Vehicle Security System Market by Type, Technology, Vehicle Type (Passenger Car, Commercial Vehicles and Off-Highway Vehicles), and by Region (Asia-Pacific, Europe, North America and Rest of the World) - Industry Trends and Forecast to 2021

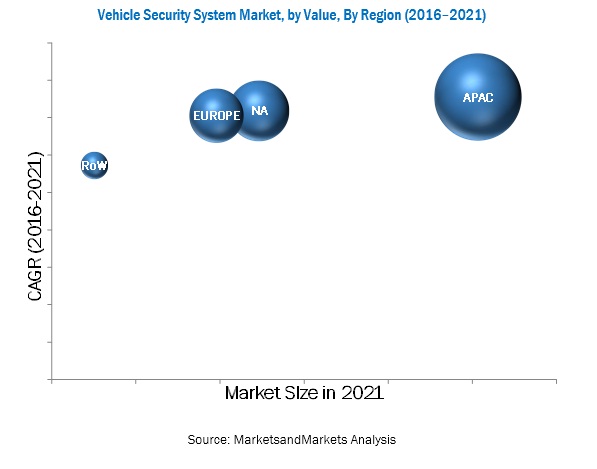

[190 Pages Report] The vehicle security system market, in terms of value, is projected to grow at a CAGR of 7.2% from 2016 to 2021. The market is estimated to be USD 7.57 billion in 2016, and is projected to reach 10.75 billion by 2021. In this study, 2015 has been considered the base year, and 2016 to 2021 the forecast period, for estimating the market size of the vehicle security system market. The study segments the market on the basis of vehicle type, product type, technology, and region.

The market has been classified by product type as follows: alarm, immobilizer, remote keyless entry, passive keyless entry, and central locking system. It has been segmented by technology into global positioning system, global system for mobile communication, face detection system, and real-time location system. Enhanced safety features and the increasing production of vehicles are expected to drive the vehicle security system market in Asia-Pacific. The region is estimated to lead the market, in terms of value, in 2016. The North American region is estimated to be the second-largest market for vehicle security systems, owing to the growing trend of installing safety features in vehicles.

The research methodology used in the report involves various secondary sources, including paid data base and directories. Experts from related industries and suppliers have been interviewed to understand the future trends of the vehicle security system market. The bottom-up approach has been used to estimate the market size, wherein country-wise vehicle production statistics have been taken into account for each vehicle type (passenger car, commercial vehicle, and off-highway vehicle).

The average number of vehicle security systems that are incorporated in each vehicle category has been identified and multiplied by vehicle production numbers to obtain the country-level vehicle security system volume to arrive at the market size. This country-wise market size, in terms of volume, for each vehicle type is then multiplied with the country-wise average OE price (AOP) of vehicle security systems required for each application. This results in the country-wise market size, in terms of value. The summation of the country-wise market provides the regional market and further summation of the regional market provides the global vehicle security system market.

Vehicle Security System Market Dynamics

Drivers

- Stringent security regulations

- Multi-factor authentication for vehicle safety

- Increasing number of advanced security technologies

Restraints

- High cost of premium security features

- Potential failure of electronic components used in vehicle security

Opportunities

- Increased demand for application based technologies

- Rise of biometric technology

Challenges

- Increase in cyber security risk

Increasing demand for application based technologies would drive the global vehicle security system market

The Asia-Pacific market is estimated to be dominated by developing countries such as India and China, where the automotive industry is set to grow at a rapid rate. Technological advancements are expected to drive the vehicle security system market in this region. Additionally, Europe is a major hub for several OEMs, with 292 vehicle assembly and production plants in 26 countries. The European vehicle security system market is therefore estimated to witness substantial growth. Germany, the U.K., and Finland in the European region were the first to impose mandatory regulations regarding the adoption of immobilizers. They were followed by Canada in the North American region, Australia and Malaysia in the Asia-Pacific region, and Brazil in the Rest of the World (RoW) region. These regulations triggered the demand for immobilizers and alarms. BMW, Audi, Mercedes-Benz, and Toyota developed their own patented GPS-based security services. Currently, these technologies/services are adopted only in the premium passenger car segment; however, mid-segment cars are also expected to incorporate these systems in coming years.

Objectives of the Study

- To analyze and forecast (2016 to 2021) the market size, in terms of volume (‘000 units) and value (USD million), of the global vehicle security system market

- To segment the vehicle security system market and forecast its size, by volume and value, on the basis of region (Asia-Pacific, Europe, North America, and the Rest of the World (RoW))

- To provide a detailed analysis of various factors influencing the global vehicle security system market (drivers, restraints, opportunities, and challenges)

- To analyze the regional markets for growth trends, future prospects, and their contribution to the overall market

- To segment the market and forecast its size, by volume and value, on the basis of vehicle type (passenger cars, commercial vehicles, and off-highway vehicles)

- To segment the vehicle security system market and forecast the market size, by volume and value, based on type (alarm, immobilizer, remote keyless entry, passive keyless entry, and central locking system)

