Emergency Shutdown System Market by Components (Switches, Sensors, Programmable Safety Systems, Safety Valves, Actuators), by Control Method (Pneumatic, Electrical, Fiber optic, Radio Telemetry), by Application, and Region - Global Trend and Forecast to 2022

The overall emergency shutdown system market (ESD) was valued at USD 987.0 Million in 2015 and is expected to grow at a CAGR of 9.1% between 2016 and 2022. The base year used for the study is 2015 and the forecast period is between 2016 and 2022. This report provides a detailed analysis of the ESD system market based on component, application, and region. It has been estimated that the safety sensors would hold a large share of the ESD system market. However, the market for programmable safety systems is expected to grow at a high CAGR between 2016 and 2022.

The overall emergency shutdown (ESD) system market is estimated to reach USD 1,816.0 Million by 2022, at a CAGR of 9.1% between 2016 and 2022. Rising demand for safety systems in the oil & gas industry and implementation of regulatory measures by several governments for industrial safety are important factors driving the ESD system market.

The oil & gas application accounted for the largest share among all applications of the ESD system market, followed by the power generation application. Safety is the most critical concern in the oil & gas industry. Lack of proper safety systems in the oil & gas industry may lead to production loss, stress on affected components and systems, and hazards during system restoration. Therefore, the market for ESD systems is expected to grow in the oil& gas application during the forecast period.

In 2015, safety sensors dominated the ESD system market based on components, followed by valves. Safety sensors are used widely in safety systems for different applications such as to sense movement and position, track tooling data, and help integrate automated systems. The market for ESD system based on components the programmable safety systems is expected to grow at a high CAGR during the forecast period. Programmable safety systems are relatively new and developing rapidly. They are flexible to design modifications, highly efficient, easy to install, highly reliable, and highly secure. These advantages of programmable safety systems have triggered the growth of this component in the ESD system market.

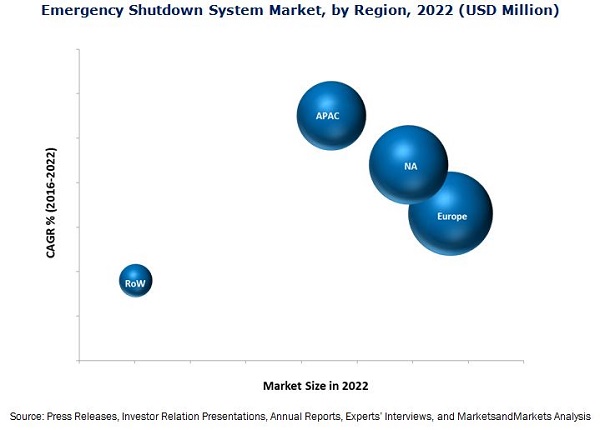

Europe accounted for the largest share of this market in 2015. A large-scale production creates the need for more intensive control of a process, especially with regards to its efficiency and safety; and this drives the ESD system market in the European region. The ESD system market in APAC is expected to grow at the highest CAGR between 2016 and 2022. With growing industrialization in APAC, increasing industrial and machine safety emphasis by the organizations and influence of multinational companies in adoption of safety systems. Moreover, a healthy growth of ESD systems is expected in the oil & gas application with a number of greenfield projects being planned in countries such as Indonesia and Malaysia are driving the demand for ESD systems in the APAC region.

One of the key restraining factors for the growth of this market is complexity of safety designs and lack of awareness regarding standards. Lack of awareness regarding safety standards among end users who adopt safety-instrumented systems and technologies is one of the major restraints. Personnel present on plants and factories are not yet aware about the type of safety devices and standards available to safeguard the machinery and labor. Some of these plants and manufacturers do not have safety experts to determine the possibility of safety devices required in each machine or process.

Rockwell Automation held the leading position in the ESD system market in 2015. The company is the leading provider of industrial automation power, control & information solutions. The key elements under architecture & software segments are the automation control and information platforms, software applications, and automation components. Its major revenue contribution comes from the architecture & software segment. Additionally, to sustain its leading position and ensure its future growth, the company adopted several other strategies such as new product launches and acquisition.

