Sustained Release Coatings Market by Application (In Vitro, In Vivo), Substrate Type (Tablets, Capsules, Pills), Polymer Material Type (Ethyl & Methyl Cellulose, Polyvinyl & Cellulose Acetate, Methacrylic Acid, PEG), and Region - Global Forecast to 2024

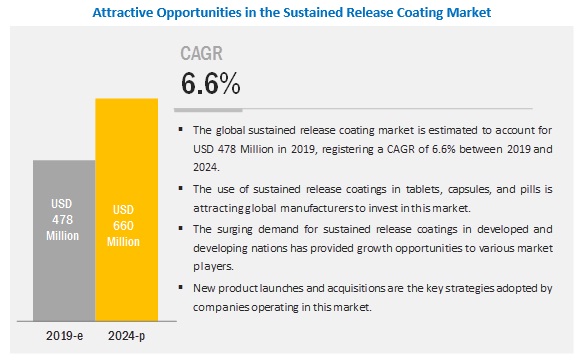

The sustained release coatings market is projected reach USD 660 million by 2024, at a CAGR of 6.6% during the forecast period. With the increasing demand for microencapsulated products, significant R&D activities are being carried out by various companies in the market, thus aiding the growth of the sustained release coating market. New technologies, such as sustained release coating, are required to tap niche markets in cancer and brain tumor-specific drug delivery.

The tablet substrate type is expected to account for the largest share of the overall sustained release coatings market.

The global tablet market will continue to dominate the global sustained release coating market with a high growth rate during the forecast period. The development of mini-tablets is a key trend in this segment, which has garnered considerable attention due to its numerous advantages including ease of manufacturing, less coating material required, less risk of dose dumping, and less inter- and intra-subject variability. Also, solvents are not required during its production, Versatile sustained release, immediate-release tablet systems, modified-release tablet formulations, and excipient technologies are the other advancements in this market.

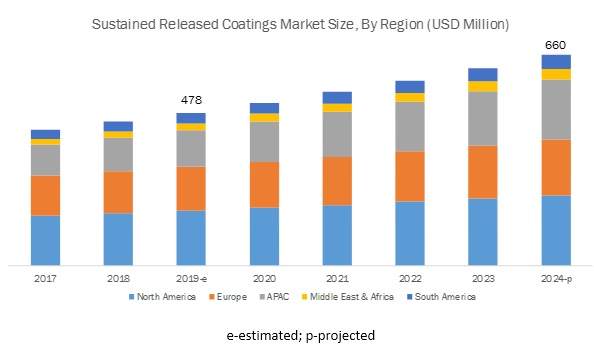

North America is expected to account for the largest market share during the forecast period.

North America is the largest sustained release coatings market and is projected to maintain its position during the forecast period. Increasing demand for microencapsulated tablets, capsules, and pills are driving the growth of the sustained release coating market. With the presence of a large number of pharmaceutical giants and huge investments for the development of novel drugs and drug delivery systems, the sustained release coatings market is expected to grow at a stable rate.

Key Market Players in Sustained Release Coatings Market

The key players in this market include Colorcon (US), BASF (Germany), Evonik (Germany), and Coating Place (US).

Sustained Release Coatings Market Report Scope

|

Report Metric |

Details |

|

Years considered for the study |

2017-2024 |

|

Base year |

2018 |

|

Forecast period |

2019-2024 |

|

Units considered |

Value (USD) |

|

Segments |

Application, Substrate, Polymer Material, and Region |

|

Regions |

APAC, North America, Europe, South America, and Middle East & Africa |

|

Companies |

Colorcon (US), BASF (Germany), Evonik (Germany), and Coating Place (US) |

This research report categorizes the sustained release coatings market based on polymer material, substrate, application, and region.

On the basis of application, the sustained release coatings market is segmented as follows:

- In Vitro

- In Vivo

On the basis of substrate, the sustained release coating market is segmented as follows:

- Tablets

- Capsules

- Pills

On the basis of polymer material, the sustained release coatings market is segmented as follows:

- Ethyl & methyl cellulose

- Polyvinyl & cellulose acetate

- Methacrylic acid

- PEG

- Others

On the basis of region, the sustained release coating market is segmented as follows:

- APAC

- North America

- Europe

- South America

- Middle East & Africa

Recent Developments in Sustained Release Coatings Market

- In April 2019, Colorcon Inc. expanded its coating portfolio by adding a range of modified release products of DuPont's Aquacoat technology. The product line includes Aquacoat ECD, a colloidal dispersion of ethylcellulose polymer for sustained release. The coatings will be used in both pharmaceutical and nutritional solid dose applications.

