Cellulose Acetate Market by Type (Fiber, Plastic), Application (Cigarette Filters, Textiles & Apparel, Photographic Films, Tapes & Labels), and Region (North America, Europe, APAC, MEA, & South America) - Global Forecast to 2026

Updated on : September 03, 2025

Cellulose Acetate Market

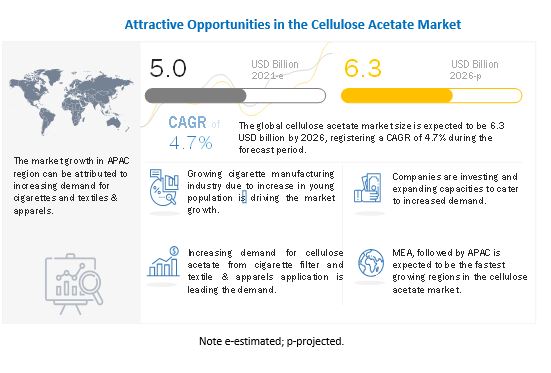

The global cellulose acetate market was valued at USD 5.0 billion in 2021 and is projected to reach USD 6.3 billion by 2026, growing at 4.7% cagr from 2021 to 2026. The market is growing due to the rise in demand from various applications, globally. It is expected to decline in 2020 due to COVID-19. However, the end of lockdown and recovery in the application sector will stimulate the demand during the forecast period.

To know about the assumptions considered for the study, Request for Free Sample Report

Impact of COVID-19 on Global Cellulose Acetate Market

The Cellulose acetate market is expected to witness a decline in market in 2020 due to the COVID-19 pandemic. This deadly virus has adversely affected the entire globe, especially the APAC and European regions. To prevent the further spread of this virus, companies have shut down their operations and manufacturing facilities and government restricted the construction activities. This has led to a reduction in the consumption of Cellulose acetate across applications.

COVID-19 and pre–existing regulatory issues such as protracted permitting procedures have slowed down the production of end-use industries, reducing the demand for cellulose acetate. However, the demand for cellulose acetate is expected to recover in 2021. China was the first country affected by COVID-19, disrupting the global cellulose acetate supply chain and resulting in reduced manufacturing activities across several end-use industries. However, the textile & apparel, cigarette, and other industries have resumed manufacturing activities and are soon expected to recover from the impact, resulting in the rise in demand for cellulose acetate.

Rising demand in growing textiles and apparels industry

The changing trends in the fashion industry is preferably one of the major factors responsible for the growth of the global cellulose acetate market. Cellulose acetate is considered to be suitable for textile application as it is comfortable and absorbent as well as can be easily dyed in many different colors. Therefore, increase in demand in the clothing sector due to changes in preferences of the consumers in order to keep themselves trendy and upgraded to the ongoing fashion changes has created a surge in demand and is responsible for the robust growth of the textiles and apparel industry.

Rising Application as a biodegradable plastic in various industries

The rising demand for environmentally friendly, biodegradable, cost-effective, and versatile cellulose acetate is also expected to boost the market growth. Cellulose acetate, which is used as a natural plastic is predicted to grow during the forecast period owing to its characteristics such as strong durability, glistened shine, lustrous texture, and high transparency. For instance, in November 2020, Celanese company launched ‘Blueridge’, a cellulose acetate product line that can be used to make objects like straws that are backyard compostable and broadly biodegradable.

Declining demand in application such as cigarette filter & photographic films

Factors such as fading interest in photographic films and major end-application i.e., cigarette filters owing to the growing awareness of the negative health impacts of smoking are likely to sluggish the market growth during the forecast period. The increase in the awareness is affecting the growth of cigarette manufacturing, which is expected to result in a decrease in the demand for cellulose acetate in the cigarette manufacturing application.

Rising demand in the emerging markets

The growing demand in the emerging markets such as Asia Pacific, Middle East Africa & South America is expected to augment the growth of the global cellulose acetate market. These markets dominate the demand for cellulose acetate owing to the rapid industrialization associated with rising cigarette filters, textile & apparel, and other applications. The growth of the market in these regions can be attributed to the developing economies, especially India & China. As per the Direct China Chamber of Commerce, China's textile and garment industry will produce more than 40% of the global textile and apparel exports in the coming years.

The fiber segment accounted for a major share in the cellulose acetate market in terms of value and volume during the forecast period

The fiber segment dominated the cellulose acetate market, accounting for the largest share of the overall cellulose acetate market in 2020. The demand for fiber-based cellulose acetates in the textile industries is majorly leading to market growth.

Cellulose acetate fibers are one of the major types of synthetic fibers. The fiber-forming substance is cellulose acetate in which at least 92% of the hydroxyl groups are acetylated. Acetate is considered to be a very valuable manufactured fiber that is low in cost and has good draping qualities. The fiber-based cellulose type is majorly used in the production of general consumer articles including clothing, lining, felts, upholstery, carpets, umbrellas, and cigarette filters. The staple acetate fibers are also used as partial substitutes for wool in the manufacture of fine fabrics and various kinds of knitwear. Therefore, the rapidly growing textile industry, especially in the emerging nations are expected to augment the growth of the fiber cellulose acetate segment.

Cigarette filters segment to dominate the cellulose acetate market

The cellulose acetate market is segmented on the basis of applications which include cigarette filters, textiles & apparel, photographic films, and tapes & labels. Cigarette filters is one of the major applications of cellulose acetate in the market. Due to its amazing filtration properties, cellulose acetate has prevailed as the filter material of choice. It also possesses superior biodegradability, which offers an advantage considering its impact on the environment.

Therefore, the cigarette filter application is expected to experience healthy growth due to growing cigarette manufacturing industry as well as in emerging economies such as China and India where the disposable income of individuals is continuously rising along with a growing young population that is more inclined towards smoking. The market is witnessing significant growth in this segment and is projected to increase in future.

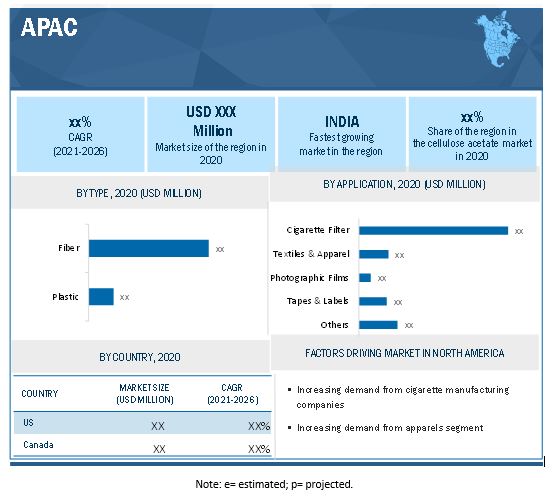

APAC held the largest market share in the Cellulose acetate market

APAC dominated the global cellulose acetate market in 2020. This dominance is attributed to the rising demand from domestic industries in the region. The demand for cellulose acetate is growing, especially, in APAC and Latin America. The markets in these regions are expected to register high growth in comparison to other regions.

Cellulose Acetate Market Players

The key players in the global Cellulose acetate market are:

- Eastman Chemical Company (US)

- Daicel Corporation (Japan)

- Celanese Corporation (US)

- Mitsubishi Chemical Holdings Corporation (Japan)

- Sappi Ltd (South Africa)

- Rayonier Advanced Materials, Inc (US)

- China National Tobacco Corporation (China)

- Sichuan Push Acetati Co Ltd (China)

- Cerdia International GmbH (Switzerland)

- Rotuba Extruders, Inc (US)

These companies are involved in adopting various inorganic and organic strategies to increase their foothold in the Cellulose acetate industry. The study includes an in-depth competitive analysis of these key players in the Cellulose acetate market, with their company profiles, recent developments, and key market strategies.

