Sterile Filtration Market by Product (Cartridge, Capsule Filter), Application (API, Vaccine, Antibody, Media, Formulation & Fill Finish), Membrane (PES, PVDF, PTFE), Pore Size, End User (Pharma & Biotech, F&B, CMO) - Global Forecast to 2028

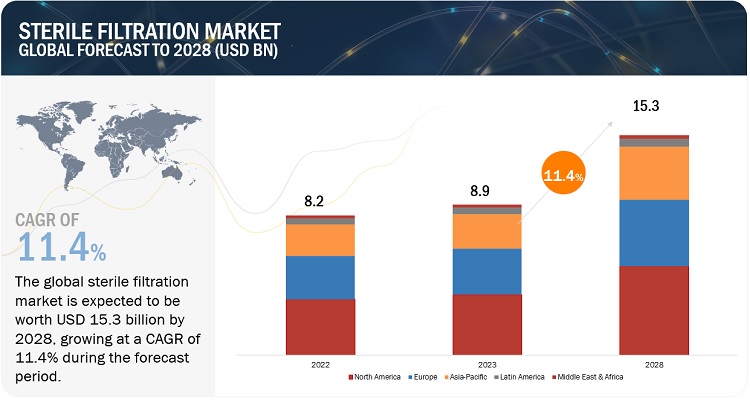

The global sterile filtration market, valued at US$8.2 billion in 2022, stood at US$8.9 billion in 2023 and is projected to advance at a resilient CAGR of 11.4% from 2023 to 2028, culminating in a forecasted valuation of US$15.3 billion by the end of the period. The new research study consists of an industry trend analysis of the market. The growth of this market is majorly driven by demand for sterile filtration in pharmaceutical companies and the food and beverage industries. In addition, increasing number of end users switching from Type II pure lab water to high-purity Type I pure lab water is also fuelling the demand for sterile filtration processes across all industry segments.

Sterile Filtration Market- Global Forecast to 2028

To know about the assumptions considered for the study, Request for Free Sample Report

Attractive Opportunities in the Sterile Filtration Market

Sterile Filtration Market Dynamics

DRIVER: Growing demand for sterile filtration in pharmaceutical industry

In the pharmaceutical industry, maintaining the utmost level of sterility during processing is of paramount importance. The risk of contamination is a significant concern, and effectively controlling microorganisms is a crucial objective. One of the primary causes of contamination is the use of water, steam, gases, and compressed air during the manufacturing process. These "utilities" can potentially transport oil, dirt, debris, and microorganisms into the final product unless they are suitably filtered. Therefore, the sterile filtration of these utilities is imperative to prevent any undesirable substances from compromising the quality and safety of the pharmaceutical product. Sterilizing-grade filters are widely used in many upstream and downstream steps in the manufacturing of biologics. These filters are also used widely in many intermediate steps to reduce cross-contamination risk from in-process liquids such as buffers. Such factors are driving the demand for sterile filters in the pharmaceutical industry.

RESTRAINT: Fouling of the filter membranes

The sterile filter membrane is a key component of the sterile filtration system, which is designed to trap and remove microorganisms and other impurities while allowing the desired product to pass through. However, one of the challenges of sterile filtration is the fouling of the filter membrane. The fouling of the filter membrane can have a significant impact on the efficiency of the sterile filtration process, increase the cost of operation, and lead to product contamination or loss. In some cases, it may even render the filtration system unusable and require the replacement of the filter membrane. Thus, negatively impacting the market growth.

OPPORTUNITY: Increased demand for sterile water in end-use industries

In the pharmaceutical industry, it is crucial that purified water meets the requirements for ionic and organic chemical purity and must be protected from microbial contamination. Sterile water for injection is used for extemporaneous preparation compounding and as a stenle diluent for parenteral products In addition Water for Injection is a crucial solvent used to produce pharmaceutical products, particularly those that need to maintain low endotoxin levels. It is a type of sterile, distilled water that is free from any additional substances and meets specific requirements for pyrogen and bacterial endotoxin levels Since water is a common source of microbial contamination, sterilizing is important to prevent contamination and eliminate endotoxins. This has driven the demand for sterile filtration devices, hence fuelling the market growth.

CHALLENGE: High price sensitivity among end users

Sterilizing-grade membrane filters are widely used for the intermediate and final filtration of liquid drug products. However, these filters have experienced rapid developments and improvements during the last decade, which have resulted in enhanced thermal and mechanical resistance. This increased efficiency has also impacted the cost of these filters, and there is a surge in the price of these products. Filters undergo extensive lot-release testing to ensure their performance as per standards. For sterilizing filters, manufacturers perform 100% integrity testing, along with appropriate validation tests, to ensure compliance with established standards. Some larger manufacturers perform additional lot-release testing to measure bacteria retention in every lot. Performing these tests in-house requires expensive equipment and specially trained scientists, which increases the cost of filters. Hence, the high price sensitivity for sterile filtration is likely to pose a challenge amongst the end users in the market.

The cartridge filter sub-segment of the product segment dominated sterile filtration market

Cartridge filters are intended for large-volume sterile filtration applications in the pharma, biopharma, and food & beverage industries. Cartridge filters are quality filters that are well-packaged and cost-efficient. They are specially designed and developed for bioburden reduction, sterilization of liquids, sterile APIs, fermentation, and vaccine manufacturing. Encapsulated 10-, 20-, and 30-in cartridges are available in single-use and reusable formats. Cartridges are sometimes fitted together to provide single-use filter trains for very large-volume applications.

To know about the assumptions considered for the study, download the pdf brochure

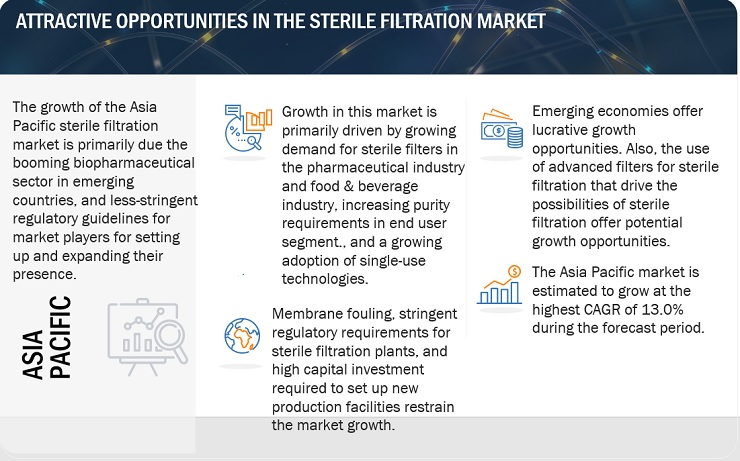

Asia Pacific region of sterile filtration market estimated to register the highest CAGR during the forecast period.

The Asia Pacific market is estimated to register the highest CAGR during the forecast period. Emerging Asian countries are a hub for pharmaceutical R&D and manufacturing. Many local players in the region have plans to secure approvals in the US in the coming years. This has prompted the pharmaceutical sector to adopt international standards of manufacturing that generate approval by the US FDA. This is expected to drive the demand for sterile filtration equipment to ensure the safety and efficacy of drugs.

Key players in the Sterile filtration market include Merck KGaA (Germany) | Danaher Corporation (US) | Sartorius AG (Germany) | Thermo Fisher Scientific Inc. (US) | 3M (US) | Parker Hannifin Corp. (US) | Porvair PLC (UK) | Alfa Laval (Sweden) | Donaldson Company, Inc. (US) | Corning Incorporated (US) | Eaton (US) | GVS S.p.A (Italy) | Sterlitech Corporation (US) | Meissner Filtration Products, Inc. (US) | Cole-Parmer Instrument, LLC. (US) | Nupore Filtration Systems Pvt. Ltd. (India) | STARLAB International GmbH (Germany) | Amazon Filters Ltd. (UK) | AMD Manufacturing Inc. (Canada) | Hangzhou Cobetter Filtration Equipment Co., Ltd. (China) | Simsii, Inc. (US) | CELLTREAT Scientific Products (US) | Wyvern Scientific Inc. (Canada) | Trinity Filtration Technologies Pvt. Ltd. (India) | Filtrox AG (Switzerland)

Sterile filtration Market Report Scope

|

Report Metric |

Details |

|

Market size available for years |

2021–2028 |

|

Base year considered |

2022 |

|

Forecast period |

2023–2028 |

|

Forecast units |

Value (USD) |

|

Segments Covered |

Product, Membrane Type, Pore Size, Application, End user and Region |

|

Geographies covered |

North America, Europe, Asia Pacific, Latin America (LATAM) and Middle East and Africa (MEA) |

|

Companies covered |

Merck KGaA (Germany), Danaher Corporation (US), Sartorius AG (Germany), Thermo Fisher Scientific Inc. (US), 3M (US), Parker Hannifin Crop. (US), Porvair PLC (UK), Alfa Laval (Sweden), Donaldson Company, Inc. (US), Corning Incorporated (US), Eaton (US), GVS S.p.A (Italy), Sterlitech Corporation (US), Meissner Filtration Products, Inc. (US), Cole-Parmer Instrument, LLC. (US), Nupore Filtration Systems Pvt. Ltd. (India), STARLAB International GmbH (Germany), Amazon Filters Ltd. (UK), AMD Manufacturing Inc. (Canada), Hangzhou Cobetter Filtration Equipment Co., Ltd. (China), Simsii, Inc. (US), CELLTREAT Scientific Products (US), Wyvern Scientific Inc. (Canada), Trinity Filtration Technologies Pvt. Ltd. (India), Filtrox AG (Switzerland) |

This report categorizes the sterile filtration market into the following segments and sub-segments:

By Product

- Cartridge Filters

- Capsule Filters

- Membranes

- Syringe Filters

- Bottle-top & Table-top Filtration Systems

- Accessories

By Membrane Type

- PES

- PVDF

- Nylon

- PTFE

- MCE & CA

- Other Membrane Types

By Pore Size

- 0.2–0.22 μm

- 0.45 μm

- 0.1 μm

By Application

- Final Product Processing

- Active Pharmaceutical Ingredient Filtration

- Protein Purification

- Vaccine and Antibody Processing

- Formulation and Filling Solutions

- Viral Clearance

- Raw Material Filtration

- Media Buffer Filtration

- Prefiltration

- Bioburden Testing

- Cell Separation

- Water Purification

- Air Purification

By End user

- Pharmaceutical & Biotechnology Companies

- Food & Beverage Companies

- CMOs & CROs

- Academic & Research Laboratories

By Region

-

North America

- US

- Canada

-

Europe

- Germany

- UK

- France

- Italy

- Spain

- Rest of Europe (RoE)

-

Asia Pacific (APAC)

- China

- Japan

- India

- Rest of Asia Pacific (RoAPAC)

-

Latin America (LATAM)

- Brazil

- RoLATAM

- Middle East and Africa (MEA)

Recent Developments

- In November 2021, Sartorius AG (Germany) launched vacuum filters for research purposes and filtration of small volumes from 50 mL to 1 L.

