Savory Snack Products Market Size, Share, Industry Growth, Trends Report by Product (Potato Chips, Extruded Snacks, Popcorn, Nuts & Seeds, Puffed Snacks, Tortillas), Flavor (Barbeque, Spice, Salty, Plain/Unflavored), Distribution Channel and Region – Global Forecast to 2027

Savory Snack Products Market Size & Share Report, 2027

The savory snack products market was estimated at USD 203.9 billion in 2022 and is expected to reach USD 263.0 billion by 2027, growing at a CAGR of 5.2%. The pandemic has caused significant shifts in work culture and lifestyles, resulting in a higher demand for savory snack products among consumers. As a result, both organized and unorganized players in the global market are experiencing a surge in demand for these products. In developing countries, the unorganized sector dominates the savory snacks market, with local players offering snacks with unique flavors that cater to specific regions.

However, major market players such as PepsiCo (US), Mondelez International Inc. (US), and Kellogg Company (US) have also entered the market by introducing their own region-specific flavored savory snacks. Their aim is to expand their customer base across different continents. This has created intense competition in the market as players strive to capture a larger share of the global savory snacks market.

To know about the assumptions considered for the study, Request for Free Sample Report

Savory Snack Products Market Dynamics

Drivers: Expansion of retail industry globally

The retail sector is one the largest sales channel for savory snack products sales across the globe. Key developed regions like the US, Canada, UK, France, Australia, and others have a large chain of supermarkets & hypermarkets that cater to most of the population. However, deep-pocket players in supermarkets & hypermarkets players are actively investing in these countries to increase their number of stores in several developing nations like India, China, and Brazil.

Restraints: Health issues associated with the consumption of snacks products

These healthy penalties associated with the key ingredients including wheat, corn, and other flours, vegetable oil, salt, sugar, artificial additives, and preservatives of savory snacks pose a serious restraint to the market growth over the forecast period. Frequent consumption of snack products adds excess calories to the body and may lead to massive weight gain and obesity. According to the statistics provided by the Centers For Disease Control and Prevention (CDC), the obesity prevalence in the US was 42.4% during 2017 – 2018. These massive health issues are posing a threat to the savory snack products market across the globe.

Opportunities: Increasing demand for healthy snacks

Inadequate consumption of essential nutrients increases the risk of chronic and cardiovascular diseases, such as hypertension (high blood pressure), cancer, obesity, and diabetes. With globalization and higher exposure to other cultures (especially Western lifestyles), consumers' eating patterns have also changed, increasing snacking among all the age groups.

Challenges: Intense competition from unorganized players

The demand for ready-to-eat snacks has increased due to busy lifestyles and a better standard of living, which in turn is increasing the requirement for high production of savory snack products. The savory snacks products market is highly fragmented, especially in the Asian and European regions. Due to this, local snack product manufacturers in these regions prefer low-cost equipment, also hampering their product quality.

These products are sold at lower prices in the local market with local flavors and spices incorporated. The local snack manufacturers are aware of the tastes and food habits of the consumers; therefore, these products experience a better acceptance by the local consumers who generally prefer traditional tastes.

Key Trends in the Global Savory Snack Products Market:

- Ethnic and Exotic Flavors: Consumers are becoming more adventurous in their snacking preferences, leading to a demand for savory snacks with bold and exotic flavors inspired by cuisines from around the world. Manufacturers are introducing a variety of ethnic flavors and ingredients to cater to this demand.

- Convenience and Portability: Busy lifestyles and on-the-go consumption habits are driving demand for convenient and portable savory snack options. Single-serve packs, resealable packaging, and snack-sized portions are becoming increasingly popular among consumers looking for quick and easy snacking solutions.

- Health and Wellness: Consumers are increasingly seeking healthier snack options. This has led to a rise in demand for savory snacks that are perceived as healthier, such as those with reduced fat, salt, or sugar content, as well as snacks made from natural and organic ingredients.

- Plant-Based Snacks: The growing trend towards plant-based diets has influenced the savory snack market. Consumers are looking for snacks made from plant-based ingredients such as vegetables, legumes, nuts, and seeds. This trend is driven by concerns over health, sustainability, and animal welfare.

- Innovation and Product Diversification: To stand out in a competitive market, manufacturers are focusing on innovation and diversification of product offerings. This includes the development of new flavors, textures, and formats, as well as the incorporation of functional ingredients such as protein, fiber, and probiotics.

- Premiumization: There is a growing demand for premium savory snack products that offer higher quality ingredients, superior taste, and a more indulgent snacking experience. Premiumization is driven by consumers' willingness to pay a premium for snacks perceived as gourmet, artisanal, or made with premium ingredients.

- E-Commerce and Direct-to-Consumer Channels: The rise of e-commerce platforms and direct-to-consumer channels has provided new opportunities for savory snack brands to reach consumers directly. Online shopping offers convenience and accessibility, allowing consumers to discover and purchase a wide range of savory snacks from the comfort of their homes.

- Sustainability and Eco-Friendly Packaging: Concerns over environmental sustainability are influencing purchasing decisions in the savory snack market. Consumers are increasingly looking for snacks packaged in eco-friendly materials such as compostable or recyclable packaging. Manufacturers are responding by adopting sustainable packaging solutions to reduce their environmental footprint.

Segment Insights:

By product, potato chips was the largest segment in the global market.

Potato chips are highly preferred among consumers due to their taste, low price, and easy availability. Over the years, the rise in consumption of potato chips and dynamic shifts in the consumption pattern have led key players in the market to innovate their products. These product portfolios now have newer product ranges and are expanding across the globe.

By flavor, spice is the second fastest growing segment in the global market.

Spicy flavor plays an important role in the snacks food industry. Chili pepper in the spicy flavor category enhances the flavor—heat, pungency, warmth, and bite—and the color of prepared foods. For food manufacturers, these ingredients often come in an extract. As regional cuisines have become more globalized, consumer preference for foods that incorporate heat has increased significantly.

By distribution channel, the retail segment accounts for the largest share in savory snack products market in 2021

Retail stores offer various brands a wide range of savory snack products, enabling the consumers to compare and make an informed purchasing decision. Furthermore, retail stores can be attributed to the large shelf spaces available in supermarkets and the importance of impulse buying when buying a pack of savory snacks. Discount options and a wider variety of options have given the customers more value for money, resulting in consumers across the globe preferring shopping or getting groceries and snacks from offline retail stores.

Regional Insights:

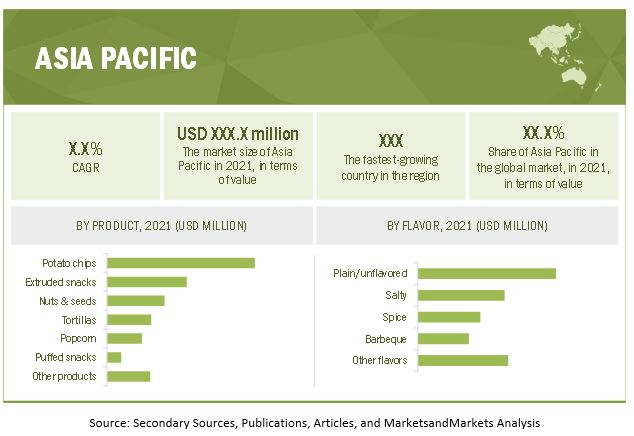

By region, Asia Pacific is projected to grow at the highest CAGR during the forecast period

To know about the assumptions considered for the study, download the pdf brochure

The savory snack products market in the Asia Pacific region is estimated to grow, owing to the growth of economies such as China, India, Japan, and Australia. The capital intensity of agricultural production is increasing in this region, resulting in higher agricultural productivity. This is causing an easier and better availability of good-quality raw materials such as wheat, and corn, required by the snack industry. Nowadays, rising consumers’ inclination towards convenience food in an urbanized world has boosted the consumption of packaged snacks.

