Medical Composites Market by Fiber Type(Carbon and Ceramic), Application (Diagnostic Imaging, Composite Body Implants, Surgical Instruments, and Dental), and Region (Europe, North America, APAC, Latin America, and MEA) - Global Forecast to 2025

Updated on : April 03, 2024

Medical Composites Market

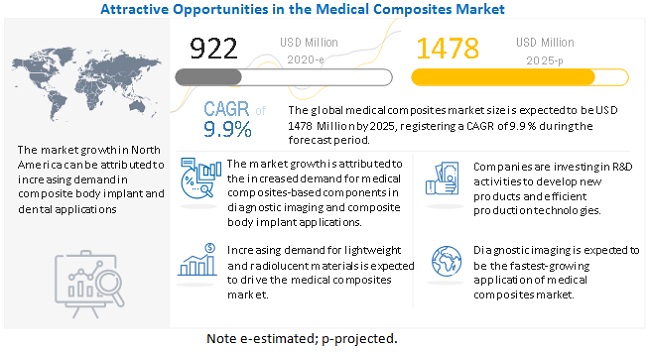

The global medical composites market was valued at USD 922 million in 2020, and is projected to reach USD 1,478 million by 2025, growing at 9.9% cagr from 2020 to 2025. The medical composites industry is growing due to the rise in demand for medical composites from various applications, globally. The market is expected to decline in 2020 due to COVID-19. However, the end of lockdown and recovery in the application sector will stimulate the demand during the forecast period.

To know about the assumptions considered for the study, Request for Free Sample Report

Impact of COVID-19 on global medical composites market

The medical composites market is expected to witness a decline in market in 2020 due to the COVID-19 pandemic. This deadly virus has adversely affected the entire globe, especially the North American and European regions. To prevent the further spread of this virus, companies have shut down their operations and manufacturing facilities, hospitals were operating at emergency patients only, and dental treatments were restricted. This has led to a reduction in the consumption of medical composites across applications such as diagnostic imaging, composite body implants, surgical instruments, and others.

Increasing demand from the diagnostic imaging applications to drive the demand for medical composites

Diagnostic imaging application drives the demand for medical composites, due to the exceptional properties of medical composites over traditional materials that enable its usage in a diagnostic imaging application. The properties include radiolucency, thermal resistance, and absorption of low levels of radiant energy. These characteristics minimize signal attenuation to enable the capturing of clear images for use in medical diagnostics. Composites are highly compatible with X-ray, CT, and MRI scans, enabling better post-operative monitoring of the fractured part. Upcoming applications such as tissue engineering, microspheres, and wheelchairs will further drive the medical composites market.

Increasing demand for lightweight and radiolucent materials is expected to drive the market

Composites manufactured using carbon fiber are used in a large number of applications. This is due to their superior physical & mechanical properties such as radiolucency, durability, stiffness, lightweight, biocompatibility, and high strength. Therefore, the applications of medical composites are growing at a significant rate in patient imaging tables and accessories employed in MRI, X-ray, CT, and PET systems.

Stringent clinical & regulatory processes is the major restraint of the market

The restraining factor for the medical composites market is regulatory laws by the FDA, European Commission, and other regional regulations. The development of medical composite products involves time-consuming processes and expensive clinical trials. The critical nature of some medical devices brings them under stringent regulations. Stringent regulations and time-consuming procedures for getting approval are impeding the growth of the market. For example, carbon-fiber and polyether ether ketone (PEEK) implants are being used over the last 20 years, but the FDA is yet to issue overall regulations for composite implants. These products have to be implanted inside the human body; they need to be biocompatible and comply with the ISO biocompatibility testing standards.

The development of low cost carbon fiber is a major challenge

The identification and development of low-cost technologies for the commercial production of low-cost carbon fiber composites is a major concern for various governments, research laboratories, and carbon fiber producers globally. New technologies need to be developed to produce low-cost carbon and glass fibers to commercialize the end products. To develop new applications and technologies for medical composites, it is required to include production processes to increase the stability of the product. Production and development projects are being undertaken to reduce manufacturing costs of carbon fiber reinforced products through technology and process solutions and create starting points for a full-fledged use of carbon products in medical technology.

The carbon fiber medical composites segment accounted for a major share of the medical composites market in terms of value and volume during the forecast period.

The bulk medical composites type holds the largest share in the global medical composites market. Bulk medical composites type of medical composites includes medical composites nanoplatelets (GNPs), medical composites oxide, reduced medical composites oxide, and other forms of medical composites. Increasing applications of Bulk medical composites find wide applications in composites applications is expected to drive the demand.

To know about the assumptions considered for the study, download the pdf brochure

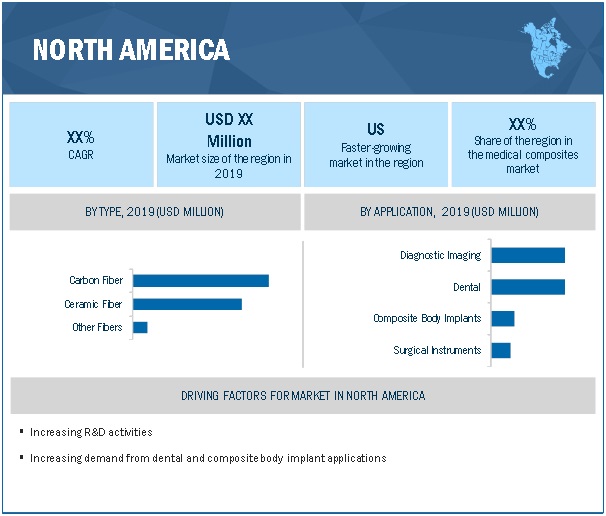

North America held the largest market share in the medical composites market

North America region held the largest share in the global medical composites market in 2019. The presence of a number of medical composite manufacturers and medical device manufacturers in the US and Canada supports the high share of the North American region. North America ranked first in total healthcare spending in 2019. The consumption of medical composites in diagnostic imaging and surgical material applications in Europe is expected to drive the global medical composites market. North America has significant consumption of medical composite materials due to the rising number of manufacturing industries in the region. The medical composites market in this region is expected to grow rapidly during the forecast period due to the rising use of these materials for dental and diagnostic imaging applications.