- In May 2016, Colorcon, Inc. and BASF signed an agreement to strengthen their co-operation in the area of pharmaceutical film coatings. As a part of this agreement, BASF sells its Kollicoat IR Coating Systems product line to Colorcon. Both companies benefitted by combining BASFs polymer expertise and Colorcons formulation and application knowledge.

Key Questions Addressed by the Report

- What are the major developments impacting the market?

- What are the new high-growth applications in the sustained release coatings market?

- What will be the major factors impacting market growth during the forecast period?

- What are the driving factors, opportunities, restraints, and challenges that affect the growth of the market?

- What are the industry trends affecting the sustained release coating market?

Frequently Asked Questions (FAQ):

How big is the Sustained Release Coatings Market Industry?

The sustained release coating market is projected to reach USD 660 million by 2024, at a CAGR of 6.6%.

Who leading market players in Sustained Release Coatings Market Industry?

The key players in Sustained Release Coatings Market include Colorcon (US), BASF (Germany), Evonik (Germany), and Coating Place (US).

To speak to our analyst for a discussion on the above findings, click Speak to Analyst

Table of Contents

1 Introduction (Page No. - 13)

1.1 Objectives of the Study

1.2 Market Definition

1.3 Market Scope

1.3.1 Regions Considered

1.3.2 Years Considered for the Study

1.4 Currency

1.5 Stakeholders

2 Research Methodology (Page No. - 16)

2.1 Research Data

2.1.1 Secondary Data

2.1.1.1 Key Data From Secondary Sources

2.1.2 Primary Data

2.1.2.1 Key Data From Primary Sources

2.1.2.2 Breakdown of Primary Interviews

2.2 Market Size Estimation

2.3 Market Breakdown and Data Triangulation

2.4 Research Assumptions & Limitations

2.4.1 Assumptions

3 Executive Summary (Page No. - 23)

4 Premium Insights (Page No. - 26)

4.1 Sustained Release Coating Market Attractiveness

4.2 Sustained Release Coatings Market, By Substrate Type

4.3 Sustained Release Coating Market, By Polymer Material Type and Country

4.4 Sustained Release Coatings Market, By Country

5 Market Overview (Page No. - 28)

5.1 Introduction

5.2 Market Dynamics

5.2.1 Drivers

5.2.1.1 Rise in Demand in the Pharmaceutical Industry

5.2.1.1.1 Controlled Drug Delivery

5.2.1.1.2 Targeted Drug Delivery

5.2.2 Restraints

5.2.2.1 High Cost Associated With the Microencapsulated Process

5.2.3 Opportunities

5.2.3.1 Development of Advanced Technologies to Tap Niche Markets

5.2.3.1.1 Reduction in Capsule Size and Increase in Bioavailability

5.2.3.1.2 Government Support and Growing Economy in Developing Countries

5.2.4 Challenges

5.2.4.1 Alcohol-Induced Dose Dumping

6 Industry Trends (Page No. - 32)

6.1 Porters Five Forces Analysis

6.2 Threat of New Entrants

6.3 Threat of Substitutes

6.4 Bargaining Power of Suppliers

6.5 Bargaining Power of Buyers

6.6 Intensity of Competitive Rivalry

7 Sustained Release Coatings Market, By Polymer Material Type (Page No. - 35)

7.1 Introduction

7.2 Ethyl & Methyl Cellulose

7.2.1 Significant Variations in Granule and Tablet Characteristics Makes Ethyl & Methyl Cellulose Dominant

7.3 Polyvinyl & Cellulose Acetate

7.3.1 Self-Sealing Property of Pva Makes Polyvinyl & Cellulose Acetate More Demanding

7.4 Methacrylic Acid

7.4.1 Ionized and Non-Ionized Groups in the Structure of These Copolymers Makes Methacrylic More Demanding

7.5 Polyethylene Glycol (PEG)

7.5.1 More Usage in In Vitro Application Drives the Market for PEG

7.6 Others

8 Sustained Release Coating Market, By Substrate (Page No. - 40)

8.1 Introduction

8.2 Tablets

8.2.1 Development of Mini Tablets is A Key Trend in This Market Segment

8.3 Capsules

8.3.1 Easy Absorption of Drugs and Decreased Irritation in the Gi Tract are Driving the Use of Capsules

8.4 Pills

8.4.1 Rising Incidence of Target Ailments to Propel the Growth of the Pills Market

9 Sustained Release Coating Market, By Application (Page No. - 44)

