Biocompatible 3D Printing Materials Market by Type (Polymer, Metal), Application (Implants & Prosthesis, Prototyping & Surgical Guides, Tissue Engineering, Hearing Aid), Form (Powder, Liquid), and Region - Global Forecast to 2023

[110 Pages Report]The biocompatible 3D printing materials market size was USD 256.7 million in 2017 and is projected to reach USD 832.7 million by 2023, at a CAGR of 22.0% during the forecast period. The increased demand for biocompatible 3D printing materials in the medical application is driving the demand for biocompatible 3D printing materials, globally. The years considered for estimating the market size of biocompatible 3D printing materials are:

Market Dynamics

Drivers

- Mass customization of biocompatible 3D printing materials

- Adoption of 3D printing in new medical applications

Opportunities

- Adoption of 3D printing technology in bioprinting organs

- Increasing government investments in 3D printing

Challenges

- Developing FDA compliant 3D printing biomaterials

- Producing low-cost 3D printing materials

Reduced production time and specifically tailored products

3D printing of biomaterials offers advantages throughout the production value chain. It quickens the production of medical devices by reducing the time that is generally required in converting a Computer Aided Design (CAD) to the physical part. In addition, as compared to the very high material utilization in the traditional methods, the 3D printing of biomaterials is energy efficient and environmentally-friendly. Also, 3D printing can produce custom and specifically-tailored parts on demand.

Objectives of the Study:

- To define, describe, and forecast the biocompatible 3D printing materials market, in terms of value and volume

- To provide detailed information regarding the major factors (drivers, restraints, opportunities, and challenges) influencing the growth of the market

- To identify and estimate the biocompatible 3D printing materials market size on the basis of type, form, and application

- To analyze significant regional trends in North America, Europe, Asia Pacific (APAC), Latin America, and the Middle East & Africa (MEA), along with their major countries

- To strategically analyze the market with respect to individual growth trends, prospects, and contribution to the overall market

- To analyze the opportunities for stakeholders and the competitive landscape of the market leaders

- To strategically profile and analyze the key market players and their core competencies*

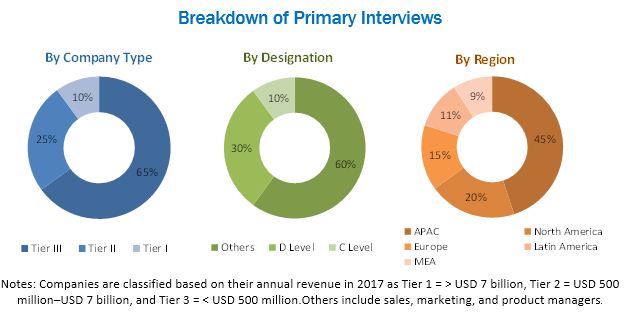

In this report, market sizes have been derived from various research methodologies. In the secondary research process, different sources have been referred to, to identify and collect information for this study on the MCA biocompatible 3D printing materials market. Several secondary sources such as Factiva, Hoovers, and Manta have been used to gain insights into the biocompatible 3D printing materials market. The experts from leading companies manufacturing biocompatible 3D printing materials have been interviewed to verify and collect critical information and to assess trends in the biocompatible 3D printing materials market during the forecast period. The top-down, bottom-up, and data triangulation approaches have been implemented to calculate exact values of the overall parent and each market segments.

To know about the assumptions considered for the study, download the pdf brochure

The biocompatible 3D printing materials market has a diversified and established ecosystem comprising upstream players, such as raw material suppliers and downstream stakeholders, manufacturers, vendors, and end users of biocompatible 3D printing materials, as well as various government organizations. The leading players operating in the biocompatible 3D printing materials market include 3D Systems, Inc. (US), Evonik Industries AG (Germany), Stratasys Ltd. (US), Concept Laser, GmBH (Germany), EOS GmBH Electro Optical Systems (Germany), Renishaw PLC. (UK), Formlabs Inc. (US), EnvisionTEC, Inc. (Germany), 3D Composites (US), and Aspect Biosystems Ltd. (Canada).