- In March 2021, Pall Corporation (US) acquired Pall-Austar Lifesciences Limited to expand its manufacturing capacity for single-use technology in China.

Frequently Asked Questions (FAQ):

What is the projected market value of the global sterile filtration market?

The global sterile filtration market boasts a total revenue value of $8.9 billion in 2023 and is projected to register a revenue value of $15.3 billion by 2028.

What is the estimated growth rate (CAGR) of the global sterile filtration market for the next five years?

The global sterile filtration market in terms of revenue is poised to grow at a CAGR of 11.4%.

What does the current study of the sterile filtration market consist of?

The new research study consists of an industry trend analysis of the market. The new research study consists of industry trends, pricing analysis, patent analysis, conference and webinar materials, key stakeholders, and buying behaviour in the market.

To speak to our analyst for a discussion on the above findings, click Speak to Analyst

- 5.1 INTRODUCTION

-

5.2 MARKET DYNAMICSDRIVERS- Growing demand for sterile filtration in pharmaceutical industry- Increasing need for sterile filters in food & beverage industry- Increased demand for sterile water in end-use industries- Adoption of single-use devices and disposables- Advantages of sterile filters over non-sterile filtersRESTRAINTS- Fouling of membrane filters- Requirement of high capital investments for new production facilities- Increased regulatory requirements for new sterile filtration plantsOPPORTUNITIES- Development and use of advanced filters for sterile filtration- Developing pharmaceutical sector in emerging countriesCHALLENGES- High price sensitivity among end users

- 5.3 SCENARIOS USED IN STERILE FILTRATION MARKET

-

5.4 TRENDS/DISRUPTIONS IMPACTING CUSTOMERS’ BUSINESSES

-

5.5 PRICING ANALYSISINDICATIVE AVERAGE SELLING PRICE FOR KEY PRODUCTS IN DEVELOPED AND DEVELOPING REGIONSAVERAGE SELLING PRICE TREND

- 5.6 VALUE CHAIN ANALYSIS

- 5.7 SUPPLY CHAIN ANALYSIS

-

5.8 ECOSYSTEM ANALYSIS

-

5.9 PATENT ANALYSIS

- 5.10 KEY CONFERENCES AND EVENTS IN 2023

-

5.11 REGULATORY ANALYSISLIST OF REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONSREGULATORY SCENARIO IN DIFFERENT REGIONS/COUNTRIES

-

5.12 PORTER’S FIVE FORCES ANALYSISTHREAT OF NEW ENTRANTSTHREAT OF SUBSTITUTESBARGAINING POWER OF BUYERSBARGAINING POWER OF SUPPLIERSINTENSITY OF COMPETITIVE RIVALRY

-

5.13 KEY STAKEHOLDERS AND BUYING CRITERIAKEY STAKEHOLDERS IN BUYING PROCESSKEY BUYING CRITERIA FOR STERILE FILTRATION PRODUCTS AMONG END USERS

- 6.1 INTRODUCTION

-

6.2 CARTRIDGE FILTERSINCREASED PRODUCTION OF BIOLOGICS AND LARGE MOLECULES TO DRIVE MARKET

-

6.3 CAPSULE FILTERSAVAILABILITY OF READY-TO-USE FORMATS TO PROPEL USE OF CAPSULE FILTERS IN DRUG PRODUCTION FACILITIES

-

6.4 MEMBRANESWIDE APPLICATIONS OF MEMBRANE FILTERS AMONG END USERS TO SUPPORT MARKET

-

6.5 SYRINGE FILTERSSYRINGE FILTERS TO BE IDEAL FOR STERILE FILTRATION APPLICATIONS IN LABORATORY SETTINGS

-

6.6 BOTTLE-TOP & TABLE-TOP FILTRATION SYSTEMSINCREASED APPLICATION OF SINGLE-USE AND DISPOSABLE SYSTEMS FOR STERILE MEDIA PREPARATION TO FUEL SEGMENT

- 6.7 ACCESSORIES

- 7.1 INTRODUCTION

-

7.2 PESHIGH RELIABILITY AND WIDE APPLICATIONS IN MICROBIAL FILTRATION TO ENSURE MARKET DOMINANCE

-

7.3 PVDFEXTENSIVE USAGE IN FORMULATION & FILLING SOLUTIONS AND PROTEIN PURIFICATION TO AID DEMAND

-

7.4 NYLONCOMPATIBILITY, DURABILITY, AND NATURAL HYDROPHILICITY TO AUGMENT DEMAND FOR STERILE FILTRATION

-

7.5 PTFECHEMICAL AND BIOLOGICAL INERTNESS AND NATURAL HYDROPHOBICITY TO AID DEMAND IN STERILE VENTING OF GASES

-

7.6 MCE & CAWIDE APPLICATIONS IN MICROBIOLOGICAL ANALYSIS OF WASTEWATER IN PHARMACEUTICAL COMPANIES TO BOOST MARKET

- 7.7 OTHER MEMBRANE TYPES

- 8.1 INTRODUCTION

-

8.2 0.2–0.22 ΜM0.2–0.22 ΜM FILTERS TO BE COMMONLY USED IN STERILE FILTRATION OF PHARMA AND BIOPHARMA DRUGS

-

8.3 0.45 ΜM0.45 ΜM FILTERS TO BE MAJORLY USED IN FOOD & BEVERAGE INDUSTRY

-

8.4 0.1 ΜM0.1 ΜM FILTERS TO BE USED IN LOW-FOULING CELL CULTURE MEDIA AND FINAL DOSAGE PREPARATIONS

- 9.1 INTRODUCTION

-

9.2 FINAL PRODUCT PROCESSINGACTIVE PHARMACEUTICAL INGREDIENT FILTRATION- Increased requirement for active pharmaceutical ingredient filtration in drug manufacturing to drive marketPROTEIN PURIFICATION- Recent advancements in protein therapeutic drugs to propel segmentVACCINE AND ANTIBODY PROCESSING- Rising incidences of COVID-19 and increasing R&D on vaccine development to fuel marketFORMULATION AND FILLING SOLUTIONS- Demand for ultra-clean sterilized packaging to augment marketVIRAL CLEARANCE- Growing popularity of sterile filters and protein concentrators for virus inactivation to drive market

-

9.3 RAW MATERIAL FILTRATIONMEDIA BUFFER FILTRATION- Media buffer filtration to sterilize upstream and downstream processes in biopharmaceutical manufacturingPREFILTRATION- Prefiltration to improve efficiency and effectiveness of sterile filtration processesBIOBURDEN TESTING- Demand for strict quality control of biopharmaceutical raw materials to aid market

-

9.4 CELL SEPARATIONGROWTH IN PERSONALIZED MEDICINE TO FUEL SEGMENT

-

9.5 WATER PURIFICATIONGROWING DEMAND FOR PURIFIED WATER IN PHARMACEUTICAL INDUSTRY TO DRIVE MARKET

-

9.6 AIR PURIFICATIONINCREASING ADOPTION OF GMP PRACTICES FOR MANUFACTURING MEDICINAL PRODUCTS TO PROPEL GROWTH

- 10.1 INTRODUCTION

-

10.2 PHARMACEUTICAL & BIOTECHNOLOGY COMPANIESSTRINGENT REGULATORY SCENARIO AND STRICT QUALITY REQUIREMENTS TO DRIVE DEMAND FOR STERILE FILTERS

-

10.3 FOOD & BEVERAGE COMPANIESINCREASED HEALTH CONCERNS AND STRINGENT CONTAMINATION CONTROL MEASURES TO FUEL MARKET

-

10.4 CMOS & CROSINCREASE IN OUTSOURCING OF PHARMA & BIOPHARMA DRUG PRODUCTS TO SUPPORT SEGMENT

-

10.5 ACADEMIC & RESEARCH INSTITUTESINCREASING R&D EXPENDITURE FOR LIFE SCIENCE AND BIOTECHNOLOGY RESEARCH TO SUPPORT SEGMENT

- 11.1 INTRODUCTION

-

11.2 NORTH AMERICANORTH AMERICA: IMPACT OF RECESSIONUS- Presence of large number of academic & research laboratories and biopharma manufacturers to drive marketCANADA- Expanding biologics manufacturing facilities with government support to fuel market

-

11.3 EUROPEEUROPE: IMPACT OF RECESSIONGERMANY- Strong base of biotechnology & pharmaceutical companies to augment marketUK- Growing commercial support for life science R&D to drive demand for sterile filtration productsFRANCE- Support from government and private investors to enhance market growthITALY- Rising research activities and growing pharmaceutical sector to aid marketSPAIN- Growing pharmaceutical manufacturing industry to drive marketREST OF EUROPE

-

11.4 ASIA PACIFICASIA PACIFIC: IMPACT OF RECESSIONCHINA- Shift from generic medicine to innovative drugs to propel marketJAPAN- Rising adoption of sterile filtration techniques to aid marketINDIA- Increasing funding for pharmaceutical sector to drive marketREST OF ASIA PACIFIC

-

11.5 LATIN AMERICALATIN AMERICA: IMPACT OF RECESSIONBRAZIL- Growth of vaccine manufacturing and pharmaceutical R&D to fuel marketREST OF LATIN AMERICA

-

11.6 MIDDLE EAST & AFRICAGROWING MARKET FOR PHARMACEUTICALS AND INCREASING DEMAND FOR DRUGS TO PROPEL MARKETMIDDLE EAST & AFRICA: IMPACT OF RECESSION

- 12.1 INTRODUCTION

- 12.2 RIGHT-TO-WIN APPROACHES ADOPTED BY KEY PLAYERS

- 12.3 MARKET SHARE ANALYSIS

- 12.4 REVENUE ANALYSIS OF KEY PLAYERS IN STERILE FILTRATION MARKET

-

12.5 COMPANY EVALUATION MATRIXSTARSEMERGING LEADERSPERVASIVE PLAYERSEMERGING COMPANIES

-

12.6 COMPETITIVE BENCHMARKING OF TOP 25 PLAYERSOVERALL FOOTPRINT OF COMPANIES (25 COMPANIES)PRODUCT FOOTPRINT OF COMPANIES (25 COMPANIES)END USER FOOTPRINT OF COMPANIES (25 COMPANIES)GEOGRAPHICAL FOOTPRINT OF COMPANIES (25 COMPANIES)

-

12.7 COMPANY EVALUATION MATRIX: START-UPS/SMESPROGRESSIVE COMPANIESSTARTING BLOCKSRESPONSIVE COMPANIESDYNAMIC COMPANIES- Competitive benchmarking of start-ups/SMEs

