Flight Simulator Market by Type (Full Flight, Flight Training Device, Full Mission, Fixed based), Platform (Commercial, Military, UAVs), Method (Virtual, Synthetic), Solution (Products, Services) and Region - Global Forecast to 2027

Flight Simulator Market Size & Share

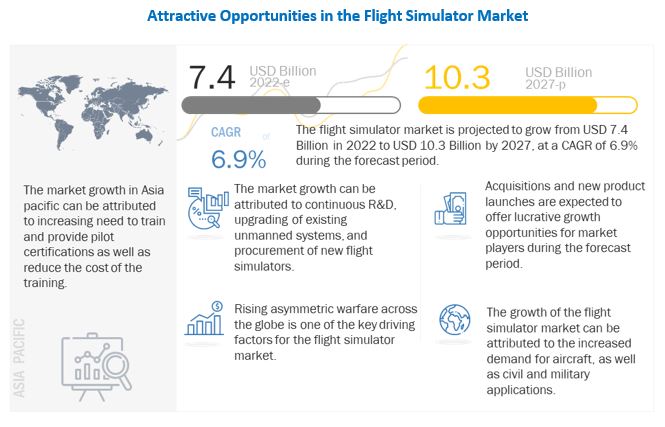

The Flight Simulator Market Size is expected to reach a value worth USD 10.3 billion by 2027, a rise from USD 7.4 billion, with a CAGR of 6.9% from 2022 to 2027. A flight simulator helps artificially recreate the aircraft flight environment to train pilots and design aircraft. It is a system that combines software and hardware to enable users to simulate the piloting of specific aircraft types. These devices provide benefits such as mission-critical training programs that assure successful aircraft operation, minimal operational costs, and visual systems that provide near the real-world experience and are expected to offer avenues for market expansion in the coming years.

Rising demand for better and more effective pilot training is expected to propel expansion. The increasing importance of aviation safety and the requirement for extensive training are expected to drive demand during the next few years.

To know about the assumptions considered for the study, Request for Free Sample Report

Flight Simulator Market Ecosystem

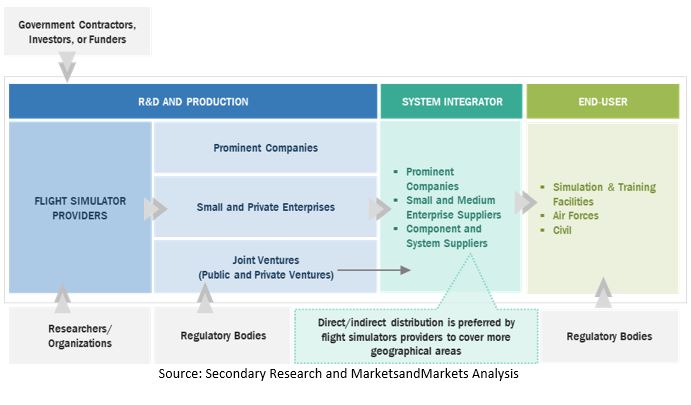

The primary stakeholders in the flight simulator market ecosystem include prominent firms and start-ups that supply simulators and their services, distributors/suppliers/retailers, and end users. The key market influences include investors, funders, academic researchers, distributors, service providers, and industry.

Flight Simulator Market Segment Overview

The full flight simulators segments projected to lead the market during the forecast period

The flight simulator market has been segmented based on type into full mission flight simulators, flight training devices, full flight simulators, and fixed base simulators.

Key players operating in the flight simulator market are focused on developing advanced simulators to explore new market opportunities. Full flight simulators (FFS) in military aircraft enable trained pilots to develop skills for combat operations. These simulators provide battlefield simulations with the use of artificial intelligence. The demand for efficient and effective pilot training drives the growth of full-flight simulators.

The synthetic segment projected to lead the flight simulator market during the forecast period

Based on method, the flight simulator market has been segmented into synthetic and virtual. Different types of simulation training methods use the concept of virtual and constructive reality to allow trainees to practice complex tasks and processes.

The increasing adoption of the synthetic environment in improving training, mission planning, rehearsal, and operational decision-making as it is more realistic and accurately simulated in the real world is driving the growth of the Flight Simulator Industry.

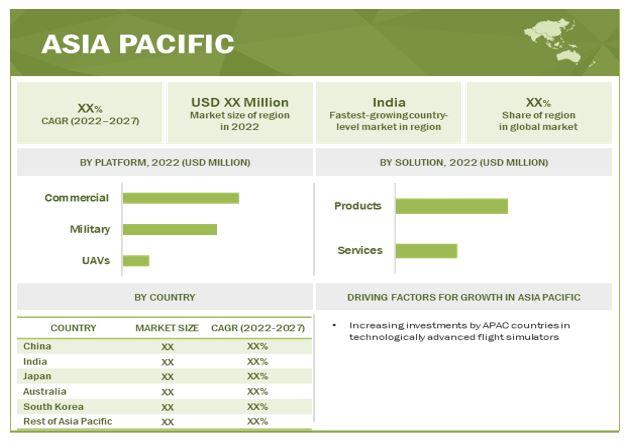

Asia Pacific witnessed the highest CAGR during the forecasted period

The Asia Pacific region's growing demand for air travel and aerial connectivity has prompted airlines to launch new routes. This is causing a significant shortage of pilots and cabin crew in the region.

This shortage of pilots and other aircraft employees is expected to drive the demand for civil aviation simulators. The construction of new training facilities by regional airlines and training providers, as well as orders for new simulators, is expected to drive the demand for simulator training during the forecast period.

To know about the assumptions considered for the study, download the pdf brochure

Top Companies in Flight Simulator Industry

The Flight Simulator Companies are dominated by globally established players such as

- CAE Inc. (Canada),

- L3Harris Technologies, Inc. (US),

- Thales SA (France),

- Saab AB (Sweden),

- Flight Safety International(US),

- The Boeing Company (US),

- Airbus S.A.S. (Netherlands),

- Tru Simulation + Training Inc. (US), and

- Raytheon Company (US).

Flight Simulator Market Scope

|

Report Metric |

Details |

| Estimated Market Size | USD 7.4 billion in 2022 |

| Projected Market Size | USD 10.3 billion by 2027 |

| Growth Rate (CAGR) | 6.9% |

|

Market size available for years |

2019-2027 |

|

Base year considered |

2021 |

|

Forecast period |

2022-2027 |

|

Forecast units |

Value (USD Million/ Billion) |

|

Segments Covered |

|

|

Geographies Covered |

North America, Asia Pacific, Europe, the Middle East, and the Rest of the World |

|

Companies Covered |

|

Flight Simulator Market Dynamics:

Driver: Acceptance of virtual pilot training

The adoption of virtual pilot instruction was spurred mostly by safety concerns. Virtual flight training has become increasingly popular lately due to various advantages, including effective training with a real-time perspective, less environmental impact, and cost-effectiveness.

