Top 10 Automotive Technologies Market (Global Vehicle Intelligence, On Board Internet Services, Remote Diagnostics, HUD, Biometric Vehicle Access, Vehicle Security, 3D Printing, Night Vision, BDS, LDWS), and Region - Global Forecast to 2021

[176 Pages Report] The top 10 automotive technologies market is projected to grow at a CAGR of 17.35% during the forecast period, to reach a market size of USD 139.02 Billion by 2021. In this study, 2015 has been considered as base year, and 2016 to 2021 as forecast period, for estimating the market size of the industrial vehicles market. The report segments the industrial vehicles market and forecasts its size, by volume and value, based on region, product type, drive type, and application.

This growth is attributed to the rise in demand of luxury vehicle and luxury features in the developed as well as developing countries, increasing trend of autonomous and semi-autonomous vehicles, increasing demand to have mobile phone like features in cars, government regulations for safe and secure drive coupled up with OEMs preference for advanced technologies has propelled growth of automotive technologies market.

It provides a detailed analysis of various forces acting in the market (drivers, restraints, opportunities, and challenges). It strategically profiles key players and comprehensively analyses their market shares and core competencies. The report also tracks and analyses competitive developments such as joint ventures, mergers & acquisitions, new product launches, expansions, and other activities carried out by key industry participants Rollout of High Speed Connectivity Services Such as 4g and 5g Networks with Decrease in Connectivity Costs is expected to boost demand for advance automotive technologies. Also, the market for Top 10 Automotive Technologies is estimated to grow at a promising CAGR from 2016 to 2021.

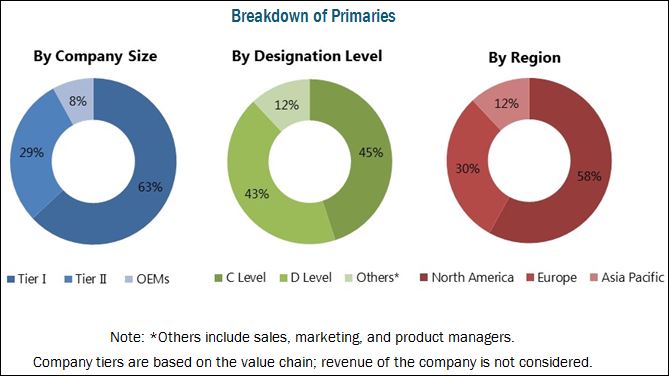

The research methodology used in the report involves primary and secondary sources. Secondary sources include automotive and component-manufacturing associations and paid databases and directories such as Factiva and Bloomberg. In the primary research stage, experts from related industries, manufacturers, and suppliers have been interviewed to understand the present situation and future trends of the market. The automotive aftermarket for top 10 automotive technologies size, in terms of volume (‘000 units/million gallons) and value (USD million/billion), for all regions has been derived using forecasting techniques based on automobile demand and sales trends.

The figure below illustrates the break-up of the profile of industry experts who participated in primary discussions.

To know about the assumptions considered for the study, download the pdf brochure

The automotive aftermarket for top 10 automotive technologies market ecosystem consists of technology providers such as Robert Bosch GmbH (Germany), Continental AG (Germany), and Delphi Automotive PLC (U.K.). The products manufactured by these companies are used by automotive companies such as BMW (Germany), Daimler (Germany), Volvo (Sweden), and Ford Motor Company (U.S.).

Target Audience

- Automotive technology manufacturers

- Automotive component suppliers

- Raw material suppliers

- Automobile organizations/associations

- Traders and distributors of advanced vehicle technologies

- Automotive Original Equipment Manufacturers (OEMs)

