Flexible Substrates Market by Type (Plastic, Glass, Metal), Application (Consumer Electronics, Solar Energy, Medical & Healthcare, Aerospace & Defense) and Region (APAC, Europe, North America, South America) - Global Forecast to 2023

The flexible substrates market is projected to reach USD 775.8 million by 2023, at a CAGR of 14.0%. The base year that has been considered for the study on the flexible substrates market is 2017 and the forecast period considered is 2018-023.

Flexible Substrates Market Report Objectives of the Study

- To define, describe, and forecast the flexible substrates market based on type, application, and region

- To provide detailed information about key factors, such as drivers, restraints, opportunities, and challenges, influencing the growth of the flexible substrate market

- To strategically analyze micromarkets with respect to individual growth trends, growth prospects, and contribution to the overall flexible substrate market

- To analyze opportunities in the flexible substrate market for stakeholders and provide detailed information on the competitive landscape of the market

- To strategically profile key players operating in the flexible substrate market and comprehensively analyze their market shares and core competencies

Both, top-down and bottom-up approaches have been used to estimate and validate the size of the flexible substrates market and estimate the sizes of various other dependent submarkets. The research study that has been used involved extensive use of secondary sources, directories, and databases, such as Hoovers, Bloomberg, Factiva, and the Securities and Exchange Commission, to identify and collect information useful for this technical, market-oriented, and commercial study of the flexible substrate market.

To know about the assumptions considered for the study, download the pdf brochure

Key players operating in the flexible substrates market include DuPont Teijin Films (US), Teijin (Japan), Schott (Germany), Corning (US), Polyonics (US), Kolon industries (South Korea), and Heraeus (Germany), among others.

Key Target Audience in Flexible Substrates Market

- Manufacturers of Flexible Substrates

- Traders, Distributors, and Suppliers of Flexible Substrates

- Regional Associations of Manufacturers of Flexible Substrates and General Chemical Associations

- Government & Regional Agencies and Research Organizations

- Investment Research Firms

“This study answers several questions for various leading players across the value chain of flexible substrates, primarily which market segments to focus on in the next two to five years for prioritizing their efforts and investments.”

Flexible Substrates Market Report Scope

This research report categorizes the flexible substrates market based on type, application, and region.

Flexible Substrates Market, By Type:

- Plastic

- Glass

- Metal

Flexible Substrate Market, By Application:

- Consumer Electronics

- Solar Energy

- Medical & healthcare

- Aerospace & Defense

Flexible Substrate Market, By Region:

- North America

- APAC

- Europe

- South America

- Middle East & Africa

The flexible substrates market has been further analyzed based on key countries of each of these regions.

Flexible Substrates Market Report Available Customizations:

With the given market data, MarketsandMarkets offers customizations according to the specific requirements of companies. The following customization options are available for the report:

Flexible Substrates Market Regional Analysis:

- A country-level analysis of the flexible substrates market

Flexible Substrates Market Company Information:

- Detailed analysis and profiling of additional market players

The flexible substrates market is projected to grow from USD 402.9 million in 2018 to USD 775.8 million by 2023, at a CAGR of 14.0% during the forecast period from 2018 to 2023. The growth of the flexible substrate market can be attributed to the increasing demand from the electronics industry across the globe. Flexible substrates are increasingly being used in the production of flexible printed circuit boards. They are also used for the production of solar modules. Moreover, their increased use in the manufacturing of medical & healthcare devices is also driving the growth of the flexible substrate market across the globe. Increased consumption of flexible substrates in solar application is also leading to the growth of the flexible substrate market, worldwide.

Based on type, the flexible substrate market has been segmented into plastic, glass, and metal. The plastic type segment accounted for the largest share of the flexible substrate market in 2017. This segment is also projected to grow at the highest CAGR during the forecast period. The growth of the plastic type segment of the flexible substrates market can be attributed to the increased demand for low-cost, flexible substrates from the electronics industry across the globe.

Based on application, the flexible substrate market has been segmented into consumer electronics, solar energy, medical & healthcare, and aerospace & defense. The consumer electronics application segment accounted for the largest share of the flexible substrates market in 2017. This segment is also projected to grow at the highest CAGR during the forecast period. The increasing use of flexible substrate in display and other portable devices is driving the growth of the consumer electronics application segment of the flexible substrate market.