To speak to our analyst for a discussion on the above findings, click Speak to Analyst

Table of Contents

1 Introduction (Page No. - 13)

1.1 Objectives of the Study

1.2 Market Definition

1.3 Study Scope

1.3.1 Markets Covered

1.3.2 Years Considered for the Study

1.4 Currency

1.5 Limitations

1.6 Stakeholders

2 Reserach Methodology (Page No. - 16)

2.1 Introduction

2.1.1 Secondary Data

2.1.1.1 Key Data From Secondary Sources

2.1.2 Primary Data

2.1.2.1 Key Data From Primary Sources

2.1.2.2 Key Industry Insights

2.1.2.3 Breakdown of Primary Interviews

2.2 Market Size Estimation

2.2.1 Bottom-Up Approach

2.2.2 Top-Down Approach

2.3 Market Breakdown & Data Triangulation

2.4 Research Assumptions

3 Executive Summary (Page No. - 25)

4 Premium Insights (Page No. - 30)

4.1 Emergency Shutdown System Market, 2013–2022 (USD Million)

4.2 Market, By Component

4.3 Market

4.4 The APAC Market Expected to Grow at the Highest Rate Between 2016 and 2022

4.5 Market, By Application

4.6 Market, By Region

5 Market Overview (Page No. - 34)

5.1 Introduction

5.2 Market Segmentation

5.2.1 ESD Market, By Component

5.2.2 ESD System Market, By Application

5.2.3 ESD System Market, By Geography

5.3 Working of an ESD System

5.3.1 Sensors

5.3.2 Logic Solvers

5.3.3 Final Control Elements

5.4 Safety Integrity Level (SIL)

5.5 Communication Protocols Used in Process Industries

5.5.1 Communication Protocols

5.5.1.1 Profibus

5.5.1.2 Profinet

5.5.1.3 Modbus

5.5.1.4 Open Platform Communications (OPC)

5.6 Market Dynamics

5.6.1 Drivers

5.6.1.1 Rising Demand for Safety Systems in the Oil & Gas Industry

5.6.1.2 Implementation of Regulatory Measures By Several Governments for Industrial Safety

5.6.2 Restraints

5.6.2.1 Complexity of Safety Designs and Lack of Awareness Regarding Standards

5.6.2.2 Additional Cost to an Organization Due to the ESD System

5.6.3 Opportunities

5.6.3.1 Rising Usage of Industrial Internet of Things (IIOT) Creating Opportunities for the Market

5.6.3.2 Growing Emphasis on Industrial Safety Measures

5.6.4 Challenges

5.6.4.1 Lack of Common Standards in the Market

5.6.4.2 Increasing Complexity of Safety Applications

6 Industry Trends (Page No. - 46)

6.1 Introduction

6.2 Value Chain Analysis

6.3 Porter’s Five Forces Analysis

6.3.1 Intensity of Competitive Rivarly

6.3.2 Threat of Substitutes

6.3.3 Threat of New Entrants

6.3.4 Bargaining Power of Suppliers

6.3.5 Bargaining Power of Buyers

7 Control Methods Used in Emergency Shutdown Systems (Page No. - 54)

7.1 Introduction

7.2 Pneumatic

7.3 Electrical/Hardwired

7.4 Fiber Optic

7.5 Radio Telemetry

8 Emergency Shutdown System Market, By Component (Page No. - 56)

8.1 Introduction

8.2 Safety Switches

8.3 Emergency Stop Devices

8.4 Safety Controllers/Modules/Relays

8.5 Safety Sensors

8.6 Logic Solvers/Programmable Safety Systems

8.7 Safety Valves

8.7.1 Water Valves/Hydraulic Valves

8.7.2 Gas Valves

8.7.3 Fusible Plugs

8.7.4 Plastic Tubing

8.7.5 Shape-Memory Alloys

8.8 Actuators

8.9 Others

9 Emegency Shutdown System Market, By Application (Page No. - 77)

9.1 Introduction

9.2 Power Generation

9.2.1 Fossil Fuel

9.2.2 Nuclear

9.2.3 Renewable

9.3 Oil & Gas

9.3.1 Upstream Sector

9.3.2 Midstream Sector

