System Integrator Market Size, Share, industry Growth, Trends & Analysis by Technology (Human Machine Interface, Machine Vision, Industrial Robotics, Industrial PC, IIoT, Distributed Control System, SCADA, PLC), Service Outlook (Consulting, Software Integration Service) - Global Forecast to 2029

System Integrator Market Size, Share & Growth

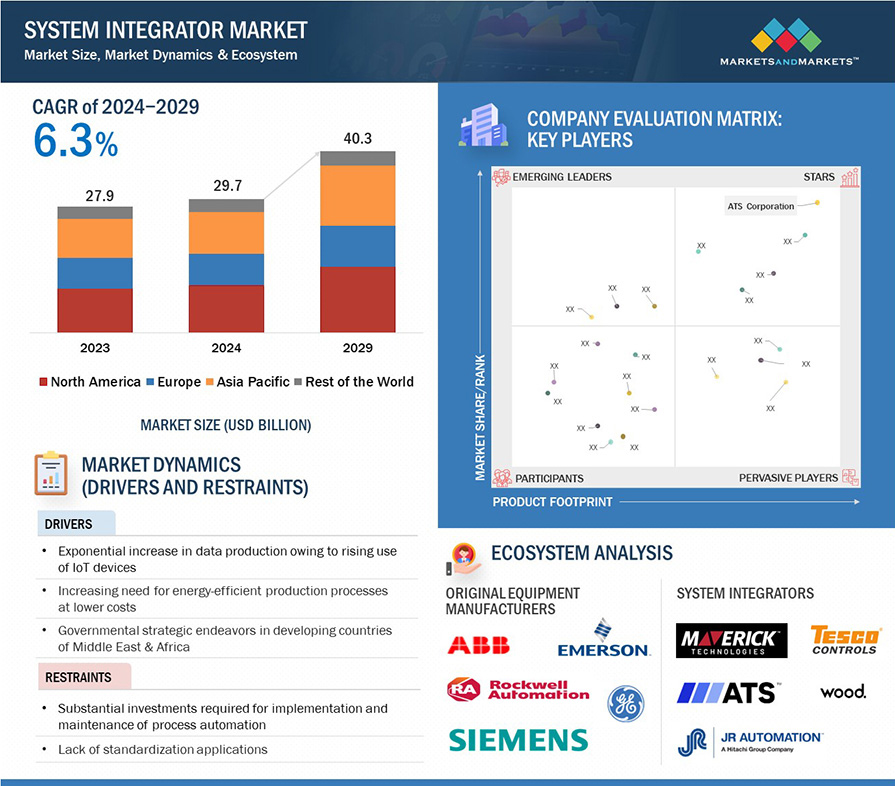

[239 Pages Report] The global System Integrator Market was valued at USD 29.66 billion in 2024 and is projected to grow from USD 31.48 billion in 2025 to USD 40.31 billion by 2029, at a CAGR of 6.3% during the forecast period.

This growth is fueled by the increasing adoption of IoT devices and the expanding use of cloud computing, which drive demand for system integration solutions. However, the market faces challenges such as the complexity of integration projects and a lack of standardization protocols, which necessitate substantial investments for implementation and maintenance.

Key Takeaways:

• The global System Integrator Market was valued at USD 29.66 billion in 2024 and is projected to grow from USD 31.48 billion in 2025 to USD 40.31 billion by 2029, at a CAGR of 6.3% during the forecast period.

• By Technology: The Industrial Internet of Things (IIoT) and Message Queueing Telemetry Transport are key technologies driving market growth, as they enhance data collection and processing capabilities.

• By Service Outlook: The increasing demand for consulting services is driving market expansion, as industries seek expert guidance to navigate complex integration processes.

• By Application: Rising automation in industries, particularly through programmable logic controllers and distributed control systems, is significantly boosting market dynamics.

• By End User: The oil & gas industry is witnessing significant growth due to the adoption of IIoT solutions, enhancing operational efficiency and safety.

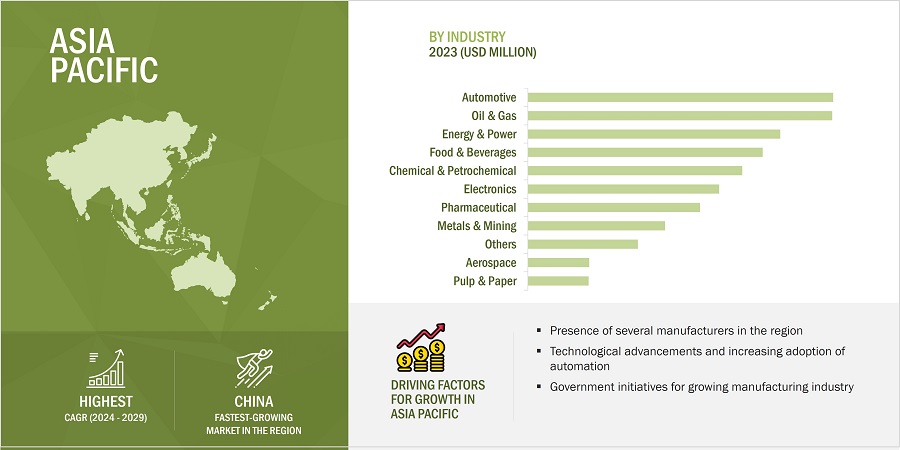

• By Region: ASIA PACIFIC is expected to grow fastest at 7.4% CAGR, driven by technological advancements and increasing industrial automation.

• Market Dynamics: The exponential increase in data production and the need for energy-efficient processes at lower costs are major drivers, while substantial investments and the need for standardized protocols pose challenges.

In conclusion, the System Integrator Market presents significant growth opportunities, particularly through Industry 4.0 and digitalization. The ongoing adoption of cloud computing is expected to continue driving market expansion. However, addressing the lack of standardization and managing the complexity of integration projects will be critical for sustaining long-term growth. As industries increasingly rely on advanced technologies, system integrators will play a pivotal role in facilitating seamless integration and enhancing operational efficiencies.

System Integrator Market Forecast to 2029

To know about the assumptions considered for the study, Request for Free Sample Report

System Integrator Market Trends & Dynamics:

Driver: Increasing adoption of internet of things (IoT) in various industries

The widespread use of IoT devices across various industries has resulted in a substantial increase in data generation. System integrators play a crucial role in creating solutions that enable efficient collection, processing, and analysis of this extensive data. By integrating analytics platforms, databases, and visualization tools, they assist organizations in extracting actionable insights from IoT-generated data. This, in turn, enhances decision-making processes and improves operational efficiency. Security is also a significant consideration. The interconnected nature of IoT devices introduces potential vulnerabilities that must be addressed. System integrators are essential in implementing robust cybersecurity measures to protect IoT ecosystems from cyber threats. Their expertise lies in developing secure communication channels, encryption protocols, and access controls, ensuring the safeguarding of sensitive data transmitted and processed by IoT devices. As a result, the increasing adoption of IoT in industries is positively impacting the system integrator market.

Restraint: Lack of standardization

Standardization involves creating and adopting common protocols, interfaces, and communication methods universally applicable across various systems and industries. Without widely accepted standards, system integrators often face challenges in establishing consistent connections among diverse components, leading to compatibility issues that can hinder the integration process. A notable consequence of the lack of standardization is the necessity for custom interfaces and connectors for each integration project. This results in additional time and costs as system integrators must customize solutions to meet the unique specifications of each system. Furthermore, the absence of standardized interfaces poses challenges in developing reusable components, limiting efficiency and scalability in future integration efforts.

Opportunity: Continued adoption of cloud computing in industries

The manufacturing sector is experiencing a significant transformation driven by the adoption of cloud technology. This shift offers heightened flexibility, improved collaboration, cost efficiencies, enhanced data security, and the potential to foster innovation. Manufacturing companies incorporating cloud technology into their operations can optimize efficiency, increase productivity, and retain a competitive edge in a continually evolving business landscape. As the widespread adoption of the cloud continues, manufacturers should recognize its substantial advantages and strategically leverage it to propel their businesses forward in the digital era.

Challenge: Complexity of integration Projects

Projects within the system integrator market are inherently intricate, primarily because of the diverse array of components, technologies, and systems involved. The integration process involves bringing together various hardware and software elements, each with its own specifications and requirements, thereby introducing layers of complexity to the project lifecycle. Clients typically demand personalized solutions that align with their specific business needs. This customization may encompass adapting off-the-shelf software or hardware components, developing bespoke software modules, or integrating proprietary systems. Navigating through these customization requirements is a challenge for system integrators, as they must ensure seamless compatibility and interoperability throughout the integration process.

