Container Security Market by Component (Container Security Products and Services (Professional, Managed)), Deployment Type (Cloud, On-premises), Vertical (BFSI, Retail, Government, Healthcare), and Region - Global Forecast to 2026

Container Security Market Analysis, Industry Size & Forecast

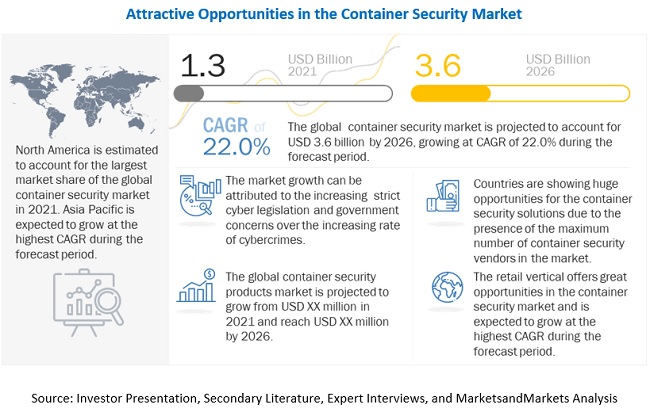

The global Container Security Market size was approximately $1.3 billion in 2021 and is poised to surpass $3.6 billion by the end of 2026, registering a CAGR of 22.0% during forecast period.

The container security industry growth is driven by Increasing popularity of microservices and digital transformation across enterprises and rise in east-west traffic in a container-based data center.

To know about the assumptions considered for the study, Request for Free Sample Report

Container Security Market Growth Dynamics

Driver: Increasing popularity of microservices and digital transformation across enterprises

Enterprises adopting DevOps methodologies utilize microservices the most. Enterprise developers following the 12-factor app methodology have a huge interest in containers. Microservice architecture is a granular software architecture in which application components are independently designed built and integrated using Application Programming Interfaces (APIs). Typically, containers are used for building and deploying microservices to the extent that the containers and microservices almost become complementary. Containers, combined with microservices and business goals, create enterprise IT policies. On the operational efficiency of the organization these IT policies become a success or failure based; therefore, over time, the adoption of containers and microservices would become a huge point of focus for operational effectiveness.

Restrain: Faster deployment of applications resulting in faster failure

Containers have helped companies build portable software that is continuously redeployed by packing more onto a single machine. Container images are easily deployable and can be shipped from one machine to another. They have also become a key technology to enable microservices. The benefit of container technology is that they accelerate application development, and deployment processes, making security updates, upgrades, and vulnerability patching fast and easy. All this process is possible without changing the original nature of the already existing application. But as container helps in deploying the application faster, the chances of failure are also high. Along with isolating the data, containers hold valuable data, which makes it more vulnerable. Because the speed of the deployment is fast, often there is no time left for testing and quality assurance. So, it’s the responsibility of the organizations to go through the manual testing phase and to make sure that they are only using the updated versions of the containers.

Opportunity: Expanding range of IoT applications

Containers and the Internet of Things (IoT) have emerged in the technology landscape at around the same time, and both have been rapidly growing since then. Precedents for both technologies have been around in the market for quite some time now, and IoT and containers have become intricately connected. Some of the major applications of IoT that demand containerizations are its massive scale and extreme data dependency. IoT applications that collect, store, and analyze thousands of petabytes of data must be capable of scaling well beyond the boundaries of normal applications. Containers handle the scaling of IoT data quite easily through the usage of microservices. Containers are also innately capable of running applications on IoT edge devices, which consist of limited resources, and majorly support the lightweight OS. The market for IoT devices is huge, and lots of interconnected devices are expected to be deployed by 2023. The front-end and back-end software on these devices would demand containers for smooth and fast functioning. Moreover, as most of the IoT applications are greenfield, they are expected to be developed by using the latest container technologies. The demand for containers in the IoT arena would also increase because frequent software updates of individual isolated microservices in distributed IoT devices are possible through containers. With the increasing adoption of containers across industry verticals in the IoT space, the demand for container security platforms is expected to gain traction in the coming years.

Challenge: Presence of a large number of open-source vendors offering container platforms

container technology has been adopted by enterprises widely due to its various benefits, such as cost-effectiveness, lower development time for applications, code reusability of the application containers, and the provision of hybrid platform deployments. However, one of the prime reasons for the enterprises looking to deploy these solutions across their platforms is the presence of many open-source vendors who offer container solutions. For instance, Docker, Kubernetes, and Red Hat offer free-of-cost container platforms to end-users for developing applications. The adoption of open-source container platforms provides enterprises with significant cost benefits and faster time-to-market, but it also presents various security challenges that need to be addressed. With the increasing adoption of the open-source container platform, organizations across the globe are also investing in container security platforms..

By vertical, healthcare vertical to record the highest growth rate during the forecast period

The healthcare vertical covers the applications for biotechnology, clinical, pharmaceutical, and medical equipment enterprises. Container security has been increasingly adopted by enterprises, as they enable health, IT, and DevOps teams to deploy applications quickly and securely in a HIPAA-compliant cloud. Moreover, organizations are readily integrating their systems with other healthcare networks to share information and work together in an orchestrated manner to accommodate growth and improve agility. Healthcare apps are very complex. These apps are composed of services that handle specific tasks, like handling patient records, file transfer, document export, and messaging. Moving the complex systems that handle protected health information (PHI) significantly easier with the Containerizing services. That’s why container security plays an important role in healthcare sector. The healthcare vertical has witnessed an immense surge in data in recent years. The adoption of container services is transforming the way healthcare applications are being deployed, and the way of collection and diffusion of information is carried on. The healthcare vertical is now focused on value creation rather than volume. Government and private healthcare organizations are facing pressure to improve their systems and enhance the population’s health while reducing costs.

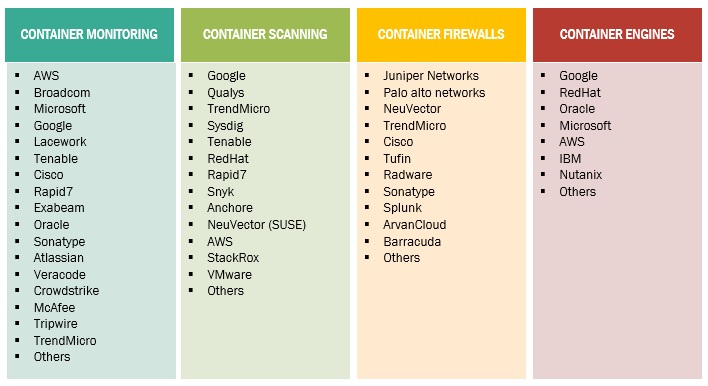

Container Security Market Eco-System

To know about the assumptions considered for the study, download the pdf brochure

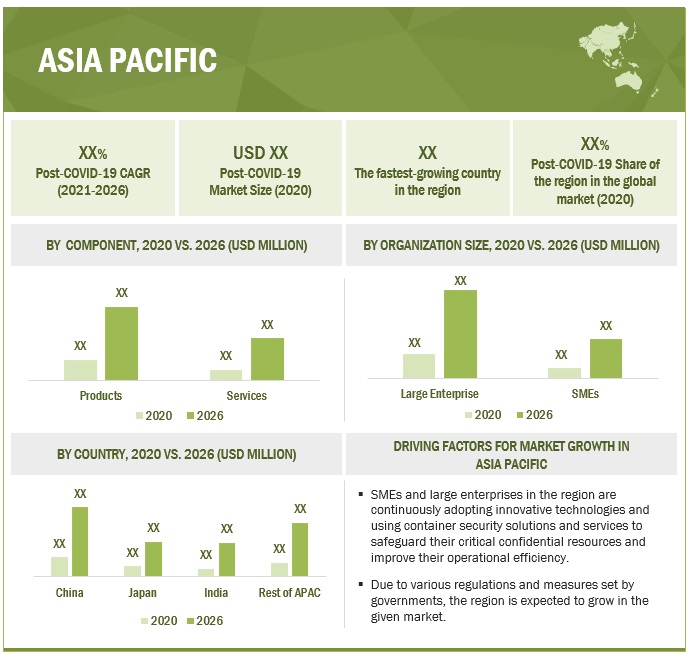

By region, Asia Pacific to grow at the highest CAGR during the forecast period

Asia Pacific has witnessed advanced and dynamic adoption of new technologies and is expected to record the highest CAGR during the forecast period. Asia Pacific includes developed and developing economies, such as China, Japan, India, Singapore, the Philippines, Vietnam, South Korea, and Indonesia. Asia Pacific is taking aggressive initiatives to leverage the IT infrastructure, enabling commercial users to adopt cutting-edge technologies. SMEs and large enterprises in the region are continuously adopting innovative technologies and using container security solutions and services to safeguard their critical confidential resources and improve their operational efficiency. The affordability and ease of deployment of container services among enterprises are the driving factors for the adoption of container security in the region.