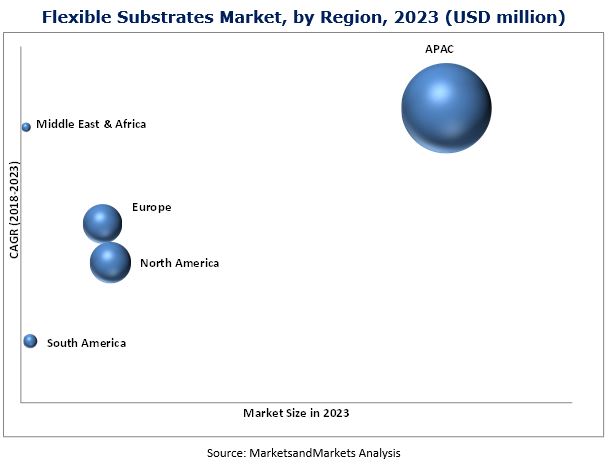

The flexible substrates market has been studied for APAC, North America, Europe, South America, and the Middle East & Africa. The APAC region is expected to lead the flexible substrate market during the forecast period. The growth of the APAC flexible substrates market can be attributed to the economic development taking place in different countries of the Asia Pacific region. Moreover, increased investments by private companies of the electronics industry in the Asia Pacific region are also creating demand for flexible substrates in the region. The flexible substrate markets in China and India are also witnessing significant growth, owing to the increased production of electronics in these countries.

Key Players in Flexible Substrates Market

Key players operating in the flexible substrates market include Nippon Electric Glass (Japan), Schott (Germany), Teijin (Japan), Kolon Industries (South Korea), American Semiconductor (US), Corning (US), and Heraeus (Germany) among others. These players have adopted various growth strategies such as new product launches, acquisitions, and expansions to strengthen their position in the flexible substrate market and widen their customer base. For instance, In December 2015, Corning invested USD 1.3 billion in a Gen 10.5 glass manufacturing facility in Hefei, China. In addition, the company entered into a long-term agreement with BOE Technology Group Co. Ltd (BOE), wherein BOE committed to buy Gen 10.5 glass substrates and Gen 8.5 glass substrates. In June 2015, the company launched Corning EAGLE XG Slim glass of 0.4mm thickness in sizes up to Gen 8.5. It provides improved performance and greater reliability for curved TV panels. It also aids in the manufacturing of thinner and lighter large-size displays.

Frequently Asked Questions (FAQ):

How big is the Flexible Substrate Market industry?

The flexible substrates market is projected to grow from USD 402.9 million in 2018 to USD 775.8 million by 2023, at a CAGR of 14.0% from 2018 to 2023.

Who leading market players in Flexible Substrate industry?

Teijin (Japan), Schott (Germany), Corning (US), Polyonics (US), Kolon industries (South Korea), and Heraeus (Germany) are the leading players operating in the flexible substrates market.

To speak to our analyst for a discussion on the above findings, click Speak to Analyst

