Containers as a Service Market by Service Type (Management and Orchestration, Security, Monitoring and Analytics), Deployment Model (Public, Private, Hybrid), Organization Size, Vertical and Region - Global Forecast to 2027

Containers as a Service Market Size and Forecast

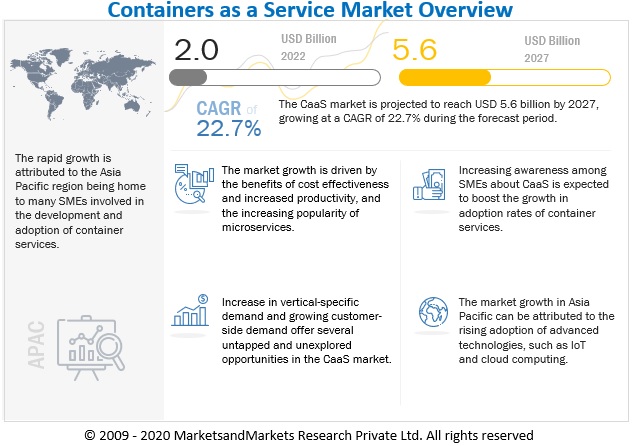

[213 Pages Report] The global Containers as a Service Market size was valued USD 2.0 billion in 2022 and is projected to reach USD 5.6 billion by 2027, at a CAGR of 22.7% during the forecast period. Due to ongoing recession, the worsening economic condition in Europe will slow down the demand for PCs and laptops. Technologies such as software solutions will also be impacted by the recession and the growing data volumes in the European telecom market will likely drive the demand for wireless equipment. According to the Bank of England, inflation in the UK will reach a peak of over 13% and stay above 10% in 2023. The consumer IT spending in Asia Pacific is already declining with the ongoing tight market conditions in the US and Europe. However, enterprise IT spending is expected to remain stable as organizations focus on IT security and digital transformation in the short run.

To know about the assumptions considered for the study, Request for Free Sample Report

Recession Impact: Containers as a Service Market

The War in Ukraine, higher inflation, bad financial conditions, economic decelerations of key trading partners, and social discontent is slowing the growth prospects. The war in Ukraine is shaking the global economy and raising uncertainty about the outlook for Latin America and the Caribbean. The impact is felt in Latin America through higher inflation that is affecting real incomes, especially for the most vulnerable. The policymakers are reacting to this difficulty by tightening the monetary policy and implementing measures to soften the blow on the most vulnerable and contain the risks of social unrest. As per The Harris Poll, 62% of Canadian organizations are confident that they can survive the upcoming recession. This is because there are many large capital projects that were delayed due to the pandemic that have secured funding and will proceed as planned, even if there is a slowdown. Despite the uncertainty, some industry researchers and individual companies continue to forecast growth. For instance, Capgemini boosted its revenue growth objective for 2022 to 14% to 15% versus its previous forecast of 8% to 10%. Higher global and domestic financing costs can accelerate capital outflows and represent a challenge for the region, given large public and external financing needs in some countries and the limited resources to finance investments in the region. Even before the war, various region’s recovery from the pandemic was losing momentum. After a sharp rebound last year, growth is returning to its pre-pandemic trend rate as policies shift, slowing to 2.5% for 2022. Exports and investment are resuming their role as main growth drivers, but central banks have had to tighten the monetary policy to combat an increase in inflation. As per the IMF, Gulf countries have strengthened their reform programs, which has supported increasing their sources of revenues and will assist them in facing the global recession. As per the report by the Central Bank of the United Arab Emirates, the UAE GDP is to grow by 5.4% and 4.2% in 2022 and 2023. This growth will be driven by higher oil production, with the growth of the manufacturing sector by 2031.

Containers as a Service Market Growth Dynamics

Drivers: Greater flexibility than on-premises containers

The enterprises deploy cloud-based container services rather than deploying containers on-premises due to several reasons, such as easy sharing of resources, negligible hardware or software footprint on-premises, and centralization of container repositories. The containers as a service enables the enterprises to avoid the complexity and immoderate cost of setting up their container development, deployment, and runtime environment by renting a full container environment from a containers as a service provider. As it is a service, the container and cloud service providers can make auto-updates to container images, repositories, and associated tools on the user’s behalf, thus making container adoption easier for enterprises. Moreover, service providers mostly have an environment that is built around their containers as a service offerings, enabling enterprises to attain security, management, and other services supporting container adoption.

Restraints: Heavy increase in container sprawl

Container sprawl is a term which is used to describe the running of unmanageable, multiple instances of applications through containers, and the corresponding heavy resource consumption resulting from it. The resource consumption by multiple instances results in fewer resources for running useful containers. Moreover, the unmanageable number of containers on a particular host speeds up the chances of misconfiguration and mishandling of containers. The containers are estimated to be running on about 10% of hosts, which was just a mere 2–3% a couple of years back. Uncontrolled interest in containerizing applications might result in hundreds of unmonitored containers, resulting in a sprawl. These containers would be able to run on physical servers, VMs, or on the cloud, making them impossible to manage. The large enterprises are at a greater risk of container sprawl than SMEs. Tracking and mapping of containers will soon become a necessity as more applications start getting containerized. For the enterprises to adopt an efficient DevOps and security strategy, it is essential for them to counter container sprawl.

Opportunities: The rise in hybrid cloud deployment models

Containers provide interoperability and portability across cloud infrastructures, making it easier for enterprises to adopt hybrid cloud. The hybrid environments are also conducive to container clustering services, which further increases container adoption. The market growth for containers as a service has coincided with the rising growth of hybrid cloud and multi-cloud markets, where the central management and portability of containers are essential. Enterprises using multiple public and private clouds in a hybrid format face the threat of getting caught up in a vendor lock-in due to proprietary services offered by some cloud providers. Container infrastructure offers an effective solution to counter the problem of hybrid and multi-cloud vendor lock-in. Most containers as a service vendors have plans to expand their container portfolio so that it can span both public and private cloud offerings.

Challenges: Persistent storage issues

When containers as a service initially started getting mainstream, it was designed for stateless (non-persistent data) applications. As its adoption started to increase, enterprises started demanding stateful (persistent data) application support, so that containers could be beneficial for more enterprise workload. Enterprise IT teams require persistent data storage, which can be easily backed up. The certain use cases, such as transactional databases, require persistent storage, without which their usage of containers would be limited to the test/dev environments. Many vendors keeping in mind this customer demands have even started focusing on ensuring persistent storage for containers.

Containers as a Service Architectural Framework

To know about the assumptions considered for the study, download the pdf brochure

Based on service type, the CI/CD framework over containers automatically build, package, and deploy applications

CI/CD merges development with testing, which enables developers to build the code collaboratively, submit it to the master branch, and check for issues. This enables developers to not only build their code but also test their code in any environment type and as often as possible. This helps the developers in catching bugs early in the application development lifecycle. Thus, the CI/CD service streamlines the process, and saves time on build and setup processes. Moreover, it enables developers to automate the tests and also run these tests in parallel. This would ultimately help the developers in continuing their work on other projects while tests are being run. Some of the features of the CI/CD service include repeatability, centralized management, isolation, parallelization, and automated release.

Based on the deployment model, the public cloud deployment to be a larger contributor to the containers as a service market growth during the forecast period

SMEs are majorly moving toward the adoption of public cloud deployment due to its major benefits, such as lower costs, no requirement of manpower for hardware maintenance, faster and efficient results, and complete flexibility and scalability, which result in reduced Operational Expenditure (OPEX) and CAPEX. Seamless flexibility and scalability enable customers to easily store and retrieve actionable insights anytime and anywhere. The public cloud deployment model offers various benefits to enterprises, such as scalability, reliability, flexibility, and location independence services. The public enterprises own and operate the infrastructure and offer access via the internet and enables users to run analytics on data from remote locations in real-time.

Based on organization size, the large enterprises to be a larger contributor to the containers as a service market growth during the forecast period

The adoption of containers as a service in large enterprises is more than small enterprises due to their ability to adapt and leverage the benefits of advanced technologies,including containers as a service. The container services helps them in improving their profit margins by reducing their operational and capital expenses and help them to focus on their core business.