With effective government regulations and technological advancements, the container security market is witnessing tremendous growth opportunities in this region. Various developments are taking place in the Asia Pacific region, concerning the adoption of technologies, such as BI compliance tools, cloud, analytics, and rapid infrastructure development. Asia Pacific is the fastest-growing region in terms of the adoption of container security solutions

Key Market Players:

The key players in the global container security market include Microsoft Corporation (US), Amazon Web Services, Inc (US), Google, LLC (US), IBM Corporation (US), VMware, Inc. (US), McAfee Corporation (US), Palo Alto Networks, Inc. (US), Cisco System, Inc. (US), Juniper Networks (US), Qualys, Inc. (US), CrowdStrike Holdings, Inc. (US), Tenable, Inc. (US), Check Point Software Technologies (Israel), Rapid7 (US), Zscaler (US), Sysdig, Inc. (US), Snyk (UK), Sonatype (US), Aqua Security (Israel), and Fidelis Cybersecurity (US).

Scope of the report

|

Report Metric |

Details |

|

Market Size in 2021 |

US$ 1.3 billion |

|

Revenue Forecast in 2026 |

US$ 3.6 billion |

|

CAGR |

22.0% |

|

Key Opportunities |

Expanding range of IoT applications |

|

Key Growth Drivers |

Increasing popularity of microservices and digital transformation across enterprises |

|

Market size available for years |

2015–2026 |

|

Base year considered |

2020 |

|

Forecast period |

2021–2026 |

|

Segments covered |

Components, Deployment Mode, Organization size, Verticals and Regions |

|

Geographies covered |

North America, Europe, APAC, Middle East and Africa (MEA), and Latin America |

|

Major companies covered |

Microsoft Corporation (US), Amazon Web Services, Inc (US), Google, LLC (US), IBM Corporation (US), VMware, Inc. (US), McAfee Corporation (US), Palo Alto Networks, Inc. (US), Cisco System, Inc. (US), Juniper Networks (US), Qualys, Inc. (US), CrowdStrike Holdings, Inc. (US), Tenable, Inc. (US), Check Point Software Technologies (Israel), Rapid7 (US), Zscaler (US), Sysdig, Inc. (US), Snyk (UK), Sonatype (US), Aqua Security (Israel), and Fidelis Cybersecurity (US) |

This research report categorizes the Container Security Market based on component, deployment mode, organization size, vertical, and region.

Based on components, the container security market has been segmented as follows:

- Products

-

Services

- Professional Services

- Managed Services

Based on deployment mode, the market has been segmented as follows:

- Cloud

- On-premises

Based on organization size, market has been segmented as follows:

- SMEs

- Large Enterprises

Based on Vertical, the container security market has been segmented as follows:

- BFSI

- Retail

- Government

- Healthcare

- Manufacturing

- IT and Telecommunication

- Other verticals

- *Other verticals include media and entertainment, and education.

Based on regions, the container security market has been segmented as follows:

- North America

- Europe

- APAC

- Middle East and Africa

- Latin America

Recent Developments

- In July 2021, IBM announced the acquisition of Bluetabtion Solution Group (Spain) to expand its data and hybrid cloud consulting market and strengthen its geographic presence in Latin America and Europe.

- In February 2021, Cisco acquired IMImobile PLC to expand its capabilities by adding cloud communications software and communications platform as a service technology of IMImobile PLC.

- 20 September, Palo Alto Networks partnered with OPSWAT. With this partnership, both companies would enable a platform for both on-premises and cloud-delivered access security and would reduce network traffic blind spots.

Frequently Asked Questions (FAQ):

What is the market value of Container Security Market?

What is the growth rate (CAGR) of Container Security Market?

What are the key opportunities in the Container Security Market?

Who are the key players in Container Security Market?

Who will be the leading hub for Container Security Market?

What is the Container Security Market Segmentation?

To speak to our analyst for a discussion on the above findings, click Speak to Analyst

TABLE OF CONTENTS

1 INTRODUCTION (Page No. - 40)

1.1 INTRODUCTION TO COVID-19

1.2 COVID-19 HEALTH ASSESSMENT

FIGURE 1 COVID-19: GLOBAL PROPAGATION

FIGURE 2 COVID-19 PROPAGATION: SELECTED COUNTRIES

1.3 COVID-19 ECONOMIC ASSESSMENT

FIGURE 3 REVISED GROSS DOMESTIC PRODUCT FORECASTS FOR SELECT G20 COUNTRIES IN 2020

1.3.1 COVID-19 ECONOMIC IMPACT—SCENARIO ASSESSMENT

FIGURE 4 CRITERIA IMPACTING GLOBAL ECONOMY

FIGURE 5 SCENARIOS IN TERMS OF RECOVERY OF GLOBAL ECONOMY

1.4 OBJECTIVES OF THE STUDY

1.5 MARKET DEFINITION

1.5.1 INCLUSIONS AND EXCLUSIONS

1.6 MARKET SCOPE

1.6.1 MARKET SEGMENTATION

1.6.2 REGIONS COVERED

1.6.3 YEARS CONSIDERED

1.7 CURRENCY CONSIDERED

TABLE 1 USD EXCHANGE RATES, 2017–2020

1.8 STAKEHOLDERS

1.9 SUMMARY OF CHANGES

2 RESEARCH METHODOLOGY (Page No. - 50)

2.1 RESEARCH DATA

FIGURE 6 CONTAINER SECURITY MARKET: RESEARCH DESIGN

2.1.1 SECONDARY DATA

2.1.2 PRIMARY DATA

2.1.2.1 Breakup of primary profiles

2.1.2.2 Key industry insights

2.2 MARKET BREAKUP AND DATA TRIANGULATION

2.3 MARKET SIZE ESTIMATION

FIGURE 7 MARKET SIZE ESTIMATION METHODOLOGY, APPROACH 1 (SUPPLY-SIDE): REVENUE OF PRODUCTS AND SERVICES IN THE MARKET

FIGURE 8 MARKET SIZE ESTIMATION METHODOLOGY - APPROACH 1: SUPPLY-SIDE ANALYSIS

FIGURE 9 MARKET: MARKET ESTIMATION APPROACH: SUPPLY-SIDE ANALYSIS [COMPANY REVENUE ESTIMATION]

FIGURE 10 MARKET SIZE ESTIMATION METHODOLOGY - APPROACH 1: BOTTOM-UP (SUPPLY-SIDE): COLLECTIVE REVENUE OF ALL SOLUTIONS AND SERVICES IN THE CONTAINER SECURITY MARKET

FIGURE 11 MARKET SIZE ESTIMATION METHODOLOGY - APPROACH 2: BOTTOM-UP (DEMAND-SIDE) VERTICALS

2.4 MARKET FORECAST

TABLE 2 FACTOR ANALYSIS

2.5 COMPANY EVALUATION QUADRANT METHODOLOGY

FIGURE 12 COMPANY EVALUATION QUADRANT: CRITERIA WEIGHTAGE

2.6 STARTUPS EVALUATION QUADRANT METHODOLOGY

FIGURE 13 STARTUP EVALUATION QUADRANT: CRITERIA WEIGHTAGE

2.7 ASSUMPTIONS FOR THE STUDY

FIGURE 14 ASSUMPTIONS: MARKET

2.8 LIMITATIONS OF THE STUDY

3 EXECUTIVE SUMMARY (Page No. - 63)

FIGURE 15 CONTAINER SECURITY MARKET EXPECTED TO WITNESS THE FASTEST GROWTH DURING THE FORECAST PERIOD

FIGURE 16 FASTEST-GROWING SEGMENTS OF THE MARKET

FIGURE 17 NORTH AMERICA EXPECTED TO ACCOUNT FOR LARGEST MARKET SHARE IN 2021

4 PREMIUM INSIGHTS (Page No. - 67)

4.1 ATTRACTIVE OPPORTUNITIES IN THE MARKET

FIGURE 18 INCREASE IN STRICT CYBER LEGISLATION AND GOVERNMENT CONCERNS OVER THE INCREASING RATE OF CYBERCRIMES EXPECTED TO DRIVE THE MARKET GROWTH