Key Companies in the Savory Snacks Products Market

Key players in this market include PepsiCo (US), Kellogg Co (US), General Mills Inc. (US), Calbee (Japan), ITC LIMITED (India), Mondelez International (US), Nestle SA (Switzerland), Grupo Bimbo (Mexico), Hain Celestial (US), and Blue Diamond Growers (US).

Savory Snack Products Market Report Scope

|

Report Metric |

Details |

|

Market Valuation in 2022 |

USD 203.9 billion |

|

Revenue Prediction in 2027 |

USD 263.0 billion |

|

Progress Rate |

CAGR of 5.2% from 2022 - 2027 |

|

Market Size Estimation |

2020–2027 |

|

Segments Covered |

Product, Flavor, Distribution Channel, and Region |

|

Regions Covered |

North America, Europe, Asia Pacific and RoW |

|

Companies Studied |

|

|

Market Driving Factors |

|

|

Market Opportunities |

Increasing demand for healthy snacks to create opportunities in the market. |

|

Largest Growing Region |

Asia Pacific (APAC) |

Savory Snack Products Market Target Audience:

- Processed food & beverage manufacturers

- Government and research organizations

- Savory snack products product manufacturers

- Health food & beverage product manufacturers

- Savory snack products product distributors

- Marketing directors

- Key executives from various key companies and organizations in the market

Savory Snack Products Market Segmentation:

This research report categorizes market based on product, flavor, distribution channel and region.

|

Segmnets |

Subsgments |

|

By Product |

|

|

By Flavor |

|

|

By Distribution Channel |

|

|

By Region |

|

Savory Snack Products Market Recent Developments:

- In January 2022, Hain Celestial agreed to acquire ParmCrisps, a fast-growing, better-for-you brand offering delicious, convenient products that are consumer favorites from Clearlake Capital Group. The acquisition deepens Hain’s position in the snacking category and represents a significant step in establishing Hain as a high-growth, global healthy food company.

- In January 2022, Mondelez International completed the acquisition of Chipita Global S.A. The acquisition marks a milestone in the strategic plan, focused on accelerating growth in core snacking adjacencies while expanding its footprint in key markets.

- In August 2021, Calbee announced to launch a new range of plant-based snacks products. The vegetable and pulse-based snacks aim to provide a healthy alternative to traditional fried crisps and snacks, being baked, not fried.

- In January 2021, PepsiCo announced to launch ready-to-eat Cheetos popcorn. The popcorn is infused with “cheetle,” the brand’s proprietary cheesy orange and red dusting.

- In February 2020, PepsiCo’s acquired Be & Cheery also known as Hanfzhou Haomusi Food Co Ltd. The acquisition allowed Pepsico to strengthen its snacks portfolio. It also widened its customer base in the Chinese market by leveraging Be & Cheery’s longstanding brand presence, manufacturing and sourcing expertise along with innovation and consumer insights capabilities.

(FAQ):

How big is the savory snack products market?

The global savory snack products market is projected to reach USD 263.0 billion by 2027 recording a CAGR of 5.2% from 2022.

What are the major revenue pockets in the savory snack products market currently?

The Asia Pacific region is expected to witness growth in the snacks market due to the economic development of countries like China, India, Japan, and Australia. Agricultural production in this region is becoming more capital-intensive, leading to increased productivity. As a result, there is a greater availability of high-quality raw materials like wheat and corn, which are essential for the snack industry. In today's urbanized world, there is a growing preference among consumers for convenient food options, which has led to an increase in the consumption of packaged snacks.

What are the factors driving the savory snacks market?

- Changing work-culture is promoting the savory snack products market

- Expansion of retail industry globally.

Which key players are involved in the savory snack products market?

Key players in this market include PepsiCo (US), Kellogg Co (US), General Mills Inc. (US), Calbee (Japan), ITC LIMITED (India), Mondelez International (US), Nestle SA (Switzerland), Grupo Bimbo (Mexico), Hain Celestial (US), and Blue Diamond Growers (US).

To speak to our analyst for a discussion on the above findings, click Speak to Analyst

TABLE OF CONTENTS

1 INTRODUCTION (Page No. - 22)

1.1 OBJECTIVES OF THE STUDY

1.2 SAVORY SNACK PRODUCTS MARKET DEFINITION

1.3 STUDY SCOPE

FIGURE 1 MARKET SEGMENTATION

1.4 REGIONS COVERED

1.5 INCLUSION & EXCLUSIONS

1.6 YEARS CONSIDEREDff

1.7 CURRENCY CONSIDERED

1.8 VOLUME UNIT CONSIDERED

TABLE 1 USD EXCHANGE RATES CONSIDERED, 2019–2021

1.9 STAKEHOLDERS

2 RESEARCH METHODOLOGY (Page No. - 26)

2.1 RESEARCH DATA

FIGURE 2 MARKET: RESEARCH DESIGN

2.1.1 SECONDARY DATA

2.1.1.1 Key data from secondary sources

2.1.2 PRIMARY DATA

2.1.2.1 Key data from primary sources

2.1.2.2 Breakdown of primaries

2.1.2.3 Key primary insights

2.2 MARKET SIZE ESTIMATION

2.2.1 APPROACH ONE – BOTTOM-UP (BASED ON SAVORY SNACK PRODUCTS, BY REGION)

2.2.2 APPROACH TWO – TOP DOWN (BASED ON THE GLOBAL MARKET)

2.3 DATA TRIANGULATION

FIGURE 3 DATA TRIANGULATION METHODOLOGY

2.4 ASSUMPTIONS FOR THE STUDY

2.5 LIMITATIONS AND RISK ASSESSMENT OF THE STUDY

2.6 SAVORY SNACK PRODUCTS MARKET SCENARIOS CONSIDERED FOR THE IMPACT OF COVID-19

2.6.1 OPTIMISTIC SCENARIO

2.6.2 REALISTIC & PESSIMISTIC SCENARIO

2.6.3 SCENARIO-BASED MODELLING

2.7 COVID-19 HEALTH ASSESSMENT

FIGURE 4 COVID-19: GLOBAL PROPAGATION

FIGURE 5 COVID-19 PROPAGATION: SELECT COUNTRIES

2.8 COVID-19 ECONOMIC ASSESSMENT

FIGURE 6 REVISED GROSS DOMESTIC PRODUCT FORECASTS FOR SELECT G20 COUNTRIES IN 2020

2.8.1 COVID-19 ECONOMIC IMPACT—SCENARIO ASSESSMENT

FIGURE 7 CRITERIA IMPACTING GLOBAL ECONOMY

FIGURE 8 SCENARIOS IN TERMS OF RECOVERY OF GLOBAL ECONOMY

3 EXECUTIVE SUMMARY (Page No. - 41)

TABLE 2 MARKET SNAPSHOT, 2022 VS. 2027

FIGURE 9 COVID-19 IMPACT ON THE SAVORY SNACKS PRODUCTS MARKET, BY SCENARIO, 2020 VS. 2021 (USD BILLION)

