Food Vacuum Machine Market by Machinery Type (External Vacuum Sealers, Chamber Vacuum Machines, Tray Sealing Machines, Other Machinery Types), End-use Sector (Industrial, Commercial, Domestic), Process, Application, Packaging Type, and Region - Global Forecast to 2025

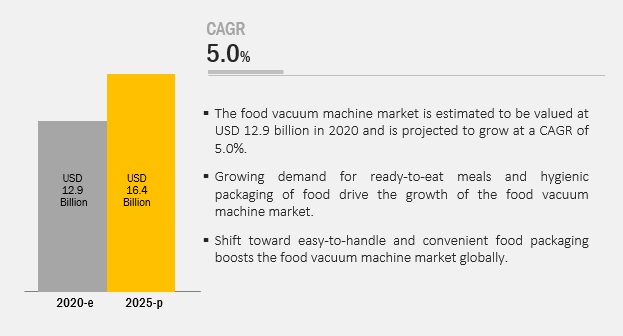

[180 Pages Report] The global food vacuum machine market size is projected to grow from USD 12.9 billion in 2020 to USD 16.4 billion by 2025, recording a compound annual growth rate (CAGR) of 5.0% during the forecast period. The increasing demand for shelf-stable products and ready-to-eat foods and the shift toward easy-to-handle and convenient packaging across regions are some of the major factors that are projected to contribute to the growth of the market during the forecast period. Furthermore, the increasing focus on hygienic packaging solutions with the advent of COVID-19 is projected to encourage the use of food vacuum machines, which contributes to market growth.

The chamber vacuum machines segment is estimated to account for the largest share in 2020 in the market.

Chamber vacuum machines are suitable for a variety of industrial applications as they are more capable for vacuum packaging of food items. Furthermore, their suitability for both solid and liquid food items is projected to drive their demand during the forecast period.

By packaging type, the flexible segment is projected to account for the largest share during the forecast period.

Food vacuum machines designed for flexible packaging use minimal natural resources for creating vacuum packs for a range of food items. Also, they are lightweight and more convenient for distributors and consumers. Thus, the sustainability of flexible packaging is projected to drive its growth in the food vacuum machine market.

Based on end-use sector, the industrial segment is projected to hold the largest market share during the forecast period.

Based on end-use sector, the industrial segment is projected to hold the largest market share due to the growing use of vacuum technology in the food industry to preserve food by increasing its shelf-life. Also, production in large batches will necessitate the use of vacuum sealers in the food industry, thereby contributing to the overall market growth. The growing use of vacuum technology in the meat and frozen food sectors will also drive the growth of the market.

Based on process, the skin segment is projected to hold the largest market share during the forecast period.

The growing demand for skin vacuum packaging for premium food options and its greater acceptance because of the introduction of new films that can accommodate different shapes of food is projected to drive the overall growth of the market.

Based on application, the meat & seafood segment is projected to hold the largest market share during the forecast period.

The demand for food vacuum machines for application in the meat industry is projected to witness significant growth in the coming years. This is attributed to the growing consumption of meat, resulting in the increasing demand among consumers to preserve it through vacuum sealing.

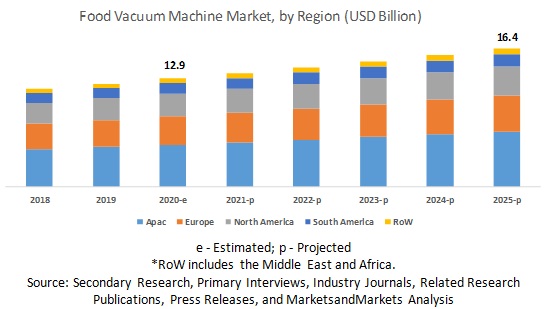

Asia Pacific is projected to account for the largest share in the food vacuum machine market during the forecast period.

The Asia Pacific market accounted for the largest share in 2020, followed by Europe. The growth of the market in this region is majorly driven by the rising disposable income of consumers, which has resulted in an increased expenditure in packaged and ready-to-eat food. Emerging local brands in the region are also fueling the demand for food vacuum machines. The rising awareness among consumers due to the advent of COVID-19 has led to an increasing focus on hygienic packaging solutions. In addition, hectic and busier lifestyles have encouraged consumers to opt for ready-to-eat meals that require vacuum sealing to protect the contents of the package. These factors will encourage the use of food vacuum machines, thereby supporting the overall market growth.

Key Market Players

Key players in the global market include Ulma Packaging (Spain), Proseal (UK), Multivac (Germany), Electrolux Professional (Sweden), Henkelman (Netherlands), Henkovac International (Netherlands), Promarks (US), and Sammic SL (Spain). These players have broad industry coverage and high operational and financial strength.

Scope of the Report

|

Report Metric |

Details |

|

Market size available for years |

2018–2025 |

|

Base year considered |

2019 |

|

Forecast period |

2020–2025 |

|

Forecast units |

Value (USD Million) |

|

Segments covered |

Machinery Type, Packaging Type, Process, Application, End-use Sector, and Region |

|

Geographies covered |

North America, Europe, Asia Pacific, South America, and RoW |

|

Companies covered (25 companies) |

Ulma Packaging (Spain), Proseal (UK), Multivac (Germany), Electrolux Professional (Sweden), Henkelman (Netherlands), Henkovac International (Netherlands), Audion Elektro B.V. (Netherlands), Webomatic (Germany), Promarks (US), Sammic SL (Spain), Technopack Corporation (US), Ridat (UK), Dadaux (France), Techno Pack (Italy), Metos (Finland), Bizerba (Germany), Sipromac (Canada), Astrapac (UK) |

This research report categorizes the food vacuum machine market based on machinery type, packaging type, process, application, end-use sector, and region.