Major Market Developments

- In April 2018, EnvisionTec has developed two new medical grade materials. The products are made from a liquid silicone material and biodegradable plastic. These products have helped the company to enhance its biocompatible 3D printing material business.

- In Feburary 2018, EOS GmBH Electro Optical Systems expanded its regional footprint in the APAC region. It has opened its offices in Japan, Singapore, and China. The expansion has helped the company to meet the growing demand for 3D printing materials.

- In September 2017, Reinshaw Plc. entered into a partnership with Infosys Limited (India). The partnership has helped the company to offer an end-to-end product development service using the metal additive manufacturing technology in collaboration with Infosys. The technology will be used in the production of high-performance parts for aerospace, medical, automotive, oil & gas, mold & die, and consumer products.

Key Target Audience

- Manufacturers of biocompatible 3D printing materials

- Suppliers of raw materials

- Distributors and suppliers of biocompatible 3D printing materials

- End-use industries

- Industry associations

This study answers several questions for the stakeholders, primarily, which market segments to focus on in the next two to five years for prioritizing their efforts and investments.

Scope Of The Report

This research report categorizes the biocompatible 3D printing materials market based on type, form, application, and region. It forecasts revenue growth and analyzes trends in each of the submarkets.

Biocompatible 3D Printing Materials Market by Type:

- Polymer

- Metal

- Others

Biocompatible 3D Printing Materials Market by Form:

- Powder

- Liquid

- Others

Biocompatible 3D Printing Materials Market by Application:

- Implants & Prosthesis

- Prototyping & Surgical Guides

- Tissue Engineering

- Hearing Aids

- Others

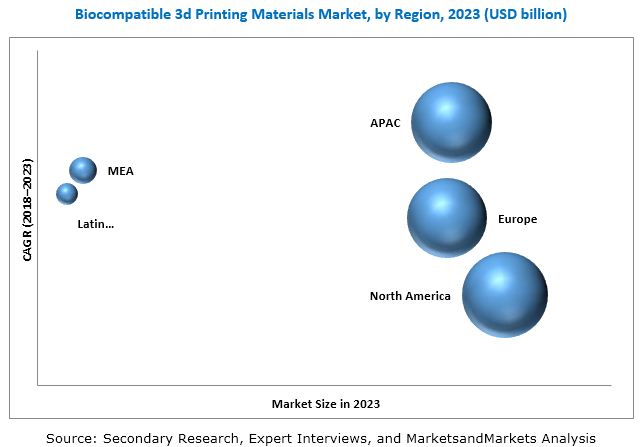

Biocompatible 3D Printing Materials Market, by Region

- North America

- Europe

- Asia Pacific (APAC)

- Middle East & Africa (MEA)

- Latin America

Available Customizations

With the given market data, MarketsandMarkets offers customizations according to the specific needs of companies. The following customization options are available for the report:

Product Analysis

- Product matrix, which offers a detailed comparison of the product portfolio of each company

Regional Analysis

- Further breakdown of the North American biocompatible 3D printing materials market

- Further breakdown of the European biocompatible 3D printing materials market

- Further breakdown of the APAC biocompatible 3D printing materials market

- Further breakdown of the Middle East & African biocompatible 3D printing materials market

- Further breakdown of the Latin American biocompatible 3D printing materials market

Company Information

- Detailed analysis and profiling of additional market players

Country Information

- Biocompatible 3D printing materials market analysis for additional countries

The biocompatible 3D printing materials market size is estimated to be USD 308.1 million in 2018 and is projected to reach USD 832.7 million by 2023, at a CAGR of 22.0% between 2018 and 2023. This growth is attributed to the increasing use of biocompatible 3D printing materials in medical applications such as implants & prosthesis, tissue engineering, and hearing aid among others.