-

12.8 COMPETITIVE SCENARIO AND TRENDSKEY PRODUCT LAUNCHESKEY DEALSKEY EXPANSIONS

-

13.1 KEY PLAYERSMERCK KGAA- Business overview- Products/Services/Solutions offered- Recent developments- MnM viewDANAHER CORPORATION- Business overview- Products/Services/Solutions offered- Recent developments- MnM viewSARTORIUS AG- Business overview- Products/Services/Solutions offered- Recent developments- MnM viewTHERMO FISHER SCIENTIFIC INC.- Business overview- Products/Services/Solutions offered- Recent developments3M- Business overview- Products/Services/Solutions offeredPARKER HANNIFIN CORP.- Business overview- Products/Services/Solutions offered- Recent developmentsPORVAIR PLC- Business overview- Products/Services/Solutions offered- Recent developmentsALFA LAVAL- Business overview- Products/Services/Solutions offeredDONALDSON COMPANY, INC.- Business overview- Products/Services/Solutions offered- Recent developmentsCORNING INCORPORATED- Business overview- Products/Services/Solutions offeredEATON- Business overview- Products/Services/Solutions offered- Recent developmentsGVS S.P.A.- Business overview- Products/Services/Solutions offered- Recent developments

-

13.2 OTHER PLAYERSSTERLITECH CORPORATIONMEISSNER FILTRATION PRODUCTS, INC.COLE-PARMER INSTRUMENT, LLCNUPORE FILTRATION SYSTEMS PVT. LTD.STARLAB INTERNATIONAL GMBHAMAZON FILTERS LTD.AMD MANUFACTURING INC.HANGZHOU COBETTER FILTRATION EQUIPMENT CO., LTD.SIMSII, INC.CELLTREAT SCIENTIFIC PRODUCTSWYVERN SCIENTIFIC INC.TRINITY FILTRATION TECHNOLOGIES PVT. LTD.FILTROX AG

- 14.1 DISCUSSION GUIDE

- 14.2 KNOWLEDGESTORE: MARKETSANDMARKETS’ SUBSCRIPTION PORTAL

- 14.3 CUSTOMIZATION OPTIONS

- 14.4 RELATED REPORTS

- 14.5 AUTHOR DETAILS

- TABLE 1 GLOBAL INFLATION RATE PROJECTION, 2024−2027

- TABLE 2 STERILE FILTRATION MARKET: IMPACT ANALYSIS

- TABLE 3 INDICATIVE LIST OF BIOLOGICAL LICENSE APPLICATION APPROVALS, 2021–2022

- TABLE 4 PRICE OF STERILE FILTRATION PRODUCTS IN DEVELOPED AND DEVELOPING REGIONS

- TABLE 5 SUPPLY CHAIN ECOSYSTEM ANALYSIS

- TABLE 6 STERILE FILTRATION MARKET: LIST OF CONFERENCES AND EVENTS

- TABLE 7 STERILE FILTRATION MARKET: PORTER’S FIVE FORCES ANALYSIS

- TABLE 8 STERILE FILTRATION MARKET, BY PRODUCT, 2021–2028 (USD MILLION)

- TABLE 9 STERILE FILTRATION MARKET FOR CARTRIDGE FILTERS, BY REGION, 2021–2028 (USD MILLION)

- TABLE 10 NORTH AMERICA: STERILE FILTRATION MARKET FOR CARTRIDGE FILTERS, BY COUNTRY, 2021–2028 (USD MILLION)

- TABLE 11 EUROPE: STERILE FILTRATION MARKET FOR CARTRIDGE FILTERS, BY COUNTRY, 2021–2028 (USD MILLION)

- TABLE 12 ASIA PACIFIC: STERILE FILTRATION MARKET FOR CARTRIDGE FILTERS, BY COUNTRY, 2021–2028 (USD MILLION)

- TABLE 13 LATIN AMERICA: STERILE FILTRATION MARKET FOR CARTRIDGE FILTERS, BY COUNTRY, 2021–2028 (USD MILLION)

- TABLE 14 STERILE FILTRATION MARKET FOR CAPSULE FILTERS, BY REGION, 2021–2028 (USD MILLION)

- TABLE 15 NORTH AMERICA: STERILE FILTRATION MARKET FOR CAPSULE FILTERS, BY COUNTRY, 2021–2028 (USD MILLION)

- TABLE 16 EUROPE: STERILE FILTRATION MARKET FOR CAPSULE FILTERS, BY COUNTRY, 2021–2028 (USD MILLION)

- TABLE 17 ASIA PACIFIC: STERILE FILTRATION MARKET FOR CAPSULE FILTERS, BY COUNTRY, 2021–2028 (USD MILLION)

- TABLE 18 LATIN AMERICA: STERILE FILTRATION MARKET FOR CAPSULE FILTERS, BY COUNTRY, 2021–2028 (USD MILLION)

- TABLE 19 STERILE FILTRATION MARKET FOR MEMBRANES, BY REGION, 2021–2028 (USD MILLION)

- TABLE 20 NORTH AMERICA: STERILE FILTRATION MARKET FOR MEMBRANES, BY REGION, 2021–2028 (USD MILLION)

- TABLE 21 EUROPE: STERILE FILTRATION MARKET FOR MEMBRANES, BY COUNTRY, 2021–2028 (USD MILLION)

- TABLE 22 ASIA PACIFIC: STERILE FILTRATION MARKET FOR MEMBRANES, BY COUNTRY, 2021–2028 (USD MILLION)

- TABLE 23 LATIN AMERICA: STERILE FILTRATION MARKET FOR MEMBRANES, BY COUNTRY, 2021–2028 (USD MILLION)

- TABLE 24 STERILE FILTRATION MARKET FOR SYRINGE FILTERS, BY REGION, 2021–2028 (USD MILLION)

- TABLE 25 NORTH AMERICA: STERILE FILTRATION MARKET FOR SYRINGE FILTERS, BY COUNTRY, 2021–2028 (USD MILLION)

- TABLE 26 EUROPE: STERILE FILTRATION MARKET FOR SYRINGE FILTERS, BY COUNTRY, 2021–2028 (USD MILLION)

- TABLE 27 ASIA PACIFIC: STERILE FILTRATION MARKET FOR SYRINGE FILTERS, BY COUNTRY, 2021–2028 (USD MILLION)

- TABLE 28 LATIN AMERICA: STERILE FILTRATION MARKET FOR SYRINGE FILTERS, BY COUNTRY, 2021–2028 (USD MILLION)

- TABLE 29 STERILE FILTRATION MARKET FOR BOTTLE-TOP & TABLE-TOP FILTRATION SYSTEMS, BY REGION, 2021–2028 (USD MILLION)

- TABLE 30 NORTH AMERICA: STERILE FILTRATION MARKET FOR BOTTLE-TOP & TABLE-TOP FILTRATION SYSTEMS, BY COUNTRY, 2021–2028 (USD MILLION)

- TABLE 31 EUROPE: STERILE FILTRATION MARKET FOR BOTTLE-TOP & TABLE-TOP FILTRATION SYSTEMS, BY COUNTRY, 2021–2028 (USD MILLION)

- TABLE 32 ASIA PACIFIC: STERILE FILTRATION MARKET FOR BOTTLE-TOP & TABLE-TOP FILTRATION SYSTEMS, BY COUNTRY, 2021–2028 (USD MILLION)

- TABLE 33 LATIN AMERICA: STERILE FILTRATION MARKET FOR BOTTLE-TOP & TABLE-TOP FILTRATION SYSTEMS, BY COUNTRY, 2021–2028 (USD MILLION)

- TABLE 34 STERILE FILTRATION MARKET FOR ACCESSORIES, BY REGION, 2021–2028 (USD MILLION)

- TABLE 35 NORTH AMERICA: STERILE FILTRATION MARKET FOR ACCESSORIES, BY REGION, 2021–2028 (USD MILLION)

- TABLE 36 EUROPE: STERILE FILTRATION MARKET FOR ACCESSORIES, BY COUNTRY, 2021–2028 (USD MILLION)

- TABLE 37 ASIA PACIFIC: STERILE FILTRATION MARKET FOR ACCESSORIES, BY COUNTRY, 2021–2028 (USD MILLION)

- TABLE 38 LATIN AMERICA: STERILE FILTRATION MARKET FOR ACCESSORIES, BY COUNTRY, 2021–2028 (USD MILLION)

- TABLE 39 STERILE FILTRATION MARKET, BY MEMBRANE TYPE, 2021–2028 (USD MILLION)

- TABLE 40 STERILE FILTRATION MARKET FOR PES, BY REGION, 2021–2028 (USD MILLION)

- TABLE 41 NORTH AMERICA: STERILE FILTRATION MARKET FOR PES, BY COUNTRY, 2021–2028 (USD MILLION)

- TABLE 42 EUROPE: STERILE FILTRATION MARKET FOR PES, BY COUNTRY, 2021–2028 (USD MILLION)

- TABLE 43 ASIA PACIFIC: STERILE FILTRATION MARKET FOR PES, BY COUNTRY, 2021–2028 (USD MILLION)

- TABLE 44 LATIN AMERICA: STERILE FILTRATION MARKET FOR PES, BY COUNTRY, 2021–2028 (USD MILLION)

- TABLE 45 STERILE FILTRATION MARKET FOR PVDF, BY REGION, 2021–2028 (USD MILLION)

- TABLE 46 NORTH AMERICA: STERILE FILTRATION MARKET FOR PVDF, BY COUNTRY, 2021–2028 (USD MILLION)

- TABLE 47 EUROPE: STERILE FILTRATION MARKET FOR PVDF, BY COUNTRY, 2021–2028 (USD MILLION)

- TABLE 48 ASIA PACIFIC: STERILE FILTRATION MARKET FOR PVDF, BY COUNTRY, 2021–2028 (USD MILLION)

- TABLE 49 LATIN AMERICA: STERILE FILTRATION MARKET FOR PVDF, BY COUNTRY, 2021–2028 (USD MILLION)

- TABLE 50 STERILE FILTRATION MARKET FOR NYLON, BY REGION, 2021–2028 (USD MILLION)

- TABLE 51 NORTH AMERICA: STERILE FILTRATION MARKET FOR NYLON, BY COUNTRY, 2021–2028 (USD MILLION)

- TABLE 52 EUROPE: STERILE FILTRATION MARKET FOR NYLON, BY COUNTRY, 2021–2028 (USD MILLION)

- TABLE 53 ASIA PACIFIC: STERILE FILTRATION MARKET FOR NYLON, BY COUNTRY, 2021–2028 (USD MILLION)

