Digital Logistics Market by Solution (Asset Management, Warehouse Management, Data Management and Analytics, Security, Network Management), Service, Function (Warehouse Management, Transportation Management), Vertical, and Region - Global Forecast to 2025

The global Digital Logistics Market size is projected to reach USD 46.5 billion by 2025, at a CAGR of 21.7% during the forecast period.

Enterprises are willingly adopting digital logistics solutions for their day-to-day logistics and supply chain operations to better serve their customers. The digital logistics market is growing rapidly as a result of the increasing requirement for cost-effective logistics and supply chain solutions across various industry verticals. The increasing customer expectation, along with the measures to control the logistics cost, plays a vital role in shaping the future of the digital logistics market.

To know about the assumptions considered for the study, Request for Free Sample Report

The outbreak of the COVID-19 pandemic has hurt the consumer sector which contributes the most to economic growth. The retail, catering, and travel services are experiencing tremendous cash flow pressure due to declining sales and high fixed costs. The logistics and supply chain companies are under pressure due to higher emphasis of national government on the continued supply of essential commodities and healthcare products. Thus, the logistics chains are witnessing unusual and massive losses from the disruption caused by the COVID-19 pandemic. The shutdown of factories and scarcity of workforce to de-stuff cargo as well as drivers to operate trucks for cargo clearing has derailed the trade and smooth functioning of the logistics industry. Digitization of core business activities such as fleet monitoring, documentation, seamless networks of communication, the management of revenue, and building digital foundations by modernizing systems in the COVID times has helped logistics companies to shorter innovation cycles, agility and quick solution.

Among the deployment mode segment, the cloud segment to grow at the highest CAGR during the forecast period

Under the deployment mode segment, the cloud is expected to grow at a higher growth rate during the forecast period. Cloud-based solutions and applications are being leveraged by various organizations all over the globe. The major benefits offered by cloud services include flexibility, ability to scale their applications, and easy management capabilities. The adoption of cloud services among SMEs is due to aggressive competition and unavailability various resources that are present with large enterprises. Large enterprises, however, are also hypersensitive to the cost of these solutions, which is leading them to increase cloud-based software deployment. Digital logistics solutions are deployed in a customized form as per the business requirements, which leads to better customer’s satisfaction due to cloud based services. New functionalities are easily added or removed with an easy-to-implement code change. Logistics solutions on the cloud also enable better communication among back office and on field leading to efficient resource management.

Among the solutions, the data management and analytics segment is expected to dominate the market during the forecast period

Under the solutions segment, the data management and analytics solution is expected to hold a larger market size during the forecast period. Data management solution helps IoT devices to collect enormous amounts of data and draw insights out of raw data, which could help improve the industry’s efficiency. Hence, to extract insights from a bulk data, vendors offer data management solutions to manage structured and unstructured data. Data management performs operation in six steps, such as data identification, gathering, authentication, storage, analysis, and generating information for making decisions. This data could be transformed into crucial information and insights with the help of advanced IT solutions to yield greater efficiency, productivity, and profitability to organizations. A real-time IoT analytics solution influences remote management, monitoring, and gains insights from remote devices. It also helps detect anomalies in data and triggers error alerts.

To know about the assumptions considered for the study, download the pdf brochure

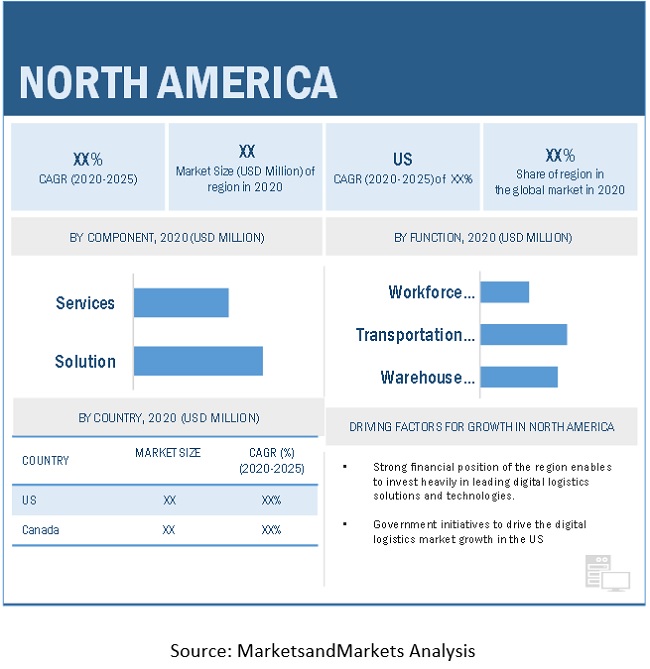

North America to account for the largest market size during the forecast period

North America constitutes of developed economies, such as the US and Canada. North America is one of the largest contributors to the digital logistics market. The market growth in this region is driven by the presence of large IT companies and rapid technological advancements, such as digitalization in the US and Canada. Well-established economies of these countries enable the region to invest heavily in leading digital logistics solutions and services. Commercial transportation and logistics is the backbone of the North American economy. The digital logistics market in North America is undergoing moderate growth due to drivers such as the regulatory developments—Compliance, Safety, and Accountability (CSA) and Hours of Service Solution (HOS) revisions attracting the growth for the market. Retail, utilities, and service sectors are the top three fastest growing verticals, contributing to the adoption of digital logistics solutions.

Market Dynamics

Driver: Exponential growth in the e-commerce industry

The exponential growth of the e-commerce industry over the past decade has been driven by the rise in online shopping and an increase in the number of Internet users. This rise in e-commerce activities requires logistics providers to operate faster and more efficiently to rapidly process small individual orders. Online customers expect order accuracy, same-day or same-hour delivery, and free returns. E-commerce companies are exploring ways to reduce order delivery times and operational costs. The e-commerce industry drives the demand for transparency, affordability, convenience, and speed in delivery as well as compelling frictionless returns. To cater to this need, it is essential to create new business models and solutions by digitalizing the logistics operations, automating material handling system, warehouse management system, and distribution management system. This has ensured faster and varied fulfillment services, especially in terms of last-mile delivery options and seamless returns processes.

Restraint: Lack of uniform governance standard in the fragmented logistics industry

One of the major restraints to the widespread adoption of digital logistics is the deficiency of governance. High levels of fragmentation within the logistics industry need the development of a logistics IoT standard. Transportation and logistics businesses around the globe are focused on maximizing the supply chain efficiency to sustain profitability and viability. There is a requirement of maintaining governance as standard as possible, as having one authority per field would lead to confusion. However, a high level of performance will result in end-to-end improvements in the connected devices as well as in integrated platforms. There are certain interoperability standards such as MTConnect, EtherCAT, and Master Control System-Distributed Control System (MCS-DCS) Interface Standardization that promote data interchange across heterogeneous domains and industries. A common standardization in the logistics and supply chain system would make it easy and convenient for every service provider to offer a majority of solutions in one package.

Opportunity: Self-driving vehicles to transform the logistics industry

Over the last few years, the importance of self-driving vehicles in the logistics industry has increased as it has gradually been adopted in carefully controlled environments such as warehouses and yard. However, deploying self-driving vehicles in shared and public spaces such as on highways and city streets can be the next big step for the industry, helping to optimize logistics operations and increase safety. The growing technological advancements in AI and increasing heavy investments in the development of sensors and vision technologies can help self-driving vehicles to transform the way vehicles are assembled, operated, utilized, and serviced.

Self-driving vehicles aim to transform logistics from trucks to last-mile robots by unlocking new levels of safety, efficiency, and quality. For instance, digital logistics providers can utilize various driverless technologies such as platooning and autonomous highway to support each driver’s health and safety. Self-driving vehicles can perform traditionally labor-intensive tasks, thereby improving indoor and outdoor logistics operations. Many companies are working on accelerating the acceptance of the fully driverless vehicle. For instance, Google and Tesla have made significant advances in driverless vehicle technologies. Tesla, a leading manufacturer of electric vehicles, is undertaking measures to introduce fully autonomous heavy-duty freight vehicles. Similarly, companies such as Amazon and UPS are investing in the development of flying drones to automate delivery processes.

Challenge: Slow adoption of digital logistics solution due to high capital investment

The digitalization of logistics operations requires high capital investments that involve the installation of automation equipment, software, and solutions, which incur heavy expenses. Replacement of existing processes is very costly. Another factor hindering the growth of the digital logistics market is the slow adoption due to integration complexities of multiple IoT platforms, numerous protocols, and a large number of APIs. The adoption of digital logistics solutions is not picking up pace, owing to the reluctance of organizations to shift from manual practices to the digitalized process involving high capital re-investment. Most enterprises have a laid-back attitude toward new digital technologies and use their intuition rather than adopting digital technologies to make informed business decisions. Thus, companies with limited financial resources are unable to opt for automation systems, thereby acting as a restraint to the growth of the digital logistics market.

Digital Logistics Companies

The report includes the study of key players offering digital logistics solutions and services. It profiles major vendors in the global digital logistics market. The major vendors include IBM (US), Oracle (US), SAP (Germany), AT&T (US), Intel (US), Infosys (India), Honeywell (US), Eurotech S.P.A (Italy), HCL Technologies (India), ORBCOMM (US), Cloud Logistics (US), Freightgate (US), Blue Yonder (US), Digilogistics (China), WebXpress (India), Ramco Systems (India), Logisuite (US), Impinj (US), Intersec (France), ICAT Logistics (US),Magaya (US), Softlink (India), Samsung SDS (South Korea), Hexaware (India), Tech Mahindra (India), and Advantech (Taiwan). These players have adopted various strategies to grow in the global digital logistics market.

