Electron Microscopy and Sample Preparation Market Size, Share, Statistics and Industry Growth Analysis Report By Type (SEM and TEM), Application (Semiconductor, Life Sciences, Material Science), Product, End-user Industry, and Geography (2021-2026)

Updated on : October 22, 2024

The Electron Microscopy and Sample Preparation Market is witnessing robust growth, fueled by an increasing demand for high-resolution imaging and analysis across various scientific and industrial applications. Key trends driving this market include advancements in microscopy technology, such as the development of cryo-electron microscopy and automated sample preparation techniques, which enhance the accuracy and efficiency of research. Additionally, the growing emphasis on nanotechnology and materials science research is further propelling market demand, as these fields require precise imaging capabilities. Looking to the future, the market is expected to expand significantly, driven by ongoing innovations, rising investments in research and development, and the increasing adoption of electron microscopy in life sciences, semiconductors, and other critical industries.

Electron Microscopy and Sample Preparation Market Size

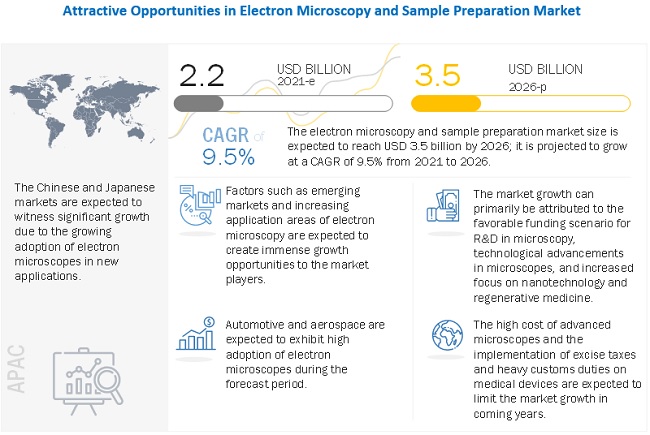

The Global Electron Microscopy and Sample Preparation Market Size is expected to grow from USD 2.2 Billion in 2021 to USD 3.5 Billion by 2026, Growing at a CAGR of 9.5%.

Favorable funding scenario for R&D in microscopy and growth opportunities in emerging markets are the key factors driving the growth of the electron microscopy and sample preparation industry.

To know about the assumptions considered for the study, Request for Free Sample Report

Electron Microscopy and Sample Preparation Market Dynamics

Driver: Technological advancements in microscopes

Technological advancements in microscopes include digitization, live-cell imaging, super resolution, and high throughput methods. These advancements help reduce product and testing costs. Recent developments in microscopes include expansion microscopes, scanning helium microscopes (SHeM), multi-view microscopes, and integrated microscopy workflows. Digital microscopy is the latest trend in the electron microscopy and sample preparation market. Digital imaging offers enhanced image resolution with greater precision, leading to fewer distorted images and better viewing of samples. The development of whole slide scanning systems has accelerated the adoption of digital microscopy. These systems offer deep visualization of specimens with 2D and 3D images used in R&D, forensics, quality control, and failure analysis.

Restraint: Availability of open-source microscopy software

The availability of open-source software is a restraint for this market. Any programmer with access to software can inspect and improve that program or, if required, can fix any issues as needed. In contrast, most software solutions available in the market are closed-source, proprietary, and expensive, whereas open-source software are usually free. Some of the free, open-source confocal microscopy analysis solutions are ImageJ/FIJI, Cell Profiler/Cell Analyst, Neuronstudio, Volume Integration and Alignment System (VIAS), and L-measure. Most small-scale end users, academic institutes, and research centers show a high preference for open-source solutions, which directly hampers the demand for licensed closed-source software.

Opportunity: Growth opportunities in emerging markets

Developing countries, including China, India, Russia, and Brazil, offer significant growth opportunities for the players in the electron microscopy and sample preparation market. Government funding for R&D in advanced microscopes has increased considerably in these countries. For instance, in February 2017, the Indian government provided ~USD 45,000 for the designing and development of multimodal optical microscopes using Fourier optical image processing. Since its inception in 2011, the Centre of Nanotechnology and Nanomaterials (Saransk, Russia) has been manufacturing unique nanopincers for microscopes that allow particles on a scale of 30 nanometers to be captured. This is a transformative trend in the electron microscopy and sample preparation market, with many potential applications in electronics and medicine.

Challenge: Lack of skilled professionals

Physicists and laboratory technicians can easily operate standard compound microscopes; however, with the development of advanced microscopes, skilled personnel are required. For example, atomic force scanning tunneling microscopes—widely used in nanotechnology—require physicists or technicians to have thorough interdisciplinary knowledge in the field of surface physics and surface analyses to study the characterization of biological and chemical compounds at the atomic or molecular level.

To know about the assumptions considered for the study, download the pdf brochure

Scanning electron microsocpes to hold largest size of Electron microscopy and sample preparation market in 2021

Scanning electron microscopes (SEMs) use a focused beam of high-energy electrons to generate a variety of signals at the surface of solid specimens. SEMs can provide magnification of up to 100,000x. These microscopes produce a high depth of field and high-resolution (less resolution as compared to TEMs) and 3-dimensional images of topographical, morphological, and compositional information of objects. Hence, they are used as essential research tools in life sciences, gemology, medical and forensic sciences, and metallurgy.

Industries end-user segment to hold largest share of Electron microscopy and sample preparation market in 2021

The scope of the industries segment comprises pharmaceutical & biotechnology, semiconductor & electronics, textiles, mining & material science, and natural resources (oil & gas) industries. The electronics industry uses electron microscopes for high-resolution imaging in the development and manufacturing processes of semiconductors and other electronics. Other industries that commonly use electron microscopes as a part of their production process include aeronautics, automotive, apparel, and pharmaceutical. Electron microscope can also be applied in industrial failure analysis and process control of diverse industries.

APAC to grow at highest CAGR during the forecast period

In terms of value, APAC to grow at highest CAGR during the forecast period. The APAC electron microscopy and sample preparation market, particularly in China, Japan, and India, is expected to witness high growth in the next 5 years. Factors such as the rising R&D funding for microscopy research, increasing application of correlative microscopy in life science and nanotechnology research, establishment of collaboration centers for microscopy research, and the low material cost and availability of low-cost skilled labor for OEMs are expected to drive market growth in the APAC during the forecast period.

Key Market Players

Bitmain (China), NVIDIA (US), Xilinx (US), Intel (US), Advanced Micro Devices (US), Ripple Labs (US), Ethereum Foundation (Switzerland), Bitfury Group (Netherlands), Coinbase (US), BitGo (US), Binance Holdings (China) Canaan Creative (China). Bitstamp (Luxemburg), Ifinex (Hong Kong), Ledger SAS (France), Xapo (Hong Kong), and Alcheminer (US), are a few major companies dominating the Electron Microscopy and Sample Preparation Companies.