FIGURE 10 MARKET, BY PRODUCT, 2022 VS. 2027 (USD BILLION)

FIGURE 11 MARKET, BY FLAVOR, 2022 VS. 2027 (USD BILLION)

FIGURE 12 MARKET, BY DISTRIBUTION CHANNEL, 2022 VS. 2027 (USD BILLION)

FIGURE 13 MARKET SHARE (VALUE), BY REGION, 2021

4 PREMIUM INSIGHTS (Page No. - 46)

4.1 ATTRACTIVE OPPORTUNITIES IN THE GLOBAL MARKET

FIGURE 14 SHIFTING CONSUMER PREFERENCE TO CONVENIENCE FOOD TO PROPEL THE MARKET FOR SAVORY SNACKS

4.2 ASIA PACIFIC: SAVORY SNACK PRODUCT MARKET, BY PRODUCT AND COUNTRY

FIGURE 15 CHINA TO ACCOUNT FOR THE LARGEST SHARES IN THE POTATO CHIPS SEGMENT IN THE ASIA PACIFIC MARKET IN 2021

4.3 MARKET, BY PRODUCT

FIGURE 16 POTATO CHIPS SEGMENT TO DOMINATE THE MARKET DURING THE FORECAST PERIOD

4.4 SAVORY SNACK PRODUCTS MARKET, BY FLAVOR

FIGURE 17 PLAIN/UNFLAVORED SEGMENT TO DOMINATE THE MARKET DURING THE FORECAST PERIOD

4.5 MARKET, BY PRODUCT AND REGION

FIGURE 18 ASIA PACIFIC TO DOMINATE THE MARKET DURING THE FORECAST PERIOD

4.6 MARKET, BY DISTRIBUTION CHANNEL

FIGURE 19 RETAIL SEGMENT TO DOMINATE THE MARKET DURING THE FORECAST PERIOD

FIGURE 20 COVID-19 IMPACT ON THE MARKET: COMPARISON OF PRE-AND POST-COVID-19 SCENARIOS

5 MARKET OVERVIEW (Page No. - 51)

5.1 INTRODUCTION

5.2 MARKET DYNAMICS

FIGURE 21 MARKET DYNAMICS

5.2.1 DRIVERS

5.2.1.1 Shifting consumer preference to convenience food

5.2.1.2 Changing work culture is promoting savory snacks among consumers

5.2.1.3 Expansion of the retail industry globally

TABLE 3 FUTURE UPCOMING LOCATIONS OF NEW ALDI LOCATIONS IN THE US

5.2.2 RESTRAINTS

5.2.2.1 Health issues associated with consumption of snacks products

5.2.2.2 Growing inclination of consumers toward low fat and low sodium products

5.2.3 OPPORTUNITIES

5.2.3.1 Increasing demand for healthy snacks

5.2.3.2 Growing eCommerce penetration in the developing countries

TABLE 4 INTERNET PENETRATION ACROSS THE GLOBE, 2019

5.2.4 CHALLENGES: SAVORY SNACK PRODUCTS MARKET

5.2.4.1 Volatile price of the raw materials

5.2.4.2 Intense competition from unorganized local players

5.3 COVID-19 IMPACT ON SAVORY SNACK PRODUCTS ECOSYSTEM

6 INDUSTRY TRENDS (Page No. - 59)

6.1 INTRODUCTION

6.2 VALUE CHAIN

6.2.1 RAW MATERIAL SOURCING

6.2.2 MANUFACTURING OF SAVORY SNACKS

6.2.3 QUALITY AND SAFETY CONTROLLERS

6.2.4 PACKAGING

6.2.5 MARKETING AND DISTRIBUTION

6.2.6 END-USE INDUSTRY

FIGURE 22 VALUE CHAIN ANALYSIS OF THE MARKET: MANUFACTURING AND QUALITY & SAFETY CONTROLLERS KEY CONTRIBUTORS

6.3 TECHNOLOGY ANALYSIS

6.4 TRADE DATA: SAVORY SNACK PRODUCT MARKET

6.4.1 NUTS AND OTHER SEEDS

TABLE 5 TOP 10 IMPORTERS AND EXPORTERS OF NUTS AND OTHER SEEDS, 2019 (KG)

6.4.2 NUTS & OTHER SEEDS

TABLE 6 TOP 10 IMPORTERS AND EXPORTERS OF NUTS AND OTHER SEEDS, 2020 (KG)

6.5 PRICING ANALYSIS: SAVORY SNACK PRODUCT MARKET

TABLE 7 GLOBAL SAVORY SNACK PRODUCTS AVERAGE SELLING PRICE (ASP), BY PRODUCT, 2019-2021 (USD/TONS)

TABLE 8 GLOBAL SAVORY SNACK PRODUCTS AVERAGE SELLING PRICE (ASP), BY REGION, 2019-2021 (USD/TONS)

6.6 MARKET MAP AND ECOSYSTEM SAVORY SNACK PRODUCTS MARKET

6.6.1 DEMAND-SIDE

6.6.2 SUPPLY-SIDE

FIGURE 23 MARKET: MARKET MAP

TABLE 9 MARKET: SUPPLY CHAIN (ECOSYSTEM)

6.7 TRENDS IMPACTING BUYERS

FIGURE 24 MARKET: TRENDS IMPACTING BUYERS

6.8 REGULATORY FRAMEWORK

6.8.1 NORTH AMERICA: REGULATORY FRAMEWORK

6.9 EUROPE: REGULATORY FRAMEWORK

6.10 PATENT ANALYSIS

FIGURE 25 NUMBER OF PATENTS GRANTED BETWEEN 2012 AND 2021

FIGURE 26 TOP 10 INVESTORS WITH THE HIGHEST NUMBER OF PATENT DOCUMENTS

FIGURE 27 TOP 10 APPLICANTS WITH THE HIGHEST NO. OF PATENT DOCUMENTS

TABLE 10 SOME OF THE PATENTS PERTAINING TO SAVORY SNACKS, 2019–2021

6.11 PORTER’S FIVE FORCES ANALYSIS

TABLE 11 SAVORY SNACK PRODUCTS MARKET: PORTER’S FIVE FORCES ANALYSIS

6.11.1 DEGREE OF COMPETITION

6.11.2 BARGAINING POWER OF SUPPLIERS

6.11.3 BARGAINING POWER OF BUYERS

6.11.4 THREAT OF SUBSTITUTES

6.11.5 THREAT OF NEW ENTRANTS

6.12 CASE STUDIES

6.12.1 RISING REGULATORY POLICIES FOR CLASSIC SAVORY SNACK PRODUCTS

6.12.2 GROWING DEMAND FOR HEALTHY SAVORY SNACK PRODUCTS

7 MARKET, BY CATEGORY (Page No. - 73)

7.1 INTRODUCTION

7.2 BAKED SNACKS

7.3 FRIED SNACKS

7.4 OTHER CATEGORIES

8 MARKET, BY PRODUCT (Page No. - 75)

8.1 INTRODUCTION

FIGURE 28 MARKET SIZE (VALUE), BY PRODUCT, 2022 VS. 2027

TABLE 12 MARKET SIZE, BY PRODUCT, 2020–2027 (USD MILLION)

TABLE 13 MARKET SIZE, BY PRODUCT, 2020–2027 (KT)

