Biomedical Textiles Market by Fiber Type (Non-Biodegradable, Biodegradable), Fabric Type (Non-Woven, Woven), Application (Non-Implantable, Surgical Sutures), and Region (North America, Europe, APAC, MEA, South America) - Global Forecast to 2027

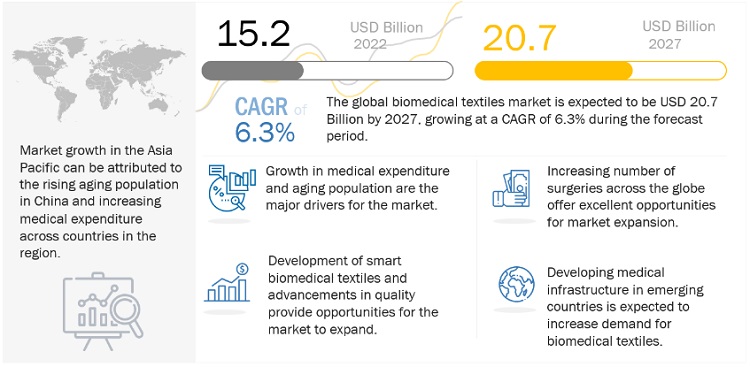

The biomedical textiles market is projected to reach USD 20.7 billion by 2027, growing at a CAGR 6.3%. The rising number of surgeries, rapidly aging population, and increased healthcare spending in emerging economies are expected to drive the biomedical textiles market during the forecast period.

Attractive Opportunities in the Biomedical Textiles Market

To know about the assumptions considered for the study, Request for Free Sample Report

Rapid growth in aging population to boost biomedical textiles market

One of the major factors driving the market is the rise in the global elderly population. Due to age-related physiological changes, elderly people are more likely to develop orthopedic, cardiovascular, spinal, and ocular disorders. The bulk of these illnesses may be effectively treated with surgical techniques; hence the aging population is driving the demand for surgical procedures. Every year in the US, emergency rooms treat 2.7 million elderly patients who have had falls, according to the Centers for Disease Control and Prevention (CDC). The body's inherent capacity to seal and heal wounds decreases with advancing age due to decreasing cellular function. In the senior population, chronic lesions such as pressure ulcers are also fairly common. The majority of the people who require sutures, implants, and wound care products are the elderly. The market for biomedical textiles is projected to be driven by the demand for these products which is anticipated to increase along with the increasing aging population.

Requirement for high R&D investment to restrict the market growth

Biomedical textiles are advanced materials specifically designed to resist a wide variety of bacteria, fungi, fire, stain, and water. The development of these fabrics involves extensive research & development to provide specialized products that meet healthcare specifications. The research & development costs analogous with producing quality fabrics are high due to labor, technology, and other associated costs. The production of raw materials such as polyester, cotton, polypropylene, polyurethane, vinyl, and other fibers involves complex processes that require large investments. The production of these materials also requires efficient machinery, state-of-the-art technology, and adequate raw materials. Raw materials used in antimicrobial biomedical textiles include a collection of fibers and antimicrobial agents such as silver, copper, and quaternary ammonium, which are very exorbitant. It is also a complex process that requires market participants to monitor the production of quality textiles. Therefore, the R&D expenditure required to produce these textiles is high, restraining market growth.

Development of smart biomedical textiles to create lucrative opportunities for the market

Smart biomedical textiles are wearable materials produced by embedding tiny semiconductors and sensors into fabrics. The smart biomedical textiles marketplace is expected to grow at a rate of 20% per year. The use of these textiles in patients’ clothing can assist in screening coronary heart charge, blood pressure, and pulse charge. They also can assist in screening body temperature, breathing rate, humidity, and pH level.

The European Commission is investing in R&D to increase research in smart biomedical textiles for diverse programs in West Sweden. Under this research, tasks including Context, Proetex, Sweet, Stella, OFSETH, Biotex, and Clevertex are being studied. The Context task is centered on the improvement of substances embedded with capacitive sensors which now no longer require direct frame touch and may screen a baby’s coronary heart charge. OFSETH is undertaking research on optical fibers that could measure the oxygen content of blood and aid in screening sufferers in MRI chambers.

The improvement of smart biomedical textiles has been efficaciously established in fibers, along with

cotton, polyester, and linen. Researchers are specializing in the growing usage of smart fabrics apart from cotton. This is expected to offer significant opportunities to the marketplace in the future.

Increasing pricing pressure on market players to be a major challenge for market growth

In response to increasing government pressure to reduce healthcare costs, many healthcare providers are joining Cluster/Group Purchasing Organizations (GPOs) and Integrated Healthcare Networks (IHNs). These organizations combine member purchase volumes and discounts to offer competitive pricing with suppliers who are still surgical equipment manufacturers. The GPO and IHN dominate the purchase of surgical products in bulk and retain their leveraging power.

For instance, IPC purchases healthcare and hygiene-certified strong point textiles in bulk quantities in addition to bandages, dressings, and opportunity merchandise from 3M, Covidien, and other organizations for its community of twenty-one hospitals. Due to the excessive quantity purchases, IPC negotiates with its providers for prices and transfers the benefits to its clients as well. As a result, through bulk shopping, IPC offers all scientific products at or approximately 15% lower costs to its clients.

Non-biodegradable fiber type accounted for the largest market share, in terms of value and volume

Non-biodegradable fiber-based biomedical textiles usage is increasing owing to the increased consumption in non-implantable applications. The increasing awareness and benefits of using this fiber in the healthcare industry are expected to drive demand between 2022 and 2027.

Non-woven fabric segment dominated the biomedical textiles market, in terms of value and volume

Non-woven fabric is widely used in non-implantable applications such as bandages. It is also used for orthopedic bandages and artificial skin applications. Non-woven fabric is used as an alternative to traditional textiles owing to its excellent absorption properties, softness, smoothness, strength, stretchability, comfort and fit, and cost-effectiveness.

Non-implantable application segment dominated the biomedical textiles market, in terms of value and volume

The non-implantable application includes various bandages that are made of polyethylene, cotton, viscose, polyamide, and spandex. The fabrics used in these products can be non-woven, woven, or knitted. Viscose and cotton are the major raw materials used to produce these products. Traditional wound care comprises first-aid treatment provided to prevent bacterial infection. These dressings include bandages, such as cohesive, elastic, tubular, triangular, and gauze, which are used for support, dressing retention, and compression.

To know about the assumptions considered for the study, download the pdf brochure

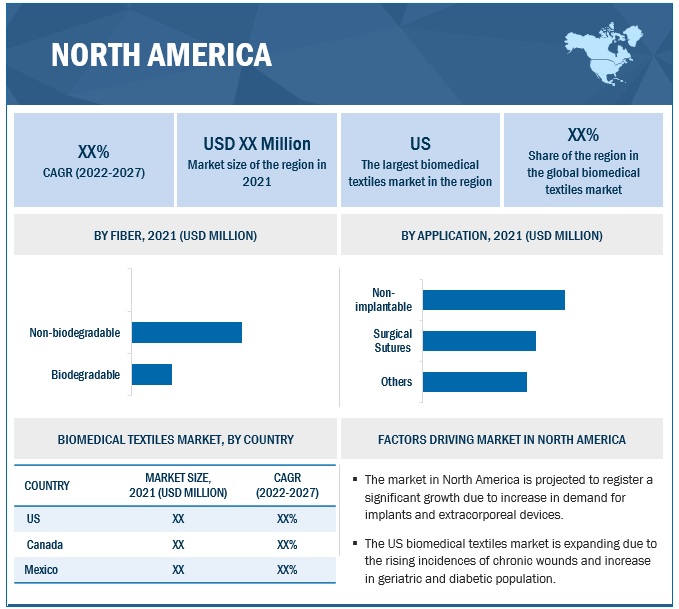

North America region held the largest market share in the biomedical textiles market

North America covers the US, Canada, and Mexico in this report. It is the largest biomedical textiles market due to the strong consumer awareness about biomedical products, rising demand for high-quality products, and most of the key players in the market concentrated in the country. Safety regulations and continuous investments in R&D activities to develop advanced fabrics also support the growth of the market. The strong export market, advanced and high-performance products, and expansion of the medical and healthcare industries are also some of the factors driving the market.

Key Biomedical Textiles Market Players

Royal DSM (Netherlands), Johnson & Johnson (US), Medtronic (US), Cardinal Health (US), Integra LifeSciences Corporation (US), Smith & Nephew (UK), Medline (US), Paul Hartmann AG (Germany), and BSN Medical (Germany) are the key players in the biomedical textiles market.

ATEX Technologies (US), Elkem Silicones (Germany), Bally Ribbon Mills (US), US Biodesign (US), Nitto Denko Corporation (Japan), Kimberly-Clark (US), Mölnlycke Health Care (Sweden), 3M Company (US), Ahlstrom-Munksjö (Sweden), Freudenberg & Co. Kommanditgesellschaft (Germany), Secant Group LLC (US), and Meister & CIE AG (Switzerland) are the other significant players in the biomedical textiles market.

These companies are involved in adopting various inorganic and organic strategies to increase their foothold in the biomedical textiles industry. The study includes an in-depth competitive analysis of these key players in the biomedical textiles market, with their company profiles, recent developments, and key market strategies.

Biomedical Textiles Market Report Scope

|

Report Metric |

Details |

|

Years considered for the study |

2018-2021 |

|

Base year |

2021 |

|

Forecast period |

2022-2027 |

|

Units considered |

Value (USD million/USD Billion), Volume (Kiloton) |

|

Segments |

Fiber type, Fabric type, Applications and Region |

|

Regions |

Europe, North America, APAC, MEA, and South America |

|

Companies |

Royal DSM (Netherlands), Johnson & Johnson (US), Medtronic (US), Cardinal Health (US), Integra LifeSciences Corporation (US), Smith & Nephew (UK), Medline (US), Paul Hartmann AG (Germany), |

This research report categorizes the Biomedical textiles market based on resin type, manufacturing process, application, and region.

By Fiber Type:

- Non-Biodegradable Fiber

- Biodegradable

By Fabric Type:

- Non-Woven

- Woven

- Others

By Application:

- Non-Implantable

- Surgical Sutures

- Others

By Region:

- North America

- Europe

- Asia Pacific

- Middle East & Africa

- South America

Recent Developments in Biomedical Textiles Market

- In September 2022, Royal DSM N.V. acquired Prodap, a leading animal nutrition and technology company in Brazil.

- In August 2022Medtronic plc acquired Affera Inc., a leading technology provider for the treatment of cardiac arrhythmia.

- In May 2022, Royal DSM sold its Engineering Materials Business to Lanxess for USD 3.91 billion.