Electron Microscopy and Sample Preparation Market Report Scope:

|

Report Metric |

Details |

| Estimated Market Size | USD 2.2 Billion in 2021 |

| Projected Market Size | USD 3.5 Billion by 2026 |

| Growth Rate | CAGR of 9.5% |

|

Market size available for years |

2017–2026 |

|

On Demand Data Available |

2030 |

|

Report Coverage |

|

|

Segments covered |

|

|

Geographies covered |

|

|

Companies covered |

|

| Key Market Driver | Technological Advancements in Microscopes |

| Largest Growing Region | Asia Pacific (APAC) |

| Largest Market Share Segment | Industries End-User Segment |

This report categorizes the Electron microscopy and sample preparation market by end-user industry, applications, type, product, and geography.

Based on Product, the Electron Microscopy and Sample Preparation Market been Segmented as below:

- Microscopes

- Software

- Others

Based on Type, the Electron Microscopy and Sample Preparation Market been Segmented as below:

- Scanning Electron Microscope

- Transmission Electron Microscope

Based on Application, the Electron Microscopy and Sample Preparation Market been Segmented as below:

- Semiconductors

- Life Sciences

- Material Sciences

- Others

Based on End-user, the Electron Microscopy and Sample Preparation Market been Segmented as below:

- Industries

- Academic & Research Institutes

- Others

Based on Geographic Analysis, the Electron Microscopy and Sample Preparation Market been Segmented as below:

-

North America

- US

- Canada

-

Europe

- Germany

- UK

- France

- Rest of Europe

-

Asia Pacific (APAC)

- China

- Japan

- India

- Rest of APAC

- Rest of the World (RoW)

Recent Developments

- In August 2019, Thermo Scientific Spectra scanning/transmission electron microscope (S/TEM) is designed to accelerate breakthrough discoveries by delivering advanced atomic-scale imaging and analysis in a single tool..

- In January 2020, JEOL Ltd. and DI Corporation entered into an agreement under which JEOL would acquire all the DI-owned shares of JEOL Korea Ltd. and make it a wholly owned subsidiary of JEOL..

Frequently Asked Questions (FAQ):

How big is the opportunity for the Electron microscopy and sample preparation market? How rising adoption of Cryptocurrency can help grasp this opportunity?

The electron microscopy and sample preparation market size is expected to grow from USD 2.2 billion in 2021 to USD 3.5 billion by 2026, at a CAGR of 9.5%. Favorable funding scenario for R&D in microscopy and growth opportunities in emerging markets are the key factors driving the growth of the electron microscopy and sample preparation market.

Which are the recent industry trends that can be implemented to generate additional revenue streams?

Gzrowing popularity electron microsocpes in emerging and developed countries will create lot of opportunities for the market.

Who are the major players operating in the Cryptocurrency detection market? Which companies are the front runners?

Carl Zeiss (Germany), Danaher (US), Thomas Fisher Scientific (US), Intel (US), Nikon (Japan), Bruker (US), Olympus (Japan), Oxford Instruments (UK), Jeol (Japan), Hitachi High-Technologies (Japan), HIrox (Japan) Microptik (Netherlands). Horiba (Japan), Arivis AG (Germany), Angstorm Advanced (US), Media Cybernetics (US), and Nion Company (US) are some of the major vendors in the market.

What are the major end-use industries of Electron microscopy and sample preparation market?

Industries, and academic & research institutes are major end-use industries of Electron microscopy and sample preparation market.

How will the increasing adoption of scanning electron microscope impact the growth rate of the overall market?

Scanning electron microscopes (SEMs) use a focused beam of high-energy electrons to generate a variety of signals at the surface of solid specimens. SEMs can provide magnification of up to 100,000x. These microscopes produce a high depth of field and high-resolution (less resolution as compared to TEMs) and 3-dimensional images of topographical, morphological, and compositional information of objects. Hence, they are used as essential research tools in life sciences, gemology, medical and forensic sciences, and metallurgy. .

To speak to our analyst for a discussion on the above findings, click Speak to Analyst

TABLE OF CONTENTS

1 INTRODUCTION (Page No. - 30)

1.1 STUDY OBJECTIVES

1.2 MARKET DEFINITION

1.3 MARKET SCOPE

1.3.1 INCLUSIONS AND EXCLUSIONS

1.3.2 MARKETS COVERED

1.3.3 YEARS CONSIDERED FOR STUDY

1.4 CURRENCY

1.5 STAKEHOLDERS

1.6 SUMMARY OF CHANGES

2 RESEARCH METHODOLOGY (Page No. - 33)

2.1 RESEARCH DATA

FIGURE 1 RESEARCH DESIGN

2.1.1 SECONDARY RESEARCH

2.1.1.1 Key data from secondary sources

2.1.2 PRIMARY DATA

2.1.2.1 Key data from primary research

FIGURE 2 PRIMARY SOURCES

2.1.2.2 Key data from primary sources

2.1.2.3 Key industry insights

2.1.2.4 Breakdown of primaries

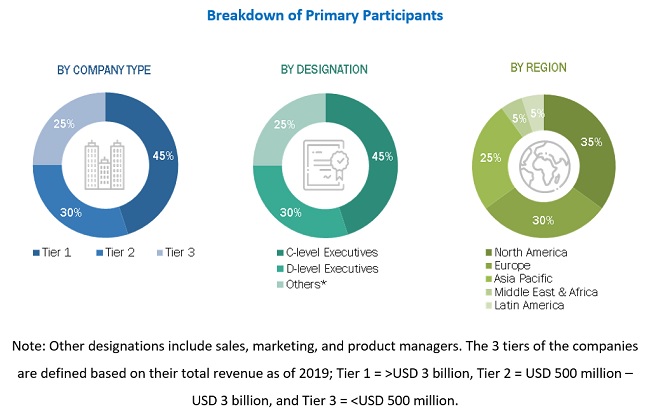

FIGURE 3 BREAKDOWN OF PRIMARY INTERVIEWS (SUPPLY SIDE): BY COMPANY TYPE, DESIGNATION, AND REGION

2.2 MARKET SIZE ESTIMATION

2.2.1 BOTTOM-UP APPROACH

2.2.2 TOP-DOWN APPROACH

FIGURE 4 ELECTRON MICROSCOPY AND SAMPLE PREPARATION MARKET: TOP-DOWN APPROACH

2.2.3 GROWTH FORECAST

2.3 DATA TRIANGULATION

FIGURE 5 DATA TRIANGULATION METHODOLOGY

2.4 RESEARCH ASSUMPTIONS

2.5 RESEARCH LIMITATIONS

3 EXECUTIVE SUMMARY (Page No. - 42)

FIGURE 6 GLOBAL ELECTRON MICROSCOPY AND SAMPLE PREPARATION MARKET, 2017–2026 (USD MILLION)

