Vehicle Access Control Market by Biometric (Fingerprint, Face, Iris, Voice), Non-biometric (Stolen Vehicle Assist, Keyless, Immobilizer, Alarm, Steering Lock), Technology (Bluetooth, NFC, RFID, Wi-Fi), Vehicle Type, EV & Region - Global Forecast to 2027

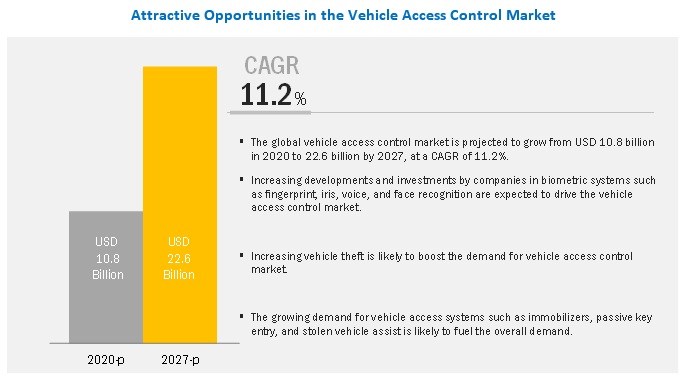

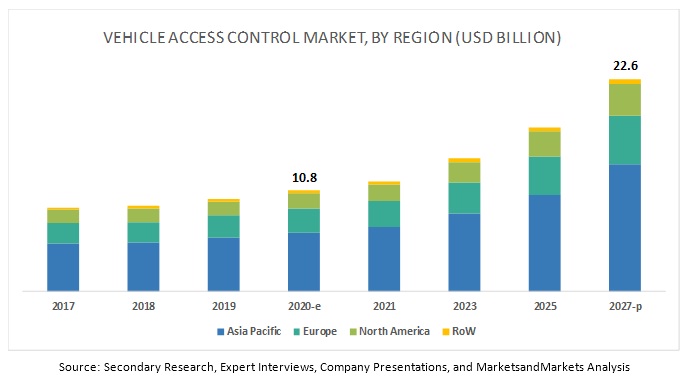

The global Vehicle Access Control Market is projected to grow from USD 10.8 billion in 2020 to 22.6 billion by 2027, at a CAGR of 11.2%. The rising concern towards vehicle security, growing production of PCs and LCVs, and the increasing demand for electric vehicle have led to the growth of the market. Premium car models would provide another sustainable and profitable revenue stream in the future for vehicle access based biometric systems in automotive industry.

Light commercial vehicle is expected to emerge as the fastest market during the forecast period

The light commercial vehicle is expected to be the fastest growing market during the forecast period. Safety features like alarms, immobilizers, and central locking are now added as a standard attribute by OEMs in the developed countries. The continuous increase in the demand for LCVs in countries such as the US, Germany, France, and the UK are attributing to the growth of this market for LCVs. Moreover, a shift in consumer preference is fuelling vehicle access control market growth. Additionally, the sales of LCV is continually increasing in many countries, which will boost demand.

Non-biometric system is expected to lead the vehicle access control system during the forecast period

The non-biometric system is expected to be the largest and the fastest growing market. The system uses automotive sensors, which are a reliable and less costly technology. These sensors are relatively simple and used in applications like keyless entry, allowing OEMs to adopt such features in almost all premium models, easily. This trend for safety features with reliability is expected to boost the market.

North America is expected to witness significant growth during the forecast period.

An increasing number of vehicle theft incidents will drive the demand for advanced security features like keyless entry and electronic immobilizers. Vehicle theft instances have grown significantly in the US. According to the National Insurance Crime Bureau, USD 6 billion was lost due to vehicle thefts in the US. Therefore, OEMs are adding new features like stolen vehicle assist and electronic immobilizers for better vehicle safety and security.

Moreover, vehicles in the US are occupied mostly with advanced systems such as vehicle stolen assist, keyless entry, electronic immobilizers, and others, which will fuel the overall growth of the vehicle access control market. Rising EV sales and demand for LCVs in Canada and the US will boost the market. Large scale autonomous vehicle testing and deployment will require vehicle safety features like face and fingerprint recognition.

