Ultra-thin Glass Market by Thickness, Manufacturing Process (Float, Fusion, Down-Draw), Application (Semiconductor Substrate, Touch Panel Display, Fingerprint Sensor), End-use Industry, and Region - Global Forecast to 2025

Updated on : March 21, 2024

Ultra-Thin Glass Market

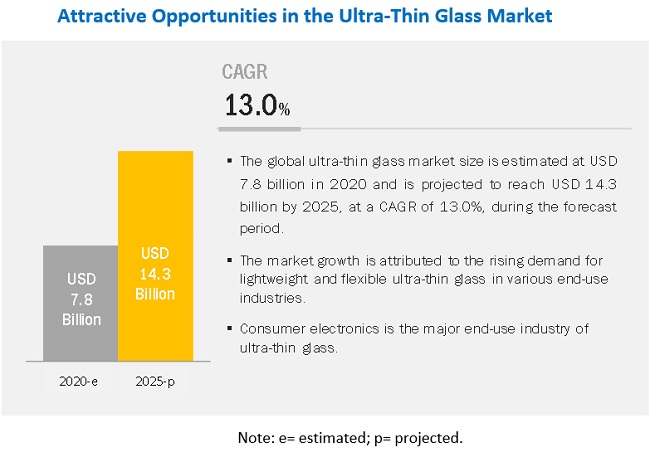

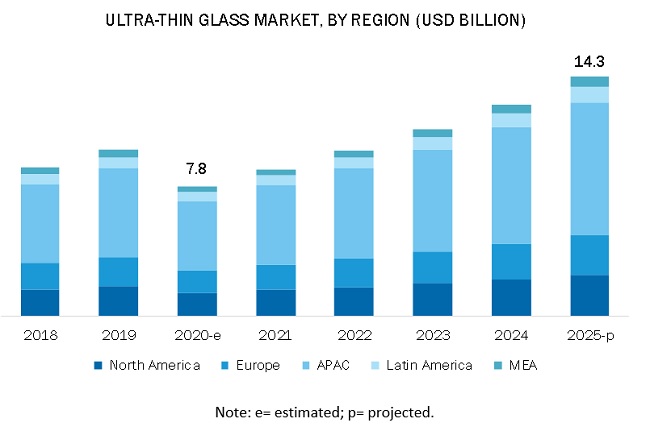

Ultra-thin glass market was valued at USD 7.8 billion in 2020 and is projected to reach USD 14.3 billion by 2025, growing at 13.0% cagr from 2020 to 2025. The global market is growing due to the rise in the demand for highly-flexible material. However, the market is expected to decline in 2020 due to the global COVID-19 pandemic.

The 0.1mm-0.5mm thick ultra-thin glass segment accounted for a significant share of the ultra-thin glass market in terms of value and volume during the forecast period.

0.1mm-0.5mm thick ultra-thin glass has its applications in touch panel display, fingerprint sensor, semiconductor substrate, vehicle infotainment system, and biotechnological devices. This ultra-thin glass is flat and has smooth surface and excellent heat resistance. It has applications in smartphones, tablets, and LCD. The demand for 0.1mm-0.5mm is high compared to other thick ultra-thin glass.

Float manufacturing process is expected to account for a major share of the ultra-thin glass market in terms of value and volume during the forecast period.

Sir Alastair Pilkington invented the float process for the British glass manufacturing company, Pilkington. Raw glass materials such as soda lime and borosilicate are used to manufacture ultra-thin glass in this process. Additives such as colorants and refining agents are also added to enhance the physical and chemical properties of the glass. In the float process, raw materials are melted in a furnace at about 15,000° C to prepare a molten mixture of glass.

The touch panel display application is expected to account for a major share of the ultra-thin glass market in terms of both value and volume during the forecast period.

Touch panel displays are extensively used in smartphones, TVs, wearable devices, and signage. Ultra-thin glass used in touch panel displays helps in weight reduction of the overall electronic product. The touch panel displays segment was the leading consumer of ultra-thin glass in 2019. This segment has grown substantially over the years owing to the increasing demand for smartphones and TVs. Digitalization has grown, and this growth is expected to drive the ultra-thin glass market in the touch panel displays application segment.

The consumer electronics end-use industry is expected to account for the largest share in the global ultra-thin glass market during the forecast period in terms of value.

The consumer electronics industry is witnessing continuous evolution owing to technological advancements (particularly in smartphones, wearable devices, and TVs). Ultra-thin glasses are widely used in consumer electronics for applications, such as displays and sensors. Properties such as electrical conductivity and sensitivity, transmissivity, and flexibility make it suitable for varied applications in this industry. Consumer electronics is the largest end-use industry of the ultra-thin glass market, and this trend is estimated to continue during the forecast period

COVID-19 pandemic impact on ultra-thin glass market

The novel coronavirus pandemic has created ripples across the global aerospace industry, affecting the global supply chains, which move materials and components rapidly across borders and fabrication facilities. This has resulted in delays or non-arrival of raw materials, disrupted financial flows, and growing absenteeism among production line workers. The loss of the consumer electronics industry has directly affected the ultra-thin glass market as it is a major end-use industry of ultra-thin glass.

APAC held the largest share in the ultra-thin glass market in 2019.

APAC accounts for the largest share in the ultra-thin glass market, owing to the growing economies of the China, Japan the presence of prominent players, and expanding consumer electronics industry. In APAC, China is projected to grow at the fastest rate during the forecast period. It is the largest market for ultra-thin glass in APAC. The economic growth of the country is the main reason for the high consumption of ultra-thin glass. The consumer electronics and other end-use industries are rapidly expanding, thereby driving the demand for ultra-thin glass in the region.

Ultra-Thin Glass Market Players

The key players in the global ultra-thin glass market are Corning (US), Asahi Glass (Japan), Nippon Electric Glass (Japan), SCHOTT AG (Germany), Nippon Sheet Glass (Japan), CSG Holding (China), Central Glass Co., Ltd. (Japan), Xinyi Glass Holdings Limited (Hong Kong), and Changzhou Almaden Co., Ltd. (China). These companies are involved in adopting various inorganic and organic strategies to increase their foothold in the ultra-thin glass market. The study includes an in-depth competitive analysis of these key players in the market, with their company profiles, recent developments, and key market strategies.

Ultra-Thin Glass Market Report Scope

|

Report Metric |

Details |

|

Years considered for the study |

2018–2025 |

|

Base year |

2019

|

|

Forecast period |

2020–2025

|

|

Units considered |

Value (USD Million), Volume (Million Square Meter)

|

|

Segments |

Thickness, Manufacturing Process, Application, End-use Industry and Region

|

|

Regions |

Europe, North America, APAC, MEA, and Latin America

|

|

Companies |

Corning (US), Asahi Glass (Japan), Nippon Electric Glass (Japan), SCHOTT AG (Germany), Nippon Sheet Glass (Japan), CSG Holding (China), Central Glass Co., Ltd. (Japan), Xinyi Glass Holdings Limited (Hong Kong), and Changzhou Almaden Co., Ltd. (China) |

This research report categorizes the ultra-thin glass market based on thickness, manufacturing process, application, end-use industry, and region.