Based on machinery type, market has been segmented as follows:

- External vacuum sealers

- Chamber vacuum machines

- Single

- Double

- Tray sealing machines

- Other machinery types (automatic belt packaging and thermoformers)

Based on packaging type, the market has been segmented as follows:

- Flexible

- Rigid

- Semi-rigid

Based on process, the market has been segmented as follows:

- Skin

- Shrink

- Traditional methods

Based on end-use sector, the market has been segmented as follows:

- Industrial

- Commercial

- Restaurants

- Small-scale companies

- Large-scale companies

- Domestic

Based on application, the market has been segmented as follows:

- Bakery & confectionery products

- Beverages

- Meat and seafood

- Snacks & savories

- Convenience food

- Dairy & frozen desserts

- Sauces, dressings, spices, and condiments

- Fruits & vegetables

- Prepared food

- Other applications (nuts, seeds, cereals)

Based on region, the market has been segmented as follows:

- North America

- Europe

- Asia Pacific

- South America

- RoW (the Middle East and Africa)

Recent Developments:

- In November 2019, Ulma Packaging (Spain) invested nearly 5 million euros to complete its expansion of a tray sealing plant in Onati, Spain, after its recent expansion. This new plant will help the company to increase its production capacity.

- In September 2019, Multivac (Germany) launched new tray sealing and chamber belt machines for automated vacuum packaging of food products in film pouches. This will help the company to boost its product portfolio.

- In January 2019, Proseal (UK) launched a new seal testing system to enable fruit growers and processors to identify the ideal seal strength for packaging applications for fruits & vegetables.

- In January 2018, Henkelman (Netherlands) launched a new tabletop model for vacuum packaging called Neo. The machine is incorporated with a touch panel. It can be operated using the VacAssist mobile app. It is specially designed for professional kitchens; this innovative technology will help the company cater to the food service industry.

Key questions addressed by the report:

- Who are the major market players in the food vacuum machine market?

- What are the regional growth trends and the largest revenue-generating regions for the food vacuum machine market?

- What are the major applications of food vacuum machines that are projected to account for a major revenue share during the forecast period?

- What are the major end-use sectors that witness increased usage of food vacuum machine, and which segment is projected to dominate during the forecast period?

- What are the major types of food vacuum machines in the industry, and which machinery type is projected to account for the largest share during the forecast period?

To speak to our analyst for a discussion on the above findings, click Speak to Analyst