The study includes an in-depth competitive analysis of these key players in the digital logistics market with their company profiles, recent developments, and key market strategies.

Scope of the Report

|

Report Metric |

Details |

|

Market size available for years |

2018-2025 |

|

Base year considered |

2019 |

|

Forecast period |

2020-2025 |

|

Forecast units |

Value (USD Billion) |

|

Segments covered |

Component (Solutions and Services), Deployment (Cloud and On-Premises), Organization Size (Large Enterprises and SMEs), Function, Vertical, and Region |

|

Regions covered |

North America, Europe, APAC, MEA, and Latin America |

|

List of Companies in Digital Logistics |

IBM (US), Oracle (US), SAP (Germany), AT&T (US), Intel (US), Infosys (India), Honeywell (US), Eurotech S.P.A (Italy), HCL Technologies (India), ORBCOMM (US), Cloud Logistics (US), Freightgate (US), Blue Yonder (US), Digilogistics (China), WebXpress (India), Ramco Systems (India), Logisuite (US), Impinj (US), Intersec (France), ICAT Logistics (US),Magaya (US), Softlink (India), Samsung SDS (South Korea), Hexaware (India), Tech Mahindra (India), and Advantech (Taiwan) |

This research report categorizes the digital logistics market to forecast revenue and analyze trends in each of the following submarkets:

Based on components

-

Solution

- Asset Management

- Warehouse Management

- Data Management and Analytics

- Security

- Network Management

-

Services

- Planning and Consulting Services

- Deployment and Integration Services

- Support and Maintenance

Based on function

- Warehouse Management

- Transportation Management

- Workforce Management

Based on organization size

- Large Enterprises

- SMEs

Based on deployment mode

- Cloud

- On-premises

Based on vertical

- Retail and eCommerce

- Manufacturing

- Pharmaceuticals and healthcare

- Aerospace and Defense

- Automotive

- Energy and Utilities

- Others (includes IT, telecom and chemicals)

Based on regions

-

North America

- United States (US)

-

Europe

- United Kingdom (UK)

- Germany

-

APAC

- China

- Japan

- MEA

- Latin America

Recent Developments:

- In July 2020, ORBCOMM Inc, a global provider of Internet of Things (IoT) solutions, introduced its next-generation analytics and reporting platform, offering enhanced features, including advanced data insights and a dynamic user interface, thereby providing customers with a single, unified view of all their transportation asset types using a single sign-on.

- In June 2020, IBM launched the IBM Sterling Inventory Control Tower to help companies manage inventory and build resilient supply chains more effectively. IBM Sterling Inventory Control Tower is enabled with AI to help organizations see, predict, and more effectively act on inventory to better predict disruptions, improve resiliency, manage exceptions, and respond to unplanned events.

- In May 2020, Intel partnered with Smart Navigation Systems to provide Intel Connected Logistic Platform to help them develop smart solutions for multiple sectors and use cases, such as warehouse management, freight management, and logistics and supply chain management.

- In January 2020, Infosys partnered with GEFCO, a world leader in multimodal supply chain solutions and the European leader in automotive logistics, to support its digital transformation journey.

- In May 2019, Oracle announced logistics management updates to Oracle Supply Chain Management (SCM) Cloud. The updates included a new logistics network modeling product and enhanced transportation management and global trade management capabilities to help customers drive better business outcomes by enhancing supply chain responsiveness, optimizing shipments and asset utilization, and improving productivity across global supply chains.

Frequently Asked Questions (FAQ):

How big is the Digital Logistics Market?

What is growth rate of the Digital Logistics market?

What are the challenges in the global Digital Logistics market?

Who are the key players in Digital Logistics market?

Who will be the leading hub for Digital Logistics market?

Who published the popular research report about Digital Logistics Market?

To speak to our analyst for a discussion on the above findings, click Speak to Analyst

TABLE OF CONTENTS

1 INTRODUCTION (Page No. - 25)

1.1 INTRODUCTION TO COVID-19

1.2 COVID-19 HEALTH ASSESSMENT

FIGURE 1 COVID-19: THE GLOBAL PROPAGATION

FIGURE 2 COVID-19 PROPAGATION: SELECT COUNTRIES

1.3 COVID-19 ECONOMIC ASSESSMENT

FIGURE 3 REVISED GROSS DOMESTIC PRODUCT FORECASTS FOR SELECT G20 COUNTRIES IN 2020

1.3.1 COVID-19 ECONOMIC IMPACT—SCENARIO ASSESSMENT

FIGURE 4 CRITERIA IMPACTING THE GLOBAL ECONOMY

FIGURE 5 SCENARIOS IN TERMS OF RECOVERY OF THE GLOBAL ECONOMY

1.4 OBJECTIVES OF THE STUDY

1.5 MARKET DEFINITION

1.5.1 INCLUSIONS AND EXCLUSIONS

1.6 MARKET SCOPE

1.6.1 MARKET SEGMENTATION

1.6.2 REGIONS COVERED

1.6.3 YEARS CONSIDERED FOR THE STUDY

1.7 CURRENCY

TABLE 1 UNITED STATES DOLLAR EXCHANGE RATE, 2017–2019

1.8 STAKEHOLDERS

1.9 SUMMARY OF CHANGES

2 RESEARCH METHODOLOGY (Page No. - 34)

2.1 RESEARCH DATA

FIGURE 6 DIGITAL LOGISTICS MARKET: RESEARCH DESIGN

2.1.1 SECONDARY DATA

2.1.2 PRIMARY DATA

2.1.2.1 Breakup of primaries

2.1.2.2 Key industry insights

2.2 MARKET BREAKUP AND DATA TRIANGULATION

FIGURE 7 DATA TRIANGULATION

2.3 MARKET SIZE ESTIMATION

FIGURE 8 MARKET SIZE ESTIMATION METHODOLOGY: APPROACH 1 (SUPPLY SIDE): REVENUE OF PLATFORMS AND SERVICES OF THE MARKET

FIGURE 9 MARKET SIZE ESTIMATION METHODOLOGY- APPROACH 2 (DEMAND SIDE): DIGITAL LOGISTICS MARKET

2.4 MARKET FORECAST

TABLE 2 FACTOR ANALYSIS

2.5 RESEARCH ASSUMPTIONS AND LIMITATIONS

2.5.1 STUDY ASSUMPTIONS

2.5.2 LIMITATIONS OF THE STUDY

3 EXECUTIVE SUMMARY (Page No. - 43)

FIGURE 10 SOLUTIONS SEGMENT TO HOLD A HIGHER MARKET SHARE IN 2020

FIGURE 11 CLOUD DEPLOYMENT MODE TO ACCOUNT FOR A HIGHER MARKET SHARE IN 2020

FIGURE 12 ASIA PACIFIC TO GROW AT HIGHEST CAGR DURING THE FORECAST PERIOD

4 PREMIUM INSIGHTS (Page No. - 46)

4.1 ATTRACTIVE OPPORTUNITIES IN THE DIGITAL LOGISTICS MARKET

FIGURE 13 EXPONENTIAL GROWTH IN THE ECOMMERCE INDUSTRY TO DRIVE MARKET GROWTH

4.2 MARKET IN ASIA PACIFIC, BY COMPONENT AND COUNTRY

FIGURE 14 SOLUTIONS SEGMENT AND CHINA TO ACCOUNT FOR HIGH MARKET SHARES IN ASIA PACIFIC IN 2020

4.3 MARKET: MAJOR COUNTRIES

FIGURE 15 JAPAN TO GROW AT THE HIGHEST CAGR DURING THE FORECAST PERIOD

5 MARKET OVERVIEW AND MARKET TRENDS (Page No. - 48)

5.1 INTRODUCTION

FIGURE 16 DIGITAL LOGISTICS MARKET: DRIVERS, RESTRAINTS, OPPORTUNITIES, AND CHALLENGES

5.1.1 DRIVERS

5.1.1.1 Digital transformation in the logistics industry

FIGURE 17 IMPACT OF DIGITAL TRANSFORMATION ACROSS INDUSTRIES, CUMULATIVE VALUE, 2016-2025 (USD BILLION)