Key Market Players

The global vehicle access control market is dominated by major players such as Denso Corporation (Japan), Valeo (France), Continental AG (Germany), Robert Bosch (Germany), and Nuance Communication (US). These companies have strong distribution networks at a global level. Besides, these companies offer an extensive service range in the market. The key strategies adopted by these companies to sustain their market position are new product developments, collaborations, and contracts & agreements.

Scope of the Report

|

Report Metric |

Details |

|

Market size available for years |

2017–2027 |

|

Base year considered |

2018 |

|

Forecast period |

2020–2027 |

|

Forecast units |

Volume (000’ units) & Value (USD Million) |

|

Segments covered |

Type, Biometric System, Non-Biometric System, Technology, Vehicle Type, Electric Vehicle and Region |

|

Geographies covered |

North America, Asia Pacific, Europe, and Rest of the World. |

|

Companies Covered |

Denso Corporation (Japan), Valeo (France), Continental AG (Germany), Robert Bosch (Germany), and Nuance Communication (US) |

This research report categorizes the vehicle access control market based on type, biometric system, non-biometric system, technology, vehicle type, electric vehicle and region.

On the basis of by type, the market has been segmented as follows:

- Biometric System

- Non-Biometric System

On the basis of biometric system, the market has been segmented as follows:

- Face Recognition

- Fingerprint Recognition

- Iris Recognition

- Voice Recognition

On the basis of non-biometric system, the market has been segmented as follows:

- Keyless entry

- Alarm

- Immobilizer

- Steering wheel lock

- Stolen Vehicle Assist

- Others (Tire Lock, Gear Lock, and Hood Lock)

On the basis of technology, the market has been segmented as follows:

- Bluetooth

- NFC

- RFID

- Wi-Fi

On the basis of vehicle type, the market has been segmented as follows:

- PC

- LCV

- HCV

On the basis of electric vehicle, the market has been segmented as follows:

- BEV

- HEV

- PHEV

- FCEV

On the basis of region, the market has been segmented as follows:

-

Asia Pacific

- China

- India

- Japan

- South Korea

- Others

-

North America

- US

- Canada

- Mexico

-

Europe

- France

- Germany

- Italy

- Russia

- Spain

- UK

- Others (Belgium, Sweden, Hungary, Poland)

-

Rest of the World

- Brazil

- Iran

- Others (Algeria, Morocco)

Recent Developments

- Continental, in February 2019, announced its successful acquisition of Kathrein Automotive GmbH. Incorporating the automotive division of Kathrein, a Rosenheim-based antenna, and satellite technology manufacturer is a move that will give Continental an important key segment to add to its wealth of expertise. Potential applications range from remote access keys and navigation applications to telematics solutions.

- Bosch has announced its keyless digital access service, in January 2019. It recognizes the owner’s smartphone digital fingerprint and opens the vehicle only for them. The keyless service offers the driver greater convenience and flexibility. The app allows the vehicle owner to grant other users access to their vehicle. For this, an additional key is sent by the cloud.

Critical Questions:

- Where will biometric access take the industry in the long term? What will be the growth of the biometric and non-biometric based vehicle access control systems?

- How will the biometric access control market cope with the challenge of the high cost of implementation?

- What is the impact of phone-based vehicle access system on the market?

- What are the upcoming trends in vehicle access technology? What impact would they make post 2020?

- What are the key strategies adopted by the top players to increase their revenue?

Frequently Asked Questions (FAQ):

What is the market size of the vehicle access control?

The vehicle access control market is projected to grow to USD 22.6 billion by 2027 from USD 10.8 billion in 2020, at a CAGR of 11.2%.

Who are the top players in the vehicle access control market? What are their organic & inorganic strategies?

Some of the key players in the vehicle access control market are Denso Corporation (Japan), Valeo (France), Continental AG (Germany), Robert Bosch (Germany), and Nuance Communication (US). These companies have adopted strategies such as new product developments and collaborations to sustain their market position.

What is the market scenario in North America region?

The North American vehicle access control market is expected witness significant growth during the forecast period. Incorporation of advanced systems such as vehicle stolen assist, electronic immobilizers, and others due to increasing vehicle theft incidents in the US will have positive impact in the market.

Which vehicle control access system would dominate the market – biometric or non-biometric?