System Integrator Market Ecosystem

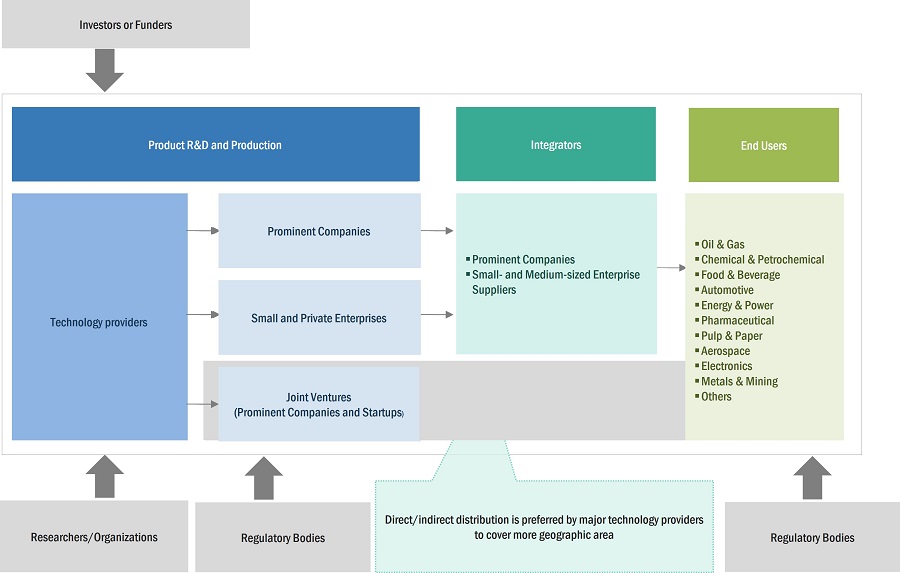

The system integrator market is consolidated, with major companies such as John Wood Group PLC (UK), ATS Corporation (Canada), JR Automation (US), Tesco Controls (US), Avanceon (US), Burrow Global, LLC (US), Prime Controls LP (US), Maverick Technologies LLC (US), BW Design Group (US), Intech (US) and numerous small- and medium-sized enterprises. Almost all players offer various services in the system integrator market. These products are used for oil & gas, automotive, chemical & petrochemical, aerospace, electronics and other industries.

System Integrator Market Segmentation

Based on service outlook, the hardware integration service segment is expected to dominate during the forecast period.

Hardware integration is often a fundamental aspect of system integration projects. It seamlessly incorporates diverse hardware components, such as servers, storage devices, sensors, and control systems, into a cohesive and functional system. With the proliferation of devices in various industries, the demand for system integrators specializing in hardware integration has surged. This includes integrating IoT devices, industrial machinery, computing hardware, and other physical components integral to modern technological ecosystems.

Based on the industry, the electronics segment is projected to grow fastest during the forecast period

Continuous technological innovations and advancements characterize the electronics industry. The fast-paced evolution of electronic components and devices necessitates the expertise of system integrators to ensure seamless integration of the latest technologies into existing systems. Moreover, the electronics manufacturing sector actively embraces Industry 4.0 principles, focusing on integrating digital technologies for smart and connected manufacturing. System integrators are instrumental in facilitating the adoption of Industry 4.0 by seamlessly integrating digital technologies into electronic manufacturing processes.

Based on region, China in the Asia Pacific region is expected to dominate in the forecasted period

China has experienced rapid economic growth over the past few decades. A growing economy often leads to increased investments in technology and infrastructure, driving demand for system integration services. Moreover, China is a global manufacturing hub, producing a significant portion of the world's electronics and industrial goods. This manufacturing strength may contribute to a high demand for system integration services in the automation and control sectors.

System Integrator Market by Region

To know about the assumptions considered for the study, download the pdf brochure

Key Market Players - System Integrator Market

The system integrator companies is dominated by a few globally established players such as

- John Wood Group PLC (UK),

- ATS Corporation (Canada),

- JR Automation (US),

- Tesco Controls (US),

- Avanceon (US),

- Burrow Global, LLC (US),

- Prime Controls LP (US),

- Maverick Technologies LLC (US),

- BW Design Group (US), Intech (US).

Scope of the Report : System Integrator Market

|

Report Metric |

Details |

| Estimated Market Size | USD 29.7 billion in 2024, |

| Projected Market Size | USD 40.3 billion in 2029 |

| Market Growth Rate | at a CAGR of 6.3% |

|

Market Size Availability for Years |

2020–2029 |

|

Base Year |

2023 |

|

Forecast Period |

2024–2029 |

|

Forecast Units |

Value (USD) |

|

Segments Covered |

By service outlook, technology, industry, and region |

|

Geographies Covered |

North America, Europe, Asia Pacific, and Rest of the world |

|

Companies Covered |

John Wood Group PLC (UK), ATS Corporation (Canada), JR Automation (US), Tesco Controls (US), Avanceon (US), Burrow Global LLC (US), Prime Controls LP (US), Maverick Technologies LLC (US), BW Design Group (US), Intech (US) |

System Integrator Market Highlights

This research report categorizes the system integrator market based on service outlook, technology, industry, and region

|

Segment |

Subsegment |

|

Based on Service Outlook: |

|

|

Based on Technology: |

|

|

Based on Industry: |

|

|

Based on Region: |

|

Recent Developments

- In November 2023, INTECH secured a project to upgrade control systems at a significant LNG plant in West Africa. This initiative involves the modernization of the current control systems and lays the groundwork for potential improvements to essential infrastructure within the facility.

- In July 2023, ATS Corporation declared the successful acquisition of Yazzoom BV, a Belgium-based company specializing in artificial intelligence and machine learning tools designed for industrial production. With a primary emphasis on advanced data analytics for monitoring and optimizing production processes, Yazzoom will be key in advancing ATS Corporation's strategy to enhance productivity through digital solutions.

- In April 2023, INTECH was entrusted with the comprehensive automation responsibilities for outfitting a significant water treatment facility in the United States with control and networking technology. With a project history spanning three continents over almost two decades, this Houston-based industrial automation and digitalization company has consistently empowered its clients to enhance the efficiency of their processes and systems.

- In February 2023, JR Automation introduced FlexChassis, a dynamic modular automation platform that enhances the company's range of comprehensive solutions for manufacturers. Revealed at ATX West 2023, this high-speed linear chassis reduces initial system conceptualization, design, and construction time, offering customers unparalleled flexibility for high-speed and high-volume assembly across various industries.

- In December 2022, ATS Corporation has officially finalized its acquisition of IPCOS Group nv, a company headquartered in Belgium that offers solutions for process optimization and digitalization. IPCOS operates across six locations spanning Europe, the United States, and India.

- In June 2022, Wood collaborated with C-Capture, creators of cutting-edge chemical processes for carbon dioxide removal, who have received USD 1.8 million in funding from the BEIS USD 1 billion Net Zero Innovation Portfolio (NZIP). This funding is a component of the £ USD 20 million Carbon Capture, Usage, and Storage (CCUS) Innovation 2.0 program, designed to expedite the implementation of advanced CCUS technology in the United Kingdom.

Frequently Asked Questions (FAQs):

Which are the major companies in the system integrator market? What are their significant strategies to strengthen their market presence?

The major companies in the system integrator market are – John Wood Group PLC (UK), ATS Corporation (Canada), JR Automation (US), Tesco Controls (US), Avanceon (US). The major strategies adopted by these players are product launches and developments, collaborations, acquisitions, and expansions.

What is the potential market for the system integrator in terms of the region?

The North American region is expected to dominate the system integrator market due to the presence of major companies in various industries.

What are the opportunities for new market entrants?

There are significant opportunities in the system integrator market for start-up companies. These companies provide innovative and diverse service portfolios for automotive, electronics, oil & gas, aerospace, and other applications.

What are the drivers and opportunities for the system integrator market?

Factors such as governmental strategic initiatives in developing nations and the increasing need for energy-efficient production processes fuel the growth of system integrators.

What are the major system integrator applications expected to drive the market's growth in the next five years?

The major applications for the system integrator are oil & gas and automotive. The system integrators are also in demand in chemical & petrochemical, energy & power, metals & mining, electronics, aerospace, pulp & paper industries. They are expected to have a significant share in this market.

To speak to our analyst for a discussion on the above findings, click Speak to Analyst

- 5.1 INTRODUCTION

-

5.2 MARKET DYNAMICSDRIVERS- Exponential increase in data production owing to rising use of IoT devices- Increasing need for energy-efficient production processes at lower costs- Governmental strategic endeavors in developing countries of Middle East & AfricaRESTRAINTS- Substantial investments required for implementation and maintenance of process automation- Lack of standardization protocolsOPPORTUNITIES- Opportunities presented by Industry 4.0 and digitalization- Continued adoption of cloud computing in industriesCHALLENGES- Increasing demand for specialized modern technological interfaces- Complexity of integration projects

- 5.3 VALUE CHAIN ANALYSIS

-

5.4 ECOSYSTEM ANALYSIS

- 5.5 INVESTMENT AND FUNDING SCENARIO

-

5.6 PRICING ANALYSISAVERAGE SELLING PRICE TREND OF TECHNOLOGIES, BY KEY PLAYER- Industrial Robots- Industrial machine vision systemsAVERAGE SELLING PRICE TREND, BY REGION

-

5.7 TRENDS/DISRUPTIONS IMPACTING CUSTOMER BUSINESS

-

5.8 TECHNOLOGY ANALYSISKEY TECHNOLOGIES- IIoT and Message Queueing Telemetry Transport- Database Management SystemsCOMPLEMENTARY TECHNOLOGY- Robotic Process AutomationADJACENT TECHNOLOGY- Artificial Intelligence and Machine Learning