Medical Composites Market Players

The key players in the global medical composites market are:

- 3M (US)

- Toray Industries, Inc. (Japan)

- CeramTec GmbH (Germany)

- Dentsply Sirona (US)

- Royal DSM N.V. (Netherlands)

- SGL Carbon (Germany)

These companies are involved in adopting various inorganic and organic strategies to increase their foothold in the medical composites industry. The study includes an in-depth competitive analysis of these key players in the medical composites market, with their company profiles, recent developments, and key market strategies.

Medical Composites Market Report Scope

|

Report Metric |

Details |

|

Market Size Value in 2020 |

USD 922 million |

|

Revenue Forecast in 2025 |

USD 1,478 million |

|

CAGR |

9.9% |

|

Years considered for the study |

2018–2025 |

|

Base year |

2019 |

|

Forecast period |

2020–2025 |

|

Units considered |

Value (USD Thousand), Volume (Ton) |

|

Segments |

Fiber Type, Application and Region |

|

Regions |

Europe, North America, APAC, MEA, and Latin America |

|

Companies |

3M (US), Toray Industries, Inc. (Japan), CeramTec GmbH (Germany), Dentsply Sirona (US), Royal DSM N.V. (Netherlands), and SGL Carbon (Germany) |

This research report categorizes the medical composites market based on type, application, end-use industry, and region.

Medical Composites Market by Fiber Type:

- Carbon Fiber

- Ceramic Fiber

- Others

Medical Composites Market by Application:

- Diagnostic Imaging

- Composite Body Implants

- Surgical Instruments

- Dental

- Others

Medical Composites Market by Region:

- North America

- Europe

- APAC

- MEA

- Latin America

Recent Developments

- In April 2019, 3M introduced Filtek Universal restorative composites product. The new product combines a unique shading system in an innovative material that not only provides efficiency but a highly esthetic and long-lasting result.

- In March 2018, Toray Industries Inc. acquired TenCate Advanced Composites, a composites division of TenCate BV, for USD 1,091 million. This acquisition has helped the company to increase its market position in the carbon fiber composites market in various end-use industries, including medical.

- In February 2016, Toray Carbon Magic (Thailand), a subsidiary of Toray Industry Inc. (Tokyo, Japan), opened a new manufacturing plant in Thailand. The plant is established to manufacture carbon fiber reinforced plastic parts for different markets, including healthcare. This new facility helped the company to provide composites products for medical applications such as wheelchairs and prosthetic limbs.

Frequently Asked Questions (FAQ):

What are the factors influencing the growth of the medical composites market?

High demand from application industries due to superior performance properties of medical composites has driving the market.

Which is the fastest-growing region-level market for medical composites s?

APAC is the fastest-growing medical composites market due to the presence of major medical composites manufacturers and the burgeoning growth of various end-use industries.

What are the factors contributing to the final price of medical composites s?

Raw material and manufacturing process play a vital role in the costs. The type of manufacturing process contributes largely to the final pricing of medical composites.

What are the challenges in the medical composites market?

To produce low cost carbon fiber is the major challenge in the medical composites market.

Which type of medical composites holds the largest market share?

Carbon fiber medical composites hold the largest share due to wide applications in diagnostic imaging and dental applications.

How is the medical composites market aligned?

The market is growing at a significant pace. It is a potential market and many manufactures are planning business strategies to expand their business.

Who are the major manufacturers?

NanoXplore Inc. (US), Medical compositesa SA (Spain), Avanzare Innovacion Tecnologica S.L. (Spain), Global Medical composites Group (US), Directa Plus S.p.A. (Italy), Haydale Medical composites Industries Plc (Italy), Changzhou Sixth Element Materials Technology Co., Ltd. (China), and Ningbo Morsh Technology Co., Ltd. (China), Nanjing XFNANO Materials Co., Ltd., Xiamen Knano Medical composites Technology Corporation Limited, (China), and JCNANO Tech Co., Ltd. (China) and among others are a few of the key players in the medical composites market.

What are the major applications for medical composites?

The major applications of medical composites include diagnostic imaging, composite body implants, dental are the major application of medical composites.

What is the biggest restraint in the medical composites market?

Stringent regulatory and clinical approvals are the major restraint of the market. .

To speak to our analyst for a discussion on the above findings, click Speak to Analyst