Based on vertical, IT & telecommunications vertical to provide on-demand availability of information and real-time services

With the explosive growth of IoT devices, telecom companies thrive on handling a massive amount of IoT data, network congestion, and equipment failure issues. According to a survey by TCS, the telecom industry stands fourth in terms of IoT technology spending. The IT and telecommunications vertical has grown rapidly due to the increasing number of subscribers and huge data generation. Moreover, there is a tremendous upsurge in consumer-generated documents, media, and other digital content, which increases the need for reliable and secure container services. Further, the growing competition in the IT and telecommunications vertical is shifting the focus on delivering enhanced customer experience and satisfaction. These factors have pushed the adoption of containerized applications, which could easily handle the increasing demand of end-users. The IT and telecommunications vertical has been adopting innovative containers as a service solutions to provide on-demand availability of information and real-time services to its customers.

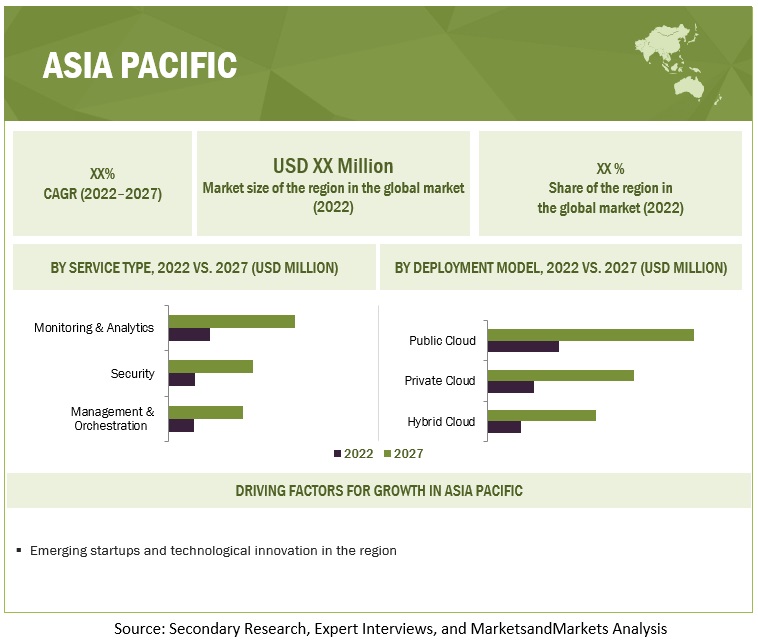

Asia Pacific to grow at the highest CAGR during the forecast period

IT spending across organizations in the region is gradually increasing, which is projected to lead to a surge in the adoption of containers as a service. Asia Pacific is expected to experience extensive growth opportunities in the next few years due to the rising adoption of advanced technologies, such as IoT and cloud computing. However, the adoption of containers as a service in Asia Pacific is low compared to North America and Europe. This is due to the lack of awareness among various small and medium-sized companies in the region. There is an increase in the number of enterprises in Asia Pacific countries. The market in the region is driven by factors like the increasing demand for microservices, technological developments, and growing demand for microservices adoption. The top containers as a service solution providers are also developing and growing their businesses to tap into the region’s enormous prospects and the largest possible market share. The increased focus of leading service providers, such as Microsoft, who announced Azure Edge Zones and Google, and unveiled its Global Mobile Edge Cloud (GMEC) strategy that was primarily targeted at the US market is expected to provide impetus to regional growth over the next few years. The increasing IT & telecom industry in the Asia Pacific region has led to an increasing demand for containers as a service. Asia Pacific is expected to emerge as the fastest-growing region in the containers as a service market during the forecast period. This growth can be attributed to the growing economies of China and India, which have more economic growth due to an increase in industrial production. Also, technologies like mobile banking and digital payments are revolutionizing the banking industry, especially in emerging countries like India and China. Hence, the use and deployment of containers as a service models are also increasing.

Key Market Players

The containers as a service market is dominated by companies such as Cisco Systems, Inc. (US), Hewlett Packard Enterprise Company (US), IBM Corporation (US), Oracle (US), Huawei Technologies Co., Ltd. (China), Amazon Web Services (US), Google (US), Microsoft (US), VMWare (US), Docker (US), SUSE (Germany), Red Hat (US), Tata Communications (India), Alibaba Cloud (Singapore), and DXC Technology (US). These vendors have a large customer base and strong geographic footprint along with organized distribution channels, which helps them to increase revenues.

Scope of the Report

|

Report Metrics |

Details |

| Market size value in 2022 | USD 2.0 Billion |

| Revenue forecast by 2027 | USD 5.6 Billion |

| Growth Rate (CAGR) | 22.7% |

| Market size available for years | 2022-2027 |

| Base year considered | 2021 |

| Forecast period | 2022-2027 |

| Forecast units | Value (USD Billion) |

| Segments covered | Service Type, Deployment Model, Organization Size, Verticals and Region |

| Regions covered | North America, Europe, Asia Pacific, Middle East & Africa, and Latin America |

| Companies covered | Cisco Systems, Inc. (US), Hewlett Packard Enterprise Company (US), IBM Corporation (US), Oracle (US), Huawei Technologies Co., Ltd. (China), Amazon Web Services (US), Google (US), Microsoft (US), VMWare (US), Docker (US), SUSE (Germany), Red Hat (US), Tata Communications (India), Alibaba Cloud (Singapore), and DXC Technology (US). |

This research report categorizes the containers as a service market to forecast revenue and analyze trends in each of the following submarkets:

Based on the Service Type:

- Management & Orchestration

- Security

- Monitoring and Analytics

- Storage and Networking

- Continuous Integration and Continuous Deployment (CI/CD)

- Training and Consulting

- Support and Maintenance

Based on the Deployment Model:

- Public Cloud

- Private Cloud

- Hybrid Cloud

Based on the Organization Size:

- Small and Medium-Sized Enterprises (SMEs)

- Large Enterprises

Based on the Vertical:

- Retail and Consumer Goods

- Manufacturing

- Media, Entertainment and Gaming

- IT and Telecommunications

- Healthcare

- BFSI

- Transportation & Logistics

- Travel & Hospitality

- Others (Education, and Government & Public Sector)

Based on Regions:

-

North America

- United States

- Canada

-

Europe

- United Kingdom

- Germany

- France

- Rest of Europe

-

Asia Pacific

- China

- Japan

- Singapore

- Australia & New Zealand

- Rest of Asia Pacific

-

Middle East and Africa

- Middle East

- Africa

-

Latin America

- Brazil

- Mexico

- Rest of Latin America

Recent Developments

- In October 2022, the general availability of Azure Savings plans for Compute solution was made on October 18th. Azure savings plan for compute is an easy and flexible way to save significantly on compute services compared to pay-as-you-go prices. The savings plan unlocks lower prices on select compute services when customers commit to spend a fixed hourly amount for one or three years.

- In October 2022, Amazon EKS announced the new Amazon EKS service delivery specialization to highlight AWS partners with consulting offerings that have demonstrated proven capabilities to architect, run, and operate containerized workloads on Amazon EKS.

- In October 2022, OCI expanded the app development portfolio with a new serverless container and messaging services and capabilities to simplify enterprise adoption of cloud-native technologies.

- In October 2022, Red Hat collaborated with FIWARE Foundation to build an integrated, smart city platform that can enable cities worldwide to be more resilient and improve citizens’ well-being with data.

- In September 2022, SUSE entered into a multi-year collaboration agreement with AWS to offer migration acceleration programs for SAP customers looking to move to the cloud. This would bring innovation to customers faster, helping them leverage the power of the cloud at their own pace.

- In August 2022, New updates on GKE include the GKE Clusters List page, which now includes a new Observability tab. This tab shows infrastructure health metric trends such as CPU, Memory, container restarts, and Control Plane metrics. It also provides visibility into ingestion into Google Cloud Managed Service for Prometheus and Cloud Logging.

- In June 2022, Docker acquired Atomist, a company that improves developer productivity and keeps cloud-native applications safe. This acquisition accelerates Docker’s secure software supply chain efforts, specifically around observability.

- In March 2022, Cisco introduced innovations to help customers accelerate and simplify their hybrid cloud journeys. New Cisco Intersight™ platform integrations with the public cloud enable a consistent operating model, with governance and multi-cloud observability for virtual machines and Kubernetes® clusters. The company also introduced the new Cisco HyperFlex™ Express, lowering the entry point for hyperconvergence solutions; delivers new hardware platforms using the latest AMD EPYC™ processors.