The majority of aircraft orientation and training is done using complete flight simulators. Simulation-based training keeps the pilot and instructor safe by simulating realistic circumstances and preventing students from damaging expensive aircraft. Simulators can also run for more than 20 hours per day with little carbon emissions and at a cost that is 22 times less than teaching pilots on an aircraft. Flight simulation is widely used in the air force for equipment-use training, such as computer-based warfare training. Most pilot exercises have been replaced by simulation training and are now used by flight crews. As the number of fighter aircraft accidents rises, so does the demand for simulator-based training to ensure safer flying.

Restraint: Lack of interoperability

Interoperability refers to the potential of a system to transmit information and exchange data within a framework. The timely exchange of accurate data is crucial within a simulator framework.

Simulation interoperability is mainly a concern for the military sector. Lack of interoperability compels the military sector to achieve their emission targets with low-grade simulation systems, which is costly and time-consuming. Despite various improvements in these systems, they cannot keep pace with constantly increasing technological complexities.

Opportunity: Simulators for air accident investigation

According to the Air Accident Investigation Branch (UK), accident investigation is considered a new application area of simulators. Manufacturers of full flight simulators, such as CAE Inc. (Canada), invest in building simulators capable of recreating a flight operation with exact environmental conditions.

The usage of flight simulators in an accident investigation is to program the simulator, usually a fixed base engineering simulator, with digital data from the flight data recorder (FDR), which will then reproduce the flight of the aircraft. Data from the air traffic control radar, Traffic Alert and Collision Avoidance System (TCAS) units, and the cockpit voice recorder can all be combined to provide the investigator with a complete picture. Many flight simulators have a brief feature that allows simulator data to be replayed for training purposes; nevertheless, a full flight simulator is not meant to accept data from the FDR, particularly since an error may occur with system integration. For example, the investigation into the accident of American Airlines Flight 587 highlighted the potential use of flight simulation as an investigative tool. Based on these findings, agencies in charge of accident investigations may consider establishing more official standards for employing flight simulation to understand human components in aviation accidents better.

Challenge: Reduction of weight and size to maintain advanced features

The aviation industry has grown significantly, leading to an increased demand for pilots and, consequently, pilot training. Product development in the flight simulator market is a very lengthy procedure, as it takes a long time to develop a replica of aircraft that have been tested.

Flight simulator developers require OEM approvals to develop a replica of an aircraft, which adds to the time and cost of development. Furthermore, manufacturers must deliver customer-centric products that are flexible and adaptable to customer needs while also allowing them to cope with the changing environment of pilot training. Manufacturers also need to comply with safety, and regulatory management issues further hamper their ability to deliver required simulators on time.

Manufacturers try to make artificial environments as realistic as possible to provide high-fidelity visuals with a wider Field of View (FOV). However, many times, the simulation fails to generate a near-real feel. Flight simulators sometimes fail to give realistic physical feedback and are imperfect for high-stress flying. Moreover, some aircraft, such as helicopters, fly differently through a simulator and do not match the real-world visuals.

Flight Simulator Market Categorization

This research report categorizes the Flight Simulator Market based on Type, Platform, Method, Solution, and Region

Flight Simulator Market, By Platform

- Commercial

- Military

- UAVs

Flight Simulator Market, By Type

- Full Flight Simulators

- Fixed Base Simulators

- Flight Training Devices

- Full Mission Flight Simulators

Flight Simulator Market, By Solution

- Products

- Services

Flight Simulator Market, By Method

- Synthetic

- Virtual

Flight Simulator Market, By Region

- North America

- Europe

- Asia Pacific

- Middle East

- Rest of the World

Recent Developments in Flight Simulator Industry

- In July 2022, Aircalin (New Caledonia) secured a contract with Airbus Asia Training Centre (AATC) to provide flight crew training for its A320 and A330 pilots. Under the terms of the agreement, up to 35 Aircalin pilots might receive recurrent training on both aircraft types to maintain their skills and credentials.

- In May 2022, CAE Inc. announced the expansion of the CAE Toronto Training Center to deploy a CAE 7000XR Boeing 787 and a CAE 7000XR Boeing 737 MAX full-flight simulators (FFS) to service its Canadian customers at the 2022 World Aviation Training Summit (WATS).

- In May 2022, PSAA, a SAUDIA Group affiliate, inked a deal with L3Harris to supply six different simulators for advanced flying training.

- In October 2021, Breeze Airways selected FlightSafety International to supply full flight simulators and flight training devices for the Airbus A220 and Embraer E190 (FTD). FlightSafety will also maintain the operation of the gadgets and other crew training equipment for Breeze as part of a long-term arrangement. FlightSafety is strengthening its focus on commercial airline training and equipment. The company has delivered almost 40 E-jet Full Flight Simulators and is a prominent Airbus A220 training technology provider.

Frequently Asked Questions (FAQs):

What is the current size of the flight Simulator market?

The flight Simulator market size is projected to grow from USD 7.4 billion in 2022 to USD 10.3 billion by 2027, at a CAGR of 6.9% from 2022 to 2027.

Who are the winners in the Simulatorsmarket?

CAE Inc. (Canada), L3Harris Technologies, Inc. (US), Thales SA (France), Saab AB (Sweden), Indra (Spain), Flight Safety International(US), and The Boeing Company (US)are some of the winners in the market.

What are the key segments covered in the market?

By type (FFS, FMS, FBS, and FTD), by solution (products and services), by method(Synthetic and virtual), and by platform (Commercial, Military, and UAVs) in the market.

To speak to our analyst for a discussion on the above findings, click Speak to Analyst