TABLE OF CONTENTS

1 INTRODUCTION (Page No. - 23)

1.1 OBJECTIVES OF THE STUDY

1.2 MARKET DEFINITION

1.3 MARKET SCOPE

1.3.1 MEDICAL COMPOSITES MARKET SEGMENTATION

1.3.2 MEDICAL COMPOSITES MARKET, REGIONAL SCOPE

1.3.3 YEARS CONSIDERED FOR THE STUDY

1.4 CURRENCY

1.5 UNIT CONSIDERED

1.6 STAKEHOLDERS

1.7 SUMMARY OF CHANGES

2 RESEARCH METHODOLOGY (Page No. - 27)

2.1 RESEARCH DATA

FIGURE 1 MEDICAL COMPOSITES MARKET: RESEARCH DESIGN

2.1.1 SECONDARY DATA

2.1.1.1 Key data from secondary sources

2.1.2 PRIMARY DATA

2.1.2.1 Key data from primary sources

2.1.2.2 Breakdown of primaries

2.2 MARKET SIZE ESTIMATION

2.3 SUPPLY-SIDE ANALYSIS

2.4 DEMAND-SIZE ANALYSIS

2.5 DATA TRIANGULATION

FIGURE 2 MEDICAL COMPOSITES MARKET: DATA TRIANGULATION

2.6 ASSUMPTIONS

2.7 LIMITATIONS

3 EXECUTIVE SUMMARY (Page No. - 34)

FIGURE 3 CARBON FIBER TYPE DOMINATED THE MARKET IN 2019

FIGURE 4 DIAGNOSTIC IMAGING APPLICATION DOMINATED THE MARKET IN 2019

FIGURE 5 THE US TO LEAD THE GLOBAL MEDICAL COMPOSITES MARKET IN 2019

FIGURE 6 NORTH AMERICA ACCOUNTED FOR THE LARGEST MARKET SHARE IN 2019

4 PREMIUM INSIGHTS (Page No. - 37)

4.1 ATTRACTIVE OPPORTUNITIES IN THE MEDICAL COMPOSITES MARKET

FIGURE 7 HIGH DEMAND FROM DIAGNOSTIC IMAGING APPLICATION TO DRIVE THE MARKET

4.2 MEDICAL COMPOSITES MARKET, BY FIBER TYPE AND APPLICATION, 2019

FIGURE 8 CARBON FIBER MEDICAL COMPOSITES ACCOUNTED FOR LARGER SHARE OF THE MARKET

4.3 MEDICAL COMPOSITES MARKET, BY APPLICATION

FIGURE 9 DIAGNOSTIC IMAGING APPLICATION LED THE DEMAND

4.4 MEDICAL COMPOSITES MARKET, BY KEY COUNTRIES

FIGURE 10 CHINA TO REGISTER THE HIGHEST CAGR

5 MARKET OVERVIEW (Page No. - 40)

5.1 INTRODUCTION

5.2 MARKET DYNAMICS

FIGURE 11 DRIVERS, RESTRAINTS, OPPORTUNITIES, AND CHALLENGES IN THE MEDICAL COMPOSITES MARKET

5.2.1 DRIVERS

5.2.1.1 Increasing demand for lightweight and radiolucent materials

5.2.1.2 Increasing demand for implantable devices

5.2.2 RESTRAINTS

5.2.2.1 Stringent clinical & regulatory processes

5.2.2.2 High cost of carbon fiber

5.2.3 OPPORTUNITIES

5.2.3.1 Increasing healthcare industry in emerging markets

5.2.3.2 Emergence of biodegradable composites for bioimplants

5.2.4 CHALLENGES

5.2.4.1 Development of low-cost carbon fiber

5.3 SUPPLY CHAIN ANALYSIS

TABLE 1 MEDICAL COMPOSITES MARKET: SUPPLY CHAIN

5.4 PORTER’S FIVE FORCES ANALYSIS

FIGURE 12 MEDICAL COMPOSITES MARKET: PORTER’S FIVE FORCES ANALYSIS

5.4.1 THREAT OF NEW ENTRANTS

5.4.2 THREAT OF SUBSTITUTES

5.4.3 BARGAINING POWER OF SUPPLIERS

5.4.4 BARGAINING POWER OF BUYERS

5.4.5 INTENSITY OF COMPETITIVE RIVALRY

TABLE 2 MEDICAL COMPOSITES MARKET: PORTER’S FIVE FORCES ANALYSIS

5.5 IMPACT OF COVID-19

5.6 VALUE CHAIN ANALYSIS

5.7 TECHNOLOGY ANALYSIS

5.8 PRICING ANALYSIS

TABLE 3 MEDICAL COMPOSITES AVERAGE SELLING PRICE, BY REGION

5.9 VALUE CHAIN ANALYSIS

5.10 KEY MARKET FOR IMPORT/EXPORT

5.10.1 CHINA

5.10.2 US

5.10.3 GERMANY

5.10.4 JAPAN

5.11 TRADE REGULATIONS

5.12 ECOSYSTEM

5.13 CASE STUDY

5.14 YC AND YCC SHIFT

5.15 PATENT ANALYSIS

5.15.1 INTRODUCTION

5.15.2 METHODOLOGY

5.15.3 DOCUMENT TYPES

5.15.4 PUBLICATION TRENDS - LAST 10 YEARS

5.15.5 JURISDICTION ANALYSIS

5.15.6 TOP COMPANIES/APPLICANTS

6 MEDICAL COMPOSITES MARKET, BY FIBER TYPE (Page No. - 58)

6.1 INTRODUCTION

FIGURE 13 CARBON FIBER TO DOMINATE THE GLOBAL MEDICAL COMPOSITES MARKET DURING THE FORECAST PERIOD

6.1.1 MEDICAL COMPOSITES MARKET SIZE, BY FIBER TYPE

TABLE 4 MEDICAL COMPOSITES MARKET SIZE, BY FIBER TYPE, 2018–2025 (USD THOUSAND)

TABLE 5 MEDICAL COMPOSITES MARKET SIZE, BY FIBER TYPE, 2018–2025 (TON)

6.2 CARBON FIBER

FIGURE 14 NORTH AMERICA TO BE THE LARGEST REGION IN THE CARBON FIBER MEDICAL COMPOSITES MARKET DURING THE FORECAST PERIOD

6.2.1 CARBON FIBER MEDICAL COMPOSITES MARKET SIZE, BY REGION

TABLE 6 CARBON FIBER MEDICAL COMPOSITES MARKET SIZE, BY REGION, 2018–2025 (USD THOUSAND)

TABLE 7 CARBON FIBER MEDICAL COMPOSITES MARKET SIZE, BY REGION 2018–2025 (TON)

6.3 CERAMIC FIBER

6.3.1 CERAMIC FIBER MEDICAL COMPOSITES MARKET SIZE, BY REGION

TABLE 8 CERAMIC FIBER MEDICAL COMPOSITES MARKET SIZE, BY REGION, 2018–2025 (USD THOUSAND)

TABLE 9 CERAMIC FIBER MEDICAL COMPOSITES MARKET SIZE, BY REGION 2018–2025 (TON)

6.4 OTHERS

6.4.1 GLASS FIBER

6.4.2 ARAMID FIBER

6.4.3 OTHER FIBER MEDICAL COMPOSITES MARKET SIZE, BY REGION

TABLE 10 OTHER FIBER MEDICAL COMPOSITES MARKET SIZE, BY REGION, 2018–2025 (USD THOUSAND)

