Cellulose Esters Market by Type (Cellulose Acetate, Cellulose Acetate Butyrate, Cellulose Acetate Propionate, Cellulose Nitrate), by Application (Coatings, Plasticizers, Cigarette Filters, Films & tapes, Inks), and Region - Global Forecast to 2023

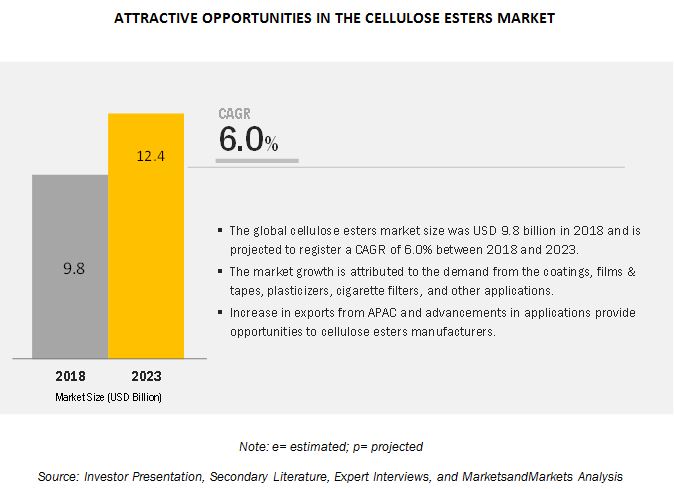

[111 Pages Report] The cellulose esters market is projected to grow from USD 8.76 billion in 2017 to USD 12.43 billion by 2023, at a CAGR of 6.0% from 2018 to 2023. The growth of the cellulose esters market across the globe is driven by the increasing use of cellulose esters in coatings, films & tapes, and cigarette filters applications.

Among types, the cellulose acetate segment is projected to lead the cellulose esters market from 2018 to 2023 in terms of both, value and volume.

The cellulose acetate type segment is projected to lead the cellulose esters market during the forecast period in terms of both, value and volume. The growth of this segment of the market can be attributed to the wide applicability of cellulose acetate esters in various applications such as cigarette filters, coatings, plasticizers, and films & tapes as these esters offer excellent mechanical and physical properties.

Among applications, the coatings segment is projected to lead the cellulose esters market from 2018 to 2023, in terms of value.

The coatings application segment is projected to lead the cellulose esters market during the forecast period, in terms of value. The growth of this segment of the market can be attributed to the increased use of cellulose esters in coatings required by the automotive and oil & gas industries.

Source: Investor Presentation, Secondary Literature, Expert Interviews, and MarketsandMarkets Analysis

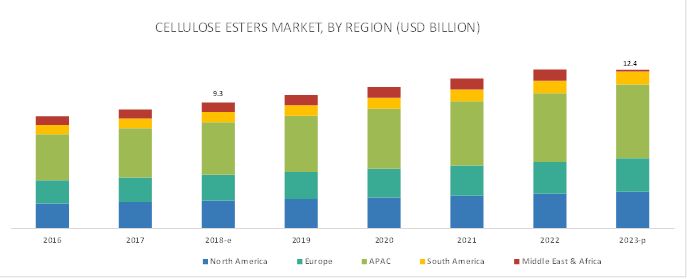

In terms of value, the Asia Pacific region is projected to lead the cellulose esters market from 2018 to 2023.

The Asia Pacific region is projected to lead the cellulose esters market during the forecast period, in terms of value. The growth of the Asia Pacific cellulose esters market can be attributed to the increased demand for cellulose esters from China, India, and the Southeast Asian countries. Factors such as a shift in the cigarette manufacturing base from developed to emerging economies and an increase in the number of cellulose ester applications are expected to drive the growth of the Asia Pacific cellulose esters market during the forecast period.

Market Dynamics

Driver: Advancement in the application of cellulose esters

Owing to a rise in the cases of lung cancer (highest in males), cigarette companies initiated a shift in cigarette design from unfiltered to filtered type. Cellulose acetate is primarily used in the production of cigarette filter tow, which is used as cigarette filters. Cigarette filters are specifically designed to accumulate smoke components and absorb vapors. They help in decreasing the amount of chemical particles and the smoke inhaled by smokers. Cellulose fibers are used in clothing and textiles because they make the material breathable, comfortable, and absorbent. They can be combined with various ranges of fibers such as wool, rayon, cotton, and silk, and also be dyed in different colors.