By Thickness:

- <0.1mm

- 0.1mm-0.5mm

- 0.5mm-1.0mm

By Manufacturing Process:

- Float

- Fusion

- Down-Draw

By Application:

- Semiconductor Substrate

- Touch Panel Display

- Fingerprint Sensor

- Others

By End-use Industry:

- Consumer Electronics

- Automotive & Transportation

- Medical & Healthcare

- Others

By Region:

- North America

- Europe

- APAC

- MEA

- Latin America

Recent Developments

- In March 2018, Asahi Glass developed an ultra-thin flexible cover glass for foldable devices. The product has bending stress over 1200 MPa. These foldable glasses can be widely used for next-generation displays.

- In October 2016, SCHOTT AG developed and launched an ultra-thin, high-strength, protective glass SCHOTT AS 87 Eco for use in consumer electronics, such as smartphones and wearable devices. With this product, the company became the only manufacturer of chemically toughened ultra-thin and environment-friendly glass in the world. This development will strengthen the company’s market position in the ultra-thin glass industry.

- In January 2016, Corning formed a joint venture with Saint-Gobain Sekurit (France) to develop, manufacture, and sell lightweight automotive glazing solutions. The venture offers laminated windows for glazing solutions, which are made with Corning’s ultra-thin Gorilla glass for automotive and Sekurit’s automotive glass and window technologies.

Frequently Asked Questions (FAQ):

Which are the major end-use industries of ultra-thin glass?

Consumer Electronics

Automotive & Transportation

Medical & Healthcare

Which industry is the major consumer of ultra-thin glass?

Consumer Electronics

Which region is the largest and fastest-growing market for ultra-thin glass?

APAC

What are the major manufacturing processes of ultra-thin glass?

Float Fusion

Down-Draw

What are the major applications of ultra-thin glass?

Touch Panel Display

Fingerprint Sensor

Semiconductor Substrate

What are the major strategies adopted by leading market players?

New product launch/ new product development, collaboration, joint-venture .

To speak to our analyst for a discussion on the above findings, click Speak to Analyst