5.1.1.2 Increasing volume and velocity of data in the logistics industry

5.1.1.3 Exponential growth in the eCommerce industry

5.1.2 RESTRAINTS

5.1.2.1 Growing concerns for data security

5.1.2.2 Lack of uniform governance standard in the fragmented logistics industry

5.1.3 OPPORTUNITIES

5.1.3.1 Self-driving vehicles to transform the logistics industry

5.1.3.2 Increasing the adoption of cloud-based technology

5.1.3.3 Increasing adoption of industry 4.0

5.1.4 CHALLENGES

5.1.4.1 Training and upskilling required to prepare existing logistics workers for changing tasks

5.1.4.2 Slow adoption of digital logistics solution due to high capital investment

5.2 CASE STUDY ANALYSIS

TABLE 3 USE CASE 1: ORACLE

TABLE 4 USE CASE 2: INFOSYS

TABLE 5 USE CASE 3: AT&T

TABLE 6 USE CASE 4: INTEL

TABLE 7 USE CASE 5: RAMCO

5.3 DISRUPTIVE TECHNOLOGIES

5.3.1 ARTIFICIAL INTELLIGENCE

5.3.2 BIG DATA AND ANALYTICS

5.3.3 AUGMENTED REALITY

5.3.4 GPS

5.4 VALUE CHAIN ANALYSIS

FIGURE 18 DIGITAL LOGISTICS MARKET: ARCHITECTURE

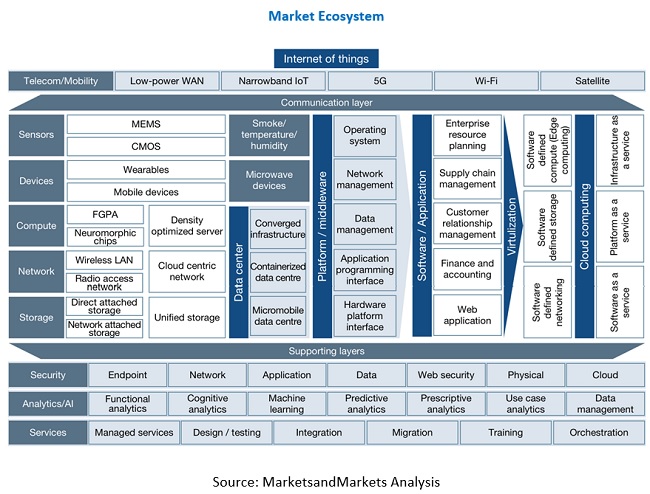

5.5 ECOSYSTEM

FIGURE 19 MARKET: ECOSYSTEM

5.6 AVERAGE SELLING PRICE TREND

TABLE 8 PRICING ANALYSIS

5.7 COVID-19 MARKET OUTLOOK FOR DIGITAL LOGISTICS

TABLE 9 MARKET: ANALYSIS OF DRIVERS AND OPPORTUNITIES IN THE COVID-19 ERA

TABLE 10 MARKET: ANALYSIS OF CHALLENGES AND RESTRAINTS IN THE COVID-19 ERA

5.7.1 CUMULATIVE GROWTH ANALYSIS

TABLE 11 MARKET: CUMULATIVE GROWTH ANALYSIS

6 DIGITAL LOGISTICS MARKET, BY COMPONENT (Page No. - 63)

6.1 INTRODUCTION

FIGURE 20 SERVICES SEGMENT TO GROW AT A HIGHER CAGR DURING THE FORECAST PERIOD

TABLE 12 MARKET SIZE, BY COMPONENT, 2016–2019 (USD MILLION)

TABLE 13 MARKET SIZE, BY COMPONENT, 2019–2025 (USD MILLION)

7 DIGITAL LOGISTICS MARKET ANALYSIS, BY SOLUTION (Page No. - 65)

7.1 SOLUTIONS

7.1.1 SOLUTIONS: MARKET DRIVERS

7.1.2 SOLUTIONS: COVID-19 IMPACT

FIGURE 21 SECURITY SEGMENT TO GROW AT THE HIGHEST CAGR DURING THE FORECAST PERIOD

TABLE 14 MARKET SIZE, BY SOLUTION, 2016–2019 (USD MILLION)

TABLE 15 MARKET SIZE, BY SOLUTION, 2019–2025 (USD MILLION)

TABLE 16 SOLUTIONS: MARKET SIZE, BY REGION, 2016–2019 (USD MILLION)

TABLE 17 SOLUTIONS: MARKET SIZE, BY REGION, 2019–2025 (USD MILLION)

7.2 ASSET MANAGEMENT

TABLE 18 ASSET MANAGEMENT: MARKET SIZE, BY REGION, 2016–2019 (USD MILLION)

TABLE 19 ASSET MANAGEMENT: MARKET SIZE, BY REGION, 2019–2025 (USD MILLION)

7.2.1 ASSET TRACKING AND MANAGEMENT

7.2.2 PREDICTIVE ASSET MAINTENANCE AND MONITORING

7.3 WAREHOUSE MANAGEMENT

TABLE 20 WAREHOUSE MANAGEMENT: DIGITAL LOGISTICS MARKET SIZE, BY REGION, 2016–2019 (USD MILLION)

TABLE 21 WAREHOUSE MANAGEMENT: MARKET SIZE, BY REGION, 2019–2025 (USD MILLION)

7.4 DATA MANAGEMENT AND ANALYTICS

TABLE 22 DATA MANAGEMENT AND ANALYTICS: MARKET SIZE, BY REGION, 2016–2019 (USD MILLION)

TABLE 23 DATA MANAGEMENT AND ANALYTICS: MARKET SIZE, BY REGION, 2019–2025 (USD MILLION)

7.5 SECURITY

TABLE 24 SECURITY: MARKET SIZE, BY REGION, 2016–2019 (USD MILLION)

TABLE 25 SECURITY: MARKET SIZE, BY REGION, 2019–2025 (USD MILLION)

7.6 NETWORK MANAGEMENT

TABLE 26 NETWORK MANAGEMENT: MARKET SIZE, BY REGION, 2016–2019 (USD MILLION)

TABLE 27 NETWORK MANAGEMENT: MARKET SIZE, BY REGION, 2019–2025 (USD MILLION)

8 DIGITAL LOGISTICS MARKET, BY SERVICE (Page No. - 75)

8.1 SERVICES

8.1.1 SERVICES: MARKET DRIVERS

8.1.2 SERVICES: COVID-19 IMPACT

FIGURE 22 PLANNING AND CONSULTING SERVICES SEGMENT TO GROW AT THE HIGHEST CAGR DURING THE FORECAST PERIOD

TABLE 28 MARKET SIZE, BY SERVICE, 2016–2019 (USD MILLION)

TABLE 29 MARKET SIZE, BY SERVICE, 2019–2025 (USD MILLION)

TABLE 30 SERVICES: MARKET SIZE, BY REGION, 2016–2019 (USD MILLION)

TABLE 31 SERVICES: MARKET SIZE, BY REGION, 2019–2025 (USD MILLION)

8.2 PLANNING AND CONSULTING

TABLE 32 PLANNING AND CONSULTING: MARKET SIZE, BY REGION, 2016–2019 (USD MILLION)

TABLE 33 PLANNING AND CONSULTING: DIGITAL LOGISTICS MARKET SIZE, BY REGION, 2019–2025 (USD MILLION)

8.3 DEPLOYMENT AND INTEGRATION

TABLE 34 DEPLOYMENT AND INTEGRATION: MARKET SIZE, BY REGION, 2016–2019 (USD MILLION)

TABLE 35 DEPLOYMENT AND INTEGRATION: MARKET SIZE, BY REGION, 2019–2025 (USD MILLION)

8.4 SUPPORT AND MAINTENANCE

TABLE 36 SUPPORT AND MAINTENANCE: MARKET SIZE, BY REGION, 2016–2019 (USD MILLION)

TABLE 37 SUPPORT AND MAINTENANCE: MARKET SIZE, BY REGION, 2019–2025 (USD MILLION)

9 DIGITAL LOGISTICS MARKET ANALYSIS, BY FUNCTION (Page No. - 82)

9.1 INTRODUCTION

9.1.1 FUNCTION: COVID-19 IMPACT

9.1.2 FUNCTION: MARKET DRIVERS

FIGURE 23 WORKFORCE MANAGEMENT SEGMENT TO GROW AT THE HIGHEST CAGR DURING THE FORECAST PERIOD

TABLE 38 MARKET SIZE, BY FUNCTION, 2016–2019 (USD MILLION)

TABLE 39 MARKET SIZE, BY FUNCTION, 2019–2025 (USD MILLION)

9.2 WAREHOUSE MANAGEMENT

TABLE 40 WAREHOUSE MANAGEMENT FUNCTION: MARKET SIZE, BY REGION, 2016–2019 (USD MILLION)

TABLE 41 WAREHOUSE MANAGEMENT FUNCTION: MARKET SIZE, BY REGION, 2019–2025 (USD MILLION)

9.3 TRANSPORTATION MANAGEMENT

TABLE 42 TRANSPORTATION MANAGEMENT: MARKET SIZE, BY REGION, 2016–2019 (USD MILLION)

TABLE 43 TRANSPORTATION MANAGEMENT: MARKET SIZE, BY REGION, 2019–2025 (USD MILLION)

9.4 WORKFORCE MANAGEMENT

TABLE 44 WORKFORCE MANAGEMENT: MARKET SIZE, BY REGION, 2016–2019 (USD MILLION)

TABLE 45 WORKFORCE MANAGEMENT: MARKET SIZE, BY REGION, 2019–2025 (USD MILLION)

10 DIGITAL LOGISTICS MARKET, BY DEPLOYMENT MODE (Page No. - 88)

10.1 INTRODUCTION

10.1.1 DEPLOYMENT MODE: COVID-19 IMPACT

10.1.2 DEPLOYMENT MODE: MARKET DRIVERS

FIGURE 24 CLOUD SEGMENT TO GROW AT A HIGHER CAGR DURING THE FORECAST PERIOD

TABLE 46 MARKET SIZE, BY DEPLOYMENT MODE, 2016–2019 (USD MILLION)

TABLE 47 MARKET SIZE, BY DEPLOYMENT MODE, 2019–2025 (USD MILLION)