TABLE 11 OTHER FIBER MEDICAL COMPOSITES MARKET SIZE, BY REGION 2018–2025 (TON)

7 MEDICAL COMPOSITES MARKET, BY APPLICATION (Page No. - 65)

7.1 INTRODUCTION

FIGURE 15 DIAGNOSTIC IMAGING APPLICATION TO DOMINATE THE GLOBAL MEDICAL COMPOSITES MARKET DURING THE FORECAST PERIOD

7.1.1 MEDICAL COMPOSITES MARKET SIZE, BY APPLICATION

TABLE 12 MEDICAL COMPOSITES MARKET SIZE, BY APPLICATION, 2018–2025 (USD THOUSAND)

TABLE 13 MEDICAL COMPOSITES MARKET SIZE, BY APPLICATION, 2018–2025 (TON)

7.2 DIAGNOSTIC IMAGING

FIGURE 16 APAC TO BE THE FASTEST-GROWING REGION IN THE DIAGNOSTIC IMAGING APPLICATION OF MEDICAL COMPOSITES DURING THE FORECAST PERIOD

7.2.1 MEDICAL COMPOSITES MARKET SIZE IN DIAGNOSTIC IMAGING APPLICATION, BY REGION

TABLE 14 MEDICAL COMPOSITES MARKET SIZE IN DIAGNOSTIC IMAGING APPLICATION, BY REGION, 2018–2025 (USD THOUSAND)

TABLE 15 MEDICAL COMPOSITES MARKET SIZE IN DIAGNOSTIC IMAGING APPLICATION, BY REGION, 2018–2025 (TON)

7.3 COMPOSITE BODY IMPLANTS

7.3.1 MEDICAL COMPOSITES MARKET SIZE IN COMPOSITE BODY IMPLANTS APPLICATION, BY REGION

TABLE 16 MEDICAL COMPOSITES MARKET SIZE IN COMPOSITE BODY IMPLANTS APPLICATION, BY REGION, 2018–2025 (USD THOUSAND)

TABLE 17 MEDICAL COMPOSITES MARKET SIZE IN COMPOSITE BODY IMPLANTS APPLICATION, BY REGION, 2018–2025 (TON)

7.4 SURGICAL INSTRUMENTS

7.4.1 MEDICAL COMPOSITES MARKET SIZE IN SURGICAL INSTRUMENTS APPLICATIONS, BY REGION

TABLE 18 MEDICAL COMPOSITES MARKET SIZE IN SURGICAL INSTRUMENTS APPLICATION, BY REGION, 2018–2025 (USD THOUSAND)

TABLE 19 MEDICAL COMPOSITES MARKET SIZE IN SURGICAL INSTRUMENTS APPLICATION, BY REGION, 2018–2025 (TON)

7.5 DENTAL

7.5.1 MEDICAL COMPOSITES MARKET SIZE IN DENTAL APPLICATIONS, BY REGION

TABLE 20 MEDICAL COMPOSITES MARKET SIZE IN DENTAL APPLICATION, BY REGION, 2018–2025 (USD THOUSAND)

TABLE 21 MEDICAL COMPOSITES MARKET SIZE IN DENTAL APPLICATION, BY REGION, 2018–2025 (TON)

7.6 OTHERS

7.6.1 MICROSPHERES

7.6.2 TISSUE ENGINEERING

7.6.3 MEDICAL COMPOSITES MARKET SIZE IN OTHER APPLICATIONS, BY REGION

TABLE 22 MEDICAL COMPOSITES MARKET SIZE IN OTHER APPLICATIONS, BY REGION, 2018–2025 (USD THOUSAND)

TABLE 23 MEDICAL COMPOSITES MARKET SIZE IN OTHER APPLICATIONS, BY REGION, 2018–2025 (TON)

8 MEDIAL COMPOSITES MARKET, BY REGION (Page No. - 75)

8.1 INTRODUCTION

FIGURE 17 CHINA TO REGISTER THE HIGHEST CAGR IN THE MEDICAL COMPOSITES MARKET

TABLE 24 MEDICAL COMPOSITES MARKET SIZE, BY REGION, 2018–2025 (USD THOUSAND)

TABLE 25 MEDICAL COMPOSITES MARKET SIZE, BY REGION, 2018–2025 (TON)

8.2 NORTH AMERICA

FIGURE 18 NORTH AMERICA: MEDICAL COMPOSITES MARKET SNAPSHOT

8.2.1 NORTH AMERICA MEDICAL COMPOSITES MARKET, BY FIBER TYPE

TABLE 26 NORTH AMERICA: MEDICAL COMPOSITES MARKET SIZE, BY FIBER TYPE, 2018–2025 (USD THOUSAND)

TABLE 27 NORTH AMERICA: MEDICAL COMPOSITES MARKET SIZE, BY FIBER TYPE, 2018–2025 (TON)

8.2.2 NORTH AMERICA MEDICAL COMPOSITES MARKET, BY APPLICATION

TABLE 28 NORTH AMERICA: MEDICAL COMPOSITES MARKET SIZE, BY APPLICATION, 2018–2025 (USD THOUSAND)

TABLE 29 NORTH AMERICA: MEDICAL COMPOSITES MARKET SIZE, BY APPLICATION, 2018–2025 (TON)

8.2.3 NORTH AMERICA MEDICAL COMPOSITES MARKET, BY COUNTRY

TABLE 30 NORTH AMERICA: MEDICAL COMPOSITES MARKET SIZE, BY COUNTRY, 2018–2025 (USD THOUSAND)

TABLE 31 NORTH AMERICA: MEDICAL COMPOSITES MARKET SIZE, BY COUNTRY, 2018–2025 (TON)

8.2.4 US

8.2.4.1 US Medical Composites Market, by Fiber Type

TABLE 32 US: MEDICAL COMPOSITES MARKET SIZE, BY FIBER TYPE, 2018–2025 (USD THOUSAND)