The non-biometric system is expected to lead the vehicle access control market. Non-biometric systems are more reliable and lower in cost compared to the biometric systems.

What are the futuristic authentication systems in the vehicle access control market?

Biometric authentication systems such as facial recognition, fingerprint recognition, iris scanning, and voice recognition systems are the upcoming trends in the vehicle access control market. Increasing investments to biometric systems would be major growth driver for the market. .

To speak to our analyst for a discussion on the above findings, click Speak to Analyst

Table of Contents

1 Introduction

1.1 Objectives of the Study

1.2 Market Definition

1.3 Market Scope

1.3.1 Markets Covered

1.3.2 Years Considered for the Study

1.4 Currency

1.5 Limitations

1.6 Stakeholders

2 Research Methodology

2.1 Research Data

2.2 Secondary Data

2.2.1 Key Secondary Sources

2.2.2 Key Data From Secondary Sources

2.3 Primary Data

2.3.1 Key Data From Primary Sources

2.4 Market Size Estimation

2.4.1 Bottom-Up Approach

2.5 Market Breakdown and Data Triangulation

2.6 Assumptions

3 Executive Summary

4 Premium Insights

4.1 Vehicle Access Control Market to Grow at A Significant Rate During the Forecast Period (2020–2027)

4.2 Asia Pacific to Lead the Global Market

4.3 Market, By System Type

4.4 Market, By Vehicle Type

4.5 Market, By Non-Biometric System

4.6 Market, By Biometric System

5 Market Overview

5.1 Introduction

5.2 Market Dynamics

5.2.1 Drivers

5.2.2 Restraints

5.2.3 Opportunities

5.2.4 Challenges

5.3 Impact Analysis

6 Industry Trend

6.1 Technology Overview

6.1.1 Application-Based Vehicle Access Control System

6.1.2 Face Recognition in Vehicle Access

6.2 Value Chain Analysis

6.3 Macroindicator Analysis

6.3.1 Germany

6.3.2 US

6.3.3 China

7 Vehicle Access Control Market, By System Type

7.1 Introduction

7.2 Market Share Analysis, By System Type

7.3 Biometric System

7.4 Non-Biometric System

8 Vehicle Access Control Market, By Biometric System

8.1 Introduction

8.2 Market Share Analysis, By Biometric System

8.3 Face Recognition System

8.4 Fingerprint Recognition System

8.5 Iris Recognition System

8.6 Voice Recognition System

8.7 Market Size Forecast , By Biometric System

9 Vehicle Access Control Market, By Non-Biometric System

9.1 Introduction

9.2 Market Share Analysis, By Non-Biometric System

9.3 Keyless Entry

9.4 Stolen Vehicle Assist

9.5 Alarm

9.6 Electronic Immobilizer

9.7 Steering Wheel Lock

9.8 Others

10 Vehicle Access Control Market, By Technology

10.1 Introduction

10.2 Market Share Analysis, By Technology

10.3 NFC

10.4 Bluetooth

10.5 RFID

10.6 Wi-Fi

11 Vehicle Access Control Market, By Vehicle Type

11.1 Introduction

11.2 Market Share Analysis, By Vehicle Type

11.3 Passenger Car

11.4 Light Commercial Vehicle

11.5 Heavy Commercial Vehicle

12 Vehicle Access Control Market, By Electric Vehicle

12.1 Introduction

12.2 Market Share Analysis, By Electric Vehicle

12.3 Battery Electric Vehicle

12.4 Hybrid Electric Vehicle

12.5 Plug-In Hybrid Electric Vehicle

12.6 Fuel Cell Electric Vehicle

13 Vehicle Access Control Market, By Region

13.1 Introduction

13.2 Asia Pacific

13.2.1 China

13.2.2 India

13.2.3 Japan

13.2.4 South Korea

13.2.5 Others

13.3 Europe

13.3.1 France

13.3.2 Germany

13.3.3 Italy

13.3.4 Russia

13.3.5 Spain

13.3.6 UK

13.3.7 Others

13.4 North America

13.4.1 US

13.4.2 Canada

13.4.3 Mexico

13.5 Rest of the World

13.5.1 Brazil

13.5.2 Iran

13.5.3 Others

14 Competitive Landscape