TABLE OF CONTENTS

1 INTRODUCTION (Page No. - 35)

1.1 STUDY OBJECTIVES

1.2 MARKET DEFINITION

1.3 STUDY SCOPE

1.3.1 FLIGHT SIMULATOR MARKET SEGMENTATION

1.3.2 REGIONAL SCOPE

1.3.3 YEARS CONSIDERED

1.4 CURRENCY

1.4.1 USD EXCHANGE RATES

1.5 INCLUSIONS AND EXCLUSIONS

TABLE 1 FLIGHT SIMULATOR MARKET: INCLUSIONS AND EXCLUSIONS

1.6 LIMITATIONS

1.7 STAKEHOLDERS

1.8 SUMMARY OF CHANGES

2 RESEARCH METHODOLOGY (Page No. - 40)

2.1 RESEARCH DATA

FIGURE 1 RESEARCH PROCESS FLOW

FIGURE 2 FLIGHT SIMULATOR MARKET: RESEARCH DESIGN

2.1.1 SECONDARY DATA

2.1.1.1 Key data from secondary sources

2.1.2 PRIMARY DATA

2.1.2.1 Key data from primary sources

FIGURE 3 BREAKDOWN OF PRIMARY INTERVIEWS: BY FLIGHT SIMULATOR COMPANY TYPE, DESIGNATION, AND REGION

2.1.2.2 Insights from industry experts

TABLE 2 DETAILS OF PRIMARY INTERVIEWEES

2.2 FACTOR ANALYSIS

2.2.1 DEMAND-SIDE INDICATORS

2.2.2 SUPPLY-SIDE INDICATORS

2.3 MARKET SIZE ESTIMATION

2.3.1 BOTTOM-UP APPROACH

2.3.1.1 Products

TABLE 3 SIMULATORS IN AIRBORNE PLATFORMS

2.3.1.2 Services

FIGURE 4 MARKET SIZE ESTIMATION METHODOLOGY: BOTTOM-UP APPROACH

2.3.2 TOP-DOWN APPROACH

FIGURE 5 MARKET SIZE ESTIMATION METHODOLOGY: TOP-DOWN APPROACH

2.4 MARKET BREAKDOWN & DATA TRIANGULATION

FIGURE 6 DATA TRIANGULATION

FIGURE 7 RESEARCH ASSUMPTIONS

2.5 RISK ANALYSIS

3 EXECUTIVE SUMMARY (Page No. - 50)

FIGURE 8 FULL FLIGHT SIMULATORS SEGMENT PROJECTED TO LEAD MARKET DURING FORECAST PERIOD

FIGURE 9 PRODUCTS SEGMENT PROJECTED TO LEAD MARKET DURING FORECAST PERIOD

FIGURE 10 NORTH AMERICA ACCOUNTED FOR LARGEST MARKET SHARE IN 2021

4 PREMIUM INSIGHTS (Page No. - 53)

4.1 ATTRACTIVE OPPORTUNITIES FOR PLAYERS IN FLIGHT SIMULATOR MARKET

FIGURE 11 DEMAND FOR COST-EFFECTIVE VIRTUAL TRAINING EXPECTED TO FUEL MARKET GROWTH DURING FORECAST PERIOD

4.2 FLIGHT SIMULATOR MARKET, BY METHOD

FIGURE 12 SYNTHETIC SEGMENT EXPECTED TO ACCOUNT FOR LARGER MARKET SHARE DURING FORECAST PERIOD

4.3 FLIGHT SIMULATOR MARKET, BY PLATFORM

FIGURE 13 UAVS SEGMENT PROJECTED TO REGISTER HIGHEST CAGR DURING FORECAST PERIOD

4.4 FLIGHT SIMULATOR MARKET, BY MILITARY PLATFORM

FIGURE 14 HELICOPTERS SEGMENT PROJECTED TO LEAD MARKET DURING FORECAST PERIOD

4.5 FLIGHT SIMULATOR MARKET, BY COUNTRY

FIGURE 15 INDIA PROJECTED TO REGISTER HIGHEST CAGR DURING FORECAST PERIOD

5 MARKET OVERVIEW (Page No. - 56)

5.1 INTRODUCTION

5.2 MARKET DYNAMICS

FIGURE 16 FLIGHT SIMULATOR MARKET: DRIVERS, RESTRAINTS, OPPORTUNITIES, AND CHALLENGES

5.2.1 DRIVERS

5.2.1.1 Growing demand for pilots

FIGURE 17 DEMAND FOR NEW PILOTS, BY REGION (2021–2040)

5.2.1.2 Acceptance of virtual pilot training

FIGURE 18 GLOBAL AIRCRAFT ACCIDENT RATE, 2016–2020

5.2.1.3 Need for cost-cutting in pilot training

FIGURE 19 COMPARISON BETWEEN REAL-TIME AND SIMULATOR-BASED TRAINING, BY TOP AIRCRAFT

5.2.2 RESTRAINTS

5.2.2.1 Longer product lifecycle

5.2.2.2 Lack of interoperability

5.2.2.3 High cost of simulators

5.2.3 OPPORTUNITIES

5.2.3.1 Development of simulators for unmanned aerial systems

5.2.3.2 Usage in air accident investigations

5.2.4 CHALLENGES

5.2.4.1 Stringent regulatory approvals

5.2.4.2 Reduction of weight and size to maintain advanced features

5.3 TRENDS/DISRUPTIONS IMPACTING CUSTOMER BUSINESS

5.3.1 REVENUE SHIFT AND NEW REVENUE POCKETS FOR FLIGHT SIMULATOR MARKET

FIGURE 20 REVENUE SHIFT IN FLIGHT SIMULATOR MARKET

5.4 FLIGHT SIMULATOR MARKET ECOSYSTEM

5.4.1 PROMINENT FLIGHT SIMULATOR COMPANIES

5.4.2 PRIVATE AND SMALL ENTERPRISES

5.4.3 END-USERS

FIGURE 21 FLIGHT SIMULATOR MARKET ECOSYSTEM MAP

TABLE 4 FLIGHT SIMULATOR MARKET ECOSYSTEM

5.5 TECHNOLOGY ANALYSIS

5.5.1 DIGITAL TWIN

5.5.2 SIMULATION IN IOT

5.5.2.1 Importance of simulation in IoT

5.5.2.2 Functions of simulation in IoT

5.5.3 SMART SIMULATION WITH VIRTUAL REALITY (VR)

5.6 USE CASE ANALYSIS

5.6.1 USE CASE: REMOTE COLLABORATION ON DEFENSE PROJECTS

5.6.2 USE CASE: MAINTAINING DEFENSE AND ENGINEERING EQUIPMENT

5.6.3 USE CASE: MILITARY AIRCRAFT SIMULATION AND TRAINING

5.7 VALUE CHAIN ANALYSIS OF FLIGHT SIMULATOR MARKET

FIGURE 22 VALUE CHAIN ANALYSIS

5.8 PRICING ANALYSIS

TABLE 5 AVERAGE SELLING PRICE ANALYSIS OF FLIGHT SIMULATORS AND SUBSYSTEMS IN 2021

5.9 OPERATIONAL DATA

TABLE 6 VOLUME DATA OF AVIATION SIMULATORS (COMMERCIAL), 2020-2021

TABLE 7 VOLUME DATA OF AVIATION SIMULATORS (MILITARY), 2020-2021

5.10 PORTER’S FIVE FORCES ANALYSIS

TABLE 8 FLIGHT SIMULATOR MARKET: PORTER’S FIVE FORCES ANALYSIS

FIGURE 23 FLIGHT SIMULATOR MARKET: PORTER’S FIVE FORCES ANALYSIS

5.10.1 THREAT OF NEW ENTRANTS

5.10.2 THREAT OF SUBSTITUTES

5.10.3 BARGAINING POWER OF SUPPLIERS

5.10.4 BARGAINING POWER OF BUYERS

5.10.5 INTENSITY OF COMPETITIVE RIVALRY

5.11 KEY STAKEHOLDERS & BUYING CRITERIA

5.11.1 KEY STAKEHOLDERS IN BUYING PROCESS

FIGURE 24 INFLUENCE OF STAKEHOLDERS ON BUYING PROCESS

TABLE 9 INFLUENCE OF STAKEHOLDERS ON BUYING PROCESS (%)