Cellulose acetate is also used during the injection molding process for the manufacturing of spectacle frames. It helps in providing proper color blends and effect to the spectacle frames. The advancements in the applications act as a driving factor for the cellulose esters market.

Restraint: Rising awareness about health risk related to smoking

There is a growing awareness about the health risks associated with cigarette smoking. A recent study by the World Health Organization (WHO) says that only 25% of the Chinese adults are aware of the health hazards related to smoking. In 2017, a survey was conducted by the Global Adults Tobacco Survey (GATS 2) in India, which showed a steep decline in tobacco consumption. India is the world’s second-largest consumer and the third-largest producer of tobacco. According to a study by GATS, the number of tobacco users declined by around 8.1 million in India, in 2017. Moreover, the Legal Metrology Act was amended by the Department of Consumer Affairs, which prohibited the sale of loose cigarettes that accounted for around 70% of the country’s total cigarette sales. These factors are affecting cigarette manufacturing and, thereby, the market for cellulose esters

Opportunity: Increase in export from APAC

China accounts for, approximately, 40% of the global cigarette manufacturing, in terms of volume. In addition, many countries (such as Bangladesh, Vietnam, China, and India) are leaders in textiles & apparel manufacturing, which boosts the cellulose esters market in the APAC region. According to recent data published by IBEF (India Brand Equity Foundation), the textile industry in India contributes around 4% to the GDP and 14% to the industrial production. China is the largest textiles producer and exporter in the world. The country’s textile exports to the US and to the EU region in the first quarter of 2016 represented a growth of 9.7%. The main reasons for the aforementioned growth are low production costs and the availability of cheap labor in APAC, especially in India and China. These factors prove to be an opportunity for the cellulose esters manufacturers.

Challenge: Volatile raw material prices

The raw materials used in the manufacturing of cellulose esters include wood pulp and purified plant-derived cellulose. The most common source of cellulose is pulp derived from trees grown in responsibly managed forests. Some of the wood pulp is obtained from third-party forest certification. Cellulose is also modified with raw materials containing acetyl groups to form cellulose acetate polymers. The raw materials used to manufacture these polymers are acetic acid and acetic anhydride. Acetic acid, one of the simplest organic acids and a key component of vinegar, can be produced by either the natural or synthetic chemical processes. Fluctuations in the prices of these raw materials, due to downstream demand and spot availability, are posing a challenge for cellulose ester manufacturers.

The cellulose esters market is also affected by high transport costs driven by rising fuel prices and higher manufacturing costs resulting from increasing energy costs. This also poses a risk to the cellulose ester manufacturers and is expected to bring down profit margins.

Scope of the Report

|

Report Metric

|

Details |

|

Years considered for the study |

2016-2023 |

|

Base year considered |

2017 |

|

Forecast period |

2018-2023 |

|

Units considered |

Value (USD Million) and Volume (Kiloton) |

|

Segments covered |

Type, Products, Process, Application and Region |

|

Regions covered |

APAC, Europe, North America, Middle East & Africa, and South America |

|

Companies profiled |

Eastman Chemical Company (US), Solvay (Belgium), China National Tobacco Corporation (China), Daicel Corporation (Japan), Celanese Corporation (US), Acordis Cellulostic Fibers (US), Sappi (South Africa), Mitsubishi Chemical Holdings Corporation (Japan), Rayonier Advanced Materials (US), and Sichuan Push Acetati (China). among others |

This research report categorizes the cellulose esters market based on type, application, and region.