Table of Contents

1 Introduction (Page No. - 13)

1.1 Objectives of the Study

1.2 Market Definition

1.3 Market Scope

1.3.1 Years Considered for the Study

1.3.2 Currency

1.4 Stakeholders

2 Research Methodology (Page No. - 16)

2.1 Research Data

2.1.1 Secondary Data

2.1.1.1 Key Data From Secondary Sources

2.1.2 Primary Data

2.1.2.1 Key Data From Primary Sources

2.1.2.2 Key Industry Insights

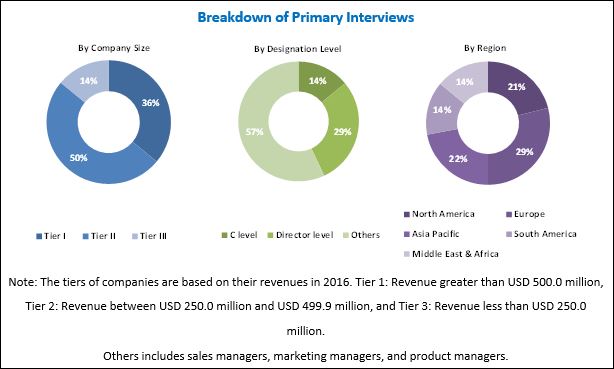

2.1.2.3 Breakdown of Primary Interviews

2.2 Market Size Estimation

2.2.1 Bottom-Up Approach

2.2.2 Top-Down Approach

2.3 Market Breakdown and Data Triangulation

2.4 Assumptions

2.5 Limitations

3 Executive Summary (Page No. - 24)

4 Premium Insights (Page No. - 28)

4.1 Flexible Substrates Market Attractiveness, 2018 vs 2023

4.2 Flexible Substrate Market, By Application

4.3 Flexible Susbtrates Market, By Region

4.4 Flexible Susbtrates Market, By Application and Country

4.5 Flexible Substrates Regional Share

5 Market Overview (Page No. - 31)

5.1 Introduction

5.2 Market Dynamics

5.2.1 Drivers

5.2.1.1 Adoption of Thin-Film Solar Modules in Various Applications

5.2.1.2 Increasing Adoption of Flexible Displays in Applications Such as Smartphones and Wearable Devices

5.2.2 Restraints

5.2.2.1 Established Market for Conventional Rigid Electronic Products

5.2.2.2 Growing Demand for Flexible Substrates in Medical & Healthcare and Environmental Monitoring Applications

5.2.3 Challenges

5.2.3.1 High Manufacturing Cost and High Prices of Certain Substrates Having Higher Temperature Resistance

5.3 Porter’s Five Forces Analysis

5.3.1 Bargaining Power of Suppliers

5.3.2 Bargaining Power of Buyers

5.3.3 Threat of New Entrants

5.3.4 Threat of Substitutes

5.3.5 Intensity of Competitive Rivalry

6 Flexible Substrates Market, By Type (Page No. - 36)

6.1 Introduction

6.2 Metal

6.3 Plastic

6.3.1 Pet

6.3.2 Polyimide

6.3.3 Others

6.4 Glass

7 Flexible Substrate Market, By Application (Page No. - 40)

7.1 Introduction

7.2 Consumer Electronics

7.3 Solar Energy

7.4 Medical & Healthcare

7.5 Aerospace & Defense

7.6 Others

8 Flexible Substrates Market, By Region (Page No. - 45)

8.1 Introduction

8.2 North America

8.2.1 US

8.2.2 Mexico

8.2.3 Canada

8.3 APAC

8.3.1 China

8.3.2 India

8.3.3 South Korea

8.3.4 Japan

8.3.5 Rest of APAC

8.4 Europe

8.4.1 Germany

8.4.2 Spain

8.4.3 Italy

8.4.4 UK

8.4.5 Rest of Europe

8.5 Middle East & Africa

8.5.1 Saudi Arabia

8.5.2 Israel

8.5.3 Rest of Middle East & Africa

8.6 South America

8.6.1 Brazil

8.6.2 Rest of South America

9 Competitive Landscape (Page No. - 77)

9.1 Overview

9.2 Market Ranking for Plastic Flexible Substrates Market

9.3 Competitive Situations & Trends

9.4 Expansions, 2015-2017

9.5 Acquisitions, 2015-2017

9.6 New Product Launches, 2015-2017

10 Company Profiles (Page No. - 81)

(Business Overview, Products Offered, Recent Developments, SWOT Analysis, MnM View)*

10.1 Dupont Teijin (Indorama)

10.2 Teijin

10.3 Kolon Industries

10.4 Polyonics

10.5 American Semiconductor

10.6 Corning

10.7 Heraeus

10.8 I-Components Co., Ltd

10.9 Nippon Electric Glass

10.10 Schott

*Details on Business Overview, Products Offered, Recent Developments, SWOT Analysis, MnM View might not be captured in case of unlisted companies.

10.11 Other Companies

10.11.1 3m

10.11.2 Coveme

10.11.3 Doosan Electronics

10.11.4 Ferrania Technologies

10.11.5 Flexcon

10.11.6 Mistubishi Chemical

10.11.7 Taimide Tech

10.11.8 Toyobo

11 Appendix (Page No. - 102)

11.1 Insights From Industry Experts

11.2 Discussion Guide

11.3 Knowledge Store: Marketsandmarkets Subscription Portal

11.4 Introducing RT: Real-Time Market Intelligence

11.5 Related Reports

11.6 Author Details

List of Tables (66 Tables)

Table 1 Flexible Substrates Market Size, By Type, 2016–2023 (USD Thousand)

Table 2 Flexible Substrate Market Size, By Application, 2016–2023 (USD Thousand)

Table 3 Flexible Substrates Market Size in Consumer Electronics Application, By Region, 2016–2023 (USD Thousand)