The implants & prosthesis is projected to be the largest application segment of the biocompatible 3D printing materials market during the forecast period, in terms of both value and volume, owing to high demand from patients suffering from critical health ailments and increasing number of accidents.

The biggest challenge for the biocompatible 3D printing materials market is to develop therapeutically safe materials. According to the Food & Drug Administration, a biocompatible material has to undergo a set of tests described by the international standards ISO 10993. These tests need to assure that the final 3D printed medical device is safe and effective for its intended use. It takes a lot of efforts, time, investment and research to prove the therapeutic compatibility of a material (referred to as USP VI). The companies in the medical 3D printing materials market, especially the resin manufacturers, have to abide by these regulations, which makes the development of biocompatible materials used in the 3D printing very challenging.

North America is the largest biocompatible 3D printing materials market. The market in the region is driven by the presence of leading biocompatible 3D printing companies, including 3D systems (US), who are continually striving to increase their market share through innovation and expansion. Also, the government in North America has undertaken substantial research with regard to healthcare to reduce the cost of various medical applications.

Biocompatible 3D printing materials are used in various applications such as implants & prosthesis, prototyping & surgical guides, tissue engineering, hearing aid, and others.

Implants & Prosthesis

Biocompatible materials such as polyamide, PEEK, titanium, and cobalt chrome alloys are widely used in the implants & prosthesis application. These materials when used in 3D printing produce fine mesh or lattice structures on the surface of surgical implants. They also help in promoting better osseointegration and reduce rejection rates. 3D printing with biocompatible materials provides superior surface geometry and increases the survival rate over traditional products. The porosity of the 3D printed products, the ability to match with users anatomy, and a high level of customization have increased the use of biocompatible 3D printing materials in the implants & prosthesis application.

Implants & Prosthesis

Biocompatible materials such as polyamide, PEEK, titanium, and cobalt chrome alloys are widely used in the implants & prosthesis application. These materials when used in 3D printing produce fine mesh or lattice structures on the surface of surgical implants. They also help in promoting better osseointegration and reduce rejection rates. 3D printing with biocompatible materials provides superior surface geometry and increases the survival rate over traditional products. The porosity of the 3D printed products, the ability to match with users anatomy, and a high level of customization have increased the use of biocompatible 3D printing materials in the implants & prosthesis application.

Prototyping & Surgical Guides

Prototyping & surgical guides is the second-largest application of biocompatible 3D printed materials. Prototyping & surgical guides made with biocompatible 3D printing materials allow clinical training, education, and device testing without the use of animal models and human cadavers. Generally, polymers are the preferred choice for this application. Thus, prototyping reduces the dependence on live models and reduces the cost and time for clinical procedures and testing. 3D printing with biocompatible materials has transformed surgical planning. 3D printing technology with biocompatible materials helps match the exact planned position and angle of interventions. This offers several benefits such as a better understanding of patient anatomy, need for fewer resources, and reduced time and costs. Patient-specific surgical guides include shoulder guides, hip guides, osteotomy guide, and knee guides.

Tissue Engineering

Tissue engineering can be further segmented into various sub-applications, such as 3D cell culture, bone regeneration, drug release, soft tissue fabrication, 3D tissue constructs, and others. The increasing cases of tissue or organ failure due to age, diseases, accidents, and birth defects are serious medical problems, globally. The current treatment for organ failure relies mostly on organ transplants from living or deceased donors. Besides the shortage of donors, there is also a problem related to tissue match. The use of biocompatible 3D printing materials in tissue engineering application can help in addressing the serious problems such as shortage of donors and tissue match. 3D bioprinting offers advantages, such as highly precise cell placement and high digital control of speed, resolution, cell concentration, drop volume, and diameter of printed cells.

