Bioburden Testing Market by Product (Consumables, Instrument (PCR, Microscope)), Test (Anerobic, Mold/Fungi, Aerobic, Spore), Application (Raw Material, Medical Devices, Sterility Testing), End User (Pharma, Biotechnology, CMO) - Global Forecast to 2023

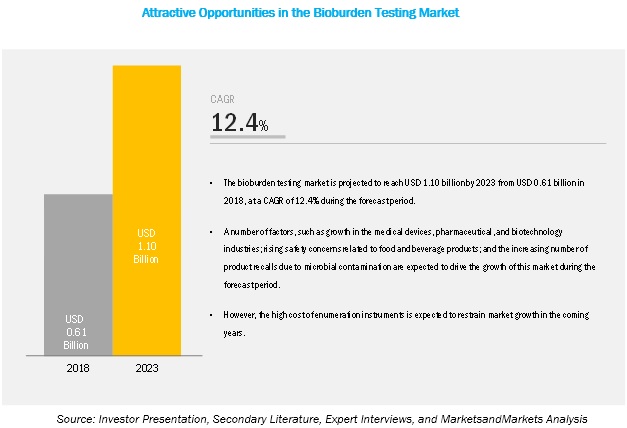

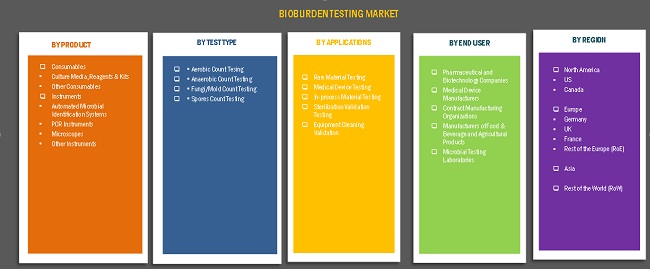

[129 Pages Report] MarketsandMarkets forecasts the bioburden testing market to grow from USD 1.10 billion by 2023 from USD 0.61 billion in 2018, at a Compound Annual Growth Rate (CAGR) of 12.4% during the forecast period. The market is witnessing growth due to factors such as growth in the medical devices, pharmaceutical, and biotechnology industries; rising safety concerns related to food and beverage products; and the increasing number of product recalls due to microbial contamination are expected to drive the growth of this market during the forecast period. However, the high cost of enumeration instruments is expected to restrain market growth in the coming years. The objective of the report is to define, describe, and forecast the hospital EMR systems market size based on product, test type, application, end user, and region.

Rising quality standards to ensure safety of finished products which is driving the growth of this segment

Based on the application, the bioburden testing market is segmented into raw materials testing, medical devices testing, in-process material testing, sterilization validation testing, and equipment cleaning validation. In 2018, the raw materials testing segment is expected to grow at the highest CAGR during the forecast period. Growth in this segment is likely to be driven by the rising quality standards to ensure safety of finished products.

Consumables segment is expected to account for the largest share of the bioburden testing market in 2018

Based on product, the bioburden testing market is segmented consumables and instruments. Consumables segment further segmented into culture media, reagents and kits, and other consumables. Instruments segment further categorised as automated microbial identification system, PCR, microscope, and other instruments. In 2018, the consumables segment is expected to account for the largest share of the bioburden testing market. The large share of this segment majorly attributed to the requirement of repeat purchase of kits and reagents, unlike instruments which are considered as a one-time investment.

CMOs segment to account for the largest share of the bioburden testing market in 2018

Based on end user, the bioburden testing market is segmented into pharmaceutical and biotechnology companies, medical device manufacturers, contract manufacturing organizations (CMOs), manufacturers of food & beverage and agricultural products, and microbial testing laboratories. In 2018, contract manufacturing organizations end user segment are expected to register the highest CAGR during the forecast period. The growth of the CMOs end-user segment can be attributed to the increasing outsourcing of manufacturing processes from pharmaceutical and biotechnology companies.