Cellulose Acetate Market Report Scope

|

Report Metric |

Details |

|

Market Size Value in 2021 |

USD 5.0 Billion |

|

Revenue Forecast in 2026 |

USD 6.3 Billion |

|

CAGR |

4.7% |

|

Years considered for the study |

2017–2020 |

|

Base year |

2020 |

|

Forecast period |

2021–2026 |

|

Units considered |

Value (USD million), Volume (Kilotons) |

|

Segments |

Cellulose Acetate Type, Applications and Region |

|

Regions |

Europe, North America, APAC, MEA, and Latin America |

|

Companies |

Eastman chemical Company (US), Solvay, Celanese Corporation (US), Daicel Corporation (Japan), China National Tobacco Corporation (China), Mitsubishi Chemical Holdings (Japan), Sichuan Push Acetati Co. Ltd. (China), Rayonier Advanced Materials Inc. (US), Acordis Cellulosic Fibers Co Ltd (Belgium), Sappi Limited (South Africa) |

This research report categorizes the cellulose acetate market based on type, application, and region.

Cellulose Acetate Market by Type:

- Fiber

- Plastics

Cellulose Acetate Market by Application:

- Cigarette Filters

- Textiles & Apparel

- Photographic Films

- Tapes & Labels

- Others

Cellulose Acetate Market by Region:

- North America

- Europe

- APAC

- MEA

- South America

Recent Developments

- In October 2020, Celanese Corporation launched a breakthrough cellulose-based material, BlueRidge Cellulosic Pellets which aligns with ESG and circular economy objectives with a product that is both, bio-based and broadly compostable.

- In February 2020, Eastman announced the expansion of its Naia fiber portfolio. With the introduction of its new cellulosic staple fiber, Naia offers another versatile, eco-conscious material choice for sustainable fashion.

FAQS

- What are the factors influencing the growth of the Cellulose acetate market?

- High demand from application industries due to superior performance properties of Cellulose acetate has driving the market.

- Which is the fastest-growing region-level market for Cellulose acetate s?

- APAC is the fastest-growing Cellulose acetate market due to the presence of major Cellulose acetate manufacturers and the burgeoning growth of various end-use industries.

- What are the factors contributing to the final price of Cellulose acetate s?

- Raw material and manufacturing process play a vital role in the costs. The type of manufacturing process contributes largely to the final pricing of Cellulose acetate.

- What are the challenges in the Cellulose acetate market?

- Volatility of prices is the major challenge in the Cellulose acetate market.

- Which type of Cellulose acetate holds the largest market share?

- Fiber Cellulose acetate hold the largest share due to wide applications in textiles & apparel.

- How is the Cellulose acetate market aligned?

- The market is growing at a significant pace. It is a potential market and many manufactures are planning business strategies to expand their business.

- Who are the major manufacturers?

- Eastman Chemical Company, Daicel Corporation, Celanese Corporation, Mitsubishi Chemical Holdings Corporation, Sappi Ltd, Rayonier Advanced Materials, Inc, China National Tobacco Corporation, Sichuan Push Acetati Co Ltd, Cerdia International GmbH, and Rotuba Extruders, Inc are a few of the key players in the Cellulose acetate market.

- What are the major applications for Cellulose acetate?

- The major applications of Cellulose acetate include cigarette filters, textiles & apparel, LCD & photographic films, tapes & labels, and others.

- What is the biggest restraint in the Cellulose acetate market?

- Declining demand in photographic films is the major restraint of the market.

To speak to our analyst for a discussion on the above findings, click Speak to Analyst

TABLE OF CONTENTS

1 INTRODUCTION (Page No. - 31)

1.1 OBJECTIVES OF THE STUDY

1.2 MARKET DEFINITION

1.3 INCLUSIONS & EXCLUSIONS

1.4 MARKET SCOPE

FIGURE 1 CELLULOSE ACETATE MARKET SEGMENTATION

1.4.1 REGIONS COVERED

1.4.2 YEARS CONSIDERED FOR THE STUDY

1.5 CURRENCY

1.6 UNIT CONSIDERED

1.7 LIMITATIONS

1.8 STAKEHOLDERS

1.9 SUMMARY OF CHANGES

2 RESEARCH METHODOLOGY (Page No. - 35)

2.1 BASE NUMBER CALCULATION

2.1.1 SUPPLY-SIDE APPROACH 1

2.1.2 DEMAND-SIDE APPROACH

2.2 FORECAST NUMBER CALCULATION

FIGURE 2 NUMBER OF SMOKERS (BILLIONS)

2.3 RESEARCH DATA

2.3.1 SECONDARY DATA

2.3.2 PRIMARY DATA

2.3.2.1 Primary interviews – top cellulose acetate manufacturers

2.3.2.2 Breakdown of primary interviews

2.3.2.3 Key industry insights

2.4 MARKET SIZE ESTIMATION

2.4.1 BOTTOM-UP APPROACH

FIGURE 3 CELLULOSE ACETATE MARKET: BOTTOM-UP APPROACH

2.4.2 TOP-DOWN APPROACH

FIGURE 4 CELLULOSE ACETATE MARKET: TOP-DOWN APPROACH

2.5 DATA TRIANGULATION

FIGURE 5 CELLULOSE ACETATE MARKET: DATA TRIANGULATION

2.6 FACTOR ANALYSIS

2.7 ASSUMPTIONS

2.8 LIMITATIONS & RISKS

3 EXECUTIVE SUMMARY (Page No. - 42)

FIGURE 6 FIBER TYPE SEGMENT DOMINATED THE CELLULOSE ACETATE MARKET IN 2020

FIGURE 7 CIGARETTE FILTERS APPLICATION DOMINATED THE OVERALL MARKET IN 2020

FIGURE 8 CHINA IS PROJECTED TO DOMINATE THE CELLULOSE ACETATE MARKET DURING THE FORECAST PERIOD

FIGURE 9 APAC DOMINATED THE CELLULOSE ACETATE MARKET IN 2020

4 PREMIUM INSIGHTS (Page No. - 46)

4.1 ATTRACTIVE OPPORTUNITIES IN THE CELLULOSE ACETATE MARKET

FIGURE 10 HIGH DEMAND FROM CIGARETTE FILTERS APPLICATION TO DRIVE THE MARKET

4.2 CELLULOSE ACETATE MARKET, BY TYPE

FIGURE 11 FIBER TYPE CELLULOSE ACETATE DOMINATED THE OVERALL MARKET

4.3 CELLULOSE ACETATE MARKET, BY APPLICATION

FIGURE 12 CIGARETTE FILTERS APPLICATION SEGMENT LED THE DEMAND FOR CELLULOSE ACETATE

4.4 CELLULOSE ACETATE MARKET, BY KEY COUNTRIES

FIGURE 13 MARKET IN INDIA TO GROW AT THE HIGHEST CAGR DURING THE FORECAST PERIOD

5 MARKET OVERVIEW (Page No. - 48)

5.1 INTRODUCTION

5.2 MARKET DYNAMICS

5.2.1 DRIVERS

5.2.1.1 Rising demand in growing textiles & apparel industry

FIGURE 15 TOP TEN TEXTILE EXPORTING COUNTRIES AND REGIONS, 2019 (USD BILLION)

