Enhanced Vision System Market by Technology (Infrared, Synthetic Vision Systems, GPS, Millimeter Wave Radar), Component (Sensors, Processing Units, Control Electronics, Camera, Display), Platform (Fixed, Rotary) and Region - Global Forecast to 2021

The enhanced vision system market is projected to grow from USD 202.7 Million in 2016 to USD 250.4 Million by 2021, at a CAGR of 4.32% during the forecast period. The objective of this study is to analyze, define, describe, and forecast the market based on technology, component, platform, and region. The report also focuses on the competitive landscape of this market by profiling companies based on their financial position, product portfolio, growth strategies, and analyzing their core competencies and market share to anticipate the degree of competition prevailing in the market. This report also tracks and analyzes competitive developments, such as partnerships, mergers & acquisitions, new product developments, and research & development (R&D) activities in the enhanced vision system market. While 2014 has been considered as the base year, the duration between 2016 and 2021 has been considered as the forecast period for this market study.

The enhanced vision system market is expected to grow from USD 202.7 Million in 2016 to USD 250.4 Million by 2021, at a CAGR of 4.32% during the forecast period. Aircraft safety, situational awareness, and reliable operations at low visibility are factors driving the growth of the market. Key players operating in the market are Honeywell International, Inc. (U.S.), United Technologies Corporation (U.S.), L-3 Communications Holdings, Inc. (U.S.), Thales Group (France), and Elbit Systems Ltd. (Israel).

Based on technology, the enhanced vision system market has been segmented into infrared, synthetic vision, global positioning system, and millimeter wave radar. The millimeter wave radar segment of the market is expected to grow at the highest CAGR during the forecast period. Pilots have to depend on active sensors like millimeter wave (MMW) radars for reliable vision and safe navigation. Among all imaging sensors, the most promising one for enhanced vision systems is the imaging MMW radar as it has the lowest weather dependency. This factor is anticipated to drive the millimeter wave radar segment.

Based on component, the display segment is projected to account for the largest share of the enhanced vision system market during the forecast period. A display unit serves as a screen for graphical representation of data collected from various sensors onboard an aircraft, and is a crucial component of the enhanced vision systems. This is one of the key factors propelling the growth of this segment.

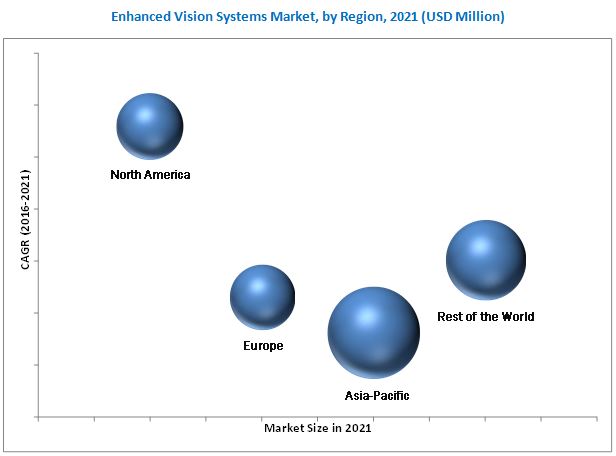

North America is expected to lead the enhanced vision system market during the forecast period. Countries in this region include the U.S. and Canada. The market in North America is driven by the large number of original component manufacturers (OCMs) and original equipment manufacturers (OEMs), major technological upgradation of existing equipment by key players, and the presence of key market players, such as Honeywell International, Inc. (U.S.), United Technologies Corporation (U.S.), and L-3 Communications Holdings, Inc. (U.S.). Whereas, the Asia-Pacific market is projected to grow at the highest CAGR during the forecast period. This high growth can be attributed to the presence of large OEMs, such as HALBIT Avionics Private Limited (India) and Samtel Group (India), demand for increased safety and reliable airline operations, and fluctuating weather conditions in the region.

Aircraft manufacturers as well as OEMs need high initial capital to set up machinery, skilled workforce, state-of-the-art technical equipment, and integration platforms. Manufactured components also need to be approved by various authorities before they are installed on board the aircraft. Besides, it is difficult to obtain approval for the replacement of conventional systems with electric systems in an aircraft. These act as major restraints for the growth of the enhanced vision system market.

The enhanced vision system market is a diversified and competitive market with a large number of players. Key players operating in the market are Honeywell International, Inc. (U.S.), United Technologies Corporation (U.S.), L-3 Communications Holdings, Inc. (U.S.), Thales Group (France), and Elbit Systems Ltd. (Israel). Honeywell International, Inc. holds 27% share of the enhanced vision system market. Market players focus on entering new markets by launching technologically advanced & cost-effective products and acquiring new businesses.