Raw materials testing segment is expected to grow at the highest CAGR in bioburden testing market in 2018.

Based on the application, the bioburden testing market is segmented into raw materials testing, medical devices testing, in-process material testing, sterilization validation testing, and equipment cleaning validation. In 2018, the raw materials testing segment is expected to grow at the highest CAGR during the forecast period. Growth in this segment is likely to be driven by the rising quality standards to ensure safety of finished products.

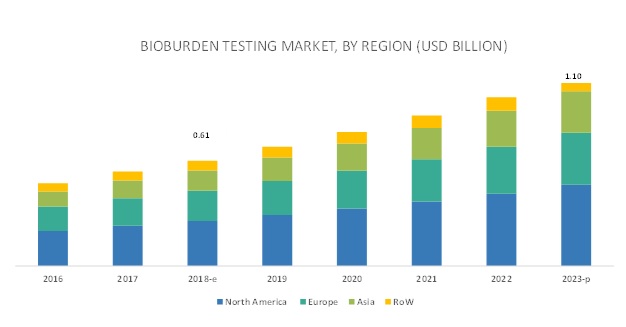

North America is expected to account for the largest market size during the forecast period

The market is dominated by North America, followed by Europe, Asia, and RoW. North America is expected to continue to dominate this market in the forecast period. The large size of the North American biotechnology industry will aid in the growth of the bioburden testing market in this region. However, Asia is expected to grow at the highest CAGR during the forecast period. Strong investments and rapid growth in the pharmaceutical and biotechnology industries will drive the growth of the bioburden testing market in this region.

Market Dynamics

Driver: Growth in the medical devices, pharmaceutical, and biotechnology industries

Bioburden testing is carried out at all levels of manufacturing in the medical devices, pharmaceutical, and biotechnology industries to minimize the risk of product contamination. Thus, growth in these industries is expected to support the growth of the bioburden testing market. According to estimates from the Sartorius forecast report 2016, the global pharmaceutical industry is expected to grow at a CAGR between 4% and 7% from 2016 to 2020. The pharmaceutical industries in emerging countries, including China, India, Brazil, and Russia, are expected to witness double-digit growth rates in the same period. Similarly, according to industry experts, the global medical devices market is estimated to grow at around 3% from 2018 to 2023). The growth in these major end-use industries is expected to boost manufacturing activities and thereby drive the growth of the bioburden testing market in the coming years.

Restraint: High cost of enumeration instruments

Some automated microbial enumeration instruments are equipped with major advanced features and functionalities and are thus priced at a premium. For instance, the price for a MALDI TOF-based system varies from USD 150,000 to USD 850,000. In addition, the consumables used for identification techniques are expensive, and there is an added labour cost. The cost of these instruments, media, and labour is very high for several end users. In addition, as pharmaceutical companies require many such systems, the capital required to procure multiple systems rises further.

The maintenance costs and several other indirect expenses result in an overall increase in the total cost of ownership of these instruments. On the other hand, conventional methods used for the enumeration of viable microorganisms are much cheaper than automated instruments. This is the major factor limiting the wider adoption of automated microbial identification systems, and in turn restraining the growth of the bioburden testing market.

Opportunities: Growth opportunities in emerging economies

Emerging countries such as India, China, Brazil, and Russia are expected to offer significant growth opportunities for market players. This can be attributed to the increasing spending power, rising healthcare awareness, and favourable regulatory policies and government initiatives in these countries.

