Frozen Bakery Products Market

Frozen Bakery Products Market by Type (Bread, Pizza Crusts, Cake & Pastries), By Distribution Channel (Conventional Stores, Specialty Stores, Foodservice Providers), By Specialty Type, By Form of Consumption, and Region – Global Forecast to 2030

OVERVIEW

Source: Secondary Research, Interviews with Experts, MarketsandMarkets Analysis

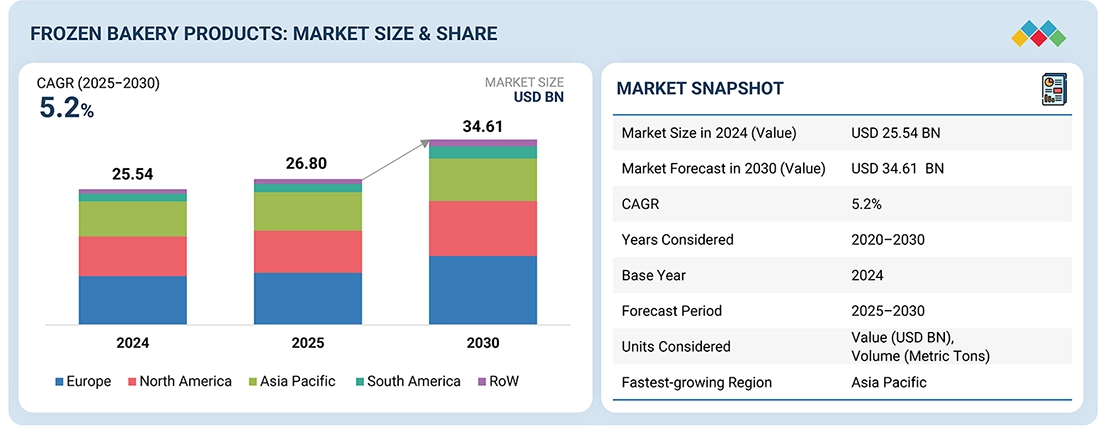

The frozen bakery products market is projected to reach USD 34.61 billion by 2030, up from USD 25.54 billion in 2024, at a CAGR of approximately 5.2% from 2025 to 2030. Market growth is supported by rising urbanization, evolving consumer preferences for convenient and ready-to-bake foods, and the expansion of modern retail and foodservice channels. Strengthening cold-chain infrastructure and broader product availability across supermarkets, hypermarkets, and quick-service restaurants continue to reinforce market demand.

KEY TAKEAWAYS

-

BY REGIONEurope accounted for 57.07% of the frozen bakery products market in 2024.

-

BY TYPEAmong types, the bread segment is projected to hold the largest market share by 2030.

-

BY DISTRIBUTION CHANNELBy distribution channel, the foodservice providers segment is poised to register the highest CAGR of 6.0%.

-

BY FORM OF CONSUMPTIONThe ready-to-bake segment accounted for 42.08% of the frozen bakery market, by form of consumption, in 2024.

-

BY SPECIALTY TYPEBy specialty type, the non-specialty segment is projected to have a large share.

-

COMPETITIVE LANDSCAPE (Key Players)Key market leaders such as Grupo Bimbo, ARYZTA AG, General Mills, and Europastry dominate the frozen bakery market through extensive product portfolios, strong global distribution, and deep expertise in frozen dough and fully baked bakery solutions. These players are heavily investing in automation, rapid-freeze technologies, high-quality dough formulations, and product innovation, while strategic partnerships, acquisitions, and expansion into foodservice channels remain core competitive strategies.

-

COMPETITIVE LANDSCAPE (SMEs/STARTUPs)Bridor, Baker & Baker, Toufayan Bakery, Bakers Circle, and Dawn Food Products have distinguished themselves within the SME landscape by building strong footholds in niche frozen bakery and dough segments, leveraging localized distribution networks, and focusing on foodservice and regional demand pockets, underscoring their growing role in the fragmented frozen bakery products market.

Frozen bakery products play a crucial role in meeting the growing demand for convenient, ready-to-bake and ready-to-eat solutions across global markets. They offer extended shelf life, consistent quality, and reduced preparation time, making them essential for both retail and foodservice channels. The category includes frozen breads, pastries, cakes, and savory items developed to align with evolving consumer lifestyles, modern retail expansion, and improvements in cold-chain logistics. As consumer preferences shift toward convenience without compromising taste or freshness, the market continues to benefit from advancements in freezing technology, product diversification, and widespread availability in supermarkets, hypermarkets, and quick-service restaurants.