- In April 2022, Medtronic plc and GE Healthcare entered into an agreement to meet the growing need for outpatient care.

- In December 2021, Royal DSM acquired Vestkorn Milling, a leading producer of pea and bean-based ingredients for plant-based protein products in Europe for USD 67 million.

Frequently Asked Questions (FAQ):

What are the factors influencing the growth of the Biomedical textiles market?

Rising aging population around the globe to boost the biomedical textiles market.

Which is the largest country-level market for Biomedical textiles market?

China is the largest Biomedical textiles market due to high demand from well-established end-use industries.

What are the factors contributing to the final price of Biomedical textiles market?

Raw material cost, and r&d costs determine the final price Biomedical textiles market.

What are the challenges in the Biomedical textiles market?

Increasing pricing pressure is the major challenge for the Biomedical textiles market. .

Which type of fiber holds the largest market share?

Non-biodegradable fiber type hold the largest share in terms of value and volume, in the Biomedical textiles market.

How is the Biomedical textiles market aligned?

The market is growing at the fastest pace. It is a potential market and many manufacturers are undertaking business strategies to expand their business.

Who are the major manufacturers?

Royal DSM (Netherlands), Johnson & Johnson (US), Medtronic (US), Cardinal Health (US), Integra LifeSciences Corporation (US), Smith & Nephew (UK), Medline (US), Paul Hartmann AG (Germany), and BSN Medical (Germany)

What is the biggest restraint in the Biomedical textiles market?

High R&D investment cost and stringent regulatory approvals in the Biomedical textiles market. .

To speak to our analyst for a discussion on the above findings, click Speak to Analyst

TABLE OF CONTENTS

1 INTRODUCTION (Page No. - 41)

1.1 STUDY OBJECTIVES

1.2 MARKET DEFINITION

1.2.1 INCLUSIONS & EXCLUSIONS

1.3 MARKET SCOPE

FIGURE 1 BIOMEDICAL TEXTILES MARKET SEGMENTATION

1.3.1 REGIONS COVERED

1.3.2 YEARS CONSIDERED

1.4 CURRENCY CONSIDERED

1.5 UNITS CONSIDERED

1.6 RESEARCH LIMITATIONS

1.7 STAKEHOLDERS

1.8 SUMMARY OF CHANGES

2 RESEARCH METHODOLOGY (Page No. - 45)

2.1 RESEARCH DATA

FIGURE 2 BIOMEDICAL TEXTILES MARKET: RESEARCH DESIGN

2.1.1 SECONDARY DATA

2.1.2 PRIMARY DATA

2.1.2.1 Primary interviews – top biomedical textiles manufacturers

2.1.2.2 Breakdown of primary interviews

2.1.2.3 Key industry insights

2.2 BASE NUMBER CALCULATION

2.2.1 APPROACH 1: SUPPLY-SIDE ANALYSIS

2.2.2 APPROACH 2: DEMAND-SIDE ANALYSIS

2.3 FORECAST NUMBER CALCULATION

2.3.1 SUPPLY SIDE

2.3.2 DEMAND SIDE

2.4 MARKET SIZE ESTIMATION

2.4.1 BOTTOM-UP APPROACH

FIGURE 3 MARKET SIZE ESTIMATION METHODOLOGY: BOTTOM-UP APPROACH

2.4.2 TOP-DOWN APPROACH

FIGURE 4 MARKET SIZE ESTIMATION: TOP-DOWN APPROACH

2.5 DATA TRIANGULATION

FIGURE 5 BIOMEDICAL TEXTILES MARKET: DATA TRIANGULATION

2.6 FACTOR ANALYSIS

2.7 ASSUMPTIONS

2.8 LIMITATIONS & RISKS

3 EXECUTIVE SUMMARY (Page No. - 53)

FIGURE 6 NON-WOVEN FABRIC SEGMENT TO LEAD BIOMEDICAL TEXTILES MARKET BETWEEN 2022 AND 2027

FIGURE 7 NON-BIODEGRADABLE FIBER SEGMENT DOMINATED BIOMEDICAL TEXTILES MARKET IN 2021

FIGURE 8 NON-IMPLANTABLE SEGMENT TO BE FASTEST-GROWING APPLICATION OF BIOMEDICAL TEXTILES BETWEEN 2022 AND 2027

FIGURE 9 MARKET IN CHINA TO GROW FASTEST DURING FORECAST PERIOD

FIGURE 10 NORTH AMERICA ACCOUNTED FOR LARGEST SHARE OF MARKET IN 2021

4 PREMIUM INSIGHTS (Page No. - 57)

4.1 BIOMEDICAL TEXTILES MARKET SIZE, BY VOLUME

FIGURE 11 RISING NUMBER OF SURGERIES TO DRIVE BIOMEDICAL TEXTILES MARKET

4.2 BIOMEDICAL TEXTILES MARKET, BY FABRIC TYPE

FIGURE 12 NON-WOVEN FABRIC SEGMENT DOMINATED BIOMEDICAL TEXTILES MARKET IN 2021

4.3 BIOMEDICAL TEXTILES MARKET, BY FIBER TYPE

FIGURE 13 NON-BIODEGRADABLE FIBER SEGMENT DOMINATED BIOMEDICAL TEXTILES MARKET IN 2021

4.4 BIOMEDICAL TEXTILES MARKET, BY APPLICATION

FIGURE 14 NON-IMPLANTABLE SEGMENT ACCOUNTED FOR LARGEST SHARE OF BIOMEDICAL TEXTILES MARKET

4.5 BIOMEDICAL TEXTILES MARKET GROWTH, BY KEY COUNTRIES

FIGURE 15 MARKET IN CHINA TO GROW AT HIGHEST CAGR DURING FORECAST PERIOD

5 MARKET OVERVIEW (Page No. - 60)

5.1 INTRODUCTION

5.2 MARKET DYNAMICS

FIGURE 16 DRIVERS, RESTRAINTS, OPPORTUNITIES, AND CHALLENGES IN BIOMEDICAL TEXTILES MARKET

5.2.1 DRIVERS

5.2.1.1 Rising number of surgeries

5.2.1.2 Rapid growth in aging population

5.2.1.3 Advancements in medical textiles

5.2.1.4 Growing need for advanced wound dressing materials

5.2.2 RESTRAINTS

5.2.2.1 Requirement for high R&D investments

5.2.2.2 Stringent regulations imposed by government bodies

5.2.3 OPPORTUNITIES

5.2.3.1 Development of smart biomedical textiles

5.2.3.2 Growth in demand from emerging markets

5.2.4 CHALLENGES

5.2.4.1 Increasing pricing pressures on market players

5.2.4.2 Product marketing challenges

5.3 POTTERS FIVE FORCE ANALYSIS

FIGURE 17 PORTER’S FIVE FORCE ANALYSIS: BIOMEDICAL TEXTILES MARKET

5.3.1 BARGAINING POWER OF SUPPLIERS

5.3.2 BARGAINING POWER OF BUYERS

5.3.3 THREAT OF SUBSTITUTES

5.3.4 THREAT OF NEW ENTRANTS

5.3.5 INTENSITY OF COMPETITIVE RIVALRY

TABLE 1 PORTER’S FIVE FORCE ANALYSIS: BIOMEDICAL TEXTILES MARKET

5.4 SUPPLY CHAIN ANALYSIS

TABLE 2 BIOMEDICAL TEXTILES MARKET: SUPPLY CHAIN

5.5 KEY STAKEHOLDERS & BUYING CRITERIA

5.5.1 KEY STAKEHOLDERS IN BUYING PROCESS

FIGURE 18 INFLUENCE OF STAKEHOLDERS ON BUYING PROCESS FOR TOP THREE APPLICATIONS

TABLE 3 INFLUENCE OF STAKEHOLDERS IN BUYING PROCESS FOR TOP THREE APPLICATIONS

5.5.2 BUYING CRITERIA

FIGURE 19 KEY BUYING CRITERIA FOR TOP THREE APPLICATIONS

TABLE 4 KEY BUYING CRITERIA FOR TOP THREE APPLICATIONS

5.6 TECHNOLOGY ANALYSIS

TABLE 5 BIOMEDICAL TEXTILES MANUFACTURING PROCESS

5.7 ECOSYSTEM: BIOMEDICAL TEXTILES MARKET

5.8 VALUE CHAIN ANALYSIS

FIGURE 20 VALUE CHAIN ANALYSIS

5.9 KEY MARKETS FOR IMPORT/EXPORT

5.9.1 US

5.9.2 CHINA

5.9.3 GERMANY

5.9.4 INDIA

5.10 PRICING ANALYSIS

5.11 AVERAGE SELLING PRICES OF KEY PLAYERS, BY APPLICATION

FIGURE 21 AVERAGE SELLING PRICES OF KEY PLAYERS FOR TOP THREE APPLICATIONS (USD/TON)

TABLE 6 AVERAGE SELLING PRICES OF KEY PLAYERS FOR TOP THREE APPLICATIONS (USD/TON)

5.12 AVERAGE SELLING PRICE BY REGION

TABLE 7 BIOMEDICAL TEXTILES AVERAGE SELLING PRICE, BY REGION

5.13 BIOMEDICAL TEXTILES MARKET: OPTIMISTIC, PESSIMISTIC, AND REALISTIC SCENARIOS

TABLE 8 BIOMEDICAL TEXTILES MARKET: CAGR (BY VALUE) IN OPTIMISTIC, PESSIMISTIC, AND REALISTIC SCENARIOS

5.13.1 OPTIMISTIC SCENARIO

5.13.2 PESSIMISTIC SCENARIO

5.13.3 REALISTIC SCENARIO

5.14 KEY CONFERENCES & EVENTS IN 2022–2023

TABLE 9 DETAILED LIST OF CONFERENCES & EVENTS RELATED TO BIOMEDICAL TEXTILES AND CORRESPONDING MARKETS

5.15 TARIFFS AND REGULATIONS

5.15.1 REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

TABLE 10 NORTH AMERICA: LIST OF REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

TABLE 11 EUROPE: LIST OF REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

TABLE 12 ASIA PACIFIC: LIST OF REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

TABLE 13 REST OF THE WORLD: LIST OF REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