TABLE OF CONTENTS

1 INTRODUCTION (Page No. - 21)

1.1 OBJECTIVES OF THE STUDY

1.2 MARKET DEFINITION

1.3 STUDY SCOPE

1.4 PERIODIZATION CONSIDERED

1.5 CURRENCY CONSIDERED

1.6 STAKEHOLDERS

2 RESEARCH METHODOLOGY (Page No. - 25)

2.1 RESEARCH DATA

2.1.1 SECONDARY DATA

2.1.1.1 Key data from secondary sources

2.1.2 PRIMARY DATA

2.1.2.1 Key data from primary sources

2.1.2.2 Breakdown of primaries

2.2 MARKET SIZE ESTIMATION

2.2.1 FOOD VACUUM MACHINE MARKET SIZE ESTIMATION - METHOD 1

2.2.2 MARKET SIZE ESTIMATION - METHOD 2

2.2.3 FOOD VACUUM MACHINE MARKET SIZE ESTIMATION NOTES

2.3 DATA TRIANGULATION

2.4 ASSUMPTIONS FOR THE STUDY

2.5 LIMITATIONS OF THE STUDY

3 EXECUTIVE SUMMARY (Page No. - 34)

4 PREMIUM INSIGHTS (Page No. - 40)

4.1 OVERVIEW OF THE MARKET

4.2 MARKET, BY MACHINERY TYPE, 2020

4.3 MARKET, BY APPLICATION, 2020

4.4 FOOD VACUUM MACHINE, BY END-USE SECTOR AND REGION, 2020

4.5 MARKET, BY KEY COUNTRY, 2020

5 MARKET OVERVIEW (Page No. - 44)

5.1 INTRODUCTION

5.2 MARKET DYNAMICS

5.2.1 DRIVERS

5.2.1.1 Growing demand for shelf-stable products

5.2.1.2 Rise in the usage of RTE (ready-to-eat) food

5.2.1.3 Growing awareness to minimize food wastage and need to preserve food

5.2.2 RESTRAINTS

5.2.2.1 Depreciating packaging capability of food vacuum machines

5.2.2.2 High installation and maintenance cost of machines

5.2.3 OPPORTUNITIES

5.2.3.1 New technologies being used in the food production and packaging industries

5.2.3.2 Introducing the market to exotic food packaging

5.2.3.3 Increasing focus on hygienic packaging solutions

5.2.4 CHALLENGES

5.2.4.1 Vacuum packaging is not easily recyclable due to lack of compostable materials

5.3 FOOD VACUUM PACKAGING FLOWCHART

5.4 PATENT ANALYSIS

5.5 REGULATIONS

5.6 MARKET ECOSYSTEM

5.7 YC AND YCC SHIFT

6 FOOD VACUUM MACHINE MARKET, BY MACHINERY TYPE (Page No. - 53)

6.1 INTRODUCTION

6.2 EXTERNAL VACUUM SEALERS

6.2.1 COMMERCIAL USES OF EXTERNAL VACUUM SEALERS TO STIMULATE THE MARKET GROWTH

6.3 CHAMBER VACUUM MACHINES

6.3.1 SUITABILITY OF CHAMBER VACUUM MACHINES FOR BOTH SOLID AND LIQUID FOOD ITEMS TO DRIVE THE MARKET GROWTH

6.3.2 SINGLE CHAMBER VACUUM MACHINES

6.3.2.1 Single chamber machines are effective for small-scale production

6.3.3 DOUBLE CHAMBER VACUUM MACHINES

6.3.3.1 Industrial applications of double chamber vacuum machines to drive the market

6.4 TRAY SEALING MACHINES

6.4.1 EFFECTIVENESS OF TRAY SEALING MACHINES IN THE MEAT INDUSTRY TO DRIVE THE MARKET

6.5 OTHER MACHINERY TYPES

6.5.1 USE OF THERMOFORMERS FOR A WIDE VARIETY OF PERISHABLE PRODUCTS TO SUPPORT THE MARKET GROWTH

6.6 COVID-19 IMPACT ANALYSIS

6.6.1 OPTIMISTIC SCENARIO

6.6.2 PESSIMISTIC SCENARIO

7 FOOD VACUUM MACHINE MARKET, BY PACKAGING TYPE (Page No. - 61)

7.1 INTRODUCTION

7.2 FLEXIBLE

7.2.1 SUSTAINABILITY OF FLEXIBLE PACKAGING TO DRIVE THE MARKET GROWTH

7.3 RIGID

7.3.1 RIGID PACKAGES PROVIDE EXCELLENT PROTECTION FROM DAMAGE AND SPILLING OF FOOD

7.4 SEMI-RIGID

7.4.1 CONVENIENCE OFFERED BY SEMI-RIGID PACKAGES TO CONTRIBUTE TO THE MARKET GROWTH

7.5 COVID-19 IMPACT ANALYSIS

7.5.1 OPTIMISTIC SCENARIO

7.5.2 PESSIMISTIC SCENARIO

8 FOOD VACUUM MACHINE MARKET, BY PROCESS (Page No. - 67)

8.1 INTRODUCTION

8.2 SKIN

8.2.1 ACCOMMODATION OF DIFFERENT SHAPES OF FOOD BY SKIN VACUUM PACKS TO DRIVE THE MARKET

8.3 SHRINK

8.3.1 SHRINK VACUUM PACKAGES ARE HIGHLY ECONOMICAL AND ECO-FRIENDLY

8.4 TRADITIONAL METHODS

8.4.1 INTRODUCTION OF NEW PROCESSES WITH ADVANCEMENTS IN TECHNOLOGY TO HINDER THE MARKET GROWTH OF TRADITIONAL VACUUM PACKAGING

8.5 COVID-19 IMPACT ANALYSIS

8.5.1 OPTIMISTIC SCENARIO

8.5.2 PESSIMISTIC SCENARIO

9 FOOD VACUUM MACHINE MARKET, BY APPLICATION (Page No. - 73)

9.1 INTRODUCTION

9.2 BAKERY & CONFECTIONERY PRODUCTS

9.2.1 INCREASING DEMAND FOR A LONGER SHELF-LIFE OF BAKERY PRODUCTS WILL DRIVE THE GROWTH

9.3 BEVERAGES

9.3.1 EASE OF CARRYING PRODUCTS THAT CAN BE CONSUMED AFTER AN EXTENDED PERIOD WILL DRIVE THE GROWTH OF FOOD VACUUM MACHINES

9.4 MEAT & SEAFOOD

9.4.1 HIGHER DEMAND FOR MEAT PRODUCTS THAT CAN BE STORED FOR A LONGER PERIOD WILL BOOST THE DEMAND FOR FOOD VACUUM MACHINES

9.5 SNACKS & SAVORIES

9.5.1 CHANGE IN LIFESTYLES ALONG WITH THE GROWING TREND OF SNACKING WILL BOOST THE APPLICATION OF FOOD VACUUM MACHINES

9.6 CONVENIENCE FOOD

9.6.1 ON-THE-GO AND PROCESSED FOOD CONSUMPTION TREND WILL BOOST THE APPLICATION OF FOOD VACUUM MACHINES FOR CONVENIENCE FOOD

9.7 DAIRY & FROZEN DESSERTS

9.7.1 HIGHER CONSUMPTION OF DAIRY-BASED PRODUCTS WILL BOOST THE MARKET FOR FOOD VACUUM MACHINES

9.8 SAUCES, DRESSINGS, SPICES, AND CONDIMENTS

9.8.1 GROWING AWARENESS ABOUT DIFFERENT CUISINES AND VARIED TASTE WILL BOOST THE DEMAND FOR FOOD VACUUM MACHINES FOR SAUCES, DRESSINGS, SPICES, AND CONDIMENTS

9.9 FRUITS & VEGETABLES

9.9.1 GROWING AWARENESS REGARDING THE CONSUMPTION OF FRESH FRUITS & VEGETABLES WILL BOOST THE GROWTH OF FOOD VACUUM MACHINES

9.10 PREPARED FOOD

9.10.1 GROWING DEMAND FOR RTE (READY-TO-EAT) MEALS WILL BOOST THE GROWTH OF FOOD VACUUM MACHINES

9.11 OTHER APPLICATIONS

9.11.1 HEALTHY EATING TRENDS WILL BOOST THE APPLICATION OF FOOD VACUUM MACHINES

9.12 COVID-19 IMPACT ANALYSIS

9.12.1 OPTIMISTIC SCENARIO

9.12.2 PESSIMISTIC SCENARIO

10 FOOD VACUUM MACHINES MARKET, BY END-USE SECTOR (Page No. - 85)

10.1 INTRODUCTION

10.2 INDUSTRIAL

10.2.1 GROWING FOOD RETAIL SECTOR WILL BOOST THE USAGE OF FOOD VACUUM MACHINES

10.3 COMMERCIAL

10.3.1 COMMERCIAL VIABILITY AND HIGH DEMAND FOR PRESERVING FOOD PRODUCTS WILL DRIVE THE APPLICATION OF FOOD VACUUM MACHINES

10.3.2 RESTAURANTS

10.3.2.1 Necessity to store huge quantities of perishable food products to positively impact the market growth

10.3.3 SMALL-SCALE COMPANIES

10.3.3.1 High operational cost of food vacuum machines to limit the market growth

10.3.4 LARGE-SCALE COMPANIES

10.3.4.1 Double chamber machines are expected to gain traction among large-scale producers

10.4 DOMESTIC

10.4.1 APPLICATION OF FOOD VACUUM MACHINES IN FRUITS & VEGETABLES TO DRIVE THE MARKET GROWTH

10.5 COVID-19 IMPACT ANALYSIS

10.5.1 OPTIMISTIC SCENARIO

10.5.2 PESSIMISTIC SCENARIO

11 FOOD VACUUM MACHINE MARKET, BY REGION (Page No. - 92)

11.1 INTRODUCTION

11.2 COVID-19 IMPACT ANALYSIS

11.3 NORTH AMERICA

11.3.1 TECHNOLOGICAL ADVANCEMENTS IN THE FOOD & BEVERAGE SECTOR WILL BOOST THE MARKET GROWTH

11.3.2 US

11.3.2.1 Growth of the food packaging sector, especially across the fresh food segment, to boost the demand for food vacuum machines