10.2 CLOUD

TABLE 48 CLOUD: MARKET SIZE, BY REGION, 2016–2019 (USD MILLION)

TABLE 49 CLOUD: MARKET SIZE, BY REGION, 2019–2025 (USD MILLION)

10.3 ON-PREMISES

TABLE 50 ON-PREMISES: MARKET SIZE, BY REGION, 2016–2019 (USD MILLION)

TABLE 51 ON-PREMISES: MARKET SIZE, BY REGION, 2019–2025 (USD MILLION)

11 DIGITAL LOGISTICS MARKET, BY ORGANIZATION SIZE (Page No. - 93)

11.1 INTRODUCTION

11.1.1 ORGANIZATION SIZE: COVID-19 IMPACT

11.1.2 ORGANIZATION SIZE: MARKET DRIVERS

FIGURE 25 SMES SEGMENT TO GROW AT A HIGHER CAGR DURING THE FORECAST PERIOD

TABLE 52 MARKET SIZE, BY ORGANIZATION SIZE, 2016–2019 (USD MILLION)

TABLE 53 MARKET SIZE, BY ORGANIZATION SIZE, 2019–2025 (USD MILLION)

11.2 LARGE ENTERPRISES

TABLE 54 LARGE ENTERPRISES: MARKET SIZE, BY REGION, 2016–2019 (USD MILLION)

TABLE 55 LARGE ENTERPRISES: MARKET SIZE, BY REGION, 2019–2025 (USD MILLION)

11.3 SMALL AND MEDIUM-SIZED ENTERPRISES

TABLE 56 SMALL AND MEDIUM-SIZED ENTERPRISES: MARKET SIZE, BY REGION, 2016–2019 (USD MILLION)

TABLE 57 SMALL AND MEDIUM-SIZED ENTERPRISES: MARKET SIZE, BY REGION, 2019–2025 (USD MILLION)

12 DIGITAL LOGISTICS MARKET, BY VERTICAL (Page No. - 98)

12.1 INTRODUCTION

FIGURE 26 PHARMACEUTICALS AND HEALTHCARE VERTICAL TO GROW AT THE HIGHEST CAGR DURING THE FORECAST PERIOD

TABLE 58 MARKET SIZE, BY VERTICAL, 2016–2019 (USD MILLION)

TABLE 59 MARKET SIZE, BY VERTICAL, 2019–2025 (USD MILLION)

12.2 RETAIL AND ECOMMERCE

12.2.1 RETAIL AND ECOMMERCE: COVID-19 IMPACT

12.2.2 RETAIL AND ECOMMERCE: MARKET DRIVERS

TABLE 60 RETAIL AND ECOMMERCE: MARKET SIZE, BY REGION, 2016–2019 (USD MILLION)

TABLE 61 RETAIL AND ECOMMERCE: MARKET SIZE, BY REGION, 2019–2025 (USD MILLION)

12.3 MANUFACTURING

12.3.1 MANUFACTURING: COVID-19 IMPACT

12.3.2 MANUFACTURING: DIGITAL LOGISTICS MARKET DRIVERS

TABLE 62 MANUFACTURING: MARKET SIZE, BY REGION, 2016–2019 (USD MILLION)

TABLE 63 MANUFACTURING: MARKET SIZE, BY REGION, 2019–2025 (USD MILLION)

12.4 PHARMACEUTICALS AND HEALTHCARE

12.4.1 PHARMACEUTICALS AND HEALTHCARE: COVID-19 IMPACT

12.4.2 PHARMACEUTICALS AND HEALTHCARE: MARKET DRIVERS

TABLE 64 PHARMACEUTICALS AND HEALTHCARE: MARKET SIZE, BY REGION, 2016–2019 (USD MILLION)

TABLE 65 PHARMACEUTICALS AND HEALTHCARE: MARKET SIZE, BY REGION, 2019–2025 (USD MILLION)

12.5 ENERGY AND UTILITIES

12.5.1 ENERGY AND UTILITIES: COVID-19 IMPACT

12.5.2 ENERGY AND UTILITIES: MARKET DRIVERS

TABLE 66 ENERGY AND UTILITIES: MARKET SIZE, BY REGION, 2016–2019 (USD MILLION)

TABLE 67 ENERGY AND UTILITIES: MARKET SIZE, BY REGION, 2019–2025 (USD MILLION)

12.6 AEROSPACE AND DEFENSE

12.6.1 AEROSPACE AND DEFENSE: COVID-19 IMPACT

12.6.2 AEROSPACE AND DEFENSE: MARKET DRIVERS

TABLE 68 AEROSPACE AND DEFENSE: MARKET SIZE, BY REGION, 2016–2019 (USD MILLION)

TABLE 69 AEROSPACE AND DEFENSE: MARKET SIZE, BY REGION, 2019–2025 (USD MILLION)

12.7 AUTOMOTIVE

12.7.1 AUTOMOTIVE: COVID-19 IMPACT

12.7.2 AUTOMOTIVE: DIGITAL LOGISTICS MARKET DRIVERS

TABLE 70 AUTOMOTIVE: MARKET SIZE, BY REGION, 2016–2019 (USD MILLION)

TABLE 71 AUTOMOTIVE: MARKET SIZE, BY REGION, 2019–2025 (USD MILLION)

12.8 OTHER VERTICALS

TABLE 72 OTHER VERTICALS: MARKET SIZE, BY REGION, 2016–2019 (USD MILLION)

TABLE 73 OTHER VERTICALS: MARKET SIZE, BY REGION, 2019–2025 (USD MILLION)

13 DIGITAL LOGISTICS MARKET, BY REGION (Page No. - 112)

13.1 INTRODUCTION

FIGURE 27 ASIA PACIFIC TO GROW AT THE HIGHEST CAGR DURING THE FORECAST PERIOD

TABLE 74 MARKET SIZE, BY REGION, 2016–2019 (USD MILLION)

TABLE 75 MARKET SIZE, BY REGION, 2019–2025 (USD MILLION)

13.2 NORTH AMERICA

13.2.1 NORTH AMERICA: COVID-19 IMPACT ON DIGITAL LOGISTICS

13.2.2 NORTH AMERICA: DIGITAL LOGISTICS MARKET REGULATORY IMPLICATIONS

FIGURE 28 NORTH AMERICA: MARKET SNAPSHOT

TABLE 76 NORTH AMERICA: MARKET SIZE, BY COMPONENT, 2016–2019 (USD MILLION)

TABLE 77 NORTH AMERICA: MARKET SIZE, BY COMPONENT, 2019–2025 (USD MILLION)

TABLE 78 NORTH AMERICA: MARKET SIZE, BY SOLUTION, 2016–2019 (USD MILLION)

TABLE 79 NORTH AMERICA: MARKET SIZE, BY SOLUTION, 2019–2025 (USD MILLION)

TABLE 80 NORTH AMERICA: MARKET SIZE, BY SERVICE, 2016–2019 (USD MILLION)

TABLE 81 NORTH AMERICA: MARKET SIZE, BY SERVICE, 2019–2025 (USD MILLION)

TABLE 82 NORTH AMERICA: MARKET SIZE, BY FUNCTION, 2016–2019 (USD MILLION)

TABLE 83 NORTH AMERICA: MARKET SIZE, BY FUNCTION, 2019–2025 (USD MILLION)

TABLE 84 NORTH AMERICA: MARKET SIZE, BY DEPLOYMENT MODE, 2016–2019 (USD MILLION)

TABLE 85 NORTH AMERICA: MARKET SIZE, BY DEPLOYMENT MODE, 2019–2025 (USD MILLION)

TABLE 86 NORTH AMERICA: MARKET SIZE, BY ORGANIZATION SIZE, 2016–2019 (USD MILLION)

TABLE 87 NORTH AMERICA: MARKET SIZE, BY ORGANIZATION SIZE, 2019–2025 (USD MILLION)

TABLE 88 NORTH AMERICA: MARKET SIZE, BY VERTICAL, 2016–2019 (USD MILLION)

TABLE 89 NORTH AMERICA: MARKET SIZE, BY VERTICAL, 2019–2025 (USD MILLION)

TABLE 90 NORTH AMERICA: MARKET SIZE, BY COUNTRY, 2016–2019 (USD MILLION)

TABLE 91 NORTH AMERICA: MARKET SIZE, BY COUNTRY, 2019–2025 (USD MILLION)

13.2.3 UNITED STATES

13.2.3.1 United States: market drivers

TABLE 92 UNITED STATES: DIGITAL LOGISTICS MARKET SIZE, BY COMPONENT, 2016–2019 (USD MILLION)

TABLE 93 UNITED STATES: MARKET SIZE, BY COMPONENT, 2019–2025 (USD MILLION)

TABLE 94 UNITED STATES: MARKET SIZE, BY SOLUTION, 2016–2019 (USD MILLION)

TABLE 95 UNITED STATES: MARKET SIZE, BY SOLUTION, 2019–2025 (USD MILLION)

TABLE 96 UNITED STATES: MARKET SIZE, BY SERVICE, 2016–2019 (USD MILLION)

TABLE 97 UNITED STATES: MARKET SIZE, BY SERVICE, 2019–2025 (USD MILLION)

TABLE 98 UNITED STATES: MARKET SIZE, BY FUNCTION, 2016–2019 (USD MILLION)