Cellulose esters market, by type:

- Cellulose Acetate

- Cellulose Acetate Propionate

- Cellulose Acetate Butyrate

- Cellulose Nitrate

- Others (Cellulose Diacetate, Cellulose Sulfates, Cellulose Acetate Phthalate, and Cellulose Phosphate)

Cellulose esters market, by products:

- Carboxymethyl Cellulose

- Methyl Cellulose

- Ethyl Cellulose

- Hydroxyethyl Cellulose

- Hydroxypropyl Cellulose

Cellulose esters market, by application:

- Coatings

- Films & tapes

- Cigarette Filters

- Inks

- Plasticizers

- Others (Fillers, Binders, Thickeners & Stabilizers, and Flow Improvers)

Cellulose esters market, by process:

- Kraft

- Sulfite

Cellulose esters market, by region:

- APAC

- Europe

- North America

- Middle East & Africa

- South America

Key Market Players

Some of the key players operating in the cellulose esters market are Eastman Chemical Company (US), Solvay (Belgium), China National Tobacco Corporation (China), Daicel Corporation (Japan), Celanese Corporation (US), Acordis Cellulostic Fibers (US), Sappi (South Africa), Mitsubishi Chemical Holdings Corporation (Japan), Rayonier Advanced Materials (US), and Sichuan Push Acetati (China). Competition among these players is high, and they mostly compete with each other on prices and quality of their products and product customization. The growth of the end-use segments of the cellulose esters market is likely to encourage the manufactures to provide better products and technologies to their customers and explore the untapped markets.

Recent Developments

- In January 2017, Eastman launched its cellulose technology-based product named Eastman Naia cellulosic yarn. This product will further enhance the product line of Eastman in the cellulosic ether category

- In November 2017, Rayonier Advanced Materials completed the acquisition of Tembec, Inc. (Canada). Through this, the company has successfully combined two complementary high purity cellulose businesses and has also diversified its product offerings with paper, integrated forest products, newsprint, and paperboard businesses

- In June 2016, Solvay has taken complete ownership of Primester, its joint venture of cellulose acetate flake plant with Eastman Chemical Company (Germany), in the US. With this, Solvay has secured long-term supply for its tow businesses while adapting capacity to demand

Keyquestions addressed by the report

- What are the upcoming hot bets for the cellulose esters market?

- How are the market dynamics for different types of cellulose esters?

- How are the market dynamics for different applications of cellulose esters?

- Who are the major manufacturers of cellulose esters?

- What are the factors governing the cellulose esters market in each region?

Divestment, 2015–2018

| Date |

Company name |

Development |

|

May 2016 |

Eastman Chemical Company (Germany) |

Eastman entered into a definitive agreement with Solvay to sell its interest in the Kingsport, Tennessee, cellulose acetate flake joint venture named Primester. Eastman and Solvay are currently equal partners in the joint venture. The transaction allows Eastman to eliminate costs associated with the excess cellulose acetate flake capacity of the joint venture. |

Acquisition & Merger, 2015–2018

| Date |

Company name |

Development |

|

November 2017 |

Rayonier Advanced Materials (US) |

Rayonier Advanced Materials completed the acquisition of Tembec, Inc. (Canada). Through this, the company has successfully combined two complementary high purity cellulose businesses and has also diversified its product offerings with paper, integrated forest products, newsprint, and paperboard businesses. |

New Product Launch, 2015–2017

| Date |

Company name |

Development |

|

January 2017 |

Eastman Chemical Company (Germany) |

Eastman launched its cellulose technology-based product named Eastman Naia cellulosic yarn. This product will further enhance the product line of Eastman in the cellulosic ether category. |

|

May 2017 |

Eastman Chemical Company (Germany) |

Eastman launched engineering bioplastic product TREVA. It is composed of cellulose sourced from trees derived exclusively from sustainably managed forests. |

Agreement, 2015–2018

| Date |

Company name |

Development |

|

June 2016 |

Solvay (Belgium) |

Solvay has taken complete ownership of Primester, its joint venture of cellulose acetate flake plant with Eastman Chemical Company (Germany), in the US. With this, Solvay has secured long-term supply for its tow businesses while adapting capacity to demand. |

To speak to our analyst for a discussion on the above findings, click Speak to Analyst

