Automotive Terminal Market by Application (Body Control & Interiors, Safety & Security, Cooling, Engine & Emission Control, Infotainment, Lighting System, and Battery System), Current Rating, Vehicle Type, EV Type, and Region - Global Forecast to 2025

The Global Automotive Terminal Market was valued at USD 11.69 Billion in 2016 and is projected to grow at a CAGR of 10.03% during the forecast period, to reach USD 27.14 Billion by 2025. In this study, 2016 has been considered the base year, and 2017–2025 the forecast period, for estimating the size of the automotive terminal market.

The report analyzes and forecasts the market size, by value (USD million), of the automotive terminal market. The report segments the automotive terminal market and forecasts its size, by region, application, current rating, on-highway vehicle, off-highway vehicle, and electric vehicle type. The report also provides a detailed analysis of various forces acting in the market including drivers, restraints, opportunities, and challenges. It strategically profiles key players and comprehensively analyzes their market shares and core competencies. It also tracks and analyzes competitive developments such as joint ventures, mergers & acquisitions, new product launches, expansions, and other activities carried out by key industry participants.

The research methodology used in the report involves various secondary sources such as National Highway Traffic Safety Administration (NHTSA), GENIVI Alliance, Japan Automobile Manufacturers Association (JAMA), European Automobile Manufacturers Association (ACEA), Canadian Automobile Association (CAA), and Korea Automobile Manufacturers Association (KAMA). Experts from related industries, automotive terminal suppliers, and manufacturers have been interviewed to understand the future trends in the automotive terminal market. The market size of the individual segments was determined through various secondary sources such as industry associations, white papers, and journals. The vendor offerings were also taken into consideration to determine the market segmentation. The bottom-up approach has been used to estimate and validate the size of the global automotive terminal market. The data triangulation and market breakdown procedures were employed to complete the overall market engineering process and arrive at the exact statistics for all the segments and sub segments.

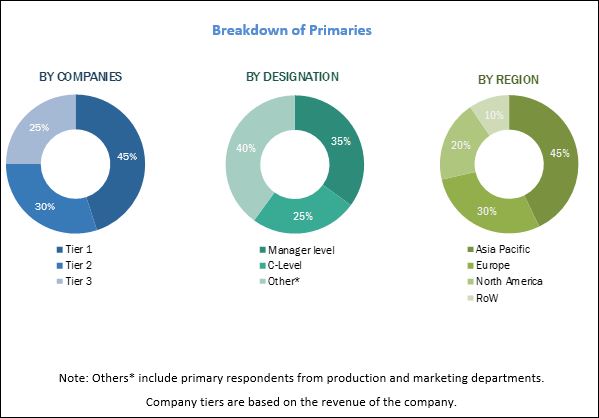

The figure given below illustrates the break-up of the profile of industry experts who participated in primary discussions.

To know about the assumptions considered for the study, download the pdf brochure

The ecosystem of the automotive terminal market consists of manufacturers such as TE Connectivity (Switzerland), Delphi (UK), Furukawa Electric (Japan), and PKC Group (Finland) and research institutes such as Colorado Off-highway Vehicle Coalition (COHVCO), Japan Automobile Manufacturers Association (JAMA), European Automobile Manufacturers Association (ACEA), Canadian Automobile Association (CAA), and Korea Automobile Manufacturers Association (KAMA).

Target Audience

- Automotive terminal manufacturers

- Infrastructure development companies

- Automobile organizations/associations

- Compliance regulatory authorities

- Government agencies

- Information Technology (IT) companies & system integrators

- Investors and Venture Capitalists (VCs)

- Raw material suppliers for automotive terminal

- Traders, distributors, and suppliers of automotive terminal

Scope of the Report

Automotive Terminal Market, By Region

Automotive Terminal Market, By Application

Automotive Terminal Market, By Current Rating

Automotive Terminal Market, By On-Highway Vehicle

Automotive Terminal Market, By Off-Highway Vehicle

Automotive Terminal Market, By Electric Vehicle

-

- North America

- Europe

- Asia Pacific

- Rest of the World (RoW)

- Body Control & Interiors

- Safety & Security

- Cooling, Engine & Emission Control

- Infotainment

- Lighting System

- Battery System

- Below 40 Ampere

- 41–100 Ampere

- Above 100 Ampere

- Passenger Cars (PC)