5.11.2 BUYING CRITERIA

FIGURE 25 KEY BUYING CRITERIA FOR TOP THREE APPLICATIONS

TABLE 10 KEY BUYING CRITERIA FOR TOP THREE APPLICATIONS

5.12 TARIFF AND REGULATORY LANDSCAPE

5.12.1 REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

TABLE 11 NORTH AMERICA: REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

TABLE 12 EUROPE: REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

TABLE 13 ASIA PACIFIC: REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

TABLE 14 MIDDLE EAST & AFRICA: REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

TABLE 15 LATIN AMERICA: REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

5.13 KEY CONFERENCES AND EVENTS, 2022–2023

TABLE 16 FLIGHT SIMULATOR MARKET: DETAILED LIST OF CONFERENCES AND EVENTS

5.14 TRADE ANALYSIS

TABLE 17 AIR COMBAT SIMULATORS AND PARTS: COUNTRY-WISE IMPORTS, 2020–2021 (USD THOUSAND)

TABLE 18 AIR COMBAT SIMULATORS AND PARTS: COUNTRY-WISE EXPORTS, 2020–2021 (USD THOUSAND)

6 INDUSTRY TRENDS (Page No. - 78)

6.1 INTRODUCTION

TABLE 19 MAPPING OF KEY SIMULATOR MANUFACTURERS AND THEIR CORE COMPETENCY AREAS

TABLE 20 CLASSIFICATION OF AIRBORNE SIMULATION SYSTEMS BASED ON APPLICATION AREAS AND TRAINING PURPOSES

6.2 TECHNOLOGY TRENDS

6.2.1 FULL COMBAT AND MISSION TRAINING IN DOME TRAINER ENVIRONMENTS

6.2.2 BLUEFIRE TECHNOLOGY

6.2.3 SYNTHETIC TRAINING ENVIRONMENT

6.2.4 NIGHT VISION TRAINING SYSTEMS

6.2.5 REAL-TIME COMPUTER IMAGE GENERATION

6.2.6 OPTIMAL MOTION-CUEING TECHNOLOGY

6.2.7 RECONFIGURABLE FLIGHT SIMULATION AND TRAINING

6.2.8 GLADIATOR SIMULATION PROGRAMME

6.3 SUPPLY CHAIN ANALYSIS

FIGURE 26 SUPPLY CHAIN ANALYSIS

6.4 IMPACT OF MEGATRENDS

6.4.1 ASYMMETRIC MILITARY SIMULATION AND TRAINING SYSTEM OPERATIONS

6.4.2 ARTIFICIAL INTELLIGENCE

6.4.3 3D PRINTING

6.4.4 INTERNET OF THINGS

6.4.5 ROBOTIC PROCESS AUTOMATION

6.4.6 CLOUD COMPUTING & MASTER DATA MANAGEMENT

6.4.7 DIGITAL TWIN

6.4.8 AR & VR

6.4.9 5G

6.5 PATENT ANALYSIS

TABLE 21 KEY PATENTS (2014–2021)

7 FLIGHT SIMULATOR MARKET, BY SOLUTION (Page No. - 87)

7.1 INTRODUCTION

FIGURE 27 PRODUCTS SEGMENT EXPECTED TO LEAD MARKET DURING FORECAST PERIOD

TABLE 22 FLIGHT SIMULATOR MARKET, BY SOLUTION, 2019–2021 (USD MILLION)

TABLE 23 FLIGHT SIMULATOR MARKET, BY SOLUTION, 2022–2027 (USD MILLION)

7.2 PRODUCTS

TABLE 24 FLIGHT SIMULATOR PRODUCTS MARKET, BY SOLUTION, 2019–2021 (USD MILLION)

TABLE 25 FLIGHT SIMULATOR PRODUCTS MARKET, BY SOLUTION, 2022–2027 (USD MILLION)

7.2.1 HARDWARE

7.2.1.1 Procurement of hardware components by simulator manufacturers

7.2.2 SOFTWARE

7.2.2.1 Integration of multiple sensors with single training systems

7.3 SERVICES

TABLE 26 FLIGHT SIMULATOR SERVICES MARKET, BY SOLUTION, 2019–2021 (USD MILLION)

TABLE 27 FLIGHT SIMULATOR SERVICES MARKET, BY SOLUTION, 2022–2027 (USD MILLION)

7.3.1 HARDWARE UPGRADES

7.3.1.1 Rapid modernization of existing airborne, land, and maritime platforms

7.3.2 SOFTWARE UPGRADES

7.3.2.1 Updates and new features, programs, and algorithms

7.3.3 MAINTENANCE & SUPPORT

7.3.3.1 Introduction of new technologies

8 FLIGHT SIMULATOR MARKET, BY PLATFORM (Page No. - 92)

8.1 INTRODUCTION

FIGURE 28 BY PLATFORM, UAVS SEGMENT PROJECTED TO REGISTER HIGHEST CAGR DURING FORECAST PERIOD

TABLE 28 FLIGHT SIMULATOR MARKET, BY PLATFORM, 2019–2021 (USD MILLION)

TABLE 29 FLIGHT SIMULATOR MARKET, BY PLATFORM, 2022–2027 (USD MILLION)

8.2 COMMERCIAL

TABLE 30 COMMERCIAL FLIGHT SIMULATOR MARKET, BY PLATFORM, 2019–2021 (USD MILLION)

TABLE 31 COMMERCIAL FLIGHT SIMULATOR MARKET, BY PLATFORM, 2022–2027 (USD MILLION)

8.2.1 NARROW-BODY AIRCRAFT

8.2.1.1 Increasing deliveries of different narrow-body aircraft models

8.2.2 WIDE-BODY AIRCRAFT

8.2.2.1 Represents market for Airbus and Boeing aircraft simulators

8.2.3 EXTRA WIDE-BODY AIRCRAFT

8.2.3.1 Increasing air passenger traffic driving demand for new aircraft and highly skilled pilots

8.2.4 REGIONAL TRANSPORT AIRCRAFT (RTA)

8.2.4.1 Regional aircraft include ATR, CRJ, Q 400, and ERJ aircraft series simulators

8.3 MILITARY

TABLE 32 MILITARY FLIGHT SIMULATOR MARKET, BY PLATFORM, 2019–2021 (USD MILLION)

TABLE 33 MILITARY FLIGHT SIMULATOR MARKET, BY PLATFORM, 2022–2027 (USD MILLION)

8.3.1 HELICOPTERS

8.3.1.1 Increasing demand for new pilots to operate superior and powerful engine helicopters

8.3.2 COMBAT AIRCRAFT

8.3.2.1 Procurement of combat aircraft and real-time combat experience training

8.3.3 TRAINING AIRCRAFT

8.3.3.1 Growing use of virtual simulation for pilot training

8.3.4 TRANSPORT AIRCRAFT

8.3.4.1 Used for transportation of supplies during critical missions

8.4 UNMANNED AERIAL VEHICLES (UAVS)

9 FLIGHT SIMULATOR MARKET, BY TYPE (Page No. - 98)

9.1 INTRODUCTION

FIGURE 29 BY TYPE, FULL FLIGHT SIMULATORS SEGMENT EXPECTED TO LEAD MARKET DURING FORECAST PERIOD

TABLE 34 FLIGHT SIMULATOR MARKET, BY TYPE, 2019–2021 (USD MILLION)

