Sample Preparation Market by Product (Instruments (Workstations, Liquid Handling Systems), Consumables (Kits, Filters)), Application (Genomics, Proteomics), End Users (Pharmaceutical and Biotechnology, Food and Beverage) - Global Forecast to 2018

The global sample preparation market is expected to grow at a CAGR of 5.5%. The sample preparation market comprises products used to prepare biological as well as chemical samples for the analysis of raw materials or final products primarily to determine the presence of unwanted materials. Sample preparation instruments, workstations, and consumables serve the purpose of the production of a homogeneous sub-sample, representative of the material submitted to a laboratory. The market growth can be attributed to increasing research activities in genomics, shift from manual sample preparation to workstations, global alliances among leading research institutes to boost drug discovery, rising adoption of modern extraction techniques, technological advancements in analytical instruments, increasing life sciences R&D spending, and increasing need for food analysis due to safety concerns.

Objectives of the Study

- To define and measure the global sample preparation market with respect to products, applications, end users and regions

- To provide detailed information regarding major factors influencing growth of the market (drivers, restraints, opportunities, and industry-specific challenges)

- To strategically analyze micromarkets with respect to individual growth trends, future prospects, and contributions to the overall market

- To analyze opportunities in the market for stakeholders and provide details of the competitive landscape for market leaders

- To forecast the size of the market with respect to four main regions, namely, North America, Europe, Asia-Pacific, and the Rest of the World

- To strategically analyze the market structure and profile the key players of the global market and comprehensively analyze their core competencies

- To track and analyze competitive developments such as product deployments, agreements, collaborations, and partnerships; new product launches, product enhancements; expansions; acquisitions; and others (such as investments, and marketing and promotions) in the sample preparation market

Research Methodology

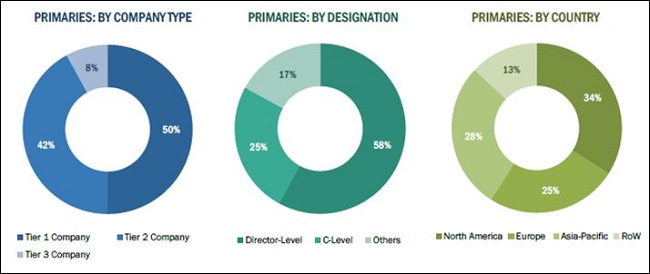

Top-down and bottom-up approaches were used to validate the size of the global sample preparation market and estimate the size of various other dependent submarkets. Various secondary sources such as directories, industry journals, databases such as Hoover’s, Bloomberg Business, Factiva, and Avention, and annual reports of the companies have been used to identify and collect information useful for the study of this market. Primary sources such as experts from both supply and demand sides have been interviewed to obtain and validate information as well as to assess dynamics of this market. The breakdown of profiles of primaries is shown in the figure below:

To know about the assumptions considered for the study, download the pdf brochure

Some of the prominent players in the sample preparation market includes Agilent Technologies, Inc. (U.S.), Danaher Corporation (U.S.), Illumina, Inc.(U.S.), QIAGEN N.V.(The Netherlands), PerkinElmer, Inc. (U.S.), Bio-Rad Laboratories, Inc. (U.S.), Thermo Fisher Scientific, Inc. (U.S.), Norgen Biotek Corporation (Canada), Hamilton Company (U.S.), Tecan Group Ltd. (Switzerland), Merck (U.S.), Promega Corporation (U.S.), and Roche Applied Science(U.S).

