Biometric Vehicle Access System Market by Authentication type (Fingerprint, Voice), Future Technology (Iris Recognition System), Vehicle Type (Passenger Car, Battery Electric Vehicle), and Region - Global Forecast to 2021

The overall biometric vehicle access system market is expected to grow from $0.44 billion in 2016 to $0.85 billion by 2021, at a CAGR of 14.06% from 2016 to 2021.

The market for fingerprint recognition system is at the growth stage, whereas the voice recognition system market is recently introduced and a slowly growing market. A fingerprint recognition system is a device that thwarts any unauthorized entry into the vehicle unless the correct fingerprint of the driver is provided. This advanced technology is expected to propel the growth of the biometric vehicle access system market. The base year considered for the study is 2015, and the forecast has been provided for the period between 2016 and 2021.

Market Dynamics

Drivers

- Premium reductions by insurance companies for vehicles installed with biometric systems

- Multi-factor authentication for vehicle safety

- Increase in legislations regarding biometric identification systems

Restraints

- Potential failure pf electronic components used in biometric vehicle access systems.

- Increased price range of biometric systems

Opportunities

- Rising demand for safety features and convenience

- Advent of concept cars and electric vehicles in the automotive industry

Challenges

- Increased connectivity would increase risk of cyber attacks

- Weather conditions might hamper the functionality of biometric systems

Use of fingerprint recognition system in automobile drives the global biometric vehicle access system market

The global biometric vehicle access is a growing new market in vehicle security industry, where these systems are presently used in luxury cars and retro fit by commercial vehicles owners for security and monitoring their fleet. The biometric security systems have technological variants, and includes fingerprints, hand geometry, voice verification, and retina/ iris/ face recognition. The technology works as automated access monitoring system, which is primarily based on driver behavioral or physiological characteristics, that does verification and recognition to access the vehicle. The biometric access systems are safeguarded by number of provisions and technique’s, namely, multimodal biometric systems, template-on-token, match-on-token, data-hiding techniques, and cancellable biometrics.

The following are the major objectives of the study.

- To define, describe, and forecast the global market for biometric vehicle access systems on the basis of authentication type, vehicle type, characteristics type and region, in terms of volume (units) and value (USD million).

- To provide detailed information about the major factors influencing the growth of the market (drivers, restraints, opportunities, and industry-specific challenges)

- To analyze opportunities for stakeholders and provide details of the competitive landscape for market leaders

- To strategically analyze sub-segments (vehicle type, authentication type, and characteristics) with respect to individual growth trends, prospects, and contribution to the total market

- To forecast the size of market segments with respect to four main regions (along with key countries) namely, Asia-Pacific, North America, Europe, and the Rest of the World (RoW)

- To strategically profile key players and comprehensively analyze their strategies and core competencies

- To track and analyze competitive developments such as joint ventures, mergers & acquisitions, new product developments, and research & development (R&D) in the biometric vehicle access system market

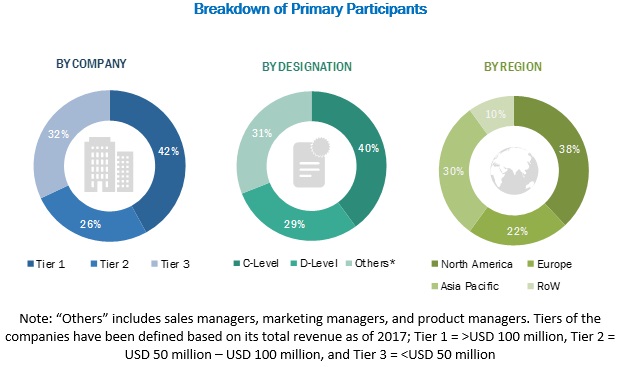

During this research study, major players operating in the biometric vehicle access system market in various regions have been identified, and their offerings, regional presence, and distribution channels have been analyzed through in-depth discussions. Top-down and bottom-up approaches have been used to determine the overall market size. Sizes of the other individual markets have been estimated using the percentage splits obtained through secondary sources such as Hoovers, Bloomberg BusinessWeek, and Factiva, along with primary respondents. The entire procedure includes the study of the annual and financial reports of the top market players and extensive interviews with industry experts such as CEOs, VPs, directors, and marketing executives for key insights (both qualitative and quantitative) pertaining to the market. The figure below shows the breakdown of the primaries on the basis of the company type, designation, and region considered during the research study.