5.16 PATENT ANALYSIS

5.16.1 INTRODUCTION

5.16.2 METHODOLOGY

5.16.3 DOCUMENT TYPE

TABLE 14 BIOMEDICAL TEXTILES MARKET: GLOBAL PATENTS

FIGURE 22 GLOBAL PATENT ANALYSIS, BY DOCUMENT TYPE

FIGURE 23 GLOBAL PATENT PUBLICATION TREND ANALYSIS: LAST 10 YEARS

5.16.4 INSIGHTS

5.16.5 LEGAL STATUS OF PATENTS

FIGURE 24 BIOMEDICAL TEXTILES MARKET: LEGAL STATUS OF PATENTS

5.16.6 JURISDICTION ANALYSIS

FIGURE 25 GLOBAL JURISDICTION ANALYSIS

5.16.7 TOP APPLICANTS' ANALYSIS

FIGURE 26 DANISCO US INC. HAS HIGHEST NUMBER OF PATENTS

5.16.8 LIST OF PATENTS, BY DANISCO US INC.

5.16.9 LIST OF PATENTS, BY PROCTER AND GAMBLE COMPANY

5.16.10 LIST OF PATENTS BY MASSACHUSETTS INSTITUTE OF TECHNOLOGY

5.16.11 TOP 10 PATENT OWNERS (US) IN LAST 10 YEARS

5.17 CASE STUDY ANALYSIS

5.18 TRENDS AND DISRUPTIONS IMPACTING CUSTOMERS

6 BIOMEDICAL TEXTILES MARKET, BY FIBER TYPE (Page No. - 85)

6.1 INTRODUCTION

FIGURE 27 NON-BIODEGRADABLE FIBER TO DOMINATE BIOMEDICAL TEXTILES MARKET DURING FORECAST PERIOD

TABLE 15 BIOMEDICAL TEXTILES MARKET SIZE, BY FIBER TYPE, 2018–2021 (USD MILLION)

TABLE 16 BIOMEDICAL TEXTILE MARKET SIZE, BY FIBER TYPE, 2018–2021 (KILOTON)

TABLE 17 BIOMEDICAL TEXTILES MARKET SIZE, BY FIBER TYPE, 2022–2027 (USD MILLION)

TABLE 18 BIOMEDICAL TEXTILE MARKET SIZE, BY FIBER TYPE, 2022–2027 (KILOTON)

6.2 NON-BIODEGRADABLE FIBER

6.2.1 USED MAINLY IN HIGH SUPPORT BANDAGES, COMPRESSION BANDAGES, ORTHOPEDIC BANDAGES, AND PLASTERS

FIGURE 28 NORTH AMERICA TO LEAD NON-BIODEGRADABLE FIBER TYPE BIOMEDICAL TEXTILES MARKET DURING FORECAST PERIOD

6.2.2 BIOMEDICAL TEXTILES MARKET FOR NON-BIODEGRADABLE FIBER TYPE, BY REGION

TABLE 19 BIOMEDICAL TEXTILES MARKET SIZE FOR NON-BIODEGRADABLE FIBER TYPE, BY REGION, 2018–2021 (USD MILLION)

TABLE 20 BIOMEDICAL TEXTILE MARKET SIZE FOR NON-BIODEGRADABLE FIBER TYPE, BY REGION, 2018–2021 (KILOTON)

TABLE 21 BIOMEDICAL TEXTILES MARKET SIZE FOR NON-BIODEGRADABLE FIBER TYPE, BY REGION, 2022–2027 (USD MILLION)

TABLE 22 BIOMEDICAL TEXTILE MARKET SIZE FOR NON-BIODEGRADABLE FIBER TYPE, BY REGION, 2022–2027 (KILOTON)

6.2.3 POLYPROPYLENE AND POLYETHYLENE

TABLE 23 POLYPROPYLENE AND POLYETHYLENE FIBER-BASED NON-BIODEGRADABLE BIOMEDICAL TEXTILES MARKET SIZE, BY REGION, 2018–2021 (USD MILLION)

TABLE 24 POLYPROPYLENE AND POLYETHYLENE FIBER-BASED NON-BIODEGRADABLE BIOMEDICAL TEXTILES MARKET SIZE, BY REGION, 2018–2021 (KILOTON)

TABLE 25 POLYPROPYLENE AND POLYETHYLENE FIBER-BASED NON-BIODEGRADABLE BIOMEDICAL TEXTILES MARKET SIZE, BY REGION, 2022–2027 (USD MILLION)

TABLE 26 POLYPROPYLENE AND POLYETHYLENE FIBER-BASED NON-BIODEGRADABLE BIOMEDICAL TEXTILES MARKET SIZE, BY REGION, 2022–2027 (KILOTON)

6.2.4 COTTON

TABLE 27 COTTON FIBER-BASED NON-BIODEGRADABLE BIOMEDICAL TEXTILES MARKET SIZE, BY REGION, 2018–2021 (USD MILLION)

TABLE 28 COTTON FIBER-BASED NON-BIODEGRADABLE BIOMEDICAL TEXTILE MARKET SIZE, BY REGION, 2018–2021 (KILOTON)

TABLE 29 COTTON FIBER-BASED NON-BIODEGRADABLE BIOMEDICAL TEXTILES MARKET SIZE, BY REGION, 2022–2027 (USD MILLION)

TABLE 30 COTTON FIBER-BASED NON-BIODEGRADABLE BIOMEDICAL TEXTILE MARKET SIZE, BY REGION, 2022–2027 (KILOTON)

6.2.5 VISCOSE

TABLE 31 VISCOSE FIBER-BASED NON-BIODEGRADABLE BIOMEDICAL TEXTILES MARKET SIZE, BY REGION, 2018–2021 (USD MILLION)

TABLE 32 VISCOSE FIBER-BASED NON-BIODEGRADABLE BIOMEDICAL TEXTILE MARKET SIZE, BY REGION, 2018–2021 (KILOTON)

TABLE 33 VISCOSE FIBER-BASED NON-BIODEGRADABLE BIOMEDICAL TEXTILES MARKET SIZE, BY REGION, 2022–2027 (USD MILLION)

TABLE 34 VISCOSE FIBER-BASED NON-BIODEGRADABLE BIOMEDICAL TEXTILE MARKET SIZE, BY REGION, 2022–2027 (KILOTON)

6.2.6 POLYESTER

TABLE 35 POLYESTER FIBER-BASED NON-BIODEGRADABLE BIOMEDICAL TEXTILES MARKET SIZE, BY REGION, 2018–2021 (USD MILLION)

TABLE 36 POLYESTER FIBER-BASED NON-BIODEGRADABLE BIOMEDICAL TEXTILE MARKET SIZE, BY REGION, 2018–2021 (KILOTON)

TABLE 37 POLYESTER FIBER-BASED NON-BIODEGRADABLE BIOMEDICAL TEXTILES MARKET SIZE, BY REGION, 2022–2027 (USD MILLION)

TABLE 38 POLYESTER FIBER-BASED NON-BIODEGRADABLE BIOMEDICAL TEXTILE MARKET SIZE, BY REGION, 2022–2027 (KILOTON)

6.2.7 POLYAMIDE

TABLE 39 POLYAMIDE FIBER-BASED NON-BIODEGRADABLE BIOMEDICAL TEXTILES MARKET SIZE, BY REGION, 2018–2021 (USD MILLION)

TABLE 40 POLYAMIDE FIBER-BASED NON-BIODEGRADABLE BIOMEDICAL TEXTILE MARKET SIZE, BY REGION, 2018–2021 (KILOTON)

TABLE 41 POLYAMIDE FIBER-BASED NON-BIODEGRADABLE BIOMEDICAL TEXTILES MARKET SIZE, BY REGION, 2022–2027 (USD MILLION)

TABLE 42 POLYAMIDE FIBER-BASED NON-BIODEGRADABLE BIOMEDICAL TEXTILE MARKET SIZE, BY REGION, 2022–2027 (KILOTON)

6.2.8 OTHERS

6.2.8.1 Polyurethane

6.2.8.2 Polytetrafluoroethylene (PTFE)

TABLE 43 OTHER FIBER-BASED NON-BIODEGRADABLE BIOMEDICAL TEXTILES MARKET SIZE, BY REGION, 2018–2021 (USD MILLION)

TABLE 44 OTHER FIBER-BASED NON-BIODEGRADABLE BIOMEDICAL TEXTILE MARKET SIZE, BY REGION, 2018–2021 (KILOTON)

TABLE 45 OTHER FIBER-BASED NON-BIODEGRADABLE BIOMEDICAL TEXTILES MARKET SIZE, BY REGION, 2022–2027 (USD MILLION)

TABLE 46 OTHER FIBER-BASED NON-BIODEGRADABLE BIOMEDICAL TEXTILE MARKET SIZE, BY REGION, 2022–2027 (KILOTON)

6.3 BIODEGRADABLE FIBER

6.3.1 RISING NUMBER OF SURGERIES GLOBALLY TO BOOST DEMAND

FIGURE 29 ASIA PACIFIC TO BE THE FASTEST-GROWING BIODEGRADABLE FIBER TYPE BIOMEDICAL TEXTILES MARKET

6.3.2 BIOMEDICAL TEXTILES MARKET SIZE FOR BIODEGRADABLE FIBER TYPE, BY REGION

TABLE 47 BIOMEDICAL TEXTILES MARKET SIZE BY BIODEGRADABLE FIBER TYPE, BY REGION, 2018–2021 (USD MILLION)

TABLE 48 BIOMEDICAL TEXTILE MARKET SIZE BY BIODEGRADABLE FIBER TYPE, BY REGION, 2018–2021 (KILOTON)

TABLE 49 BIOMEDICAL TEXTILES MARKET SIZE BY BIODEGRADABLE FIBER TYPE, BY REGION, 2022–2027 (USD MILLION)

TABLE 50 BIOMEDICAL TEXTILE MARKET SIZE BY BIODEGRADABLE FIBER TYPE, BY REGION, 2022–2027 (KILOTON)

6.3.3 COLLAGEN

TABLE 51 COLLAGEN FIBER-BASED BIODEGRADABLE BIOMEDICAL TEXTILES MARKET SIZE, BY REGION, 2018–2021 (USD MILLION)

TABLE 52 COLLAGEN FIBER-BASED BIODEGRADABLE BIOMEDICAL TEXTILE MARKET SIZE, BY REGION, 2018–2021 (KILOTON)

TABLE 53 COLLAGEN FIBER-BASED BIODEGRADABLE BIOMEDICAL TEXTILES MARKET SIZE, BY REGION, 2022–2027 (USD MILLION)

TABLE 54 COLLAGEN FIBER-BASED BIODEGRADABLE BIOMEDICAL TEXTILE MARKET SIZE, BY REGION, 2022–2027 (KILOTON)

6.3.4 CHITIN

TABLE 55 CHITIN FIBER-BASED BIODEGRADABLE BIOMEDICAL TEXTILES MARKET SIZE, BY REGION, 2018–2021 (USD MILLION)

TABLE 56 CHITIN FIBER-BASED BIODEGRADABLE BIOMEDICAL TEXTILE MARKET SIZE, BY REGION, 2018–2021 (KILOTON)

TABLE 57 CHITIN FIBER-BASED BIODEGRADABLE BIOMEDICAL TEXTILES MARKET SIZE, BY REGION, 2022–2027 (USD MILLION)