Target Audience:

- Sample preparation instruments, consumables, accessories, and related products manufacturing companies

- Suppliers and distributors of sample preparation instruments, consumables, and accessories

- Research institutes and academic centers

- Pharmaceutical and biopharmaceutical companies

- Biotechnology companies

- Molecular diagnostic companies

- Food and beverage analysis companies

- Business research and consulting service providers

- Environmental testing organizations

- Government departments and agencies

- Venture capitalists

Scope of the Report

This research report categorizes the market into the following segments and sub-segments:

Sample Preparation Market, by Product

-

Instruments

- Sample Preparation workstations/systems

-

Liquid Handling systems

- Liquid handling workstations

- Pipetting systems

- Reagent dispensers

- Microplate Washer

- Other Liquid Handling systems

- Extraction Systems

- Other Instruments

-

Consumables

- Kits

- Filters

- Columns

- Tubes

- Plates

- Other Consumables

- Accessories

- Other Sample Preparation products

Sample Preparation Market, by Application

- Genomics

- Proteomics

- Epigenomics and Epigenetics

- Other Applications

Sample Preparation Market, by End-Users

- Pharmaceutical & Biotechnology Industry

- Research and Academic Institutes

- Food and Beverage industry

- Other End Users

Sample Preparation Market, by Geography

-

North America

- U.S

- Canada

- Europe

- Asia-Pacific

- RoW

Available Customizations

- With the given market data, MarketsandMarkets offers customizations as per the company’s specific needs. The following customization option is available for the report:

- Portfolio Assessment

- Product Matrix, which gives a detailed comparison of the product portfolios of the top five companies in the market

- Detailed analysis and profiling of additional market players (up to 3)

This growth can be attributed to factors such as increasing research activities in genomics, shift from manual sample preparation to workstations, global alliances among leading research institutes to boost drug discovery, rising adoption of modern extraction techniques, technological advancements in analytical instruments, increasing life sciences R&D spending, and increasing need for food analysis due to safety concerns.

The sample preparation market comprises products used to prepare biological as well as chemical samples for the analysis of raw materials or final products primarily to determine the presence of unwanted materials. Sample preparation instruments, workstations, and consumables serve the purpose of the production of a homogeneous sub-sample, representative of the material submitted to a laboratory.

The sample preparation market has been segmented, on the basis of product, into workstations/systems, consumables, and accessories. The consumables segment is estimated to witness the highest CAGR during 2016–2021. The high growth can be attributed to the recurring purchase of these products. The consumables segment of the global sample preparation market is broadly segmented into kits, columns, filters, tubes, plates, and other consumables.

By applications, the market is broadly segmented genomics, proteomics, epigenomics and epigenetics, and other applications. In 2016, the genomics segment accounted for the largest share of the sample preparation market. The largest share of this segment can be attributed to a number of automated solutions that are emerging for improving sample preparation process efficiency and quality in various genomic applications, such as DNA extraction, normalization, PCR setup, DNA shearing, and next-generation sequencing. Automation reduces errors and thus reduces the cost per PCR test, thereby driving the market.

By end user, the market is segmented into pharmaceutical and biotechnology industries, research and academic institutes, food and beverage industry, and other end users. In 2016, the pharmaceutical and biotechnology industries segment accounted for the largest share of the sample preparation market. With continuous research activities in pharmaceutical and biotechnology companies, there is a greater focus on the introduction of new technologies in the market. In this regard, sample preparation techniques aid in providing rapid analysis, and accurate results while handling different and multiple samples.

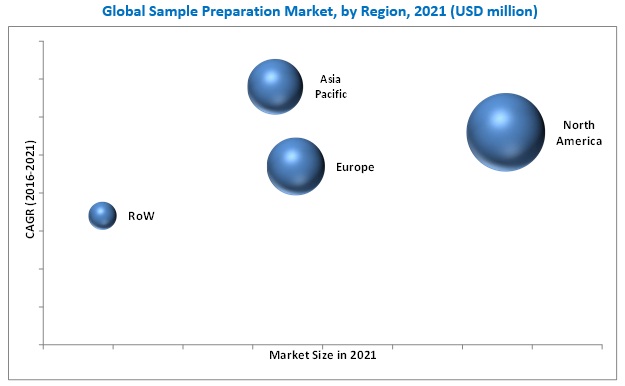

Geographically, the North American market accounted for the largest share of the global sample preparation market in 2016. The large share can be attributed to factors such as steady increase in laboratory spending, advances in forensic sciences, and initiation of the Genomic Applications Partnership Program (GAPP) as well as the growing food testing industry in Canada are some of the key factors driving the growth of the sample preparation market in North America.