- In September 2021, Oracle announced the availability of the Oracle Cloud Infrastructure (OCI) Service Operator for Kubernetes (OSOK). OSOK is an open-source Kubernetes add-on that allows users to manage OCI resources, such as the Autonomous Database service and the MySQL Database service, through the Kubernetes API. OSOK makes it easy to create, manage, and connect to OCI resources from a Kubernetes environment and using Kubernetes tooling.

- In May 2021, Huawei Cloud unveiled CCE Turbo, a Revolutionary Container Cluster. CCE Turbo facilitates innovation by accelerating compute, network, and scheduling

Frequently Asked Questions (FAQ):

What is the projected market value of the containers as a service market?

The containers as a service market size is expected to grow from USD 2.0 billion in 2022 to USD 5.6 billion by 2027, at a Compound Annual Growth Rate (CAGR) of 22.7% during the forecast period.

Which region has the highest market share in the containers as a service market?

North American region has a higher market share in the containers as a service market.

Which service type is expected to witness high adoption in the coming years?

Security services is expected to witness the highest rate adoption in the coming five years.

Which are the major vendors in the containers as a service market?

AWS, Microsoft, Google, Alibaba Cloud, and IBM are major vendors in containers as a service market.

What are some of the drivers in the containers as a service market?

Greater flexibility than on-premise containers

Benefits of increased productivity .

To speak to our analyst for a discussion on the above findings, click Speak to Analyst

TABLE OF CONTENTS

1 INTRODUCTION (Page No. - 34)

1.1 STUDY OBJECTIVES

1.2 MARKET DEFINITION

1.2.1 INCLUSIONS AND EXCLUSIONS

1.3 MARKET SCOPE

1.3.1 MARKET SEGMENTATION

1.3.2 REGIONS COVERED

1.3.3 YEARS CONSIDERED

1.4 CURRENCY CONSIDERED

TABLE 1 UNITED STATES DOLLAR EXCHANGE RATE, 2019–2021

1.5 STAKEHOLDERS

1.6 SUMMARY OF CHANGES

2 RESEARCH METHODOLOGY (Page No. - 39)

2.1 RESEARCH DATA

FIGURE 1 CONTAINERS AS A SERVICE MARKET: RESEARCH DESIGN

2.1.1 SECONDARY DATA

2.1.2 PRIMARY DATA

2.1.2.1 Breakup of primaries

FIGURE 2 BREAKUP OF PRIMARY INTERVIEWS: BY COMPANY TYPE, DESIGNATION, AND REGION

2.1.2.2 Key industry insights

2.2 MARKET BREAKUP AND DATA TRIANGULATION

FIGURE 3 DATA TRIANGULATION

2.3 MARKET SIZE ESTIMATION

FIGURE 4 MARKET: TOP-DOWN AND BOTTOM-UP APPROACHES

FIGURE 5 MARKET SIZE ESTIMATION METHODOLOGY – APPROACH 1 (SUPPLY SIDE): REVENUE OF SERVICES FROM CONTAINERS AS A SERVICE VENDORS

FIGURE 6 MARKET SIZE ESTIMATION METHODOLOGY - BOTTOM-UP APPROACH (SUPPLY SIDE): COLLECTIVE REVENUE OF CONTAINERS AS A SERVICE VENDORS

FIGURE 7 MARKET SIZE ESTIMATION METHODOLOGY - APPROACH 2 (DEMAND SIDE): CONTAINERS AS A SERVICE MARKET

2.4 MARKET FORECAST

TABLE 2 FACTOR ANALYSIS

2.5 COMPANY EVALUATION MATRIX METHODOLOGY

FIGURE 8 COMPANY EVALUATION MATRIX: CRITERIA WEIGHTAGE

2.6 START-UP/SME EVALUATION MATRIX METHODOLOGY

FIGURE 9 START-UP/SME EVALUATION MATRIX: CRITERIA WEIGHTAGE

2.7 ASSUMPTIONS

2.8 LIMITATIONS

3 EXECUTIVE SUMMARY (Page No. - 50)

FIGURE 10 CONTAINERS AS A SERVICE MARKET: GLOBAL SNAPSHOT, 2020–2027

FIGURE 11 TOP-GROWING SEGMENTS IN MARKET

FIGURE 12 MANAGEMENT & ORCHESTRATION TO ACCOUNT FOR LARGEST MARKET SIZE DURING FORECAST PERIOD

FIGURE 13 PUBLIC CLOUD TO ACCOUNT FOR LARGEST MARKET SIZE DURING FORECAST PERIOD

FIGURE 14 LARGE ENTERPRISES TO ACCOUNT FOR LARGER MARKET SIZE DURING FORECAST PERIOD

FIGURE 15 RETAIL & CONSUMER GOODS TO HOLD LARGEST MARKET SHARE DURING FORECAST PERIOD

FIGURE 16 NORTH AMERICA TO ACCOUNT FOR LARGEST MARKET SHARE DURING FORECAST PERIOD

4 PREMIUM INSIGHTS (Page No. - 56)

4.1 BRIEF OVERVIEW OF CONTAINERS AS A SERVICE MARKET

FIGURE 17 MICROSERVICE ARCHITECTURE TO FUEL MARKET GROWTH

4.2 MARKET, BY COMPONENT, 2022 VS. 2027

FIGURE 18 MANAGEMENT & ORCHESTRATION SEGMENT TO ACCOUNT FOR LARGEST MARKET SHARE BY 2027

4.3 MARKET, BY DEPLOYMENT MODEL, 2022 VS. 2027

FIGURE 19 PUBLIC CLOUD SEGMENT TO ACCOUNT FOR LARGEST MARKET SHARE BY 2027

4.4 MARKET, BY ORGANIZATION SIZE, 2022 VS. 2027

FIGURE 20 LARGE ENTERPRISES TO ACCOUNT FOR LARGER MARKET SHARE BY 2027

4.5 MARKET, BY VERTICAL, 2022 VS. 2027

FIGURE 21 RETAIL & CONSUMER GOODS TO ACCOUNT FOR LARGEST MARKET SHARE BY 2027

4.6 MARKET: INVESTMENT SCENARIO

FIGURE 22 ASIA PACIFIC TO EMERGE AS BEST MARKET FOR INVESTMENTS IN NEXT FIVE YEARS

5 MARKET OVERVIEW AND INDUSTRY TRENDS (Page No. - 59)

5.1 INTRODUCTION

5.2 MARKET DYNAMICS

FIGURE 23 DRIVERS, RESTRAINTS, OPPORTUNITIES, AND CHALLENGES: CONTAINERS AS A SERVICE MARKET

5.2.1 DRIVERS

5.2.1.1 Benefits of cost-effectiveness and increased productivity

5.2.1.2 Greater flexibility than on-premises containers

5.2.1.3 Increasing popularity of microservices

5.2.2 RESTRAINTS

5.2.2.1 Heavy increase in container sprawl

5.2.2.2 Difficulty in achieving security and compliance

5.2.3 OPPORTUNITIES

5.2.3.1 Emergence of IoT applications

5.2.3.2 Rise in hybrid cloud deployment models

5.2.4 CHALLENGES

5.2.4.1 Persistent storage issues

5.2.4.2 Lack of enterprise DevOps culture

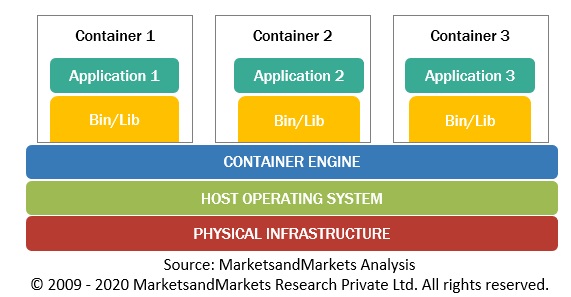

5.3 ARCHITECTURAL FRAMEWORK

FIGURE 24 CONTAINERS AS A SERVICE REFERENCE ARCHITECTURE

5.4 PRICING AND DEAL ANALYSIS

5.5 TARIFF AND REGULATORY LANDSCAPE

5.5.1 REGULATIONS

5.5.1.1 North America

5.5.1.2 Europe

5.5.1.3 Asia Pacific

5.5.1.4 Middle East and South Africa

5.5.1.5 Latin America

6 CONTAINERS AS A SERVICE MARKET, BY SERVICE TYPE (Page No. - 66)

6.1 INTRODUCTION

FIGURE 25 SECURITY SEGMENT TO GROW AT HIGHEST CAGR DURING FORECAST PERIOD

TABLE 3 MARKET, BY SERVICE TYPE, 2016–2020 (USD MILLION)