9.3.3 Downstream Sector

9.4 Refining

9.5 Chemical

9.6 Metal & Mining

9.7 Paper & Pulp

9.8 Pharmaceutical

9.9 Food & Beverages

9.10 Water & Wastewater

9.11 Others

10 Emergency Shutdown System Market, By Geography (Page No. - 102)

10.1 Introduction

10.2 Americas

10.2.1 North America

10.2.1.1 U.S.

10.2.1.2 Canada

10.2.1.3 Mexico

10.2.2 South America

10.3 Europe

10.3.1 U.K.

10.3.2 Germany

10.3.3 France

10.3.4 Italy

10.3.5 Rest of Europe (RoE)

10.4 APAC

10.4.1 China

10.4.2 Japan

10.4.3 India

10.4.4 South Korea

10.4.5 Rest of APAC (RoAPAC)

10.5 Rest of the World (RoW)

10.5.1 Middle East

10.5.2 Africa

11 Competitive Landscape (Page No. - 123)

11.1 Overview

11.2 Market Share Analysis - ESD System Market

11.3 Competitive Situations and Trends

11.3.1 New Product Launches

11.3.2 Acquisitions

11.3.3 Partnerships & Contracts

12 Company Profiles (Page No. - 130)

12.1 Introduction

12.2 ABB Ltd.

12.3 Emerson Electric Co.

12.4 General Electric Company

12.5 Honeywell International Inc.

12.6 Schneider Electric SE

12.7 Rockwell Automation, Inc.

12.8 Siemens AG

12.9 Yokogawa Electric Corp.

12.10 Omron Corporation

12.11 Proserv Ingenious Simplicity

12.12 Hima Paul Hildebrandt GmbH

13 Appendix (Page No. - 157)

13.1 Insights of Industry Experts

13.2 Discussion Guide

13.3 Knowledge Store: Marketsandmarkets’ Subscription Portal

13.4 Introducing RT: Real-Time Market Intelligence

13.5 Available Customizations

13.6 Related Reports

List of Tables (69 Tables)

Table 1 SIL-Related Measures

Table 2 Rising Demand for Safety Systems in the Oil & Gas Industry is Driving the Growth of the ESD System Market

Table 3 Complexity of Safety Designs and Lack of Awareness Regarding Standards is Expected to Affect the Growth of the Market

Table 4 Rising Usage of Industrial Internet of Things (IIOT) Creating Opportunities for the ESD System Market

Table 5 Increasing Complexity of Safety Applications is A Challenge for the Emergency Shutdown System Market

Table 6 SIL Level and Performance Ranges for On-Demand Mode

Table 7 Market Size, By Component, 2013–2022 (USD Million)

Table 8 Market, By Component, 2013–2022 (Thousand Units)

Table 9 ESD System Market for Safety Switches , By Application, 2013–2022 (USD Million)

Table 10 ESD System Market for Safety Switches , By Region, 2013–2022 (USD Million)

Table 11 ESD System Market for Emergency Stop Devices, By Application, 2013–2022 (USD Million)

Table 12 ESD System Market for Emergency Stop Devices, By Region, 2013–2022 (USD Million)

Table 13 ESD System Market for Safety Controllers/Modules/Relays, By Application, 2013–2022 (USD Million)

Table 14 ESD System Market for Safety Controllers/Modules/Relays, By Region, 2013–2022 (USD Million)

Table 15 ESD System Market for Safety Sensors, By Application, 2013–2022 (USD Million)

Table 16 ESD System Market for Safety Sensors, By Region, 2013–2022 (USD Million)

Table 17 ESD System Market for Programmable Safety Systems, By Application, 2013–2022 (USD Million)

Table 18 ESD System Market for Programmable Safety Systems, By Region, 2013–2022 (USD Million)

Table 19 ESD System Market for Valves, By Application, 2013–2022 (USD Million)

Table 20 ESD System Market for Valves, By Region, 2013–2022 (USD Million)