China, for example, is the world’s second-largest investor in R&D, with an estimated spending of USD 429.5 billion in 2017 (Source: R&D Magazine 2017). Similarly, Brazil is a leader in terms of research and investments in industrial biotechnology, particularly in cellulosic sugars and agribusiness. In 2012, there were 89 biotechnology companies in Brazil focusing on the development of new medications (small molecules and biologicals), diagnostics, vaccines, cell therapies, regenerative medicine and tissue engineering, and genetic and molecular testing. In India, the government invested USD 5 billion to boost the biotechnology sector in the country and make it a USD 100-billion industry by 2025 (Source: Ministry of Commerce & Industry, Government of India, 2017). Considering these factors, emerging countries are expected to offer high-growth opportunities in the biologics safety testing market (and therefore the bioburden testing market). In addition, most players are expected to shift their focus to emerging countries, as the US and European markets become saturated.

Challenge: Shortage of skilled professionals

Bioburden testing has a major role to play in manufacturing and obtaining rapid results for these tests is important for manufacturers as it enables continuous manufacturing. However, the duration and accuracy of the results of bioburden testing can be affected if the personnel conducting these tests do not have the requisite skills. Also, though automated enumerations systems, PCR, flow cytometry, and high-content screening, offer more accurate results than conventional methods, they require skilled personnel for their efficient handling. Therefore, the dearth of skilled professionals is a major challenge for the growth of the bioburden testing market.

Scope of the Report

|

Report Metric |

Details |

|

Market size available for years |

2016–2023 |

|

Base year considered |

2017 |

|

Forecast period |

2018–2023 |

|

Forecast units |

Value (USD) |

|

Segments covered |

Product, Test Type, Application, End User, and Region |

|

Geographies covered |

North America (US, Canada), Asia, Europe (Germany, UK, France, RoE), and the Rest of the World |

|

Companies covered |

Charles River (US), Merck KGaA (Germany), SGS SA (Switzerland), WuXi AppTec (China), Becton, Dickinson, and Company (US), NAMSA (US), Nelson Laboratories, LLC (US), Thermo Fisher Scientific, Inc. (US), Biomérieux SA (France), and Pacific BioLlabs (US) |

Bioburden testing market, by product:

- Consumables

- Culture Media and Reagents & Kits

- Other Consumables

- Instruments

- Automated Microbial Identification Systems

- PCR

- Microscopes

- Other Instruments

Bioburden testing market, by test type:

- Aerobic Count Testing

- Anaerobic Count Testing

- Fungi/Mold Count Testing

- Spores Count Testing

Bioburden testing market, by application:

- Raw Material Testing

- Medical Devices Testing

- In-process Testing

- Sterilization Validation Testing

- Equipment Cleaning Validation

Bioburden testing market, by end user:

- Pharmaceutical and Biotechnology Companies

- Medical Device Manufacturers

- Contract Manufacturing Organizations (CMOs)

- Manufacturers of Food & Beverage and Agricultural Products

- Microbial Testing Laboratories

Bioburden testing market, by region:

- North America

- US

- Canada

- Europe

- Germany

- UK

- France

- RoE

- Asia

- RoW

Key players in bioburden testing market

The bioburden testing market is competitive in nature, with several big as well as emerging players. Prominent players in this market include Charles River (US), Merck KGaA (Germany), SGS SA (Switzerland), WuXi AppTec (China), Becton, Dickinson, and Company (US), NAMSA (US), Nelson Laboratories, LLC (US), Thermo Fisher Scientific, Inc. (US), Biomérieux SA (France), and Pacific BioLlabs (US)

Charles River Laboratories International, Inc. is one of the prominent players in the bioburden testing market. This position of the company is attributed to its robust portfolio that includes traditional as well as innovative technology platform that helps streamline bioburden testing. The company’s wide presence across the globe has also played a very important role in securing its position in the bioburden testing market. The company focuses on inorganic growth strategies such as acquisition to strengthen its position in the bioburden testing market. For instance, in April 2018, Charles River acquired MPI Research (US) a premier non-clinical CRO to increase its customer base. Through this strategy, the company is focusing on increasing its customer base. Moreover, it helps the company improve its endotoxin and microbial detection portfolio and expand its presence in the bioburden testing market.