TABLE 4 MARKET, BY SERVICE TYPE, 2021–2027 (USD MILLION)

6.1.1 SERVICE TYPE: MARKET DRIVERS

6.2 MONITORING & ANALYTICS

6.2.1 MODERN MONITORING SOLUTIONS TO PROVIDE ROBUST CAPABILITIES TO TRACK POTENTIAL FAILURES

TABLE 5 MONITORING & ANALYTICS: MARKET, BY REGION, 2016–2020 (USD MILLION)

TABLE 6 MONITORING & ANALYTICS: MARKET, BY REGION, 2021–2027 (USD MILLION)

6.3 SECURITY

6.3.1 ENABLES ENTERPRISES TO PROTECT WORKLOADS AGAINST MODERN THREATS

TABLE 7 SECURITY: MARKET, BY REGION, 2016–2020 (USD MILLION)

TABLE 8 SECURITY: MARKET, BY REGION, 2021–2027 (USD MILLION)

6.4 CONTINUOUS INTEGRATION & CONTINUOUS DEPLOYMENT

6.4.1 CI/CD FRAMEWORK OVER CONTAINERS AUTOMATICALLY BUILD, PACKAGE, AND DEPLOY APPLICATIONS

TABLE 9 CONTINUOUS INTEGRATION & CONTINUOUS DEPLOYMENT: CONTAINERS AS A SERVICE MARKET, BY REGION, 2016–2020 (USD MILLION)

TABLE 10 CONTINUOUS INTEGRATION & CONTINUOUS DEPLOYMENT: MARKET, BY REGION, 2021–2027 (USD MILLION)

6.5 STORAGE & NETWORKING

6.5.1 NETWORK & STORAGE SERVICES DELIVERED BY SOFTWARE-DEFINED, CONTAINER-NATIVE PLUGINS DESIGNED FOR KUBERNETES

TABLE 11 STORAGE & NETWORKING: MARKET, BY REGION, 2016–2020 (USD MILLION)

TABLE 12 STORAGE & NETWORKING: MARKET, BY REGION, 2021–2027 (USD MILLION)

6.6 MANAGEMENT & ORCHESTRATION

6.6.1 CONTAINER ORCHESTRATION TO AUTOMATE DEPLOYMENT, MANAGEMENT, SCALING, AND NETWORKING

TABLE 13 MANAGEMENT & ORCHESTRATION: MARKET, BY REGION, 2016–2020 (USD MILLION)

TABLE 14 MANAGEMENT & ORCHESTRATION: MARKET, BY REGION, 2021–2027 (USD MILLION)

6.7 TRAINING & CONSULTING

6.7.1 CONSULTING SERVICES HELP ENTERPRISES MAKE INFORMED DECISIONS

TABLE 15 TRAINING & CONSULTING: CONTAINERS AS A SERVICE MARKET, BY REGION, 2016–2020 (USD MILLION)

TABLE 16 TRAINING & CONSULTING: MARKET, BY REGION, 2021–2027 (USD MILLION)

6.8 SUPPORT & MAINTENANCE

6.8.1 HELPS ADDRESS TECHNICAL QUERIES AND DELIVERS COST-EFFECTIVE SUPPORT

TABLE 17 SUPPORT & MAINTENANCE: MARKET, BY REGION, 2016–2020 (USD MILLION)

TABLE 18 SUPPORT & MAINTENANCE: MARKET, BY REGION, 2021–2027 (USD MILLION)

7 CONTAINERS AS A SERVICE MARKET, BY DEPLOYMENT MODEL (Page No. - 76)

7.1 INTRODUCTION

FIGURE 26 HYBRID CLOUD TO GROW AT HIGHEST CAGR DURING FORECAST PERIOD

TABLE 19 MARKET, BY DEPLOYMENT MODEL, 2016–2020 (USD MILLION)

TABLE 20 MARKET, BY DEPLOYMENT MODEL, 2021–2027 (USD MILLION)

7.1.1 DEPLOYMENT MODEL: MARKET DRIVERS

7.2 PUBLIC CLOUD

7.2.1 OFFERS SCALABILITY, RELIABILITY, FLEXIBILITY, AND LOCATION-INDEPENDENT SERVICES

TABLE 21 PUBLIC CLOUD: MARKET, BY REGION, 2016–2020 (USD MILLION)

TABLE 22 PUBLIC CLOUD: MARKET, BY REGION, 2021–2027 (USD MILLION)

7.3 PRIVATE CLOUD

7.3.1 PRIVATE CLOUDS CREATED FOR SPECIFIC GROUPS OR ORGANIZATIONS THAT REQUIRE GRANULAR DATA CONTROL

TABLE 23 PRIVATE CLOUD: MARKET, BY REGION, 2016–2020 (USD MILLION)

TABLE 24 PRIVATE CLOUD: MARKET, BY REGION, 2021–2027 (USD MILLION)

7.4 HYBRID CLOUD

7.4.1 RISING HYBRID CLOUD USAGE DUE TO INCREASING MICROSERVICE AND MANAGEMENT SERVICE DATA ENVIRONMENT

TABLE 25 HYBRID CLOUD: MARKET, BY REGION, 2016–2020 (USD MILLION)

TABLE 26 HYBRID CLOUD: MARKET, BY REGION, 2021–2027 (USD MILLION)

8 CONTAINERS AS A SERVICE MARKET, BY ORGANIZATION SIZE (Page No. - 82)

8.1 INTRODUCTION

FIGURE 27 SMES SEGMENT TO GROW AT HIGHER CAGR DURING FORECAST PERIOD

TABLE 27 MARKET, BY ORGANIZATION SIZE, 2016–2020 (USD MILLION)

TABLE 28 MARKET, BY ORGANIZATION SIZE, 2021–2027 (USD MILLION)

8.1.1 ORGANIZATION SIZE: MARKET DRIVERS

8.2 SMALL AND MEDIUM-SIZED ENTERPRISES

8.2.1 ADOPTION OF CAAS TO RESULT IN INCREASED REVENUE AND IMPROVED BUSINESS EFFICIENCY

TABLE 29 SMALL AND MEDIUM-SIZED ENTERPRISES: MARKET, BY REGION, 2016–2020 (USD MILLION)

TABLE 30 SMALL AND MEDIUM-SIZED ENTERPRISES: MARKET, BY REGION, 2021–2027 (USD MILLION)

8.3 LARGE ENTERPRISES

8.3.1 CAAS SOLUTIONS AND SERVICES ENABLE LARGE ENTERPRISES TO IMPROVE PROFIT MARGINS BY REDUCING OPEX AND CAPEX

TABLE 31 LARGE ENTERPRISES: MARKET, BY REGION, 2016–2020 (USD MILLION)

TABLE 32 LARGE ENTERPRISES: MARKET, BY REGION, 2021–2027 (USD MILLION)

9 CONTAINERS AS A SERVICE MARKET, BY VERTICAL (Page No. - 86)

9.1 INTRODUCTION

FIGURE 28 BFSI TO GROW AT HIGHEST CAGR DURING FORECAST PERIOD

TABLE 33 MARKET, BY VERTICAL, 2016–2020 (USD MILLION)

TABLE 34 MARKET, BY VERTICAL, 2021–2027 (USD MILLION)

9.1.1 VERTICAL: MARKET DRIVERS

9.2 BANKING, FINANCIAL SERVICES, AND INSURANCE

9.2.1 CAAS SOLUTIONS HELP BANKS MODERNIZE DIGITAL FOUNDATIONS FOR A COMPETITIVE EDGE

TABLE 35 BANKING, FINANCIAL SERVICES, AND INSURANCE: MARKET, BY REGION, 2016–2020 (USD MILLION)

