Cloud Security Market by Offering (Solution and Services), Solutions (CASB, CWPP, CSPM, CDR, and CIEM), Services (Professional and Managed), Service Model (IaaS, SaaS, and PaaS), Type, Vertical, and Region - Global Forecast to 2028

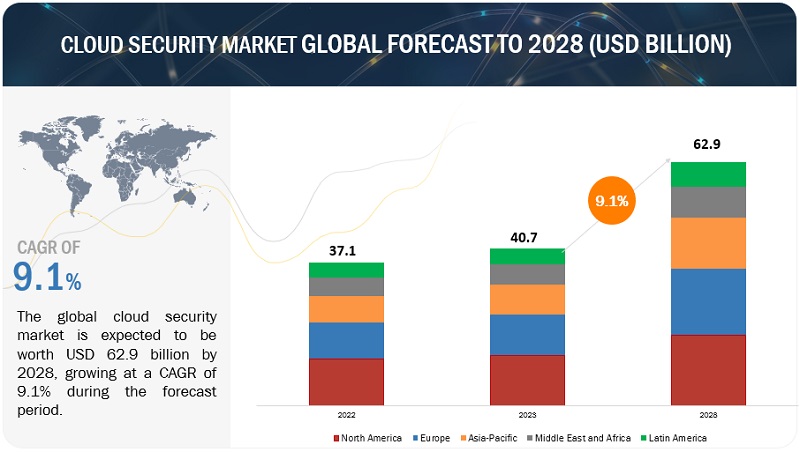

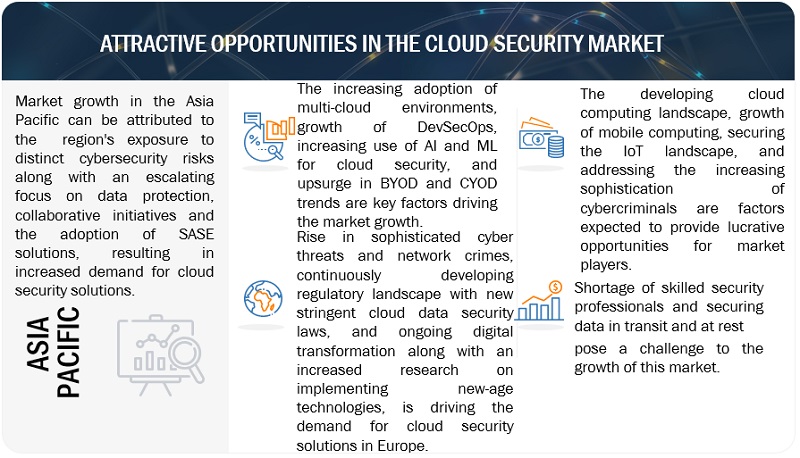

[446 Pages Report] The global cloud security market size is projected to grow from USD 40.7 billion in 2023 to USD 62.9 billion by 2028 at a CAGR of 9.1% during the forecast period. The cloud security market is witnessing significant growth driven by several factors. These include the increasing popularity of multi-cloud environments, the integration of DevSecOps practices, the utilization of AI and ML technologies for cloud security, and the rising demand for cloud security solutions due to the adoption of BYOD and CYOD trends. These trends collectively contribute to the expansion and importance of cloud security in the market. The cloud security market is benefiting from opportunities driven by the dynamic cloud computing landscape, the increasing adoption of mobile computing, the demand for securing the IoT ecosystem, and the need to combat the growing sophistication of cybercriminals. These factors create favorable conditions for the market’s growth, with organizations seeking advanced solutions to safeguard their cloud-based systems and valuable data, further contributing to the rising demand for cloud security solutions.

To know about the assumptions considered for the study, Request for Free Sample Report

To know about the assumptions considered for the study, download the pdf brochure

The cloud security market is projected to provide billion-dollar opportunities for solutions and service providers. The recession would also have a substantial impact on the cloud security market. During a potential slowdown, the impact on the cloud security market is likely to be influenced by CIOs’ budget considerations and cost-control measures. While there may be a moderation in IT budget growth and tightening budgets, cloud computing, security software, and digital transformation are expected to remain key priorities for enterprises. Despite the possibility of cuts in data center build-outs and consulting projects, the IT services and product firms are well-positioned to make incremental gains and emerge stronger from this phase of economic uncertainty. The resilience of cloud security solutions in times of recession lies in their ability to provide cost-effective options while addressing critical security needs, making them a valuable investment for enterprises seeking to navigate challenging economic conditions.

Cloud Security Market Dynamics

Driver: Growth of DevSecOps

The rise of DevSecOps is driving the growth of the cloud security market. DevSecOps combines development, security, and operations to ensure security is integrated throughout the software development process. It focuses on identifying and addressing security issues early on, making cloud environments safer. Using DevSecOps practices, organizations proactively detect and fix security vulnerabilities during development, reducing the risk of breaches. Automated security testing and continuous monitoring also help keep cloud environments secure. Overall, the adoption of DevSecOps is playing a crucial role in driving the expansion of cloud security.

Restraint: Lack of Awareness

A significant restraint in the cloud security market is the insufficient awareness among businesses regarding the potential security risks associated with cloud computing. Despite the widespread adoption of cloud technologies, many organizations lack a comprehensive understanding of the vulnerabilities and threats present in the cloud environment. This lack of awareness often leads to misconceptions, such as assuming the sole responsibility for security lies with the cloud service provider, overlooking the shared responsibility model. Additionally, some businesses may be unaware of specific security risks, such as data breaches, unauthorized access, or misconfigurations. As a result, crucial security practices like robust access controls, data encryption, regular security audits, and incident response plans may not be adequately implemented or prioritized. Moreover, the lack of awareness can hinder informed decision-making when selecting cloud service providers or security solutions.

Opportunity: Securing the IoT landscape

The rise of IoT devices offers a significant opportunity for the cloud security market. These devices, like smart home appliances and industrial sensors, are becoming common and create a vast network of connected devices that collect and analyze data. While they offer many benefits, they also pose security challenges. IoT devices often lack robust security features and can be vulnerable to cyber-attacks, potentially leading to data breaches and disruptions. Cloud security providers can benefit from it by offering specialized solutions for IoT security, such as strong authentication, secure communication, and real-time monitoring. They can also work with IoT device makers and regulators to establish security standards and best practices, building trust and improving overall IoT security.

Challenge: Securing data in transit and at rest

Keeping data safe during its transfer and storage presents a big challenge for cloud security. When data moves between devices and the cloud or rests within cloud systems, it becomes vulnerable to breaches and unauthorized access. Ensuring data confidentiality, integrity, and availability throughout its lifecycle is crucial. Protecting data in transit involves using encryption to keep it secure while it travels between devices and networks. However, managing encryption keys and configuring specific communication channels can be complex. Securing data at rest, stored within the cloud or databases, also requires careful measures. Cloud providers offer encryption options, but organizations must manage encryption keys properly. Robust access controls, IAM policies, and regular monitoring are essential to protect data at rest and detect any unauthorized access.

Cloud security Market Ecosystem

By Offering, the Services segment accounts for the highest CAGR during the forecast period.

The services segment is expected to have the highest CAGR in the cloud security market during the forecasted period. Due to increasing complexity and growing cyber threats, businesses need expert assistance to manage and secure their cloud environments. Managed services offer continuous monitoring and threat detection, while professional services provide consulting and compliance management, helping organizations stay secure and compliant with industry standards. As cloud security becomes more crucial, the demand for these services drives their growth in the market.

By Service Model, IaaS accounts for the largest market size during the forecast period.

IaaS accounts for the most significant cloud security market due to its widespread adoption by businesses. IaaS provides a flexible and cost-effective solution for organizations to access and manage IT infrastructure over the Internet. Securing their infrastructure becomes paramount as more companies shift their operations to the cloud. IaaS allows businesses to outsource their hardware and software resources, reducing the burden of managing complex infrastructure in-house. However, this outsourcing also increases security concerns, as organizations must protect their sensitive data and applications hosted on cloud servers. Therefore, robust cloud security solutions are highly demanded to safeguard IaaS environments from potential cyber threats and data breaches. With the increasing adoption of IaaS by enterprises of all sizes, its market size continues to expand, driving growth.

By Services, Managed services account for the highest CAGR during the forecast period.

Managed services account for the highest CAGR in the cloud security market during the forecasted period due to their growing popularity among businesses. With the rapid adoption of cloud technologies, organizations are increasingly seeking external expertise to manage and enhance their cloud security. Managed services offer a comprehensive approach, where specialized providers handle cloud security tasks on behalf of the businesses. It allows companies to focus on their core operations while ensuring their cloud environments remain secure. Managed service providers offer continuous monitoring, threat detection, incident response, and security updates to mitigate potential risks effectively. As cyber threats become more sophisticated, businesses realize the importance of initiative-taking security measures and managed services provide an aggressive and vigilant approach to safeguarding cloud assets. The flexibility and scalability of managed services make them suitable for businesses of all sizes, driving their increasing adoption.

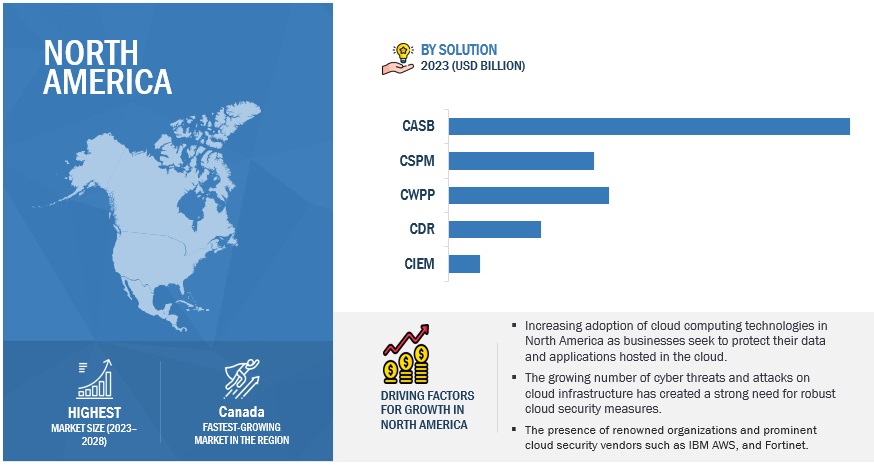

By region, North America accounts for the highest market size during the forecast period.

North America is expected to have the largest market share in the cloud security market during the forecasted period for a few important reasons. Firstly, the region has top-notch cloud service providers that offer a wide range of solutions. Businesses from different industries prefer these well-established providers. Secondly, North America has advanced IT infrastructure, making it easier for businesses to adopt cloud solutions smoothly. Additionally, companies in North America are becoming more aware of the need for strong security measures due to increasing cyber threats. Strict data protection regulations also push the demand for cloud security solutions. Furthermore, the rise of remote work and digital transformation after the pandemic has boosted the adoption of cloud services in the region.

Key Market Players

Some of the well-established and key market players in the cloud security market include IBM (US), Broadcom (US), Check Point (Israel and US), Google (US), AWS (US), Zscaler (US), Akamai Technologies (US), Forcepoint (US), Fortinet (US), F5 (US), Qualys (US), TrendMicro (Japan), Palo Alto Networks (US), Proofpoint (US), Tenable (US), Netskope (US), Microsoft (US), Cisco (US), Imperva (US), Trellix (US), Rapid7 (US), Skyhigh Security (US), FireMon (US), Sysdig (US), LookOut (US), Fidelis Cybersecurity (US), DataTheorem (US), OpsCompass (US), Tufin (US), Menlo Security (US), Tigera (US), Orca Security (US), Ascend Technologies (US), Secberus (US), Ermetic (Israel), Sonrai Security (US), Wiz (US), Caveonix (US), Banyan cloud (US), and AccuKnox (US).

Scope of the Report

|

Report Metrics |

Details |

|

Market size available for years |

2017-2028 |

|

Base year considered |

2022 |

|

Forecast period |

2023–2028 |

|

Forecast units |

Value (USD Million) |

|

Segments Covered |

Offerings, Service Model, Type, Verticals, and Regions |

|

Geographies covered |

North America, Europe, Asia Pacific, Middle East and Africa, and Latin America |

|

Companies covered |

Major vendors in the global cloud security market include IBM (US), Broadcom (US), Check Point (Israel and US), Google (US), AWS (US), Zscaler (US), Akamai Technologies (US), Forcepoint (US), Fortinet (US), F5 (US), Qualys (US), TrendMicro (Japan), Palo Alto Networks (US), Proofpoint (US), Tenable (US), Netskope (US), Microsoft (US), Cisco (US), Imperva (US), Trellix (US), Rapid7 (US), Skyhigh Security (US), FireMon (US), Sysdig (US), LookOut (US), Fidelis Cybersecurity (US), DataTheorem (US), OpsCompass (US), Tufin (US), Menlo Security (US), Tigera (US), Orca Security (US), Ascend Technologies (US), Secberus (US), Ermetic (Israel), Sonrai Security (US), Wiz (US), Caveonix (US), Banyan cloud (US), and AccuKnox (US). |

The study categorizes the cloud security market by offerings, service models, types, verticals, and regions.