- 5.9 PORTER’S FIVE FORCES ANALYSIS

-

5.10 KEY STAKEHOLDERS AND BUYING CRITERIAKEY STAKEHOLDERS IN BUYING PROCESSBUYING CRITERIA

-

5.11 CASE STUDY ANALYSISATS GLOBAL DEVELOPED CENTRAL MONITORING, CONTROL, AND MES SOLUTIONS FOR CONTACT LENS MANUFACTUREREXIT LINE AUTOMATION AND CONTROLS UPGRADEPHARMACEUTICALS COMPANY USED ADVANCED PROCESS AUTOMATION SYSTEM FOR MANUFACTURINGSYSTEM INTEGRATOR FIXES FOOD PROCESSING EQUIPMENT FOR THREE OEMSACS DELIVERED CONTROL SYSTEMS TO SEMI-TRAILER MANUFACTURER

-

5.12 TRADE ANALYSISIMPORT SCENARIOEXPORT SCENARIO

-

5.13 PATENT ANALYSIS

- 5.14 KEY CONFERENCES AND EVENTS IN 2024–2025

-

5.15 TARIFF AND REGULATORY LANDSCAPETARIFF ANALYSISREGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONSSAFETY STANDARDS FOR SYSTEM INTEGRATORS

- 6.1 HYPERVISOR

- 6.2 PLATFORM AS A SERVICE (PAAS) INTEGRATION SERVICES

- 6.3 SOFTWARE AS A SERVICE (SAAS) INTEGRATION SERVICES

- 6.4 INFRASTRUCTURE AS A SERVICE (IAAS) INTEGRATION SERVICES

- 7.1 INTRODUCTION

-

7.2 CONSULTINGINCREASING DEMAND FOR CONSULTING SERVICES IN INDUSTRIES TO DRIVE MARKET

-

7.3 HARDWARE INTEGRATION SERVICEINCREASING ADOPTION OF EMERGING TECHNOLOGIES TO FUEL GROWTH

-

7.4 SOFTWARE INTEGRATION SERVICERAPID TECHNOLOGICAL ADVANCEMENTS TO FUEL DEMAND FOR SOFTWARE INTEGRATION SERVICE

- 8.1 INTRODUCTION

-

8.2 HUMAN-MACHINE INTERFACEINCREASING DEMAND FROM OIL & GAS INDUSTRY TO DRIVE MARKET

-

8.3 SUPERVISORY CONTROL AND DATA ACQUISITIONPRESSING NEED FOR CONTROLLERS AND SMART FIELD DEVICES TO DRIVE MARKET

-

8.4 MANUFACTURING EXECUTION SYSTEMGROWING INCLINATION TOWARD REGULATORY COMPLIANCE AND SAFETY MEASURES TO DRIVE MARKET

-

8.5 FUNCTIONAL SAFETY SYSTEMSSURGING DEMAND FOR FUNCTIONAL SAFETY SOLUTIONS TO REDUCE ACCIDENTS

-

8.6 MACHINE VISIONGROWING NEED FOR AUTOMATED INSPECTION ACROSS INDUSTRIES TO DRIVE MARKET

-

8.7 INDUSTRIAL ROBOTICSINCREASING ADOPTION OF INDUSTRY 4.0 IN MANUFACTURING TO DRIVE MARKET

-

8.8 INDUSTRIAL PCRISING ADOPTION OF INDUSTRIAL IOT TO FUEL DEMAND FOR INDUSTRIAL PCS

-

8.9 INDUSTRIAL INTERNET OF THINGSRISING USE OF IOT DEVICES ACROSS INDUSTRIES TO DRIVE MARKET

-

8.10 MACHINE CONDITION MONITORINGEMERGENCE OF SMART FACTORIES TO DRIVE MARKET

-

8.11 PLANT ASSET MANAGEMENTPRESSING NEED FOR REAL-TIME DATA ANALYTICS TO DRIVE MARKET

-

8.12 DISTRIBUTED CONTROL SYSTEMGROWING ENERGY & POWER SECTOR TO FUEL DEMAND FOR DISTRIBUTED CONTROL SYSTEM

-

8.13 PROGRAMMABLE LOGIC CONTROLLERRISING AUTOMATION IN INDUSTRIES TO DRIVE MARKET

- 9.1 INTRODUCTION

-

9.2 OIL & GASINCREASING ADOPTION OF IIOT TO DRIVE GROWTH

-

9.3 CHEMICALS & PETROCHEMICALSWIDE USE OF AUTOMATION IN CHEMICAL INDUSTRY TO DRIVE MARKET

-

9.4 FOOD & BEVERAGESRAPID INTEGRATION OF ROBOTICS IN FOOD & BEVERAGE INDUSTRY TO DRIVE MARKET

-

9.5 AUTOMOTIVEINTRODUCTION OF HYBRID AND ELECTRIC VEHICLES TO DRIVE MARKET

-

9.6 ENERGY & POWERSHIFT TOWARD RENEWABLE ENERGY TO DRIVE MARKET

-

9.7 PHARMACEUTICALSEXTENSIVE USE OF AUTOMATION TO DRIVE NEED FOR SYSTEM INTEGRATORS

-

9.8 PULP & PAPERINCREASED DEPLOYMENT OF AUTOMATION TO BOOST MARKET

-

9.9 AEROSPACERISING DEPLOYMENT OF ROBOTICS TO INCREASE PRODUCTION

-

9.10 ELECTRONICSSURGE IN DEMAND FOR AUTOMATION TECHNOLOGIES TO DRIVE MARKET

-

9.11 METALS & MININGINCREASING ADOPTION OF ROBOTICS TO DRIVE MARKET

- 9.12 OTHER INDUSTRIES

- 10.1 INTRODUCTION

-

10.2 NORTH AMERICANORTH AMERICA: RECESSION IMPACTUS- Increasing robotics and automation installations to drive marketCANADA- Increasing innovations in manufacturing automation to drive marketMEXICO- Expanding manufacturing landscape to drive market

-

10.3 EUROPEEUROPE: RECESSION IMPACTGERMANY- Increasing investments in smart manufacturing to drive marketFRANCE- Increased adoption of new technologies in various industries to drive marketUK- Increasing automation in food & beverage industry to boost marketREST OF EUROPE

-

10.4 ASIA PACIFICASIA PACIFIC: RECESSION IMPACTCHINA- Decreasing labor force to drive adoption of industrial roboticsJAPAN- Government initiatives for industrial automation to drive marketINDIA- Manufacturing industry’s shift toward automation technologies to drive marketSOUTH KOREA- Government initiatives for upscaling manufacturing facilities to propel marketREST OF ASIA PACIFIC

-

10.5 REST OF THE WORLD (ROW)ROW: RECESSION IMPACTSOUTH AMERICA- Rising adoption of industrial automation technologies to drive marketMIDDLE EAST & AFRICA- Economic diversification to fuel demand for industrial automation technologies

-

11.1 KEY PLAYER STRATEGIES/RIGHT TO WINPRODUCT PORTFOLIOREGIONAL FOCUSSOLUTION OFFERINGSORGANIC/INORGANIC STRATEGIES

- 11.2 REVENUE ANALYSIS OF KEY PLAYERS

- 11.3 MARKET SHARE ANALYSIS

- 11.4 COMPANY VALUATION AND FINANCIAL METRICS

- 11.5 BRAND/PRODUCT COMPARISON

-

11.6 COMPANY EVALUATION MATRIX FOR KEY PLAYERS, 2023STARSEMERGING LEADERSPERVASIVE PLAYERSPARTICIPANTS- Company footprint- Service outlook footprint- Technology footprint- End-user industry footprint- Region Footprint

-

11.7 COMPANY EVALUATION MATRIX: STARTUPS/SMES, 2023PROGRESSIVE COMPANIESRESPONSIVE COMPANIESDYNAMIC COMPANIESSTARTING BLOCKSCOMPETITIVE BENCHMARKING: STARTUPS/SMES, 2023

-

11.8 COMPETITIVE SCENARIOPRODUCT LAUNCHESDEALSOTHER DEVELOPMENTSEXPANSIONS

-

12.1 KEY PLAYERSJOHN WOOD GROUP PLC- Business overview- Services offered- Recent developments- MnM viewATS CORPORATION- Business overview- Services offered- Recent developments- MnM viewJR AUTOMATION- Business overview- Services offered- Recent developments- MnM viewTESCO CONTROLS- Business overview- Services offered- MnM viewAVANCEON- Business overview- Services offered- MnM viewBURROW GLOBAL, LLC.- Business overview- Services offeredPRIME CONTROLS, LP- Business overview- Services offeredMAVERICK TECHNOLOGIES, LLC- Business overview- Services offeredBW DESIGN GROUP- Business overview- Services offered- Recent developmentsINTECH- Business overview- Services offered- Recent developments

