Vacuum Packaging Market by Packaging Material (PE, Polyamide, EVA), by Type (Rigid, Semi-rigid), by Machinery (Thermoformers, External Vacuum Sealers, Others), by Process (Skin Vacuum, Shrink Vacuum, Others), by Application (Food, Others) & Region - Global Forecast to 2020

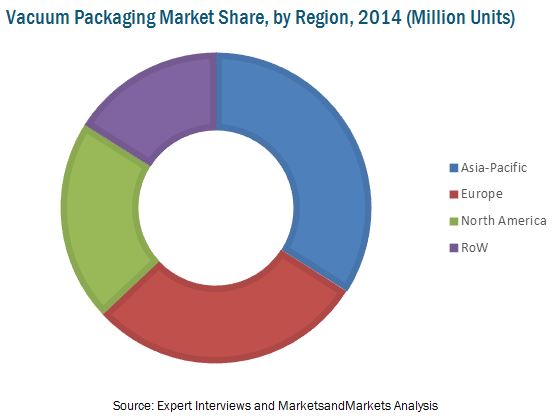

[242 Pages Report] The market for vacuum packaging has increased since the last decade because of the technological upgradations and innovations in the packaging industry. The global vacuum packaging market is projected to reach USD 27.67 Billion by 2020, at a CAGR of 4.24% from 2015 to 2020. The Asia-Pacific region accounted for the largest share of the total market value in 2014, followed by Europe and North America. The vacuum packaging market in developed countries is well-established; however, markets in developing economies such as China and India are estimated to grow at a higher rate from 2015 to 2020. This is owing to the growing demand for hygienic packaging that ensures product safety and freshness for longer durations.

The vacuum packaging market has been growing in accordance with the packaging industry. With the increase in demand for hygienic, eco-friendly, and economical packaging solutions, the demand for vacuum packaging has increased.

This report estimates the market size for vacuum packaging in terms of both value and volume. In this report, the market is broadly segmented based on application, process, packaging material, machinery, pack type, and region. Market drivers, restraints, opportunities & challenges, and market share by participant for the overall market are discussed in detail. Vacuum packaging is one of the fastest-growing markets in the packaging industry, which has witnessed significant growth over the last decade in several key economies across the world. The vacuum packaging market has kept pace with technological advances and is poised to attain high growth in the near future.

Scope of the report

This research study categorizes the global vacuum packaging market on the basis of application, process, packaging material, machinery, pack type, and region:

On the basis of application, the vacuum packaging market has been segmented as follows:

- Food

- Pharmaceuticals

- Industrial Goods

- Others (Consumer Goods)

On the basis of process, the market has been segmented as follows:

- Skin Vacuum Packaging

- Shrink Vacuum Packaging

- Others (Traditional Vacuum Packaging)

On the basis of packaging material, the vacuum packaging market has been segmented as follows:

- Polyethylene

- Polyamide

- Ethylene Vinyl Alcohol

- Others (Paper, Polyvinyl Chloride, Polypropylene, Polyester)

On the basis of machinery, the vacuum packaging market has been segmented as follows:

- Thermoformers

- External Vacuum Sealers

- Tray-sealing Machines

- Others (Vacuum Chamber Machines, Mini Vacuum Machines)

On the basis of pack type, the vacuum packaging market has been segmented as follows:

- Flexible Packaging

- Semi-rigid Packaging

- Rigid Packaging

On the basis of region, the vacuum packaging market has been segmented as follows:

- Asia-Pacific

- Europe

- North America

- Rest of the World (RoW)

With the advent of packaging technologies, product safety and longer shelf-life have become requisites for product manufacturers. This developed an ever increasing need for packaging techniques to undergo packaging without hampering the quality of packaged products. Vacuum packaging has become an imperative for many industries such as food, pharmaceuticals, industrial goods, and consumer goods, where preservation of a product is paramount.

Vacuum packaging is one such technology through which air is removed, thereby impeding the ability of oxygen-breathing microorganisms to grow and spoil the product. It is very essential that the precise integration of the product, process, package, and distribution exist in the supply chain to evade recontamination. The global vacuum packaging market is gaining momentum with an increase in demand for hygienic packaging for various applications. The market players have responded to these opportunities by bringing technological advancements in the process of vacuum packaging.

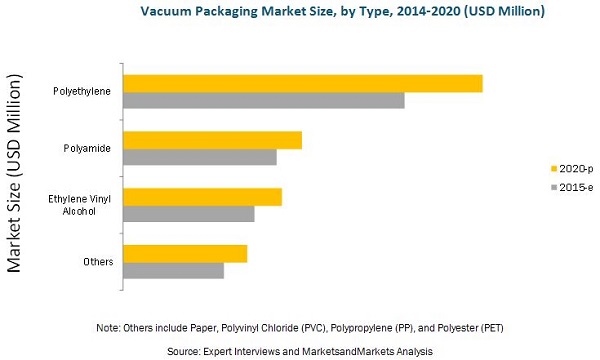

There are various types of packaging materials that are used for vacuum packaging, such as polyethylene, polyamide, ethylene vinyl alcohol, and other materials such as packaging films, foils, trays, bags, and lids. These packaging materials used to vacuum pack products ensure that the modified atmosphere is retained during the lifetime of the product.

The polyethylene segment is projected to reach USD 12.11 Billion by 2020. The Asia-Pacific region is projected to grow at the highest rate during the forecast period, that is, from 2015 to 2020.

The growth of the vacuum packaging market is primarily driven by the following factors:

- High demand for hygienic packaging

- Manufacturers’ demand of longer shelf-life

- Shift towards easy-to-handle and convenient packaging

- Growth of parent industry

The global vacuum packaging market is expected to witness significant growth in the coming years due to multiple factors. The demand for hygienic and convenient packaging is witnessing continual rise. This rise in demand has pushed manufacturers and retailers to use vacuum packaging technology to extend the shelf-life and safety of the products without hampering their production.

Among raw materials, polyethylene is projected to attain highest growth in the global vacuum packaging market. The high growth of polyethylene can be attributed to its low production & processing cost that has encouraged producers to prefer polyethylene over other packaging materials. Polyamide, the second-largest segment in the global vacuum packaging market, is gaining demand owing to its ability to manufacture films with high transparency, flexibility, good thermoformability, and high shrink properties.

The vacuum packaging market is marked with intense competition due to the presence of a large number of players. The market for this industry is highly unorganized because of the small and medium manufacturers. New product launches and expansions are the key strategies adopted by market players to expand their business in the industry. The key players in the vacuum packaging market include Amcor Limited (Australia), Bemis Company, Inc. (U.S.), Berry Plastics Corporation (U.S.), Sealed Air Corporation (U.S.), Linpac Packaging Limited (U.K.), Multisorb Technologies, Inc. (U.S.), Coveris Holding SA (U.S.), CVP Systems Inc. (U.S.), Ulma Packaging, and SCOOP (Spain), and Orics Industries, Inc. (U.S.).