To know about the assumptions considered for the study, download the pdf brochure

The biometric vehicle access system market comprises a network of players involved in the research and product development; raw material supply; component manufacturing; distribution and sale; and post-sales services. Key players considered in the analysis of the biometric vehicle access system market are Safran S.A (France), Hitachi Ltd. (Japan), and Fujitsu Ltd. (Japan)

Major Market Developments

- In October 2016, Fujitsu announced development of a new technology that would utilise machine learning and image processing to analyze surveillance camera images of traffic. The company is planning to increase the accuracy and incidents recognizable with this technology.

- In February 2016, EyeLock(subsidiary) has announced on a new iris identification technology to start the ignition of cars. EyeLock's technology looks at over 240 points in each eye, and the vehicle starts only after the scan is matched to the driver's iris template.

- In March 2016, Nuance Communications ntroduced a Dragon Drive connected car platform and Nuance Mix voice platform. This technology would provide automakers with a set of capabilities to create intelligent and conversational voice experiences for cars.

Target Audience:

- Original equipment manufacturers (OEMs) of biometric vehicle access system

- Integrated device manufacturers

- Consumer electronics manufacturers

- Research organizations and consulting companies

- Subcomponent manufacturers

- Technology providers

- HMI manufacturer

Report Scope:

By Authentication Type

- Fingerprint Recognition

- Voice Recognition

By Future Technology

- Iris Recognition System

By Vehicle Type

- Passenger Car

- Battery Electric Vehicle

By Geography:

- North America

- Europe

- Asia Pacific (APAC)

- Rest of the World (RoW)

Critical questions which the report answers

- What are new application areas which the biometric vehicle access system and HMI companies are exploring?

- Which are the key players in the market and how intense is the competition?

Available Customizations:

Based on the given market data, MarketsandMarkets offers customizations in the reports as per the client’s specific requirements. The available customization options are as follows:

Geographic Analysis

- Further country-wise breakdown of the market in APAC based on authentication type

Company Information

- Detailed analysis and profiling of additional market players (Up to 5)

The overall biometric vehicle access system is expected to grow from USD 0.44 billion in 2016 to USD 0.85 billion by 2021 at a CAGR of 14.06%. premium reductions by insurance companies for vehicles installed biometric systems, multi-factor authentication for vehicle safety and increase in legislations regarding biometric identification systems are the key factors driving the growth of this market.

Biometric vehicle access systems comprise of different mechanisms that use biometric identification factors such as voice, iris, and fingerprint to unlock the vehicle. Biometric technology is an automated access monitoring system, based on behavioral or physiological characteristics, used for verification and recognition of a manual access. Some of the versions of this technology available for vehicle access are fingerprint recognition systems, iris recognition systems, and voice recognition systems.

The biometric vehicle access system has been segmented, based on authentication type, into fingerprint recognition and voice recognition. The market for into voice recognition system is expected to grow at the highest CAGR between 2016 and 2021. The fingerprint recognition system is more widely present in the market as compared to voice recognition system for vehicle access. Biometric vehicle access systems are still in a growing phase.

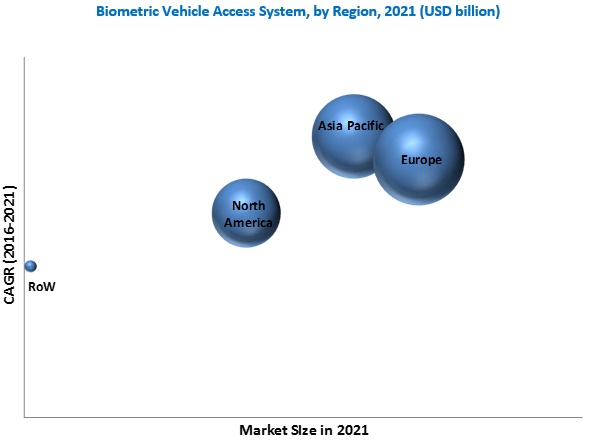

The biometric vehicle access system in APAC is expected to grow at the highest CAGR during the forecast period. APAC is the fastest-growing market for biometric vehicle access system. The rise in disposable income in APAC countries has led to the increase in the demand for vehicles and consumer appliances, which, in turn, has increased the growth of biometric vehicle access system in this region. Europe is projected to account for the largest share, in terms of value. Rising innovations and technological advancements in Europe could be a contributing factor for this growth.

