Automotive Engineering Services Market by Application, Service Type, Location (In-house, Outsource), Vehicle Type (Passenger Cars, Commercial Vehicles), Nature Type (Body Leasing, Turnkey), Propulsion (ICE, Electric) and Region - Global Forecast to 2028

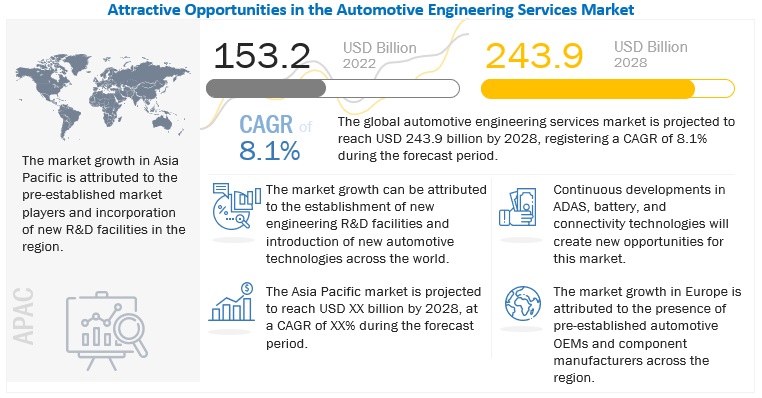

The global automotive engineering services market in terms of revenue was estimated to be worth USD 153.2 billion in 2022 and is poised to reach USD 243.9 billion by 2028, growing at a CAGR of 8.1% from 2022 to 2028. Automotive engineering service providers provide services such as concept/research, designing, prototyping, system integration, testing, among others to various global OEMs and component manufactures. Factors such as increased demand for zero-emission vehicles and strong government support have caused leading original equipment manufacturers (OEMs) to invest in R&D for automotive engineering services. OEMs and AES providers have set up R&D infrastructure all over the world to meet the rising demand of automotive engineering service in the global automotive market. With advances in technologies such as connected mobility, ADAS and safety features, new age battery technologies, among others, the automotive engineering services market is likely to grow.

To know about the assumptions considered for the study, Request for Free Sample Report

Market Dynamics:

Driver: Electrification of vehicles and increase in shared mobility

The increasing adoption of electric vehicles and the introduction of shared mobility are expected to change urban transportation. Increasing concerns over air pollution and global warming have compelled the governments of several countries to enforce strict emission policies and regulations for ICE vehicles. For example, in 2021, the US government announced its plan to replace all government vehicles with electric cars in a move to lower emissions by 2027. And the purchases of gas-powered vehicles are planned to end by 2035. The governments of Germany, Norway, the Netherlands, Japan, Singapore, and China have planned roadmaps to set up charging stations and provide subsidies to encourage more people to adopt electric vehicles. Similarly, the city of Toronto has announced its plan to replace 50% of its internal combustion engine (ICE fleet) with EVs and FCEVs. According to industry experts, electric vehicles will become more affordable than ICE vehicles as the cost of batteries declines over time. More EV sales would accentuate the need to develop new battery technologies, new chassis systems, innovative exterior designs, and advanced transmission systems for these vehicles. EV manufacturers such as Tesla, Nissan, and BAIC outsource the design and development of new technologies and solutions to Tier 1 engineering companies. This trend is likely to grow with the rise of EV sales and is expected to drive the automotive engineering services market during the forecast period.

Shared mobility allows sharing of rides among drivers and passengers with similar destination pairings. Operating expenses are shared among the passengers. Shared mobility reduces the number of vehicles on the road. Thus, it reduces traffic congestion and air pollution, especially in urban areas. Lyft, an online ridesharing services provider, plans to shift fully to EVs in the coming years and has set a target to operate 2,000,000 EVs by 2030 for its North American automotive engineering services market. This is currently the largest EV fleet commitment around the world. Many governments around the world are taking initiatives to uplift congestion-reduction solutions. Factors such as enhanced accessibility and reduced traffic by increased use of public transport, among others, will affect the shared mobility services. The governments of China, Japan, and the US have formed standard regulations for e-hailing service providers to allow ride-sharing features. Ride-sharing needs advanced location tracking, telematics, and vehicle connectivity solutions for smooth operations. These solutions require engineering service providers to develop advanced connectivity and safety features for ride-sharing. For instance, in 2021, Ricardo initiated the development of a new generation of connected vehicle software to fulfill its vision of fully autonomous ride-hailing and ride-sharing vehicles for global mobility-as-a-service.