Table of Contents

1 Introduction (Page No. - 26)

1.1 Objectives of the Study

1.2 Market Definition

1.3 Study Scope

1.3.1 Years Considered

1.4 Currency Considered

1.5 Unit Considered for the Vacuum Packaging Market

1.6 Stakeholders

2 Research Methodology (Page No. - 29)

2.1 Research Data

2.1.1 Secondary Data

2.1.1.1 Key Data From Secondary Sources

2.1.2 Primary Data

2.1.2.1 Key Data From Primary Sources

2.1.2.2 Key Industry Insights

2.1.2.3 Breakdown of Primaries, By Company Type, Designation, and Region

2.2 Factor Analysis

2.2.1 Introduction

2.2.2 Overview of the Parent Industry

2.2.3 Demand-Side Analysis

2.2.3.1 Rising Population

2.2.3.2 Rapid Urbanization

2.2.3.3 Increase in Per-Capita GDP Growth Rate

2.2.3.4 Growth in Manufacturing Sector

2.2.4 Supply-Side Analysis

2.2.4.1 Regulations

2.2.4.2 Research & Development

2.2.4.3 Packaging Equipment and Technologies

2.3 Market Size Estimation

2.4 Market Breakdown & Data Triangulation

2.5 Market Share Estimation

2.6 Research Assumptions & Limitations

2.6.1 Assumptions of the Research Study

2.6.2 Limitations of the Research Study

3 Executive Summary (Page No. - 43)

3.1 Demand From End-Use Markets to Drive the Demand for Vacuum Packaging

3.2 Evolution of Vacuum Packaging

3.3 Vacuum Packaging Market

3.4 Food: Largest Market for Vacuum Packaging

3.5 Polyethylene (PE) Projected to Be the Largest Segment Among Packaging Materials Market By 2020

3.6 Thermoformers Projected to Be the Largest Segment in the Vacuum Packaging Machinery Market By 2020

3.7 Skin Vacuum Packaging Projected to Be the Largest Segment in the Vacuum Packaging Process Market By 2020

3.8 Flexible Packaging Projected to Be the Largest Segment in the Vacuum Packaging Market, By Pack Type, By 2020

3.9 Asia-Pacific Projected to Be the Largest and Fastest-Growing Market By 2020

4 Premium Insights (Page No. - 51)

4.1 Attractive Market Opportunity for the Vacuum Packaging Market Players

4.2 Vacuum Packaging Market: Major Growth Regions

4.3 Vacuum Packaging Market in Asia-Pacific

4.4 Vacuum Packaging Market Attractiveness

4.5 Vacuum Packaging Market Attractiveness, By Application

4.6 Vacuum Packaging Market Attractiveness, By Packaging Material

4.7 Vacuum Packaging Market Attractiveness, By Process

4.8 Vacuum Packaging Market Attractiveness, By Pack Type

4.9 Thermoformers Emerged as the Largest Segment in the Vacuum Packaging Machinery Market, 2015 to 2020

4.10 Vacuum Packaging Market: Developed vs Emerging Markets

4.11 Life Cycle Analysis, By Region

5 Market Overview (Page No. - 58)

5.1 Introduction

5.2 Evolution of Vacuum Packaging Market

5.3 Market Segmentation

5.3.1 By Application

5.3.2 By Machinery

5.3.3 By Material

5.3.4 By Process

5.3.5 By Pack Type

5.4 Market Dynamics

5.4.1 Drivers

5.4.1.1 Hygienic Packaging of Food: A Critical Driver in the Packaging Industry

5.4.1.2 Manufacturers’ Demand for A Longer Shelf-Life

5.4.1.3 Shift Towards Easy-To-Handle and Convenient Packaging

5.4.1.4 Growth in Pharmaceutical Industry

5.4.1.5 Growth of the Parent Industry

5.4.2 Restraints

5.4.2.1 High Cost of Development

5.4.3 Opportunities

5.4.3.1 Emerging Economies: High-Growth Potential Markets

5.4.3.2 Sustainable Packaging: High Focus on Not Just Recycle But Reuse

5.4.3.3 Emergence of New Technologies

5.4.3.4 Growth of the E-Commerce Industry

5.4.4 Challenges

5.4.4.1 Variation in Environmental Mandates Across Regions

5.4.4.2 Difficulty in Managing the Vacuum Packaging Supply Chain

5.4.5 Burning Issues

5.4.5.1 Increasing Occurrences of Product Counterfeiting

5.4.5.2 Strong Emphasis on Lightweight Packaging

6 Industry Trends (Page No. - 76)

6.1 Introduction

6.2 Value Chain Analysis

6.3 Supply Chain Analysis

6.3.1 Prominent Companies

6.3.2 Small & Medium Enterprises

6.4 Porter’s Five Forces Analysis

6.4.1 Threat of New Entrants

6.4.2 Threat of Substitutes

6.4.3 Bargaining Power of Suppliers

6.4.4 Bargaining Power of Buyers

6.4.5 Intensity of Competitive Rivalry

7 Vacuum Packaging Market, By Application (Page No. - 84)

7.1 Introduction

7.2 Food

7.2.1 Food in Vacuum Packaging Market, By Process

7.2.1.1 Skin Vacuum Packaging: Largest Segment for Food

7.2.2 Food: Vacuum Packaging Market, By Pack Type

7.2.2.1 Flexible Packaging: Largest Market for Food Among Pack Types

7.3 Pharmaceuticals

7.3.1 Pharmaceuticals: Vacuum Packaging Market, By Process

7.3.1.1 Skin Vacuum Packaging: High-Growth Segment for Pharmaceuticals in Vacuum Packaging Market

7.3.2 Pharmaceuticals: Vacuum Packaging Market, By Pack Type

7.3.2.1 Flexible Packaging: High Growth Segment Among Pack Type in Pharmaceuticals Vacuum Packaging Market

7.4 Industrial Goods

7.4.1 Industrial Goods: Vacuum Packaging Market, By Process

7.4.1.1 Skin Vacuum Packaging: High-Growth Segment for Industrial Goods in Vacuum Packaging Market

7.4.2 Industrial Goods: Vacuum Packaging Market, By Pack Type

7.4.2.1 Flexible Packaging: High-Growth Segment for Industrial Goods

7.5 Others

7.5.1 Others: Vacuum Packaging Market, By Process

7.5.1.1 Skin Vacuum Packaging: High-Growth Segment for Others

7.5.2 Others: Vacuum Packaging Market, By Pack Type

7.5.2.1 Flexible Packaging: High-Growth Segment for Others

8 Vacuum Packaging Market, By Packaging Material (Page No. - 95)

8.1 Introduction

8.2 Polyethylene

8.3 Polyamide

8.4 Ethylene Vinyl Alcohol

8.5 Other Packaging Materials

9 Vacuum Packaging Market, By Machinery (Page No. - 100)

9.1 Introduction

9.2 Thermoformers