FIGURE 7 MARKET, BY PRODUCT, 2021

FIGURE 8 MARKET, BY TYPE, 2021

FIGURE 9 MARKET, BY APPLICATION, 2021

FIGURE 10 MARKET, BY END USER, 2021

FIGURE 11 GEOGRAPHICAL SNAPSHOT OF MARKET

4 PREMIUM INSIGHTS (Page No. - 46)

4.1 ATTRACTIVE OPPORTUNITIES IN ELECTRON MICROSCOPY AND SAMPLE PREPARATION MARKET

FIGURE 12 INCREASING R&D FUNDING IS DRIVING GROWTH OF MARKET

4.2 NORTH AMERICA MARKET, BY END USER & COUNTRY (2021)

FIGURE 13 INDUSTRIES SEGMENT AND US TO DOMINATE NORTH AMERICAN MARKET IN 2021

4.3 MARKET, BY TYPE, 2026

FIGURE 14 SCANNING ELECTRON MICROSCOPE SEGMENT TO ACCOUNT FOR LARGEST MARKET SHARE BY 2026

4.4 MARKET, BY APPLICATION, 2026

FIGURE 15 SEMICONDUCTORS APPLICATION SEGMENT TO ACCOUNT FOR LARGEST MARKET SHARE BY 2026

4.5 MARKET, BY END USER, 2026

FIGURE 16 INDUSTRIES SEGMENT TO ACCOUNT FOR LARGEST MARKET SHARE BY 2026

5 MARKET OVERVIEW (Page No. - 49)

5.1 INTRODUCTION

5.2 MARKET DYNAMICS

FIGURE 17 ELECTRON MICROSCOPY AND SAMPLE PREPARATION MARKET: DRIVERS, RESTRAINTS, OPPORTUNITIES, AND CHALLENGES

5.2.1 DRIVERS

5.2.1.1 Favorable funding scenario for R&D in microscopy

TABLE 1 RECENT FUNDING FOR R&D IN MICROSCOPY

5.2.1.2 Technological advancements in microscopes

5.2.1.3 Increased focus on nanotechnology and regenerative medicine

FIGURE 18 ELECTRON MICROSCOPY AN D SAMPLE PREPARATION MARKET DRIVERS AND THEIR IMPACT

5.2.2 RESTRAINTS

5.2.2.1 Availability of open-source microscopy software

FIGURE 19 MARKET RESTRAINTS AND THEIR IMPACT

5.2.3 OPPORTUNITIES

5.2.3.1 Growth opportunities in emerging markets

5.2.3.2 Increasing application areas of microscopy

FIGURE 20 MARKET OPPORTUNITIES AND THEIR IMPACT

5.2.4 CHALLENGES

5.2.4.1 Lack of skilled professionals

FIGURE 21 MARKET CHALLENGES AND THEIR IMPACT

6 INDUSTRY TRENDS (Page No. - 56)

6.1 TRENDS/DISRUPTIONS IMPACTING CUSTOMERS’ BUSINESS

6.1.1 REVENUE SHIFT AND NEW REVENUE POCKETS FOR ELECTRON MICROSCOPY AND SAMPLE PREPARATION MARKET

FIGURE 22 REVENUE SHIFT IN MARKET

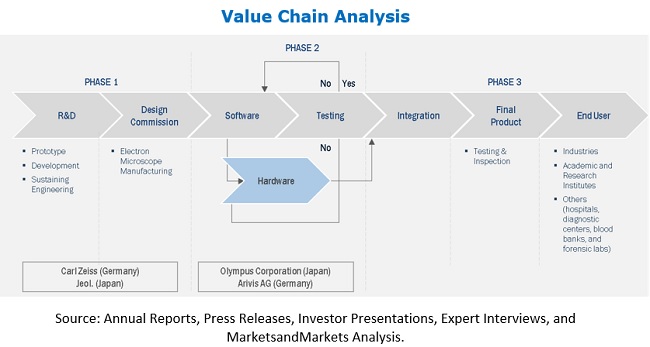

6.2 VALUE CHAIN ANALYSIS

FIGURE 23 VALUE CHAIN ANALYSIS OF ELECTRON MICROSCOPES

TABLE 2 ELECTRON MICROSCOPE AND SAMPLE PREPARATION MARKETS: VALUE CHAIN

6.3 TECHNOLOGY ANALYSIS

6.3.1 ROLE AND IMPACT OF AI AND MACHINE VISION ON MICROSCOPY SOFTWARE MARKET

6.3.2 TECHNOLOGICAL ADVANCEMENTS IN MICROSCOPY SOFTWARE AND MICROSCOPES

6.3.3 CONVERTING REGULAR ELECTRON MICROSCOPE TO HIGH-SPEED ATOM SCALE CAMERAS

6.4 CASE STUDY

6.4.1 USE OF ELECTRON MICROSCOPES IN AUTOMOTIVE INDUSTRY

6.4.2 USE OF ELECTRON MICROSCOPES IN AEROSPACE INDUSTRY

6.5 REGULATION OF ELECTRON MICROSCOPES

6.5.1 SAFETY REGULATIONS (VIRGINIA, US)

6.6 TRADE ANALYSIS

6.6.1 TRADE ANALYSIS FOR ELECTRON MICROSCOPES

TABLE 3 ELECTRON MICROSCOPE IMPORTS, BY COUNTRY, 2015–2019 (USD THOUSAND)

TABLE 4 ELECTRON MICROSCOPE EXPORTS, BY COUNTRY, 2015–2019 (USD THOUSAND)

6.7 TARIFF ANALYSIS FOR ELECTRON MICROSCOPES

TABLE 5 MFN TARIFFS FOR ELECTRON MICROSCOPES EXPORTED BY NETHERLANDS

TABLE 6 MFN TARIFFS FOR ELECTRON MICROSCOPES EXPORTED BY CZECH REPUBLIC

6.8 PATENT ANALYSIS

TABLE 7 IMPORTANT INNOVATIONS AND PATENT REGISTRATIONS

6.9 PORTER’S FIVE FORCES MODEL

TABLE 8 ELECTRON MICROSCOPY AND SAMPLE PREPARATION MARKET: PORTER’S FIVE FORCES ANALYSIS

FIGURE 24 PORTER’S FIVE FORCES ANALYSIS

6.9.1 THREAT OF NEW ENTRANTS

6.9.2 THREAT OF SUBSTITUTES

6.9.3 BARGAINING POWER OF SUPPLIERS

6.9.4 BARGAINING POWER OF BUYERS

6.9.5 INTENSITY OF COMPETITIVE RIVALRY

6.10 ELECTRON MICROSCOPY AND SAMPLE PREPARATION ECOSYSTEM

FIGURE 25 ECOSYSTEM OF MARKET

6.11 IMPACT OF COVID-19 ON ELECTRON MICROSCOPE AND SAMPLE PREPARATION MARKET

6.12 AVERAGE SELLING PRICE OF VARIOUS MICROSCOPES

TABLE 9 PRICE COMPARISON OF VARIOUS MICROSCOPES

7 ELECTRON MICROSCOPY AND SAMPLE PREPARATION MARKET, BY PRODUCT (Page No. - 73)

7.1 INTRODUCTION

FIGURE 26 SOFTWARE SEGMENT TO REGISTER HIGHEST CAGR DURING FORECAST PERIOD

TABLE 10 MARKET, BY PRODUCT, 2017–2020 (USD MILLION)