Recent Developments

- In May 2023, AWS introduced a new service, Amazon Security Lake, a cloud security offering that automatically centralizes an organization’s security data from multiple sources into a purpose-built data lake. It helps customers improve their security posture, respond faster to security events, and simplify security data management across hybrid and multi-cloud environments. With Amazon Security Lake, organizations can aggregate, normalize, and store security data, enabling faster threat detection, investigation, and response. It gives customers greater visibility into potential security threats and allows them to leverage their preferred analytics tools for comprehensive security insights.

- In May 2023, Check Point (US & Israel) expanded Harmony Endpoint protection solutions to include vulnerability assessment and automated patch management capabilities. It helps organizations address the growing number of cyberattacks that exploit unpatched system vulnerabilities.

- In April 2023, IBM (US) introduced a new platform, IBM Security QRadar Suite, a comprehensive cloud security offering that combines EDR/XDR, SIEM, SOAR, and cloud-native log management capabilities. It is designed to unify and streamline the security analyst experience in hybrid cloud environments. With advanced AI and automation, the suite empowers analysts to detect, investigate, and respond to threats faster and more efficiently. It is delivered as a service on AWS and provides simplified deployment, visibility, and integration across cloud environments and data sources.

- In September 2022, Google (US) acquired Mandiant (US). Integrating Mandiant’s capabilities will enhance Google Cloud’s security operations suite, providing organizations with improved threat intelligence, incident management, and exposure management. The addition of Mandiant will enable organizations to monitor assets for exposures, validate security controls, and enhance their security posture. The acquisition reinforces Google Cloud’s commitment to providing comprehensive security solutions to its customers.

- In November 2021, Qualys (US) partnered with TD SYNNEX (US). The partnership enables TD SYNNEX’s resellers to access Qualys’ cloud-based security and compliance solutions, including the VMDR app and Patch Management. It simplifies security operations, enhances threat detection, and reduces business compliance costs. This partnership strengthens Qualys’ presence and extends its access to TD SYNNEX’s partner ecosystem.

Frequently Asked Questions (FAQ):

What are the opportunities in the global cloud security market?

The developing cloud computing landscape, growth of mobile computing, securing the IoT landscape, and addressing the increasing sophistication of cybercriminals are the market opportunities for the global cloud security market.

What is the definition of the cloud security market?

According to MarketsandMarkets, cloud security falls under the umbrella of cybersecurity and is dedicated to safeguarding cloud computing systems. Its primary aim is to ensure the protection and privacy of data within online-based infrastructure, applications, and platforms.

Which region is expected to show the highest market share in the cloud security market?

North America is expected to account for the largest market share during the forecast period.

What are the major market players covered in the report?

Major vendors, namely, include IBM (US), Broadcom (US), Check Point (Israel and US), Google (US), AWS (US), Zscaler (US), Akamai Technologies (US), Forcepoint (US), Fortinet (US), F5 (US), Qualys (US), TrendMicro (Japan), Palo Alto Networks (US), Proofpoint (US), Tenable (US), Netskope (US), Microsoft (US), Cisco (US), Imperva (US), Trellix (US), Rapid7 (US), Skyhigh Security (US), FireMon (US), Sysdig (US), LookOut (US), Fidelis Cybersecurity (US), DataTheorem (US), OpsCompass (US), Tufin (US), Menlo Security (US), Tigera (US), Orca Security (US), Ascend Technologies (US), Secberus (US), Ermetic (Israel), Sonrai Security (US), Wiz (US), Caveonix (US), Banyan cloud (US), and AccuKnox (US).

What is the current size of the global cloud security market?

The global cloud security market size is projected to grow from USD 40.7 billion in 2023 to USD 62.9 billion by 2028 at a CAGR of 9.1% during the forecast period.

To speak to our analyst for a discussion on the above findings, click Speak to Analyst

- 5.1 INTRODUCTION

-

5.2 MARKET DYNAMICSDRIVERS- Increasing adoption of multi-cloud environments- Growth of DevSecOps- High adoption of AI and ML solutions- Upsurge in BYOD and CYOD trendsRESTRAINTS- Lack of awareness regarding cloud security- Complexity in cloud security management- High navigation costs and stringent regulations- Reliance of organizations on cloud security providersOPPORTUNITIES- Development of cloud computing landscape- Growth of mobile computing- High adoption of IoT devices- Sophistication of cybercriminalsCHALLENGES- Shortage of skilled security professionals- Difficulty securing data in transit

- 5.3 CLOUD SECURITY MARKET: SHARED RESPONSIBILITY MODEL

-

5.4 CASE STUDY ANALYSISFORTINET EMPOWERED AUTODESK WITH SCALABLE CLOUD SECURITY IN AWS ENVIRONMENTFINANCIAL SERVICES COMPANIES DEPLOYED PALO ALTO NETWORKS’ PRISMA CLOUD SECURITY SUITE TO OPTIMIZE COMPUTING COSTSST. JOHN’S HOSPITAL ADOPTED MICROSOFT AZURE TO SECURE CLOUD INFRASTRUCTURE

-

5.5 VALUE CHAIN ANALYSISCLOUD SECURITY VENDORSTECHNOLOGY VENDORS- Cloud service providers- Regulatory bodies and compliance organizations- Auditing and certificationSYSTEM INTEGRATORS- Managed security service providersTRAINING AND EDUCATION PROVIDERSENTERPRISES AND CUSTOMERS

-

5.6 ECOSYSTEM ANALYSISROLE OF PLAYERS IN MARKET ECOSYSTEM

-

5.7 PORTER’S FIVE FORCES ANALYSISTHREAT OF NEW ENTRANTSTHREAT OF SUBSTITUTESBARGAINING POWER OF SUPPLIERSBARGAINING POWER OF BUYERSINTENSITY OF COMPETITIVE RIVALRY

- 5.8 PRICING MODEL ANALYSIS

-

5.9 TECHNOLOGY ANALYSISIMPACT OF EDGE COMPUTING ON CLOUD SECURITYIMPACT OF SERVERLESS COMPUTING ON CLOUD SECURITYIMPACT OF SASE ON CLOUD SECURITYIMPACT OF AUTOMATED CLOUD ORCHESTRATION ON CLOUD SECURITYIMPACT OF MULTI-CLOUD ENVIRONMENTS ON CLOUD SECURITY

-

5.10 PATENT ANALYSIS

- 5.11 TRENDS AND DISRUPTIONS IMPACTING CUSTOMERS’ BUSINESSES

-

5.12 TARIFF AND REGULATORY LANDSCAPEPAYMENT CARD INDUSTRY DATA SECURITY STANDARD (PCI–DSS)GENERAL DATA PROTECTION REGULATION (GDPR)CALIFORNIA CONSUMER PRIVACY ACT (CCPA)PERSONAL INFORMATION PROTECTION AND ELECTRONIC DOCUMENTS ACT (PIPEDA)HEALTH INSURANCE PORTABILITY AND ACCOUNTABILITY ACT (HIPAA)INTERNATIONAL ORGANIZATION FOR STANDARDIZATION 27001 (ISO)

- 5.13 REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

-

5.14 KEY STAKEHOLDERS AND BUYING CRITERIAKEY STAKEHOLDERS IN BUYING PROCESS

- 5.15 KEY CONFERENCES & EVENTS, 2023–2024

-

6.1 INTRODUCTIONOFFERINGS: CLOUD SECURITY MARKET DRIVERS

-

6.2 SOLUTIONSCASB- Focus on harnessing ability of CASBs to safeguard digital assets to propel demandCWPP- Demand to empower workload protection to spur growth of CWPP solutionsCSPM- Need to prioritize safeguarding of data and infrastructure in digital era to foster growthCDR- Need for innovative approach to safeguard cloud applications to drive demandCIEM- Rapid adoption of CIEM solutions for enhanced access governance and protection to boost market

-

6.3 SERVICESPROFESSIONAL SERVICES- Need to empower organizations with robust and secure cloud infrastructure to drive demandMANAGED SERVICES- Focus on tackling security risks associated with cloud computing solutions to boost demand

- 7.1 INTRODUCTION

-

7.2 VISIBILITY AND RISK ASSESSMENTSHIFT TOWARD CLOUD COMPUTING AND RAPID DIGITAL TRANSFORMATION TO DRIVE DEMAND

-

7.3 GOVERNANCEINCREASED RELIANCE ON CLOUD COMPUTING TO ACHIEVE EFFICIENCY TO ENCOURAGE ADOPTION OF CLOUD SECURITY SOLUTIONS

-

7.4 IAMNEED TO TRACK UNAUTHORIZED ACCESS AND DATA BREACHES TO ENCOURAGE USE OF IAM SOLUTIONS

-

7.5 DATA SECURITYNEED TO SAFEGUARD AND IMPLEMENT DATA TO BOOST MARKET

-

7.6 DISASTER RECOVERY AND BUSINESS CONTINUITYGROWING IMPORTANCE OF CLOUD-BASED DISASTER RECOVERY AND BUSINESS CONTINUITY TO ENCOURAGE GROWTH

- 8.1 INTRODUCTION

-

8.2 IAASGROWING DEMAND FOR SECURE CLOUD INFRASTRUCTURE TO PROPEL MARKET

-

8.3 SAASONGOING DIGITAL TRANSFORMATION AND FOCUS ON OPERATIONAL EFFICIENCY TO DRIVE MARKET

-

8.4 PAASRISING SECURITY IMPLICATIONS TO BOOST MARKET FOR PAAS SOLUTIONS

- 9.1 INTRODUCTION

-

9.2 BFSIGROWING IMPORTANCE OF DATA CONFIDENTIALITY AND INTEGRITY TO DRIVE DEMAND

-

9.3 HEALTHCARERISING AWARENESS REGARDING PROTECTION OF PATIENT DATA TO BOOST GROWTH

-

9.4 GOVERNMENTRISING DEPENDENCY OF GOVERNMENT INSTITUTIONS ON CLOUD SECURITY SOLUTIONS TO ENCOURAGE DEMAND

-

9.5 RETAIL & ECOMMERCERISING CUSTOMER EXPECTATIONS ABOUT DIGITAL TRANSFORMATION OF RETAIL & ECOMMERCE SECTOR TO ENHANCE GROWTH

-

9.6 IT & ITESNEED TO SAFEGUARD ASSETS FROM SOPHISTICATED CYBERATTACKS TO ENCOURAGE USE OF CLOUD SECURITY SOLUTIONS IN IT & ITES SECTOR

-

9.7 MANUFACTURINGCAPABILITY OF CLOUD SECURITY SOLUTIONS TO ENSURE DATA CONFIDENTIALITY AND INTEGRITY TO BOOST DEMAND

-

9.8 GAMING & ENTERTAINMENTNEED TO TIGHTEN SECURITY IN GAMING & ENTERTAINMENT VERTICAL TO DRIVE GROWTH

-

9.9 TELECOMMUNICATIONFOCUS ON IMPLEMENTING ROBUST CLOUD SECURITY MEASURES FOR TELECOM OPERATORS TO BOOST MARKET

-

9.10 ENERGY & UTILITIESDEMAND FOR PROTECTING CRITICAL INFRASTRUCTURE WITH CLOUD SECURITY TO SUSTAIN GROWTH

-

9.11 TRAVEL & HOSPITALITYGROWTH OF TRAVEL & HOSPITALITY SECTOR TO BOOST MARKET

-

9.12 RESEARCH & ACADEMIAREALIZATION OF ESSENCE OF ENHANCING SECURITY IN RESEARCH & EDUCATION SECTOR TO ENCOURAGE GROWTH

- 10.1 INTRODUCTION

-

10.2 NORTH AMERICANORTH AMERICA: CLOUD SECURITY MARKET DRIVERSNORTH AMERICA: RECESSION IMPACTNORTH AMERICA: REGULATORY LANDSCAPEUS- Rise of cloud computing and increased sophistication of cyberattacks to drive marketCANADA- Technological advancements and government initiatives to strengthen market