- TABLE 54 LATIN AMERICA: STERILE FILTRATION MARKET FOR NYLON, BY COUNTRY, 2021–2028 (USD MILLION)

- TABLE 55 STERILE FILTRATION MARKET FOR PTFE, BY REGION, 2021–2028 (USD MILLION)

- TABLE 56 NORTH AMERICA: STERILE FILTRATION MARKET FOR PTFE, BY COUNTRY, 2021–2028 (USD MILLION)

- TABLE 57 EUROPE: STERILE FILTRATION MARKET FOR PTFE, BY COUNTRY, 2021–2028 (USD MILLION)

- TABLE 58 ASIA PACIFIC: STERILE FILTRATION MARKET FOR PTFE, BY COUNTRY, 2021–2028 (USD MILLION)

- TABLE 59 LATIN AMERICA: STERILE FILTRATION MARKET FOR PTFE, BY COUNTRY, 2021–2028 (USD MILLION)

- TABLE 60 STERILE FILTRATION MARKET FOR MCE & CA, BY REGION, 2021–2028 (USD MILLION)

- TABLE 61 NORTH AMERICA: STERILE FILTRATION MARKET FOR MCE & CA, BY COUNTRY, 2021–2028 (USD MILLION)

- TABLE 62 EUROPE: STERILE FILTRATION MARKET FOR MCE & CA, BY COUNTRY, 2021–2028 (USD MILLION)

- TABLE 63 ASIA PACIFIC: STERILE FILTRATION MARKET FOR MCE & CA, BY COUNTRY, 2021–2028 (USD MILLION)

- TABLE 64 LATIN AMERICA: STERILE FILTRATION MARKET FOR MCE & CA, BY COUNTRY, 2021–2028 (USD MILLION)

- TABLE 65 STERILE FILTRATION MARKET FOR OTHER MEMBRANE TYPES, BY REGION, 2021–2028 (USD MILLION)

- TABLE 66 NORTH AMERICA: STERILE FILTRATION MARKET FOR OTHER MEMBRANE TYPES, BY COUNTRY, 2021–2028 (USD MILLION)

- TABLE 67 EUROPE: STERILE FILTRATION MARKET FOR OTHER MEMBRANE TYPES, BY COUNTRY, 2021–2028 (USD MILLION)

- TABLE 68 ASIA PACIFIC: STERILE FILTRATION MARKET FOR OTHER MEMBRANE TYPES, BY COUNTRY, 2021–2028 (USD MILLION)

- TABLE 69 LATIN AMERICA: STERILE FILTRATION MARKET FOR OTHER MEMBRANE TYPES, BY COUNTRY, 2021–2028 (USD MILLION)

- TABLE 70 STERILE FILTRATION MARKET, BY MEMBRANE PORE SIZE, 2021–2028 (USD MILLION)

- TABLE 71 STERILE FILTRATION MARKET FOR 0.2–0.22 ΜM, BY REGION, 2021–2028 (USD MILLION)

- TABLE 72 NORTH AMERICA: STERILE FILTRATION MARKET FOR 0.2–0.22 ΜM, BY COUNTRY, 2021–2028 (USD MILLION)

- TABLE 73 EUROPE: STERILE FILTRATION MARKET FOR 0.2–0.22 ΜM, BY COUNTRY, 2021–2028 (USD MILLION)

- TABLE 74 ASIA PACIFIC: STERILE FILTRATION MARKET FOR 0.2–0.22 ΜM, BY COUNTRY, 2021–2028 (USD MILLION)

- TABLE 75 LATIN AMERICA: STERILE FILTRATION MARKET FOR 0.2–0.22 ΜM, BY COUNTRY, 2021–2028 (USD MILLION)

- TABLE 76 STERILE FILTRATION MARKET FOR 0.45 ΜM, BY REGION, 2021–2028 (USD MILLION)

- TABLE 77 NORTH AMERICA: STERILE FILTRATION MARKET FOR 0.45 ΜM, BY COUNTRY, 2021–2028 (USD MILLION)

- TABLE 78 EUROPE: STERILE FILTRATION MARKET FOR 0.45 ΜM, BY COUNTRY, 2021–2028 (USD MILLION)

- TABLE 79 ASIA PACIFIC: STERILE FILTRATION MARKET FOR 0.45 ΜM, BY COUNTRY, 2021–2028 (USD MILLION)

- TABLE 80 LATIN AMERICA: STERILE FILTRATION MARKET FOR 0.45 ΜM, BY COUNTRY, 2021–2028 (USD MILLION)

- TABLE 81 STERILE FILTRATION MARKET FOR 0.1 ΜM, BY REGION, 2021–2028 (USD MILLION)

- TABLE 82 NORTH AMERICA: STERILE FILTRATION MARKET FOR 0.1 ΜM, BY COUNTRY, 2021–2028 (USD MILLION)

- TABLE 83 EUROPE: STERILE FILTRATION MARKET FOR 0.1 ΜM, BY COUNTRY, 2021–2028 (USD MILLION)

- TABLE 84 ASIA PACIFIC: STERILE FILTRATION MARKET FOR 0.1 ΜM, BY COUNTRY, 2021–2028 (USD MILLION)

- TABLE 85 LATIN AMERICA: STERILE FILTRATION MARKET FOR 0.1 ΜM, BY COUNTRY, 2021–2028 (USD MILLION)

- TABLE 86 STERILE FILTRATION MARKET, BY APPLICATION, 2021–2028 (USD MILLION)

- TABLE 87 STERILE FILTRATION MARKET FOR FINAL PRODUCT PROCESSING, BY REGION, 2021–2028 (USD MILLION)

- TABLE 88 NORTH AMERICA: STERILE FILTRATION MARKET FOR FINAL PRODUCT PROCESSING, BY COUNTRY, 2021–2028 (USD MILLION)

- TABLE 89 EUROPE: STERILE FILTRATION MARKET FOR FINAL PRODUCT PROCESSING, BY COUNTRY, 2021–2028 (USD MILLION)

- TABLE 90 ASIA PACIFIC: STERILE FILTRATION MARKET FOR FINAL PRODUCT PROCESSING, BY COUNTRY, 2021–2028 (USD MILLION)

- TABLE 91 LATIN AMERICA: STERILE FILTRATION MARKET FOR FINAL PRODUCT PROCESSING, BY COUNTRY, 2021–2028 (USD MILLION)

- TABLE 92 STERILE FILTRATION MARKET FOR FINAL PRODUCT PROCESSING, BY TYPE, 2021–2028 (USD MILLION)

- TABLE 93 ACTIVE PHARMACEUTICAL INGREDIENT FILTRATION MARKET, BY REGION, 2021–2028 (USD MILLION)

- TABLE 94 NORTH AMERICA: ACTIVE PHARMACEUTICAL INGREDIENT FILTRATION MARKET, BY COUNTRY, 2021–2028 (USD MILLION)

- TABLE 95 EUROPE: ACTIVE PHARMACEUTICAL INGREDIENT FILTRATION MARKET, BY COUNTRY, 2021–2028 (USD MILLION)

- TABLE 96 ASIA PACIFIC: ACTIVE PHARMACEUTICAL INGREDIENT FILTRATION MARKET, BY COUNTRY, 2021–2028 (USD MILLION)

- TABLE 97 LATIN AMERICA: ACTIVE PHARMACEUTICAL INGREDIENT FILTRATION MARKET, BY COUNTRY, 2021–2028 (USD MILLION)

- TABLE 98 PROTEIN PURIFICATION MARKET, BY REGION, 2021–2028 (USD MILLION)

- TABLE 99 NORTH AMERICA: PROTEIN PURIFICATION MARKET, BY COUNTRY, 2021–2028 (USD MILLION)

- TABLE 100 EUROPE: PROTEIN PURIFICATION MARKET, BY COUNTRY, 2021–2028 (USD MILLION)

- TABLE 101 ASIA PACIFIC: PROTEIN PURIFICATION MARKET, BY COUNTRY, 2021–2028 (USD MILLION)

- TABLE 102 LATIN AMERICA: PROTEIN PURIFICATION MARKET, BY COUNTRY, 2021–2028 (USD MILLION)

- TABLE 103 VACCINE AND ANTIBODY PROCESSING MARKET, BY REGION, 2021–2028 (USD MILLION)

- TABLE 104 NORTH AMERICA: VACCINE AND ANTIBODY PROCESSING MARKET, BY COUNTRY, 2021–2028 (USD MILLION)

- TABLE 105 EUROPE: VACCINE AND ANTIBODY PROCESSING MARKET, BY COUNTRY, 2021–2028 (USD MILLION)

- TABLE 106 ASIA PACIFIC: VACCINE AND ANTIBODY PROCESSING MARKET, BY COUNTRY, 2021–2028 (USD MILLION)

- TABLE 107 LATIN AMERICA: VACCINE AND ANTIBODY PROCESSING MARKET, BY COUNTRY, 2021–2028 (USD MILLION)

- TABLE 108 FORMULATION AND FILLING SOLUTIONS MARKET, BY REGION, 2021–2028 (USD MILLION)

- TABLE 109 NORTH AMERICA: FORMULATION AND FILLING SOLUTIONS MARKET, BY COUNTRY, 2021–2028 (USD MILLION)

- TABLE 110 EUROPE: FORMULATION AND FILLING SOLUTIONS MARKET, BY COUNTRY, 2021–2028 (USD MILLION)

- TABLE 111 ASIA PACIFIC: FORMULATION AND FILLING SOLUTIONS MARKET, BY COUNTRY, 2021–2028 (USD MILLION)

- TABLE 112 LATIN AMERICA: FORMULATION AND FILLING SOLUTIONS MARKET, BY COUNTRY, 2021–2028 (USD MILLION)

- TABLE 113 VIRAL CLEARANCE MARKET, BY REGION, 2021–2028 (USD MILLION)

- TABLE 114 NORTH AMERICA: VIRAL CLEARANCE MARKET, BY COUNTRY, 2021–2028 (USD MILLION)

- TABLE 115 EUROPE: VIRAL CLEARANCE MARKET, BY COUNTRY, 2021–2028 (USD MILLION)

- TABLE 116 ASIA PACIFIC: VIRAL CLEARANCE MARKET, BY COUNTRY, 2021–2028 (USD MILLION)

- TABLE 117 LATIN AMERICA: VIRAL CLEARANCE MARKET, BY COUNTRY, 2021–2028 (USD MILLION)

- TABLE 118 STERILE FILTRATION MARKET FOR RAW MATERIAL FILTRATION, BY REGION, 2021–2028 (USD MILLION)

- TABLE 119 NORTH AMERICA: STERILE FILTRATION MARKET FOR RAW MATERIAL FILTRATION, BY COUNTRY, 2021–2028 (USD MILLION)