14.1 Introduction

14.1.1 Vanguards

14.1.2 Innovators

14.1.3 Dynamic

14.1.4 Emerging

14.2 Vehicle Access Control Market: Vendor Dive Matrix

14.2.1 Global Vehicle Access Control Market: Competitive Leadership Mapping For Non-Biometric, 2019

14.2.2 Global Vehicle Access Control Market: Competitive Leadership Mapping For Biometric, 2019

14.3 Competitive Leadership Mapping

14.4 Market Ranking

14.5 Competitive Scenario

14.5.1 Expansion

14.5.2 New Product Launches/Developments

14.5.3 Collaborations/Joint Ventures/Supply Contracts/Partnerships/Agreements/ Mergers/Acquisition

15 Company Profiles

(Business Overview, Products Offered, Recent Developments, SWOT Analysis, MnM View)*

15.1 Denso Corporation

15.2 Valeo

15.3 Continental AG

15.4 Robert Bosch

15.5 Mitsubishi Electric

15.6 Johnson Electric

15.7 Lear Corporation

15.8 Naunce Communication

15.9 Synaptics Incorporated

15.10 Fingerprint Cards AB

15.11 Voxx International

15.12 Methode Electronics

15.13 Tokai Rika

15.14 U-Shin Ltd

15.15 Deepglint

15.16 Omron Corporation

15.17 Delphi Automotive

15.18 HUF Hülsbeck

15.19 Biodit

15.20 Precise Biometrics

15.21 Calamp

15.22 Onstar

15.23 Hypr

15.24 The Club

15.25 Sanji Security Systems

15.26 Intellicar

*Details On Business Overview, Products Offered, Recent Developments, SWOT Analysis, MnM View Might Not Be Captured In Case Of Unlisted Companies.

16 Appendix

16.1 Discussion Guide

16.2 Knowledge Store: Marketsandmarkets’ Subscription Portal

16.3 Available Customizations

16.4 Related Reports

16.5 Authors Details

List of Tables (58 Tables)

Table 1 Currency Exchange Rates (Per 1 USD)

Table 2 Motor Vehicle Theft in the US, 2008-2017

Table 3 Impact of Market Dynamics

Table 4 Macroindicators Analysis: Germany

Table 5 Macroindicators Analysis: US

Table 6 Macroindicators Analysis: China

Table 7 Biometric: Market, By Region, 2017−2027 (USD Million)

Table 8 Non-Biometric: Market, By Region, 2017−2027 (USD Million)

Table 9 Vehicle Access Control Market Forecast, By Biometric System, 2017 – 2027 (USD Million)

Table 10 Stolen Vehicle Assist System: Market, By Region, 2017 − 2027 (USD Million)

Table 11 Keyless Entry: Market, By Region, 2017−2027 (USD Million)

Table 12 Market Forecast, By Technology, 2017−2027 (000’ Units)

Table 13 Market Forecast, By Vehicle Type, 2017–2027 (USD Million)

Table 14 Market Forecast, By Electric Vehicle, 2017–2027 (USD Million)

Table 15 Market Forecast, By Region, 2017–2027 (USD Million)

Table 16 China: Market Forecast, (USD Million), 2017–2027

Table 17 India: Market Forecast, (USD Million), 2017–2027

Table 18 Japan Market Forecast, (USD Million), 2017–2027

Table 19 South Korea: Market Forecast, (USD Million), 2017–2027

Table 20 Others*: Market Forecast, (USD Million), 2017–2027

Table 21 France: Market Forecast, (USD Million), 2017–2027

Table 22 Germany: Market Forecast, (USD Million), 2017–2027

Table 23 Italy: Market Forecast, (USD Million), 2017–2027

Table 24 Russia: Market Forecast, (USD Million), 2017–2027

Table 25 Spain: Market Forecast, (USD Million), 2017–2027

Table 26 UK: Market Forecast, (USD Million), 2017–2027

Table 27 Others*: Market Forecast, (USD Million), 2017–2027

Table 28 US: Market Forecast, (USD Million), 2017–2027

Table 29 Canada: Market Forecast, (USD Million), 2017–2027

Table 30 Mexico: Market Forecast, (USD Million), 2017–2027

Table 31 Brazil: Market Forecast, (USD Million), 2017–2027

Table 32 Iran : Market Forecast, (USD Million), 2017–2027

Table 33 Others*: Vehicle Access Control Market Forecast, (USD Million), 2017–2027