8.2 COVID-19 IMPACT ON THE SAVORY SNACK PRODUCTS MARKET, BY PRODUCT

8.2.1 OPTIMISTIC SCENARIO

TABLE 14 OPTIMISTIC SCENARIO: IMPACT OF COVID–19 ON THE GLOBAL MARKET SIZE, BY PRODUCT, 2020–2023 (USD MILLION)

8.2.2 REALISTIC SCENARIO

TABLE 15 REALISTIC SCENARIO: IMPACT OF COVID–19 ON THE GLOBAL MARKET SIZE, BY PRODUCT, 2020–2023 (USD MILLION)

8.2.3 PESSIMISTIC SCENARIO

TABLE 16 PESSIMISTIC SCENARIO: IMPACT OF COVID–19 ON THE GLOBAL MARKET SIZE, BY PRODUCT, 2020–2023 (USD MILLION)

8.3 POTATO CHIPS

8.3.1 INCREASING CONSUMPTION OF POTATO CHIPS IS ANTICIPATED TO BOOM MARKET GROWTH

TABLE 17 POTATO CHIPS: MARKET SIZE, BY REGION, 2020–2027 (USD MILLION)

TABLE 18 POTATO CHIPS: MARKET SIZE, BY REGION, 2020–2027 (KT)

8.4 EXTRUDED SNACKS

8.4.1 GROWING PREFERENCES FOR READY-TO-EAT PACKAGED FOOD

TABLE 19 EXTRUDED SNACKS: MARKET SIZE, BY REGION, 2020–2027 (USD MILLION)

TABLE 20 EXTRUDED SNACKS: MARKET SIZE, BY REGION, 2020–2027 (KT)

8.5 POPCORN

8.5.1 HEALTH-CONSCIOUS CONSUMERS FOCUSING ON LOW-CALORIE COUNT

TABLE 21 POPCORN: MARKET SIZE, BY REGION, 2020–2027 (USD MILLION)

TABLE 22 POPCORN: SAVORY SNACKS PRODUCTS MARKET SIZE, BY REGION, 2020–2027 (KT)

8.6 NUTS AND SEEDS

8.6.1 RISING INNOVATION IN HEALTHY SNACK SEGMENT

TABLE 23 NUTS AND SEEDS: MARKET SIZE, BY REGION, 2020–2027 (USD MILLION)

TABLE 24 NUTS AND SEEDS: MARKET SIZE, BY REGION, 2020–2027 (KT)

8.7 PUFFED SNACKS

8.7.1 GROWING FOCUS OF CONSUMERS ON REDUCING FAT INTAKE

TABLE 25 PUFFED SNACKS: MARKET SIZE, BY REGION, 2020–2027 (USD MILLION)

TABLE 26 PUFFED SNACKS: MARKET SIZE, BY REGION, 2020–2027 (KT)

8.8 TORTILLAS

8.8.1 VARIETY OF FLAVORS GRABBING ATTENTION OF CONSUMERS

TABLE 27 TORTILLAS: MARKET SIZE, BY REGION, 2020–2027 (USD MILLION)

TABLE 28 TORTILLAS: MARKET SIZE, BY REGION, 2020–2027 (KT)

8.9 OTHER PRODUCTS

8.9.1 INCLINATION OF HEALTH-CONSCIOUS CONSUMERS TOWARD CONVENIENT FOOD

TABLE 29 OTHER PRODUCTS: MARKET SIZE, BY REGION, 2020–2027 (USD MILLION)

TABLE 30 OTHER PRODUCTS: MARKET SIZE, BY REGION, 2020–2027 (KT)

9 SAVORY SNACK PRODUCTS MARKET, BY FLAVOR (Page No. - 87)

9.1 INTRODUCTION

FIGURE 29 MARKET SIZE (VALUE), BY FLAVOR, 2022 VS. 2027

TABLE 31 MARKET SIZE, BY FLAVOR, 2020–2027 (USD MILLION)

9.2 COVID-19 IMPACT ON THE MARKET, BY FLAVOR

9.2.1 OPTIMISTIC SCENARIO

TABLE 32 OPTIMISTIC SCENARIO: IMPACT OF COVID–19 ON THE GLOBAL MARKET SIZE, BY FLAVOR, 2020–2023 (USD MILLION)

9.2.2 REALISTIC SCENARIO

TABLE 33 REALISTIC SCENARIO: IMPACT OF COVID–19 ON THE GLOBAL MARKET SIZE, BY FLAVOR, 2020–2023 (USD MILLION)

9.2.3 PESSIMISTIC SCENARIO

TABLE 34 PESSIMISTIC SCENARIO: IMPACT OF COVID–19 ON THE GLOBAL MARKET SIZE, BY FLAVOR, 2020–2023 (USD MILLION)

9.3 BARBEQUE

9.3.1 INNOVATION IN FLAVORS BY THE KEY MANUFACTURERS TO DRIVE THE GROWTH

TABLE 35 BARBEQUE: SAVORY SNACKS PRODUCTS MARKET SIZE, BY REGION, 2020–2027 (USD MILLION)

9.4 SPICE

9.4.1 GROWING TREND OF SPICY FLAVORS

TABLE 36 SPICE: MARKET SIZE, BY REGION, 2020–2027 (USD MILLION)

9.5 SALTY

9.5.1 SALT A MAJOR CONTRIBUTION TO THE FLAVOR

TABLE 37 SALTY: MARKET SIZE, BY REGION, 2020–2027 (USD MILLION)

9.6 PLAIN/UNFLAVOURED

9.6.1 EMERGING FLAVORS IMPACTING PROACTIVE CONSUMERS

TABLE 38 PLAIN/UNFLAVOURED: MARKET SIZE, BY REGION, 2020–2027 (USD MILLION)

9.7 OTHER FLAVORS

9.7.1 RISING POPULARITY OF EXOTIC FLAVORS

TABLE 39 OTHER FLAVORS: MARKET SIZE, BY REGION, 2020–2027 (USD MILLION)

10 SAVORY SNACK PRODUCTS MARKET, BY DISTRIBUTION CHANNEL (Page No. - 94)

10.1 INTRODUCTION

FIGURE 30 MARKET SIZE (VALUE), BY DISTRIBUTION CHANNEL, 2022 VS. 2027

TABLE 40 MARKET SIZE, BY DISTRIBUTION CHANNEL, 2020–2027 (USD MILLION)

10.2 COVID-19 IMPACT ON THE MARKET, BY DISTRIBUTION CHANNEL

10.2.1 OPTIMISTIC SCENARIO

TABLE 41 OPTIMISTIC SCENARIO: IMPACT OF COVID–19 ON THE GLOBAL MARKET SIZE, BY DISTRIBUTION CHANNEL, 2020–2023 (USD MILLION)

10.2.2 REALISTIC SCENARIO

TABLE 42 REALISTIC SCENARIO: IMPACT OF COVID–19 ON THE GLOBAL MARKET SIZE, DISTRIBUTION CHANNEL, 2020–2023 (USD MILLION)

10.2.3 PESSIMISTIC SCENARIO

TABLE 43 PESSIMISTIC SCENARIO: IMPACT OF COVID–19 ON THE GLOBAL SIZE, DISTRIBUTION CHANNEL, 2020–2023 (USD MILLION)

10.3 RETAIL

TABLE 44 RETAIL: MARKET SIZE, BY TYPE, 2020–2027 (USD MILLION)

TABLE 45 RETAIL: MARKET SIZE, BY REGION, 2020–2027 (USD MILLION)

