Remote Monitoring and Control Market by Type(Solutions (SCADA, Vibration Monitoring), Field Instruments (Level Transmitters, Pressure Transmitters, Temperature Transmitters, Intelligent Flow Meters)), Industry and Region - Global Forecast to 2027

Updated on : October 23, 2024

Remote Monitoring and Control Market Size & Growth

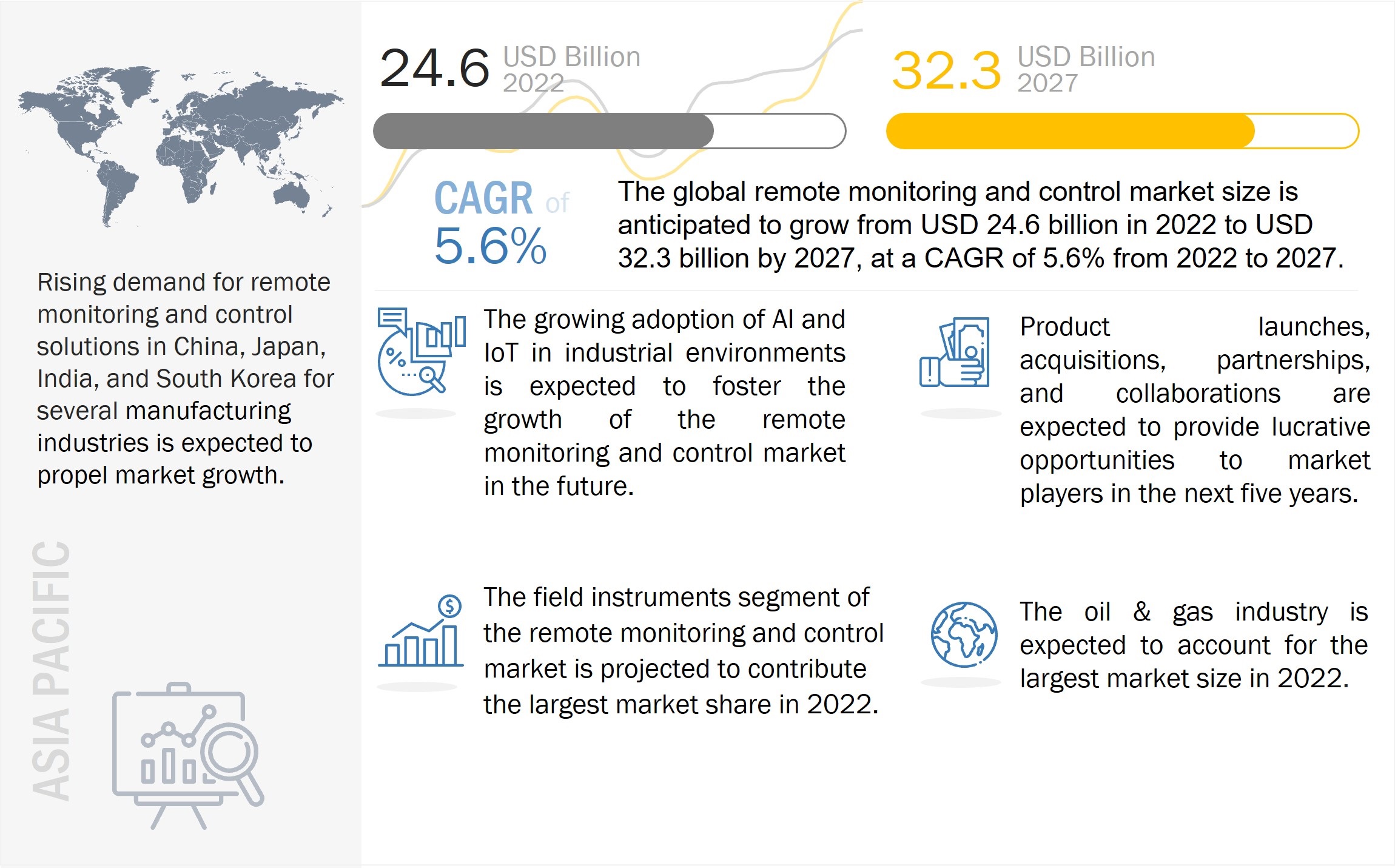

The global remote monitoring and control market size is foreseen to grow from USD 24.6 billion in 2022 to USD 32.3 billion by 2027, growing at a CAGR of 5.6% during the forecast period from 2022 to 2027.