TABLE 35 FLIGHT SIMULATOR MARKET, BY TYPE, 2022–2027 (USD MILLION)

9.2 FLIGHT TRAINING DEVICES

9.2.1 NEED FOR PILOT TRAINING TO SUPPORT AIRCREWS AND CADET PILOTS

9.3 FULL FLIGHT SIMULATORS

9.3.1 DEMAND FOR EFFICIENCY AND EFFECTIVENESS IN PILOT TRAINING

TABLE 36 FLIGHT SIMULATOR TYPE, BY VOLUME & MANUFACTURER, 2021

9.4 FULL MISSION FLIGHT SIMULATORS

9.4.1 SIMULATION OF REALISTIC FLIGHT TRAINING

9.5 FIXED BASE SIMULATORS

9.5.1 INTEGRATION OF GAMING PLATFORMS

10 FLIGHT SIMULATOR MARKET, BY METHOD (Page No. - 102)

10.1 INTRODUCTION

FIGURE 30 BY METHOD, SYNTHETIC SEGMENT PROJECTED TO REGISTER HIGHER CAGR FROM 2022 TO 2027

TABLE 37 FLIGHT SIMULATOR MARKET, BY METHOD, 2019–2021 (USD MILLION)

TABLE 38 FLIGHT SIMULATOR MARKET, BY METHOD, 2022–2027 (USD MILLION)

10.2 SYNTHETIC

10.2.1 SYNTHETIC SIMULATION METHODS INCREASINGLY USED

10.3 VIRTUAL

10.3.1 INCREASING ADOPTION OF VIRTUAL TRAINING METHODS TO DRIVE MARKET

11 REGIONAL ANALYSIS (Page No. - 105)

11.1 INTRODUCTION

FIGURE 31 NORTH AMERICA ACCOUNTED FOR LARGEST MARKET SHARE IN 2021

TABLE 39 FLIGHT SIMULATOR MARKET, BY REGION, 2019–2021 (USD MILLION)

TABLE 40 FLIGHT SIMULATOR MARKET, BY REGION, 2022–2027 (USD MILLION)

11.2 NORTH AMERICA

11.2.1 PESTLE ANALYSIS: NORTH AMERICA

FIGURE 32 NORTH AMERICA FLIGHT SIMULATOR MARKET SNAPSHOT

TABLE 41 NORTH AMERICA: FLIGHT SIMULATOR MARKET, BY TYPE, 2019–2021 (USD MILLION)

TABLE 42 NORTH AMERICA: FLIGHT SIMULATOR MARKET, BY TYPE, 2022–2027 (USD MILLION)

TABLE 43 NORTH AMERICA: FLIGHT SIMULATOR MARKET, BY SOLUTION, 2019–2021 (USD MILLION)

TABLE 44 NORTH AMERICA: FLIGHT SIMULATOR MARKET, BY SOLUTION, 2022–2027 (USD MILLION)

TABLE 45 NORTH AMERICA: FLIGHT SIMULATOR MARKET, BY PLATFORM, 2019–2021 (USD MILLION)

TABLE 46 NORTH AMERICA: FLIGHT SIMULATOR MARKET, BY PLATFORM, 2022–2027 (USD MILLION)

TABLE 47 NORTH AMERICA: FLIGHT SIMULATOR MARKET, BY METHOD, 2019–2021 (USD MILLION)

TABLE 48 NORTH AMERICA: FLIGHT SIMULATOR MARKET, BY METHOD, 2022–2027 (USD MILLION)

TABLE 49 NORTH AMERICA: FLIGHT SIMULATOR MARKET, BY COUNTRY, 2019–2021 (USD MILLION)

TABLE 50 NORTH AMERICA: FLIGHT SIMULATOR MARKET, BY COUNTRY, 2022–2027 (USD MILLION)

11.2.2 US

11.2.2.1 Rise in air passenger traffic to drive demand for airborne simulators

TABLE 51 US: FLIGHT SIMULATOR MARKET, BY TYPE, 2019–2021 (USD MILLION)

TABLE 52 US: FLIGHT SIMULATOR MARKET, BY TYPE, 2022–2027 (USD MILLION)

TABLE 53 US: FLIGHT SIMULATOR MARKET, BY SOLUTION, 2019–2021 (USD MILLION)

TABLE 54 US: FLIGHT SIMULATOR MARKET, BY SOLUTION, 2022–2027 (USD MILLION)

TABLE 55 US: FLIGHT SIMULATOR MARKET, BY METHOD, 2019–2021 (USD MILLION)

TABLE 56 US: MARKET, BY METHOD, 2022–2027 (USD MILLION)

11.2.3 CANADA

11.2.3.1 Civil aircraft training institutions hold significant potential for Canadian OEMs

TABLE 57 CANADA: FLIGHT SIMULATOR MARKET, BY TYPE, 2019–2021 (USD MILLION)

TABLE 58 CANADA: MARKET, BY TYPE, 2022–2027 (USD MILLION)

TABLE 59 CANADA: MARKET, BY SOLUTION, 2019–2021 (USD MILLION)

TABLE 60 CANADA: MARKET, BY SOLUTION, 2022–2027 (USD MILLION)

TABLE 61 CANADA: MARKET, BY METHOD, 2019–2021 (USD MILLION)

TABLE 62 CANADA: MARKET, BY METHOD, 2022–2027 (USD MILLION)

11.3 EUROPE

11.3.1 PESTLE ANALYSIS: EUROPE

FIGURE 33 EUROPE FLIGHT SIMULATOR MARKET SNAPSHOT

TABLE 63 EUROPE: MARKET, BY TYPE, 2019–2021 (USD MILLION)

TABLE 64 EUROPE: MARKET, BY TYPE, 2022–2027 (USD MILLION)

TABLE 65 EUROPE: MARKET, BY SOLUTION, 2019–2021 (USD MILLION)

TABLE 66 EUROPE: MARKET, BY SOLUTION, 2022–2027 (USD MILLION)

TABLE 67 EUROPE: MARKET, BY PLATFORM, 2019–2021 (USD MILLION)

TABLE 68 EUROPE: MARKET, BY PLATFORM, 2022–2027 (USD MILLION)

TABLE 69 EUROPE: MARKET, BY METHOD, 2019–2021 (USD MILLION)

TABLE 70 EUROPE: MARKET, BY METHOD, 2022–2027 (USD MILLION)

TABLE 71 EUROPE: MARKET, BY COUNTRY, 2019–2021 (USD MILLION)

TABLE 72 EUROPE: MARKET, BY COUNTRY, 2022–2027 (USD MILLION)

11.3.2 UK

11.3.2.1 Procurement of commercial aircraft to increase demand for simulators

TABLE 73 UK: MARKET, BY TYPE, 2019–2021 (USD MILLION)