-

10.3 EUROPEEUROPE: CLOUD SECURITY MARKET DRIVERSEUROPE: RECESSION IMPACTEUROPE: REGULATORY LANDSCAPEUK- Adoption of cloud services and migration of businesses to cloud to boost growthGERMANY- Strong economy and commitment to innovation to drive marketFRANCE- Rising initiatives by government and private sector to propel growthSWEDEN- Demand for hybrid cloud and rising security challenges to drive marketDENMARK- Increasing investments in cloud security startups and need for security measures to boost demandREST OF EUROPE

-

10.4 ASIA PACIFICASIA PACIFIC: CLOUD SECURITY MARKET DRIVERSASIA PACIFIC: RECESSION IMPACTASIA PACIFIC: REGULATORY LANDSCAPECHINA- Rise in cloud technology and governments’ focus on cybersecurity to boost demandJAPAN- Growing need for advanced technologies to boost growthAUSTRALIA & NEW ZEALAND- Rapid increase in public-private initiatives to boost demandINDIA- Rising concerns regarding data security to drive adoption of cloud security solutionsSINGAPORE- Collaboration between government and private sector for enhanced data protection to drive demandREST OF ASIA PACIFIC

-

10.5 MIDDLE EAST & AFRICAMIDDLE EAST & AFRICA: CLOUD SECURITY MARKET DRIVERSMIDDLE EAST & AFRICA: RECESSION IMPACTMIDDLE EAST & AFRICA: REGULATORY LANDSCAPEUAE- Government mandates and industry initiatives to enhance cloud security to encourage growthISRAEL- Establishment of cloud and cybersecurity startups to drive marketKSA- Rising geopolitical conflicts to boost adoption of cloud security servicesSOUTH AFRICA- Increasing digitalization and need for robust digital data security measures to spur growthREST OF MIDDLE EAST & AFRICA

-

10.6 LATIN AMERICALATIN AMERICA: CLOUD SECURITY MARKET DRIVERSLATIN AMERICA: RECESSION IMPACTLATIN AMERICA: REGULATORY LANDSCAPEBRAZIL- Need to embrace advanced cloud computing technologies to drive marketMEXICO- Rapid digital transformation and rising private investments to encourage growthREST OF LATIN AMERICA

- 11.1 OVERVIEW

- 11.2 GLOBAL SNAPSHOT OF KEY MARKET PARTICIPANTS

- 11.3 HISTORICAL REVENUE ANALYSIS FOR KEY PLAYERS

- 11.4 VALUATION AND FINANCIAL METRICS FOR KEY CLOUD SECURITY VENDORS

- 11.5 RANKING OF KEY PLAYERS

- 11.6 MARKET SHARE ANALYSIS

-

11.7 COMPANY EVALUATION MATRIX FOR KEY PLAYERS, 2022STARSEMERGING LEADERSPERVASIVE PLAYERSPARTICIPANTSCOMPETITIVE BENCHMARKING

-

11.8 COMPANY EVALUATION MATRIX FOR STARTUPS/SMES, 2022PROGRESSIVE COMPANIESRESPONSIVE COMPANIESDYNAMIC COMPANIESSTARTING BLOCKSCOMPETITIVE BENCHMARKING

-

11.9 COMPETITIVE SCENARIOPRODUCT LAUNCHESDEALS

-

12.1 KEY PLAYERSIBM- Business overview- Products/Solutions/Services offered- Recent developments- MnM viewBROADCOM- Business overview- Products/Solutions/Services offered- Recent developments- MnM viewCHECK POINT- Business overview- Products/Solutions/Services offered- Recent developments- MnM viewGOOGLE- Business overview- Products/Solutions/Services offered- Recent developments- MnM viewAWS- Business overview- Products/Solutions/Services offered- Recent developments- MnM viewZSCALER- Business overview- Products/Solutions/Services offered- Recent developmentsAKAMAI TECHNOLOGIES- Business overview- Products/Solutions/Services offered- Recent developmentsFORTINET- Business overview- Products/Solutions/Services offered- Recent developmentsF5- Business overview- Products/Solutions/Services offered- Recent developmentsFORCEPOINT- Business overview- Products/Solutions/Services offered- Recent developmentsQUALYS- Business overview- Products/Solutions/Services offered- Recent developmentsTREND MICRO- Business overview- Products/Solutions/Services offeredPALO ALTO NETWORKS- Business overview- Products/Solutions/Services offered- Recent developmentsPROOFPOINT- Business overview- Products/Solutions/Services offered- Recent developmentsTENABLE- Business overview- Products/Solutions/Services offered- Recent developmentsNETSKOPE- Business overview- Products/Solutions/Services offered- Recent developmentsMICROSOFT- Business overview- Products/Solutions/Services offered- Recent developmentsCISCO- Business overview- Products/Solutions/Services offered- Recent developmentsIMPERVA- Business overview- Products/Solutions/Services offered- Recent developmentsTRELLIX- Business overview- Products/Solutions/Services offered- Recent developmentsRAPID7- Business overview- Products/Solutions/Services offered- Recent developments

-

12.2 OTHER PLAYERSSKYHIGH SECURITYFIREMONSYSDIGLOOKOUTFIDELIS CYBERSECURITYDATA THEOREMOPSCOMPASSTUFINMENLO SECURITYTIGERAORCA SECURITYASCEND TECHNOLOGIESSECBERUSERMETICSONRAI SECURITYWIZCAVEONIXBANYAN CLOUDACCUKNOX

- 13.1 LIMITATIONS

- 13.2 MULTI-CLOUD SECURITY MARKET

- 13.3 CLOUD SECURITY POSTURE MANAGEMENT MARKET

- 13.4 CYBERSECURITY MARKET

- 14.1 DISCUSSION GUIDE

- 14.2 KNOWLEDGESTORE: MARKETSANDMARKETS’ SUBSCRIPTION PORTAL

- 14.3 CUSTOMIZATION OPTIONS

- 14.4 RELATED REPORTS

- 14.5 AUTHOR DETAILS

- TABLE 1 USD EXCHANGE RATES, 2017–2022

- TABLE 2 FACTOR ANALYSIS

- TABLE 3 ROLE OF PLAYERS IN MARKET ECOSYSTEM

- TABLE 4 IMPACT OF PORTER’S FIVE FORCES ANALYSIS ON CLOUD SECURITY MARKET

- TABLE 5 PRICING ANALYSIS

- TABLE 6 LIST OF REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- TABLE 7 INFLUENCE OF STAKEHOLDERS ON BUYING PROCESS

- TABLE 8 KEY CONFERENCES & EVENTS, 2023–2024

- TABLE 9 MARKET, BY OFFERING, 2017–2022 (USD MILLION)

- TABLE 10 MARKET, BY OFFERING, 2023–2028 (USD MILLION)

- TABLE 11 SOLUTIONS: MARKET, BY REGION, 2017–2022 (USD MILLION)

- TABLE 12 SOLUTIONS: MARKET, BY REGION, 2023–2028 (USD MILLION)

- TABLE 13 CLOUD SECURITY MARKET, BY SOLUTION, 2017–2022 (USD MILLION)

- TABLE 14 MARKET, BY SOLUTION, 2023–2028 (USD MILLION)

- TABLE 15 SERVICES: MARKET, BY REGION, 2017–2022 (USD MILLION)

- TABLE 16 SERVICES: MARKET, BY REGION, 2023–2028 (USD MILLION)

- TABLE 17 MARKET, BY SERVICE, 2017–2022 (USD MILLION)

- TABLE 18 MARKET, BY SERVICE, 2023–2028 (USD MILLION)

- TABLE 19 MARKET, BY TYPE, 2017–2022 (USD MILLION)

- TABLE 20 MARKET, BY TYPE, 2023–2028 (USD MILLION)

- TABLE 21 VISIBILITY AND RISK ASSESSMENT: MARKET, BY REGION, 2017–2022 (USD MILLION)

- TABLE 22 VISIBILITY AND RISK ASSESSMENT: CLOUD SECURITY MARKET, BY REGION, 2023–2028 (USD MILLION)

- TABLE 23 GOVERNANCE: MARKET, BY REGION, 2017–2022 (USD MILLION)

- TABLE 24 GOVERNANCE: MARKET, BY REGION, 2023–2028 (USD MILLION)

- TABLE 25 IAM: MARKET, BY REGION, 2017–2022 (USD MILLION)

- TABLE 26 IAM: MARKET, BY REGION, 2023–2028 (USD MILLION)

- TABLE 27 DATA SECURITY: MARKET, BY REGION, 2017–2022 (USD MILLION)

- TABLE 28 DATA SECURITY: CLOUD SECURITY MARKET, BY REGION, 2023–2028 (USD MILLION)

- TABLE 29 DISASTER RECOVERY AND BUSINESS CONTINUITY: MARKET, BY REGION, 2017–2022 (USD MILLION)

- TABLE 30 DISASTER RECOVERY AND BUSINESS CONTINUITY: MARKET, BY REGION, 2023–2028 (USD MILLION)

- TABLE 31 MARKET, BY SERVICE MODEL, 2017–2022 (USD MILLION)

- TABLE 32 CLOUD SECURITY MARKET, BY SERVICE MODEL, 2023–2028 (USD MILLION)

- TABLE 33 IAAS: MARKET, BY REGION, 2017–2022 (USD MILLION)

- TABLE 34 IAAS: MARKET, BY REGION, 2023–2028 (USD MILLION)

- TABLE 35 SAAS: MARKET, BY REGION, 2017–2022 (USD MILLION)

- TABLE 36 SAAS: MARKET, BY REGION, 2023–2028 (USD MILLION)

- TABLE 37 PAAS: MARKET, BY REGION, 2017–2022 (USD MILLION)

- TABLE 38 PAAS: MARKET, BY REGION, 2023–2028 (USD MILLION)

- TABLE 39 MARKET, BY VERTICAL, 2017–2022 (USD MILLION)

- TABLE 40 MARKET, BY VERTICAL, 2023–2028 (USD MILLION)

- TABLE 41 BFSI: MARKET, BY REGION, 2017–2022 (USD MILLION)

- TABLE 42 BFSI: MARKET, BY REGION, 2023–2028 (USD MILLION)

- TABLE 43 HEALTHCARE: CLOUD SECURITY MARKET, BY REGION, 2017–2022 (USD MILLION)

- TABLE 44 HEALTHCARE: MARKET, BY REGION, 2023–2028 (USD MILLION)

- TABLE 45 GOVERNMENT: MARKET, BY REGION, 2017–2022 (USD MILLION)

- TABLE 46 GOVERNMENT: MARKET, BY REGION, 2023–2028 (USD MILLION)

- TABLE 47 RETAIL & ECOMMERCE: MARKET, BY REGION, 2017–2022 (USD MILLION)

- TABLE 48 RETAIL & ECOMMERCE: MARKET, BY REGION, 2023–2028 (USD MILLION)

- TABLE 49 IT & ITES: MARKET, BY REGION, 2017–2022 (USD MILLION)

- TABLE 50 IT & ITES: MARKET, BY REGION, 2023–2028 (USD MILLION)

- TABLE 51 MANUFACTURING: MARKET, BY REGION, 2017–2022 (USD MILLION)

- TABLE 52 MANUFACTURING: MARKET, BY REGION, 2023–2028 (USD MILLION)

- TABLE 53 GAMING & ENTERTAINMENT: MARKET, BY REGION, 2017–2022 (USD MILLION)

- TABLE 54 GAMING & ENTERTAINMENT: MARKET, BY REGION, 2023–2028 (USD MILLION)

- TABLE 55 TELECOMMUNICATION: CLOUD SECURITY MARKET, BY REGION, 2017–2022 (USD MILLION)

- TABLE 56 TELECOMMUNICATION: MARKET, BY REGION, 2023–2028 (USD MILLION)

- TABLE 57 ENERGY & UTILITIES: MARKET, BY REGION, 2017–2022 (USD MILLION)

- TABLE 58 ENERGY & UTILITIES: MARKET, BY REGION, 2023–2028 (USD MILLION)

- TABLE 59 TRAVEL & HOSPITALITY: MARKET, BY REGION, 2017–2022 (USD MILLION)

- TABLE 60 TRAVEL & HOSPITALITY: MARKET, BY REGION, 2023–2028 (USD MILLION)

- TABLE 61 RESEARCH & ACADEMIA: MARKET, BY REGION, 2017–2022 (USD MILLION)

- TABLE 62 RESEARCH & ACADEMIA: MARKET, BY REGION, 2023–2028 (USD MILLION)

- TABLE 63 CLOUD SECURITY MARKET, BY REGION, 2017–2022 (USD MILLION)

- TABLE 64 MARKET, BY REGION, 2023–2028 (USD MILLION)

- TABLE 65 NORTH AMERICA: CLOUD SECURITY MARKET, BY OFFERING, 2017–2022 (USD MILLION)