9.1 Introduction

9.2 In Vitro

9.2.1 Increasing R&D Expenditure in the Healthcare Sector Drives the in Vitro Application

9.3 In Vivo

9.3.1 Increasing Rate of Prevalence in Many Chronic Diseases Drives the Demand for in Vivo Application

10 Sustained Release Coatings Market, By Region (Page No. - 48)

10.1 Introduction

10.2 North America

10.2.1 US

10.2.1.1 More Increasing Focus on Capsule-Based Pharmaceutical Formulations Drives the Market of Coating in Us

10.2.2 Canada

10.2.2.1 The Growing Demand for Pharmaceutical Formulations in the Country has Led to an Increase in R&D Activities in Medicine and Healthcare

10.2.3 Mexico

10.2.3.1 Measures to Curtail Healthcare Costs By Reducing the Prices of Drugs Drives the Mexican Market

10.3 Europe

10.3.1 Switzerland

10.3.1.1 Hub for Many Pharmaceutical Manufacturing Companies Makes Switzerland for More Demanding

10.3.2 Russia

10.3.2.1 Federal Drug Reimbursement Programme Drives the Russian Market

10.3.3 Germany

10.3.3.1 Accelerating Urbanization, Increasing Life Expectancy, and the Growth of the Aging Population Segment Also Support the Growth of the Pharmaceutical Industry in the Country

10.3.4 France

10.3.4.1 Presence of A Significantly Large Geriatric Population in the Country Drives the Demand Fro Sustained Release Coating in France

10.3.5 UK

10.3.5.1 Growing Adoption of Generics and the Increasing Demand for Drugs Among the Aging Population Drives the Market

10.3.6 Italy

10.3.6.1 Gradual Recovery of the Italian Pharmaceutical Manufacturing Industry Drives the Market

10.3.7 Spain

10.3.7.1 The Growing Pressure for Cost Containment From the Government is Expected to Drive the Growth of the Generic Pharmaceuticals Market in Spain

10.3.8 Rest of Europe

10.4 APAC

10.4.1 Japan

10.4.1.1 The Market in Japan is Largely Driven By the Growing Pharmaceutical Market in the Country, Along With High Levels of Affordability and Access to Healthcare Facilities.

10.4.2 China

10.4.2.1 Being One of the Largest Domestic Pharmaceutical Industries China Demand More Usage of Sustained Release Coating in APAC

10.4.3 India

10.4.3.1 Largest Provider of Generic Drugs Globally Makes India More Demanding in World for Sustained Release Coating

10.4.4 South Korea

10.4.4.1 Increasing Its New Drug R&D Abilities Drive the Demand for Sustained Release Coating

10.4.5 Indonesia

10.4.5.1 Increasing Universal Health Coverage Scheme in Indonesia Drives the Market for Pharmaceutical Industry

10.4.6 Taiwan

10.4.6.1 Ease of Doing Business in Taiwan Makes Country Best for Pharmaceutical Industry

10.4.7 Thailand

10.4.7.1 Increasing Prevalence Rate for Communicable Diseases Drives the Thailand Market

10.4.8 Vietnam

10.4.8.1 Chronic Diseases Related to Old Age Will Boost the Demand for Pharmaceuticals in Vietnam

10.4.9 Rest of APAC

10.5 South America

10.5.1 Brazil

10.5.1.1 Low Labor and Manufacturing Costs in the Country Drives Brazil More Demanding

10.5.2 Argentina

10.5.2.1 Favorable Healthcare Regulations Implemented By Argentina Authorities have Provided Opportunities for Growth of Sustained Release Coating

10.5.3 Rest of South America

10.6 Middle East & Africa

10.6.1 South Africa

10.6.1.1 Paradigm Shift in the Burden of Illness Towards Non-Communicable Diseases Drives the Demand for Chronic Prescription Drugs

10.6.2 Saudi Arabia

10.6.2.1 Changes in Nutritional and Lifestyle Habits in Saudi Arabia have Increased the Frequency of Lifestyle-Related Health Concerns in Country

10.6.3 Rest of Mea

11 Competitive Landscape (Page No. - 80)

11.1 Overview

11.2 Ranking of Key Players, 2018

11.3 Competitive Scenario

11.3.1 New Product Launches

11.3.2 Agreements, Collaborations, Partnerships, and Joint Ventures

12 Company Profiles (Page No. - 82)

(Business Overview, Products Offered, Recent Developments, SWOT Analysis, MnM View)*

12.1 BASF SE

12.2 Evonik

12.3 Colorcon

12.4 Coating Place, Inc.

*Details on Business Overview, Products Offered, Recent Developments, SWOT Analysis, MnM View Might Not Be Captured in Case of Unlisted Companies.

