Industrial Safety Market Size, Share, Trends & Industry Analysis by Component (Presence Sensing Safety Sensors, Safety Controllers, Programmable Safety Systems), Industry (Energy & Power, Automotive, Oil & Gas) and Region - 2030

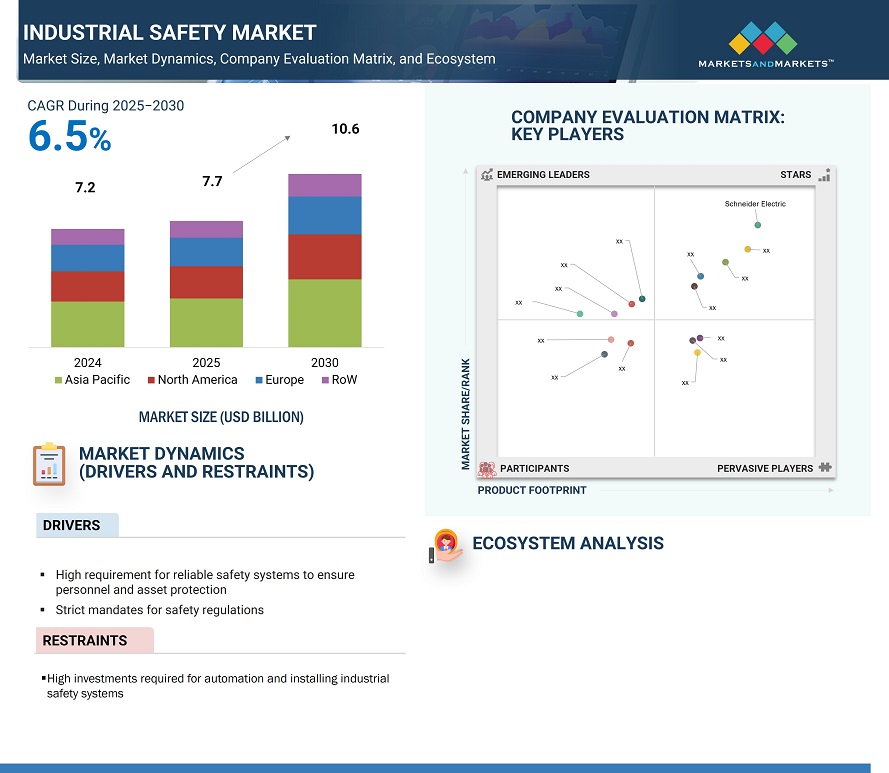

The global industrial safety market is anticipated to grow from USD 7.7 billion in 2025 to USD 10.6 billion by 2030, recording a CAGR of 6.5% during 2025–2030. This growth is driven by the high demand for reliable safety systems to protect personnel and assets, stringent safety regulations, and the rapidly expanding oil & gas industry. Additionally, increasing adoption of workplace safety standards in emerging economies and the growing use of Industrial Internet of Things (IIoT) technologies are creating significant opportunities in the industrial safety market.

To know about the assumptions considered for the study, Request for Free Sample Report

Market Dynamics

Driver: Strict mandates for safety regulations

Safety regulations are a significant factor driving the growth of the industrial safety market. US and European governments have taken proactive measures to reduce accidents by enforcing strict safety regulations related to personnel and process safety. These regulations require the installation of certified safety equipment, such as explosion-proof sensors, switches, and actuators, particularly in hazardous locations. Organizations like the Occupational Safety and Health Administration (OSHA), International Electrotechnical Commission (IEC), International Organization for Standardization (ISO), and American National Standards Institute (ANSI) have established comprehensive safety standards and regulatory frameworks aimed at enhancing industrial process efficiency and safety. In addition, machine safety regulations, including the EU Machinery Directive and North American OSHA regulations, have profoundly impacted the industrial safety product market. These regulations ensure that organizations adhere to safety standards that help prevent accidents, protect workers, and safeguard industrial assets. As safety awareness increases globally, these regulatory measures continue to drive demand for advanced safety solutions in industrial environments, contributing to the market’s expansion.

Restraint: High investments are required for automation and installing industrial safety systems

Industrial safety systems are essential for protecting employees, machinery, and production lines during emergencies. However, the cost of industrial safety components, installation, and ongoing maintenance can significantly burden organizations. While large companies can manage these expenses, it becomes a challenge for small and medium-sized enterprises (SMEs). Additionally, industrial safety systems must comply with regulatory standards, which are often updated in response to technological advancements and new mandates. This constant evolution of safety standards forces organizations to regularly upgrade their systems, leading to further investments in safety components and infrastructure. This ongoing need for upgrades can be a major restraint, especially for SMEs that may already be stretched thin with their budgets. Historically, investments in safety equipment were not considered part of plant and facility building costs despite the significant financial impact of installing and maintaining these systems. While large organizations have the resources to absorb these costs, smaller entities may struggle to allocate funds for such essential upgrades. The frequent updates to safety regulations add another layer of complexity, requiring continuous investment to ensure compliance and maintain a safe working environment.

Opportunity: Growing acceptance of workplace safety standards in emerging economies

Developed countries like the US, the UK, France, Australia, Japan, and the Netherlands have adopted workplace safety standards established by local and international regulatory bodies. Governments in these regions have enforced strict laws against industries that violate safety norms concerning human and equipment protection. In contrast, the manufacturing sectors in countries such as South Korea, India, and China have expanded in recent years due to the availability of cheap labor. However, awareness of occupational safety has been limited in these countries. Recently, worker unions in these regions have protested to push for implementing safety standards in industries. The Human Development Index (HDI) and the increasing demands from worker unions for improved workplace safety have driven the adoption of safety systems in both emerging and developed countries, creating significant growth opportunities for safety system manufacturers. The Asia-Pacific region is one of the fastest-growing economic zones globally, with countries like China, India, Japan, South Korea, Australia, and Indonesia rapidly expanding their industrial manufacturing sectors. China, one of the world’s largest manufacturing hubs, plays a crucial role in driving the Asia Pacific sector. As multinational companies establish manufacturing plants across the region, the increasing adoption of safety standards is fueling the demand for advanced safety systems.

Challenge: Failure to access all machinery-related risks

Effective machine guarding requires a detailed risk assessment that involves input from multiple stakeholders, such as machine designers, operators, maintenance staff, engineers, safety experts, and representatives from original equipment manufacturers (OEMs). A designer alone cannot foresee all potential hazards during equipment setup, operation, inspection, or maintenance. Therefore, a comprehensive approach is necessary to identify and address all risks. When workers need to access areas inside machine guards, careful planning is essential to ensure their safety. Inadequate risk assessments can overlook important safety features, such as interlock devices and monitoring systems like relays and safety-rated programmable logic controllers (PLCs), which are critical for protecting workers during maintenance or other tasks. Organizations can ensure that safety systems are properly designed and performed effectively by involving various experts in the planning and design process. This collaborative approach helps identify hazards and implement necessary safeguards, minimizing the risk of accidents. Proper machine guarding protects workers and maintains smooth, safe operations.

Industrial Safety Market Ecosystem

The industrial safety market ecosystem includes key players across various segments, such as component manufacturers, system integrators, and end-users, each playing a critical role in ensuring safety across industries.

Presence sensing safety sensors expected to Dominate the Industrial Safety Market from 2025 to 2030.

The presence-sensing sensor market is projected to hold the largest market share due to the critical need to ensure worker and production unit safety. This demand is driven by strict adherence to industrial safety regulations mandated by national and international standards. Additionally, the market growth is fueled by several factors, including the rise of Industry 4.0, which emphasizes advanced automation and smart manufacturing. The increasing adoption of safety light curtains, particularly in the robotics-powered packaging industry, further bolsters the demand for these sensors. Moreover, the rising number of industrial accidents has heightened the need for robust safety solutions, contributing to the growing adoption of presence-sensing safety sensors within the industrial safety market.