TABLE 36 BANKING, FINANCIAL SERVICES, AND INSURANCE: MARKET, BY REGION, 2021–2027 (USD MILLION)

9.3 MANUFACTURING

9.3.1 ADOPTION OF CONTAINERIZED APPLICATIONS TO HELP ENTERPRISES ESTIMATE DEMAND ACCURATELY AND QUICKLY

TABLE 37 MANUFACTURING: MARKET, BY REGION, 2016–2020 (USD MILLION)

TABLE 38 MANUFACTURING: MARKET, BY REGION, 2021–2027 (USD MILLION)

9.4 MEDIA, ENTERTAINMENT & GAMING

9.4.1 MEDIA, ENTERTAINMENT & GAMING COMPANIES TO REDUCE OPEX AND OFFER BETTER CUSTOMER EXPERIENCES USING CAAS

TABLE 39 MEDIA, ENTERTAINMENT & GAMING: CONTAINERS AS A SERVICE MARKET, BY REGION, 2016–2020 (USD MILLION)

TABLE 40 MEDIA, ENTERTAINMENT & GAMING: MARKET, BY REGION, 2021–2027 (USD MILLION)

9.5 IT & TELECOMMUNICATIONS

9.5.1 IT & TELECOMMUNICATIONS VERTICAL TO PROVIDE ON-DEMAND AVAILABILITY OF INFORMATION AND REAL-TIME SERVICES

TABLE 41 IT & TELECOMMUNICATIONS: MARKET, BY REGION, 2016–2020 (USD MILLION)

TABLE 42 IT & TELECOMMUNICATIONS: MARKET, BY REGION, 2021–2027 (USD MILLION)

9.6 RETAIL & CONSUMER GOODS

9.6.1 CAAS TO LEVERAGE NEW TECHNOLOGIES TO GATHER INSIGHTS INTO CONSUMER’S PURCHASE PREFERENCES

TABLE 43 RETAIL & CONSUMER GOODS: MARKET, BY REGION, 2016–2020 (USD MILLION)

TABLE 44 RETAIL & CONSUMER GOODS: MARKET, BY REGION, 2021–2027 (USD MILLION)

9.7 TRANSPORTATION & LOGISTICS

9.7.1 ADOPTION OF CONTAINER SERVICES ACROSS ORGANIZATIONS TO HELP ACHIEVE FREIGHT AND FARE MANAGEMENT

TABLE 45 TRANSPORTATION & LOGISTICS: MARKET, BY REGION, 2016–2020 (USD MILLION)

TABLE 46 TRANSPORTATION & LOGISTICS: MARKET, BY REGION, 2021–2027 (USD MILLION)

9.8 HEALTHCARE & LIFE SCIENCES

9.8.1 CAAS TO ENABLE HEALTHCARE IT AND DEVOPS TEAMS DEPLOY APPLICATIONS IN HIPAA-COMPLIANT CLOUD

TABLE 47 HEALTHCARE & LIFE SCIENCES: CONTAINERS AS A SERVICE MARKET, BY REGION, 2016–2020 (USD MILLION)

TABLE 48 HEALTHCARE & LIFE SCIENCES: MARKET, BY REGION, 2021–2027 (USD MILLION)

9.9 TRAVEL & HOSPITALITY

9.9.1 CAAS TO HELP TRAVEL & HOSPITALITY COMPANIES BETTER MANAGE CURRENT AND FUTURE INDUSTRY CHALLENGES

TABLE 49 TRAVEL & HOSPITALITY: MARKET, BY REGION, 2016–2020 (USD MILLION)

TABLE 50 TRAVEL & HOSPITALITY: MARKET, BY REGION, 2021–2027 (USD MILLION)

9.10 OTHER VERTICALS

TABLE 51 OTHER VERTICALS: MARKET, BY REGION, 2016–2020 (USD MILLION)

TABLE 52 OTHER VERTICALS: MARKET, BY REGION, 2021–2027 (USD MILLION)

10 CONTAINERS AS A SERVICE MARKET, BY REGION (Page No. - 99)

10.1 INTRODUCTION

FIGURE 29 ASIA PACIFIC TO GROW AT HIGHEST RATE DURING FORECAST PERIOD

TABLE 53 MARKET, BY REGION, 2016–2020 (USD MILLION)

TABLE 54 MARKET, BY REGION, 2021–2027 (USD MILLION)

10.2 NORTH AMERICA

10.2.1 NORTH AMERICA: MARKET DRIVERS

10.2.2 NORTH AMERICA: RECESSION IMPACT

FIGURE 30 NORTH AMERICA: MARKET SNAPSHOT

TABLE 55 NORTH AMERICA: MARKET, BY SERVICE TYPE, 2016–2020 (USD MILLION)

TABLE 56 NORTH AMERICA: CONTAINERS AS A SERVICE MARKET, BY SERVICE TYPE, 2021–2027 (USD MILLION)

TABLE 57 NORTH AMERICA: MARKET, BY DEPLOYMENT MODEL, 2016–2020 (USD MILLION)

TABLE 58 NORTH AMERICA: MARKET, BY DEPLOYMENT MODEL, 2021–2027 (USD MILLION)

TABLE 59 NORTH AMERICA: MARKET, BY ORGANIZATION SIZE, 2016–2020 (USD MILLION)

TABLE 60 NORTH AMERICA: MARKET, BY ORGANIZATION SIZE, 2021–2027 (USD MILLION)

TABLE 61 NORTH AMERICA: MARKET, BY VERTICAL, 2016–2020 (USD MILLION)

TABLE 62 NORTH AMERICA: MARKET, BY VERTICAL, 2021–2027 (USD MILLION)

TABLE 63 NORTH AMERICA: MARKET, BY COUNTRY, 2016–2020 (USD MILLION)

TABLE 64 NORTH AMERICA: MARKET, BY COUNTRY, 2021–2027 (USD MILLION)

10.2.3 US

10.2.3.1 Advanced IT infrastructure, presence of several enterprises, and availability of proficient technical expertise

TABLE 65 US: CONTAINERS AS A SERVICE MARKET, BY ORGANIZATION SIZE, 2016–2020 (USD MILLION)

TABLE 66 US: MARKET, BY ORGANIZATION SIZE, 2021–2027 (USD MILLION)

10.2.4 CANADA

10.2.4.1 Growth driven by technological evolutions, increasing demand for microservices, and CaaS solutions

TABLE 67 CANADA: MARKET, BY ORGANIZATION SIZE, 2016–2020 (USD MILLION)

TABLE 68 CANADA: MARKET, BY ORGANIZATION SIZE, 2021–2027 (USD MILLION)

10.3 EUROPE

10.3.1 EUROPE: MARKET DRIVERS

10.3.2 EUROPE: RECESSION IMPACT

TABLE 69 EUROPE: CONTAINERS AS A SERVICE MARKET, BY SERVICE TYPE, 2016–2020 (USD MILLION)

TABLE 70 EUROPE: MARKET, BY SERVICE TYPE, 2021–2027 (USD MILLION)

TABLE 71 EUROPE: MARKET, BY DEPLOYMENT MODEL, 2016–2020 (USD MILLION)

TABLE 72 EUROPE: MARKET, BY DEPLOYMENT MODEL, 2021–2027 (USD MILLION)

TABLE 73 EUROPE: MARKET, BY ORGANIZATION SIZE, 2016–2020 (USD MILLION)

TABLE 74 EUROPE: MARKET, BY ORGANIZATION SIZE, 2021–2027 (USD MILLION)

TABLE 75 EUROPE: MARKET, BY VERTICAL, 2016–2020 (USD MILLION)

TABLE 76 EUROPE: MARKET, BY VERTICAL, 2021–2027 (USD MILLION)

TABLE 77 EUROPE: MARKET, BY COUNTRY, 2016–2020 (USD MILLION)

TABLE 78 EUROPE: MARKET, BY COUNTRY, 2021–2027 (USD MILLION)

10.3.3 UK

10.3.3.1 Companies adopting CaaS applications to enhance their operational efficiency

TABLE 79 UK: CONTAINERS AS A SERVICE MARKET, BY ORGANIZATION SIZE, 2016–2020 (USD MILLION)

TABLE 80 UK: MARKET, BY ORGANIZATION SIZE, 2021–2027 (USD MILLION)

