Application Container Market by Service (Container Monitoring, Security, Data Management, Networking, Orchestration), Platform (Docker, Kubernetes), Application Area, Deployment Mode, Organization Size, Vertical, and Region - Global Forecast to 2023

[178 Pages Report] An application container is an Operating System (OS)-level virtualization that deploys and runs distributed applications without actually running a virtual machine. It is more efficient than hardware infrastructure virtualization, which provides the same Kernel OS to various isolated applications and enables them to run on a single host. Application containers usually work on virtual machines, cloud instances, and bare-metal cloud systems across different OS.

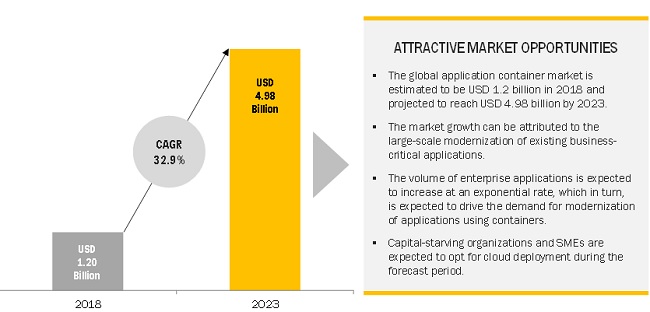

The global application container market is expected to grow from USD 1.2 billion in 2018 to USD 4.98 billion by 2023, at a CAGR of 32.9% during the forecast period. This growth is expected to be fueled by the increasing number of container orchestration services and container security services deployed in enterprises globally.

By service, container orchestration service is expected to hold the largest market share during the forecast period

The application container market by service has been segmented into container orchestration, container data management, container security, container networking, container monitoring, consulting, and support and maintenance. As more and more applications are migrating to the cloud, the demand for application containers is also expected to be increasing among enterprises. Cloud-native applications and legacy application modernization, bundled with DevOps strategies adopted by various enterprises, are expected to be driving the demand for application container services. The container orchestration segment is expected to hold the largest market share during the forecast period; this significant market share can be attributed to the high demand for efficient container management and container orchestration services among organizations.

By vertical, banking, financial services and insurance vertical is expected to hold the largest market share during the forecast period

The application container market has been segmented based on different verticals, namely, telecommunications and IT, education, BFSI, media and entertainment, healthcare and life sciences, retail and e-commerce, and others. The BFSI vertical is estimated to hold the largest market share and expected to grow at the highest CAGR during the forecast period. The main factor driving the growth of the application container services in the BFSI vertical is the omnichannel approach and the trend of shifting towards cloud environment. The demand for application container services is estimated to be gaining traction across all industries. Since cloud transformation has become one of the key elements of enterprise strategies today, the demand for application container services is also seen to be increasing.

Asia Pacific is expected to grow at the highest CAGR during the forecast period

APAC is expected to experience the highest growth in terms of adopting application container services during the forecast period. The growth is likely to be driven by factors, such as the increased spending on improving infrastructures and the emergence of advanced and secured cloud-based solutions, tax reformation policies, smart cities initiatives, and the rise of the digital economy. The major countries that are expected to witness high growth rates in this region include China, Japan, Singapore, Australia and New Zealand (ANZ), and the rest of the Association of Southeast Asian Nations (ASEAN) countries. Companies in this region are transforming their strategy from customer acquisition to customer experience. Most of the leading companies are changing their legacy applications and securing them. With the application container technology, organizations can make their applications agiler. Moreover, organizations can quickly adapt or migrate to the cloud by developing their applications on application container platforms.

Market Dynamics

Driver: Growing need for business agility and faster time-to-market

Enterprises require coordination to grow and respond to the increase in competition. This can be achieved only by adopting the latest technologies and developing and delivering modern applications. The existence of legacy environments hinder technological adoptions and require transformations at the application, platform, and technology levels. Application containers help in quickening the application development process by minimizing the testing time and reducing the complexities of testing processes, thereby bringing about agility. In addition to this, the container orchestration streamlines the deployment of applications in various environments, such as physical or virtual and public, private, or hybrid cloud infrastructures. This gives a competitive advantage to enterprises and results in increased efficiency, reduced application-related costs, and a better Return on Investment (RoI).