9.3 External Vacuum Sealers

9.4 Tray Sealing Machines

9.5 Others

10 Vacuum Packaging Market, By Process (Page No. - 104)

10.1 Introduction

10.2 Skin Vacuum Packaging

10.3 Shrink Vacuum Packaging

10.4 Others

11 Vacuum Packaging Market, By Pack Type (Page No. - 108)

11.1 Introduction

11.2 Flexible Packaging

11.3 Semi-Rigid Packaging

11.4 Rigid Packaging

12 Vacuum Packaging Market, By Region (Page No. - 112)

12.1 Introduction

12.2 Asia-Pacific

12.2.1 Asia-Pacific: Vacuum Packaging Market, By Country

12.2.1.1 China & India to Witness Remarkable Growth

12.2.2 Asia-Pacific: Vacuum Packaging Market, By Application

12.2.2.1 Rising Demand From End-User Industry is the Main Driving Factor

12.2.3 Asia-Pacific: Vacuum Packaging Market, By Process

12.2.3.1 Skin Vacuum Packaging Witnessed Fastest Growth in Asia-Pacific

12.2.4 Asia-Pacific: Vacuum Packaging Market, By Packaging Material

12.2.4.1 Increased Demand for Hygienic Packaging to Drive the Vacuum Packaging Market in Asia-Pacific

12.2.5 Asia-Pacific: Vacuum Packaging Market, By Pack Type

12.2.5.1 Construction is the Fastest-Growing Segment in Asia-Pacific

12.2.6 China

12.2.6.1 China: Vacuum Packaging Market, By Application

12.2.6.1.1 Pharmaceuticals to Witness Fastest Growth in China

12.2.6.2 China: Vacuum Packaging Market, By Process

12.2.6.2.1 Skin Vacuum Packaging Dominated the Vacuum Packaging Market in China

12.2.6.3 China: Vacuum Packaging Market, By Packaging Material

12.2.6.3.1 Polyethylene Segment Accounted for the Largest Share in China in 2014

12.2.6.4 China: Vacuum Packaging Market, By Pack Type

12.2.6.4.1 Polyethylene Segment Accounted for the Largest Share in China in 2014

12.2.7 Japan

12.2.7.1 Japan: Vacuum Packaging Market, By Application

12.2.7.1.1 Food Segment Witnessed Wide Application in the Japanese Vacuum Packaging Market

12.2.7.2 Japan: Vacuum Packaging Market, By Process

12.2.7.2.1 Skin Vacuum Packaging Process Accounted for the Largest Share in Japan’s

12.2.7.3 Japan: Vacuum Packaging Market, By Packaging Material

12.2.7.3.1 Polyethylene Segment Accounted for the Largest Share in the Japanese

12.2.7.4 Japan: Vacuum Packaging Market, By Pack Type

12.2.7.4.1 Flexible Packaging Segment Accounted for the Largest Share in the Japanese

12.2.8 India

12.2.8.1 India: Vacuum Packaging Market, By Application

12.2.8.1.1 Pharmaceuticals Projected to Grow at the Highest CAGR

12.2.8.2 India: Vacuum Packaging Market, By Process

12.2.8.2.1 Shrink Vacuum Packaging Projected to Grow at Relatively Lower Rate

12.2.8.3 India: Vacuum Packaging Market, By Packaging Material

12.2.8.3.1 Polyethylene Projected to Grow at the Highest CAGR in the Indian

12.2.8.4 India: Vacuum Packaging Market, By Pack Type

12.2.8.4.1 Flexible Packaging Accounted for the Largest Share in the Indian

12.2.9 Rest of Asia-Pacific

12.2.9.1 Rest of Asia-Pacific: Vacuum Packaging Market, By Application

12.2.9.1.1 Pharmaceutical Segment Projected to Grow at the Highest Rate

12.2.9.2 Rest of Asia-Pacific: Vacuum Packaging Market, By Process

12.2.9.2.1 Skin Vacuum Packaging Segment Projected to Grow at the Highest Rate

12.2.9.3 Rest of Asia-Pacific: Vacuum Packaging Market, By Packaging Material

12.2.9.3.1 Polyethylene Segment Projected to Grow at the Highest Rate

12.2.9.4 Rest of Asia-Pacific: Vacuum Packaging Market, By Pack Type

12.2.9.4.1 Polyethylene Segment Projected to Grow at the Highest Rate

12.3 Europe

12.3.1 Europe: Vacuum Packaging Market, By Country

12.3.1.1 Germany & France to Witness Remarkable Growth in the Vacuum Packaging Market

12.3.2 Europe: Vacuum Packaging Market, By Application

12.3.2.1 Rising Demand From End-User Industry: Driving Factor in the Growth of Vacuum Packaging

12.3.3 Europe: Vacuum Packaging Market, By Process

12.3.3.1 Skin Vacuum Packaging Witnessed Fastest Growth in Europe

12.3.4 Europe: Vacuum Packaging Market, By Packaging Material

12.3.4.1 Increased Demand for Hygienic Packaging to Drive the Market for Vacuum Packaging in Europe

12.3.5 Europe: Vacuum Packaging Market, By Pack Type

12.3.5.1 Flexible Packaging Projected to Be the Fastest Growing Segment in European

12.3.6 Germany

12.3.6.1 Germany: Vacuum Packaging Market, By Application

12.3.6.1.1 Pharmaceuticals Segment Projected to Grow at Highest Rate

12.3.6.2 Germany: Vacuum Packaging Market, By Process

12.3.6.2.1 Skin Vacuum Packaging Process Accounted for the Largest Share in German

12.3.6.3 Germany: Vacuum Packaging Market, By Packaging Material

12.3.6.3.1 Polyethylene Segment Projected to Grow at A Highest Rate in German

12.3.6.4 Germany: Vacuum Packaging Market, By Pack Type

12.3.6.4.1 Flexible Packaging Segment Projected to Grow at A Highest Rate in the German

12.3.7 France

12.3.7.1 France: Vacuum Packaging Market, By Application

12.3.7.1.1 Pharmaceuticals Segment Projected to Grow at Highest Rate

12.3.7.2 France: Vacuum Packaging Market, By Process

12.3.7.2.1 Skin Vacuum Packaging Process Accounted for the Largest Share in the Frence

12.3.7.3 France: Vacuum Packaging Market, By Packaging Material

12.3.7.3.1 Polyethylene Segment Projected to Grow at A Highest Rate in the French

12.3.7.4 France: Vacuum Packaging Market, By Pack Type

12.3.7.4.1 Semi-Rigid Packaging Segment Projected to Grow at A Lower Rate in the French

12.3.8 U.K.

12.3.8.1 U.K.: Vacuum Packaging Market, By Application

12.3.8.1.1 Pharmaceuticals Segment Projected to Grow at Highest Rate

12.3.8.2 U.K.: Vacuum Packaging Market, By Process