- To segment the vehicle security system market and forecast the market size, by volume and value, based on technology type (global positioning system, global system for mobile communication, face detection system, radio frequency identification, and real-time location system)

- To track and analyze competitive developments such as joint ventures, mergers & acquisitions, new product launches, expansions, and other activities carried out by key industry participants

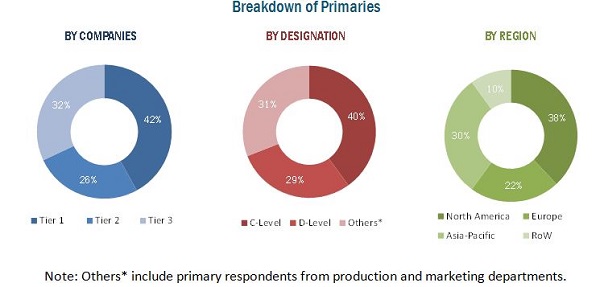

During this research study, major players operating in the vehicle safety market in various regions have been identified, and their offerings, regional presence, and distribution channels have been analyzed through in-depth discussions. The top-down and bottom-up approaches have been used to determine the overall market size. The size of the other individual markets has been estimated using the percentage splits obtained through secondary sources such as Hoovers, Bloomberg BusinessWeek, and Factiva along with primary respondents. The entire procedure includes the study of the annual and financial reports of the top market players and extensive interviews with industry experts such as CEOs, VPs, directors, and marketing executives for key insights (both qualitative and quantitative) pertaining to the market. The figure below shows the breakdown of the primaries on the basis of the company type, designation, and region considered during the research study.

To know about the assumptions considered for the study, download the pdf brochure

The ecosystem of the vehicle security system industry consists of manufacturers such as Robert Bosch GmbH (Germany), Continental AG (Germany), and Lear Corporation (U.S.), research institutes such as the Automotive Research Association of India (ARAI), European Automotive Research Partners Association (EARPA), and the United States Council for Automotive Research (USCAR), and regional automobile associations such as China Association of Automobile Manufacturers (CAAM), Japan Automobile Manufacturers Association (JAMA), and the European Automobile Manufacturers Association (ACEA).

Major Developments in Vehicle Security System Market

- Continental AG acquired Zytek Automotive (UK). Zytek Automotive will be part of Continental Engineering Services (CES). This acquisition would help Continental AG increase its presence in the UK.

- Lear Corporation acquired intellectual property and technology from Autonet Mobile (US). The acquired assets will likely supplement Lear Corporation's wireless systems business, and provide growth opportunities for the company’s electrical segment.

- Lear Corporation signed a definitive agreement to acquire Eagle Ottawa (US) for approximately USD 850 million on a cash and debt-free basis. The transaction was completed in the first quarter of 2015, subject to customary conditions, including regulatory approvals.

Target Audience of Vehicle Security System Market

- Manufacturers of vehicle security systems

- Dealers and distributors of vehicle security systems

- Industry associations

- Investment firms

- Equity research firms

- Private equity firms

Scope of the Vehicle Security System Market Report

Vehicle Security System Market, By Product Type

Vehicle Security System Market, By Vehicle Type

Vehicle Security System Market, By Technology

Vehicle Security System Market, By Region

-

- Alarm

- Immobilizer

- Remote Keyless Entry

- Passive Keyless Entry

- Central Locking System

- Passenger Car

- Commercial Vehicle

- Off-Highway Vehicle

- Global Positioning System

- Global System for Mobile Communication

- Face Detection System

- Real-Time Location System

- North America

- Asia-Pacific

- Europe

- RoW

Available Customizations of Vehicle Security System Market

MarketsandMarkets offers the following customizations for this market:

- Vehicle security aftermarket, by region

- Detailed analysis and profiling of additional market players (up to 3)

The vehicle security system market, in terms of value, is projected to grow at a CAGR of 7.2% from 2016 to 2021. The market is estimated to be USD 7. 57 billion in 2016, and is projected to reach 10.75 billion by 2021. Asia-Pacific is estimated to be the largest market for vehicle security systems, followed by North America and Europe. The growth of the vehicle security system market is fueled by increasing vehicle production, growing awareness regarding vehicle safety, and increasing installation of safety features in automobiles.

The vehicle security system market has been segmented on the basis of product, technology, and vehicle type (passenger cars, commercial vehicles, and off-highway vehicles). In terms of product type, the remote keyless entry and immobilizer markets are set to grow at the highest CAGRs from 2016 to 2021. On the basis of technology, the face detection system and global positioning system segments are expected to account for the largest market shares, in terms of value, in 2016.

The vehicle security system market has been segmented on the basis of product type into alarm, immobilizer, remote keyless entry, passive keyless entry, and central locking system. The immobilizer segment is estimated to account for the largest market share, in terms of value, in 2016. This can be mainly attributed to the increasing installation of immobilizers in vehicles.