Restraint: Emergence of application container sprawl

Container sprawl is a term used to describe the running of unmanageable, multiple instances of applications through containers, and the corresponding heavy resource consumption resulting from it. Resource consumption, in various cases, results in fewer resources for running useful containers. Moreover, the chances of misconfiguration and mishandling of unmanageable containers on a particular host increase its chances of misconfiguration and mishandling. Container sprawl can drive up the costs of the public cloud environment. Large enterprises are at a higher risk of container sprawls than the Small and Medium-sized Enterprises (SMEs). Tracking and mapping of containers would soon become a necessity, as more and more applications are starting to get containerized. To counter the container sprawl, enterprises need to adopt an efficient DevOps and security strategy.

Opportunity: Rising adoption of IoT among various verticals

IoT has become the frontline technology due to its enormous business benefits. Multiple organizations across the globe are rapidly implementing IoT technology. The application container technology helps in realizing the real benefits of the IoT technology. Application containers offer features, such as the ability to migrate applications between IoT devices, enable application sign-ups and switch to different hosts, offer easy application upgrades, and provide simplicity and faster configuration, which are all well-suited for IoT technology. Application containers are also innately capable of running applications on IoT edge devices that consist of limited resources and majorly support lightweight OS. The demand for application containers in the IoT arena can be attributed to the need for frequent and fast IoT application updates at scale.

Challenge: Security risks associated with the application container technology

Committing to the application container technology could result in significant cost benefits and faster time-to-market, but it also presents various security challenges that need to be addressed. Application containers cannot isolate from the host operating system, as they share the same host OS as the other containers. There is a chance that if a hacker gains access to the host OS, it can breach the security of other containers as well. In addition to this, network hacking could lead to cross-container threats. Container-based security, like encryption services, can be challenging to attain, as users may have to build an Application Programming Interface (API) call from the containers to enable encryption services. Therefore, the whole application development process in containers need to be monitored continuously to minimize the risks and improve the security features.

Scope of the Report:

|

Report Metric |

Details |

|

Market size available for years |

20162023 |

|

Base year considered |

2017 |

|

Forecast period |

20182023 |

|

Forecast units |

USD Million (Value) |

|

Segments covered |

Platform, Service, Deployment Mode, Organization Size, ndustry Vertical, and Region |

|

Geographies covered |

North America, Europe, Asia Pacific (APAC), Latin America, and the Middle East and Africa (MEA) |

|

Companies covered |

IBM (US), AWS (US), Microsoft (US), Google (US), VMware (US), Apprenda (US), Joyent (US), Rancher Labs (US), SUSE (Germany), Sysdig (US), Jelastic (US), Kontena (Finland), Mesosphere (US), Puppet (US), Twistlock (US), Weaveworks (UK), CA Technologies (US), Oracle (US), Nimble Storage (US), BlueData (US), Apcera (US), Cisco (US), Red Hat (US), Docker (US), and Portworx (US) |

The study includes platform, service, deployment mode, application area, organization size, vertical, and region segments to arrive at the global application container market size during the forecast period.

By Service:

- Consulting

- Container monitoring

- Container security

- Container data management

- Container networking

- Container orchestration

- Support and maintenance

By Deployment Mode:

- Cloud

- On-premises

By Organization Size:

- SMEs

- Large enterprises

By Application Area

- Production

- Collaboration

- Modernization

- Others (resource optimization and content management)

By Vertical

- BFSI

- Healthcare and life science

- Telecommunication and IT

- Retail and e-commerce

- Education

- Media and entertainment

- Others (manufacturing, utilities, transportation and logistics, travel and hospitality, and government)

By Region:

- North America (US, Canada)

- Europe (UK, Germany, France, Rest of Europe)

- APAC (Australia & New Zealand, China, Japan, Singapore, Rest of Asia Pacific)

- MEA (Kingdom of Saudi Arabia, United Arab Emirates, Qatar, South Africa, Rest of Middle East and Africa)

- Latin America (Brazil Mexico, Rest of Latin America)

Key Market Players

IBM (US), Amazon Web Services (AWS) (US), Microsoft (US), Google (US), VMware (US)

Recent Developments

- In December 2017, AWS announced the launch of the AWS EU (Paris) Region. The AWS EU Region is the companys fourth in Europe, joining the existing regions in Germany, Ireland, and the UK. Thousands of French customers already use AWS in other areas, and developers, startups, enterprises, as well as government, education, and non-profit organizations, would be able to leverage AWS to run applications and store data in France.