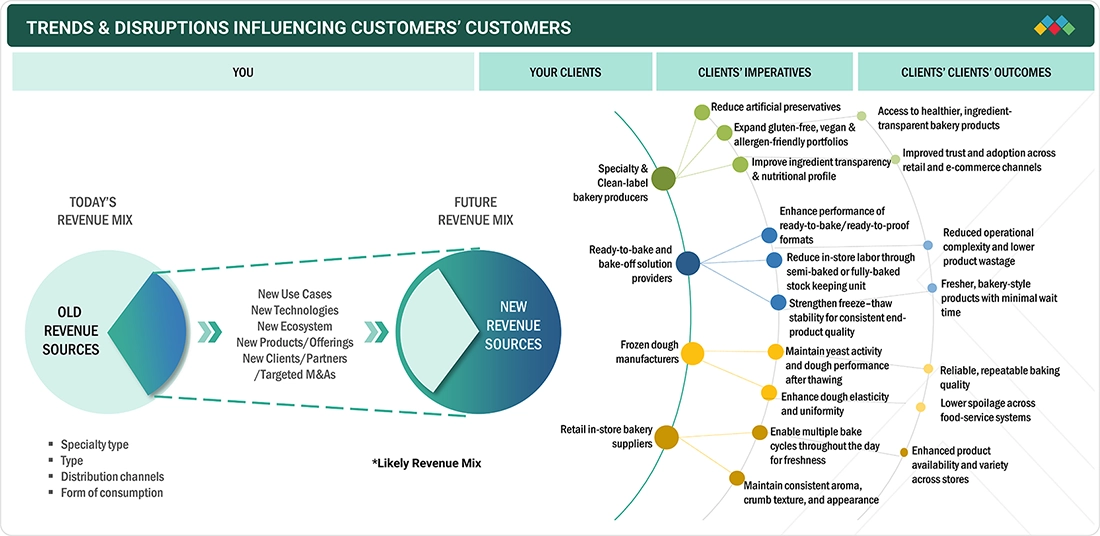

TRENDS & DISRUPTIONS IMPACTING CUSTOMERS' CUSTOMERS

Consumer businesses in the frozen bakery products market are shaped by evolving food consumption trends, shifts in retail and foodservice operations, and ongoing pressures across global cold-chain networks. Supermarkets, hypermarkets, quick-service restaurants, cafés, in-store bakery counters, and e-commerce grocery platforms remain the primary end users of frozen bakery solutions. Rising demand for convenience, freshness, and ready-to-bake or ready-to-serve formats significantly influences the operational efficiency, assortment strategies, and revenue generation of these end users. These shifts directly accelerate the adoption of frozen breads, pastries, croissants, pizza bases, dough products, and fully baked items, reinforcing the market’s growth trajectory and strengthening the role of frozen bakery manufacturers and suppliers within modern retail and foodservice ecosystems.

Source: Secondary Research, Interviews with Experts, MarketsandMarkets Analysis

MARKET DYNAMICS

Level

-

• Rising demand for convenient, ready-to-eat and ready-to-bake bakery items

-

• Advancements in freezing and cold-chain technologies improving shelf life and product quality

Level

-

• High operational costs associated with refrigerated storage and temperature-controlled logistics

-

• Consumer preference for fresh bakery products, limiting frozen category penetration

Level

-

• Growing adoption of clean-label, whole-grain, and specialty frozen bakery formulations

-

• Expansion of modern retail and foodservice channels across emerging markets

Level

-

• Supply-chain and temperature-sensitive handling complexities impacting product consistency

-

• Raw material volatility

Source: Secondary Research, Interviews with Experts, MarketsandMarkets Analysis

Driver: Rising demand for convenient, ready-to-eat and ready-to-bake bakery items

The frozen bakery sector is growing rapidly as consumers increasingly prefer convenient meal and snack options that fit busy lifestyles. Products such as frozen breads, pastries, pizzas, cakes, and doughs provide quick preparation, longer shelf lives, and reliable quality, making them ideal for households, foodservice providers, and institutional buyers. The rise in working populations and urbanization further supports this trend, as consumers seek products that save time in the kitchen while still offering freshness and flavor. Advances in product formulation and the development of artisanal-style frozen baked goods have improved taste and texture, narrowing the gap between frozen and fresh-baked items. Consequently, frozen bakery products are now key elements in modern retail shelves and quick-service restaurant menus, fueling steady market growth.

Restraint: High operational costs associated with refrigerated storage and temperature-controlled logistics

Despite their strong market appeal, frozen bakery products require a robust cold chain, which significantly raises operational costs for manufacturers, distributors, and retailers. Maintaining subzero temperatures across production, storage, transportation, and point-of-sale stages requires continuous energy use, specialized equipment, and highly coordinated logistics. These costs are further magnified in regions with unreliable infrastructure or high electricity prices, creating barriers to entry for smaller bakeries and limiting market penetration in developing economies. Any disruption in the cold chain can lead to product spoilage, safety risks, and financial losses, making frozen bakery operations inherently more capital-intensive than ambient or fresh bakery formats. As a result, cost pressures remain a major constraint on scaling and profitability in the frozen bakery value chain.