12.3.8.2.1 Skin Vacuum Packaging Process Accounted for the Largest Share in the U.K.

12.3.8.3 U.K.: Vacuum Packaging Market, By Packaging Material

12.3.8.3.1 Polyethylene Segment Projected to Grow at A Highest Rate in U.K.

12.3.8.4 U.K.: Vacuum Packaging Market, By Pack Type

12.3.8.4.1 Semi-Rigid Packaging Segment Projected to Grow at A Lower Rate in the U.K.

12.3.9 Rest of Europe

12.3.9.1 Rest of Europe: Vacuum Packaging Market, By Application

12.3.9.1.1 Pharmaceuticals Segment Projected to Grow at the Highest Rate

12.3.9.2 Rest of Europe: Vacuum Packaging Market, By Process

12.3.9.2.1 Skin Vacuum Packaging Process Accounted for the Largest Share

12.3.9.3 Rest of Europe: Vacuum Packaging Market, By Packaging Material

12.3.9.3.1 Polyethylene Segment Projected to Grow at A Highest Rate

12.3.9.4 Rest of Europe: Vacuum Packaging Market, By Pack Type

12.3.9.4.1 Flexible Packaging Segment Projected to Grow at A Highest Rate in RoE

12.4 North America

12.4.1 North America: Vacuum Packaging Market, By Country

12.4.1.1 U.S. Dominated the Vacuum Packaging Market in North America

12.4.2 North America: Vacuum Packaging Market, By Country

12.4.2.1 U.S. Accounted for the Largest Share in the North American Vacuum Packaging Market

12.4.3 North America: Vacuum Packaging Market, By Application

12.4.3.1 Rising Demand From End-User Industry: Driving Factor in the Growth of Vacuum Packaging

12.4.4 North America: Vacuum Packaging Market, By Process

12.4.4.1 Skin Vacuum Packaging Witnessed Fastest Growth in North America

12.4.5 North America: Vacuum Packaging Market, By Packaging Material

12.4.5.1 Polyethylene Projected to Grow at the Highest Rate in the North American Vacuum Packaging

12.4.6 North America: Vacuum Packaging Market, By Pack Type

12.4.6.1 Flexible Packaging Projected to Be the Fastest Growing Segment in North American

12.4.7 U.S.

12.4.7.1 U.S.: Vacuum Packaging Market, By Application

12.4.7.1.1 Pharmaceuticals Segment Projected to Grow at Highest Rate in the U.S.

12.4.7.2 U.S.: Vacuum Packaging Market, By Process

12.4.7.2.1 Skin Vacuum Packaging Process Accounted for the Largest Share in the U.S.

12.4.7.3 U.S.: Vacuum Packaging Market, By Packaging Material

12.4.7.3.1 Polyethylene Segment Projected to Grow at the Highest Rate in the U.S.

12.4.7.4 U.S.: Vacuum Packaging Market, By Pack Type

12.4.7.4.1 Flexible Packaging Accounted for the Largest Share in the U.S.

12.4.8 Canada

12.4.8.1 Canada: Vacuum Packaging Market, By Application

12.4.8.1.1 Pharmaceuticals Segment Projected to Grow at Highest Rate in the in Canada

12.4.8.2 Canada: Vacuum Packaging Market, By Process

12.4.8.2.1 Skin Vacuum Packaging Process Accounted for the Largest Share in Canada

12.4.8.3 Canada: Vacuum Packaging Market, By Packaging Material

12.4.8.3.1 Polyethylene Segment Projected to Grow at the Highest Rate in the Canada

12.4.8.4 Canada: Vacuum Packaging Market, By Pack Type

12.4.8.4.1 Flexible Packaging Segment Projected to Grow at the Highest Rate in Canada

12.4.9 Mexico

12.4.9.1 Mexico: Vacuum Packaging Market, By Application

12.4.9.1.1 Pharmaceuticals Segment Projected to Grow at Highest Rate in the Mexican

12.4.9.2 Mexico: Vacuum Packaging Market, By Process

12.4.9.2.1 Skin Vacuum Packaging Process Accounted for the Largest Share in Mexico

12.4.9.3 Mexico: Vacuum Packaging Market, By Packaging Material

12.4.9.3.1 Polyethylene Segment Projected to Grow at the Highest Rate in the Mexico

12.4.9.4 Mexico: Vacuum Packaging Market, By Pack Type

12.4.9.4.1 Semi-Rigid Packaging Segment Projected to Grow at A Lower Rate in theMexico

12.5 Rest of the World (RoW)

12.5.1 RoW: Vacuum Packaging Market, By Country

12.5.1.1 Brazil & Argentina Projected to Witness Remarkable Growth in the RoW

12.5.2 RoW: Vacuum Packaging Market, By Application

12.5.2.1 Rising Demand From End-User Industry: Driving Factor in the Growth

12.5.3 RoW: Vacuum Packaging Market, By Process

12.5.3.1 Skin Vacuum Packaging Witnessed Fastest Growth in RoW

12.5.4 RoW: Vacuum Packaging Market, By Packaging Material

12.5.4.1 Increased Demand for Hygienic Packaging to Drive the Market for the RoW

12.5.5 RoW: Vacuum Packaging Market, By Pack Type

12.5.5.1 Flexible Packaging Projected to Be the Fastest Growing Segment in the RoW

12.5.6 Brazil

12.5.6.1 Brazil: Vacuum Packaging Market, By Application

12.5.6.1.1 Pharmaceuticals Segment Projected to Grow at Highest Rate in Brazil

12.5.6.2 Brazil: Vacuum Packaging Market, By Process

12.5.6.2.1 Skin Vacuum Packaging Process Accounted for the Largest Share in the Brazil

12.5.6.3 Brazil: Vacuum Packaging Market, By Packaging Material

12.5.6.3.1 Polyethylene Segment Projected to Grow at the Highest Rate in the Brazil

12.5.6.4 Brazil: Vacuum Packaging Market, By Pack Type

12.5.6.4.1 Flexible Packaging Accounted for the Largest Share in the Brazil

12.5.7 Argentina

12.5.7.1 Argentina: Vacuum Packaging Market, By Application

12.5.7.1.1 Pharmaceuticals Segment Projected to Grow at Highest Rate in Argentina

12.5.7.2 Argentina: Vacuum Packaging Market, By Process

12.5.7.2.1 Skin Vacuum Packaging Process Accounted for the Largest Share in Argentina

12.5.7.3 Argentina: Vacuum Packaging Market, By Packaging Material

12.5.7.3.1 Polyethylene Segment Projected to Grow at the Highest Rate in the Argentina

12.5.7.4 Argentina: Vacuum Packaging Market, By Pack Type

12.5.7.4.1 Flexible Packaging Segment Projected to Grow at the Highest Rate in the Argentina

12.5.8 South Africa

12.5.8.1 South Africa: Vacuum Packaging Market, By Application