-

12.2 OTHER PLAYERSAVID SOLUTIONSBROCK SOLUTIONSCONTROL ASSOCIATES, INC.DENNIS GROUPDYNAMYSK AUTOMATION LTDE TECH GROUPFORI AUTOMATION, LLCMANGAN, INC.MATRIX TECHNOLOGIES, INC.OPTIMATION TECHNOLOGY, INC.QUANTUM DESIGN INC.THE ROVISYS COMPANYSAGE AUTOMATIONW-INDUSTRIES, INC.PREMIER AUTOMATION

- 13.1 INTRODUCTION

- 13.2 ROBOT CONTROLLER, INTEGRATOR, AND SOFTWARE MARKET, BY TYPE

-

13.3 CONTROLLERSTECHNOLOGICAL ADVANCEMENTS IN ROBOT CONTROLLERS TO OFFER LUCRATIVE OPPORTUNITIES

-

13.4 INTEGRATORSABILITY TO OFFER COMPREHENSIVE AND CUSTOMIZED ROBOTIC SOLUTIONS TO DRIVE MARKET

-

13.5 SOFTWAREINTEGRATION OF SOFTWARE SOLUTIONS TO ENABLE TASK EXECUTION AND AUTOMATE PROCESSES TO BOOST DEMANDSIMULATION- Emphasis on resource and time-saving to benefit marketPREDICTIVE MAINTENANCE- Enhanced operational efficiency and minimized downtime to drive marketCOMMUNICATION MANAGEMENT- Increasing use of communication management software for seamless data exchange to drive marketDATA MANAGEMENT AND ANALYSIS- Multi-language support and real-time analytics to offer lucrative opportunitiesRECOGNITION- Integration of AI technology with recognition software to tackle language-related issues to drive market

- 14.1 INSIGHTS FROM INDUSTRY EXPERTS

- 14.2 DISCUSSION GUIDE

- 14.3 KNOWLEDGESTORE: MARKETSANDMARKETS’ SUBSCRIPTION PORTAL

- 14.4 CUSTOMIZATION OPTIONS

- 14.5 RELATED REPORTS

- 14.6 AUTHOR DETAILS

- TABLE 1 SYSTEM INTEGRATOR MARKET: RESEARCH ASSUMPTIONS

- TABLE 2 SYSTEM INTEGRATOR MARKET: ROLE IN ECOSYSTEM

- TABLE 3 AVERAGE SELLING PRICES OF INDUSTRIAL ROBOTS, BY KEY PLAYER (USD)

- TABLE 4 PRICE RANGE OF MACHINE VISION SYSTEMS

- TABLE 5 SYSTEM INTEGRATOR MARKET: PORTER’S FIVE FORCES ANALYSIS

- TABLE 6 INFLUENCE OF STAKEHOLDERS ON BUYING PROCESS FOR TOP-THREE END-USE INDUSTRIES (%)

- TABLE 7 KEY BUYING CRITERIA FOR TOP THREE END-USE INDUSTRIES

- TABLE 8 LIST OF KEY PATENTS IN SYSTEM INTEGRATOR MARKET

- TABLE 9 SYSTEM INTEGRATOR MARKET: DETAILED LIST OF CONFERENCES & EVENTS

- TABLE 10 MFN TARIFF FOR HS CODE 847950-COMPLIANT PRODUCTS EXPORTED BY INDIA

- TABLE 11 NORTH AMERICA: LIST OF REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- TABLE 12 EUROPE: LIST OF REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- TABLE 13 ASIA PACIFIC: LIST OF REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- TABLE 14 ROW: LIST OF REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- TABLE 15 SAFETY STANDARDS FOR SYSTEM INTEGRATORS

- TABLE 16 SYSTEM INTEGRATOR MARKET, BY SERVICE OUTLOOK, 2020–2023 (USD MILLION)

- TABLE 17 SYSTEM INTEGRATOR MARKET, BY SERVICE OUTLOOK, 2024–2029 (USD MILLION)

- TABLE 18 CONSULTING: SYSTEM INTEGRATOR MARKET, BY TECHNOLOGY, 2020–2023 (USD MILLION)

- TABLE 19 CONSULTING: SYSTEM INTEGRATOR MARKET, BY TECHNOLOGY, 2024–2029 (USD MILLION)

- TABLE 20 HARDWARE INTEGRATION SERVICE: SYSTEM INTEGRATOR MARKET, BY TECHNOLOGY, 2020–2023 (USD MILLION)

- TABLE 21 HARDWARE INTEGRATION SERVICE: SYSTEM INTEGRATOR MARKET, BY TECHNOLOGY, 2024–2029 (USD MILLION)

- TABLE 22 SOFTWARE INTEGRATION SERVICE: SYSTEM INTEGRATOR MARKET, BY TECHNOLOGY, 2020–2023 (USD MILLION)

- TABLE 23 SOFTWARE INTEGRATION SERVICE: SYSTEM INTEGRATOR MARKET, BY TECHNOLOGY, 2024–2029 (USD MILLION)

- TABLE 24 SYSTEM INTEGRATOR MARKET, BY TECHNOLOGY, 2020–2023 (USD MILLION)

- TABLE 25 SYSTEM INTEGRATOR MARKET, BY TECHNOLOGY, 2024–2029 (USD MILLION)

- TABLE 26 HUMAN MACHINE INTERFACE: SYSTEM INTEGRATOR MARKET, BY SERVICE OUTLOOK, 2020–2023 (USD MILLION)

- TABLE 27 HUMAN MACHINE INTERFACE: SYSTEM INTEGRATOR MARKET, BY SERVICE OUTLOOK, 2024–2029 (USD MILLION)

- TABLE 28 HUMAN MACHINE INTERFACE: SYSTEM INTEGRATOR MARKET, BY END-USER INDUSTRY, 2020–2023 (USD MILLION)

- TABLE 29 HUMAN MACHINE INTERFACE: SYSTEM INTEGRATOR MARKET, BY END-USER INDUSTRY, 2024–2029 (USD MILLION)

- TABLE 30 HUMAN MACHINE INTERFACE: SYSTEM INTEGRATOR MARKET, BY REGION, 2020–2023 (USD MILLION)

- TABLE 31 HUMAN MACHINE INTERFACE: SYSTEM INTEGRATOR MARKET, BY REGION, 2024–2029 (USD MILLION)

- TABLE 32 SUPERVISORY CONTROL AND DATA ACQUISITION: SYSTEM INTEGRATOR MARKET, BY SERVICE OUTLOOK, 2020–2023 (USD MILLION)

- TABLE 33 SUPERVISORY CONTROL AND DATA ACQUISITION: SYSTEM INTEGRATOR MARKET, BY SERVICE OUTLOOK, 2024–2029 (USD MILLION)

- TABLE 34 SUPERVISORY CONTROL AND DATA ACQUISITION: SYSTEM INTEGRATOR MARKET, BY END-USER INDUSTRY, 2020–2023 (USD MILLION)

- TABLE 35 SUPERVISORY CONTROL AND DATA ACQUISITION: SYSTEM INTEGRATOR MARKET, BY END-USER INDUSTRY, 2024–2029 (USD MILLION)

- TABLE 36 SUPERVISORY CONTROL AND DATA ACQUISITION: SYSTEM INTEGRATOR MARKET, BY REGION, 2020–2023 (USD MILLION)

- TABLE 37 SUPERVISORY CONTROL AND DATA ACQUISITION: SYSTEM INTEGRATOR MARKET, BY REGION, 2024–2029 (USD MILLION)

- TABLE 38 MANUFACTURING EXECUTION SYSTEM: SYSTEM INTEGRATOR MARKET, BY SERVICE OUTLOOK, 2020–2023 (USD MILLION)

- TABLE 39 MANUFACTURING EXECUTION SYSTEM: SYSTEM INTEGRATOR MARKET, BY SERVICE OUTLOOK, 2024–2029 (USD MILLION)

- TABLE 40 MANUFACTURING EXECUTION SYSTEM: SYSTEM INTEGRATOR MARKET, BY END-USER INDUSTRY, 2020–2023 (USD MILLION)

- TABLE 41 MANUFACTURING EXECUTION SYSTEM: SYSTEM INTEGRATOR MARKET, BY END-USER INDUSTRY, 2024–2029 (USD MILLION)

- TABLE 42 MANUFACTURING EXECUTION SYSTEM: SYSTEM INTEGRATOR MARKET, BY REGION, 2020–2023 (USD MILLION)

- TABLE 43 MANUFACTURING EXECUTION SYSTEM: SYSTEM INTEGRATOR MARKET, BY REGION, 2024–2029 (USD MILLION)

- TABLE 44 FUNCTIONAL SAFETY SYSTEMS: SYSTEM INTEGRATOR MARKET, BY SERVICE OUTLOOK, 2020–2023 (USD MILLION)

- TABLE 45 FUNCTIONAL SAFETY SYSTEMS: SYSTEM INTEGRATOR MARKET, BY SERVICE OUTLOOK, 2024–2029 (USD MILLION)

- TABLE 46 FUNCTIONAL SAFETY SYSTEMS: SYSTEM INTEGRATOR MARKET, BY END-USER INDUSTRY, 2020–2023 (USD MILLION)