- In August 2017, Microsoft and Red Hat expanded their strategic partnership to help enterprises quickly adopt containers. As per the partnership, the Red Hat container service would support Microsoft services, such as native support for Windows Server containers on Red Hat OpenShift Container Platform, Red Hat OpenShift Dedicated on Microsoft Azure, and SQL Server on Red Hat Enterprise Linux and OpenShift.

- In June 2017, Apcera announced that the Apcera Platform had achieved VMware Ready status, which would enable end-users to use VMware vSphere 6 for production environments. The use of the Apcera Platform with vSphere 6 would help enterprises modernize their legacy applications.

- In April 2017, IBM announced that the Docker Enterprise Edition (EE) is available for Linux on IBM zSystems, LinuxONE, and Power Systems. It would provide enterprises advanced performance and flexibility for developing and deploying business-critical applications across hybrid cloud environments. LinuxONE and z Systems can support up to 1 million Docker containers on a single system, with high levels of security.

- In March 2017, Cisco acquired AppDynamics, a US-based software provider of application and business performance monitoring. The acquisition is aimed at reinforcing Cisco's strategic direction and shift toward software-centric solutions.

Key questions addressed in the report

- Which regions are likely to grow at the highest CAGR?

- What are the recent trends affecting the application container market?

- Who are the key players in the market, and how intense is the competition?

- What are the key implementation areas of application management?

- What are the challenges hindering the adoption of application management services?

To speak to our analyst for a discussion on the above findings, click Speak to Analyst