10.4 SUPERMARKETS & HYPERMARKETS

10.4.1 DIFFERENT BRANDS AND PACKAGING SIZES TO ESCALATE SAVORY SNACKS PRODUCTS MARKET

TABLE 46 SUPERMARKETS & HYPERMARKETS: SAVORY SNACK PRODUCT MARKET SIZE, BY REGION, 2020–2027 (USD MILLION)

10.5 CONVENIENCE STORES

10.5.1 ADDITION OF ON-DEMAND DELIVERY CAPABILITIES PROVIDES GOOD BUSINESS OPPORTUNITIES FOR CONVENIENCE STORES

TABLE 47 CONVENIENCE STORES: MARKET SIZE, BY REGION, 2020–2027 (USD MILLION)

10.6 ONLINE STORES

10.6.1 POST-PANDEMIC ERA PRESENTS A HUGE BUSINESS OPPORTUNITY FOR SAVORY SNACKS THROUGH E-COMMERCE SITES

TABLE 48 ONLINE STORES: MARKET SIZE, BY REGION, 2020–2027 (USD MILLION)

10.7 OTHER RETAIL STORES

10.7.1 RAPID GLOBALIZATION HAS PAVED THE WAY FOR BUSINESS OPPORTUNITIES IN SMALLER RETAIL STORES

TABLE 49 OTHER RETAIL STORES: MARKET SIZE, BY REGION, 2020–2027 (USD MILLION)

10.8 FOODSERVICES

10.8.1 COVID-19 PANDEMIC SIGNIFICANTLY IMPACT THE SALE OF SAVORY SNACKS IN THE FOOD SERVICE CHANNEL

TABLE 50 FOODSERVICES: MARKET SIZE, BY REGION, 2020–2027 (USD MILLION)

11 SAVORY SNACK PRODUCTS MARKET, BY REGION (Page No. - 102)

11.1 INTRODUCTION

FIGURE 31 INDIA TO RECORD THE FASTEST GROWTH DURING THE FORECAST PERIOD

TABLE 51 MARKET SIZE, BY REGION, 2020–2027 (USD MILLION)

11.2 COVID-19 IMPACT ON THE MARKET, BY REGION

11.2.1 OPTIMISTIC SCENARIO

TABLE 52 OPTIMISTIC SCENARIO: MARKET SIZE, BY REGION, 2020–2023 (USD MILLION)

11.2.2 REALISTIC SCENARIO

TABLE 53 REALISTIC SCENARIO: MARKET SIZE, BY REGION, 2020–2023 (USD MILLION)

11.2.3 PESSIMISTIC SCENARIO

TABLE 54 PESSIMISTIC SCENARIO: MARKET SIZE, BY REGION, 2020–2023 (USD MILLION)

11.3 NORTH AMERICA

FIGURE 32 NORTH AMERICA: MARKET SNAPSHOT

TABLE 55 NORTH AMERICA: MARKET SIZE, BY COUNTRY, 2020–2027 (USD MILLION)

TABLE 56 NORTH AMERICA: MARKET SIZE, BY PRODUCT, 2020–2027 (USD MILLION)

TABLE 57 NORTH AMERICA: MARKET SIZE, BY FLAVOR, 2020–2027 (USD MILLION)

TABLE 58 NORTH AMERICA: MARKET SIZE, BY DISTRIBUTION CHANNEL, 2020–2027 (USD MILLION)

TABLE 59 RETAIL: MARKET SIZE FOR NORTH AMERICA, BY TYPE, 2020–2027 (USD MILLION)

11.3.1 US

11.3.1.1 High consumption of snacks by the millennial generation is contributing to the market

TABLE 60 US: MARKET SIZE, BY PRODUCT, 2020–2027 (USD MILLION)

TABLE 61 US: MARKET SIZE, BY FLAVOR, 2020–2027 (USD MILLION)

TABLE 62 US: SAVORY SNACK PRODUCTS MARKET SIZE, BY DISTRIBUTION CHANNEL, 2020–2027 (USD MILLION)

11.3.2 CANADA

11.3.2.1 Increasing fast-paced society escalating the market growth

TABLE 63 CANADA: MARKET SIZE, BY PRODUCT, 2020–2027 (USD MILLION)

TABLE 64 CANADA: MARKET SIZE, BY FLAVOR, 2020–2027 (USD MILLION)

TABLE 65 CANADA: MARKET SIZE, BY DISTRIBUTION CHANNEL, 2020–2027 (USD MILLION)

11.3.3 MEXICO

11.3.3.1 Increasing awareness of healthy snacks is driving the market growth

TABLE 66 MEXICO: MARKET SIZE, BY PRODUCT, 2020–2027 (USD MILLION)

TABLE 67 MEXICO: MARKET SIZE, BY FLAVOR, 2020–2027 (USD MILLION)

TABLE 68 MEXICO: MARKET SIZE, BY DISTRIBUTION CHANNEL, 2020–2027 (USD MILLION)

11.4 EUROPE

TABLE 69 EUROPE: MARKET SIZE, BY COUNTRY, 2020–2027 (USD MILLION)

TABLE 70 EUROPE: MARKET SIZE, BY PRODUCT, 2020–2027 (USD MILLION)

TABLE 71 EUROPE: MARKET SIZE, BY FLAVOR, 2020–2027 (USD MILLION)

TABLE 72 EUROPE: MARKET SIZE, BY DISTRIBUTION CHANNEL, 2020–2027 (USD MILLION)

TABLE 73 RETAIL: MARKET SIZE FOR EUROPE, BY TYPE, 2020–2027 (USD MILLION)

11.4.1 UK

11.4.1.1 Evolving snacking trends is escalating market growth

TABLE 74 UK: SAVORY SNACK PRODUCTS MARKET SIZE, BY PRODUCT, 2020–2027 (USD MILLION)

TABLE 75 UK: MARKET SIZE, BY FLAVOR, 2020–2027 (USD MILLION)

TABLE 76 UK: MARKET SIZE, BY DISTRIBUTION CHANNEL, 2020–2027 (USD MILLION)

11.4.2 GERMANY

11.4.2.1 Increasing fast-paced society escalating the market growth

TABLE 77 GERMANY: MARKET SIZE, BY PRODUCT, 2020–2027 (USD MILLION)

TABLE 78 GERMANY: MARKET SIZE, BY FLAVOR, 2020–2027 (USD MILLION)

TABLE 79 GERMANY: MARKET SIZE, BY DISTRIBUTION CHANNEL, 2020–2027 (USD MILLION)

11.4.3 SPAIN

11.4.3.1 Innovations in the products of tortillas to drive the market growth

TABLE 80 SPAIN: MARKET SIZE, BY PRODUCT, 2020–2027 (USD MILLION)

TABLE 81 SPAIN: MARKET SIZE, BY FLAVOR, 2020–2027 (USD MILLION)

TABLE 82 SPAIN: MARKET SIZE, BY DISTRIBUTION CHANNEL, 2020–2027 (USD MILLION)

11.4.4 ITALY

11.4.4.1 Innovations to raise demand for savory snack products

TABLE 83 ITALY: SAVORY SNACKS PRODUCTS MARKET SIZE, BY PRODUCT, 2020–2027 (USD MILLION)

TABLE 84 ITALY: MARKET SIZE, BY FLAVOR, 2020–2027 (USD MILLION)

TABLE 85 ITALY: MARKET SIZE, BY DISTRIBUTION CHANNEL, 2020–2027 (USD MILLION)