Recent Developments

- In 2018, Charles River acquired MPI Research, is a premier non-clinical contract research organization (CRO). This acquisition enhanced Charles River’s ability to partner with clients across the drug discovery and development continuum.

- In 2016, Charles River acquired WIL Research, is a premier provider of safety assessment and contract development and manufacturing (CDMO) services. This acquisition strengthened the company’s position as a leading global early-stage CRO

- In 2016, SGS acquired Quality Compliance Laboratories to provide microbiological and analytical testing to the pharmaceutical, nutraceutical, and cosmeceutical industries

- In 2015, Merck KGaA acquired Sigma-Aldrich Corporation (US) to expand its life science research product portfolio

Key Questions addressed by the report

- Where will all these developments take the industry in the mid to long term?

- What types of annual and multi-year partnership are bioburden testing companies exploring?

- Which are the key players in the market and how intense is the competition?

- Which are the recent contracts and agreements key players have signed?

- What are the recent trends affecting bioburden product manufacturers and independent service organizations?

Available Customizations

With the given market data, MarketsandMarkets offers customizations as per the company‘s specific needs. The following customization options are available for this report.

Company Information

Detailed analysis and profiling of additional market players (up to 5)

To speak to our analyst for a discussion on the above findings, click Speak to Analyst

Table of Contents

1 Introduction (Page No. - 14)

1.1 Objectives of the Study

1.2 Market Definition

1.2.1 Markets Covered

1.2.2 Years Considered for the Study

1.3 Currency

1.4 Limitations

1.5 Market Stakeholders

2 Research Methodology (Page No. - 17)

2.1 Research Data

2.1.1 Secondary Data

2.1.1.1 Key Data From Secondary Sources

2.1.2 Primary Data

2.1.2.1 Key Data From Primary Sources

2.2 Market Size Estimation

2.3 Market Breakdown and Data Triangulation

2.4 Assumptions for the Study

3 Executive Summary (Page No. - 24)

4 Premium Insights (Page No. - 28)

4.1 Bioburden Testing Market: Market Overview

4.2 Bioburden Testing Market, By Product, 2018 vs 2023 (USD Million)

4.3 Bioburden Testing Market, By Application, 2018 vs 2023 (USD Million)

4.4 Bioburden Testing Market, By End User

4.5 Geographic Analysis: Bioburden Testing Market

4.6 Geographical Snapshot of the Bioburden Testing Market

5 Market Overview (Page No. - 33)

5.1 Introduction

5.2 Market Dynamics

5.2.1 Drivers

5.2.1.1 Growth in the Medical Devices, Pharmaceutical, and Biotechnology Industries

5.2.1.2 Rising Safety Concerns Related to Food and Beverage Products

5.2.1.3 Increasing Number of Product Recalls Due to Microbial Contamination

5.2.2 Restraints

5.2.2.1 High Cost of Enumeration Instruments

5.2.3 Opportunities

5.2.3.1 Growth Opportunities in Emerging Economies

5.2.4 Challenges

5.2.4.1 Shortage of Skilled Professionals

6 Bioburden Testing Market, By Product (Page No. - 36)

6.1 Introduction

6.2 Consumables

6.2.1 Culture Media, Reagents, and Kits

6.2.1.1 Culture Media, Reagents, and Kits to Witness the Highest Growth in the Bioburden Testing Consumables Market

6.2.2 Other Consumables

6.3 Instruments

6.3.1 Automated Microbial Identification Systems

6.3.1.1 Automated Microbial Identification Systems to Witness the Highest Growth, Primarily Due to the Ease of Use of These Systems and Their Ability to Produce Cost-Effective Results