4.2 CONTAINER SECURITY MARKET, BY COMPONENT, 2021

FIGURE 19 PRODUCTS SEGMENT EXPECTED TO ACCOUNT FOR A HIGHER MARKET SHARE IN 2021

4.3 MARKET, BY DEPLOYMENT MODE, 2021 VS. 2026

FIGURE 20 ON-PREMISES SEGMENT EXPECTED TO ACCOUNT FOR A LARGER MARKET SIZE BY 2026

4.4 MARKET SHARE OF TOP THREE VERTICALS AND REGIONS, 2021

FIGURE 21 BFSI VERTICAL AND NORTH AMERICA EXPECTED TO ACCOUNT FOR A SIGNIFICANT MARKET SHARE IN 2021

4.5 MARKET, BY ORGANIZATION SIZE, 2021 & 2026

FIGURE 22 LARGE ENTERPRISES SEGMENT ESTIMATED TO HAVE LARGEST MARKET VALUE DURING THE FORECAST PERIOD

4.6 MARKET INVESTMENT SCENARIO

FIGURE 23 ASIA PACIFIC TO EMERGE AS THE BEST MARKET FOR INVESTMENTS IN THE NEXT FIVE YEARS

5 MARKET OVERVIEW AND INDUSTRY TRENDS (Page No. - 70)

5.1 INTRODUCTION

5.2 MARKET DYNAMICS

FIGURE 24 DRIVERS, RESTRAINTS, OPPORTUNITIES, AND CHALLENGES: CONTAINER SECURITY MARKET

5.2.1 DRIVERS

5.2.1.1 Increasing vulnerabilities and cyberattacks promoting container security platforms

5.2.1.2 Increasing popularity of microservices and digital transformation across enterprises

5.2.1.3 Rise in east-west traffic in a container-based data center

5.2.2 RESTRAINTS

5.2.2.1 Limited security budgets among startups/SMEs

5.2.2.2 Faster deployment of applications resulting in faster failure

5.2.3 OPPORTUNITIES

5.2.3.1 Increasing adoption of cloud-based containers (Container-as-a-Service) across verticals

5.2.3.2 Expanding range of IoT applications

5.2.3.3 Leveraging AI and ML to provide better container security

5.2.4 CHALLENGES

5.2.4.1 Limited technical expertise and lack of awareness about container technologies and security

5.2.4.2 Presence of a large number of open-source vendors offering container platforms

5.3 IMPACT OF COVID- 19 ON MARKET DYNAMICS

5.3.1 DRIVERS AND OPPORTUNITIES

5.3.2 RESTRAINTS AND CHALLENGES

5.3.2.1 Cumulative growth analysis

5.4 REGULATORY IMPLICATIONS

5.4.1 INTRODUCTION

5.4.2 PAYMENT CARD INDUSTRY DATA SECURITY STANDARD (PCI DSS)

5.4.3 INFORMATION TECHNOLOGY (IT) ACT, 2000

5.4.4 GENERAL DATA PROTECTION REGULATION COMPLIANCE

5.4.5 CONTAINER SECURITY VERIFICATION STANDARD

5.4.6 CYBERSECURITY INFORMATION SHARING ACT (CISA), 2015

5.4.7 EU CYBERSECURITY ACT

5.5 USE CASES

5.5.1 USE CASE: AQUA SECURITY HELPED THOUGHTWORKS TO MANAGE CONTAINER VULNERABILITIES AND SECURE CLOUD ACCOUNTS

5.5.2 USE CASE: RED HAT HELPED ASCEND MONEY TO DEVELOP A CENTRALIZED PLATFORM FOR FASTER SERVICE DELIVERIES

5.5.3 USE CASE: TREND MICRO HELPED CLOUTICITY TO PROTECT THE HEALTHCARE DATA FOR MILLIONS OF PATIENTS

5.5.4 USE CASE: SYSDIG HELPED BLABLACAR TO EMPOWER DEVELOPERS TO MANAGE SECURITY RISKS

5.6 TECHNOLOGY ANALYSIS

FIGURE 25 CONTAINER SECURITY TECHNOLOGY ANALYSIS

5.6.1 CONTAINER SECURITY AND ARTIFICIAL INTELLIGENCE

5.6.2 CONTAINER SECURITY AND DEEP LEARNING

5.6.3 CONTAINER SECURITY AND CLOUD COMPUTING

5.7 ECOSYSTEM

FIGURE 26 ECOSYSTEM: CONTAINER SECURITY MARKET

TABLE 3 CONTAINER SECURITY: MARKET ECOSYSTEM

5.8 VALUE CHAIN

FIGURE 27 MARKET: VALUE-CHAIN

5.9 PATENTS

TABLE 4 MARKET: PATENTS

5.10 PRICING

TABLE 5 PRICING ANALYSIS

5.11 TRENDS AND DISRUPTIONS IMPACTING CUSTOMERS

FIGURE 28 MARKET: TRENDS AND DISRUPTIONS IMPACTING CUSTOMERS

5.12 PORTER’S FIVE FORCES ANALYSIS

TABLE 6 PORTER'S FIVE FORCES ANALYSIS: CONTAINER SECURITY MARKET

FIGURE 29 CONTAINER SECURITY: PORTER’S FIVE FORCES ANALYSIS

5.12.1 THREAT FROM NEW ENTRANTS

5.12.2 THREAT OF SUBSTITUTES

5.12.3 BARGAINING POWER OF SUPPLIERS

5.12.4 BARGAINING POWER OF BUYERS

5.12.5 INTENSITY OF COMPETITIVE RIVALRY

6 CONTAINER SECURITY MARKET, BY FEATURE (Page No. - 92)

6.1 INTRODUCTION

6.2 VULNERABILITY MANAGEMENT

6.3 RUNTIME PROTECTION

6.4 COMPLIANCE MANAGEMENT

6.5 AUTHENTICATION MANAGEMENT

6.6 CONTINUOUS INTEGRATION/CONTINUOUS DELIVERY INTEGRATIONS

6.7 ACCESS CONTROL

7 CONTAINER SECURITY MARKET, BY COMPONENT (Page No. - 94)

7.1 INTRODUCTION

FIGURE 30 SERVICES SEGMENT EXPECTED TO GROW AT A HIGHER CAGR DURING THE FORECAST PERIOD

TABLE 7 MARKET, BY COMPONENT, 2015–2020 (USD MILLION)

TABLE 8 MARKET, BY COMPONENT, 2021–2026 (USD MILLION)

7.2 PRODUCTS

7.2.1 PRODUCTS: MARKET DRIVERS

7.2.2 PRODUCTS: COVID-19 IMPACT

TABLE 9 PRODUCTS: MARKET, BY REGION, 2015–2020 (USD MILLION)

TABLE 10 PRODUCTS: MARKET, BY REGION, 2021–2026 (USD MILLION)

7.3 SERVICES

7.3.1 SERVICES: MARKET DRIVERS

7.3.2 SERVICES: COVID-19 IMPACT

TABLE 11 CONTAINER SECURITY MARKET, BY SERVICES, 2015–2020 (USD MILLION)

TABLE 12 MARKET, BY SERVICES, 2021–2026 (USD MILLION)

TABLE 13 SERVICES: MARKET, BY REGION, 2015–2020 (USD MILLION)

TABLE 14 SERVICES: MARKET, BY REGION, 2021–2026 (USD MILLION)

7.3.3 PROFESSIONAL SERVICES

TABLE 15 PROFESSIONAL SERVICES: MARKET, BY REGION, 2015–2020 (USD MILLION)

TABLE 16 PROFESSIONAL SERVICES: MARKET, BY REGION, 2021–2026 (USD MILLION)

7.3.4 MANAGED SERVICES

TABLE 17 MANAGED SERVICES: MARKET, BY REGION, 2015–2020 (USD MILLION)

TABLE 18 MANAGED SERVICES: MARKET, BY REGION, 2021–2026 (USD MILLION)

8 CONTAINER SECURITY MARKET, BY DEPLOYMENT MODE (Page No. - 102)

8.1 INTRODUCTION

TABLE 19 MARKET, BY DEPLOYMENT MODE, 2015–2020 (USD MILLION)

TABLE 20 MARKET, BY DEPLOYMENT MODE, 2021–2026 (USD MILLION)

8.2 CLOUD

8.2.1 CLOUD DEPLOYMENT MODE: MARKET DRIVERS

8.2.2 CLOUD DEPLOYMENT MODE: COVID-19 IMPACT

TABLE 21 CLOUD: MARKET, BY REGION, 2015–2020 (USD MILLION)

TABLE 22 CLOUD: MARKET, BY REGION, 2021–2026 (USD MILLION)

8.3 ON-PREMISES

8.3.1 ON-PREMISES DEPLOYMENT MODE: MARKET DRIVERS

8.3.2 ON-PREMISES DEPLOYMENT MODE: COVID-19 IMPACT

TABLE 23 ON-PREMISES: MARKET, BY REGION, 2015–2020 (USD MILLION)

TABLE 24 ON-PREMISES: MARKET, BY REGION, 2021–2026 (USD MILLION)

9 CONTAINER SECURITY MARKET, BY ORGANIZATION SIZE (Page No. - 106)

9.1 INTRODUCTION

FIGURE 31 SMALL AND MEDIUM-SIZED ENTERPRISES SEGMENT EXPECTED TO RECORD A HIGHER CAGR DURING THE FORECAST PERIOD

TABLE 25 MARKET, BY ORGANIZATION SIZE, 2015–2020 (USD MILLION)

TABLE 26 MARKET, BY ORGANIZATION SIZE, 2021–2026 (USD MILLION)

9.2 SMALL AND MEDIUM-SIZED ENTERPRISES

9.2.1 SMALL AND MEDIUM-SIZED ENTERPRISES: MARKET DRIVERS

9.2.2 SMALL AND MEDIUM-SIZED ENTERPRISES: COVID-19 IMPACT

TABLE 27 SMALL AND MEDIUM-SIZED ENTERPRISES: MARKET, BY REGION, 2015–2020 (USD MILLION)

TABLE 28 SMALL AND MEDIUM-SIZED ENTERPRISES: MARKET, BY REGION, 2021–2026 (USD MILLION)

