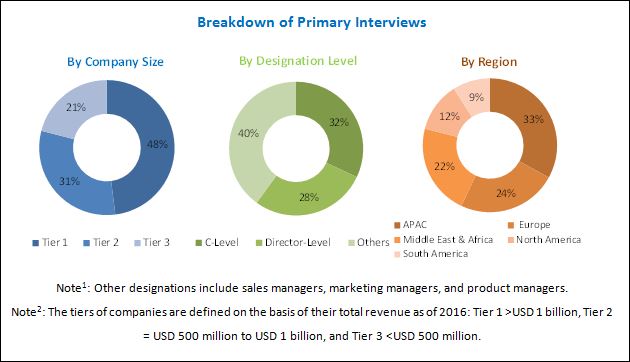

The top-down and bottom-up approaches were used to estimate and validate the size of the global glass flake coating market and other dependent submarkets. This research study involved the extensive use of secondary sources, directories, and databases, such as Hoovers, Bloomberg, Chemical Weekly, Factiva, related associations/institutes, and other government associations. Public as well as private company websites were also used to identify and collect information useful for a technical, market-oriented, and commercial study of the global glass flake coatings market. After arriving at the total market size, the overall market was split into several segments and subsegments. The figure given below provides a breakdown of the primaries conducted during the research study based on company type, designation, and region.

To know about the assumptions considered for the study, download the pdf brochure

Key manufacturers of glass flake coatings include Akzo Nobel (Netherlands), PPG Industries (US), Jotun (Norway), Hempel (Denmark), Chugoku Marine (Japan), The Sherwin-Williams Company (US), KCC Corporation (South Korea), Nippon Paint (Japan), Kansai Paint (Japan), and RPM International (US).

Key Target Audience:

- Manufacturers of glass flake coatings

- Raw material suppliers

- End-users of glass flake coatings, such as the oil & gas, marine, and chemical & petrochemical industries

- Traders, distributors, and suppliers of glass flake coatings

- Regional manufacturer associations and various general coatings associations

- Governments, investment banks, venture capitalists, and private equity firms

Scope of the report:

This research report categorizes the global glass flake coatings market based on resin, substrate, end-use industry, and region.

Glass Flake Coatings Market, Based on Resin Type:

- Epoxy

- Vinyl Ester

- Polyester

Glass Flake Coatings Market, Based on Substrate Type:

- Steel

- Concrete

Glass Flake Coatings Market, Based on End-use Industry:

- Oil & Gas

- Marine

- Chemical & Petrochemical

- Others

Glass Flake Coatings Market, Based on Region:

- Asia Pacific

- Europe

- North America

- Middle East & Africa

- South America

Available Customizations:

Along with the given market data, MarketsandMarkets offers customizations according to the companys specific needs. The following customization options are available for the report:

Glass Flake Coatings Market, Regional Analysis:

- Country-level analysis of the glass flake coatings market

Glass Flake Coatings Market, Company Information:

- Detailed analysis and profiles of additional market players

The global glass flake coatings market is estimated to be USD 1.44 Billion in 2017 and is projected to reach USD 1.80 Billion by 2022, at a CAGR of 4.48% from 2017 to 2022. The growing demand for advanced and high-performance coatings to protect tanks, pipelines, and onshore & offshore infrastructures made of steel and concrete has led to an increase in the demand for glass flake coatings from the marine industry.

Based on resin, the epoxy segment is expected to witness the highest growth during the forecast period. The growth of this segment can be attributed to the increase in the use of epoxy-based glass flake coatings in tank lining, pipe coating, and ballast tank coating. Upcoming and ongoing oil & gas projects will also use epoxy-based glass flake coatings, further driving the market.

Based on substrate, the steel segment is projected to witness the highest growth during the forecast period. The increase in the use of glass flake coatings to coat the steel used in the building of large and medium ships, offshore & onshore platforms, storage tanks, and pipelines is a major factor driving the growth of this segment. Glass flake coatings reduce the effects of the abrasive & corrosive environments steel substrates are mostly used in, thereby increasing their durability.

Based on end-use industry, the marine segment is projected to witness the highest growth during the forecast period. The increase in global trading has forced the marine industry to invest in various shipbuilding projects. These projects have increased the demand for novel coating solutions for the protection of marine vessels and structures from corrosion, fouling, abrasion, salt water, air, and UV degradation.