TABLE OF CONTENTS

1 INTRODUCTION (Page No. - 19)

1.1 OBJECTIVES OF THE STUDY

1.2 MARKET DEFINITION

1.2.1 ULTRA-THIN GLASS MARKET: BY THICKNESS - INCLUSION AND EXCLUSION

1.2.2 ULTRA-THIN GLASS MARKET: BY APPLICATION - INCLUSION AND EXCLUSION

1.2.3 ULTRA-THIN GLASS MARKET: BY END-USE INDUSTRY - INCLUSION AND EXCLUSION

1.2.4 ULTRA-THIN GLASS MARKET: BY MANUFACTURING PROCESS - INCLUSION AND EXCLUSION

1.3 MARKET SCOPE

1.3.1 REGIONS COVERED

1.3.2 YEARS CONSIDERED FOR THE STUDY

1.4 CURRENCY

1.5 UNIT CONSIDERED

1.6 STAKEHOLDERS

1.7 SUMMARY OF CHANGES

2 RESEARCH METHODOLOGY (Page No. - 25)

2.1 RESEARCH DATA

2.1.1 SECONDARY DATA

2.1.1.1 Key data from secondary sources

2.1.2 PRIMARY DATA

2.1.2.1 Key data from primary sources

2.2 MARKET SIZE ESTIMATION

2.2.1 TOP-DOWN APPROACH

2.3 DATA TRIANGULATION

2.4 ASSUMPTIONS & ASSOCIATED RISKS

2.5 RISKS

2.6 LIMITATIONS

3 EXECUTIVE SUMMARY (Page No. - 34)

4 PREMIUM INSIGHTS (Page No. - 39)

4.1 ATTRACTIVE OPPORTUNITIES IN THE ULTRA-THIN GLASS MARKET

4.2 ULTRA-THIN GLASS MARKET, BY END-USE INDUSTRY AND REGION

4.3 ULTRA-THIN GLASS MARKET, BY END-USE INDUSTRY

4.4 ULTRA-THIN GLASS MARKET, BY THICKNESS

4.5 ULTRA-THIN GLASS MARKET, BY APPLICATION

4.6 ULTRA-THIN GLASS MARKET, BY KEY COUNTRIES

5 MARKET OVERVIEW (Page No. - 42)

5.1 INTRODUCTION

5.2 MARKET DYNAMICS

5.2.1 DRIVERS

5.2.1.1 Increasing use of lightweight materials to enhance energy efficiency in various industries

5.2.1.2 Growing demand for consumer electronic products due to improved lifestyle

5.2.2 RESTRAINTS

5.2.2.1 Critical manufacturing processes of ultra-thin glass

5.2.2.2 Decrease in demand for ultra-thin glass due to COVID-19 pandemic

5.2.3 OPPORTUNITIES

5.2.3.1 Shorter product lifecycles of consumer electronics

5.2.3.2 Increasing usage of ultra-thin glass in solar panels

5.2.4 CHALLENGES

5.2.4.1 High breakeven cost in new application areas

5.2.4.2 Improving durability of ultra-thin glass used in foldable smart-phones

5.3 PORTER’S FIVE FORCES ANALYSIS

5.3.1 BARGAINING POWER OF BUYERS

5.3.2 BARGAINING POWER OF SUPPLIERS

5.3.3 THREAT OF NEW ENTRANTS

5.3.4 THREAT OF SUBSTITUTES

5.3.5 INTENSITY OF COMPETITIVE RIVALRY

5.4 VALUE CHAIN ANALYSIS

6 MACROECONOMIC OVERVIEW AND KEY TRENDS (Page No. - 49)

6.1 TRENDS AND FORECAST OF GDP

6.2 TRENDS IN CONSUMER ELECTRONICS INDUSTRY

7 ULTRA-THIN GLASS MARKET, BY THICKNESS (Page No. - 52)

7.1 INTRODUCTION

7.2 <0.1MM

7.2.1 CONSUMER ELECTRONICS INDUSTRY DRIVING CONSUMPTION OF <0.1MM ULTRA-THIN GLASS

7.3 0.1MM-0.5MM

7.3.1 INCREASING DEMAND FOR 0.1MM-0.5MM ULTRA-THIN GLASS DUE TO ITS FLEXIBLE PROPERTIES

7.4 0.5MM-1.0MM

7.4.1 INCREASING DEMAND FOR 0.5MM-1.0MM ULTRA-THIN GLASS WITNESSED FROM MEDICAL & BIOTECHNOLOGY INDUSTRY

8 ULTRA-THIN GLASS MARKET, BY MANUFACTURING PROCESS (Page No. - 59)

8.1 INTRODUCTION

8.2 FLOAT

8.2.1 FLOAT PROCESS ENHANCES PHYSICAL AND CHEMICAL PROPERTIES OF ULTRA-THIN GLASS

8.3 FUSION

8.3.1 FUSION INCREASINGLY USED FOR ITS COST-EFFECTIVENESS

8.4 DOWN-DRAW

8.4.1 DOWN-DRAW PROCESS PROFICIENT IN PRODUCING FLAWLESS SURFACE

9 ULTRA-THIN GLASS MARKET, BY APPLICATION (Page No. - 66)

9.1 INTRODUCTION

9.2 TOUCH PANEL DISPLAY

9.2.1 ULTRA-THIN GLASS REDUCES WEIGHT OF TOUCH-PANEL DISPLAY DEVICES

9.3 SEMICONDUCTOR SUBSTRATE

9.3.1 ULTRA-THIN GLASS USED IN SEMICONDUCTOR SUBSTRATE DUE TO ITS ELECTRO-CONDUCTIVITY AND LIGHTWEIGHT PROPERTIES

9.4 FINGERPRINT SENSOR

9.4.1 NEED FOR CUSTOMER’S DATA PRIVACY HAS INCREASED DEMAND FOR ULTRA-THIN GLASS

9.5 OTHERS

10 ULTRA-THIN GLASS MARKET, BY END-USE INDUSTRY (Page No. - 73)

10.1 INTRODUCTION

10.2 CONSUMER ELECTRONICS

10.2.1 ULTRA-THIN GLASS INCREASINGLY USED IN SMARTPHONES AND OTHER ELECTRONIC DEVICES

10.2.2 SMARTPHONES

10.2.3 TELEVISIONS

10.2.4 WEARABLE DEVICES

10.3 AUTOMOTIVE & TRANSPORTATION

10.3.1 LIGHTWEIGHT PROPERTY OF ULTRA-THIN GLASS TO DRIVE DEMAND IN AUTOMOTIVE & TRANSPORTATION

10.4 MEDICAL & HEALTHCARE

10.4.1 APAC IS LARGEST MARKET FOR ULTRA-THIN GLASS IN MEDICAL & HEALTHCARE INDUSTRY

10.5 OTHERS

11 ULTRA-THIN GLASS MARKET, BY REGION (Page No. - 81)

11.1 INTRODUCTION

11.2 NORTH AMERICA

11.2.1 NORTH AMERICA: ULTRA-THIN GLASS MARKET, BY END-USE INDUSTRY

11.2.2 NORTH AMERICA: ULTRA-THIN GLASS MARKET, BY APPLICATION

11.2.3 NORTH AMERICA: ULTRA-THIN GLASS MARKET, BY COUNTRY

11.2.3.1 US

11.2.3.1.1 Major ultra-thin glass manufacturers present in the country

11.2.3.1.2 US: Ultra-thin glass market, by end-use Industry

11.2.3.2 Canada

11.2.3.2.1 Consumer electronics is major consumer of ultra-thin glass in Canada

11.2.3.2.2 Canada: Ultra-thin glass market, by end-use Industry

11.3 EUROPE

11.3.1 EUROPE: ULTRA-THIN GLASS MARKET, BY END-USE INDUSTRY

11.3.2 EUROPE: ULTRA-THIN GLASS MARKET, BY APPLICATION

11.3.3 EUROPE: ULTRA-THIN GLASS MARKET, BY COUNTRY

11.3.3.1 Germany

11.3.3.1.1 Germany is largest ultra-thin glass market in Europe

11.3.3.1.2 Germany: Ultra-thin glass market, by end-use Industry

11.3.3.2 France

11.3.3.2.1 France is second-largest consumer of ultra-thin glass in the region

11.3.3.2.2 France: Ultra-thin glass market, by end-use Industry

11.3.3.3 UK

11.3.3.3.1 High demand for lightweight vehicles in UK

11.3.3.3.2 UK: Ultra-thin glass market, by end-use Industry

11.3.3.4 Italy

11.3.3.4.1 Italy’s consumer electronics industry to create demand for ultra-thin glass

11.3.3.4.2 Italy: Ultra-thin glass market, by end-use Industry

11.3.3.5 Spain

11.3.3.5.1 Highly focused on increasing use of ultra-thin glass in aircraft

11.3.3.5.2 Spain: Ultra-thin glass market, by end-use Industry

11.3.3.6 Rest of Europe