The vehicle security system market has been segmented by technology into global positioning system, global system for mobile communication, face detection system, and real-time location system. Increasing global vehicle production and growing awareness regarding vehicle safety are the key factors driving the growth of the vehicle security system market across all regions.

The Asia-Pacific region is estimated to account for the largest market share, in terms of value, in 2016, with China being a key contributor to the growth of the vehicle security system market in the region.

Bosch is one of the major players in vehicle security market. Bosch manufactures automotive components, power tools, security solutions, and household appliances. The company operates in four business sectors: mobility solutions, industrial technology, consumer goods, and energy & building technology. It provides driver assistance systems and components for passenger cars and commercial vehicles through its mobility solutions segment.

Vehicle Security System by technology, Face detection technology would drive the growth of vehicle security system market

Alarms

A vehicle alarm is a device that generates a high-pitched sound if an unauthorised person enters the vehicle. To protect against theft, an increasing number of cars are being equipped with systems that are set off and deactivated via a coded radio remote control or a remote key fob. The radio receiver uses a rolling code, which is cryptographically secured. This helps in increasing the overall security of the vehicle. Generally, these alarms cannot be disarmed externally from the key fob; however, they may have an override switch mounted in a hidden location. Alarms are usually fitted in the vehicle’s bonnet, boot, and doors. Currently, vehicles are also equipped with an ultrasonic system that can detect when an intruder enters the car through an open window.

The latest generation of alarms are time-controlled, and feature warning signals that work independently of the car’s electronics. The alarm is activated when the door is locked, and deactivated when it is unlocked. Recent car alarm technologies also include tilt sensors that can detect a change the car’s position if the vehicle is being towed.

Immobilizers

The immobilizer is a device in the vehicle that thwarts unauthorized entry and prevents the vehicle from being started unless the correct individual key code is provided. The car key is integrated with an electronic code, which controls the functioning of the immobilizer. The code contains a permanent personal code and a second code; the second code is modified by the immobilizer every time the engine is switched on.

A key-based immobilizer has four essential components, of which the transponder is the core component. The vehicle data for the electronic code is transmitted wirelessly via an aerial in the steering wheel lock. Manufacturers have launched biometric and retinal scan immobilizers to enhance vehicle security.

Eye lock systems or retinal scan immobilizers are an upcoming technology in the market. These systems scan the iris of the person in the driver’s seat, and the car can be started only if the iris is recognized. The system consists of infrared cameras mounted in the dashboard or visor that measure more than 240 distinct aspects of the iris.

Central Locking System

A central locking system or power door locks enable the front passenger or driver to simultaneously lock and unlock all the doors with the help of a button or switch. This is now a standard feature in most vehicles. Smart keys are also used to unlock or lock a car electronically. Additionally, with a smart key system, the vehicle ignition can be activated without the insertion of a key.

Technological advancements in this market have given rise to the ability to unlock a vehicle using smartphones. Hyundai has developed a concept that uses NFC technology to lock or unlock a car. The vehicle has an NFC tag placed in it, and the driver has to swipe the phone over the tag to unlock the vehicle. This technology eliminates the need for a key, and turns the smartphone into the primary device used to open the vehicle.

Passive Keyless Entry

A passive keyless entry and start system allows users to unlock and start the car while keeping the car keys in their pocket. The term passive is used as the system requires no action from the user. A magnetically coupled radio frequency signal facilitates the communication between the key and the car. Through this system, the car detects that the key is in close proximity when it is within communication range. Low frequency antennas attached to the door handles or outer mirrors initiate the communication and detect the key fob at a distance of 1.5 m to 2 m.

Recent developments in passive entry systems indicate that smartphones and smartwatches will likely be incorporated into the vehicle system. This technology can also be linked with various other features to enhance the driving experience. For instance, apart from performing locking functions, it can also indicate the amount of fuel in the vehicle, maps of areas nearby, distances, and so on.

Remote Keyless Entry

Over 70% of vehicles manufactured today are equipped with a remote keyless entry system, either as a standard or an optional feature. Most remote keyless entry systems alert the user if the vehicle door is being locked or unlocked. Car finder and remote start functions are additional features available in some remote keyless entry systems.

The key fob consists of a radio frequency transmitter that transmits a brief burst of digital data to a receiver in the vehicle. This data is decoded inside the receiver. The receiver-controlled actuators then initiate the door locking or unlocking functions. Generally, these systems engage in one-way (simplex) communication. The second and third-generation systems may monitor the car requirements and respond through the key.

Global Positioning System

The GPS is a space-based navigation system. It provides beneficial capabilities to military, commercial, and civil users around the world. In the automotive industry, the GPS is used to locate or track vehicles. The system is an additional security feature in the vehicle. Currently, it is widely adopted in passenger cars and lightweight commercial vehicles.

A GPS tracking unit is a device that uses GPS technology to determine the exact location of a person or vehicle, and records the position at regular intervals. The location data that is recorded is generally stored within the tracking unit. The location can also be transmitted to a central location server that is connected to the internet using a cellular (GPRS or SMS).