TABLE 11 MARKET, BY PRODUCT, 2021–2026 (USD MILLION)

7.2 MICROSCOPES

7.2.1 BROAD APPLICATIONS AND EMERGING TECHNOLOGIES HAVE RESULTED IN GROWING DEMAND FOR MICROSCOPES

TABLE 12 KEY PRODUCT PORTFOLIO OF CLEM

7.3 SOFTWARE

7.3.1 INTRODUCTION OF NOVEL IMAGE ACQUISITION SOFTWARE FOR MICROSCOPES IS DRIVING MARKET GROWTH

7.4 ACCESSORIES

7.4.1 HIGH DEMAND FOR MICROSCOPE OBJECTIVE LENSES IN LIFE SCIENCE RESEARCH TO DRIVE GROWTH OF SEGMENT

8 ELECTRON MICROSCOPY AND SAMPLE PREPARATION MARKET, BY TYPE (Page No. - 78)

8.1 INTRODUCTION

FIGURE 27 SCANNING ELECTRON MICROSCOPE SEGMENT TO EXHIBIT HIGHER CAGR DURING FORECAST PERIOD

TABLE 13 MARKET, BY TYPE, 2017–2020 (USD MILLION)

TABLE 14 MARKET, BY TYPE, 2021–2026 (USD MILLION)

8.2 SCANNING ELECTRON MICROSCOPE (SEM)

8.2.1 SEMS CAN PROVIDE MAGNIFICATION OF UP TO 100,000X

TABLE 15 SCANNING ELECTRON MICROSCOPE: MARKET, BY REGION, 2017–2020 (USD MILLION)

TABLE 16 SCANNING ELECTRON MICROSCOPE: MARKET, BY REGION, 2021–2026 (USD MILLION)

TABLE 17 SCANNING ELECTRON MICROSCOPE: NORTH AMERICA MARKET, BY COUNTRY, 2017–2020 (USD MILLION)

TABLE 18 SCANNING ELECTRON MICROSCOPE: NORTH AMERICA MARKET, BY COUNTRY, 2021–2026 (USD MILLION)

TABLE 19 SCANNING ELECTRON MICROSCOPE: EUROPE MARKET, BY COUNTRY, 2017–2020 (USD MILLION)

TABLE 20 SCANNING ELECTRON MICROSCOPE: EUROPE MARKET, BY COUNTRY, 2021–2026 (USD MILLION)

TABLE 21 SCANNING ELECTRON MICROSCOPE: APAC MARKET, BY COUNTRY, 2017–2020 (USD MILLION)

TABLE 22 SCANNING ELECTRON MICROSCOPE: APAC MARKET, 2021–2026 (USD MILLION)

8.3 TRANSMISSION ELECTRON MICROSCOPE (TEM)

8.3.1 TEMS ARE MAJORLY USED TO STUDY ULTRASTRUCTURE OF COMPONENTS

TABLE 23 TRANSMISSION ELECTRON MICROSCOPE: ELECTRON MICROSCOPY AND SAMPLE PREPARATION MARKET, BY REGION, 2017–2020 (USD MILLION)

TABLE 24 TRANSMISSION ELECTRON MICROSCOPE: MARKET, BY REGION, 2021–2026 (USD MILLION)

TABLE 25 TRANSMISSION ELECTRON MICROSCOPE: NORTH AMERICA MARKET, BY COUNTRY, 2017–2020 (USD MILLION)

TABLE 26 TRANSMISSION ELECTRON MICROSCOPE: NORTH AMERICA MARKET, BY COUNTRY, 2021–2026 (USD MILLION)

TABLE 27 TRANSMISSION ELECTRON MICROSCOPE: EUROPE MARKET, BY COUNTRY, 2017–2020 (USD MILLION)

TABLE 28 TRANSMISSION ELECTRON MICROSCOPE: EUROPE MARKET, 2021–2026 (USD MILLION)

TABLE 29 TRANSMISSION ELECTRON MICROSCOPE: APAC MARKET, BY COUNTRY, 2017–2020 (USD MILLION)

TABLE 30 TRANSMISSION ELECTRON MICROSCOPE: APAC MARKET, BY COUNTRY, 2021–2026 (USD MILLION)

9 ELECTRON MICROSCOPY AND SAMPLE PREPARATION MARKET, BY APPLICATION (Page No. - 87)

9.1 INTRODUCTION

FIGURE 28 MATERIALS SCIENCE SEGMENT TO REGISTER HIGHEST CAGR DURING FORECAST PERIOD

TABLE 31 MARKET, BY APPLICATION, 2017–2020 (USD MILLION)

TABLE 32 MARKET, BY APPLICATION, 2021–2026 (USD MILLION)

9.2 SEMICONDUCTOR

9.2.1 SEMICONDUCTOR TO BE LARGEST APPLICATION SEGMENT OF ELECTRON MICROSCOPY AND SAMPLE PREPARATION MARKET DURING FORECAST PERIOD

TABLE 33 MARKET FOR SEMICONDUCTOR, BY REGION, 2017–2020 (USD MILLION)

TABLE 34 MARKET FOR SEMICONDUCTOR, BY REGION, 2021–2026 (USD MILLION)

TABLE 35 NORTH AMERICA: MARKET FOR SEMICONDUCTOR, BY COUNTRY, 2017–2020 (USD MILLION)

TABLE 36 NORTH AMERICA: MARKET FOR SEMICONDUCTOR, BY COUNTRY, 2021–2026 (USD MILLION)

TABLE 37 EUROPE: MARKET FOR SEMICONDUCTOR, BY COUNTRY, 2017–2020 (USD MILLION)

TABLE 38 EUROPE: MARKET FOR SEMICONDUCTOR, BY COUNTRY, 2021–2026 (USD MILLION)

TABLE 39 APAC: MARKET FOR SEMICONDUCTOR, BY COUNTRY, 2017–2020 (USD MILLION)

TABLE 40 APAC: PREPARATION MARKET FOR SEMICONDUCTOR, BY COUNTRY, 2021–2026 (USD MILLION)

9.3 LIFE SCIENCES

9.3.1 INCREASING R&D SUPPORTED BY GOVERNMENT FUNDING TO FUEL MARKET GROWTH

TABLE 41 ELECTRON MICROSCOPY AND SAMPLE PREPARATION MARKET FOR LIFE SCIENCES, BY REGION, 2017–2020 (USD MILLION)

TABLE 42 MARKET FOR LIFE SCIENCES, BY REGION, 2021–2026 (USD MILLION)