Table 34 New Product Developments, 2016–2019

Table 35 Expansions, 2017–2019

Table 36 Collaborations/Joint Ventures/Supply Contracts/Partnerships/Agreements, 2016–2019

Table 37 Denso Corporation:New Product Developments/Expansions

Table 38 Denso Corporation:Partnerships/Collaborations/Joint Ventures/Supply Contracts/Agreements/Mergers & Acquisitions

Table 39 Valeo:Partnerships/Collaborations/Joint Ventures/Supply Contracts/Agreements/Mergers & Acquisitions

Table 40 Continental AG:New Product Developments/Expansions

Table 41 Continental AG:Partnerships/Collaborations/Joint Ventures/Supply Contracts/Agreements/Mergers & Acquisitions

Table 42 Robert Bosch:New Product Developments/Expansions

Table 43 Robert Bosch:Partnerships/Collaborations/Joint Ventures/Supply Contracts/Agreements/Mergers & Acquisitions

Table 44 Mitsubishi Electric:New Product Developments/Expansions

Table 45 Johnson Electric:Partnerships/Collaborations/Joint Ventures/Supply Contracts/Agreements/Mergers & Acquisitions

Table 46 Lear Corporation:Partnerships/Collaborations/Joint Ventures/Supply Contracts/Agreements/Mergers & Acquisitions

Table 47 Naunce Communication:New Product Developments/Expansions

Table 48 Naunce Communication:Partnerships/Collaborations/Joint Ventures/Supply Contracts/Agreements/Mergers & Acquisitions

Table 49 Naunce Communication:Partnerships/Collaborations/Joint Ventures/Supply Contracts/Agreements/Mergers & Acquisitions

Table 50 Synaptics Incorporated:New Product Developments/Expansions

Table 51 Synaptics Incorporated:Partnerships/Collaborations/Joint Ventures/Supply Contracts/Agreements/Mergers & Acquisitions

Table 52 Fingerprint Cards Ab:New Product Developments/Expansions

Table 53 Fingerprint Cards Ab:Partnerships/Collaborations/Joint Ventures/Supply Contracts/Agreements/Mergers & Acquisitions

Table 54 Voxx International:New Product Developments/Expansions

Table 55 Voxx International :Partnerships/Collaborations/Joint Ventures/Supply Contracts/Agreements/Mergers & Acquisitions

Table 56 Methode Electronics:Partnerships/Collaborations/Joint Ventures/Supply Contracts/Agreements/Mergers & Acquisitions

Table 57 Tokai Rika:New Product Developments/Expansions

Table 58 Tokai Rika:Partnerships/Collaborations/Joint Ventures/Supply Contracts/Agreements/Mergers & Acquisitions

List of Figures (67 Figures)

Figure 1 Years Considered for the Study

Figure 2 Market: Research Design

Figure 3 Market: Research Methodology Model

Figure 4 Key Data From Secondary Sources

Figure 5 Key Data From Primary Sources

Figure 6 Research Methodology

Figure 7 Data Triangulation

Figure 8 Assumptions

Figure 9 Vehicle Access Control Market: By Region, 2020–2027 (Market Share)

Figure 10 Market: By Vehicle Type, 2020–2027 (USD Million)

Figure 11 Vehicle Access Control Market to Grow at A Significant Rate During the Forecast Period (2020–2027)

Figure 12 Biometric Segment to Witness the Highest Growth in this Market (USD Million)

Figure 13 Light Commercial Vehicle Segment to Witness the Highest Growth in this Market (USD Million)

Figure 14 Stolen Vehicle Assist Segment to Witness the Highest Growth in the VAC Market (USD Million)

Figure 15 Fingerprint Recognition Segment to Witness the Highest Growth in the VAC Market (USD Million)