Opportunity: Growing adoption of clean-label, whole-grain, and specialty frozen bakery formulations

Health-conscious consumers are increasingly shaping purchasing decisions in the frozen bakery category, creating strong opportunities for manufacturers to innovate with clean-label, whole-grain, high-fiber, gluten-free, and reduced-sugar formulations. These products address rising concerns about processed foods and align with broader trends toward transparency, natural ingredients, and nutritional value. Companies that invest in reformulating traditional frozen bakery items with premium ingredients, fewer additives, and improved nutritional profiles are gaining traction across retail and foodservice channels. Additionally, demand for specialty and artisanal-inspired frozen bakery items, such as sourdough loaves, protein-enriched variants, and vegan pastries, is accelerating, particularly in North America and Europe. This shift toward premium and functional frozen bakery offerings presents a substantial opportunity for differentiation and market growth.

Challenge: Supply-chain and temperature-sensitive handling complexities impacting product consistency

Frozen bakery products rely on stringent temperature control to preserve texture, flavor, and structure from production through final consumption. Even minor deviations in storage or transport conditions can cause thawing, moisture migration, crystallization, or microbial risks that compromise product integrity and customer satisfaction. These sensitivities increase the operational burden on retailers, distributors, and foodservice operators, who must maintain reliable freezer capacity and monitor temperatures consistently. The sector is also vulnerable to broader supply-chain disruptions, including shortages of refrigerated transport, rising energy costs, and labor constraints in logistics and warehousing. Ensuring product stability throughout the extended supply network remains a critical challenge for manufacturers seeking to deliver high-quality frozen bakery products in a scalable and cost-efficient manner.

FROZEN BAKERY PRODUCTS MARKET: COMMERCIAL USE CASES ACROSS INDUSTRIES

| COMPANY | USE CASE DESCRIPTION | BENEFITS |

|---|---|---|

|

Uses frozen croissants, muffins, Danish pastries, and other bakery items | Ensures consistent product quality across outlets, supports multiple daily bake cycles, and reduces reliance on skilled in-store bakers |

|

Uses frozen bread, rolls, pastries, and dough for in-store | Enhances freshness perception, minimizes food waste, expands bakery assortment, and enables continuous baking |

|

Operates bake-off programs using frozen part-baked breads, pastries, and specialty items | Ensures availability throughout the day, reduces preparation time, and standardizes product quality |

|

Uses frozen breads, rolls, croissants, and dessert bases | Delivers consistent quality at scale, ensures food safety, and supports efficient large-batch production for global routes |

Logos and trademarks shown above are the property of their respective owners. Their use here is for informational and illustrative purposes only.

MARKET ECOSYSTEM

The frozen bakery products ecosystem brings together manufacturers, regulatory bodies, distributors, and end-use foodservice and retail companies. Manufacturers produce frozen bread, pastries, cakes, and pizza bases using processes that preserve freshness and extend shelf life. Distributors and cold-chain partners connect producers with supermarkets, QSRs, cafés, and hotels, ensuring consistent quality during storage and transport. Regulatory authorities oversee food safety, labeling, and temperature-control standards. This ecosystem supports reliable supply, convenience, and consistent product availability across global markets.

Logos and trademarks shown above are the property of their respective owners. Their use here is for informational and illustrative purposes only.

MARKET SEGMENTS

Source: Secondary Research, Interviews with Experts, MarketsandMarkets Analysis

Frozen Bakery Products Market, By Specialty Type

Within the specialty type segment, non-specialty products hold the dominant share of the global frozen bakery products market. This strong position is driven by widespread consumption of traditional frozen bread, pastries, dough, and bakery snacks that offer familiar taste profiles, affordability, and consistent quality. Non-specialty frozen bakery items are widely used in households, retail bakeries, cafés, and foodservice chains due to their long shelf life, ease of preparation, and broad product variety. Their mainstream appeal, reliable supply through established cold-chain networks, and suitability for high-volume commercial use continue to reinforce the non-specialty segment as the leading category in the frozen bakery products market.