TABLE 43 NORTH AMERICA: MARKET FOR LIFE SCIENCES, BY COUNTRY, 2017–2020 (USD MILLION)

TABLE 44 NORTH AMERICA: MARKET FOR LIFE SCIENCES, BY COUNTRY, 2021–2026 (USD MILLION)

TABLE 45 EUROPE: MARKET FOR LIFE SCIENCES, BY COUNTRY, 2017–2020 (USD MILLION)

TABLE 46 EUROPE: MARKET FOR LIFE SCIENCES, BY COUNTRY, 2021–2026 (USD MILLION)

TABLE 47 APAC: MARKET FOR LIFE SCIENCES, BY COUNTRY, 2017–2020 (USD MILLION)

TABLE 48 APAC: MARKET FOR LIFE SCIENCES, BY COUNTRY, 2021–2026 (USD MILLION)

9.4 MATERIALS SCIENCE

9.4.1 INCREASING FOCUS ON RESEARCH IN MATERIALS SCIENCE TO FUEL ADOPTION OF ELECTRON MICROSCOPES

TABLE 49 ELECTRON MICROSCOPY AND SAMPLE PREPARATION MARKET FOR MATERIALS SCIENCE, BY REGION, 2017–2020 (USD MILLION)

TABLE 50 MARKET FOR MATERIALS SCIENCE, BY REGION, 2021–2026 (USD MILLION)

TABLE 51 NORTH AMERICA: MARKET FOR MATERIALS SCIENCE, BY COUNTRY, 2017–2020 (USD MILLION)

TABLE 52 NORTH AMERICA: MARKET FOR MATERIALS SCIENCE, BY COUNTRY, 2021–2026 (USD MILLION)

TABLE 53 EUROPE: MARKET FOR MATERIALS SCIENCE, BY COUNTRY, 2017–2020 (USD MILLION)

TABLE 54 EUROPE: MARKET FOR MATERIALS SCIENCE, BY COUNTRY, 2021–2026 (USD MILLION)

TABLE 55 APAC: MARKET FOR MATERIALS SCIENCE, BY COUNTRY, 2017–2020 (USD MILLION)

TABLE 56 APAC: MARKET FOR MATERIALS SCIENCE, BY COUNTRY, 2021–2026 (USD MILLION)

9.5 OTHERS

TABLE 57 ELECTRON MICROSCOPY AND SAMPLE PREPARATION MARKET FOR OTHERS BY REGION, 2017–2020 (USD MILLION)

TABLE 58 MARKET BY REGION, FOR OTHERS, 2021–2026 (USD MILLION)

TABLE 59 NORTH AMERICA: MARKET FOR OTHERS BY COUNTRY, 2017–2020 (USD MILLION)

TABLE 60 NORTH AMERICA: MARKET FOR OTHERS BY COUNTRY, 2021–2026 (USD MILLION)

TABLE 61 EUROPE: MARKET FOR OTHERS BY COUNTRY, 2017–2020 (USD MILLION)

TABLE 62 EUROPE: MARKET FOR OTHERS BY COUNTRY, 2021–2026 (USD MILLION)

TABLE 63 APAC: MARKET FOR OTHERS BY COUNTRY, 2017–2020 (USD MILLION)

TABLE 64 APAC: MARKET FOR OTHERS BY COUNTRY, 2021–2026 (USD MILLION)

10 ELECTRON MICROSCOPY AND SAMPLE PREPARATION MARKET, BY END USER (Page No. - 102)

10.1 INTRODUCTION

FIGURE 29 INDUSTRIES SEGMENT TO REGISTER HIGHEST CAGR DURING FORECAST PERIOD

TABLE 65 MARKET, BY END USER, 2017–2020 (USD MILLION)

TABLE 66 MARKET, BY END USER, 2021–2026 (USD MILLION)

10.2 INDUSTRIES

10.2.1 TECHNOLOGICAL INNOVATIONS TO FUEL ADOPTION OF MICROSCOPES IN SEVERAL INDUSTRIES

TABLE 67 INDUSTRIAL APPLICATIONS OF VARIOUS MICROSCOPES

TABLE 68 MARKET FOR INDUSTRIES, BY REGION, 2017–2020 (USD MILLION)

TABLE 69 MARKET FOR INDUSTRIES, BY REGION, 2021–2026 (USD MILLION)

TABLE 70 NORTH AMERICA: MARKET FOR INDUSTRIES, BY COUNTRY, 2017–2020 (USD MILLION)

TABLE 71 NORTH AMERICA: MARKET FOR INDUSTRIES, BY COUNTRY, 2021–2026 (USD MILLION)

TABLE 72 EUROPE: MARKET FOR INDUSTRIES, BY COUNTRY, 2017–2020 (USD MILLION)

TABLE 73 EUROPE: MARKET FOR INDUSTRIES, BY COUNTRY, 2021–2026 (USD MILLION)

TABLE 74 APAC: MARKET FOR INDUSTRIES, BY COUNTRY, 2017–2020 (USD MILLION)

TABLE 75 APAC: MARKET FOR INDUSTRIES, BY COUNTRY, 2021–2026 (USD MILLION)

10.3 ACADEMIC & RESEARCH INSTITUTES

10.3.1 INCREASING R&D TO SURGE ADOPTION OF MICROSCOPES IN ACADEMIC & RESEARCH INSTITUTES

TABLE 76 SOME OF FUNDS/GRANTS RELEASED FOR BIOMEDICAL RESEARCH

TABLE 77 ELECTRON MICROSCOPY AND SAMPLE PREPARATION MARKET FOR ACADEMIC & RESEARCH INSTITUTES, BY REGION 2017–2020 (USD MILLION)

TABLE 78 MARKET FOR ACADEMIC & RESEARCH INSTITUTES, BY REGION, 2021–2026 (USD MILLION)

TABLE 79 NORTH AMERICA: MARKET FOR ACADEMIC & RESEARCH INSTITUTES, BY COUNTRY, 2017–2020 (USD MILLION)

TABLE 80 NORTH AMERICA: MARKET FOR ACADEMIC & RESEARCH INSTITUTES, BY COUNTRY, 2021–2026 (USD MILLION)

TABLE 81 EUROPE: MARKET FOR ACADEMIC & RESEARCH INSTITUTES, BY COUNTRY, 2017–2020 (USD MILLION)

TABLE 82 EUROPE: MARKET FOR ACADEMIC & RESEARCH INSTITUTES, BY COUNTRY, 2021–2026 (USD MILLION)

TABLE 83 APAC: MARKET FOR ACADEMIC & RESEARCH INSTITUTES, BY COUNTRY, 2017–2020 (USD MILLION)

TABLE 84 APAC: MARKET FOR ACADEMIC & RESEARCH INSTITUTES, BY COUNTRY, 2021–2026 (USD MILLION)

10.4 OTHERS

TABLE 85 ELECTRON MICROSCOPY AND SAMPLE PREPARATION MARKET FOR OTHERS, BY REGION, 2017–2020 (USD MILLION)