Table 21 ESD System Market for Actuators, By Application, 2013–2022 (USD Million)

Table 22 ESD System Market for Actuators, By Region, 2013–2022 (USD Million)

Table 23 ESD System Marketfor Other Components, By Application, 2013–2022 (USD Million)

Table 24 ESD System Market for Othercomponents, By Region, 2013–2022 (USD Million)

Table 25 Emergency Shutdown System Market Size, By Application, 2013–2022 (USD Million)

Table 26 ESD System Marketfor Power Generation, By Component, 2013–2022 (USD Million)

Table 27 ESD System Marketfor Power Generation, By Region, 2013–2022 (USD Million)

Table 28 ESD System Market for Power Generation in Americas, By Region, 2013–2022 (USD Million)

Table 29 ESD System Market Size, By Power Generation Type, 2013–2022 (USD Million)

Table 30 ESD System Market for Oil & Gas, By Component, 2013–2022 (USD Million)

Table 31 ESD System Market for Oil & Gas, By Region, 2013–2022 (USD Million)

Table 32 ESD System Market for Oil & Gas in Americas, By Region, 2013–2022 (USD Million)

Table 33 ESD System Market for Upstream Sector for Oil & Gas, By Region, 2013–2022 (USD Million)

Table 34 ESD Marketfor Midstream Sector for Oil & Gas, By Region, 2013–2022 (USD Million)

Table 35 ESD Market Size for Downstream Sector for Oil & Gas, By Region, 2013–2022 (USD Million)

Table 36 Market, By Oil & Gas Sector, 2013–2022 (USD Million)

Table 37 ESD System Marketfor Refining, By Component, 2013–2022 (USD Million)

Table 38 ESD System Marketfor Refining, By Region, 2013–2022 (USD Million)

Table 39 ESD System Marketfor Chemical, By Component, 2013–2022 (USD Million)

Table 40 ESD System Marketfor Chemical, By Region, 2013–2022 (USD Million)

Table 41 ESD System Marketfor Metal & Mining, By Component, 2013–2022 (USD Million)

Table 42 ESD System Marketfor Metal & Mining, By Region, 2013–2022 (USD Million)

Table 43 ESD System Market for Paper & Pulp, By Component, 2013–2022 (USD Million)

Table 44 ESD System Marketfor Paper & Pulp, By Region, 2013–2022 (USD Million)

Table 45 ESD System Marketfor Pharmaceutical, By Component, 2013–2022 (USD Million)

Table 46 ESD System Marketfor Pharmaceutical, By Region, 2013–2022 (USD Million)

Table 47 ESD System Market for Food & Beverages, By Component, 2013–2022 (USD Million)

Table 48 ESD System Marketfor Food & Beverages, By Region, 2013–2022 (USD Million)

Table 49 ESD System Market for Water & Wastewater, By Component, 2013–2022 (USD Million)

Table 50 ESD System Market for Water & Wastewater, By Region, 2013–2022 (USD Million)

Table 51 ESD System Marketfor Other Applications, By Component, 2013–2022 (USD Million)

Table 52 ESD System Market for Other Applications, By Region, 2013–2022 (USD Million)

Table 53 Emergency Shutdown System Market, By Region, 2013–2022 (USD Million)

Table 54 ESD System Market in Americas, By Component, 2013–2022 (USD Million)

Table 55 EDS System Market in Americas, By Application, 2013–2022 (USD Million)

Table 56 ESD System Market in Americas, By Region, 2013–2022 (USD Million)

Table 57 ESD System Market in North America, By Country, 2013–2022 (USD Million)

Table 58 ESD System Market in Europe, By Component, 2013–2022 (USD Million)

Table 59 ESD System Market in Europe, By Application, 2013–2022 (USD Million)

Table 60 ESD System Market in Europe, By Country, 2013–2022 (USD Million)

Table 61 EDS System Market in APAC, By Component, 2013–2022 (USD Million)

Table 62 EDS System Market in APAC, By Application, 2013–2022 (USD Million)

Table 63 ESD System Market in APAC, By Country, 2013–2022 (USD Million)