Table of Contents

1 Introduction (Page No. - 17)

1.1 Objectives of the Study

1.1.1 Business Intelligence

1.1.2 Competitive Intelligence

1.2 Market Definition

1.3 Market Scope

1.4 Years Considered for the Study

1.5 Currency

1.6 Stakeholders

2 Research Methodology (Page No. - 21)

2.1 Research Data

2.1.1 Research Methodology

2.1.1.1 Breakdown of Primaries

2.1.1.2 Key Industry Insights

2.2 Market Size Estimation

2.3 Assumptions

2.4 Limitations

3 Executive Summary (Page No. - 28)

4 Premium Insights (Page No. - 34)

4.1 Attractive Market Opportunities in the Global Market

4.2 Application Container Market, By Service, 2018 vs 2023

4.3 Market, By Deployment Mode, 2018 vs 2023

4.4 Market, By Organization Size, 2018 vs 2023

4.5 Market, By Vertical, 20182023

4.6 Market, Market Share Across Various Regions

4.7 Market Investment Scenario

5 Market Overview and Industry Trends (Page No. - 38)

5.1 Introduction

5.2 Market Dynamics

5.2.1 Drivers

5.2.1.1 Growing Need for Business Agility and Faster Time-To-Market

5.2.1.2 Gaining Momentum in Microservices Architecture

5.2.1.3 Large-Scale Modernization of Existing Business-Critical Applications

5.2.1.4 Wide Presence of Open Source Vendors Offering Application Container-Based Services

5.2.2 Restraints

5.2.2.1 Emergence of Application Container Sprawl

5.2.3 Opportunities

5.2.3.1 SMES Increasing Investment in Technologies

5.2.3.2 Rising Adoption of IoT Among Various Verticals

5.2.4 Challenges

5.2.4.1 Security Risks Associated With the Application Container Technology

5.2.4.2 Presence of Skill Gap in the Market

5.3 Virtual Machines vs Application Containers

5.4 Container Technology Life Cycle

5.5 Application Container Use Cases

6 Application Container Platforms (Page No. - 45)

6.1 Introduction

6.2 Docker Swarm

6.3 Kubernetes

6.4 AWS ECS

6.5 Mesos

6.6 Hashicorp Nomad

6.7 Cloud Foundry

6.8 Openstack Magnum

6.9 Azure Container

6.10 Internally Developed Tools

7 Application Container Market, By Service (Page No. - 48)

7.1 Introduction

7.2 Consulting

7.3 Container Monitoring

7.4 Container Security

7.5 Container Data Management

7.6 Container Networking

7.7 Container Orchestration

7.8 Support and Maintenance

8 Application Container Market, By Deployment Mode (Page No. - 56)

8.1 Introduction

8.2 Cloud

8.3 Private Cloud

8.4 Public Cloud

8.5 On-Premises

9 Application Container Market, By Application Area (Page No. - 61)

9.1 Introduction

9.2 Production

9.3 Collaboration

9.4 Modernization

9.5 Others

10 Application Container Market, By Organization Size (Page No. - 67)

10.1 Introduction

10.2 Small and Medium-Sized Enterprises

10.3 Large Enterprises

11 Application Container Market, By Vertical (Page No. - 71)

11.1 Introduction

11.2 Banking, Financial Services, and Insurance

11.3 Healthcare and Life Sciences

11.4 Telecommunications and IT

11.5 Retail and Ecommerce

11.6 Education

11.7 Media and Entertainment

11.8 Others

12 Application Container Market, By Region (Page No. - 80)

12.1 Introduction

12.2 North America

12.2.1 United States

12.2.2 Canada

12.3 Europe

12.3.1 United Kingdom

12.3.2 Germany

12.3.3 France

12.3.4 Rest of Europe

12.4 Asia Pacific

12.4.1 Australia and New Zealand

12.4.2 China

12.4.3 Japan

12.4.4 Singapore

12.4.5 Rest of Asia Pacific

12.5 Middle East and Africa

12.5.1 Kingdom of Saudi Arabia

12.5.2 United Arab Emirates

12.5.3 Qatar

12.5.4 South Africa

12.5.5 Rest of Middle East and Africa

12.6 Latin America

12.6.1 Brazil

12.6.2 Mexico

12.6.3 Rest of Latin America

13 Competitive Landscape (Page No. - 105)

13.1 Overview

13.2 Market Ranking Analysis for the Application Container Market

13.3 Competitive Scenario

13.3.1 New Service/Product Launches

13.3.2 Business Expansions

13.3.3 Mergers and Acquisitions

13.3.4 Agreements and Partnerships

14 Company Profiles (Page No. - 111)

(Business Overview, Products & Services, Key Insights, Recent Developments, SWOT Analysis, MnM View)*

14.1 AWS

14.2 IBM

14.3 Microsoft

14.4 Apcera

14.5 Cisco

14.6 Red Hat

14.7 Docker

14.8 Google

14.9 VMware

14.10 Apprenda

14.11 Joyent

14.12 Rancher Labs

14.13 SUSE

14.14 Sysdig

14.15 Jelastic

14.16 Kontena

14.17 Mesosphere

14.18 Puppet Enterprise

14.19 Twistlock

14.20 Weaveworks

14.21 CA Technologies

14.22 Oracle

14.23 Nimble Storage (An HPE Company)

14.24 BlueData

14.25 Portworx

15 Appendix (Page No. - 170)

15.1 Discussion Guide

15.2 Knowledge Store: Marketsandmarkets Subscription Portal

15.3 Introducing RT: Real-Time Market Intelligence

15.4 Available Customization

15.5 Related Reports

15.6 Author Details

*Details on Business Overview, Products & Services, Key Insights, Recent Developments, SWOT Analysis, MnM View Might Not Be Captured in Case of Unlisted Companies.

List of Tables (75 Tables)

Table 1 United States Dollar Exchange Rate, 20142017

Table 2 Virtual Machines vs Application Containers

Table 3 Application Container Use Cases

Table 4 Services: Application Container Market Size, By Type, 20162023 (USD Million)

Table 5 Services: Market Size, By Region, 20162023 (USD Million)

Table 6 Consulting: Market Size, By Region, 20162023 (USD Million)

Table 7 Container Monitoring: Market Size, By Region, 20162023 (USD Million)

Table 8 Container Security: Market Size, By Region, 20162023 (USD Million)

Table 9 Container Data Management: Market Size, By Region, 20162023 (USD Million)

Table 10 Container Networking: Market Size, By Region, 20162023 (USD Million)

Table 11 Container Orchestration: Market Size, By Region, 20162023 (USD Million)

Table 12 Support and Maintenance: Market Size, By Region, 20162023 (USD Million)

Table 13 Application Container Market Size, By Deployment Mode, 20162023 (USD Million)