- TABLE 66 NORTH AMERICA: MARKET, BY OFFERING, 2023–2028 (USD MILLION)

- TABLE 67 NORTH AMERICA: MARKET, BY SOLUTION, 2017–2022 (USD MILLION)

- TABLE 68 NORTH AMERICA: MARKET, BY SOLUTION, 2023–2028 (USD MILLION)

- TABLE 69 NORTH AMERICA: MARKET, BY SERVICE, 2017–2022 (USD MILLION)

- TABLE 70 NORTH AMERICA: MARKET, BY SERVICE, 2023–2028 (USD MILLION)

- TABLE 71 NORTH AMERICA: MARKET, BY TYPE, 2017–2022 (USD MILLION)

- TABLE 72 NORTH AMERICA: MARKET, BY TYPE, 2023–2028 (USD MILLION)

- TABLE 73 NORTH AMERICA: MARKET, BY SERVICE MODEL, 2017–2022 (USD MILLION)

- TABLE 74 NORTH AMERICA: MARKET, BY SERVICE MODEL, 2023–2028 (USD MILLION)

- TABLE 75 NORTH AMERICA: MARKET, BY VERTICAL, 2017–2022 (USD MILLION)

- TABLE 76 NORTH AMERICA: MARKET, BY VERTICAL, 2023–2028 (USD MILLION)

- TABLE 77 NORTH AMERICA: MARKET, BY COUNTRY, 2017–2022 (USD MILLION)

- TABLE 78 NORTH AMERICA: MARKET, BY COUNTRY, 2023–2028 (USD MILLION)

- TABLE 79 US: CLOUD SECURITY MARKET, BY OFFERING, 2017–2022 (USD MILLION)

- TABLE 80 US: MARKET, BY OFFERING, 2023–2028 (USD MILLION)

- TABLE 81 US: MARKET, BY SOLUTION, 2017–2022 (USD MILLION)

- TABLE 82 US: MARKET, BY SOLUTION, 2023–2028 (USD MILLION)

- TABLE 83 US: MARKET, BY SERVICE, 2017–2022 (USD MILLION)

- TABLE 84 US: MARKET, BY SERVICE, 2023–2028 (USD MILLION)

- TABLE 85 US: MARKET, BY TYPE, 2017–2022 (USD MILLION)

- TABLE 86 US: MARKET, BY TYPE, 2023–2028 (USD MILLION)

- TABLE 87 US: MARKET, BY SERVICE MODEL, 2017–2022 (USD MILLION)

- TABLE 88 US: MARKET, BY SERVICE MODEL, 2023–2028 (USD MILLION)

- TABLE 89 US: MARKET, BY VERTICAL, 2017–2022 (USD MILLION)

- TABLE 90 US: MARKET, BY VERTICAL, 2023–2028 (USD MILLION)

- TABLE 91 CANADA: CLOUD SECURITY MARKET, BY OFFERING, 2017–2022 (USD MILLION)

- TABLE 92 CANADA: MARKET, BY OFFERING, 2023–2028 (USD MILLION)

- TABLE 93 CANADA: MARKET, BY SOLUTION, 2017–2022 (USD MILLION)

- TABLE 94 CANADA: MARKET, BY SOLUTION, 2023–2028 (USD MILLION)

- TABLE 95 CANADA: MARKET, BY SERVICE, 2017–2022 (USD MILLION)

- TABLE 96 CANADA: MARKET, BY SERVICE, 2023–2028 (USD MILLION)

- TABLE 97 CANADA: MARKET, BY TYPE, 2017–2022 (USD MILLION)

- TABLE 98 CANADA: MARKET, BY TYPE, 2023–2028 (USD MILLION)

- TABLE 99 CANADA: MARKET, BY SERVICE MODEL, 2017–2022 (USD MILLION)

- TABLE 100 CANADA: MARKET, BY SERVICE MODEL, 2023–2028 (USD MILLION)

- TABLE 101 CANADA: MARKET, BY VERTICAL, 2017–2022 (USD MILLION)

- TABLE 102 CANADA: MARKET, BY VERTICAL, 2023–2028 (USD MILLION)

- TABLE 103 EUROPE: CLOUD SECURITY MARKET, BY OFFERING, 2017–2022 (USD MILLION)

- TABLE 104 EUROPE: MARKET, BY OFFERING, 2023–2028 (USD MILLION)

- TABLE 105 EUROPE: MARKET, BY SOLUTION, 2017–2022 (USD MILLION)

- TABLE 106 EUROPE: MARKET, BY SOLUTION, 2023–2028 (USD MILLION)

- TABLE 107 EUROPE: MARKET, BY SERVICE, 2017–2022 (USD MILLION)

- TABLE 108 EUROPE: MARKET, BY SERVICE, 2023–2028 (USD MILLION)

- TABLE 109 EUROPE: MARKET, BY TYPE, 2017–2022 (USD MILLION)

- TABLE 110 EUROPE: MARKET, BY TYPE, 2023–2028 (USD MILLION)

- TABLE 111 EUROPE: MARKET, BY SERVICE MODEL, 2017–2022 (USD MILLION)

- TABLE 112 EUROPE: MARKET, BY SERVICE MODEL, 2023–2028 (USD MILLION)

- TABLE 113 EUROPE: MARKET, BY VERTICAL, 2017–2022 (USD MILLION)

- TABLE 114 EUROPE: MARKET, BY VERTICAL, 2023–2028 (USD MILLION)

- TABLE 115 EUROPE: MARKET, BY COUNTRY, 2017–2022 (USD MILLION)

- TABLE 116 EUROPE: MARKET, BY COUNTRY, 2023–2028 (USD MILLION)

- TABLE 117 UK: CLOUD SECURITY MARKET, BY OFFERING, 2017–2022 (USD MILLION)

- TABLE 118 UK: MARKET, BY OFFERING, 2023–2028 (USD MILLION)

- TABLE 119 UK: MARKET, BY SOLUTION, 2017–2022 (USD MILLION)

- TABLE 120 UK: MARKET, BY SOLUTION, 2023–2028 (USD MILLION)

- TABLE 121 UK: MARKET, BY SERVICE, 2017–2022 (USD MILLION)

- TABLE 122 UK: MARKET, BY SERVICE, 2023–2028 (USD MILLION)

- TABLE 123 UK: MARKET, BY TYPE, 2017–2022 (USD MILLION)

- TABLE 124 UK: MARKET, BY TYPE, 2023–2028 (USD MILLION)

- TABLE 125 UK: MARKET, BY SERVICE MODEL, 2017–2022 (USD MILLION)

- TABLE 126 UK: MARKET, BY SERVICE MODEL, 2023–2028 (USD MILLION)

- TABLE 127 UK: MARKET, BY VERTICAL, 2017–2022 (USD MILLION)

- TABLE 128 UK: MARKET, BY VERTICAL, 2023–2028 (USD MILLION)

- TABLE 129 GERMANY: CLOUD SECURITY MARKET, BY OFFERING, 2017–2022 (USD MILLION)

- TABLE 130 GERMANY: MARKET, BY OFFERING, 2023–2028 (USD MILLION)

- TABLE 131 GERMANY: MARKET, BY SOLUTION, 2017–2022 (USD MILLION)

- TABLE 132 GERMANY: MARKET, BY SOLUTION, 2023–2028 (USD MILLION)

- TABLE 133 GERMANY: MARKET, BY SERVICE, 2017–2022 (USD MILLION)

- TABLE 134 GERMANY: MARKET, BY SERVICE, 2023–2028 (USD MILLION)

- TABLE 135 GERMANY: MARKET, BY TYPE, 2017–2022 (USD MILLION)

- TABLE 136 GERMANY: MARKET, BY TYPE, 2023–2028 (USD MILLION)

- TABLE 137 GERMANY: MARKET, BY SERVICE MODEL, 2017–2022 (USD MILLION)

- TABLE 138 GERMANY: MARKET, BY SERVICE MODEL, 2023–2028 (USD MILLION)

- TABLE 139 GERMANY: MARKET, BY VERTICAL, 2017–2022 (USD MILLION)

- TABLE 140 GERMANY: MARKET, BY VERTICAL, 2023–2028 (USD MILLION)

- TABLE 141 FRANCE: CLOUD SECURITY MARKET, BY OFFERING, 2017–2022 (USD MILLION)

- TABLE 142 FRANCE: MARKET, BY OFFERING, 2023–2028 (USD MILLION)

- TABLE 143 FRANCE: MARKET, BY SOLUTION, 2017–2022 (USD MILLION)

- TABLE 144 FRANCE: MARKET, BY SOLUTION, 2023–2028 (USD MILLION)

- TABLE 145 FRANCE: MARKET, BY SERVICE, 2017–2022 (USD MILLION)

- TABLE 146 FRANCE: MARKET, BY SERVICE, 2023–2028 (USD MILLION)

- TABLE 147 FRANCE: MARKET, BY TYPE, 2017–2022 (USD MILLION)

- TABLE 148 FRANCE: MARKET, BY TYPE, 2023–2028 (USD MILLION)

- TABLE 149 FRANCE: MARKET, BY SERVICE MODEL, 2017–2022 (USD MILLION)

- TABLE 150 FRANCE: MARKET, BY SERVICE MODEL, 2023–2028 (USD MILLION)

- TABLE 151 FRANCE: MARKET, BY VERTICAL, 2017–2022 (USD MILLION)

- TABLE 152 FRANCE: MARKET, BY VERTICAL, 2023–2028 (USD MILLION)

- TABLE 153 SWEDEN: CLOUD SECURITY MARKET, BY OFFERING, 2017–2022 (USD MILLION)

- TABLE 154 SWEDEN: MARKET, BY OFFERING, 2023–2028 (USD MILLION)

- TABLE 155 SWEDEN: MARKET, BY SOLUTION, 2017–2022 (USD MILLION)

- TABLE 156 SWEDEN: MARKET, BY SOLUTION, 2023–2028 (USD MILLION)

- TABLE 157 SWEDEN: MARKET, BY SERVICE, 2017–2022 (USD MILLION)

- TABLE 158 SWEDEN: MARKET, BY SERVICE, 2023–2028 (USD MILLION)

- TABLE 159 SWEDEN: MARKET, BY TYPE, 2017–2022 (USD MILLION)

- TABLE 160 SWEDEN: MARKET, BY TYPE, 2023–2028 (USD MILLION)

- TABLE 161 SWEDEN: MARKET, BY SERVICE MODEL, 2017–2022 (USD MILLION)

- TABLE 162 SWEDEN: MARKET, BY SERVICE MODEL, 2023–2028 (USD MILLION)

- TABLE 163 SWEDEN: MARKET, BY VERTICAL, 2017–2022 (USD MILLION)

- TABLE 164 SWEDEN: MARKET, BY VERTICAL, 2023–2028 (USD MILLION)

- TABLE 165 DENMARK: CLOUD SECURITY MARKET, BY OFFERING, 2017–2022 (USD MILLION)

- TABLE 166 DENMARK: MARKET, BY OFFERING, 2023–2028 (USD MILLION)

- TABLE 167 DENMARK: MARKET, BY SOLUTION, 2017–2022 (USD MILLION)

- TABLE 168 DENMARK: MARKET, BY SOLUTION, 2023–2028 (USD MILLION)

- TABLE 169 DENMARK: MARKET, BY SERVICE, 2017–2022 (USD MILLION)

- TABLE 170 DENMARK: MARKET, BY SERVICE, 2023–2028 (USD MILLION)

- TABLE 171 DENMARK: MARKET, BY TYPE, 2017–2022 (USD MILLION)

- TABLE 172 DENMARK: MARKET, BY TYPE, 2023–2028 (USD MILLION)

- TABLE 173 DENMARK: MARKET, BY SERVICE MODEL, 2017–2022 (USD MILLION)

- TABLE 174 DENMARK: MARKET, BY SERVICE MODEL, 2023–2028 (USD MILLION)

- TABLE 175 DENMARK: MARKET, BY VERTICAL, 2017–2022 (USD MILLION)

- TABLE 176 DENMARK: MARKET, BY VERTICAL, 2023–2028 (USD MILLION)

- TABLE 177 REST OF EUROPE: CLOUD SECURITY MARKET, BY OFFERING, 2017–2022 (USD MILLION)

- TABLE 178 REST OF EUROPE: MARKET, BY OFFERING, 2023–2028 (USD MILLION)

- TABLE 179 REST OF EUROPE: MARKET, BY SOLUTION, 2017–2022 (USD MILLION)

- TABLE 180 REST OF EUROPE: MARKET, BY SOLUTION, 2023–2028 (USD MILLION)