12.5.8.1.1 Pharmaceuticals Segment Projected to Grow at Highest Rate

12.5.8.2 South Africa: Vacuum Packaging Market, By Process

12.5.8.2.1 Skin Vacuum Packaging Process Accounted for the Largest Share in South Africa

12.5.8.3 South Africa: Vacuum Packaging Market, By Packaging Material

12.5.8.3.1 Polyethylene Segment Projected to Grow at the Highest Rate in SA

12.5.8.4 South Africa: Vacuum Packaging Market, By Pack Type

12.5.8.4.1 Semi-Rigid Packaging Segment Projected to Grow at A Lower Rate in the SA

12.5.9 Other RoW Countries

12.5.9.1 Other RoW Countries: Vacuum Packaging Market, By Application

12.5.9.1.1 Pharmaceuticals Segment Projected to Grow at the Highest Rate

12.5.9.2 Other RoW Countries: Vacuum Packaging Market, By Process

12.5.9.2.1 Skin Vacuum Packaging Process Accounted for the Largest Share in Others Market of RoW

12.5.9.3 Other RoW Countries: Vacuum Packaging Market, By Packaging Material

12.5.9.3.1 Polyethylene Segment Projected to Grow at the Highest Rate in Other RoW Countries

12.5.9.4 Other RoW Countries: Vacuum Packaging Market, By Pack Type

12.5.9.4.1 Flexible Packaging Segment Projected to Grow at the Highest Rate in RoW Countries

13 Competitive Landscape (Page No. - 201)

13.1 Overview

13.2 Leading Players in the Vacuum Packaging Market

13.3 Competitive Situation and Trends

13.4 New Product Launches

13.5 Mergers & Acquisitions

13.6 Expansions, Investments, and Patent Issuance

13.7 Agreements & Contracts

13.8 Joint Ventures, Partnerships & Alliances

14 Company Profiles (Page No. - 209)

14.1 Introduction

(Business Overview, Products & Services, Key Insights, Recent Developments, SWOT Analysis, MnM View)*

14.2 Amcor Limited

14.3 Bemis Company, Inc.

14.4 Berry Plastics Corporation

14.5 Sealed Air Corporation

14.6 Coveris Holdings S.A.

14.7 CVP Systems, Inc.

14.8 Linpac Packaging Limited

14.9 Multisorb Technologies, Inc

14.10 ULMA Packaging, S.Coop

14.11 Orics Industries, Inc.

*Details on Business Overview, Products & Services, Key Insights, Recent Developments, SWOT Analysis, MnM View Might Not Be Captured in Case of Unlisted Companies.

15 Appendix (Page No. - 237)

15.1 Discussion Guide

15.2 Introducing RT: Real Time Market Intelligence

15.3 Available Customization

15.4 Related Reports

List of Tables (204 Tables)

Table 1 Asia-Pacific: Urbanization Prospects

Table 2 Vacuum Packaging Applications & Their Descriptions

Table 3 Vacuum Packaging Machinery & Their Descriptions

Table 4 Vacuum Packaging Materials & Their Descriptions

Table 5 Vacuum Packaging Processes & Their Descriptions

Table 6 Vacuum Packaging Pack Types & Their Descriptions

Table 7 High Demand for Hygienic Packaging has Played A Major Role in Driving the Growth of the Vacuum Packaging Market

Table 8 High Cost of Development has Played A Major Role in Restraining the Growth of the Vacuum Packaging Market

Table 9 Growing Demand for Sustainable Packaging is A Key Opportunity for the Vacuum Packaging Market

Table 10 High Demand for Hygienic Packaging has Played A Major Role in Driving the Growth of the Vacuum Packaging Market

Table 11 Vacuum Packaging Market Size, By Application, 2013–2020 (USD Million)

Table 12 Vacuum Packaging Market Size, By Application, 2013–2020 (Million Units)

Table 13 Food in Vacuum Packaging Market Size, By Process, 2013–2020 (USD Million)

Table 14 Food in Vacuum Packaging Market Size, By Process, 2013–2020 (Million Units)

Table 15 Food in Vacuum Packaging Market Size, By Pack Type, 2013–2020 (USD Million)

Table 16 Food in Vacuum Packaging Market Size, By Pack Type, 2013–2020 (Million Units)

Table 17 Pharmaceuticals in Vacuum Packaging Market Size, By Process, 2013–2020 (USD Million)

Table 18 Pharmaceuticals in Vacuum Packaging Market Size, By Process, 2013–2020 (Million Units)

Table 19 Pharmaceuticals in Vacuum Packaging Market Size, By Pack Type, 2013–2020 (USD Million)

Table 20 Pharmaceuticals in Vacuum Packaging Market Size, By Pack Type, 2013–2020 (Million Units)

Table 21 Industrial Goods in Vacuum Packaging Market Size, By Process, 2013–2020 (USD Million)

Table 22 Industrial Goods in Vacuum Packaging Market Size, By Process, 2013–2020 (Million Units)

Table 23 Industrial Goods in Vacuum Packaging Market Size, By Pack Type, 2013–2020 (USD Million)

Table 24 Industrial Goods in Vacuum Packaging Market Size, By Pack Type, 2013–2020 (Million Units)

Table 25 Other Applications in Vacuum Packaging Market Size, By Process, 2013–2020 (USD Million)

Table 26 Other Applications in Vacuum Packaging Market Size, By Process, 2013–2020 (Million Units)

Table 27 Other Applications in Vacuum Packaging Market Size, By Pack Type, 2013–2020 (USD Million)

Table 28 Other Applications in Vacuum Packaging Market Size, By Pack Type, 2013–2020 (Million Units)

Table 29 Vacuum Packaging Market Size, By Packaging Material, 2013–2020 (USD Million)

Table 30 Vacuum Packaging Market Size, By Packaging Material, 2013–2020 (Million Units)

Table 31 Vacuum Packaging Market Size, By Machinery, 2013–2020 (USD Million)

Table 32 Vacuum Packaging Market Size, By Machinery, 2013–2020 (Million Units)

Table 33 Vacuum Packaging Market Size, By Process, 2013–2020 (USD Million)

Table 34 Vacuum Packaging Market Size, By Process, 2013–2020 (Million Units)

Table 35 Vacuum Packaging Market Size, By Pack Type, 2013–2020 (USD Million)

Table 36 Vacuum Packaging Market Size, By Pack Type, 2013–2020 (Million Units)

Table 37 Vacuum Packaging Market Size, By Region, 2013–2020 (USD Million)