- Light Commercial Vehicle (LCV)

- Heavy Commercial Vehicle (HCV)

- Construction Vehicle

- Agricultural Vehicle

- Battery Electric Vehicle (BEV)

- Hybrid Electric Vehicle (HEV)

- Plug-In Hybrid Electric Vehicle (PHEV)

Available Customizations

MarketsandMarkets offers the following customizations for this market report:

- Detailed analysis and profiling of additional market players (up to 3)

- Detailed analysis of automotive terminal application for off-highway vehicle market

- Detailed analysis of automotive terminal for aftermarket

Increasing use of terminals that operate below 40 Ampere current rating are driving the global automotive terminal market close to $27 billion by 2025

The market share of automotive terminals below 40 Ampere is estimated to be the largest. These terminals are used in most of the power electronics in vehicles. This segment is projected to grow at a CAGR of 9.89% during the forecast period. The growth of the automotive terminal market depends on the factors mentioned below:

- Increasing sales of mid-size and luxury class vehicles in developing countries

- Increasing demand for vehicles with advanced electronics

- Expansion of leading OEMs and automotive component suppliers in low-cost countries and developing economies

- Innovation and development in the field of automotive artificial intelligence

The ecosystem of the automotive terminal market includes global automotive terminal manufacturers such as TE Connectivity (Switzerland), Delphi (UK), Furukawa Electric (Japan), and PKC Group (Finland). These original equipment manufacturers (OEMs) account for more than 80% share of the global automotive terminal market. These OEMs have long-term supply contracts with global automakers such as General Motors (US), Daimler (Germany), FCA (UK), BMW (Germany), and Tata Motors (India). It is therefore difficult for the new entrants and local manufacturers of terminals to compete in the automotive terminal market. TE Connectivity offers more than 1000 varieties of terminals that are used in vehicles more than any other competitor.

Market Dynamics

Drivers

- Increasing demand for automotive safety system supported by government mandates

- Increasing number of electrical systems in the vehicle

Restraints

- Terminals that are capable of handling vibration requirements

- Highly consolidated automotive terminal market

Opportunities

- Energy efficient E-Mobility

- Future perspective of connected, autonomous and semi-autonomous vehicles

Challenges

- Design issues with high voltage terminals

- Long term reliability challenge for battery terminals

Critical Questions:

- Compliance like Restrictions on Hazardous Substances (RoHS) is restricting terminal manufacturers to limit the use of hazardous raw material for manufacturing terminals. How this will impact overall pricing of terminals?

- The ecosystem of the automotive terminal market is dominated by few key players. How competitors and new entrants will strategize their growth?

- Where will all these developments take the industry in the mid to long term?

The Global Automotive Terminal Market is estimated to be USD 12.64 Billion in 2017 and is projected to grow at a CAGR of 10.03% during the forecast period, to reach USD 27.14 Billion by 2025. Some of the major growth drivers for the market are the increasing demand for automotive safety systems supported by government mandates and increasing number of electrical systems in the vehicle. The evolution of connected, autonomous, and semi-autonomous vehicles, as well as energy-efficient E-mobility, can create new revenue generation opportunities for automotive terminal manufacturers. However, design issues with high voltage terminals and long-term reliability of battery terminals can pose a challenge for automotive terminal manufacturers.

The global automotive terminal market is segmented by application, current rating, on-highway vehicle, off-highway vehicle, electric vehicle, and region. The report discusses six automotive terminal applications, namely, Body Control & Interiors, Safety & Security System, Cooling, Engine & Emission Control, Infotainment, Lighting System, and Battery System. Cooling, Engine & Emission Control segment accounted for the largest share in the automotive terminal market. This segment is driven by factors such as increasing electronic content for cooling and other applications such as engine controls and treatment of emitted gases.

The battery system segment is estimated to be the fastest growing market for automotive terminals, by application. It is followed by the lighting system, infotainment, body control & interiors, safety & security system, and cooling, engine & emission control. The battery system segment is estimated to experience significant growth due to the increasing number of battery packs in a vehicle for carrying out multiple applications.