Hearing Aid

The hearing aid application has completely transformed with 3D printing. 3D printing has generated a transformative effect on hearing aid manufacturing. Currently, 99% of hearing aids are custom-made using 3D printing. 3D printed hearing aid is designed according to the ear canal and is produced efficiently and cost-effectively. In addition, the customized 3D-printed hearing aids are categorized under class I medical devices for external use. According to an article published in Forbes, there are more than 10,000,000 3D printed hearing aids in circulation, worldwide. EnvisionTEC, which is a leading manufacturer of 3D printers for the hearing aid industry has claimed that a majority of hearing aids in the world are manufactured using 3D printers. Thus, benefits offered by 3D printing technology in manufacturing hearing aids, coupled with the less regulatory approvals involved in 3D printed hearing aids are expected to boost the biocompatible 3D materials market in the hearing aids application.

Critical questions the report answers:

- What are the upcoming hot bets for biocompatible 3D printing materials market market?

- How market dynamics is changing for different forms in different applications?

3D Systems, Inc. (US), Evonik Industries AG (Germany), Stratasys Ltd. (US), Concept Laser, GmBH (Germany), EOS GmBH Electro Optical Systems (Germany), Renishaw PLC. (UK), Formlabs Inc. (US), EnvisionTEC, Inc. (Germany), 3D Composites (US), and Aspect Biosystems Ltd. (Canada) are the key players operating in the biocompatible 3D printing materials market. These players have adopted strategies such as new product development, expansions, acquisitions, partnerships and agreements to strengthen their competitive position in the market.

Frequently Asked Questions (FAQ):

What are the factors Influencing the growth of biocompatible 3D printing materials?

Which is the fastest growing country for biocompatible 3D printing materials market?

What are the challenges faced in the market?

What are the opportunities present in the market?

How government policies can affect the growth and commercialization of biocompatible 3D printing materials?

How is the biocompatible 3D printing materials market aligned?

Who are the major manufacturers?

What are the applications of biocompatible 3D printing materials?

What are the major types of biocompatible 3D printing materials for biocompatible 3D printing materials?

What is the biggest restraint for biocompatible 3D printing materials?

To speak to our analyst for a discussion on the above findings, click Speak to Analyst