GPS technology is also gaining acceptance in the HCV segment of the automotive industry. Truck tracking provides location-based information that can be used to provide proper routing information to trucks in the field. Additionally, several systems have the facility to locate the truck that is closest to the job or construction site. Furthermore, truck GPS tracking can offer information regarding driving behavior. This includes idling time, engine start-up and shutdown, and truck speed.

Face Detection System

A face detection system is used for automatically verifying or identifying a person from a video or image. The face detection system validates a face by extracting its unique features, such as the shape of the eyes, nose, jaws, and so on. The vehicle is equipped with a camera that faces the driver. The camera is trained with different images of the authorized driver or owner. The system identifies an authorized vehicle-user based on a facial recognition system. The vehicle immobilizer system also sends a message to the registered phone number of the vehicle-user in case of any discrepancy. The message includes additional information such as the image of the user in the driver seat or the GPS location of the vehicle.

Face detection technology is also being incorporated in vehicles to prevent drunk driving. The system is used to monitor the driver's state of consciousness through the movement of their eyes. A message or a voice alert is triggered if the system detects drowsiness or weakness in the driver’s face. Some vehicles also feature a seat belt mechanism that tightens around the driver to gain his or her attention.

Radio Frequency Identification

RFID is a technology that enables data collection via contactless electronic tags and wireless transmitters (readers) for identification and other purposes.

The latest development in this technology is the RFID-based vehicle immobilizer system. The immobilizer uses RFID technology to generate an identification tag with large character sets. The unit that receives these characters is integrated into three control circuits in the vehicle—namely, ignition circuit, power control unit, and automatic gear changing system. The integration enables the system to bring the vehicle to a halt in a secure manner.

Critical questions the report answers:

- What are major trends in vehicle security market?

- Which type of product will lead vehicle security market in mid and long term?

- What will be the impact of increasing demand for safety and security on vehicle security market?

Restraints for Vehicle Security System Market:

High cost of premium security features is a restraint to vehicle security system market. The vehicle security system market has witnessed numerous innovations and technological advancements. Security features such as passive entry systems offer convenience to the users, but are expensive to develop. They require customized development for each model, and have a complex installation process.

To speak to our analyst for a discussion on the above findings, click Speak to Analyst