Rising demand for industry 4.0 across process and manufacturing industries and the surging adoption of AI and IoT in industrial environments are notable factors empowering the growth of the remote monitoring and control industry.

Remote Monitoring and Control Market Forecast to 2027

To know about the assumptions considered for the study, Request for Free Sample Report

The remote monitoring and control market will be showing significant growth due to its various applications in several industries, such as oil & gas, food & beverage, pharmaceutical, automotive, and power, among others. Various key players in the market adapting different strategies such as acquisitions, product launches, collaborations, and partnerships are driving the growth of the remote monitoring and control market.

Remote Monitoring and Control Market Trends and Dynamics

Driver: Surging adoption of Industry 4.0 across process and manufacturing industries

Industry 4.0 is an integration of cyber-physical systems, IoT, and cloud computing. It consists of automation infrastructure, such as SCADA or IoT, which enables an operator to carry out manufacturing processes remotely, and real-time information is collected resourcefully to ensure optimum operations. SCADA systems allow reports to be run in real time to obtain current and historical data and predict futuristic events. Therefore, using a SCADA system in smart factories enables operators to predict the maintenance needs of machines, plan production accordingly, and avoid emergencies and machine failure while manufacturing valuable products. The use of HMI in a SCADA system enables an operator to visually monitor the process daily and alerts the operator in case of any emergency in any section of a plant. SCADA, being a rugged system, is fit for handling the complex environment of processing plants, mostly located offshore. Thus, the increased adoption of Industry 4.0 in the process and manufacturing industries drives the demand for remote monitoring and control systems.

Restraint: High costs associated with installation and maintenance of SCADA systems

A SCADA system is an integration of hardware and software consisting of sensors, RTUs, PLCs, and HMIs. Systems in a plant are controlled and maintained from remote locations with the help of the data gathered in real time and process control applications provided by a SCADA system. Gathering data is one of the principal tasks in process industries to achieve optimum resource utilization and high quality of the end product. However, the initial capital and maintenance costs associated with SCADA systems are high. Components included in SCADA systems, such as centralized computer equipment and software, are highly expensive. If more concurrent users such as consulting engineers, system integrators, service providers, facility managers, and owners are there in the industrial facility, the SCADA system will be more expensive since a few SCADA systems charge per concurrent user and a few provide unlimited licenses. Hence, it is necessary to state the exact number of simultaneous stakeholders at the beginning of the project, so that system integrators generally recommend SCADA software that minimizes the cost of concurrent users. Thus, in a SCADA system, a greater number of users may lead to additional hardware costs.

Opportunity: Large requirement for integration of field instruments with remote monitoring systems

Field measurement of various parameters such as temperature, pressure, humidity, level, and flow is crucial in many industrial applications, and many processes require a monitored or controlled environment. These field instruments are widely used in power, oil & gas, food & beverages, pulp & paper, pharmaceutical, metal & mining, and other industries. Field instruments produce digital and analog signals that are monitored by remote stations. These instruments are connected to the controlled or monitored equipment connected to the remote station to enable for manipulation of processes in remote locations. It is also used to collect data from equipment and transfer it to the central SCADA system. The benefit of the integration of field instruments is that it gives a consolidated view of the field instruments' data, which helps monitor and control the industrial process. This data can be further monetized to generate insights to improve and achieve process excellence. The integration with the SCADA system helps increase process efficiency and raises the industrial process view over a single HMI display, which can help enhance industrial safety.

Challenge: Vulnerability of SCADA systems to cyberattacks

Cyber threats are prominent while developing any network based on sensors to monitor and control critical infrastructures. As SCADA is a network of sensors, computers, communication systems, and storage systems, it is vulnerable to cyberattacks. The SCADA system manages the operational aspects of critical infrastructure by using logical processes and physical operations. The failure of this system can affect an organization, a community, and an economy. Disasters such as oil or sewage pipelines releasing their contents in inappropriate locations and electricity grid failure can have a long-term effect and may also lead to collateral damage.