Food & beverages industry is projected to grow at the highest CAGR during the forecast period.

The food & beverages segment is projected to grow at the highest CAGR during the forecast period. As regulations become increasingly stringent, the demand for industrial safety systems in food and beverage manufacturing plants is rising significantly. These systems are essential for ensuring safe and efficient operations while maintaining compliance with regulatory standards. The food & beverages industry focuses on achieving high-quality and consistent production at a low cost. This goal can be realized by making manufacturing plants safer, more flexible, and more profitable. Implementing an integrated approach with automated safety control systems, such as industrial safety solutions, plays a key role in achieving these objectives. These advanced safety systems enhance operational transparency across production lines, allowing manufacturers to monitor processes effectively and address issues proactively. Additionally, they help reduce compliance costs by enabling timely corrective actions and ensuring adherence to safety protocols. By adopting these solutions, the food and beverage industry can improve efficiency, maintain consistent product quality, and meet growing consumer demand while adhering to evolving safety standards. This drives the robust growth of the segment in the industrial safety market.

Asia Pacific is projected to hold the largest share throughout the forecast period.

Asia Pacific is expected to dominate the global industrial safety market during the forecast period, primarily due to the rapid industrialization in emerging economies like China and India. These nations have already implemented industrial safety practices in critical sectors such as oil & gas and power generation. The growing emphasis on workplace safety and compliance with stringent regulations has led to a significant increase in the adoption of safety automation solutions across manufacturing industries in the region. China and India, as key industrial hubs, are heavily investing in advanced safety technologies to align with global standards while enhancing operational efficiency. The rise of Industry 4.0 has further accelerated this trend as industries increasingly adopt smart automation and digital safety solutions to improve productivity and minimize risks.

Additionally, infrastructure development, urbanization, and expanding the industrial base across Asia have created a robust demand for comprehensive safety systems. Industries are prioritizing the integration of safety measures to address workplace hazards and prevent accidents. These factors position Asia Pacific as a leading region in the industrial safety market, driving innovation and setting global benchmarks for safety and automation solutions.

To know about the assumptions considered for the study, download the pdf brochure

Key Market Players

- Schneider Electric (France)

- Honeywell International (US)

- ABB (Switzerland)

- Rockwell Automation Inc. (US)

- Siemens (Germany)

- HIMA (Germany)

- Yokogawa Electric Corp. (Japan)

- Emerson ElectricCo. (US)

- Baker Hughes (US)

- Omron Corporation (Japan)

- Johnson Controls (Ireland)

- Balluff GmbH (Germany)

- Keyence Corporation (Japan)

- IDEC Corporation (Japan)

- SICK AG (Germany)

Industrial Safety Market Report Scope :

|

Report Metric |

Detail |

| Estimated Market Size | USD 7.7 Billion |

| Projected Market Size | USD 10.6 Billion |

| Growth Rate | 6.5% CAGR |

|

Market Size Availability for Years |

2025–2030 |

|

Base Year |

2021 |

|

Forecast Period |

2025–2030 |

|

Forecast Units |

Value (USD) |

|

Segments Covered |

|

|

Geographies Covered |

|

|

Market Leaders |

|

| Top Companies in North America |

|

| Key Market Driver | Strict mandates for safety regulations |

| Key Market Opportunity | Increasing usage of Industrial Internet of Things |

| Largest Growing Region | Asia Pacific |

| Largest Market Share Segment | Presence sensing safety sensors component |

| Highest CAGR Segment | Food & beverages industry |

This research report categorizes the industrial safety market, by type, component, industry, and region

Industrial Safety Market By Type:

- Machine Safety

- Worker Safety

Industrial Safety Market By Component:

- Presence Sensing Safety Sensors

- Safety Controllers/ Modules/ Relays

- Programmable Safety Systems

- Safety Interlock Switches

- Emergency Stop Controls

- Two-Hand Safety Controls

- Others

By Industry:

- Oil & Gas

- Energy & Power

- Chemicals

- Food & Beverages

- Aerospace & Defense

- Automotive

- Semiconductor

- Healthcare & Pharmaceuticals

- Metals & Mining

- Others

By Region

-

North America

- US

- Canada

- Mexico

-

Europe

- UK

- Germany

- France

- Denmark

- Finland

- Norway

- RoE

-

Asia Pacific (APAC)

- China

- Japan

- India

- South Korea

- Rest of APAC

-

Rest of the World (RoW)

- Middle East and Africa

- South America

The study includes an in-depth competitive analysis of these key players in the industrial safety market with their company profiles, recent developments, and key market strategies.

Recent Developments

- In June 2024, Sick introduced a new sensor designed for harsh industrial environments. This sensor enhances machinery reliability, durability, and consistency, reducing maintenance needs and preventing costly disruptions. It is aimed at manufacturers and system integrators who frequently deal with maintenance issues due to component failures.

- In February 2024, Schneider Electric (France)announced the acquisition of Itron, Inc., a prominent smart grid and metering solutions provider. This acquisition enhances Schneider Electric's position in industrial automation and control systems, which are vital for industrial safety.

- In January 2024, Schneider Electric (France) launched EcoStruxure for Mining, a comprehensive suite of integrated solutions designed to enhance safety and productivity in mining operations. This suite includes tools for asset management, process optimization, and worker safety.

- In November 2023, ABB (Switzerland) launched the ABB Ability Smart Sensor for Hazardous Areas, a wireless gas detector designed for demanding industrial environments. This sensor streamlines installation and maintenance while enhancing worker safety.

- In April 2022, Rockwell Automation (US) introduced its Allen-Bradley Armor PowerFlex AC variable frequency drives for industrial motor control applications. These drives feature integrated CIP safety and support integrated and hardwired safe-torque-off (STO) or safe-stop-1 (SS1) safety functions.

Frequently Asked Questions (FAQ):

Which are the major companies in the industrial safety market? What are their major strategies to strengthen their market presence?

The major companies in the industrial safety market are - Schneider Electric (France), Honeywell International Inc. (US), ABB (Switzerland), Rockwell Automation, Inc. (US), Siemens AG (Germany). Players in this market have adopted product launches and acquisition strategy to increase their market share.

Which is the potential market for industrial safety in terms of the region?

Asia Pacific held the largest share of the industrial safety market in 2024. This is due to increasing industrialization in emerging economies such as China and India.

What are the opportunities for new market entrants?

Significant opportunities in the industrial safety market include growing acceptance of workplace safety standards in emerging economies and increasing usage of the Industrial Internet of Things.

Which industries are expected to drive the growth of the market in the next five years?

Major application areas for the industrial safety market include – automotive, energy & power, oil & gas, and food & beverages. Energy & power are expected to hold the largest size of the industrial safety market in 2025, owing to the industry's high demand for safety equipment and stringent safety regulations.