Table of Contents

1 Introduction

1.1 Objectives of the Study

1.2 Vehicle Security System Market Scope

1.3 Years Considered for the Study

1.4 Currency

1.5 Package Size

1.6 Stakeholders

1.7 Limitations

2 Research Methodology

2.1 Secondary Data

2.1.1 Key Secondary Sources

2.1.2 Key Data From Secondary Sources

2.2 Primary Data

2.2.1 Sampling Techniques & Data Collection Methods

2.2.2 Primary Participants

2.3 Factor Analysis

2.3.1 Introduction

2.3.2 Demand-Side Analysis

2.3.3 Impact of Gdp on Total Vehicle Sales

2.3.4 Urbanization vs Passenger Cars Per 1,000 People

2.3.5 Infrastructure: Roadways

2.3.6 Increasing Vehicle Production in Developing Countries

2.3.7 Supply Side Analysis

2.3.8 Technological Development

2.4 Vehicle Security System Market Size Estimation

2.5 Data Triangulation

2.6 Assumptions

3 Executive Summary

4 Premium Insights

4.1 Opportunities in Vehicle Security System Market

4.2 Vehicle Security System Market, By Region, 2016 & 2021

4.3 Off-Highway Vehicle Security System Market, By Region, 2016 & 2021

4.4 Vehicle Security System Market, By Product Type

4.5 Vehicle Security System Market, By Technology

4.6 Vehicle Security System Market - Product Life Cycle

5 Vehicle Security System Market Overview

5.1 Introduction

5.2 Market Segmentation

5.2.1 Vehicle Security System Market

5.3 Market Dynamics

5.3.1 Drivers

5.3.2 Stringent Security Regulations

5.3.3 Multi-Factor Authentication for Car Safety

5.3.4 Increasing Number of Advanced Vehicle Security Technologies

5.3.5 Restraints

5.3.6 High Cost of Premium Security Features

5.3.7 Potential Failure of Electronic Components Used in Vehicle Security Systems

5.3.8 Opportunities

5.3.9 Increased Demand for Application-Based Technologies

5.3.10 Rise of Biometric Technology

5.3.11 Challenges

5.3.12 Increase in Cyber Security Risk

6 Technological Overview

6.1 Introduction

6.2 Key Security Systems

6.2.1 Alarms

6.2.2 Immobilizers

6.2.3 Central Locking System

6.2.4 Passive Keyless Entry

6.2.5 Remote Keyless Entry

6.2.6 Global Positioning System

6.2.7 Face Detection System

6.2.8 Radio Frequency Identification

7 Vehicle Security System Market, By Product Type

7.1 Introduction

7.2 Vehicle Security System Market, By Vehicle Type

7.2.1 Passenger Car Security System Market Size, By Product Type

7.2.2 Commercial Vehicle Security System Market Size, By Product Type

7.2.3 Off-Highway Vehicle Security System Market Size, By Product Type

8 Vehicle Security System Market, By Technology

8.1 Introduction

8.2 Vehicle Security System Market, By Vehicle Type

8.2.1 Passenger Car Security System Market Size, By Technology

8.2.2 Commercial Vehicle Security System Market Size, By Technology

8.2.3 Off-Highway Vehicle Security System Market Size, By Technology

9 Vehicle Security System Market, By Vehicle Type

9.1 Introduction

9.2 Vehicle Security System Market, By Product Type

9.2.1 Alarm Market Size, By Vehicle Type

9.2.2 Immobilizer Market Size, By Vehicle Type

9.2.3 Remote Keyless Entry Market Size, By Vehicle Type

9.2.4 Passive Keyless Entry Market Size, By Vehicle Type

9.2.5 Central Locking System Market Size, By Vehicle Type

9.3 Vehicle Security System Market, By Technology

9.3.1 Global Positioning System Market Size, By Vehicle Type

9.3.2 Global System for Mobile Communication Market Size, By Vehicle Type

9.3.3 Face Detection System Market Size, By Vehicle Type

9.3.4 Real-Time Location System Market Size, By Vehicle Type

10 Vehicle Security System Market, By Region

10.1 Vehicle Security System Market, By Product Type

10.2 Introduction

10.2.1 North America

10.2.2 U.S.

10.2.3 Canada

10.2.4 Mexico

10.2.5 Europe

10.2.6 Germany

10.2.7 France

10.2.8 U.K.

10.2.9 Italy

10.2.10 Asia-Pacific

10.2.11 China

10.2.12 Japan

10.2.13 India

10.2.14 Rest of the World

10.2.15 Brazil

10.2.16 Russia

10.3 Off-Highway Vehicle Security System Market, By Region

10.4 Introduction

10.4.1 North America

10.4.2 Europe

10.4.3 Asia-Pacific

10.4.4 Rest of the World

10.5 Vehicle Security System Market, By Technology

10.6 Introduction

10.6.1 North America

10.6.2 Europe

10.6.3 Asia-Pacific

10.6.4 Rest of the World

11 Competitive Landscape

11.1 Overview

11.2 Market Share Analysis: Vehicle Security System Market

11.3 Battle for Market Share: Expansion Was the Key Strategy

11.4 Expansion

11.5 New Product Launch

11.6 Agreements/Supply Contracts/Joint Ventures

11.7 Mergers & Acquisitions

12 Company Profiles

12.1 Introduction

12.2 Continental AG

12.2.1 Business Overview

12.2.2 Products Offered

12.2.3 Recent Developments

12.2.4 SWOT Analysis

12.2.5 MnM View

12.3 Delphi Automotive

12.3.1 Business Overview

12.3.2 Products Offered

12.3.3 Recent Developments

12.3.4 SWOT Analysis

12.3.5 MnM View

12.4 Lear Corporation

12.4.1 Business Overview

12.4.2 Products Offered

12.4.3 Recent Developments

12.4.4 SWOT Analysis

12.4.5 MnM View

12.5 Robert Bosch GmbH

12.5.1 Business Overview

12.5.2 Products Offered

12.5.3 Recent Developments

12.5.4 SWOT Analysis

12.5.5 MnM View

12.6 Valeo SA

12.6.1 Business Overview

12.6.2 Products Offered

12.6.3 Recent Developments

12.6.4 SWOT Analysis

12.6.5 MnM View

12.7 Hella Kgaa Hueck & Co.

12.7.1 Business Overview

12.7.2 Products Offered

12.7.3 Recent Developments

12.7.4 MnM View

12.8 Mitsubishi Electric Corporation

12.8.1 Business Overview

12.8.2 Products Offered

12.8.3 Recent Developments

12.8.4 MnM View

12.9 ZF TRW Automotive Holdings Corporation

12.9.1 Business Overview

12.9.2 Products Offered

12.9.3 Recent Developments

12.9.4 MnM View

12.10 Denso Corporation

12.10.1 Business Overview

12.10.2 Products Offered

12.10.3 Recent Developments

12.10.4 MnM View

12.11 Tokai Rika Co., Ltd.

12.11.1 Business Overview

12.11.2 Products Offered

12.11.3 Recent Developments

12.11.4 MnM View

13 Appendix

13.1 Discussion Guide

13.2 Knowledge Store: Marketsandmarkets’ Subscription Portal

13.3 Introducing RT: Real Time Market Intelligence

13.3.1 Features and Benefits of RT:

13.4 Available Customizations

13.5 Related Reports

List of Tables (96 Tables)

Table 1 Vehicle Security System Market Size, By Vehicle Type, 2014–2021 (‘000 Units)

Table 2 Vehicle Security System Market Size, By Vehicle Type, 2014–2021 (USD Million)