Table of Contents

1 Introduction (Page No. - 13)

1.1 Objectives of the Study

1.2 Market Definition

1.3 Market Scope

1.3.1 Years Considered for the Study

1.4 Currency

1.5 Stakeholders

2 Research Methodology (Page No. - 16)

2.1 Research Data

2.1.1 Secondary Data

2.1.1.1 Key Data From Secondary Sources

2.1.2 Primary Data

2.1.2.1 Key Data From Primary Sources

2.1.2.2 Key Industry Insights

2.1.2.3 Breakdown of Primary Interviews

2.2 Market Size Estimation

2.2.1 Bottom-Up Approach

2.2.2 Top-Down Approach

2.3 Data Triangulation

2.4 Research Assumptions

2.5 Limitations

3 Executive Summary (Page No. - 24)

4 Premium Insights (Page No. - 28)

4.1 Attractive Opportunities in the Biocompatible 3D Printing Materials Market

4.2 Biocompatible 3D Printing Materials By Market, By Type

4.3 Biocompatible 3D Printing Materials, By Application and Region

4.4 Biocompatible 3D Printing Materials By Market, By Form

4.5 Biocompatible 3D Printing Materials By Market, By Country

5 Market Overview (Page No. - 31)

5.1 Introduction

5.2 Market Dynamics

5.2.1 Drivers

5.2.1.1 Mass Customization of Biocompatible 3D Printing Materials

5.2.1.2 Adoption of 3D Printing in New Medical Applications

5.2.1.3 Reduced Production Time and Specifically Tailored Products

5.2.2 Restraints

5.2.2.1 High Material Costs

5.2.3 Opportunities

5.2.3.1 Adoption of 3D Printing Technology in Bioprinting Organs

5.2.4 Increasing Government Investments in 3D Printing

5.2.5 Challenges

5.2.5.1 Developing Fda Compliant 3D Printing Biomaterials

5.2.5.2 Producing Low-Cost 3D Printing Materials

6 Industry Trends (Page No. - 34)

6.1 Porters Five Forces Analysis

6.1.1 Threat 0f New Entrants

6.1.2 Threat of Substitutes

6.1.3 Bargaining Power of Buyers

6.1.4 Bargaining Power of Suppliers

6.1.5 Intensity of Competitive Rivalry

7 Biocompatible 3D Printing Materials Market, By Type (Page No. - 37)

7.1 Introduction

7.2 Polymer

7.3 Metal

7.4 Others

8 Biocompatible 3D Printing Materials Market, By Form (Page No. - 42)

8.1 Introduction

8.2 Powder

8.3 Liquid

8.4 Others

9 Biocompatible 3D Printing Materials Market, By Application (Page No. - 48)

9.1 Introduction

9.2 Implants & Prosthesis

9.3 Prototyping & Surgical Guides

9.4 Tissue Engineering

9.5 Hearing Aid

9.6 Others

10 Biocompatible 3D Printing Materials Market, By Region (Page No. - 56)

10.1 Introduction

10.2 North America

10.2.1 US

10.2.2 Canada

10.3 Europe

10.3.1 Germany

10.3.2 UK

10.3.3 Italy

10.3.4 France

10.3.5 Spain

10.3.6 Rest of Europe

10.4 APAC

10.4.1 China

10.4.2 Japan

10.4.3 South Korea

10.4.4 Rest of APAC

10.5 Latin America

10.5.1 Brazil

10.5.2 Mexico

10.5.3 Rest of Latin America

10.6 MEA

10.6.1 South Africa

10.6.2 UAE

10.6.3 Saudi Arabia

10.6.4 Rest of MEA

11 Competitive Landscape (Page No. - 77)

11.1 Introduction

11.2 Market Ranking of Key Players, 2017

11.3 Competitive Scenario

11.3.1 New Product Developments

11.3.2 Expansions

11.3.3 Acquisitions

11.3.4 Partnerships

11.3.5 Agreements

12 Company Profiles (Page No. - 82)

(Business Overview, Products Offered, Recent Developments, SWOT Analysis, and MnM View)*

12.1 3D Systems, Inc.

12.2 Evonik Industries AG

12.3 Stratasys Ltd.

12.4 Concept Laser GmbH

12.5 Eos GmbH Electro Optical Systems

12.6 Renishaw Plc

12.7 Formlabs, Inc.

12.8 Envisiontec, Inc.

12.9 3D Composites

12.10 Aspect Biosystems Ltd.

12.11 Other Companies

12.11.1 Regenhu

12.11.2 3Dresyns

12.11.3 Apium Additive Technologies GmbH

12.11.4 Detax Ettlingen

12.11.5 Fibretuff Medical Biopolymers, Llc

12.11.6 PMG 3D Tech. (Shanghai) Co., Ltd.

12.11.7 Advanced Solutions, Inc.

12.11.8 Hoganas AB

12.11.9 Medprin Regenerative Medical Technologies Co., Ltd.

12.11.10 Bioink Solutions, Inc.

12.11.11 Poly-Med, Inc.

12.11.12 Elix Polymers S.L.U

12.11.13 Cellink AB

12.11.14 Arcam AB

12.11.15 Sandvik AB

*Details on Business Overview, Products Offered, Recent Developments, SWOT Analysis, and MnM View Might Not Be Captured in Case of Unlisted Companies.