Figure 16 Vehicle Access Control Market Dynamics

Figure 17 Value Chain Analysis

Figure 18 Vehicle Access Control Market Share By Type, 2020−2027

Figure 19 Market: Biometric System, 2017−2027

Figure 20 Market: Non-Biometric System, 2017− 2027

Figure 21 Market Share By Biometric System, 2020−2027

Figure 22 Market: Face Recognition, 2020−2027

Figure 23 Market: Fingerprint Recognition, 2020−2027

Figure 24 Market: Stolen Vehicle Assist System, 2017−2027

Figure 25 Market: Keyless Entry, 2017−2027

Figure 26 Market Share By Technology, 2020−2027

Figure 27 Market: Bluetooth, 2017 − 2027

Figure 28 Market: RFID, 2017 − 2027

Figure 29 Market Share By Vehicle Type, 2020−2027

Figure 30 Market: Lcv, 2017−2027

Figure 31 Market: Pc, 2017 − 2027

Figure 32 Market Share By Electric Vehicle, 2020−2027

Figure 33 Market: Bev, 2017−2027

Figure 34 Market: Hev, 2017 − 2027

Figure 35 Regional Landscape: 2020–2027

Figure 36 Global Vehicle Access Control Market Value (USD Billion), 2017–2027

Figure 37 Global Vehicle Access Control Market Share, By Region, 2020 –2027

Figure 38 Asia Pacific: Market Snapshot

Figure 39 Asia Pacific Market Share, By Country, 2020–2027

Figure 40 China: Market Forecast, (USD Billion), 2017–2027

Figure 41 India: Market Forecast, (USD Million), 2017–2027

Figure 42 Japan: VAC Market Forecast, (USD Billion), 2017–2027

Figure 43 South Korea: VAC Market Forecast, (USD Million), 2017–2027

Figure 44 Others*: Market Forecast, (USD Million), 2017–2027

Figure 45 Europe: Market Snapshot

Figure 46 Europe: Market Share, By Country, 2020–2027

Figure 47 France: Market Forecast, (USD Million), 2017–2027

Figure 48 Germany: Market Forecast, (USD Million), 2017–2027

Figure 49 Italy: Market Forecast, (USD Million), 2017–2027

Figure 50 Russia: Market Forecast, (USD Million), 2017–2027

Figure 51 Spain: Market Forecast, (USD Million), 2017–2027

Figure 52 UK: Market Forecast, (USD Million), 2017–2027

Figure 53 Others*: Market Forecast, (USD Million), 2017–2027

Figure 54 North America: Market Snapshot

Figure 55 North America Market Share, By Country, 2020–2027

Figure 56 US: Market Forecast, (USD Million), 2017–2027

Figure 57 Canada: Market Forecast, (USD Million), 2017–2027

Figure 58 Mexico: Market Forecast, (USD Million), 2017–2027

Figure 59 Rest of the World: Market Snapshot

Figure 60 Rest of the World Market Share, By Country, 2020–2027

Figure 61 Brazil: Market Forecast, (USD Million), 2017–2027

Figure 62 Iran: Market Forecast, (USD Million), 2017–2027

Figure 63 Others* :Market Forecast, (USD Million), 2017–2027

Figure 64 Global Vehicle Access Control Market: Competitive Leadership Mapping for Non-Biometric, 2019

Figure 65 Global Vehicle Access Control Market: Competitive Leadership Mapping for Biometric, 2019

Figure 66 Key Developments By Leading Players in the Market, 2016–2019

Figure 67 Market Ranking Analysis

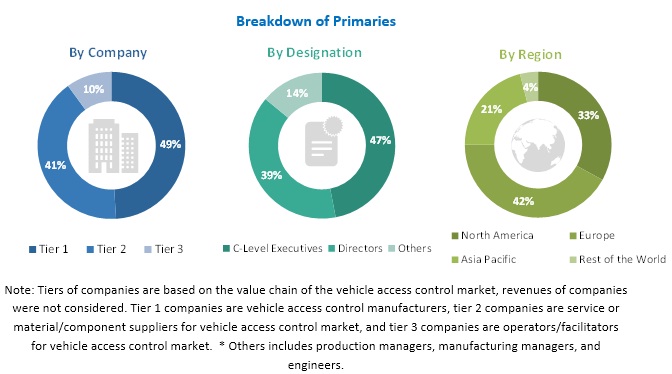

The study involved estimating the current size of the vehicle access control market. Exhaustive secondary research was done to collect information on the market, the peer market, and model mapping. The next step was to validate these findings, assumptions, and sizing with the industry experts across value chains through primary research. The bottom-up approach was employed to estimate the complete market size. Thereafter, market breakdown and data triangulation were used in estimating the market size of segments and subsegments.