Table 14 Cloud: Market Size, By Type, 20162023 (USD Million)

Table 15 Cloud: Market Size, By Region, 20162023 (USD Million)

Table 16 Private Cloud Market Size, By Region, 20162023 (USD Million)

Table 17 Public Cloud Market Size, By Region, 20162023 (USD Million)

Table 18 On-Premises: Market Size, By Region, 20162023 (USD Million)

Table 19 Application Container Market Size, By Application Area, 20162023 (USD Million)

Table 20 Production: Market Size, By Region, 20162023 (USD Million)

Table 21 Collaboration: Market Size, By Region, 20162023 (USD Million)

Table 22 Modernization: Market Size, By Region, 20162023 (USD Million)

Table 23 Others: Market Size, By Region, 20162023 (USD Million)

Table 24 Application Container Market Size, By Organization Size, 20162023 (USD Million)

Table 25 Small and Medium-Sized Enterprises: Market Size, By Region, 20162023 (USD Million)

Table 26 Large Enterprises: Market Size, By Region, 20162023 (USD Million)

Table 27 Application Container Market Size, By Vertical, 20162023 (USD Million)

Table 28 Banking, Financial Services, and Insurance: Market Size, By Region, 20162023 (USD Million)

Table 29 Healthcare and Life Sciences: Market Size, By Region, 20162023 (USD Million)

Table 30 Telecommunications and IT: Market Size, By Region, 20162023 (USD Million)

Table 31 Retail and Ecommerce: Market Size, By Region, 20162023 (USD Million)

Table 32 Education: Market Size, By Region, 20162023 (USD Million)

Table 33 Media and Entertainment: Market Size, By Region, 20162023 (USD Million)

Table 34 Others: Market Size, By Region, 20162023 (USD Million)

Table 35 Application Container Market Size, By Region, 20162023 (USD Million)

Table 36 North America: Application Container Market Size, By Country, 20162023 (USD Million)

Table 37 North America: Market Size, By Service, 20162023 (USD Million)

Table 38 North America: Market Size, By Deployment Mode, 20162023 (USD Million)

Table 39 North America: Market Size, By Cloud, 20162023 (USD Million)

Table 40 North America: Market Size, By Application Area, 20162023 (USD Million)

Table 41 North America: Market Size, By Organization Size, 20162023 (USD Million)

Table 42 North America: Market Size, By Vertical, 20162023 (USD Million)

Table 43 Europe: Application Container Market Size, By Country, 20162023 (USD Million)

Table 44 Europe: Market Size, By Service, 20162023 (USD Million)

Table 45 Europe: Market Size, By Deployment Mode, 20162023 (USD Million)

Table 46 Europe: Market Size, By Cloud, 20162023 (USD Million)

Table 47 Europe: Market Size, By Application Area, 20162023 (USD Million)

Table 48 Europe: Market Size, By Organization Size, 20162023 (USD Million)

Table 49 Europe: Market Size, By Vertical, 20162023 (USD Million)

Table 50 Asia Pacific: Application Container Market Size, By Country, 20162023 (USD Million)

Table 51 Asia Pacific: Market Size, By Service, 20162023 (USD Million)

Table 52 Asia Pacific: Market Size, By Deployment Mode, 20162023 (USD Million)

Table 53 Asia Pacific: Market Size, By Cloud, 20162023 (USD Million)

Table 54 Asia Pacific: Market Size, By Application Area, 20162023 (USD Million)

Table 55 Asia Pacific: Market Size, By Organization Size, 20162023 (USD Million)

Table 56 Asia Pacific: Market Size, By Vertical, 20162023 (USD Million)

Table 57 Middle East and Africa: Application Container Market Size, By Country, 20162023 (USD Million)

Table 58 Middle East and Africa: Market Size, By Service, 20162023 (USD Million)

Table 59 Middle East and Africa: Market Size, By Deployment Mode, 20162023 (USD Million)

Table 60 Middle East and Africa: Market Size, By Cloud, 20162023 (USD Million)

Table 61 Middle East and Africa: Market Size, By Application Area, 20162023 (USD Million)

Table 62 Middle East and Africa: Market Size, By Organization Size, 20162023 (USD Million)

