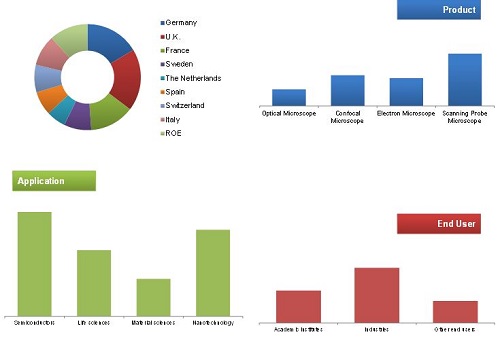

European Microscopy Market by Product (Optical (Fluorescence, Super-Resolution), Confocal, Electron (Transmission), Scanning (AFM)), Application (Semiconductor, Life Science, Nanotechnology), End User (Academic Institute, Industries) - Forecast to 2020

The European microscopy market is estimated to grow at a CAGR of 7.0% to reach $ 1,798.4 Million by 2020. Optical microscopy is the largest segment of the european microscopy market. The electron microscopes product segment is expected to show the fastest growth during the forecast period.

In this report, the European microscopy market is broadly segmented by product, application, end user, and region. By type of product, the global is categorized into optical microscopes, confocal microscopes, electron microscopes, and scanning probe microscopes. The optical microscopy segment is further segmented into fluorescence microscopy (FM), and super-resolution microscopy. The subsegments of fluorescence microscopy included in this report are total internal reflection fluorescence microscopy (TIRF), fluorescence resonance energy transfer (FRET), fluorescence recovery after photo-bleaching (FRAP), and fluorescence lifetime imaging microscopy (FLIM). Super-resolution microscopy is subsegmented into stochastic optical reconstruction microscopy (STORM), structured illumination microscopy (SIM), stimulated emission depletion microscopy (STED), coherent anti-strokes Raman scattering microscopy (CARS), photo-activated localization microscopy (PALM), and reversible saturable optical fluorescence transitions (RELSOFT). The confocal microscopy is categorized into multi-photon microscopy and confocal disk spinning microscopy. The electron microscopy segment is further divided into transmission electron microscopy (TEM) and scanning electron microscopy (SEM). The scanning probe microscopy segment is further segmented into scanning tunneling microscopy (STM), atomic force microscopy (AFM), and near-field scanning optical microscopy (NSOM).

Based on application, the European microscopy market is broadly classified into semiconductors, life sciences, nanotechnology, and material science. Nanotechnology is the fastest-growing segment. The high growth rate of this market can be attributed to growing focus on nanotechnology, favorable government and corporate funding, and technological advancements.

On the basis of end users, the european microscopy market is categorized into academic institutions, industries, and others (government research institutes and private laboratories). Academic institutions emerged as the major end users of the european microscopy market in 2014. This can be attributed to the growing research and development in the field of neuroscience, optogentics, and nanotechnology, and increasing government funding for research purpose.

Growth of this market is propelled by the rising worldwide focus on nanotechnology and favorable government and corporate funding. The market is further driven by technological advancements like high-throughput techniques, super resolution, and digitization of microscopes. Optogenetics and integration of microscopy with spectroscopy, novel application areas such as quantum dots and emerging markets in countries such as U.K., Germany provide new growth opportunities to players in the european microscopy market. However, the high cost of advanced microscopes is the key factors limiting the growth of this market. In addition, the time-consuming sample preparation process and high degree of technical expertise required are key market challenges.

A thorough analysis of this market identified super resolution microscopy and low adoption rate of microscopes as major burning issues. On the other hand, the availability of customized microscopy solutions and superior customer support for microscopy were identified as a winning imperative.

Key players operating in the european microscopy market are Carl Zeiss (Germany), FEI Co. (U.S.), Leica Microsystems (Danaher Corp.) (U.K.) and Nikon Corporation (Japan).

European Microscopy Market : Scope of the Report

- The market study does not cover the market in terms of volume

- This study does not cover the accessories and services markets for microscopy

- The market size for super-resolution microscopes and fluorescence microscopes are not covered due to limited availability of data

|

Particular |

Scope |

|

Region |

|

|

Historical Years |

2013 |

|

Base Year |

2014 |

|

Projected Year |

2015 |

|

Forecast Period |

20152020 |

|

Revenue Currency |

USD ($) |

Market Segmentation

This research report categorizes the european microscopy market on the basis of products, applications, end users, and geographies.