11.3.3.6.1 Rest of Europe: Ultra-thin glass market, by end-use Industry

11.4 APAC

11.4.1 APAC: ULTRA-THIN GLASS MARKET, BY END-USE INDUSTRY

11.4.2 APAC: ULTRA-THIN GLASS MARKET, BY APPLICATION

11.4.3 APAC: ULTRA-THIN GLASS MARKET, BY COUNTRY

11.4.3.1 China

11.4.3.1.1 China is fastest-growing market for ultra-thin glass in APAC

11.4.3.1.2 China: Ultra-thin glass market, by end-use Industry

11.4.3.2 Japan

11.4.3.2.1 Japan is second-largest market for ultra-thin glass in APAC

11.4.3.2.2 Japan: Ultra-thin glass market, by end-use Industry

11.4.3.3 South Korea

11.4.3.3.1 Promising market for ultra-thin glass in APAC

11.4.3.3.2 South Korea: Ultra-thin glass market, by end-use Industry

11.4.3.4 Taiwan

11.4.3.4.1 Taiwan is one of the advanced economies in the world

11.4.3.4.2 Taiwan: Ultra-thin glass market, by end-use Industry

11.4.3.5 Rest of APAC

11.4.3.5.1 Rest of APAC: Ultra-thin glass market, by end-use Industry

11.5 MIDDLE EAST & AFRICA (MEA)

11.5.1 MEA: ULTRA-THIN GLASS MARKET, BY END-USE INDUSTRY

11.5.2 MEA: ULTRA-THIN GLASS MARKET, BY APPLICATION

11.5.3 MEA: ULTRA-THIN GLASS MARKET, BY COUNTRY

11.5.3.1 UAE

11.5.3.1.1 The largest market for ultra-thin glass in MEA

11.5.3.1.2 UAE, Ultra-thin glass market, by end-use Industry

11.5.3.2 South Africa

11.5.3.2.1 High demand for ultra-thin glass witnessed in consumer electronics industry

11.5.3.2.2 South Africa, Ultra-thin glass market, by end-use Industry

11.5.3.3 Saudi Arabia

11.5.3.3.1 Saudi Arabia is third-largest market in MEA

11.5.3.3.2 Saudi Arabia, Ultra-thin glass market, by end-use Industry

11.5.3.4 Rest of MEA

11.5.3.4.1 Rest of MEA, Ultra-thin glass market, by end-use Industry

11.6 LATIN AMERICA

11.6.1 LATIN AMERICA: ULTRA-THIN GLASS MARKET, BY END-USE INDUSTRY

11.6.2 LATIN AMERICA: ULTRA-THIN GLASS MARKET, BY APPLICATION

11.6.3 LATIN AMERICA: ULTRA-THIN GLASS MARKET, BY COUNTRY

11.6.3.1 Brazil

11.6.3.1.1 Growing consumer electronics industry boosting the market for ultra-thin glass

11.6.3.1.2 Brazil: Ultra-thin glass market, by end-use Industry

11.6.3.2 Mexico

11.6.3.2.1 Mexico is second-largest market for ultra-thin glass in Latin America

11.6.3.2.2 Mexico: Ultra-thin glass market, by end-use Industry

11.6.3.3 Rest of Latin America

11.6.3.3.1 Rest of Latin America: Ultra-thin glass market, by end-use Industry

12 COMPETITIVE LANDSCAPE (Page No. - 118)

12.1 INTRODUCTION

12.2 COMPETITIVE LEADERSHIP MAPPING

12.2.1 VISIONARY LEADERS

12.2.2 DYNAMIC DIFFERENTIATORS

12.2.3 EMERGING COMPANIES

12.2.4 INNOVATORS

12.3 STRENGTH OF PRODUCT PORTFOLIO

12.4 BUSINESS STRATEGY EXCELLENCE

12.5 MARKET RANKING

12.6 REVENUE ANALYSIS OF TOP PLAYERS

12.7 COMPETITIVE SCENARIO

12.7.1 NEW PRODUCT LAUNCH

12.7.2 JOINT VENTURE

12.7.3 COLLABORATION

12.7.4 PARTNERSHIP

13 COMPANY PROFILES (Page No. - 126)

13.1 CORNING

13.1.1 BUSINESS OVERVIEW

13.1.2 PRODUCTS OFFERED

13.1.3 RECENT DEVELOPMENTS

13.1.4 SWOT ANALYSIS

13.1.5 WINNING IMPERATIVES

13.1.6 CURRENT FOCUS AND STRATEGIES

13.1.7 THREAT FROM COMPETITION

13.1.8 RIGHT TO WIN

13.2 ASAHI GLASS

13.2.1 BUSINESS OVERVIEW

13.2.2 PRODUCTS OFFERED

13.2.3 RECENT DEVELOPMENTS

13.2.4 SWOT ANALYSIS

13.2.5 WINNING IMPERATIVES

13.2.6 CURRENT FOCUS AND STRATEGIES

13.2.7 THREAT FROM COMPETITION

13.2.8 RIGHT TO WIN

13.3 NIPPON ELECTRIC GLASS

13.3.1 BUSINESS OVERVIEW

13.3.2 PRODUCTS OFFERED

13.3.3 RECENT DEVELOPMENTS

13.3.4 SWOT ANALYSIS

13.3.5 WINNING IMPERATIVES

13.3.6 CURRENT FOCUS AND STRATEGIES

13.3.7 THREAT FROM COMPETITION

13.3.8 RIGHT TO WIN

13.4 SCHOTT AG

13.4.1 BUSINESS OVERVIEW

13.4.2 PRODUCTS OFFERED

13.4.3 RECENT DEVELOPMENTS

13.4.4 SWOT ANALYSIS

13.4.5 WINNING IMPERATIVES

13.4.6 CURRENT FOCUS AND STRATEGIES

13.4.7 THREAT FROM COMPETITION

13.4.8 RIGHT TO WIN

13.5 NIPPON SHEET GLASS

13.5.1 BUSINESS OVERVIEW

13.5.2 PRODUCTS OFFERED

13.5.3 SWOT ANALYSIS

13.5.4 WINNING IMPERATIVES

13.5.5 CURRENT FOCUS AND STRATEGIES

13.5.6 THREAT FROM COMPETITION

13.5.7 RIGHT TO WIN

13.6 CSG HOLDING

13.6.1 BUSINESS OVERVIEW

13.6.2 PRODUCTS OFFERED

13.6.3 MNM VIEW

13.7 CENTRAL GLASS CO., LTD.

13.7.1 BUSINESS OVERVIEW

13.7.2 PRODUCTS OFFERED

13.7.3 MNM VIEW

13.8 XINYI GLASS HOLDINGS LIMITED

13.8.1 BUSINESS OVERVIEW

13.8.2 PRODUCTS OFFERED

13.8.3 MNM VIEW

13.9 CHANGZHOU ALMADEN CO., LTD.

13.9.1 BUSINESS OVERVIEW

13.9.2 PRODUCTS OFFERED

13.9.3 MNM VIEW

13.10 AIR-CRAFTGLASS

13.10.1 BUSINESS OVERVIEW

13.10.2 PRODUCTS OFFERED

13.10.3 RECENT DEVELOPMENTS

13.10.4 MNM VIEW

13.11 OTHER COMPANIES

13.11.1 EMERGE GLASS

13.11.2 AVIATIONGLASS & TECHNOLOGY

13.11.3 TAIWAN GLASS

13.11.4 CHINA NATIONAL BUILDING MATERIALS (CNBM)

13.11.5 HILGENBERG

13.11.6 NOVAL GLASS

13.11.7 RUNTAI INDUSTRY

13.11.8 HOYA (USA)

13.11.9 AVANSTRATE

13.11.10 HUIHUA GLASS

14 APPENDIX (Page No. - 155)

14.1 DISCUSSION GUIDE

14.2 KNOWLEDGE STORE: MARKETSANDMARKETS’ SUBSCRIPTION PORTAL

14.3 AVAILABLE CUSTOMIZATIONS

14.4 RELATED REPORTS

14.5 AUTHOR DETAILS

LIST OF TABLES (115 TABLES)

TABLE 1 PRIMARY INTERVIEWS

TABLE 2 ANNUAL PERCENTAGE CHANGE OF GDP, BY REGION, APRIL 2020

TABLE 3 SMARTPHONES MARKET SHARE, BY COMPANY

TABLE 4 ULTRA-THIN GLASS MARKET SIZE, BY THICKNESS, 2018–2025 (USD MILLION)

TABLE 5 ULTRA-THIN GLASS MARKET SIZE, BY THICKNESS, 2018–2025 (MILLION SQUARE METER)

TABLE 6 <0.1MM ULTRA-THIN GLASS MARKET SIZE, BY REGION, 2018–2025 (USD MILLION)

TABLE 7 <0.1MM ULTRA-THIN GLASS MARKET SIZE, BY REGION, 2018–2025 (MILLION SQUARE METER)

TABLE 8 0.1MM-0.5MM: ULTRA-THIN GLASS MARKET SIZE, BY REGION, 2018–2025 (USD MILLION)