Attempt by healthcare organizations to upgrade CDSS systems is driving the growth of this market

Automated Instruments

Sample preparation automated instruments include workstations/systems and liquid handling systems, extraction systems and other instruments such as tissue lysers, tissue disruptors, and homogenizers. Automation in sample preparation instruments has eliminated the need for manual and tedious tasks such as pipetting, reagent dispensing, plate washing, and liquid transport within the lab for processing and storage. It improves reproducibility, reduces errors and sample contamination in multi -user labs, and conserves expensive reagents used in medical testing, biological research, and high-throughput screening labs.

Consumables

Sample preparation consumables form a part of the internal assembly of the system; they include kits, columns, filters, tubes, plates, tips, and syringes. They are of single use and require to be purchased again for every procedure as opposed to the instruments.

Critical questions the report answers:

- Where will all these developments take the industry in the mid to long term?

- What are the upcoming applications for sample preparation systems?

High cost of workstations, and difficulty in developing ‘one-size-f it-all’ sample preparation kits may impede the growth of this market to some extent. T

QIAGEN N.V. (Netherlands), Thermo Fisher Scientific, Inc. (U.S.), PerkinElmer, Inc. (U.S.), and others Agilent Technologies, Inc. (U.S.), Danaher Corporation (U.S.), Hamilton Company (U.S.), Sigma-Aldrich Corporation (U.S.), Norgen Biotek Corporation (Canada), Millipore Corporation (U.S.), Bio-Rad Laboratories, Inc. (U.S.), Roche Applied Science (Switzerland), Illumina, Inc. (U.S.), and Tecan Group Ltd. (Switzerland) are the leading players in the market.

To speak to our analyst for a discussion on the above findings, click Speak to Analyst