5.2.1.2 Technological advancements in applications

5.2.1.3 Rising applications as biodegradable plastic in various industries

5.2.1.4 Increased industrialization offers potential for market growth

5.2.2 RESTRAINTS

5.2.2.1 Declining demand in applications such as cigarette filters and photographic films

5.2.3 OPPORTUNITIES

5.2.3.1 Rising demand in emerging markets

5.2.4 CHALLENGES

5.2.4.1 Volatility in prices of raw materials

5.2.4.2 Stringent rules & regulations

5.3 PORTER’S FIVE FORCES ANALYSIS

5.3.1 BARGAINING POWER OF SUPPLIERS

5.3.2 BARGAINING POWER OF BUYERS

5.3.3 THREAT OF SUBSTITUTES

5.3.4 THREAT OF NEW ENTRANTS

5.3.5 INTENSITY OF COMPETITIVE RIVALRY

TABLE 1 CELLULOSE ACETATE MARKET: PORTER’S FIVE FORCES ANALYSIS

5.4 TECHNOLOGY ANALYSIS

5.5 ECOSYSTEM: CELLULOSE ACETATE MARKET

FIGURE 17 CELLULOSE ACETATE MARKET ECOSYSTEM

5.6 VALUE CHAIN ANALYSIS

5.6.1 RAW MATERIAL SELECTION

5.6.2 MANUFACTURING

5.6.3 DISTRIBUTION & APPLICATIONS

5.7 CASE STUDY

5.8 SUPPLY CHAIN ANALYSIS

5.9 CELLULOSE ACETATE MARKET: OPTIMISTIC, PESSIMISTIC, AND REALISTIC SCENARIOS

TABLE 3 CELLULOSE ACETATE MARKET: CAGR (BY VALUE) IN REALISTIC, PESSIMISTIC, AND OPTIMISTIC SCENARIOS

5.9.1 OPTIMISTIC SCENARIO

5.9.2 PESSIMISTIC SCENARIO

5.9.3 REALISTIC SCENARIO

5.10 PRICING ANALYSIS

5.11 AVERAGE SELLING PRICE

TABLE 4 AVERAGE SELLING PRICE, BY TYPE

5.12 KEY MARKETS FOR IMPORTS/EXPORTS

5.12.1 EXPORT SCENARIO OF CELLULOSE ACETATE

FIGURE 19 EXPORT OF NON-PLASTICIZED CELLULOSE ACETATE, BY KEY COUNTRY, 2016-2020 (USD MILLION)

FIGURE 20 EXPORT OF PLASTICIZED CELLULOSE ACETATE, BY KEY COUNTRY, 2016-2020 (USD MILLION)

5.12.2 IMPORT SCENARIO OF CELLULOSE ACETATE

FIGURE 21 IMPORT OF NON-PLASTICIZED CELLULOSE ACETATE, BY KEY COUNTRY, 2016-2020 (USD MILLION)

FIGURE 22 PLASTICIZED CELLULOSE ACETATE IMPORT, BY KEY COUNTRY, 2016-2020 (USD MILLION)

5.13 PATENT ANALYSIS

5.13.1 INTRODUCTION

5.13.2 METHODOLOGY

5.13.3 DOCUMENT TYPE

FIGURE 23 GLOBAL PATENT ANALYSIS, BY DOCUMENT TYPE, 2010–2020

FIGURE 24 PUBLICATION TRENDS, 2010–2020

5.13.4 INSIGHTS

FIGURE 25 PATENT JURISDICTION ANALYSIS, 2020

5.13.5 TOP APPLICANTS OF PATENTS

FIGURE 26 TOP APPLICANTS OF PATENTS

5.13.6 LIST OF PATENTS BY DAICEL CORPORATION

5.13.7 LIST OF PATENTS BY CELANESE ACETATE LLC.

5.13.8 LIST OF PATENTS BY FUJIYAN LGCELLULOSE CHEMICAL CO LTD

5.13.9 LIST OF PATENTS BY DOW GLOBAL TECHNOLOGIES LLC

5.13.10 TOP TEN PATENT OWNERS (US) DURING THE LAST 10 YEARS

5.14 CELLULOSE ACETATE MARKET: YC AND YCC SHIFT

5.15 TARIFFS AND REGULATIONS

TABLE 5 CURRENT STANDARD CODES FOR CELLULOSE ACETATES

6 CELLULOSE ACETATE MARKET, BY TYPE (Page No. - 70)

6.1 INTRODUCTION

FIGURE 27 FIBER TO BE THE DOMINATING TYPE OF CELLULOSE ACETATE

TABLE 6 CELLULOSE ACETATE MARKET SIZE, BY TYPE, 2017–2020 (KILOTON)

TABLE 7 CELLULOSE ACETATE MARKET SIZE, BY TYPE, 2017–2020 (USD MILLION)

TABLE 8 CELLULOSE ACETATE MARKET SIZE, BY TYPE, 2021–2026 (KILOTON)

TABLE 9 CELLULOSE ACETATE MARKET SIZE, BY TYPE, 2021–2026 (USD MILLION)

6.2 FIBER

FIGURE 28 APAC TO BE THE DOMINATING REGION IN THE CELLULOSE ACETATE MARKET

6.2.1 CELLULOSE ACETATE FIBER MARKET BY REGION

TABLE 10 CELLULOSE ACETATE FIBER MARKET SIZE, BY REGION, 2017–2020 (KILOTON)

TABLE 11 CELLULOSE ACETATE FIBER MARKET SIZE, BY REGION, 2017–2020 (USD MILLION)

TABLE 12 CELLULOSE ACETATE FIBER MARKET SIZE, BY REGION, 2021–2026 (KILOTON)

TABLE 13 CELLULOSE ACETATE FIBER MARKET SIZE, BY REGION, 2021–2026 (USD MILLION)

6.3 PLASTIC

6.3.1 PLASTIC CELLULOSE ACETATE MARKET SIZE BY REGION

TABLE 14 PLASTIC CELLULOSE ACETATE MARKET SIZE, BY REGION, 2017–2020 (KILOTON)

TABLE 15 PLASTIC CELLULOSE ACETATE MARKET SIZE, BY REGION, 2017–2020 (USD MILLION)

TABLE 16 PLASTIC CELLULOSE ACETATE MARKET SIZE, BY REGION, 2021–2026 (KILOTON)

TABLE 17 PLASTIC CELLULOSE ACETATE MARKET SIZE, BY REGION, 2021–2026 (USD MILLION)

7 CELLULOSE ACETATE MARKET, BY APPLICATION (Page No. - 76)

7.1 INTRODUCTION

FIGURE 29 CIGARETTE FILTERS SEGMENT PROJECTED TO ACCOUNT FOR THE LARGEST SHARE OF THE GLOBAL CELLULOSE ACETATE MARKET

TABLE 18 CELLULOSE ACETATE MARKET SIZE, BY APPLICATION, 2017–2020 (KILOTON)

TABLE 19 CELLULOSE ACETATE MARKET SIZE, BY APPLICATION, 2017–2020 (USD MILLION)

TABLE 20 CELLULOSE ACETATE MARKET SIZE, BY APPLICATION, 2021–2026 (KILOTON)

TABLE 21 CELLULOSE ACETATE MARKET SIZE, BY APPLICATION,2021–2026 (USD MILLION)

7.2 CIGARETTE FILTERS

FIGURE 30 APAC TO DOMINATE THE CELLULOSE ACETATE MARKET IN THE CIGARETTE FILTERS APPLICATION

7.2.1 CELLULOSE ACETATE MARKET SIZE IN THE CIGARETTE FILTERS APPLICATION, BY REGION

TABLE 22 CELLULOSE ACETATE MARKET SIZE IN THE CIGARETTE FILTERS APPLICATION, BY REGION, 2017–2020 (KILOTON)

TABLE 23 CELLULOSE ACETATE MARKET SIZE IN THE CIGARETTE FILTERS APPLICATION, BY REGION, 2017–2020 (USD MILLION)

TABLE 24 CELLULOSE ACETATE MARKET SIZE IN THE CIGARETTE FILTERS APPLICATION, BY REGION, 2021–2026 (KILOTON)

TABLE 25 CELLULOSE ACETATE MARKET SIZE IN THE CIGARETTE FILTERS APPLICATION, BY REGION, 2021–2026 (USD MILLION)

7.3 TEXTILES & APPAREL

7.3.1 CELLULOSE ACETATE MARKET SIZE IN TEXTILES & APPAREL APPLICATION, BY REGION

TABLE 26 CELLULOSE ACETATE MARKET SIZE IN TEXTILES & APPAREL APPLICATION, BY REGION, 2017–2020 (KILOTON)