Restraint: Digitization of R&D operations of global automotive OEMs

The shift in the business model of the automotive engineering services market has affected several vendors. Earlier, engineering services were charged based on the time and material business model. In this model, the client paid for the number of hours put into a project and additional material expenses. The vendor had the option to go over the budget to achieve the desired results and standards. Currently, clients are moving toward a fixed bid business model. In this model, a specific task is performed under a fixed price or a price range. This new model has significantly affected the revenue stream of vendors. For example, a vendor estimates a low price at the start of the project, but the budget goes beyond the set price at the end of the project. This scenario could negatively impact the business of the vendor after several repetitions. Similarly, if the vendor charges more, it may lose the project to a competitor.

Automotive research and development are a capital-intensive process. Making an early estimation for a process or technology can be a very risky proposition for the vendors. From the last decade, most of the automotive OEMs across the globe are shifting their business to digital. According to recent statistics, almost all the automotive OEMs have developed their digital strategy for different automotive engineering services. For instance, at the CES 2022, Hyundai announced its partnership with Unity Technologies to create and operate real-time 3D content (RT3D) and to together design and create an all new metaverse roadmap and a platform for Meta-factory. Through this partnership, Hyundai became the first mobility pioneer to create a Meta-factory concept. NVIDIA has also developed Omniverse for providing services such as training and simulation, advertising, car design, among others.

Opportunity: Stringent government regulations for automotive safety features

Governments of several countries have mandated safety features in upcoming vehicles to minimize incidents of over-speeding and fatal accidents. For example, the Union Road Transport Ministry of India proposed a mandate to incorporate advanced safety features, including Electronic Stability Control (ESC) and Autonomous Emergency Braking (AEB), in new vehicles between 2022 and 2023. The authority has also stressed that advanced safety features are required in all vehicles in India and cannot be confined to luxury vehicles only.

Likewise, in 2021, the US government signed a USD 1 trillion infrastructure law containing 10 new auto safety provisions including "modernizing standards" for crash avoidance technologies. Advanced safety features include advanced emergency braking, emergency lane-keeping systems, and improved car crash tests. All these mandates are crucial for overall road safety. Automotive manufacturers need to abide by the new mandates to improve passenger safety. For example, from July 2022, in Europe, a new Vehicle General Safety Regulation was applied which includes several mandatory advanced driver assistant systems to increase traffic safety and create the legal foundation for the EU's acceptance of automated and fully driverless vehicles systems. All these mandates will have a serious impact on vehicle safety in the coming years and are expected to save over 25,000 lives and avoid at least 140,000 injuries by 2038 in Europe. OEM initiatives to implement these features early will create a huge demand for these solutions from engineering service providers.

Challenge: Highly competitive and scattered market

There is intense competition among automotive engineering services market players in automotive engineering services with regards to pricing, capacity, size of the project, and time required to accomplish the project. Big companies are facing stiff competition from small players that have rapidly scaled their capacity and technology. Most top players have 1-3% market share, and the presence of multiple large players with around 0-1% market share means huge competition in the automotive engineering services market. The combination of IT and engineering as a total solution has helped system integrators such as HCL Technologies, Tata Consultancy Services, L&T Technologies, and Tech Mahindra to emerge as truly global competitors in engineering solutions. These companies provide almost all kinds of automotive engineering services, such as body engineering, chassis engineering, hybrid & electric mobility, infotainment & connectivity and powertrain engineering to various global OEMs around the world, which makes the competition intense manifolds in market. Earlier, these players were limited in offering cloud-based connectivity solutions. Presently, they provide engineering solutions, including engineering design, hardware system development, body engineering, and mechanical engineering. These solutions were earlier provided by big players such as Ricardo, AVL, and FEV. In addition, smaller players have cross-industry expertise in automotive engineering services. These vendors have a presence in emerging economies such as India and China due to low-cost operations. Their diverse expertise and low-cost services have increased competition in the industry.