Remote Monitoring and Control Market Segmentation

Within field instruments, intelligent flow meters to grow at highest CAGR during forecast period

Intelligent flow meters are low-cost, easy to deploy, have increased flexibility, and have embedded intelligence for delivering value-added services. They are used in various applications such as oil & gas, water & wastewater treatment, pharmaceutical, and chemical with different engineering requirements. The intelligent flowmeter is used to precisely measure the flow of impure liquids and slurries. They are used in many gas applications replacing differential pressure and turbine flowmeters.

Chemical industry is anticipated to contribute significant share of market during forecast period.

The chemical industry is one of the potential end users of remote monitoring and control solutions, owing to its volatile nature, where unexpected circumstances can occur during manual operations, resulting in considerable losses in terms of human lives. These solutions link field devices, processes, and manpower in the chemical industry to create a system that can quickly avert disasters, and in case of any untoward incident, identify survivors and potential dangers in the aftermath of the disaster. A combination of advanced technologies, such as artificial intelligence (AI) and machine learning (ML) and remote monitoring solutions, such SCADA, enables production optimization through better quality, enhanced safety, and improved throughput.

Remote Monitoring and Control Market by Region

To know about the assumptions considered for the study, download the pdf brochure

Remote Monitoring and Control Industry Regional Analysis

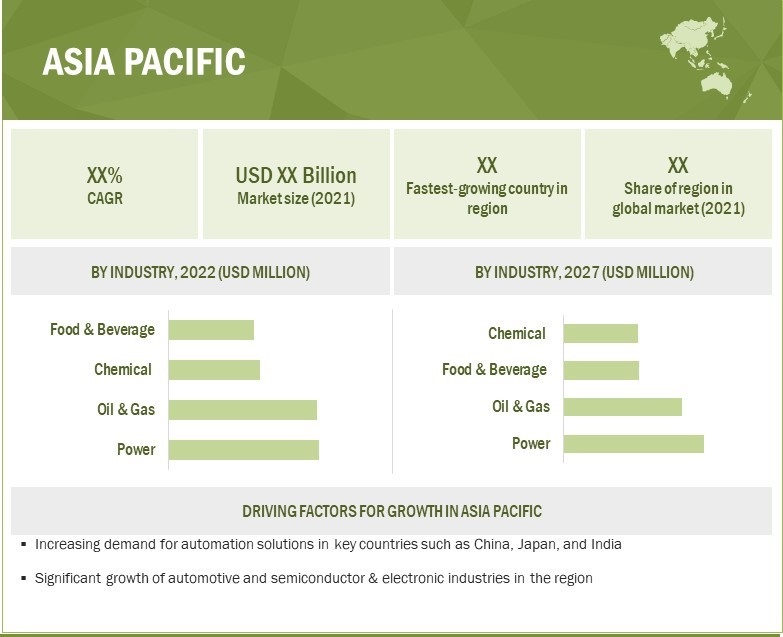

The remote monitoring and control market in Asia Pacific to grow at highest CAGR during forecast period

Asia Pacific is expected to grow at the highest CAGR in the remote monitoring and control market during the forecast period. Growing population, rising standards of living, and developing economies have led to rising demand for energy. Automation is increasing in Asia Pacific because of the rising necessity for high-quality products, along with the increased production rates. The increasing energy demand would lead to the development of the energy sector, including the oil & gas and power industries. This, in turn, would generate the demand for automation products, including remote monitoring and control systems, in the Asia Pacific region.

Top Remote Monitoring and Control Companies - Key Market Players

The remote monitoring and control companies players have implemented various organic and inorganic growth strategies, such as product launches, collaborations, partnerships, and acquisitions, to strengthen their offerings in the market.

The major players in the market are

- Emerson Electric (US),

- Honeywell International (US),

- Siemens (Germany),

- Schneider Electric (France),

- ABB (Switzerland).

The study includes an in-depth competitive analysis of these key players in the remote monitoring and control market with their company profiles, recent developments, and key market strategies.