To speak to our analyst for a discussion on the above findings, click Speak to Analyst

Table of Contents

1 Introduction (Page No. - 16)

1.1 Objectives of Study

1.2 Market Definition

1.3 Study Scope

1.3.1 Markets Covered

1.3.2 Regional Scope

1.3.3 Years Considered for the Study

1.4 Currency & Pricing

1.5 Study Limitations

1.6 Market Stakeholders

2 Research Methodology (Page No. - 20)

2.1 Research Data

2.1.1 Secondary Data

2.1.1.1 Key Data From Secondary Sources

2.1.2 Primary Data

2.1.2.1 Key Data From Primary Sources

2.1.2.2 Key Industry Insights

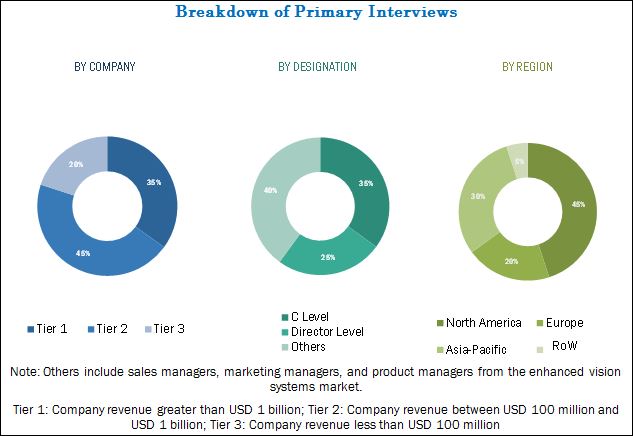

2.1.2.3 Breakdown of Primaries

2.2 Factor Analysis

2.2.1 Introduction

2.2.2 Demand-Side Indicators

2.2.2.1 General Aviation Safety

2.2.2.2 Operational Flexibility

2.2.3 Supply-Side Indicators

2.2.3.1 High Growth Prospects for Component Manufacturers

2.3 Market Size Estimation

2.3.1 Bottom-Up Approach

2.3.2 Top-Down Approach

2.4 Data Triangulation

2.5 Research Assumptions

3 Executive Summary (Page No. - 31)

4 Premium Insights (Page No. - 35)

4.1 Increasing Global Demand for Enhanced Vision System

4.2 Enhanced Vision Systems (EVS) Market, By Technology

4.3 Enhanced Vision Systems Market Size, By Component

4.4 Market Share and Growth Analysis, By Region

4.5 Life Cycle Analysis, By Region

5 Market Overview (Page No. - 38)

5.1 Introduction

5.2 Market Segmentation

5.2.1 By Technology

5.2.2 By Component

5.2.3 By Platform

5.2.4 By Region

5.3 Market Dynamics

5.3.1 Drivers

5.3.1.1 Improved Safety and Situational Awareness

5.3.1.2 Reliable Operations at Poor Visibility

5.3.1.3 Smaller Airports With Inadequate Infrastructure

5.3.2 Restraints

5.3.2.1 Industry Regulations

5.3.2.2 High Cost of Technology

5.3.3 Opportunities

5.3.3.1 Retrofit and Aftermarket

5.3.3.2 Standard Fit for Business Jets and Operational Efficiency for Aircraft

5.3.4 Challenges

5.3.4.1 Create Awareness of EVS Among Aircraft Operators

6 Industry Trends (Page No. - 48)

6.1 Introduction

6.2 Value Chain

6.3 Supply Chain

6.4 Advancements in Existing Technologies

6.4.1 Infrared Technologies

6.4.2 Radar Technologies

6.4.3 Wave Guide Display vs Oled Display

6.5 Emerging Technology Trends

6.5.1 Forward Looking Infrared (FLIR) Technology

6.5.2 Multispectral & Hyper Spectral Cameras

6.5.3 Multi-Sensor Technology

6.5.4 Cooled Thermal Cameras

6.6 Patent Registrations

6.7 Vision Systems for UAV

6.7.1 Intelligence Surveillance and Reconnaissance (ISR)

6.7.1.1 Intelligence

6.7.1.2 Surveillance

6.7.1.3 Reconnaissance

6.8 Combined Vision Systems

6.8.1 Enhanced Vision System (EVS)

6.8.2 Synthetic Vision Systems (SVS)

6.8.3 Synthetic Aperture Radar (SAR)

6.8.4 Milli Metric Wave Radar

7 Enhanced Vision System Market, By Technology (Page No. - 58)

7.1 Introduction

7.2 Infrared

7.3 Synthetic Vision