13 Appendix (Page No. - 88)

13.1 Discussion Guide

13.2 Knowledge Store: Marketsandmarkets Subscription Portal

13.3 Available Customizations

13.4 Related Reports

13.5 Author Details

List of Tables (63 Tables)

Table 1 Sustained Release Coating Market Snapshot (2019 vs 2024)

Table 2 Sustained Release Coatings Market Size, By Polymer Material Type, 20172024 (USD Million)

Table 3 Ethyl & Methyl Cellulose: Sustained Release Coating Market Size, By Region, 20172024 (USD Million)

Table 4 Polyvinyl & Cellulose Acetate: Sustained Release Coatings Market Size, By Region, 20172024 (USD Million)

Table 5 Methacrylic Acid: Sustained Release Coating Market Size, By Region, 20172024 (USD Million)

Table 6 PEG: Sustained Release Coatings Market Size, By Region, 20172024 (USD Million)

Table 7 Others: Sustained Release Coating Market Size, By Region, 20172024 (USD Million)

Table 8 Sustained Release Coatings Market Size, By Substrate Type, 20172024 (USD Million)

Table 9 Tablets: Sustained Release Coating Market, By Region, 20172024 (USD Million)

Table 10 Capsules: Sustained Release Coatings Market, By Region, 20172024 (USD Million)

Table 11 Pills: Sustained Release Coating Market, By Region, 20172024 (USD Million)

Table 12 Sustained Release Coatings Market Size, By Application, 20172024 (USD Million)

Table 13 Sustained Release Coating Market Size for in Vitro, By Region, 20172024 (USD Million)

Table 14 Sustained Release Coatings Market Size for in Vivo, By Region, 20172024 (USD Million)

Table 15 Sustained Release Coating Market Size, By Region, 20172024 (USD Million)

Table 16 North America: Sustained Release Coatings Market Size, By Country, 20172024 (USD Million)

Table 17 North America: Sustained Release Coating Market Size, By Polymer Material Type, 20172024 (USD Million)

Table 18 North America: Market Size, By Substrate Type, 20172024 (USD Million)

Table 19 North America: Market Size, By Application, 20172024 (USD Million)

Table 20 US: Sustained Release Coating Market Size, By Substrate Type, 20172024 (USD Million)

Table 21 Canada: Sustained Release Coatings Market Size, By Substrate Type, 20172024 (USD Million)

Table 22 Mexico: Sustained Release Coating Market Size, By Substrate Type, 20172024 (USD Million)

Table 23 Europe: Sustained Release Coatings Market Size, By Country, 20172024 (USD Million)

Table 24 Europe: Market Size, By Substrate Type, 20172024 (USD Million)

Table 25 Europe: Market Size, By Polymer Material, 20172024 (USD Million)

Table 26 Europe: Market Size, By Application, 20172024 (USD Million)

Table 27 Switzerland: Sustained Release Coatings Market Size, By Substrate Type, 20172024 (USD Million)

Table 28 Russia: Sustained Release Coating Market Size, By Substrate Type, 20172024 (USD Million)

Table 29 Germany: Sustained Release Coatings Market Size, By Substrate Type, 20172024 (USD Million)

Table 30 France: Sustained Release Coating Market Size, By Substrate Type, 20172024 (USD Million)

Table 31 UK: Sustained Release Coatings Market Size, By Substrate Type, 20172024 (USD Million)

Table 32 Italy: Sustained Release Coating Market Size, By Substrate Type, 20172024 (USD Million)

Table 33 Spain: Sustained Release Coatings Market Size, By Substrate Type, 20172024 (USD Million)

Table 34 Rest of Europe: Sustained Release Coating Market Size, By Substrate Type, 20172024 (USD Million)