TABLE 74 UK: MARKET, BY TYPE, 2022–2027 (USD MILLION)

TABLE 75 UK: MARKET, BY SOLUTION, 2019–2021 (USD MILLION)

TABLE 76 UK: MARKET, BY SOLUTION, 2022–2027 (USD MILLION)

TABLE 77 UK: MARKET, BY METHOD, 2019–2021 (USD MILLION)

TABLE 78 UK: MARKET, BY METHOD, 2022–2027 (USD MILLION)

11.3.3 GERMANY

11.3.3.1 Adoption of virtual training for pilots to increase demand for simulators

TABLE 79 GERMANY: FLIGHT SIMULATOR MARKET, BY TYPE, 2019–2021 (USD MILLION)

TABLE 80 GERMANY: MARKET, BY TYPE, 2022–2027 (USD MILLION)

TABLE 81 GERMANY: MARKET, BY SOLUTION, 2019–2021 (USD MILLION)

TABLE 82 GERMANY: MARKET, BY SOLUTION, 2022–2027 (USD MILLION)

TABLE 83 GERMANY: MARKET, BY METHOD, 2019–2021 (USD MILLION)

TABLE 84 GERMANY: MARKET, BY METHOD, 2022–2027 (USD MILLION)

11.3.4 ITALY

11.3.4.1 New aircraft deliveries increase demand for simulators

TABLE 85 ITALY: MARKET, BY TYPE, 2019–2021 (USD MILLION)

TABLE 86 ITALY: MARKET, BY TYPE, 2022–2027 (USD MILLION)

TABLE 87 ITALY: MARKET, BY SOLUTION, 2019–2021 (USD MILLION)

TABLE 88 ITALY: MARKET, BY SOLUTION, 2022–2027 (USD MILLION)

TABLE 89 ITALY: MARKET, BY METHOD, 2019–2021 (USD MILLION)

TABLE 90 ITALY: MARKET, BY METHOD, 2022–2027 (USD MILLION)

11.3.5 FRANCE

11.3.5.1 Rising need for pilots to increase demand for simulators

TABLE 91 FRANCE: MARKET, BY TYPE, 2019–2021 (USD MILLION)

TABLE 92 FRANCE: MARKET, BY TYPE, 2022–2027 (USD MILLION)

TABLE 93 FRANCE: MARKET, BY SOLUTION, 2019–2021 (USD MILLION)

TABLE 94 FRANCE: MARKET, BY SOLUTION, 2022–2027 (USD MILLION)

TABLE 95 FRANCE: MARKET, BY METHOD, 2019–2021 (USD MILLION)

TABLE 96 FRANCE: MARKET, BY METHOD, 2022–2027 (USD MILLION)

11.3.6 SPAIN

11.3.6.1 Rise in air passenger traffic to increase aircraft deliveries & drive demand for pilots

TABLE 97 SPAIN: MARKET, BY TYPE, 2019–2021 (USD MILLION)

TABLE 98 SPAIN: MARKET, BY TYPE, 2022–2027 (USD MILLION)

TABLE 99 SPAIN: MARKET, BY SOLUTION, 2019–2021 (USD MILLION)

TABLE 100 SPAIN: MARKET, BY SOLUTION, 2022–2027 (USD MILLION)

TABLE 101 SPAIN: MARKET, BY METHOD, 2019–2021 (USD MILLION)

TABLE 102 SPAIN: MARKET, BY METHOD, 2022–2027 (USD MILLION)

11.3.7 REST OF EUROPE

11.3.7.1 Rise in aircraft deliveries to increase demand for new pilots and simulators

TABLE 103 REST OF EUROPE: MARKET, BY TYPE, 2019–2021 (USD MILLION)

TABLE 104 REST OF EUROPE: MARKET, BY TYPE, 2022–2027 (USD MILLION)

TABLE 105 REST OF EUROPE: MARKET, BY SOLUTION, 2019–2021 (USD MILLION)

TABLE 106 REST OF EUROPE: MARKET, BY SOLUTION, 2022–2027 (USD MILLION)

TABLE 107 REST OF EUROPE: MARKET, BY METHOD, 2019–2021 (USD MILLION)

TABLE 108 REST OF EUROPE: MARKET, BY METHOD, 2022–2027 (USD MILLION)

11.4 ASIA PACIFIC

11.4.1 PESTLE ANALYSIS: ASIA PACIFIC

FIGURE 34 ASIA PACIFIC MARKET SNAPSHOT

TABLE 109 ASIA PACIFIC: MARKET, BY TYPE, 2019–2021 (USD MILLION)

TABLE 110 ASIA PACIFIC: MARKET, BY TYPE, 2022–2027 (USD MILLION)

TABLE 111 ASIA PACIFIC: MARKET, BY SOLUTION, 2019–2021 (USD MILLION)

TABLE 112 ASIA PACIFIC: MARKET, BY SOLUTION, 2022–2027 (USD MILLION)

TABLE 113 ASIA PACIFIC: MARKET, BY PLATFORM, 2019–2021 (USD MILLION)

TABLE 114 ASIA PACIFIC: MARKET, BY PLATFORM, 2022–2027 (USD MILLION)

TABLE 115 ASIA PACIFIC: MARKET, BY METHOD, 2019–2021 (USD MILLION)

TABLE 116 ASIA PACIFIC: MARKET, BY METHOD, 2022–2027 (USD MILLION)

TABLE 117 ASIA PACIFIC: MARKET, BY COUNTRY, 2019–2021 (USD MILLION)

TABLE 118 ASIA PACIFIC: MARKET, BY COUNTRY, 2022–2027 (USD MILLION)

11.4.2 CHINA

11.4.2.1 Recruitment of new pilots to drive market growth

TABLE 119 CHINA: MARKET, BY TYPE, 2019–2021 (USD MILLION)

TABLE 120 CHINA: MARKET, BY TYPE, 2022–2027 (USD MILLION)

TABLE 121 CHINA: MARKET, BY SOLUTION, 2019–2021 (USD MILLION)

TABLE 122 CHINA: MARKET, BY SOLUTION, 2022–2027 (USD MILLION)

TABLE 123 CHINA: MARKET, BY METHOD, 2019–2021 (USD MILLION)

TABLE 124 CHINA: MARKET, BY METHOD, 2022–2027 (USD MILLION)

11.4.3 JAPAN

11.4.3.1 Increasing demand for flight simulators from domestic airline companies

TABLE 125 JAPAN: MARKET, BY TYPE, 2019–2021 (USD MILLION)

TABLE 126 JAPAN: MARKET, BY TYPE, 2022–2027 (USD MILLION)

TABLE 127 JAPAN: MARKET, BY SOLUTION, 2019–2021 (USD MILLION)

TABLE 128 JAPAN: MARKET, BY SOLUTION, 2022–2027 (USD MILLION)

TABLE 129 JAPAN: MARKET, BY METHOD, 2019–2021 (USD MILLION)