Table 3 Passenger Car Security System Market Size, By Product Type, 2014–2021 (‘000 Units)

Table 4 Passenger Car Security System Market Size, By Product Type, 2014–2021 (USD Million)

Table 5 Commercial Vehicle Security System Market Size, By Product Type, 2014–2021 (‘000 Units)

Table 6 Commercial Vehicle Security System Market Size, By Product Type, 2014–2021 (USD Million)

Table 7 Off-Highway Vehicle Security System Market Size, By Product Type, 2014–2021 (‘000 Units)

Table 8 Off-Highway Vehicle Security System Market Size, By Product Type, 2014–2021 (USD Million)

Table 9 Vehicle Security System Market Size, By Vehicle Type, 2014–2021 (‘000 Units)

Table 10 Vehicle Security System Market Size, By Vehicle Type, 2014–2021 (USD Million)

Table 11 Passenger Car Security System Market Size, By Technology, 2014–2021 (‘000 Units)

Table 12 Passenger Car Security System Market Size, By Technology, 2014–2021 (USD Million)

Table 13 Commercial Vehicle Security System Market Size, By Technology, 2014–2021 (‘000 Units)

Table 14 Commercial Vehicle Security System Market Size, By Technology, 2014–2021 (USD Million)

Table 15 Off-Highway Vehicle Security System Market Size, By Technology, 2014–2021 (‘000 Units)

Table 16 Off-Highway Vehicle Security System Market Size, By Technology, 2014–2021 (USD Million)

Table 17 Vehicle Security System Market Size, By Product Type, 2014–2021 (000’ Units)

Table 18 Vehicle Security System Market Size, By Product Type, 2014–2021 (USD Million)

Table 19 Alarm Market Size, By Vehicle Type, 2014–2021 (000’ Units)

Table 20 Alarm Market Size, By Vehicle Type, 2014–2021 (USD Million)

Table 21 Immobilizer Market Size, By Vehicle Type, 2014–2021 (000’ Units)

Table 22 Immobilizer Market Size, By Vehicle Type, 2014–2021 (USD Million)

Table 23 Remote Keyless Entry Market Size, By Vehicle Type, 2014–2021 (000’ Units)

Table 24 Remote Keyless Entry Market Size, By Vehicle Type, 2014–2021 (USD Million)

Table 25 Passive Keyless Entry Market Size, By Vehicle Type, 2014–2021 (000’ Units)

Table 26 Passive Keyless Entry Market Size, By Vehicle Type, 2014–2021 (USD Million)

Table 27 Central Locking System Market Size, By Vehicle Type, 2014–2021 (000’ Units)

Table 28 Central Locking System Market Size, By Vehicle Type, 2014–2021 (USD Million)

Table 29 Vehicle Security System Market Size, By Technology, 2014–2021 (000’ Units)

Table 30 Vehicle Security System Market Size, By Technology, 2014–2021 (USD Million)

Table 31 Global Positioning System Market Size, By Vehicle Type, 2014–2021 (000’ Units)

Table 32 Global Positioning System Market Size, By Vehicle Type, 2014–2021 (USD Million)

Table 33 Global System for Mobile Communication Market Size, By Vehicle Type, 2014–2021 (000’ Units)

Table 34 Global System for Mobile Communication Market Size, By Vehicle Type, 2014–2021 (USD Million)

Table 35 Face Detection System Market Size, By Vehicle Type, 2014–2021 (000’ Units)

Table 36 Face Detection System Market Size, By Vehicle Type, 2014–2021 (USD Million)

Table 37 Real-Time Location System Market Size, By Vehicle Type, 2014–2021 (000’units)

Table 38 Real-Time Location System Market Size, By Vehicle Type, 2014–2021 (USD Million)

Table 39 Vehicle Security System Market Size, By Region, 2014–2021 (‘000 Units)

Table 40 Vehicle Security System Market Size, By Region, 2014–2021 (USD Million)

Table 41 North America: Vehicle Security System Market Size, By Product Type, 2014–2021 (‘000 Units)

Table 42 North America: Vehicle Security System Market Size, By Product Type, 2014–2021 (USD Million)

Table 43 U.S.: Vehicle Security System Market Size, By Product Type, 2014–2021 (‘000 Units)

Table 44 U.S.: Vehicle Security System Market Size, By Product Type, 2014–2021 (USD Million)

Table 45 Canada: Vehicle Security System Market Size, By Product Type, 2014–2021 (‘000 Units)

Table 46 Canada: Market Size, By Product Type, 2014–2021 (USD Million)

Table 47 Mexico: Vehicle Security System Market Size, By Product Type, 2014–2021 (‘000 Units)

Table 48 Mexico: Market Size, By Product Type, 2014–2021 (USD Million)

Table 49 Europe: Vehicle Security System Market Size, By Product Type, 2014–2021 (‘000 Units)

Table 50 Europe: Vehicle Security System Market Size, By Product Type, 2014–2021 (USD Million)