6.3.2 Pcr Instruments

6.3.2.1 Pcr Instruments Find Applications in Molecular Biology, Recombinant Dna Technology, and Genotypic Identification

6.3.3 Microscopes

6.3.3.1 Low Cost of Microscopes has Resulted in Their Increased Adoption, Especially in Developing Countries

6.3.4 Other Instruments

7 Bioburden Testing Market, By Test Type (Page No. - 45)

7.1 Introduction

7.2 Aerobic Count Testing

7.2.1 These Tests Check for the Most Frequently Found Contaminants That Can Affect Finished Products

7.3 Anaerobic Count Testing

7.3.1 Need to Test for Anaerobic Microorganisms in Raw Materials and Canned Food Will Drive Market Growth

7.4 Fungi/Mold Count Testing

7.4.1 Used to Detect Bioburden Affecting Paint, Glass, Electrical Equipment

7.5 Spore Count Testing

7.5.1 Resistance to Sterilizers Makes It Important to Check for Spores

8 Bioburden Testing Market, By Application (Page No. - 51)

8.1 Introduction

8.2 Raw Material Testing

8.2.1 Raw Materials Can Be Major Contributors to the Bioburden Count of the Finished Product

8.3 Medical Device Testing

8.3.1 Favorable Regulations for Medical Device Manufacturing Have Sustained the Demand for Bioburden Testing

8.4 In-Process Material Testing

8.4.1 Recommendations for In-Control Material Testing for Bioburden Contribute to the Growth of the Market

8.5 Sterilization Validation Testing

8.5.1 Sterility Validation is Mandated for Biologics

8.6 Equipment Cleaning Validation

8.6.1 to Avoid Contamination From the Final Product, Manufacturing Equipment Must Be Cleaned Enough to Use

9 Bioburden Testing Market, By End User (Page No. - 58)

9.1 Introduction

9.2 Pharmaceutical & Biotechnology Companies

9.2.1 Growing Number of Drug Recalls Due to Microbial Contamination—Key Driver for This End-User Segment

9.3 Medical Device Manufacturers

9.3.1 Growth in the Medical Device Industry is Driving the Demand for Bioburden Testing Among Medical Device Manufacturers

9.4 Contract Manufacturing Organizations

9.4.1 Contract Manufacturing Organizations to Witness the Highest Growth in the Forecast Period

9.5 Manufacturers of Food & Beverage and Agricultural Products

9.5.1 Rising Concerns Related to the Safety of Food & Beverage Products is Driving the Growth of the Bioburden Testing Market

9.6 Microbial Testing Laboratories

9.6.1 Microbial Testing Laboratories are Equipped With Advanced Automated Tools to Carry Out Complex, Specialized, and Obscure Tests