7.4 Global Positioning System

7.5 Millimeter Wave Radar

8 Enhanced Vision System Market, By Component (Page No. - 63)

8.1 Introduction

8.2 Displays

8.3 Cameras

8.4 Processing Unit

8.5 Sensors

8.6 Control Electronics

9 Enhanced Vision System Market, By Platform (Page No. - 68)

9.1 Introduction

9.2 Fixed Wing

9.2.1 Commercial Jets

9.2.2 Fighter Jets

9.2.3 Business Jets

9.3 Rotary Wing

9.3.1 Commercial Helicopters

9.3.2 Military Helicopters

10 Regional Analysis (Page No. - 73)

10.1 Introduction

10.2 North America

10.2.1 By Technology

10.2.2 By Component

10.2.3 By Platform

10.2.4 By Country

10.2.4.1 U.S.

10.2.4.1.1 By Technology

10.2.4.1.2 By Component

10.2.4.1.3 By Platform

10.2.4.2 Canada

10.2.4.2.1 By Technology

10.2.4.2.2 By Component

10.2.4.2.3 By Platform

10.3 Europe

10.3.1 By Technology

10.3.2 By Component

10.3.3 By Platform

10.3.4 By Country

10.3.4.1 U.K.

10.3.4.1.1 By Technology

10.3.4.1.2 By Component

10.3.4.1.3 By Platform

10.3.4.2 France

10.3.4.2.1 By Technology

10.3.4.2.2 By Component

10.3.4.2.3 By Platform

10.3.4.3 Germany

10.3.4.3.1 By Technology

10.3.4.3.2 By Component

10.3.4.3.3 By Platform

10.3.4.4 Russia

10.3.4.4.1 By Technology

10.3.4.4.2 By Component

10.3.4.4.3 By Platform

10.4 Asia-Pacific

10.4.1 By Technology

10.4.2 By Component

10.4.3 By Platform

10.4.4 By Country

10.4.4.1 China

10.4.4.1.1 By Technology

10.4.4.1.2 By Component

10.4.4.1.3 By Platform

10.4.4.2 Japan

10.4.4.2.1 By Technology

10.4.4.2.2 By Component

10.4.4.2.3 By Platform

10.4.4.3 India

10.4.4.3.1 By Technology

10.4.4.3.2 By Component

10.4.4.3.3 By Platform

10.5 Rest of the World

10.5.1 By Technology

10.5.2 By Component

10.5.3 By Platform

10.5.4 By Country

10.5.4.1 UAE

10.5.4.1.1 By Technology

10.5.4.1.2 By Component

10.5.4.1.3 By Platform

10.5.4.2 Brazil

10.5.4.2.1 By Technology

10.5.4.2.2 By Component

10.5.4.2.3 By Platform

10.5.4.3 South Africa

10.5.4.3.1 By Technology

10.5.4.3.2 By Component

10.5.4.3.3 By Platform

11 Competitive Landscape (Page No. - 109)

11.1 Overview

11.2 Market Rank Analysis, By Company

11.3 Brand Analysis

11.4 Competitive Situations & Trends

11.4.1 Contracts

11.4.2 New Product Launches

11.4.3 Acquisitions

12 Company Profiles (Page No. - 117)

(Company at A Glance, Recent Financials, Products & Services, Strategies & Insights, & Recent Developments)*

12.1 Introduction

12.2 Honeywell International, Inc.

12.3 United Technologies Corporation

12.4 L-3 Communications Holdings, Inc.

12.5 Thales Group

12.6 Elbit Systems Ltd.

12.7 Rockwell Collins, Inc.

12.8 Esterline Technologies Corporation

12.9 Astronics Corporation

12.10 MBDA

12.11 Opgal

*Details on Company at A Glance, Recent Financials, Products & Services, Strategies & Insights, & Recent Developments Might Not Be Captured in Case of Unlisted Companies.