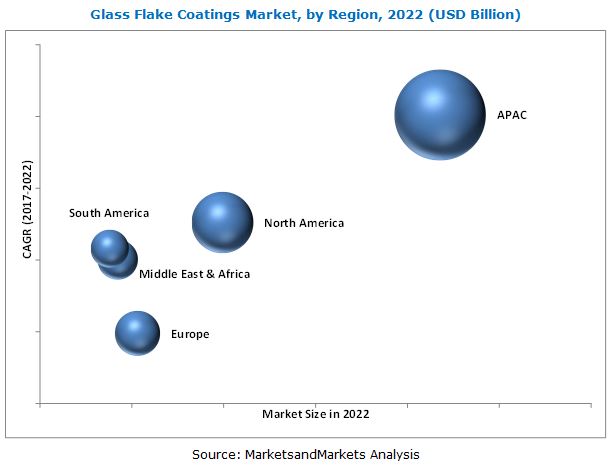

The Asia Pacific glass flake coatings market is projected to witness the highest growth from 2017 to 2022, in terms of value and volume. Manufacturers of glass flake coatings are targeting this region as the shipbuilding and chemical industries in the region are the largest. The China glass flake coating market has grown rapidly in recent years and is projected to witness high growth in the near future, due to a large number of established shipbuilding and chemical industries in the country. Countries such as India, Indonesia, and Australia are making significant developments in marine and chemical & petrochemical projects, which is anticipated to propel the growth of the glass flake coatings market in these countries.

The growth of the glass flake coatings market may be restrained by the slow growth of the industrial sector in Europe. This slow growth is due to the decline in the chemical & petrochemical and marine industries in the region.

Companies such as Akzo Nobel (Netherlands), PPG Industries (US), Jotun (Norway), Hempel (Denmark), Chugoku Marine (Japan), The Sherwin-Williams Company (US), KCC Corporation (South Korea), Nippon Paint (Japan), Kansai Paint (Japan), and RPM International (US) are key players in the global glass flake coating market. Diverse product portfolios, strategically-positioned R&D centers, adoption of varied development strategies, and technological advancements are some of the factors that have helped these companies strengthen their position in the glass flake coatings market. These players have been adopting various organic and inorganic strategies to achieve growth in the glass flake coatings market.

To speak to our analyst for a discussion on the above findings, click Speak to Analyst