10 Bioburden Testing Market, By Region (Page No. - 65)

10.1 Introduction

10.2 North America

10.2.1 US

10.2.1.1 Increasing Food Imports Into the US Will Contribute to Market Growth

10.2.2 Canada

10.2.2.1 R&D Activity is Increasing in Canada, Supported By Rising Expenditure

10.3 Europe

10.3.1 Germany

10.3.1.1 Strong Infrastructural Base and Increasing Public-Private Collaboration Will Favor Market Growth

10.3.2 UK

10.3.2.1 One-Third of the Uk’s Biotech Companies are Engaged in Drug R&D

10.3.3 France

10.3.3.1 High Consumption of Pharma Products has Drawn Attention to Generics, to Cut Costs

10.3.4 Rest of Europe

10.4 Asia

10.4.1 Growth of the Pharma Industry in China and India Will Drive Bioburden Testing Activity

10.5 Rest of the World

11 Competitive Landscape (Page No. - 98)

11.1 Overview

11.2 Market Ranking Analysis

11.3 Competitive Situation and Trends

11.3.1 Expansions

11.3.2 Acquisitions

11.3.3 Agreements, Partnerships, and Collaborations

11.3.4 Product Launches

12 Company Profiles (Page No. - 103)

12.1 Charles River

12.1.1 Business Overview

12.1.2 Services Offered

12.1.3 Recent Developments

12.1.4 MnM View

12.2 Merck KGaA

12.2.1 Business Overview

12.2.2 Products and Services

12.2.3 Recent Developments

12.2.4 MnM View

12.3 SGS SA

12.3.1 Business Overview

12.3.2 Services Offered

12.3.3 Recent Developments

12.3.4 MnM View

12.4 Wuxi Apptec

12.4.1 Business Overview

12.4.2 Services Offered

12.4.3 Recent Developments

12.4.4 MnM View

12.5 BD

12.5.1 Business Overview

12.5.2 Products/Services Offered

12.5.3 MnM View

12.6 North American Science Associates Inc. (NAMSA)

12.6.1 Business Overview

12.6.2 Services Offered

12.7 Nelson Laboratories, LLC

12.7.1 Business Overview

12.7.2 Services Offered

12.8 Thermo Fisher Scientific

12.8.1 Business Overview

12.8.2 Products Offered

12.8.3 Recent Developments

12.9 Biomérieux SA

12.9.1 Business Overview

12.9.2 Products Offered

12.9.3 Recent Developments

12.10 Pacific Biolabs

12.10.1 Business Overview

12.10.2 Services Offered

13 Appendix (Page No. - 122)

13.1 Insights From Industry Experts

13.2 Discussion Guide

13.3 Knowledge Store: Marketsandmarkets’ Subscription Portal

13.4 Available Customizations

13.5 Related Reports

13.6 Author Details

List of Tables (78 Tables)

Table 1 Product Recalls During 2017–2018

Table 2 Bioburden Testing Market, By Product, 2016–2023 (USD Million)

Table 3 Bioburden Testing Consumables Market, By Type, 2016–2023 (USD Million)

Table 4 Bioburden Testing Consumables Market, By Region, 2016–2023 (USD Million)

Table 5 Culture Media, Reagents, and Kits Market, By Region, 2016–2023 (USD Million)

Table 6 Other Consumables Market, By Region, 2016–2023 (USD Million)

Table 7 Bioburden Testing Instruments Market, By Type, 2016–2023 (USD Million)

Table 8 Bioburden Testing Instruments Market, By Region, 2016–2023 (USD Million)

Table 9 Automated Microbial Identification Systems Market, By Region, 2016–2023 (USD Million)

Table 10 Pcr Instruments Market, By Region, 2016–2023 (USD Million)

Table 11 Microscopes Market, By Region, 2016–2023 (USD Million)

Table 12 Other Instruments Market, By Region, 2016–2023 (USD Million)

Table 13 Bioburden Testing Market, By Test Type, 2016–2023 (USD Million)

Table 14 Aerobic Count Testing Market, By Region, 2016–2023 (USD Million)

Table 15 Anaerobic Count Testing Market, By Region, 2016–2023 (USD Million)

Table 16 Bioburden Testing Market for Fungi/Mold Count Testing, By Region, 2016–2023 (USD Million)

Table 17 Bioburden Testing Market for Spore Count Testing, By Region, 2016–2023 (USD Million)

Table 18 Bioburden Testing Market, By Application, 2016–2023 (USD Million)

Table 19 Bioburden Testing Market for Raw Material Testing, By Region, 2016–2023 (USD Million)

Table 20 Bioburden Testing Market for Medical Device Testing, By Region, 2016–2023 (USD Million)

Table 21 Bioburden Testing Market for In-Process Material Testing, By Region, 2016–2023 (USD Million)

Table 22 Bioburden Testing Market for Sterilization Validation Testing, By Region, 2016–2023 (USD Million)

Table 23 Bioburden Testing Market for Equipment Cleaning Validation, By Region, 2016–2023 (USD Million)

Table 24 Bioburden Testing Market, By End User, 2016–2023 (USD Million)

Table 25 Bioburden Testing Market for Pharmaceutical & Biotechnology Companies, By Region, 2016–2023 (USD Million)

Table 26 Bioburden Testing Market for Medical Device Manufacturers, By Region, 2016–2023 (USD Million)