To speak to our analyst for a discussion on the above findings, click Speak to Analyst

TABLE OF CONTENTS

1 INTRODUCTION (Page No. - 28)

1.1 STUDY OBJECTIVES

1.2 MARKET DEFINITION AND SCOPE

1.2.1 INCLUSIONS & EXCLUSIONS

1.3 STUDY SCOPE

1.3.1 MARKETS COVERED

1.3.2 GEOGRAPHIC SCOPE

FIGURE 1 INDUSTRIAL SAFETY MARKET: GEOGRAPHIC SEGMENTATION

1.3.3 YEARS CONSIDERED

1.4 CURRENCY

1.5 LIMITATIONS

1.6 STAKEHOLDERS

1.7 SUMMARY OF CHANGES

2 RESEARCH METHODOLOGY (Page No. - 33)

2.1 RESEARCH DATA

FIGURE 2 INDUSTRIAL SAFETY MARKET: RESEARCH DESIGN

2.1.1 SECONDARY & PRIMARY RESEARCH

2.1.2 SECONDARY DATA

2.1.2.1 Major secondary sources

2.1.2.2 Secondary sources

2.1.3 PRIMARY DATA

2.1.3.1 Breakdown of primaries

2.1.3.2 Key data from primary sources

2.1.3.3 Key industry insights

2.2 MARKET SIZE ESTIMATION

2.2.1 BOTTOM-UP APPROACH

2.2.1.1 Approach for arriving at market share by bottom-up analysis (demand side)

FIGURE 3 INDUSTRIAL SAFETY MARKET: BOTTOM-UP APPROACH

2.2.2 TOP-DOWN APPROACH

2.2.2.1 Approach for capturing market share by top-down analysis (supply side)

FIGURE 4 MARKET: TOP-DOWN APPROACH

FIGURE 5 MARKET: SUPPLY-SIDE APPROACH

2.3 MARKET BREAKDOWN & DATA TRIANGULATION

FIGURE 6 DATA TRIANGULATION

2.4 RESEARCH ASSUMPTIONS

2.5 RISK ASSESSMENT

TABLE 1 LIMITATIONS AND ASSOCIATED RISKS

3 EXECUTIVE SUMMARY (Page No. - 42)

FIGURE 7 INDUSTRIAL SAFETY MARKET, 2018–2027 (USD MILLION)

FIGURE 8 MARKET FOR PROGRAMMABLE SAFETY SYSTEMS TO GROW AT HIGHEST CAGR DURING FORECAST PERIOD

FIGURE 9 ENERGY & POWER TO ACCOUNT FOR LARGEST MARKET SIZE FROM 2022 TO 2027

FIGURE 10 APAC IS EXPECTED TO HOLD LARGEST SHARE OF INDUSTRIAL SAFETY MARKET THROUGHOUT FORECAST PERIOD

4 PREMIUM INSIGHTS (Page No. - 46)

4.1 ATTRACTIVE GROWTH OPPORTUNITIES IN MARKET

FIGURE 11 MANDATES FOR SAFETY AND RISING DEMAND FOR SAFETY SYSTEMS IN OIL & GAS INDUSTRY TO BOOST MARKET GROWTH

4.2 INDUSTRIAL SAFETY MARKET, BY TYPE

FIGURE 12 MACHINE SAFETY TO HOLD LARGER SIZE OF MARKET IN 2027

4.3 INDUSTRIAL MACHINE SAFETY MARKET, BY COMPONENT

FIGURE 13 PRESENCE SENSING SAFETY SENSORS TO HOLD LARGEST SIZE OF MARKET IN 2027

4.4 MARKET, BY INDUSTRY

FIGURE 14 AUTOMOTIVE TO HOLD LARGEST SIZE OFMARKET IN 2022

4.5 INDUSTRIAL SAFETY MARKET, BY COUNTRY

FIGURE 15 US TO HOLD LARGEST SIZE OF MARKET IN 2027

5 MARKET OVERVIEW (Page No. - 49)

5.1 INTRODUCTION

5.2 MARKET DYNAMICS

FIGURE 16 INDUSTRIAL SAFETY MARKET: DRIVERS, RESTRAINTS, OPPORTUNITIES, AND CHALLENGES

5.2.1 DRIVERS

5.2.1.1 High requirement for reliable safety systems to ensure personnel and asset protection

5.2.1.2 Strict mandates for safety regulations

5.2.1.3 Rapidly growing oil & gas industry driving adoption of industrial safety systems

FIGURE 17 INDUSTRIAL SAFETY MARKET: IMPACT ANALYSIS OF DRIVERS

5.2.2 RESTRAINTS

5.2.2.1 High investments required for automation and installing industrial safety systems

5.2.2.2 Lack of awareness and complexity of standards

FIGURE 18 INDUSTRIAL SAFETY MARKET: IMPACT ANALYSIS OF RESTRAINTS

5.2.3 OPPORTUNITIES

5.2.3.1 Growing acceptance of workplace safety standards in emerging economies

5.2.3.2 Increasing usage of Industrial Internet of Things

FIGURE 19 INDUSTRIAL SAFETY MARKET: IMPACT ANALYSIS OF OPPORTUNITIES

5.2.4 CHALLENGES

5.2.4.1 Failure to access all machinery-related risks

5.2.4.2 Local manufacturers offering low-priced industrial safety systems

FIGURE 20 INDUSTRIAL SAFETY MARKET: IMPACT ANALYSIS OF CHALLENGES

5.3 VALUE CHAIN ANALYSIS

FIGURE 21 RAW MATERIAL AND COMPONENT SUPPLIERS AND ORIGINAL EQUIPMENT MANUFACTURERS COLLECTIVELY ADD MAJOR VALUE TO FINAL PRODUCT

5.4 TECHNOLOGY ANALYSIS

5.4.1 COMPUTER VISION

5.4.2 AUTOMATED MACHINE LEARNING

5.4.3 INTERNET OF THINGS

5.4.4 VIRTUAL REALITY

5.5 ECOSYSTEM ANALYSIS

FIGURE 22 INDUSTRIAL SAFETY MARKET: ECOSYSTEM

TABLE 2 MARKET: ECOSYSTEM

5.6 TRENDS/DISRUPTIONS IMPACTING CUSTOMERS

5.7 CASE STUDIES

5.7.1 NEW WAYS TO ENHANCE WATER CUTTER SAFETY

5.7.2 ALTINTEL USED SMART WIRELESS TANKRADAR TO IMPROVE SAFETY

5.7.3 ULRASONIC DETECTION OF GAS LEAKS IN AMMONIA PLANT FOR FERTILIZER MANUFACTURING

5.8 PRICING ANALYSIS

TABLE 3 AVERAGE SELLING PRICES OF COMPONENTS OF INDUSTRIAL SAFETY SYSTEMS OFFERED BY TOP COMPANIES, 2021

TABLE 4 INDICATIVE PRICES OF COMPONENTS OF INDUSTRIAL SAFETY SYSTEMS

5.8.1 AVERAGE SELLING PRICES OF COMPONENTS OFFERED BY KEY PLAYERS

FIGURE 23 AVERAGE SELLING PRICES OF COMPONENTS OFFERED BY KEY PLAYERS

TABLE 5 AVERAGE SELLING PRICES OF COMPONENTS OFFERED BY KEY PLAYERS (USD)

5.9 PORTER’S FIVE FORCES ANALYSIS

TABLE 6 IMPACT OF PORTER’S FIVE FORCES ON INDUSTRIAL SAFETY MARKET, 2021

5.10 KEY STAKEHOLDERS & BUYING CRITERIA

5.10.1 KEY STAKEHOLDERS IN BUYING PROCESS

FIGURE 24 INFLUENCE OF STAKEHOLDERS IN BUYING PROCESS FOR TOP 3 INDUSTRIES

TABLE 7 INFLUENCE OF STAKEHOLDERS IN BUYING PROCESS FOR TOP 3 INDUSTRIES (%)

5.10.2 BUYING CRITERIA

FIGURE 25 KEY BUYING CRITERIA FOR TOP 3 INDUSTRIES

TABLE 8 KEY BUYING CRITERIA FOR TOP 3 INDUSTRIES

5.11 TRADE ANALYSIS

FIGURE 26 IMPORT DATA, BY COUNTRY, 2016–2020 (USD MILLION)