- TABLE 120 EUROPE: STERILE FILTRATION MARKET FOR RAW MATERIAL FILTRATION, BY COUNTRY, 2021–2028 (USD MILLION)

- TABLE 121 ASIA PACIFIC: STERILE FILTRATION MARKET FOR RAW MATERIAL FILTRATION, BY COUNTRY, 2021–2028 (USD MILLION)

- TABLE 122 LATIN AMERICA: STERILE FILTRATION MARKET FOR RAW MATERIAL FILTRATION, BY COUNTRY, 2021–2028 (USD MILLION)

- TABLE 123 STERILE FILTRATION MARKET FOR RAW MATERIAL FILTRATION, BY TYPE, 2021–2028 (USD MILLION)

- TABLE 124 MEDIA BUFFER FILTRATION MARKET, BY REGION, 2021–2028 (USD MILLION)

- TABLE 125 NORTH AMERICA: MEDIA BUFFER FILTRATION MARKET, BY COUNTRY, 2021–2028 (USD MILLION)

- TABLE 126 EUROPE: MEDIA BUFFER FILTRATION MARKET, BY COUNTRY, 2021–2028 (USD MILLION)

- TABLE 127 ASIA PACIFIC: MEDIA BUFFER FILTRATION MARKET, BY COUNTRY, 2021–2028 (USD MILLION)

- TABLE 128 LATIN AMERICA: MEDIA BUFFER FILTRATION MARKET, BY COUNTRY, 2021–2028 (USD MILLION)

- TABLE 129 PREFILTRATION MARKET, BY REGION, 2021–2028 (USD MILLION)

- TABLE 130 NORTH AMERICA: PREFILTRATION MARKET, BY COUNTRY, 2021–2028 (USD MILLION)

- TABLE 131 EUROPE: PREFILTRATION MARKET, BY COUNTRY, 2021–2028 (USD MILLION)

- TABLE 132 ASIA PACIFIC: PREFILTRATION MARKET, BY COUNTRY, 2021–2028 (USD MILLION)

- TABLE 133 LATIN AMERICA: PREFILTRATION MARKET, BY COUNTRY, 2021–2028 (USD MILLION)

- TABLE 134 BIOBURDEN TESTING MARKET, BY REGION, 2021–2028 (USD MILLION)

- TABLE 135 NORTH AMERICA: BIOBURDEN TESTING MARKET, BY COUNTRY, 2021–2028 (USD MILLION)

- TABLE 136 EUROPE: BIOBURDEN TESTING MARKET, BY COUNTRY, 2021–2028 (USD MILLION)

- TABLE 137 ASIA PACIFIC: BIOBURDEN TESTING MARKET, BY COUNTRY, 2021–2028 (USD MILLION)

- TABLE 138 LATIN AMERICA: BIOBURDEN TESTING MARKET, BY COUNTRY, 2021–2028 (USD MILLION)

- TABLE 139 STERILE FILTRATION MARKET FOR CELL SEPARATION, BY REGION, 2021–2028 (USD MILLION)

- TABLE 140 NORTH AMERICA: STERILE FILTRATION MARKET FOR CELL SEPARATION, BY COUNTRY, 2021–2028 (USD MILLION)

- TABLE 141 EUROPE: STERILE FILTRATION MARKET FOR CELL SEPARATION, BY COUNTRY, 2021–2028 (USD MILLION)

- TABLE 142 ASIA PACIFIC: STERILE FILTRATION MARKET FOR CELL SEPARATION, BY COUNTRY, 2021–2028 (USD MILLION)

- TABLE 143 LATIN AMERICA: STERILE FILTRATION MARKET FOR CELL SEPARATION, BY COUNTRY, 2021–2028 (USD MILLION)

- TABLE 144 STERILE FILTRATION MARKET FOR WATER PURIFICATION, BY REGION, 2021–2028 (USD MILLION)

- TABLE 145 NORTH AMERICA: STERILE FILTRATION MARKET FOR WATER PURIFICATION, BY COUNTRY, 2021–2028 (USD MILLION)

- TABLE 146 EUROPE: STERILE FILTRATION MARKET FOR WATER PURIFICATION, BY COUNTRY, 2021–2028 (USD MILLION)

- TABLE 147 ASIA PACIFIC: STERILE FILTRATION MARKET FOR WATER PURIFICATION, BY COUNTRY, 2021–2028 (USD MILLION)

- TABLE 148 LATIN AMERICA: STERILE FILTRATION MARKET FOR WATER PURIFICATION, BY COUNTRY, 2021–2028 (USD MILLION)

- TABLE 149 STERILE FILTRATION MARKET FOR AIR PURIFICATION, BY REGION, 2021–2028 (USD MILLION)

- TABLE 150 NORTH AMERICA: STERILE FILTRATION MARKET FOR AIR PURIFICATION, BY COUNTRY, 2021–2028 (USD MILLION)

- TABLE 151 EUROPE: STERILE FILTRATION MARKET FOR AIR PURIFICATION, BY COUNTRY, 2021–2028 (USD MILLION)

- TABLE 152 ASIA PACIFIC: STERILE FILTRATION MARKET FOR AIR PURIFICATION, BY COUNTRY, 2021–2028 (USD MILLION)

- TABLE 153 LATIN AMERICA: STERILE FILTRATION MARKET FOR AIR PURIFICATION, BY COUNTRY, 2021–2028 (USD MILLION)

- TABLE 154 STERILE FILTRATION MARKET, BY END USER, 2021–2028 (USD MILLION)

- TABLE 155 STERILE FILTRATION MARKET FOR PHARMACEUTICAL & BIOTECHNOLOGY COMPANIES, BY REGION, 2021–2028 (USD MILLION)

- TABLE 156 NORTH AMERICA: STERILE FILTRATION MARKET FOR PHARMACEUTICAL & BIOTECHNOLOGY COMPANIES, BY COUNTRY, 2021–2028 (USD MILLION)

- TABLE 157 EUROPE: STERILE FILTRATION MARKET FOR PHARMACEUTICAL & BIOTECHNOLOGY COMPANIES, BY COUNTRY, 2021–2028 (USD MILLION)

- TABLE 158 ASIA PACIFIC: STERILE FILTRATION MARKET FOR PHARMACEUTICAL & BIOTECHNOLOGY COMPANIES, BY COUNTRY, 2021–2028 (USD MILLION)

- TABLE 159 LATIN AMERICA: STERILE FILTRATION MARKET FOR PHARMACEUTICAL & BIOTECHNOLOGY COMPANIES, BY COUNTRY, 2021–2028 (USD MILLION)

- TABLE 160 STERILE FILTRATION MARKET FOR FOOD & BEVERAGE COMPANIES, BY REGION, 2021–2028 (USD MILLION)

- TABLE 161 NORTH AMERICA: STERILE FILTRATION MARKET FOR FOOD & BEVERAGE COMPANIES, BY COUNTRY, 2021–2028 (USD MILLION)

- TABLE 162 EUROPE: STERILE FILTRATION MARKET FOR FOOD & BEVERAGE COMPANIES, BY COUNTRY, 2021–2028 (USD MILLION)

- TABLE 163 ASIA PACIFIC: STERILE FILTRATION MARKET FOR FOOD & BEVERAGE COMPANIES, BY COUNTRY, 2021–2028 (USD MILLION)

- TABLE 164 LATIN AMERICA: STERILE FILTRATION MARKET FOR FOOD & BEVERAGE COMPANIES, BY COUNTRY, 2021–2028 (USD MILLION)

- TABLE 165 STERILE FILTRATION MARKET FOR CMOS & CROS, BY REGION, 2021–2028 (USD MILLION)

- TABLE 166 NORTH AMERICA: STERILE FILTRATION MARKET FOR CMOS & CROS, BY COUNTRY, 2021–2028 (USD MILLION)

- TABLE 167 EUROPE: STERILE FILTRATION MARKET FOR CMOS & CROS, BY COUNTRY, 2021–2028 (USD MILLION)

- TABLE 168 ASIA PACIFIC: STERILE FILTRATION MARKET FOR CMOS & CROS, BY COUNTRY, 2021–2028 (USD MILLION)

- TABLE 169 LATIN AMERICA: STERILE FILTRATION MARKET FOR CMOS & CROS, BY COUNTRY, 2021–2028 (USD MILLION)

- TABLE 170 STERILE FILTRATION MARKET FOR ACADEMIC & RESEARCH INSTITUTES, BY REGION, 2021–2028 (USD MILLION)

- TABLE 171 NORTH AMERICA: STERILE FILTRATION MARKET FOR ACADEMIC & RESEARCH INSTITUTES, BY COUNTRY, 2021–2028 (USD MILLION)

- TABLE 172 EUROPE: STERILE FILTRATION MARKET FOR ACADEMIC & RESEARCH INSTITUTES BY COUNTRY, 2021–2028 (USD MILLION)

- TABLE 173 ASIA PACIFIC: STERILE FILTRATION MARKET FOR ACADEMIC & RESEARCH INSTITUTES, BY COUNTRY, 2021–2028 (USD MILLION)

- TABLE 174 LATIN AMERICA: STERILE FILTRATION MARKET FOR ACADEMIC & RESEARCH INSTITUTES, BY COUNTRY, 2021–2028 (USD MILLION)

- TABLE 175 STERILE FILTRATION MARKET, BY REGION, 2021–2028 (USD MILLION)

- TABLE 176 NORTH AMERICA: STERILE FILTRATION MARKET, BY COUNTRY, 2021–2028 (USD MILLION)

- TABLE 177 NORTH AMERICA: STERILE FILTRATION MARKET, BY PRODUCT, 2021–2028 (USD MILLION)

- TABLE 178 NORTH AMERICA: STERILE FILTRATION MARKET, BY MEMBRANE TYPE, 2021–2028 (USD MILLION)

- TABLE 179 NORTH AMERICA: STERILE FILTRATION MARKET, BY MEMBRANE PORE SIZE, 2021–2028 (USD MILLION)

- TABLE 180 NORTH AMERICA: STERILE FILTRATION MARKET, BY APPLICATION, 2021–2028 (USD MILLION)

- TABLE 181 NORTH AMERICA: APPLICATION MARKET FOR FINAL PRODUCT PROCESSING, BY TYPE, 2021–2028 (USD MILLION)

- TABLE 182 NORTH AMERICA: APPLICATION MARKET FOR RAW MATERIAL FILTRATION, BY TYPE, 2021–2028 (USD MILLION)

- TABLE 183 NORTH AMERICA: STERILE FILTRATION MARKET, BY END USER, 2021–2028 (USD MILLION)

- TABLE 184 US: STERILE FILTRATION MARKET, BY PRODUCT, 2021–2028 (USD MILLION)