- Software development companies for automotive industry

- Hardware manufacturers

Scope of the Report

-

Automotive Aftermarket for top 10 automotive technologies market, By Technology

- Remote Diagnostics

- 3D Printing Automotive

- On Board Internet Services

- Advance Head-Up Display

- Security Systems in Automotive

- Biometric Vehicle Access Systems

- Vehicle Intelligence Systems

- Night Vision

- Blind Spot Detection System

- Lane Departure Warning System

-

Automotive Aftermarket for top 10 automotive technologies market, By Region

- Asia-Pacific

- Europe

- North America

- RoW

Available Customizations

- Automotive technology market by vehicle type

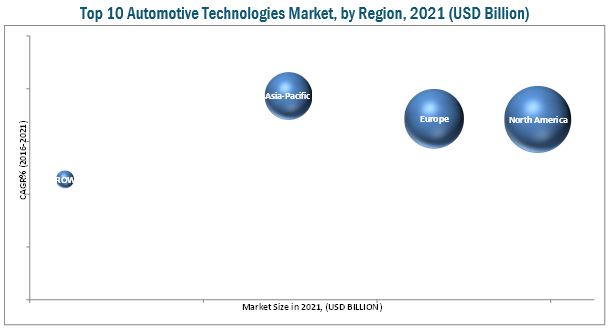

The top 10 automotive technologies are projected to grow at a CAGR of 17.35%, to reach a market size of USD 139.02 Billion by 2021. Increase in demand for luxury vehicles with advance technologies is driving the market for Top 10 Automotive technologies. Also, Government Regulations towards safety feature has propelled growth of automotive technologies.

On board internet services market is largest market as compared to other automotive technologies. The automotive on board internet services market is driven by increasing concerns regarding safety and security, government regulations, reduction in connectivity cost, and the growth in the usage of the smart phones. Data security and privacy concerns, the short life of electronic systems, and lack of on board internet services infrastructure in emerging economies such as Brazil, and Russia are factors responsible for hindering the growth of this market

The major players in top 10 automotive technologies market are Delphi Automotive PLC (U.K.), Continental AG (Germany), Robert Bosch GmbH (Germany), and some on board internet service providers are Agero (U.S.), Airbiquity (U.S.), and WirelessCar (Sweden). The major telecom companies which provide connectivity for on board internet services are AT&T (U.S.), Verizon (U.S.), and Vodafone (U.K.).

The Asia-Pacific is expected to dominate the market for the top 10 automotive technologies, and is projected to capture the highest market share in terms of value during the forecast period. Asia-Pacific has created promising opportunities for automobile market and technology provider companies. Rapid Urbanization contribute to increase in vehicle sales, which is expected to push the market by leading to growth in vehicle sales. Presence of high growth potential markets such as India, China, South Korea amongst other Asia-Pacific countries having rigid economic strictures, favorable regulations for establishing business are among the few factors the automotive technologies market has witnessed high growth. The Asia-Pacific aftermarket for top 10 automotive technologies is growing at a CAGR of 19.30% during the forecast period

A key factor restraining the growth of the top 10 automotive technologies is over increase in vehicle cost; the demand for safety features has increased and the consumers expect better products. The competition between OEMs has forced them to innovate. However, the cost of on board internet services is high, making consumer friendly and regulatory compliant systems an important aspect of system development. The companies invest heavily in R&D for developing such sophisticated systems. The system contains a number of software-driven electronic components, which increases the overall cost of the vehicle.

To speak to our analyst for a discussion on the above findings, click Speak to Analyst