Remote Monitoring and Control Market Report Scope

|

Report Metric |

Details |

| Estimated Market Size | USD 24.6 billion in 2022 |

| Projected Market Size | USD 32.3 billion by 2027 |

| Growth Rate | 5.6% |

|

Years Considered |

2018–2027 |

|

Base Year Considered |

2021 |

|

Forecast Period |

2022–2027 |

|

Forecast Units |

Value (USD Million/ Billion) |

|

Segments Covered |

|

|

Regions Covered |

|

|

Companies Covered |

Emerson Electric (US), Honeywell International (US), Siemens (Germany), Schneider Electric (France), and ABB (Switzerland) |

Remote Monitoring and Control Market Highlights

In this report, the overall remote monitoring and control market has been segmented based on type, industry, and region.

|

Aspect |

Details |

|

By Type |

|

|

By Industry |

|

|

By Region |

|

Recent Developments in Remote Monitoring and Control Industry

- In September 2022, Schneider Electric completely acquired AVEVA, a global leader in industrial software that drives digital transformation for industrial organizations managing complex operational processes. The deal would help the company accelerate both its software growth strategy and hybrid cloud-based subscription model.

- In June 2022, Senseye was fully acquired by Siemens. The company provides artificial intelligence-powered solutions for industrial machine performance and reliability. This acquisition will enable Siemens to expand its portfolio in the field of predictive maintenance and asset intelligence.

- In May 2022, Emerson Electric collaborated with Toyota to provide control systems to manufacture hydrogen fuel cells production, storage, and refuelling plant in Australia.

Frequently Asked Questions (FAQ):

What is the market size of the remote monitoring and control market expected in 2022?

The remote monitoring and control market is expected to be valued at USD 24.6 billion in 2022.

What is the total CAGR expected to be recorded for the remote monitoring and control market from 2022 to 2027?

The global remote monitoring and control market is expected to record a CAGR of 5.6% from 2022–2027.

Which are the top players in the remote monitoring and control market?

The major vendors operating in the remote monitoring and control market include Emerson Electric (US), Honeywell International (US), Siemens (Germany), Schneider Electric (France), and ABB (Switzerland).

Which major countries are considered in the North American region?

The report includes an analysis of the US, Canada, and Mexico.

Which solutions have been considered under the remote monitoring and control market?

SCADA and vibration monitoring are the major solutions considered in the market study.

To speak to our analyst for a discussion on the above findings, click Speak to Analyst