- TABLE 47 FUNCTIONAL SAFETY SYSTEMS: SYSTEM INTEGRATOR MARKET, BY END-USER INDUSTRY, 2024–2029 (USD MILLION)

- TABLE 48 FUNCTIONAL SAFETY SYSTEMS: SYSTEM INTEGRATOR MARKET, BY REGION, 2020–2023 (USD MILLION)

- TABLE 49 FUNCTIONAL SAFETY SYSTEMS: SYSTEM INTEGRATOR MARKET, BY REGION, 2024–2029 (USD MILLION)

- TABLE 50 MACHINE VISION: SYSTEM INTEGRATOR MARKET, BY SERVICE OUTLOOK, 2020–2023 (USD MILLION)

- TABLE 51 MACHINE VISION: SYSTEM INTEGRATOR MARKET, BY SERVICE OUTLOOK, 2024–2029 (USD MILLION)

- TABLE 52 MACHINE VISION: SYSTEM INTEGRATOR MARKET, BY END-USER INDUSTRY, 2020–2023 (USD MILLION)

- TABLE 53 MACHINE VISION: SYSTEM INTEGRATOR MARKET, BY END-USER INDUSTRY, 2024–2029 (USD MILLION)

- TABLE 54 MACHINE VISION: SYSTEM INTEGRATOR MARKET, BY REGION, 2020–2023 (USD MILLION)

- TABLE 55 MACHINE VISION: SYSTEM INTEGRATOR MARKET, BY REGION, 2024–2029 (USD MILLION)

- TABLE 56 INDUSTRIAL ROBOTICS: SYSTEM INTEGRATOR MARKET, BY SERVICE OUTLOOK, 2020–2023 (USD MILLION)

- TABLE 57 INDUSTRIAL ROBOTICS: SYSTEM INTEGRATOR MARKET, BY SERVICE OUTLOOK, 2024–2029 (USD MILLION)

- TABLE 58 INDUSTRIAL ROBOTICS: SYSTEM INTEGRATOR MARKET, BY END-USER INDUSTRY, 2020–2023 (USD MILLION)

- TABLE 59 INDUSTRIAL ROBOTICS: SYSTEM INTEGRATOR MARKET, BY END-USER INDUSTRY, 2024–2029 (USD MILLION)

- TABLE 60 INDUSTRIAL ROBOTICS: SYSTEM INTEGRATOR MARKET, BY REGION, 2020–2023 (USD MILLION)

- TABLE 61 INDUSTRIAL ROBOTICS: SYSTEM INTEGRATOR MARKET, BY REGION, 2024–2029 (USD MILLION)

- TABLE 62 INDUSTRIAL PC: SYSTEM INTEGRATOR MARKET, BY SERVICE OUTLOOK, 2020–2023 (USD MILLION)

- TABLE 63 INDUSTRIAL PC: SYSTEM INTEGRATOR MARKET, BY SERVICE OUTLOOK, 2024–2029 (USD MILLION)

- TABLE 64 INDUSTRIAL PC: SYSTEM INTEGRATOR MARKET, BY END-USER INDUSTRY, 2020–2023 (USD MILLION)

- TABLE 65 INDUSTRIAL PC: SYSTEM INTEGRATOR MARKET, BY END-USER INDUSTRY, 2024–2029 (USD MILLION)

- TABLE 66 INDUSTRIAL PC: SYSTEM INTEGRATOR MARKET, BY REGION, 2020–2023 (USD MILLION)

- TABLE 67 INDUSTRIAL PC: SYSTEM INTEGRATOR MARKET, BY REGION, 2024–2029 (USD MILLION)

- TABLE 68 INDUSTRIAL INTERNET OF THINGS: SYSTEM INTEGRATOR MARKET, BY SERVICE OUTLOOK, 2020–2023 (USD MILLION)

- TABLE 69 INDUSTRIAL INTERNET OF THINGS: SYSTEM INTEGRATOR MARKET, BY SERVICE OUTLOOK, 2024–2029 (USD MILLION)

- TABLE 70 INDUSTRIAL INTERNET OF THINGS: SYSTEM INTEGRATOR MARKET, BY END-USER INDUSTRY, 2020–2023 (USD MILLION)

- TABLE 71 INDUSTRIAL INTERNET OF THINGS: SYSTEM INTEGRATOR MARKET, BY END-USER INDUSTRY, 2024–2029 (USD MILLION)

- TABLE 72 INDUSTRIAL INTERNET OF THINGS: SYSTEM INTEGRATOR MARKET, BY REGION, 2020–2023 (USD MILLION)

- TABLE 73 INDUSTRIAL INTERNET OF THINGS: SYSTEM INTEGRATOR MARKET, BY REGION, 2024–2029 (USD MILLION)

- TABLE 74 MACHINE CONDITION MONITORING: SYSTEM INTEGRATOR MARKET, BY SERVICE OUTLOOK, 2020–2023 (USD MILLION)

- TABLE 75 MACHINE CONDITION MONITORING: SYSTEM INTEGRATOR MARKET, BY SERVICE OUTLOOK, 2024–2029 (USD MILLION)

- TABLE 76 MACHINE CONDITION MONITORING: SYSTEM INTEGRATOR MARKET, BY END-USER INDUSTRY, 2020–2023 (USD MILLION)

- TABLE 77 MACHINE CONDITION MONITORING: SYSTEM INTEGRATOR MARKET, BY END-USER INDUSTRY, 2024–2029 (USD MILLION)

- TABLE 78 MACHINE CONDITION MONITORING: SYSTEM INTEGRATOR MARKET, BY REGION, 2020–2023 (USD MILLION)

- TABLE 79 MACHINE CONDITION MONITORING: SYSTEM INTEGRATOR MARKET, BY REGION, 2024–2029 (USD MILLION)

- TABLE 80 PLANT ASSET MANAGEMENT: SYSTEM INTEGRATOR MARKET, BY SERVICE OUTLOOK, 2020–2023 (USD MILLION)

- TABLE 81 PLANT ASSET MANAGEMENT: SYSTEM INTEGRATOR MARKET, BY SERVICE OUTLOOK, 2024–2029 (USD MILLION)

- TABLE 82 PLANT ASSET MANAGEMENT: SYSTEM INTEGRATOR MARKET, BY END-USER INDUSTRY, 2020–2023 (USD MILLION)

- TABLE 83 PLANT ASSET MANAGEMENT: SYSTEM INTEGRATOR MARKET, BY END-USER INDUSTRY, 2024–2029 (USD MILLION)

- TABLE 84 PLANT ASSET MANAGEMENT: SYSTEM INTEGRATOR MARKET, BY REGION, 2020–2023 (USD MILLION)

- TABLE 85 PLANT ASSET MANAGEMENT: SYSTEM INTEGRATOR MARKET, BY REGION, 2024–2029 (USD MILLION)

- TABLE 86 DISTRIBUTED CONTROL SYSTEM: SYSTEM INTEGRATOR MARKET, BY SERVICE OUTLOOK, 2020–2023 (USD MILLION)

- TABLE 87 DISTRIBUTED CONTROL SYSTEM: SYSTEM INTEGRATOR MARKET, BY SERVICE OUTLOOK, 2024–2029 (USD MILLION)

- TABLE 88 DISTRIBUTED CONTROL SYSTEM: SYSTEM INTEGRATOR MARKET, BY END-USER INDUSTRY, 2020–2023 (USD MILLION)

- TABLE 89 DISTRIBUTED CONTROL SYSTEM: SYSTEM INTEGRATOR MARKET, BY END-USER INDUSTRY, 2024–2029 (USD MILLION)

- TABLE 90 DISTRIBUTED CONTROL SYSTEM: SYSTEM INTEGRATOR MARKET, BY REGION, 2020–2023 (USD MILLION)

- TABLE 91 DISTRIBUTED CONTROL SYSTEM: SYSTEM INTEGRATOR MARKET, BY REGION, 2024–2029 (USD MILLION)

- TABLE 92 PROGRAMMABLE LOGIC CONTROLLER: SYSTEM INTEGRATOR MARKET, BY SERVICE OUTLOOK, 2020–2023 (USD MILLION)

- TABLE 93 PROGRAMMABLE LOGIC CONTROLLER: SYSTEM INTEGRATOR MARKET, BY SERVICE OUTLOOK, 2024–2029 (USD MILLION)

- TABLE 94 PROGRAMMABLE LOGIC CONTROLLER: SYSTEM INTEGRATOR MARKET, BY END-USER INDUSTRY, 2020–2023 (USD MILLION)

- TABLE 95 PROGRAMMABLE LOGIC CONTROLLER: SYSTEM INTEGRATOR MARKET, BY END-USER INDUSTRY, 2024–2029 (USD MILLION)

- TABLE 96 PROGRAMMABLE LOGIC CONTROLLER: SYSTEM INTEGRATOR MARKET, BY REGION, 2020–2023 (USD MILLION)

- TABLE 97 PROGRAMMABLE LOGIC CONTROLLER: SYSTEM INTEGRATOR MARKET, BY REGION, 2024–2029 (USD MILLION)

- TABLE 98 SYSTEM INTEGRATOR MARKET, BY END-USER INDUSTRY, 2020–2023 (USD MILLION)