Table Of Contents

1 Introduction (Page No.-20)

1.1 Objectives of the Study

1.2 Report Description

1.3 Markets Covered

1.4 Stakeholders

1.5 Research Methodology

1.5.1 Secondary Research

1.5.2 Primary Research

1.5.2.1 Key Data Points From Primary Sources

1.5.3 Sample Preparation Market Size Estimation Methodology

1.5.4 Market Forecast

1.5.5 Market Data Validation & Data Triangulation

1.6 Assumptions

2 Executive Summary (Page No.-34)

3 Market Overview (Page No.-38)

3.1 Introduction

3.2 Market Dynamics

3.2.1 Drivers

3.2.1.1 Advantages of Automated Sample Preparation Workstations to Create High Demand

3.2.1.2 Technological Advancements in Sample Preparation Workstations

3.2.1.3 Global Alliances Amongst Leading Research Institutes to Boost Drug Discovery

3.2.1.4 Rising Adoption of Modern Extraction Techniques

3.2.1.5 Technological Advancements in Analytical Instruments Demand Better Samples

3.2.1.6 Increasing Life Sciences R&D Spending

3.2.2 Restraints

3.2.2.1 High Costs of Workstations Restrict Purchase

3.2.2.2 Difficulty in Developing ‘One-Size-Fit-All’ Sample Preparation Kits

3.2.3 Opportunities

3.2.3.1 Growing Proteomics Market

3.2.3.2 Personalized Medicine to Fuel the Demand For Sample Preparation Solutions

3.2.3.3 Increased Government Investment in Medical Researches Set to Increase Market Applications

3.3 Market Share Analysis

3.3.1 Sample Preparation Instruments and Consumables Market, By Key Player

4 Sample Preparation Market, By Product (Page No.-52)

4.1 Introduction

4.2 Sample Preparation Instruments

4.2.1 Introduction

4.2.2 Workstations/Systems

4.2.3 Liquid Handling Systems

4.2.3.1 Introduction

4.2.3.2 Liquid Handling Workstations

4.2.3.3 Pipetting Systems

4.2.3.4 Reagent Dispensers

4.2.3.5 Microplate Washers

4.2.3.6 Other Liquid Handling Systems

4.2.4 Extraction Systems

4.2.5 Other Sample Preparation Instruments

4.3 Consumables

4.3.1 Introduction

4.3.2 Columns

4.3.3 Filters

4.3.4 Tubes

4.3.5 Plates

4.3.6 Other Consumables

4.4 Accessories

4.5 Sample Preparation Kits

4.5.1 Introduction

4.5.2 Purification Kits

4.5.2.1 DNA Purification

4.5.2.2 RNA Purification

4.5.2.3 Nucleic Acid Purification

4.5.2.4 Protein Purification

4.5.3 Isolation Kits

4.5.3.1 DNA Isolation

4.5.3.2 RNA Isolation

4.5.3.3 Nucleic Acid Isolation

4.5.3.4 Protein Isolation

4.5.4 Extraction Kits

4.5.4.1 DNA Extraction

4.5.4.2 RNA Extraction

4.5.4.3 Nucleic Acid Extraction

4.5.4.4 Protein Extraction

4.5.5 Other Kits

5 Sample Preparation Market, By Application (Page No.-104)

5.1 Introduction

5.2 Genomics

5.3 Proteomics

5.4 Epigenomics

5.5 Other Application

6 Sample Preparation Market, By End User (Page No.-113)

6.1 Introduction

6.2 Molecular Diagnostics

6.3 Applied Testing

6.4 Pharmaceutical & Biotechnology

6.5 Academic Research Institutes

7 Sample Preparation Market, By Geography (Page No.-121)

7.1 Introduction

7.2 North America

7.2.1 Increase in Research of Bio-Based Drug Markets Propels the Market

7.2.2 Increase in Use of Genetic Modified Crops Triggers the Market in North America

7.2.3 Availability of Funds From the Government to Drive the North American Market

7.2.4 Growing Pharmaceutical & Biotechnology Industries to Drive Market

7.2.5 Not For Profit Corporations Investment to Boost the Genomics Market in Canada

7.2.6 Sample Preparations Conferences to Trigger Research & Development Activities

7.3 Europe

7.3.1 Increase in R&D Investment to Boost the Sample Preparation Market in Europe

7.3.2 Acquisitions & Partnerships Among Companies to Trigger the Growth of Market

7.3.3 Increase in Funding Triggers the Growth of Market

7.3.4 Increase in Use of Genetically Modified Crops in European Union Likely to Boost the Market

7.4 Asia

7.4.1 Potential Market For Proteomics in India & China Is Boosting the Growth of the Market

7.4.2 Growing Pharmaceutical & Biotechnology Industry in India & China Is Propelling the Growth of the Market

7.4.3 Growing Demand For Analytical Instruments to Increase the Presence of Major Companies in China

7.4.4 Extensive Crop Research in Asia to Feed the Growing Population Is Likely to Boost the Market

7.4.5 Free Trade Agreement of Korea With U.S. Opens An Array of Opportunities For Companies in Asia

7.5 Rest of the World (ROW)

7.5.1 Regulatory Changes to Increase the Market in Israel, New Zealand & Australia

7.5.2 Genomic & Proteomic Research in Australia to Drive the Growth of the Market

7.5.3 Federal Collaborations in Australia to Increase the Market Growth

7.5.4 Flourishing Biotechnology & Pharmaceutical Markets in Brazil & Mexico to Bolster the Growth of the Market

7.5.5 Increasing Focus on Africa By Pharmaceutical Companies Likely to Boost the Market

8 Competitive Landscape (Page No.-175)

8.1 Introduction

8.2 New Product Launches

8.3 Agreements, Partnerships, & Collaborations

8.4 Expansions

8.5 Acquisitions

8.6 Others

9 Company Profiles (Overview, Financials, Products & Services, Strategy, & Developments)* (Page No.-192)

9.1 Agilent Technologies, Inc.

9.2 Bio-Rad Laboratories, Inc.

9.3 Danaher Corporation

9.4 Hamilton Company

9.5 Illumina, Inc

9.6 Merck Millipore

9.7 Norgen Biotek Corporation

9.8 Perkinelmer, Inc.

9.9 Qiagen N.V.

9.10 Roche Applied Science

9.11 Sigma-Aldrich Corporation

9.12 Tecan Group Ltd.

9.13 thermo Fisher Scientific, Inc.