Electrical, Electronics, and Body Controls to be the largest automotive engineering services market during forecast period

Electrical, electronics, and body controls play a crucial role in handling all the functions dedicated to passenger comfort and convenience. Services under the automotive electrical and electronics include power management modules, climate controls, power windows, body control modules, and smart mirrors and wipers. According to industry experts, automotive electrical, electronics, and body controls already have a high value-added proportion in vehicle development. The trend is expected to grow due to the adoption of electric vehicles and complex electronic components for a safer and functional driving experience. Service providers like L&T Technology Services and FEV have invested plenty of resources to develop electrical, electronics, and body control solutions in automotive engineering services. Increasing electrification would bring increasing complexity to equip these technologies in vehicles. These electric technologies need to be calibrated with the electronic control system to deliver a seamless experience to the driver. Also, the sheer number of OEMs from Europe moving toward electric versions of their existing models would require specialized engineering service providers for electrification. The autonomous driving-friendly regulations and infrastructure for electrified public transport from lawmakers in China, Japan, and Singapore have already encouraged OEMs like BYD to invest more in environment-friendly transportation. According to a report by Bloomberg NEF, China has a fleet of 421,000 electric buses compared to 300 in the US in 2020. The number is expected to reach 600,000 by 2025. More fleets would require specialized engineering solutions for electric, electronics, and body controls. Further developments in hybrid and electric vehicles would drive the global automotive engineering services market for electric, electronics, and body controls during the forecast period.

Electric Vehicle segment to be the fastest growing segment during the forecast period

Electric vehicles have witnessed rapid evolution with the ongoing developments in EV-related technologies and EV services. Automotive engineering services for EVs include services such as ADAS and safety; electrical, electronics, and body controls; battery development and management; charger testing; and motor controls. Growing EV demand due to incentives and OEM support will increase ER&D spending on electric vehicle technologies in the coming years. Electric vehicles represent a significant step forward to curb the environmental concerns related to pollution. Many companies such as IAV Automotive Engineering, and HARMAN International provide automotive engineering services to OEMs globally. For instance, in November 2021, IAV Automotive Engineering partnered with the Federal Ministry of Economics and Energy (Germany) and various other players to develop a more efficient EV technology. HARMAN also launched the Harman ExP Integrated Solution Suite in CES 2020 specifically for OEMs. The suite offers services such as Advanced Driver Assistance Bundle, Hyper Productivity Bundle, Multi-Modal Experience Bundle, and EV Plus Solution Bundle. Due to the rapid shift to EVs, OEMs and AES providers will increase their automotive engineering services spending on technologies related to EV batteries, motors and propulsion systems, ADAS and connectivity systems, and autonomous vehicles.

Automotive Engineering Services Companies

Autonomous driving and electrification would remain the focus areas of automotive engineering service providers

Automotive engineering services Companies are the driving force behind the development, innovation, and optimization of vehicles in the ever-evolving automotive industry. Some notable industry leaders in this automotive engineering services market include Capgemini (France), AKKA Technologies (Belgium), Tech Mahindra (India), HCL Technologies (India), AVL (Austria), Ricardo (UK), Bertrandt AG (Germany), Alten Group (France), L&T Technology Services (India), FEV (Germany) among others. These firms offer comprehensive services spanning powertrain development, vehicle safety, emissions testing, and more, contributing substantially to the industry's innovation and operational efficiency. Their pivotal role is to assist OEMs and component manufacturers in conceiving, designing, and producing advanced vehicles while adhering to rigorous regulatory standards.

The ramifications of these engineering service companies providers on the automotive ecosystem are far-reaching. They catalyze innovation, propelling cutting-edge technologies such as electric and autonomous vehicles and connected car solutions. Moreover, they actively drive cost optimization by enabling OEMs to outsource specific functions, ensuring regulatory compliance, expediting the time-to-market for new vehicle models, and upholding stringent quality and safety standards. Their collective impact is transformative, influencing the industry's evolution and charting a course toward cleaner, safer, and technologically advanced mobility solutions.

Automotive engineering service companies are increasingly focusing on new technologies, such as Automotive Electrification, ADAS, Autonomous Driving, and Connectivity. These technologies are areas where OEMs and Tier-1 Companies prefer outsourcing to develop competencies at lower costs. Prototyping and Designing are expected to remain the critical fields of investment by these companies, with the major focus area being passenger transport. Meanwhile, this automotive engineering services market expects to grow demand for Turnkey solutions in the coming years. Asia Pacific and Europe are expected to be the most prominent destinations of Automotive Engineering Service Operations, along with a rapid growth in setup across the North American Market.