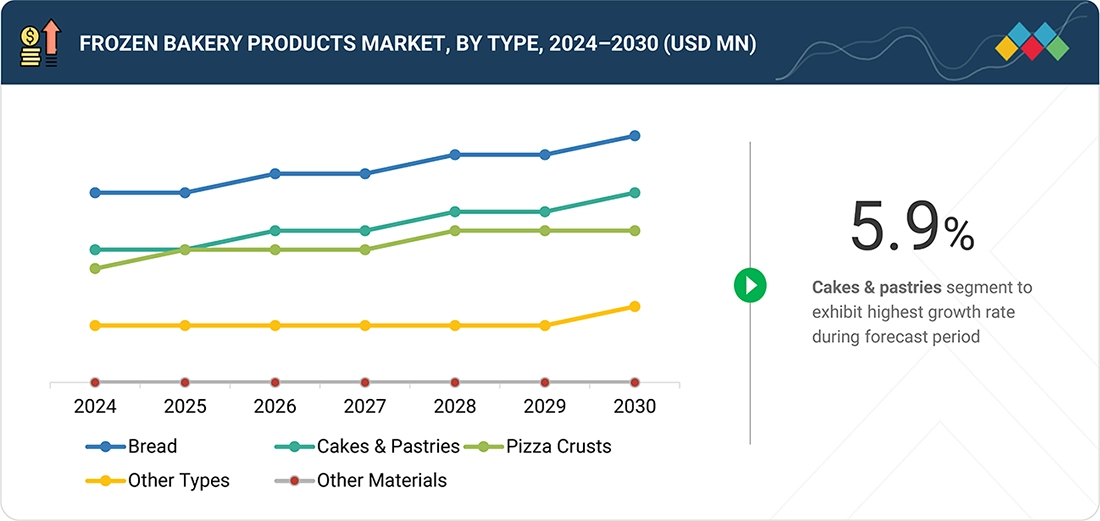

Frozen Bakery Products Market, By Type

Within the type segment, bread, comprising buns, donuts, scones, and loaves, holds the largest share of the global frozen bakery products market. Its leading position is supported by widespread household and foodservice use, consistent demand for ready-to-bake and par-baked formats, and frozen bread's role as a staple across diverse cuisines. Bread products offer long shelf life, ease of handling, and reduced preparation time, making them highly preferred by quick-service restaurants, cafés, and institutional kitchens. Their versatility, strong retail penetration, and steady consumption patterns continue to reinforce bread's dominance in the frozen bakery products market.

Frozen Bakery Products Market, By Distribution Channel

Among distribution channels, foodservice providers represent the fastest-growing segment of the global frozen bakery products market. This growth is driven by high-volume demand for frozen bread, pastries, pizza bases, and dough products that deliver consistent quality, reduce preparation time, and minimize operational complexity. Hotels, restaurants, cafés, quick-service chains, and institutional kitchens rely heavily on frozen bakery items to streamline workflows, ensure standardization, and manage peak service periods efficiently. This sustained dependence on convenient, ready-to-bake formats continues to reinforce foodservice providers as the leading channel for frozen bakery product distribution.

Frozen Bakery Products Market, By Form of Consumption

By form of consumption, the ready-to-bake category, which includes partially baked frozen products, holds the largest share of the global frozen bakery products market. Its dominance is driven by strong adoption across retail bakeries, cafés, QSRs, and institutional kitchens that rely on ready-to-bake croissants, pastries, bread rolls, and pizza bases to deliver consistent freshness with minimal preparation time. The ability to bake items on demand, reduce labor intensity, and maintain product uniformity makes ready-to-bake formats the preferred choice for both foodservice operators and households, reinforcing their position as the leading consumption format in the frozen bakery market.