10.3.4 GERMANY

10.3.4.1 Germany’s consumer base and existing infrastructure to fuel growth of cloud services

TABLE 81 GERMANY: MARKET, BY ORGANIZATION SIZE, 2016–2020 (USD MILLION)

TABLE 82 GERMANY: MARKET, BY ORGANIZATION SIZE, 2021–2027 (USD MILLION)

10.3.5 FRANCE

10.3.5.1 Organizations to adopt robust solutions to enhance business effectivity and understand customers

TABLE 83 FRANCE: MARKET, BY ORGANIZATION SIZE, 2016–2020 (USD MILLION)

TABLE 84 FRANCE: MARKET, BY ORGANIZATION SIZE, 2021–2027 (USD MILLION)

10.3.6 REST OF EUROPE

TABLE 85 REST OF EUROPE: MARKET, BY ORGANIZATION SIZE, 2016–2020 (USD MILLION)

TABLE 86 REST OF EUROPE: MARKET, BY ORGANIZATION SIZE, 2021–2027 (USD MILLION)

10.4 ASIA PACIFIC

10.4.1 ASIA PACIFIC: CONTAINERS AS A SERVICE MARKET DRIVERS

10.4.2 ASIA PACIFIC: RECESSION IMPACT

FIGURE 31 ASIA PACIFIC: MARKET SNAPSHOT

TABLE 87 ASIA PACIFIC: MARKET, BY SERVICE TYPE, 2016–2020 (USD MILLION)

TABLE 88 ASIA PACIFIC: MARKET, BY SERVICE TYPE, 2021–2027 (USD MILLION)

TABLE 89 ASIA PACIFIC: MARKET, BY DEPLOYMENT MODEL, 2016–2020 (USD MILLION)

TABLE 90 ASIA PACIFIC: MARKET, BY DEPLOYMENT MODEL, 2021–2027 (USD MILLION)

TABLE 91 ASIA PACIFIC: MARKET, BY ORGANIZATION SIZE, 2016–2020 (USD MILLION)

TABLE 92 ASIA PACIFIC: MARKET, BY ORGANIZATION SIZE, 2021–2027 (USD MILLION)

TABLE 93 ASIA PACIFIC: MARKET, BY VERTICAL, 2016–2020 (USD MILLION)

TABLE 94 ASIA PACIFIC: MARKET, BY VERTICAL, 2021–2027 (USD MILLION)

TABLE 95 ASIA PACIFIC: MARKET, BY COUNTRY, 2016–2020 (USD MILLION)

TABLE 96 ASIA PACIFIC: MARKET, BY COUNTRY, 2021–2027 (USD MILLION)

10.4.3 CHINA

10.4.3.1 Chinese CaaS companies to expand operations in other countries to serve customers globally

TABLE 97 CHINA: CONTAINERS AS A SERVICE MARKET, BY ORGANIZATION SIZE, 2016–2020 (USD MILLION)

TABLE 98 CHINA: MARKET, BY ORGANIZATION SIZE, 2021–2027 (USD MILLION)

10.4.4 JAPAN

10.4.4.1 Japan to be focus of CaaS in future

TABLE 99 JAPAN: MARKET, BY ORGANIZATION SIZE, 2016–2020 (USD MILLION)

TABLE 100 JAPAN: MARKET, BY ORGANIZATION SIZE, 2021–2027 (USD MILLION)

10.4.5 AUSTRALIA & NEW ZEALAND

10.4.5.1 Increased spending on CaaS in ANZ driven by rapid adoption of digital transformation initiatives

TABLE 101 AUSTRALIA & NEW ZEALAND: MARKET, BY ORGANIZATION SIZE, 2016–2020 (USD MILLION)

TABLE 102 AUSTRALIA & NEW ZEALAND: MARKET, BY ORGANIZATION SIZE, 2021–2027 (USD MILLION)

10.4.6 SINGAPORE

10.4.6.1 Increasing number of CaaS vendors tapping into growth opportunities

TABLE 103 SINGAPORE: MARKET, BY ORGANIZATION SIZE, 2016–2020 (USD MILLION)

TABLE 104 SINGAPORE: MARKET, BY ORGANIZATION SIZE, 2021–2027 (USD MILLION)

10.4.7 REST OF ASIA PACIFIC

TABLE 105 REST OF ASIA PACIFIC: MARKET, BY ORGANIZATION SIZE, 2016–2020 (USD MILLION)

TABLE 106 REST OF ASIA PACIFIC: MARKET, BY ORGANIZATION SIZE, 2021–2027 (USD MILLION)

10.5 MIDDLE EAST & AFRICA

10.5.1 MIDDLE EAST & AFRICA: CONTAINERS AS A SERVICE MARKET DRIVERS

10.5.2 MIDDLE EAST & AFRICA: RECESSION IMPACT

TABLE 107 MIDDLE EAST & AFRICA: MARKET, BY SERVICE TYPE, 2016–2020 (USD MILLION)

TABLE 108 MIDDLE EAST & AFRICA: MARKET, BY SERVICE TYPE, 2021–2027 (USD MILLION)

TABLE 109 MIDDLE EAST & AFRICA: MARKET, BY DEPLOYMENT MODEL, 2016–2020 (USD MILLION)

TABLE 110 MIDDLE EAST & AFRICA: MARKET, BY DEPLOYMENT MODEL, 2021–2027 (USD MILLION)

TABLE 111 MIDDLE EAST & AFRICA: MARKET, BY ORGANIZATION SIZE, 2016–2020 (USD MILLION)

TABLE 112 MIDDLE EAST & AFRICA: MARKET, BY ORGANIZATION SIZE, 2021–2027 (USD MILLION)

TABLE 113 MIDDLE EAST & AFRICA: MARKET, BY VERTICAL, 2016–2020 (USD MILLION)

TABLE 114 MIDDLE EAST & AFRICA: MARKET, BY VERTICAL, 2021–2027 (USD MILLION)

TABLE 115 MIDDLE EAST & AFRICA: MARKET, BY REGION, 2016–2020 (USD MILLION)

TABLE 116 MIDDLE EAST & AFRICA: MARKET, BY REGION, 2021–2027 (USD MILLION)

10.5.3 MIDDLE EAST

10.5.3.1 Enterprises adopting cloud technologies and reducing their CAPEX to save time and effort

TABLE 117 MIDDLE EAST: CONTAINERS AS A SERVICE MARKET, BY ORGANIZATION SIZE, 2016–2020 (USD MILLION)

TABLE 118 MIDDLE EAST: MARKET, BY ORGANIZATION SIZE, 2021–2027 (USD MILLION)

10.5.4 AFRICA

10.5.4.1 Increasing need for mobility to be major driving factor for CaaS implementation

TABLE 119 AFRICA: MARKET, BY ORGANIZATION SIZE, 2016–2020 (USD MILLION)

TABLE 120 AFRICA: MARKET, BY ORGANIZATION SIZE, 2021–2027 (USD MILLION)

10.6 LATIN AMERICA

10.6.1 LATIN AMERICA: MARKET DRIVERS

10.6.2 LATIN AMERICA: RECESSION IMPACT

TABLE 121 LATIN AMERICA: CONTAINERS AS A SERVICE MARKET, BY SERVICE TYPE, 2016–2020 (USD MILLION)

TABLE 122 LATIN AMERICA: MARKET, BY SERVICE TYPE, 2021–2027 (USD MILLION)

TABLE 123 LATIN AMERICA: MARKET, BY DEPLOYMENT MODEL, 2016–2020 (USD MILLION)

TABLE 124 LATIN AMERICA: MARKET, BY DEPLOYMENT MODEL, 2021–2027 (USD MILLION)

TABLE 125 LATIN AMERICA: MARKET, BY ORGANIZATION SIZE, 2016–2020 (USD MILLION)

TABLE 126 LATIN AMERICA: MARKET, BY ORGANIZATION SIZE, 2021–2027 (USD MILLION)

TABLE 127 LATIN AMERICA: MARKET, BY VERTICAL, 2016–2020 (USD MILLION)

TABLE 128 LATIN AMERICA: MARKET, BY VERTICAL, 2021–2027 (USD MILLION)

TABLE 129 LATIN AMERICA: MARKET, BY COUNTRY, 2016–2020 (USD MILLION)