TABLE 33 US: MEDICAL COMPOSITES MARKET SIZE, BY APPLICATION, 2018–2025 (TON)

8.2.5 CANADA

8.2.5.1 Canada Medical Composites Market, by Fiber Type

TABLE 34 CANADA: MEDICAL COMPOSITES MARKET SIZE, BY FIBER TYPE, 2018–2025 (USD THOUSAND)

TABLE 35 CANADA: MEDICAL COMPOSITES MARKET SIZE, BY FIBER TYPE, 2018–2025 (TON)

8.3 EUROPE

FIGURE 19 EUROPE: MEDICAL COMPOSITES MARKET SNAPSHOT

8.3.1 EUROPE MEDICAL COMPOSITES MARKET, BY FIBER TYPE

TABLE 36 EUROPE: MEDICAL COMPOSITES MARKET SIZE, BY FIBER TYPE, 2018–2025 (USD THOUSAND)

TABLE 37 EUROPE: MEDICAL COMPOSITES MARKET SIZE, BY FIBER TYPE, 2018–2025 (TON)

8.3.2 EUROPE MEDICAL COMPOSITES MARKET, BY APPLICATION

TABLE 38 EUROPE: MEDICAL COMPOSITES MARKET SIZE, BY APPLICATION, 2018–2025 (USD THOUSAND)

TABLE 39 EUROPE: MEDICAL COMPOSITES MARKET SIZE, BY APPLICATION, 2018–2025 (TON)

8.3.3 EUROPE MEDICAL COMPOSITES MARKET, BY COUNTRY

TABLE 40 EUROPE: MEDICAL COMPOSITES MARKET SIZE, BY COUNTRY, 2018–2025 (USD THOUSAND)

TABLE 41 EUROPE: MEDICAL COMPOSITES MARKET SIZE, BY COUNTRY, 2018–2025 (TON)

8.3.4 GERMANY

8.3.4.1 Germany Medical Composites Market, by Fiber Type

TABLE 42 GERMANY: MEDICAL COMPOSITES MARKET SIZE, BY FIBER TYPE, 2018–2025 (USD THOUSAND)

TABLE 43 GERMANY: MEDICAL COMPOSITES MARKET SIZE, BY FIBER TYPE, 2018–2025 (TON)

8.3.5 FRANCE

8.3.5.1 France Medical Composites Market, by Fiber Type

TABLE 44 FRANCE: MEDICAL COMPOSITES MARKET SIZE, BY FIBER TYPE, 2018–2025 (USD THOUSAND)

TABLE 45 FRANCE: MEDICAL COMPOSITES MARKET SIZE, BY FIBER TYPE, 2018–2025 (TON)

8.3.6 UK

8.3.6.1 UK Medical Composites Market, by Fiber Type

TABLE 46 UK: MEDICAL COMPOSITES MARKET SIZE, BY FIBER TYPE, 2018–2025 (USD THOUSAND)

TABLE 47 UK: MEDICAL COMPOSITES MARKET SIZE, BY FIBER TYPE, 2018–2025 (TON)

8.3.7 SPAIN

8.3.7.1 Spain Medical Composites Market, by Fiber Type

TABLE 48 SPAIN: MEDICAL COMPOSITES MARKET SIZE, BY FIBER TYPE, 2018–2025 (USD THOUSAND)

TABLE 49 SPAIN: MEDICAL COMPOSITES MARKET SIZE, BY FIBER TYPE, 2018–2025 (TON)

8.3.8 ITALY

8.3.8.1 Italy Medical Composites Market, by Fiber Type

TABLE 50 ITALY: MEDICAL COMPOSITES MARKET SIZE, BY FIBER TYPE, 2018–2025 (USD THOUSAND)

TABLE 51 ITALY: MEDICAL COMPOSITES MARKET SIZE, BY FIBER TYPE, 2018–2025 (TON)

8.3.9 RUSSIA

8.3.9.1 Russia Medical Composites Market, by Fiber Type

TABLE 52 RUSSIA: MEDICAL COMPOSITES MARKET SIZE, BY FIBER TYPE, 2018–2025 (USD THOUSAND)

TABLE 53 RUSSIA: MEDICAL COMPOSITES MARKET SIZE, BY FIBER TYPE, 2018–2025 (TON)

8.3.10 REST OF EUROPE

8.3.10.1 Rest of Europe Medical Composites Market, by Fiber Type

TABLE 54 REST OF EUROPE: MEDICAL COMPOSITES MARKET SIZE, BY FIBER TYPE, 2018–2025 (USD THOUSAND)

TABLE 55 REST OF EUROPE: MEDICAL COMPOSITES MARKET SIZE, BY FIBER TYPE, 2018–2025 (TON)

8.4 APAC

FIGURE 20 APAC: MEDICAL COMPOSITES MARKET SNAPSHOT

8.4.1 APAC MEDICAL COMPOSITES MARKET, BY FIBER TYPE

TABLE 56 APAC: MEDICAL COMPOSITES MARKET SIZE, BY FIBER TYPE, 2018–2025 (USD THOUSAND)

TABLE 57 APAC: MEDICAL COMPOSITES MARKET SIZE, BY FIBER TYPE, 2018–2025 (TON)

8.4.2 APAC MEDICAL COMPOSITES MARKET, BY APPLICATION

TABLE 58 APAC: MEDICAL COMPOSITES MARKET SIZE, BY APPLICATION, 2018–2025 (USD THOUSAND)

TABLE 59 APAC: MEDICAL COMPOSITES MARKET SIZE, BY APPLICATION, 2018–2025 (TON)

8.4.3 APAC MEDICAL COMPOSITES MARKET, BY COUNTRY

TABLE 60 APAC: MEDICAL COMPOSITES MARKET SIZE, BY COUNTRY, 2018–2025 (USD THOUSAND)

TABLE 61 APAC: MEDICAL COMPOSITES MARKET SIZE, BY COUNTRY, 2018–2025 (TON)