Table 4 Flexible Substrate Market Size in Solar Energy Application, By Region, 2016–2023 (USD Thousand)

Table 5 Flexible Substrates Market Size in Medical & Healthcare Application, By Region, 2016–2023 (USD Thousand)

Table 6 Flexible Substrate Market Size in Aerospace & Defense Application, By Region, 2016–2023 (USD Thousand)

Table 7 Flexible Substrates Market Size in Other Applications, By Region, 2016–2023 (USD Thousand)

Table 8 Flexible Substrate Market Size, By Region, 2016–2023 (USD Thousand)

Table 9 Flexible Substrates Market Size in Consumer Electronics Application, By Region, 2016–2023 (USD Thousand)

Table 10 Flexible Substrate Market Size in Solar Energy Application, By Region, 2016–2023 (USD Thousand)

Table 11 Flexible Substrates Market Size in Medical & Healthcare Application, By Region, 2016–2023 (USD Thousand)

Table 12 Flexible Substrate Market Size in Aerospace & Defense Application, By Region, 2016–2023 (USD Thousand)

Table 13 Flexible Substrates Market Size in Other Applications, By Region, 2016–2023 (USD Thousand)

Table 14 North America: Flexible Substrates Market Size, By Country, 2016–2023 (USD Thousand)

Table 15 North America: Market Size, By Application, 2016–2023 (USD Thousand)

Table 16 North America: Market Size in Consumer Electronics Application, By Country, 2016–2023 (USD Thousand)

Table 17 North America: Market Size in Solar Energy Application, By Country, 2016–2023 (USD Thousand)

Table 18 North America: Market Size in Medical & Healthcare Application, By Country, 2016–2023 (USD Thousand)

Table 19 North America: Market Size in Aerospace & Defense Application, By Country, 2016–2023 (USD Thousand)

Table 20 North America: Market Size in Other Applications, By Country, 2016–2023 (USD Thousand)

Table 21 US: Flexible Substrate Market Size, By Application, 2016–2023 (USD Thousand)

Table 22 Mexico: Flexible Substrates Market Size, By Application, 2016–2023 (USD Thousand)

Table 23 Canada: Flexible Substrate Market Size, By Application, 2016–2023 (USD Thousand)

Table 24 APAC: Flexible Substrates Market Size, By Country, 2016–2023 (USD Thousand)

Table 25 APAC: Market Size, By Application, 2016–2023 (USD Thousand)

Table 26 APAC: Market Size in Consumer Electronics Application, By Country, 2016–2023 (USD Thousand)

Table 27 APAC: Market Size in Solar Energy Application, By Country, 2016–2023 (USD Thousand)

Table 28 APAC: Market Size in Medical & Healthcare Application, By Country, 2016–2023 (USD Thousand)

Table 29 APAC: Market Size in Aerospace & Defense Application, By Country, 2016–2023 (USD Thousand)

Table 30 APAC: Market Size in Other Applications, By Country, 2016–2023 (USD Thousand)

Table 31 China: Flexible Substrates Market Size, By Application, 2016–2023 (USD Thousand)

Table 32 India: Flexible Substrate Market Size, By Application, 2016–2023 (USD Thousand)

Table 33 South Korea: Flexible Substrate Market Size, By Application, 2016–2023 (USD Thousand)

Table 34 Japan: Flexible Substrates Market Size, By Application, 2016–2023 (USD Thousand)

Table 35 Rest of APAC: Flexible Substrate Market Size, By Application, 2016–2023 (USD Thousand)

Table 36 Europe: Flexible Substrates Market Size, By Country, 2016–2023 (USD Thousand)

Table 37 Europe: Market Size, By Application, 2016–2023 (USD Thousand)

Table 38 Europe: Market Size in Consumer Electronics Application, By Country, 2016–2023 (USD Thousand)

Table 39 Europe: Market Size in Solar Energy Application, By Country, 2016–2023 (USD Thousand)

Table 40 Europe: Market Size in Medical & Healthcare Application, By Country, 2016–2023 (USD Thousand)

Table 41 Europe: Market Size in Aerospace & Defense Application, By Country, 2016–2023 (USD Thousand)

Table 42 Europe: Market Size in Other Applications, By Country, 2016–2023 (USD Thousand)

Table 43 Germany: Flexible Substrates Market Size, By Application, 2016–2023 (USD Thousand)