The rise in adoption of biometric technology would drive growth in the biometric vehicle access system market

Finger Print Recognition System

A device and method for accessing a vehicle with electrically activated door locks. The system uses a fingerprint sensor to detect whether the person has the right to entry. The device includes means to selectively open doors, trunks, etc., using different fingers and is used in conjunction with an existing access control and alarm system.

Iris Recognition System

An iris recognition system is as an automated method of biometric identification that uses mathematical pattern recognition techniques on images of one or both of the irises of an individual's eyes. Such systems can be used to unlock and start a vehicle.

Voice Recognition System

The system uses voice recognition software to detect whether the person has the right to entry. Voice recognition systems are also used to access other features like multimedia in the vehicle.

Critical questions the report answers:

- Where will all these developments take the industry in the mid to long term?

- What are the upcoming applications for biometric vehicle access?

- How human machine interface will affect the biometric vehicle access system market?

Potential failure of electronic components used in biometric vehicle access systems is a major factor restraining the growth of the market. Biometric vehicle access systems are highly dependent on electronic components such as electrical wiring and batteries for their smooth functioning. Failure in any of these components could adversely affect the vehicle’s security system. This also results in many replacements in case of minor damage to the security system. The reliability of electronic components is extremely important in the case of complex security systems such as fingerprint recognition systems. Thus, the potential failure of electronic components can prove to be a restraint for the biometric vehicle access market.

Key players in the market include Hitachi Ltd (Japan) and Fujitsu Ltd (Japan), Safran S.A (France), Synaptics Incorporated (US.), and Nuance Communications (US). These players are increasingly undertaking new product launches, expansions to develop and introduce modern technologies and products in the market.

To speak to our analyst for a discussion on the above findings, click Speak to Analyst