*Details on Financials, Product & Services, Strategy, & Developments Might Not Be Captured in Case of Unlisted Companies.

List of Tables (98 Tables)

Table 1 Sample Preparation Market Size, By Product, 2011–2018 ($Million)

Table 2 Sample Preparations Instruments Market Size, By Type, 2011–2018 ($Million)

Table 3 Sample Preparations Instruments Market Size, By Geography, 2011–2018 ($Million)

Table 4 Sample Preparation Workstations/Systems Market Size, By Geography, 2011–2018 ($Million)

Table 5 Sample Preparation Liquid Handling System Market Size, By Type, 2011–2018 ($Million)

Table 6 Sample Preparation Liquid Handling System Market Size, By Geography, 2011–2018 ($Million)

Table 7 Sample Preparation Liquid Handling Workstation Market Size, By Geography, 2011–2018 ($Million)

Table 8 Sample Preparations Pipetting System Market Size, By Geography, 2011–2018 ($Million)

Table 9 Sample Preparations Reagent Dispenser Market Size, By Geography, 2011–2018 ($Million)

Table 10 Sample Preparations Microplate Washer Market Size, By Geography, 2011–2018 ($Million)

Table 11 Others Liquid Handling System Market Size, By Geography, 2011–2018 ($Million)

Table 12 Sample Preparations Extraction System Market Size, By Geography, 2011–2018 ($Million)

Table 13 Sample Preparations Other Instruments Market Size, By Geography, 2011–2018 ($Million)

Table 14 Sample Preparations Consumables Market Size, By Type, 2011–2018 ($Million)

Table 15 Sample Preparations Consumables Market Size, By Geography, 2011–2018 ($Million)

Table 16 Sample Preparations Columns Market Size, By Geography, 2011–2018 ($Million)

Table 17 Sample Preparations Filters Market Size, By Geography, 2011–2018 ($Million)

Table 18 Sample Preparations Tubes Market Size, By Geography, 2011–2018 ($Million)

Table 19 Sample Preparations Plates Market Size, By Geography, 2011–2018 ($Million)

Table 20 Other Sample Preparations Consumables Market Size, By Geography, 2011–2018 ($Million)

Table 21 Sample Preparations Accessories Market Size, By Geography, 2011–2018 ($Million)

Table 22 Sample Preparations Kits Market Size, By Type, 2011–2018 ($Million)

Table 23 Sample Preparations Kits Market Size, By Geography, 2011–2018 ($Million)

Table 24 Sample Preparations Purification Kits Market Size, By Sample, 2011–2018 ($Million)

Table 25 Sample Preparations Purification Kits Market Size, By Geography, 2011–2018 ($Million)

Table 26 Sample Preparations DNA Purification Kits Market Size, By Geography, 2011–2018 ($Million)

Table 27 Sample Preparations RNA Purification Kits Market Size, By Geography, 2011–2018 ($Million)

Table 28 Sample Preparations Nucleic Acid Purification Kits Market Size, By Geography, 2011–2018 ($Million)

Table 29 Sample Preparations Protein Purification Kits Market Size, By Geography, 2011–2018 ($Million)

Table 30 Sample Preparations Isolation Kits Market Size, By Sample, 2011–2018 ($Million)

Table 31 Sample Preparations Isolation Kits Market Size, By Geography, 2011–2018 ($Million)

Table 32 Sample Preparations DNA Isolation Kits Market Size, By Geography, 2011–2018 ($Million)

Table 33 Sample Preparations RNA Isolation Kits Market Size, By Geography, 2011–2018 ($Million)