Table of Contents

1 Introduction (Page No. - 16)

1.1 Objectives of the Study

1.2 Market Definition

1.3 Market Scope

1.3.1 Years Considered for the Study

1.4 Currency

1.5 Unit Considered

1.6 Limitations

1.7 Stakeholders

2 Research Methodology (Page No. - 20)

2.1 Research Data

2.1.1 Secondary Data

2.1.1.1 Key Data From Secondary Sources

2.1.2 Primary Data

2.1.2.1 Key Data From Primary Sources

2.1.2.2 Key Industry Insights

2.1.2.3 Breakdown of Primary Interviews

2.2 Market Size Estimation

2.2.1 Bottom-Up Approach

2.2.2 Top-Down Approach

2.3 Data Triangulation

2.4 Assumptions

3 Executive Summary (Page No. - 27)

4 Premium Insights (Page No. - 31)

4.1 Attractive Opportunities for Market Players

4.2 Glass Flake Coatings Market Growth, By Resin

4.3 Glass Flake Coating Market: Developed vs Emerging Countries

4.4 APAC Glass Flake Coatings Market, By End-Use Industry and Country

4.5 Glass Flake Coatings Market Size, By Substrate

4.6 Global Glass Flake Coating Market, By Region

5 Market Overview (Page No. - 34)

5.1 Introduction

5.2 Market Dynamics

5.2.1 Drivers

5.2.1.1 Demand for Advanced and Highly-Efficient Coatings

5.2.1.2 Upcoming Shipbuilding and New Pipeline Construction Projects

5.2.1.3 Increasing Need for Improving Performance and Lifespan of Equipment and Devices

5.2.2 Restraints

5.2.2.1 Fluctuation in Glass Flake Coatings Price

5.2.2.2 Slow Growth in Industrial Sectors in Europe

5.2.3 Opportunities

5.2.3.1 Expanding of Oil & Gas Exploration Industry

5.2.4 Challenges

5.2.4.1 Less Penetration of Glass Flake Coatings in the Industrial Sectors

5.3 Porters Five Forces Analysis

5.3.1 Threat of New Entrants

5.3.2 Threat of Substitutes

5.3.3 Bargaining Power of Buyers

5.3.4 Bargaining Power of Suppliers

5.3.5 Intensity of Competitive Rivalry

5.4 Macroeconomic Indicators

5.4.1 Trends and Forecast of GDP

5.4.2 Trends in Marine Industry

5.4.3 Trends of Natural Gas Production

5.4.4 Trends of Crude Oil Production

6 Glass Flake Coatings Market, By Resin (Page No. - 45)

6.1 Introduction

6.2 Epoxy

6.3 Vinyl Ester

6.4 Polyester

7 Glass Flake Coatings Market, By Substrate (Page No. - 50)

7.1 Introduction

7.2 Steel

7.3 Concrete

8 Glass Flake Coatings Market, By End-Use Industry (Page No. - 54)

8.1 Introduction

8.2 Oil & Gas

8.3 Marine

8.4 Chemical & Petrochemical

8.5 Others

9 Glass Flake Coatings Market, By Region (Page No. - 61)

9.1 Introduction

9.2 APAC

9.2.1 Glass Flake Coatings Market, By Resin

9.2.2 Glass Flake Coating Market, By Substrate

9.2.3 Glass Flake Coatings Market, By End-Use Industry

9.2.4 Glass Flake Coating Market, By Country

9.2.4.1 China

9.2.4.2 South Korea

9.2.4.3 Japan

9.2.4.4 India

9.2.4.5 Indonesia

9.2.4.6 Rest of APAC

9.3 North America

9.3.1 Glass Flake Coatings Market, By Resin

9.3.2 Glass Flake Coating Market, By Substrate

9.3.3 Glass Flake Coatings Market, By End-Use Industry

9.3.4 Glass Flake Coating Market, By Country

9.3.4.1 US

9.3.4.2 Canada

9.3.4.3 Mexico

9.4 Europe

9.4.1 Glass Flake Coatings Market, By Resin

9.4.2 Glass Flake Coating Market, By Substrate

9.4.3 Glass Flake Coatings Market, By End-Use Industry

9.4.4 Glass Flake Coating Market, By Country

9.4.4.1 Russia

9.4.4.2 Germany

9.4.4.3 Norway

9.4.4.4 Italy

9.4.4.5 France

9.4.4.6 UK

9.4.4.7 Rest of Europe

9.5 South America

9.5.1 Glass Flake Coatings Market, By Resin

9.5.2 Glass Flake Coating Market, By Substrate

9.5.3 Glass Flake Coatings Market, By End-Use Industry

9.5.4 Glass Flake Coating Market, By Country

9.5.4.1 Brazil

9.5.4.2 Venezuela

9.5.4.3 Argentina

9.5.4.4 Rest of South America

9.6 Middle East & Africa

9.6.1 Glass Flake Coatings Market, By Resin

9.6.2 Glass Flake Coating Market, By Substrate

9.6.3 Glass Flake Coatings Market, By End-Use Industry

9.6.4 Glass Flake Coating Market, By Country

9.6.4.1 Saudi Arabia

9.6.4.2 UAE

9.6.4.3 Qatar

9.6.4.4 Africa

9.6.4.5 Rest of Middle East & Africa

10 Competitive Landscape (Page No. - 97)

10.1 Overview

10.2 Market Ranking Analysis

10.3 Competitive Scenario

10.3.1 Investments & Expansions

10.3.2 New Product Developments/Launches

10.3.3 Acquisitions

11 Company Profiles (Page No. - 101)

Business Overview, Products Offered, Recent Developments, SWOT Analysis, MnM View