13 Appendix (Page No. - 145)

13.1 Discussion Guide

13.2 Knowledge Store: Marketsandmarkets¡¯ Subscription Portal

13.3 Introducing RT: Real Time Market Intelligence

13.4 Available Customizations

13.5 Related Reports

13.6 Author Details

List of Tables (80 Tables)

Table 1 Market Segmentation: By Technology

Table 2 Market Segmentation: By Component

Table 3 Market Segmentation: By Platform

Table 4 Geographic Analysis of EVS Market

Table 5 Parameters and Compliance Characteristic for EVS

Table 6 Misconceptions and Comprehensions of Enhanced Vision System (EVS)

Table 7 Increasing Role of Drones for Intelligence Activities

Table 8 Micro Drone Applications

Table 9 Characteristics of Milli Meter Wave Radar (MMWR)

Table 10 EVS Market Size, By Technology, 2014-2021 (USD Million)

Table 11 Infrared Segment, By Region, 2014-2021 (USD Million)

Table 12 Synthetic Vision Segment, By Region, 2014-2021 (USD Million)

Table 13 Global Positioning System Segment, By Region, 2014-2021 (USD Million)

Table 14 Millimeter Wave Radar Segment, By Region, 2014-2021 (USD Million)

Table 15 Features of Enhanced Vision System Sensors

Table 16 EVS Market, By Component, 2014-2021 (USD Million)

Table 17 Displays Segment, By Region, 2014-2021 (USD Million)

Table 18 Cameras Segment, By Region, 2014-2021 (USD Million)

Table 19 Processing Unit Segment, By Region, 2014-2021 (USD Million)

Table 20 Sensors Segment, By Region, 2014-2021 (USD Million)

Table 21 Control Electronics Segment, By Region, 2014-2021 (USD Million)

Table 22 EVS Market Size, By Platform, 2014-2021 (USD Million)

Table 23 Fixed Wing Segment, By Region, 2014-2021 (USD Million)

Table 24 Rotary Wing Segment, By Region, 2014-2021 (USD Million)

Table 25 EVS Market Size, By Region, 2015-2021 (USD Million)

Table 26 North America: EVS Market Size, By Technology, 2014-2021 (USD Million)

Table 27 North America: EVSMarket Size, By Component, 2014-2021 (USD Million)

Table 28 North America: EVS Market Size, By Platform, 2014-2021 (USD Million)

Table 29 North America: EVS Market Size, By Country, 2014-2021 (USD Million)

Table 30 U.S.: Enhanced Vision System Industry Size, By Technology, 2014-2021 (USD Million)

Table 31 U.S.: Enhanced Vision System Industry Size, By Component, 2014-2021 (USD Billion)

Table 32 U.S.: Enhanced Vision System Industry Size, By Platform, 2014-2021 (USD Million)

Table 33 Canada: EVS Market Size, By Technology, 2014-2021 (USD Million)

Table 34 Canada: EVS Market Size, By Component, 2014-2021 (USD Million)

Table 35 Canada: EVS Market Size, By Platform, 2014-2021 (USD Million)

Table 36 Europe: EVS Market Size, By Technology, 2014-2021 (USD Million)

Table 37 Europe: EVS Market Size, By Component, 2014-2021 (USD Million)

Table 38 Europe: EVS Market Size, By Platform, 2014-2021 (USD Million)

Table 39 Europe: EVS Market Size, By Country, 2014-2021 (USD Million)

Table 40 U.K.: Market Size, By Technology, 2014-2021 (USD Million)

Table 41 U.K.: Market Size, By Application, 2014-2021 (USD Million)

Table 42 U.K.: Market Size, By Platform, 2014-2021 (USD Million)

Table 43 France: Market Size, By Technology, 2014-2021 (USD Million)

Table 44 France: Market Size, By Component, 2014-2021 (USD Thousand)

Table 45 France: Market Size, By Platform, 2014-2021 (USD Million)

Table 46 Germany: Market Size, By Technology, 2014-2021 (USD Million)

Table 47 Germany: Market Size, By Component, 2014-2021 (USD Thousand)

Table 48 Germany: Enhanced Vision System Size, By Platform, 2014-2021 (USD Million)

Table 49 Russia: Market Size, By Technology, 2014-2021 (USD Million)

Table 50 Russia: EnhancMarket Size, By Component, 2014-2021 (USD Thousand)

Table 51 Russia: Market Size, By Platform, 2014-2021 (USD Million)

Table 52 Asia-Pacific: EVS Market Size, By Technology, 2014-2021 (USD Million)

Table 53 Asia-Pacific: EVS Market Size, By Component, 2014-2021 (USD Million)

Table 54 Asia-Pacific: EVS Market Size, By Platform, 2014-2021 (USD Million)

Table 55 Asia-Pacific: EVS Market Size, By Country, 2015-2021 (USD Million)

Table 56 China: EVS Market Size, By Technology, 2014-2021 (USD Million)