Table of Contents

1 Introduction (Page No. - 13)

1.1 Objectives of the Study

1.2 Market Definition

1.3 Market Scope

1.3.1 Market Segmentation

1.3.2 Years Considered for the Study

1.4 Currency

1.5 Unit Considered

1.6 Stakeholders

2 Research Methodology (Page No. - 16)

2.1 Research Data

2.2 Secondary Data

2.2.1 Key Data From Secondary Sources

2.3 Primary Data

2.3.1 Key Data From Primary Sources

2.3.1.1 Key Industry Insights

2.3.1.2 Breakdown of Primary Interviews

2.4 Market Size Estimation

2.5 Data Triangulation

2.6 Assumptions and Limitations

2.6.1 Assumptions

2.6.2 Limitations

3 Executive Summary (Page No. - 24)

4 Premium Insights (Page No. - 27)

4.1 Attractive Opportunities in the Cellulose Esters Market

4.2 Cellulose Esters Market, By Region

4.3 Cellulose Esters Market, By Region and Application

4.4 Cellulose Esters Market, By Application

4.5 Cellulose Esters Market, By Country

5 Market Overview (Page No. - 31)

5.1 Introduction

5.2 Market Dynamics

5.2.1 Drivers

5.2.1.1 Increasing Demand for Cellulose Esters From APAC

5.2.1.2 Advancements in the Applications of Cellulose Esters

5.2.2 Restraints

5.2.2.1 Rising Awareness About Health Risks Related to Smoking

5.2.3 Opportunities

5.2.3.1 Increase in Exports From APAC

5.2.4 Challenges

5.2.4.1 Volatile Raw Material Prices

5.2.4.2 Stringent Regulations

5.3 Porter’s Five Forces Analysis

5.3.1 Threat of New Entrants

5.3.2 Threat of Substitutes

5.3.3 Bargaining Power of Suppliers

5.3.4 Bargaining Power of Buyers

5.3.5 Intensity of Competitive Rivalry

5.4 Macroeconomic Overview

5.5 Trends and Forecast of GDP

6 Cellulose Esters Market, By Type (Page No. - 39)

6.1 Introduction

6.2 Cellulose Acetate

6.3 Cellulose Acetate Propionate

6.4 Cellulose Acetate Butyrate

6.5 Cellulose Nitrate

6.6 Others

7 Cellulose Esters Market, By Process (Page No. - 43)

7.1 Introduction

7.2 Kraft

7.3 Sulfite

8 Cellulose Esters Market, By Products (Page No. - 44)

8.1 Introduction

8.2 Carboxymethyl Cellulose

8.3 Methyl Cellulose

8.4 Ethyl Cellulose

8.5 Hydroxyethyl Cellulose

8.5 Hydroxypropyl Cellulose

8.6 Others

9 Cellulose Esters Market, By Application (Page No. - 46)

9.1 Introduction

9.2 Coatings

9.3 Plasticizers

9.4 Cigarette Filters

9.5 Films & Tapes

9.6 Inks

9.7 Others

10 Cellulose Esters Market, By Region (Page No. - 54)

10.1 Introduction

10.2 North America

10.2.1 US

10.2.2 Canada

10.2.3 Mexico

10.3 Europe

10.3.1 Germany

10.3.2 France

10.3.3 UK

10.3.4 Italy

10.3.5 Russia

10.3.6 Turkey

10.3.7 Rest of Europe

10.4 APAC

10.4.1 China

10.4.2 Japan

10.4.3 India

10.4.4 South Korea

10.4.5 Indonesia

10.4.6 Malaysia

10.4.7 Rest of APAC

10.5 Middle East & Africa

10.5.1 Saudi Arabia

10.5.2 South Africa

10.5.3 UAE

10.5.4 Rest of Middle East & Africa

10.6 South America

10.6.1 Brazil

10.6.2 Argentina

10.6.3 Rest of South America

11 Competitive Landscape (Page No. - 82)

11.1 Introduction

11.2 Market Ranking

11.3 Competitive Scenario

11.3.1 Divestment

11.3.2 Acquisition & Merger

11.3.3 New Product Launch

11.3.4 Agreement

12 Company Profiles (Page No. - 86)

(Overview, Financial*, Products & Services, Strategy, and Developments)