TABLE 9 0.1MM-0.5MM: ULTRA-THIN GLASS MARKET SIZE, BY REGION, 2018–2028 (MILLION SQUARE METER)

TABLE 10 0.5MM-1.0MM: ULTRA-THIN GLASS MARKET SIZE, BY REGION, 2018–2025 (USD MILLION)

TABLE 11 0.5MM-1.0MM: ULTRA-THIN GLASS MARKET SIZE, BY REGION, 2018–2028 (MILLION SQUARE METER)

TABLE 12 ULTRA-THIN GLASS MARKET SIZE, BY MANUFACTURING PROCESS, 2018–2025 (USD MILLION)

TABLE 13 ULTRA-THIN GLASS MARKET SIZE, BY MANUFACTURING PROCESS, 2018–2025 (MILLION SQUARE METER)

TABLE 14 FLOAT PROCESS: ULTRA-THIN GLASS MARKET SIZE, BY REGION, 2018–2025 (USD MILLION)

TABLE 15 FLOAT PROCESS: ULTRA-THIN GLASS MARKET SIZE, BY REGION, 2018–2025 (MILLION SQUARE METER)

TABLE 16 FUSION: ULTRA-THIN GLASS MARKET SIZE, BY REGION, 2018–2025 (USD MILLION)

TABLE 17 FUSION: ULTRA-THIN GLASS MARKET SIZE, BY REGION, 2018–2028 (MILLION SQUARE METER)

TABLE 18 DOWN-DRAW: ULTRA-THIN GLASS MARKET SIZE, BY REGION, 2018–2025 (USD MILLION)

TABLE 19 DOWN-DRAW: ULTRA-THIN GLASS MARKET SIZE, BY REGION, 2018–2028 (MILLION SQUARE METER)

TABLE 20 ULTRA-THIN GLASS MARKET SIZE, BY APPLICATION, 2018–2025 (USD MILLION)

TABLE 21 ULTRA-THIN GLASS MARKET SIZE, BY APPLICATION, 2018–2025 (MILLION SQUARE METER)

TABLE 22 ULTRA-THIN GLASS MARKET SIZE IN TOUCH PANEL DISPLAY, BY REGION, 2018–2025 (USD MILLION)

TABLE 23 ULTRA-THIN GLASS MARKET SIZE IN TOUCH PANEL DISPLAY, BY REGION, 2018–2025 (MILLION SQUARE METER)

TABLE 24 ULTRA-THIN GLASS MARKET SIZE IN SEMICONDUCTOR SUBSTRATE, BY REGION, 2018–2025 (USD MILLION)

TABLE 25 ULTRA-THIN GLASS MARKET SIZE IN SEMICONDUCTOR SUBSTRATE, BY REGION, 2018–2028 (MILLION SQUARE METER)

TABLE 26 ULTRA-THIN GLASS MARKET SIZE IN FINGERPRINT SENSOR, BY REGION, 2018–2025 (USD MILLION)

TABLE 27 ULTRA-THIN GLASS MARKET SIZE IN FINGERPRINT SENSOR, BY REGION, 2018–2028 (MILLION SQUARE METER)

TABLE 28 ULTRA-THIN GLASS MARKET SIZE IN OTHER APPLICATIONS, BY REGION, 2018–2025 (USD MILLION)

TABLE 29 ULTRA-THIN GLASS MARKET SIZE IN OTHER APPLICATIONS, BY REGION, 2 018–2028 (MILLION SQUARE METER)

TABLE 30 ULTRA-THIN GLASS MARKET SIZE, BY END-USE INDUSTRY, 2018–2025 (USD MILLION)

TABLE 31 ULTRA-THIN GLASS MARKET SIZE, BY END-USE INDUSTRY, 2018–2025 (MILLION SQUARE METER)

TABLE 32 ULTRA-THIN GLASS MARKET SIZE IN CONSUMER ELECTRONICS, BY REGION, 2018–2025 (USD MILLION)

TABLE 33 ULTRA-THIN GLASS MARKET SIZE IN CONSUMER ELECTRONICS, BY REGION, 2018–2025 (MILLION SQUARE METER)

TABLE 34 ULTRA-THIN GLASS MARKET SIZE IN AUTOMOTIVE & TRANSPORTATION, BY REGION, 2018–2025 (USD MILLION)

TABLE 35 ULTRA-THIN GLASS MARKET SIZE IN AUTOMOTIVE & TRANSPORTATION, BY REGION, 2018–2025 (MILLION SQUARE METER)

TABLE 36 ULTRA-THIN GLASS MARKET SIZE IN MEDICAL & HEALTHCARE, BY REGION, 2018–2025 (USD MILLION)

TABLE 37 ULTRA-THIN GLASS MARKET SIZE IN MEDICAL & HEALTHCARE, BY REGION, 2018–2025 (MILLION SQUARE METER)

TABLE 38 ULTRA-THIN GLASS MARKET SIZE IN OTHER INDUSTRIES, BY REGION, 2018–2025 (USD MILLION)

TABLE 39 ULTRA-THIN GLASS MARKET SIZE IN OTHER INDUSTRIES, BY REGION, 2018–2025 (MILLION SQUARE METER)

TABLE 40 ULTRA-THIN GLASS MARKET SIZE, BY REGION, 2018–2025 (USD MILLION)

TABLE 41 ULTRA-THIN GLASS MARKET SIZE, BY REGION, 2018–2025 (MILLION SQUARE METER)

TABLE 42 NORTH AMERICA: ULTRA-THIN GLASS MARKET SIZE, BY END-USE INDUSTRY, 2018–2025 (USD MILLION)

TABLE 43 NORTH AMERICA: ULTRA-THIN GLASS MARKET SIZE, BY END-USE INDUSTRY, 2018–2025 (MILLION SQUARE METER)

TABLE 44 NORTH AMERICA: ULTRA-THIN GLASS MARKET SIZE, BY APPLICATION, 2018–2025 (USD MILLION)

TABLE 45 NORTH AMERICA: ULTRA-THIN GLASS MARKET SIZE, BY APPLICATION, 2018–2025 (MILLION SQUARE METER)

TABLE 46 NORTH AMERICA: ULTRA-THIN GLASS MARKET SIZE, BY COUNTRY, 2018–2025 (USD MILLION)

TABLE 47 NORTH AMERICA: ULTRA-THIN GLASS MARKET SIZE, BY COUNTRY, 2018–2025 (MILLION SQUARE METER)

TABLE 48 US: ULTRA-THIN GLASS MARKET SIZE, BY END-USE INDUSTRY, 2018–2025 (USD MILLION)

TABLE 49 US: ULTRA-THIN GLASS MARKET SIZE, BY END-USE INDUSTRY, 2018–2025 (MILLION SQUARE METER)