Table 51 Germany: Vehicle Security System Market Size, By Product Type, 2014–2021 (‘000 Units)

Table 52 Germany: Vehicle Security System Market Size, By Product Type, 2014–2021 (USD Million)

Table 53 France: Vehicle Security System Market Size, By Product Type, 2014–2021 (‘000 Units)

Table 54 France: Market Size, By Product Type, 2014–2021 (USD Million)

Table 55 U.K.: Vehicle Security System Market Size, By Product Type, 2014–2021 (‘000 Units)

Table 56 U.K.: Market Size, By Product Type, 2014–2021 (USD Million)

Table 57 Italy: Vehicle Security System Market Size, By Product Type, 2014–2021 (‘000 Units)

Table 58 Italy: Market Size, By Product Type, 2014–2021 (USD Million)

Table 59 Asia-Pacific: Vehicle Security System Market Size, By Product Type, 2014–2021 (‘000 Units)

Table 60 Asia-Pacific: Vehicle Security System Market Size, By Product Type, 2014–2021 (USD Million)

Table 61 China: Vehicle Security System Market Size, By Product Type, 2014–2021 (‘000 Units)

Table 62 China: Market Size, By Product Type, 2014–2021 (USD Million)

Table 63 Japan: Vehicle Security System Market Size, By Product Type, 2014–2021 (‘000 Units)

Table 64 Japan: Market Size, By Product Type, 2014–2021 (USD Million)

Table 65 India: Vehicle Security System Market Size, By Product Type, 2014–2021 (‘000 Units)

Table 66 India : Market Size, By Product Type, 2014–2021 (USD Million)

Table 67 RoW: Vehicle Security System Market Size, By Product Type, 2014–2021 (‘000 Units)

Table 68 RoW: Vehicle Security System Market Size, By Product Type, 2014–2021 (USD Million)

Table 69 Brazil: Vehicle Security System Market Size, By Product Type, 2014–2021 (‘000 Units)

Table 70 Brazil: Market Size, By Product Type, 2014–2021 (USD Million)

Table 71 Russia: Vehicle Security System Market Size, By Product Type, 2014–2021 (‘000 Units)

Table 72 Russia: Market Size, By Product Type, 2014–2021 (USD Million)

Table 73 Off-Highway Vehicle Security System Market Size, By Region, 2014–2021 (‘000 Units)

Table 74 Off-Highway Vehicle Security System Market Size, By Region, 2014–2021 (USD Million)

Table 75 North America: Off-Highway Vehicle Security System Market Size, By Product Type, 2014–2021 (‘000 Units)

Table 76 North America: Off-Highway Vehicle Security System Market Size, By Product Type, 2014–2021 (USD Million)

Table 77 Europe: Off-Highway Vehicle Security System Market Size, By Product Type, 2014–2021 (‘000 Units)

Table 78 Europe: Off-Highway Vehicle Security System Market Size, By Product Type, 2014–2021 (USD Million)

Table 79 Asia-Pacific: Off-Highway Vehicle Security System Market Size, By Product Type, 2014–2021 (‘000 Units)

Table 80 Asia-Pacific: Off-Highway Vehicle Security System Market Size, By Product Type, 2014–2021 (USD Million)

Table 81 RoW: Off-Highway Vehicle Security System Market Size, By Product Type, 2014–2021 (‘000 Units)

Table 82 RoW: Off-Highway Vehicle Security System Market Size, By Product Type, 2014–2021 (USD Million)

Table 83 Vehicle Security System Market Size, By Region, 2014–2021 (‘000 Units)

Table 84 Vehicle Security System Market Size, By Region, 2014–2021 (USD Million)

Table 85 North America: Vehicle Security System Market Size, By Technology, 2014–2021 (‘000 Units)

Table 86 North America: Vehicle Security System Market Size, By Technology, 2014–2021 (USD Million)

Table 87 Europe: Vehicle Security System Market Size, By Technology, 2014–2021 (‘000 Units)

Table 88 Europe: Vehicle Security System Market Size, By Technology, 2014–2021 (USD Million)

Table 89 Asia-Pacific: Vehicle Security System Market Size, By Technology, 2014–2021 (‘000 Units)

Table 90 Asia-Pacific: Vehicle Security System Market Size, By Technology, 2014–2021 (USD Million)

Table 91 RoW: Vehicle Security System Market Size, By Technology, 2014–2021 (‘000 Units)

Table 92 RoW: Vehicle Security System Market Size, By Technology, 2014–2021 (USD Million)

Table 93 Expansions, 2014–2015

Table 94 New Product Launches, 2012–2014

Table 95 Agreements/Supply Contracts/Joint Ventures, 2013–2015

Table 96 Mergers & Acquisitions, 2013–2015

List of Figures (62 Figures)