- TABLE 185 US: STERILE FILTRATION MARKET, BY MEMBRANE TYPE, 2021–2028 (USD MILLION)

- TABLE 186 US: STERILE FILTRATION MARKET, BY MEMBRANE PORE SIZE, 2021–2028 (USD MILLION)

- TABLE 187 US: STERILE FILTRATION MARKET, BY APPLICATION, 2021–2028 (USD MILLION)

- TABLE 188 US: STERILE FILTRATION MARKET FOR FINAL PRODUCT PROCESSING, BY TYPE, 2021–2028 (USD MILLION)

- TABLE 189 US: STERILE FILTRATION MARKET FOR RAW MATERIAL FILTRATION, BY TYPE, 2021–2028 (USD MILLION)

- TABLE 190 US: STERILE FILTRATION MARKET, BY END USER, 2021–2028 (USD MILLION)

- TABLE 191 CANADA: STERILE FILTRATION MARKET, BY PRODUCT, 2021–2028 (USD MILLION)

- TABLE 192 CANADA: STERILE FILTRATION MARKET, BY MEMBRANE TYPE, 2021–2028 (USD MILLION)

- TABLE 193 CANADA: STERILE FILTRATION MARKET, BY MEMBRANE PORE SIZE, 2021–2028 (USD MILLION)

- TABLE 194 CANADA: STERILE FILTRATION MARKET, BY APPLICATION, 2021–2028 (USD MILLION)

- TABLE 195 CANADA: STERILE FILTRATION MARKET FOR FINAL PRODUCT PROCESSING, BY TYPE, 2021–2028 (USD MILLION)

- TABLE 196 CANADA: STERILE FILTRATION MARKET FOR RAW MATERIAL FILTRATION, BY TYPE, 2021–2028 (USD MILLION)

- TABLE 197 CANADA: STERILE FILTRATION MARKET, BY END USER, 2021–2028 (USD MILLION)

- TABLE 198 EUROPE: STERILE FILTRATION MARKET, BY COUNTRY, 2021–2028 (USD MILLION)

- TABLE 199 EUROPE: STERILE FILTRATION MARKET, BY PRODUCT, 2021–2028 (USD MILLION)

- TABLE 200 EUROPE: STERILE FILTRATION MARKET, BY MEMBRANE TYPE, 2021–2028 (USD MILLION)

- TABLE 201 EUROPE: STERILE FILTRATION MARKET, BY MEMBRANE PORE SIZE, 2021–2028 (USD MILLION)

- TABLE 202 EUROPE: STERILE FILTRATION MARKET, BY APPLICATION, 2021–2028 (USD MILLION)

- TABLE 203 EUROPE: STERILE FILTRATION MARKET FOR FINAL PRODUCT PROCESSING, BY TYPE, 2021–2028 (USD MILLION)

- TABLE 204 EUROPE: STERILE FILTRATION MARKET FOR RAW MATERIAL FILTRATION, BY TYPE, 2021–2028 (USD MILLION)

- TABLE 205 EUROPE: STERILE FILTRATION MARKET, BY END USER, 2021–2028 (USD MILLION)

- TABLE 206 GERMANY: STERILE FILTRATION MARKET, BY PRODUCT, 2021–2028 (USD MILLION)

- TABLE 207 GERMANY: STERILE FILTRATION MARKET, BY MEMBRANE TYPE, 2021–2028 (USD MILLION)

- TABLE 208 GERMANY: STERILE FILTRATION MARKET, BY MEMBRANE PORE SIZE, 2021–2028 (USD MILLION)

- TABLE 209 GERMANY: STERILE FILTRATION MARKET, BY APPLICATION, 2021–2028 (USD MILLION)

- TABLE 210 GERMANY: STERILE FILTRATION MARKET FOR FINAL PRODUCT PROCESSING, BY TYPE, 2021–2028 (USD MILLION)

- TABLE 211 GERMANY: STERILE FILTRATION MARKET FOR RAW MATERIAL FILTRATION, BY TYPE, 2021–2028 (USD MILLION)

- TABLE 212 GERMANY: STERILE FILTRATION MARKET, BY END USER, 2021–2028 (USD MILLION)

- TABLE 213 UK: STERILE FILTRATION MARKET, BY PRODUCT, 2021–2028 (USD MILLION)

- TABLE 214 UK: STERILE FILTRATION MARKET, BY MEMBRANE TYPE, 2021–2028 (USD MILLION)

- TABLE 215 UK: STERILE FILTRATION MARKET, BY MEMBRANE PORE SIZE, 2021–2028 (USD MILLION)

- TABLE 216 UK: STERILE FILTRATION MARKET, BY APPLICATION, 2021–2028 (USD MILLION)

- TABLE 217 UK: STERILE FILTRATION MARKET FOR FINAL PRODUCT PROCESSING, BY TYPE, 2021–2028 (USD MILLION)

- TABLE 218 UK: STERILE FILTRATION MARKET FOR RAW MATERIAL FILTRATION, BY TYPE, 2021–2028 (USD MILLION)

- TABLE 219 UK: STERILE FILTRATION MARKET, BY END USER, 2021–2028 (USD MILLION)

- TABLE 220 FRANCE: STERILE FILTRATION MARKET, BY PRODUCT, 2021–2028 (USD MILLION)

- TABLE 221 FRANCE: STERILE FILTRATION MARKET, BY MEMBRANE TYPE, 2021–2028 (USD MILLION)

- TABLE 222 FRANCE: STERILE FILTRATION MARKET, BY MEMBRANE PORE SIZE, 2021–2028 (USD MILLION)

- TABLE 223 FRANCE: STERILE FILTRATION MARKET, BY APPLICATION, 2021–2028 (USD MILLION)

- TABLE 224 FRANCE: STERILE FILTRATION MARKET FOR FINAL PRODUCT PROCESSING, BY TYPE, 2021–2028 (USD MILLION)

- TABLE 225 FRANCE: STERILE FILTRATION MARKET FOR RAW MATERIAL FILTRATION, BY TYPE, 2021–2028 (USD MILLION)

- TABLE 226 FRANCE: STERILE FILTRATION MARKET, BY END USER, 2021–2028 (USD MILLION)

- TABLE 227 ITALY: STERILE FILTRATION MARKET, BY PRODUCT, 2021–2028 (USD MILLION)

- TABLE 228 ITALY: STERILE FILTRATION MARKET, BY MEMBRANE TYPE, 2021–2028 (USD MILLION)

- TABLE 229 ITALY: STERILE FILTRATION MARKET, BY PORE SIZE, 2021–2028 (USD MILLION)

- TABLE 230 ITALY: STERILE FILTRATION MARKET, BY APPLICATION, 2021–2028 (USD MILLION)

- TABLE 231 ITALY: STERILE FILTRATION MARKET FOR FINAL PRODUCT PROCESSING, BY TYPE, 2021–2028 (USD MILLION)

- TABLE 232 ITALY: STERILE FILTRATION MARKET FOR RAW MATERIAL FILTRATION, BY TYPE, 2021–2028 (USD MILLION)

- TABLE 233 ITALY: STERILE FILTRATION MARKET, BY END USER, 2021–2028 (USD MILLION)

- TABLE 234 SPAIN: STERILE FILTRATION MARKET, BY PRODUCT, 2021–2028 (USD MILLION)

- TABLE 235 SPAIN: STERILE FILTRATION MARKET, BY MEMBRANE TYPE, 2021–2028 (USD MILLION)

- TABLE 236 SPAIN: STERILE FILTRATION MARKET, BY MEMBRANE PORE SIZE, 2021–2028 (USD MILLION)

- TABLE 237 SPAIN: STERILE FILTRATION MARKET, BY APPLICATION, 2021–2028 (USD MILLION)

- TABLE 238 SPAIN: STERILE FILTRATION MARKET FOR FINAL PRODUCT PROCESSING, BY TYPE, 2021–2028 (USD MILLION)

- TABLE 239 SPAIN: STERILE FILTRATION MARKET FOR RAW MATERIAL FILTRATION, BY TYPE, 2021–2028 (USD MILLION)

- TABLE 240 SPAIN: STERILE FILTRATION MARKET, BY END USER, 2021–2028 (USD MILLION)

- TABLE 241 REST OF EUROPE: STERILE FILTRATION MARKET, BY PRODUCT, 2021–2028 (USD MILLION)

- TABLE 242 REST OF EUROPE: STERILE FILTRATION MARKET, BY MEMBRANE TYPE, 2021–2028 (USD MILLION)

- TABLE 243 REST OF EUROPE: STERILE FILTRATION MARKET, BY MEMBRANE PORE SIZE, 2021–2028 (USD MILLION)

- TABLE 244 REST OF EUROPE: STERILE FILTRATION MARKET, BY APPLICATION, 2021–2028 (USD MILLION)

- TABLE 245 REST OF EUROPE: STERILE FILTRATION MARKET FOR FINAL PRODUCT PROCESSING, BY TYPE, 2021–2028 (USD MILLION)

- TABLE 246 REST OF EUROPE: STERILE FILTRATION MARKET FOR RAW MATERIAL FILTRATION, BY TYPE, 2021–2028 (USD MILLION)

- TABLE 247 REST OF EUROPE: STERILE FILTRATION MARKET, BY END USER, 2021–2028 (USD MILLION)

- TABLE 248 ASIA PACIFIC: STERILE FILTRATION MARKET, BY COUNTRY, 2021–2028 (USD MILLION)

- TABLE 249 ASIA PACIFIC: STERILE FILTRATION MARKET, BY PRODUCT, 2021–2028 (USD MILLION)

- TABLE 250 ASIA PACIFIC: STERILE FILTRATION MARKET, BY MEMBRANE TYPE, 2021–2028 (USD MILLION)

- TABLE 251 ASIA PACIFIC: STERILE FILTRATION MARKET, BY MEMBRANE PORE SIZE, 2021–2028 (USD MILLION)

- TABLE 252 ASIA PACIFIC: STERILE FILTRATION MARKET, BY APPLICATION, 2021–2028 (USD MILLION)

- TABLE 253 ASIA PACIFIC: STERILE FILTRATION MARKET FOR FINAL PRODUCT PROCESSING, BY TYPE, 2021–2028 (USD MILLION)

- TABLE 254 ASIA PACIFIC: STERILE FILTRATION MARKET FOR RAW MATERIAL FILTRATION, BY TYPE, 2021–2028 (USD MILLION)

- TABLE 255 ASIA PACIFIC: STERILE FILTRATION MARKET, BY END USER, 2021–2028 (USD MILLION)

- TABLE 256 CHINA: STERILE FILTRATION MARKET, BY PRODUCT, 2021–2028 (USD MILLION)

- TABLE 257 CHINA: STERILE FILTRATION MARKET, BY MEMBRANE TYPE, 2021–2028 (USD MILLION)