TABLE 130 LATIN AMERICA: MARKET, BY COUNTRY, 2021–2027 (USD MILLION)

10.6.3 BRAZIL

TABLE 131 BRAZIL: CONTAINERS AS A SERVICE MARKET, BY ORGANIZATION SIZE, 2016–2020 (USD MILLION)

TABLE 132 BRAZIL: MARKET, BY ORGANIZATION SIZE, 2021–2027 (USD MILLION)

10.6.4 MEXICO

TABLE 133 MEXICO: MARKET, BY ORGANIZATION SIZE, 2016–2020 (USD MILLION)

TABLE 134 MEXICO: MARKET, BY ORGANIZATION SIZE, 2021–2027 (USD MILLION)

10.6.5 REST OF LATIN AMERICA

TABLE 135 REST OF LATIN AMERICA: MARKET, BY ORGANIZATION SIZE, 2016–2020 (USD MILLION)

TABLE 136 REST OF LATIN AMERICA: MARKET, BY ORGANIZATION SIZE, 2021–2027 (USD MILLION)

11 COMPETITIVE LANDSCAPE (Page No. - 140)

11.1 INTRODUCTION

FIGURE 32 MARKET EVALUATION FRAMEWORK, 2019–2022

11.2 MARKET SHARE OF TOP VENDORS

FIGURE 33 MARKET SHARE ANALYSIS OF COMPANIES IN CONTAINERS AS A SERVICE MARKET

11.3 HISTORICAL REVENUE ANALYSIS OF LEADING PLAYERS

FIGURE 34 HISTORICAL FIVE-YEAR REVENUE ANALYSIS OF LEADING PLAYERS, 2017–2021

11.4 COMPETITIVE SCENARIO

TABLE 137 MARKET: PRODUCT LAUNCHES AND ENHANCEMENTS, 2019–2022

TABLE 138 MARKET: DEALS, 2019–2022

11.5 COMPANY EVALUATION QUADRANT

11.5.1 STARS

11.5.2 EMERGING LEADERS

11.5.3 PERVASIVE PLAYERS

11.5.4 PARTICIPANTS

FIGURE 35 CONTAINERS AS A SERVICE MARKET (GLOBAL): COMPANY EVALUATION QUADRANT, 2021

11.6 COMPANY PRODUCT FOOTPRINT ANALYSIS

TABLE 139 COMPANY FOOTPRINT, BY SERVICE TYPE

TABLE 140 COMPANY FOOTPRINT, BY VERTICAL

TABLE 141 COMPANY FOOTPRINT, BY REGION

TABLE 142 COMPANY FOOTPRINT

12 COMPANY PROFILES (Page No. - 149)

12.1 INTRODUCTION

(Business Overview, Products/Solutions/Services offered, Recent Developments, MnM view, Key Right to win, Strategic choices made, Weakness/competitive threats) *

12.2 KEY COMPANIES

12.2.1 MICROSOFT

TABLE 143 MICROSOFT: BUSINESS OVERVIEW

FIGURE 36 MICROSOFT: COMPANY SNAPSHOT

TABLE 144 MICROSOFT: PRODUCTS/SOLUTIONS/SERVICES OFFERED

TABLE 145 MICROSOFT: PRODUCT LAUNCHES AND ENHANCEMENTS

TABLE 146 MICROSOFT: DEALS

12.2.2 CISCO

TABLE 147 CISCO: BUSINESS OVERVIEW

FIGURE 37 CISCO: COMPANY SNAPSHOT

TABLE 148 CISCO: PRODUCTS/SOLUTIONS/SERVICES OFFERED

TABLE 149 CISCO: PRODUCT LAUNCHES AND ENHANCEMENTS

12.2.3 HUAWEI TECHNOLOGIES

TABLE 150 HUAWEI TECHNOLOGIES: BUSINESS OVERVIEW

TABLE 151 HUAWEI TECHNOLOGIES: PRODUCTS/SOLUTIONS/SERVICES OFFERED

TABLE 152 HUAWEI TECHNOLOGIES: PRODUCT LAUNCHES AND ENHANCEMENTS

12.2.4 ORACLE

TABLE 153 ORACLE: BUSINESS OVERVIEW

FIGURE 38 ORACLE: COMPANY SNAPSHOT

TABLE 154 ORACLE: PRODUCTS/SOLUTIONS/SERVICES OFFERED

TABLE 155 ORACLE: PRODUCT LAUNCHES AND ENHANCEMENTS

12.2.5 IBM

TABLE 156 IBM: BUSINESS OVERVIEW

FIGURE 39 IBM: COMPANY SNAPSHOT

TABLE 157 IBM: SOLUTIONS OFFERED

TABLE 158 IBM: PRODUCT LAUNCHES

12.2.6 AMAZON WEB SERVICES (AWS)

TABLE 159 AMAZON WEB SERVICES: BUSINESS OVERVIEW

FIGURE 40 AMAZON WEB SERVICES: COMPANY SNAPSHOT

TABLE 160 AMAZON WEB SERVICES: PRODUCTS/SOLUTIONS/SERVICES OFFERED

TABLE 161 AMAZON WEB SERVICES: PRODUCT LAUNCHES

12.2.7 HEWLETT PACKARD ENTERPRISE

TABLE 162 HEWLETT PACKARD ENTERPRISE: BUSINESS OVERVIEW

FIGURE 41 HEWLETT PACKARD ENTERPRISE: COMPANY SNAPSHOT

TABLE 163 HEWLETT PACKARD ENTERPRISE: PRODUCTS/SOLUTIONS/SERVICES OFFERED

TABLE 164 HEWLETT PACKARD ENTERPRISE: PRODUCT LAUNCHES AND ENHANCEMENTS

TABLE 165 HEWLETT PACKARD ENTERPRISE: DEALS

12.2.8 GOOGLE

TABLE 166 GOOGLE: BUSINESS OVERVIEW

FIGURE 42 GOOGLE: COMPANY SNAPSHOT

TABLE 167 GOOGLE: PRODUCTS/SOLUTIONS/SERVICES OFFERED

TABLE 168 GOOGLE: PRODUCT LAUNCHES

TABLE 169 GOOGLE: DEALS

12.2.9 VMWARE

TABLE 170 VMWARE: BUSINESS OVERVIEW

FIGURE 43 VMWARE: COMPANY SNAPSHOT

TABLE 171 VMWARE: PRODUCTS/SOLUTIONS/SERVICES OFFERED

TABLE 172 VMWARE: PRODUCT LAUNCHES AND ENHANCEMENTS

TABLE 173 VMWARE: DEALS

12.2.10 DOCKER

TABLE 174 DOCKER: BUSINESS OVERVIEW

TABLE 175 DOCKER: PRODUCTS/SOLUTIONS/SERVICES OFFERED

TABLE 176 DOCKER: PRODUCT LAUNCHES AND ENHANCEMENTS

TABLE 177 DOCKER: DEALS

12.2.11 SUSE

TABLE 178 SUSE: BUSINESS OVERVIEW

FIGURE 44 SUSE: COMPANY SNAPSHOT

TABLE 179 SUSE: PRODUCTS/SOLUTIONS/SERVICES OFFERED

TABLE 180 SUSE: PRODUCT LAUNCHES AND ENHANCEMENTS

TABLE 181 SUSE: DEALS

12.2.12 RED HAT

TABLE 182 RED HAT: BUSINESS OVERVIEW

TABLE 183 RED HAT: PRODUCTS/SOLUTIONS/SERVICES OFFERED

TABLE 184 RED HAT: PRODUCT LAUNCHES AND ENHANCEMENTS

TABLE 185 RED HAT: DEALS

12.2.13 TATA COMMUNICATIONS

TABLE 186 TATA COMMUNICATIONS: BUSINESS OVERVIEW

FIGURE 45 TATA COMMUNICATIONS: COMPANY SNAPSHOT

TABLE 187 TATA COMMUNICATIONS: PRODUCTS/SOLUTIONS/SERVICES OFFERED

TABLE 188 TATA COMMUNICATIONS: DEALS

12.2.14 ALIBABA CLOUD

TABLE 189 ALIBABA CLOUD: BUSINESS OVERVIEW

FIGURE 46 ALIBABA CLOUD: COMPANY SNAPSHOT

TABLE 190 ALIBABA CLOUD: PRODUCTS/SOLUTIONS/SERVICES OFFERED

TABLE 191 ALIBABA CLOUD: PRODUCT LAUNCHES AND ENHANCEMENTS

TABLE 192 ALIBABA CLOUD: DEALS

TABLE 193 ALIBABA CLOUD: OTHERS

12.2.15 DXC TECHNOLOGY

TABLE 194 DXC TECHNOLOGY: BUSINESS OVERVIEW

FIGURE 47 DXC TECHNOLOGY: COMPANY SNAPSHOT

TABLE 195 DXC TECHNOLOGY: PRODUCTS/SOLUTIONS/SERVICES OFFERED

TABLE 196 DXC TECHNOLOGY: DEALS

TABLE 197 DXC TECHNOLOGY: OTHERS

*Details on Business Overview, Products/Solutions/Services offered, Recent Developments, MnM view, Key Right to win, Strategic choices made, Weakness/competitive threats might not be captured in case of unlisted companies.