TABLE 58 CHITIN FIBER-BASED BIODEGRADABLE BIOMEDICAL TEXTILE MARKET SIZE, BY REGION, 2022–2027 (KILOTON)

6.3.5 POLYLACTIC ACID PLA

TABLE 59 POLYLACTIC ACID FIBER-BASED BIODEGRADABLE BIOMEDICAL TEXTILES MARKET SIZE, BY REGION, 2018–2021 (USD MILLION)

TABLE 60 POLYLACTIC ACID FIBER-BASED BIODEGRADABLE BIOMEDICAL TEXTILE MARKET SIZE, BY REGION, 2018–2021 (KILOTON)

TABLE 61 POLYLACTIC ACID FIBER-BASED BIODEGRADABLE BIOMEDICAL TEXTILES MARKET SIZE, BY REGION, 2022–2027 (USD MILLION)

TABLE 62 POLYLACTIC ACID FIBER-BASED BIODEGRADABLE BIOMEDICAL TEXTILE MARKET SIZE, BY REGION, 2022–2027 (KILOTON)

6.3.6 POLYGLYCOLIC ACID PGA

TABLE 63 POLYGLYCOLIC ACID FIBER-BASED BIODEGRADABLE BIOMEDICAL TEXTILES MARKET SIZE, BY REGION, 2018–2021 (USD MILLION)

TABLE 64 POLYGLYCOLIC ACID FIBER-BASED BIODEGRADABLE BIOMEDICAL TEXTILE MARKET SIZE, BY REGION, 2018–2021 (KILOTON)

TABLE 65 POLYGLYCOLIC ACID FIBER-BASED BIODEGRADABLE BIOMEDICAL TEXTILES MARKET SIZE, BY REGION, 2022–2027 (USD MILLION)

TABLE 66 POLYGLYCOLIC ACID FIBER-BASED BIODEGRADABLE BIOMEDICAL TEXTILE MARKET SIZE, BY REGION, 2022–2027 (KILOTON)

6.3.7 OTHERS

TABLE 67 OTHER FIBER-BASED BIODEGRADABLE BIOMEDICAL TEXTILES MARKET SIZE, BY REGION, 2018–2021 (USD MILLION)

TABLE 68 OTHER FIBER-BASED BIODEGRADABLE BIOMEDICAL TEXTILE MARKET SIZE, BY REGION, 2018–2021 (KILOTON)

TABLE 69 OTHER FIBER-BASED BIODEGRADABLE BIOMEDICAL TEXTILES MARKET SIZE, BY REGION, 2022–2027 (USD MILLION)

TABLE 70 OTHER FIBER-BASED BIODEGRADABLE BIOMEDICAL TEXTILE MARKET SIZE, BY REGION, 2022–2027 (KILOTON)

7 BIOMEDICAL TEXTILES MARKET, BY FABRIC TYPE (Page No. - 107)

7.1 INTRODUCTION

FIGURE 30 NON-WOVEN FABRIC SEGMENT TO GROW AT HIGHEST CAGR DURING FORECAST PERIOD

TABLE 71 BIOMEDICAL TEXTILES MARKET SIZE, BY FABRIC TYPE, 2018–2021 (USD MILLION)

TABLE 72 BIOMEDICAL TEXTILE MARKET SIZE, BY FABRIC TYPE, 2018–2021 (KILOTON)

TABLE 73 BIOMEDICAL TEXTILES MARKET SIZE, BY FABRIC TYPE, 2022–2027 (USD MILLION)

TABLE 74 BIOMEDICAL TEXTILE MARKET SIZE, BY FABRIC TYPE, 2022–2027 (KILOTON)

7.2 NON-WOVEN FABRIC

7.2.1 WOUND CARE APPLICATIONS TO BOOST CONSUMPTION

FIGURE 31 NORTH AMERICA TO LEAD NON-WOVEN FABRIC TYPE BIOMEDICAL TEXTILES MARKET DURING FORECAST PERIOD

7.2.2 BIOMEDICAL TEXTILES MARKET FOR NON-WOVEN FABRIC TYPE, BY REGION

TABLE 75 BIOMEDICAL TEXTILES MARKET SIZE FOR NON-WOVEN FABRIC TYPE, BY REGION, 2018–2021 (USD MILLION)

TABLE 76 BIOMEDICAL TEXTILE MARKET SIZE FOR NON-WOVEN FABRIC TYPE, BY REGION, 2018–2021 (KILOTON)

TABLE 77 BIOMEDICAL TEXTILES MARKET SIZE FOR NON-WOVEN FABRIC TYPE, BY REGION, 2022–2027 (USD MILLION)

TABLE 78 BIOMEDICAL TEXTILE MARKET SIZE FOR NON-WOVEN FABRIC TYPE, BY REGION, 2022–2027 (KILOTON)

7.3 WOVEN FABRIC

7.3.1 INCREASING HEART SURGERIES AND ARTIFICIAL ORGAN IMPLANTS TO BOOST MARKET

FIGURE 32 ASIA PACIFIC TO BE FASTEST-GROWING WOVEN FABRIC TYPE BIOMEDICAL TEXTILES MARKET DURING FORECAST PERIOD

7.3.2 BIOMEDICAL TEXTILES MARKET SIZE FOR WOVEN FABRIC TYPE, BY REGION

TABLE 79 BIOMEDICAL TEXTILES MARKET SIZE FOR WOVEN FABRIC TYPE, BY REGION, 2018–2021 (USD MILLION)

TABLE 80 BIOMEDICAL TEXTILE MARKET SIZE FOR WOVEN FABRIC TYPE, BY REGION, 2018–2021 (KILOTON)

TABLE 81 BIOMEDICAL TEXTILES MARKET SIZE FOR WOVEN FABRIC TYPE, BY REGION, 2022–2027 (USD MILLION)

TABLE 82 BIOMEDICAL TEXTILE MARKET SIZE FOR WOVEN FABRIC TYPE, BY REGION, 2022–2027 (KILOTON)

7.4 OTHERS

7.4.1 KNITTED & BRAIDED FABRIC

7.4.2 HOLLOW FABRIC

FIGURE 33 NORTH AMERICA TO LEAD OTHER FABRIC TYPE BIOMEDICAL TEXTILES MARKET DURING FORECAST PERIOD

7.4.3 BIOMEDICAL TEXTILES MARKET SIZE FOR OTHER FABRIC TYPES, BY REGION

TABLE 83 BIOMEDICAL TEXTILES MARKET SIZE FOR OTHER FABRIC TYPES, BY REGION, 2018–2021 (USD MILLION)

TABLE 84 BIOMEDICAL TEXTILE MARKET SIZE FOR OTHER FABRIC TYPES, BY REGION, 2018–2021 (KILOTON)

TABLE 85 BIOMEDICAL TEXTILES MARKET SIZE FOR OTHER FABRIC TYPES, BY REGION, 2022–2027 (USD MILLION)

TABLE 86 BIOMEDICAL TEXTILE MARKET SIZE FOR OTHER FABRIC TYPES, BY REGION, 2022–2027 (KILOTON)

8 BIOMEDICAL TEXTILES MARKET, BY APPLICATION (Page No. - 116)

8.1 INTRODUCTION

FIGURE 34 NON-IMPLANTABLE FABRIC TO LEAD BIOMEDICAL TEXTILES MARKET DURING FORECAST PERIOD

TABLE 87 BIOMEDICAL TEXTILES MARKET SIZE, BY APPLICATION, 2018–2021 (USD MILLION)

TABLE 88 BIOMEDICAL TEXTILE MARKET SIZE, BY APPLICATION, 2018–2021 (KILOTON)

TABLE 89 BIOMEDICAL TEXTILES MARKET SIZE, BY APPLICATION, 2022–2027 (USD MILLION)

TABLE 90 BIOMEDICAL TEXTILE MARKET SIZE, BY APPLICATION, 2022–2027 (KILOTON)

8.2 NON-IMPLANTABLE

8.2.1 INCREASING WOUND CARE TREATMENT TO BOOST APPLICATION

FIGURE 35 ASIA PACIFIC TO BE FASTEST-GROWING MARKET FOR NON-IMPLANTABLE FABRIC APPLICATION

8.2.2 BIOMEDICAL TEXTILES MARKET FOR NON-IMPLANTABLE APPLICATION, BY REGION

TABLE 91 BIOMEDICAL TEXTILES MARKET SIZE FOR NON-IMPLANTABLE APPLICATION, BY REGION, 2018–2021 (USD MILLION)

TABLE 92 BIOMEDICAL TEXTILE MARKET SIZE FOR NON-IMPLANTABLE APPLICATION, BY REGION, 2018–2021 (KILOTON)

TABLE 93 BIOMEDICAL TEXTILES MARKET SIZE FOR NON-IMPLANTABLE APPLICATION, BY REGION, 2022–2027 (USD MILLION)

TABLE 94 BIOMEDICAL TEXTILE MARKET SIZE FOR NON-IMPLANTABLE APPLICATION, BY REGION, 2022–2027 (KILOTON)

8.3 SURGICAL SUTURES

8.3.1 RISING NUMBER OF SURGERIES TO BOOST CONSUMPTION

FIGURE 36 ASIA PACIFIC TO BE FASTEST-GROWING BIOMEDICAL TEXTILES MARKET FOR SURGICAL SUTURES BETWEEN 2022 AND 2027

8.3.2 BIOMEDICAL TEXTILES MARKET SIZE FOR SURGICAL SUTURES APPLICATION, BY REGION

TABLE 95 BIOMEDICAL TEXTILES MARKET SIZE FOR SURGICAL SUTURES APPLICATION, BY REGION, 2018–2021 (USD MILLION)

TABLE 96 BIOMEDICAL TEXTILE MARKET SIZE FOR SURGICAL SUTURES APPLICATION, BY REGION, 2018–2021 (KILOTON)

TABLE 97 BIOMEDICAL TEXTILES MARKET SIZE FOR SURGICAL SUTURES APPLICATION, BY REGION, 2022–2027 (USD MILLION)

TABLE 98 BIOMEDICAL TEXTILE MARKET SIZE FOR SURGICAL SUTURES APPLICATION, BY REGION, 2022–2027 (KILOTON)

8.4 OTHERS

8.4.1 IMPLANTABLE

8.4.1.1 Soft tissue implants

8.4.1.2 Hard tissue implants

8.4.1.3 Dental prosthesis

8.4.1.4 Vascular devices

8.4.2 EXTRACORPOREAL DEVICES

FIGURE 37 NORTH AMERICA TO DOMINATE OTHER FABRIC TYPE BIOMEDICAL TEXTILES MARKET DURING FORECAST PERIOD

8.4.3 BIOMEDICAL TEXTILES MARKET SIZE FOR OTHER APPLICATIONS, BY REGION

TABLE 99 BIOMEDICAL TEXTILES MARKET SIZE FOR OTHER APPLICATIONS, BY REGION, 2018–2021 (USD MILLION)