TABLE 99 UNITED STATES: MARKET SIZE, BY FUNCTION, 2019–2025 (USD MILLION)

TABLE 100 UNITED STATES: MARKET SIZE, BY DEPLOYMENT MODE, 2016–2019 (USD MILLION)

TABLE 101 UNITED STATES: MARKET SIZE, BY DEPLOYMENT MODE, 2019–2025 (USD MILLION)

TABLE 102 UNITED STATES: MARKET SIZE, BY ORGANIZATION SIZE, 2016–2019 (USD MILLION)

TABLE 103 UNITED STATES: MARKET SIZE, BY ORGANIZATION SIZE, 2019–2025 (USD MILLION)

13.3 EUROPE

13.3.1 EUROPE: COVID-19 IMPLICATIONS ON DIGITAL LOGISTICS

13.3.2 EUROPE: DIGITAL LOGISTICS MARKET REGULATORY IMPLICATIONS

TABLE 104 EUROPE: MARKET SIZE, BY COMPONENT, 2016–2019 (USD MILLION)

TABLE 105 EUROPE: MARKET SIZE, BY COMPONENT, 2019–2025 (USD MILLION)

TABLE 106 EUROPE: MARKET SIZE, BY SOLUTION, 2016–2019 (USD MILLION)

TABLE 107 EUROPE: MARKET SIZE, BY SOLUTION, 2019–2025 (USD MILLION)

TABLE 108 EUROPE: MARKET SIZE, BY SERVICE, 2016–2019 (USD MILLION)

TABLE 109 EUROPE: MARKET SIZE, BY SERVICE, 2019–2025 (USD MILLION)

TABLE 110 EUROPE: MARKET SIZE, BY FUNCTION, 2016–2019 (USD MILLION)

TABLE 111 EUROPE: MARKET SIZE, BY FUNCTION, 2019–2025 (USD MILLION)

TABLE 112 EUROPE: MARKET SIZE, BY DEPLOYMENT MODE, 2016–2019 (USD MILLION)

TABLE 113 EUROPE: MARKET SIZE, BY DEPLOYMENT MODE, 2019–2025 (USD MILLION)

TABLE 114 EUROPE: MARKET SIZE, BY ORGANIZATION SIZE, 2016–2019 (USD MILLION)

TABLE 115 EUROPE: MARKET SIZE, BY ORGANIZATION SIZE, 2019–2025 (USD MILLION)

TABLE 116 EUROPE: MARKET SIZE, BY VERTICAL, 2016–2019 (USD MILLION)

TABLE 117 EUROPE: MARKET SIZE, BY VERTICAL, 2019–2025 (USD MILLION)

TABLE 118 EUROPE: MARKET SIZE, BY COUNTRY, 2016–2019 (USD MILLION)

TABLE 119 EUROPE: MARKET SIZE, BY COUNTRY, 2019–2025 (USD MILLION)

13.3.3 UNITED KINGDOM

13.3.3.1 United Kingdom: digital logistics market drivers

TABLE 120 UNITED KINGDOM: MARKET SIZE, BY COMPONENT, 2016–2019 (USD MILLION)

TABLE 121 UNITED KINGDOM: MARKET SIZE, BY COMPONENT, 2019–2025 (USD MILLION)

TABLE 122 UNITED KINGDOM: MARKET SIZE, BY SOLUTION, 2016–2019 (USD MILLION)

TABLE 123 UNITED KINGDOM: MARKET SIZE, BY SOLUTION, 2019–2025 (USD MILLION)

TABLE 124 UNITED KINGDOM: MARKET SIZE, BY SERVICE, 2016–2019 (USD MILLION)

TABLE 125 UNITED KINGDOM: MARKET SIZE, BY SERVICES, 2019–2025 (USD MILLION)

TABLE 126 UNITED KINGDOM: MARKET SIZE, BY FUNCTION, 2016–2019 (USD MILLION)

TABLE 127 UNITED KINGDOM: MARKET SIZE, BY FUNCTION, 2019–2025 (USD MILLION)

TABLE 128 UNITED KINGDOM: MARKET SIZE, BY DEPLOYMENT MODE, 2016–2019 (USD MILLION)

TABLE 129 UNITED KINGDOM: MARKET SIZE, BY DEPLOYMENT MODE, 2019–2025 (USD MILLION)

TABLE 130 UNITED KINGDOM: MARKET SIZE, BY ORGANIZATION SIZE, 2016–2019 (USD MILLION)

TABLE 131 UNITED KINGDOM: MARKET SIZE, BY ORGANIZATION SIZE, 2019–2025 (USD MILLION)

13.3.4 GERMANY

13.3.4.1 Germany: digital logistics market drivers

TABLE 132 GERMANY: MARKET SIZE, BY COMPONENT, 2016–2019 (USD MILLION)

TABLE 133 GERMANY: MARKET SIZE, BY COMPONENT, 2019–2025 (USD MILLION)

TABLE 134 GERMANY: MARKET SIZE, BY SOLUTION, 2016–2019 (USD MILLION)

TABLE 135 GERMANY: MARKET SIZE, BY SOLUTION, 2019–2025 (USD MILLION)

TABLE 136 GERMANY: MARKET SIZE, BY SERVICE, 2016–2019 (USD MILLION)

TABLE 137 GERMANY: MARKET SIZE, BY SERVICE, 2019–2025 (USD MILLION)

TABLE 138 GERMANY: MARKET SIZE, BY FUNCTION, 2016–2019 (USD MILLION)

TABLE 139 GERMANY: MARKET SIZE, BY FUNCTION, 2019–2025 (USD MILLION)

TABLE 140 GERMANY: MARKET SIZE, BY DEPLOYMENT MODE, 2016–2019 (USD MILLION)

TABLE 141 GERMANY: MARKET SIZE, BY DEPLOYMENT MODE, 2019–2025 (USD MILLION)

TABLE 142 GERMANY: MARKET SIZE, BY ORGANIZATION SIZE, 2016–2019 (USD MILLION)

TABLE 143 GERMANY: MARKET SIZE, BY ORGANIZATION SIZE, 2019–2025 (USD MILLION)

13.4 ASIA PACIFIC

13.4.1 ASIA PACIFIC: COVID-19 IMPLICATIONS ON DIGITAL LOGISTICS

13.4.2 ASIA PACIFIC: DIGITAL LOGISTICS MARKET REGULATORY IMPLICATIONS

FIGURE 29 ASIA PACIFIC: MARKET SNAPSHOT

TABLE 144 ASIA PACIFIC: MARKET SIZE, BY COMPONENT, 2016–2019 (USD MILLION)

TABLE 145 ASIA PACIFIC: MARKET SIZE, BY COMPONENT, 2019–2025 (USD MILLION)

TABLE 146 ASIA PACIFIC: MARKET SIZE, BY SOLUTION, 2016–2019 (USD MILLION)

TABLE 147 ASIA PACIFIC: MARKET SIZE, BY SOLUTION, 2019–2025 (USD MILLION)

TABLE 148 ASIA PACIFIC: MARKET SIZE, BY SERVICE, 2016–2019 (USD MILLION)

TABLE 149 ASIA PACIFIC: MARKET SIZE, BY SERVICE, 2019–2025 (USD MILLION)

TABLE 150 ASIA PACIFIC: MARKET SIZE, BY FUNCTION, 2016–2019 (USD MILLION)

TABLE 151 ASIA PACIFIC: MARKET SIZE, BY FUNCTION, 2019–2025 (USD MILLION)

TABLE 152 ASIA PACIFIC: MARKET SIZE, BY DEPLOYMENT MODE, 2016–2019 (USD MILLION)

TABLE 153 ASIA PACIFIC: MARKET SIZE, BY DEPLOYMENT MODE, 2019–2025 (USD MILLION)

TABLE 154 ASIA PACIFIC: MARKET SIZE, BY ORGANIZATION SIZE, 2016–2019 (USD MILLION)

TABLE 155 ASIA PACIFIC: MARKET SIZE, BY ORGANIZATION SIZE, 2019–2025 (USD MILLION)

TABLE 156 ASIA PACIFIC: MARKET SIZE, BY VERTICAL, 2016–2019 (USD MILLION)

TABLE 157 ASIA PACIFIC: MARKET SIZE, BY VERTICAL, 2019–2025 (USD MILLION)

TABLE 158 ASIA PACIFIC: MARKET SIZE, BY COUNTRY, 2016–2019 (USD MILLION)

TABLE 159 ASIA PACIFIC: MARKET SIZE, BY COUNTRY, 2019–2025 (USD MILLION)

13.4.3 CHINA

13.4.3.1 China: digital logistics market drivers

TABLE 160 CHINA: MARKET SIZE, BY COMPONENT, 2016–2019 (USD MILLION)

TABLE 161 CHINA: MARKET SIZE, BY COMPONENT, 2019–2025 (USD MILLION)

TABLE 162 CHINA: MARKET SIZE, BY SOLUTION, 2016–2019 (USD MILLION)

TABLE 163 CHINA: MARKET SIZE, BY SOLUTION, 2019–2025 (USD MILLION)

TABLE 164 CHINA: MARKET SIZE, BY SERVICE, 2016–2019 (USD MILLION)

TABLE 165 CHINA: MARKET SIZE, BY SERVICE, 2019–2025 (USD MILLION)

TABLE 166 CHINA: MARKET SIZE, BY FUNCTION, 2016–2019 (USD MILLION)