11.4.5 FRANCE

11.4.5.1 Growing inclination towards indulgent snacking

TABLE 86 FRANCE: MARKET SIZE, BY PRODUCT, 2020–2027 (USD MILLION)

TABLE 87 FRANCE: MARKET SIZE, BY FLAVOR, 2020–2027 (USD MILLION)

TABLE 88 FRANCE: MARKET SIZE, BY DISTRIBUTION CHANNEL, 2020–2027 (USD MILLION)

11.4.6 NETHERLANDS

11.4.6.1 Increasing vegetable-based snacks demand

TABLE 89 NETHERLANDS: MARKET SIZE, BY PRODUCT, 2020–2027 (USD MILLION)

TABLE 90 NETHERLANDS: MARKET SIZE, BY FLAVOR, 2020–2027 (USD MILLION)

TABLE 91 NETHERLANDS: MARKET SIZE, BY DISTRIBUTION CHANNEL, 2020–2027 (USD MILLION)

11.4.7 REST OF EUROPE

TABLE 92 REST OF EUROPE: MARKET SIZE, BY PRODUCT, 2020–2027 (USD MILLION)

TABLE 93 REST OF EUROPE: MARKET SIZE, BY FLAVOR, 2020–2027 (USD MILLION)

TABLE 94 REST OF EUROPE: MARKET SIZE, BY DISTRIBUTION CHANNEL, 2020–2027 (USD MILLION)

11.5 ASIA PACIFIC

FIGURE 33 ASIA PACIFIC: SAVORY SNACK PRODUCTS MARKET SNAPSHOT

TABLE 95 ASIA PACIFIC: MARKET SIZE, BY COUNTRY, 2020–2027 (USD MILLION)

TABLE 96 ASIA PACIFIC: MARKET SIZE, BY PRODUCT, 2020–2027 (USD MILLION)

TABLE 97 ASIA PACIFIC MARKET SIZE, BY FLAVOR, 2020–2027 (USD MILLION)

TABLE 98 ASIA PACIFIC: MARKET SIZE, BY DISTRIBUTION CHANNEL, 2020–2027 (USD MILLION)

TABLE 99 RETAIL: MARKET SIZE FOR ASIA PACIFIC, BY TYPE, 2020–2027 (USD MILLION)

11.5.1 CHINA

11.5.1.1 Rising distribution channel is contributing to the market growth

TABLE 100 CHINA: MARKET SIZE, BY PRODUCT, 2020–2027 (USD MILLION)

TABLE 101 CHINA: MARKET SIZE, BY FLAVOR, 2020–2027 (USD MILLION)

TABLE 102 CHINA: MARKET SIZE, BY DISTRIBUTION CHANNEL, 2020–2027 (USD MILLION)

11.5.2 JAPAN

11.5.2.1 Growing popularity of a wide variety of savory flavors increase the market growth

TABLE 103 JAPAN: MARKET SIZE, BY PRODUCT, 2020–2027 (USD MILLION)

TABLE 104 JAPAN: MARKET SIZE, BY FLAVOR, 2020–2027 (USD MILLION)

TABLE 105 JAPAN: MARKET SIZE, BY DISTRIBUTION CHANNEL, 2020–2027 (USD MILLION)

11.5.3 INDIA

11.5.3.1 Changing dietary habits of consumers to increase the savory snacks products market

TABLE 106 INDIA: MARKET SIZE, BY PRODUCT, 2020–2027 (USD MILLION)

TABLE 107 INDIA: RODUCTS MARKET SIZE, BY FLAVOR, 2020–2027 (USD MILLION)

TABLE 108 INDIA: MARKET SIZE, BY DISTRIBUTION CHANNEL, 2020–2027 (USD MILLION)

11.5.4 AUSTRALIA & NEW ZEALAND

11.5.4.1 Demand for premium and gourmet products to enhance the market

TABLE 109 AUSTRALIA & NEW ZEALAND: MARKET SIZE, BY PRODUCT, 2020–2027 (USD MILLION)

TABLE 110 AUSTRALIA & NEW ZEALAND: MARKET SIZE, BY FLAVOR, 2020–2027 (USD MILLION)

TABLE 111 AUSTRALIA & NEW ZEALAND: MARKET SIZE, BY DISTRIBUTION CHANNEL, 2020–2027 (USD MILLION)

11.5.5 REST OF ASIA PACIFIC

TABLE 112 REST OF ASIA PACIFIC: MARKET SIZE, BY PRODUCT, 2020–2027 (USD MILLION)

TABLE 113 REST OF ASIA PACIFIC: MARKET SIZE, BY FLAVOR, 2020–2027 (USD MILLION)

TABLE 114 REST OF ASIA PACIFIC: MARKET SIZE, BY DISTRIBUTION CHANNEL, 2020–2027 (USD MILLION)

11.6 REST OF THE WORLD

TABLE 115 REST OF THE WORLD: MARKET SIZE, BY COUNTRY, 2020–2027 (USD MILLION)

TABLE 116 REST OF THE WORLD: MARKET SIZE, BY PRODUCT, 2020–2027 (USD MILLION)

TABLE 117 REST OF THE WORLD: MARKET SIZE, BY FLAVOR, 2020–2027 (USD MILLION)

TABLE 118 REST OF THE WORLD: MARKET SIZE, BY DISTRIBUTION CHANNEL, 2020–2027 (USD MILLION)

TABLE 119 RETAIL: SAVORY SNACK PRODUCTS MARKET SIZE FOR ROW, BY TYPE, 2020–2027 (USD MILLION)

11.6.1 SOUTH AMERICA

11.6.1.1 Easy Availability Witnessed a Growing Demand for Savory Snack Products

TABLE 120 SOUTH AMERICA: MARKET SIZE, BY PRODUCT, 2020–2027 (USD MILLION)

TABLE 121 SOUTH AMERICA: MARKET SIZE, BY FLAVOR, 2020–2027 (USD MILLION)

TABLE 122 SOUTH AMERICA: MARKET SIZE, BY DISTRIBUTION CHANNEL, 2020–2027 (USD MILLION)

11.6.2 AFRICA

11.6.2.1 Growing Demand of Savory Snacks and Better Marketing Escalating the Market Growth

TABLE 123 AFRICA: MARKET SIZE, BY PRODUCT, 2020–2027 (USD MILLION)

TABLE 124 AFRICA: MARKET SIZE, BY FLAVOR, 2020–2027 (USD MILLION)

TABLE 125 AFRICA: MARKET SIZE, BY DISTRIBUTION CHANNEL, 2020–2027 (USD MILLION)

11.6.3 TURKEY

11.6.3.1 Rising Consumption of Indulgence Snacks Increasing the Market Growth

TABLE 126 TURKEY: MARKET SIZE, BY PRODUCT, 2020–2027 (USD MILLION)

TABLE 127 TURKEY: MARKET SIZE, BY FLAVOR, 2020–2027 (USD MILLION)

TABLE 128 TURKEY: MARKET SIZE, BY DISTRIBUTION CHANNEL, 2020–2027 (USD MILLION)

11.6.4 MIDDLE EAST

11.6.4.1 International Brands Driving the Market Growth

TABLE 129 MIDDLE EAST: MARKET SIZE, BY PRODUCT, 2020–2027 (USD MILLION)

TABLE 130 MIDDLE EAST: MARKET SIZE, BY FLAVOR, 2020–2027 (USD MILLION)