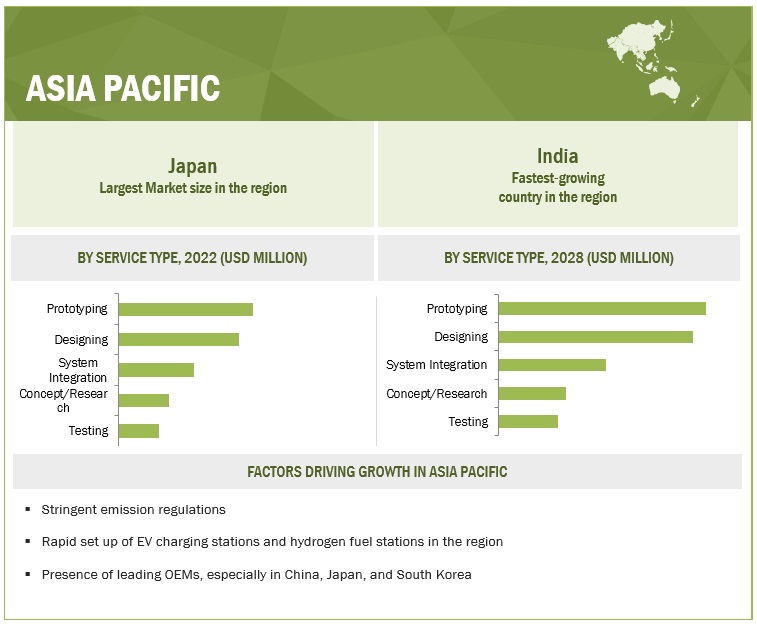

Asia Pacific to be the fastest growing market by value during the forecast period

Asia Pacific is expected to be the fastest-growing automotive engineering services market, with AES providers opening ER&D centres in the region due to lower resource cost and increasing profitability. Many governments in the Asia Pacific region are planning to replace their existing public fleets with electric vehicles in the future. The region is home to some big giants in the automotive engineering services industry, such as Tech Mahindra, HCL Technologies, Onward Technologies, Automotive Engineering Services (AES), T-Net Japan Co., Ltd., DesignTech Systems., and Horiba, Ltd. Apart from these, some new companies, such as L&T Technology Services and Imaginative Automotive Engineering Services, also provide automotive engineering services to OEMs worldwide. For instance, the newly incorporated L&T Technology Services partnered with BMW in August 2022 to provide engineering services to the OEM for a five-year period, mainly targeting connectivity and infotainment systems of BMW’s hybrid vehicle suite. Likewise, in October 2022, Tech Mahindra partnered with Foxconn. This partnership will focus on leveraging the R&D strength of various participants and developing reference designs with standards to bridge the gap for alliance members, thus accelerating innovation and reducing development cycles.

India is also expected to start exclusive programs to promote fuel cells. As of now, India ‘s presence is seen in the form of installations of backup power fuel cell systems for telecom towers. In December 2020, Indian Oil Corporation announced plans to buy 15 fuel cell buses for Delhi NCR. The company will produce hydrogen fuel in Faridabad. In February 2020, the Ministry of New and Renewable Energy (MNRE) partnered with NTPC and proposed the launch of a fuel cell bus project. The fuel cell bus developed by Tata Motors and ISRO in 2019 will be used for this purpose. Similarly, in 2022, KPIT launched the country’s first self-developed fuel cell bus.

Several European and American automobile manufacturers, such as Volkswagen (Germany), Mercedes-Benz (Germany), and General Motors (US), have shifted their production plants to developing countries. Major engineering solution providers such as Bertrandt AG (Germany), Capgemini (France), and Continental Engineering Services (Germany) have facilities across Asia Pacific region. In October 2021, US automaker Tesla opened its new R&D centre and gigafactory data centre in China to manufacture EVs. In March 2022, the Swedish OEM, Volvo Group, announced the expansion of its R&D operations in India. The new R&D facility in India will become Volvo’s largest R&D site outside Sweden. In August 2022, Japanese automaker, Suzuki, announced the setting up a global R&D company in India. Global OEMs in Japan, such as Toyota, Nissan, and Honda, have also worked with various automotive service providers. For instance, in February 2022, Toyota partnered with AVL to develop technologies such as Driver in Loop (DiL) with model-based calibration and testing to promote driving efficiency and quality. The DiL technology will mainly be used in the automotive testing process.