TABLE 27 CELLULOSE ACETATE MARKET SIZE IN TEXTILES & APPAREL APPLICATION, BY REGION, 2017–2020 (USD MILLION)

TABLE 28 CELLULOSE ACETATE MARKET SIZE IN TEXTILES & APPAREL APPLICATION, BY REGION, 2021–2026 (KILOTON)

TABLE 29 CELLULOSE ACETATE MARKET SIZE IN TEXTILES & APPAREL APPLICATION, BY REGION, 2021–2026 (USD MILLION)

7.4 LCD & PHOTOGRAPHIC FILMS

7.4.1 CELLULOSE ACETATE MARKET SIZE IN LCD & PHOTOGRAPHIC FILMS APPLICATION, BY REGION

TABLE 30 CELLULOSE ACETATE MARKET SIZE IN LCD & PHOTOGRAPHIC FILMS APPLICATION, BY REGION, 2017–2020 (KILOTON)

TABLE 31 CELLULOSE ACETATE MARKET SIZE IN LCD & PHOTOGRAPHIC FILMS APPLICATION, BY REGION, 2017–2020 (USD MILLION)

TABLE 32 CELLULOSE ACETATE MARKET SIZE IN LCD & PHOTOGRAPHIC FILMS APPLICATION, BY REGION, 2021–2026 (KILOTON)

TABLE 33 CELLULOSE ACETATE MARKET SIZE IN LCD & PHOTOGRAPHIC FILMS APPLICATION, BY REGION, 2021–2026 (USD MILLION)

7.5 TAPES & LABELS

7.5.1 CELLULOSE ACETATE MARKET SIZE IN TAPES & LABELS APPLICATION, BY REGION

TABLE 34 CELLULOSE ACETATE MARKET SIZE IN TAPES & LABELS APPLICATION, BY REGION, 2017–2020 (KILOTON)

TABLE 35 CELLULOSE ACETATE MARKET SIZE IN TAPES & LABELS APPLICATION, BY REGION, 2017–2020 (USD MILLION)

TABLE 36 CELLULOSE ACETATE MARKET SIZE IN TAPES & LABELS APPLICATION, BY REGION, 2021–2026 (KILOTON)

TABLE 37 CELLULOSE ACETATE MARKET SIZE IN TAPES & LABELS APPLICATION, BY REGION, 2021–2026 (USD MILLION)

7.6 OTHERS

7.6.1 CELLULOSE ACETATE MARKET SIZE IN OTHER APPLICATIONS, BY REGION

TABLE 38 CELLULOSE ACETATE MARKET SIZE IN OTHER APPLICATIONS, BY REGION, 2017–2020 (KILOTON)

TABLE 39 CELLULOSE ACETATE MARKET SIZE IN OTHER APPLICATIONS, BY REGION, 2017–2020 (USD MILLION)

TABLE 40 CELLULOSE ACETATE MARKET SIZE IN OTHER APPLICATIONS, BY REGION, 2021–2026 (KILOTON)

TABLE 41 CELLULOSE ACETATE MARKET SIZE IN OTHER APPLICATIONS, BY REGION, 2021–2026 (USD MILLION)

8 CELLULOSE ACETATE MARKET, BY REGION (Page No. - 89)

8.1 INTRODUCTION

FIGURE 31 CAGRS FOR THE KEY COUNTRIES FROM 2021 TO 2026

8.1.1 CELLULOSE ACETATE MARKET SIZE BY REGION

TABLE 42 CELLULOSE ACETATE MARKET SIZE, BY REGION, 2017–2020 (KILOTON)

TABLE 43 CELLULOSE ACETATE MARKET SIZE, BY REGION, 2017–2020 (USD MILLION)

TABLE 44 CELLULOSE ACETATE MARKET SIZE, BY REGION, 2021–2026 (KILOTON)

TABLE 45 CELLULOSE ACETATE MARKET SIZE, BY REGION, 2021–2026 (USD MILLION)

8.2 NORTH AMERICA

FIGURE 32 NORTH AMERICA: CELLULOSE ACETATE MARKET SNAPSHOT

8.2.1 CELLULOSE ACETATE MARKET SIZE IN NORTH AMERICA, BY TYPE

TABLE 46 NORTH AMERICA: CELLULOSE ACETATE MARKET SIZE, BY TYPE, 2017–2020 (KILOTON)

TABLE 47 NORTH AMERICA: CELLULOSE ACETATE MARKET SIZE, BY TYPE, 2017–2020 (USD MILLION)

TABLE 48 NORTH AMERICA: CELLULOSE ACETATE MARKET SIZE, BY TYPE, 2021–2026 (KILOTON)

TABLE 49 NORTH AMERICA: CELLULOSE ACETATE MARKET SIZE, BY TYPE, 2021–2026 (USD MILLION)

8.2.2 CELLULOSE ACETATE MARKET SIZE IN NORTH AMERICA, BY APPLICATION

TABLE 50 NORTH AMERICA: CELLULOSE ACETATE MARKET SIZE, BY APPLICATION, 2017–2020 (KILOTON)

TABLE 51 NORTH AMERICA: CELLULOSE ACETATE MARKET SIZE, BY APPLICATION, 2017–2020 (USD MILLION)

TABLE 52 NORTH AMERICA: CELLULOSE ACETATE MARKET SIZE, BY APPLICATION, 2021–2026 (KILOTON)

TABLE 53 NORTH AMERICA: CELLULOSE ACETATE MARKET SIZE, BY APPLICATION, 2021–2026 (USD MILLION)

8.2.3 CELLULOSE ACETATE MARKET SIZE IN NORTH AMERICA, BY COUNTRY

TABLE 54 NORTH AMERICA: CELLULOSE ACETATE MARKET SIZE, BY COUNTRY, 2017–2020 (KILOTON)

TABLE 55 NORTH AMERICA: CELLULOSE ACETATE MARKET SIZE, BY COUNTRY, 2017–2020 (USD MILLION)

TABLE 56 NORTH AMERICA: CELLULOSE ACETATE MARKET SIZE, BY COUNTRY, 2021–2026 (KILOTON)

TABLE 57 NORTH AMERICA: CELLULOSE ACETATE MARKET SIZE, BY COUNTRY, 2021–2026 (USD MILLION)

8.2.3.1 US

8.2.3.1.1 Cellulose acetate market size in the US, by application

TABLE 58 US: CELLULOSE ACETATE MARKET SIZE, BY APPLICATION, 2017–2020 (KILOTON)

TABLE 59 US: CELLULOSE ACETATE MARKET SIZE, BY APPLICATION, 2017–2020 (USD MILLION)

TABLE 60 US: CELLULOSE ACETATE MARKET SIZE, BY APPLICATION, 2021–2026 (KILOTON)

TABLE 61 US: CELLULOSE ACETATE MARKET SIZE, BY APPLICATION, 2021–2026 (USD MILLION)

8.2.3.2 Canada

8.2.3.2.1 Cellulose acetate market size in Canada, by application

TABLE 62 CANADA: CELLULOSE ACETATE MARKET SIZE, BY APPLICATION, 2017–2020 (KILOTON)

TABLE 63 CANADA: CELLULOSE ACETATE MARKET SIZE, BY APPLICATION, 2017–2020 (USD MILLION)

TABLE 64 CANADA: CELLULOSE ACETATE MARKET SIZE, BY APPLICATION, 2021–2026 (KILOTON)

TABLE 65 CANADA: CELLULOSE ACETATE MARKET SIZE, BY APPLICATION, 2021–2026 (USD MILLION)

8.3 EUROPE

TABLE 66 GLOBAL APPAREL MARKET SIZE OF TOP FIVE COUNTRIES, USD TRILLION, 2018-25

FIGURE 33 EUROPE: CELLULOSE ACETATE MARKET SNAPSHOT

8.3.1 CELLULOSE ACETATE MARKET SIZE IN EUROPE, BY TYPE

TABLE 67 EUROPE: CELLULOSE ACETATE MARKET SIZE, BY TYPE, 2017–2020 (KILOTON)