FIGURE 27 EXPORT DATA, BY COUNTRY, 2016–2020 (USD MILLION)

5.11.1 PATENTS ANALYSIS

FIGURE 28 NUMBER OF PATENTS GRANTED PER YEAR FROM 2012 TO 2021

FIGURE 29 TOP 10 COMPANIES WITH HIGHEST NUMBER OF PATENT APPLICATIONS IN LAST 10 YEARS

TABLE 9 TOP 20 PATENT OWNERS IN LAST 10 YEARS

TABLE 10 LIST OF FEW PATENTS IN INDUSTRIAL SAFETY MARKET, 2020–2021

5.12 KEY CONFERENCES & EVENTS IN 2022-2023

TABLE 11 INDUSTRIAL SAFETY MARKET: DETAILED LIST OF CONFERENCES & EVENTS

5.13 REGULATIONS AND STANDARDS

TABLE 12 REGULATIONS AND STANDARDS FOR INDUSTRIAL SAFETY

5.14 REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

TABLE 13 NORTH AMERICA: LIST OF REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

TABLE 14 EUROPE: LIST OF REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

TABLE 15 ASIA PACIFIC: LIST OF REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

TABLE 16 REST OF WORLD: LIST OF REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

6 INDUSTRIAL SAFETY MARKET, BY TYPE (Page No. - 71)

6.1 INTRODUCTION

FIGURE 30 INDUSTRIAL SAFETY MARKET, BY TYPE

TABLE 17 MARKET, BY TYPE, 2018–2021 (USD MILLION)

TABLE 18 MARKET, BY TYPE, 2022–2027 (USD MILLION)

6.2 MACHINE SAFETY

6.2.1 MACHINE SAFETY SYSTEMS ENABLE SAFETY OF PLANT ASSET AND PERSONNEL

TABLE 19 INDUSTRIAL MACHINE SAFETY MARKET, BY INDUSTRY, 2018–2021 (USD MILLION)

TABLE 20 INDUSTRIAL MACHINE SAFETY MARKET, BY INDUSTRY, 2022–2027 (USD MILLION)

TABLE 21 INDUSTRIAL MACHINE SAFETY MARKET, BY REGION, 2018–2021 (USD MILLION)

TABLE 22 INDUSTRIAL MACHINE SAFETY MARKET, BY REGION, 2022–2027 (USD MILLION)

6.3 WORKER SAFETY

6.3.1 SMART WORKER SAFETY SOLUTIONS TO DRIVE INDUSTRIAL WORKER SAFETY MARKET

TABLE 23 INDUSTRIAL WORKER SAFETY MARKET, BY INDUSTRY, 2018–2021 (USD MILLION)

TABLE 24 INDUSTRIAL WORKER SAFETY MARKET, BY INDUSTRY, 2022–2027 (USD MILLION)

TABLE 25 INDUSTRIAL WORKER SAFETY MARKET, BY REGION, 2018–2021 (USD MILLION)

TABLE 26 INDUSTRIAL WORKER SAFETY MARKET, BY REGION, 2022–2027 (USD MILLION)

7 INDUSTRIAL SAFETY MARKET, BY COMPONENT (Page No. - 77)

7.1 INTRODUCTION

FIGURE 31 PRESENCE SENSING SAFETY SENSORS TO DOMINATE INDUSTRIAL SAFETY MARKET THROUGHOUT FORECAST PERIOD

TABLE 27 INDUSTRIAL MACHINE SAFETY MARKET, BY COMPONENT, 2018–2021 (USD MILLION)

TABLE 28 INDUSTRIAL MACHINE SAFETY MARKET, BY COMPONENT, 2022–2027 (USD MILLION)

7.2 PRESENCE SENSING SAFETY SENSORS

7.2.1 SAFETY SENSORS HOLD LARGEST SHARE OF INDUSTRIAL SAFETY MARKET

TABLE 29 PRESENCE SENSING SAFETY SENSORS MARKET, BY INDUSTRY, 2018–2021 (USD MILLION)

TABLE 30 PRESENCE SENSING SAFETY SENSORS MARKET, BY INDUSTRY, 2022–2027 (USD MILLION)

7.3 PROGRAMMABLE SAFETY SYSTEMS

7.3.1 MARKET FOR PROGRAMMABLE SAFETY SYSTEMS TO GROW AT HIGHEST RATE DURING FORECAST PERIOD

TABLE 31 PROGRAMMABLE SAFETY SYSTEMS MARKET, BY INDUSTRY, 2018–2021 (USD MILLION)

TABLE 32 PROGRAMMABLE SAFETY SYSTEMS MARKET, BY INDUSTRY, 2022–2027 (USD MILLION)

7.4 SAFETY CONTROLLERS/MODULES/RELAYS

7.4.1 SAFETY CONTROLLERS/MODULES/RELAYS ARE USED TO SHUT DOWN EQUIPMENT IN CASE OF ANY EMERGENCY

TABLE 33 SAFETY CONTROLLERS/MODULES/RELAYS MARKET, BY INDUSTRY, 2018–2021 (USD MILLION)

TABLE 34 SAFETY CONTROLLERS/MODULES/RELAYS MARKET, BY INDUSTRY, 2022–2027 (USD MILLION)

7.5 SAFETY INTERLOCK SWITCHES

7.5.1 SAFETY INTERLOCK SWITCHES ARE USED TO PROTECT EQUIPMENT AND USERS DURING HAZARDOUS SITUATIONS

TABLE 35 SAFETY INTERLOCK SWITCHES MARKET, BY INDUSTRY, 2018–2021 (USD MILLION)

TABLE 36 SAFETY INTERLOCK SWITCHES MARKET, BY INDUSTRY, 2022–2027 (USD MILLION)

7.6 EMERGENCY STOP CONTROLS

7.6.1 EMERGENCY STOP CONTROLS HAVE WIDE RANGE OF SAFETY APPLICATIONS IN INDUSTRIES

TABLE 37 EMERGENCY STOP CONTROLS MARKET, BY INDUSTRY, 2018–2021 (USD MILLION)

TABLE 38 EMERGENCY STOP CONTROLS MARKET, BY INDUSTRY, 2022–2027 (USD MILLION)

7.7 TWO-HAND SAFETY CONTROLS

7.7.1 DEMAND FOR TWO-HAND SAFETY FOR POWER GENERATION INDUSTRIES TO CONTINUE TO RISE IN FUTURE

TABLE 39 TWO-HAND SAFETY CONTROLS MARKET, BY INDUSTRY, 2018–2021 (USD MILLION)

TABLE 40 TWO-HAND SAFETY CONTROLS MARKET, BY INDUSTRY, 2022–2027 (USD MILLION)

7.8 OTHERS

TABLE 41 OTHER COMPONENTS MARKET, BY INDUSTRY, 2018–2021 (USD MILLION)

TABLE 42 OTHER COMPONENTS MARKET, BY INDUSTRY, 2022–2027 (USD MILLION)