- TABLE 181 REST OF EUROPE: MARKET, BY SERVICE, 2017–2022 (USD MILLION)

- TABLE 182 REST OF EUROPE: MARKET, BY SERVICE, 2023–2028 (USD MILLION)

- TABLE 183 REST OF EUROPE: MARKET, BY TYPE, 2017–2022 (USD MILLION)

- TABLE 184 REST OF EUROPE: MARKET, BY TYPE, 2023–2028 (USD MILLION)

- TABLE 185 REST OF EUROPE: MARKET, BY SERVICE MODEL, 2017–2022 (USD MILLION)

- TABLE 186 REST OF EUROPE: MARKET, BY SERVICE MODEL, 2023–2028 (USD MILLION)

- TABLE 187 REST OF EUROPE: MARKET, BY VERTICAL, 2017–2022 (USD MILLION)

- TABLE 188 REST OF EUROPE: MARKET, BY VERTICAL, 2023–2028 (USD MILLION)

- TABLE 189 ASIA PACIFIC: CLOUD SECURITY MARKET, BY OFFERING, 2017–2022 (USD MILLION)

- TABLE 190 ASIA PACIFIC: MARKET, BY OFFERING, 2023–2028 (USD MILLION)

- TABLE 191 ASIA PACIFIC: MARKET, BY SOLUTION, 2017–2022 (USD MILLION)

- TABLE 192 ASIA PACIFIC: MARKET, BY SOLUTION, 2023–2028 (USD MILLION)

- TABLE 193 ASIA PACIFIC: MARKET, BY SERVICE, 2017–2022 (USD MILLION)

- TABLE 194 ASIA PACIFIC: MARKET, BY SERVICE, 2023–2028 (USD MILLION)

- TABLE 195 ASIA PACIFIC: MARKET, BY TYPE, 2017–2022 (USD MILLION)

- TABLE 196 ASIA PACIFIC: MARKET, BY TYPE, 2023–2028 (USD MILLION)

- TABLE 197 ASIA PACIFIC: MARKET, BY SERVICE MODEL, 2017–2022 (USD MILLION)

- TABLE 198 ASIA PACIFIC: MARKET, BY SERVICE MODEL, 2023–2028 (USD MILLION)

- TABLE 199 ASIA PACIFIC: MARKET, BY VERTICAL, 2017–2022 (USD MILLION)

- TABLE 200 ASIA PACIFIC: MARKET, BY VERTICAL, 2023–2028 (USD MILLION)

- TABLE 201 ASIA PACIFIC: MARKET, BY COUNTRY, 2017–2022 (USD MILLION)

- TABLE 202 ASIA PACIFIC: MARKET, BY COUNTRY, 2023–2028 (USD MILLION)

- TABLE 203 CHINA: CLOUD SECURITY MARKET, BY OFFERING, 2017–2022 (USD MILLION)

- TABLE 204 CHINA: MARKET, BY OFFERING, 2023–2028 (USD MILLION)

- TABLE 205 CHINA: MARKET, BY SOLUTION, 2017–2022 (USD MILLION)

- TABLE 206 CHINA: MARKET, BY SOLUTION, 2023–2028 (USD MILLION)

- TABLE 207 CHINA: MARKET, BY SERVICE, 2017–2022 (USD MILLION)

- TABLE 208 CHINA: MARKET, BY SERVICE, 2023–2028 (USD MILLION)

- TABLE 209 CHINA: MARKET, BY TYPE, 2017–2022 (USD MILLION)

- TABLE 210 CHINA: MARKET, BY TYPE, 2023–2028 (USD MILLION)

- TABLE 211 CHINA: MARKET, BY SERVICE MODEL, 2017–2022 (USD MILLION)

- TABLE 212 CHINA: MARKET, BY SERVICE MODEL, 2023–2028 (USD MILLION)

- TABLE 213 CHINA: MARKET, BY VERTICAL, 2017–2022 (USD MILLION)

- TABLE 214 CHINA: MARKET, BY VERTICAL, 2023–2028 (USD MILLION)

- TABLE 215 JAPAN: CLOUD SECURITY MARKET, BY OFFERING, 2017–2022 (USD MILLION)

- TABLE 216 JAPAN: MARKET, BY OFFERING, 2023–2028 (USD MILLION)

- TABLE 217 JAPAN: MARKET, BY SOLUTION, 2017–2022 (USD MILLION)

- TABLE 218 JAPAN: MARKET, BY SOLUTION, 2023–2028 (USD MILLION)

- TABLE 219 JAPAN: MARKET, BY SERVICE, 2017–2022 (USD MILLION)

- TABLE 220 JAPAN: MARKET, BY SERVICE, 2023–2028 (USD MILLION)

- TABLE 221 JAPAN: MARKET, BY TYPE, 2017–2022 (USD MILLION)

- TABLE 222 JAPAN: MARKET, BY TYPE, 2023–2028 (USD MILLION)

- TABLE 223 JAPAN: MARKET, BY SERVICE MODEL, 2017–2022 (USD MILLION)

- TABLE 224 JAPAN: MARKET, BY SERVICE MODEL, 2023–2028 (USD MILLION)

- TABLE 225 JAPAN: MARKET, BY VERTICAL, 2017–2022 (USD MILLION)

- TABLE 226 JAPAN: MARKET, BY VERTICAL, 2023–2028 (USD MILLION)

- TABLE 227 AUSTRALIA & NEW ZEALAND: CLOUD SECURITY MARKET, BY OFFERING, 2017–2022 (USD MILLION)

- TABLE 228 AUSTRALIA & NEW ZEALAND: MARKET, BY OFFERING, 2023–2028 (USD MILLION)

- TABLE 229 AUSTRALIA & NEW ZEALAND: MARKET, BY SOLUTION, 2017–2022 (USD MILLION)

- TABLE 230 AUSTRALIA & NEW ZEALAND: MARKET, BY SOLUTION, 2023–2028 (USD MILLION)

- TABLE 231 AUSTRALIA & NEW ZEALAND: MARKET, BY SERVICE, 2017–2022 (USD MILLION)

- TABLE 232 AUSTRALIA & NEW ZEALAND: MARKET, BY SERVICE, 2023–2028 (USD MILLION)

- TABLE 233 AUSTRALIA & NEW ZEALAND: MARKET, BY TYPE, 2017–2022 (USD MILLION)

- TABLE 234 AUSTRALIA & NEW ZEALAND: MARKET, BY TYPE, 2023–2028 (USD MILLION)

- TABLE 235 AUSTRALIA & NEW ZEALAND: MARKET, BY SERVICE MODEL, 2017–2022 (USD MILLION)

- TABLE 236 AUSTRALIA & NEW ZEALAND: MARKET, BY SERVICE MODEL, 2023–2028 (USD MILLION)

- TABLE 237 AUSTRALIA & NEW ZEALAND: MARKET, BY VERTICAL, 2017–2022 (USD MILLION)

- TABLE 238 AUSTRALIA & NEW ZEALAND: MARKET, BY VERTICAL, 2023–2028 (USD MILLION)

- TABLE 239 INDIA: CLOUD SECURITY MARKET, BY OFFERING, 2017–2022 (USD MILLION)

- TABLE 240 INDIA: MARKET, BY OFFERING, 2023–2028 (USD MILLION)

- TABLE 241 INDIA: MARKET, BY SOLUTION, 2017–2022 (USD MILLION)

- TABLE 242 INDIA: MARKET, BY SOLUTION, 2023–2028 (USD MILLION)

- TABLE 243 INDIA: MARKET, BY SERVICE, 2017–2022 (USD MILLION)

- TABLE 244 INDIA: MARKET, BY SERVICE, 2023–2028 (USD MILLION)

- TABLE 245 INDIA: MARKET, BY TYPE, 2017–2022 (USD MILLION)

- TABLE 246 INDIA: MARKET, BY TYPE, 2023–2028 (USD MILLION)

- TABLE 247 INDIA: MARKET, BY SERVICE MODEL, 2017–2022 (USD MILLION)

- TABLE 248 INDIA: MARKET, BY SERVICE MODEL, 2023–2028 (USD MILLION)

- TABLE 249 INDIA: MARKET, BY VERTICAL, 2017–2022 (USD MILLION)

- TABLE 250 INDIA: MARKET, BY VERTICAL, 2023–2028 (USD MILLION)

- TABLE 251 SINGAPORE: CLOUD SECURITY MARKET, BY OFFERING, 2017–2022 (USD MILLION)

- TABLE 252 SINGAPORE: MARKET, BY OFFERING, 2023–2028 (USD MILLION)

- TABLE 253 SINGAPORE: MARKET, BY SOLUTION, 2017–2022 (USD MILLION)

- TABLE 254 SINGAPORE: MARKET, BY SOLUTION, 2023–2028 (USD MILLION)

- TABLE 255 SINGAPORE: MARKET, BY SERVICE, 2017–2022 (USD MILLION)

- TABLE 256 SINGAPORE: MARKET, BY SERVICE, 2023–2028 (USD MILLION)

- TABLE 257 SINGAPORE: MARKET, BY TYPE, 2017–2022 (USD MILLION)

- TABLE 258 SINGAPORE: MARKET, BY TYPE, 2023–2028 (USD MILLION)

- TABLE 259 SINGAPORE: MARKET, BY SERVICE MODEL, 2017–2022 (USD MILLION)

- TABLE 260 SINGAPORE: MARKET, BY SERVICE MODEL, 2023–2028 (USD MILLION)

- TABLE 261 SINGAPORE: MARKET, BY VERTICAL, 2017–2022 (USD MILLION)

- TABLE 262 SINGAPORE: MARKET, BY VERTICAL, 2023–2028 (USD MILLION)

- TABLE 263 REST OF ASIA PACIFIC: CLOUD SECURITY MARKET, BY OFFERING, 2017–2022 (USD MILLION)

- TABLE 264 REST OF ASIA PACIFIC: MARKET, BY OFFERING, 2023–2028 (USD MILLION)

- TABLE 265 REST OF ASIA PACIFIC: MARKET, BY SOLUTION, 2017–2022 (USD MILLION)

- TABLE 266 REST OF ASIA PACIFIC: MARKET, BY SOLUTION, 2023–2028 (USD MILLION)

- TABLE 267 REST OF ASIA PACIFIC: MARKET, BY SERVICE, 2017–2022 (USD MILLION)

- TABLE 268 REST OF ASIA PACIFIC: MARKET, BY SERVICE, 2023–2028 (USD MILLION)

- TABLE 269 REST OF ASIA PACIFIC: MARKET, BY TYPE, 2017–2022 (USD MILLION)

- TABLE 270 REST OF ASIA PACIFIC: MARKET, BY TYPE, 2023–2028 (USD MILLION)

- TABLE 271 REST OF ASIA PACIFIC: MARKET, BY SERVICE MODEL, 2017–2022 (USD MILLION)

- TABLE 272 REST OF ASIA PACIFIC: MARKET, BY SERVICE MODEL, 2023–2028 (USD MILLION)

- TABLE 273 REST OF ASIA PACIFIC: MARKET, BY VERTICAL, 2017–2022 (USD MILLION)

- TABLE 274 REST OF ASIA PACIFIC: MARKET, BY VERTICAL, 2023–2028 (USD MILLION)

- TABLE 275 MIDDLE EAST & AFRICA: CLOUD SECURITY MARKET, BY OFFERING, 2017–2022 (USD MILLION)

- TABLE 276 MIDDLE EAST & AFRICA: MARKET, BY OFFERING, 2023–2028 (USD MILLION)

- TABLE 277 MIDDLE EAST & AFRICA: MARKET, BY SOLUTION, 2017–2022 (USD MILLION)

- TABLE 278 MIDDLE EAST & AFRICA: MARKET, BY SOLUTION, 2023–2028 (USD MILLION)

- TABLE 279 MIDDLE EAST & AFRICA: MARKET, BY SERVICE, 2017–2022 (USD MILLION)

- TABLE 280 MIDDLE EAST & AFRICA: MARKET, BY SERVICE, 2023–2028 (USD MILLION)

- TABLE 281 MIDDLE EAST & AFRICA: MARKET, BY TYPE, 2017–2022 (USD MILLION)

- TABLE 282 MIDDLE EAST & AFRICA: MARKET, BY TYPE, 2023–2028 (USD MILLION)

- TABLE 283 MIDDLE EAST & AFRICA: MARKET, BY SERVICE MODEL, 2017–2022 (USD MILLION)

- TABLE 284 MIDDLE EAST & AFRICA: MARKET, BY SERVICE MODEL, 2023–2028 (USD MILLION)

- TABLE 285 MIDDLE EAST & AFRICA: MARKET, BY VERTICAL, 2017–2022 (USD MILLION)