TABLE 68 EUROPE: CELLULOSE ACETATE MARKET SIZE, BY TYPE, 2017–2020 (USD MILLION)

TABLE 69 EUROPE: CELLULOSE ACETATE MARKET SIZE, BY TYPE, 2021–2026 (KILOTON)

TABLE 70 EUROPE: CELLULOSE ACETATE MARKET SIZE, BY TYPE, 2021–2026 (USD MILLION)

8.3.2 CELLULOSE ACETATE MARKET SIZE IN EUROPE, BY APPLICATION

TABLE 71 EUROPE: CELLULOSE ACETATE MARKET SIZE, BY APPLICATION, 2017–2020 (KILOTON)

TABLE 72 EUROPE: CELLULOSE ACETATE MARKET SIZE, BY APPLICATION, 2017–2020 (USD MILLION)

TABLE 73 EUROPE: CELLULOSE ACETATE MARKET SIZE, BY APPLICATION, 2021–2026 (KILOTON)

TABLE 74 EUROPE: CELLULOSE ACETATE MARKET SIZE, BY APPLICATION, 2021–2026 (USD MILLION)

8.3.3 CELLULOSE ACETATE MARKET SIZE IN EUROPE, BY COUNTRY

TABLE 75 EUROPE: CELLULOSE ACETATE MARKET SIZE, BY COUNTRY, 2017–2020 (KILOTON)

TABLE 76 EUROPE: CELLULOSE ACETATE MARKET SIZE, BY COUNTRY, 2017–2020 (USD MILLION)

TABLE 77 EUROPE: CELLULOSE ACETATE MARKET SIZE, BY COUNTRY, 2021–2026 (KILOTON)

TABLE 78 EUROPE: CELLULOSE ACETATE MARKET SIZE, BY COUNTRY, 2021–2026 (USD MILLION)

8.3.3.1 Germany

8.3.3.1.1 Cellulose acetate market size in Germany, by application

TABLE 79 GERMANY: CELLULOSE ACETATE MARKET SIZE, BY APPLICATION, 2017–2020 (KILOTON)

TABLE 80 GERMANY: CELLULOSE ACETATE AS MARKET SIZE, BY APPLICATION, 2017–2020 (USD MILLION)

TABLE 81 GERMANY: CELLULOSE ACETATE MARKET SIZE, BY APPLICATION, 2021–2026 (KILOTON)

TABLE 82 GERMANY: CELLULOSE ACETATE MARKET SIZE, BY APPLICATION, 2021–2026 (USD MILLION)

8.3.3.2 Russia

8.3.3.2.1 Cellulose acetate market size in Russia, by application

TABLE 83 RUSSIA: CELLULOSE ACETATE MARKET SIZE, BY APPLICATION, 2017–2020 (KILOTON)

TABLE 84 RUSSIA: CELLULOSE ACETATE MARKET SIZE, BY APPLICATION, 2017–2020 (USD MILLION)

TABLE 85 RUSSIA: CELLULOSE ACETATE MARKET SIZE, BY APPLICATION, 2021–2026 (KILOTON)

TABLE 86 RUSSIA: CELLULOSE ACETATE MARKET SIZE, BY APPLICATION, 2021–2026 (USD MILLION)

8.3.3.3 UK

8.3.3.3.1 Cellulose acetate market size in the UK, by application

TABLE 87 UK: CELLULOSE ACETATE MARKET SIZE, BY APPLICATION, 2017–2020 (KILOTON)

TABLE 88 UK: CELLULOSE ACETATE MARKET SIZE, BY APPLICATION, 2017–2020 (USD MILLION)

TABLE 89 UK: CELLULOSE ACETATE MARKET SIZE, BY APPLICATION, 2021–2026 (KILOTON)

TABLE 90 UK: CELLULOSE ACETATE MARKET SIZE, BY APPLICATION, 2021–2026 (USD MILLION)

8.3.3.4 France

8.3.3.4.1 Cellulose acetate market size in France, by application

TABLE 91 FRANCE: CELLULOSE ACETATE MARKET SIZE, BY APPLICATION, 2017–2020 (KILOTON)

TABLE 92 FRANCE: CELLULOSE ACETATE MARKET SIZE, BY APPLICATION, 2017–2020 (USD MILLION)

TABLE 93 FRANCE: CELLULOSE ACETATE MARKET SIZE, BY APPLICATION, 2021–2026 (KILOTON)

TABLE 94 FRANCE: CELLULOSE ACETATE MARKET SIZE, BY APPLICATION, 2021–2026 (USD MILLION)

8.3.3.5 Turkey

8.3.3.5.1 Cellulose acetate market size in Turkey, by application

TABLE 95 TURKEY: CELLULOSE ACETATE MARKET SIZE, BY APPLICATION, 2017–2020 (KILOTON)

TABLE 96 TURKEY: CELLULOSE ACETATE MARKET SIZE, BY APPLICATION, 2017–2020 (USD MILLION)

TABLE 97 TURKEY: CELLULOSE ACETATE MARKET SIZE, BY APPLICATION, 2021–2026 (KILOTON)

TABLE 98 TURKEY: CELLULOSE ACETATE MARKET SIZE, BY APPLICATION, 2021–2026 (USD MILLION)

8.3.3.6 Rest of Europe

TABLE 99 REST OF EUROPE: CELLULOSE ACETATE MARKET SIZE, BY APPLICATION, 2017–2020 (KILOTON)

TABLE 100 REST OF EUROPE: CELLULOSE ACETATE MARKET SIZE, BY APPLICATION, 2017–2020 (USD MILLION)

TABLE 101 REST OF EUROPE: CELLULOSE ACETATE MARKET SIZE, BY APPLICATION, 2021–2026 (KILOTON)

TABLE 102 REST OF EUROPE: CELLULOSE ACETATE MARKET SIZE, BY APPLICATION, 2021–2026 (USD MILLION)

8.4 APAC

FIGURE 34 APAC: CELLULOSE ACETATE MARKET SNAPSHOT

8.4.1 CELLULOSE ACETATE MARKET SIZE IN THE APAC, BY TYPE

TABLE 103 APAC: CELLULOSE ACETATE MARKET SIZE, BY TYPE, 2017–2020 (KILOTON)

TABLE 104 APAC: CELLULOSE ACETATE MARKET SIZE, BY TYPE, 2017–2020 (USD MILLION)

TABLE 105 APAC: CELLULOSE ACETATE MARKET SIZE, BY TYPE, 2021–2026 (KILOTON)

TABLE 106 APAC: CELLULOSE ACETATE MARKET SIZE, BY TYPE, 2021–2026 (USD MILLION)

8.4.2 CELLULOSE ACETATE MARKET SIZE IN THE APAC, BY APPLICATION

TABLE 107 APAC: CELLULOSE ACETATE MARKET SIZE, BY APPLICATION, 2017–2020 (KILOTON)

TABLE 108 APAC: CELLULOSE ACETATE MARKET SIZE, BY APPLICATION, 2017–2020 (USD MILLION)

TABLE 109 APAC: CELLULOSE ACETATE MARKET SIZE, BY APPLICATION, 2021–2026 (KILOTON)

TABLE 110 APAC: CELLULOSE ACETATE MARKET SIZE, BY APPLICATION, 2021–2026 (USD MILLION)

8.4.3 CELLULOSE ACETATE MARKET SIZE IN THE APAC, BY COUNTRY

TABLE 111 APAC: CELLULOSE ACETATE MARKET SIZE, BY COUNTRY, 2017–2020 (KILOTON)

TABLE 112 APAC: CELLULOSE ACETATE MARKET SIZE, BY COUNTRY, 2017–2020 (USD MILLION)

TABLE 113 APAC: CELLULOSE ACETATE MARKET SIZE, BY COUNTRY, 2021–2026 (KILOTON)