The above 100 Ampere segment of the automotive terminal market is expected to grow at the highest CAGR during the forecast period. It is followed by 41–100 Ampere and below 40 Ampere segment. The below 40 Ampere segment is estimated to account for the largest share in the automotive terminal market, following its wide applications in vehicle electronics.

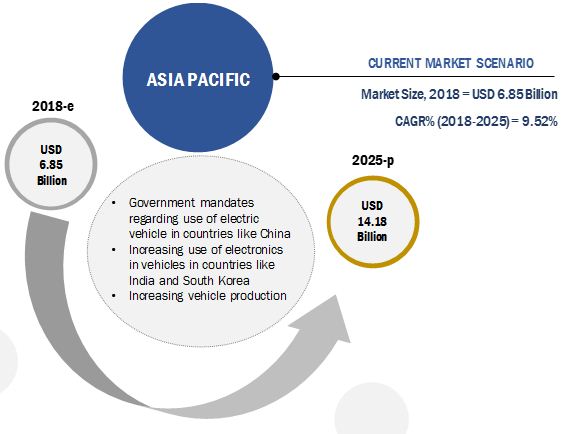

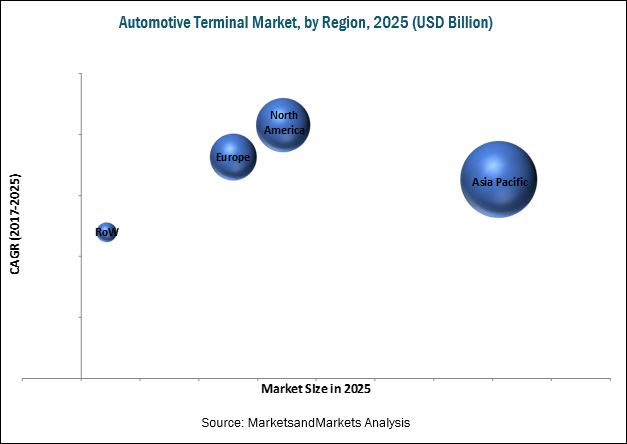

The extensive study has been done on four key regions, namely, Asia Pacific, Europe, North America, and the Rest of the World (RoW).

The Asia Pacific market is forecasted to hold the largest market share and is estimated to grow at a significant CAGR during the forecast period. The market growth in the region can be attributed to the increase in vehicle production and government mandates regarding the active and passive safety of vehicles. Increasing investment in infrastructure, construction activities, and increasing vehicle sales are also projected to drive the growth in this region.

Some of the major restraints for the global automotive terminal market are a highly consolidated market and terminals that are capable of handling vibration requirements. The advantages of mechatronics systems over traditional mechanical systems help to offer friendly operations and make the systems cost-effective for the end-user.

Some of the major players in the global automotive terminal market are TE Connectivity (Switzerland), Delphi (UK), Furukawa Electric (Japan), and PKC Group (Finland). The last chapter of this report covers a comprehensive study of the key vendors operating in the automotive terminal market. The evaluation of market players is done by taking several factors into account, such as new product development, R&D expenditure, business strategies, product revenue, and organic and inorganic growth.

The increasing number of electronic content in various vehicle applications such as engine management, safety system, body control, infotainment, lighting system and battery system to create tremendous growth opportunities for supply-side players.

Cooling, Engine & Emission Control

The cooling system is basically used to prevent overheating of a vehicle’s engine. Engine control unit serves various functions, which include regulating and maintaining the amount of fuel and air in the fuel injection part. Emission control system limits the discharge of noxious gases from the internal combustion engine and other components. These electronics applications require the maximum number of automotive terminals for their operations compared to other applications.

Safety & Security System

Various advanced technologies such as airbags, anti-lock braking system, steering control systems, and electronic stability control have enhanced the safety and security systems of a vehicle. Governments and transportation authorities of various developed and developing countries have mandated the installation of active and passive safety technologies in vehicles. The trend is expected to continue in the future. Thus, the use of factory fitted electronic components has increased over the years, which, in turn, requires several connection systems comprising various terminals.

Body Control & Interiors

The body controls are the electronic control units that monitor and control all the systems of the vehicle body. Terminals play a key role in body control and interiors. The body control and interiors consist of the wiper motor, switches, doors, mirrors, power windows, cluster, electric seats, active suspensions, and HVAC system, among others.