Table of Content

1 Introduction (Page No. - 19)

1.1 Objectives

1.2 Market Scope

1.2.1 Markets Covered

1.2.2 Years Considered in the Report

1.3 Currency

1.4 Package Size

1.5 Limitations

1.6 Stakeholders

2 Research Methodology (Page No. - 22)

2.1 Research Data

2.2 Secondary Data

2.2.1 Key Secondary Sources

2.3 Data From Secondary Sources

2.4 Primary Data

2.4.1 Sampling Techniques & Data Collection Methods

2.4.2 Primary Participants

2.5 Factor Analysis

2.5.1 Introduction

2.5.2 Demand-Side Analysis

2.5.2.1 Impact of Disposable Income on Total Vehicle Sales

2.5.2.2 Infrastructure: Roadways

2.5.2.3 Increasing Population in Developing Countries

2.5.2.4 Impact of GDP on Commercial Vehicle Sales

2.5.3 Supply-Side Analysis

2.5.3.1 Rising Demand for Hybrid and Electric Vehicles

2.5.3.2 Technological Advancements in Vehicle Safety and Security

2.6 Market Size Estimation

2.7 Data Triangulation

2.8 Assumptions

3 Executive Summary (Page No. - 36)

3.1 Introduction

4 Remote Vehicle Diagnostics in Automotive (Page No. - 40)

4.1 Introduction

4.2 By Region

4.3 By Deployment

4.4 By Enterprise Size

4.5 Market Dynamics

4.5.1 Drivers

4.5.1.1 Pressure From OEMS to Improve Vehicle Performance & Collect Relevant Data

4.5.1.2 Increasingly Stringent Emission and Fuel Economy Regulations

4.5.1.3 Rising Demand for Luxury and Comfort

4.5.1.4 Introduction of RDE Test

4.5.2 Restraints

4.5.2.1 Data Security Concerns

4.5.3 Opportunities

4.5.3.1 Opportunities for Telecom Service Providers

4.5.3.2 Benefits for Fleet Operators & Insurance Companies

4.5.4 Challenges

4.5.4.1 Low-Cost Devices in the Aftermarket

4.6 Competitve Landscape

4.6.1 Recent Devlopment

4.7 Company Profile

4.7.1 Robert Bosch GmbH

4.7.1.1 Business Overview

4.7.1.2 SWOT Analysis

4.7.1.3 MnM View

4.7.2 Continental AG

4.7.2.1 Business Overview

4.7.2.2 SWOT Analysis

4.7.2.3 MnM View

5 3D Printing in Automotive Application (Page No. - 55)