TABLE 114 APAC: CELLULOSE ACETATE MARKET SIZE, BY COUNTRY, 2021–2026 (USD MILLION)

8.4.3.1 China

8.4.3.1.1 Cellulose acetate market size in China, by application

TABLE 115 CHINA: CELLULOSE ACETATE MARKET SIZE, BY APPLICATION, 2017–2020 (KILOTON)

TABLE 116 CHINA: CELLULOSE ACETATE MARKET SIZE, BY APPLICATION, 2017–2020 (USD MILLION)

TABLE 117 CHINA: CELLULOSE ACETATE MARKET SIZE, BY APPLICATION, 2021–2026 (KILOTON)

TABLE 118 CHINA: CELLULOSE ACETATE MARKET SIZE, BY APPLICATION, 2021–2026 (USD MILLION)

8.4.3.2 Japan

8.4.3.2.1 Cellulose acetate market size in Japan, by application

TABLE 119 JAPAN: CELLULOSE ACETATE MARKET SIZE, BY APPLICATION, 2017–2020 (KILOTON)

TABLE 120 JAPAN: CELLULOSE ACETATE MARKET SIZE, BY APPLICATION, 2017–2020 (USD MILLION)

TABLE 121 JAPAN: CELLULOSE ACETATE MARKET SIZE, BY APPLICATION, 2021–2026 (KILOTON)

TABLE 122 JAPAN: CELLULOSE ACETATE MARKET SIZE, BY APPLICATION, 2021–2026 (USD MILLION)

8.4.3.3 India

8.4.3.3.1 Cellulose acetate market size in India, by application

TABLE 123 INDIA: CELLULOSE ACETATE MARKET SIZE, BY APPLICATION, 2017–2020 (KILOTON)

TABLE 124 INDIA: CELLULOSE ACETATE MARKET SIZE, BY APPLICATION, 2017–2020 (USD MILLION)

TABLE 125 INDIA: CELLULOSE ACETATE MARKET SIZE, BY APPLICATION, 2021–2026 (KILOTON)

TABLE 126 INDIA: CELLULOSE ACETATE MARKET SIZE, BY APPLICATION, 2021–2026 (USD MILLION)

8.4.3.4 Indonesia

8.4.3.4.1 Cellulose acetate market size in Indonesia, by application

TABLE 127 INDONESIA: CELLULOSE ACETATE MARKET SIZE, BY APPLICATION, 2017–2020 (KILOTON)

TABLE 128 INDONESIA: CELLULOSE ACETATE MARKET SIZE, BY APPLICATION, 2017–2020 (USD MILLION)

TABLE 129 INDONESIA: CELLULOSE ACETATE MARKET SIZE, BY APPLICATION, 2021–2026 (KILOTON)

TABLE 130 INDONESIA: CELLULOSE ACETATE MARKET SIZE, BY APPLICATION, 2021–2026 (USD MILLION)

8.4.3.5 Rest of APAC

TABLE 131 REST OF APAC: CELLULOSE ACETATE MARKET SIZE, BY APPLICATION, 2017–2020 (KILOTON)

TABLE 132 REST OF APAC: CELLULOSE ACETATE MARKET SIZE, BY APPLICATION, 2017–2020 (USD MILLION)

TABLE 133 REST OF APAC: CELLULOSE ACETATE MARKET SIZE, BY APPLICATION, 2021–2026 (KILOTON)

TABLE 134 REST OF APAC: CELLULOSE ACETATE MARKET SIZE, BY APPLICATION, 2021–2026 (USD MILLION)

8.5 MEA

8.5.1 CELLULOSE ACETATE MARKET SIZE IN MEA, BY TYPE

TABLE 135 MEA: CELLULOSE ACETATE MARKET SIZE, BY TYPE, 2017–2020 (KILOTON)

TABLE 136 MEA: CELLULOSE ACETATE MARKET SIZE, BY TYPE,2017–2020 (USD MILLION)

TABLE 137 MEA: CELLULOSE ACETATE MARKET SIZE, BY TYPE, 2021–2026 (KILOTON)

TABLE 138 MEA: CELLULOSE ACETATE MARKET SIZE, BY TYPE, 2021–2026 (USD MILLION)

8.5.2 CELLULOSE ACETATE MARKET SIZE IN MEA, BY APPLICATION

TABLE 139 MEA: CELLULOSE ACETATE MARKET SIZE, BY APPLICATION, 2017–2020 (KILOTON)

TABLE 140 MEA: CELLULOSE ACETATE MARKET SIZE, BY APPLICATION, 2017–2020 (USD MILLION)

TABLE 141 MEA: CELLULOSE ACETATE MARKET SIZE, BY APPLICATION, 2021–2026 (KILOTON)

TABLE 142 MEA: CELLULOSE ACETATE MARKET SIZE, BY APPLICATION,2021–2026 (USD MILLION)

8.5.3 CELLULOSE ACETATE MARKET SIZE IN MEA, BY COUNTRY

TABLE 143 MEA: CELLULOSE ACETATE MARKET SIZE, BY COUNTRY, 2017–2020 (KILOTON)

TABLE 144 MEA: CELLULOSE ACETATE MARKET SIZE, BY COUNTRY, 2017–2020 (USD MILLION)

TABLE 145 MEA: CELLULOSE ACETATE MARKET SIZE, BY COUNTRY, 2021–2026 (KILOTON)

TABLE 146 MEA: CELLULOSE ACETATE MARKET SIZE, BY COUNTRY, 2021–2026 (USD MILLION)

8.5.3.1 Saudi Arabia

8.5.3.1.1 Cellulose acetate market size in Saudi Arabia,by application

TABLE 147 SAUDI ARABIA: CELLULOSE ACETATE MARKET SIZE, BY APPLICATION, 2017–2020 (KILOTON)

TABLE 148 SAUDI ARABIA: CELLULOSE ACETATE AS MARKET SIZE, BY APPLICATION, 2017–2020 (USD MILLION)

TABLE 149 SAUDI ARABIA: CELLULOSE ACETATE MARKET SIZE, BY APPLICATION, 2021–2026 (KILOTON)

TABLE 150 SAUDI ARABIA: CELLULOSE ACETATE MARKET SIZE, BY APPLICATION, 2021–2026 (USD MILLION)

8.5.3.2 UAE

8.5.3.2.1 Cellulose acetate market size in the UAE, by application

TABLE 151 UAE: CELLULOSE ACETATE MARKET SIZE, BY APPLICATION, 2017–2020 (KILOTON)

TABLE 152 UAE: CELLULOSE ACETATE MARKET SIZE, BY APPLICATION, 2017–2020 (USD MILLION)

TABLE 153 UAE: CELLULOSE ACETATE MARKET SIZE, BY APPLICATION, 2021–2026 (KILOTON)

TABLE 154 UAE: CELLULOSE ACETATE MARKET SIZE, BY APPLICATION, 2021–2026 (USD MILLION)

8.5.3.3 South Africa

8.5.3.3.1 Cellulose acetate market size in South Africa, by application

TABLE 155 SOUTH AFRICA: CELLULOSE ACETATE MARKET SIZE, BY APPLICATION, 2017–2020 (KILOTON)

TABLE 156 SOUTH AFRICA: CELLULOSE ACETATE MARKET SIZE, BY APPLICATION, 2017–2020 (USD MILLION)

TABLE 157 SOUTH AFRICA: CELLULOSE ACETATE MARKET SIZE, BY APPLICATION, 2021–2026 (KILOTON)

TABLE 158 SOUTH AFRICA: CELLULOSE ACETATE MARKET SIZE, BY APPLICATION, 2021–2026 (USD MILLION)

8.5.3.4 Rest of MEA

TABLE 159 REST OF MEA: CELLULOSE ACETATE MARKET SIZE, BY APPLICATION, 2017–2020 (KILOTON)