To know about the assumptions considered for the study, download the pdf brochure

Key Market Players

The automotive engineering services market is dominated by established players such as Capgemini (France), IAV Automotive Engineering (Germany), Tech Mahindra (India), AKKA Technologies (Belgium), and HCL Technologies (India), among others. These companies provide automotive engineering services to global OEMs and component manufacturers. These companies have set up R&D infrastructure and offer best-in-class engineering services to their customers.

Scope of the Report

|

Report Metrics |

Details |

| Market Size Available for Years | 2018–2028 |

| Base Year Considered | 2021 |

| Forecast Period | 2022–2028 |

| Forecast Units | Value (USD Million/USD Billion) |

| Segments Covered | Application, Location, Vehicle Type, Service, Propulsion, Nature Type |

| Geographies Covered | North America, Europe, Asia Pacific and Rest of the World |

| Companies Covered |

Capgemini (France), IAV Automotive Engineering (Germany), Tech Mahindra (India), AKKA Technologies (Belgium), and HCL Technologies (India) and others. A total of 30 major company profiles were covered and provided. |

This research report categorizes the automotive engineering services market based on application, location, vehicle type, service type, propulsion, nature type, and region

Based on Vehicle Type:

- Passenger Cars

- Commercial Vehicles

Based on Location:

- In-house

- Outsource

Based on Application:

- ADAS and safety

- Electrical, electronics, and body controls

- Chassis

- Connectivity services

- Interior, exterior, and body engineering

- Powertrain and exhaust

- Simulation

- Battery development and management

- Charger testing

- Motor controls

- Others

Based on Service:

- Concept/Research

- Designing

- Prototyping

- System Integration

- Testing

Based on Propulsion:

- ICE

- Electric

Based on Nature Type:

- Body Leasing

- Turnkey

Based on Region:

-

Asia Pacific

- China

- Japan

- India

- South Korea

- Rest of Asia Pacific

-

North America

- US

- Canada

- Mexico

-

Europe

- France

- Germany

- Italy

- Russia

- Spain

- UK

- Rest of Europe

-

Rest of the World

- Brazil

- Iran

- Others

Recent Developments

- In November 2022, IAV Automotive Engineering (IAV) launched a project which provides a method to find the emission from ICE vehicles on braking. It allows IAV to precisely evaluate the mass, number, and size of fine, ultra-fine particles generated during the braking process. This project was undertaken under the EU emission reduction project.

- In September 2022, Harman International (Harman) launched its new Ready Care service that detects driver behavior and provides solutions for safer driving. It offers solutions like Cognitive Distraction, Stress-Free Routing, and Personalized Comfort along with Herman’s connected vehicle solutions to improve driver safety.

- In September 2022, Tech Mahindra launched YANTRA.AI, a cognitive AI solution, to strengthen the company’s automotive solution portfolio and provide insights to enterprise partners for better planning and execution of their field services.

- In August 2022, AVL launched its new inverter test system service for testing inverters from e-motors and batteries and provide representation of safety-related reactions with standard specifications. The testing will provide a detailed, comprehensive validation of inverter performance.

- In April 2022, FEV launched its FEV.io Intelligent Mobility Software, which combines its expertise in intelligent mobility, software development, and innovative power solutions. As part of this offering, ADAS and connectivity services will be available for the automotive industry in an all-inclusive software suite.

- In February 2022, Harman International announced the launch of Ready Together and Software Enabled Branded Audio solution for integrated in-car experiences. This solution will combine the company’s connected vehicle solution offerings with its best-in-class automotive entertainment offerings for full engagement while driving cars.

- In February 2022, Bertrandt AG started providing radar-based ADAS testing services to its range of engineering services. This will enable its customers to carry out radar measurements and verifications using the testing laboratory before testing in an actual vehicle.

- In January 2022, FEV added a set of offering solutions for developing hybrid electric vehicles. The hybrid-BEV platform eliminates the need for developing multiple platforms for automakers.

Frequently Asked Questions (FAQ):

What is the current size of the automotive engineering services market?

The current size of the automotive engineering services market is estimated at USD 153.2 billion in 2022.

Who are the winners in the automotive engineering services market?

The automotive engineering services market is dominated by Capgemini (France), IAV Automotive Engineering (Germany), Tech Mahindra (India), AKKA Technologies (Belgium), and HCL Technologies (India), among others. These companies provide automotive engineering services to global OEMs and component manufacturers. These companies have set up R&D infrastructure and offer best-in-class engineering services to their customers.