Table 57 China: EVS Market Size, By Application, 2014-2021 (USD Million)

Table 58 China: EVS Market Size, By Platform, 2014-2021 (USD Million)

Table 59 Japan: EVS Market Size, By Technology, 2014-2021 (USD Million)

Table 60 Japan: EVS Market Size, By Application, 2014-2021 (USD Million)

Table 61 Japan: Market Size, By Platform, 2014-2021 (USD Million)

Table 62 India: Market Size, By Technology, 2014-2021 (USD Million)

Table 63 India: Market Size, By Application, 2014-2021 (USD Million)

Table 64 India: Market Size, By Platform, 2014-2021 (USD Million)

Table 65 Rest of the World: Market, By Technology, 2014-2021 (USD Billion)

Table 66 Rest of the World: Market, By Application, 2014-2021 (USD Million)

Table 67 Rest of the World: Market, By Platform, 2015-2021 (USD Million)

Table 68 Rest of the World: Market, By Country, 2014-2021 (USD Million)

Table 69 UAE: Market Size, By Technology, 2014-2021 (USD Billion)

Table 70 UAE: Market Size, By Component, 2014-2021 (USD Million)

Table 71 UAE: Market Size, By Platform, 2014-2021 (USD Million)

Table 72 Brazil: Market Size, By Technology, 2014-2021 (USD Million)

Table 73 Brazil: Market Size, By Component, 2014-2021 (USD Million)

Table 74 Brazil: Market Size, By Platform, 2014-2021 (USD Million)

Table 75 South Africa: Market Size, By Technology, 2014-2021 (USD Million)

Table 76 South Africa: Market Size, By Component, 2014-2021 (USD Thousand)

Table 77 South Africa: Market Size, By Platform, 2014-2021 (USD Million)

Table 78 Contracts, October 2014 - October 2016

Table 79 New Product Launches: October 2013 - November 2015

Table 80 Acquisitions: October 2016

List of Figures (55 Figures)

Figure 1 Enhanced Vision System Market: Markets Covered

Figure 2 Years Considered for the Study

Figure 3 Research Process Flow

Figure 4 Research Design

Figure 5 Breakdown of Primary Interviews: By Company Type, Designation and Region

Figure 6 Benefits of Enhanced Vision System

Figure 7 Global Air Passenger Growth (%), 2005-2015

Figure 8 Market Size Estimation Methodology: Bottom-Up Approach

Figure 9 Market Size Estimation Methodology: Top-Down Approach

Figure 10 Data Triangulation

Figure 11 Assumptions of the Research Study

Figure 12 Enhanced Vision System Market, By Region, 2016 & 2021 (USD Million)

Figure 13 The Infrared Segment Led the Enhanced Vision System Market in 2016

Figure 14 Asia-Pacific Projected to Be the Fastest-Growing Market for Enhanced Vision System During the Forecast Period

Figure 15 Contracts Was the Key Growth Strategy Adopted By Top Players, October 2014- October 2016

Figure 16 Attractive Market Opportunities in the Enhanced Vision Systems Market

Figure 17 The Infrared Segment Projected to Grow at the Highest CAGR During the Forecast Period

Figure 18 Displays Segment Projected to Be the Largest Segment By 2021

Figure 19 Enhance Vision System Market in Asia-Pacific Projected to Grow at the Highest CAGR During the Forecast Period

Figure 20 Enhanced Vision System Market: Drivers, Restraints, Opportunities & Challenges

Figure 21 Global Temperature Rise (¢ªc), 1951-2010

Figure 22 Value Chain : Enhanced Vision Systems Market

Figure 23 Supply Chain : Enhanced Vision Systems Market

Figure 24 Advancements in Existing Technologies

Figure 25 Patent Registration in Enhanced Vision Systems

Figure 26 Infrared Expected to Be the Largest Segment of the Market By 2021

Figure 27 Displays Segment Projected to Grow at the Highest CAGR During the Forecast Period

Figure 28 Fixed Wing Segment Projected to Grow at the Highest CAGR During the Forecast Period

Figure 29 Enhanced Vision System Market: Regional Snapshot, 2016-2021

Figure 30 North America: Enhanced Vision System Market Snapshot (2016)

Figure 31 Europe: Enhanced Vision System Market Snapshot (2016)

Figure 32 Asia-Pacific: Enhanced Vision System Market Snapshot (2016)

Figure 33 Rest of the World: Enhanced Vision System Market Snapshot

Figure 34 Companies Adopted Contracts as the Key Growth Strategy From October 2013 to October 2016