TABLE 50 CANADA: ULTRA-THIN GLASS MARKET SIZE, BY END-USE INDUSTRY, 2018–2025 (USD MILLION)

TABLE 51 CANADA: ULTRA-THIN GLASS MARKET SIZE, BY END-USE INDUSTRY, 2018–2025 (MILLION SQUARE METER)

TABLE 52 EUROPE: ULTRA-THIN GLASS MARKET SIZE, BY END-USE INDUSTRY, 2018–2025 (USD MILLION)

TABLE 53 EUROPE: ULTRA-THIN GLASS MARKET SIZE, BY END-USE INDUSTRY, 2018–2025 (MILLION SQUARE METER)

TABLE 54 EUROPE: ULTRA-THIN GLASS MARKET SIZE, BY APPLICATION, 2018–2025 (USD MILLION)

TABLE 55 EUROPE: ULTRA-THIN GLASS MARKET SIZE, BY APPLICATION, 2018–2025 (MILLION SQUARE METER)

TABLE 56 EUROPE: ULTRA-THIN GLASS MARKET SIZE, BY COUNTRY, 2018–2025 (USD MILLION)

TABLE 57 EUROPE: ULTRA-THIN GLASS MARKET SIZE, BY COUNTRY, 2018–2025 (MILLION SQUARE METER)

TABLE 58 GERMANY: ULTRA-THIN GLASS MARKET SIZE, BY END-USE INDUSTRY, 2018–2025 (USD MILLION)

TABLE 59 GERMANY: ULTRA-THIN GLASS MARKET SIZE, BY END-USE INDUSTRY, 2018–2025 (MILLION SQUARE METER)

TABLE 60 FRANCE: ULTRA-THIN GLASS MARKET SIZE, BY END-USE INDUSTRY, 2018–2025 (USD MILLION)

TABLE 61 FRANCE: ULTRA-THIN GLASS MARKET SIZE, BY END-USE INDUSTRY, 2018–2025 (MILLION SQUARE METER)

TABLE 62 UK: ULTRA-THIN GLASS MARKET SIZE, BY END-USE INDUSTRY, 2018–2025 (USD MILLION)

TABLE 63 UK: ULTRA-THIN GLASS MARKET SIZE, BY END-USE INDUSTRY, 2018–2025 (MILLION SQUARE METER)

TABLE 64 ITALY: ULTRA-THIN GLASS MARKET SIZE, BY END-USE INDUSTRY, 2018–2025 (USD MILLION)

TABLE 65 ITALY: ULTRA-THIN GLASS MARKET SIZE, BY END-USE INDUSTRY, 2018–2025 (MILLION SQUARE METER)

TABLE 66 SPAIN: ULTRA-THIN GLASS MARKET SIZE, BY END-USE INDUSTRY, 2018–2025 (USD MILLION)

TABLE 67 SPAIN: ULTRA-THIN GLASS MARKET SIZE, BY END-USE INDUSTRY, 2018–2025 (MILLION SQUARE METER)

TABLE 68 REST OF EUROPE: ULTRA-THIN GLASS MARKET SIZE, BY END-USE INDUSTRY, 2018–2025 (USD MILLION)

TABLE 69 REST OF EUROPE: ULTRA-THIN GLASS MARKET SIZE, BY END-USE INDUSTRY, 2018–2025 (MILLION SQUARE METER)

TABLE 70 APAC: ULTRA-THIN GLASS MARKET SIZE, BY END-USE INDUSTRY, 2018–2025 (USD MILLION)

TABLE 71 APAC: ULTRA-THIN GLASS MARKET SIZE, BY END-USE INDUSTRY, 2018–2025 (MILLION SQUARE METER)

TABLE 72 APAC: ULTRA-THIN GLASS MARKET SIZE, BY APPLICATION, 2018–2025 (USD MILLION)

TABLE 73 APAC: ULTRA-THIN GLASS MARKET SIZE, BY APPLICATION, 2018–2025 (MILLION SQUARE METER)

TABLE 74 APAC: ULTRA-THIN GLASS MARKET SIZE, BY COUNTRY, 2018–2025 (USD MILLION)

TABLE 75 APAC: ULTRA-THIN GLASS MARKET SIZE, BY COUNTRY, 2018–2025 (MILLION SQUARE METER)

TABLE 76 CHINA: ULTRA-THIN GLASS MARKET SIZE, BY END-USE INDUSTRY, 2018–2025 (USD MILLION)

TABLE 77 CHINA: ULTRA-THIN GLASS MARKET SIZE, BY END-USE INDUSTRY, 2018–2025 (MILLION SQUARE METER)

TABLE 78 JAPAN: ULTRA-THIN GLASS MARKET SIZE, BY END-USE INDUSTRY, 2018–2025 (USD MILLION)

TABLE 79 JAPAN: ULTRA-THIN GLASS MARKET SIZE, BY END-USE INDUSTRY, 2018–2025 (MILLION SQUARE METER)

TABLE 80 SOUTH KOREA: ULTRA-THIN GLASS MARKET SIZE, BY END-USE INDUSTRY, 2018–2025 (USD MILLION)

TABLE 81 SOUTH KOREA: ULTRA-THIN GLASS MARKET SIZE, BY END-USE INDUSTRY, 2018–2025 (MILLION SQUARE METER)

TABLE 82 TAIWAN: ULTRA-THIN GLASS MARKET SIZE, BY END-USE INDUSTRY, 2018–2025 (USD MILLION)

TABLE 83 TAIWAN: ULTRA-THIN GLASS MARKET SIZE, BY END-USE INDUSTRY, 2018–2025 (MILLION SQUARE METER)

TABLE 84 REST OF APAC: ULTRA-THIN GLASS MARKET SIZE, BY END-USE INDUSTRY, 2018–2025 (USD MILLION)

TABLE 85 REST OF APAC: ULTRA-THIN GLASS MARKET SIZE, BY END-USE INDUSTRY, 2018–2025 (MILLION SQUARE METER)

TABLE 86 MEA: ULTRA-THIN GLASS MARKET SIZE, BY END-USE INDUSTRY, 2018–2025 (USD MILLION)

TABLE 87 MEA: ULTRA-THIN GLASS MARKET SIZE, BY END-USE INDUSTRY, 2018–2025 (MILLION SQUARE METER)

TABLE 88 MEA: ULTRA-THIN GLASS MARKET SIZE, BY APPLICATION, 2018–2025 (USD MILLION)

TABLE 89 MEA: ULTRA-THIN GLASS MARKET SIZE, BY APPLICATION, 2018–2025 (MILLION SQUARE METER)

TABLE 90 MEA: ULTRA-THIN GLASS MARKET SIZE, BY COUNTRY, 2018–2025 (USD MILLION)

TABLE 91 MEA: ULTRA-THIN GLASS MARKET SIZE, BY COUNTRY, 2018–2025 (MILLION SQUARE METER)