TABLE 100 BIOMEDICAL TEXTILE MARKET SIZE FOR OTHER APPLICATIONS, BY REGION, 2018–2021 (KILOTON)

TABLE 101 BIOMEDICAL TEXTILES MARKET SIZE FOR OTHER APPLICATIONS, BY REGION, 2022–2027 (USD MILLION)

TABLE 102 BIOMEDICAL TEXTILE MARKET SIZE FOR OTHER APPLICATIONS, BY REGION, 2022–2027 (KILOTON)

9 BIOMEDICAL TEXTILES MARKET, BY REGION (Page No. - 126)

9.1 INTRODUCTION

FIGURE 38 REGIONAL MARKET SNAPSHOT: MARKET IN CHINA TO GROW AT HIGHEST CAGR BETWEEN 2022 AND 2027

TABLE 103 BIOMEDICAL TEXTILES MARKET SIZE, BY REGION, 2018–2021 (USD MILLION)

TABLE 104 BIOMEDICAL TEXTILE MARKET SIZE, BY REGION, 2018–2021 (KILOTON)

TABLE 105 BIOMEDICAL TEXTILES MARKET SIZE, BY REGION, 2022–2027 (USD MILLION)

TABLE 106 BIOMEDICAL TEXTILE MARKET SIZE, BY REGION, 2022–2027 (KILOTON)

9.2 NORTH AMERICA

FIGURE 39 NORTH AMERICA BIOMEDICAL TEXTILES MARKET SNAPSHOT: US LEADS BIOMEDICAL TEXTILES MARKET

9.2.1 NORTH AMERICA: BIOMEDICAL TEXTILES MARKET, BY FIBER TYPE

TABLE 107 NORTH AMERICA: MARKET SIZE, BY FIBER TYPE, 2018–2021 (USD MILLION)

TABLE 108 NORTH AMERICA: MARKET SIZE, BY FIBER TYPE, 2018–2021 (KILOTON)

TABLE 109 NORTH AMERICA: MARKET SIZE, BY FIBER TYPE, 2022–2027 (USD MILLION)

TABLE 110 NORTH AMERICA: MARKET SIZE, BY FIBER TYPE, 2022–2027 (KILOTON)

9.2.2 NORTH AMERICA: BIOMEDICAL TEXTILES MARKET, BY FABRIC TYPE

TABLE 111 NORTH AMERICA: MARKET SIZE, BY FABRIC TYPE, 2018–2021 (USD MILLION)

TABLE 112 NORTH AMERICA: MARKET SIZE, BY FABRIC TYPE, 2018–2021 (KILOTON)

TABLE 113 NORTH AMERICA: MARKET SIZE, BY FABRIC TYPE, 2022–2027 (USD MILLION)

TABLE 114 NORTH AMERICA: MARKET SIZE, BY FABRIC TYPE, 2022–2027 (KILOTON)

9.2.3 NORTH AMERICA: BIOMEDICAL TEXTILES MARKET, BY APPLICATION

TABLE 115 NORTH AMERICA: MARKET SIZE, BY APPLICATION, 2018–2021 (USD MILLION)

TABLE 116 NORTH AMERICA: MARKET SIZE, BY APPLICATION, 2018–2021 (KILOTON)

TABLE 117 NORTH AMERICA: MARKET SIZE, BY APPLICATION, 2022–2027 (USD MILLION)

TABLE 118 NORTH AMERICA: MARKET SIZE, BY APPLICATION, 2022–2027 (KILOTON)

9.2.4 NORTH AMERICA: BIOMEDICAL TEXTILES MARKET, BY COUNTRY

TABLE 119 NORTH AMERICA: MARKET SIZE, BY COUNTRY, 2018–2021 (USD MILLION)

TABLE 120 NORTH AMERICA: MARKET SIZE, BY COUNTRY, 2018–2021 (KILOTON)

TABLE 121 NORTH AMERICA: MARKET SIZE, BY COUNTRY, 2022–2027 (USD MILLION)

TABLE 122 NORTH AMERICA: MARKET SIZE, BY COUNTRY, 2022–2027 (KILOTON)

9.2.5 US

9.2.5.1 Consumer demand to drive market

9.2.5.2 US: Biomedical textiles market, by fiber type

TABLE 123 US: BIOMEDICAL TEXTILES MARKET SIZE, BY FIBER TYPE, 2018–2021 (USD MILLION)

TABLE 124 US: MARKET SIZE, BY FIBER TYPE, 2018–2021 (KILOTON)

TABLE 125 US: MARKET SIZE, BY FIBER TYPE, 2022–2027 (USD MILLION)

TABLE 126 US: MARKET SIZE, BY FIBER TYPE, 2022–2027 (KILOTON)

9.2.6 CANADA

9.2.6.1 Development of healthcare infrastructure and expenditure toward health to drive market

9.2.6.2 Canada: Biomedical textiles market, by fiber type

TABLE 127 CANADA: BIOMEDICAL TEXTILES MARKET SIZE, BY FIBER TYPE, 2018–2021 (USD MILLION)

TABLE 128 CANADA: MARKET SIZE, BY FIBER TYPE, 2018–2021 (KILOTON)

TABLE 129 CANADA: MARKET SIZE, BY FIBER TYPE, 2022–2027 (USD MILLION)

TABLE 130 CANADA: MARKET SIZE, BY FIBER TYPE, 2022–2027 (KILOTON)

9.2.7 MEXICO

9.2.7.1 Growing healthcare expenditure to boost consumption of biomedical textiles

9.2.7.2 Mexico: Biomedical textiles market, by fiber type

TABLE 131 MEXICO: BIOMEDICAL TEXTILES MARKET SIZE, BY FIBER TYPE, 2018–2021 (USD MILLION)

TABLE 132 MEXICO: MARKET SIZE, BY FIBER TYPE, 2018–2021 (KILOTON)

TABLE 133 MEXICO: MARKET SIZE, BY FIBER TYPE, 2022–2027 (USD MILLION)

TABLE 134 MEXICO: MARKET SIZE, BY FIBER TYPE, 2022–2027 (KILOTON)

9.3 EUROPE

FIGURE 40 EUROPE BIOMEDICAL TEXTILES MARKET SNAPSHOT: GERMANY LEADS BIOMEDICAL TEXTILES MARKET

9.3.1 EUROPE: BIOMEDICAL TEXTILES MARKET, BY FIBER TYPE

TABLE 135 EUROPE: MARKET SIZE, BY FIBER TYPE, 2018–2021 (USD MILLION)

TABLE 136 EUROPE: MARKET SIZE, BY FIBER TYPE, 2018–2021 (KILOTON)

TABLE 137 EUROPE: MARKET SIZE, BY FIBER TYPE, 2022–2027 (USD MILLION)

TABLE 138 EUROPE: MARKET SIZE, BY FIBER TYPE, 2022–2027 (KILOTON)

9.3.2 EUROPE: BIOMEDICAL TEXTILES MARKET, BY FABRIC TYPE

TABLE 139 EUROPE: MARKET SIZE, BY FABRIC TYPE, 2018–2021 (USD MILLION)

TABLE 140 EUROPE: MARKET SIZE, BY FABRIC TYPE, 2018–2021 (KILOTON)

TABLE 141 EUROPE: MARKET SIZE, BY FABRIC TYPE, 2022–2027 (USD MILLION)

TABLE 142 EUROPE: MARKET SIZE, BY FABRIC TYPE, 2022–2027 (KILOTON)

9.3.3 EUROPE: BIOMEDICAL TEXTILES MARKET, BY APPLICATION

TABLE 143 EUROPE: MARKET SIZE, BY APPLICATION, 2018–2021 (USD MILLION)

TABLE 144 EUROPE: MARKET SIZE, BY APPLICATION, 2018–2021 (KILOTON)

TABLE 145 EUROPE: MARKET SIZE, BY APPLICATION, 2022–2027 (USD MILLION)

TABLE 146 EUROPE: MARKET SIZE, BY APPLICATION, 2022–2027 (KILOTON)

9.3.4 EUROPE: BIOMEDICAL TEXTILES MARKET, BY COUNTRY

TABLE 147 EUROPE: MARKET SIZE, BY COUNTRY, 2018–2021 (USD MILLION)

TABLE 148 EUROPE: MARKET SIZE, BY COUNTRY, 2018–2021 (KILOTON)

TABLE 149 EUROPE: MARKET SIZE, BY COUNTRY, 2022–2027 (USD MILLION)

TABLE 150 EUROPE: MARKET SIZE, BY COUNTRY, 2022–2027 (KILOTON)

9.3.5 GERMANY

9.3.5.1 Rising awareness and aging population to drive market

9.3.5.2 Germany: Biomedical textiles market, by fiber type

TABLE 151 GERMANY: BIOMEDICAL TEXTILES MARKET SIZE, BY FIBER TYPE, 2018–2021 (USD MILLION)

TABLE 152 GERMANY: MARKET SIZE, BY FIBER TYPE, 2018–2021 (KILOTON)

TABLE 153 GERMANY: MARKET SIZE, BY FIBER TYPE, 2022–2027 (USD MILLION)

TABLE 154 GERMANY: MARKET SIZE, BY FIBER TYPE, 2022–2027 (KILOTON)

9.3.6 FRANCE

9.3.6.1 Development of healthcare infrastructure and expenditure toward health to drive market

9.3.6.2 France: Biomedical textiles market, by fiber type

TABLE 155 FRANCE: MARKET SIZE, BY FIBER TYPE, 2018–2021 (USD MILLION)

TABLE 156 FRANCE: MARKET SIZE, BY FIBER TYPE, 2018–2021 (KILOTON)

TABLE 157 FRANCE: MARKET SIZE, BY FIBER TYPE, 2022–2027 (USD MILLION)

TABLE 158 FRANCE: MARKET SIZE, BY FIBER TYPE, 2022–2027 (KILOTON)

9.3.7 UK

9.3.7.1 Growing healthcare expenditure to boost consumption of biomedical textiles

9.3.7.2 UK: Biomedical textiles market, by fiber type

TABLE 159 UK: BIOMEDICAL TEXTILES MARKET SIZE, BY FIBER TYPE, 2018–2021 (USD MILLION)

TABLE 160 UK: MARKET SIZE, BY FIBER TYPE, 2018–2021 (KILOTON)

TABLE 161 UK: MARKET SIZE, BY FIBER TYPE, 2022–2027 (USD MILLION)

TABLE 162 UK: MARKET SIZE, BY FIBER TYPE, 2022–2027 (KILOTON)