Table of Contents

1 Introduction (Page No. - 14)

1.1 Objectives of the Study

1.2 Market Definition

1.3 Market Scope

1.3.1 Biometric Vehicle Access System Market Segmentation

1.3.2 Years Considered for the Study

1.4 Currency

1.5 Package Size

1.6 Limitations

1.7 Stakeholders

2 Research Methodology (Page No. - 17)

2.1 Secondary Data

2.1.1 Key Secondary Sources

2.1.2 Key Data From Secondary Sources

2.2 Primary Data

2.2.1 Sampling Techniques & Data Collection Methods

2.2.2 Primary Participants

2.3 Factor Analysis

2.3.1 Introduction

2.3.2 Demand-Side Analysis

2.3.2.1 Impact of Infrastructure Investment on Vehicle Sales

2.3.2.2 Urbanization vs Passenger Cars Per 1000 People

2.3.2.3 Increasing Vehicle Production in Developing Economies

2.3.2.4 Increasing Global Sales of Premium Vehicles

2.3.3 Supply Side Analysis

2.3.3.1 Technological Development

2.4 Market Size Estimation

2.5 Data Triangulation

2.6 Assumptions

3 Executive Summary (Page No. - 27)

4 Premium Insights (Page No. - 32)

4.1 Opportunities in the Biometric Vehicle Access System Market

4.2 Biometric Vehicle Access System Market, By Region, 2016

4.3 Biometric Vehicle Access System Market, By Future Technology, 2025

4.4 Biometric Vehicle Access System Market, By Authentication Type

4.5 Biometric Vehicle Access System Market, By Battery Electric Vehicle

4.6 Biometric Vehicle Access System Market - Product Life Cycle

5 Market Overview (Page No. - 38)

5.1 Introduction

5.2 Market Segmentation

5.2.1 Biometric Vehicle Access System Market

5.3 Market Dynamics

5.3.1 Drivers

5.3.1.1 Premium Reductions By Insurance Companies for Vehicles Installed With Biometric Systems

5.3.1.2 Multi-Factor Authentication for Vehicle Safety

5.3.1.3 Increase in Legislations Regarding Biometric Identification Systems

5.3.2 Restraints

5.3.2.1 Potential Failure of Electronic Components Used in Biometric Vehicle Access Systems

5.3.2.2 Increased Price Range of Biometric Systems

5.3.3 Opportunities

5.3.3.1 Rising Demand for Safety Features and Convenience

5.3.3.2 Advent of Concept Cars and Electric Vehicles in the Automotive Industry

5.3.4 Challenges

5.3.4.1 Increased Connectivity Would Induce Risk of Cyber Attacks

5.3.4.2 Weather Conditions Might Hamper the Functionality of Biometric Systems

5.4 Porter’s Five Forces Analysis

5.4.1 Threat of New Entrants

5.4.1.1 Limited Players in the Market

5.4.2 Threat of Substitutes

5.4.2.1 Biometric Vehicle Access System is A Growing Technology

5.4.3 Bargaining Power of Suppliers

5.4.3.1 Small Number of Organized Players

5.4.4 Bargaining Power of Buyers

5.4.5 Intensity of Competitive Rivalry

5.4.5.1 High Exit Barriers

6 Biometric Vehicle Access System Market, By Region (Page No. - 46)

6.1 Introduction

6.1.1 North America

6.1.1.1 U.S.

6.1.1.2 Canada

6.1.1.3 Mexico

6.1.2 Europe

6.1.2.1 Germany

6.1.2.2 France

6.1.2.3 U.K.

6.1.2.4 Rest of Europe

6.1.3 Asia-Pacific

6.1.3.1 China

6.1.3.2 Japan

6.1.3.3 South Korea

6.1.3.4 India

6.1.4 Rest of the World

6.1.4.1 Brazil

6.1.4.2 Russia

7 Biometric Vehicle Access System Market, By Authentication Type (Page No. - 73)

7.1 Introduction

7.2 Biometric Vehicle Access System Market Size, By Region

7.2.1 Fingerprint Recognition System

7.3 Voice Recognition System

8 Biometric Vehicle Access System Market, By Future Technology (Page No. - 80)

8.1 Introduction

8.2 IRIS Recognition System Market, By Region Type

8.2.1 Asia Pacific

8.3 Europe

8.3.1 European IRIS Recognition System Market, By Country

8.4 North America

8.4.1 North America IRIS Recognition System Market, By Country

8.5 Rest of World

8.5.1 Rest of the World IRIS Recognition System Market, By Country

9 Biometric Vehicle Access System Market, By Vehicle Type (Page No. - 89)

9.1 Introduction

9.2 Biometric Vehicle Access System Market, By Region

9.2.1 Passenger Cars

9.2.2 Battery Electric Vehicle

10 Competitive Landscape (Page No. - 94)

10.1 Overview

10.2 Market Ranking Analysis: Biometric Vehicle Access System Market

10.3 New Product Launches

10.4 Expansions

10.5 Supply Contracts/Agreements/Partnerships

10.6 Joint Ventures/Mergers & Acquisitions

10.7 Glance on Patented Biomteric Technology

11 Company Profiles (Page No. - 103)

(Overview, Financial*, Products & Services, Strategy, and Developments)

11.1 Hitachi Ltd

11.2 Fujitsu Ltd

11.3 Safran S.A

11.4 Synaptics Incorporated

11.5 Nuance Communications

11.6 Methode Electronics

11.7 Hid-Global

11.8 VOXX International

11.9 Fingerprint Cards Ab

11.10 Voicebox Technologies

*Details Might Not Be Captured in Case of Unlisted Companies

12 Appendix (Page No. - 127)

12.1 Key Insights of Industry Experts

12.2 Discussion Guide

12.3 Knowledge Store: Marketsandmarkets’ Subscription Portal

12.4 Available Customizations

12.5 Related Reports

12.6 Author Details

List of Tables (69 Tables)

Table 1 Biometric Vehicle Access System Market Size, By Region, 2014–2021, (‘000 Units)