Microscopy Market, by Product

- Optical Microscopy

- Fluorescence Microscopy

- Total internal reflection fluorescence microscopy(TIRF)

- Fluorescence resonance energy transfer (FRET)

- Fluorescence recovery after photo-bleaching (FRAP)

- Fluorescence lifetime imaging microscopy (FLIM)

- Super-Resolution Microscopy

- Stochastic Optical Reconstruction Microscopy (STORM)

- Structured Illumination Microscopy (SIM)

- Stimulated Emission Depletion Microscopy (STED)

- Coherent Anti-Strokes Raman Scattering Microscopy (CARS)

- Photo-Activated Localization Microscopy (PALM)

- Reversible Saturable Optical Fluorescence Transitions (RELSOFT)

- Confocal Microscopy

- Multi-photon Confocal Microscopy

- Disk Spinning Confocal Microscopy

- Electron Microscopy

- Transmission Electron Microscope (TEM)

- Scanning Electron Microscope (SEM)

- Scanning Probe Microscopy

- Scanning Tunneling Microscopes (STM)

- Atomic Force Microscopes (AFM)

- Near-Field Scanning Optical Microscope (NSOM)

Microscopy Market, by Application

- Semiconductors

- Life Sciences

- Material Sciences

- Nanotechnology

Microscopy Market, by End User

- Academic Institutions

- Industries

- Others (Government Research Institutions & Private Laboratories)

European

Microscopy Market, by Region

- U.K.

- Germany

- France

- Spain

- Italy

- Netherlands

- Swedenroe

The European microscopy market is expected to grow at a single digit CAGR of 7.0% to reach $1,798.4 Million by 2020 from $1,284.9 Million in 2015. Major factors fueling market growth are the rising global focus on nanotechnology, favorable government and corporate funding, and technological advancements such as super-resolution microscopy, high-throughput techniques, and digitization of microscopes. However, the high cost of advanced microscopes is restricting the growth of the european microscopy market.

This market is broadly segmented into optical microscopes, confocal microscopes, electron microscopes, and scanning probe microscopes. The optical microscopy segment is further divided into fluorescence microscopy (FM) and super-resolution microscopy. The fluorescence microscopy is further subsegmented into total internal reflection fluorescence microscopy (TIRF), fluorescence resonance energy transfer (FRET), fluorescence recovery after photo-bleaching (FRAP), and fluorescence lifetime imaging microscopy (FLIM). The super-resolution microscopy is subdivided into stochastic optical reconstruction microscopy (STORM), structured illumination microscopy (SIM), stimulated emission depletion microscopy (STED), coherent anti-strokes Raman scattering microscopy (CARS), photo-activated localization microscopy (PALM), and reversible saturable optical fluorescence transitions (RELSOFT).

Confocal microscopy is segmented into multi-photon microscopy and confocal disk spinning microscopy. The electron microscopy segment is categorized into transmission electron microscopy (TEM) and scanning electron microscopy (SEM). The scanning probe microscopy segment is divided into scanning tunneling microscopy (STM), atomic force microscopy (AFM), and near-field scanning optical microscopy (NSOM).

The microscopy market, by application, is segmented into semiconductors, life sciences, nanotechnology, and material science. Nanotechnology is the fastest-growing segment of the market. The high growth rate of this market can be attributed to the growing focus on nanotechnology, favorable government and corporate funding, and technological advancements.

The microscopy market, by end user, is categorized into academic institutes, industries, and others (government research institutes and private laboratories). Academic institutes are the major end users of this market.

Geographically, this market is dominated by North America, followed by Europe. Asia-Pacific is expected to grow at a double digit CAGR during the forecast period.

Key players operating in the European Microscopy Market are Carl Zeiss (Germany), Leica Microsystems (Danaher Corp.) (U.K.), Nikon Corporation (Japan) and FEI Co. (U.S.).