- TABLE 99 SYSTEM INTEGRATOR MARKET, BY END-USER INDUSTRY, 2024–2029 (USD MILLION)

- TABLE 100 OIL & GAS: SYSTEM INTEGRATOR MARKET, BY TECHNOLOGY, 2020–2023 (USD MILLION)

- TABLE 101 OIL & GAS: SYSTEM INTEGRATOR MARKET, BY TECHNOLOGY, 2024–2029 (USD MILLION)

- TABLE 102 CHEMICALS & PETROCHEMICALS: SYSTEM INTEGRATOR MARKET, BY TECHNOLOGY, 2020–2023 (USD MILLION)

- TABLE 103 CHEMICALS & PETROCHEMICALS: SYSTEM INTEGRATOR MARKET, BY TECHNOLOGY, 2024–2029 (USD MILLION)

- TABLE 104 FOOD & BEVERAGES: SYSTEM INTEGRATOR MARKET, BY TECHNOLOGY, 2020–2023 (USD MILLION)

- TABLE 105 FOOD & BEVERAGES: SYSTEM INTEGRATOR MARKET, BY TECHNOLOGY, 2024–2029 (USD MILLION)

- TABLE 106 AUTOMOTIVE: SYSTEM INTEGRATOR MARKET, BY TECHNOLOGY, 2020–2023 (USD MILLION)

- TABLE 107 AUTOMOTIVE: SYSTEM INTEGRATOR MARKET, BY TECHNOLOGY, 2024–2029 (USD MILLION)

- TABLE 108 ENERGY & POWER: SYSTEM INTEGRATOR MARKET, BY TECHNOLOGY, 2020–2023 (USD MILLION)

- TABLE 109 ENERGY & POWER: SYSTEM INTEGRATOR MARKET, BY TECHNOLOGY, 2024–2029 (USD MILLION)

- TABLE 110 PHARMACEUTICALS: SYSTEM INTEGRATOR MARKET, BY TECHNOLOGY, 2020–2023 (USD MILLION)

- TABLE 111 PHARMACEUTICALS: SYSTEM INTEGRATOR MARKET, BY TECHNOLOGY, 2024–2029 (USD MILLION)

- TABLE 112 PULP & PAPER: SYSTEM INTEGRATOR MARKET, BY TECHNOLOGY, 2020–2023 (USD MILLION)

- TABLE 113 PULP & PAPER: SYSTEM INTEGRATOR MARKET, BY TECHNOLOGY, 2024–2029 (USD MILLION)

- TABLE 114 AEROSPACE: SYSTEM INTEGRATOR MARKET, BY TECHNOLOGY, 2020–2023 (USD MILLION)

- TABLE 115 AEROSPACE: SYSTEM INTEGRATOR MARKET, BY TECHNOLOGY, 2024–2029 (USD MILLION)

- TABLE 116 ELECTRONICS: SYSTEM INTEGRATOR MARKET, BY TECHNOLOGY, 2020–2023 (USD MILLION)

- TABLE 117 ELECTRONICS: SYSTEM INTEGRATOR MARKET, BY TECHNOLOGY, 2024–2029 (USD MILLION)

- TABLE 118 METALS & MINING: SYSTEM INTEGRATOR MARKET, BY TECHNOLOGY, 2020–2023 (USD MILLION)

- TABLE 119 METALS & MINING: SYSTEM INTEGRATOR MARKET, BY TECHNOLOGY, 2024–2029 (USD MILLION)

- TABLE 120 OTHER INDUSTRIES: SYSTEM INTEGRATOR MARKET, BY TECHNOLOGY, 2020–2023 (USD MILLION)

- TABLE 121 OTHER INDUSTRIES: SYSTEM INTEGRATOR MARKET, BY TECHNOLOGY, 2024–2029 (USD MILLION)

- TABLE 122 SYSTEM INTEGRATOR MARKET, BY REGION, 2020–2023 (USD MILLION)

- TABLE 123 SYSTEM INTEGRATOR MARKET, BY REGION, 2024–2029 (USD MILLION)

- TABLE 124 NORTH AMERICA: SYSTEM INTEGRATOR MARKET, BY COUNTRY, 2020–2023 (USD MILLION)

- TABLE 125 NORTH AMERICA: SYSTEM INTEGRATOR MARKET, BY COUNTRY, 2024–2029 (USD MILLION)

- TABLE 126 NORTH AMERICA: SYSTEM INTEGRATOR MARKET, BY TECHNOLOGY, 2020–2023 (USD MILLION)

- TABLE 127 NORTH AMERICA: SYSTEM INTEGRATOR MARKET, BY TECHNOLOGY, 2024–2029 (USD MILLION)

- TABLE 128 EUROPE: SYSTEM INTEGRATOR MARKET, BY COUNTRY, 2020–2023 (USD MILLION)

- TABLE 129 EUROPE: SYSTEM INTEGRATOR MARKET, BY COUNTRY, 2024–2029 (USD MILLION)

- TABLE 130 EUROPE: SYSTEM INTEGRATOR MARKET, BY TECHNOLOGY, 2020–2023 (USD MILLION)

- TABLE 131 EUROPE: SYSTEM INTEGRATOR MARKET, BY TECHNOLOGY, 2024–2029 (USD MILLION)

- TABLE 132 ASIA PACIFIC: SYSTEM INTEGRATOR MARKET, BY COUNTRY, 2020–2023 (USD MILLION)

- TABLE 133 ASIA PACIFIC: SYSTEM INTEGRATOR MARKET, BY COUNTRY, 2024–2029 (USD MILLION)

- TABLE 134 ASIA PACIFIC: SYSTEM INTEGRATOR MARKET, BY TECHNOLOGY, 2020–2023 (USD MILLION)

- TABLE 135 ASIA PACIFIC: SYSTEM INTEGRATOR MARKET, BY TECHNOLOGY, 2024–2029 (USD MILLION)

- TABLE 136 ROW: SYSTEM INTEGRATOR MARKET, BY COUNTRY, 2020–2023 (USD MILLION)

- TABLE 137 ROW: SYSTEM INTEGRATOR MARKET, BY COUNTRY, 2024–2029 (USD MILLION)

- TABLE 138 ROW: SYSTEM INTEGRATOR MARKET, BY TECHNOLOGY, 2020–2023 (USD MILLION)

- TABLE 139 ROW: SYSTEM INTEGRATOR MARKET, BY TECHNOLOGY, 2024–2029 (USD MILLION)

- TABLE 140 MIDDLE EAST & AFRICA: SYSTEM INTEGRATOR MARKET, BY COUNTRY, 2020–2023 (USD MILLION)

- TABLE 141 MIDDLE EAST & AFRICA: SYSTEM INTEGRATOR MARKET, BY COUNTRY, 2024–2029 (USD MILLION)