9.3.8 ITALY

9.3.8.1 Rising aging population and growing healthcare expenditure to boost market

9.3.8.2 Italy: Biomedical textiles market, by fiber type

TABLE 163 ITALY: BIOMEDICAL TEXTILES MARKET SIZE, BY FIBER TYPE, 2018–2021 (USD MILLION)

TABLE 164 ITALY: MARKET SIZE, BY FIBER TYPE, 2018–2021 (KILOTON)

TABLE 165 ITALY: MARKET SIZE, BY FIBER TYPE, 2022–2027 (USD MILLION)

TABLE 166 ITALY: MARKET SIZE, BY FIBER TYPE, 2022–2027 (KILOTON)

9.3.9 SPAIN

9.3.9.1 Growing aging population to drive demand for implan TABLE devices, bandages, and surgical sutures

9.3.9.2 Spain: Biomedical textiles market, by fiber type

TABLE 167 SPAIN: BIOMEDICAL TEXTILES MARKET SIZE, BY FIBER TYPE, 2018–2021 (USD MILLION)

TABLE 168 SPAIN: MARKET SIZE, BY FIBER TYPE, 2018–2021 (KILOTON)

TABLE 169 SPAIN: MARKET SIZE, BY FIBER TYPE, 2022–2027 (USD MILLION)

TABLE 170 SPAIN: MARKET SIZE, BY FIBER TYPE, 2022–2027 (KILOTON)

9.3.10 REST OF EUROPE

9.3.10.1 Treatment of diabetes and obesity to drive market

9.3.10.2 Rest of Europe: Biomedical textiles market, by fiber type

TABLE 171 REST OF EUROPE: BIOMEDICAL TEXTILES MARKET SIZE, BY FIBER TYPE, 2018–2021 (USD MILLION)

TABLE 172 REST OF EUROPE: MARKET SIZE, BY FIBER TYPE, 2018–2021 (KILOTON)

TABLE 173 REST OF EUROPE: MARKET SIZE, BY FIBER TYPE, 2022–2027 (USD MILLION)

TABLE 174 REST OF EUROPE: MARKET SIZE, BY FIBER TYPE, 2022–2027 (KILOTON)

9.4 ASIA PACIFIC

FIGURE 41 ASIA PACIFIC BIOMEDICAL TEXTILES MARKET SNAPSHOT: CHINA LEADS BIOMEDICAL TEXTILES MARKET

9.4.1 ASIA PACIFIC: BIOMEDICAL TEXTILES MARKET, BY FIBER TYPE

TABLE 175 ASIA PACIFIC: BIOMEDICAL TEXTILES MARKET SIZE, BY FIBER TYPE, 2018–2021 (USD MILLION)

TABLE 176 ASIA PACIFIC: MARKET SIZE, BY FIBER TYPE, 2018–2021 (KILOTON)

TABLE 177 ASIA PACIFIC: MARKET SIZE, BY FIBER TYPE, 2022–2027 (USD MILLION)

TABLE 178 ASIA PACIFIC: MARKET SIZE, BY FIBER TYPE, 2022–2027 (KILOTON)

9.4.2 ASIA PACIFIC: BIOMEDICAL TEXTILES MARKET, BY FABRIC TYPE

TABLE 179 ASIA PACIFIC: MARKET SIZE, BY FABRIC TYPE, 2018–2021 (USD MILLION)

TABLE 180 ASIA PACIFIC: MARKET SIZE, BY FABRIC TYPE, 2018–2021 (KILOTON)

TABLE 181 ASIA PACIFIC: MARKET SIZE, BY FABRIC TYPE, 2022–2027 (USD MILLION)

TABLE 182 ASIA PACIFIC: MARKET SIZE, BY FABRIC TYPE, 2022–2027 (KILOTON)

9.4.3 ASIA PACIFIC: BIOMEDICAL TEXTILES MARKET, BY APPLICATION

TABLE 183 ASIA PACIFIC: MARKET SIZE, BY APPLICATION, 2018–2021 (USD MILLION)

TABLE 184 ASIA PACIFIC: MARKET SIZE, BY APPLICATION, 2018–2021 (KILOTON)

TABLE 185 ASIA PACIFIC: MARKET SIZE, BY APPLICATION, 2022–2027 (USD MILLION)

TABLE 186 ASIA PACIFIC: MARKET SIZE, BY APPLICATION, 2022–2027 (KILOTON)

9.4.4 ASIA PACIFIC: BIOMEDICAL TEXTILES MARKET, BY COUNTRY

TABLE 187 ASIA PACIFIC: MARKET SIZE, BY COUNTRY, 2018–2021 (USD MILLION)

TABLE 188 ASIA PACIFIC: MARKET SIZE, BY COUNTRY, 2018–2021 (KILOTON)

TABLE 189 ASIA PACIFIC: MARKET SIZE, BY COUNTRY, 2022–2027 (USD MILLION)

TABLE 190 ASIA PACIFIC: MARKET SIZE, BY COUNTRY, 2022–2027 (KILOTON)

9.4.5 CHINA

9.4.5.1 Largest biomedical textiles market in Asia Pacific

9.4.5.2 China: Biomedical textiles market, by fiber type

TABLE 191 CHINA: MARKET SIZE, BY FIBER TYPE, 2018–2021 (USD MILLION)

TABLE 192 CHINA: MARKET SIZE, BY FIBER TYPE, 2018–2021 (KILOTON)

TABLE 193 CHINA: MARKET SIZE, BY FIBER TYPE, 2022–2027 (USD MILLION)

TABLE 194 CHINA: MARKET SIZE, BY FIBER TYPE, 2022–2027 (KILOTON)

9.4.6 JAPAN

9.4.6.1 Development of healthcare infrastructure and expenditure toward health expected to drive market

9.4.6.2 Japan: Biomedical textiles market, by fiber type

TABLE 195 JAPAN: BIOMEDICAL TEXTILES MARKET SIZE, BY FIBER TYPE, 2018–2021 (USD MILLION)

TABLE 196 JAPAN: MARKET SIZE, BY FIBER TYPE, 2018–2021 (KILOTON)

TABLE 197 JAPAN: MARKET SIZE, BY FIBER TYPE, 2022–2027 (USD MILLION)

TABLE 198 JAPAN: MARKET SIZE, BY FIBER TYPE, 2022–2027 (KILOTON)

9.4.7 INDIA

9.4.7.1 Growing healthcare expenditure to boost consumption of biomedical textiles

9.4.7.2 India: Biomedical textiles market, by fiber type

TABLE 199 INDIA: BIOMEDICAL TEXTILES MARKET SIZE, BY FIBER TYPE, 2018–2021 (USD MILLION)

TABLE 200 INDIA: MARKET SIZE, BY FIBER TYPE, 2018–2021 (KILOTON)

TABLE 201 INDIA: MARKET SIZE, BY FIBER TYPE, 2022–2027 (USD MILLION)

TABLE 202 INDIA: MARKET SIZE, BY FIBER TYPE, 2022–2027 (KILOTON)

9.4.8 AUSTRALIA & NEW ZEALAND

9.4.8.1 Developing medical technology and rising consumer awareness regarding healthcare to drive market

9.4.8.2 Australia & New Zealand: biomedical textiles market, by fiber type

TABLE 203 AUSTRALIA & NEW ZEALAND: BIOMEDICAL TEXTILES MARKET SIZE, BY FIBER TYPE, 2018–2021 (USD MILLION)

TABLE 204 AUSTRALIA & NEW ZEALAND: MARKET SIZE, BY FIBER TYPE, 2018–2021 (KILOTON)

TABLE 205 AUSTRALIA & NEW ZEALAND: MARKET SIZE, BY FIBER TYPE, 2022–2027 (USD MILLION)

TABLE 206 AUSTRALIA & NEW ZEALAND: MARKET SIZE, BY FIBER TYPE, 2022–2027 (KILOTON)

9.4.9 SOUTH KOREA

9.4.9.1 Rising demand for high-end, value-added textile materials to drive biomedical textiles market

9.4.9.2 South Korea: Biomedical textiles market, by fiber type

TABLE 207 SOUTH KOREA: BIOMEDICAL TEXTILES MARKET SIZE, BY FIBER TYPE, 2018–2021 (USD MILLION)

TABLE 208 SOUTH KOREA: MARKET SIZE, BY FIBER TYPE, 2018–2021 (KILOTON)

TABLE 209 SOUTH KOREA: MARKET SIZE, BY FIBER TYPE, 2022–2027 (USD MILLION)

TABLE 210 SOUTH KOREA: MARKET SIZE, BY FIBER TYPE, 2022–2027 (KILOTON)

9.4.10 SINGAPORE

9.4.10.1 Demand for biomedical textiles to increase due to fast-developing economy

9.4.10.2 Singapore: Biomedical textiles market, by fiber type

TABLE 211 SINGAPORE: BIOMEDICAL TEXTILES MARKET SIZE, BY FIBER TYPE, 2018–2021 (USD MILLION)

TABLE 212 SINGAPORE: MARKET SIZE, BY FIBER TYPE, 2018–2021 (KILOTON)

TABLE 213 SINGAPORE: MARKET SIZE, BY FIBER TYPE, 2022–2027 (USD MILLION)

TABLE 214 SINGAPORE: MARKET SIZE, BY FIBER TYPE, 2022–2027 (KILOTON)

9.4.11 REST OF ASIA PACIFIC

9.4.11.1 Development of healthcare infrastructure to stimulate market growth

9.4.11.2 Rest of Asia Pacific: Biomedical textiles market, by fiber type

TABLE 215 REST OF ASIA PACIFIC: BIOMEDICAL TEXTILES MARKET SIZE, BY FIBER TYPE, 2018–2021 (USD MILLION)

TABLE 216 REST OF ASIA PACIFIC: MARKET SIZE, BY FIBER TYPE, 2018–2021 (KILOTON)

TABLE 217 REST OF ASIA PACIFIC: MARKET SIZE, BY FIBER TYPE, 2022–2027 (USD MILLION)

TABLE 218 REST OF ASIA PACIFIC: MARKET SIZE, BY FIBER TYPE, 2022–2027 (KILOTON)

9.5 SOUTH AMERICA

9.5.1 SOUTH AMERICA: BIOMEDICAL TEXTILES MARKET, BY FIBER TYPE

TABLE 219 SOUTH AMERICA: MARKET SIZE, BY FIBER TYPE, 2018–2021 (USD MILLION)

TABLE 220 SOUTH AMERICA: MARKET SIZE, BY FIBER TYPE, 2018–2021 (KILOTON)

TABLE 221 SOUTH AMERICA: MARKET SIZE, BY FIBER TYPE, 2022–2027 (USD MILLION)