8.4.4 CHINA

8.4.4.1 China Medical Composites Market, by Fiber Type

TABLE 62 CHINA: MEDICAL COMPOSITES MARKET SIZE, BY FIBER TYPE 2018–2025 (USD THOUSAND)

TABLE 63 CHINA: MEDICAL COMPOSITES MARKET SIZE, BY FIBER TYPE, 2018–2025 (TON)

8.4.5 JAPAN

8.4.5.1 Japan Medical Composites Market, by Fiber Type

TABLE 64 JAPAN: MEDICAL COMPOSITES MARKET SIZE, BY FIBER TYPE, 2018–2025 (USD THOUSAND)

TABLE 65 JAPAN: MEDICAL COMPOSITES MARKET SIZE, BY FIBER TYPE, 2018–2025 (TON)

8.4.6 INDIA

8.4.6.1 India Medical Composites Market, by Fiber Type

TABLE 66 INDIA: MEDICAL COMPOSITES MARKET SIZE, BY FIBER TYPE, 2018–2025 (USD THOUSAND)

TABLE 67 INDIA: MEDICAL COMPOSITES MARKET SIZE, BY FIBER TYPE, 2018–2025 (TON)

8.4.7 SOUTH KOREA

8.4.7.1 South Korea Medical Composites Market, by Application

TABLE 68 SOUTH KOREA: MEDICAL COMPOSITES MARKET SIZE, BY FIBER TYPE, 2018–2025 (USD THOUSAND)

TABLE 69 SOUTH KOREA: MEDICAL COMPOSITES MARKET SIZE, BY FIBER TYPE, 2018–2025 (TON)

8.4.8 REST OF APAC

8.4.8.1 Rest of APAC Medical Composites Market, by Fiber Type

TABLE 70 REST OF APAC: MEDICAL COMPOSITES MARKET SIZE, BY FIBER TYPE, 2018–2025 (USD THOUSAND)

TABLE 71 REST OF APAC: MEDICAL COMPOSITES MARKET SIZE, BY FIBER TYPE, 2018–2025 (TON)

8.5 MIDDLE EAST & AFRICA

8.5.1 MIDDLE EAST & AFRICA MEDICAL COMPOSITES MARKET, BY FIBER TYPE

TABLE 72 MIDDLE EAST & AFRICA: MEDICAL COMPOSITES MARKET SIZE, BY FIBER TYPE, 2018–2025 (USD THOUSAND)

TABLE 73 MIDDLE EAST & AFRICA: MEDICAL COMPOSITES MARKET SIZE, BY FIBER TYPE, 2018–2025 (TON)

8.5.2 MIDDLE EAST & AFRICA MEDICAL COMPOSITES MARKET, BY APPLICATION

TABLE 74 MIDDLE EAST & AFRICA: MEDICAL COMPOSITES MARKET SIZE, BY APPLICATION, 2018–2025 (USD THOUSAND)

TABLE 75 MIDDLE EAST & AFRICA: MEDICAL COMPOSITES MARKET SIZE, BY APPLICATION, 2018–2025 (TON)

8.5.3 MIDDLE EAST & AFRICA MEDICAL COMPOSITES MARKET, BY COUNTRY

TABLE 76 MIDDLE EAST & AFRICA: MEDICAL COMPOSITES MARKET SIZE, BY COUNTRY, 2018–2025 (USD THOUSAND)

TABLE 77 MIDDLE EAST & AFRICA: MEDICAL COMPOSITES MARKET SIZE, BY COUNTRY, 2018–2025 (TON)

8.5.4 UAE

8.5.4.1 UAE Medical Composites Market, by Fiber Type

TABLE 78 UAE: MEDICAL COMPOSITES MARKET SIZE, BY FIBER TYPE, 2018–2025 (USD THOUSAND)

TABLE 79 UAE: MEDICAL COMPOSITES MARKET SIZE, BY FIBER TYPE, 2018–2025 (TON)

8.5.5 SAUDI ARABIA

8.5.5.1 Saudi Arabia Medical Composites Market, by Fiber Type

TABLE 80 SAUDI ARABIA: MEDICAL COMPOSITES MARKET SIZE, BY FIBER TYPE, 2018–2025 (USD THOUSAND)

TABLE 81 SAUDI ARABIA: MEDICAL COMPOSITES MARKET SIZE, BY FIBER TYPE, 2018–2025 (TON)

8.5.6 SOUTH AFRICA

8.5.6.1 South Africa Medical Composites Market, by Fiber Type

TABLE 82 SOUTH AFRICA: MEDICAL COMPOSITES MARKET SIZE, BY FIBER TYPE, 2018–2025 (USD THOUSAND)

TABLE 83 SOUTH AFRICA: MEDICAL COMPOSITES MARKET SIZE, BY FIBER TYPE, 2018–2025 (TON)

8.5.7 REST OF MIDDLE EAST & AFRICA

8.5.7.1 Rest of Middle East & Africa Medical Composites Market, by Fiber Type

TABLE 84 REST OF MIDDLE EAST & AFRICA: MEDICAL COMPOSITES MARKET SIZE, BY FIBER TYPE, 2018–2025 (USD THOUSAND)

TABLE 85 REST OF MIDDLE EAST & AFRICA: MEDICAL COMPOSITES MARKET SIZE, BY FIBER TYPE, 2018–2025 (TON)

8.6 LATIN AMERICA

8.6.1 LATIN AMERICA MEDICAL COMPOSITES MARKET, BY FIBER TYPE

TABLE 86 LATIN AMERICA: MEDICAL COMPOSITES MARKET SIZE, BY FIBER TYPE, 2018–2025 (USD THOUSAND)

TABLE 87 LATIN AMERICA: MEDICAL COMPOSITES MARKET SIZE, BY FIBER TYPE, 2018–2025 (TON)

8.6.2 LATIN AMERICA MEDICAL COMPOSITES MARKET, BY APPLICATION

TABLE 88 LATIN AMERICA: MEDICAL COMPOSITES MARKET SIZE, BY APPLICATION, 2018–2025 (USD THOUSAND)