Table 2 Biometric Vehicle Access System Market Size, By Region, 2014–2021, (USD Million)

Table 3 North America: Biometric Vehicle Access System Market Size, By Product Type, 2014–2021, (‘000 Units)

Table 4 North America: Biometric Vehicle Access System Market Size, By Product Type, 2014–2021, (USD Million)

Table 5 North America: Biometric Vehicle Access System Market Size, By Country, 2014–2021, (‘000 Units)

Table 6 North America: Biometric Vehicle Access System Market Size, By Country, 2014–2021, (USD Million)

Table 7 U.S.: Biometric Vehicle Access System Market Size, By Product Type, 2014–2021, (‘000 Units)

Table 8 U.S.: Biometric Vehicle Access System Market Size, By Product Type, 2014–2021, (USD Million)

Table 9 Canada: Biometric Vehicle Access System Market Size, By Product Type, 2014–2021, (‘000 Units)

Table 10 Canada: Biometric Vehicle Access System Market Size, By Product Type, 2014–2021, (USD Million)

Table 11 Mexico: Biometric Vehicle Access System Market Size, By Product Type, 2014–2021, (‘000 Units)

Table 12 Mexico: Biometric Vehicle Access System Market Size, By Product Type, 2014–2021, (USD Million)

Table 13 Europe: Biometric Vehicle Access System Market Size, By Product Type, 2014–2021, (‘000 Units)

Table 14 Europe: Biometric Vehicle Access System Market Size, By Product Type, 2014–2021, (USD Million)

Table 15 Europe: Biometric Vehicle Access System Market Size, By Country, 2014–2021, (‘000 Units)

Table 16 Europe: Biometric Vehicle Access System Market Size, By Country, 2014–2021, (USD Million)

Table 17 Germany: Biometric Vehicle Access System Market Size, By Product Type, 2014–2021, (‘000 Units)

Table 18 Germany: Biometric Vehicle Access System Market Size, By Product Type, 2014–2021, (USD Million)

Table 19 France: Biometric Vehicle Access System Market Size, By Product Type, 2014–2021, (‘000 Units)

Table 20 France: Biometric Vehicle Access System Market Size, By Product Type, 2014–2021, (USD Million)

Table 21 U.K.: Biometric Vehicle Access System Market Size, By Product Type, 2014–2021, (‘000 Units)

Table 22 U.K.: Biometric Vehicle Access System Market Size, By Product Type, 2014–2021, (USD Million)

Table 23 Rest of Europe: Biometric Vehicle Access System Market Size, By Product Type, 2014–2021 (‘000 Units)

Table 24 Rest of Europe: Biometric Vehicle Access System Market Size, By Product Type, 2014–2021 (USD Million)

Table 25 Asia-Pacific: Biometric Vehicle Access System Market Size, By Product Type, 2014–2021, (‘000 Units)

Table 26 Asia-Pacific: Biometric Vehicle Access System Market Size, By Product Type, 2014–2021 (USD Million)

Table 27 Asia-Pacific: Biometric Vehicle Access System Market Size, By Country, 2014–2021 (‘000 Units)

Table 28 Asia-Pacific: Biometric Vehicle Access System Market Size, By Product Type, 2014–2021 (USD Million)

Table 29 China: Biometric Vehicle Access System Market Size, By Product Type, 2014–2021 (‘000 Units)

Table 30 China: Biometric Vehicle Access System Market Size, By Product Type, 2014–2021 (USD Million)

Table 31 Japan: Biometric Vehicle Access System Market Size, By Product Type, 2014–2021 (‘000 Units)

Table 32 Japan: Biometric Vehicle Access System Market Size, By Product Type, 2014–2021 (USD Million)

Table 33 South Korea: Biometric Vehicle Access System Market Size, By Product Type, 2014–2021 (‘000 Units)

Table 34 South Korea: Biometric Vehicle Access System Market Size, By Product Type, 2014–2021 (USD Million)

Table 35 India: Biometric Vehicle Access System Market Size, By Product Type, 2014–2021 (‘000 Units)

Table 36 India: Biometric Vehicle Access System Market Size, By Product Type, 2014–2021 (USD Million)