8 INDUSTRIAL SAFETY SYSTEMS (Page No. - 91)

8.1 INTRODUCTION

8.2 EMERGENCY SHUTDOWN SYSTEM (ESD)

8.2.1 EMERGENCY SHUTDOWN SYSTEMS OFFER QUICK SHUTDOWN CAPABILITIES IN HAZARDOUS SITUATIONS

8.3 HIGH-INTEGRITY PRESSURE PROTECTION SYSTEM (HIPPS)

8.3.1 HIPPS PLAYS VITAL ROLE IN PROTECTING EQUIPMENT FROM OVER-PRESSURIZATION SITUATIONS

8.4 BURNER MANAGEMENT SYSTEM (BMS)

8.4.1 BMS HELPS IN RELIABLE MONITORING, OPERATIONS, AND MAINTENANCE OF ALL ASSETS IN PLANTS

8.5 FIRE & GAS MONITORING SYSTEM

8.5.1 FIRE & GAS MONITORING SYSTEMS MAINLY USED TO PREVENT AND LOWER AFTER EFFECTS OF FIRE ACCIDENTS

8.6 TURBOMACHINERY CONTROL SYSTEM (TMC)

8.6.1 TMC PROVIDES TIGHT CONTROL OVER SPEED OF STEAM, HYDRO, AND GAS TURBINES

9 IMPLEMENTATION TYPES OF INDUSTRIAL SAFETY COMPONENTS (Page No. - 94)

9.1 INTRODUCTION

FIGURE 32 INDIVIDUAL COMPONENTS LED INDUSTRIAL SAFETY MARKET IN 2021

9.2 INDIVIDUAL COMPONENTS

9.2.1 INDIVIDUAL COMPONENTS ARE EASY TO INTEGRATE AND CONTROL

9.3 EMBEDDED COMPONENTS

9.3.1 EMBEDDED COMPONENTS OFFER BETTER PERFORMANCE AND ADVANCED SAFETY FOR INDUSTRIAL MACHINES

10 INDUSTRIAL SAFETY MARKET, BY INDUSTRY (Page No. - 96)

10.1 INTRODUCTION

FIGURE 33 INDUSTRIAL SAFETY MARKET, BY INDUSTRY

TABLE 43 MARKET, BY INDUSTRY, 2018–2021 (USD MILLION)

TABLE 44 MARKET, BY INDUSTRY, 2022–2027 (USD MILLION)

10.2 OIL & GAS

10.2.1 INDUSTRIAL SAFETY COMPONENTS AND SYSTEM IN OIL & GAS INDUSTRY REDUCES RISK OF EMERGENCY SHUTDOWNS

TABLE 45 INDUSTRIAL MACHINE SAFETY MARKET FOR OIL & GAS, BY COMPONENT, 2018–2021 (USD MILLION)

TABLE 46 INDUSTRIAL MACHINE SAFETY MARKET FOR OIL & GAS, BY COMPONENT, 2022–2027 (USD MILLION)

TABLE 47 INDUSTRIAL MACHINE SAFETY MARKET FOR OIL & GAS, BY REGION, 2018–2021 (USD MILLION)

TABLE 48 INDUSTRIAL MACHINE SAFETY MARKET FOR OIL & GAS, BY REGION, 2022–2027 (USD MILLION)

10.3 ENERGY & POWER

10.3.1 POWER INDUSTRY USES INDUSTRIAL SAFETY SYSTEMS TO PROTECT PLANTS FROM HAZARDS

TABLE 49 INDUSTRIAL MACHINE SAFETY MARKET FOR ENERGY & POWER, BY COMPONENT, 2018–2021 (USD MILLION)

TABLE 50 INDUSTRIAL MACHINE SAFETY MARKET FOR ENERGY & POWER, BY COMPONENT, 2022–2027 (USD MILLION)

TABLE 51 INDUSTRIAL MACHINE SAFETY MARKET FOR ENERGY & POWER, BY REGION, 2018–2021 (USD MILLION)

TABLE 52 INDUSTRIAL MACHINE SAFETY MARKET FOR ENERGY & POWER, BY REGION, 2022–2027 (USD MILLION)

10.4 CHEMICALS

10.4.1 DEMAND FOR SAFETY AND RELIABILITY IN CHEMICALS INDUSTRY TO PROPEL MARKET GROWTH

TABLE 53 INDUSTRIAL MACHINE SAFETY MARKET FOR CHEMICALS, BY COMPONENT, 2018–2021 (USD MILLION)

TABLE 54 INDUSTRIAL MACHINE SAFETY MARKET FOR CHEMICALS, BY COMPONENT, 2022–2027 (USD MILLION)

TABLE 55 INDUSTRIAL MACHINE SAFETY MARKET FOR CHEMICALS, BY REGION, 2018–2021 (USD MILLION)

TABLE 56 INDUSTRIAL MACHINE SAFETY MARKET FOR CHEMICALS, BY REGION, 2022–2027 (USD MILLION)

10.5 FOOD & BEVERAGES

10.5.1 SAFETY SYSTEMS ARE WIDELY ADOPTED BY FOOD & BEVERAGES INDUSTRY TO INCREASE PRODUCTION PRECISION AND FLEXIBILITY

TABLE 57 INDUSTRIAL MACHINE SAFETY MARKET FOR FOOD & BEVERAGES, BY COMPONENT, 2018–2021 (USD MILLION)

TABLE 58 INDUSTRIAL MACHINE SAFETY MARKET FOR FOOD & BEVERAGES, BY COMPONENT, 2022–2027 (USD MILLION)

TABLE 59 INDUSTRIAL MACHINE SAFETY MARKET FOR FOOD & BEVERAGES, BY REGION, 2018–2021 (USD MILLION)

TABLE 60 INDUSTRIAL MACHINE SAFETY MARKET FOR FOOD & BEVERAGES, BY REGION, 2022–2027 (USD MILLION)

10.6 AEROSPACE

10.6.1 AEROSPACE INDUSTRY ADOPTS INDUSTRIAL SAFETY TO INCREASE PRODUCTION PRECISION AND FLEXIBILITY

TABLE 61 INDUSTRIAL MACHINE SAFETY MARKET FOR AEROSPACE, BY COMPONENT, 2018–2021 (USD MILLION)

TABLE 62 INDUSTRIAL MACHINE SAFETY MARKET FOR AEROSPACE, BY COMPONENT, 2022–2027 (USD MILLION)

TABLE 63 INDUSTRIAL MACHINE SAFETY MARKET FOR AEROSPACE, BY REGION, 2018–2021 (USD MILLION)

TABLE 64 INDUSTRIAL MACHINE SAFETY MARKET FOR AEROSPACE, BY REGION, 2022–2027 (USD MILLION)

10.7 AUTOMOTIVE

10.7.1 AUTOMOTIVE INDUSTRY PRIMARILY EMPLOYS INDUSTRIAL SAFETY FOR ASSEMBLING/DISASSEMBLING, PRESSING, AND MATERIAL HANDLING

TABLE 65 INDUSTRIAL MACHINE SAFETY MARKET FOR AUTOMOTIVE, BY COMPONENT, 2018–2021 (USD MILLION)

TABLE 66 INDUSTRIAL MACHINE SAFETY MARKET FOR AUTOMOTIVE, BY COMPONENT, 2022–2027 (USD MILLION)

TABLE 67 INDUSTRIAL MACHINE SAFETY MARKET FOR AUTOMOTIVE, BY REGION, 2018–2021 (USD MILLION)

TABLE 68 INDUSTRIAL MACHINE SAFETY MARKET FOR AUTOMOTIVE, BY REGION, 2022–2027 (USD MILLION)

10.8 SEMICONDUCTORS

10.8.1 SEMICONDUCTORS INDUSTRY USES INDUSTRIAL SAFETY EQUIPMENT TO ENSURE WORKER AND ASSET PROTECTION

TABLE 69 INDUSTRIAL MACHINE SAFETY MARKET FOR SEMICONDUCTORS, BY COMPONENT, 2018–2021 (USD MILLION)

TABLE 70 INDUSTRIAL MACHINE SAFETY MARKET FOR SEMICONDUCTORS, BY COMPONENT, 2022–2027 (USD MILLION)

TABLE 71 INDUSTRIAL MACHINE SAFETY MARKET FOR SEMICONDUCTORS, BY REGION, 2018–2021 (USD MILLION)