Table 27 Bioburden Testing Market for Contract Manufacturing Organizations, By Region, 2016–2023 (USD Million)

Table 28 Bioburden Testing Market for Manufacturers of Food & Beverage and Agricultural Products, By Region, 2016–2023 (USD Million)

Table 29 Bioburden Testing Market for Microbial Testing Laboratories, By Region, 2016–2023 (USD Million)

Table 30 Bioburden Testing Market, By Region, 2016–2023 (USD Million)

Table 31 North America: Bioburden Testing Market, By Country, 2016–2023 (USD Million)

Table 32 North America: Bioburden Testing Market, By Product, 2016–2023 (USD Million)

Table 33 North America: Bioburden Testing Consumables Market, By Type, 2016–2023 (USD Million)

Table 34 North America: Bioburden Testing Instruments Market, By Type, 2016–2023 (USD Million)

Table 35 North America: Bioburden Testing Market, By Test Type, 2016–2023 (USD Million)

Table 36 North America: Bioburden Testing Market, By Application, 2016–2023 (USD Million)

Table 37 North America: Bioburden Testing Market, By End User, 2016–2023 (USD Million)

Table 38 US: Bioburden Testing Market, By Product, 2016–2023 (USD Million)

Table 39 US: Bioburden Testing Market, By Test Type, 2016–2023 (USD Million)

Table 40 US: Bioburden Testing Market, By Application, 2016–2023 (USD Million)

Table 41 US: Bioburden Testing Market, By End User, 2016–2023 (USD Million)

Table 42 Canada: Bioburden Testing Market, By Product, 2016–2023 (USD Million)

Table 43 Canada: Bioburden Testing Market, By Test Type, 2016–2023 (USD Million)

Table 44 Canada: Bioburden Testing Market, By Application, 2016–2023 (USD Million)

Table 45 Canada: Bioburden Testing Market, By End User, 2016–2023 (USD Million)

Table 46 Europe: Bioburden Testing Market, By Country, 2016–2023 (USD Million)

Table 47 Europe: Bioburden Testing Market, By Product, 2016–2023 (USD Million)

Table 48 Europe: Bioburden Testing Consumables Market, By Type, 2016–2023 (USD Million)

Table 49 Europe: Bioburden Testing Instruments Market, By Type, 2016–2023 (USD Million)

Table 50 Europe: Bioburden Testing Market, By Test Type, 2016–2023 (USD Million)

Table 51 Europe: Bioburden Testing Market, By Application, 2016–2023 (USD Million)

Table 52 Europe: Bioburden Testing Market, By End User, 2016–2023 (USD Million)

Table 53 Germany: Bioburden Testing Market, By Product, 2016–2023 (USD Million)

Table 54 Germany: Bioburden Testing Market, By Test Type, 2016–2023 (USD Million)

Table 55 Germany: Bioburden Testing Market, By Application, 2016–2023 (USD Million)

Table 56 Germany: Bioburden Testing Market, By End User, 2016–2023 (USD Million)

Table 57 UK: Bioburden Testing Market, By Product, 2016–2023 (USD Million)

Table 58 UK: Bioburden Testing Market, By Test Type, 2016–2023 (USD Million)

Table 59 UK: Bioburden Testing Market, By Application, 2016–2023 (USD Million)

Table 60 UK: Bioburden Testing Market, By End User, 2016–2023 (USD Million)

Table 61 France: Bioburden Testing Market, By Product, 2016–2023 (USD Million)

Table 62 France: Bioburden Testing Market, By Test Type, 2016–2023 (USD Million)

Table 63 France: Bioburden Testing Market, By Application, 2016–2023 (USD Million)

Table 64 France: Bioburden Testing Market, By End User, 2016–2023 (USD Million)

Table 65 RoE: Bioburden Testing Market, By Product, 2016–2023 (USD Million)

Table 66 RoE: Bioburden Testing Market, By Test Type, 2016–2023 (USD Million)