11.3.3 CANADA

11.3.3.1 Health concerns and growing awareness among people regarding the availability of food and its packaging will boost the market for food vacuum machines

11.3.4 MEXICO

11.3.4.1 Growth of manufacturing and equipment industries will boost the market growth

11.4 EUROPE

11.4.1 GROWTH OF THE FOOD & BEVERAGE SECTOR AND RELATED MANUFACTURING WILL BOOST THE GROWTH OF THE MARKET

11.4.2 GERMANY

11.4.2.1 Presence of major players and strong manufacturing industry lead Germany to become one of the major hubs for food vacuum machines in Europe

11.4.3 FRANCE

11.4.3.1 Strong presence of the food service industry to help boost the demand for food vacuum machines in France

11.4.4 UK

11.4.4.1 Growing awareness about hygiene and innovations across the equipment and machinery industry to drive the market growth

11.4.5 ITALY

11.4.5.1 Increasing demand from various food applications to drive the growth of food vacuum machines

11.4.6 SPAIN

11.4.6.1 Increasing applications across the meat & seafood sector to drive the growth of food vacuum machines in Spain

11.4.7 RUSSIA

11.4.7.1 Growing consumption of packaged food to drive the demand for food vacuum machines

11.4.8 REST OF EUROPE

11.4.8.1 Manufacturing-driven industry trends for boosting the food retail sector expected to fuel the demand for food vacuum machines

11.5 ASIA PACIFIC

11.5.1 GROWTH OF SMES (SMALL & MEDIUM ENTERPRISES) IN THE CONVENIENCE AND PACKAGED FOOD SEGMENT TO BOOST THE MARKET GROWTH

11.5.2 CHINA

11.5.2.1 Growing awareness regarding food safety to boost the market growth for food vacuum machines

11.5.3 JAPAN

11.5.3.1 Product convenience and safety are the major factors boosting the usage of food vacuum machines

11.5.4 INDIA

11.5.4.1 Increasing demand for food products that have a longer shelf-life to boost the market growth

11.5.5 SOUTH KOREA

11.5.5.1 Increasing consumption of ready-to-eat products to boost the market growth

11.5.6 AUSTRALIA & NEW ZEALAND

11.5.6.1 Rise in snacking trend and preference for prepared food will boost the application of food vacuum machines

11.5.7 REST OF ASIA PACIFIC

11.5.7.1 Growing awareness among consumers to opt for global cuisines with exotic ingredients will boost the growth of food vacuum machines used for product preservation

11.6 SOUTH AMERICA

11.6.1 INCREASING CONSUMPTION MEAT PRODUCTS AND GROWING DEMAND FOR EXTENDED SHELF-LIFE OF MEAT-BASED PRODUCTS WILL DRIVE THE MARKET DEMAND FOR FOOD VACUUM MACHINES

11.6.2 BRAZIL

11.6.2.1 Higher adoption of snacking trend and growth of the convenience food sector to boost the market demand

11.6.3 ARGENTINA

11.6.3.1 Growing demand for the storage of fresh agricultural products to boost the market growth

11.6.4 REST OF SOUTH AMERICA

11.6.4.1 Increase in the demand for the preservation of fresh fruits to boost the growth of food vacuum machines

11.7 REST OF THE WORLD

11.7.1 INCREASE IN AWARENESS ABOUT PRESERVATION OF FOOD PRODUCTS TO BOOST THE MARKET GROWTH

11.7.2 MIDDLE EAST

11.7.2.1 Growing concern regarding the reduction of food wastage to boost the market growth

11.7.3 AFRICA

11.7.3.1 High consumption of beverages that have a longer shelf-life to boost the market growth

12 COMPETITIVE LANDSCAPE (Page No. - 128)

12.1 OVERVIEW

12.2 KEY MARKET DEVELOPMENTS

12.2.1 EXPANSIONS & INVESTMENTS

12.2.2 NEW PRODUCT LAUNCHES

12.2.3 MERGERS & ACQUISITIONS

13 COMPANY EVALUATION MATRIX AND COMPANY PROFILES (Page No. - 131)

13.1 OVERVIEW

13.2 COMPETITIVE LEADERSHIP MAPPING

13.2.1 PERVASIVE

13.2.2 EMERGING LEADERS

13.2.3 STAR

13.2.4 EMERGING COMPANIES

(Business overview, Products offered, Recent developments & Right to win)*

13.3 COMPANY PROFILES

13.3.1 ULMA PACKAGING

13.3.2 PROSEAL

13.3.3 MULTIVAC

13.3.4 ELECTROLUX PROFESSIONAL

13.3.5 HENKELMAN

13.3.6 HENKOVAC INTERNATIONAL

13.3.7 PROMARKS INC.

13.3.8 SAMMIC S.L.

13.3.9 METOS

13.3.10 BIZERBA

13.4 COMPETITIVE LEADERSHIP MAPPING (EMERGING PLAYERS)

13.4.1 PERVASIVE

13.4.2 EMERGING LEADERS

13.4.3 STAR

13.4.4 EMERGING COMPANIES

13.4.5 SIPROMAC

13.4.6 WEBOMATIC

13.4.7 AUDION ELEKTRO B.V.

13.4.8 DADAUX

13.4.9 BOSS VAKUUM

13.4.10 MINIPACK-TORRE S.P.A

13.4.11 TECHNOPACK CORPORATION

13.4.12 ISG PACK

13.4.13 ZERMAT

13.4.14 ASTRAPAC

13.4.15 LAVEZZINI

13.4.16 FERPLAST

13.4.17 TECHNOPAST

13.4.18 S.P. AUTOMATION AND PACKAGING MACHINE

13.4.19 RIDAT

*Details on Business overview, Products offered, Recent developments & Right to win might not be captured in case of unlisted companies.