9.3 LARGE ENTERPRISES

9.3.1 LARGE ENTERPRISES: MARKET DRIVERS

9.3.2 LARGE ENTERPRISES: COVID-19 IMPACT

TABLE 29 LARGE ENTERPRISES: MARKET, BY REGION, 2015–2020 (USD MILLION)

TABLE 30 LARGE ENTERPRISES: MARKET, BY REGION, 2021–2026(USD MILLION)

10 CONTAINER SECURITY MARKET, BY VERTICAL (Page No. - 111)

10.1 INTRODUCTION

FIGURE 32 RETAIL VERTICAL EXPECTED TO GROW AT THE HIGHEST CAGR DURING THE FORECAST PERIOD

TABLE 31 MARKET, BY VERTICAL, 2015–2020 (USD MILLION)

TABLE 32 MARKET, BY VERTICAL, 2021–2026 (USD MILLION)

10.2 BANKING, FINANCIAL SERVICES, AND INSURANCE

10.2.1 BFSI: MARKET DRIVERS

10.2.2 BFSI: MARKET COVID-19 IMPACT

TABLE 33 BANKING, FINANCIAL SERVICES, AND INSURANCE: MARKET, BY REGION, 2015–2020 (USD MILLION)

TABLE 34 BANKING, FINANCIAL SERVICES, AND INSURANCE: MARKET, BY REGION, 2021–2026 (USD MILLION)

10.3 RETAIL

10.3.1 RETAIL: MARKET DRIVERS

10.3.2 RETAIL: MARKET COVID-19 IMPACT

TABLE 35 RETAIL: CONTAINER SECURITY MARKET, BY REGION, 2015–2020 (USD MILLION)

TABLE 36 RETAIL: MARKET, BY REGION, 2021–2026 (USD MILLION)

10.4 GOVERNMENT

10.4.1 GOVERNMENT: MARKET DRIVERS

10.4.2 GOVERNMENT: MARKET COVID-19 IMPACT

TABLE 37 GOVERNMENT: MARKET, BY REGION, 2015–2020 (USD MILLION)

TABLE 38 GOVERNMENT: MARKET, BY REGION, 2021–2026 (USD MILLION)

10.5 HEALTHCARE

10.5.1 HEALTHCARE: MARKET DRIVERS

10.5.2 HEALTHCARE: MARKET COVID-19 IMPACT

TABLE 39 HEALTHCARE: MARKET, BY REGION 2015–2020 (USD MILLION)

TABLE 40 HEALTHCARE: MARKET, BY REGION, 2021–2026 (USD MILLION)

10.6 MANUFACTURING

10.6.1 MANUFACTURING: MARKET DRIVERS

10.6.2 MANUFACTURING: MARKET COVID-19 IMPACT

TABLE 41 MANUFACTURING: CONTAINER SECURITY MARKET, BY REGION 2015–2020 (USD MILLION)

TABLE 42 MANUFACTURING: MARKET, BY REGION, 2021–2026 (USD MILLION)

10.7 IT & TELECOMMUNICATION

10.7.1 IT & TELECOMMUNICATION: MARKET DRIVERS

10.7.2 IT & TELECOMMUNICATION: MARKET COVID-19 IMPACT

TABLE 43 IT & TELECOMMUNICATION: MARKET, BY REGION, 2015–2020 (USD MILLION)

TABLE 44 IT & TELECOMMUNICATION: MARKET, BY REGION, 2021–2026 (USD MILLION)

10.8 OTHER VERTICALS

TABLE 45 OTHER VERTICALS: MARKET, BY REGION, 2015–2020 (USD MILLION)

TABLE 46 OTHER VERTICALS: MARKET, BY REGION, 2021–2026 (USD MILLION)

11 CONTAINER SECURITY MARKET, BY REGION (Page No. - 122)

11.1 INTRODUCTION

FIGURE 33 ASIA PACIFIC EXPECTED TO GROW AT THE HIGHEST CAGR DURING THE FORECAST PERIOD

TABLE 47 MARKET, BY REGION, 2015–2020 (USD MILLION)

TABLE 48 MARKET, BY REGION, 2021–2026 (USD MILLION)

11.2 NORTH AMERICA

11.2.1 NORTH AMERICA: MARKET DRIVERS

11.2.2 NORTH AMERICA: COVID-19 IMPACT

11.2.3 NORTH AMERICA: MARKET REGULATIONS

11.2.4 NORTH AMERICA: REGULATORY LANDSCAPE

FIGURE 34 NORTH AMERICA: MARKET SNAPSHOT

TABLE 49 NORTH AMERICA: CONTAINER SECURITY MARKET, BY COMPONENT, 2015–2020 (USD MILLION)

TABLE 50 NORTH AMERICA: MARKET, BY COMPONENT, 2021–2026 (USD MILLION)

TABLE 51 NORTH AMERICA: MARKET, BY SERVICES, 2015–2020 (USD MILLION)

TABLE 52 NORTH AMERICA: MARKET, BY SERVICES, 2021–2026 (USD MILLION)

TABLE 53 NORTH AMERICA: MARKET, BY DEPLOYMENT MODE, 2015–2020 (USD MILLION)

TABLE 54 NORTH AMERICA: MARKET, BY DEPLOYMENT MODE, 2021–2026 (USD MILLION)

TABLE 55 NORTH AMERICA: MARKET, BY ORGANIZATION SIZE, 2015–2020 (USD MILLION)

TABLE 56 NORTH AMERICA: MARKET, BY ORGANIZATION SIZE, 2021–2026 (USD MILLION)

TABLE 57 NORTH AMERICA: MARKET, BY VERTICAL, 2015–2020 (USD MILLION)

TABLE 58 NORTH AMERICA: MARKET, BY VERTICAL, 2021–2026 (USD MILLION)

TABLE 59 NORTH AMERICA: MARKET, BY COUNTRY, 2015–2020 (USD MILLION)

TABLE 60 NORTH AMERICA: MARKET, BY COUNTRY, 2021–2026 (USD MILLION)

11.2.5 UNITED STATES

TABLE 61 UNITED STATES: CONTAINER SECURITY MARKET, BY COMPONENT, 2015–2020 (USD MILLION)

TABLE 62 UNITED STATES: MARKET, BY COMPONENT, 2021–2026 (USD MILLION)

TABLE 63 UNITED STATES: MARKET, BY SERVICES, 2015–2020 (USD MILLION)

TABLE 64 UNITED STATES: MARKET, BY SERVICES, 2021–2026 (USD MILLION)

TABLE 65 UNITED STATES: MARKET, BY DEPLOYMENT MODE, 2015–2020 (USD MILLION)

TABLE 66 UNITED STATES: MARKET, BY DEPLOYMENT MODE, 2021–2026 (USD MILLION)

TABLE 67 UNITED STATES: MARKET, BY ORGANIZATION SIZE, 2015–2020 (USD MILLION)

TABLE 68 UNITED STATES: MARKET, BY ORGANIZATION SIZE, 2021–2026 (USD MILLION)

TABLE 69 UNITED STATES: MARKET, BY VERTICAL, 2015–2020 (USD MILLION)

TABLE 70 UNITED STATES: MARKET, BY VERTICAL, 2021–2026 (USD MILLION)

11.2.6 CANADA

TABLE 71 CANADA: CONTAINER SECURITY MARKET, BY COMPONENT, 2015–2020 (USD MILLION)

TABLE 72 CANADA: MARKET, BY COMPONENT, 2021–2026 (USD MILLION)

TABLE 73 CANADA: MARKET, BY SERVICES, 2015–2020 (USD MILLION)

TABLE 74 CANADA: MARKET, BY SERVICES, 2021–2026 (USD MILLION)

TABLE 75 CANADA: MARKET, BY DEPLOYMENT MODE, 2015–2020 (USD MILLION)

TABLE 76 CANADA: MARKET, BY DEPLOYMENT MODE, 2021–2026 (USD MILLION)

TABLE 77 CANADA: MARKET, BY ORGANIZATION SIZE, 2015–2020 (USD MILLION)

TABLE 78 CANADA: MARKET, BY ORGANIZATION SIZE, 2021–2026 (USD MILLION)

TABLE 79 CANADA: MARKET, BY VERTICAL, 2015–2020 (USD MILLION)

TABLE 80 CANADA: MARKET, BY VERTICAL, 2021–2026 (USD MILLION)

11.3 EUROPE

11.3.1 EUROPE: CONTAINER SECURITY MARKET DRIVERS

11.3.2 EUROPE: COVID-19 IMPACT

11.3.3 EUROPE: MARKET REGULATIONS

11.3.4 EUROPE: REGULATORY LANDSCAPE

TABLE 81 EUROPE: MARKET, BY COMPONENT, 2015–2020 (USD MILLION)

TABLE 82 EUROPE: MARKET, BY COMPONENT, 2021–2026 (USD MILLION)

TABLE 83 EUROPE: MARKET, BY SERVICES, 2015–2020 (USD MILLION)