Table 63 Middle East and Africa: Market Size, By Vertical, 20162023 (USD Million)

Table 64 Latin America: Application Container Market Size, By Country, 20162023 (USD Million)

Table 65 Latin America: Market Size, By Service, 20162023 (USD Million)

Table 66 Latin America: Market Size, By Deployment Mode, 20162023 (USD Million)

Table 67 Latin America: Market Size, By Cloud, 20162023 (USD Million)

Table 68 Latin America: Market Size, By Application Area, 20162023 (USD Million)

Table 69 Latin America: Market Size, By Organization Size, 20162023 (USD Million)

Table 70 Latin America: Market Size, By Vertical, 20162023 (USD Million)

Table 71 Market Ranking, 2018

Table 72 New Service/Product Launches, 20162017

Table 73 Business Expansions, 20152017

Table 74 Mergers and Acquisitions, 20162018

Table 75 Agreements and Partnerships, 20162017

List of Figures (49 Figures)

Figure 1 Global Application Container Market: Market Segmentation

Figure 2 Global Market: Regional Scope

Figure 3 Global Market: Research Design

Figure 4 Breakdown of Primary Interviews: By Company, Designation, and Region

Figure 5 Data Triangulation

Figure 6 Market Size Estimation Methodology: Bottom-Up Approach

Figure 7 Market Size Estimation Methodology: Top-Down Approach

Figure 8 Application Container Evolution

Figure 9 Application Container Market Size, 20162023

Figure 10 Market Analysis

Figure 11 Fastest Growing Segments in the Market, 20182023

Figure 12 Large Scale Modernization of Legacy Applications is Expected to Drive the Growth of the Application Container Market

Figure 13 Container Orchestration Service is Expected to Hold the Largest Market Share During the Forecast Period

Figure 14 Cloud Deployment Mode is Expected to Hold the Larger Market Share During the Forecast Period

Figure 15 Large Enterprises Segment is Expected to Hold the Larger Market Share During the Forecast Period

Figure 16 Banking, Financial Services, and Insurance Vertical is Expected to Hold the Largest Market Share During the Forecast Period

Figure 17 North America is Estimated to Hold the Largest Market Size in 2018

Figure 18 Market Investment Scenario

Figure 19 Drivers, Restraints, Opportunities, and Challenges

Figure 20 Container Technology Architecture and Life Cycle Phases

Figure 21 Kubernetes and Docker Swarm are Expected to Be the Most Adopted Container Platforms, 2018

Figure 22 Container Security Segment is Expected to Grow at the Highest CAGR During the Forecast Period

Figure 23 Container Network Model

Figure 24 Cloud Deployment Mode is Expected to Grow at the Higher CAGR During the Forecast Period

Figure 25 Modernization Application Area is Expected to Grow at the Highest CAGR During the Forecast Period

Figure 26 Small and Medium-Sized Enterprises Segment is Expected to Grow at A Higher CAGR During the Forecast Period

Figure 27 Banking, Financial Services, and Insurance Vertical is Expected to Grow at the Highest CAGR During the Forecast Period

Figure 28 Asia Pacific is Expected to Grow at the Highest CAGR During the Forecast Period

Figure 29 Asia Pacific: A Hotspot in the Application Container Market During the Forecast Period

Figure 30 North America: Market Snapshot

Figure 31 Asia Pacific: Market Snapshot

Figure 32 Key Developments By Leading Players in the Application Container Market During 20162018

Figure 33 Market Evaluation Framework

Figure 34 AWS: Company Snapshot

Figure 35 AWS: SWOT Analysis

Figure 36 IBM: Company Snapshot

Figure 37 IBM: SWOT Analysis

Figure 38 Microsoft: Company Snapshot

Figure 39 Microsoft: SWOT Analysis

Figure 40 Apcera: SWOT Analysis

Figure 41 Cisco: Company Snapshot

Figure 42 Cisco: SWOT Analysis

Figure 43 Red Hat: Company Snapshot

Figure 44 Docker: SWOT Analysis

Figure 45 Google: Company Snapshot

Figure 46 Google: SWOT Analysis

Figure 47 VMware: Company Snapshot

Figure 48 CA Technologies: Company Snapshot

Figure 49 Oracle: Company Snapshot

Growth opportunities and latent adjacency in Application Container Market