Table 37 RoW: Biometric Vehicle Access System Market Size, By Product Type, 2014–2021 (‘000 Units)

Table 38 RoW: Biometric Vehicle Access System Market Size, By Product Type, 2014–2021 (USD Million)

Table 39 RoW: Biometric Vehicle Access System Market Size, By Country, 2014–2021 (‘000 Units)

Table 40 RoW: Biometric Vehicle Access System Market Size, By Country, 2014–2021 (USD Million)

Table 41 Brazil: Biometric Vehicle Access System Market Size, By Product Type, 2014–2021 (‘000 Units)

Table 42 Brazil: Biometric Vehicle Access System Market Size, By Product Type, 2014–2021 (USD Million)

Table 43 Russia: Biometric Vehicle Access System Market Size, By Product Type, 2014–2021 (‘000 Units)

Table 44 Russia: Biometric Vehicle Access System Market Size, By Product Type, 2014–2021 (USD Million)

Table 45 Biometric Vehicle Access System Market Size, By Region, 2014–2021 (‘000 Units)

Table 46 Biometric Vehicle Access System Market Size, By Region, 2014–2021 (USD Million)

Table 47 Finger Print Recognition System Market Size, By Region, 2014–2021 (‘000 Units)

Table 48 Finger Print Recognition System Market Size, By Region, 2014–2021 (USD Million)

Table 49 Voice Recognition System Market Size, By Region, 2014–2021 (‘000 Units)

Table 50 Voice Recognition System Market Size, By Region, 2014–2021 (USD Million)

Table 51 Vehicle IRIS Recognition System Market Size, By Region, 2021–2025, (‘000 Units)

Table 52 Vehicle IRIS Recognition System Market Size, By Region, 2021–2025, (USD Million)

Table 53 Asia Pacific: IRIS Recognition System Market Size, By Country, 2021–2025, (‘000 Units)

Table 54 Asia Pacific: IRIS Recognition Market Size, By Country, 2021–2025, (USD Million)

Table 55 Europe: IRIS Recognition System Market Size, By Country, 2021–2025 (‘000 Units)

Table 56 Europe: IRIS Recognition System Market Size, By Country, 2021–2025 (USD Million)

Table 57 North America: IRIS Recognition System Market Size, By Country, 2021–2025, (‘000 Units)

Table 58 North America: IRIS Recognition System Market Size, By Country, 2021–2025 (USD Million)

Table 59 Rest of World - IRIS Recognition System Market Size, By Country, 2021–2025 (‘000 Units)

Table 60 Rest of World - IRIS Recognition System Market Size, By Country, 2021–2025 (USD Million)

Table 61 Passenger Car Biometric Vehicle Access System, By Region, 2014–2021 (000’ Units)

Table 62 Passenger Car Biometric Vehicle Access System, By Region, 2014–2021 (USD Million)

Table 63 Battery Electric Vehicle Biometric Vehicle Access System, By Region, 2014–2021 (Units)

Table 64 Battery Electric Vehicle Biometric Vehicle Access System, By Region, 2014–2021 (USD Thousand)

Table 65 Biometric Vehicle Access System Market Ranking: 2016

Table 66 New Product Launches, 2013–2016

Table 67 Expansions, 2013–2016

Table 68 Supply Contracts/Agreements/Partnerships, 2013–2016

Table 69 Joint Ventures/Mergers & Acquisitions, 2014–2016

List of Figures (54 Figures)

Figure 1 Biometric Vehicle Access System Market: Research Design

Figure 2 Research Methodology Model

Figure 3 Breakdown of Primary Interviews: By Company Type, Designation, & Region

Figure 4 Urbanization vs Passenger Cars Per 1,000 People

Figure 5 Vehicle Production, 2010–2015

Figure 6 Market Size Estimation Methodology: Bottom-Up Approach

Figure 7 Fingerprint Recognition System to Be the Largest Contributor to the Biometric Vehicle Access System Market, By Product Type (2016 & 2021)

Figure 8 Europe Estimated to Be the Largest Contributor to the Biometric Vehicle Access System Market, By Passenger Cars (2016 & 2021)