- TABLE 258 CHINA: STERILE FILTRATION MARKET, BY MEMBRANE PORE SIZE, 2021–2028 (USD MILLION)

- TABLE 259 CHINA: STERILE FILTRATION MARKET, BY APPLICATION, 2021–2028 (USD MILLION)

- TABLE 260 CHINA: STERILE FILTRATION MARKET FOR FINAL PRODUCT PROCESSING, BY TYPE, 2021–2028 (USD MILLION)

- TABLE 261 CHINA: STERILE FILTRATION MARKET FOR RAW MATERIAL FILTRATION, BY TYPE, 2021–2028 (USD MILLION)

- TABLE 262 CHINA: STERILE FILTRATION MARKET, BY END USER, 2021–2028 (USD MILLION)

- TABLE 263 JAPAN: STERILE FILTRATION MARKET, BY PRODUCT, 2021–2028 (USD MILLION)

- TABLE 264 JAPAN: STERILE FILTRATION MARKET, BY MEMBRANE TYPE, 2021–2028 (USD MILLION)

- TABLE 265 JAPAN: STERILE FILTRATION MARKET, BY MEMBRANE PORE SIZE, 2021–2028 (USD MILLION)

- TABLE 266 JAPAN: STERILE FILTRATION MARKET, BY APPLICATION, 2021–2028 (USD MILLION)

- TABLE 267 JAPAN: STERILE FILTRATION MARKET FOR FINAL PRODUCT PROCESSING, BY TYPE, 2021–2028 (USD MILLION)

- TABLE 268 JAPAN: STERILE FILTRATION MARKET FOR RAW MATERIAL FILTRATION, BY TYPE, 2021–2028 (USD MILLION)

- TABLE 269 JAPAN: STERILE FILTRATION MARKET, BY END USER, 2021–2028 (USD MILLION)

- TABLE 270 INDIA: STERILE FILTRATION MARKET, BY PRODUCT, 2021–2028 (USD MILLION)

- TABLE 271 INDIA: STERILE FILTRATION MARKET, BY MEMBRANE TYPE, 2021–2028 (USD MILLION)

- TABLE 272 INDIA: STERILE FILTRATION MARKET, BY MEMBRANE PORE SIZE, 2021–2028 (USD MILLION)

- TABLE 273 INDIA: STERILE FILTRATION MARKET, BY APPLICATION, 2021–2028 (USD MILLION)

- TABLE 274 INDIA: STERILE FILTRATION MARKET FOR FINAL PRODUCT PROCESSING, BY TYPE, 2021–2028 (USD MILLION)

- TABLE 275 INDIA: STERILE FILTRATION MARKET FOR RAW MATERIAL FILTRATION, BY TYPE, 2021–2028 (USD MILLION)

- TABLE 276 INDIA: STERILE FILTRATION MARKET, BY END USER, 2021–2028 (USD MILLION)

- TABLE 277 REST OF ASIA PACIFIC: STERILE FILTRATION MARKET, BY PRODUCT, 2021–2028 (USD MILLION)

- TABLE 278 REST OF ASIA PACIFIC: STERILE FILTRATION MARKET, BY MEMBRANE TYPE, 2021–2028 (USD MILLION)

- TABLE 279 REST OF ASIA PACIFIC: STERILE FILTRATION MARKET, BY MEMBRANE PORE SIZE, 2021–2028 (USD MILLION)

- TABLE 280 REST OF ASIA PACIFIC: STERILE FILTRATION MARKET, BY APPLICATION, 2021–2028 (USD MILLION)

- TABLE 281 REST OF ASIA PACIFIC: STERILE FILTRATION MARKET FOR FINAL PRODUCT PROCESSING, BY TYPE, 2021–2028 (USD MILLION)

- TABLE 282 REST OF ASIA PACIFIC: STERILE FILTRATION MARKET FOR RAW MATERIAL FILTRATION, BY TYPE, 2021–2028 (USD MILLION)

- TABLE 283 REST OF ASIA PACIFIC: STERILE FILTRATION MARKET, BY END USER, 2021–2028 (USD MILLION)

- TABLE 284 LATIN AMERICA: STERILE FILTRATION MARKET, BY COUNTRY, 2021–2028 (USD MILLION)

- TABLE 285 LATIN AMERICA: STERILE FILTRATION MARKET, BY PRODUCT, 2021–2028 (USD MILLION)

- TABLE 286 LATIN AMERICA: STERILE FILTRATION MARKET, BY MEMBRANE TYPE, 2021–2028 (USD MILLION)

- TABLE 287 LATIN AMERICA: STERILE FILTRATION MARKET, BY MEMBRANE PORE SIZE, 2021–2028 (USD MILLION)

- TABLE 288 LATIN AMERICA: STERILE FILTRATION MARKET, BY APPLICATION, 2021–2028 (USD MILLION)

- TABLE 289 LATIN AMERICA: STERILE FILTRATION MARKET FOR FINAL PRODUCT PROCESSING, BY TYPE, 2021–2028 (USD MILLION)

- TABLE 290 LATIN AMERICA: STERILE FILTRATION MARKET FOR RAW MATERIAL FILTRATION, BY TYPE, 2021–2028 (USD MILLION)

- TABLE 291 LATIN AMERICA: STERILE FILTRATION MARKET, BY END USER, 2021–2028 (USD MILLION)

- TABLE 292 BRAZIL: STERILE FILTRATION MARKET, BY PRODUCT, 2021–2028 (USD MILLION)

- TABLE 293 BRAZIL: STERILE FILTRATION MARKET, BY MEMBRANE TYPE, 2021–2028 (USD MILLION)

- TABLE 294 BRAZIL: STERILE FILTRATION MARKET, BY MEMBRANE PORE SIZE, 2021–2028 (USD MILLION)

- TABLE 295 BRAZIL: STERILE FILTRATION MARKET, BY APPLICATION, 2021–2028 (USD MILLION)

- TABLE 296 BRAZIL: STERILE FILTRATION MARKET FOR FINAL PRODUCT PROCESSING, BY TYPE, 2021–2028 (USD MILLION)

- TABLE 297 BRAZIL: STERILE FILTRATION MARKET FOR RAW MATERIAL FILTRATION, BY TYPE, 2021–2028 (USD MILLION)

- TABLE 298 BRAZIL: STERILE FILTRATION MARKET, BY END USER, 2021–2028 (USD MILLION)

- TABLE 299 REST OF LATIN AMERICA: STERILE FILTRATION MARKET, BY PRODUCT, 2021–2028 (USD MILLION)

- TABLE 300 REST OF LATIN AMERICA: STERILE FILTRATION MARKET, BY MEMBRANE TYPE, 2021–2028 (USD MILLION)

- TABLE 301 REST OF LATIN AMERICA: STERILE FILTRATION MARKET, BY MEMBRANE PORE SIZE, 2021–2028 (USD MILLION)

- TABLE 302 REST OF LATIN AMERICA: STERILE FILTRATION MARKET, BY APPLICATION, 2021–2028 (USD MILLION)

- TABLE 303 REST OF LATIN AMERICA: STERILE FILTRATION MARKET FOR FINAL PRODUCT PROCESSING, BY TYPE, 2021–2028 (USD MILLION)

- TABLE 304 REST OF LATIN AMERICA: STERILE FILTRATION MARKET FOR RAW MATERIAL FILTRATION, BY TYPE, 2021–2028 (USD MILLION)

- TABLE 305 REST OF LATIN AMERICA: STERILE FILTRATION MARKET, BY END USER, 2021–2028 (USD MILLION)

- TABLE 306 MIDDLE EAST & AFRICA: STERILE FILTRATION MARKET, BY PRODUCT, 2021–2028 (USD MILLION)

- TABLE 307 MIDDLE EAST & AFRICA: STERILE FILTRATION MARKET, BY MEMBRANE TYPE, 2021–2028 (USD MILLION)

- TABLE 308 MIDDLE EAST & AFRICA: STERILE FILTRATION MARKET, BY MEMBRANE PORE SIZE, 2021–2028 (USD MILLION)

- TABLE 309 MIDDLE EAST & AFRICA: STERILE FILTRATION MARKET, BY APPLICATION, 2021–2028 (USD MILLION)

- TABLE 310 MIDDLE EAST & AFRICA: STERILE FILTRATION MARKET FOR FINAL PRODUCT PROCESSING, BY TYPE, 2021–2028 (USD MILLION)

- TABLE 311 MIDDLE EAST & AFRICA: STERILE FILTRATION MARKET FOR RAW MATERIAL FILTRATION, BY TYPE, 2021–2028 (USD MILLION)

- TABLE 312 MIDDLE EAST & AFRICA: STERILE FILTRATION MARKET, BY END USER, 2021–2028 (USD MILLION)

- TABLE 313 STERILE FILTRATION MARKET: DEGREE OF COMPETITION

- TABLE 314 FOOTPRINT ANALYSIS OF KEY PLAYERS IN STERILE FILTRATION MARKET

- TABLE 315 PRODUCT FOOTPRINT ANALYSIS OF KEY PLAYERS IN STERILE FILTRATION MARKET

- TABLE 316 END USER FOOTPRINT ANALYSIS OF KEY PLAYERS IN STERILE FILTRATION MARKET

- TABLE 317 GEOGRAPHICAL FOOTPRINT ANALYSIS OF KEY PLAYERS IN STERILE FILTRATION MARKET

- TABLE 318 STERILE FILTRATION MARKET: DETAILED LIST OF KEY START-UPS/SMES

- TABLE 319 STERILE FILTRATION MARKET: COMPETITIVE BENCHMARKING OF KEY START-UPS/SMES

- TABLE 320 STERILE FILTRATION MARKET: KEY PRODUCT LAUNCHES

- TABLE 321 STERILE FILTRATION MARKET: KEY DEALS

- TABLE 322 STERILE FILTRATION MARKET: KEY EXPANSIONS

- TABLE 323 MERCK KGAA: COMPANY OVERVIEW

- TABLE 324 DANAHER CORPORATION: COMPANY OVERVIEW

- TABLE 325 SARTORIUS AG: COMPANY OVERVIEW

- TABLE 326 THERMO FISHER SCIENTIFIC INC.: COMPANY OVERVIEW

- TABLE 327 3M: COMPANY OVERVIEW

- TABLE 328 PARKER HANNIFIN CORP.: COMPANY OVERVIEW

- TABLE 329 PORVAIR PLC: COMPANY OVERVIEW

- TABLE 330 ALFA LAVAL: COMPANY OVERVIEW

- TABLE 331 DONALDSON COMPANY, INC.: COMPANY OVERVIEW

- TABLE 332 CORNING INCORPORATED: COMPANY OVERVIEW

- TABLE 333 EATON: COMPANY OVERVIEW

- TABLE 334 GVS S.P.A.: COMPANY OVERVIEW

- FIGURE 1 RESEARCH DESIGN

- FIGURE 2 BREAKDOWN OF PRIMARIES, BY RESPONDENT, DESIGNATION, AND REGION

- FIGURE 3 STERILE FILTRATION MARKET SIZE ESTIMATION (SUPPLY SIDE ANALYSIS), 2022

- FIGURE 4 MARKET SIZE ESTIMATION: APPROACH 1-COMPANY REVENUE ANALYSIS, 2022

- FIGURE 5 MARKET SIZE VALIDATION FROM PRIMARY SOURCES

- FIGURE 6 STERILE FILTRATION MARKET (SUPPLY SIDE): CAGR PROJECTIONS

- FIGURE 7 STERILE FILTRATION MARKET (DEMAND SIDE): GROWTH ANALYSIS OF DEMAND SIDE FACTORS

- FIGURE 8 DATA TRIANGULATION METHODOLOGY

- FIGURE 9 STERILE FILTRATION MARKET, BY PRODUCT, 2023 VS. 2028 (USD MILLION)