European Microscopy Market Scenario, by Application, 2014

Source: MarketsandMarkets Analysis

Table of Contents

1 Introduction (Page No. - 14)

1.1 Objectives of the Study

1.2 Market Definition

1.3 Market Scope

1.3.1 Markets Covered

1.3.2 Years Considered for the Study

1.4 Currency

1.5 Limitations

1.6 Stakeholders

2 Research Methodology (Page No. - 18)

2.1 Market Size Estimation

2.2 Market Breakdown and Data Triangulation

2.2.1 Key Data From Secondary Sources

2.2.2 Key Data From Primary Sources

2.2.2.1 Key Industry Insights

2.2.3 Assumptions for the Study

3 Executive Summary (Page No. - 27)

4 Premium Insights (Page No. - 35)

4.1 European Microscopy Market to Grow at a Steady Rate

4.2 European Microscopy Market, By Product

4.3 European Microscopy Market, By Country/Region

4.4 European Microscopy Market, By Application

4.5 European Microscopy Market, By End User

5 Market Overview (Page No. - 40)

5.1 Introduction

5.2 Market Dynamics

5.2.1 Drivers

5.2.1.1 Rising Focus on Nanotechnology

5.2.1.2 Favourable Government and Corporate Funding

5.2.1.3 Technological Advancements

5.2.2 Restraints

5.2.2.1 High Costs of Advanced Microscopes

5.2.3 Opportunities

5.2.3.1 High-Growth Markets in Europe

5.2.3.2 New Application Areas Such as Quantum Dots and Optogenetics

5.2.4 Challenges

5.2.4.1 Time-Consuming Sample Preparation Process

5.2.4.2 Requirement of High Degree of Technical Expertise

5.2.5 Winning Imperatives

5.2.5.1 Customized Microscopy Solutions

5.2.5.2 Superior Customer Support

5.2.6 Burning Issues

5.2.6.1 SuperResolution Microscopy

5.2.6.2 Low Adoption Rate

6 Industry Trends (Page No. - 48)

6.1 Introduction

6.2 Supply Chain Analysis

6.2.1 Key Influencers

6.3 Pest Analysis

6.3.1 Political Factors

6.3.2 Economical Factors

6.3.3 Social Factors

6.3.4 Technological Factors

6.4 Industry Insights

6.5 Strategic Benchmarking

6.5.1 New Product Launches

7 European Microscopy Market, By Product (Page No. - 53)

7.1 Introduction

7.2 Optical Microscopy

7.2.1 Fluorescence Microscopes

7.2.1.1 Total Internal Reflection Fluorescence Microscopy (TIRF)

7.2.1.2 Fluorescence Resonance Energy Transfer (FRET)

7.2.1.3 Fluorescence Recovery After Photo-Bleaching (FRAP)

7.2.1.4 Fluorescence Lifetime Imaging Microscopy (FLIM)

7.2.2 Super-Resolution Microscopes

7.2.2.1 Stochastic Optical Reconstruction Microscopy (STORM)

7.2.2.2 Structured Illumination Microscopy (SIM)

7.2.2.3 Stimulated Emission Depletion Microscopy (STED)

7.2.2.4 Coherent Anti-Strokes Raman Scattering (CARS) Microscopy

7.2.2.5 Photo-Activated Localization Microscopy (PALM)

7.2.2.6 Reversible Saturable Optical Fluorescence Transitions (ReSOFT)

7.3 Electron Microscopy

7.3.1 Transmission Electron Microscopy (TEM)

7.3.2 Scanning Electron Microscopy (SEM)

7.4 Confocal Microscopy

7.4.1 Multi-Photon Confocal Microscopy

7.4.2 Spinning Disk Confocal Microscopy

7.5 Scanning Probe Microscopy

7.5.1 Scanning Tunneling Microscopy (STM)

7.5.2 Atomic Force Microscopy (AFM)

7.5.3 Near-Field Scanning Optical Microscopy (NSOM)

8 European Microscopy Market, By Application (Page No. - 71)

8.1 Introduction

8.2 Semiconductors

8.3 Life Sciences

8.4 Material Sciences

8.5 Nanotechnology

9 European Microscopy Market, By End User (Page No. - 79)

9.1 Introduction

9.2 Academic Institutes

9.3 Industries

9.4 Other End Users

10 Geographic Analysis (Page No. - 87)

10.1 Introduction

10.2 Germany

10.3 U.K.

10.4 France

10.5 Italy

10.6 Sweden

10.7 Switzerland

10.8 the Netherlands