Table 35 APAC: Sustained Release Coatings Market Size, By Country, 20172024 (USD Million)

Table 36 APAC: Market Size, By Substrate Type, 20172024 (USD Million)

Table 37 APAC: Enteric Coating Market Size, By Polymer Material Type, 20172024 (USD Million)

Table 38 APAC: Market Size, By Application, 20172024 (USD Million)

Table 39 Japan: Sustained Release Coatings Market Size, By Substrate Type, 20172024 (USD Million)

Table 40 China: Sustained Release Coating Market Size, By Substrate Type, 20172024 (USD Million)

Table 41 India: Sustained Release Coatings Market Size, By Substrate Type, 20172024 (USD Million)

Table 42 South Korea: Sustained Release Coating Market Size, By Substrate Type, 20172024 (USD Million)

Table 43 Indonesia: Sustained Release Coatings Market Size, By Substrate Type, 20172024 (USD Million)

Table 44 Taiwan: Sustained Release Coating Market Size, By Substrate Type, 20172024 (USD Million)

Table 45 Thailand: Sustained Release Coatings Market Size, By Substrate Type, 20172024 (USD Million)

Table 46 Vietnam: Sustained Release Coating Market Size, By Substrate Type, 20172024 (USD Million)

Table 47 Rest of APAC: Sustained Release Coating Market Size, By Substrate Type, 20172024 (USD Million)

Table 48 South America: Sustained Release Coating Market Size, By Country, 20172024 (USD Million)

Table 49 South America: Enteric Coating Market Size, By Substrate Type, 20172024 (USD Million)

Table 50 South America: Market Size, By Polymer Material, 20172024 (USD Million)

Table 51 South America: Enteric Coating Market Size, By Application, 20172024 (USD Million)

Table 52 Brazil: Sustained Release Coating Market Size, By Substrate Type, 20172024 (USD Million)

Table 53 Argentina: Sustained Release Coating Market Size, By Substrate Type, 20172024 (USD Million)

Table 54 Rest of South America: Sustained Release Coating Market Size, By Substrate Type, 20172024 (USD Million)

Table 55 Middle East & Africa: Sustained Release Coating Market Size, By Country, 20172024 (USD Million)

Table 56 Middle East & Africa: Enteric Coating Market Size, By Substrate Type, 20172024 (USD Million)

Table 57 Middle East & Africa: Market Size, By Polymer Material Type, 20172024 (USD Million)

Table 58 Middle East & Africa: Enteric Coating Market Size, By Application, 20172024 (USD Million)

Table 59 South Africa: Sustained Release Coating Market Size, By Substrate Type, 20172024 (USD Million)

Table 60 Saudi Arabia: Enteric Coating Market Size, By Substrate Type, 20172024 (USD Million)

Table 61 Rest of MEA: Sustained Release Coating Market Size, By Substrate Type, 20172024 (USD Million)

Table 62 New Service, Technology, and Product Launches, 20162019

Table 63 Agreements, Collaborations, Partnerships, and Joint Ventures, 20162019

List of Figures (24 Figures)

Figure 1 Sustained Release Coating Market Segmentation

Figure 2 Sustained Release Coatings Market: Research Design

Figure 3 Breakdown of Primary Interviews:

Figure 4 Market Size Estimation Methodology: Top-Down Approach

Figure 5 Market Size Estimation Methodology: Bottom-Up Approach

Figure 6 Market Breakdown and Data Triangulation

Figure 7 Ethyl & Methyl Cellulose to Be the Largest Type of Sustained Release Coating

Figure 8 in Vitro Application to Dominate the Sustained Release Coatings Market

Figure 9 North America Accounted for the Largest Market Share

Figure 10 Sustained Release Coating Market to Witness Moderate Growth Between 2019 and 2024

Figure 11 Tablets to Be the Fastest-Growing Substrate Type

Figure 12 The US Accounted for the Largest Market Share

Figure 13 US and China: the Dominant Markets in 2019

Figure 14 Drivers, Restraints, Opportunities, and Challenges in the Sustained Release Coating Market

Figure 15 Sustained Release Coating Market: Porters Five Forces Analysis

Figure 16 Sustained Release Coatings Market Size, By Application, 2019 vs 2024 (USD Million)

Figure 17 Sustained Release Coating Market: Regional Snapshot (2019)