14 APPENDIX (Page No. - 172)

14.1 DISCUSSION GUIDE

14.2 KNOWLEDGE STORE: MARKETSANDMARKETS’ SUBSCRIPTION PORTAL

14.3 AVAILABLE CUSTOMIZATIONS

14.4 RELATED REPORTS

14.5 AUTHOR DETAILS

LIST OF TABLES (120 Tables)

TABLE 1 USD EXCHANGE RATES, 2014–2018

TABLE 2 MARKET SNAPSHOT, 2020 VS. 2025

TABLE 3 LIST OF IMPORTANT PATENTS FOR FOOD VACUUM MACHINES, 2013–2018

TABLE 4 MARKET SIZE FOR FOOD VACUUM MACHINE, BY MACHINERY TYPE, 2018–2025 (USD MILLION)

TABLE 5 EXTERNAL VACUUM SEALERS MARKET SIZE, BY REGION, 2018–2025 (USD MILLION)

TABLE 6 CHAMBER VACUUM MACHINES MARKET SIZE, BY SUBTYPE, 2018–2025 (USD MILLION)

TABLE 7 CHAMBER VACUUM MACHINES MARKET SIZE, BY REGION, 2018–2025 (USD MILLION)

TABLE 8 TRAY SEALING MACHINES MARKET SIZE, BY REGION, 2018–2025 (USD MILLION)

TABLE 9 OTHER MACHINERY TYPES MARKET SIZE, BY REGION, 2018–2025 (USD MILLION)

TABLE 10 OPTIMISTIC SCENARIO: COVID-19 IMPACT ON THE FOOD VACUUM MACHINE MARKET SIZE, BY MACHINERY TYPE, 2018–2021 (USD MILLION)

TABLE 11 PESSIMISTIC SCENARIO: COVID-19 IMPACT ON THE FOOD VACUUM MACHINE MARKET SIZE, BY MACHINERY TYPE, 2018–2021 (USD MILLION)

TABLE 12 MARKET SIZE FOR FOOD VACUUM MACHINE, BY PACKAGING TYPE, 2018–2025 (USD MILLION)

TABLE 13 FLEXIBLE PACKAGING MARKET SIZE, BY REGION, 2018–2025 (USD MILLION)

TABLE 14 RIGID PACKAGING MARKET SIZE, BY REGION, 2018–2025 (USD MILLION)

TABLE 15 SEMI-RIGID PACKAGING MARKET SIZE, BY REGION, 2018–2025 (USD MILLION)

TABLE 16 OPTIMISTIC SCENARIO: COVID-19 IMPACT ON THE FOOD VACUUM MACHINE MARKET SIZE, BY PACKAGING TYPE, 2018–2021 (USD MILLION)

TABLE 17 PESSIMISTIC SCENARIO: COVID-19 IMPACT ON THE FOOD VACUUM MACHINE MARKET SIZE, BY PACKAGING TYPE, 2018–2021 (USD MILLION)

TABLE 18 MARKET SIZE FOR FOOD VACUUM MACHINE, BY PROCESS, 2018–2025 (USD MILLION)

TABLE 19 SKIN VACUUM PACKAGING PROCESS MARKET SIZE, BY REGION, 2018–2025 (USD MILLION)

TABLE 20 SHRINK VACUUM PACKAGING PROCESS MARKET SIZE, BY REGION, 2018–2025 (USD MILLION)

TABLE 21 TRADITIONAL METHODS MARKET SIZE, BY REGION, 2018–2025 (USD MILLION)

TABLE 22 OPTIMISTIC SCENARIO: COVID-19 IMPACT ON THE FOOD VACUUM MACHINE MARKET SIZE, BY PROCESS, 2018–2021 (USD MILLION)

TABLE 23 PESSIMISTIC SCENARIO: COVID-19 IMPACT ON THE FOOD VACUUM MACHINE MARKET SIZE, BY PROCESS, 2018–2021 (USD MILLION)

TABLE 24 MARKET SIZE FOR FOOD VACUUM MACHINE, BY APPLICATION, 2018–2025 (USD MILLION)

TABLE 25 BAKERY & CONFECTIONERY PRODUCTS MARKET SIZE, BY REGION, 2018–2025 (USD MILLION)

TABLE 26 BEVERAGES MARKET SIZE, BY REGION, 2018–2025 (USD MILLION)

TABLE 27 MEAT & SEAFOOD MARKET SIZE, BY REGION, 2018–2025 (USD MILLION)

TABLE 28 SNACKS & SAVORIES MARKET SIZE, BY REGION, 2018–2025 (USD MILLION)

TABLE 29 CONVENIENCE FOOD MARKET SIZE, BY REGION, 2018–2025 (USD MILLION)

TABLE 30 DAIRY & FROZEN DESSERTS MARKET SIZE, BY REGION, 2018–2025 (USD MILLION)

TABLE 31 SAUCES, DRESSINGS, SPICES, AND CONDIMENTS MARKET SIZE, BY REGION, 2018–2025 (USD MILLION)

TABLE 32 FRUITS & VEGETABLES MARKET SIZE, BY REGION, 2018–2025 (USD MILLION)

TABLE 33 PREPARED FOOD MARKET SIZE, BY REGION, 2018–2025 (USD MILLION)

TABLE 34 OTHER APPLICATIONS MARKET SIZE, BY REGION, 2018–2025 (USD MILLION)

TABLE 35 OPTIMISTIC SCENARIO: COVID-19 IMPACT ON THE FOOD VACUUM MACHINES MARKET SIZE, BY APPLICATION, 2018–2021 (USD MILLION)

TABLE 36 PESSIMISTIC SCENARIO: COVID-19 IMPACT ON THE FOOD VACUUM MACHINES MARKET SIZE, BY APPLICATION, 2018–2021 (USD MILLION)

TABLE 37 MARKET SIZE FOR FOOD VACUUM MACHINE, BY END-USE SECTOR, 2018–2025 (USD MILLION)

TABLE 38 INDUSTRIAL MARKET SIZE, BY REGION, 2018–2025 (USD MILLION)

TABLE 39 COMMERCIAL MARKET SIZE, BY SUBTYPE, 2018–2025 (USD MILLION)

TABLE 40 COMMERCIAL MARKET SIZE, BY REGION, 2018–2025 (USD MILLION)

TABLE 41 DOMESTIC MARKET SIZE, BY REGION, 2018–2025 (USD MILLION)

TABLE 42 OPTIMISTIC SCENARIO: COVID-19 IMPACT ON THE FOOD VACUUM MACHINE MARKET SIZE, BY END-USE SECTOR, 2018–2021 (USD MILLION)