TABLE 72 INDUSTRIAL MACHINE SAFETY MARKET FOR SEMICONDUCTORS, BY REGION, 2022–2027 (USD MILLION)

10.9 HEALTHCARE & PHARMACEUTICALS

10.9.1 PHARMACEUTICAL COMPANIES IMPLEMENT INDUSTRIAL SAFETY TO PREVENT POTENTIAL HAZARDS

TABLE 73 INDUSTRIAL MACHINE SAFETY MARKET FOR HEALTHCARE & PHARMACEUTICALS, BY COMPONENT, 2018–2021 (USD MILLION)

TABLE 74 INDUSTRIAL MACHINE SAFETY MARKET FOR HEALTHCARE & PHARMACEUTICALS, BY COMPONENTS, 2022–2027 (USD MILLION)

TABLE 75 INDUSTRIAL MACHINE SAFETY MARKET FOR HEALTHCARE & PHARMACEUTICALS, BY REGION, 2018–2021 (USD MILLION)

TABLE 76 INDUSTRIAL MACHINE SAFETY MARKET FOR HEALTHCARE & PHARMACEUTICALS, BY REGION, 2022–2027 (USD MILLION)

10.10 METALS & MINING

10.10.1 STRINGENT RULES AND REGULATIONS PERTAINING TO METALS & MINING INDUSTRY BOOST ADOPTION OF INDUSTRIAL SAFETY SYSTEMS

TABLE 77 INDUSTRIAL MACHINE SAFETY MARKET FOR METALS & MINING, BY COMPONENT, 2018–2021 (USD MILLION)

TABLE 78 INDUSTRIAL MACHINE SAFETY MARKET FOR METALS & MINING, BY COMPONENT, 2022–2027 (USD MILLION)

TABLE 79 INDUSTRIAL MACHINE SAFETY MARKET FOR METALS & MINING, BY REGION, 2018–2021 (USD MILLION)

TABLE 80 INDUSTRIAL MACHINE SAFETY MARKET FOR METALS & MINING, BY REGION, 2022–2027 (USD MILLION)

10.11 OTHERS

TABLE 81 INDUSTRIAL MACHINE SAFETY MARKET FOR OTHER INDUSTRIES, BY COMPONENT, 2018–2021 (USD MILLION)

TABLE 82 INDUSTRIAL MACHINE SAFETY MARKET FOR OTHER INDUSTRIES, BY COMPONENT, 2022–2027 (USD MILLION)

TABLE 83 INDUSTRIAL MACHINE SAFETY MARKET FOR OTHER INDUSTRIES, BY REGION, 2018–2021 (USD MILLION)

TABLE 84 INDUSTRIAL MACHINE SAFETY MARKET FOR OTHER INDUSTRIES, BY REGION, 2022–2027 (USD MILLION)

11 GEOGRAPHIC ANALYSIS (Page No. - 119)

11.1 INTRODUCTION

FIGURE 34 INDUSTRIAL SAFETY MARKET, BY GEOGRAPHY

TABLE 85 ARKET, BY REGION, 2018–2021 (USD MILLION)

TABLE 86 MARKET, BY REGION, 2022–2027 (USD MILLION)

11.2 NORTH AMERICA

FIGURE 35 SNAPSHOT: MARKET IN NORTH AMERICA

TABLE 87 MARKET IN NORTH AMERICA, BY COUNTRY, 2018–2021 (USD MILLION)

TABLE 88 MARKET IN NORTH AMERICA, BY COUNTRY, 2022–2027 (USD MILLION)

TABLE 89 MARKET IN NORTH AMERICA, BY TYPE, 2018–2021 (USD MILLION)

TABLE 90 MARKET IN NORTH AMERICA, BY TYPE, 2022–2027 (USD MILLION)

TABLE 91 INDUSTRIAL MACHINE SAFETY MARKET IN NORTH AMERICA, BY INDUSTRY, 2018–2021 (USD MILLION)

TABLE 92 INDUSTRIAL MACHINE SAFETY MARKET IN NORTH AMERICA, BY INDUSTRY, 2022–2027 (USD MILLION)

11.2.1 US

11.2.1.1 US to hold largest size of industrial safety market in North America during forecast period

11.2.2 CANADA

11.2.2.1 Strict government regulations drive market in Canada

11.2.3 MEXICO

11.2.3.1 Abundance of oil & gas reserves to offer opportunities for industrial safety manufacturers in Mexico

11.3 EUROPE

FIGURE 36 SNAPSHOT: INDUSTRIAL SAFETY MARKET IN EUROPE

TABLE 93 MARKET IN EUROPE, BY COUNTRY, 2018–2021 (USD MILLION)

TABLE 94 MARKET IN EUROPE, BY COUNTRY, 2022–2027 (USD MILLION)

TABLE 95 MARKET IN EUROPE, BY TYPE, 2018–2021 (USD MILLION)

TABLE 96 MARKET IN EUROPE, BY TYPE, 2022–2027 (USD MILLION)

TABLE 97 INDUSTRIAL MACHINE SAFETY MARKET IN EUROPE, BY INDUSTRY, 2018–2021 (USD MILLION)

TABLE 98 INDUSTRIAL MACHINE SAFETY MARKET IN EUROPE, BY INDUSTRY, 2022–2027 (USD MILLION)

11.3.1 UK

11.3.1.1 Mandates for safety regulations propel demand for industrial safety systems and services in UK

11.3.2 GERMANY

11.3.2.1 Growing chemicals industry to drive industrial safety market in Germany

11.3.3 FRANCE

11.3.3.1 Stringent industrial safety requirements driving market in France

11.3.4 DENMARK

11.3.4.1 Oil & gas industry in Denmark offers significant growth opportunities for Industrial Safety Market

11.3.5 FINLAND

11.3.5.1 Dedicated institutes and associations will help growth of market in Finland

11.3.6 NORWAY

11.3.6.1 Extensive oil and gas exploration activities foster market growth in Norway

11.3.7 REST OF EUROPE

11.4 APAC

FIGURE 37 SNAPSHOT: MARKET IN ASIA PACIFIC

TABLE 99 MARKET IN ASIA PACIFIC, BY COUNTRY, 2018–2021 (USD MILLION)

TABLE 100 MARKET IN ASIA PACIFIC, BY COUNTRY, 2022–2027 (USD MILLION)

TABLE 101 MARKET IN ASIA PACIFIC, BY TYPE, 2018–2021 (USD MILLION)

TABLE 102 MARKET IN ASIA PACIFIC, BY TYPE, 2022–2027 (USD MILLION)

TABLE 103 INDUSTRIAL MACHINE SAFETY MARKET IN ASIA PACIFIC, BY INDUSTRY, 2018–2021 (USD MILLION)

TABLE 104 INDUSTRIAL MACHINE SAFETY MARKET IN ASIA PACIFIC, BY INDUSTRY, 2022–2027 (USD MILLION)

11.4.1 CHINA

11.4.1.1 Automotive and chemicals industries substantiate industrial safety market growth in China

11.4.2 JAPAN

11.4.2.1 Fast-growing process industries driving adoption of industrial safety products in Japan

11.4.3 INDIA

11.4.3.1 Rising oil & gas production and refining activities boost industrial safety market in India

11.4.4 SOUTH KOREA

11.4.4.1 Industrial safety and health laws to prevent industrial accidents drive industrial safety market in South Korea

11.4.5 REST OF APAC

11.5 ROW

TABLE 105 INDUSTRIAL SAFETY MARKET IN ROW, BY REGION, 2018–2021 (USD MILLION)

TABLE 106 MARKET IN ROW, BY REGION, 2022–2027 (USD MILLION)