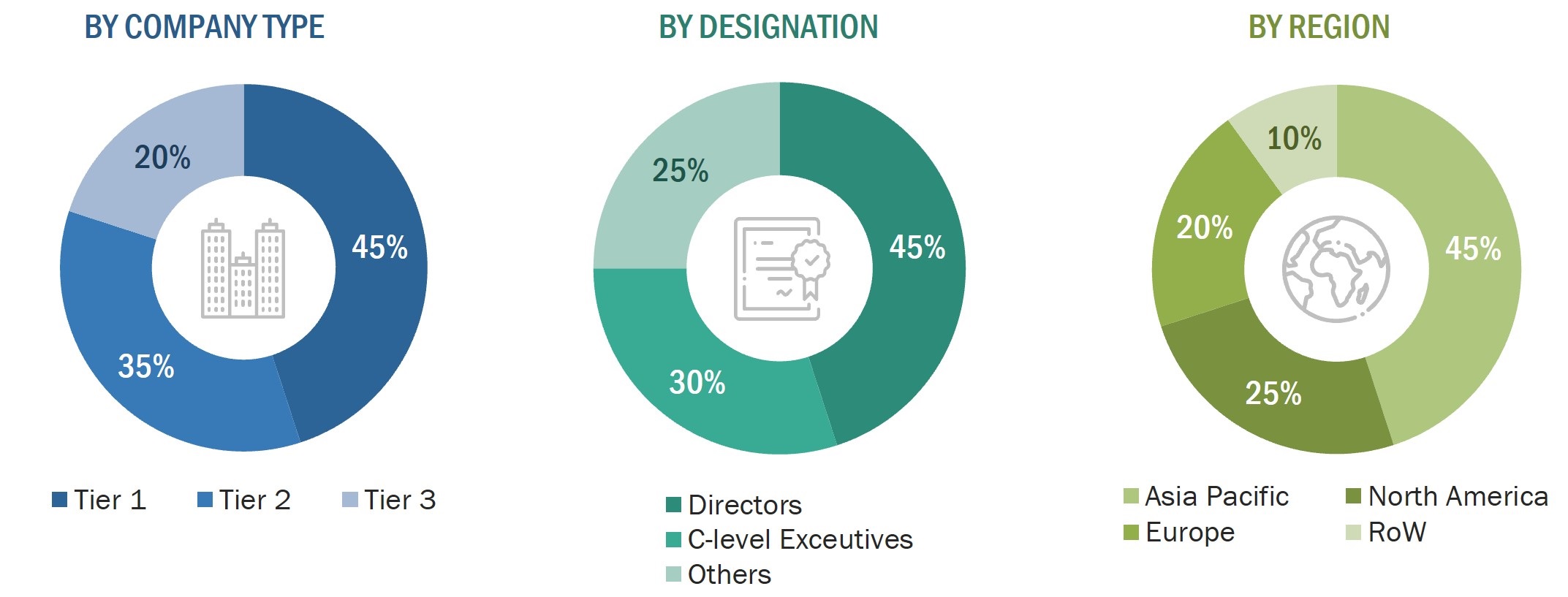

The study involves four major activities for estimating the size of the remote monitoring and control market. Exhaustive secondary research was conducted to collect information related to the market. The next step was validating these findings, assumptions, and sizing with the industry experts across the value chain through primary research. Both top-down and bottom-up approaches were employed to estimate the overall size of the remote monitoring and control market. After that, market breakdown and data triangulation procedures were used to determine the extent of different segments and subsegments of the market.

Secondary Research

Secondary sources referred to for this research study included corporate filings (such as annual reports, investor presentations, and financial statements); trade, business, and professional associations; white papers; certified publications; articles by recognized authors; directories; and databases. The secondary data was collected and analyzed to arrive at the overall market size, which was further validated through primary research.

Primary Research

Extensive primary research was conducted after gaining knowledge about the current scenario of the remote monitoring and control market through secondary research. Several primary interviews were conducted with experts from both demand and supply sides across four major regions—North America, Europe, Asia Pacific, and RoW. This primary data was collected through questionnaires, emails, and telephonic interviews.

To know about the assumptions considered for the study, download the pdf brochure

Market Size Estimation

In the complete market engineering process, both top-down and bottom-up approaches were implemented, along with several data triangulation methods, to estimate and validate the size of the remote monitoring and control market and other dependent submarkets listed in this report.

- The key players in the industry and markets were identified through extensive secondary research.

- Both the supply chain of the industry and the market size, in terms of value, were determined through primary and secondary research.

- All percentage shares, splits, and breakdowns were determined using secondary sources and verified through primary sources.

Data Triangulation

After arriving at the overall market size, the total market was split into several segments. To complete the overall market engineering process and arrive at exact statistics for all segments, the market breakdown and data triangulation procedures were employed wherever applicable. The data was then triangulated by studying various factors and trends from both the demand and supply sides. The market was also validated using both top-down and bottom-up approaches.

Study Objectives:

- To define, describe, and forecast the global remote monitoring and control market based on type, industry, and region

- To forecast the market size, in terms of value, for various segments with regard to four main regions—North America, Europe, Asia Pacific, and Rest of the World (RoW)

- To describe processes involved in remote monitoring

- To describe detailed information regarding the drivers, restraints, opportunities, and challenges influencing the growth of the market

- To provide a detailed overview of the supply/value chain and ecosystem pertaining to the remote monitoring and control market, along with the average selling price of products

- To strategically analyze the ecosystem, regulations, patents, Porter’s five forces, trade landscape, and case studies pertaining to the market under study

- To strategically analyze micromarkets1 with respect to individual growth trends, future prospects, and contribution to the total market

- To strategically profile key players and comprehensively analyze their market ranking and core competencies2, and provide the competitive landscape of the market

- To track and analyze competitive developments such as product launches, partnerships, acquisitions, and collaborations in the remote monitoring and control market

Available Customizations

With the given market data, MarketsandMarkets offers customizations according to the company's specific needs. The following customization options are available for this report:

Company Information

- Detailed analysis and profiling of additional five market players

Generating Response ...

Generating Response ...

Growth opportunities and latent adjacency in Remote Monitoring and Control Market