TABLE 43 PESSIMISTIC SCENARIO: COVID-19 IMPACT ON THE FOOD VACUUM MACHINE MARKET SIZE, BY END-USE SECTOR, 2018–2021 (USD MILLION)

TABLE 44 COVID-19 IMPACT ANALYSIS, BY REGION (OPTIMISTIC SCENARIO) (USD MILLION)

TABLE 45 COVID-19 IMPACT ANALYSIS, BY REGION (PESSIMISTIC SCENARIO) (USD MILLION)

TABLE 46 NORTH AMERICA: MARKET SIZE FOR FOOD VACUUM MACHINE, BY COUNTRY, 2018–2025 (USD MILLION)

TABLE 47 NORTH AMERICA: MARKET SIZE, BY MACHINERY TYPE, 2018–2025 (USD MILLION)

TABLE 48 NORTH AMERICA: MARKET SIZE, BY PACKAGING TYPE, 2018–2025 (USD MILLION)

TABLE 49 NORTH AMERICA: MARKET SIZE, BY PROCESS, 2018–2025 (USD MILLION)

TABLE 50 NORTH AMERICA: MARKET SIZE, BY APPLICATION, 2018–2025 (USD MILLION)

TABLE 51 NORTH AMERICA: MARKET SIZE, BY END-USE SECTOR, 2018–2025 (USD MILLION)

TABLE 52 US: MARKET SIZE, BY MACHINERY TYPE, 2018–2025 (USD MILLION)

TABLE 53 US: MARKET SIZE, BY END-USE SECTOR, 2018–2025 (USD MILLION)

TABLE 54 CANADA: MARKET SIZE, BY MACHINERY TYPE, 2018–2025 (USD MILLION)

TABLE 55 CANADA: MARKET SIZE, BY END-USE SECTOR, 2018–2025 (USD MILLION)

TABLE 56 MEXICO: MARKET SIZE, BY MACHINERY TYPE, 2018–2025 (USD MILLION)

TABLE 57 MEXICO: MARKET SIZE, BY END-USE SECTOR, 2018–2025 (USD MILLION)

TABLE 58 EUROPE: MARKET SIZE FOR FOOD VACUUM MACHINE, BY COUNTRY, 2018–2025 (USD MILLION)

TABLE 59 EUROPE: MARKET SIZE, BY MACHINERY TYPE, 2018–2025 (USD MILLION)

TABLE 60 EUROPE: MARKET SIZE, BY PACKAGING TYPE, 2018–2025 (USD MILLION)

TABLE 61 EUROPE: MARKET SIZE, BY PROCESS, 2018–2025 (USD MILLION)

TABLE 62 EUROPE: MARKET SIZE, BY APPLICATION, 2018–2025 (USD MILLION)

TABLE 63 EUROPE: MARKET SIZE, BY END-USE SECTOR, 2018–2025 (USD MILLION)

TABLE 64 GERMANY: MARKET SIZE, BY MACHINERY TYPE, 2018–2025 (USD MILLION)

TABLE 65 GERMANY: MARKET SIZE, BY END-USE SECTOR, 2018–2025 (USD MILLION)

TABLE 66 FRANCE: MARKET SIZE, BY MACHINERY TYPE, 2018–2025 (USD MILLION)

TABLE 67 FRANCE: MARKET SIZE, BY END-USE SECTOR, 2018–2025 (USD MILLION)

TABLE 68 UK: MARKET SIZE, BY MACHINERY TYPE, 2018–2025 (USD MILLION)

TABLE 69 UK: MARKET SIZE, BY END-USE SECTOR, 2018–2025 (USD MILLION)

TABLE 70 ITALY: MARKET SIZE, BY MACHINERY TYPE, 2018–2025 (USD MILLION)

TABLE 71 ITALY: MARKET SIZE, BY END-USE SECTOR, 2018–2025 (USD MILLION)

TABLE 72 SPAIN: MARKET SIZE, BY MACHINERY TYPE, 2018–2025 (USD MILLION)

TABLE 73 SPAIN: MARKET SIZE, BY END-USE SECTOR, 2018–2025 (USD MILLION)

TABLE 74 RUSSIA: MARKET SIZE, BY MACHINERY TYPE, 2018–2025 (USD MILLION)

TABLE 75 RUSSIA: MARKET SIZE, BY END-USE SECTOR, 2018–2025 (USD MILLION)

TABLE 76 REST OF EUROPE: MARKET SIZE, BY MACHINERY TYPE, 2018–2025 (USD MILLION)

TABLE 77 REST OF EUROPE: MARKET SIZE, BY END-USE SECTOR, 2018–2025 (USD MILLION)

TABLE 78 ASIA PACIFIC: MARKET SIZE FOR FOOD VACUUM MACHINE, BY COUNTRY, 2018–2025 (USD MILLION)

TABLE 79 ASIA PACIFIC: MARKET SIZE, BY MACHINERY TYPE, 2018–2025 (USD MILLION)

TABLE 80 ASIA PACIFIC: MARKET SIZE, BY PACKAGING TYPE, 2018–2025 (USD MILLION)

TABLE 81 ASIA PACIFIC: MARKET SIZE, BY PROCESS, 2018–2025 (USD MILLION)

TABLE 82 ASIA PACIFIC: MARKET SIZE, BY APPLICATION, 2018–2025 (USD MILLION)

TABLE 83 ASIA PACIFIC: MARKET SIZE, BY END-USE SECTOR, 2018–2025 (USD MILLION)

TABLE 84 CHINA: MARKET SIZE, BY MACHINERY TYPE, 2018–2025 (USD MILLION)

TABLE 85 CHINA: MARKET SIZE, BY END-USE SECTOR, 2018–2025 (USD MILLION)

TABLE 86 JAPAN: MARKET SIZE, BY MACHINERY TYPE, 2018–2025 (USD MILLION)

TABLE 87 JAPAN: MARKET SIZE, BY END-USE SECTOR, 2018–2025 (USD MILLION)

TABLE 88 INDIA: MARKET SIZE, BY MACHINERY TYPE, 2018–2025 (USD MILLION)

TABLE 89 INDIA: MARKET SIZE, BY END-USE SECTOR, 2018–2025 (USD MILLION)