TABLE 167 CHINA: MARKET SIZE, BY FUNCTION, 2019–2025 (USD MILLION)

TABLE 168 CHINA: MARKET SIZE, BY DEPLOYMENT MODE, 2016–2019 (USD MILLION)

TABLE 169 CHINA: MARKET SIZE, BY DEPLOYMENT MODE, 2019–2025 (USD MILLION)

TABLE 170 CHINA: MARKET SIZE, BY ORGANIZATION SIZE, 2016–2019 (USD MILLION)

TABLE 171 CHINA: MARKET SIZE, BY ORGANIZATION SIZE, 2019–2025 (USD MILLION)

13.4.4 JAPAN

13.4.4.1 Japan: digital logistics market drivers

TABLE 172 JAPAN: MARKET SIZE, BY COMPONENT, 2016–2019 (USD MILLION)

TABLE 173 JAPAN: MARKET SIZE, BY COMPONENT, 2019–2025 (USD MILLION)

TABLE 174 JAPAN: MARKET SIZE, BY SOLUTION, 2016–2019 (USD MILLION)

TABLE 175 JAPAN: MARKET SIZE, BY SOLUTION, 2019–2025 (USD MILLION)

TABLE 176 JAPAN: MARKET SIZE, BY SERVICE, 2016–2019 (USD MILLION)

TABLE 177 JAPAN: MARKET SIZE, BY SERVICE, 2019–2025 (USD MILLION)

TABLE 178 JAPAN: MARKET SIZE, BY FUNCTION, 2016–2019 (USD MILLION)

TABLE 179 JAPAN: MARKET SIZE, BY FUNCTION, 2019–2025 (USD MILLION)

TABLE 180 JAPAN: MARKET SIZE, BY DEPLOYMENT MODE, 2016–2019 (USD MILLION)

TABLE 181 JAPAN: MARKET SIZE, BY DEPLOYMENT MODE, 2019–2025 (USD MILLION)

TABLE 182 JAPAN: MARKET SIZE, BY ORGANIZATION SIZE, 2016–2019 (USD MILLION)

TABLE 183 JAPAN: MARKET SIZE, BY ORGANIZATION SIZE, 2019–2025 (USD MILLION)

13.5 MIDDLE EAST AND AFRICA

13.5.1 MIDDLE EAST AND AFRICA: COVID-19 IMPLICATIONS ON DIGITAL LOGISTICS

13.5.2 MIDDLE EAST AND AFRICA: DIGITAL LOGISTICS MARKET REGULATORY IMPLICATIONS

TABLE 184 MIDDLE EAST AND AFRICA: MARKET SIZE, BY COMPONENT, 2016–2019 (USD MILLION)

TABLE 185 MIDDLE EAST AND AFRICA: MARKET SIZE, BY COMPONENT, 2019–2025 (USD MILLION)

TABLE 186 MIDDLE EAST AND AFRICA: MARKET SIZE, BY SOLUTION, 2016–2019 (USD MILLION)

TABLE 187 MIDDLE EAST AND AFRICA: MARKET SIZE, BY SOLUTION, 2019–2025 (USD MILLION)

TABLE 188 MIDDLE EAST AND AFRICA: MARKET SIZE, BY SERVICE, 2016–2019 (USD MILLION)

TABLE 189 MIDDLE EAST AND AFRICA: MARKET SIZE, BY SERVICE, 2019–2025 (USD MILLION)

TABLE 190 MIDDLE EAST AND AFRICA: MARKET SIZE, BY FUNCTION, 2016–2019 (USD MILLION)

TABLE 191 MIDDLE EAST AND AFRICA: MARKET SIZE, BY FUNCTION, 2019–2025 (USD MILLION)

TABLE 192 MIDDLE EAST AND AFRICA: MARKET SIZE, BY DEPLOYMENT MODE, 2016–2019 (USD MILLION)

TABLE 193 MIDDLE EAST AND AFRICA: MARKET SIZE, BY DEPLOYMENT MODE, 2019–2025 (USD MILLION)

TABLE 194 MIDDLE EAST AND AFRICA: MARKET SIZE, BY ORGANIZATION SIZE, 2016–2019 (USD MILLION)

TABLE 195 MIDDLE EAST AND AFRICA: MARKET SIZE, BY ORGANIZATION SIZE, 2019–2025 (USD MILLION)

TABLE 196 MIDDLE EAST AND AFRICA: MARKET SIZE, BY VERTICAL, 2016–2019 (USD MILLION)

TABLE 197 MIDDLE EAST AND AFRICA: MARKET SIZE, BY VERTICAL, 2019–2025 (USD MILLION)

13.6 LATIN AMERICA

13.6.1 LATIN AMERICA: COVID-19 IMPLICATIONS ON DIGITAL LOGISTICS

13.6.2 LATIN AMERICA: DIGITAL LOGISTICS MARKET REGULATORY IMPLICATIONS

TABLE 198 LATIN AMERICA: MARKET SIZE, BY COMPONENT, 2016–2019 (USD MILLION)

TABLE 199 LATIN AMERICA: MARKET SIZE, BY COMPONENT, 2019–2025 (USD MILLION)

TABLE 200 LATIN AMERICA: MARKET SIZE, BY SOLUTION, 2016–2019 (USD MILLION)

TABLE 201 LATIN AMERICA: MARKET SIZE, BY SOLUTION, 2019–2025 (USD MILLION)

TABLE 202 LATIN AMERICA: MARKET SIZE, BY SERVICE, 2016–2019 (USD MILLION)

TABLE 203 LATIN AMERICA: MARKET SIZE, BY SERVICES, 2019–2025 (USD MILLION)

TABLE 204 LATIN AMERICA: MARKET SIZE, BY FUNCTION, 2016–2019 (USD MILLION)

TABLE 205 LATIN AMERICA: MARKET SIZE, BY FUNCTION, 2019–2025 (USD MILLION)

TABLE 206 LATIN AMERICA: MARKET SIZE, BY DEPLOYMENT MODE, 2016–2019 (USD MILLION)

TABLE 207 LATIN AMERICA: MARKET SIZE, BY DEPLOYMENT MODE, 2019–2025 (USD MILLION)

TABLE 208 LATIN AMERICA: MARKET SIZE, BY ORGANIZATION SIZE, 2016–2019 (USD MILLION)

TABLE 209 LATIN AMERICA: MARKET SIZE, BY ORGANIZATION SIZE, 2019–2025 (USD MILLION)

TABLE 210 LATIN AMERICA: MARKET SIZE, BY VERTICAL, 2016–2019 (USD MILLION)

TABLE 211 LATIN AMERICA: MARKET SIZE, BY VERTICAL, 2019–2025 (USD MILLION)

14 COMPETITIVE LANDSCAPE (Page No. - 163)

14.1 INTRODUCTION

14.2 MARKET EVALUATION FRAMEWORK

FIGURE 30 MARKET EVALUATION FRAMEWORK

14.3 REVENUE ANALYSIS OF TOP MARKET PLAYERS

FIGURE 31 REVENUE ANALYSIS OF THE DIGITAL LOGISTICS MARKET

14.4 HISTORICAL REVENUE ANALYSIS

14.4.1 INTRODUCTION

FIGURE 32 HISTORIC FIVE YEARS REVENUE ANALYSIS OF LEADING PLAYERS

14.5 RANKING OF KEY PLAYERS IN THE MARKET, 2020

FIGURE 33 RANKING OF KEY PLAYERS, 2020

14.6 COMPANY EVALUATION MATRIX

14.6.1 STAR

14.6.2 EMERGING LEADER

14.6.3 PERVASIVE

14.6.4 PARTICIPANT

FIGURE 34 DIGITAL LOGISTICS MARKET (GLOBAL), COMPANY EVALUATION MATRIX, 2020

14.7 STARTUP/SME EVALUATION MATRIX, 2020

14.7.1 PROGRESSIVE COMPANIES

14.7.2 RESPONSIVE COMPANIES

14.7.3 DYNAMIC COMPANIES

14.7.4 STARTING BLOCKS

FIGURE 35 MARKET (GLOBAL), STARTUP/SME EVALUATION MATRIX, 2020

15 COMPANY PROFILES (Page No. - 170)

(Business Overview, Products & Services, Key Insights, Recent Developments, SWOT Analysis, MnM View)*

15.1 IBM

FIGURE 36 IBM: COMPANY SNAPSHOT

15.2 ORACLE

FIGURE 37 ORACLE: COMPANY SNAPSHOT

15.3 SAP

FIGURE 38 SAP: COMPANY SNAPSHOT

15.4 AT&T

FIGURE 39 AT&T: COMPANY SNAPSHOT

15.5 INTEL

FIGURE 40 INTEL: COMPANY SNAPSHOT

15.6 INFOSYS LIMITED

FIGURE 41 INFOSYS: COMPANY SNAPSHOT

15.7 HONEYWELL

FIGURE 42 HONEYWELL: COMPANY SNAPSHOT

15.8 EUROTECH S.P.A

FIGURE 43 EUROTECH S.P.A: COMPANY SNAPSHOT

15.9 HCL TECHNOLOGIES

FIGURE 44 HCL TECHNOLOGIES: COMPANY SNAPSHOT

15.10 ORBCOMM INC.

FIGURE 45 ORBCOMM: COMPANY SNAPSHOT

15.11 CLOUD LOGISTICS

15.12 FREIGHTGATE INC.

15.13 BLUE YONDER (FORMERLY KNOWN AS JDA SOFTWARE)

15.14 DIGILOGISTICS TECHNOLOGY LIMITED

15.15 WEBXPRESS

15.16 RAMCO SYSTEMS

15.17 LOGISUITE

15.18 IMPINJ

15.19 INTERSEC

15.20 ICAT LOGISTICS

15.21 MAGAYA

15.22 SOFTLINK

15.23 SAMSUNG SDS

15.24 HEXAWARE

15.25 TECH MAHINDRA

15.26 ADVANTECH

*Details on Business Overview, Products & Services, Key Insights, Recent Developments, SWOT Analysis, MnM View might not be captured in case of unlisted companies.