Table 34 Sample Preparations Nucleic Acid Isolation Kits Market Size, By Geography, 2011–2018 ($Million)

Table 35 Sample Preparations Protein Isolation Kits Market Size, By Geography, 2011–2018 ($Million)

Table 36 Sample Preparations Extration Kits Market Size, By Sample, 2011–2018 ($Million)

Table 37 Sample Preparations Extraction Kits Market Size, By Geography, 2011–2018 ($Million)

Table 38 Sample Preparations DNA Extraction Kits Market Size, By Geography, 2011–2018 ($Million)

Table 39 Sample Preparations RNA Extraction Kits Market Size, By Geography, 2011–2018 ($Million)

Table 40 Sample Preparations Nucleic Acid Extraction Kits Market Size, By Geography, 2011–2018 ($Million)

Table 41 Sample Preparations Protein Extraction Kits Market Size, By Geography, 2011–2018 ($Million)

Table 42 Sample Preparations For Other Kits Market Size, By Geography, 2011–2018 ($Million)

Table 43 Sample Preparation Market Size, By Application, 2011–2018 ($Million)

Table 44 Genomics Market Size, By Geography, 2011–2018 ($Million)

Table 45 Proteomics Market Size, By Geography, 2011–2018 ($Million)

Table 46 Epigenomics Market Size, By Geography, 2011–2018 ($Million)

Table 47 Other Applications Market Size, By Geography, 2011–2018 ($Million)

Table 48 Sample Preparation Market Size, By End User, 2011–2018 ($Million)

Table 49 Molecular Diagnostics Market Size, By Geography, 2011–2018 ($Million)

Table 50 Applied Testing Market Size, By Geography, 2011–2018 ($Million)

Table 51 Pharmaceutical & Biotechnology Market Size, By Geography, 2011–2018 ($Million)

Table 52 Academic Research Institutes Market Size, By Geography, 2011–2018 ($Million)

Table 53 Market Size, By Geography, 2011–2018 ($Million)

Table 54 North America: Sample Preparation Market Size, By Product, 2011–2018 ($Million)

Table 55 North America: Instruments Market Size, By Type, 2011–2018 ($Million)

Table 56 North America: Sample Preparations Liquid Handling Systems Market Size, By Type, 2011–2018 ($Million)

Table 57 North America: Sample Preparations Consumables Market Size, By Type, 2011–2018 ($Million)

Table 58 North America: Sample Preparations Kits Market Size, By Type, 2011–2018 ($Million)

Table 59 North America: Sample Preparations Extraction Kits Market Size, By Sample, 2011–2018 ($Million)

Table 60 North America: Sample Preparations Purification Kits Market Size, By Sample, 2011–2018 ($Million)

Table 61 North America: Sample Preparations Isolation Kits Market Size, By Sample, 2011–2018 ($Million)

Table 62 North America: Market Size, By Application, 2011–2018 ($Million)

Table 63 North America: Market Size, By End User, 2011–2018 ($Million)

Table 64 Europe: Sample Preparation Market Size, By Product, 2011–2018 ($Million)

Table 65 Europe: Sample Preparations Instruments Market Size, By Type, 2011–2018 ($Million)

Table 66 Europe: Sample Preparations Liquid Handling Systems Market Size, By Type, 2011–2018 ($Million)

Table 67 Europe: Sample Preparations Consumables Market Size, By Type, 2011–2018 ($Million)

Table 68 Europe: Sample Preparations Kits Market Size, By Type, 2011–2018 ($Million)

Table 69 Europe: Sample Preparations Extraction Kits Market Size, By Sample, 2011–2018 ($Million)

Table 70 Europe: Sample Preparations Purification Kits Market Size, By Sample, 2011–2018 ($Million)

Table 71 Europe: Sample Preparations Isolation Kits Market Size, By Sample, 2011–2018 ($Million)

Table 72 Europe: Market Size, By Application, 2011–2018 ($Million)