Table 67 RoE: Bioburden Testing Market, By Application, 2016–2023 (USD Million)

Table 68 RoE: Bioburden Testing Market, By End User, 2016–2023 (USD Million)

Table 69 Asia: Bioburden Testing Market, By Product, 2016–2023 (USD Million)

Table 70 Asia: Bioburden Testing Consumables Market, By Type, 2016–2023 (USD Million)

Table 71 Asia: Bioburden Testing Instruments Market, By Type, 2016–2023 (USD Million)

Table 72 Asia: Bioburden Testing Market, By Test Type, 2016–2023 (USD Million)

Table 73 Asia: Bioburden Testing Market, By Application, 2016–2023 (USD Million)

Table 74 Asia: Bioburden Testing Market, By End User, 2016–2023 (USD Million)

Table 75 RoW: Bioburden Testing Market, By Product, 2016–2023 (USD Million)

Table 76 RoW: Bioburden Testing Market, By Test Type, 2016–2023 (USD Million)

Table 77 RoW: Bioburden Testing Market, By Application, 2016–2023 (USD Million)

Table 78 RoW: Bioburden Testing Market, By End User, 2016–2023 (USD Million)

List of Figures (33 Figures)

Figure 1 Research Design

Figure 2 Market Size Estimation: Bottom-Up Approach

Figure 3 Market Size Estimation: Top-Down Approach

Figure 4 Breakdown of Primary Interviews: By Company Type, Designation, and Region

Figure 5 Data Triangulation Methodology

Figure 6 Bioburden Testing, By Product, 2018 vs 2023 (USD Million)

Figure 7 Bioburden Testing Market, By Test Type, 2018 vs 2023 (USD Million)

Figure 8 Bioburden Testing Market, By Application, 2018 vs 2023 (USD Million)

Figure 9 Bioburden Testing Market, By End User, 2018–2023 (USD Million)

Figure 10 Geographical Snapshot of the Bioburden Testing Market

Figure 11 Rising Safety Concerns Related to Food and Beverage Products —A Key Factor Driving Market Growth

Figure 12 Consumables to Dominate the Bioburden Testing Products Market Between 2018 & 2023

Figure 13 Raw Material Testing Segment to Dominate the Bioburden Testing Market During the Forecast Period

Figure 14 Contract Manufacturing Organizations to Register the Highest CAGR During 2018–2023

Figure 15 Aerobic Count Segment to Account for the Largest Market Share in 2018

Figure 16 Asia to Witness the Highest Growth During the Forecast Period (2018–2023)

Figure 17 Bioburden Testing Market: Drivers, Restraints, Opportunities, and Challenges

Figure 18 Consumables Segment to Dominate the Bioburden Testing Products Market During the Forecast Period

Figure 19 Aerobic Count Segment to Command Largest Share of the Market in 2018

Figure 20 Raw Materials Testing Segment to Command Largest Share of the Market in 2018

Figure 21 Pharmaceutical & Biotechnology Companies Segment to Dominate the Bioburden Testing Market During the Forecast Period

Figure 22 Asia to Witness Highest Growth During the Forecast Period (2018–2023)

Figure 23 North America: Market Snapshot

Figure 24 Europe: Market Snapshot

Figure 25 Key Developments in the Bioburden Testing Market From 2015 to 2018

Figure 26 Market Evolution Framework

Figure 27 Bioburden Testing Market Ranking, By Key Player, 2017

Figure 28 Charles River: Company Snapshot (2017)

Figure 29 Merck KGaA: Company Snapshot (2017

Figure 30 SGS SA: Company Snapshot (2017)

Figure 31 BD: Company Snapshots (2017)

Figure 32 Thermo Fisher Scientific, Inc.: Company Snapshots (2017)

Figure 33 Biomérieux SA: Company Snapshots (2017)

Generating Response ...

Generating Response ...

Growth opportunities and latent adjacency in Bioburden Testing Market