TABLE 84 EUROPE: MARKET, BY SERVICES, 2021–2026 (USD MILLION)

TABLE 85 EUROPE: MARKET, BY DEPLOYMENT MODE, 2015–2020 (USD MILLION)

TABLE 86 EUROPE: MARKET, BY DEPLOYMENT MODE, 2021–2026 (USD MILLION)

TABLE 87 EUROPE: MARKET, BY ORGANIZATION SIZE, 2015–2020 (USD MILLION)

TABLE 88 EUROPE: MARKET, BY ORGANIZATION SIZE, 2021–2026 (USD MILLION)

TABLE 89 EUROPE: MARKET, BY VERTICAL, 2015–2020 (USD MILLION)

TABLE 90 EUROPE: MARKET, BY VERTICAL, 2021–2026 (USD MILLION)

TABLE 91 EUROPE: MARKET, BY COUNTRY, 2015–2020 (USD MILLION)

TABLE 92 EUROPE MARKET SIZE, BY COUNTRY, 2021–2026 (USD MILLION)

11.3.5 UNITED KINGDOM

TABLE 93 UNITED KINGDOM: CONTAINER SECURITY MARKET, BY COMPONENT, 2015–2020 (USD MILLION)

TABLE 94 UNITED KINGDOM: MARKET, BY COMPONENT, 2021–2026 (USD MILLION)

TABLE 95 UNITED KINGDOM: MARKET, BY SERVICES, 2015–2020 (USD MILLION)

TABLE 96 UNITED KINGDOM: MARKET, BY SERVICES, 2021–2026 (USD MILLION)

TABLE 97 UNITED KINGDOM: MARKET, BY DEPLOYMENT MODE, 2015–2020 (USD MILLION)

TABLE 98 UNITED KINGDOM: MARKET, BY DEPLOYMENT MODE, 2021–2026 (USD MILLION)

TABLE 99 UNITED KINGDOM: MARKET, BY ORGANIZATION SIZE, 2015–2020 (USD MILLION)

TABLE 100 UNITED KINGDOM: MARKET, BY ORGANIZATION SIZE, 2021–2026 (USD MILLION)

TABLE 101 UNITED KINGDOM: MARKET, BY VERTICAL, 2015–2020 (USD MILLION)

TABLE 102 UNITED KINGDOM: MARKET, BY VERTICAL, 2021–2026 (USD MILLION)

11.3.6 GERMANY

TABLE 103 GERMANY: CONTAINER SECURITY MARKET, BY COMPONENT, 2015–2020 (USD MILLION)

TABLE 104 GERMANY: MARKET, BY COMPONENT, 2021–2026 (USD MILLION)

TABLE 105 GERMANY: MARKET, BY SERVICES, 2015–2020 (USD MILLION)

TABLE 106 GERMANY: MARKET, BY SERVICES, 2021–2026 (USD MILLION)

TABLE 107 GERMANY: MARKET, BY DEPLOYMENT MODE, 2015–2020 (USD MILLION)

TABLE 108 GERMANY: MARKET, BY DEPLOYMENT MODE, 2021–2026 (USD MILLION)

TABLE 109 GERMANY: MARKET, BY ORGANIZATION SIZE, 2015–2020 (USD MILLION)

TABLE 110 GERMANY: MARKET, BY ORGANIZATION SIZE, 2021–2026 (USD MILLION)

TABLE 111 GERMANY: MARKET, BY VERTICAL, 2015–2020 (USD MILLION)

TABLE 112 GERMANY: MARKET, BY VERTICAL, 2021–2026 (USD MILLION)

11.3.7 FRANCE

TABLE 113 FRANCE: CONTAINER SECURITY MARKET, BY COMPONENT, 2015–2020 (USD MILLION)

TABLE 114 FRANCE: MARKET, BY COMPONENT, 2021–2026 (USD MILLION)

TABLE 115 FRANCE: MARKET, BY SERVICES, 2015–2020 (USD MILLION)

TABLE 116 FRANCE: MARKET, BY SERVICES, 2021–2026 (USD MILLION)

TABLE 117 FRANCE: MARKET, BY DEPLOYMENT MODE, 2015–2020 (USD MILLION)

TABLE 118 FRANCE: MARKET, BY DEPLOYMENT MODE, 2021–2026 (USD MILLION)

TABLE 119 FRANCE: MARKET, BY ORGANIZATION SIZE, 2015–2020 (USD MILLION)

TABLE 120 FRANCE: MARKET, BY ORGANIZATION SIZE, 2021–2026 (USD MILLION)

TABLE 121 FRANCE: MARKET, BY VERTICAL, 2015–2020 (USD MILLION)

TABLE 122 FRANCE: MARKET, BY VERTICAL, 2021–2026 (USD MILLION)

11.3.8 REST OF EUROPE

TABLE 123 REST OF EUROPE: CONTAINER SECURITY MARKET, BY COMPONENT, 2015–2020 (USD MILLION)

TABLE 124 REST OF EUROPE: MARKET, BY COMPONENT, 2021–2026 (USD MILLION)

TABLE 125 REST OF EUROPE: MARKET, BY SERVICES, 2015–2020 (USD MILLION)

TABLE 126 REST OF EUROPE: MARKET, BY SERVICES, 2021–2026 (USD MILLION)

TABLE 127 REST OF EUROPE: MARKET, BY DEPLOYMENT MODE, 2015–2020 (USD MILLION)

TABLE 128 REST OF EUROPE: MARKET, BY DEPLOYMENT MODE, 2021–2026 (USD MILLION)

TABLE 129 REST OF EUROPE: MARKET, BY ORGANIZATION SIZE, 2015–2020 (USD MILLION)

TABLE 130 REST OF EUROPE: MARKET, BY ORGANIZATION SIZE, 2021–2026 (USD MILLION)

TABLE 131 REST OF EUROPE: MARKET, BY VERTICAL, 2015–2020 (USD MILLION)

TABLE 132 REST OF EUROPE: MARKET, BY VERTICAL, 2021–2026 (USD MILLION)

11.4 ASIA PACIFIC

11.4.1 ASIA PACIFIC: CONTAINER SECURITY MARKET DRIVERS

11.4.2 ASIA PACIFIC: COVID-19 IMPACT

11.4.3 ASIA PACIFIC: MARKET REGULATIONS

11.4.4 ASIA PACIFIC: REGULATORY LANDSCAPE

FIGURE 35 ASIA PACIFIC: MARKET SNAPSHOT

TABLE 133 ASIA PACIFIC: MARKET, BY COMPONENT, 2015–2020 (USD MILLION)

TABLE 134 ASIA PACIFIC: MARKET, BY COMPONENT, 2021–2026 (USD MILLION)

TABLE 135 ASIA PACIFIC: MARKET, BY SERVICES, 2015–2020 (USD MILLION)

TABLE 136 ASIA PACIFIC: MARKET, BY SERVICES, 2021–2026 (USD MILLION)

TABLE 137 ASIA PACIFIC: MARKET, BY DEPLOYMENT MODE, 2015–2020 (USD MILLION)

TABLE 138 ASIA PACIFIC: MARKET, BY DEPLOYMENT MODE, 2021–2026 (USD MILLION)

TABLE 139 ASIA PACIFIC: MARKET, BY ORGANIZATION SIZE, 2015–2020 (USD MILLION)

TABLE 140 ASIA PACIFIC: MARKET, BY ORGANIZATION SIZE, 2021–2026 (USD MILLION)

TABLE 141 ASIA PACIFIC: MARKET, BY VERTICAL, 2015–2020 (USD MILLION)

TABLE 142 ASIA PACIFIC: MARKET, BY VERTICAL, 2021–2026 (USD MILLION)

TABLE 143 ASIA PACIFIC: MARKET, BY COUNTRY, 2015–2020 (USD MILLION)

TABLE 144 ASIA PACIFIC: MARKET, BY VERTICAL, 2021–2026 (USD MILLION)

11.4.5 CHINA

TABLE 145 CHINA: CONTAINER SECURITY MARKET, BY COMPONENT, 2015–2020 (USD MILLION)

TABLE 146 CHINA: MARKET, BY COMPONENT, 2021–2026 (USD MILLION)

TABLE 147 CHINA: MARKET, BY SERVICES, 2015–2020 (USD MILLION)

TABLE 148 CHINA: MARKET, BY SERVICES, 2021–2026 (USD MILLION)

TABLE 149 CHINA: MARKET, BY DEPLOYMENT MODE, 2015–2020 (USD MILLION)

TABLE 150 CHINA: MARKET, BY DEPLOYMENT MODE, 2021–2026 (USD MILLION)

TABLE 151 CHINA: MARKET, BY ORGANIZATION SIZE, 2015–2020 (USD MILLION)

TABLE 152 CHINA: MARKET, BY ORGANIZATION SIZE, 2021–2026 (USD MILLION)

TABLE 153 CHINA: MARKET, BY VERTICAL, 2015–2020 (USD MILLION)

TABLE 154 CHINA: MARKET, BY VERTICAL, 2021–2026 (USD MILLION)