TABLE 107 MARKET IN ROW, BY TYPE, 2018–2021 (USD MILLION)

TABLE 108 MARKET IN ROW, BY TYPE,2022–2027 (USD MILLION)

TABLE 109 INDUSTRIAL MACHINE SAFETY MARKET IN ROW, BY INDUSTRY, 2018–2021 (USD MILLION)

TABLE 110 MARKET IN ROW, BY INDUSTRY, 2022–2027 (USD MILLION)

11.5.1 MIDDLE EAST & AFRICA

11.5.1.1 Oil & gas industry underpins industrial safety market in Middle East & Africa

11.5.2 SOUTH AMERICA

11.5.2.1 Expanding pharmaceuticals industry supports market growth in South America

12 COMPETITIVE LANDSCAPE (Page No. - 140)

12.1 OVERVIEW

12.2 TOP FIVE COMPANY REVENUE ANALYSIS

FIGURE 38 INDUSTRIAL SAFETY MARKET: REVENUE ANALYSIS OF TOP FIVE PLAYERS, 2017–2021

12.3 MARKET SHARE ANALYSIS, 2021

TABLE 111 MARKET SHARE ANALYSIS (2021)

12.4 COMPETITIVE LEADERSHIP MAPPING

12.4.1 STAR

12.4.2 EMERGING LEADER

12.4.3 PERVASIVE

12.4.4 PARTICIPANT

FIGURE 39 MARKET: COMPETITIVE LEADERSHIP MAPPING, 2021

12.5 SMALL AND MEDIUM ENTERPRISES (SME) EVALUATION MATRIX, 2021

12.5.1 PROGRESSIVE COMPANY

12.5.2 RESPONSIVE COMPANY

12.5.3 DYNAMIC COMPANY

12.5.4 STARTING BLOCK

FIGURE 40 INDUSTRIAL SAFETY MARKET (GLOBAL), SME EVALUATION QUADRANT, 2021

12.6 STARTUP EVALUATION MATRIX

TABLE 112 MARKET: DETAILED LIST OF KEY STARTUPS/SMES

TABLE 113 MARKET: COMPETITIVE BENCHMARKING OF KEY STARTUPS/SMES

12.7 MARKET: COMPANY FOOTPRINT

TABLE 114 COMPANY FOOTPRINT

TABLE 115 PRODUCT FOOTPRINT OF COMPANIES

TABLE 116 INDUSTRY FOOTPRINT OF COMPANIES

TABLE 117 REGIONAL FOOTPRINT OF COMPANIES

12.8 COMPETITIVE SITUATIONS AND TRENDS

12.8.1 MARKET: PRODUCT LAUNCHES, 2019–2021

12.8.2 INDUSTRIAL SAFETY MARKET: DEALS, 2019–2021

13 COMPANY PROFILES (Page No. - 154)

13.1 KEY PLAYERS

(Business Overview, Products Offered, Recent Developments, Deals, MnM view, Key strengths/right to win, Strategic choices made, Weakness/competitive threats)*

13.1.1 SCHNEIDER ELECTRIC

TABLE 118 SCHNEIDER ELECTRIC: BUSINESS OVERVIEW

FIGURE 41 SCHNEIDER ELECTRIC: COMPANY SNAPSHOT

TABLE 119 SCHNEIDER ELECTRIC: PRODUCTS OFFERED

13.1.2 HONEYWELL INTERNATIONAL INC.

TABLE 120 HONEYWELL INTERNATIONAL INC.: BUSINESS OVERVIEW

FIGURE 42 HONEYWELL INTERNATIONAL INC.: COMPANY SNAPSHOT

13.1.3 ABB

TABLE 121 ABB: BUSINESS OVERVIEW

FIGURE 43 ABB: COMPANY SNAPSHOT

13.1.4 ROCKWELL AUTOMATION, INC.

TABLE 122 ROCKWELL AUTOMATION, INC.: BUSINESS OVERVIEW

FIGURE 44 ROCKWELL AUTOMATION, INC.: COMPANY SNAPSHOT

13.1.5 SIEMENS

TABLE 123 SIEMENS: BUSINESS OVERVIEW

FIGURE 45 SIEMENS: COMPANY SNAPSHOT

13.1.6 HIMA

TABLE 124 HIMA: BUSINESS OVERVIEW

13.1.7 YOKOGAWA ELECTRIC CORPORATION

TABLE 125 YOKOGAWA ELECTRIC CORPORATION: BUSINESS OVERVIEW

FIGURE 46 YOKOGAWA ELECTRIC CORPORATION: COMPANY SNAPSHOT

13.1.8 EMERSON ELECTRIC CO

TABLE 126 EMERSON ELECTRIC CO.: BUSINESS OVERVIEW

FIGURE 47 EMERSON ELECTRIC CO: COMPANY SNAPSHOT

13.1.9 BAKER HUGHES

TABLE 127 BAKER HUGHES.: BUSINESS OVERVIEW

FIGURE 48 BAKER HUGHES: COMPANY SNAPSHOT

TABLE 128 BAKER HUGHES: PRODUCT OFFERINGS

13.1.10 OMRON CORPORATION

TABLE 129 OMRON CORPORATION: BUSINESS OVERVIEW

FIGURE 49 OMRON CORPORATION: COMPANY SNAPSHOT

TABLE 130 OMRON CORPORATION: PRODUCT OFFERINGS

13.2 OTHER PLAYERS

13.2.1 JOHNSON CONTROLS

TABLE 131 JOHNSON CONTROLS: BUSINESS OVERVIEW

13.2.2 BALLUFF GMBH

TABLE 132 BALLUFF GMBH: BUSINESS OVERVIEW

13.2.3 KEYENCE

TABLE 133 KEYENCE: BUSINESS OVERVIEW

13.2.4 IDEC CORPORATION

TABLE 134 IDEC CORPORATION: BUSINESS OVERVIEW

13.2.5 SICK

TABLE 135 SICK: BUSINESS OVERVIEW

13.2.6 EUCHNER

TABLE 136 EUCHNER: BUSINESS OVERVIEW

13.2.7 FORTRESS INTERLOCKS (HALMA PLC)

TABLE 137 FORTRESS INTERLOCKS (HALMA PLC): BUSINESS OVERVIEW

13.2.8 SGS GROUP

TABLE 138 SGS GROUP: BUSINESS OVERVIEW

13.2.9 MITSUBISHI ELECTRIC

TABLE 139 MITSUBISHI ELECTRIC: BUSINESS OVERVIEW

13.2.10 PILZ

TABLE 140 PILZ: BUSINESS OVERVIEW

13.2.11 VELAN INC.

TABLE 141 VELAN INC: BUSINESS OVERVIEW

13.2.12 PALADON SYSTEMS LTD.

TABLE 142 PALADON SYSTEMS LTD.: BUSINESS OVERVIEW

13.2.13 PROSERV INGENIOUS SIMPLICITY

TABLE 143 PROSERV INGENIOUS SIMPLICITY: BUSINESS OVERVIEW

13.2.14 BANNER ENGINEERING

TABLE 144 BANNER ENGINEERING: BUSINESS OVERVIEW

13.2.15 K.A. SCHMERSAL

TABLE 145 K.A. SCHMERSAL: BUSINESS OVERVIEW

*Details on Business Overview, Products Offered, Recent Developments, Deals, MnM view, Key strengths/right to win, Strategic choices made, Weakness/competitive threats might not be captured in case of unlisted companies.