TABLE 92 UAE: ULTRA-THIN GLASS MARKET SIZE, BY END-USE INDUSTRY, 2018–2025 (USD MILLION)

TABLE 93 UAE: ULTRA-THIN GLASS MARKET SIZE, BY END-USE INDUSTRY, 2018–2025 (MILLION SQUARE METER)

TABLE 94 SOUTH AFRICA: ULTRA-THIN GLASS MARKET SIZE, BY END-USE INDUSTRY, 2018–2025 (USD MILLION)

TABLE 95 SOUTH AFRICA: ULTRA-THIN GLASS MARKET SIZE, BY END-USE INDUSTRY, 2018–2025 (MILLION SQUARE METER)

TABLE 96 SAUDI ARABIA: ULTRA-THIN GLASS MARKET SIZE, BY END-USE INDUSTRY, 2018–2025 (USD MILLION)

TABLE 97 SAUDI ARABIA: ULTRA-THIN GLASS MARKET SIZE, BY END-USE INDUSTRY, 2018–2025 (MILLION SQUARE METER)

TABLE 98 REST OF MEA: ULTRA-THIN GLASS MARKET SIZE, BY END-USE INDUSTRY, 2018–2025 (USD MILLION)

TABLE 99 REST OF MEA: ULTRA-THIN GLASS MARKET SIZE, BY END-USE INDUSTRY, 2018–2025 (MILLION SQUARE METER)

TABLE 100 LATIN AMERICA: ULTRA-THIN GLASS MARKET SIZE, BY END-USE INDUSTRY, 2018–2025 (USD MILLION)

TABLE 101 LATIN AMERICA: ULTRA-THIN GLASS MARKET SIZE, BY END-USE INDUSTRY, 2018–2025 (MILLION SQUARE METER)

TABLE 102 LATIN AMERICA: ULTRA-THIN GLASS MARKET SIZE, BY APPLICATION, 2018–2025 (USD MILLION)

TABLE 103 LATIN AMERICA: ULTRA-THIN GLASS MARKET SIZE, BY APPLICATION, 2018–2025 (MILLION SQUARE METER)

TABLE 104 LATIN AMERICA: ULTRA-THIN GLASS MARKET SIZE, BY COUNTRY, 2018–2025 (USD MILLION)

TABLE 105 LATIN AMERICA: ULTRA-THIN GLASS MARKET SIZE, BY COUNTRY, 2018–2025 (MILLION SQUARE METER)

TABLE 106 BRAZIL: ULTRA-THIN GLASS MARKET SIZE, BY END-USE INDUSTRY, 2018–2025 (USD MILLION)

TABLE 107 BRAZIL: ULTRA-THIN GLASS MARKET SIZE, BY END-USE INDUSTRY, 2018–2025 (MILLION SQUARE METER)

TABLE 108 MEXICO: ULTRA-THIN GLASS MARKET SIZE, BY END-USE INDUSTRY, 2018–2025 (USD MILLION)

TABLE 109 MEXICO: ULTRA-THIN GLASS MARKET SIZE, BY END-USE INDUSTRY, 2018–2025 (MILLION SQUARE METER)

TABLE 110 REST OF LATIN AMERICA: ULTRA-THIN GLASS MARKET SIZE, BY END-USE INDUSTRY, 2018–2025 (USD MILLION)

TABLE 111 REST OF LATIN AMERICA: ULTRA-THIN GLASS MARKET SIZE, BY END-USE INDUSTRY, 2018–2025 (MILLION SQUARE METER)

TABLE 112 NEW PRODUCT LAUNCH, 2015–2020

TABLE 113 JOINT VENTURE, 2015-2020

TABLE 114 COLLABORATION, 2015-2020

TABLE 115 PARTNERSHIP, 2015-2020

LIST OF FIGURES (49 FIGURES)

FIGURE 1 ULTRA-THIN GLASS MARKET SEGMENTATION

FIGURE 2 ULTRA-THIN GLASS MARKET: RESEARCH DESIGN

FIGURE 3 MARKET SIZE ESTIMATION METHODOLOGY: TOP-DOWN APPROACH

FIGURE 4 METHODOLOGY FOR “SUPPLY-SIDE” SIZING OF ULTRA-THIN GLASS MARKET (1/2)

FIGURE 5 METHODOLOGY FOR “DEMAND-SIDE” SIZING OF ULTRA-THIN GLASS MARKET (2/2)