- TABLE 142 OVERVIEW OF STRATEGIES DEPLOYED BY KEY SYSTEM INTEGRATORS

- TABLE 143 SYSTEM INTEGRATOR MARKET: DEGREE OF COMPETITION, 2023

- TABLE 144 SYSTEM INTEGRATOR MARKET: SERVICE OUTLOOK FOOTPRINT

- TABLE 145 SYSTEM INTEGRATOR MARKET: TECHNOLOGY FOOTPRINT

- TABLE 146 SYSTEM INTEGRATOR MARKET: END-USER INDUSTRY FOOTPRINT

- TABLE 147 SYSTEM INTEGRATOR MARKET: REGIONAL FOOTPRINT

- TABLE 148 SYSTEM INTEGRATOR MARKET: LIST OF KEY STARTUPS/SMES

- TABLE 149 SYSTEM INTEGRATOR MARKET: SERVICE OUTLOOK FOOTPRINT

- TABLE 150 SYSTEM INTEGRATOR MARKET:: TECHNOLOGY FOOTPRINT

- TABLE 151 SYSTEM INTEGRATOR MARKET:: END-USER INDUSTRY FOOTPRINT

- TABLE 152 SYSTEM INTEGRATOR MARKET:: REGION FOOTPRINT

- TABLE 153 SYSTEM INTEGRATOR MARKET: PRODUCT LAUNCHES, JANUARY 2020– MARCH 2024

- TABLE 154 SYSTEM INTEGRATOR MARKET: DEALS, JANUARY 2020–MARCH 2024

- TABLE 155 SYSTEM INTEGRATOR MARKET: OTHER DEVELOPMENTS, JANUARY 2020–MARCH 2024

- TABLE 156 SYSTEM INTEGRATOR MARKET: EXPANSIONS, JANUARY 2020–MARCH 2024

- TABLE 157 JOHN WOOD GROUP PLC: COMPANY OVERVIEW

- TABLE 158 JOHN WOOD GROUP PLC: SERVICES OFFERED

- TABLE 159 JOHN WOOD GROUP PLC: DEALS

- TABLE 160 ATS CORPORATION: COMPANY OVERVIEW

- TABLE 161 ATS CORPORATION: SERVICES OFFERED

- TABLE 162 ATS CORPORATION: DEALS

- TABLE 163 JR AUTOMATION: COMPANY OVERVIEW

- TABLE 164 JR AUTOMATION: SERVICES OFFERED

- TABLE 165 JR AUTOMATION: PRODUCT LAUNCHES

- TABLE 166 JR AUTOMATION: EXPANSION

- TABLE 167 TESCO CONTROLS: COMPANY OVERVIEW

- TABLE 168 TESCO CONTROLS: SERVICES OFFERED

- TABLE 169 AVANCEON: COMPANY OVERVIEW

- TABLE 170 AVANCEON: SERVICES OFFERED

- TABLE 171 BURROW GLOBAL, LLC: COMPANY OVERVIEW

- TABLE 172 BURROW GLOBAL, LLC: SERVICES OFFERED

- TABLE 173 PRIME CONTROLS, LP: COMPANY OVERVIEW

- TABLE 174 PRIME CONTROLS, LP: SERVICES OFFERED

- TABLE 175 MAVERICK TECHNOLOGIES, LLC: COMPANY OVERVIEW

- TABLE 176 MAVERICK TECHNOLOGIES, LLC: SERVICES OFFERED

- TABLE 177 BW DESIGN GROUP: COMPANY OVERVIEW

- TABLE 178 BW DESIGN GROUP: SERVICES OFFERED

- TABLE 179 BW DESIGN GROUP: EXPANSION

- TABLE 180 INTECH: COMPANY OVERVIEW

- TABLE 181 INTECH: SERVICES OFFERED

- TABLE 182 INTECH: DEALS

- TABLE 183 INTECH: OTHER DEVELOPMENTS

- TABLE 184 ROBOT CONTROLLER, INTEGRATOR, AND SOFTWARE MARKET, BY TYPE, 2019–2022 (USD MILLION)

- TABLE 185 ROBOT CONTROLLER, INTEGRATOR, AND SOFTWARE MARKET, BY TYPE, 2023–2028 (USD MILLION)

- TABLE 186 CONTROLLERS: ROBOT CONTROLLER, INTEGRATOR, AND SOFTWARE MARKET, BY VERTICAL, 2019–2022 (USD MILLION)

- TABLE 187 CONTROLLERS: ROBOT CONTROLLER, INTEGRATOR, AND SOFTWARE MARKET, BY VERTICAL, 2023–2028 (USD MILLION)

- TABLE 188 INTEGRATORS: ROBOT CONTROLLER, INTEGRATOR, AND SOFTWARE MARKET, BY VERTICAL, 2019–2022 (USD MILLION)

- TABLE 189 INTEGRATORS: ROBOT CONTROLLER, INTEGRATOR, AND SOFTWARE MARKET, BY VERTICAL, 2023–2028 (USD MILLION)

- TABLE 190 SOFTWARE: ROBOT CONTROLLER, INTEGRATOR, AND SOFTWARE MARKET, BY SOFTWARE TYPE, 2019–2022 (USD MILLION)

- TABLE 191 SOFTWARE: ROBOT CONTROLLER, INTEGRATOR, AND SOFTWARE MARKET, BY SOFTWARE TYPE, 2023–2028 (USD MILLION)

- TABLE 192 SOFTWARE: ROBOT CONTROLLER, INTEGRATOR, AND SOFTWARE MARKET, BY VERTICAL, 2019–2022 (USD MILLION)

- TABLE 193 SOFTWARE: ROBOT CONTROLLER, INTEGRATOR, AND SOFTWARE MARKET, BY VERTICAL, 2023–2028 (USD MILLION)

- FIGURE 1 SYSTEM INTEGRATOR MARKET SEGMENTATION

- FIGURE 2 SYSTEM INTEGRATOR MARKET: RESEARCH DESIGN

- FIGURE 3 SYSTEM INTEGRATOR MARKET: REVENUE GENERATED BY COMPANIES FROM SALES OF SYSTEM INTEGRATOR SERVICES

- FIGURE 4 MARKET SIZE ESTIMATION METHODOLOGY: BOTTOM-UP APPROACH

- FIGURE 5 MARKET SIZE ESTIMATION METHODOLOGY: TOP-DOWN APPROACH

- FIGURE 6 SYSTEM INTEGRATOR MARKET: DATA TRIANGULATION

- FIGURE 7 HARDWARE INTEGRATION SERVICE SEGMENT TO GROW FASTEST DURING FORECAST PERIOD

- FIGURE 8 IIOT SEGMENT TO ACCOUNT FOR LARGEST MARKET SHARE DURING FORECAST PERIOD

- FIGURE 9 ELECTRONICS INDUSTRY TO WITNESS HIGHEST CAGR DURING FORECAST PERIOD

- FIGURE 10 ASIA PACIFIC TO BE FASTEST-GROWING REGIONAL MARKET DURING FORECAST PERIOD

- FIGURE 11 GROWTH OF MANUFACTURING AND INDUSTRIAL SECTORS TO FUEL DEMAND FOR SYSTEM INTEGRATORS

- FIGURE 12 HARDWARE INTEGRATION SERVICE TO HAVE LARGEST MARKET SHARE IN 2024

- FIGURE 13 INDUSTRIAL ROBOTICS SEGMENT TO HAVE SIGNIFICANT SHARE

- FIGURE 14 AUTOMOTIVE END-USER INDUSTRY AND NORTH AMERICA TO BE LARGEST SHAREHOLDERS IN 2029

- FIGURE 15 CHINA TO REGISTER HIGHEST CAGR BETWEEN 2024 AND 2029

- FIGURE 16 SYSTEM INTEGRATOR MARKET: DRIVERS, RESTRAINTS, OPPORTUNITIES, AND CHALLENGES

- FIGURE 17 SYSTEM INTEGRATOR MARKET IMPACT ANALYSIS OF DRIVERS

- FIGURE 18 SYSTEM INTEGRATOR MARKET IMPACT ANALYSIS OF RESTRAINTS

- FIGURE 19 SYSTEM INTEGRATOR MARKET IMPACT ANALYSIS OF OPPORTUNITIES

- FIGURE 20 CHALLENGES FOR SYSTEM INTEGRATOR MARKET AND THEIR IMPACT

- FIGURE 21 VALUE CHAIN ANALYSIS: MAJOR VALUE ADDED DURING ORIGINAL EQUIPMENT MANUFACTURING AND SYSTEM INTEGRATOR PHASES

- FIGURE 22 SYSTEM INTEGRATOR MARKET: ECOSYSTEM MAPPING

- FIGURE 23 FUNDS AUTHORIZED IN US FOR ROBOTICS STARTUP FUNDING

- FIGURE 24 SYSTEM INTEGRATOR MARKET: AVERAGE SELLING PRICE OF INDUSTRIAL ROBOTS, BY KEY PLAYER (USD)

- FIGURE 25 SYSTEM INTEGRATOR MARKET: AVERAGE SELLING PRICE TREND OF INDUSTRIAL ROBOTS, BY REGION (USD)

- FIGURE 26 TRENDS/DISRUPTIONS IMPACTING CUSTOMER BUSINESS

- FIGURE 27 PORTER’S FIVE FORCES ANALYSIS: SYSTEM INTEGRATOR MARKET

- FIGURE 28 INFLUENCE OF STAKEHOLDERS ON BUYING PROCESS FOR TOP THREE END-USE INDUSTRIES

- FIGURE 29 KEY BUYING CRITERIA FOR TOP THREE END-USE INDUSTRIES

- FIGURE 30 IMPORTS, BY KEY COUNTRY, 2018–2022 (USD MILLION)

- FIGURE 31 EXPORTS, BY KEY COUNTRY, 2018–2022 (USD MILLION)