12.1 Eastman Chemical Company

12.2 Solvay

12.3 Celanese Corporation

12.4 China National Tobacco Corporation

12.5 Daicel Corporation

12.6 Acordis Cellulostic Fibers

12.7 Mitsubishi Chemical Holdings Corporation

12.8 Sichuan Push Acetati

12.9 Rayonier Advanced Materials

12.10 Sappi

12.11 0ther Market Players

12.11.1 Rotuba

12.11.2 Dowdupont

12.11.3 Nitrex Chemicals India

12.11.4 Nitro Química

12.11.5 Synthesia

12.11.6 Sichuan Nitrocell

12.11.7 Hangzhou Dayangchem

12.11.8 Nobel NC

12.11.9 Hagedorn AG

*Details Might Not Be Captured in Case of Unlisted Companies

13 Appendix (Page No. - 104)

13.1 Discussion Guide

13.2 Knowledge Store: Marketsandmarkets Subscription Portal

13.3 Available Customizations

13.4 Related Reports

13.5 Author Details

List of Tables (101 Tables)

Table 1 Real GDP Growth (Annual Percentage Change)

Table 2 Cellulose Esters Market Size, By Type, 2016–2023 (USD Million)

Table 3 Cellulose Esters Market Size, By Type, 2016–2023 (Kiloton)

Table 4 Cellulose Acetate Market Size, By Region, 2016–2023 (USD Million)

Table 5 Cellulose Acetate Market Size, By Region, 2016–2023 (Kiloton)

Table 6 Cellulose Acetate Propionate Market Size, By Region, 2016–2023 (USD Million)

Table 7 Cellulose Acetate Propionate Market Size, By Region, 2016–2023 (Kiloton)

Table 8 Cellulose Acetate Butyrate Market Size, By Region, 2016–2023 (USD Million)

Table 9 Cellulose Acetate Butyrate Market Size, By Region, 2016–2023 (Kiloton)

Table 10 Cellulose Nitrate Market Size, By Region, 2016–2023 (USD Million)

Table 11 Cellulose Nitrate Market Size, By Region, 2016–2023 (Kiloton)

Table 12 Other Cellulose Esters Market Size, By Region, 2016–2023 (USD Million)

Table 13 Other Cellulose Esters Market Size, By Region, 2016–2023 (Kiloton)

Table 14 Cellulose Esters Market Size, By Product, 2016–2023 (USD Million)

Table 15 Cellulose Esters Market Size, By Product, 2016–2023 (Kiloton)

Table 16 Carboxymethyl Cellulose Market Size, By Region, 2016–2023 (USD Million)

Table 17 Carboxymethyl Cellulose Market Size, By Region, 2016–2023 (Kiloton)

Table 18 Methyl Cellulose Market Size, By Region, 2016–2023 (USD Million)

Table 19 Methyl Cellulosemarket Size, By Region, 2016–2023 (Kiloton)

Table 20 Ethyl Cellulose Market Size, By Region, 2016–2023 (USD Million)

Table 21 Ethyl Cellulose Market Size, By Region, 2016–2023 (Kiloton)

Table 22 Hydroxyethyl Cellulose Market Size, By Region, 2016–2023 (USD Million)

Table 23 Hydroxyethyl Cellulose Market Size, By Region, 2016–2023 (Kiloton)

Table 24 Hydroxypropyl Cellulose Market Size, By Region, 2016–2023 (USD Million)

Table 25 Hydroxypropyl Cellulose Market Size, By Region, 2016–2023 (Kiloton)

Table 26 Hydroxyethyl Cellulose Market Size, By Region, 2016–2023 (USD Million)

Table 27 Cellulose Esters Market Size, By Process, 2016–2023 (USD Million)

Table 28 Cellulose Esters Market Size, By Process, 2016–2023 (Kiloton)

Table 29 Kraft Market Size, By Region, 2016–2023 (USD Million)

Table 30 Kraft Market Size, By Region, 2016–2023 (Kiloton)

Table 31 Sulfite Market Size, By Region, 2016–2023 (USD Million)

Table 32 Sulfite Market Size, By Region, 2016–2023 (Kiloton)

Table 33 Cellulose Esters Market Size, By Application, 2016–2023 (USD Million)

Table 34 Cellulose Esters Market Size, By Application, 2016–2028 (Kiloton)

Table 35 Cellulose Esters Market Size in Coatings Application, By Region, 2016–2023 (USD Million)

Table 36 Cellulose Esters Market Size in Coatings Application, By Region, 2016–2023 (Kiloton)

Table 37 Cellulose Esters Market Size in Plasticizers Application, By Region, 2016–2023 (USD Million)