Figure 35 Market Rank Analysis, 2015

Figure 36 Brand Analysis: Enhanced Vision Systems Market

Figure 37 Enhanced Vision Systems Market Witnessed Significant Developments From October 2013 to October 2016

Figure 38 Contracts & Agreements is the Most Preferred Strategy Adopted By the Market Players

Figure 39 Regional Revenue Mix of Top 5 Market Players (2015)

Figure 40 Honeywell International, Inc.: Company Snapshot

Figure 41 Honeywell International, Inc.: SWOT Analysis

Figure 42 United Technologies Corporation: Company Snapshot

Figure 43 United Technologies Corporation: SWOT Analysis

Figure 44 L-3 Communications Holdings, Inc.: Company Snapshot

Figure 45 L-3 Communications Holdings, Inc.: SWOT Analysis

Figure 46 Thales Group: Company Snapshot

Figure 47 Thales Group: SWOT Analysis

Figure 48 Elbit Systems Ltd.: Company Snapshot

Figure 49 Elbit Systems Ltd.: SWOT Analysis

Figure 50 Rockwell Collins, Inc.: Company Snapshot

Figure 51 Rockwell Collins, Inc.: SWOT Analysis

Figure 52 Esterline Technologies Corporation: Company Snapshot

Figure 53 Esterline Technologies Corporation: SWOT Analysis

Figure 54 Astronics Corporation: Company Snapshot

Figure 55 Astronics Corporation: SWOT Analysis

The research methodology used to estimate and forecast the market includes study of data and revenues of key market players through secondary resources, such as annual reports, Yahoo Finance, Federal Aviation Administration (FAA), International Civil Aviation Organization (ICAO), International Air Transport Association (IATA), and Stockholm International Peace Research Institute (SIPRI). The bottom-up procedure was employed to arrive at the overall size of the enhanced vision system market from the revenue of key players in the market. After arriving at the overall market size, the market was split into several segments and subsegments, which were then verified through primary research by conducting extensive interviews with key industry experts, such as CEOs, VPs, directors, executives, and engineers. These data triangulation and market breakdown procedures were employed to complete the overall market engineering process and arrive at the exact statistics for all segments and subsegments. Breakdown of profiles of primaries is shown in the figure given below:

To know about the assumptions considered for the study, download the pdf brochure

Market Ecosystem

The ecosystem of the enhanced vision systems market comprises platform, technology, and component industries. The enhanced vision systems value chain includes component suppliers, such as Honeywell International, Inc. (U.S.), United Technologies Corporation (U.S.), L-3 Communications Holdings, Inc. (U.S.), Thales Group (France), Elbit Systems Ltd. (Israel), Rockwell Collins, Inc. (U.S.), Esterline Technologies Corporation (U.S.), and Astronics Corporation (U.S.). Dassault Falcon Jets Corp. (U.S.), Gulfstream Aerospace Corporation (U.S.), Bombardier Inc. (Canada), and Embraer SA (Brazil) are some of the aircraft manufacturers using enhanced vision systems manufactured by the various component suppliers listed above. Acquisitions and new product launches are the major strategies adopted by key players operational in the market.

Target Audience for this Report

- Manufacturers of Enhanced Vision Systems

- Original Equipment Manufacturers (OEMs)

- Sub-component Manufacturers

- Technology Support Providers

- Government and Certification Bodies

- Aircraft Manufacturer Associations

- Manufacturers of Unmanned Aerial Vehicles and Drones

¡°This study answers several questions for stakeholders, primarily, which market segments to focus on during the next two to five years for prioritizing their efforts and investments.¡±

Scope of the Report:

Enhanced Vision Systems Market, By Technology

- Infrared

- Synthetic Vision

- Global Positioning System

- Millimeter Wave Radar

Enhanced Vision Systems Market, By Component

- Sensors

- Processing Unit

- Control Electronics

- Camera

- Display

Enhanced Vision Systems Market, By Platform

- Fixed Wing

- Rotary Wing

Enhanced Vision Systems Market, By Region

- North America

- Europe

- Asia-Pacific

- Rest of the World

Available Customizations

Along with market data, MarketsandMarkets offers customizations as per specific needs of a company. The following customization options are available for this report:

-

Geographic Analysis

- Further breakdown of the Rest of the World market

-

Company Information

- Detailed analysis and profiling of additional market players (up to five)

- Additional Level Segmentation

Growth opportunities and latent adjacency in Enhanced Vision System Market