11.1 Akzo Nobel

11.2 PPG Industries

11.3 Jotun

11.4 Hempel

11.5 Chugoku Marine

11.6 Sherwin-Williams

11.7 Nippon Paint

11.8 Kansai Paints

11.9 RPM International

11.10 KCC Corporation

11.11 S K Kaken

11.12 Berger Paints

11.13 Shalimar Paints

11.14 BASF

11.15 Duluxgroup

11.16 Grauer & Weil

11.17 Samhwa Paints

11.18 Yung Chi Paint & Varnish

11.19 Other Key Market Players

11.19.1 National Paint Factories

11.19.2 Demech Chemicals

11.19.3 Chemiprotect Engineers

11.19.4 Corrosioneering Group

11.19.5 Specialized Coating Systems

11.19.6 Winn & Coales (Denso)

11.19.7 Clean Coats

*Details Might Not Be Captured in Case of Unlisted Companies.

12 Appendix (Page No. - 129)

12.1 Key Insights From Industry Experts

12.2 Discussion Guide

12.3 Knowledge Store: Marketsandmarkets Subscription Portal

12.4 Introducing RT: Real-Time Market Intelligence

12.5 Available Customizations

12.6 Related Reports

12.7 Author Details

List of Tables (91 Tables)

Table 1 Glass Flake Coatings Market Snapshot (2017 vs 2022)

Table 2 Major Shipbuilding Projects Till 2020

Table 3 Planned Crude Oil & Gas Pipeline Construction Beyond 2017

Table 4 Trends and Forecast of GDP, 20162022 (USD Billion)

Table 5 Ships Built, By Country, 20142016 (Gross Tonnage)

Table 6 Natural Gas Production By Country, 20142016 (Billion Cubic Metres)

Table 7 Crude Oil Production, By Country, 2014-2016 (Thousand Barrels/Day)

Table 8 Glass Flake Coating Market Size, By Resin, 20152022 (Kiloton)

Table 9 Market Size, By Resin, 20152022 (USD Million)

Table 10 Epoxy-Based Glass Flake Coating Market Size, By Region, 20152022 (Kiloton)

Table 11 Epoxy-Based Glass Flake Coating Market Size, By Region, 20152022 (USD Million)

Table 12 Vinyl Ester-Based Glass Flake Coating Market Size, By Region, 20152022 (Kiloton)

Table 13 Vinyl Ester-Based Glass Flake Coating Market Size, By Region, 20152022 (USD Million)

Table 14 Polyester-Based Glass Flake Coating Market Size, By Region, 20152022 (Kiloton)

Table 15 Polyester -Based Glass Flake Coating Market Size, By Region, 20152022 (USD Million)

Table 16 Glass Flake Coating Market Size, By Substrate, 20152022 (Kiloton)

Table 17 By Market Size, By Substrate, 20152022 (USD Million)

Table 18 Glass Flake Coating Market Size for Steel Substrate, By Region, 20152022 (Kiloton)

Table 19 By Market Size for Steel Substrate, By Region, 20152022 (USD Million)

Table 20 By Market Size for Concrete Substrate, By Region, 20152022 (Kiloton)

Table 21 By Market Size for Concrete Substrate, By Region, 20152022 (USD Million)

Table 22 Application Area Considered Under Each End-Use Industry

Table 23 Glass Flake Coating Market Size, By End-Use Industry, 20152022 (Kiloton)

Table 24 Market Size, By End-Use Industry, 20152022 (USD Million)

Table 25 Glass Flake Coating Market Size in Oil & Gas End-Use Industry, By Region, 20152022 (Kiloton)

Table 26 Market Size in Oil & Gas End-Use Industry, By Region, 20152022 (USD Million)

Table 27 Glass Flake Coating Market Size in Marine End-Use Industry, By Region, 20152022 (Kiloton)

Table 28 Market Size in Marine End-Use Industry, By Region, 20152022 (USD Million)

Table 29 Glass Flake Coating Market Size in Chemical & Petrochemical End-Use Industry, By Region, 20152022 (Kiloton)

Table 30 Market Size in Chemical & Petrochemical End-Use Industry, By Region, 20152022 (USD Million)

Table 31 Glass Flake Coating Market Size in Others End-Use Industries, By Region, 20152022 (Kiloton)

Table 32 Market Size in Others End-Use Industries, By Region, 20152022 (USD Million)

Table 33 Glass Flake Coating Market Size, By Region, 20152022 (Kiloton)

Table 34 Market Size, By Region, 20152022 (USD Million)