Table 38 Vacuum Packaging Market Size, By Region, 2013–2020 (Million Units)

Table 39 Asia-Pacific: Vacuum Packaging Market Size, By Country, 2013–2020 (USD Million)

Table 40 Asia-Pacific: Market Size, By Country, 2013–2020 (Million Units)

Table 41 Asia-Pacific: Market Size, By Application, 2013–2020 (USD Million)

Table 42 Asia-Pacific: Market Size, By Application, 2013–2020 (Million Units)

Table 43 Asia-Pacific: Market Size, By Process, 2013–2020 (USD Million)

Table 44 Asia-Pacific: Market Size, By Process, 2013–2020 (Million Units)

Table 45 Asia-Pacific: Market Size, By Packaging Material, 2013–2020 (USD Million)

Table 46 Asia-Pacific: Market Size, By Packaging Material, 2013–2020 (Million Units)

Table 47 Asia-Pacific: Market Size, By Pack Type, 2013–2020 (USD Million)

Table 48 Asia-Pacific: Market Size, By Pack Type, 2013–2020 (Million Units)

Table 49 China: Vacuum Packaging Market Size, By Application, 2013–2020 (USD Million)

Table 50 China: Market Size, By Application, 2013–2020 (Million Units)

Table 51 China: Market Size, By Process, 2013–2020 (USD Million)

Table 52 China: Market Size, By Process, 2013–2020 (Million Units)

Table 53 China: Market Size, By Packaging Material, 2013–2020 (USD Million)

Table 54 China: Market Size, By Packaging Material, 2013–2020 (Million Units)

Table 55 China: Market Size, By Pack Type, 2013–2020 (USD Million)

Table 56 China: Market Size, By Pack Type, 2013–2020 (Million Units)

Table 57 Japan: Vacuum Packaging Market Size, By Application, 2013–2020 (USD Million)

Table 58 Japan: Market Size, By Application, 2013–2020 (Million Units)

Table 59 Japan: Market Size, By Process, 2013–2020 (USD Million)

Table 60 Japan: Market Size, By Process, 2013–2020 (Million Units)

Table 61 Japan: Market Size, By Packaging Material, 2013–2020 (USD Million)

Table 62 Japan: Market Size, By Packaging Material, 2013–2020 (Million Units)

Table 63 Japan: Market Size, By Pack Type, 2013–2020 (USD Million)

Table 64 Japan: Market Size, By Pack Type, 2013–2020 (Million Units)

Table 65 India: Vacuum Packaging Market Size, By Application, 2013–2020 (USD Million)

Table 66 India: By Market Size, By Application, 2013–2020 (Million Units)

Table 67 India: By Market Size, By Process, 2013–2020 (USD Million)

Table 68 India: Market Size, By Process, 2013–2020 (Million Units)

Table 69 India: Market Size, By Packaging Material, 2013–2020 (USD Million)

Table 70 India: Market Size, By Packaging Material, 2013–2020 (USD Million)

Table 71 India: Market Size, By Pack Type, 2013–2020 (USD Million)

Table 72 India: Market Size, By Pack Type, 2013–2020 (USD Million)

Table 73 Rest of Asia-Pacific: Vacuum Packaging Market Size, By Application, 2013–2020 (USD Million)

Table 74 Rest of Asia-Pacific: Market Size, By Application, 2013–2020 (Million Units)

Table 75 Rest of Asia-Pacific: Market Size, By Process, 2013–2020 (USD Million)

Table 76 Rest of Asia-Pacific: Market Size, By Process, 2013–2020 (Million Units)

Table 77 Rest of Asia-Pacific: Market Size, By Packaging Material, 2013–2020 (USD Million)

Table 78 Rest of Asia-Pacific: Market Size, By Packaging Material, 2013–2020 (Million Units)

Table 79 Rest of Asia-Pacific: Market Size, By Pack Type, 2013–2020 (USD Million)

Table 80 Rest of Asia-Pacific: Market Size, By Pack Type, 2013–2020 (Million Units)

Table 81 Europe: Vacuum Packaging Market Size, By Country, 2013–2020 (USD Million)

Table 82 Europe: Market Size, By Country, 2013–2020 (Million Units)

Table 83 Europe: Market Size, By Application, 2013–2020 (USD Million)

Table 84 Europe: Market Size, By Application, 2013–2020 (Million Units)

Table 85 Europe: Market Size, By Process, 2013–2020 (USD Million)

Table 86 Europe: Market Size, By Process, 2013–2020 (Million Units)

Table 87 Europe: Market Size, By Packaging Material, 2013–2020 (USD Million)

Table 88 Europe: Market Size, By Packaging Material, 2013–2020 (Million Units)

Table 89 Europe: Market Size, By Pack Type, 2013–2020 (USD Million)

Table 90 Europe: Market Size, By Pack Type, 2013–2020 (Million Units)

Table 91 Germany: Vacuum Packaging Market Size, By Application, 2013–2020 (USD Million)

Table 92 Germany: Market Size, By Application, 2013–2020 (Million Units)

Table 93 Germany: Market Size, By Process, 2013–2020 (USD Million)

Table 94 Germany: Market Size, By Process, 2013–2020 (Million Units)

Table 95 Germany: Market Size, By Packaging Material, 2013–2020 (USD Million)

Table 96 Germany: Market Size, By Packaging Material, 2013–2020 (Million Units)

Table 97 Germany: Market Size, By Pack Type, 2013–2020 (USD Million)

Table 98 Germany: Market Size, By Pack Type, 2013–2020 (Million Units)

Table 99 France: Vacuum Packaging Market Size, By Application, 2013–2020 (USD Million)

Table 100 France: Market Size, By Application, 2013–2020 (Million Units)

Table 101 France: Market Size, By Process, 2013–2020 (USD Million)

Table 102 France: Market Size, By Process, 2013–2020 (Million Units)

Table 103 France: Market Size, By Packaging Material, 2013–2020 (USD Million)

Table 104 France: Market Size, By Packaging Material, 2013–2020 (Million Units)

Table 105 France: Market Size, By Pack Type, 2013–2020 (USD Million)

Table 106 France: Market Size, By Pack Type, 2013–2020 (Million Units)

Table 107 U.K.: Vacuum Packaging Market Size, By Application, 2013–2020 (USD Million)

Table 108 U.K.: Market Size, By Application, 2013–2020 (Million Units)

Table 109 U.K.: Market Size, By Process, 2013–2020 (USD Million)

Table 110 U.K.: Market Size, By Process, 2013–2020 (Million Units)

Table 111 U.K.: Market Size, By Packaging Material, 2013–2020 (USD Million)

Table 112 U.K.: Market Size, By Packaging Material, 2013–2020 (Million Units)

Table 113 U.K.: Market Size, By Pack Type, 2013–2020 (USD Million)