REGION

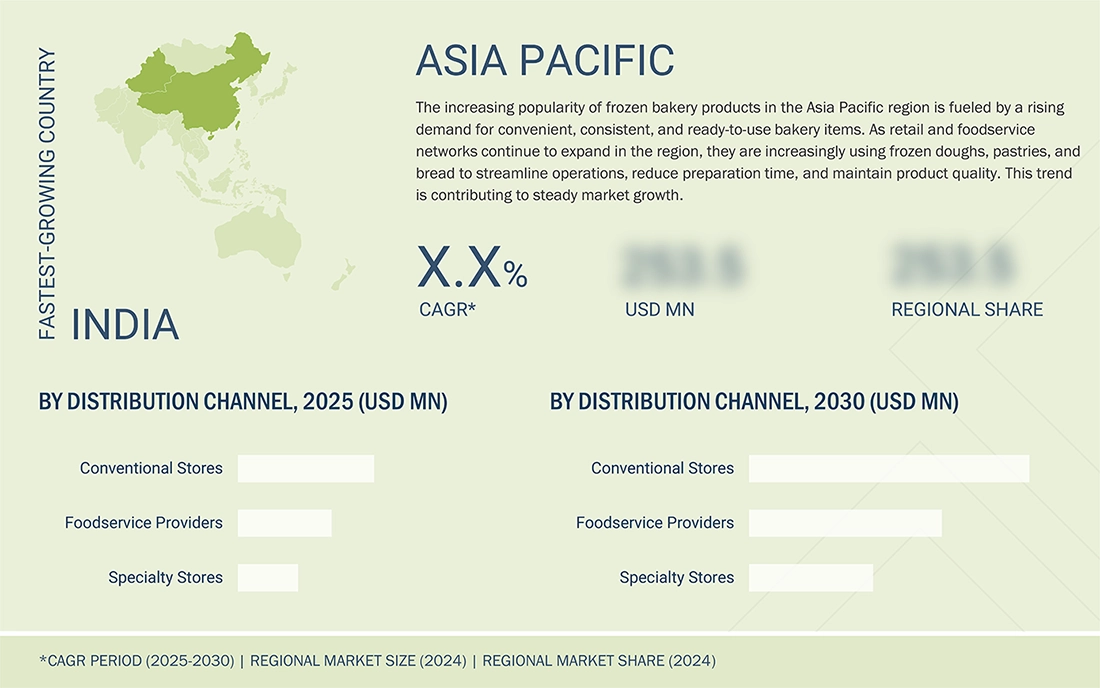

Asia Pacific projected to be fastest-growing region in frozen bakery products market

Asia Pacific is recognized as the fastest-growing region in the frozen bakery products market, supported by rapid urbanization, rising disposable incomes, and growing demand for convenient ready-to-eat and ready-to-bake bakery items. The region’s expanding middle class and growing preference for Western-style bakery products are driving strong uptake, with China leading in market size and India emerging as the fastest-growing market. Growth is further supported by the expansion of modern retail, improved cold chain infrastructure, and the rise of e-commerce platforms, which are enhancing access to frozen bakery products. Additionally, rapid development in the foodservice sector, including cafés and quick-service restaurants, is boosting demand for frozen dough and partially baked items. These factors collectively position Asia Pacific as a key driver of growth in the global frozen bakery products market.

FROZEN BAKERY PRODUCTS MARKET: COMPANY EVALUATION MATRIX

In the frozen bakery products market, the key companies profiled include Grupo Bimbo, ARYZTA AG, Europastry, Lantmännen Unibake, Vandemoortele, Associated British Foods plc, Kellogg Company, Conagra Brands, Inc., and Premier Foods Group Limited.

Source: Secondary Research, Interviews with Experts, MarketsandMarkets Analysis

KEY MARKET PLAYERS

- Group Bimbo (Mexico)

- ARYZTA AG (Switzerland)

- Europastry (Spain)

- Lantmännen Unibake (Sweden)

- Vandemoortele (Belgium)

- Associated British Foods plc (UK)

- Kellogg Company (US)

- Conagra Brands, Inc. (US)

- Cargill, Incorporated (US)

- Flowers Foods (US)

- Rich Products Corporation (US)

- Dr. Oetker KG (Germany)

- Sunbulah Group (Saudi Arabia)

- La Lorraine Bakery Group (Belgium)

- Premier Foods Group Limited (UK)

MARKET SCOPE

| REPORT METRIC | DETAILS |

|---|---|

| Market Size in 2024 (Value) | USD 25.54 Billion |

| Market Forecast in 2030 (Value) | USD 34.61 Billion |

| Growth Rate | CAGR of 5.2% from 2025-2030 |

| Years Considered | 2020–2030 |

| Base Year | 2024 |

| Forecast Period | 2025–2030 |

| Units Considered | Value (USD Million/Billion), Volume (Metric Tons) |

| Report Coverage | Revenue forecast, company ranking, competitive landscape, growth factors, and trends |