10.9 Rest of Europe (Roe)

11 Company Profiles (Page No. - 114)

11.1 Introduction

11.2 Bruker Corporation

11.2.1 Business Overview

11.2.2 Bruker Corporation: Company Snapshot

11.2.3 Product Portfolio

11.2.4 Key Strategy

11.2.5 Recent Development

11.3 Carl Zeiss AG

11.3.1 Business Overview

11.3.2 Carl Zeiss AG: Company Snapshot

11.3.3 Products & Services

11.3.4 Key Strategy

11.3.5 Recent Developments

11.4 Danaher Corporation

11.4.1 Business Overview

11.4.2 Danaher Corporation: Company Snapshot

11.4.3 Product Portfolio

1.2.4 Key Strategy

11.4.5 Recent Developments

11.5 Danish Micro Engineering

11.5.1 Products & Services

11.5.2 Key Strategy

11.6 FEI Company

11.6.1 Business Overview

11.6.2 Fei Company: Company Snapshot

11.6.3 Product Portfolio

11.6.4 Key Strategy

11.6.5 Recent Developments

11.7 Hitachi High-Technologies Corporation

11.7.1 Business Overview

11.7.2 Product Portfolio

11.7.3 Key Strategy

11.7.4 Recent Developments

11.8 Jeol, Ltd.

11.8.1 Business Overview

11.8.2 Product Portfolio

11.8.3 Key Strategy

11.8.4 Recent Development

11.9 Nikon Corporation

11.9.1 Business Overview

11.9.2 Nikon Corporation: Company Snapshot

11.9.3 Product Portfolio

11.9.4 Key Strategy

11.10 Olympus Corporation

11.10.1 Business Overview

11.10.2 Product Portfolio

11.10.3 Key Strategy

11.11 Vision Engineering

11.11.1 Business Overview

11.11.2 Product Portfolio

11.11.3 Key Strategy

11.11.4 Recent Developments

12 Appendix (Page No. - 139)

12.1 Insights of Industry Experts

12.2 Discussion Guide

12.3 Other Developments

12.4 Introducing RT: Real-Time Market Intelligence

12.5 Available Customizations

12.6 Related Reports

List of Tables (72 Tables)

Table 1 Growing Government and Corporate Funding to Drive Market Growth

Table 2 High Costs of Advanced Microscopes to Hinder Market Growth

Table 3 High-Growth Markets Offer New Growth Avenues for Players in Microscopy Market

Table 4 Tedious Sample Preparation Process and High Degree of Technical Expertise Constraining the Growth of Microscopy Market

Table 5 European Microscopy Market Size, By Product, 2013-2020 ($Million)

Table 6 Optical Microscopy Market Size, By Type, 2013-2020 ($Million)

Table 7 Optical Microscopy Market Size, By Country, 2013-2020 ($Million)

Table 8 Fluorescence Microscopes Market Size, By Country, 2013-2020 ($Million)

Table 9 Super-Resolution Microscopy Market Size, By Country, 2013-2020 ($Million)

Table 10 Electron Microscopy Market Size, By Type, 2013-2020 ($Million)

Table 11 Electron Microscopy Market Size, By Country, 2013-2020 ($Million)

Table 12 Transmission Electron Microscopy Market Size, By Country, 2013-2020 ($Million)

Table 13 Scanning Electron Microscopy Market Size, By Country, 2013-2020 ($Million)

Table 14 Confocal Microscopy Market Size, By Country, 2013-2020 ($Million)

Table 15 Scanning Probe Microscopy Market Size, By Type, 2013-2020 ($Million)

Table 16 Scanning Probe Microscopy Market Size, By Country, 2013-2020 ($Million)

Table 17 Scanning Tunneling Microscopy Market Size, By Country, 2013-2020 ($Million)

Table 18 Atomic Force Microscopy Market Size, By Country, 2013-2020 ($Million)

Table 19 Near-Field Scanning Optical Microscopy Market Size, By Country, 2013-2020 ($Million)

Table 20 European Microscopy Market Size, By Application, 20132020 ($Million)

Table 21 European Microscopy Market Size for Semiconductors, By Country, 2013-2020 ($Million)

Table 22 European Microscopy Market Size for Life Sciences, By Country, 20132020 ($Million)