TABLE 160 REST OF MEA: CELLULOSE ACETATE MARKET SIZE, BY APPLICATION, 2017–2020 (USD MILLION)

TABLE 161 REST OF MEA: CELLULOSE ACETATE MARKET SIZE, BY APPLICATION, 2021–2026 (KILOTON)

TABLE 162 REST OF MEA: CELLULOSE ACETATE MARKET SIZE, BY APPLICATION, 2021–2026 (USD MILLION)

8.6 LATIN AMERICA

8.6.1 CELLULOSE ACETATE MARKET SIZE IN LATIN AMERICA, BY TYPE

TABLE 163 LATIN AMERICA: CELLULOSE ACETATE MARKET SIZE, BY TYPE, 2017–2020 (KILOTON)

TABLE 164 LATIN AMERICA: CELLULOSE ACETATE MARKET SIZE, BY TYPE, 2017–2020 (USD MILLION)

TABLE 165 LATIN AMERICA: CELLULOSE ACETATE MARKET SIZE, BY TYPE, 2021–2026 (KILOTON)

TABLE 166 LATIN AMERICA: CELLULOSE ACETATE MARKET SIZE, BY TYPE, 2021–2026 (USD MILLION)

8.6.2 CELLULOSE ACETATE MARKET SIZE IN LATIN AMERICA, BY APPLICATION

TABLE 167 LATIN AMERICA: CELLULOSE ACETATE MARKET SIZE, BY APPLICATION, 2017–2020 (KILOTON)

TABLE 168 LATIN AMERICA: CELLULOSE ACETATE MARKET SIZE, BY APPLICATION, 2017–2020 (USD MILLION)

TABLE 169 LATIN AMERICA: CELLULOSE ACETATE MARKET SIZE, BY APPLICATION, 2021–2026 (KILOTON)

TABLE 170 LATIN AMERICA: CELLULOSE ACETATE MARKET SIZE, BY APPLICATION, 2021–2026 (USD MILLION)

8.6.3 CELLULOSE ACETATE MARKET SIZE IN LATIN AMERICA, BY COUNTRY

TABLE 171 LATIN AMERICA: CELLULOSE ACETATE MARKET SIZE, BY COUNTRY, 2017–2020 (KILOTON)

TABLE 172 LATIN AMERICA: CELLULOSE ACETATE MARKET SIZE, BY COUNTRY, 2017–2020 (USD MILLION)

TABLE 173 LATIN AMERICA: CELLULOSE ACETATE MARKET SIZE, BY COUNTRY, 2021–2026 (KILOTON)

TABLE 174 LATIN AMERICA: CELLULOSE ACETATE MARKET SIZE, BY COUNTRY, 2021–2026 (USD MILLION)

8.6.3.1 Brazil

8.6.3.1.1 Cellulose acetate market size in Brazil, by application

TABLE 175 BRAZIL: CELLULOSE ACETATE MARKET SIZE, BY APPLICATION, 2017–2020 (KILOTON)

TABLE 176 BRAZIL: CELLULOSE ACETATE AS MARKET SIZE, BY APPLICATION, 2017–2020 (USD MILLION)

TABLE 177 BRAZIL: CELLULOSE ACETATE MARKET SIZE, BY APPLICATION, 2021–2026 (KILOTON)

TABLE 178 BRAZIL: CELLULOSE ACETATE MARKET SIZE, BY APPLICATION, 2021–2026 (USD MILLION)

8.6.3.2 Mexico

8.6.3.2.1 Cellulose acetate market size in Mexico, by application

TABLE 179 MEXICO: CELLULOSE ACETATE MARKET SIZE, BY APPLICATION, 2017–2020 (KILOTON)

TABLE 180 MEXICO: CELLULOSE ACETATE MARKET SIZE, BY APPLICATION, 2017–2020 (USD MILLION)

TABLE 181 MEXICO: CELLULOSE ACETATE MARKET SIZE, BY APPLICATION, 2021–2026 (KILOTON)

TABLE 182 MEXICO: CELLULOSE ACETATE MARKET SIZE, BY APPLICATION, 2021–2026 (USD MILLION)

8.6.3.3 Rest of Latin America

TABLE 183 REST OF LATIN AMERICA: CELLULOSE ACETATE MARKET SIZE, BY APPLICATION, 2017–2020 (KILOTON)

TABLE 184 REST OF LATIN AMERICA: CELLULOSE ACETATE MARKET SIZE, BY APPLICATION, 2017–2020 (USD MILLION)

TABLE 185 REST OF LATIN AMERICA: CELLULOSE ACETATE MARKET SIZE, BY APPLICATION, 2021–2026 (KILOTON)

TABLE 186 REST OF LATIN AMERICA: CELLULOSE ACETATE MARKET SIZE, BY APPLICATION, 2021–2026 (USD MILLION)

9 COMPETITIVE LANDSCAPE (Page No. - 154)

9.1 INTRODUCTION

9.2 MARKET SHARE ANALYSIS

FIGURE 35 MARKET SHARE OF TOP COMPANIES IN THE CELLULOSE ACETATE MARKET

TABLE 187 CELLULOSE ACETATE MARKET: DEGREE OF COMPETITION

9.3 MARKET RANKING

FIGURE 36 RANKING OF TOP FIVE PLAYERS IN THE CELLULOSE ACETATE MARKET

9.4 MARKET EVALUATION FRAMEWORK

TABLE 188 CELLULOSE ACETATE MARKET: NEW PRODUCT LAUNCHES/DEVELOPMENTS, 2015-2020

TABLE 189 CELLULOSE ACETATE MARKET: DEALS, 2015-2020

TABLE 190 CELLULOSE ACETATE MARKET: OTHER DEVELOPMENTS, 2015-2020

9.5 REVENUE ANALYSIS OF TOP MARKET PLAYERS

TABLE 191 REVENUE ANALYSIS OF TOP MARKET PLAYERS, 2020 (USD BILLION)

9.6 COMPANY EVALUATION MATRIX

TABLE 192 COMPANY PRODUCT FOOTPRINT

TABLE 193 COMPANY APPLICATION FOOTPRINT

TABLE 194 COMPANY REGION FOOTPRINT

9.6.1 STAR

9.6.2 PERVASIVE

9.6.3 PARTICIPANTS

9.6.4 EMERGING LEADERS

FIGURE 37 CELLULOSE ACETATE MARKET (GLOBAL) COMPETITIVE LEADERSHIP MAPPING, 2020

FIGURE 38 STRENGTH OF PRODUCT PORTFOLIO

FIGURE 39 BUSINESS STRATEGY EXCELLENCE

9.7 SMALL AND MEDIUM-SIZED ENTERPRISES (SME) EVALUATION MATRIX

9.7.1 PROGRESSIVE COMPANIES

9.7.2 RESPONSIVE COMPANIES

9.7.3 DYNAMIC COMPANIES

9.7.4 STARTING BLOCKS

FIGURE 40 CELLULOSE ACETATE MARKET: SMALL AND MEDIUM-SIZED ENTERPRISES MAPPING, 2020

10 COMPANY PROFILES (Page No. - 167)

10.1 CIGARETTE FILTERS

(Business Overview, Products Offered, New product development, Deals, MnM View, Right to win, Strategic choices made, Weaknesses and competitive threats)* APAC TO DOMINATE THE CELLULOSE ACETATE MARKET IN THE CIGARETTE FILTERS APPLICATION