Infotainment

The infotainment system, also known as in-vehicle infotainment, consists of audio and video entertainment, navigation systems, Bluetooth connectivity, and Wi-Fi. It is used for enhancing driver and passenger experience. The infotainment systems consist of several electronic devices, which require various automotive terminals. The in-vehicle infotainment market is driven by the high installation rate of infotainment system in mid and premium segment cars. Additionally, the increasing application in entry-level vehicles will drive the market in developing countries.

Lighting System

The lighting system of an automobile comprises various lighting and signaling devices or components fixed to the front, sides, and rear of the vehicle. The lighting system of vehicles consists of the headlamp, tail lamp, fog lamp, and daytime running lamp. The lighting market for automotive is mainly driven by the increasing vehicle production and increasing lighting applications, especially in passenger cars. Additionally, factors such as passenger and pedestrian safety regulations and increased demand for luxury, comfort, and ambience are driving technological advancements in the automotive lighting industry.

Battery System

The main purpose of the battery pack in a vehicle is to supply the necessary power to the starter motor and ignition system while cranking to start the engine. It also supplies additional power when the demand is higher than the alternator’s capacity and acts as an electrical reservoir. Battery system in a vehicle includes the battery, battery cable, voltage regulator, battery terminals, main fuse block, starter motor, alternator, charging system wiring harness, and accessary fuse block. In this section, only the battery terminals that are attached to the battery are considered.

As electric content in cars has increased steadily in the last two decades, vehicle electronics has become a key product differentiator for automakers in recent years. In developing countries, the adoption of advanced safety features in vehicles is fueled largely by the regulatory bodies and consumer interest. Increasing adoption of advanced safety features, in turn, increases the number of electronic devices in the vehicle. Hence, the number of wiring harnesses that connect electrical devices has been increasing year-on-year. The addition of cameras and other safety-related sensors, along with multiple terminals needed for battery packs used in electrified powertrains, is driving the growth of the terminal market.

Critical Questions would be:

- Vehicles are getting smarter and smarter day by day with advanced electronics. How it is creating opportunities for the supply side?

- How increasing vehicle electrification will help terminal manufacturers to grab new revenue opportunities?

- In which regions, companies can create new revenue pockets for short as well as long term?

To speak to our analyst for a discussion on the above findings, click Speak to Analyst