TABLE 130 JAPAN: MARKET, BY METHOD, 2022–2027 (USD MILLION)

11.4.4 INDIA

11.4.4.1 Significant demand for commercial pilots to drive market

TABLE 131 INDIA: MARKET, BY TYPE, 2019–2021 (USD MILLION)

TABLE 132 INDIA: MARKET, BY TYPE, 2022–2027 (USD MILLION)

TABLE 133 INDIA: MARKET, BY SOLUTION, 2019–2021 (USD MILLION)

TABLE 134 INDIA: MARKET, BY SOLUTION, 2022–2027 (USD MILLION)

TABLE 135 INDIA: MARKET, BY METHOD, 2019–2021 (USD MILLION)

TABLE 136 INDIA: MARKET, BY METHOD, 2022–2027 (USD MILLION)

11.4.5 SOUTH KOREA

11.4.5.1 Demand for new commercial and military pilots to drive market growth

TABLE 137 SOUTH KOREA: MARKET, BY TYPE, 2019–2021 (USD MILLION)

TABLE 138 SOUTH KOREA: MARKET, BY TYPE, 2022–2027 (USD MILLION)

TABLE 139 SOUTH KOREA: MARKET, BY SOLUTION, 2019–2021 (USD MILLION)

TABLE 140 SOUTH KOREA: MARKET, BY SOLUTION, 2022–2027 (USD MILLION)

TABLE 141 SOUTH KOREA: MARKET, BY METHOD, 2019–2021 (USD MILLION)

TABLE 142 SOUTH KOREA: MARKET, BY METHOD, 2022–2027 (USD MILLION)

11.4.6 AUSTRALIA

11.4.6.1 Rise in demand for pilots to boost market growth

TABLE 143 AUSTRALIA: MARKET, BY TYPE, 2019–2021 (USD MILLION)

TABLE 144 AUSTRALIA: MARKET, BY TYPE, 2022–2027 (USD MILLION)

TABLE 145 AUSTRALIA: MARKET, BY SOLUTION, 2019–2021 (USD MILLION)

TABLE 146 AUSTRALIA: MARKET, BY SOLUTION, 2022–2027 (USD MILLION)

TABLE 147 AUSTRALIA: MARKET, BY METHOD, 2019–2021 (USD MILLION)

TABLE 148 AUSTRALIA: MARKET, BY METHOD, 2022–2027 (USD MILLION)

11.4.7 REST OF ASIA PACIFIC

11.4.7.1 Rise in aircraft orders to drive demand for pilots and simulators

TABLE 149 REST OF ASIA PACIFIC: MARKET, BY TYPE, 2019–2021 (USD MILLION)

TABLE 150 REST OF ASIA PACIFIC: MARKET, BY TYPE, 2022–2027 (USD MILLION)

TABLE 151 REST OF ASIA PACIFIC: MARKET, BY SOLUTION, 2019–2021 (USD MILLION)

TABLE 152 REST OF ASIA PACIFIC: MARKET, BY SOLUTION, 2022–2027 (USD MILLION)

TABLE 153 REST OF ASIA PACIFIC: MARKET, BY METHOD, 2019–2021 (USD MILLION)

TABLE 154 REST OF ASIA PACIFIC: MARKET, BY METHOD, 2022–2027 (USD MILLION)

11.5 MIDDLE EAST

11.5.1 PESTLE ANALYSIS: MIDDLE EAST

FIGURE 35 MIDDLE EAST MARKET SNAPSHOT

TABLE 155 MIDDLE EAST: MARKET, BY TYPE, 2019–2021 (USD MILLION)

TABLE 156 MIDDLE EAST: MARKET, BY TYPE, 2022–2027 (USD MILLION)

TABLE 157 MIDDLE EAST: MARKET, BY SOLUTION, 2019–2021 (USD MILLION)

TABLE 158 MIDDLE EAST: MARKET, BY SOLUTION, 2022–2027 (USD MILLION)

TABLE 159 MIDDLE EAST: MARKET, BY PLATFORM, 2019–2021 (USD MILLION)

TABLE 160 MIDDLE EAST: MARKET, BY PLATFORM, 2022–2027 (USD MILLION)

TABLE 161 MIDDLE EAST: MARKET, BY METHOD, 2019–2021 (USD MILLION)

TABLE 162 MIDDLE EAST: MARKET, BY METHOD, 2022–2027 (USD MILLION)

TABLE 163 MIDDLE EAST: MARKET, BY COUNTRY, 2019–2021 (USD MILLION)

TABLE 164 MIDDLE EAST: MARKET, BY COUNTRY, 2022–2027 (USD MILLION)

11.5.2 UAE

11.5.2.1 Growing demand for new pilots for increasing aircraft fleet

TABLE 165 UAE: MARKET, BY TYPE, 2019–2021 (USD MILLION)

TABLE 166 UAE: MARKET, BY TYPE, 2022–2027 (USD MILLION)

TABLE 167 UAE: MARKET, BY SOLUTION, 2019–2021 (USD MILLION)

TABLE 168 UAE: MARKET, BY SOLUTION, 2022–2027 (USD MILLION)

TABLE 169 UAE: MARKET, BY METHOD, 2019–2021 (USD MILLION)

TABLE 170 UAE: MARKET, BY METHOD, 2022–2027 (USD MILLION)

11.5.3 SAUDI ARABIA

11.5.3.1 Demand for new pilots and technicians to fuel market growth

TABLE 171 SAUDI ARABIA: MARKET, BY TYPE, 2019–2021 (USD MILLION)

TABLE 172 SAUDI ARABIA: MARKET, BY TYPE, 2022–2027 (USD MILLION)

TABLE 173 SAUDI ARABIA: MARKET, BY SOLUTION, 2019–2021 (USD MILLION)

TABLE 174 SAUDI ARABIA: MARKET, BY SOLUTION, 2022–2027 (USD MILLION)

TABLE 175 SAUDI ARABIA: MARKET, BY METHOD, 2019–2021 (USD MILLION)

TABLE 176 SAUDI ARABIA: MARKET, BY METHOD, 2022–2027 (USD MILLION)

11.5.4 REST OF MIDDLE EAST

11.5.4.1 Rise in aircraft orders to drive demand for pilots and simulators

TABLE 177 REST OF MIDDLE EAST: MARKET, BY TYPE, 2019–2021 (USD MILLION)

TABLE 178 REST OF MIDDLE EAST: MARKET, BY TYPE, 2022–2027 (USD MILLION)

TABLE 179 REST OF MIDDLE EAST: MARKET, BY SOLUTION, 2019–2021 (USD MILLION)

TABLE 180 REST OF MIDDLE EAST: MARKET, BY SOLUTION, 2022–2027 (USD MILLION)

TABLE 181 REST OF MIDDLE EAST: MARKET, BY METHOD, 2019–2021 (USD MILLION)

TABLE 182 REST OF MIDDLE EAST: MARKET, BY METHOD, 2022–2027 (USD MILLION)