TABLE 90 SOUTH KOREA: MARKET SIZE, BY MACHINERY TYPE, 2018–2025 (USD MILLION)

TABLE 91 SOUTH KOREA: MARKET SIZE, BY END-USE SECTOR, 2018–2025 (USD MILLION)

TABLE 92 AUSTRALIA & NEW ZEALAND: MARKET SIZE, BY MACHINERY TYPE, 2018–2025 (USD MILLION)

TABLE 93 AUSTRALIA & NEW ZEALAND: MARKET SIZE, BY END-USE SECTOR, 2018–2025 (USD MILLION)

TABLE 94 REST OF ASIA PACIFIC: MARKET SIZE, MACHINERY TYPE, 2018–2025 (USD MILLION)

TABLE 95 REST OF ASIA PACIFIC: MARKET SIZE, BY END-USE SECTOR, 2018–2025 (USD MILLION)

TABLE 96 SOUTH AMERICA: MARKET SIZE, BY COUNTRY, 2018–2025 (USD MILLION)

TABLE 97 SOUTH AMERICA: MARKET SIZE, BY MACHINERY TYPE, 2018–2025 (USD MILLION)

TABLE 98 SOUTH AMERICA: MARKET SIZE, BY PACKAGING TYPE, 2018–2025 (USD MILLION)

TABLE 99 SOUTH AMERICA: MARKET SIZE FOR FOOD VACUUM MACHINE, BY PROCESS, 2018–2025 (USD MILLION)

TABLE 100 SOUTH AMERICA: MARKET SIZE, BY APPLICATION, 2018–2025 (USD MILLION)

TABLE 101 SOUTH AMERICA: MARKET SIZE, BY END-USE SECTOR, 2018–2025 (USD MILLION)

TABLE 102 BRAZIL: MARKET SIZE, BY MACHINERY TYPE, 2018–2025 (USD MILLION)

TABLE 103 BRAZIL: MARKET SIZE, BY END-USE SECTOR, 2018–2025 (USD MILLION)

TABLE 104 ARGENTINA: MARKET SIZE, BY MACHINERY TYPE, 2018–2025 (USD MILLION)

TABLE 105 ARGENTINA: MARKET SIZE, BY END-USE SECTOR, 2018–2025 (USD MILLION)

TABLE 106 REST OF SOUTH AMERICA: MARKET SIZE, BY MACHINERY TYPE, 2018–2025 (USD MILLION)

TABLE 107 REST OF SOUTH AMERICA: MARKET SIZE, BY END-USE SECTOR, 2018–2025 (USD MILLION)

TABLE 108 REST OF THE WORLD: MARKET SIZE, BY REGION, 2018–2025 (USD MILLION)

TABLE 109 REST OF THE WORLD: MARKET SIZE FOR FOOD VACUUM MACHINE, BY MACHINERY TYPE, 2018–2025 (USD MILLION)

TABLE 110 REST OF THE WORLD: MARKET SIZE, BY PACKAGING TYPE, 2018–2025 (USD MILLION)

TABLE 111 REST OF THE WORLD: MARKET SIZE, BY PROCESS, 2018–2025 (USD MILLION)

TABLE 112 REST OF THE WORLD: MARKET SIZE, BY APPLICATION, 2018–2025 (USD MILLION)

TABLE 113 REST OF THE WORLD: MARKET SIZE, BY END-USE SECTOR, 2018–2025 (USD MILLION)

TABLE 114 MIDDLE EAST: MARKET SIZE, BY MACHINERY TYPE, 2018–2025 (USD MILLION)

TABLE 115 MIDDLE EAST: MARKET SIZE, BY END-USE SECTOR, 2018–2025 (USD MILLION)

TABLE 116 AFRICA: MARKET SIZE, BY MACHINERY TYPE, 2018–2025 (USD MILLION)

TABLE 117 AFRICA: MARKET SIZE, BY END-USE SECTOR, 2018–2025 (USD MILLION)

TABLE 118 EXPANSIONS & INVESTMENTS, 2018–2020

TABLE 119 NEW PRODUCT LAUNCHES, 2017–2020

TABLE 120 MERGERS & ACQUISITIONS, 2019

LIST OF FIGURES (33 Figures)

FIGURE 1 MARKET SEGMENTATION

FIGURE 2 REGIONAL SEGMENTATION

FIGURE 3 MARKET: RESEARCH DESIGN

FIGURE 4 DATA TRIANGULATION METHODOLOGY

FIGURE 5 MARKET SIZE, BY MACHINERY TYPE, 2020 VS. 2025 (USD MILLION)

FIGURE 6 MARKET SIZE, BY PACKAGING TYPE, 2020 VS. 2025 (USD MILLION)

FIGURE 7 MARKET SIZE, BY PROCESS, 2020 VS. 2025 (USD MILLION)

FIGURE 8 MARKET SIZE, BY APPLICATION, 2020 VS. 2025 (USD MILLION)

FIGURE 9 MARKET SIZE, BY END-USE SECTOR, 2020 VS. 2025 (USD MILLION)

FIGURE 10 MARKET SHARE AND GROWTH (VALUE), BY REGION

FIGURE 11 GROWING DEMAND FOR HYGIENIC PACKAGING OF FOOD AND READY-TO-EAT MEALS TO DRIVE THE GROWTH OF MARKET

FIGURE 12 CHAMBER VACUUM MACHINES SEGMENT TO ACCOUNT FOR THE LARGEST SHARE IN THE MARKET

FIGURE 13 MEAT & SEAFOOD TO HOLD THE LARGEST SHARE IN THE MARKET

FIGURE 14 ASIA PACIFIC TO ACCOUNT FOR THE LARGEST SHARE IN THE FOOD VACUUM MACHINE MARKET IN 2020

FIGURE 15 US AND CHINA TO ACCOUNT FOR THE LARGEST MARKET SHARES IN 2020

FIGURE 16 FOOD VACUUM MACHINE MARKET: DRIVERS, RESTRAINTS, OPPORTUNITIES, AND CHALLENGES

FIGURE 17 VALUE-CHAIN FOR VACUUM PACKAGING

FIGURE 18 NUMBER OF PATENTS APPROVED FOR FOOD VACUUM MACHINES, BY APPLICANT, 2019–2020 (APRIL)