Table 64 ESD System Market in RoW, By Component, 2013–2022 (USD Million)

Table 65 ESD System Market in RoW, By Application, 2013–2022 (USD Million)

Table 66 ESD System Market in RoW, By Region, 2013–2022 (USD Million)

Table 67 New Product Launches, 2014–2015

Table 68 Acquisitions, 2014–2016

Table 69 Partnerships & Contracts in 2014-2015

List of Figures (60 Figures)

Figure 1 Emergency Shutdown System Market Segmentation

Figure 2 ESD System Market: Research Design

Figure 3 Market Size Estimation Methodology: Bottom-Up Approach

Figure 4 Market Size Estimation Methodology: Top-Down Approach

Figure 5 Data Triangulation

Figure 6 Emergency Shutdown System Market Size, 2013–2022 (USD Million)

Figure 7 Market for Programmable Safety Systems Expected to Grow at the Highest Rate During the Forecast Period

Figure 8 Emergency Shutdown System Market, By Application, 2015

Figure 9 APAC Market Expected to Grow at the Highest Rate During the Forecast Period

Figure 10 Rising Demand for Safety Systems in Process Industries is Driving the Emergency Shutdown System Market During the Forecast Period

Figure 11 Market for Programmable Safety Systems Expected to Grow at the Highest Rate During the Forecast Period

Figure 12 Safety Sensors Held the Largest Share of the Emergency Shutdown System Market in 2015

Figure 13 Europe Expected to Hold the Largest Share During the Forecast Period

Figure 14 Oil & Gas Application Dominated the Emergency Shutdown System Market in 2015

Figure 15 Europe Would Dominate the ESD Market During the Forecast Period

Figure 16 Market Segmentation, By Geography

Figure 17 Implementation of Regulatory Measures By Several Governments for Industrial Safety Expected to Bring Opportunities in the ESD System Market

Figure 18 Major Value is Added During the Design of an ESD System and Its Validation Phase

Figure 19 Porter’s Five Forces Analysis, 2015

Figure 20 Intensity of Competitive Rivarly Had A High Impact on the ESD System Market in 2015

Figure 21 Threat of Substitutes Had Low Impact and Would Remain Low in the Future

Figure 22 Threat of New Entrants has Medium Impact Due to the Requirement of Huge Investment

Figure 23 Bargaining Power of Suppliers is Medium as Stringent Safety Standards are Required to Be Followed for Designing ESD Systems

Figure 24 Bargaining Power of Buyers in the ESD System Market is Medium

Figure 25 Components of the ESD System

Figure 26 Programmable Safety Systems Market Expected to Grow at the Highest Rate During the Forecast Period

Figure 27 Europe Expected to Hold the Largest Size of the ESD System Market for Safety Switches During the Forecast Period

Figure 28 Power Generation Expected to Grow at the Highest Rate in the ESD System Market for Safety Controllers/Modules/Relays During the Forecast Period

Figure 29 APAC ESD System Market for Programmable Safety Systems Expected to Grow at the Highest Rate During the Forecast Period

Figure 30 Power Generation Application Expected to Dominate the ESD System Market for Safety Valves By 2022

Figure 31 ESD System Market, By Application

Figure 32 Power Generation Application Expected to Grow at the Highest Rate in the ESD System Market During the Forecast Period

Figure 33 Safety Sensors in ESD Systems for the Oil & Gas Application Expected to Hold the Largest Market Size By 2022

Figure 34 ESD System Market for the Chemical Application in APAC Expected to Grow at the Highest Rate During the Forecast Period

Figure 35 Market for Safety Sensors Used in ESD Systems for the Food & Beverages Application Expected to Grow at the Highest Rate During the Forecast Period

Figure 36 Emergency Shutdown System Market, Geographic Snapshot, 2016–2022

Figure 37 The APAC Market for ESD Systems Expected to Grow at the Highest Rate During the Forecast Period

Figure 38 Power Generation Application Expected to Dominate the ESD System Market in the Americas During the Forecast Period