TABLE 131 MIDDLE EAST: MARKET SIZE, BY DISTRIBUTION CHANNEL, 2020–2027 (USD MILLION)

12 COMPETITIVE LANDSCAPE (Page No. - 146)

12.1 OVERVIEW: SAVORY SNACK PRODUCTS MARKET

12.2 MARKET SHARE ANALYSIS, 2020

TABLE 132 MARKET SHARE ANALYSIS, 2020

12.3 HISTORICAL REVENUE ANALYSIS OF KEY PLAYERS

FIGURE 34 FIVE-YEAR TOTAL REVENUE ANALYSIS OF KEY PLAYERS IN THE MARKET, 2016–2020 (USD BILLION)

12.4 COVID-19-SPECIFIC COMPANY RESPONSE

12.4.1 PEPSICO

12.4.2 KELLOGG CO

12.4.3 GENERAL MILLS INC.

12.4.4 CALBEE

12.4.5 ITC LIMITED

12.5 COMPANY EVALUATION QUADRANT

12.5.1 STARS

12.5.2 PERVASIVE PLAYERS

12.5.3 EMERGING LEADERS

12.5.4 PARTICIPANTS

FIGURE 35 SAVORY SNACKS PRODUCTS MARKET, COMPANY EVALUATION QUADRANT, 2020

12.5.5 PRODUCT FOOTPRINT (KEY PLAYERS)

TABLE 133 COMPANY FOOTPRINT, BY PRODUCT

TABLE 134 COMPANY FOOTPRINT, BY FLAVOR

TABLE 135 COMPANY FOOTPRINT, BY DISTRIBUTION CHANNEL

TABLE 136 COMPANY REGIONAL, BY REGIONAL FOOTPRINT

TABLE 137 OVERALL COMPANY FOOTPRINT

12.6 COMPETITIVE SCENARIO

12.6.1 NEW PRODUCT LAUNCHES

TABLE 138 MARKET: NEW PRODUCT LAUNCHES, 2018-2021

12.6.2 DEALS

TABLE 139 MARKET: DEALS, 2018-2022

12.6.3 OTHERS

TABLE 140 MARKET: OTHERS, 2019-2021

13 COMPANY PROFILES (Page No. - 159)

13.1 KEY PLAYERS IN THE SAVORY SNACK PRODUCTS MARKET

(Business overview, Products/solutions/services offered, Recent Developments, MNM view)*