- TABLE 286 MIDDLE EAST & AFRICA: MARKET, BY VERTICAL, 2023–2028 (USD MILLION)

- TABLE 287 MIDDLE EAST & AFRICA: MARKET, BY COUNTRY, 2017–2022 (USD MILLION)

- TABLE 288 MIDDLE EAST & AFRICA: MARKET, BY COUNTRY, 2023–2028 (USD MILLION)

- TABLE 289 UAE: CLOUD SECURITY MARKET, BY OFFERING, 2017–2022 (USD MILLION)

- TABLE 290 UAE: MARKET, BY OFFERING, 2023–2028 (USD MILLION)

- TABLE 291 UAE: MARKET, BY SOLUTION, 2017–2022 (USD MILLION)

- TABLE 292 UAE: MARKET, BY SOLUTION, 2023–2028 (USD MILLION)

- TABLE 293 UAE: MARKET, BY SERVICE, 2017–2022 (USD MILLION)

- TABLE 294 UAE: MARKET, BY SERVICE, 2023–2028 (USD MILLION)

- TABLE 295 UAE: MARKET, BY TYPE, 2017–2022 (USD MILLION)

- TABLE 296 UAE: MARKET, BY TYPE, 2023–2028 (USD MILLION)

- TABLE 297 UAE: MARKET, BY SERVICE MODEL, 2017–2022 (USD MILLION)

- TABLE 298 UAE: MARKET, BY SERVICE MODEL, 2023–2028 (USD MILLION)

- TABLE 299 UAE: MARKET, BY VERTICAL, 2017–2022 (USD MILLION)

- TABLE 300 UAE: CLOUD SECURITY MARKET, BY VERTICAL, 2023–2028 (USD MILLION)

- TABLE 301 ISRAEL: MARKET, BY OFFERING, 2017–2022 (USD MILLION)

- TABLE 302 ISRAEL: MARKET, BY OFFERING, 2023–2028 (USD MILLION)

- TABLE 303 ISRAEL: MARKET, BY SOLUTION, 2017–2022 (USD MILLION)

- TABLE 304 ISRAEL: MARKET, BY SOLUTION, 2023–2028 (USD MILLION)

- TABLE 305 ISRAEL: MARKET, BY SERVICE, 2017–2022 (USD MILLION)

- TABLE 306 ISRAEL: MARKET, BY SERVICE, 2023–2028 (USD MILLION)

- TABLE 307 ISRAEL: MARKET, BY TYPE, 2017–2022 (USD MILLION)

- TABLE 308 ISRAEL: CLOUD SECURITY MARKET, BY TYPE, 2023–2028 (USD MILLION)

- TABLE 309 ISRAEL: MARKET, BY SERVICE MODEL, 2017–2022 (USD MILLION)

- TABLE 310 ISRAEL: MARKET, BY SERVICE MODEL, 2023–2028 (USD MILLION)

- TABLE 311 ISRAEL: MARKET, BY VERTICAL, 2017–2022 (USD MILLION)

- TABLE 312 ISRAEL: MARKET, BY VERTICAL, 2023–2028 (USD MILLION)

- TABLE 313 KSA: MARKET, BY OFFERING, 2017–2022 (USD MILLION)

- TABLE 314 KSA: MARKET, BY OFFERING, 2023–2028 (USD MILLION)

- TABLE 315 KSA: MARKET, BY SOLUTION, 2017–2022 (USD MILLION)

- TABLE 316 KSA: MARKET, BY SOLUTION, 2023–2028 (USD MILLION)

- TABLE 317 KSA: CLOUD SECURITY MARKET, BY SERVICE, 2017–2022 (USD MILLION)

- TABLE 318 KSA: MARKET, BY SERVICE, 2023–2028 (USD MILLION)

- TABLE 319 KSA: MARKET, BY TYPE, 2017–2022 (USD MILLION)

- TABLE 320 KSA: MARKET, BY TYPE, 2023–2028 (USD MILLION)

- TABLE 321 KSA: MARKET, BY SERVICE MODEL, 2017–2022 (USD MILLION)

- TABLE 322 KSA: MARKET, BY SERVICE MODEL, 2023–2028 (USD MILLION)

- TABLE 323 KSA: MARKET, BY VERTICAL, 2017–2022 (USD MILLION)

- TABLE 324 KSA: MARKET, BY VERTICAL, 2023–2028 (USD MILLION)

- TABLE 325 SOUTH AFRICA: CLOUD SECURITY MARKET, BY OFFERING, 2017–2022 (USD MILLION)

- TABLE 326 SOUTH AFRICA: MARKET, BY OFFERING, 2023–2028 (USD MILLION)

- TABLE 327 SOUTH AFRICA: MARKET, BY SOLUTION, 2017–2022 (USD MILLION)

- TABLE 328 SOUTH AFRICA: MARKET, BY SOLUTION, 2023–2028 (USD MILLION)

- TABLE 329 SOUTH AFRICA: MARKET, BY SERVICE, 2017–2022 (USD MILLION)

- TABLE 330 SOUTH AFRICA: MARKET, BY SERVICE, 2023–2028 (USD MILLION)

- TABLE 331 SOUTH AFRICA: MARKET, BY TYPE, 2017–2022 (USD MILLION)

- TABLE 332 SOUTH AFRICA: MARKET, BY TYPE, 2023–2028 (USD MILLION)

- TABLE 333 SOUTH AFRICA: MARKET, BY SERVICE MODEL, 2017–2022 (USD MILLION)

- TABLE 334 SOUTH AFRICA: MARKET, BY SERVICE MODEL, 2023–2028 (USD MILLION)

- TABLE 335 SOUTH AFRICA: MARKET, BY VERTICAL, 2017–2022 (USD MILLION)

- TABLE 336 SOUTH AFRICA: MARKET, BY VERTICAL, 2023–2028 (USD MILLION)

- TABLE 337 REST OF MIDDLE EAST & AFRICA: CLOUD SECURITY MARKET, BY OFFERING, 2017–2022 (USD MILLION)

- TABLE 338 REST OF MIDDLE EAST & AFRICA: MARKET, BY OFFERING, 2023–2028 (USD MILLION)

- TABLE 339 REST OF MIDDLE EAST & AFRICA: MARKET, BY SOLUTION, 2017–2022 (USD MILLION)

- TABLE 340 REST OF MIDDLE EAST & AFRICA: MARKET, BY SOLUTION, 2023–2028 (USD MILLION)

- TABLE 341 REST OF MIDDLE EAST & AFRICA: MARKET, BY SERVICE, 2017–2022 (USD MILLION)

- TABLE 342 REST OF MIDDLE EAST & AFRICA: MARKET, BY SERVICE, 2023–2028 (USD MILLION)

- TABLE 343 REST OF MIDDLE EAST & AFRICA: MARKET, BY TYPE, 2017–2022 (USD MILLION)

- TABLE 344 REST OF MIDDLE EAST & AFRICA: MARKET, BY TYPE, 2023–2028 (USD MILLION)

- TABLE 345 REST OF MIDDLE EAST & AFRICA: MARKET, BY SERVICE MODEL, 2017–2022 (USD MILLION)

- TABLE 346 REST OF MIDDLE EAST & AFRICA: MARKET, BY SERVICE MODEL, 2023–2028 (USD MILLION)

- TABLE 347 REST OF MIDDLE EAST & AFRICA: MARKET, BY VERTICAL, 2017–2022 (USD MILLION)

- TABLE 348 REST OF MIDDLE EAST & AFRICA: MARKET, BY VERTICAL, 2023–2028 (USD MILLION)

- TABLE 349 LATIN AMERICA: CLOUD SECURITY MARKET, BY OFFERING, 2017–2022 (USD MILLION)

- TABLE 350 LATIN AMERICA: MARKET, BY OFFERING, 2023–2028 (USD MILLION)

- TABLE 351 LATIN AMERICA: MARKET, BY SOLUTION, 2017–2022 (USD MILLION)

- TABLE 352 LATIN AMERICA: MARKET, BY SOLUTION, 2023–2028 (USD MILLION)

- TABLE 353 LATIN AMERICA: MARKET, BY SERVICE, 2017–2022 (USD MILLION)

- TABLE 354 LATIN AMERICA: MARKET, BY SERVICE, 2023–2028 (USD MILLION)

- TABLE 355 LATIN AMERICA: MARKET, BY TYPE, 2017–2022 (USD MILLION)

- TABLE 356 LATIN AMERICA: MARKET, BY TYPE, 2023–2028 (USD MILLION)

- TABLE 357 LATIN AMERICA: MARKET, BY SERVICE MODEL, 2017–2022 (USD MILLION)

- TABLE 358 LATIN AMERICA: CLOUD SECURITY MARKET, BY SERVICE MODEL, 2023–2028 (USD MILLION)

- TABLE 359 LATIN AMERICA: MARKET, BY VERTICAL, 2017–2022 (USD MILLION)

- TABLE 360 LATIN AMERICA: MARKET, BY VERTICAL, 2023–2028 (USD MILLION)

- TABLE 361 LATIN AMERICA: MARKET, BY COUNTRY, 2017–2022 (USD MILLION)

- TABLE 362 LATIN AMERICA: MARKET, BY COUNTRY, 2023–2028 (USD MILLION)

- TABLE 363 BRAZIL: MARKET, BY OFFERING, 2017–2022 (USD MILLION)

- TABLE 364 BRAZIL: CLOUD SECURITY MARKET, BY OFFERING, 2023–2028 (USD MILLION)

- TABLE 365 BRAZIL: MARKET, BY SOLUTION, 2017–2022 (USD MILLION)

- TABLE 366 BRAZIL: MARKET, BY SOLUTION, 2023–2028 (USD MILLION)

- TABLE 367 BRAZIL: MARKET, BY SERVICE, 2017–2022 (USD MILLION)

- TABLE 368 BRAZIL: MARKET, BY SERVICE, 2023–2028 (USD MILLION)

- TABLE 369 BRAZIL: MARKET, BY TYPE, 2017–2022 (USD MILLION)

- TABLE 370 BRAZIL: MARKET, BY TYPE, 2023–2028 (USD MILLION)

- TABLE 371 BRAZIL: MARKET, BY SERVICE MODEL, 2017–2022 (USD MILLION)

- TABLE 372 BRAZIL: MARKET, BY SERVICE MODEL, 2023–2028 (USD MILLION)

- TABLE 373 BRAZIL: MARKET, BY VERTICAL, 2017–2022 (USD MILLION)

- TABLE 374 BRAZIL: MARKET, BY VERTICAL, 2023–2028 (USD MILLION)

- TABLE 375 MEXICO: MARKET, BY OFFERING, 2017–2022 (USD MILLION)

- TABLE 376 MEXICO: CLOUD SECURITY MARKET, BY OFFERING, 2023–2028 (USD MILLION)

- TABLE 377 MEXICO: MARKET, BY SOLUTION, 2017–2022 (USD MILLION)

- TABLE 378 MEXICO: MARKET, BY SOLUTION, 2023–2028 (USD MILLION)

- TABLE 379 MEXICO: MARKET, BY SERVICE, 2017–2022 (USD MILLION)

- TABLE 380 MEXICO: MARKET, BY SERVICE, 2023–2028 (USD MILLION)

- TABLE 381 MEXICO: MARKET, BY TYPE, 2017–2022 (USD MILLION)

- TABLE 382 MEXICO: MARKET, BY TYPE, 2023–2028 (USD MILLION)

- TABLE 383 MEXICO: MARKET, BY SERVICE MODEL, 2017–2022 (USD MILLION)

- TABLE 384 MEXICO: MARKET, BY SERVICE MODEL, 2023–2028 (USD MILLION)

- TABLE 385 MEXICO: MARKET, BY VERTICAL, 2017–2022 (USD MILLION)

- TABLE 386 MEXICO: MARKET, BY VERTICAL, 2023–2028 (USD MILLION)

- TABLE 387 REST OF LATIN AMERICA: CLOUD SECURITY MARKET, BY OFFERING, 2017–2022 (USD MILLION)

- TABLE 388 REST OF LATIN AMERICA: MARKET, BY OFFERING, 2023–2028 (USD MILLION)

- TABLE 389 REST OF LATIN AMERICA: MARKET, BY SOLUTION, 2017–2022 (USD MILLION)

- TABLE 390 REST OF LATIN AMERICA: MARKET, BY SOLUTION, 2023–2028 (USD MILLION)

- TABLE 391 REST OF LATIN AMERICA: MARKET, BY SERVICE, 2017–2022 (USD MILLION)

- TABLE 392 REST OF LATIN AMERICA: MARKET, BY SERVICE, 2023–2028 (USD MILLION)