16 APPENDIX (Page No. - 215)

16.1 ALIGNED MARKETS

16.1.1 FLEET MANAGEMENT MARKET

16.1.1.1 Market definition

16.1.1.2 Market overview

16.1.1.3 Fleet management market, by solution

TABLE 212 FLEET MANAGEMENT MARKET SIZE, BY SOLUTION, 2015–2019 (USD MILLION)

TABLE 213 FLEET MANAGEMENT MARKET SIZE, BY SOLUTION, 2019–2025 (USD MILLION)

TABLE 214 OPERATIONS MANAGEMENT: FLEET MANAGEMENT MARKET SIZE, BY REGION, 2015–2019 (USD MILLION)

TABLE 215 OPERATIONS MANAGEMENT : FLEET MANAGEMENT MARKET SIZE, BY REGION, 2019–2025 (USD MILLION)

TABLE 216 VEHICLE MAINTENANCE AND DIAGNOSTICS: FLEET MANAGEMENT MARKET SIZE, BY REGION, 2015–2019 (USD MILLION)

TABLE 217 VEHICLE MAINTENANCE AND DIAGNOSTICS: FLEET MANAGEMENT MARKET SIZE, BY REGION, 2019–2025 (USD MILLION)

TABLE 218 PERFORMANCE MANAGEMENT: FLEET MANAGEMENT MARKET SIZE, BY REGION, 2015–2019 (USD MILLION)

TABLE 219 PERFORMANCE MANAGEMENT: FLEET MANAGEMENT MARKET SIZE, BY REGION, 2019–2025 (USD MILLION)

TABLE 220 FLEET ANALYTICS AND REPORTING: FLEET MANAGEMENT MARKET SIZE, BY REGION, 2016–2019 (USD MILLION)

TABLE 221 FLEET ANALYTICS AND REPORTING: FLEET MANAGEMENT MARKET SIZE, BY REGION, 2019–2025 (USD MILLION)

TABLE 222 OTHER SOLUTIONS: FLEET MANAGEMENT MARKET SIZE, BY REGION, 2015–2019 (USD MILLION)

TABLE 223 OTHER SOLUTIONS: FLEET MANAGEMENT MARKET SIZE, BY REGION, 2019–2025 (USD MILLION)

16.1.1.4 Fleet management market, by region

TABLE 224 NORTH AMERICA: FLEET MANAGEMENT MARKET SIZE, BY COMPONENT, 2019–2025 (USD MILLION)

TABLE 225 NORTH AMERICA: FLEET MANAGEMENT MARKET SIZE, BY SOLUTION, 2015–2019 (USD MILLION)

TABLE 226 NORTH AMERICA: FLEET MANAGEMENT MARKET SIZE, BY SOLUTION, 2019–2025 (USD MILLION)

TABLE 227 NORTH AMERICA: OPERATIONS MANAGEMENT MARKET SIZE, BY TYPE, 2015–2019 (USD MILLION)

TABLE 228 NORTH AMERICA: OPERATIONS MANAGEMENT MARKET SIZE, BY TYPE, 2019–2025 (USD MILLION)

TABLE 229 NORTH AMERICA: PERFORMANCE MANAGEMENT MARKET SIZE, BY TYPE, 2015–2019 (USD MILLION)

TABLE 230 NORTH AMERICA: PERFORMANCE MANAGEMENT MARKET SIZE, BY TYPE, 2019–2025 (USD MILLION)

TABLE 231 NORTH AMERICA: FLEET MANAGEMENT MARKET SIZE, BY SERVICE, 2015–2019 (USD MILLION)

TABLE 232 NORTH AMERICA: FLEET MANAGEMENT MARKET SIZE, BY SERVICE, 2019–2025 (USD MILLION)

TABLE 233 NORTH AMERICA: FLEET MANAGEMENT MARKET SIZE, BY PROFESSIONAL SERVICE, 2015–2019 (USD MILLION)

TABLE 234 NORTH AMERICA: FLEET MANAGEMENT MARKET SIZE, BY PROFESSIONAL SERVICE, 2019–2025 (USD MILLION)

TABLE 235 NORTH AMERICA: FLEET MANAGEMENT MARKET SIZE, BY DEPLOYMENT TYPE, 2015–2019 (USD MILLION)

TABLE 236 NORTH AMERICA: FLEET MANAGEMENT MARKET SIZE, BY DEPLOYMENT TYPE, 2019–2025 (USD MILLION)

TABLE 237 NORTH AMERICA: FLEET MANAGEMENT MARKET SIZE, BY FLEET TYPE, 2015–2019 (USD MILLION)

TABLE 238 NORTH AMERICA: FLEET MANAGEMENT MARKET SIZE, BY FLEET TYPE, 2019–2025 (USD MILLION)

TABLE 239 NORTH AMERICA: COMMERCIAL FLEETS MARKET SIZE, BY TYPE, 2015–2019 (USD MILLION)

TABLE 240 NORTH AMERICA: COMMERCIAL FLEETS MARKET SIZE, BY TYPE, 2019–2025 (USD MILLION)

TABLE 241 NORTH AMERICA: PASSENGER CARS MARKET SIZE, BY TYPE, 2015–2019 (USD MILLION)

TABLE 242 NORTH AMERICA: PASSENGER CARS MARKET SIZE, BY TYPE, 2019–2025 (USD MILLION)

TABLE 243 NORTH AMERICA: FLEET MANAGEMENT MARKET SIZE, BY COUNTRY, 2015–2019 (USD MILLION)

TABLE 244 NORTH AMERICA: FLEET MANAGEMENT MARKET SIZE, BY COUNTRY, 2019–2025 (USD MILLION)

16.1.2 REMOTE ASSET MANAGEMENT MARKET

16.1.2.1 Market definition

16.1.2.2 Market overview

16.1.2.3 Remote asset management market, by solution

TABLE 245 REMOTE ASSET MANAGEMENT MARKET SIZE, BY SOLUTION, 2018–2025 (USD MILLION)

TABLE 246 REAL-TIME LOCATION SYSTEM: REMOTE ASSET MANAGEMENT MARKET SIZE, BY REGION, 2018–2025 (USD MILLION)

TABLE 247 ANALYTICS AND REPORTING: REMOTE ASSET MANAGEMENT MARKET SIZE, BY REGION, 2018–2025 (USD MILLION)

TABLE 248 ASSET PERFORMANCE MANAGEMENT: REMOTE ASSET MANAGEMENT MARKET SIZE, BY REGION, 2018–2025 (USD MILLION)

TABLE 249 ASSET PERFORMANCE MANAGEMENT: REMOTE ASSET MANAGEMENT MARKET SIZE, BY TYPE, 2018–2025 (USD MILLION)

TABLE 250 ASSET CONDITION MONITORING: REMOTE ASSET MANAGEMENT MARKET SIZE, BY REGION, 2018–2025 (USD MILLION)

TABLE 251 PREDICTIVE MAINTENANCE: REMOTE ASSET MANAGEMENT MARKET SIZE, BY REGION, 2018–2025 (USD MILLION)

TABLE 252 SURVEILLANCE AND SECURITY: REMOTE ASSET MANAGEMENT MARKET SIZE, BY REGION, 2018–2025 (USD MILLION)

TABLE 253 NETWORK BANDWIDTH MANAGEMENT: REMOTE ASSET MANAGEMENT MARKET SIZE, BY REGION, 2018–2025 (USD MILLION)

TABLE 254 MOBILE WORKFORCE MANAGEMENT: REMOTE ASSET MANAGEMENT MARKET SIZE, BY REGION, 2018–2025 (USD MILLION)

TABLE 255 OTHERS: REMOTE ASSET MANAGEMENT MARKET SIZE, BY REGION, 2018–2025 (USD MILLION)

16.1.2.4 Remote asset management market, by asset type

TABLE 256 REMOTE ASSET MANAGEMENT MARKET SIZE, BY ASSET TYPE, 2018–2025 (USD MILLION)

TABLE 257 FIXED ASSET: REMOTE ASSET MANAGEMENT MARKET SIZE, BY REGION, 2018–2025 (USD MILLION)

TABLE 258 MOBILE ASSET: REMOTE ASSET MANAGEMENT MARKET SIZE, BY REGION, 2018–2025 (USD MILLION)

16.1.2.5 Remote asset management market, by vertical

TABLE 259 REMOTE ASSET MANAGEMENT MARKET SIZE, BY VERTICAL, 2018–2025 (USD MILLION)

TABLE 260 BUILDING AUTOMATION: REMOTE ASSET MANAGEMENT MARKET SIZE, BY REGION, 2018–2025 (USD MILLION)