TABLE 86 MARKET BY REGION, FOR OTHERS, 2021–2026 (USD MILLION)

TABLE 87 NORTH AMERICA: MARKET FOR OTHERS, BY COUNTRY, 2017–2020 (USD MILLION)

TABLE 88 NORTH AMERICA: MARKET FOR OTHERS, BY COUNTRY, 2021–2026 (USD MILLION)

TABLE 89 EUROPE: MARKET FOR OTHERS, BY COUNTRY, 2017–2020 (USD MILLION)

TABLE 90 EUROPE: MARKET FOR OTHERS, BY COUNTRY, 2021–2026 (USD MILLION)

TABLE 91 APAC: MARKET FOR OTHERS, BY COUNTRY, 2017–2020 (USD MILLION)

TABLE 92 APAC: MARKET FOR OTHERS, BY COUNTRY, 2021–2026 (USD MILLION)

11 SAMPLE PREPARATION TECHNIQUES (Page No. - 115)

11.1 INTRODUCTION

11.2 SAMPLE PREPARATION MARKET, BY METHOD

11.2.1 CUTTING AND SLICING

11.2.1.1 Ion beam milling

TABLE 93 ELECTRON MICROSCOPY AND SAMPLE PREPARATION MARKET FOR ION BEAM MILLING SYSTEM, BY ELECTRON MICROSCOPE TYPE, 2017–2020 (USD MILLION)

TABLE 94 MARKET FOR ION BEAM MILLING SYSTEM, BY ELECTRON MICROSCOPE TYPE, 2021–2026 (USD MILLION)

11.2.1.2 Ultramicrotomy

11.2.1.3 Freeze-fracturing and CRYO-ultramicrotomy

11.2.2 FIXATION

11.2.2.1 Chemical fixation

11.2.2.2 Critical point drying

11.2.2.3 Cryofixation

11.2.3 EMBEDDING

11.2.4 COATING

11.2.4.1 Sputter coater

11.2.4.2 Evaporation coater

11.2.4.3 Glow discharge sputtering

11.2.5 IMMUNOGOLD LABELING

11.2.6 CRYO SAMPLE PREPARATION

12 ELECTRON MICROSCOPY AND SAMPLE PREPARATION MARKET, BY REGION (Page No. - 119)

12.1 INTRODUCTION

FIGURE 30 MARKET: GEOGRAPHIC GROWTH OPPORTUNITIES

FIGURE 31 APAC REGION TO REGISTER HIGHEST CAGR DURING FORECAST PERIOD

TABLE 95 MARKET, BY REGION, 2017–2020 (USD MILLION)

TABLE 96 MARKET, BY REGION, 2021–2026 (USD MILLION)

12.2 NORTH AMERICA

FIGURE 32 NORTH AMERICA: MARKET SNAPSHOT

TABLE 97 NORTH AMERICA: ELECTRON MICROSCOPES MARKET, BY TYPE, 2017–2020 (USD MILLION)

TABLE 98 NORTH AMERICA: ELECTRON MICROSCOPES MARKET, BY TYPE, 2021–2026 (USD MILLION)

TABLE 99 NORTH AMERICA: MARKET, BY END USER, 2017–2020 (USD MILLION)

TABLE 100 NORTH AMERICA: MARKET, BY END USER, 2021–2026 (USD MILLION)

TABLE 101 NORTH AMERICA: MARKET, BY COUNTRY, 2017–2020 (USD MILLION)

TABLE 102 NORTH AMERICA: MARKET, BY COUNTRY, 2021–2026 (USD MILLION)

12.2.1 US

12.2.1.1 Increasing R&D and commercialization of nanotechnology-based products are driving demand for electron microscopes in US

TABLE 103 US: MARKET, BY TYPE, 2017–2020 (USD MILLION)

TABLE 104 US: MARKET, BY TYPE, 2021–2026 (USD MILLION)

TABLE 105 US: MARKET, BY END USER, 2017–2020 (USD MILLION)

TABLE 106 US: MARKET, BY END USER, 2021–2026 (USD MILLION)

12.2.2 CANADA

12.2.2.1 Increasing R&D funding for microscopy research and nanotechnology is driving market growth in Canada

TABLE 107 CANADA: ELECTRON MICROSCOPY AND SAMPLE PREPARATION MARKET, BY TYPE, 2017–2020 (USD MILLION)

TABLE 108 CANADA: MARKET, BY TYPE, 2021–2026 (USD MILLION)

TABLE 109 CANADA: MARKET, BY END USER, 2017–2020 (USD MILLION)

TABLE 110 CANADA: MARKET, BY END USER, 2021–2026 (USD MILLION)

12.3 EUROPE

TABLE 111 MAJOR DEVELOPMENTS IN EUROPEAN MARKET

TABLE 112 EUROPE: ELECTRON MICROSCOPES MARKET, BY TYPE, 2017–2020 (USD MILLION)

TABLE 113 EUROPE: ELECTRON MICROSCOPES MARKET, BY TYPE, 2021–2026 (USD MILLION)

TABLE 114 EUROPE: MARKET, BY END USER, 2017–2020 (USD MILLION)

TABLE 115 EUROPE: MARKET, BY END USER, 2021–2026 (USD MILLION)

TABLE 116 EUROPE: MARKET, BY COUNTRY, 2017–2020 (USD MILLION)

TABLE 117 EUROPE: MARKET, BY COUNTRY, 2021–2026 (USD MILLION)

12.3.1 GERMANY

12.3.1.1 High public sector investments in nanotechnology to boost market growth

TABLE 118 GERMANY MARKET, BY TYPE, 2017–2020 (USD MILLION)

TABLE 119 GERMANY: MARKET, BY TYPE, 2021–2026 (USD MILLION)

TABLE 120 GERMANY: MARKET, BY END USER, 2017–2020 (USD MILLION)

TABLE 121 GERMANY: MARKET, BY END USER, 2021–2026 (USD MILLION)

12.3.2 UK

12.3.2.1 Continuous increase in life science research to drive market growth in UK

TABLE 122 UK: ELECTRON MICROSCOPY AND SAMPLE PREPARATION MARKET, BY TYPE, 2017–2020 (USD MILLION)

TABLE 123 UK: MARKET, BY TYPE, 2021–2026 (USD MILLION)

TABLE 124 UK: MARKET, BY END USER, 2017–2020 (USD MILLION)

TABLE 125 UK: MARKET, BY END USER, 2021–2026 (USD MILLION)

12.3.3 FRANCE

12.3.3.1 Expanding biotechnology industry to support market growth in France

TABLE 126 FRANCE: MARKET, BY TYPE, 2017–2020 (USD MILLION)

TABLE 127 FRANCE: MARKET, BY TYPE, 2021–2026 (USD MILLION)

TABLE 128 FRANCE: MARKET, BY END USER, 2017–2020 (USD MILLION)