11.4.6 JAPAN

TABLE 155 JAPAN: CONTAINER SECURITY MARKET, BY COMPONENT, 2015–2020 (USD MILLION)

TABLE 156 JAPAN: MARKET, BY COMPONENT, 2021–2026 (USD MILLION)

TABLE 157 JAPAN: MARKET, BY SERVICES, 2015–2020 (USD MILLION)

TABLE 158 JAPAN: MARKET, BY SERVICES, 2021–2026 (USD MILLION)

TABLE 159 JAPAN: MARKET, BY DEPLOYMENT MODE, 2015–2020 (USD MILLION)

TABLE 160 JAPAN: MARKET, BY DEPLOYMENT MODE, 2021–2026 (USD MILLION)

TABLE 161 JAPAN: MARKET, BY ORGANIZATION SIZE, 2015–2020 (USD MILLION)

TABLE 162 JAPAN: MARKET, BY ORGANIZATION SIZE, 2021–2026 (USD MILLION)

TABLE 163 JAPAN: MARKET, BY VERTICAL, 2015–2020 (USD MILLION)

TABLE 164 JAPAN: MARKET, BY VERTICAL, 2021–2026 (USD MILLION)

11.4.7 INDIA

TABLE 165 INDIA: CONTAINER SECURITY MARKET, BY COMPONENT, 2015–2020 (USD MILLION)

TABLE 166 INDIA: MARKET, BY COMPONENT, 2021–2026 (USD MILLION)

TABLE 167 INDIA: MARKET, BY SERVICES, 2015–2020 (USD MILLION)

TABLE 168 INDIA: MARKET, BY SERVICES, 2021–2026 (USD MILLION)

TABLE 169 INDIA: MARKET, BY DEPLOYMENT MODE, 2015–2020 (USD MILLION)

TABLE 170 INDIA: MARKET, BY DEPLOYMENT MODE, 2021–2026 (USD MILLION)

TABLE 171 INDIA: MARKET, BY ORGANIZATION SIZE, 2015–2020 (USD MILLION)

TABLE 172 INDIA: MARKET, BY ORGANIZATION SIZE, 2021–2026 (USD MILLION)

TABLE 173 INDIA: MARKET, BY VERTICAL, 2015–2020 (USD MILLION)

TABLE 174 INDIA: MARKET, BY VERTICAL, 2021–2026 (USD MILLION)

11.4.8 REST OF ASIA PACIFIC

TABLE 175 REST OF ASIA PACIFIC: CONTAINER SECURITY MARKET, BY COMPONENT, 2015–2020 (USD MILLION)

TABLE 176 REST OF ASIA PACIFIC: MARKET, BY COMPONENT, 2021–2026 (USD MILLION)

TABLE 177 REST OF ASIA PACIFIC: MARKET, BY SERVICES, 2015–2020 (USD MILLION)

TABLE 178 REST OF ASIA PACIFIC: MARKET, BY SERVICES, 2021–2026 (USD MILLION)

TABLE 179 REST OF ASIA PACIFIC: MARKET, BY DEPLOYMENT MODE, 2015–2020 (USD MILLION)

TABLE 180 REST OF ASIA PACIFIC: MARKET, BY DEPLOYMENT MODE, 2021–2026 (USD MILLION)

TABLE 181 REST OF ASIA PACIFIC: MARKET, BY ORGANIZATION SIZE, 2015–2020 (USD MILLION)

TABLE 182 REST OF ASIA PACIFIC: MARKET, BY ORGANIZATION SIZE, 2021–2026 (USD MILLION)

TABLE 183 REST OF ASIA PACIFIC: MARKET, BY VERTICAL, 2015–2020 (USD MILLION)

TABLE 184 REST OF ASIA PACIFIC: MARKET, BY VERTICAL, 2021–2026 (USD MILLION)

11.5 MIDDLE EAST & AFRICA

11.5.1 MIDDLE EAST & AFRICA: CONTAINER SECURITY MARKET DRIVERS

11.5.2 MIDDLE EAST & AFRICA: COVID-19 IMPACT

11.5.3 MIDDLE EAST & AFRICA: MARKET REGULATIONS

11.5.4 MIDDLE EAST & AFRICA: REGULATORY LANDSCAPE

TABLE 185 MIDDLE EAST & AFRICA: MARKET, BY COMPONENT, 2015–2020 (USD MILLION)

TABLE 186 MIDDLE EAST & AFRICA: MARKET, BY COMPONENT, 2021–2026 (USD MILLION)

TABLE 187 MIDDLE EAST & AFRICA: MARKET, BY SERVICES, 2015–2020 (USD MILLION)

TABLE 188 MIDDLE EAST & AFRICA: MARKET, BY SERVICES, 2021–2026 (USD MILLION)

TABLE 189 MIDDLE EAST & AFRICA: MARKET, BY DEPLOYMENT MODE, 2015–2020 (USD MILLION)

TABLE 190 MIDDLE EAST & AFRICA: MARKET, BY DEPLOYMENT MODE, 2021–2026 (USD MILLION)

TABLE 191 MIDDLE EAST & AFRICA: MARKET, BY ORGANIZATION SIZE, 2015–2020 (USD MILLION)

TABLE 192 MIDDLE EAST & AFRICA: MARKET, BY ORGANIZATION SIZE, 2021–2026 (USD MILLION)

TABLE 193 MIDDLE EAST & AFRICA: MARKET, BY VERTICAL, 2015–2020 (USD MILLION)

TABLE 194 MIDDLE EAST & AFRICA: MARKET, BY VERTICAL, 2021–2026 (USD MILLION)

TABLE 195 MIDDLE EAST & AFRICA: MARKET, BY COUNTRY/REGION, 2015–2020 (USD MILLION)

TABLE 196 MIDDLE EAST & AFRICA MARKET, BY COUNTRY/REGION, 2021–2026 (USD MILLION)

11.5.5 UNITED ARAB EMIRATES

11.5.6 KINGDOM OF SAUDI ARABIA

11.5.7 SOUTH AFRICA

11.5.8 REST OF MIDDLE EAST & AFRICA

11.6 LATIN AMERICA

11.6.1 LATIN AMERICA: CONTAINER SECURITY MARKET DRIVERS

11.6.2 LATIN AMERICA: COVID-19 IMPACT

11.6.3 LATIN AMERICA: MARKET REGULATIONS

11.6.4 LATIN AMERICA: REGULATORY LANDSCAPE

TABLE 197 LATIN AMERICA: MARKET, BY COMPONENT, 2015–2020 (USD MILLION)

TABLE 198 LATIN AMERICA: MARKET, BY COMPONENT, 2021–2026 (USD MILLION)

TABLE 199 LATIN AMERICA: MARKET, BY SERVICES, 2015–2020 (USD MILLION)

TABLE 200 LATIN AMERICA: MARKET, BY SERVICES, 2021–2026 (USD MILLION)

TABLE 201 LATIN AMERICA: MARKET, BY DEPLOYMENT MODE, 2015–2020 (USD MILLION)

TABLE 202 LATIN AMERICA: MARKET, BY DEPLOYMENT MODE, 2021–2026 (USD MILLION)

TABLE 203 LATIN AMERICA: MARKET, BY ORGANIZATION SIZE, 2015–2020 (USD MILLION)

TABLE 204 LATIN AMERICA: MARKET, BY ORGANIZATION SIZE, 2021–2026 (USD MILLION)

TABLE 205 LATIN AMERICA: MARKET, BY VERTICAL, 2015–2020 (USD MILLION)

TABLE 206 LATIN AMERICA: MARKET, BY VERTICAL, 2021–2026 (USD MILLION)

TABLE 207 LATIN AMERICA: MARKET, BY COUNTRY, 2015–2020 (USD MILLION)

TABLE 208 LATIN AMERICA MARKET, BY VERTICAL, 2021–2026 (USD MILLION)

11.6.5 BRAZIL

11.6.6 MEXICO

11.6.7 REST OF LATIN AMERICA

12 COMPETITIVE LANDSCAPE (Page No. - 184)

12.1 OVERVIEW

12.2 MARKET EVALUATION FRAMEWORK

FIGURE 36 MARKET EVALUATION FRAMEWORK: 2019, 2020, AND 2021 EXPECTED TO WITNESS CONTAINER SECURITY MARKET DEVELOPMENTS AND CONSOLIDATION