Figure 39 Emergency Shutdown System Market Overview in Europe

Figure 40 Emergency Shutdown System Market Overview in APAC

Figure 41 Safety Sensors Expected to Lead the ESD System Market in APAC During the Forecast Period

Figure 42 Companies Adopted Acquisitions and New Product Launches as Key Growth Strategies During 2013–2016

Figure 43 ESD System Market Share Analysis, 2015

Figure 44 Market Evaluation Framework - New Product Launches Fueled Growth and Innovation in 2014 and 2015

Figure 45 Battle for Market Share: New Product Launches Was the Key Strategy During 2013–2015

Figure 46 Geographic Revenue Mix of Top 5 Market Players

Figure 47 ABB Ltd.: Company Snapshot

Figure 48 ABB Ltd: SWOT Analysis

Figure 49 Emerson Electric Co.: Company Snapshot

Figure 50 Emerson Electric Co.: SWOT Analysis

Figure 51 General Electric Co.: Company Snapshot

Figure 52 Honeywell International Inc.: Company Snapshot

Figure 53 Honeywell International Inc.: SWOT Analysis

Figure 54 Schneider Electric SE: Company Snapshot

Figure 55 Schneider Electric SE: SWOT Analysis

Figure 56 Rockwell Automation, Inc.: Company Snapshot

Figure 57 Rockwell Automation, Inc.: SWOT Analysis

Figure 58 Siemens AG: Company Snapshot

Figure 59 Yokogawa Electric Corp.: Company Snapshot

Figure 60 Omron Corporation: Company Snapshot

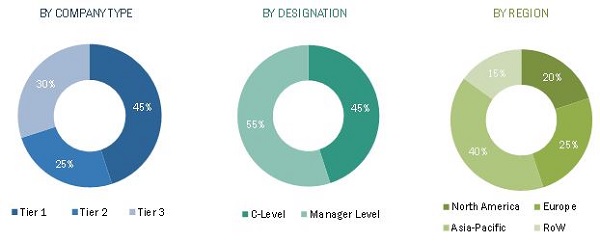

The research methodology used to estimate and forecast this market begins with capturing data on key vendor revenue through the secondary research. The vendor offerings are also taken into consideration to determine the market segmentation. The bottom-up procedure has been employed to arrive at the overall size of the ESD system market from the revenue of key players in the market. After arriving at the overall market size, the total market has been split into several segments and subsegments which have been verified through the primary research by conducting extensive interviews of people holding key positions such as CEOs, VPs, directors, and executives. These market breakdown and data triangulation procedures have been employed to complete the overall market engineering process and arrive at the exact statistics for all segments and subsegments. The breakdown of profiles of primary respondents is depicted in the figure below:

To know about the assumptions considered for the study, download the pdf brochure

The stakeholders of this report include technology providers; semiconductor product designers & fabricators; raw material & manufacturing equipment suppliers; research organizations & consulting companies;, associations, forums, and alliances related to process instrumentation; government bodies such as regulating authorities & policy makers; and investors. Key players profiled in the report are Rockwell Automation (U.S.), Schneider Electric SE (France), Emerson Electric Company (U.S.), Siemens AG (Germany), Honeywell International (U.S.).

The Target Audience:

- Emergency shutdown system manufactures

- Safety system solution providers

- Software providers

- Research organizations and consulting companies

- Associations, forums, and alliances related to safety systems

- Investors

Scope of the Report:

This research report categorizes the emergency shutdown system market based on method, industry, and region.

Global Emergency Shutdown System Market, by Method:

- Safety switches

- Emergency stop devices

- Safety controllers/modules/relays

- Safety sensors

- Logic solver/programmable safety systems

- Valves

- Actuators

Global Emergency Shutdown System Market, by Industry:

- Power generation

- Oil & gas

- Refining

- Chemical

- Pharmaceutical

- Paper & pulp

- Metal & mining

- Food & beverages

- Water & wastewater

Available Customizations:

With the given market data, MarketsandMarkets offers customizations according to a company’s specific needs. The following customization options are available for the report.

Company Information

Detailed analysis and profiling of additional market players (up to five)

Growth opportunities and latent adjacency in Emergency Shutdown System Market