Table 23 European Microscopy Market Size for Material Sciences, By Country, 2013-2020 ($Million)

Table 24 European Microscopy Market Size for Nanotechnology, By Country, 20132020 ($Million)

Table 25 European Microscopy Market Size, By End User, 20132020 ($Million)

Table 26 European Microscopy Market Size for Academic Institutes, By Country, 20132020 ($Million)

Table 27 European Microscopy Market Size for Industries, By Country, 20132020 ($Million)

Table 28 European Microscopy Market Size for Other End Users, By Country, 20132020 ($Million)

Table 29 European Microscopy Market Size, By Country/Region, 20132020 ($Million)

Table 30 Germany: Market Size, By Product, 20132020 ($Million)

Table 31 Germany: Optical Microscopy Market Size, By Type, 20132020 ($Million)

Table 32 Germany: Electron Microscopy Market Size, By Type, 20132020 ($Million)

Table 33 Germany: Scanning Probe Microscopy Market Size, By Type, 20132020 ($Million)

Table 34 Germany: Market Size, By Application, 20132020 ($Million)

Table 35 Germany: Market Size, By End User, 20132020 ($Million)

Table 36 U.K.: Market Size, By Product, 20132020 ($Million)

Table 37 U.K.: Optical Microscopy Market Size, By Type, 20132020 ($Million)

Table 38 U.K.: Electron Microscopy Market Size, By Type, 20132020 ($Million)

Table 39 U.K.: Scanning Probe Microscopy Market Size, By Type, 20132020 ($Million)

Table 40 U.K.: Microscopy Market Size, By Application, 20132020 ($Million)

Table 41 U.K.: Microscopy Market Size, By End User, 20132020 ($Million)

Table 42 France: Microscopy Market Size, By Product, 20132020 ($Million)

Table 43 France: Optical Microscopy Market Size, By Type, 20132020 ($Million)

Table 44 France.: Electron Microscopy Market Size, By Type, 20132020 ($Million)

Table 45 France: Scanning Probe Microscopy Market Size, By Type, 20132020 ($Million)

Table 46 France: Microscopy Market Size, By Application, 20132020 ($Million)

Table 47 France: Market Size, By End User, 20132020 ($Million)

Table 48 Italy: Microscopy Market Size, By Product, 20132020 ($Million)

Table 49 Italy: Optical Microscopy Market Size, By Type, 20132020 ($Million)

Table 50 Italy: Electron Microscopy Market Size, By Type, 20132020 ($Million)

Table 51 Italy: Scanning Probe Microscopy Market Size, By Type, 20132020 ($Million)

Table 52 Italy: Market Size, By Application, 20132020 ($Million)

Table 53 Italy: Market Size, By End User, 20132020 ($Million)

Table 54 Sweden: Microscopy Market Size, By Product, 20132020 ($Million)

Table 55 Sweden: Electron Microscopy Market Size, By Type, 20132020 ($Million)

Table 56 Sweden: Scanning Probe Microscopy Market Size, By Type, 20132020 ($Million)

Table 57 Switzerland: Market Size, By Product, 20132020 ($Million)

Table 58 Switzerland: Electron Microscopy Market Size, By Type, 20132020 ($Million)

Table 59 Switzerland: Scanning Probe Microscopy Market Size, By Type, 20132020 ($Million)

Table 60 Switzerland: European Microscopy Market Size, By Application, 20132020 ($Million)

Table 61 Switzerland: European Microscopy Market Size, By End User, 20132020 ($Million)

Table 62 Netherlands: Microscopy Market Size, By Product, 20132020 ($Million)

Table 63 Netherlands: Optical Microscopy Market Size, By Type, 20132020 ($Million)

Table 64 Netherlands: Electron Microscopy Market Size, By Type, 20132020 ($Million)

Table 65 Netherlands: Scanning Probe Microscopy Market Size, By Type, 20132020 ($Million)

Table 66 Netherlands: Market Size, By Application, 20132020 ($Million)

Table 67 Netherlands: Market Size, By End User, 20132020 ($Million)

Table 68 ROE: European Microscopy Market Size, By Product, 20132020 ($Million)

Table 69 ROE: Electron Microscopy Market Size, By Type, 20132020 ($Million)

Table 70 ROE: Scanning Probe Market Size, By Type, 20132020 ($Million)