Table 114 U.K.: Market Size, By Pack Type, 2013–2020 (Million Units)

Table 115 Rest of Europe: Vacuum Packaging Market Size, By Application, 2013–2020 (USD Million)

Table 116 Rest of Europe: Market Size, By Application, 2013–2020 (Million Units)

Table 117 Rest of Europe: Market Size, By Process, 2013–2020 (USD Million)

Table 118 Rest of Europe: Market Size, By Process, 2013–2020 (Million Units)

Table 119 Rest of Europe: Market Size, By Packaging Material, 2013–2020 (USD Million)

Table 120 Rest of Europe: Market Size, By Packaging Material, 2013–2020 (Million Units)

Table 121 Rest of Europe: Market Size, By Pack Type, 2013–2020 (USD Million)

Table 122 Rest of Europe: Market Size, By Pack Type, 2013–2020 (Million Units)

Table 123 North America: Vacuum Packaging Market Size, By Country, 2013–2020 (USD Million)

Table 124 North America: Market Size, By Country, 2013–2020 (Million Units)

Table 125 North America: Market Size, By Application, 2013–2020 (USD Million)

Table 126 North America: Market Size, By Application, 2013–2020 (Million Units)

Table 127 North America: Market Size, By Process, 2013–2020 (USD Million)

Table 128 North America: Market Size, By Process, 2013–2020 (Million Units)

Table 129 North America: Market Size, By Packaging Material, 2013–2020 (USD Million)

Table 130 North America: Market Size, By Packaging Material, 2013–2020 (Million Units)

Table 131 North America: Market Size, By Pack Type, 2013–2020 (USD Million)

Table 132 North America: Market Size, By Pack Type, 2013–2020 (Million Units)

Table 133 U.S.: Vacuum Packaging Market Size, By Application, 2013–2020 (USD Million)

Table 134 U.S.: Market Size, By Application, 2013–2020 (Million Units)

Table 135 U.S.: Market Size, By Process, 2013–2020 (USD Million)

Table 136 U.S.: Market Size, By Process, 2013–2020 (Million Units)

Table 137 U.S.: Market Size, By Packaging Material, 2013–2020 (USD Million)

Table 138 U.S.: Market Size, By Packaging Material, 2013–2020 (Million Units)

Table 139 U.S.: Market Size, By Pack Type, 2013–2020 (USD Million)

Table 140 U.S.: Market Size, By Pack Type, 2013–2020 (Million Units)

Table 141 Canada: Vacuum Packaging Market Size, By Application, 2013–2020 (USD Million)

Table 142 Canada: Market Size, By Application, 2013–2020 (Million Units)

Table 143 Canada: Market Size, By Process, 2013–2020 (USD Million)

Table 144 Canada: Market Size, By Process, 2013–2020 (Million Units)

Table 145 Canada: Market Size, By Packaging Material, 2013–2020 (USD Million)

Table 146 Canada: Market Size, By Packaging Material, 2013–2020 (Million Units)

Table 147 Canada: Market Size, By Pack Type, 2013–2020 (USD Million)

Table 148 Canada: Market Size, By Pack Type, 2013–2020 (Million Units)

Table 149 Mexico: Vacuum Packaging Market Size, By Application, 2013–2020 (USD Million)

Table 150 Mexico: Market Size, By Application, 2013–2020 (Million Units)

Table 151 Mexico: Market Size, By Process, 2013–2020 (USD Million)

Table 152 Mexico: Market Size, By Process, 2013–2020 (Million Units)

Table 153 Mexico: Market Size, By Packaging Material, 2013–2020 (USD Million)

Table 154 Mexico: Market Size, By Packaging Material, 2013–2020 (Million Units)

Table 155 Mexico: Market Size, By Pack Type, 2013–2020 (USD Million)

Table 156 Mexico: Market Size, By Pack Type, 2013–2020 (Million Units)

Table 157 RoW: Market Size, By Country, 2013–2020 (USD Million)

Table 158 RoW: Market Size, By Country, 2013–2020 (Million Units)

Table 159 RoW: Market Size, By Application, 2013–2020 (USD Million)

Table 160 RoW: Market Size, By Application, 2013–2020 (Million Units)

Table 161 RoW: Market Size, By Process, 2013–2020 (USD Million)

Table 162 RoW: Market Size, By Process, 2013–2020 (Million Units)

Table 163 RoW: Market Size, By Packaging Material, 2013–2020 (USD Million)

Table 164 RoW: Market Size, By Packaging Material, 2013–2020 (Million Units)

Table 165 RoW: Market Size, By Pack Type, 2013–2020 (USD Million)

Table 166 RoW: Market Size, By Pack Type, 2013–2020 (Million Units)

Table 167 Brazil: Vacuum Packaging Market Size, By Application, 2013–2020 (USD Million)

Table 168 Brazil: Vacuum Packaging Market Size, By Application, 2013–2020 (Million Units)

Table 169 Brazil: Vacuum Packaging Market Size, By Process, 2013–2020 (USD Million)

Table 170 Brazil: Vacuum Packaging Market Size, By Process, 2013–2020 (Million Units)

Table 171 Brazil: Vacuum Packaging Market Size, By Packaging Material, 2013–2020 (USD Million)

Table 172 Brazil: Vacuum Packaging Market Size, By Packaging Material, 2013–2020 (Million Units)

Table 173 Brazil: Vacuum Packaging Market Size, By Pack Type, 2013–2020 (USD Million)

Table 174 Brazil: Vacuum Packaging Market Size, By Pack Type, 2013–2020 (Million Units)

Table 175 Argentina: Vacuum Packaging Market Size, By Application, 2013–2020 (USD Million)

Table 176 Argentina: Vacuum Packaging Market Size, By Application, 2013–2020 (Million Units)

Table 177 Argentina: Vacuum Packaging Market Size, By Process, 2013–2020 (USD Million)

Table 178 Argentina: Vacuum Packaging Market Size, By Process, 2013–2020 (Million Units)

Table 179 Argentina: Vacuum Packaging Market Size, By Packaging Material, 2013–2020 (USD Million)

Table 180 Argentina: Vacuum Packaging Market Size, By Packaging Material, 2013–2020 (Million Units)

Table 181 Argentina: Vacuum Packaging Market Size, By Pack Type, 2013–2020 (USD Million)

Table 182 Argentina: Vacuum Packaging Market Size, By Pack Type, 2013–2020 (Million Units)

Table 183 South Africa: Vacuum Packaging Market Size, By Application, 2013–2020 (USD Million)

Table 184 South Africa: Vacuum Packaging Market Size, By Application, 2013–2020 (Million Units)

Table 185 South Africa: Vacuum Packaging Market Size, By Process, 2013–2020 (USD Million)

Table 186 South Africa: Vacuum Packaging Market Size, By Process, 2013–2020 (Million Units)