12.3 COMPANY EVALUATION QUADRANT

12.3.1 OVERVIEW

12.3.2 PRODUCT FOOTPRINT

FIGURE 37 COMPANY EVALUATION QUADRANT: PRODUCT FOOTPRINT OF KEY COMPANIES

12.3.3 COMPANY EVALUATION QUADRANT

TABLE 209 EVALUATION CRITERIA

12.3.4 STARS

12.3.5 EMERGING LEADERS

12.3.6 PERVASIVE PLAYERS

12.3.7 PARTICIPANTS

FIGURE 38 CONTAINER SECURITY MARKET (GLOBAL), COMPANY EVALUATION QUADRANT, 2020

12.4 STARTUP EVALUATION QUADRANT

12.4.1 PROGRESSIVE COMPANIES

12.4.2 RESPONSIVE COMPANIES

12.4.3 DYNAMIC COMPANIES

12.4.4 STARTING BLOCKS

FIGURE 39 MARKET (GLOBAL), STARTUP EVALUATION QUADRANT, 2020

12.5 REVENUE ANALYSIS

FIGURE 40 FIVE-YEAR REVENUE ANALYSIS OF KEY CONTAINER SECURITY VENDORS

TABLE 210 PRODUCT LAUNCHES, 2020-2021

TABLE 211 DEALS, 2020-2021

12.6 MARKET SHARE ANALYSIS

FIGURE 41 CONTAINER SECURITY MARKET (GLOBAL), MARKET SHARE, 2021

TABLE 212 DEGREE OF COMPETITION

13 COMPANY PROFILES (Page No. - 194)

13.1 INTRODUCTION

13.2 LARGE PLAYERS

(Business overview, Products/solutions/services offered, Recent developments, COVID-19 related developments, MnM view, Key strengths/right to win, Strategic choices made, and Weaknesses and competitive threats)*

13.2.1 MICROSOFT

TABLE 213 MICROSOFT: BUSINESS OVERVIEW

FIGURE 42 MICROSOFT: COMPANY SNAPSHOT

TABLE 214 MICROSOFT: PRODUCTS OFFERED

TABLE 215 MICROSOFT: SERVICES OFFERED

TABLE 216 MICROSOFT: PRODUCT LAUNCHES

TABLE 217 MICROSOFT: DEALS

13.2.2 GOOGLE

TABLE 218 GOOGLE: BUSINESS OVERVIEW

FIGURE 43 GOOGLE: COMPANY SNAPSHOT

TABLE 219 GOOGLE: PRODUCTS OFFERED

TABLE 220 GOOGLE: PRODUCT LAUNCHES

TABLE 221 GOOGLE: DEALS

13.2.3 AWS

TABLE 222 AWS: BUSINESS OVERVIEW

FIGURE 44 AWS: COMPANY SNAPSHOT

TABLE 223 AWS: SERVICES OFFERED

TABLE 224 AWS: PRODUCT LAUNCHES

TABLE 225 AWS: DEALS

13.2.4 IBM

TABLE 226 IBM: BUSINESS OVERVIEW

FIGURE 45 IBM: COMPANY SNAPSHOT

TABLE 227 IBM: PRODUCTS OFFERED

TABLE 228 IBM: PRODUCT LAUNCHES

TABLE 229 IBM: DEALS

13.2.5 VMWARE

TABLE 230 VMWARE: BUSINESS OVERVIEW

FIGURE 46 VMWARE: COMPANY SNAPSHOT

TABLE 231 VMWARE: PRODUCTS OFFERED

TABLE 232 VMWARE: PRODUCT LAUNCHES

TABLE 233 VMWARE: DEALS

13.2.6 MCAFEE

TABLE 234 MCAFEE: BUSINESS OVERVIEW

FIGURE 47 MCAFEE: COMPANY SNAPSHOT

TABLE 235 MCAFEE: PRODUCTS OFFERED

TABLE 236 MCAFEE: PRODUCT LAUNCHES

TABLE 237 MCAFEE: DEALS

13.2.7 PALO ALTO NETWORKS

TABLE 238 PALO ALTO NETWORKS: BUSINESS OVERVIEW

FIGURE 48 PALO ALTO NETWORKS: COMPANY SNAPSHOT

TABLE 239 PALO ALTO NETWORKS: PRODUCTS OFFERED

TABLE 240 PALO ALTO NETWORKS: SERVICES OFFERED

TABLE 241 PALO ALTO NETWORKS: PRODUCT LAUNCHES

TABLE 242 PALO ALTO NETWORKS: DEALS

13.2.8 CISCO

TABLE 243 CISCO: BUSINESS OVERVIEW

FIGURE 49 CISCO: COMPANY SNAPSHOT

TABLE 244 CISCO: PRODUCTS OFFERED

TABLE 245 CISCO: SERVICES OFFERED

TABLE 246 CISCO: PRODUCT LAUNCHES

TABLE 247 CISCO: DEALS

13.2.9 JUNIPER NETWORKS

TABLE 248 JUNIPER NETWORKS: BUSINESS OVERVIEW

FIGURE 50 JUNIPER NETWORKS: COMPANY SNAPSHOT

13.2.10 PRODUCTS/SOLUTIONS/SERVICES OFFERED

TABLE 249 JUNIPER NETWORKS: PRODUCTS OFFERED

TABLE 250 JUNIPER NETWORKS: PRODUCT LAUNCHES

TABLE 251 JUNIPER NETWORKS: DEALS

13.2.11 QUALYS

TABLE 252 QUALYS: BUSINESS OVERVIEW

FIGURE 51 QUALYS: COMPANY SNAPSHOT

TABLE 253 QUALYS: PRODUCTS OFFERED

TABLE 254 QUALYS: PRODUCT LAUNCHES

TABLE 255 QUALYS: DEALS

13.2.12 CROWDSTRIKE

TABLE 256 CROWDSTRIKE: BUSINESS OVERVIEW

FIGURE 52 CROWDSTRIKE: COMPANY SNAPSHOT

TABLE 257 CROWDSTRIKE: PRODUCTS OFFERED

TABLE 258 CROWDSTRIKE: PRODUCT LAUNCHES

TABLE 259 CROWDSTRIKE: DEALS

13.2.13 TENABLE

TABLE 260 TENABLE: BUSINESS OVERVIEW

FIGURE 53 TENABLE: COMPANY SNAPSHOT

TABLE 261 TENABLE: PRODUCTS OFFERED

TABLE 262 TENABLE: PRODUCT LAUNCHES

TABLE 263 TENABLE: DEALS

13.2.14 CHECK POINT

TABLE 264 CHECK POINT: BUSINESS OVERVIEW

FIGURE 54 CHECK POINT: COMPANY SNAPSHOT

TABLE 265 CHECK POINT: PRODUCTS OFFERED

TABLE 266 CHECK POINT: PRODUCT LAUNCHES

TABLE 267 CHECK POINT: DEALS

13.2.15 RAPID7

TABLE 268 RAPID7: BUSINESS OVERVIEW

FIGURE 55 RAPID7: COMPANY SNAPSHOT

TABLE 269 RAPID7: PRODUCTS OFFERED

TABLE 270 RAPID7: DEALS

13.2.16 ZSCALER

TABLE 271 ZSCALER: BUSINESS OVERVIEW

FIGURE 56 ZSCALER: COMPANY SNAPSHOT

TABLE 272 ZSCALER: PRODCUTS OFFERED

TABLE 273 ZSCALER: PRODUCT LAUNCHES

TABLE 274 ZSCALER: DEALS

13.2.17 TREND MICRO

TABLE 275 TREND MICRO: BUSINESS OVERVIEW

FIGURE 57 TREND MICRO: COMPANY SNAPSHOT

13.2.18 PRODUCTS/SOLUTIONS/SERVICES OFFERED

TABLE 276 TREND MICRO: PRODCUTS OFFERED

TABLE 277 TREND MICRO: PRODUCT LAUNCHES

TABLE 278 TREND MICRO: DEALS

13.3 SME PLAYERS

13.3.1 SYSDIG

13.3.2 SNYK

13.3.3 SONATYPE

13.3.4 AQUA SECURITY

13.3.5 FIDELIS CYBERSECURITY

13.4 START-UP PLAYERS

13.4.1 ANCHORE

13.4.2 CAPSULE8

13.4.3 NEUVECTOR (ACQUIRED BY SUSE)

13.4.4 THREAT STACK

13.4.5 CONFLUERA

13.4.6 FUGUE INC.

*Details on Business overview, Products/solutions/services offered, Recent developments, COVID-19 related developments, MnM view, Key strengths/right to win, Strategic choices made, and Weaknesses and competitive threats might not be captured in case of unlisted companies.