Figure 9 Biometric Vehicle Access System Market, By Future Technology, 2023 to 2025

Figure 10 Battery Electric Vehicle Biometric Vehicle Access System Market, By Region (2016-2021 )

Figure 11 Europe to Hold the Largest Share in the Biometric Vehicle Access System Market, By Product Type, in 2016

Figure 12 Technological Advancements & the Growth of the Automotive Industry are Expected to Drive the Biometric Vehicle Access System Market

Figure 13 Europe to Be the Largest Market for Biometric Vehicle Access Systems

Figure 14 Asia-Pacific to Hold the Largest Share in the Future IRIS Recognition System Market

Figure 15 Fingerprint Recognition System Estimated to Occupy the Largest Share in the Biometric Vehicle Access System Market From 2016 to 2021

Figure 16 Asia-Pacific to Hold the Largest Share in the Biometric Vehicle Access System Market, By Battery Electric Vehicle, From 2016 to 2021

Figure 17 Product Life Cycle of Biometric Vehicle Access Systems

Figure 18 Fingerprint Recognition System to Hold the Largest Share in the Biometric Vehicle Access System Market, By Product Type, in 2016

Figure 19 Biometric Vehicle Access System Market Segmentation

Figure 20 Increasing Benefits From the Insurance Companies to Drive the Market for Biometric Vehicle Access Systems

Figure 21 Regional Snapshot– Japanese Biometric Vehicle Access System Market Set to Grow at the Highest CAGR of 17.18% During the Forecast Period

Figure 22 North American Market Snapshot: Demand to Be Driven By the Increasing Vehicle Production

Figure 23 Biometric Vehicle Access System Market Split, By Country, in Major European Markets (2016 vs 2021)

Figure 24 European Biometric Vehicle Access System Market Snapshot : Germany to Lead the European Market

Figure 25 Asia-Pacific Biometric Vehicle Access System Market Snapshot – China to Account for the Largest Market Share in 2016

Figure 26 Asia-Pacific Biometric Vehicle Access System Market Snapshot – Voice Recognition System Segment to Hold the Largest Share

Figure 27 Biometric Vehicle Access System Market Split, By Country, in the Rest of the World (2016 vs 2021)

Figure 28 Biometric Vehicle Access System Market Size, By Region, 2016–2021

Figure 29 Finger Print Recognition System Market Growth, 2016–2021

Figure 30 Voice Recognition System Market, 2016 vs 2021

Figure 31 IRIS Recognition System Market, By Region Type, 2023–2025

Figure 32 Asia Pacific: IRIS Recognition System Market Growth, 2023–2025

Figure 33 European IRIS Recognition System Market, 2023 vs 2025

Figure 34 North American IRIS Recognition System Market, 2023 vs 2025

Figure 35 Rest of the World IRIS Recognition System Market, 2023 vs 2025

Figure 36 Biometric Vehicle Access System Market, By Region, 2016–2021

Figure 37 North America to Constitute the Largest Market for Biometric Vehicle Access System

Figure 38 Companies Adopted New Product Launches as Key Growth Strategies From 2014 to 2016

Figure 39 Market Evaluation Framework: New Product Launches Fuelled Market Growth From 2015 to 2016

Figure 40 Battle for Market Share: New Product Launches Were the Key Strategy

Figure 41 Company Snapshot: Hitachi Ltd

Figure 42 Hitachi Ltd: SWOT Analysis

Figure 43 Company Snapshot: Fujitsu Ltd

Figure 44 Fujitsu Ltd: SWOT Analysis

Figure 45 Company Snapshot: Safran S.A

Figure 46 Safran S.A: SWOT Analysis

Figure 47 Company Snapshot: Synaptics Incorporated

Figure 48 Synaptics Incorporated: SWOT Analysis

Figure 49 Company Snapshot: Nuance Communications

Figure 50 Nuance Communications: SWOT Analysis

Figure 51 Company Snapshot: Methode Electronics

Figure 52 Company Snapshot: Hid-Global

Figure 53 Company Snapshot: VOXX International

Figure 54 Company Snapshot: Fingerprint Cards AB

Growth opportunities and latent adjacency in Biometric Vehicle Access System Market