TABLE 129 FRANCE: MARKET, BY END USER, 2021–2026 (USD MILLION)

12.3.4 REST OF EUROPE

TABLE 130 ROE: MARKET, BY TYPE, 2017–2020 (USD MILLION)

TABLE 131 ROE: MARKET, BY TYPE, 2021–2026 (USD MILLION)

TABLE 132 ROE: MARKET, BY END USER, 2017–2020 (USD MILLION)

TABLE 133 ROE: MARKET, BY END USER, 2021–2026 (USD MILLION)

12.4 ASIA PACIFIC

FIGURE 33 ASIA PACIFIC: ELECTRON MICROSCOPY AND SAMPLE PREPARATION MARKET SNAPSHOT

TABLE 134 APAC: ELECTRON MICROSCOPES MARKET, BY TYPE, 2017–2020 (USD MILLION)

TABLE 135 APAC: ELECTRON MICROSCOPES MARKET, BY TYPE, 2021–2026 (USD MILLION)

TABLE 136 APAC: MARKET, BY END USER, 2017–2020 (USD MILLION)

TABLE 137 APAC: MARKET, BY END USER, 2021–2026 (USD MILLION)

TABLE 138 APAC: MARKET, BY COUNTRY, 2017–2020 (USD MILLION)

TABLE 139 APAC: MARKET, BY COUNTRY, 2017–2026 (USD MILLION)

12.4.1 JAPAN

12.4.1.1 Launch of new products to drive market growth in Japan

TABLE 140 MAJOR DEVELOPMENTS IN JAPANESE MARKET

TABLE 141 JAPAN: MARKET, BY TYPE, 2017–2020 (USD MILLION)

TABLE 142 JAPAN: MARKET, BY TYPE, 2021–2026 (USD MILLION)

TABLE 143 JAPAN: MARKET, BY END USER, 2017–2020 (USD MILLION)

TABLE 144 JAPAN: MARKET, BY END USER, 2021–2026 (USD MILLION)

12.4.2 CHINA

12.4.2.1 Strategic government initiatives for life science research to fuel market growth in China

TABLE 145 MAJOR DEVELOPMENTS IN CHINESE ELECTRON MICROSCOPY AND SAMPLE PREPARATION MARKET

TABLE 146 CHINA: MARKET, BY TYPE, 2017–2020 (USD MILLION)

TABLE 147 CHINA: MARKET, BY TYPE, 2021–2026 (USD MILLION)

TABLE 148 CHINA: MARKET, BY END USER, 2017–2020 (USD MILLION)

TABLE 149 CHINA: MARKET, BY END USER, 2021–2026 (USD MILLION)

12.4.3 INDIA

12.4.3.1 Expanding biotechnology industry to drive demand for microscopes in India

TABLE 150 INDIA: MARKET, BY TYPE, 2017–2020 (USD MILLION)

TABLE 151 INDIA: MARKET, BY TYPE, 2021–2026 (USD MILLION)

TABLE 152 INDIA: MARKET, BY END USER, 2017–2020 (USD MILLION)

TABLE 153 INDIA: MARKET, BY END USER, 2021–2026 (USD MILLION)

12.4.4 REST OF APAC

TABLE 154 ROPAC: MARKET, BY TYPE, 2017–2020 (USD MILLION)

TABLE 155 ROPAC: MARKET, BY TYPE, 2021–2026 (USD MILLION)

TABLE 156 ROPAC: MARKET, BY END USER, 2017–2020 (USD MILLION)

TABLE 157 ROPAC: MARKET, BY END USER, 2021–2026 (USD MILLION)

12.5 REST OF THE WORLD

TABLE 158 ROW: ELECTRON MICROSCOPES MARKET, BY TYPE, 2017–2020 (USD MILLION)

TABLE 159 ROW: ELECTRON MICROSCOPES MARKET, BY TYPE, 2021–2026 (USD MILLION)

TABLE 160 ROW: MARKET, BY END USER, 2017–2020 (USD MILLION)

TABLE 161 ROW: MARKET, BY END USER, 2021–2026 (USD MILLION)

13 COMPETITIVE LANDSCAPE (Page No. - 150)

13.1 OVERVIEW

FIGURE 34 KEY DEVELOPMENTS IN ELECTRON MICROSCOPY AND SAMPLE PREPARATION MARKET FROM 2017 TO 2020

13.2 MARKET SHARE ANALYSIS: MARKET

TABLE 162 MARKET SHARE OF KEY PLAYERS IN MARKET, 2020

13.3 REVENUE SHARE ANALYSIS OF TOP FIVE PLAYERS IN MARKET

FIGURE 35 REVENUE SHARE ANALYSIS OF TOP FIVE PLAYERS IN MARKET, 2016–2020

13.4 MARKET EVALUATION FRAMEWORK

TABLE 163 OVERVIEW OF STRATEGIES DEPLOYED BY KEY ELECTRON MICROSCOPE PROVIDERS

13.4.1 PRODUCT PORTFOLIO

13.4.2 REGIONAL FOCUS

13.4.3 MANUFACTURING FOOTPRINT

13.4.4 ORGANIC/INORGANIC GROWTH STRATEGIES

13.5 COMPANY EVALUATION MATRIX

13.5.1 STAR

13.5.2 EMERGING LEADER

13.5.3 PERVASIVE

13.5.4 PARTICIPANT

FIGURE 36 ELECTRON MICROSCOPY AND SAMPLE PREPARATION MARKET: COMPANY EVALUATION MATRIX, 2020

13.6 STARTUP/SME EVALUATION MATRIX, 2020

13.6.1 PROGRESSIVE COMPANY

13.6.2 RESPONSIVE COMPANY

13.6.3 DYNAMIC COMPANY

13.6.4 STARTING BLOCK

FIGURE 37 ELECTRON MICROSCOPY AND SAMPLE PREPARATION MARKET: STARTUP/SME EVALUATION MATRIX, 2020

13.7 COMPANY PRODUCT FOOTPRINT

TABLE 164 PRODUCT FOOTPRINT OF COMPANIES

TABLE 165 APPLICATION FOOTPRINT OF COMPANIES

TABLE 166 PRODUCT FOOTPRINT OF COMPANIES

TABLE 167 REGIONAL FOOTPRINT OF COMPANIES

13.8 COMPETITIVE SITUATIONS AND TRENDS

13.8.1 PRODUCT LAUNCHES

13.8.2 DEALS

14 COMPANY PROFILES (Page No. - 167)

(Business Overview, Products Offered, Recent Developments, and MnM View (Key strengths/Right to Win, Strategic Choices Made, and Weaknesses and Competitive Threats))*

14.1 KEY PLAYERS

14.1.1 CARL ZEISS

TABLE 168 CARL ZEISS: COMPANY SNAPSHOT

FIGURE 38 CARL ZEISS: COMPANY SNAPSHOT (2020)