Table 35 APAC: Glass Flake Coatings Market Size, By Country, 20152022 (Kiloton)

Table 36 APAC: Market Size, By Country, 20152022 (USD Million)

Table 37 APAC: Market Size, By Resin, 20152022 (Kiloton)

Table 38 APAC: Market Size, By Resin, 20152022 (USD Million)

Table 39 APAC: Market Size, By Substrate, 20152022 (Kiloton)

Table 40 APAC: Market Size, By Substrate, 20152022 (USD Million)

Table 41 APAC: Market Size, By End-Use Industry, 20152022 (Kiloton)

Table 42 APAC: Market Size, By End-Use Industry, 20152022 (USD Million)

Table 43 China: Glass Flake Coating Market Size, By End-Use Industry, 20152022 (Kiloton)

Table 44 China: Market Size, By End-Use Industry, 20152022 (USD Million)

Table 45 South Korea: Glass Flake Coating Market Size, By End-Use Industry, 20152022 (Ton)

Table 46 South Korea: Market Size, By End-Use Industry, 20152022 (USD Million)

Table 47 North America: Glass Flake Coating Market Size, By Country, 20152022 (Kiloton)

Table 48 North America: Market Size, By Country, 20152022 (USD Million)

Table 49 North America: Market Size, By Resin, 20152022 (Kiloton)

Table 50 North America: Market Size, By Resin, 20152022 (USD Million)

Table 51 North America: Market Size, By Substrate, 20152022 (Kiloton)

Table 52 North America: Market Size, By Substrate, 20152022 (USD Million)

Table 53 North America: Market Size, By End-Use Industry, 20152022 (Kiloton)

Table 54 North America: Market Size, By End-Use Industry, 20152022 (USD Million)

Table 55 US: Glass Flake Coating Market Size, By End-Use Industry, 20152022 (Kiloton)

Table 56 US: Market Size, By End-Use Industry, 20152022 (USD Million)

Table 57 Canada: Glass Flake Coating Market Size, By End-Use Industry, 20152022 (Ton)

Table 58 Canada: Market Size, By End-Use Industry, 20152022 (USD Million)

Table 59 Europe Oil & Gas Projects in 2017

Table 60 Europe: Glass Flake Coatings Market Size, By Country, 20152022 (Kiloton)

Table 61 Europe: Market Size, By Country, 20152022 (USD Million)

Table 62 Europe: Market Size, By Resin, 20152022 (Kiloton)

Table 63 Europe: Market Size, By Resin, 20152022 (USD Million)

Table 64 Europe: Market Size, By Substrate, 20152022 (Kiloton)

Table 65 Europe: Market Size, By Substrate, 20152022 (USD Million)

Table 66 Europe: Market Size, By End-Use Industry, 20152022 (Kiloton)

Table 67 Europe: Market Size, By End-Use Industry, 20152022 (USD Million)

Table 68 Russia: Glass Flake Coating Market Size, By End-Use Industry, 20152022 (Ton)

Table 69 Russia: Market Size, By End-Use Industry, 20152022 (USD Million)

Table 70 South America: Glass Flake Coating Market Size, By Country, 20152022 (Kiloton)

Table 71 South America: Market Size, By Country, 20152022 (USD Million)

Table 72 South America: Market Size, By Resin, 20152022 (Kiloton)

Table 73 South America: Market Size, By Resin, 20152022 (USD Million)

Table 74 South America: Market Size, By Substrate, 20152022 (Kiloton)

Table 75 South America: Market Size, By Substrate, 20152022 (USD Million)

Table 76 South America: Market Size, By End-Use Industry, 20152022 (Ton)

Table 77 South America: Market Size, By End-Use Industry, 20152022 (USD Million)

Table 78 Brazil: Glass Flake Coating Market Size, By End-Use Industry, 20152022 (Ton)

Table 79 Brazil: Market Size, By End-Use Industry, 20152022 (USD Million)

Table 80 Middle East & Africa: Glass Flake Coatings Market Size, By Country, 20152022 (Kiloton)

Table 81 Middle East & Africa: Market Size, By Country, 20152022 (USD Million)

Table 82 Middle East & Africa: Market Size, By Resin, 20152022 (Kiloton)