5.1 Introduction

5.2 By Region

5.3 By Deployment

5.4 By Enterprise Size

5.5 Market Dynamics

5.5.1 Drivers

5.5.1.1 Reduction in Costs & Time of Rapid Prototyping

5.5.1.2 Increasing Investments in R&D for 3D Printing Technologies & Materials

5.5.1.3 Government Investments in 3D Printing-Related R&D Projects

5.5.2 Restraints

5.5.2.1 Limited Availability, High Cost, & Standardization Issues of 3D Printing Materials

5.5.2.2 Lack of Standardized Process Control

5.5.3 Opportunities

5.5.3.1 Untapped Markets for 3D Printing Applications

5.5.3.2 Mergers & Acquisitions in the 3D Printing Industry

5.5.4 Challenges

5.5.4.1 Limitations in Prototyping, Printing Speed, & Material Composition

5.6 Competitive Landscape

5.6.1 Recent Development

5.7 Company Profile

5.7.1 3D Systems Corporation

5.7.1.1 Business Overview

5.7.1.2 SWOT Analysis

5.7.1.3 MnM View

5.7.2 Autodesk, Inc.

5.7.2.1 Business Overview

5.7.2.2 SWOT Analysis

5.7.2.3 MnM View

6 On Board Internet Services (Page No. - 72)

6.1 Introduction

6.2 By Region

6.3 By Deployment

6.4 By Enterprise Size

6.5 Market Dynamics

6.5.1 Drivers

6.5.1.1 Rollout of High Speed Connectivity Services Such as 4g and 5g Networks With Decrease in Connectivity Costs

6.5.1.2 Acceleration in Technological Innovations in the Automotive Industry

6.5.1.3 Increasing Penetration of Telecommunication Services in the Automotive Industry

6.5.2 Restraints

6.5.2.1 Increase in Overall Cost of the Vehicle

6.5.3 Opportunities

6.5.3.1 Low Penetration in Developing Markets

6.5.3.2 Upcoming Trend of Connected Cars

6.5.4 Challenges

6.5.4.1 Safety of the Car’s Digital Information

6.6 Competitve Landscape

6.6.1 Recent Devlopment

6.7 Company Profile

6.7.1 AT&T Inc.

6.7.1.1 Business Overview

6.7.1.2 Products Offered

6.7.1.3 Recent Developments

6.7.1.4 SWOT Analysis

6.7.1.5 MnM View

6.7.2 Continental AG

6.7.2.1 Business Overview

6.7.2.2 SWOT Analysis

6.7.2.3 MnM View

7 Automotive Head-Up Display (Page No. - 87)

7.1 Introduction

7.2 By Region

7.3 By Deployment

7.4 By Enterprise Size

7.5 Market Dynamics

7.5.1 Drivers

7.5.1.1 Increasing Demand for Premium & Luxury Passenger Cars in Developed as Well as Developing Economies

7.5.1.2 Increasing Awareness for Safety Features Among Consumers

7.5.2 Restraints

7.5.2.1 High Requirement for Power, Luminance and Brightness is A Major Hurdle for Automotive Hud Market

7.5.3 Opportunities

7.5.3.1 Reduced Cost of Hud Would Create an Opportunity in the Mid-Segment Cars Application

7.5.4 Challenges

7.5.4.1 High Storage Space Requirement for Augmented Reality Hud

7.6 Competitive Landscape

7.6.1 Recent Development

7.7 Company Profile

7.7.1 Denso Corporation

7.7.1.1 Business Overview

7.7.1.2 SWOT Analysis

7.7.1.3 MnM View

7.7.2 Continental AG

7.7.2.1 Business Overview

7.7.2.2 SWOT Analysis

7.7.2.3 MnM View

8 Security System in Automoive (Page No. - 101)

8.1 Introduction

8.2 By Region

8.3 By Deployment

8.4 By Enterprise Size

8.5 Market Dynamics

8.5.1 Drivers

8.5.1.1 Stringent Security Regulations

8.5.1.2 Multi-Factor Authentication for Car Safety

8.5.1.3 Increasing Number of Advanced Vehicle Security Technologies

8.5.2 Restraints

8.5.2.1 High Cost of Premium Security Features

8.5.2.2 Potential Failure of Electronic Components Used in Vehicle Security Systems

8.5.3 Opportunities

8.5.3.1 Increased Demand for Application-Based Technologies

8.5.3.2 Rise of Biometric Technology

8.5.4 Challenges

8.5.4.1 Increase in Cyber Security Risk

8.6 Competitive Landscape

8.6.1 Recent Devlopment

8.7 Company Profile

8.7.1 Continental AG

8.7.1.1 Business Overview

8.7.2 SWOT Analysis

8.7.3 MnM View

8.8 Delphi Automotive

8.8.1 Business Overview

8.8.2 SWOT Analysis

8.8.3 MnM View

9 Biometric Vehicle Access System (Page No. - 114)

9.1 Introduction

9.2 By Region

9.3 By Deployment

9.4 By Enterprise Size

9.5 Market Dynamics

9.5.1 Drivers

9.5.1.1 Pressure From OEMS to Improve Vehicle Performance & Collect Relevant Data

9.5.1.2 Multi-Factor Authentication for Vehicle Safety

9.5.1.3 Increase in Legislations Regarding Biometric Identification System

9.5.2 Restraints

9.5.2.1 Potential Failure of Electronic Components Used in Biometric Vehicle Access System

9.5.2.2 Increased Price Range of Biometric System

9.5.3 Opportunities

9.5.3.1 Rising Demand for Safety Features and Convenience

9.5.3.2 Advent of Concept Cars and Electric Vehicles in the Automotive Industry

9.5.4 Challenges

9.5.4.1 Increased Connectivity Would Induce Risk of Cyber Attacks

9.5.4.2 Weather Conditions Might Hamper the Functionality of Biometric Systems

9.6 Competitive Landscape

9.6.1 Recent Developments

9.7 Company Profile

9.7.1 Hitachi Ltd

9.7.1.1 Business Overview

9.7.1.2 SWOT Analysis