Which region will have the fastest-growing market for automotive engineering services market?

Asia Pacific will be the fastest-growing region in the automotive engineering services market due to the huge volume of investments in the region and the high demand for zero-emission commercial and passenger transport vehicles.

What are the key technologies affecting the automotive engineering services market?

The key technologies affecting the automotive engineering services market are the ADAS and safety, hybrid EVs, connected mobility, and new battery technologies.

To speak to our analyst for a discussion on the above findings, click Speak to Analyst

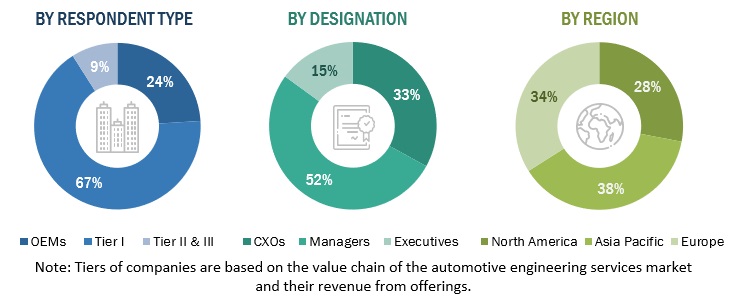

The study involved four major activities in estimating the current size of the automotive engineering services market. Exhaustive secondary research was done to collect information on the market, the peer market, and the parent market. The next step was to validate these findings, assumptions, and sizing with the industry experts across value chains through primary research. The top-down approach was employed to estimate the total market size. Thereafter, market breakdown and data triangulation were used in estimating the market size of segments and subsegments.

Secondary Research

In the secondary research process, various secondary sources such as company annual reports/presentations, press releases, industry association publications (for example, publications of automobile OEMs), automotive component associations, American Automobile Association (AAA), European Alternative Fuels Observatory (EAFO), International Energy Agency (IEA), country-level automotive associations, automobile magazines, articles, directories, technical handbooks, World Economic Outlook, trade websites, technical articles, and databases (for example, Marklines and Factiva) were used to identify and collect information for an extensive commercial study of the automotive engineering services market.

Primary Research

Extensive primary research was conducted after acquiring an understanding of the automotive engineering services market scenario through secondary research. Several primary interviews were conducted with market experts from both the demand (country-level government associations, AES providers, trade associations, institutes, R&D centers, OEMs/vehicle manufacturers) and supply (component manufacturers, software providers) sides across four major regions, namely North America, Europe, Asia Pacific and Rest of the world. 21% of the experts involved in primary interviews were from the demand side, while the remaining 79% were from the supply side.

Primary data was collected through questionnaires, emails, and telephonic interviews. Primary interviews were conducted from various departments within organizations, such as sales, operations, and administration, to provide a holistic viewpoint of the report. After interacting with industry participants, brief sessions were conducted with experienced independent consultants to reinforce the findings from the primaries. This, along with the in-house subject matter experts’ opinions, has led to the findings delineated in the rest of this report. Following is the breakdown of primary respondents:

To know about the assumptions considered for the study, download the pdf brochure

Market Size Estimation

The top-down approach was used to estimate and validate the total size of the automotive engineering services market. These methods were also used extensively to estimate the size of various subsegments in the market. The research methodology used to estimate the market size includes the following:

- The key players in the industry and markets have been identified through extensive secondary research.

- The industry’s future supply chain and market size, in terms of value, have been determined through primary and secondary research processes.

- All percentage shares, splits, and breakdowns have been determined using secondary sources and verified through primary sources.

Data Triangulation

After arriving at the overall market size—using the market size estimation processes as explained above—the market was split into several segments and subsegments. Data triangulation and market breakdown procedures were employed, wherever applicable, to complete the overall market engineering process and arrive at the exact statistics of each market segment and subsegment. The data was triangulated by studying various factors and trends from the supply side.