| Segments Covered |

|

| Regions Covered | North America, Europe, Asia Pacific, South America, RoW |

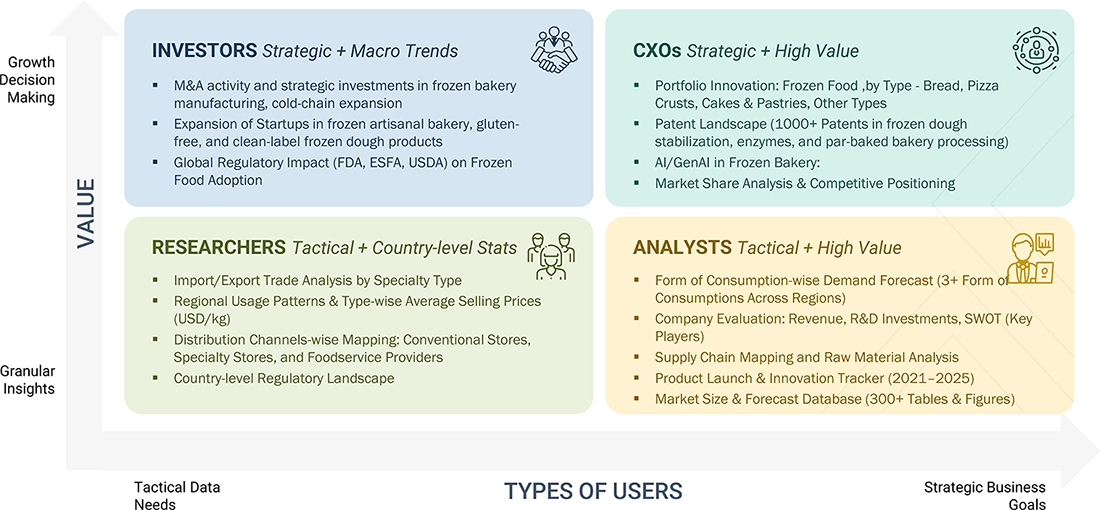

WHAT IS IN IT FOR YOU: FROZEN BAKERY PRODUCTS MARKET REPORT CONTENT GUIDE

DELIVERED CUSTOMIZATIONS

We have successfully delivered the following deep-dive customizations:

| CLIENT REQUEST | CUSTOMIZATION DELIVERED | VALUE ADDS |

|---|---|---|

| Frozen Foods Market |

|

|

| Nut Products Market |

|

|

| Food Inclusions Market |

|

|

RECENT DEVELOPMENTS

- July 2025 : Europastry acquired a majority stake in Art of Baking, a Thailand-based frozen bakery specializing in sweet and savory pastries, flatbreads, and pizza bases, with an annual production capacity of ~15,000 tonnes and exports to Japan, Singapore, and the Philippines. The deal also involved strategic partners, including Minor International and Srifa Bakery, which retained minority stakes. This move accelerates product innovation and frozen bakery growth in Asia Pacific.

- March 2025 : Vandemoortele acquired Délifrance, creating one of the largest global players in the frozen bakery segment. The deal brings together Délifrance’s extensive frozen bakery portfolio, including croissants, Danish pastries, artisan breads, and savory bake-off items, with Vandemoortele’s established footprint across Europe. Strategically, the acquisition enhances geographic reach across Europe and Asia, strengthens its position in foodservice and retail frozen formats, and accelerates innovation in high-growth frozen viennoiserie and bake-off technologies.

- June 2024 : La Lorraine Bakery Group entered the North American market by acquiring a 50% stake in US-based Bakery de France, a manufacturer of frozen and par-baked artisan breads, baguettes, and rolls. The partnership provides LLBG with an immediate production and distribution platform in the US, strengthening its global frozen bakery footprint. The joint venture supports LLBG’s strategy to expand internationally in high-growth markets and to enhance its ability to supply frozen bakery products to retail, foodservice, and bakery-café channels across North America.

Table of Contents

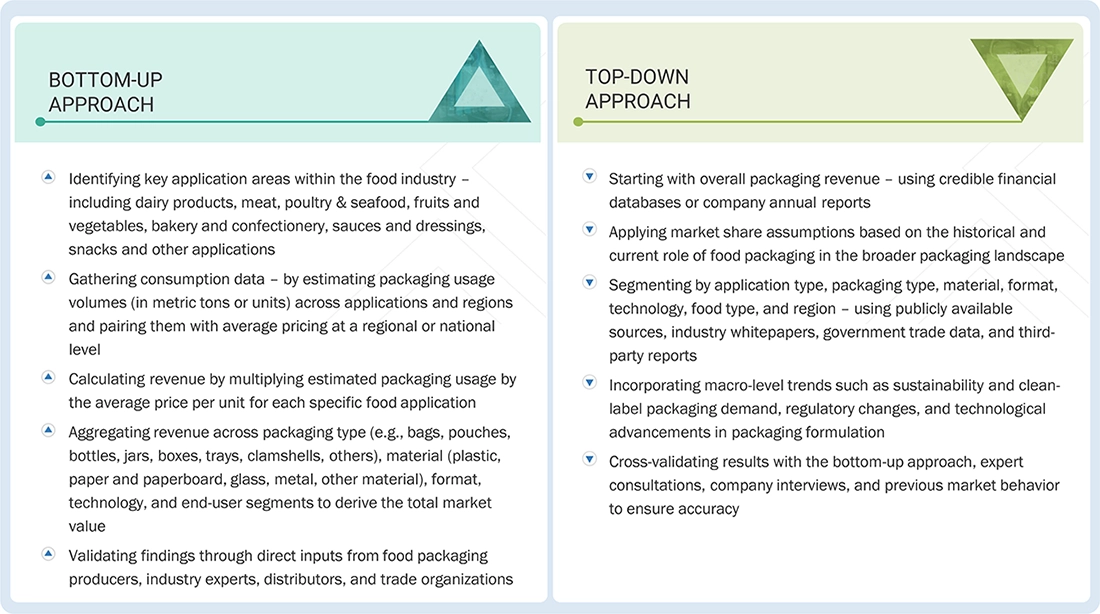

Methodology

The study employed two primary approaches to estimate the current size of the frozen bakery products market. Exhaustive secondary research was conducted to gather information on the market, peer markets, and parent markets. The next step was to validate these findings, assumptions, and sizing with industry experts across the value chain through primary research. Both top-down and bottom-up approaches were used to estimate the total market size. After that, market breakdown and data triangulation were used to estimate the market size of segments and subsegments.