- FIGURE 10 STERILE FILTRATION MARKET, BY MEMBRANE TYPE, 2023 VS. 2028 (USD MILLION)

- FIGURE 11 STERILE FILTRATION MARKET, BY MEMBRANE PORE SIZE, 2023 VS. 2028 (USD MILLION)

- FIGURE 12 STERILE FILTRATION MARKET, BY APPLICATION, 2023 VS. 2028 (USD MILLION)

- FIGURE 13 STERILE FILTRATION MARKET, BY END USER, 2022 VS. 2028 (USD MILLION)

- FIGURE 14 GEOGRAPHICAL SNAPSHOT OF STERILE FILTRATION MARKET

- FIGURE 15 GROWING DEMAND FOR STERILE FILTERS AND INCREASING PURITY REQUIREMENTS TO DRIVE MARKET

- FIGURE 16 PHARMACEUTICAL & BIOTECHNOLOGY COMPANIES DOMINATED NORTH AMERICAN STERILE FILTRATION MARKET IN 2022

- FIGURE 17 FINAL PRODUCT PROCESSING APPLICATION SEGMENT TO POSSESS LARGEST MARKET SHARE IN 2028

- FIGURE 18 PHARMACEUTICAL & BIOTECHNOLOGY COMPANIES END USER SEGMENT COMMANDED MARKET IN 2022

- FIGURE 19 ASIA PACIFIC TO REGISTER HIGHEST GROWTH RATE FROM 2023 TO 2028

- FIGURE 20 STERILE FILTRATION MARKET: DRIVERS, RESTRAINTS, OPPORTUNITIES, AND CHALLENGES

- FIGURE 21 SPECTRUM OF SCENARIOS BASED ON IMPACT OF UNCERTAINTIES ON GROWTH OF STERILE FILTRATION MARKET

- FIGURE 22 REVENUE SHIFT AND NEW REVENUE POCKETS FOR STERILE FILTRATION PRODUCT PROVIDERS

- FIGURE 23 VALUE CHAIN ANALYSIS OF STERILE FILTRATION MARKET

- FIGURE 24 STERILE FILTRATION MARKET: SUPPLY CHAIN ANALYSIS

- FIGURE 25 STERILE FILTRATION MARKET: ECOSYSTEM ANALYSIS

- FIGURE 26 PATENT APPLICATIONS FOR STERILE FILTRATION MARKET, JANUARY 2013–MARCH 2023

- FIGURE 27 INFLUENCE OF STAKEHOLDERS ON BUYING PROCESS OF STERILE FILTRATION PRODUCTS

- FIGURE 28 KEY BUYING CRITERIA FOR END USERS

- FIGURE 29 NORTH AMERICA: STERILE FILTRATION MARKET SNAPSHOT

- FIGURE 30 ASIA PACIFIC: STERILE FILTRATION MARKET SNAPSHOT

- FIGURE 31 KEY STRATEGIES ADOPTED BY MAJOR COMPANIES IN STERILE FILTRATION MARKET

- FIGURE 32 STERILE FILTRATION MARKET: MARKET SHARE ANALYSIS OF KEY PLAYERS (2022)

- FIGURE 33 REVENUE ANALYSIS FOR KEY COMPANIES (2020–2022)

- FIGURE 34 STERILE FILTRATION MARKET: COMPANY EVALUATION MATRIX, 2022

- FIGURE 35 STERILE FILTRATION MARKET: COMPANY EVALUATION MATRIX FOR START-UPS/SMES, 2021

- FIGURE 36 MERCK KGAA: COMPANY SNAPSHOT

- FIGURE 37 DANAHER CORPORATION: COMPANY SNAPSHOT

- FIGURE 38 SARTORIUS AG: COMPANY SNAPSHOT

- FIGURE 39 THERMO FISHER SCIENTIFIC INC.: COMPANY SNAPSHOT

- FIGURE 40 3M: COMPANY SNAPSHOT

- FIGURE 41 PARKER HANNIFIN CORP.: COMPANY SNAPSHOT

- FIGURE 42 PORVAIR PLC: COMPANY SNAPSHOT

- FIGURE 43 ALFA LAVAL: COMPANY SNAPSHOT

- FIGURE 44 DONALDSON COMPANY, INC.: COMPANY SNAPSHOT

- FIGURE 45 CORNING INCORPORATED: COMPANY SNAPSHOT

- FIGURE 46 EATON: COMPANY SNAPSHOT

- FIGURE 47 GVS S.P.A.: COMPANY SNAPSHOT

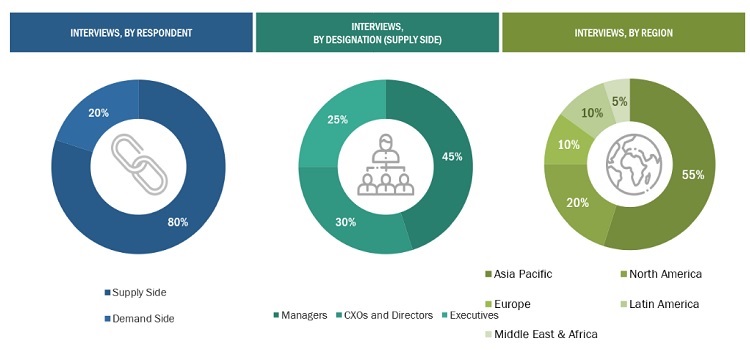

This research study involved the extensive use of secondary sources, directories, and databases to identify and collect valuable information for the analysis of the global sterile filtration market. In-depth interviews were conducted with various primary respondents, including key industry participants, subject-matter experts (SMEs), C-level executives of key market players, and industry consultants, to obtain and verify critical qualitative and quantitative information and assess growth prospects of the market. The global market size estimated through secondary research was then triangulated with inputs from primary research to arrive at the final market size.

Secondary Research

The secondary sources referred to for this research study include publications from government sources, such as the World Bank, International Society for Pharmaceutical Engineering (ISPE), Bio-Process Systems Alliance (BPSA), U.S. Food and Drug Administration (US FDA), American Filtration and Separations Society (AFS), American Membrane Technology Association (AMTA), Indian Pharmaceutical Association (IPA), Parenteral Drug Association (PDA). Secondary sources also include corporate and regulatory filings, such as annual reports, SEC filings, investor presentations, and financial statements; business magazines & research journals; press releases; and trade, business, and professional associations. Secondary data was collected and analyzed to arrive at the overall size of the global sterile filtration market, which was validated through primary research.

Primary Research

Extensive primary research was conducted after acquiring basic knowledge about the global sterile filtration market scenario through secondary research. Several primary interviews were conducted with market experts from the demand side, such as personnel from pharmaceutical and biopharmaceutical industries, food and beverage companies, CMOs and CROs, academic & research institutes, and experts from the supply side, such as C-level and D-level executives, product managers, marketing & sales managers of key manufacturers, distributors, and channel partners. These interviews were conducted across four major regions, including the Asia Pacific, North America, Europe, Latin America, and the Middle East & Africa. Approximately 80% and 20% of the primary interviews were conducted with supply-side and demand-side participants, respectively. This primary data was collected through questionnaires, e-mails, online surveys, personal interviews, and telephonic interviews.

The following is a breakdown of the primary respondents:

To know about the assumptions considered for the study, download the pdf brochure

Market Size Estimation

The global size of the market was estimated through multiple approaches. A detailed market estimation approach was followed to estimate and validate the value of the sterile filtration market and other dependent submarkets. These methods were also used extensively to estimate the size of various subsegments in the market. The research methodology used to estimate the market size includes the following:

- The key players in the industry and market have been identified through extensive primary and secondary research.

- The revenues generated from the sterile filtration business of leading players have been determined through primary and secondary research.

- All percentage shares, splits, and breakdowns have been determined using secondary sources and verified through primary sources.

Data Triangulation

After arriving at the market size from the market size estimation process explained above, the total market was divided into several segments and subsegments. Data triangulation and market breakdown procedures were employed, wherever applicable, to complete the overall market engineering process and arrive at the exact statistics for all segments and subsegments.

Market Definition

Sterile filtration is the process of removing microorganisms from a fluid stream without adversely affecting product quality. It is the most common step in the manufacturing of small- and large-drug molecules and food & beverage products, it also helps to prevent microbial contamination

Stakeholders

- Filter Manufacturers, Vendors, and Distributors

- Academic and Government Research Institutes

- Pharmaceutical and Biotechnology Companies

- Life Science Companies

- Venture Capitalists and Investors

- Government Organizations

- Private Research Firms

- Research & Development (R&D) Companies

- Contract Research Organizations (CROS)

- Contract Development and Manufacturing Organizations Market Research and Consulting Firms

Report Objectives

- To define, describe, and forecast the global sterile filtration market based on product, membrane type, pore size, application, end user, and region

- To provide detailed information regarding the major factors influencing the growth of the market (such as drivers, restraints, opportunities, and challenges)

- To strategically analyze micromarkets with respect to individual growth trends, prospects, and contributions to the overall market

- To analyze the opportunities in the market for stakeholders and provide details of the competitive landscape for market leaders

- To forecast the size of the market segments with respect to five main regions, namely, North America, Europe, the Asia Pacific, Latin America, and the Middle East & Africa

- To profile the key players and comprehensively analyze their product portfolios, market positions, and core competencies

- To track and analyze competitive developments such as acquisitions, product launches, expansions, agreements, partnerships, and collaborations in the market

Available Customizations

With the given market data, MarketsandMarkets offers customizations as per the company’s specific needs. The following customization options are available for this report:

Generating Response ...

Generating Response ...

Growth opportunities and latent adjacency in Sterile Filtration Market