14 APPENDIX (Page No. - 258)

14.1 ADJACENT MARKETS

TABLE 279 ADJACENT MARKETS AND FORECASTS

14.1.1 LIMITATIONS

14.1.2 APPLICATION SECURITY MARKET

TABLE 280 APPLICATION SECURITY MARKET, BY TYPE, 2014–2019 (USD MILLION)

TABLE 281 APPLICATION SECURITY MARKET, BY TYPE, 2019–2025 (USD MILLION)

TABLE 282 APPLICATION SECURITY MARKET, BY COMPONENT, 2014–2019 (USD MILLION)

TABLE 283 APPLICATION SECURITY MARKET, BY COMPONENT, 2019–2025 (USD MILLION)

TABLE 284 APPLICATION SECURITY MARKET, BY SOFTWARE TOOL, 2014–2019 (USD MILLION)

TABLE 285 APPLICATION SECURITY MARKET, BY SOFTWARE TOOL, 2019–2025 (USD MILLION)

TABLE 286 APPLICATION SECURITY MARKET, BY SERVICE, 2014–2019 (USD MILLION)

TABLE 287 APPLICATION SECURITY MARKET, BY SERVICE, 2019–2025 (USD MILLION)

TABLE 288 APPLICATION SECURITY MARKET, BY ORGANIZATION SIZE, 2014–2019 (USD MILLION)

TABLE 289 APPLICATION SECURITY MARKET, BY ORGANIZATION SIZE, 2019–2025 (USD MILLION)

TABLE 290 APPLICATION SECURITY MARKET, BY VERTICAL, 2014–2019 (USD MILLION)

TABLE 291 APPLICATION SECURITY MARKET, BY VERTICAL, 2019–2025 (USD MILLION)

TABLE 292 APPLICATION SECURITY MARKET, BY REGION, 2014–2019 (USD MILLION)

TABLE 293 APPLICATION SECURITY MARKET, BY REGION, 2019–2025 (USD MILLION)

14.1.3 CLOUD SECURITY MARKET

TABLE 294 CLOUD SECURITY MARKET, BY SECURITY TYPE, 2014–2019 (USD MILLION)

TABLE 295 POST-COVID-19: CLOUD SECURITY MARKET, BY SECURITY TYPE, 2019–2025 (USD MILLION)

TABLE 296 CLOUD SECURITY MARKET, BY APPLICATION, 2014–2019 (USD MILLION)

TABLE 297 POST-COVID-19: CLOUD SECURITY MARKET, BY APPLICATION, 2019–2025 (USD MILLION)

TABLE 298 CLOUD SECURITY MARKET, BY ORGANIZATION SIZE, 2014–2019 (USD MILLION)

TABLE 299 POST-COVID-19: CLOUD SECURITY MARKET, BY ORGANIZATION SIZE, 2019–2025 (USD MILLION)

TABLE 300 CLOUD SECURITY MARKET, BY VERTICAL, 2014–2019 (USD MILLION)

TABLE 301 POST-COVID-19: CLOUD SECURITY MARKET, BY VERTICAL, 2019–2025 (USD MILLION)

TABLE 302 CLOUD SECURITY MARKET, BY REGION, 2014–2019 (USD MILLION)

TABLE 303 POST-COVID-19: CLOUD SECURITY MARKET, BY REGION, 2019–2025 (USD MILLION)

14.1.4 CLOUD SECURITY POSTURE MANAGEMENT (CSPM) MARKET

TABLE 304 CLOUD SECURITY POSTURE MANAGEMENT MARKET, BY COMPONENT, 2014–2019 (USD MILLION)

TABLE 305 CLOUD SECURITY POSTURE MANAGEMENT MARKET, BY COMPONENT, 2020–2026 (USD MILLION)

TABLE 306 CLOUD SECURITY POSTURE MANAGEMENT MARKET, BY CLOUD MODEL, 2014–2019 (USD MILLION)

TABLE 307 CLOUD SECURITY POSTURE MANAGEMENT MARKET, BY CLOUD MODEL, 2020–2026 (USD MILLION)

TABLE 308 CLOUD SECURITY POSTURE MANAGEMENT MARKET, BY VERTICAL, 2014–2019 (USD MILLION)

TABLE 309 CLOUD SECURITY POSTURE MANAGEMENT MARKET, BY VERTICAL, 2020–2026 (USD MILLION)

TABLE 310 CLOUD SECURITY POSTURE MANAGEMENT MARKET, BY REGION, 2014–2019 (USD MILLION)

TABLE 311 CLOUD SECURITY POSTURE MANAGEMENT MARKET, BY REGION, 2020–2026 (USD MILLION)

14.2 DISCUSSION GUIDE

14.3 KNOWLEDGE STORE: MARKETSANDMARKETS' SUBSCRIPTION PORTAL

14.4 AVAILABLE CUSTOMIZATIONS

14.5 RELATED REPORTS

14.6 AUTHOR DETAILS

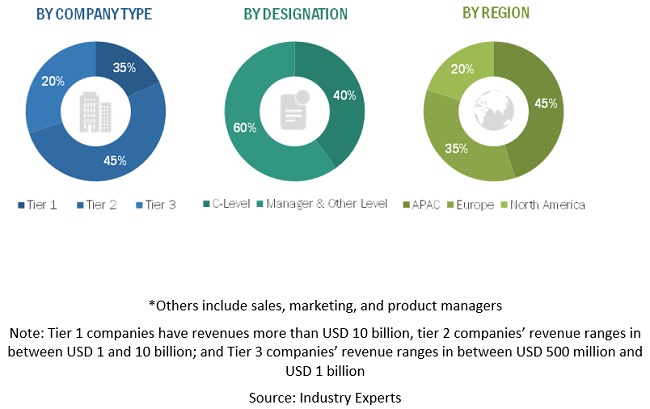

The study involved major activities in estimating the current market size for the container security market. Exhaustive secondary research was done to collect information on the container security industry. The next step was to validate these findings, assumptions, and sizing with industry experts across the value chain using primary research. Different approaches like Top-down, bottom up were employed to estimate the total market size. After that, the market breakup and data triangulation procedures were used to estimate the market size of the segments and sub segments of the container security market.

Secondary Research

In the secondary research process, various secondary sources were referred to, for identifying and collecting information regarding the study. The secondary sources included annual reports, press releases, investor presentations of container security solutions and service vendors, forums, certified publications, and whitepapers. The secondary research was mainly used to obtain key information about the industry’s supply chain, the total pool of key players, market classification and segmentation according to industry trends to the bottom-most level, regional markets, and key developments from both market- and technology-oriented perspectives, all of which were further validated by primary sources.

Primary Research

In the primary research process, various primary sources from both supply and demand sides of the container security market ecosystem have been interviewed to obtain qualitative and quantitative information for the study. The primary sources from the supply side include industry experts, such as Chief Executive Officers (CEOs), Vice Presidents (VPs), marketing directors, technology and innovation directors, and related key executives of various vendors providing container security solutions and services, associated service providers, and system integrators operating in the targeted regions. All possible parameters that affect the market covered in this research study have been accounted for, viewed in extensive detail, verified through primary research, and analyzed to obtain the final quantitative and qualitative data.

After a complete market engineering process (calculations for market statistics, market breakups, market size estimations, market forecasting, and data triangulation), extensive primary research has been conducted to gather information and verify and validate the critical numbers arrived at. The primary research helps in identifying and validating segmentation; industry trends; key players; competitive landscape of container security solutions and services offered by several market vendors; and key market dynamics, such as drivers, restraints, opportunities, challenges, industry trends, and key strategies.

In the complete market engineering process, both bottom-up and top-down approaches have been extensively used, along with several data triangulation methods, to perform the market estimation and market forecasting for the overall market segments and sub-segments listed in this report. Extensive qualitative and quantitative analyses have been performed on the complete market engineering process to list the key information/insights throughout the report.

Following is the breakup of the primary respondents:

To know about the assumptions considered for the study, download the pdf brochure

Market Size Estimation

Top-down and bottom-up approaches were used to estimate and validate the size of the global container security market and estimate the size of various other dependent sub segments. The research methodology used to estimate the market size included the following details: the key players in the market were identified through secondary research, and their revenue contribution in respective regions were determined through primary and secondary research. This entire procedure included the study of the annual and financial reports of top market players and extensive interviews for key insights from industry leaders, such as CEOs, VPs, directors, and marketing executives. All percentage splits and breakups were determined using secondary sources and verified through primary sources. All the possible parameters that affect the market are covered in this research study have been accounted for, viewed in extensive detail, verified through primary research, and analyzed to get the final quantitative and qualitative data. This data is consolidated and added to detailed inputs and analysis from MarketsandMarkets.

Data Triangulation

After arriving at the overall market size using the market size estimation processes as explained above, the market was split into several segments and subsegments. The data triangulation and market breakup procedures were employed, wherever applicable, to complete the overall market engineering process and arrive at the exact statistics of each market segment and subsegments. The data was triangulated by studying various factors and trends from both the demand and supply sides.

Report Objectives

- To define, describe, and forecast the container security market by component, deployment mode, organization size, vertical, and region

- To provide detailed information about the major factors (drivers, restraints, opportunities, and industry-specific challenges) influencing the market growth

- To analyze the opportunities in the market and provide details of the competitive landscape for stakeholders and market leaders

- To forecast the market size of the segments with respect to four main regions: North America, Europe, Asia Pacific (APAC), Middle East & Africa (MEA), and Latin America

- To profile key players and comprehensively analyze their market rankings and core competencies

- To analyze competitive developments, such as mergers and acquisitions, new product developments, and Research and Development (R&D) activities, in the market

- To analyze the impact of COVID-19 on the market growth

Available customizations

Along with the market data, MarketsandMarkets offers customizations as per the company’s specific needs. The following customization options are available for the report:

Geographic analysis

- Further breakup of the North America container security market into countries

- Further breakup of the Europe market into countries

- Further breakup of the APAC market into countries

- Further breakup of the MEA market into countries

- Further breakup of the Latin America market into countries

Company information

- Detailed analysis and profiling of additional market players

Generating Response ...

Generating Response ...

Growth opportunities and latent adjacency in Container Security Market