- TABLE 393 REST OF LATIN AMERICA: MARKET, BY TYPE, 2017–2022 (USD MILLION)

- TABLE 394 REST OF LATIN AMERICA: MARKET, BY TYPE, 2023–2028 (USD MILLION)

- TABLE 395 REST OF LATIN AMERICA: MARKET, BY SERVICE MODEL, 2017–2022 (USD MILLION)

- TABLE 396 REST OF LATIN AMERICA: MARKET, BY SERVICE MODEL, 2023–2028 (USD MILLION)

- TABLE 397 REST OF LATIN AMERICA: MARKET, BY VERTICAL, 2017–2022 (USD MILLION)

- TABLE 398 REST OF LATIN AMERICA: MARKET, BY VERTICAL, 2023–2028 (USD MILLION)

- TABLE 399 CLOUD SECURITY MARKET: INTENSITY OF COMPETITIVE RIVALRY

- TABLE 400 COMPANY FOOTPRINT FOR KEY PLAYERS, BY OFFERING

- TABLE 401 COMPANY FOOTPRINT FOR KEY PLAYERS, BY REGION

- TABLE 402 LIST OF STARTUPS/SMES AND FUNDING

- TABLE 403 COMPANY FOOTPRINT FOR STARTUPS/SMES, BY REGION

- TABLE 404 MARKET: PRODUCT LAUNCHES, 2020–2023

- TABLE 405 MARKET: DEALS, 2022–2023

- TABLE 406 IBM: BUSINESS OVERVIEW

- TABLE 407 IBM: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 408 IBM: PRODUCT LAUNCHES

- TABLE 409 IBM: DEALS

- TABLE 410 BROADCOM: BUSINESS OVERVIEW

- TABLE 411 BROADCOM: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 412 BROADCOM: DEALS

- TABLE 413 CHECK POINT: BUSINESS OVERVIEW

- TABLE 414 CHECK POINT: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 415 CHECK POINT: PRODUCT LAUNCHES

- TABLE 416 CHECK POINT: DEALS

- TABLE 417 GOOGLE: BUSINESS OVERVIEW

- TABLE 418 GOOGLE: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 419 GOOGLE: DEALS

- TABLE 420 AWS: BUSINESS OVERVIEW

- TABLE 421 AWS: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 422 AWS: PRODUCT LAUNCHES

- TABLE 423 AWS: DEALS

- TABLE 424 ZSCALER: BUSINESS OVERVIEW

- TABLE 425 ZSCALER: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 426 ZSCALER: PRODUCT LAUNCHES

- TABLE 427 ZSCALER: DEALS

- TABLE 428 AKAMAI TECHNOLOGIES: BUSINESS OVERVIEW

- TABLE 429 AKAMAI TECHNOLOGIES: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 430 AKAMAI TECHNOLOGIES: PRODUCT LAUNCHES

- TABLE 431 AKAMAI TECHNOLOGIES: DEALS

- TABLE 432 FORTINET: BUSINESS OVERVIEW

- TABLE 433 FORTINET: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 434 FORTINET: PRODUCT LAUNCHES

- TABLE 435 FORTINET: DEALS

- TABLE 436 F5: BUSINESS OVERVIEW

- TABLE 437 F5: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 438 F5: PRODUCT LAUNCHES

- TABLE 439 F5: DEALS

- TABLE 440 FORCEPOINT: BUSINESS OVERVIEW

- TABLE 441 FORCEPOINT: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 442 FORCEPOINT: PRODUCT LAUNCHES

- TABLE 443 FORCEPOINT: DEALS

- TABLE 444 QUALYS: BUSINESS OVERVIEW

- TABLE 445 QUALYS: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 446 QUALYS: PRODUCT LAUNCHES

- TABLE 447 QUALYS: DEALS

- TABLE 448 TREND MICRO: BUSINESS OVERVIEW

- TABLE 449 TREND MICRO: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 450 TREND MICRO: DEALS

- TABLE 451 PALO ALTO NETWORKS: BUSINESS OVERVIEW

- TABLE 452 PALO ALTO NETWORKS: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 453 PALO ALTO NETWORKS: PRODUCT LAUNCHES

- TABLE 454 PALO ALTO NETWORKS: DEALS

- TABLE 455 PROOFPOINT: BUSINESS OVERVIEW

- TABLE 456 PROOFPOINT: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 457 PROOFPOINT: PRODUCT LAUNCHES

- TABLE 458 PROOFPOINT: DEALS

- TABLE 459 TENABLE: BUSINESS OVERVIEW

- TABLE 460 TENABLE: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 461 TENABLE: PRODUCT LAUNCHES

- TABLE 462 TENABLE: DEALS

- TABLE 463 NETSKOPE: BUSINESS OVERVIEW

- TABLE 464 NETSKOPE: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 465 NETSKOPE: PRODUCT LAUNCHES

- TABLE 466 NETSKOPE: DEALS

- TABLE 467 MICROSOFT: BUSINESS OVERVIEW

- TABLE 468 MICROSOFT: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 469 MICROSOFT: PRODUCT LAUNCHES

- TABLE 470 MICROSOFT: DEALS

- TABLE 471 CISCO: BUSINESS OVERVIEW

- TABLE 472 CISCO: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 473 CISCO: PRODUCT LAUNCHES

- TABLE 474 CISCO: DEALS

- TABLE 475 IMPERVA: BUSINESS OVERVIEW

- TABLE 476 IMPERVA: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 477 IMPERVA: PRODUCT LAUNCHES

- TABLE 478 IMPERVA: DEALS

- TABLE 479 TRELLIX: BUSINESS OVERVIEW

- TABLE 480 TRELLIX: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 481 TRELLIX: PRODUCT LAUNCHES

- TABLE 482 RAPID7: BUSINESS OVERVIEW

- TABLE 483 RAPID7: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 484 RAPID7: PRODUCT LAUNCHES

- TABLE 485 RAPID7: DEALS

- TABLE 486 ADJACENT MARKETS AND FORECASTS

- TABLE 487 MULTI-CLOUD SECURITY MARKET, BY OFFERING, 2016–2021 (USD MILLION)

- TABLE 488 MULTI-CLOUD SECURITY MARKET, BY OFFERING, 2022–2027 (USD MILLION)

- TABLE 489 MULTI-CLOUD SECURITY MARKET, BY CLOUD MODEL, 2016–2021 (USD MILLION)

- TABLE 490 MULTI-CLOUD SECURITY MARKET, BY CLOUD MODEL, 2022–2027 (USD MILLION)

- TABLE 491 MULTI-CLOUD SECURITY MARKET, BY ORGANIZATION SIZE, 2016–2021 (USD MILLION)

- TABLE 492 MULTI-CLOUD SECURITY MARKET, BY ORGANIZATION SIZE, 2022–2027 (USD MILLION)

- TABLE 493 MULTI-CLOUD SECURITY MARKET, BY APPLICATION, 2016–2021 (USD MILLION)

- TABLE 494 MULTI-CLOUD SECURITY MARKET, BY APPLICATION, 2022–2027 (USD MILLION)

- TABLE 495 MULTI-CLOUD SECURITY MARKET, BY VERTICAL, 2016–2021 (USD MILLION)

- TABLE 496 MULTI-CLOUD SECURITY MARKET, BY VERTICAL, 2022–2027 (USD MILLION)

- TABLE 497 MULTI-CLOUD SECURITY MARKET, BY REGION, 2016–2021 (USD MILLION)

- TABLE 498 MULTI-CLOUD SECURITY MARKET, BY REGION, 2022–2027 (USD MILLION)

- TABLE 499 CLOUD SECURITY POSTURE MANAGEMENT MARKET, BY COMPONENT, 2016–2021 (USD MILLION)

- TABLE 500 CLOUD SECURITY POSTURE MANAGEMENT MARKET, BY COMPONENT, 2022–2027 (USD MILLION)

- TABLE 501 CLOUD SECURITY POSTURE MANAGEMENT MARKET, BY CLOUD MODEL, 2016–2021 (USD MILLION)

- TABLE 502 CLOUD SECURITY POSTURE MANAGEMENT MARKET, BY CLOUD MODEL, 2022–2027 (USD MILLION)

- TABLE 503 CLOUD SECURITY POSTURE MANAGEMENT MARKET, BY ORGANIZATION SIZE, 2016–2021 (USD MILLION)

- TABLE 504 CLOUD SECURITY POSTURE MANAGEMENT MARKET, BY ORGANIZATION SIZE, 2022–2027 (USD MILLION)

- TABLE 505 CLOUD SECURITY POSTURE MANAGEMENT MARKET, BY VERTICAL, 2016–2021 (USD MILLION)

- TABLE 506 CLOUD SECURITY POSTURE MANAGEMENT MARKET, BY VERTICAL, 2022–2027 (USD MILLION)

- TABLE 507 CLOUD SECURITY POSTURE MANAGEMENT MARKET, BY REGION, 2016–2021 (USD MILLION)

- TABLE 508 CLOUD SECURITY POSTURE MANAGEMENT MARKET, BY REGION, 2022–2027 (USD MILLION)

- TABLE 509 CYBERSECURITY MARKET, BY COMPONENT, 2016–2021 (USD MILLION)

- TABLE 510 CYBERSECURITY MARKET, BY COMPONENT, 2022–2027 (USD MILLION)

- TABLE 511 CYBERSECURITY MARKET, BY SOFTWARE, 2016–2021 (USD MILLION)

- TABLE 512 CYBERSECURITY MARKET, BY SOFTWARE, 2022–2027 (USD MILLION)

- TABLE 513 CYBERSECURITY MARKET, BY SERVICE, 2016–2021 (USD MILLION)

- TABLE 514 CYBERSECURITY MARKET, BY SERVICE, 2022–2027 (USD MILLION)

- TABLE 515 CYBERSECURITY MARKET, BY SECURITY TYPE, 2016–2021 (USD MILLION)

- TABLE 516 CYBERSECURITY MARKET, BY SECURITY TYPE, 2022–2027 (USD MILLION)

- TABLE 517 CYBERSECURITY MARKET, BY DEPLOYMENT MODE, 2016–2021 (USD MILLION)

- TABLE 518 CYBERSECURITY MARKET, BY DEPLOYMENT MODE, 2022–2027 (USD MILLION)

- TABLE 519 CYBERSECURITY MARKET, BY ORGANIZATION SIZE, 2016–2021 (USD MILLION)

- TABLE 520 CYBERSECURITY MARKET, BY ORGANIZATION SIZE, 2022–2027 (USD MILLION)

- TABLE 521 CYBERSECURITY MARKET, BY VERTICAL, 2016–2021 (USD MILLION)

- TABLE 522 CYBERSECURITY MARKET, BY VERTICAL, 2022–2027 (USD MILLION)

- TABLE 523 CYBERSECURITY MARKET, BY REGION, 2016–2021 (USD MILLION)

- TABLE 524 CYBERSECURITY MARKET, BY REGION, 2022–2027 (USD MILLION)