Figure 18 North America: Sustained Release Coatings Market Snapshot

Figure 19 APAC: Sustained Release Coating Market Snapshot

Figure 20 BASF Led the Sustained Release Coatings Market in 2018

Figure 21 BASF SE: Company Snapshot

Figure 22 BASF SE: SWOT Analysis

Figure 23 Evonik: Company Snapshot

Figure 24 Evonik: SWOT Analysis

The study involved four major activities in estimating the current market size of sustained release coatings. Exhaustive secondary research was done to collect information on the market, the peer market, and the parent market. The next step was to validate these findings, assumptions, and sizing with industry experts across the value chain through primary research. Both top-down and bottom-up approaches were employed to estimate the complete market size. Thereafter, market breakdown and data triangulation methods were used to estimate the market size of the segments and subsegments.

Sustained Release Coatings Market Secondary Research

In the secondary research process, various secondary sources, such as Hoovers, Bloomberg, and BusinessWeek, were referred to for identifying and collecting information for this study. These secondary sources included annual reports, press releases & investor presentations of companies; white papers; certified publications; articles by recognized authors; gold standard & silver standard websites; regulatory bodies; trade directories; and databases.

Sustained Release Coatings Market Primary Research

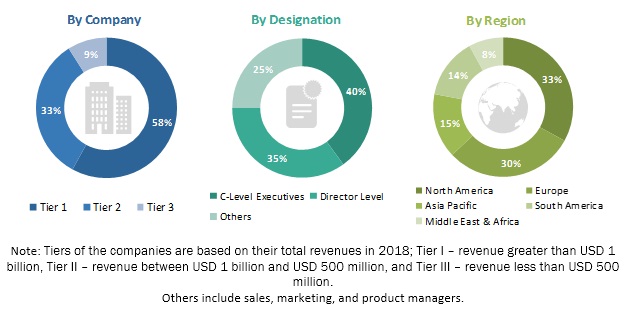

The sustained release coating market comprises several stakeholders, such as raw material suppliers, processors, end-product manufacturers, and regulatory organizations. The demand side for this market is characterized by the development of pharmaceutical drug manufacturers and applications, such as In Vitro and In Vivo. The supply side is characterized by advancements in functions, technologies, and diverse end-use industries. Various primary sources from both the supply and demand sides of the market were interviewed to obtain qualitative and quantitative information. Following is the breakdown of primary respondents:

To know about the assumptions considered for the study, download the pdf brochure

Sustained Release Coatings Market Size Estimation

Both the top-down and bottom-up approaches were used to estimate and validate the overall size of the sustained release coating market. These methods were also used extensively to estimate the size of various subsegments in the market. The research methodology used to estimate the market size includes the following:

- The key players in the industry were identified through extensive secondary research.

- The industrys supply chain and market size, in terms of value, were determined through primary and secondary research processes.

- All percentage shares, splits, and breakdowns were determined using secondary sources and verified through primary sources.

Sustained Release Coatings Market Data Triangulation

After arriving at the overall market sizeusing the market size estimation processes as explained abovethe market was split into several segments and subsegments. In order to complete the overall market engineering process and arrive at the exact statistics of each market segment and subsegment, the data triangulation and market breakdown procedures were employed, wherever applicable. Data was triangulated by studying various factors and trends from both the demand and supply sides.

Report Objectives

- To define, describe, and forecast the global sustained release coating market, in terms of value

- To provide information about the factors (drivers, restraints, opportunities, and industry-specific challenges) influencing the growth of the market

- To analyze and forecast the sustained release coatings market based on applications, polymer material types, and substrates

- To analyze and forecast the market size, with respect to five main regions (along with their respective key countries), namely, North America, Europe, APAC, the Middle East & Africa, and South America

- To strategically analyze micromarkets with respect to individual growth trends, prospects, and their contribution to the overall market

- To analyze competitive developments, for instance, new product developments in the market

- To analyze opportunities in the market for stakeholders and provide details of a competitive landscape of the market leaders

- To strategically profile the key players in the market and comprehensively analyze their core competencies

Sustained Release Coatings Market Report Available Customizations:

MarketsandMarkets offers customizations according to the specific needs of the companies with the given market data.

The following customization options are available for the report:

Product Analysis:

- Product matrix, which gives a detailed comparison of the product portfolio of each company

Regional Analysis:

- Further breakdown of a specific country based on substrates

Company Information:

- Detailed analysis and profiling of top market players

Growth opportunities and latent adjacency in Sustained Release Coatings Market