TABLE 261 MANUFACTURING: REMOTE ASSET MANAGEMENT MARKET SIZE, BY REGION, 2018–2025 (USD MILLION)

TABLE 262 HEALTHCARE: REMOTE ASSET MANAGEMENT MARKET SIZE, BY REGION, 2018–2025 (USD MILLION)

TABLE 263 RETAIL: REMOTE ASSET MANAGEMENT MARKET SIZE, BY REGION, 2018–2025 (USD MILLION)

TABLE 264 ENERGY AND UTILITIES: REMOTE ASSET MANAGEMENT MARKET SIZE, BY REGION, 2018–2025 (USD MILLION)

TABLE 265 TRANSPORTATION AND LOGISTICS: REMOTE ASSET MANAGEMENT MARKET SIZE, BY REGION, 2018–2025 (USD MILLION)

TABLE 266 METAL AND MINING: REMOTE ASSET MANAGEMENT MARKET SIZE, BY REGION, 2018–2025 (USD MILLION)

16.1.2.6 Remote asset management market, by region

TABLE 267 REMOTE ASSET MANAGEMENT MARKET SIZE, BY REGION, 2018–2025 (USD MILLION)

TABLE 268 NORTH AMERICA: REMOTE ASSET MANAGEMENT MARKET SIZE, BY COMPONENT, 2018–2025 (USD MILLION)

TABLE 269 NORTH AMERICA: REMOTE ASSET MANAGEMENT MARKET SIZE, BY SOLUTION, 2018–2025 (USD MILLION)

TABLE 270 NORTH AMERICA: REMOTE ASSET MANAGEMENT MARKET SIZE, BY SERVICE, 2018–2025 (USD MILLION)

TABLE 271 NORTH AMERICA: REMOTE ASSET MANAGEMENT MARKET SIZE, BY PROFESSIONAL SERVICE, 2018–2025 (USD MILLION)

TABLE 272 NORTH AMERICA: REMOTE ASSET MANAGEMENT MARKET SIZE, BY ASSET TYPE, 2018–2025 (USD MILLION)

TABLE 273 NORTH AMERICA: REMOTE ASSET MANAGEMENT MARKET SIZE, BY DEPLOYMENT MODE, 2018–2025 (USD MILLION)

TABLE 274 NORTH AMERICA: REMOTE ASSET MANAGEMENT MARKET SIZE, BY ORGANIZATION SIZE, 2018–2025 (USD MILLION)

TABLE 275 NORTH AMERICA: REMOTE ASSET MANAGEMENT MARKET SIZE, BY VERTICAL, 2018–2025 (USD MILLION)

TABLE 276 NORTH AMERICA: REMOTE ASSET MANAGEMENT MARKET SIZE, BY COUNTRY, 2018–2025 (USD MILLION)

TABLE 277 ASIA PACIFIC: REMOTE ASSET MANAGEMENT MARKET SIZE, BY COMPONENT, 2018–2025 (USD MILLION)

TABLE 278 ASIA PACIFIC: REMOTE ASSET MANAGEMENT MARKET SIZE, BY SOLUTION, 2018–2025 (USD MILLION)

TABLE 279 ASIA PACIFIC: REMOTE ASSET MANAGEMENT MARKET SIZE, BY ASSET PERFORMANCE MANAGEMENT, 2018–2025 (USD MILLION)

TABLE 280 ASIA PACIFIC: REMOTE ASSET MANAGEMENT MARKET SIZE, BY SERVICE, 2018–2025 (USD MILLION)

TABLE 281 ASIA PACIFIC: REMOTE ASSET MANAGEMENT MARKET SIZE, BY PROFESSIONAL SERVICE, 2018–2025 (USD MILLION)

TABLE 282 ASIA PACIFIC: REMOTE ASSET MANAGEMENT MARKET SIZE, BY ASSET TYPE, 2018–2025 (USD MILLION)

TABLE 283 ASIA PACIFIC: REMOTE ASSET MANAGEMENT MARKET SIZE, BY DEPLOYMENT MODE, 2018–2025 (USD MILLION)

TABLE 284 ASIA PACIFIC: REMOTE ASSET MANAGEMENT MARKET SIZE, BY ORGANIZATION SIZE, 2018–2025 (USD MILLION)

TABLE 285 ASIA PACIFIC: REMOTE ASSET MANAGEMENT MARKET SIZE, BY VERTICAL, 2018–2025 (USD MILLION)

TABLE 286 ASIA PACIFIC: REMOTE ASSET MANAGEMENT MARKET SIZE, BY COUNTRY, 2018–2025 (USD MILLION)

16.2 DISCUSSION GUIDE

16.3 KNOWLEDGE STORE: MARKETSANDMARKETS’ SUBSCRIPTION PORTAL

16.4 AVAILABLE CUSTOMIZATIONS

16.5 RELATED REPORTS

16.6 AUTHOR DETAILS

The study involved four major activities in estimating the current size for the Digital Logistics market. An exhaustive secondary research was done to collect information on the logistics industry. The next step was to validate these findings, assumptions, and sizing with industry experts across the value chain using primary research. Both top-down and bottom-up approaches were employed to estimate the total market size. After that, the market breakup and data triangulation procedures were used to estimate the market size of the segments and subsegments of the digital logistics market.

Secondary Research

In the secondary research process, various secondary sources, such as D&B Hoovers, Bloomberg BusinessWeek, and Dun & Bradstreet, were referred, to identify and collect information for this study. These secondary sources included annual reports, press releases, and investor presentations of companies; whitepapers, certified publications, and articles by recognized authors; gold standard and silver standard websites; regulatory bodies; trade directories; and databases.

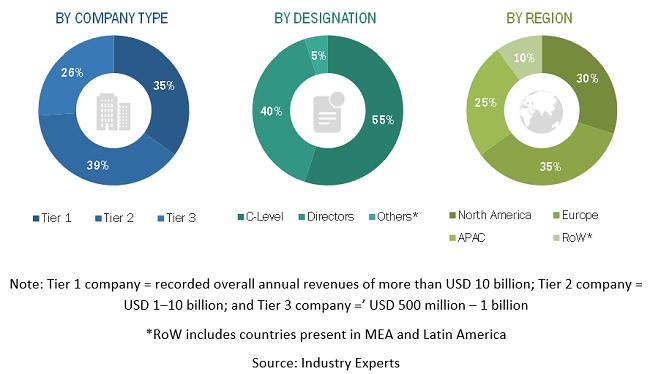

Primary Research

The digital logistics market comprises several stakeholders, such as digital logistics vendors, digital logistics service providers, venture capitalists, government organizations, regulatory authorities, policymakers, and financial organizations, consulting firms, research organizations, academic institutions, resellers and distributors and training providers. The demand side of the digital logistics market consists of all the firms operating in several industry verticals. The supply side includes digital logistics providers, offering digital logistics services. Various primary sources from both the supply and demand sides of the market were interviewed to obtain qualitative and quantitative information. Given below is the breakup of the primary respondents:

To know about the assumptions considered for the study, download the pdf brochure

Market Size Estimation

The top-down and bottom-up approaches were used to estimate and validate the size of the global digital logistics market and various other dependent submarkets in the overall market. An exhaustive list of all the vendors offering solutions and services in the digital logistics market was prepared while using the top-down approach. The market share for all the vendors in the market was estimated through annual reports, press releases, funding, investor presentations, paid databases, and primary interviews. Each vendor was evaluated based on its components (soutions, and services). The aggregate of all companies’ revenues was extrapolated to reach the overall market size.

Further, each subsegment was studied and analyzed for its global market size and regional penetration. The markets were triangulated through both primary and secondary research. The primary procedure included extensive interviews for key insights from the industry leaders, such as Chief Executive Officers (CEOs), Vice Presidents (VPs), directors, and managers.

Data Triangulation

After arriving at the overall market size using the market size estimation processes as explained above, the market was split into several segments and subsegments. The data triangulation and market breakup procedures were employed, wherever applicable, to complete the overall market engineering process and arrive at the exact statistics of each market segment and subsegment. The data was triangulated by studying various factors and trends from both the demand and supply sides.

Report Objectives

- To determine and forecast the global digital logistics market by component, deployment mode, organization size, function, vertical, and region during the forecast period, and analyze the various macroeconomic and microeconomic factors that affect the market growth

- To forecast the size of the market segments with respect to five main regions: North America, Europe, Asia Pacific (APAC), Latin America, and Middle East and Africa (MEA)

- To provide detailed information about the major factors (drivers, opportunities, and challenges) influencing the growth of the digital logistics market

- To analyze each submarket with respect to individual growth trends, prospects, and contribution to the overall digital logistics market

- To analyze the opportunities in the market for stakeholders by identifying the high-growth segments of the digital logistics market

- To profile key market players; provide a comparative analysis based on business overview, regional presence, product offerings, business strategies, and key financials; and illustrate the competitive landscape of the market

- To track and analyze competitive developments, such as mergers and acquisitions, product developments, partnerships and collaborations, and Research & Development (R&D) activities, in the market

Available customizations

Along with the market data, MarketsandMarkets offers customizations as per the company’s specific needs. The following customization options are available for the report:

Company information

- Detailed analysis and profiling of additional market players (Up to 5)

Growth opportunities and latent adjacency in Digital Logistics Market