14 ADJACENT & RELATED MARKETS (Page No. - 201)

14.1 INTRODUCTION

14.2 LIMITATIONS

14.3 HIPPS MARKET, BY INDUSTRY

TABLE 146 HIPPS MARKET, BY INDUSTRY, 2018–2021 (USD MILLION)

TABLE 147 HIPPS MARKET, BY INDUSTRY, 2022–2027 (USD MILLION)

14.3.1 OIL & GAS

TABLE 148 HIPPS MARKET FOR OIL & GAS INDUSTRY, BY REGION, 2018–2021 (USD MILLION)

TABLE 149 HIPPS MARKET FOR OIL & GAS INDUSTRY, BY REGION, 2022–2027 (USD MILLION)

TABLE 150 TYPICAL APPLICATIONS OF HIPPS IN UPSTREAM, MIDSTREAM, AND DOWNSTREAM SECTORS

TABLE 151 HIPPS MARKET FOR OIL & GAS INDUSTRY, BY STREAM TYPE, 2018–2021 (USD MILLION)

TABLE 152 HIPPS MARKET FOR OIL & GAS INDUSTRY, BY STREAM TYPE, 2022–2027 (USD MILLION)

14.3.1.1 Upstream

14.3.1.1.1 Upstream sector held largest size of HIPPS market for oil & gas industry in 2021

14.3.1.2 Midstream

14.3.1.2.1 Increasing number of oil and gas pipelines to fuel demand for HIPPS in midstream sector

14.3.1.3 Downstream

14.3.1.3.1 Increasing demand for HIPPS from LNG regasification plants in downstream sector to drive market growth

14.3.2 CHEMICAL

14.3.2.1 Stringent regulations and standards to fuel demand for high-integrity pressure protection system (HIPPS) in chemical industry

TABLE 153 HIPPS MARKET FOR CHEMICAL INDUSTRY, BY REGION, 2018–2021 (USD MILLION)

TABLE 154 HIPPS MARKET FOR CHEMICAL INDUSTRY, BY REGION, 2022–2027 (USD MILLION)

15 APPENDIX (Page No. - 207)

15.1 DISCUSSION GUIDE

15.2 KNOWLEDGE STORE: MARKETSANDMARKETS’ SUBSCRIPTION PORTAL

15.3 AVAILABLE CUSTOMIZATIONS

15.4 RELATED REPORTS

15.5 AUTHOR DETAILS

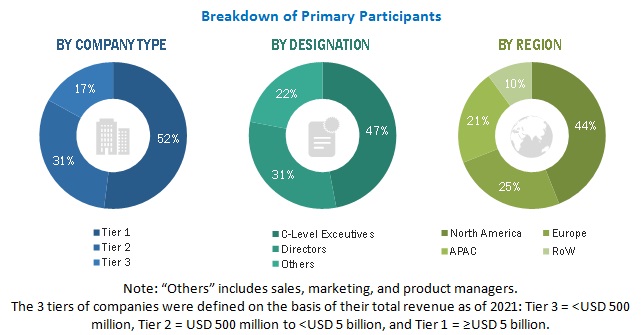

The study involves four major activities for estimating the size of the industrial safety market. Exhaustive secondary research has been conducted to collect information related to the market. The next step has been the validation of these findings, assumptions, and sizing with the industry experts across the value chain through primary research. Both top-down and bottom-up approaches have been employed to estimate the overall size of the industrial safety market. After that, market breakdown and data triangulation procedures have been used to determine the extent of different segments and subsegments of the market.

Secondary Research

In the secondary research process, various secondary sources have been referred to for identifying and collecting information important for this study. The secondary sources used for this research study include government sources; corporate filings (such as annual reports, investor presentations, and financial statements); and trade, business, and professional associations. The secondary data have been sourced from associations such as International Safety Equipment Association, Asia Industrial Gases Association, US Oil & Gas Association, European Automobile Manufacturers' Association, and International Road Safety Association among others.

Primary Research

In the primary research process, primary sources from both supply and demand sides have been interviewed to obtain qualitative and quantitative information important for this report. Primary sources, such as experts from related industries and suppliers, have been interviewed to obtain and verify critical information, as well as assess prospects. Key players such as Schneider Electric, Honeywell International, Siemens AG, Rockwell Automation, Johnson Controls, Rockwell, ABB, HIMA, Emerson, GE, Yokogawa, Omron, in the industrial safety market have been identified through secondary research, and their respective market rankings have been determined through primary and secondary research. This research includes the study of annual reports of the top market players and interviews with key opinion leaders, such as chief executive officers (CEOs), directors, and marketing personnel.

To know about the assumptions considered for the study, download the pdf brochure

Market Size Estimation

- The bottom-up approach has been employed to arrive at the overall size of the industrial safety market from the Identifying products currently provided or expected to be offered by product providers

- Analyzing the market penetration of each component through secondary and primary research for both pre- and post-COVID-19 scenarios

- Identifying the ratio for various industrial safety solutions demanded by end-user industries and the anticipated change in demand in the post-COVID-19 scenario

- Conducting multiple discussion sessions with key opinion leaders to understand various components of industrial safety systems and their implementation and applications in various industries, which would help in analyzing the break-up of the scope of work carried out by each major company; the discussion also includes the impact of COVID-19 on the ecosystem of the market

- Estimating the size of the safety market based on the demand-side scenario

- Tracking ongoing and upcoming product launches by companies, and forecasting market based on these developments and other critical parameters

- Conducting multiple discussions with key opinion leaders to understand the demand for industrial safety, and analyzing the break-up of the scope of work carried out by each major company Arriving at market estimates by analyzing revenues generated by manufacturers, based on their locations (countries), and then combining country-based data to get a market estimate based on region

- Verifying and crosschecking estimates at every level by discussing with key opinion leaders, including CEOs, directors, operation managers, and then finally with domain experts at MarketsandMarkets

- Studying various paid and unpaid information sources such as annual reports, press releases, and white papers

To know about the assumptions considered for the study, Request for Free Sample Report

The top-down approach has been used to estimate and validate the total size of the industrial safety market.

- Focusing on top-line investments and expenditures made in industrial safety ecosystem

- Building and developing information related to revenue generated from product and component sales

- Conducting multiple on-field discussions with key opinion leaders from major companies involved in developing industrial safety products and components

- Estimating geographic splits by using secondary sources, based on various factors, such as the number of players in a specific country and region, types of services used in various industries

- Analyzing the implications of COVID-19 on the industrial safety market and its segments, which have been measured in terms of value

Data Triangulation

After arriving at the overall market size—using the market size estimation processes as explained above—the market has been split into several segments and subsegments. To complete the entire market engineering process and arrive at the exact statistics of each market segment and subsegment, data triangulation, and market breakdown procedures have been employed, wherever applicable. The data has been triangulated by studying various factors and trends from both the demand and supply sides in the industrial safety market.

Report Objectives

- To describe and forecast the industrial safety market, in terms of value, by type, component, and industry

-

To describe and forecast the market, in terms of value, by region—North America, Europe,

Asia Pacific (APAC), and Rest of the World (RoW) - To provide detailed information regarding factors (drivers, restraints, opportunities, and challenges) influencing market growth

- To provide a detailed overview of the process flow of the industrial safety market

- To analyze opportunities for stakeholders in the industrial safety market by identifying its high-growth segments

- To strategically analyze micromarkets1 with respect to individual growth trends, prospects, and contributions to the overall market

- To strategically profile key players and comprehensively analyze their market shares and core competencies2 along with detailing the competitive leadership and analyzing growth strategies such as product launches and developments, acquisitions, and agreements of leading players.

Available Customizations:

With the given market data, MarketsandMarkets offers customizations according to the company’s specific needs. The following customization options are available for the report:

Company Information:

- Detailed analysis and profiling of additional market players based on various blocks of the value chain.

Generating Response ...

Generating Response ...

Growth opportunities and latent adjacency in Industrial Safety Market