Table of Contents

1 Introduction (Page No. - 15)

1.1 Objectives of the Study

1.2 Product and Market Definition

1.3 Market Scope

1.3.1 Years Considered for the Study

1.4 Currency Exchange Rates

1.5 Package Size

1.6 Limitations

1.7 Stakeholders

2 Research Methodology (Page No. - 19)

2.1 Research Data

2.2 Secondary Data

2.2.1 Key Secondary Sources

2.2.2 Key Data From Secondary Sources

2.3 Primary Data

2.3.1 Sampling Techniques & Data Collection Methods

2.3.2 Primary Participants

2.4 Market Size Estimation

2.4.1 Bottom-Up Approach

2.5 Market Breakdown and Data Triangulation

2.6 Assumptions

3 Executive Summary (Page No. - 27)

4 Premium Insights (Page No. - 32)

4.1 Attractive Opportunities in the Automotive Terminal Market

4.2 Automotive Terminal Market, By Region

4.3 Automotive Terminal Market, By Application

4.4 Automotive Terminal Market, By Current Rating

4.5 Automotive Terminal Market, By On-Highway Vehicle Type

4.6 Automotive Terminal Market, By Off-Highway Vehicle Type

4.7 Automotive Terminal Market, By Electric Vehicle Type

5 Market Overview (Page No. - 39)

5.1 Introduction

5.2 Market Dynamics

5.2.1 Drivers

5.2.1.1 Increasing Demand for Automotive Safety Systems Supported By Government Mandates

5.2.1.2 Increasing Number of Electrical Systems in the Vehicle

5.2.2 Restraints

5.2.2.1 Terminals That are Capable of Handling Vibration Requirements

5.2.2.2 Highly Consolidated Automotive Terminal Market

5.2.3 Opportunities

5.2.3.1 Energy Efficient E-Mobility

5.2.3.2 Future Perspective of Connected, Autonomous and Semi-Autonomous Vehicles

5.2.4 Challenges

5.2.4.1 Design Issues With High Voltage Terminals

5.2.4.2 Long-Term Reliability Challenge for Battery Terminals

6 Automotive Terminal Market, By Application (Page No. - 46)

6.1 Introduction

6.2 Cooling, Engine, & Emission Control

6.3 Safety & Security System

6.4 Body Control & Interiors

6.5 Infotainment

6.6 Lighting System

6.7 Battery System

7 Automotive Terminal Market, By Current Rating (Page No. - 55)

7.1 Introduction

7.2 Below 40 Ampere

7.3 41–100 Ampere

7.4 Above 100 Ampere

8 Automotive Terminal Market for On–Highway Vehicle, By Type (Page No. - 61)

8.1 Introduction

8.2 Passenger Car (PC)

8.3 Light Commercial Vehicle (LCV)

8.4 Heavy Commercial Vehicle (HCV)

9 Automotive Terminal Market, By Electric Vehicle (Page No. - 67)

9.1 Introduction

9.2 Battery Electric Vehicle (BEV)

9.3 Hybrid Electric Vehicle (HEV)

9.4 Plug-In Hybrid Electric Vehicle (PHEV)

10 Automotive Terminal Market for Off-Highway Vehicle, By Type (Page No. - 73)

10.1 Introduction

10.2 Agricultural Vehicle

10.3 Construction Vehicle

11 Automotive Terminal Market, By Region, 2017–2025 (Page No. - 77)

11.1 Introduction

11.2 Asia Pacific

11.2.1 China

11.2.2 Japan

11.2.3 India

11.2.4 South Korea

11.3 Europe

11.3.1 France

11.3.2 Germany

11.3.3 Italy

11.3.4 Spain

11.3.5 UK

11.4 North America

11.4.1 Canada

11.4.2 Mexico

11.4.3 US

11.5 Rest of the World

11.5.1 Brazil

11.5.2 Russia

12 Competitive Landscape (Page No. - 102)

12.1 Introduction

12.2 Market Ranking Analysis

12.3 Competitive Situation & Trends

12.3.1 Partnerships/Supply Contracts/Collaborations/ Joint Ventures

12.3.2 Mergers & Acquisitions

12.3.3 New Product Developments

13 Company Profiles (Page No. - 107)

(Business Overview, Products Offered, Recent Developments, SWOT Analysis, MnM View)*

13.1 TE Connectivity

13.2 Sumitomo Electric

13.3 Delphi

13.4 Lear

13.5 Furukawa Electric

13.6 PKC Group

13.7 Molex

13.8 Grote Industries

13.9 Keats Manufacturing

13.10 Viney Corporation

*Details on Business Overview, Products Offered, Recent Developments, SWOT Analysis, MnM View Might Not Be Captured in Case of Unlisted Companies.

14 Appendix (Page No. - 128)

14.1 Discussion Guide

14.2 Knowledge Store: Marketsandmarkets’ Subscription Portal

14.3 Introducing RT: Real Time Market Intelligence

14.4 Available Customizations

14.4.1 Additional Company Profiles

14.4.1.1 Business Overview

14.4.1.2 SWOT Analysis

14.4.1.3 Recent Developments

14.4.1.4 MnM View

14.4.1.5 Who–Supplies–Whom Data

14.4.2 Detailed Analysis of Automotive Applications

14.4.3 Detailed Analysis of Automotive Terminal in Off-Highway Vehicles

14.4.4 Detailed Analysis of Aftermarket

14.5 Related Reports

14.6 Author Details

List of Tables (83 Tables)

Table 1 Automotive Terminal Market, By Application, 2015–2025 (Million Units)

Table 2 Automotive Terminal Market, By Application, 2015–2025 (USD Million)

Table 3 Cooling, Engine, & Emission Control: Market, By Region, 2015–2025 (Million Units)

Table 4 Cooling, Engine, & Emission Control: Market, By Region, 2015–2025 (USD Million)

Table 5 Safety & Security System: Market, By Region, 2015–2025 (Million Units)

Table 6 Safety & Security System: Market, By Region, 2015–2025 (USD Million)

Table 7 Body Control & Interiors: Market, By Region, 2015–2025 (Million Units)

Table 8 Body Control & Interiors: Market, By Region, 2015–2025 (USD Million)