14.1.2 DANAHER

TABLE 169 DANAHER: COMPANY SNAPSHOT

FIGURE 39 DANAHER: COMPANY SNAPSHOT (2019

14.1.3 THERMO FISHER SCIENTIFIC

TABLE 170 THERMO FISHER SCIENTIFIC: COMPANY SNAPSHOT

FIGURE 40 THERMO FISHER SCIENTIFIC: COMPANY SNAPSHOT (2019)

14.1.4 NIKON

TABLE 171 NIKON: COMPANY SNAPSHOT

FIGURE 41 NIKON: COMPANY SNAPSHOT (2020)

14.1.5 BRUKER

TABLE 172 BRUKER: COMPANY SNAPSHOT

FIGURE 42 BRUKER: COMPANY SNAPSHOT (2019)

14.1.6 OLYMPUS

TABLE 173 OLYMPUS: COMPANY SNAPSHOT

FIGURE 43 OLYMPUS: COMPANY SNAPSHOT (2020)

14.1.7 OXFORD INSTRUMENTS

TABLE 174 OXFORD INSTRUMENTS: COMPANY SNAPSHOT

FIGURE 44 OXFORD INSTRUMENTS: COMPANY SNAPSHOT (2020)

14.1.8 JEOL

TABLE 175 JEOL: COMPANY SNAPSHOT

FIGURE 45 JEOL: COMPANY SNAPSHOT (2018)

14.1.9 HITACHI HIGH-TECHNOLOGIES

TABLE 176 HITACHI HIGH-TECHNOLOGIES: COMPANY SNAPSHOT

FIGURE 46 HITACHI HIGH-TECHNOLOGIES: COMPANY SNAPSHOT (2019)

14.1.10 HIROX

TABLE 177 HIROX: COMPANY SNAPSHOT

14.2 OTHER COMPANIES

14.2.1 MICROPTIK

14.2.2 HORIBA

14.2.3 ARIVIS AG

14.2.4 ANGSTORM ADVANCED INC

14.2.5 MEDIA CYBERNETICS

14.2.6 NION COMPANY

14.2.7 TESCAN ORSAY HOLDING

14.2.8 CORDOUAN TECHNOLOGIES SAS

14.2.9 RENISHAW PLC

14.2.10 WITEC

*Details on Business Overview, Products Offered, Recent Developments, and MnM View (Key strengths/Right to Win, Strategic Choices Made, and Weaknesses and Competitive Threats) might not be captured in case of unlisted companies.

15 APPENDIX (Page No. - 205)

15.1 DISCUSSION GUIDE

15.2 KNOWLEDGE STORE: MARKETSANDMARKETS’ SUBSCRIPTION PORTAL

15.3 AVAILABLE CUSTOMIZATIONS

15.4 RELATED REPORTS

15.5 AUTHOR DETAILS

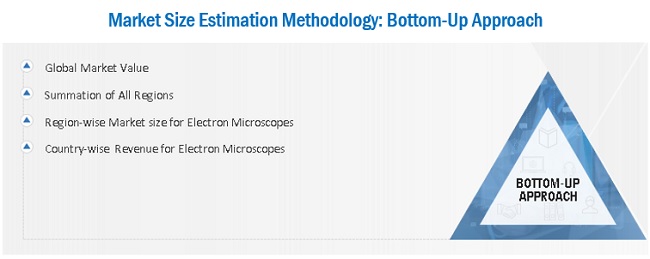

The study involved 4 major activities in estimating the current size of the Electron microscopy and sample preparation market. Exhaustive secondary research has been done to collect information about the market, the peer markets, and the parent market. Validating findings, assumptions, and sizing with industry experts across the value chain through primary research has been the next step. Both top-down and bottom-up approaches have been employed to estimate the complete market size. After that, market breakdown and data triangulation methods have been used to estimate the market size of segments and subsegments.

Secondary Research

In the secondary research process, various secondary sources have been referred to for identifying and collecting information pertinent to this study. Secondary sources include annual reports; press releases; investor presentations; white papers; journals and certified publications; and articles from recognized authors, directories, and databases. Secondary research has been conducted to obtain important information about the industry’s supply chain, value chain, total pool of key players, market segmentation according to the industry trends (to the bottommost level), geographic markets, and key developments from both market- and technology-oriented perspectives.

Primary Research

Extensive primary research has been conducted after gaining knowledge about the Electron microscopy and sample preparation market scenario through secondary research. Several primary interviews have been conducted with market experts from both demand (commercial application providers) and supply (equipment manufacturers and distributors) sides across four major regions: North America, Europe, APAC, and RoW. Approximately 20% and 80% of primary interviews have been conducted with parties from demand and supply sides, respectively. The primary data has been collected through questionnaires, emails, and telephonic interviews.

To know about the assumptions considered for the study, download the pdf brochure

Market Size Estimation

- In the complete engineering process, both top-down and bottom-up approaches, along with several data triangulation methods, have been used to estimate and validate the size of the Electron microscopy and sample preparation market and other dependent submarkets.

- The key players in the market have been determined through primary and secondary research. This entire research methodology involves the study of the annual and financial reports of the top market players and extensive interviews with industry experts such as CEOs, VPs, directors, and marketing executives for key insights (both qualitative and quantitative) into the Electron microscopy and sample preparation market.

To know about the assumptions considered for the study, Request for Free Sample Report

Data Triangulation

All the percentage shares, splits, and breakdowns have been determined using secondary sources and verified through primary sources. All the possible parameters that affect the markets covered in this research study have been accounted for, viewed in extensive detail, verified through primary research, and analyzed to get the final quantitative and qualitative data. This data has been consolidated and supplemented with detailed inputs and analysis from MarketsandMarkets and presented in the report.

Report Objectives

- To describe and forecast the Electron microscopy and sample preparation market, in terms of value, by type, end-users, and application

- To describe and forecast the market, in terms of value, by region—North America, Europe, Asia Pacific (APAC), and Rest of the World (RoW)

- To provide detailed information regarding major factors influencing growth (drivers, restraints, opportunities, and challenges)

- To strategically analyze micromarkets with respect to individual growth trends, future prospects, and contributions to the overall market

- To provide detailed overview of value chain analysis in the Electron microscopy and sample preparation market

- To analyze opportunities in the market for various stakeholders by identifying high-growth segments of the Electron microscopy and sample preparation market

- To strategically profile key players and comprehensively analyze their market position in terms of ranking and core competencies, along with detailing the competitive landscape for market leaders

- To analyze competitive developments such as product developments, expansions, mergers and research & development in the Electron microscopy and sample preparation market

Available Customizations

With the given market data, MarketsandMarkets offers customizations according to the company’s specific needs. The following customization options are available for the report:

Product Analysis

- Product matrix that gives a detailed comparison of the product portfolio of each company

Company Information

- Detailed analysis and profiling of additional market players (up to 5)

Generating Response ...

Generating Response ...

Growth opportunities and latent adjacency in Electron Microscopy and Sample Preparation Market