Table 73 Europe: Market Size, By End User, 2011–2018 ($Million)

Table 74 Asia: Sample Preparation Market Size, By Product, 2011–2018 ($Million)

Table 75 Asia: Sample Preparations Instruments Market Size, By Type, 2011–2018 ($Million)

Table 76 Asia: Sample Preparations Liquid Handling Systems Market Size, By Type, 2011–2018 ($Million)

Table 77 Asia: Sample Preparations Consumables Market Size, By Type, 2011–2018 ($Million)

Table 78 Asia: Sample Preparations Kits Market Size, By Type, 2011–2018 ($Million)

Table 79 Asia: Sample Preparations Extraction Kits Market Size, By Sample, 2011–2018 ($Million)

Table 80 Asia: Sample Preparations Purification Kits Market Size, By Sample, 2011–2018 ($Million)

Table 81 Asia: Sample Preparations Isolation Kits Market Size, By Sample, 2011–2018 ($Million)

Table 82 Asia: Market Size, By Application, 2011–2018 ($Million)

Table 83 Asia: Market Size, By End User, 2011–2018 ($Million)

Table 84 ROW: Sample Preparation Market Size, By Product, 2011–2018 ($Million)

Table 85 ROW: Sample Preparation sInstruments Market Size, By Type, 2011–2018 ($Million)

Table 86 ROW: Sample Preparations Liquid Handling Systems Market Size, By Type, 2011–2018 ($Million)

Table 87 ROW: Sample Preparation Consumables Market Size, By Type, 2011–2018 ($Million)

Table 88 ROW: Sample Preparation Kits Market Size, By Type, 2011–2018 ($Million)

Table 89 ROW: Sample Preparation Purification Kits Market Size, By Sample, 2011–2018 ($Million)

Table 90 ROW: Sample Preparation Extraction Kits Market Size, By Sample, 2011–2018 ($Million)

Table 91 ROW: Sample Preparation Isolation Kits Market Size, By Sample, 2011–2018 ($Million)

Table 92 ROW: Market Size, By Application, 2011–2018 ($Million)

Table 93 ROW: Market Size, By End User, 2011–2018 ($Million)

Table 94 New Product Launches, 2011–2014

Table 95 Agreements, Partnerships, & Collaborations, 2011–2014

Table 96 Expansions, 2011–2013

Table 97 Acquisitions, 2011–2014

Table 98 Other Strategies, 2011–2014

List of Figures (23 Figures)

Figure 1 Research Methodology

Figure 2 Sampling Frame: Primary Research

Figure 3 Sample Preparation Market Size Estimation Methodology

Figure 4 Market Sizing ($Value Analysis)

Figure 5 Competitive Assessment (Market Share/Strategies Assessment For Sample Preparation Instruments & Kits)

Figure 6 Market Forecasting Model

Figure 7 Data Triangulation Methodology

Figure 8 Sample Preparation Market, By Product, 2013–2018, ($Million)

Figure 9 Market, By Geography, 2013–2018 ($Million)

Figure 10 Sample Preparation Market Dynamics

Figure 11 Market Share Analysis, By Key Player, 2013

Figure 12 Sample Preparation Market Segmentation

Figure 13 Consumables Market Segmentation

Figure 14 Kits Market Segmentation

Figure 15 Market, By Application

Figure 16 Market, By End User

Figure 17 Geographic Split For Sample Preparation Market, By Product, 2013–2018 ($Million)

Figure 18 Key Growth Strategies of the Global Market, 2011–2014

Figure 19 Key Players Focusing on New Product Launches, 2011–2014

Figure 20 Key Players Focusing on Agreements, Partnerships, & Collaborations, 2011–2014

Figure 21 Key Players Focusing on Expansions, 2011–2014

Figure 22 Key Players Focusing on Acquisitions, 2011–2014

Figure 23 Key Players Focusing on Other Strategies, 2011–2014

Generating Response ...

Generating Response ...

Growth opportunities and latent adjacency in Sample Preparation Market