- FIGURE 1 RESEARCH DESIGN

- FIGURE 2 DATA TRIANGULATION

- FIGURE 3 APPROACH 1 (SUPPLY-SIDE): REVENUE FROM SOFTWARE/SERVICES OFFERED BY CLOUD SECURITY VENDORS

- FIGURE 4 APPROACH 1: SUPPLY-SIDE ANALYSIS

- FIGURE 5 CLOUD SECURITY MARKET ESTIMATION: RESEARCH FLOW

- FIGURE 6 APPROACH 2 (BOTTOM-UP; DEMAND-SIDE): PRODUCTS/SOLUTIONS/SERVICES

- FIGURE 7 COMPANY EVALUATION MATRIX FOR KEY PLAYERS: CRITERIA WEIGHTAGE

- FIGURE 8 COMPANY EVALUATION MATRIX FOR STARTUPS/SMES: CRITERIA WEIGHTAGE

- FIGURE 9 CLOUD SECURITY MARKET TO ACHIEVE SIGNIFICANT GROWTH DURING FORECAST PERIOD

- FIGURE 10 MARKET: MAJOR SEGMENTS

- FIGURE 11 CLOUD SECURITY MARKET: REGIONAL SNAPSHOT

- FIGURE 12 RISE IN INVESTMENTS AND ORGANIC AND INORGANIC DEVELOPMENTS BY KEY VENDORS TO BOOST MARKET

- FIGURE 13 SOLUTIONS SEGMENT TO ACCOUNT FOR LARGER SHARE BY 2028

- FIGURE 14 CASB SEGMENT TO ACCOUNT FOR LARGEST SHARE BY 2028

- FIGURE 15 PROFESSIONAL SERVICES SEGMENT TO LEAD MARKET DURING FORECAST PERIOD

- FIGURE 16 VISIBILITY AND RISK ASSESSMENT SEGMENT TO LEAD MARKET DURING FORECAST PERIOD

- FIGURE 17 IAAS SEGMENT TO LEAD MARKET DURING FORECAST PERIOD

- FIGURE 18 BFSI SEGMENT TO ACCOUNT FOR LARGEST SHARE DURING FORECAST PERIOD

- FIGURE 19 ASIA PACIFIC TO EMERGE AS BEST MARKET FOR INVESTMENTS IN NEXT FIVE YEARS

- FIGURE 20 PILLARS OF CLOUD SECURITY

- FIGURE 21 CLOUD SECURITY MARKET: DRIVERS, RESTRAINTS, OPPORTUNITIES, AND CHALLENGES

- FIGURE 22 MARKET: SHARED RESPONSIBILITY MODEL

- FIGURE 23 VALUE CHAIN ANALYSIS

- FIGURE 24 ECOSYSTEM MAP

- FIGURE 25 PORTER’S FIVE FORCES ANALYSIS

- FIGURE 26 TOP 10 PATENT OWNERS

- FIGURE 27 TRENDS AND DISRUPTIONS IMPACTING CUSTOMERS’ BUSINESSES

- FIGURE 28 INFLUENCE OF STAKEHOLDERS ON BUYING PROCESS

- FIGURE 29 SERVICES SEGMENT TO RECORD HIGHEST GROWTH DURING FORECAST PERIOD

- FIGURE 30 CIEM SEGMENT TO ACHIEVE HIGHEST GROWTH DURING FORECAST PERIOD

- FIGURE 31 OVERVIEW OF CASB

- FIGURE 32 CLOUD WORKLOAD PROTECTION CONTROLS HIERARCHY

- FIGURE 33 CLOUD MANAGEMENT PLATFORM CAPABILITIES

- FIGURE 34 MANAGED SERVICES SEGMENT TO ACHIEVE HIGHER GROWTH DURING FORECAST PERIOD

- FIGURE 35 VISIBILITY AND RISK ASSESSMENT SEGMENT TO LEAD MARKET DURING FORECAST PERIOD

- FIGURE 36 IAAS SEGMENT TO LEAD MARKET DURING FORECAST PERIOD

- FIGURE 37 RETAIL & ECOMMERCE SEGMENT TO LEAD MARKET DURING FORECAST PERIOD

- FIGURE 38 ASIA PACIFIC TO GROW AT HIGHEST CAGR BY 2028

- FIGURE 39 NORTH AMERICA: CLOUD SECURITY MARKET SNAPSHOT

- FIGURE 40 ASIA PACIFIC: MARKET SNAPSHOT

- FIGURE 41 GLOBAL SNAPSHOT OF KEY MARKET PARTICIPANTS

- FIGURE 42 HISTORICAL REVENUE ANALYSIS FOR KEY PLAYERS, 2017–2022 (USD MILLION)

- FIGURE 43 VALUATION AND FINANCIAL METRICS FOR KEY CLOUD SECURITY VENDORS, 2022

- FIGURE 44 RANKING OF KEY PLAYERS

- FIGURE 45 MARKET SHARE ANALYSIS, 2022

- FIGURE 46 COMPANY EVALUATION MATRIX FOR KEY PLAYERS, 2022

- FIGURE 47 COMPANY EVALUATION MATRIX FOR STARTUPS/SMES, 2022

- FIGURE 48 IBM: COMPANY SNAPSHOT

- FIGURE 49 BROADCOM: COMPANY SNAPSHOT

- FIGURE 50 CHECK POINT: COMPANY SNAPSHOT

- FIGURE 51 GOOGLE: COMPANY SNAPSHOT

- FIGURE 52 AWS: COMPANY SNAPSHOT

- FIGURE 53 ZSCALER: COMPANY SNAPSHOT

- FIGURE 54 AKAMAI TECHNOLOGIES: COMPANY SNAPSHOT

- FIGURE 55 FORTINET: COMPANY SNAPSHOT

- FIGURE 56 F5: COMPANY SNAPSHOT

- FIGURE 57 QUALYS: COMPANY SNAPSHOT

- FIGURE 58 TREND MICRO: COMPANY SNAPSHOT

- FIGURE 59 PALO ALTO NETWORKS: COMPANY SNAPSHOT

- FIGURE 60 TENABLE: COMPANY SNAPSHOT

- FIGURE 61 MICROSOFT: COMPANY SNAPSHOT

- FIGURE 62 CISCO: COMPANY SNAPSHOT

- FIGURE 63 RAPID7: COMPANY SNAPSHOT

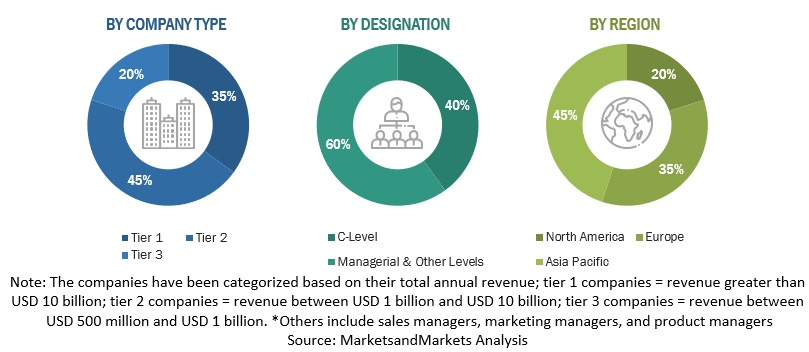

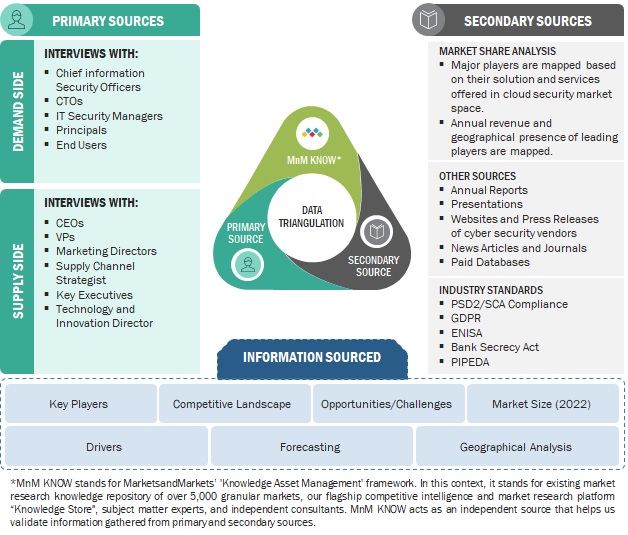

The study involved significant activities in estimating the current market size for cloud security. Intensive secondary research was conducted to collect information about cloud security and related ecosystems. The industry executives validated these findings, assumptions, and sizing across the value chain using a primary research process as a next step. Top-down and bottom-up market estimation approaches were used to estimate the market size globally, followed by the market breakup and data triangulation procedures to assess the market segment and sub-segments in cloud security.

Secondary Research Process:

In the secondary research process, various sources were referred to for identifying and collecting information regarding cloud security. These sources include annual reports, press releases, cloud security software and service vendor investor presentations, forums, vendor-certified publications, and industry/associations white papers. These secondary sources were utilized to obtain key information about the cloud security’s solutions and services supply & value chain, a list of 100+ key players and SMEs, market classification, and segmentation per the industry trends and regional markets. The secondary research also gives us insights into the key developments from market and technology perspectives, which primary respondents further validated.

The factors considered for estimating the regional market size include technological initiatives undertaken by governments of different countries, gross domestic product (GDP) growth, ICT spending, recent market developments, and market ranking analysis of primary cloud security solutions and service vendors.

Primary Research Process:

We have conducted primary research with industry executives from both the supply and demand sides. The primary sources from the supply side include chief executive officers (CEOs), vice presidents (VPs), marketing directors, and technology and innovation executives of key companies operating in the cloud security market. We have conducted primary interviews with the executives to obtain qualitative and quantitative information for cloud security.

The market engineering process implemented the top-down and bottom-up approaches and various data triangulation methods to estimate and forecast the market segments and subsegments. Post-market engineering process, we conducted primary research to verify and validate the critical numbers we arrived at. The primary research was also undertaken to identify the segmentation types; industry trends; the competitive landscape of the cloud security market players; and fundamental market dynamics, such as drivers, restraints, opportunities, challenges, industry trends, and key strategies.

Following is the breakup of the primary research:

To know about the assumptions considered for the study, download the pdf brochure

Market Size Estimation Process:

Both top-down and bottom-up approaches were implemented for market size estimation to estimate, project, and forecast the size of the global and other dependent sub-segments in the overall cloud security market.

The research methodology that has been used to estimate the market size includes these steps:

- The key players, SMEs, and startups were identified through secondary sources. Their revenue contributions in the market were determined through primary and secondary sources.

- Annual and financial reports of the publicly listed market players were considered for the company’s revenue details and,

- Primary interviews were also conducted with industry leaders to collect information about their companies, competitors, and key players in the market.

- All percentage splits, and breakups were determined using secondary sources and verified through primary sources.

Top-down and Bottom-up Approach-

To know about the assumptions considered for the study, Request for Free Sample Report

Data Triangulation

Data triangulation is a crucial step in the market engineering process for cloud security. It involves utilizing multiple data sources and methodologies to validate and cross-reference findings, thereby enhancing the reliability and accuracy of the market segment and subsegment statistics. To conduct data triangulation, various factors and trends related to the cloud security market are studied from both the demand and supply sides. It includes analyzing data from diverse sources such as market research reports, industry publications, regulatory bodies, financial institutions, and technology providers. By examining data from different perspectives and sources, data triangulation helps mitigate potential biases and discrepancies. It provides a more comprehensive understanding of the market dynamics, including the size, growth rate, market trends, and customer preferences.

Furthermore, data triangulation aids in identifying any inconsistencies or outliers in the data, enabling researchers to refine their analysis and make informed decisions. It strengthens the credibility of the market engineering process by ensuring that the conclusions drawn are based on robust and corroborated data. Data triangulation is a rigorous and systematic approach that enhances the reliability and validity of market segment and subsegment statistics in cloud security. It provides a solid foundation for informed decision-making and strategic planning within the industry.

Market Definition

As defined by MarketsandMarkets, cloud security is a subset of cybersecurity that pertains to the protection of cloud computing systems. Its core objective is to ensure the confidentiality and security of data across online infrastructure, applications, and platforms. This is achieved through the implementation of robust access controls, encryption techniques, IAM, and regular security audits. Cloud security also involves addressing potential vulnerabilities and threats, monitoring the cloud environment, and adhering to regulatory requirements and industry standards for data protection. Its ultimate aim is to establish trust and confidence in cloud computing by safeguarding sensitive information and maintaining the integrity and availability of resources within the cloud.

Key Stakeholders

- Chief technology and data officers

- Cloud security professionals

- Business analysts

- Information Technology (IT) professionals

- Government agencies

- Investors and venture capitalists

- Small and Medium-sized Enterprises (SMEs) and large enterprises

- Third-party service providers

- Consultants/consultancies/advisory firms

- Managed and professional service providers

Report Objectives

- To define, describe, and forecast the cloud security market based on offerings, service models, types, verticals, and regions:

- To predict and estimate the market size of five main regions: North America, Europe, Asia Pacific, Middle East & Africa, and Latin America

- To analyze the subsegments of the market with respect to individual growth trends, prospects, and contributions to the overall market

- To provide detailed information related to the primary factors (drivers, restraints, opportunities, and challenges) influencing the growth of the cloud security market

- To analyze opportunities in the market for stakeholders by identifying high-growth segments of the cloud security market

- To profile the key players of the cloud security market and comprehensively analyze their market size and core competencies.

- To track and analyze competitive developments, such as new product launches; mergers and acquisitions; and partnerships, agreements, and collaborations in the global cloud security market.

Customization Options

With the given market data, MarketsandMarkets offers customizations based on company-specific needs. The following customization options are available for the report:

Geographic Analysis

- Further breakup of the Asia Pacific market into countries contributing 75% to the regional market size

- Further breakup of the North American market into countries contributing 75% to the regional market size

- Further breakup of the Latin American market into countries contributing 75% to the regional market size

- Further breakup of the Middle Eastern and African market into countries contributing 75% to the regional market size

- Further breakup of the European market into countries contributing 75% to the regional market size

Company Information

- Detailed analysis and profiling of additional market players (up to 5)

Generating Response ...

Generating Response ...

Growth opportunities and latent adjacency in Cloud Security Market

Understanding Cloud Security Market revenues and Future trends