FIGURE 6 CONSUMER ELECTRONICS INDUSTRY TO DOMINATE THE ULTRA-THIN GLASS MARKET

FIGURE 7 0.1MM-0.5MM THICK ULTRA-THIN GLASS ACCOUNTED FOR LARGEST MARKET SHARE

FIGURE 8 TOUCH PANEL DISPLAY APPLICATION ACCOUNTED FOR LARGEST MARKET SHARE

FIGURE 9 FLOAT PROCESS SEGMENT ACCOUNT FOR THE LARGEST MARKET SHARE

FIGURE 10 APAC HOLDS THE LARGEST SHARE OF THE GLOBAL ULTRA-THIN GLASS MARKET

FIGURE 11 HIGH DEMAND FROM CONSUMER ELECTRONICS INDUSTRY TO DRIVE THE MARKET

FIGURE 12 APAC ACCOUNTED FOR THE LARGEST MARKET SHARE

FIGURE 13 CONSUMER ELECTRONICS TO BE THE LARGEST END-USE INDUSTRY

FIGURE 14 0.1MM-0.5MM THICKNESS IS LARGEST SEGMENT IN OVERALL MARKET

FIGURE 15 TOUCH PANEL DISPLAY ACCOUNTED FOR LARGEST MARKET SHARE

FIGURE 16 CHINA TO REGISTER THE HIGHEST CAGR

FIGURE 17 ULTRA-THIN GLASS MARKET: DRIVERS, RESTRAINTS, OPPORTUNITIES, AND CHALLENGES

FIGURE 18 PORTER’S FIVE FORCES ANALYSIS

FIGURE 19 0.1-0.5 MM THICKNESS SEGMENT TO DOMINATE THE MARKET

FIGURE 20 APAC IS LARGEST MARKET FOR 0.1MM-0.5MM THICK ULTRA-THIN GLASS

FIGURE 21 FLOAT MANUFACTURING PROCESS TO LEAD THE ULTRA-THIN GLASS MARKET

FIGURE 22 APAC TO DOMINATE THE MARKET FOR FLOAT PROCESS SEGMENT

FIGURE 23 TOUCH PANEL DISPLAY APPLICATION TO LEAD ULTRA-THIN GLASS MARKET

FIGURE 24 APAC TO BE FASTEST-GROWING MARKET FOR ULTRA-THIN GLASS IN TOUCH PANEL DISPLAY SEGMENT

FIGURE 25 CONSUMER ELECTRONICS INDUSTRY TO DOMINATE THE ULTRA-THIN GLASS MARKET

FIGURE 26 APAC TO LEAD ULTRA-THIN GLASS MARKET IN CONSUMER ELECTRONICS SEGMENT

FIGURE 27 CHINA TO BE FASTEST-GROWING MARKET FOR ULTRA-THIN GLASS

FIGURE 28 NORTH AMERICA: ULTRA-THIN GLASS MARKET SNAPSHOT

FIGURE 29 EUROPE: ULTRA-THIN GLASS MARKET SNAPSHOT

FIGURE 30 APAC: ULTRA-THIN GLASS MARKET SNAPSHOT

FIGURE 31 NEW PRODUCT LAUNCH IS THE KEY GROWTH STRATEGY ADOPTED BETWEEN 2015 AND 2020

FIGURE 32 ULTRA-THIN GLASS MARKET: COMPETITIVE LEADERSHIP MAPPING, 2019

FIGURE 33 PRODUCT PORTFOLIO ANALYSIS OF TOP PLAYERS IN ULTRA-THIN GLASS MARKET

FIGURE 34 BUSINESS STRATEGY EXCELLENCE OF TOP PLAYERS IN ULTRA-THIN GLASS MARKET

FIGURE 35 MARKET RANKING OF KEY PLAYERS, 2019

FIGURE 36 REVENUE SHARE ANALYSIS OF MARKET PLAYERS, 2019

FIGURE 37 CORNING: COMPANY SNAPSHOT

FIGURE 38 CORNING: SWOT ANALYSIS

FIGURE 39 ASAHI GLASS: COMPANY SNAPSHOT

FIGURE 40 ASAHI GLASS: SWOT ANALYSIS

FIGURE 41 NIPPON ELECTRIC GLASS: COMPANY SNAPSHOT

FIGURE 42 NIPPON ELECTRIC GLASS: SWOT ANALYSIS

FIGURE 43 SCHOTT AG: COMPANY SNAPSHOT

FIGURE 44 SCHOTT AG: SWOT ANALYSIS

FIGURE 45 NIPPON SHEET GLASS: COMPANY SNAPSHOT

FIGURE 46 NIPPON SHEET GLASS: SWOT ANALYSIS

FIGURE 47 CSG HOLDING: COMPANY SNAPSHOT

FIGURE 48 CENTRAL GLASS CO., LTD.: COMPANY SNAPSHOT

FIGURE 49 XINYI GLASS HOLDINGS LIMITED: COMPANY SNAPSHOT

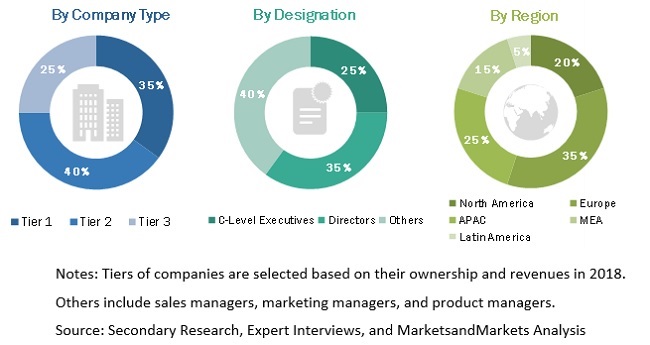

The study involved two major activities in estimating the current size of the ultra-thin glass market. Exhaustive secondary research was performed to collect information on the market, the peer market, and the parent market. The next step was to validate these findings, assumptions, and sizing with industry experts across the value chain through primary research. Both top-down and bottom-up approaches were employed to estimate the total market size. After that, market breakdown and data triangulation procedures were used to determine the extent of market segments and sub-segments.

Secondary Research

In the secondary research process, various secondary sources, such as Hoovers, Bloomberg BusinessWeek, and Factiva, were referred to for identifying and collecting information for this study. These secondary sources included annual reports, press releases and investor presentations of companies, white papers, certified publications, articles by recognized authors, gold standard & silver standard websites, regulatory bodies, trade directories, and databases.

Primary Research

The ultra-thin glass market comprises several stakeholders, such as raw material suppliers, processors, end-product manufacturers, and regulatory organizations in the supply chain. The demand side of this market is primarily characterized by the development of the consumer electronics, automotive & transportation, medical & healthcare, and other end-use industries. Advancements in technology and diverse applications in various end-use industries describe the supply side. Various primary sources from both the supply and demand sides of the market were interviewed to obtain qualitative and quantitative information.

To know about the assumptions considered for the study, download the pdf brochure

Market Size Estimation

Both the top-down and bottom-up approaches were used to estimate and validate the total size of the ultra-thin glass market. These methods were also used extensively to determine the size of various sub-segments in the market. The research methodology used to estimate the market size included the following:

- The key players in the industry and markets were identified through extensive secondary research.

- The industry’s supply chain and market size, in terms of value, were determined through primary and secondary research processes.

- All percentage shares, splits, and breakdowns were determined using secondary sources and verified through primary sources.

Data Triangulation

After arriving at the overall ultra-thin glass market size, using the market size estimation processes explained above, the market was split into several segments and sub-segments. To complete the whole market engineering process and arrive at the exact statistics of each market segment and sub-segment, the data triangulation, and market breakdown procedures were employed, wherever applicable. The data was triangulated by studying various factors and trends from both the demand and supply sides, mainly from the automotive & transportation, consumer electronics, medical & healthcare, and other end-use industries.

Report Objectives

- To define, describe, and forecast the size of the ultra-thin glass market, in terms of value and volume

- To provide detailed information about the key factors (drivers, restraints, opportunities, and challenges) influencing the growth of the market

- To analyze and forecast the market based on thickness, application, manufacturing process, and end-use industry

- To analyze and project the market based on five regions, namely, Europe, North America, Asia Pacific (APAC), the Middle East & Africa (MEA), and Latin America

- To strategically analyze the micromarkets concerning individual growth trends, prospects, and their contribution to the overall market

- To analyze the opportunities in the market for stakeholders and provide a competitive landscape for market leaders

- To strategically profile the key players and comprehensively analyze their market shares and core competencies

Available Customizations

MarketsandMarkets offers customizations according to the specific needs of the companies with the given market data.

The following customization options are available for the report:

Product Analysis

- Product matrix, which gives a detailed comparison of the product portfolio of each company

Regional Analysis

- Further breakdown of Rest of APAC ultra-thin glass market

- Further breakdown of Rest of European ultra-thin glass market

- Further breakdown of Rest of MEA ultra-thin glass market

- Further breakdown of Rest of Latin American ultra-thin glass market

Company Information

- Detailed analysis and profiling of additional market players (up to 10)

Growth opportunities and latent adjacency in Ultra-thin Glass Market