13 ADJACENT MARKETS (Page No. - 201)

13.1 INTRODUCTION

TABLE 198 RELATED MARKETS

13.2 FUNCTION-AS-A-SERVICE MARKET

TABLE 199 FUNCTION-AS-A-SERVICE MARKET, BY USER TYPE, 2014–2021 (USD MILLION)

TABLE 200 FUNCTION-AS-A-SERVICE MARKET, BY SERVICE TYPE, 2014–2021 (USD MILLION)

TABLE 201 FUNCTION-AS-A-SERVICE MARKET, BY APPLICATION, 2014–2021 (USD MILLION)

TABLE 202 FUNCTION-AS-A-SERVICE MARKET, BY DEPLOYMENT MODEL, 2014–2021 (USD MILLION)

TABLE 203 FUNCTION-AS-A-SERVICE MARKET, BY ORGANIZATION SIZE, 2014–2021 (USD MILLION)

TABLE 204 FUNCTION-AS-A-SERVICE MARKET, BY INDUSTRY VERTICAL, 2014–2021 (USD MILLION)

TABLE 205 FUNCTION-AS-A-SERVICE MARKET, BY REGION, 2014–2021 (USD MILLION)

13.3 CLOUD ORCHESTRATION MARKET

TABLE 206 CLOUD ORCHESTRATION MARKET, BY SERVICE TYPE, 2014–2021 (USD MILLION)

TABLE 207 CLOUD ORCHESTRATION MARKET, BY APPLICATION, 2014–2021 (USD MILLION)

TABLE 208 CLOUD ORCHESTRATION MARKET, BY DEPLOYMENT MODEL, 2014–2021 (USD MILLION)

TABLE 209 CLOUD ORCHESTRATION MARKET, BY ORGANIZATION SIZE, 2014–2021 (USD MILLION)

TABLE 210 CLOUD ORCHESTRATION MARKET, BY VERTICAL, 2014–2021 (USD MILLION)

TABLE 211 CLOUD ORCHESTRATION MARKET, BY REGION, 2014–2021 (USD MILLION)

14 APPENDIX (Page No. - 206)

14.1 DISCUSSION GUIDE

14.2 KNOWLEDGESTORE: MARKETSANDMARKETS’ SUBSCRIPTION PORTAL

14.3 CUSTOMIZATION OPTIONS

14.4 RELATED REPORTS

14.5 AUTHOR DETAILS

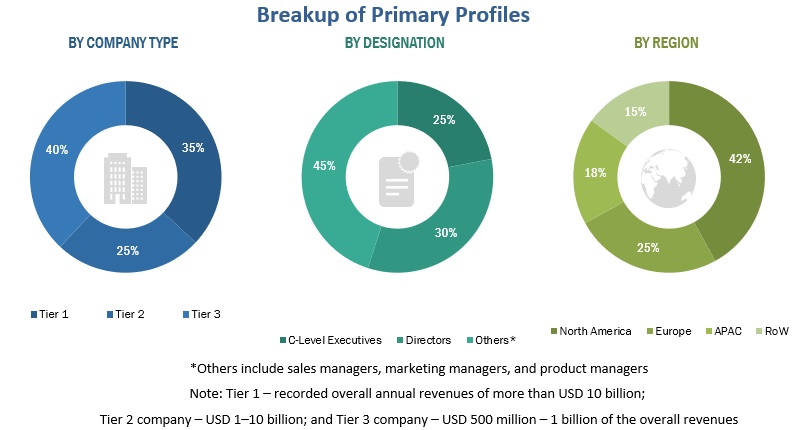

The study involved 4 major activities to estimate the current market size of Containers as a Service. Exhaustive secondary research was done to collect information on the market, the peer market, and the parent market. The next step was to validate these findings, assumptions, and sizing with industry experts across the value chain through primary research. Both top-down and bottom-up approaches were employed to estimate the complete market size. After that, the market breakup and data triangulation procedures were used to estimate the market size of the segments and subsegments.

Secondary Research

In the secondary research process, various secondary sources were referred to for identifying and collecting information for this study. The secondary sources included annual reports, press releases, and investor presentations of companies; whitepapers; certified publications; and articles from recognized associations, such as data center knowledge and government publishing sources. The research study involved the use of extensive secondary sources, directories, and databases, such as D&B Hoovers, DiscoverOrg, Factiva, Bloomberg BusinessWeek, Statista.com, Cloud Computing Association, OpenFog Consortium, European Telecommunications Standards Institute (ETSI), International Trade Associations, Arab Information and Communication Technology Organization (AICTO) to identify and collect information useful for this technical, market-oriented, and commercial study of the CaaS market. Secondary research was mainly used to obtain key information about the industry’s value chain, the total pool of key players, market classification and segmentation as per the industry trends to the bottom-most level, regional markets, and key developments from both market and technology-oriented perspectives.

Primary Research

In the primary research process, various primary sources from both the supply and demand sides were interviewed to obtain qualitative and quantitative information for this report. Primary sources from the supply-side included industry experts, such as Chief Executive Officers (CEOs), Vice Presidents (VPs), marketing directors, technology and innovation directors, and related key executives from various key companies and organizations providing CaaS solution. The primary sources from the demand side included the end-users of event management software solutions, which included Chief Information Officers (CIOs), IT technicians and technologists, and IT managers at public and investor-owned utilities.

The following figure depicts the breakup of the primary profiles:

To know about the assumptions considered for the study, Request for Free Sample Report

Market Size Estimation

Both top-down and bottom-up approaches were used to estimate and validate the total size of the CaaS market. They were also used extensively to estimate the size of various subsegments in the market. The research methodology used to estimate the market size includes the following:

- The key players in the industry and markets have been identified through extensive secondary research.

- The industry’s supply chain and market size, in terms of value, have been determined through primary and secondary research processes.

- All percentage shares, splits, and breakdowns have been determined using secondary sources and verified through primary sources.

Data Triangulation

After arriving at the overall market size—using the market size estimation processes as explained above—the market was split into several segments and subsegments. To complete the overall market engineering process and arrive at the exact statistics of each market segment and subsegment, the data triangulation and market breakup procedures were employed, wherever applicable. The data was triangulated by studying several factors and trends from both, the demand and supply sides, in the CaaS market.

Report Objectives

- To describe and forecast the global Containers as a Service (CaaS) market based on service type, deployment model, organization size, vertical, and region

- To forecast the market size of regional segments: North America, Europe, Asia Pacific, Middle East & Africa, and Latin America

- To strategically analyze the market’s subsegments with respect to individual growth trends, prospects, and contributions to the total market

- To provide detailed information related to the major factors (drivers, restraints, opportunities, and challenges) influencing the growth of the market

- To analyze the opportunities in the market for stakeholders and provide details of the competitive landscape for major players

- To comprehensively analyze the core competencies of key players

- To analyze the recession impact on regional segments: North America, Europe, Asia Pacific, Middle East & Africa, and Latin America

- To track and analyze competitive developments, such as mergers and acquisitions, new product developments, and partnerships and collaborations, in the market

Available Customizations

With the given market data, MarketsandMarkets offers customizations as per the company’s specific needs and on best effort basis for profiling of additional market players.

Generating Response ...

Generating Response ...

Growth opportunities and latent adjacency in Containers as a Service Market