Figure 1 Vehicle Security System Market: Market Segmentation

Figure 2 Vehicle Security System Market: Research Design

Figure 3 Research Methodology Model

Figure 4 Breakdown of Primary Interviews: By Company Type, Designation, & Region

Figure 5 Gross Domestic Product vs Total Vehicle Sales

Figure 6 Urbanization vs Passenger Cars Per 1,000 People

Figure 7 Vehicle Production, 2010–2014

Figure 8 Market Size Estimation Methodology: Bottom-Up Approach

Figure 9 Immobilizers to Be the Largest Contributor to the Vehicle Security System Market, By Product Type (2016 & 2021)

Figure 10 Face Detection System to Be the Largest Contributor to the Vehicle Security System Market, By Technology (2016 & 2021)

Figure 11 Vehicle Security System Market, By Product Type & Technology, 2021

Figure 12 Off-Highway Vehicle Security System Market, By Product Type & Technology (2016 & 2021)

Figure 13 Asia-Pacific to Hold the Largest Share in the Vehicle Security System Market, By Product Type, in 2021

Figure 14 Technological Advancements & the Growth of the Automotive Industry are Expected to Drive this Market

Figure 15 Asia-Pacific to Be the Largest Market for Vehicle Security Systems

Figure 16 Asia-Pacific to Hold the Largest Share in the Off-Highway Vehicle Security System Market

Figure 17 Immobilizer Segment Estimated to Occupy the Largest Share in this Market From 2016 to 2021

Figure 18 Face Detection System to Hold the Largest Share in the Vehicle Security System Market, By Technology, From 2016 to 2021

Figure 19 Product Life Cycle of Vehicle Security Systems

Figure 20 Immobilizers to Hold the Largest Share in the Vehicle Security System Market, By Product Type, in 2016

Figure 21 Vehicle Security System Market Segmentation

Figure 22 Multi-Factor Authentication for Car Safety to Drive the Vehicle Security System Market

Figure 23 Vehicle Security System Market Size, By Vehicle Type, 2016–2021

Figure 24 Passenger Car Security System Market Growth, 2016–2021

Figure 25 Commercial Vehicle Security System Market, 2016 vs 2021

Figure 26 Off-Highway Vehicle Security System Market, 2016 vs 2021

Figure 27 Vehicle Security System Market, By Vehicle Type, 2016–2021

Figure 28 Passenger Car Security System Market Growth, 2016–2021

Figure 29 Commercial Vehicle Security System Market, 2016 vs 2021

Figure 30 Off-Highway Vehicle Security System Market, 2016 vs 2021

Figure 31 Vehicle Security System Market , By Product 2016–2021

Figure 32 Passenger Cars to Constitute the Largest Market for Immobilizers

Figure 33 Passenger Cars to Hold the Largest Share in the Remote Keyless Entry Market

Figure 34 Vehicle Security System Market, By Technology

Figure 35 Global Positioning System Market, By Vehicle Type

Figure 36 Face Detection System Market Share, By Vehicle Type

Figure 37 Regional Snapshot– German Vehicle Security System Market Set to Grow at the Highest CAGR of 7.7% During the Forecast Period

Figure 38 North American Market Snapshot: Demand to Be Driven By the Increasing Rate of Vehicle Population

Figure 39 Vehicle Security System Market Split, By Country, in Major European Markets (2016 vs 2021)

Figure 40 Asia-Pacific Vehicle Security System Market Snapshot – China to Account for the Largest Market Share in 2016

Figure 41 Vehicle Security System Market Split, By Country, in Major Rest of the World Markets (2016 vs 2021)

Figure 42 Off-Highway Vehicle Security System Market Split, By Region (2016 vs 2021)

Figure 43 Vehicle Security System Market Split, By Region (2016 vs 2021)

Figure 44 Companies Adopted Expansion as A Key Growth Strategy From 2012 to 2015

Figure 45 Vehicle Security System Market Share, By Key Player Ranking, 2015

Figure 46 Market Evaluation Framework: Expansions Fuelled Market Growth From 2012 to 2015

Figure 47 Region-Wise Revenue Mix of Top Five Players

Figure 48 Company Snapshot: Continental AG

Figure 49 Continental AG: SWOT Analysis

Figure 50 Company Snapshot: Delphi Automotive

Figure 51 Delphi Automotive: SWOT Analysis

Figure 52 Company Snapshot: Lear Corporation

Figure 53 Lear Corporation: SWOT Analysis

Figure 54 Company Snapshot: Robert Bosch GmbH

Figure 55 Robert Bosch GmbH: SWOT Analysis

Figure 56 Company Snapshot: Valeo SA

Figure 57 Valeo SA: SWOT Analysis

Figure 58 Company Snapshot: Hella Kgaa Hueck & Co.

Figure 59 Company Snapshot: Mitsubishi Electric Corporation

Figure 60 Company Snapshot: ZF TRW Automotive Holdings Corporation

Figure 61 Company Snapshot: Denso Corporation

Figure 62 Company Snapshot: Tokai Rika Co. Ltd.

Growth opportunities and latent adjacency in Vehicle Security System Market

Thank you for the tips and knowledge you have shared!