TABLE 89 LATIN AMERICA: MEDICAL COMPOSITES MARKET SIZE, BY APPLICATION, 2018–2025 (TON)

8.6.3 LATIN AMERICA MEDICAL COMPOSITES MARKET, BY COUNTRY

TABLE 90 LATIN AMERICA: MEDICAL COMPOSITES MARKET SIZE, BY COUNTRY, 2018–2025 (USD THOUSAND)

TABLE 91 LATIN AMERICA: MEDICAL COMPOSITES MARKET SIZE, BY COUNTRY, 2018–2025 (TON)

8.6.4 BRAZIL

8.6.4.1 Brazil Medical Composites Market, by Fiber Type

TABLE 92 BRAZIL: MEDICAL COMPOSITES MARKET SIZE, BY FIBER TYPE, 2018–2025 (USD THOUSAND)

TABLE 93 BRAZIL: MEDICAL COMPOSITES MARKET SIZE, BY FIBER TYPE, 2018–2025 (TON)

8.6.5 MEXICO

8.6.5.1 Mexico Medical Composites Market, by Fiber Type

TABLE 94 MEXICO: MEDICAL COMPOSITES MARKET SIZE, BY FIBER TYPE, 2018–2025 (USD THOUSAND)

TABLE 95 MEXICO: MEDICAL COMPOSITES MARKET SIZE, BY FIBER TYPE, 2018–2025 (TON)

8.6.6 REST OF LATIN AMERICA

8.6.6.1 Rest of Latin America Medical Composites Market, by Fiber Type

TABLE 96 REST OF LATIN AMERICA: MEDICAL COMPOSITES MARKET SIZE, BY FIBER TYPE, 2018–2025 (USD THOUSAND)

TABLE 97 REST OF LATIN AMERICA: MEDICAL COMPOSITES MARKET SIZE, BY FIBER TYPE, 2018–2025 (TON)

9 COMPETITIVE LANDSCAPE (Page No. - 113)

9.1 INTRODUCTION

9.2 MARKET SHARE ANALYSIS

FIGURE 21 MARKET SHARE OF TOP COMPANIES IN THE MEDICAL COMPOSITES MARKET

TABLE 98 DEGREE OF COMPETITION: COMPETITIVE

9.3 MARKET RANKING

FIGURE 22 MARKET RANKING OF KEY PLAYERS

9.4 MARKET EVALUATION FRAMEWORK

TABLE 99 MEDICAL COMPOSITES MARKET: NEW PRODUCT LAUNCH/DEVELOPMENT, 2016-2020

TABLE 100 MEDICAL COMPOSITES MARKET: DEALS, 2016-2020

9.5 REVENUE ANALYSIS OF TOP MARKET PLAYERS

TABLE 101 REVENUE ANALYSIS OF TOP MARKET PLAYERS, 2019 (USD MILLION)

9.6 COMPANY EVALUATION MATRIX

TABLE 102 COMPANY PRODUCT FOOTPRINT

TABLE 103 COMPANY APPLICATION FOOTPRINT

TABLE 104 COMPANY REGION FOOTPRINT

9.6.1 STAR

9.6.2 PERVASIVE

9.6.3 PARTICIPANTS

9.6.4 EMERGING LEADERS

FIGURE 23 MEDICAL COMPOSITES MARKET (GLOBAL): COMPETITIVE LEADERSHIP MAPPING, 2019

FIGURE 24 STRENGTH OF PRODUCT PORTFOLIO

FIGURE 25 BUSINESS STRATEGY EXCELLENCE

9.7 SMALL AND MEDIUM-SIZED ENTERPRISES (SME) EVALUATION MATRIX

9.7.1 PROGRESSIVE COMPANIES

9.7.2 RESPONSIVE COMPANIES

9.7.3 DYNAMIC COMPANIES

9.7.4 STARTING BLOCKS

FIGURE 26 SME MAPPING

10 COMPANY PROFILE (Page No. - 125)

(Business Overview, Products Offered, Recent Developments, SWOT Analysis, Winning Imperatives, Development And Growth Strategies, Threat From Competition, Right To Win)*