11.6 REST OF THE WORLD

FIGURE 36 REST OF THE WORLD MARKET SNAPSHOT

TABLE 183 REST OF THE WORLD: MARKET, BY TYPE, 2019–2021 (USD MILLION)

TABLE 184 REST OF THE WORLD: MARKET, BY TYPE, 2022–2027 (USD MILLION)

TABLE 185 REST OF THE WORLD: MARKET, BY SOLUTION, 2019–2021 (USD MILLION)

TABLE 186 REST OF THE WORLD: MARKET, BY SOLUTION, 2022–2027 (USD MILLION)

TABLE 187 REST OF THE WORLD: MARKET, BY PLATFORM, 2019–2021 (USD MILLION)

TABLE 188 REST OF THE WORLD: MARKET, BY PLATFORM, 2022–2027 (USD MILLION)

TABLE 189 REST OF THE WORLD: MARKET, BY METHOD, 2019–2021 (USD MILLION)

TABLE 190 REST OF THE WORLD: MARKET, BY METHOD, 2022–2027 (USD MILLION)

TABLE 191 REST OF THE WORLD: MARKET, BY REGION, 2019–2021 (USD MILLION)

TABLE 192 REST OF THE WORLD: MARKET, BY REGION, 2022–2027 (USD MILLION)

11.6.1 LATIN AMERICA

11.6.1.1 Increase in ship operators to fuel demand for simulators

TABLE 193 LATIN AMERICA: MARKET, BY TYPE, 2019–2021 (USD MILLION)

TABLE 194 LATIN AMERICA: MARKET, BY TYPE, 2022–2027 (USD MILLION)

TABLE 195 LATIN AMERICA: MARKET, BY SOLUTION, 2019–2021 (USD MILLION)

TABLE 196 LATIN AMERICA: MARKET, BY SOLUTION, 2022–2027 (USD MILLION)

TABLE 197 LATIN AMERICA: MARKET, BY METHOD, 2019–2021 (USD MILLION)

TABLE 198 LATIN AMERICA: MARKET, BY METHOD, 2022–2027 (USD MILLION)

11.6.2 AFRICA

11.6.2.1 Demand for trained pilots to increase due to growth in aviation industry in Africa

TABLE 199 AFRICA: MARKET, BY TYPE, 2019–2021 (USD MILLION)

TABLE 200 AFRICA: MARKET, BY TYPE, 2022–2027 (USD MILLION)

TABLE 201 AFRICA: MARKET, BY SOLUTION, 2019–2021 (USD MILLION)

TABLE 202 AFRICA: MARKET, BY SOLUTION, 2022–2027 (USD MILLION)

TABLE 203 AFRICA: MARKET, BY METHOD, 2019–2021 (USD MILLION)

TABLE 204 AFRICA: MARKET, BY METHOD, 2022–2027 (USD MILLION)

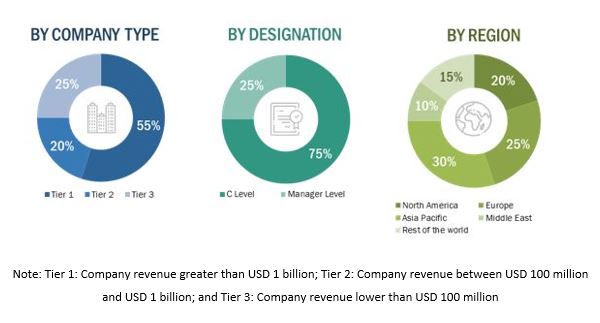

The study included four primary tasks to estimate the current market size for flight simulators. Extensive secondary research was conducted to gather information on the market, peer markets, and the parent market. The next stage was to conduct primary research to confirm these results, assumptions, and sizing with industry experts across the value chain. Both top-down and bottom-up methodologies were used to estimate the total market size. The market size of segments and subsegments was then estimated using market breakdown and data triangulation processes.

Secondary Research

Various secondary sources, such as GAMA (General Aviation Manufacturer Association), FlightGlobal Simulator Census, International Air Transport Association (IATA), Boeing Outlook 2021, Airbus Outlook 2021, D&B Hoovers, Bloomberg, BusinessWeek, and various periodicals, were used to locate and collect material for this study during the secondary research process. Secondary sources included company annual reports, press announcements, investor presentations, certified publications, essays by acknowledged writers, and simulator databases.

Primary Research

There are various stakeholders in the flight simulator market, including software and hardware providers, flight simulator manufacturers and suppliers, and regulatory agencies along the supply chain. This market's demand is defined by various end customers, including hardware makers, facility providers, and OEMs. Simulator technical breakthroughs characterize the supply side. To acquire qualitative and quantitative information, several primary sources from both the supply and demand sides of the market were interviewed. The primary respondents are divided as follows:

To know about the assumptions considered for the study, download the pdf brochure

Market Size Estimation

The overall size of the flight simulator market was estimated and validated using both top-down and bottom-up methodologies. These methodologies were also extensively employed to estimate the size of various market subsegments. The following research methodologies were utilized to estimate the market size:

- Extensive secondary research was used to identify key participants in the sector and marketplaces.

- Primary and secondary research was used to assess the industry's supply chain and market size in value.

- Secondary sources were used to calculate percentage shares, splits, and breakdowns, which were then validated using primary sources.

Market size estimation methodology: Bottom-up approach

Market size estimation methodology: Top-down approach

Data Triangulation

Following the evaluation of the total market size (as described above), the market was divided into segments and subsegments. Data triangulation and market breakdown processes were used whenever appropriate to complete the whole market engineering process and arrive at the exact statistics of each market segment and subsegment. The data was triangulated by evaluating numerous elements and trends from the flight simulator market's demand and supply sides.

Report Objectives

- Identify and analyze major drivers, constraints, challenges, and opportunities driving the flight simulator market's growth.

- Analyze the market effect of macro and micro indicators

- To forecast market segment sizes for five regions, including North America, Europe, Asia Pacific, the Middle East, and the Rest of the World, as well as significant nations within each of these areas.

- To conduct a strategic analysis of micro markets regarding particular technical trends, prospects, and their contribution to the total market.

- To profile key market participants strategically and thoroughly study their market ranking and essential skills

- To give a complete market competitive landscape, as well as an examination of the company and corporate strategies such as contracts, collaborations, partnerships, expansions, and new product developments.

- Identifying comprehensive financial positions, key products, unique selling points, and key developments of industry leaders

Available customizations

MarketsandMarkets provides customizations in addition to market data to meet the individual demands of businesses. The following report customization options are available:

Product Evaluation

- The product matrix provides a thorough comparison of each flight simulator company's product portfolio.

Regional Examination

- Further segmentation of the market at the national level

Information About the Flight Simulator Company

- Additional market participants will be thoroughly examined and profiled (up to 5)

Generating Response ...

Generating Response ...

Growth opportunities and latent adjacency in Flight Simulator Market

I am trying to understand the market size of the flight simulator market for flight schools, and "flight sim joy ride" businesses to identify the demand for flight scenery software that can be installed on a simulator.