Table 71 ROE: Market Size, By Application, 20132020 ($Million)

Table 72 ROE: Market Size, By End User, 20132020 ($Million)

List of Figures (48 Figures)

Figure 1 Research Design: European Microscopy Market

Figure 2 Market Size Estimation

Figure 3 Breakdown of Primary Interviews: By Company Type, Designation, and Country/Region

Figure 4 Data Triangulation Methodology

Figure 5 European Microscopy Market Snapshot (2014 vs 2020)

Figure 6 Electron Microscopy Segment to Witness Highest Growth Rate From 2015 to 2020

Figure 7 European Microscopy Market, By Application, 2014

Figure 8 Academic Institutes Were the Major End Users of the Market in 2014

Figure 9 Geographical Snapshot: Germany Dominated the European Microscopy Market in 2014

Figure 10 New Product Launches, the Dominant Strategy Among Market Players

Figure 11 Rising Focus on Nanotechnology and Favorable Funding Scenario to Drive Market Growth

Figure 12 Optical Microscopy Accounted for the Largest Share in 2014

Figure 13 Germany to See the Highest Growth During the Forecast Period

Figure 14 Semiconductors Application Segment to Dominate European Microscopy Market During the Forecast Period

Figure 15 Academic Institutes Are the Major End Users of the Microscopy Market

Figure 16 Favorable Government & Corporate Funding to Boost Market Growth

Figure 17 Supply Chain Analysis: European Microscopy Market

Figure 18 Development of Super-Resolution Microscopy an Area of Focus for Players in the Market

Figure 19 Market Players Adopted New Product Launches as a Key Strategy

Figure 20 Optical Microscopy Held Largest Share in the European Microscopy Market in 2014

Figure 21 Fluorescence Microscopes Dominate the Optical Microscopy Market

Figure 22 Scanning Electron Microscopes Dominate Electron Microscopy Market

Figure 23 Germany to Witness High Growth in the Confocal Microscopy Market From 2014 to 2020

Figure 24 Scanning Tunneling Microscopes Dominate the Scanning Probe Microscopy Market

Figure 25 Semiconductors Segment to Dominate the European Microscopy Applications Market in the Forecast Period

Figure 26 Microscopy Instruments in Life Sciences

Figure 27 Germany Accounted for the Largest Share of the Nanotechnology Segment in 2014

Figure 28 Broad End-User Base of the European Microscopy Market

Figure 29 Academic Institutes Segment Held the Largest Share of the European Microscope End-Users Market in 2014

Figure 30 Germany to Dominate the European Microscopy Market for Academic Institutes From 2015 to 2020

Figure 31 Germany Commanded the Largest Share of the European Microscopy Market for Industries in 2014

Figure 32 Germany Dominated the European Microscopy Market for Other End Users

Figure 33 Geographic Snapshot (2014): Germany Will be the Fastest-Growing Region By 2020

Figure 34 Germany, an Attractive Destination for All Microscopy Products

Figure 35 Germany Market Snapshot: Demand in European Microscopy Market Will be Driven By Growth in Nanotechnology Research

Figure 36 Semiconductors Segment Dominated the U.K. Microscopy Market, By Application, in 2014

Figure 37 Electron Microscopy Segment is Expected to Witness Highest Growth From 2015 to 2020

Figure 38 Semiconductors Segment Commanded the Largest Share of the Italian Microscopy Applications Market in 2014

Figure 39 Academic Institutes Were the Major End Users of the Swedish Microscopy Market in 2014

Figure 40 Academic Institutes Held the Largest Share of the Swiss Microscopy Market in 2014

Figure 41 Semiconductors Commanded the Largest Share of the Applications Market in 2014

Figure 42 Electron Microscopy Segment is Expected to Witness the Highest Growth From 2015 to 2020

Figure 43 Geographic Revenue Mix of Top Five Market Players

Figure 44 Danish Micro Engineering: Company Snapshot

Figure 45 Hitachi High-Technologies Corporation: Company Snapshot

Figure 46 Jeol, Ltd.: Company Snapshot

Figure 47 Olympus Corporation: Company Snapshot

Figure 48 Vision Engineering: Company Snapshot

Generating Response ...

Generating Response ...

Growth opportunities and latent adjacency in European Microscopy Market