TABLE 222 SOUTH AMERICA: MARKET SIZE, BY FIBER TYPE, 2022–2027 (KILOTON)

9.5.2 SOUTH AMERICA: BIOMEDICAL TEXTILES MARKET, BY FABRIC TYPE

TABLE 223 SOUTH AMERICA: MARKET SIZE, BY FABRIC TYPE, 2018–2021 (USD MILLION)

TABLE 224 SOUTH AMERICA: MARKET SIZE, BY FABRIC TYPE, 2018–2021 (KILOTON)

TABLE 225 SOUTH AMERICA: MARKET SIZE, BY FABRIC TYPE, 2022–2027 (USD MILLION)

TABLE 226 SOUTH AMERICA: MARKET SIZE, BY FABRIC TYPE, 2022–2027 (KILOTON)

9.5.3 SOUTH AMERICA: BIOMEDICAL TEXTILES MARKET, BY APPLICATION

TABLE 227 SOUTH AMERICA: MARKET SIZE, BY APPLICATION, 2018–2021 (USD MILLION)

TABLE 228 SOUTH AMERICA: MARKET SIZE, BY APPLICATION, 2018–2021 (KILOTON)

TABLE 229 SOUTH AMERICA: MARKET SIZE, BY APPLICATION, 2022–2027 (USD MILLION)

TABLE 230 SOUTH AMERICA: MARKET SIZE, BY APPLICATION, 2022–2027 (KILOTON)

9.5.4 SOUTH AMERICA: BIOMEDICAL TEXTILES MARKET, BY COUNTRY

TABLE 231 SOUTH AMERICA: MARKET SIZE, BY COUNTRY, 2018–2021 (USD MILLION)

TABLE 232 SOUTH AMERICA: MARKET SIZE, BY COUNTRY, 2018–2021 (KILOTON)

TABLE 233 SOUTH AMERICA: MARKET SIZE, BY COUNTRY, 2022–2027 (USD MILLION)

TABLE 234 SOUTH AMERICA: MARKET SIZE, BY COUNTRY, 2022–2027 (KILOTON)

9.5.5 BRAZIL

9.5.5.1 Largest biomedical textiles market in South America

9.5.5.2 Brazil: Biomedical textiles market, by fiber type

TABLE 235 BRAZIL: BIOMEDICAL TEXTILES MARKET SIZE, BY FIBER TYPE, 2018–2021 (USD MILLION)

TABLE 236 BRAZIL: MARKET SIZE, BY FIBER TYPE, 2018–2021 (KILOTON)

TABLE 237 BRAZIL: MARKET SIZE, BY FIBER TYPE, 2022–2027 (USD MILLION)

TABLE 238 BRAZIL: MARKET SIZE, BY FIBER TYPE, 2022–2027 (KILOTON)

9.5.6 ARGENTINA

9.5.6.1 Developing healthcare infrastructure and rising healthcare expenditure to drive market

9.5.6.2 Argentina: Biomedical textiles market, by fiber type

TABLE 239 ARGENTINA: BIOMEDICAL TEXTILES MARKET SIZE, BY FIBER TYPE, 2018–2021 (USD MILLION)

TABLE 240 ARGENTINA: MARKET SIZE, BY FIBER TYPE, 2018–2021 (KILOTON)

TABLE 241 ARGENTINA: MARKET SIZE, BY FIBER TYPE, 2022–2027 (USD MILLION)

TABLE 242 ARGENTINA: MARKET SIZE, BY FIBER TYPE, 2022–2027 (KILOTON)

9.5.7 REST OF SOUTH AMERICA

9.5.7.1 Increasing demand for biomedical textiles due to rising demand for better healthcare

9.5.7.2 Rest of South America: Biomedical textiles market, by fiber type

TABLE 243 REST OF SOUTH AMERICA: BIOMEDICAL TEXTILES MARKET SIZE, BY FIBER TYPE, 2018–2021 (USD MILLION)

TABLE 244 REST OF SOUTH AMERICA: MARKET SIZE, BY FIBER TYPE, 2018–2021 (KILOTON)

TABLE 245 REST OF SOUTH AMERICA: MARKET SIZE, BY FIBER TYPE, 2022–2027 (USD MILLION)

TABLE 246 REST OF SOUTH AMERICA: MARKET SIZE, BY FIBER TYPE, 2022–2027 (KILOTON)

9.6 MIDDLE EAST & AFRICA

9.6.1 MIDDLE EAST & AFRICA: BIOMEDICAL TEXTILES MARKET, BY FIBER TYPE

TABLE 247 MIDDLE EAST & AFRICA: MARKET SIZE, BY FIBER TYPE, 2018–2021 (USD MILLION)

TABLE 248 MIDDLE EAST & AFRICA: MARKET SIZE, BY FIBER TYPE, 2018–2021 (KILOTON)

TABLE 249 MIDDLE EAST & AFRICA: MARKET SIZE, BY FIBER TYPE, 2022–2027 (USD MILLION)

TABLE 250 MIDDLE EAST & AFRICA: MARKET SIZE, BY FIBER TYPE, 2022–2027 (KILOTON)

9.6.2 MIDDLE EAST & AFRICA: BIOMEDICAL TEXTILES MARKET, BY FABRIC TYPE

TABLE 251 MIDDLE EAST & AFRICA: MARKET SIZE, BY FABRIC TYPE, 2018–2021 (USD MILLION)

TABLE 252 MIDDLE EAST & AFRICA: MARKET SIZE, BY FABRIC TYPE, 2018–2021 (KILOTON)

TABLE 253 MIDDLE EAST & AFRICA: MARKET SIZE, BY FABRIC TYPE, 2022–2027 (USD MILLION)

TABLE 254 MIDDLE EAST & AFRICA: MARKET SIZE, BY FABRIC TYPE, 2022–2027 (KILOTON)

9.6.3 MIDDLE EAST & AFRICA: BIOMEDICAL TEXTILES MARKET, BY APPLICATION

TABLE 255 MIDDLE EAST & AFRICA: MARKET SIZE, BY APPLICATION, 2018–2021 (USD MILLION)

TABLE 256 MIDDLE EAST & AFRICA: MARKET SIZE, BY APPLICATION, 2018–2021 (KILOTON)

TABLE 257 MIDDLE EAST & AFRICA: MARKET SIZE, BY APPLICATION, 2022–2027 (USD MILLION)

TABLE 258 MIDDLE EAST & AFRICA: MARKET SIZE, BY APPLICATION, 2022–2027 (KILOTON)

9.6.4 MIDDLE EAST & AFRICA: BIOMEDICAL TEXTILES MARKET, BY COUNTRY

TABLE 259 MIDDLE EAST & AFRICA: MARKET SIZE, BY COUNTRY, 2018–2021 (USD MILLION)

TABLE 260 MIDDLE EAST & AFRICA: MARKET SIZE, BY COUNTRY, 2018–2021 (KILOTON)

TABLE 261 MIDDLE EAST & AFRICA: MARKET SIZE, BY COUNTRY, 2022–2027 (USD MILLION)

TABLE 262 MIDDLE EAST & AFRICA: MARKET SIZE, BY COUNTRY, 2022–2027 (KILOTON)

9.6.5 SOUTH AFRICA

9.6.5.1 Largest biomedical textiles market in Middle East & Africa

9.6.5.2 South Africa: Biomedical textiles market, by fiber type

TABLE 263 SOUTH AFRICA: BIOMEDICAL TEXTILES MARKET SIZE, BY FIBER TYPE, 2018–2021 (USD MILLION)

TABLE 264 SOUTH AFRICA: MARKET SIZE, BY FIBER TYPE, 2018–2021 (KILOTON)

TABLE 265 SOUTH AFRICA: MARKET SIZE, BY FIBER TYPE, 2022–2027 (USD MILLION)

TABLE 266 SOUTH AFRICA: MARKET SIZE, BY FIBER TYPE, 2022–2027 (KILOTON)

9.6.6 SAUDI ARABIA

9.6.6.1 Improving healthcare infrastructure and increasing healthcare expenditure to drive market

9.6.6.2 Saudi Arabia: Biomedical textiles market, by fiber type

TABLE 267 SAUDI ARABIA: BIOMEDICAL TEXTILES MARKET SIZE, BY FIBER TYPE, 2018–2021 (USD MILLION)

TABLE 268 SAUDI ARABIA: MARKET SIZE, BY FIBER TYPE, 2018–2021 (KILOTON)

TABLE 269 SAUDI ARABIA: MARKET SIZE, BY FIBER TYPE, 2022–2027 (USD MILLION)

TABLE 270 SAUDI ARABIA: MARKET SIZE, BY FIBER TYPE, 2022–2027 (KILOTON)

9.6.7 UAE

9.6.7.1 High awareness and rising consumer spending on healthcare to drive market

9.6.7.2 UAE: Biomedical textiles market, by fiber type

TABLE 271 UAE: BIOMEDICAL TEXTILES MARKET SIZE, BY FIBER TYPE, 2018–2021 (USD MILLION)

TABLE 272 UAE: MARKET SIZE, BY FIBER TYPE, 2018–2021 (KILOTON)

TABLE 273 UAE: MARKET SIZE, BY FIBER TYPE, 2022–2027 (USD MILLION)

TABLE 274 UAE: MARKET SIZE, BY FIBER TYPE, 2022–2027 (KILOTON)

9.6.8 REST OF MIDDLE EAST & AFRICA

9.6.8.1 Growing market for biomedical textiles due to rising demand for better healthcare

9.6.8.2 Rest of Middle East & Africa: Biomedical textiles market, by fiber type

TABLE 275 REST OF MIDDLE EAST & AFRICA: BIOMEDICAL TEXTILES MARKET SIZE, BY FIBER TYPE, 2018–2021 (USD MILLION)

TABLE 276 REST OF MIDDLE EAST & AFRICA: MARKET SIZE, BY FIBER TYPE, 2018–2021 (KILOTON)

TABLE 277 REST OF MIDDLE EAST & AFRICA: MARKET SIZE, BY FIBER TYPE, 2022–2027 (USD MILLION)

TABLE 278 REST OF MIDDLE EAST & AFRICA: MARKET SIZE, BY FIBER TYPE, 2022–2027 (KILOTON)