- FIGURE 32 SYSTEM INTEGRATOR MARKET: PATENT ANALYSIS, 2013−2023

- FIGURE 33 SYSTEM INTEGRATOR MARKET, BY SERVICE OUTLOOK

- FIGURE 34 HARDWARE INTEGRATION SERVICE SEGMENT TO CAPTURE LARGEST SHARE OF SYSTEM INTEGRATOR MARKET IN 2029

- FIGURE 35 SYSTEM INTEGRATOR MARKET, BY TECHNOLOGY

- FIGURE 36 IIOT ACCOUNTED FOR LARGEST SHARE OF SYSTEM INTEGRATOR MARKET, 2024

- FIGURE 37 SYSTEM INTEGRATOR MARKET, BY END-USER INDUSTRY

- FIGURE 38 ELECTRONICS INDUSTRY TO GROW AT HIGHEST CAGR DURING FORECAST PERIOD

- FIGURE 39 REGIONAL SPLIT OF SYSTEM INTEGRATOR MARKET

- FIGURE 40 ASIA PACIFIC TO REGISTER HIGHEST CAGR IN SYSTEM INTEGRATOR MARKET FROM 2024 TO 2029

- FIGURE 41 NORTH AMERICA: SYSTEM INTEGRATOR MARKET SNAPSHOT

- FIGURE 42 EUROPE: SYSTEM INTEGRATOR MARKET SNAPSHOT

- FIGURE 43 ASIA PACIFIC: SYSTEM INTEGRATOR MARKET SNAPSHOT

- FIGURE 44 FIVE-YEAR REVENUE ANALYSIS OF KEY PLAYERS IN SYSTEM INTEGRATOR MARKET

- FIGURE 45 MARKET SHARE ANALYSIS OF KEY PLAYERS, 2023

- FIGURE 46 COMPANY VALUATION (USD BILLION), 2022

- FIGURE 47 FINANCIAL METRICS (ENTERPRISE VALUE/EBITDA), 2022

- FIGURE 48 BRAND/PRODUCT COMPARISON

- FIGURE 49 SYSTEM INTEGRATOR MARKET: COMPANY EVALUATION MATRIX (KEY PLAYERS), 2023

- FIGURE 50 COMPANY FOOTPRINT: KEY PLAYERS

- FIGURE 51 SYSTEM INTEGRATOR MARKET: COMPANY EVALUATION MATRIX (STARTUPS/SMES), 2023

- FIGURE 52 JOHN WOOD GROUP PLC: COMPANY SNAPSHOT

- FIGURE 53 ATS CORPORATION: COMPANY SNAPSHOT

- FIGURE 54 AVANCEON: COMPANY SNAPSHOT

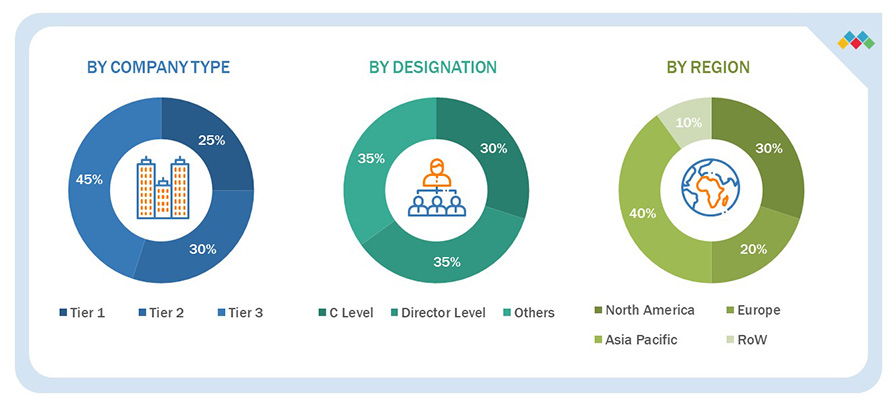

The study utilized four major activities to estimate the system integrator market size. Exhaustive secondary research was conducted to gather information on the market and its peer and parent markets. The next step was to validate these findings, assumptions, and sizing with industry experts across the value chain through primary research. Both top-down and bottom-up approaches were employed to estimate the total market size. Finally, market breakdown and data triangulation methods were utilized to estimate the market size for different segments and subsegments.

Secondary Research

In the secondary research process, various sources have been referred to for identifying and collecting information for this study on the system integrator market. Secondary sources for this research study include corporate filings (such as annual reports, investor presentations, and financial statements), trade, business, and professional associations, white papers, certified publications, articles by recognized authors, directories, and databases. The secondary data was collected and analyzed to determine the overall market size, further validated through primary research.

List of key secondary sources

|

SOURCE NAME |

WEBLINK |

|

International Society of Automation |

|

|

Industrial Automation Exchange |

www.csiaexchange.com |

|

Control System Integrators Association (CSIA) |

Primary Research

Primary interviews were conducted to gather insights on market statistics, revenue data, market breakdowns, size estimations, and forecasting. Additionally, primary research was used to comprehend the various technology, application, vertical, and regional trends. Interviews with stakeholders from the demand side, including CIOs, CTOs, CSOs, and customers/end-users using system integrator, were also conducted to understand their perspective on suppliers, products, component providers, and their current and future use of system integrator, which will impact the overall market. Several primary interviews were conducted across major countries of North America, Europe, Asia Pacific, the Middle East & Africa, and Latin America.

To know about the assumptions considered for the study, download the pdf brochure

Market Size Estimation

To estimate and validate the size of the system integrator market and its submarkets, both top-down and bottom-up approaches were utilized. Secondary research was conducted to identify the key players in the market, and primary and secondary research was used to determine their market share in specific regions. The entire process involved studying top players' annual and financial reports and conducting extensive interviews with industry leaders such as CEOs, VPs, directors, and marketing executives. Secondary sources were used to determine all percentage shares and breakdowns, which were verified through primary sources. All parameters that could impact the markets covered in this research study were accounted for, analyzed in detail, verified through primary research, and consolidated to obtain the final quantitative and qualitative data.

Global System Integrator Market Size: Botton Up Approach

- Companies offering system integrator services have been identified, and their mapping with respect to different parameters, such as service outlook, technology, and industry has been carried out.

- The market size has been estimated based on the demand for different system integrators for different applications. The anticipated change in demand for system integrator offered by these companies in the recession and company revenues have been analyzed and estimated.

- Primary research has been conducted with a few major players operating in the system integrator market to validate the global market size. Discussions included the impact of the recession on the system integrator ecosystem.

- The size of the system integrator market has been validated through secondary sources, which include the International Trade Centre (ITC), the World Trade Organization, and the World Economic Forum.

- The CAGR of the system integrator market has been calculated considering the historical and future market trends and the impact of the recession by understanding the adoption rate of system integrator for different applications.

- The estimates at every level have been verified and cross-checked through discussions with key opinion leaders, such as corporate executives (CXOs), directors, and sales heads, and with the domain experts in MarketsandMarkets.

- Various paid and unpaid information sources, such as company websites, annual reports, press releases, research journals, magazines, white papers, and databases, have also been studied.

Global System Integrator Market Size: Top Down Approach

The top-down approach has been used to estimate and validate the total size of the system integrator market.

- Focusing initially on R&D investments and expenditures being made in the ecosystem of the system integrator market; further splitting the market on the basis of service outlook, technology, and industry and region and listing key developments

- Identifying leading players in the system integrator market through secondary research and verifying them through brief discussions with industry experts

- Analyzing revenue, product mix, geographic presence, and key applications for which all identified players serve products to estimate and arrive at percentage splits for all key segments

- Discussing splits with industry experts to validate the information and identify key growth pockets across all key segments

- Breaking down the total market based on verified splits and key growth pockets across all segments.

Data Triangulation

Once the overall size of the system integrator market was determined using the methods described above, it was divided into multiple segments and subsegments. Market engineering was performed for each segment and subsegment using market breakdown and data triangulation methods, as applicable, to obtain accurate statistics. To triangulate the data, various factors and trends from the demand and supply sides were studied. The market was validated using both top-down and bottom-up approaches.

Market Definition

System integrators are entities, whether companies or individuals, that assist manufacturing plants in the deployment and installation of hardware and software solutions. Specifically within the realm of industrial automation, these professionals offer services encompassing consultation, hardware installation, software integration, and ongoing system maintenance. Their role is pivotal in enabling the seamless collaboration of various versions of automation hardware and software, effectively amalgamating multiple subsystems into a cohesive and unified large system.

Industrial automation, in broader terms, refers to the utilization of automatic control systems, such as computers, robots, vision systems, and information technology, to manage diverse processes and machinery in the industrial sector. This approach provides manufacturing companies with advantages such as reduced operational costs, heightened productivity, superior quality, increased flexibility, and enhanced safety measures.

Key Stakeholders

- Raw Material and Manufacturing Equipment Suppliers

- Original Equipment Manufacturers (OEMs)

- Integrated Device Manufacturers (IDMs)

- Original Design Manufacturers (ODMs)

- Technology, Service, and Solution Providers

- Intellectual Property (IP) Core and Licensing Providers

- Suppliers and Distributors

- System Integrators

- Government and Other Regulatory Bodies

- Technology Investors

- Research Institutes and Organizations

- Market Research and Consulting Firms

Report Objectives

- To describe and forecast the system integrator market, by service outlook, technology, industry, and region, in terms of value

- To describe and forecast the market for various segments across four central regions, namely, North America, Europe, Asia Pacific, and Rest of the World (RoW), in terms of value

- To strategically analyze the micromarkets with regard to the individual growth trends, prospects, and contribution to the market

- To provide detailed information regarding drivers, restraints, opportunities, and challenges influencing the growth of the market

- To analyze opportunities for stakeholders by identifying high-growth segments in the market

- To provide a detailed overview of the value chain

- To strategically analyze the ecosystem, regulatory landscape, patent landscape, Porter’s five forces, import and export scenarios trade landscape, and case studies pertaining to the market under study

- To strategically profile key players in the system integrator market and comprehensively analyze their market shares and core competencies

- To strategically profile the key players and provide a detailed competitive landscape of the market

- To analyze competitive developments such as partnerships, acquisitions, expansions, collaborations, and product launches, along with research and development (R&D) in the system integrator market

Available customizations:

With the given market data, MarketsandMarkets offers customizations according to the specific requirements of companies. The following customization options are available for the report:

- Detailed analysis and profiling of additional market players (up to 5)

- Additional country-level analysis of the system integrator market

Product Analysis

- Product matrix, which provides a detailed comparison of the product portfolio of each company in the system integrator market.

Generating Response ...

Generating Response ...

Growth opportunities and latent adjacency in System Integrator Market