Table 38 Cellulose Esters Market Size in Plasticizers Application, By Region, 2016–2023 (Kiloton)

Table 39 Cellulose Esters Market Size in Cigarette Filters Application, By Region, 2016–2023 (USD Million)

Table 40 Cellulose Esters Market Size in Cigarette Filters Application, By Region, 2016–2023 (Kiloton)

Table 41 Cellulose Esters Market Size in Films & Tapes Application, By Region, 2016–2023 (USD Million)

Table 42 Cellulose Esters Market Size in Films & Tapes Application, By Region, 2016–2023 (Kiloton)

Table 43 Cellulose Esters Market Size in Inks Application, By Region, 2016–2023 (USD Million)

Table 44 Cellulose Esters Market Size in Inks Application, By Region, 2016–2023 (Kiloton)

Table 45 Cellulose Esters Market Size in Other Applications, By Region, 2016–2023 (USD Million)

Table 46 Cellulose Esters Market Size in Other Applications, By Region, 2016–2023 (Kiloton)

Table 47 Cellulose Esters Market Size, By Region, 2016–2023 (USD Million)

Table 48 Cellulose Esters Market Size, By Region, 2016–2023 (Kiloton)

Table 49 North America: Cellulose Esters Market Size, By Country, 2016–2023 (USD Million)

Table 50 North America: Cellulose Esters Market Size, By Application, 2016–2023 (USD Million)

Table 51 North America: Cellulose Esters Market Size, By Application, 2016–2023 (Kiloton)

Table 52 North America: Cellulose Esters Market Size, By Type, 2016–2023 (USD Million)

Table 53 North America: Cellulose Esters Market Size, By Type, 2016–2023 (Kiloton)

Table 54 US: Cellulose Esters Market Size, By Type, 2016–2023 (USD Million)

Table 55 Canada: Cellulose Esters Market Size, By Type, 2016–2023 (USD Million)

Table 56 Mexico: Cellulose Esters Market Size, Type, 2016–2023 (USD Million)

Table 57 Europe: Cellulose Esters Market Size, By Country, 2016–2023 (USD Million)

Table 58 Europe: Cellulose Esters Market Size, By Type, 2016–2023 (USD Million)

Table 59 Europe: Cellulose Esters Market Size, By Type, 2016–2023 (Kiloton)

Table 60 Europe: Cellulose Esters Market Size, By Application, 2016–2023 (USD Million)

Table 61 Europe: Cellulose Esters Market Size, By Application, 2016–2023 (Kiloton)

Table 62 Germany: Cellulose Esters Market Size, By Type, 2016–2023 (USD Million)

Table 63 France: Cellulose Esters Market Size, By Type, 2016–2023 (USD Million)

Table 64 UK: Cellulose Esters Market Size, By Type, 2016–2023 (USD Million)

Table 65 Italy: Cellulose Esters Market Size, By Type, 2016–2023 (USD Million)

Table 66 Russia: Cellulose Esters Market Size, By Type, 2016–2023 (USD Million)

Table 67 Turkey: Cellulose Esters Market Size, By Type, 2016–2023 (USD Million)

Table 68 Rest of Europe: Cellulose Esters Market Size, By Type, 2016–2023 (USD Million)

Table 69 APAC: Cellulose Esters Market Size, By Country, 2016–2023 (USD Million)

Table 70 APAC: Cellulose Esters Market Size, By Type, 2016–2023 (USD Million)

Table 71 APAC: Cellulose Esters Market Size, By Type, 2016–2023 (Kiloton)

Table 72 APAC: Cellulose Esters Market Size, By Application, 2016–2023 (USD Million)

Table 73 APAC: Cellulose Esters Market Size, By Application, 2016–2023 (Kiloton)

Table 74 China: Cellulose Esters Market Size, By Type, 2016–2023 (USD Million)

Table 75 Japan: Cellulose Esters Market Size, By Type, 2016–2023 (USD Million)

Table 76 India: Cellulose Esters Market Size, By Type, 2016–2023 (USD Million)

Table 77 South Korea: Cellulose Esters Market Size, By Type, 2016–2023 (USD Million)

Table 78 Indonesia: Cellulose Esters Market Size, By Type, 2016–2023 (USD Million)