10 COMPETITIVE LANDSCAPE (Page No. - 186)

10.1 INTRODUCTION

10.2 MARKET SHARE ANALYSIS

FIGURE 42 SHARE OF TOP COMPANIES IN BIOMEDICAL TEXTILES MARKET

TABLE 279 DEGREE OF COMPETITION: BIOMEDICAL TEXTILE MARKET

10.3 MARKET RANKING

FIGURE 43 RANKING OF TOP FIVE PLAYERS IN BIOMEDICAL TEXTILES MARKET

10.4 MARKET EVALUATION FRAMEWORK

TABLE 280 PRODUCT LAUNCHES/DEALS, 2017–2022

TABLE 281 OTHERS, 2017–2022

10.5 REVENUE ANALYSIS OF TOP MARKET PLAYERS

FIGURE 44 REVENUE ANALYSIS

10.6 COMPANY EVALUATION MATRIX

TABLE 282 COMPANY PRODUCT FOOTPRINT

TABLE 283 COMPANY APPLICATION FOOTPRINT

TABLE 284 COMPANY REGION FOOTPRINT

10.7 COMPETITIVE LANDSCAPE MAPPING

10.7.1 STARS

10.7.2 PERVASIVE PLAYERS

10.7.3 PARTICIPANTS

10.7.4 EMERGING LEADERS

FIGURE 45 COMPETITIVE LEADERSHIP MAPPING, 2021

10.7.5 STRENGTH OF PRODUCT PORTFOLIO

FIGURE 46 PRODUCT PORTFOLIO ANALYSIS OF TOP PLAYERS IN BIOMEDICAL TEXTILES MARKET

10.7.6 BUSINESS STRATEGY EXCELLENCE

FIGURE 47 BUSINESS STRATEGY EXCELLENCE OF TOP PLAYERS IN BIOMEDICAL TEXTILES MARKET

10.8 SMALL AND MEDIUM-SIZED ENTERPRISES (SME) EVALUATION MATRIX

10.8.1 PROGRESSIVE COMPANIES

10.8.2 RESPONSIVE COMPANIES

10.8.3 DYNAMIC COMPANIES

10.8.4 STARTING BLOCKS

FIGURE 48 SMALL AND MEDIUM-SIZED ENTERPRISES MAPPING, 2021

11 COMPANY PROFILES (Page No. - 203)

(Business Overview, Products/Solutions/Services offered, Recent Developments, Deals, MnM view, Key strengths/right to win, Strategic choices made, Weakness/competitive threats)*

11.1 KEY COMPANIES

11.1.1 ROYAL DSM N.V.

TABLE 285 ROYAL DSM N.V.: COMPANY OVERVIEW

FIGURE 49 ROYAL DSM N.V.: COMPANY SNAPSHOT

11.1.2 MEDTRONIC PLC

TABLE 286 MEDTRONIC PLC: COMPANY OVERVIEW

FIGURE 50 MEDTRONIC PLC: COMPANY SNAPSHOT

11.1.3 INTEGRA LIFESCIENCES CORPORATION

TABLE 287 INTEGRA LIFESCIENCES CORPORATION: COMPANY OVERVIEW

FIGURE 51 INTEGRA LIFESCIENCES CORPORATION: COMPANY SNAPSHOT

11.1.4 JOHNSON & JOHNSON

TABLE 288 JOHNSON & JOHNSON: COMPANY OVERVIEW

FIGURE 52 JOHNSON & JOHNSON: COMPANY SNAPSHOT

11.1.5 SMITH & NEPHEW PLC

TABLE 289 SMITH & NEPHEW PLC: COMPANY OVERVIEW

FIGURE 53 SMITH & NEPHEW PLC: COMPANY SNAPSHOT

11.1.6 MEDLINE INDUSTRIES INC.

TABLE 290 MEDLINE INDUSTRIES INC.: COMPANY OVERVIEW

11.1.7 B. BRAUN MELSUNGEN AG

TABLE 291 B. BRAUN MELSUNGEN AG: COMPANY OVERVIEW

FIGURE 54 B. BRAUN MELSUNGEN AG: COMPANY SNAPSHOT

11.1.8 CARDINAL HEALTH, INC.

TABLE 292 CARDINAL HEALTH, INC.: COMPANY OVERVIEW

FIGURE 55 CARDINAL HEALTH, INC.: COMPANY SNAPSHOT

11.1.9 PAUL HARTMANN AG

TABLE 293 PAUL HARTMANN AG: COMPANY OVERVIEW

11.1.10 BSN MEDICAL (A PART OF SVENSKA CELLULOSA AKTIEBOLAGET SCA)

TABLE 294 BSN MEDICAL: COMPANY OVERVIEW

11.1.11 BECTON, DICKINSON AND COMPANY

TABLE 295 BECTON, DICKINSON AND COMPANY: COMPANY OVERVIEW

11.1.12 W. L. GORE & ASSOCIATES INC.

TABLE 296 W. L. GORE & ASSOCIATES INC: COMPANY OVERVIEW

11.1.13 GUNZE LIMITED

TABLE 297 GUNZE LIMITED: COMPANY OVERVIEW

*Details on Business Overview, Products Offered, Recent Developments, Deals, MnM view, Key strengths/right to win, Strategic choices made, Weakness/competitive threats might not be captured in case of unlisted companies.

11.2 OTHER PLAYERS

11.2.1 ATEX TECHNOLOGIES

11.2.2 ELKEM SILICONES

11.2.3 BALLY RIBBON MILLS

11.2.4 US BIODESIGN

11.2.5 NITTO DENKO CORPORATION

11.2.6 KIMBERLY-CLARK CORPORATION

11.2.7 MÖLNLYCKE HEALTH CARE

11.2.8 3M COMPANY

11.2.9 AHLSTROM- MUNKSJÖ

11.2.10 FREUDENBERG & CO. KOMMANDITGESELLSCHAFT

11.2.11 SECANT GROUP, LLC

11.2.12 MEISTER & CIE AG

12 APPENDIX (Page No. - 240)

12.1 DISCUSSION GUIDE

12.2 KNOWLEDGESTORE: MARKETSANDMARKETS' SUBSCRIPTION PORTAL

12.3 CUSTOMIZATION OPTIONS

12.4 RELATED REPORTS

12.5 AUTHOR DETAILS

The study involves two major activities in estimating the current size of the Biomedical textiles market. Exhaustive secondary research was done to collect information on the market, the peer market, and the parent market. The next step was to validate these findings, assumptions, and sizing with industry experts across the value chain through primary research. Both the top-down and bottom-up approaches were employed to estimate the total market size. After that, market breakdown and data triangulation procedures were used to determine the extent of market segments and sub-segments.

Biomedical Textiles Market Secondary Research

In the secondary research process, information was sourced from annual reports, press releases & investor presentations of companies, white papers, certified publications, trade directories, articles from recognized authors, gold standard and silver standard websites, and databases. Secondary research was used to obtain critical information about the industry's value chain, the total pool of key players, market classification, and segmentation according to industry trends to the bottom-most level and regional markets. It was also used to obtain information about the key developments from a market-oriented perspective.

Biomedical Textiles Market Primary Research

The Biomedical textiles market comprises several stakeholders in the value chain, including raw material suppliers, processors, end-product manufacturers, and end users. Various primary sources from the supply and demand sides of the market were interviewed to obtain qualitative and quantitative information. Primary sources from the demand side include key opinion leaders from various end-use applications of Biomedical textiles. Supply-side primary sources include experts from companies manufacturing Biomedical textiles.

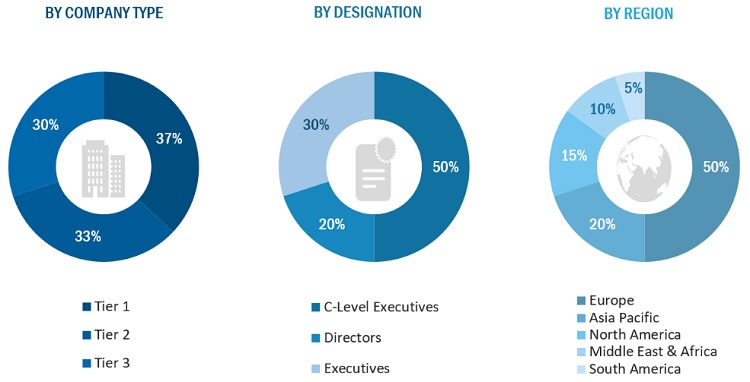

Following is the breakdown of primary respondents:

Notes: Tiers of companies are selected based on their ownership and revenues in 2021.

Others include sales managers, marketing managers, and product managers.

Source: Secondary Research, Expert Interviews, and MarketsandMarkets Analysis

To know about the assumptions considered for the study, download the pdf brochure

Biomedical Textiles Market Size Estimation

Both the top-down and bottom-up approaches were used to estimate and validate the total Biomedical textiles market. These methods were also used extensively to determine the size of various sub-segments in the market. The research methodology used to estimate the market size included the following:

- The key players in the industry and markets were identified through extensive secondary research.

- The industry’s supply chain and market size, in terms of value, were determined through primary and secondary research processes.

- All percentage shares, splits, and breakdowns were determined using secondary sources and verified through primary sources.

Biomedical Textiles Market Data Triangulation

After arriving at the overall Biomedical textiles market size using the market size estimation processes as explained above, the market was split into several segments and sub-segments. To complete the whole market engineering process and arrive at the exact statistics of each market segment and subsegment, the data triangulation, and market breakdown procedures were employed, wherever applicable. The data was triangulated by studying various factors and trends from both the demand and supply sides, mainly from the highways, bridges & buildings, marine structures & waterfronts and other applications.

Biomedical Textiles Market Report Objectives

- To analyze and forecast the global Biomedical textiles market size, in terms of volume and value

- To provide detailed information about the key factors (drivers, restraints, opportunities, and challenges) influencing the growth of the market

- To analyze the market segmentation and forecast the market size based on resin type, fiber type, and applications.

- To analyze and forecast the market size based on five main regions, namely, Asia Pacific (APAC), Europe, North America, Middle East & Africa (MEA), and South America.

- To analyze the market with respect to individual growth trends, prospects, and contribution of submarkets to the total market

- To analyze the market opportunities and the competitive landscape for stakeholders and market leaders

- To analyze competitive developments such as expansions, partnership, agreement, new product/technology launch, joint venture, contract, and merger & acquisition in the market

- To profile key players and comprehensively analyze their market share and core competencies

Biomedical Textiles Market Report Available Customizations

With the given market data, MarketsandMarkets offers customizations according to the company’s specific needs.

The following customization options are available for the report:

Biomedical Textiles Market Product Analysis

- Product matrix, which gives a detailed comparison of the product portfolio of each company

Biomedical Textiles Market Regional Analysis

- Further breakdown of Rest of Asia Pacific Biomedical textiles market

- Further breakdown of Rest of European Biomedical textiles market

- Further breakdown of Rest of Middle East & Africa Biomedical textiles market

- Further breakdown of Rest of South American Biomedical textiles market

Biomedical Textiles Market Company Information

- Detailed analysis and profiling of additional market players (up to 10)

Generating Response ...

Generating Response ...

Growth opportunities and latent adjacency in Biomedical Textiles Market