9.7.1.3 MnM View

9.7.2 Fujitsu Ltd

9.7.2.1 Business Overview

9.7.2.2 SWOT Analysis

9.7.2.3 MnM View

10 Global Vehicle Intelligence (Page No. - 126)

10.1 Introduction

10.2 By Region

10.3 By Deployment

10.4 By Enterprise Size

10.5 Market Dynamics

10.5.1 Drivers

10.5.1.1 Increasing Awareness Regarding Stringent Safety Regulations

10.5.1.2 Increasing Demand for Luxury Cars in Developing Countries

10.5.2 Restraints

10.5.2.1 High Cost of Integration

10.5.3 Opportunities

10.5.3.1 Trend of Autonomous Cars

10.5.4 Challenges

10.5.4.1 Effective Functioning of Vehicle Intelligence Systems

10.6 Competitve Landscape

10.6.1 Recent Devlopment

10.7 Company Profile

10.7.1 Delphi Automotive PLC

10.7.1.1 Business Overview

10.7.1.2 SWOT Analysis

10.7.1.3 MnM View

10.7.2 Valeo Sa

10.7.2.1 Business Overview

10.7.2.2 SWOT Analysis

10.7.2.3 MnM View

11 Automotive Night Vision Market (Page No. - 139)

11.1 Introduction

11.2 By Region

11.3 By Deployment

11.4 By Enterprise Size

11.5 Market Dynamics

11.5.1 Drivers

11.5.1.1 Growing Focus of Consumers and OEMS on Occupant Safety

11.5.1.2 Growing Auto Collision Rate

11.5.2 Restraints

11.5.2.1 High Cost of Integration

11.5.3 Opportunities

11.5.3.1 Growing Automotive Safety Norms in Developing Countries

11.5.4 Challenges

11.5.4.1 Cost Incurred at the Design and Testing Phase

11.6 Competitive Landscape

11.6.1 Recent Developments

11.7 Company Profile

11.7.1 Autoliv Inc.

11.7.1.1 Business Overview

11.7.1.2 SWOT Analysis

11.7.1.3 MnM View

11.7.2 Robert Bosch GmbH

11.7.2.1 Business Overview

11.7.2.2 SWOT Analysis

11.7.2.3 MnM View

12 Automotive Night Vision Market (Page No. - 151)

12.1 Introduction

12.2 By Region

12.3 By Deployment

12.4 By Enterprise Size

12.5 Market Dynamics

12.5.1 Drivers

12.5.1.1 Rising Concerns & Government Regulations Pertaining to Vehicle Safety

12.5.2 Restraints

12.5.2.1 Complex & Expensive Features

12.5.3 Opportunities

12.5.3.1 Low Penetration in Developing Markets

12.5.4 Challenges

12.5.4.1 Maintaining the Balance Between Cost & Quality

12.6 Competitive Landscape

12.6.1 Recent Development

12.7 Company Profile

12.7.1 ZF TRW

12.7.1.1 Business Overview

12.7.1.2 SWOT Analysis

12.7.1.3 MnM View

12.7.2 Delphi Automotive PLC

12.7.2.1 Business Overview

12.7.2.2 SWOT Analysis

12.7.2.3 MnM View

13 Lande Departure Warning System (Page No. - 163)

13.1 Introduction

13.2 By Region

13.3 By Deployment

13.4 By Enterprise Size

13.5 Market Dynamics

13.5.1 Drivers

13.5.1.1 Growing Concerns & Government Regulations Pertaining to Vehicle Safety

13.5.2 Restraints

13.5.2.1 Complex & Expensive Features

13.5.2.2 Increase in Overall Cost of the Vehicle

13.5.3 Opportunities

13.5.3.1 Low Penetration in Developing Markets

13.5.4 Challenges

13.5.4.1 Effective Functioning of the Ldws Systems

13.6 Competitve Landscape

13.6.1 Recent Devlopment

13.7 Company Profile

13.7.1 Continental AG

13.7.1.1 Business Overview

13.7.1.2 Products Offered

13.7.1.3 Recent Developments

13.7.1.4 SWOT Analysis

13.7.1.5 MnM View

13.7.2 Delphi Automotive PLC

13.7.2.1 Business Overview

13.7.2.2 Products Offered

13.7.2.3 Recent Developments

13.7.2.4 SWOT Analysis

13.7.2.5 MnM View

13.8 Author Details

List of Tables (87 Tables)

Table 1 Top 10 Automotive Technologies Market Size, By Region, 2014–2021 ( Million Units )

Table 2 Top 10 Automotive Technologies Market Size, By Technology, 2014–2021 (USD Billion)

Table 3 Remote Vehicle Diagnostics Market Size, By Region, 2014–2021 (‘000 Units)

Table 4 Remote Vehicle Diagnostics Market Size, By Region, 2014–2021 (USD Million)

Table 5 Remote Vehicle Diagnostics Market Size, By Enterprise Size, 2014–2021 (‘000 Units)

Table 6 Remote Vehicle Diagnostics Market Size, By Enterprise Size, 2014–2021 (USD Million)

Table 7 Passenger Cars With Remote Vehicle Diagnostics Applications

Table 8 Recent Devlopment, 2014–2015

Table 9 Products Offered

Table 10 Recent Developments

Table 11 Products Offered

Table 12 Recent Developments

Table 13 3D Printing in Automotive Application Market Size, By Region, 2014–2021 (‘000 Units)

Table 14 3D Printing in Automotive Application Market Size, By Region, 2014–2021 (USD Million)

Table 15 3D Printing in Automotive Application Market Size, By Deployment Size, 2014–2021 (‘000 Units)

Table 16 3D Printing in Automotive Application Market Size, By Enterprise Size, 2014–2021 (USD Million)

Table 17 Recent Developments, 2014–2015

Table 18 Products Offered

Table 19 Recent Developments, 2015

Table 20 Products Offered

Table 21 Recent Development, 2014–2015

Table 22 On Board Internet Services Market Size, By Region, 2014–2021 ( 000’ Units )

Table 23 On Board Internet Services Market Size, By Region, 2014–2021 (USD Million)