Table 187 South Africa: Vacuum Packaging Market Size, By Packaging Material, 2013–2020 (USD Million)

Table 188 South Africa: Vacuum Packaging Market Size, By Packaging Material, 2013–2020 (Million Units)

Table 189 South Africa: Vacuum Packaging Market Size, By Pack Type, 2013–2020 (USD Million)

Table 190 South Africa: Vacuum Packaging Market Size, By Pack Type, 2013–2020 (Million Units)

Table 191 Other RoW Countries: Vacuum Packaging Market Size, By Application, 2013–2020 (USD Million)

Table 192 Other RoW Countries: Vacuum Packaging Market Size, By Application, 2013–2020 (Million Units)

Table 193 Other RoW Countries: Vacuum Packaging Market Size, By Process, 2013–2020 (USD Million)

Table 194 Other RoW Countries: Vacuum Packaging Market Size, By Process, 2013–2020 (Million Units)

Table 195 Other RoW Countries: Vacuum Packaging Market Size, By Packaging Material, 2013–2020 (USD Million)

Table 196 Other RoW Countries: Vacuum Packaging Market Size, By Packaging Material, 2013–2020 (Million Units)

Table 197 Other RoW Countries: Vacuum Packaging Market Size, By Pack Type, 2013–2020 (USD Million)

Table 198 Other RoW Countries: Vacuum Packaging Market Size, By Pack Type, 2013–2020 (Million Units)

Table 199 Rank of Companies in the Global Vacuum Packaging Market, 2015

Table 200 New Product Launches, 20011-2015

Table 201 Mergers & Acquisitions, 2011-2015

Table 202 Expansions, Investments, and Patent Issuance, 2011-2015

Table 203 Agreements & Contracts, 2011-2015

Table 204 Joint Ventures & Partnerships & Alliances, 2011-2015

List of Figures (56 Figures)

Figure 1 Vacuum Packaging Market: Research Design

Figure 2 Vacuum Packaging Market Application Snapshot, By Value, 2015 vs 2020

Figure 3 Global Population Projected to Reach ?9.5 Billion By 2050

Figure 4 Per-Capita GDP Growth Rate

Figure 5 Gross Value Add (USD Billion)

Figure 6 Market Size Estimation Methodology: Bottom-Up Approach

Figure 7 Market Size Estimation Methodology: Top-Down Approach

Figure 8 Market Breakdown & Data Triangulation

Figure 9 Vacuum Packaging Market Application Snapshot, By Value, 2015 vs 2020

Figure 10 Pharmaceuticals Segment to Witness Highest Growth, 2015

Figure 11 Vacuum Packaging Market Size, By Packaging Material, 2015–2020 (USD Million)

Figure 12 Vacuum Packaging Market Size, By Machinery, 2015–2020 (USD Million)

Figure 13 Vacuum Packaging Market Size, By Process, 2015–2020 (USD Million)

Figure 14 Vacuum Packaging Market Size, By Pack Type, 2015–2020 (USD Million)

Figure 15 Vacuum Packaging Market Share (Value) and Growth Rate, By Region, 2015

Figure 16 Emerging Economies Offer Attractive Opportunities in the Global Vacuum Packaging Market

Figure 17 Asia-Pacific is Expected to Grow at the Highest Rate Between 2015 & 2020

Figure 18 China Accounted for the Largest Share in the Asia-Pacific Region in 2014

Figure 19 Rising Population and Rapid Urbanization in the Asia-Pacific Region to Boost Demand for Vacuum Packaging Between 2015 & 2020

Figure 20 Food Dominated the Global Vacuum Packaging Market in 2014 (USD Million)

Figure 21 Polyethylene Witnessed Largest Consumption in the Global Vacuum Packaging Market in 2014

Figure 22 Skin Vacuum Packaging Dominated in Terms of Value in the Global Vacuum Packaging Market in 2014

Figure 23 Flexible Packaging Dominated in Terms of Value in the Global Vacuum Packaging Market in 2014

Figure 24 Thermoformers Accounted for the Largest Value in the Vacuum Packaging Market During the Forecast Period

Figure 25 China & India to Emerge as Lucrative Markets During the Forecast Period

Figure 26 Asia-Pacific to Experience High Growth During the Forecast Period for Vacuum Packaging

Figure 27 Evolution of Vacuum Packaging

Figure 28 Vacuum Packaging Market Segmentation

Figure 29 High Demand for Hygienic Packaging Driving the Growth of Vacuum Packaging Market

Figure 30 Global E-Commerce Industry Market Size, 2013-2015

Figure 31 Value Chain Analysis for Vacuum Packaging: Major Value is Added During the Production, Processing, and Assembly Phases

Figure 32 Supply Chain of Vacuum Packaging Industry

Figure 33 Porter’s Five Forces Analysis

Figure 34 Vacuum Packaging Market Size, By Application: 2015 vs 2020 (USD Million)

Figure 35 Vacuum Packaging Market, By Packaging Material, 2015 vs 2020 (USD Million)

Figure 36 Vacuum Packaging Market, By Machinery, 2015 vs 2020, (USD Million)

Figure 37 Vacuum Packaging Market, By Process, 2015 vs 2020 (USD Million)

Figure 38 Vacuum Packaging Market, By Pack Type, 2015 vs 2020 (USD Million)

Figure 39 Geographic Snapshot (2015-2020): the Markets in Asia-Pacific are Emerging as New Hot Spots

Figure 40 Vacuum Packaging Market Size, By Region, 2015 vs 2020 (USD Billion)

Figure 41 Asia-Pacific Vacuum Packaging Market Snapshot: China is Projected to Be the Global Leader Between 2015 & 2020

Figure 42 European Vacuum Packaging Market Snapshot: Germany is Projected to Be the Global Leader Between 2015 & 2020

Figure 43 North American Vacuum Packaging Market Snapshot: the U.S. is Projected to Be the Global Leader Between 2015 & 2020

Figure 44 Companies Adopted Product Innovation as the Key Growth Strategy Over the Last Three Years (2013-2015)

Figure 45 New Product Launches: the Key Growth Strategy

Figure 46 Geographic Revenue Mix of Top Five Market Players -

Figure 47 Amcor Limited: Company Snapshot

Figure 48 SWOT Analysis: Amcor Limited

Figure 49 Bemis Company, Inc.: Company Snapshot

Figure 50 SWOT Analysis: Bemis Company, Inc.

Figure 51 Berry Plastics Corporation: Company Snapshot

Figure 52 SWOT Analysis: Berry Plastics Corporation

Figure 53 Sealed Air Corporation: Company Snapshot

Figure 54 SWOT Analysis: Sealed Air Corporation

Figure 55 Coveris Holdings S.A.: Company Snapshot

Figure 56 SWOT Analysis: Coveris Holdings S.A.

Growth opportunities and latent adjacency in Vacuum Packaging Market