Table 44 Spain: Flexible Susbtrates Market Size, By Application, 2016–2023 (USD Thousand)

Table 45 Italy: Flexible Substrates Market Size, By Application, 2016–2023 (USD Thousand)

Table 46 UK: Flexible Substrate Market Size, By Application, 2016–2023 (USD Thousand)

Table 47 Rest of Europe: Flexible Substrate Market Size, By Application, 2016–2023 (USD Thousand)

Table 48 Middle East & Africa: Flexible Substrates Market Size, By Country, 2016–2023 (USD Thousand)

Table 49 Middle East & Africa: Market Size, By Application, 2016–2023 (USD Thousand)

Table 50 Middle East & Africa: Market Size in Consumer Electronics Application, By Country, 2016–2023 (USD Thousand)

Table 51 Middle East & Africa: Market in Solar Energy Application, By Country, 2016–2023 (USD Thousand)

Table 52 Middle East & Africa: Market Size in Medical & Healthcare Application, By Country, 2016–2023 (USD Thousand)

Table 53 Middle East & Africa: Market Size in Aerospace & Defense Application, By Country, 2016–2023 (USD Thousand)

Table 54 Middle East & Africa: Market Size in Other Applications, By Country, 2016–2023 (USD Thousand)

Table 55 Saudi Arabia: Flexible Substrate Market Size, By Application, 2016–2023 (USD Thousand)

Table 56 Israel: Flexible Substrates Market Size, By Application, 2016–2023 (USD Thousand)

Table 57 Rest of Middle East & Africa: Flexible Substrate Market Size, By Application, 2016–2023 (USD Thousand)

Table 58 South America: Flexible Substrates Market Size, By Country, 2016–2023 (USD Thousand)

Table 59 South America: Flexible Substrate Market Size, By Application, 2016–2023 (USD Thousand)

Table 60 South America: Market Size in Consumer Electronics Application, By Country, 2016–2023 (USD Thousand)

Table 61 South America: Market Size in Solar Energy Application, By Country, 2016–2023 (USD Thousand)

Table 62 South America: Market Size in Medical & Healthcare Application, By Country, 2016–2023 (USD Thousand)

Table 63 South America: Market Size in Aerospace & Defense Application, By Country, 2016–2023 (USD Thousand)

Table 64 South America: Market Size in Other Applications, By Country, 2016–2023 (USD Thousand)

Table 65 Brazil: Flexible Substrate Market Size, By Application, 2016–2023 (USD Thousand)

Table 66 Rest of South America: Flexible Substrate Market Size, By Application, 2016–2023 (USD Thousand)

List of Figures (28 Figures)

Figure 1 Flexible Substrates Market Segmentation

Figure 2 Flexible Substrate Market: Research Design

Figure 3 Bottom-Up Approach

Figure 4 Top-Down Approach

Figure 5 Data Triangulation

Figure 6 Plastic Substrates to Be the Largest Type

Figure 7 Consumer Electronics to Be the Largest Application of Flexible Substrates

Figure 8 APAC to Be the Fastest-Growing Flexible Substrate Market

Figure 9 APAC Dominated the Flexible Substrate Market in 2017

Figure 10 Flexible Substrates Market to Witness High Growth

Figure 11 Consumer Electronics Application to Lead the Flexible Substrates Market

Figure 12 APAC to Register the Highest CAGR

Figure 13 China Accounted for the Largest Market Share

Figure 14 APAC to Be the Largest Market

Figure 15 Factors Governing the Flexible Substrates Market

Figure 16 Flexible Substrates Market: Porter’s Five Forces Analysis

Figure 17 Plastic Substrate to Be the Leading Type

Figure 18 Consumer Electronics to Be the Leading Application of Flexible Substrates

Figure 19 India, China, and Spain to Be the Fastest-Growing Flexible Substrate Market

Figure 20 North America: Flexible Substrates Market Snapshot

Figure 21 APAC: Flexible Substrate Market Snapshot

Figure 22 Companies Adopted Product Launches, Expansions as the Key Strategies, 2015-2017

Figure 23 Teijin: Company Snapshot

Figure 24 Kolon Industries: Company Snapshot

Figure 25 Corning: Company Snapshot

Figure 26 Heraeus: Company Snapshot

Figure 27 Nippon Electric Glass: Company Snapshot

Figure 28 Schott: Company Snapshot

Growth opportunities and latent adjacency in Flexible Substrates Market