13 Appendix (Page No. - 104)

13.1 Insights From Industry Experts

13.2 Discussion Guide

13.3 Knowledge Store: Marketsandmarkets Subscription Portal

13.4 Available Customizations

13.5 Related Reports

13.6 Author Details

List of Tables (65 Tables)

Table 1 Biocompatible 3D Printing Materials Market Size, By Type, 2016-2023 (Ton)

Table 2 Biocompatible 3D Printing Materials Market Size, By Type, 2016-2023 (USD Thousand)

Table 3 Biocompatible 3D Printing Polymer Market Size, By Region, 2016-2023 (Ton)

Table 4 Biocompatible 3D Printing Polymer Market Size, By Region, 2016-2023 (USD Thousand)

Table 5 Biocompatible 3D Printing Metal Market Size, By Region, 2016-2023 (Ton)

Table 6 Biocompatible 3D Printing Metal Market Size, By Region, 2016-2023 (USD Thousand)

Table 7 Other Biocompatible 3D Printing Materials Market Size, By Region, 2016-2023 (Ton)

Table 8 Other Biocompatible 3D Printing Materials Market Size, By Region, 2016-2023 (USD Thousand)

Table 9 Biocompatible 3D Printing Materials Market Size, By Form, 20162023 (Ton)

Table 10 Biocompatible 3D Printing Materials Market Size, By Form, 20162023 (USD Thousand)

Table 11 Powder: By Market Size, By Region, 2016-2023 (Ton)

Table 12 Powder: By Market Size, By Region, 20162023 (USD Thousand)

Table 13 Liquid: By Market Size, By Region, 2016-2023 (Ton)

Table 14 Liquid: By Market Size, By Region, 2016-2023 (USD Thousand)

Table 15 Others: By Market Size, By Region, 2016-2023 (Ton)

Table 16 Others: By Market Size, By Region, 2016-2023 (USD Thousand)

Table 17 By Market Size, By Application, 20162023 (Ton)

Table 18 By Market Size, By Application, 20162023 (USD Thousand)

Table 19 By Market Size in Implants & Prosthesis, By Region, 20162023 (Ton)

Table 20 By Market Size in Implants & Prosthesis, By Region, 20162023 (USD Thousand)

Table 21 By Market Size in Prototyping & Surgical Guides, By Region, 20162023 (Ton)

Table 22 By Market Size in Prototyping & Surgical Guides, By Region, 20162023 (USD Thousand)

Table 23 By Market Size in Tissue Engineering, By Region, 20162023 (Ton)

Table 24 By Market Size in Tissue Engineering, By Region, 20162023 (USD Thousand)

Table 25 By Market Size in Hearing Aids, By Region, 20162023 (Ton)

Table 26 By Market Size in Hearing Aids, By Region, 20162023 (USD Thousand)

Table 27 By Market Size in Other Applications, By Region, 20162023 (Ton)

Table 28 By Market Size in Other Applications, By Region, 20162023 (USD Thousand)

Table 29 North America: By Market Size, By Region, 20162023 (Ton)

Table 30 North America: By Market Size, By Region, 20162023 (USD Thousand)

Table 31 North America: By Market Size, By Application, 20162023 (Ton)

Table 32 North America: By Market Size, By Application, 20162023 (USD Thousand)

Table 33 North America: By Market Size, By Type, 20162023 (Ton)

Table 34 North America: By Market Size, By Type, 20162023 (USD Thousand)

Table 35 North America: By Market Size, By Country, 20162023 (Ton)

Table 36 North America: By Market Size, By Country, 20162023 (USD Thousand)

Table 37 Europe: By Market Size, By Application, 20162023 (Ton)

Table 38 Europe: By Market Size, By Application, 20162023 (USD Thousand)

Table 39 Europe: By Market Size, By Type, 20162023 (Ton)

Table 40 Europe: By Market Size, By Type, 20162023 USD Thousand)

Table 41 Europe: By Market Size, By Country, 20162023 (Ton)

Table 42 Europe: By Market Size, By Country, 20162023 (USD Thousand)

Table 43 APAC: By Market Size, By Application, 20162023 (Ton)

Table 44 APAC: By Market Size, By Application, 20162023 (USD Thousand)

Table 45 APAC: By Market Size, By Type, 20162023 (Ton)

Table 46 APAC: By Market Size, By Type, 20162023 (USD Thousand)

Table 47 APAC: By Market Size, By Country, 20162023 (Ton)