Report Objectives

-

To segment and forecast the automotive engineering services market size in terms of value (USD million)

- To define, describe, and forecast the market based on vehicle type, location, application, propulsion, service type, nature type, and region

- To segment the market and forecast its size, by volume and value, based on region (Asia Pacific, Europe, North America, and the Rest of the World)

- To segment and forecast the market based on vehicle type (passenger cars and commercial vehicles)

- To segment and forecast the market based on application (ADAS and safety; electrical, electronics, and body controls; chassis; connectivity services; interior, exterior, and body engineering; powertrain and exhaust; simulation; battery development & management; charger testing; motor controls; and others [portfolio management, acoustic engineering, energy consulting, quality management, and product lifecycle])

- To segment and forecast the market based on location (in-house and outsource

- To segment and forecast the market based on service type (concept/research, designing, prototyping, system integration, and testing)

- To segment and forecast the market based on propulsion (ICE and electric)

- To segment and forecast the market based on nature type (body leasing and turnkey)

- To analyze the technological developments impacting the market

- To analyze opportunities for stakeholders and the competitive landscape for market leaders

- To provide detailed information regarding the major factors influencing the market growth (drivers, challenges, restraints, and opportunities)

- To strategically analyze markets with respect to individual growth trends, prospects, and contributions to the total market

-

To study the following with respect to the market

- Value Chain Analysis

- Ecosystem

- Porter’s Five Forces Analysis

- Technology Analysis

- Case Study Analysis

- Patent Analysis

- Buying Criteria

- To strategically profile key players and comprehensively analyze their market shares and core competencies

- To track and analyze competitive developments such as deals (joint ventures, mergers & acquisitions, partnerships, collaborations), new product developments, and other activities carried out by key industry participants

Body Leasing & Its impact on Automotive Engineering Services Market

Body leasing is a business practise in which companies hire temporary employees, typically on a contract basis, to work on specific projects or to fill a temporary staffing need. The workers are not employees of the company, but rather of a third-party staffing agency that provides workers to the company. The market for companies that provide services related to the construction and engineering of buildings, infrastructure, and vehicles is referred to as the market. This includes design, engineering, construction, turnkey, and maintenance services.

Body leasing can be a valuable resource for companies in the construction and markets, giving them the flexibility and skilled labour they need to complete projects successfully.

Body Leasing can have a significant impact on the Automotive Engineering Services Market in several ways. Here are a few examples:

- Increased Flexibility: Body leasing provides companies with the flexibility to quickly adjust their workforce based on changing project needs.

- Access to Skilled Labour: Body leasing agencies can provide access to a wider pool of skilled labour, which can be particularly important for companies working on specialized projects or in regions with a shortage of skilled workers.

- Reduced Administrative Burden: Companies in the sequence of construction and market can reduce their administrative burden by outsourcing the recruitment, hiring, and management of temporary workers to a body leasing agency, allowing them to focus on their core business activities.

- Cost Savings: Body leasing can be a cost-effective way for companies to hire temporary workers, particularly for short-term or project-based work.

- Increased Competition: As body leasing becomes more widespread, it may increase competition in the sequence of construction and market.

The top players in the Body Leasing market are Adecco, Randstad, ManpowerGroup, Allegis Group, Kelly Services, Hays, Gi Group.

Some of the key industries that are going to get impacted because of the growth of Body Leasing are,

1. Information Technology (IT) - Body leasing can be used to hire temporary IT workers, allowing companies to quickly fill skill gaps or increase their workforce during busy periods.

2. Healthcare - Body leasing can be used to hire temporary healthcare professionals, such as nurses and physicians, to fill staffing gaps or provide additional support during busy periods.

3. Manufacturing - Body leasing can be used to hire temporary workers for manufacturing facilities, providing companies with flexibility and access to skilled labour when needed.

4. Hospitality - Body leasing can be used to hire temporary workers for hotels and restaurants, allowing companies to quickly scale up their workforce during busy periods.

5. Retail - Body leasing can be used to hire temporary workers for retail stores, allowing businesses to respond quickly to changing demand and provide extra assistance during peak sales periods.

6. Finance and Accounting - Body leasing can be used to hire temporary workers for finance and accounting functions, providing companies with access to specialized skills and expertise when needed.

7. Transportation and Logistics - Body leasing can be used to hire temporary workers for transportation and logistics functions like truck driving or warehouse operations, giving businesses flexibility and access to skilled labour when it is needed.

Speak to our Analyst today to know more about, "Body Leasing Market"

Available Customizations

Along with the market data, MarketsandMarkets offers customizations in line with a company’s specific needs.

- Automotive engineering services market, by vehicle type at country-level (for countries covered in the report)

- Automotive engineering services market, by application at country-level (for countries covered in the report)

Company Information:

- Profiling of additional market players (Up to 5)

Generating Response ...

Generating Response ...

Growth opportunities and latent adjacency in Automotive Engineering Services Market