Secondary Research

In the secondary research process, various secondary sources such as company annual reports/presentations, press releases, paid databases, journals, automobile magazines, articles, directories, technical handbooks, World Economic Outlook, trade websites, technical articles, and MarketsandMarkets data repository have been used to identify and collect information useful for an extensive commercial study of the global market.

Primary Research

Extensive primary research has been conducted after acquiring an understanding of the vehicle access control market scenario through secondary research. Several primary interviews have been conducted with the market experts from both the demand-side [system integrators (in terms of services, country-level government associations, and trade associations)] and supply-side (OEMs and component manufacturers) across 4 major regions, namely, North America, Europe, Asia Pacific, and the Rest of the World. Approximately, 12% and 88% of primary interviews have been conducted from the demand and supply side, respectively. Primary data has been collected through questionnaires, emails, and telephonic interviews. In the canvassing of primaries, we have strived to cover various departments within organizations, such as sales, operations, and administration, to provide a holistic viewpoint in our report.

After interacting with the industry experts, we have also conducted brief sessions with highly experienced independent consultants to reinforce the findings from our primaries. This, along with the in-house subject-matter experts’ opinions, has led us to the findings as described in the remainder of this report. Following is the breakdown of primary respondents

To know about the assumptions considered for the study, download the pdf brochure

Market Size Estimation

The bottom-up approach was used to estimate and validate the total size of vehicle access control market. These methods were also used extensively to estimate the size of various subsegments in the market. The research methodology used to estimate the market size includes the following:

- The key players in the industry and markets have been identified through extensive secondary research.

- The industry’s supply chain and market size, in terms of volume and value, have been determined through primary and secondary research processes.

- All percentage shares, splits, and breakdowns have been determined using secondary sources and verified through primary sources.

Data Triangulation

After arriving at the overall market size-using the market size estimation processes as explained above-the market was split into several segments and subsegments. To complete the overall market engineering process and arrive at the exact statistics of each market segment and subsegment, data triangulation, and market breakdown procedures were employed, wherever applicable. The data was triangulated by studying various factors and trends from both the demand and supply sides.

Report Objectives

- To segment and forecast the market, in terms of volume (000’ units) and value (USD Million)

- To define, describe, and forecast the market based on by type, biometric system, non-biometric system, technology, vehicle type, electric vehicle, and region.

- To analyze the regional markets for growth trends, prospects, and their contribution to the overall vehicle access control market

- To segment and forecast the market, by type (biometric system and non-biometric system)

- To segment and forecast the market, by biometric system (fingerprint, face, iris, and voice recognition)

- To segment and forecast the market, by non-biometric system (keyless entry, alarm, immobilizer, stolen vehicle assist, steering wheel lock and others)

- To segment and forecast the market, by technology (Bluetooth, NFC, RFID, and Wi-Fi)

- To segment and forecast the market, by vehicle type (PC, LCV, and HCV)

- To segment and forecast the market, by electric vehicle (BEV, HEV, PHEV and FCEV)

- To forecast the vehicle access control market with respect to the key regions, namely, North America, Europe, Asia Pacific, and Rest of the World

- To provide detailed information regarding the major factors influencing the market growth (drivers, restraints, opportunities, and challenges)

- To strategically analyze markets with respect to individual growth trends, future prospects, and contribution to the total market

- To analyze opportunities for stakeholders and details of the competitive landscape for market leaders

- To strategically profile key players and comprehensively analyze their respective market share and core competencies

- To analyze recent developments, alliances, joint ventures, product innovations, and mergers & acquisitions in vehicle access control market

Available Customizations

With the given market data, MarketsandMarkets offers customizations in accordance to the company’s specific needs.

- vehicle access control market, by biometric system at country level (for countries not covered in the report)

- vehicle access control market, by technology at country level (for countries not covered in the report)

-

Company Information

- Profiling of Additional Market Players (Up to 3)

Growth opportunities and latent adjacency in Vehicle Access Control Market

Which are the Top 3 players in this market ?

Which are the leading OEMs who are using these kind of updated technology in their cars ?

What will be the decline in overall automotive market you guys expect this year ?

Is South America market covered in this report ?