Table 48 APAC: By Market Size, By Country, 20162023 (USD Thousand)

Table 49 Latin America: By Market Size, By Application, 20162023 (Ton)

Table 50 Latin America: By Market Size, By Application, 20162023 (USD Thousand)

Table 51 Latin America: By Market Size, By Type, 20162023 (Ton)

Table 52 Latin America: By Market Size, By Type, 20162023 (USD Thousand)

Table 53 Latin America: By Market Size, By Country, 20162023 (Ton)

Table 54 Latin America: By Market Size, By Country, 20162023 (USD Thousand)

Table 55 MEA: By Market Size, By Application, 20162023 (Ton)

Table 56 MEA: By Market Size, By Application, 20162023 (USD Thousand)

Table 57 MEA: By Market Size, By Type, 20162023 (Ton)

Table 58 MEA: By Market Size, By Type, 20162023 (USD Thousand)

Table 59 MEA: By Market Size, By Country, 20162023 (Ton)

Table 60 MEA: By Market Size, By Country, 20162023 (USD Thousand)

Table 61 New Product Developments, 20152018

Table 62 Expansions, 20152018

Table 63 Acquisitions, 20152018

Table 64 Partnerships, 20152018

Table 65 Agreements, 20152018

List of Figures (33 Figures)

Figure 1 Biocompatible 3D Printing Materials : Market Segmentation

Figure 2 Biocompatible 3D Printing Materials Market: Research Design

Figure 3 Market Size Estimation: Bottom-Up Approach

Figure 4 Market Size Estimation: Top-Down Approach

Figure 5 Biocompatible 3D Printing Materials Market: Data Triangulation

Figure 6 Implants & Prosthesis Application to Lead the Biocompatible 3D Materials Market

Figure 7 Polymer Type to Lead the Biocompatible 3D Printing Materials Market

Figure 8 China to Be the Fastest-Growing Biocompatible 3D Materials Market

Figure 9 Powder to Be the Fastest-Growing Form in Biocompatible 3D Printing Materials Market

Figure 10 APAC to Lead the Biocompatible 3D Materials Market

Figure 11 Adoption of 3D Printing in New Medical Applications to Drive the Biocompatible 3D Printing Materials Market

Figure 12 Polymer Material to Dominate the Biocompatible 3D Printing Materials Market

Figure 13 Implants & Prosthesis Segment Dominated the Biocompatible 3D Printing Materials Market in 2017

Figure 14 Powder Form to Lead Biocompatible 3D Printing Materials Market

Figure 15 China to Be the Fastest-Growing Market During the Forecast Period

Figure 16 Overview of Factors Governing the 3D Printing Materials Market

Figure 17 Porters Five Forces Analysis of the Biocompatible 3D Printing Materials Market

Figure 18 Polymer to Dominate the Biocompatible 3D Printing Materials Market

Figure 19 Powder Form to Register the Fastest Growth in the Biocompatible 3D Printing Materials Market

Figure 20 Implants & Prosthesis Application to Dominate the Biocompatible 3D Printing Materials Market

Figure 21 China to Be the Largest 3D Printing Materials Market

Figure 22 North America: Biocompatible 3D Printing Materials Market Snapshot

Figure 23 Europe: Biocompatible 3D Printing Materials Market Snapshot

Figure 24 APAC: Biocompatible 3D Printing Materials Market Snapshot

Figure 25 Companies Have Adopted Expansions as the Key Growth Strategy Between 2015 and 2018

Figure 26 3D Systems: Company Snapshot

Figure 27 3D Systems: SWOT Analysis

Figure 28 Evonik Industries: Company Snapshot

Figure 29 Evonik Industries: SWOT Analysis

Figure 30 Stratasys: Company Snapshot

Figure 31 Stratasys: SWOT Analysis

Figure 32 Renishaw: Company Snapshot

Figure 33 Renishaw: SWOT Analysis

Growth opportunities and latent adjacency in Biocompatible 3D Printing Materials Market