FIGURE 19 F&B PROCESSING AND TECHNOLOGY: ECOSYSTEM VIEW

FIGURE 20 F&B PROCESSING AND TECHNOLOGY: MARKET MAP

FIGURE 21 YC-YCC SHIFT: FOOD VACUUM MACHINE MARKET

FIGURE 22 MARKET SIZE FOR FOOD VACUUM MACHINE, BY MACHINERY TYPE, 2020 VS. 2025 (USD MILLION)

FIGURE 23 MARKET SIZE, BY PACKAGING TYPE, 2020 VS. 2025 (USD MILLION)

FIGURE 24 MARKET SIZE, BY PROCESS, 2020 VS. 2025 (USD MILLION)

FIGURE 25 MARKET SIZE, BY APPLICATION, 2020 VS. 2025 (USD MILLION)

FIGURE 26 MARKET SIZE, BY END-USE SECTOR, 2020 VS. 2025 (USD MILLION)

FIGURE 27 CHINA AND INDIA TO WITNESS SIGNIFICANT MARKET GROWTH IN THE MARKET, 2020–2025

FIGURE 28 NORTH AMERICA: MARKET SNAPSHOT

FIGURE 29 ASIA PACIFIC: MARKET SNAPSHOT

FIGURE 30 KEY DEVELOPMENTS OF LEADING PLAYERS IN THE GLOBAL MARKET, 2017–2020

FIGURE 31 GLOBAL MARKET: COMPETITIVE LEADERSHIP MAPPING, 2020

FIGURE 32 ELECTROLUX PROFESSIONAL: COMPANY SNAPSHOT

FIGURE 33 GLOBAL MARKET: COMPETITIVE LEADERSHIP MAPPING, 2020 (SMALL & MEDIUM ENTERPRISES)

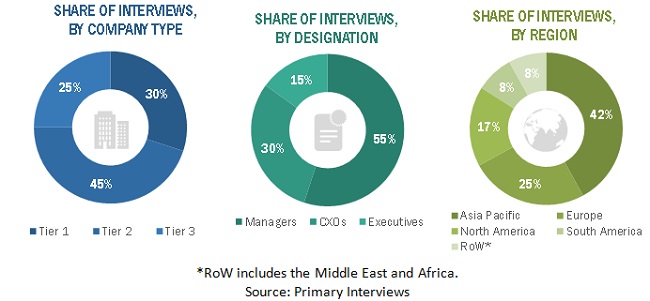

The study involved four major steps in estimating the size of the food vacuum machine market. Exhaustive secondary research was done to collect information on the market, as well as the parent market. The next step was to validate these findings, assumptions, and sizing with industry experts across the value chain through primary research. Both the top-down and bottom-up approaches were employed to estimate the complete market size. After that, market breakdown and data triangulation were used to estimate the market size of segments and subsegments.

Secondary Research

In the secondary research process, various sources were referred to identify and collect information for this study. These secondary sources included reports from the PMMI (The Association for Processing and Packaging), USDA (United States Department of Agriculture), and the FDA (US Food and Drug Administration). The secondary sources also included annual reports, press releases, investor presentations of companies, white papers, certified publications, articles by recognized authors and regulatory bodies, trade directories, and databases.

Secondary research was mainly conducted to obtain key information about the industry’s supply chain, the total pool of key players, market classification & segmentation according to the industry trends to the bottom-most level, and geographical markets. It was also used to obtain information about the key developments from a market-oriented perspective.

Primary Research

The overall market comprises several stakeholders in the supply chain, which include global and regional product manufacturers, suppliers, and retailers. Primary sources from both the supply and demand sides of the market were interviewed to obtain qualitative and quantitative information, which include primary interviews of major product manufacturers. Products offered in the market include different types of food vacuum machines, such as external vacuum sealers, tray sealing machines, chamber vacuum machines, and thermoformers.

To know about the assumptions considered for the study, download the pdf brochure

Market Size Estimation

Both the top-down and bottom-up approaches were used to estimate and validate the total size of the food vacuum machine market. These approaches were also used extensively to estimate the size of various subsegments in the market. The research methodology used to estimate the market size includes the following details:

- The key players were identified through extensive secondary research.

- The market size, in terms of value, was determined through primary and secondary research.

- All percentage share splits and breakdowns were determined using secondary sources and verified through primary sources.

- All the possible parameters that affect the market covered in this research study were accounted for, viewed in extensive detail, verified through primary research, and analyzed to obtain the final quantitative and qualitative data.

Data Triangulation

After arriving at the overall market size from the estimation process explained above, the total market was split into several segments and subsegments. The data triangulation and market breakdown procedures were employed to estimate the global food vacuum machine market and arrive at the exact statistics for all segments and subsegments, wherever applicable. The data was triangulated by studying various factors and trends from the demand and supply sides. Along with this, the market size was validated using both the top-down and bottom-up approaches.

Report Objectives

- Determining and projecting the size of the food vacuum machine market, with respect to machinery type, packaging type, process, application, end-use sector, and regional markets, over five years, ranging from 2020 to 2025

- Identifying the attractive opportunities in the market by determining the largest and fastest-growing segments across regions

- Providing detailed information about the key factors influencing the growth of the market (drivers, restraints, opportunities, and industry-specific challenges)

- Analyzing the micromarkets, with respect to individual growth trends, prospects, and their contribution to the total market

- Identifying and profiling the key players in the market

-

Providing a comparative analysis of market leaders on the basis of the following:

- Product offerings

- Business strategies

- Strengths and weaknesses

- Key financials

- Understanding the competitive landscape and identifying the major growth strategies adopted by players across the key regions

- Analyzing the value chain and products offered across key regions and their impact on the growth of prominent market players

- Providing insights on key product innovations and investments in the global market

Available Customizations

Geographical Analysis

- Further breakdown of the Rest of European food vacuum machine market, by key country

- Further breakdown of the Rest of Asia Pacific food vacuum machine market, by key country

Company Information

- Analyses and profiling of additional market players (up to five)

Growth opportunities and latent adjacency in Food Vacuum Machine Market