13.1.1 PEPSICO

TABLE 141 PEPSICO: BUSINESS OVERVIEW

FIGURE 36 PEPSICO: COMPANY SNAPSHOT

TABLE 142 PEPSICO: PRODUCTS/SOLUTIONS/SERVICES OFFERED

TABLE 143 PEPSICO: NEW PRODUCT LAUNCHES

TABLE 144 PEPSICO: DEALS

13.1.2 KELLOGG CO.

TABLE 145 KELLOGG CO.: BUSINESS OVERVIEW

FIGURE 37 KELLOGG CO.: COMPANY SNAPSHOT

TABLE 146 KELLOGG CO.: PRODUCTS/SOLUTIONS/SERVICES OFFERED

TABLE 147 KELLOGG CO.: NEW PRODUCT LAUNCHES

TABLE 148 KELLOGG CO.: OTHERS

13.1.3 GENERAL MILLS, INC.

TABLE 149 GENERAL MILLS INC.: BUSINESS OVERVIEW

FIGURE 38 GENERAL MILLS INC.: COMPANY SNAPSHOT

TABLE 150 GENERAL MILLS INC.: PRODUCTS/SOLUTIONS/SERVICES OFFERED

TABLE 151 GENERAL MILLS INC.: NEW PRODUCT LAUNCHES

TABLE 152 GENERAL MILLS INC.: OTHERS

13.1.4 CALBEE

TABLE 153 CALBEE: SAVORY SNACK PRODUCTS MARKET BUSINESS OVERVIEW

FIGURE 39 CALBEE: COMPANY SNAPSHOT

TABLE 154 CALBEE: PRODUCTS/SOLUTIONS/SERVICES OFFERED

TABLE 155 CALBEE: NEW PRODUCT LAUNCHES

TABLE 156 CALBEE: DEALS

TABLE 157 CALBEE: OTHERS

13.1.5 ITC LIMITED

TABLE 158 ITC LIMITED: BUSINESS OVERVIEW

FIGURE 40 ITC LIMITED: COMPANY SNAPSHOT

TABLE 159 ITC LIMITED: PRODUCTS/SOLUTIONS/SERVICES OFFERED

TABLE 160 ITC LIMITED: NEW PRODUCT LAUNCHES

TABLE 161 ITC LIMITED: OTHERS

13.1.6 MONDELEZ INTERNATIONAL

TABLE 162 MONDELEZ INTERNATIONAL: BUSINESS OVERVIEW

FIGURE 41 MONDELEZ INTERNATIONAL: COMPANY SNAPSHOT

TABLE 163 MONDELEZ INTERNATIONAL: PRODUCTS/SOLUTIONS/SERVICES OFFERED

TABLE 164 MONDELEZ INTERNATIONAL: DEALS

13.1.7 NESTLE SA

TABLE 165 NESTLE SA: BUSINESS OVERVIEW

FIGURE 42 NESTLE SA: COMPANY SNAPSHOT

TABLE 166 NESTLE SA: PRODUCTS/SOLUTIONS/SERVICES OFFERED

13.1.8 GRUPO BIMBO

TABLE 167 GRUPO BIMBO: SAVORY SNACK PRODUCTS MARKET BUSINESS OVERVIEW

FIGURE 43 GRUPO BIMBO: COMPANY SNAPSHOT

TABLE 168 GRUPO BIMBO: PRODUCTS/SOLUTIONS/SERVICES OFFERED

TABLE 169 GRUPO BIMBO: NEW PRODUCT LAUNCHES

TABLE 170 GRUPO BIMBO: OTHERS

13.1.9 HAIN CELESTIAL

TABLE 171 HAIN CELESTIAL: BUSINESS OVERVIEW

FIGURE 44 HAIN CELESTIAL: COMPANY SNAPSHOT

TABLE 172 HAIN CELESTIAL: PRODUCTS/SOLUTIONS/SERVICES OFFERED

TABLE 173 HAIN CELESTIAL: NEW PRODUCT LAUNCHES

TABLE 174 HAIN CELESTIAL: DEALS

13.1.10 BLUE DIAMOND GROWERS

TABLE 175 BLUE DIAMOND GROWERS: BUSINESS OVERVIEW

TABLE 176 BLUE DIAMOND GROWERS: PRODUCTS/SOLUTIONS/SERVICES OFFERED

TABLE 177 BLUE DIAMOND GROWERS: OTHERS

13.2 OTHER PLAYERS

13.2.1 CONAGRA BRANDS

TABLE 178 CONAGRA BRANDS: BUSINESS OVERVIEW

FIGURE 45 CONAGRA BRANDS: COMPANY SNAPSHOT

TABLE 179 CONAGRA BRANDS: PRODUCTS/SOLUTIONS/SERVICES OFFERED

13.2.2 THE KRAFT HEINZ COMPANY

TABLE 180 THE KRAFT HEINZ COMPANY: BUSINESS OVERVIEW

FIGURE 46 THE KRAFT HEINZ COMPANY: COMPANY SNAPSHOT

TABLE 181 THE KRAFT HEINZ COMPANY: PRODUCTS/SOLUTIONS/SERVICES OFFERED

13.2.3 MARS, INCORPORATED

TABLE 182 MARS, INCORPORATED: SAVORY SNACK PRODUCTS MARKET BUSINESS OVERVIEW

TABLE 183 MARS, INCORPORATED: PRODUCTS/SOLUTIONS/SERVICES OFFERED

13.2.4 UNIVERSAL ROBINA CORPORATION

TABLE 184 UNIVERSAL ROBINA CORPORATION: BUSINESS OVERVIEW

TABLE 185 UNIVERSAL ROBINA CORPORATION: PRODUCTS/SOLUTIONS/SERVICES OFFERED

13.2.5 THE LORENZ BAHLSEN SNACK-WORLD GMBH & CO KG GERMANY

TABLE 186 THE LORENZ BAHLSEN SNACK-WORLD GMBH & CO KG GERMANY: BUSINESS OVERVIEW

TABLE 187 THE LORENZ BAHLSEN SNACK-WORLD GMBH & CO KG GERMANY: PRODUCTS/ SOLUTIONS/SERVICES OFFERED

13.2.6 CAMPBELL SOUP COMPANY

13.2.7 OLD DUTCH FOODS INC.

13.2.8 AMICA CHIPS S.P.A.

13.2.9 INTERSNACK GROUP GMBH & CO.

13.2.10 TROPICAL HEAT

*Details on Business overview, Products/solutions/services offered, Recent Developments, MNM view might not be captured in case of unlisted companies.

14 ADJACENT AND RELATED MARKETS (Page No. - 204)

14.1 INTRODUCTION

TABLE 188 ADJACENT MARKETS TO SAVORY SNACK PRODUCTS MARKET

14.2 LIMITATIONS

14.3 FOOD EXTRUSION MARKET

14.3.1 MARKET DEFINITION

14.3.2 MARKET OVERVIEW

TABLE 189 FOOD EXTRUSION MARKET, BY PRODUCT TYPE, 2021–2026 (USD MILLION)

14.4 EXTRUDED SNACKS MARKET

14.4.1 MARKET DEFINITION

14.4.2 MARKET OVERVIEW

TABLE 190 EXTRUDED SNACKS MARKET, BY TYPE, 2017–2026 (USD MILLION)

15 APPENDIX (Page No. - 207)

15.1 DISCUSSION GUIDE

15.2 KNOWLEDGE STORE: MARKETSANDMARKETS’ SUBSCRIPTION PORTAL

15.3 AVAILABLE CUSTOMIZATIONS

15.4 RELATED REPORTS

15.5 AUTHOR DETAILS

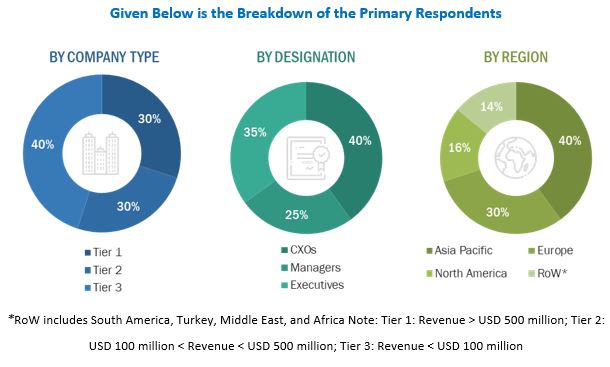

The study involved four major activities in estimating savory snack products market size. Exhaustive secondary research was conducted to collect information on the market, peer market, and parent market. The next step was to validate these findings, assumptions, and sizing with industry experts across the value chain through primary research. Both the demand-side and supply-side approaches were employed to estimate the complete market size. Thereafter, market breakdown and data triangulation were used to estimate the market size of segments and sub-segments.

Secondary Research

In the secondary research process, various secondary sources, such as Hoovers, Bloomberg BusinessWeek, and Dun & Bradstreet, were referred to, to identify and collect information for this study. These secondary sources included annual reports, press releases & investor presentations of companies, white papers, certified publications, articles by recognized authors, gold & silver standard websites, regulatory bodies, trade directories, and databases.

Primary Research

The market comprises several stakeholders, such as raw material suppliers, processors, end-product manufacturers, and regulatory organizations in the supply chain. The demand side of the market is characterized by the presence of processed food & beverage manufacturers, and government & research organizations. The supply side is characterized by the presence of savory snack products manufacturer, distributors, marketing directors, research officers and quality control officers, and key executives from various key companies and organizations operating in savory snack products market. Various primary sources from both the supply and demand sides of the market were interviewed to obtain qualitative and quantitative information.

To know about the assumptions considered for the study, download the pdf brochure

Savory Snack Products Market Size Estimation

Both the top-down and bottom-up approaches were used to estimate and validate the total size of market. These methods were also used extensively to estimate the size of various subsegments in the market. The research methodology used to estimate the market size include the following:

- The key players were identified through extensive primary and secondary research.

- The value chain and market size of market, in terms of value and volume, were determined through primary and secondary research.

- All percentage shares, splits, and breakdowns were determined using secondary sources and verified through primary sources.

- All possible parameters that affect the market covered in this research study were accounted for, viewed in extensive detail, verified through primary research, and analyzed to obtain the final quantitative and qualitative data.

- The research included the study of reports, reviews, newsletters of top market players, along with extensive interviews for opinions from key leaders, such as CEOs, directors, and marketing executives.

Data Triangulation

After arriving at the overall market size from the estimation process described above, the total market was split into several segments. To complete the overall market engineering process and arrive at the exact statistics for all segments, the data triangulation and market breakdown procedures were employed, wherever applicable. The data was triangulated by studying various factors and trends from both the demand and supply sides. In addition, the market size was validated using both top-down and bottom-up approaches. It was then verified through primary interviews. Hence, three approaches were adopted—top-down approach, bottom-up approach, and the one involving expert interviews. Only when the values arrived at from the three points matches, the data is assumed to be correct.

Savory Snack Products Market Report Objectives

- Determining and projecting the size of the market, with respect to its product, flavor, distribution channel and regional markets, from 2021 to 2026

- To describe and forecast market, in terms of value, by region–North America, Europe, Asia Pacific, and the Rest of the World—along with their respective countries

- To strategically analyze micro-markets with respect to individual growth trends, prospects, and contributions to the overall market

- To study the complete value chain of the market

- Identifying the attractive opportunities in the market by determining the largest and fastest-growing segments across regions

- Providing detailed information about the key factors influencing the growth of the market (drivers, restraints, opportunities, and industry-specific challenges)

- To strategically profile the key players and comprehensively analyze their market positions, in terms of ranking and core competencies, along with details on the competitive landscape of market leaders

- To analyze strategic approaches, such as expansions & investments, product launches & approvals, mergers & acquisitions, and agreements in savory snack products market

Available Customizations

Based on the given market data, MarketsandMarkets offers customizations in the reports according to client-specific requirements. The available customization options are as follows:

Product Analysis

- Product Matrix, which gives a detailed comparison of the product portfolio of each company

Geographic Analysis

- Further breakdown of the Rest of Asia Pacific savory snack products market, by key country

- Further breakdown of the Rest of European market, by key country

Company Information

- Detailed analyses and profiling of additional market players (up to five)

Generating Response ...

Generating Response ...

Growth opportunities and latent adjacency in Savory Snack Products Market