Table 24 On Board Internet Services Market Size, By Deployment Size, 2014–2021 (‘000 Units)

Table 25 On Board Internet Services Market Size, By Enterprise Size, 2014–2021 (USD Million)

Table 26 Recent Devlopment, 2014–2015

Table 27 Products Offered

Table 28 Recent Developments

Table 29 3D Printing in Automotive Application Market Size, By Region, 2014–2021 (‘000 Units)

Table 30 3D Printing in Automotive Application Market Size, By Region, 2014–2021 (USD Million)

Table 31 3D Printing in Automotive Application Market Size, By Deployment Size, 2014–2021 (‘000 Units)

Table 32 3D Printing in Automotive Application Market Size, By Enterprise Size, 2014–2021 (USD Million)

Table 33 Recent Development, 2012–2016

Table 34 Products Offered

Table 35 Recent Developments

Table 36 Products Offered

Table 37 Recent Developments, 2012–2016

Table 38 Vehicle Security System Market Size, By Region, 2014–2021 (‘000 Units)

Table 39 Vehicle Security System Market Size, By Region, 2014–2021 (USD Million)

Table 40 Vehicle Security System Market Size, By Enterprise Size, 2014–2021 (‘000 Units)

Table 41 Vehicle Security System Market Size, By Enterprise Size, 2014–2021 (USD Million)

Table 42 Recent Devlopment, 2014–2015

Table 43 Products Offered

Table 44 Recent Developments

Table 45 Products Offered

Table 46 Recent Developments

Table 47 Biometric Vehicle Access System Market Size, By Region, 2014–2021 (‘000 Units)

Table 48 Biometric Vehicle Access System Market Size, By Region, 2014–2021 (USD Million)

Table 49 Biometric Vehicle Access System Market Size, By Enterprise Size, 2014–2021 (‘000 Units)

Table 50 Biometric Vehicle Access System Market Size, By Enterprise Size, 2014–2021 (USD Million)

Table 51 Recent Development, 2014–2015

Table 52 Products Offered

Table 53 Recent Developments

Table 54 Products Offered

Table 55 Recent Developments

Table 56 Global Vehicle Intelligence Systems Market Size, By Region, 2014–2021 (000’ Units )

Table 57 Global Vehicle Intelligence Systems Market Size, By Region, 2014–2021 (USD Million)

Table 58 Global Vehicle Intelligence Systems Market Size, By Deployment Size, 2014–2021 (‘000 Units)

Table 59 Global Vehicle Intelligence Systems Market Size, By Enterprise Size, 2014–2021 (USD Million)

Table 60 Recent Devlopment, 2014–2015

Table 61 Products Offered

Table 62 Recent Developments

Table 63 Products Offered

Table 64 Recent Developments

Table 65 Global Automotive Night Vision Systems Market Size, By Region, 2014–2021 ( 000’ Units )

Table 66 Global Automotive Night Vision Systems Market Size, By Region, 2014–2021 (USD Million)

Table 67 Global Automotive Night Vision Systems Market Size, By Deployment Size, 2014–2021 (‘000 Units)

Table 68 Global Automotive Night Vision Systems Market Size, By Enterprise Size, 2014–2021 (USD Million)

Table 69 Recent Developments, 2014–2015

Table 70 Products Offered

Table 71 Recent Developments

Table 72 Products Offered

Table 73 Recent Developments

Table 74 Global Blind Spot Detection Systems Market Size, By Region, 2014–2021 ( 000’ Units )

Table 75 Global Blind Spot Detection Systems Market Size, By Region, 2014–2021 (USD Million)

Table 76 Global Blind Spot Detection Systems Market Size, By Deployment Size, 2014–2021 (‘000 Units)

Table 77 Global Blind Spot Detection Systems Market Size, By Enterprise Size, 2014–2021 (USD Million)

Table 78 Recent Development, 2014–2015

Table 79 Products Offered

Table 80 Recent Developments

Table 81 Products Offered

Table 82 Recent Developments

Table 83 Global Lane Departure Warning Systems Market Size, By Region, 2014–2021 ( 000’ Units )

Table 84 Global Lane Departure Warning Systems Market Size, By Region, 2014–2021 (USD Million)

Table 85 Global Lane Departure Warning Systems Market Size, By Deployment Size, 2014–2021 (‘000 Units)

Table 86 Global Lane Departure Warning Systems Market Size, By Enterprise Size, 2014–2021 (USD Million)