Secondary Research

This research study relied extensively on secondary sources—directories and databases such as Bloomberg Businessweek and Factiva—to identify and collect information useful for a technical, market-oriented, and commercial study of the market.

In the secondary research process, various sources, including annual reports, press releases and investor presentations from companies, white papers, food journals, certified publications, articles by recognized authors, directories, and databases, were consulted to identify and collect information.

Secondary research was primarily used to obtain key information about the industry’s supply chain, the total pool of key players, market classification and segmentation, regional markets, and key developments, as well as industry trends, from both market- and technology-oriented perspectives.

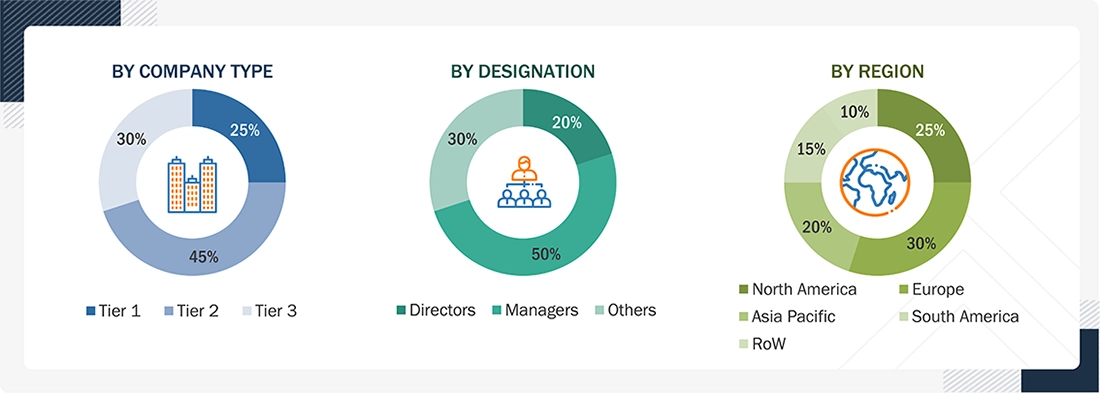

Pimary Research

Extensive primary research was conducted after gathering information on the frozen bakery products market through secondary research. Several primary interviews were conducted with market experts from both the demand and supply sides across major countries in North America, Europe, Asia-Pacific, South America, and RoW. Primary data was collected through questionnaires, emails, and telephonic interviews. The primary sources from the supply side included industry experts such as Chief X Officers (CXOs), Vice Presidents (VPs), Directors from business development, marketing, research, and development teams, and key opinion leaders. Primary interviews were conducted to gather insights such as market statistics, revenue data for products and services, market breakdowns, market size estimates, market forecasts, and data triangulation. Primary research also helped in understanding various trends related to frozen bakery products by type, specialty, distribution channels, and form of consumption. Stakeholders from the demand side, such as research institutions and universities, and third-party vendors, were interviewed to understand the buyer’s perspective on the service, their current usage of frozen bakery products, and the outlook of their business, which will affect the overall market.

Breakdown of Primary Interviews

To know about the assumptions considered for the study, download the pdf brochure

Note: The three tiers of companies are defined based on their total revenue in 2023 or 2024, as per the availability of financial data: Tier 1: Revenue >USD 1 billion; Tier 2: USD 100 million ≤ Revenue ≤ USD 1 billion; Tier 3: Revenue <USD 100 million.

|

COMPANY NAME |

DESIGNATION |

|

Kellogg Company (US) |

R&D Expert |

|

Conagra Brands, Inc. (US) |

Sales Manager |

|

Vandemoortele (Belgium) |

Manager |

|

Flowers Foods (US) |

Sales Manager |

|

Bakers Circle (India) |

Marketing Manager |

Market Size Estimation

Both the top-down and bottom-up approaches were used to estimate and validate the total size of the frozen bakery products market. These approaches were also used extensively to determine the size of various subsegments within the market. The research methodology for estimating the market size includes the following details:

- The key players in the industry and the overall markets were identified through extensive secondary research.

- All shares, splits, and breakdowns were determined using secondary sources and verified through primary sources.

- All possible parameters that affect the market covered in this research study were accounted for, viewed in extensive detail, verified through primary research, and analyzed to obtain final quantitative and qualitative data.