Table 79 Malaysia: Cellulose Esters Market Size, By Type, 2016–2023 (USD Million)

Table 80 Rest of APAC: Cellulose Esters Market Size, By Type, 2016–2023 (USD Million)

Table 81 Middle East & Africa: Cellulose Esters Market Size, By Country, 2016–2023 (USD Million)

Table 82 Middle East and Africa: Cellulose Esters Market Size, By Type, 2016–2023 (USD Million)

Table 83 Middle East and Africa: Cellulose Esters Market Size, By Type, 2016–2023 (Kiloton)

Table 84 Middle East and Africa: Cellulose Esters Market Size, By Application, 2016–2023 (USD Million)

Table 85 Middle East and Africa: Cellulose Esters Market Size, By Application, 2016–2023 (Kiloton)

Table 86 Saudi Arabia: Cellulose Esters Market Size, By Type, 2016–2023 (USD Million)

Table 87 South Africa: Cellulose Esters Market Size, By Type, 2016–2023 (USD Million)

Table 88 UAE: Cellulose Esters Market Size, By Type, 2016–2023 (USD Million)

Table 89 Rest of Middle East & Africa: Cellulose Esters Market Size, Type, 2016–2023 (USD Million)

Table 90 South America: Cellulose Esters Market Size, By Country, 2016–2023 (USD Million)

Table 91 South America: Cellulose Esters Market Size, By Type, 2016–2023 (USD Million)

Table 92 South America: Cellulose Esters Market Size, By Type, 2016–2023 (Kiloton)

Table 93 South America: Cellulose Esters Market Size, By Application, 2016–2023 (USD Million)

Table 94 South America: Cellulose Esters Market Size, By Application, 2016–2023 (Kiloton)

Table 95 Brazil: Cellulose Esters Market Size, By Type Industry, 2016–2023 (USD Million)

Table 96 Argentina: Cellulose Esters Market Size, By Type, 2016–2023 (USD Million)

Table 95 Rest of South America: Cellulose Esters Market Size, By Type, 2016–2023 (USD Million)

Table 98 Divestment, 2015–2018

Table 99 Acquisition & Merger, 2015–2018

Table 100 New Product Launch, 2015–2017

Table 101 Agreement, 2015–2018

List of Figures (27 Figures)

Figure 1 Cellulose Esters Market: Research Design

Figure 2 Bottom-Up Approach

Figure 3 Top-Down Approach

Figure 4 Cellulose Esters Market: Data Triangulation

Figure 5 Cellulose Acetate Segment to Lead the Cellulose Esters Market

Figure 6 Coatings to Be the Fastest-Growing Application of Cellulose Esters

Figure 7 APAC Was the Largest Cellulose Esters Market in 2017

Figure 8 Cellulose Esters Market to Witness Rapid Growth During 2018–2023

Figure 9 APAC to Lead the Cellulose Esters Market

Figure 10 Cigarette Filters Was the Largest Application of Cellulose Esters

Figure 11 Cigarette Filters to Be the Largest Segment of the Cellulose Esters Market

Figure 12 China to Be the Fastest-Growing Cellulose Esters Market

Figure 13 Overview of Factors Governing the Cellulose Esters Market

Figure 14 Cellulose Acetate to Be the Largest Segment of the Cellulose Esters Market

Figure 15 Cigarette Filters to Be the Leading Application of Cellulose Esters

Figure 16 Regional Snapshot: Cellulose Esters Market in China to Register A High CAGR

Figure 17 North America: Cellulose Esters Market Snapshot

Figure 18 APAC: Cellulose Esters Market Snapshot

Figure 19 Companies Adopted New Product Launch and Agreement as the Key Growth Strategies, 2015–2018

Figure 20 Eastman and Solvay Dominated Cellulose Esters Market in 2017

Figure 21 Eastman Chemical Company: Company Snapshot

Figure 22 Solvay: Company Snapshot

Figure 23 Celanese Corporation: Company Snapshot

Figure 24 Daicel Corporation: Company Snapshot

Figure 25 Mitsubishi Chemical Holdings Company: Company Snapshot

Figure 26 Rayonier Advanced Materials: Company Snapshot

Figure 27 Sappi: Company Snapshot

Growth opportunities and latent adjacency in Cellulose Esters Market