Table 87 Recent Devlopment, 2014–2015

List of Figures (66 Figures)

Figure 1 Research Design

Figure 2 Research Design Model

Figure 3 Breakdown of Primary Interviews: By Company Type, Designation, & Region

Figure 4 Impact of Disposable Income on Vehicle Sales, 2014

Figure 5 Roadways Infrastructure: Road Network (Km), By Country, 2011

Figure 6 Top 10 Automotive Technologies Market, By Type: Bottom-Up Approach

Figure 7 North America is Estimated to Be the Largest Market for Top 10 Automotive Technologies, 2016 vs 2021 (USD Billion)

Figure 8 OBIS Segment to Dominate the Top 10 Automotive Technologies in 2016

Figure 9 Remote Vehicle Diagnostics Market: Market Dynamics

Figure 10 Robert Bosch GmbH: Company Snapshot

Figure 11 SWOT Analysis: Robert Bosch GmbH

Figure 12 Company Snapshot: Continental AG

Figure 13 Continental AG: SWOT Analysis

Figure 14 3D Printing in Automotive Application Market: Market Dynamics

Figure 15 3D Printing Market Share, 2015

Figure 16 Company Snapshot: 3D Systems Corporation

Figure 17 SWOT Analysis: 3D Systems Corporation

Figure 18 Company Snapshot: Autodesk, Inc.

Figure 19 Autodesk, Inc: SWOT Analysis

Figure 20 On Board Internet Services: Study Scope

Figure 21 On Board Internet Services: Eco System

Figure 22 On Board Internet Services: Market Trends (2010-2025)

Figure 23 On Board Internet Services: Market Dynamics

Figure 24 AT&T Inc: Company Snapshot

Figure 25 SWOT Analysis: AT&T Inc

Figure 26 Company Snapshot: Continental AG

Figure 27 Continental AG: SWOT Analysis

Figure 28 3D Printing in Automotive Application Market: Market Dynamics

Figure 29 Automotive Head Up Display Market, 2015

Figure 30 Company Snapshot: Denso Corporation

Figure 31 SWOT Analysis: 3D Systems Corporation Denso Corporation

Figure 32 Company Snapshot: Continental AG

Figure 33 Continental AG

Figure 34 Multi-Factor Authentication for Car Safety to Drive the Vehicle Security System Market

Figure 35 Vehicle Security System Market Share, By Key Player Ranking, 2015

Figure 36 Company Snapshot: Continental AG

Figure 37 Continental AG: SWOT Analysis

Figure 38 Company Snapshot: Delphi Automotive

Figure 39 Delphi Automotive: SWOT Analysis

Figure 40 Biometric Vehicle Access System Market: Market Dynamics

Figure 41 Company Snapshot: Hitachi Ltd

Figure 42 SWOT Analysis: Hitachi Ltd

Figure 43 Company Snapshot: Fujitsu Ltd

Figure 44 Fujitsu Ltd: SWOT Analysis

Figure 45 Global Vehicle Intelligence Systems Market: Market Dynamics

Figure 46 Global Vehicle Intelligence Systems Market, 2015

Figure 47 Delphi Automotive PLC: Company Snapshot

Figure 48 SWOT Analysis: Delphi Automotive PLC

Figure 49 Valeo Sa: Company Snapshot

Figure 50 SWOT Analysis: Valeo Sa

Figure 51 Global Automotive Night Vision Systems Market: Market Dynamics

Figure 52 Global Automotive Night Vision Systems Market, 2015

Figure 53 Autoliv Inc. : Company Snapshot

Figure 54 SWOT Analysis: Autoliv Inc.

Figure 55 Robert Bosch GmbH: Company Snapshot

Figure 56 SWOT Analysis: Robert Bosch PLC GmbH

Figure 57 Global Blind Spot Detection Systems Market: Market Dynamics

Figure 58 ZF TRW : Company Snapshot

Figure 59 ZF TRW Automotive: SWOT Analysis

Figure 60 Company Snapshot: Delphi Automotive

Figure 61 Delphi Automotive: SWOT Analysis

Figure 62 Global Lane Departure Warning Systems Market: Market Dynamics

Figure 63 Continental AG: Company Snapshot

Figure 64 SWOT Analysis: Continental AG

Figure 65 Company Snapshot: Delphi Automotive

Figure 66 Delphi Automotive: SWOT Analysis

Growth opportunities and latent adjacency in Top 10 Automotive Technologies Market