- The research included the study of reports, reviews, and newsletters of top market players, along with extensive interviews for opinions from leaders, such as CEOs, directors, and marketing executives.

Frozen Bakery Products Market : Top-Down and Bottom-Up Approach

Data Triangulation

After determining the overall market size through the estimation process described above, the total market was divided into several segments and subsegments. Data triangulation and market breakdown procedures were applied, wherever applicable, to estimate the overall frozen bakery products market and derive the exact statistics for all segments and subsegments. The data was triangulated by analyzing various factors and trends from both the demand and supply sides. The market size was also validated using both the top-down and bottom-up approaches.

Market Definition

The frozen bakery products market comprises bakery items that are fully baked, partially baked, or prepared as dough and preserved through controlled freezing to maintain quality, stability, and shelf life during storage and distribution. This includes frozen dough (ready-to-proof), partially baked frozen items (ready-to-bake), and fully baked frozen products (ready-to-eat). These formats enable manufacturers, retailers, and foodservice operators to deliver bakery goods with consistent texture, structure, and flavor while reducing on-site preparation time and minimizing waste.

According to the Food and Agriculture Organization (FAO), freezing is a recognized method of food preservation that slows chemical, physical, and microbiological changes, helping food products maintain safety and quality. The Codex Alimentarius Commission (FAO/WHO) further classifies frozen foods, including frozen dough and baked goods, under its hygiene and safety standards, requiring that freezing, handling, and storage be conducted at temperatures that prevent microbial growth and preserve product integrity. These principles form the scientific and regulatory foundation for frozen bakery production and distribution worldwide.

- Ingredient suppliers

- Frozen bakery manufacturers

- Foodservice operators

- Equipment and technology providers

- Cold-chain and distribution providers

- Retail channels

- Government and food-safety authorities

- Associations, regulatory bodies, and other industry-related bodies:

- Food and Agriculture Organization (FAO)

- Codex Alimentarius Commission (FAO/WHO)

- United States Department of Agriculture (USDA)

- Food and Drug Administration (FDA)

- Research Institutes and Universities

- Organizations/Associations

- European Food Safety Authority (EFSA)

- Federation of Bakers (UK)

- American Bakers Association (ABA)

- Food Safety and Standards Authority of India (FSSAI)

- Association of Bakery Ingredient Manufacturers (ABIM)

- Trade associations and industry bodies

Report Objectives

- To determine, define, and project the size of the frozen bakery products market, with respect to specialty type, type, distribution channel, form of consumption, and region, over a five-year period, ranging from 2025 to 2030

- To identify attractive opportunities in the market by determining the largest and fastest-growing segments across regions

- To provide detailed information about the key factors influencing the growth of the market (drivers, restraints, opportunities, and challenges)

- To analyze micromarkets with respect to individual growth trends, prospects, and their contribution to the total market

- To strategically profile key market players and comprehensively analyze their core competencies in each segment

- To analyze competitive developments, such as alliances, joint ventures, new product developments, mergers, and acquisitions, in the frozen bakery products market

Available customizations:

With the provided market data, MarketsandMarkets offers customizations tailored to company-specific scientific needs.

The following customization options are available for the report:

PRODUCTS ANALYSIS

Products Matrix, which provides a detailed comparison of each company's service portfolio.

GEOGRAPHIC ANALYSIS

Based on the given market data, MarketsandMarkets offers customizations tailored to company-specific scientific needs.

- Further breakdown of the Rest of Europe frozen bakery products market into key countries.

- Further breakdown of the Rest of Asia Pacific frozen bakery products market into key countries.

- Further breakdown of the Rest of South America frozen bakery products market into key countries.

COMPANY INFORMATION

- Detailed analyses and profiling of additional market players (up to five).

Need a Tailored Report?

Customize this report to your needs

Get 10% FREE Customization

Customize This ReportPersonalize This Research

- Triangulate with your Own Data

- Get Data as per your Format and Definition

- Gain a Deeper Dive on a Specific Application, Geography, Customer or Competitor

- Any level of Personalization

Let Us Help You

- What are the Known and Unknown Adjacencies Impacting the Frozen Bakery Products Market

- What will your New Revenue Sources be?

- Who will be your Top Customer; what will make them switch?

- Defend your Market Share or Win Competitors

- Get a Scorecard for Target Partners

Custom Market Research Services

We Will Customise The Research For You, In Case The Report Listed Above Does Not Meet With Your Requirements

Get 10% Free CustomisationGrowth opportunities and latent adjacency in Frozen Bakery Products Market

Wang

Oct, 2020

We are interested in any data that you may have regarding the frozen dessert market growing slowly in Korea. We are looking for new market trends or new products. Would your report have any data related to the Korean market?.