10.1 3M

TABLE 105 3M: COMPANY OVERVIEW

FIGURE 27 3M: COMPANY SNAPSHOT

TABLE 106 3M: PRODUCTS OFFERED

10.2 TORAY INDUSTRIES INC.

TABLE 107 TORAY INDUSTRIES INC.: COMPANY OVERVIEW

FIGURE 28 TORAY INDUSTRIES INC.: COMPANY SNAPSHOT

TABLE 108 TORAY INDUSTRIES INC.: PRODUCTS OFFERED

10.3 CERAMTEC

TABLE 109 CERAMTEC GMBH: COMPANY OVERVIEW

FIGURE 29 CERAMTEC: COMPANY SNAPSHOT

TABLE 110 CERAMTEC: PRODUCTS OFFERED

10.4 DENTSPLY SIRONA

TABLE 111 DENTSPLY SIRONA: COMPANY OVERVIEW

FIGURE 30 DENTSPLY SIRONA: COMPANY SNAPSHOT

TABLE 112 DENTSPLY SIRONA: PRODUCTS OFFERED

10.5 ROYAL DSM NV

TABLE 113 ROYAL DSM NV: COMPANY OVERVIEW

FIGURE 31 ROYAL DSM NV: COMPANY SNAPSHOT

TABLE 114 ROYAL DSM NV: PRODUCTS OFFERED

10.6 SGL CARBON

TABLE 115 SGL CARBON: COMPANY OVERVIEW

FIGURE 32 SGL CARBON: COMPANY SNAPSHOT

TABLE 116 SGL CARBON: PRODUCTS OFFERED

10.7 IDI COMPOSITES INTERNATIONAL

TABLE 117 IDI COMPOSITES INTERNATIONAL: COMPANY OVERVIEW

TABLE 118 IDI COMPOSITES INTERNATIONAL: PRODUCTS OFFERED

10.8 ICOTEC AG

TABLE 119 ICOTECH AG: COMPANY OVERVIEW

TABLE 120 KYOCERA CORPORATION: PRODUCTS OFFERED

10.9 COMPOSIFLEX INC.

TABLE 121 COMPOSIFLEX INC.: COMPANY OVERVIEW

TABLE 122 COMPOSIFLEX INC.: PRODUCTS OFFERED

10.10 VERMONT COMPOSITES INC.

TABLE 123 VERMONT COMPOSITES INC.: COMPANY OVERVIEW

TABLE 124 VERMONT COMPOSITES INC.: PRODUCTS OFFERED

10.11 ACP COMPOSITES INC.

TABLE 125 ACP COMPOSITES INC.: COMPANY OVERVIEW

TABLE 126 ACP COMPOSITES INC.: PRODUCTS OFFERED

10.12 OTHER COMPANIES

10.12.1 MORGAN ADVANCED MATERIALS PLC

10.12.2 KYOCERA CORPORATION

10.12.3 COORSTEK INC.

10.12.4 TOKUYAMA DENTAL CORPORATION, INC.

10.12.5 IVOCLAR VIVADENT AG

10.12.6 SHOFU, INC.

10.12.7 KULZER GMBH

10.12.8 COLTENE GROUP

10.12.9 DEN-MAT HOLDINGS, LLC.

*Business Overview, Products Offered, Recent Developments, SWOT Analysis, Winning Imperatives, Development And Growth Strategies, Threat From Competition, Right To Win might not be captured in case of unlisted companies.

11 APPENDIX (Page No. - 157)

11.1 DISCUSSION GUIDE

11.2 KNOWLEDGE STORE: MARKETSANDMARKETS’ SUBSCRIPTION PORTAL

11.3 AVAILABLE CUSTOMIZATIONS

11.4 RELATED REPORTS

11.5 AUTHOR DETAILS

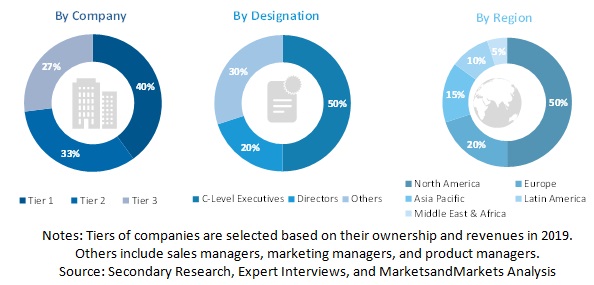

The study involves two major activities in estimating the current size of the medical composites market. Exhaustive secondary research was done to collect information on the market, the peer market, and the parent market. The next step was to validate these findings, assumptions, and sizing with industry experts across the value chain through primary research. Both the top-down and bottom-up approaches were employed to estimate the total market size. After that, market breakdown and data triangulation procedures were used to determine the extent of market segments and sub-segments.

Secondary Research

In the secondary research process, various secondary sources, such as Hoovers, Bloomberg BusinessWeek, and Factiva, were referred to identify and collect information for this study. These secondary sources included annual reports, press releases & investor presentations of companies, white papers, certified publications, articles by recognized authors, gold standard & silver standard websites, regulatory bodies, trade directories, and databases.

Primary Research

The medical composites market comprises several stakeholders, such as raw material suppliers, manufacturers, end-product users, and regulatory organizations in the supply chain. The demand side of this market is characterized by the development of mainly diagnostic imaging, composite body implants, dental, surgical instruments, and others. Advancements in technology and diverse usages in various application sectors describe the supply side. Various primary sources from both the supply and demand sides of the market were interviewed to obtain qualitative and quantitative information.

Following is the breakdown of primary respondents:

To know about the assumptions considered for the study, download the pdf brochure

Market Size Estimation

Both the top-down and bottom-up approaches were used to estimate and validate the total medical composites market. These methods were also used extensively to determine the size of various sub-segments in the market. The research methodology used to estimate the market size included the following:

- The key players in the industry and markets were identified through extensive secondary research.

- The industry’s supply chain and market size, in terms of value, were determined through primary and secondary research processes.

- All percentage shares, splits, and breakdowns were determined using secondary sources and verified through primary sources.

Data Triangulation

After arriving at the overall medical composites market size using the market size estimation processes as explained above, the market was split into several segments and sub-segments. To complete the whole market engineering process and arrive at the exact statistics of each market segment and subsegment, the data triangulation, and market breakdown procedures were employed, wherever applicable. The data was triangulated by studying various factors and trends from both the demand and supply sides, mainly from the diagnostic imaging, composite body implants, dental, and others.

Report Objectives

- To analyze and forecast the global medical composites market size, in terms of volume and value

- To provide detailed information about the key factors (drivers, restraints, opportunities, and challenges) influencing the growth of the market

- To analyze the market segmentation and forecast the market size based on fiber type and application.

- To analyze and forecast the market size based on five main regions, namely, Asia Pacific (APAC), Europe, North America, Middle East & Africa (MEA), and Latin America

- To analyze the market with respect to individual growth trends, prospects, and contribution of submarkets to the total market

- To analyze the market opportunities and the competitive landscape for stakeholders and market leaders

- To analyze competitive developments such as expansions, partnership, agreement, new product/technology launch, joint venture, contract, and merger & acquisition in the market

- To profile key players and comprehensively analyze their market share and core competencies

Available Customizations

With the given market data, MarketsandMarkets offers customizations according to the company’s specific needs.

The following customization options are available for the report:

Product Analysis

- Product matrix, which gives a detailed comparison of the product portfolio of each company

Regional Analysis

- Further breakdown of Rest of APAC medical composites market

- Further breakdown of Rest of European medical composites market

- Further breakdown of Rest of North American medical composites market

- Further breakdown of Rest of MEA medical composites market

- Further breakdown of Rest of Latin American medical composites market

Company Information

- Detailed analysis and profiling of additional market players (up to 10)

Generating Response ...

Generating Response ...

Growth opportunities and latent adjacency in Medical Composites Market