Table 83 Middle East & Africa: Market Size, By Resin, 20152022 (USD Million)

Table 84 Middle East & Africa: Market Size, By Substrate, 20152022 (Kiloton)

Table 85 Middle East & Africa: Market Size, By Substrate, 20152022 (USD Million)

Table 86 Middle East & Africa: Market Size, By End-Use Industry, 20152022 (Kiloton)

Table 87 Middle East & Africa: Market Size, By End-Use Industry, 20152022 (USD Million)

Table 88 Market Ranking of Key Players (2016)

Table 89 Investments & Expansions, 20152017

Table 90 New Product Developments/Launches, 20152017

Table 91 Acquisitions, 20152017

List of Figures (44 Figures)

Figure 1 Market Segmentation

Figure 2 Glass Flake Coatings Market: Research Design

Figure 3 Market Size Estimation: Bottom-Up Approach

Figure 4 Market Size Estimation: Top-Down Approach

Figure 5 Glass Flake Coatings: Data Triangulation

Figure 6 Epoxy-Based Glass Flake Coatings to Register Highest CAGR During Forecast Period

Figure 7 Steel Substrate Segment to Register Highest CAGR During Forecast Period

Figure 8 Oil & Gas End-Use Industry to Account for Largest Share of Glass Flake Coating Market (20172022)

Figure 9 APAC Accounted for Largest Share of Glass Flake Coatings Market, 2016

Figure 10 Emerging Economies to Offer Lucrative Growth Opportunities to Key Players in the Glass Flake Coating Market Between 2017 and 2022

Figure 11 Epoxy-Based Glass Flake Coating Market Projected to Witness Highest CAGR Between 2017 and 2022

Figure 12 Glass Flake Coating Market in China Projected to Grow at Highest Rate

Figure 13 Oil & Gas Segment Accounted for Largest Share of APAC Glass Flake Coating Market in 2016

Figure 14 Steel Substrate Segment to Lead Glass Flake Coating Market During Forecast Period

Figure 15 China and US Accounted for Largest Shares of Glass Flake Coatings Market in 2016

Figure 16 Drivers, Restraints, Opportunities, and Challenges in the Glass Flake Coating Market

Figure 17 Glass Flake Coatings Market: Porters Five Forces Analysis

Figure 18 Epoxy-Based Glass Flake Coatings to Dominate the Overall Market Between 2017 and 2022

Figure 19 Steel Substrate Segment to Lead Glass Flake Coating Market Between 2017 and 2022

Figure 20 Oil & Gas End-Use Industry to Remain the Leading Consumer of Glass Flake Coatings Till 2022

Figure 21 Regional Market Snapshot: China to Witness Highest Growth in Glass Flake Coatings Market

Figure 22 APAC to Be Fastest-Growing Glass Flake Coating Market, 20172022

Figure 23 APAC Market Snapshot: China is the Largest Glass Flake Coating Market

Figure 24 North America Market Snapshot: US to Account for the Largest Market Share

Figure 25 Europe Market Snapshot: Russia to Account for Largest Market Share

Figure 26 Companies Adopted Investment & Expansion as the Key Growth Strategy Between 2015 and 2017

Figure 27 Akzo Nobel: Company Snapshot

Figure 28 PPG Industries: Company Snapshot

Figure 29 Jotun: Company Snapshot

Figure 30 Hempel: Company Snapshot

Figure 31 Chugoku Marine: Company Snapshot

Figure 32 Sherwin-Williams: Company Snapshot

Figure 33 Nippon Paints: Company Snapshot

Figure 34 Kansai Paints: Company Snapshot

Figure 35 RPM International: Company Snapshot

Figure 36 KCC Corporation: Company Snapshot

Figure 37 S K Kaken: Company Snapshot

Figure 38 Berger Paints India Limited: Company Snapshot

Figure 39 Shalimar Paints: Company Snapshot

Figure 40 BASF: Company Snapshot

Figure 41 Duluxgroup: Company Snapshot

Figure 42 Grauer & Weil: Company Snapshot

Figure 43 Samhwa Paints: Company Snapshot

Figure 44 Yung Chi Paint & Varnish: Company Snapshot

Growth opportunities and latent adjacency in Glass Flake Coatings Market