10.1.1 EASTMAN CHEMICAL COMPANY

TABLE 195 EASTMAN CHEMICAL COMPANY: BUSINESS OVERVIEW

FIGURE 41 EASTMAN CHEMICAL COMPANY: COMPANY SNAPSHOT

10.1.2 CELANESE CORPORATION

TABLE 196 CELANESE CORPORATION: BUSINESS OVERVIEW

FIGURE 42 CELANESE CORPORATION: COMPANY SNAPSHOT

10.1.3 CHINA NATIONAL TOBACCO CORPORATION

TABLE 197 CHINA NATIONAL TOBACCO CORPORATION: BUSINESS OVERVIEW

10.1.4 SICHUAN PUSH ACETATI CO., LTD.

TABLE 198 SICHUAN PUSH ACETATI CO., LTD.: BUSINESS OVERVIEW

10.1.5 CERDIA INTERNATIONAL GMBH

TABLE 199 CERDIA INTERNATIONAL GMBH: BUSINESS OVERVIEW

10.1.6 RAYONIER ADVANCED MATERIALS INC.

TABLE 200 RAYONIER ADVANCED MATERIALS INC.: BUSINESS OVERVIEW

FIGURE 43 RAYONIER ADVANCED MATERIALS INC.: COMPANY SNAPSHOT

10.1.7 SAPPI LTD.

TABLE 201 SAPPI LTD.: BUSINESS OVERVIEW

FIGURE 44 SAPPI LTD.: COMPANY SNAPSHOT

10.1.8 DAICEL CORPORATION

TABLE 202 DAICEL CORPORATION: BUSINESS OVERVIEW

FIGURE 45 DAICEL CORPORATION: COMPANY SNAPSHOT

10.1.9 MITSUBISHI CHEMICAL HOLDINGS

TABLE 203 MITSUBISHI CHEMICAL HOLDINGS: BUSINESS OVERVIEW

FIGURE 46 MITSUBISHI CHEMICAL HOLDINGS: COMPANY SNAPSHOT

10.1.10 ROTUBA EXTRUDERS INC.

TABLE 204 ROTUBA EXTRUDERS INC.: BUSINESS OVERVIEW

10.2 CELLULOSE ACETATE MARKET SIZE IN OTHER APPLICATIONS, BY REGION, 2017–2020 (USD MILLION)

10.2.1 CARBOMER, INC

10.2.2 BIOSYNTH CARBOSYNTH

10.2.3 SAE MANUFACTURING

10.2.4 CHEMOS

10.2.5 DONGGUAN HE-HONG PLASTIC CO LTD

10.2.6 TAYLOR SCIENTIFIC (SAMCO)

10.2.7 VASU CHEMICALS

10.2.8 MIL-SPEC INDUSTRIES CORP

10.2.9 JUNSEI

10.2.10 SIMAGCHEM

10.2.11 CHEMVALVE INDUSTRIES PVT LTD

10.2.12 DAYANG CHEM (HANGZHOU) CO. LTD

10.2.13 HAIHANG INDUSTRY CO.

10.2.14 MAZZUCCHELLI 1849 S.P.A

*Details on Business Overview, Products Offered, New product development, Deals, MnM View, Right to win, Strategic choices made, Weaknesses and competitive threats might not be captured in case of unlisted companies. NORTH AMERICA: CELLULOSE ACETATE MARKET SIZE, BY TYPE, 2017–2020 (USD MILLION)

11 APPENDIX (Page No. - 203)

11.1 NORTH AMERICA: CELLULOSE ACETATE MARKET SIZE, BY TYPE, 2021–2026 (USD MILLION)

11.2 CELLULOSE ACETATE MARKET SIZE IN NORTH AMERICA, BY APPLICATION

11.3 NORTH AMERICA: CELLULOSE ACETATE MARKET SIZE, BY APPLICATION, 2017–2020 (KILOTON)

11.4 NORTH AMERICA: CELLULOSE ACETATE MARKET SIZE, BY APPLICATION, 2017–2020 (USD MILLION)

11.5 NORTH AMERICA: CELLULOSE ACETATE MARKET SIZE, BY APPLICATION, 2021–2026 (KILOTON)

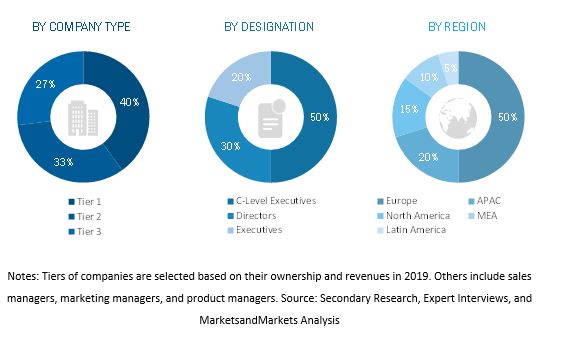

The study involves two major activities in estimating the current size of the Cellulose acetate market. Exhaustive secondary research was done to collect information on the market, the peer market, and the parent market. The next step was to validate these findings, assumptions, and sizing with industry experts across the value chain through primary research. Both the top-down and bottom-up approaches were employed to estimate the total market size. After that, market breakdown and data triangulation procedures were used to determine the extent of market segments and sub-segments.

Secondary Research

In the secondary research process, various secondary sources such as annual reports, press releases, and investor presentations of companies; certified publications; articles from recognized authors; gold & silver standard websites; and various databases were referred to for identifying and collecting information for this study.

Secondary research was mainly conducted to obtain key information about the supply chain of the industry, the total pool of players, market classification and segmentation according to industry trends to the bottom-most level, regional markets, and key developments from both market- and technology-oriented perspectives.

Primary Research

In the primary research process, various sources from both the supply and demand sides were interviewed to obtain qualitative and quantitative information for this report. The primary sources from the supply side included industry experts such as CEOs, VPs, marketing directors, technology & innovation directors, and related key executives from various leading companies and organizations operating in the cellulose acetate market. Primary sources from the demand side included procurement managers and experts from end-use industries.

Following is the breakdown of primary respondents:

To know about the assumptions considered for the study, download the pdf brochure

Market Size Estimation

Both the top-down and bottom-up approaches were used to estimate and validate the total Cellulose acetate market. These methods were also used extensively to determine the size of various sub-segments in the market. The research methodology used to estimate the market size included the following:

- The key players in the industry and markets were identified through extensive secondary research.

- The industry’s supply chain and market size, in terms of value, were determined through primary and secondary research processes.

- All percentage shares, splits, and breakdowns were determined using secondary sources and verified through primary sources.

Data Triangulation

After arriving at the overall Cellulose acetate market size using the market size estimation processes as explained above, the market was split into several segments and sub-segments. To complete the whole market engineering process and arrive at the exact statistics of each market segment and subsegment, the data triangulation, and market breakdown procedures were employed, wherever applicable. The data was triangulated by studying various factors and trends from both the demand and supply sides, mainly from the highways, bridges & buildings, marine structurers & waterfronts and other applications.

Report Objectives

- To analyze and forecast the global Cellulose acetate market size, in terms of volume and value

- To provide detailed information about the key factors (drivers, restraints, opportunities, and challenges) influencing the growth of the market

- To analyze the market segmentation and forecast the market size based on fiber type, resin type and application.

- To analyze and forecast the market size based on five main regions, namely, Asia Pacific (APAC), Europe, North America, Middle East & Africa (MEA), and South America

- To analyze the market with respect to individual growth trends, prospects, and contribution of submarkets to the total market

- To analyze the market opportunities and the competitive landscape for stakeholders and market leaders

- To analyze competitive developments such as expansions, partnership, agreement, new product/technology launch, joint venture, contract, and merger & acquisition in the market

- To profile key players and comprehensively analyze their market share and core competencies

Available Customizations

With the given market data, MarketsandMarkets offers customizations according to the company’s specific needs.

The following customization options are available for the report:

Product Analysis

- Product matrix, which gives a detailed comparison of the product portfolio of each company

Regional Analysis

- Further breakdown of Rest of APAC Cellulose acetate market

- Further breakdown of Rest of European Cellulose acetate market

- Further breakdown of Rest of North American Cellulose acetate market

- Further breakdown of Rest of MEA Cellulose acetate market

- Further breakdown of Rest of Latin American Cellulose acetate market

Company Information

- Detailed analysis and profiling of additional market players (up to 10)

Generating Response ...

Generating Response ...

Growth opportunities and latent adjacency in Cellulose Acetate Market