Table 9 Infotainment: Market, By Region, 2015–2025 (Million Units)

Table 10 Infotainment: Market, By Region, 2015–2025 (USD Million)

Table 11 Lighting System: Market, By Region, 2015–2025 (Million Units)

Table 12 Lighting System: Market, By Region, 2015–2025 (USD Million)

Table 13 Battery System: Market, By Region, 2015–2025 (Million Units)

Table 14 Battery System: Market, By Region, 2015–2025 (USD Million)

Table 15 Automotive Terminal Market, By Current Rating, 2015–2025 (Million Units)

Table 16 Automotive Terminal Market, By Current Rating, 2015–2025 (USD Million)

Table 17 Below 40 Ampere: Market, By Region, 2015–2025 (Million Units)

Table 18 Below 40 Ampere: Market, By Region, 2015–2025 (USD Million)

Table 19 41–100 Ampere: Market, By Region, 2015–2025 (Million Units)

Table 20 41–100 Ampere: Market, By Region, 2015–2025 (USD Million)

Table 21 Above 100 Ampere: Market, By Region, 2015–2025 (Million Units)

Table 22 Above 100 Ampere: Market, By Region, 2015–2025 (USD Million)

Table 23 Automotive Terminal Market for On-Highway Vehicles, By Type, 2015–2025 (Million Units)

Table 24 Automotive Terminal Market for On-Highway Vehicles, By Type, 2015–2025 (USD Million)

Table 25 Passenger Car: Market, By Region, 2015–2025 (Million Units)

Table 26 Passenger Car: Market, By Region, 2015–2025 (USD Million)

Table 27 Light Commercial Vehicle: Market, By Region, 2015–2025 (Million Units)

Table 28 Light Commercial Vehicle: Market, By Region, 2015–2025 (USD Million)

Table 29 Heavy Commercial Vehicle: Market, By Region, 2015–2025 (Million Units)

Table 30 Heavy Commercial Vehicle: Market, By Region, 2015–2025 (USD Million)

Table 31 Automotive Terminal Market for Electric Vehicles, By Type, 2015–2025 (Million Units)

Table 32 Automotive Terminal Market for Electric Vehicles, By Type, 2015–2025 (USD Million)

Table 33 BEV: Market, By Region, 2015–2025 (Million Units)

Table 34 BEV: Market, By Region, 2015–2025 (USD Million)

Table 35 HEV: Market, By Region, 2015–2025 (Million Units)

Table 36 HEV: Market, By Region, 2015–2025 (USD Million)

Table 37 PHEV: Market, By Region, 2015–2025 (Million Units)

Table 38 PHEV: Market, By Region, 2015–2025 (USD Million)

Table 39 Automotive Terminal Market for Off-Highway Vehicles, By Type, 2015–2025 (Million Units)

Table 40 Agricultural Vehicle: Market, By Region, 2015–2025 (Million Units)

Table 41 Construction Vehicle: Market, By Region, 2015–2025 (Million Units)

Table 42 Automotive Terminal Market, By Region, 2015–2025 (Million Units)

Table 43 Automotive Terminal Market, By Region, 2015–2025 (USD Million)

Table 44 Asia Pacific: Market, By Country, 2015–2025 (Million Units)

Table 45 Asia Pacific: Market, By Country, 2015–2025 (USD Million)

Table 46 China: Market, By Application, 2015–2025 (Million Units)

Table 47 China: Market, By Application, 2015–2025 (USD Million)

Table 48 Japan: Market, By Application, 2015–2025 (Million Units)

Table 49 Japan: Market, By Application, 2015–2025 (USD Million)

Table 50 India: Market, By Application, 2015–2025 (Million Units)

Table 51 India: Market, By Application, 2015–2025 (USD Million)

Table 52 South Korea: Market, By Application, 2015–2025 (Million Units)

Table 53 South Korea: Market, By Application, 2015–2025 (USD Million)

Table 54 Europe: Market, By Country, 2015–2025 (Million Units)

Table 55 Europe: Market, By Country, 2015–2025 (USD Million)

Table 56 France: Market, By Application, 2015–2025 (Million Units)

Table 57 France: Market, By Application, 2015–2025 (USD Million)

Table 58 Germany: Market, By Application, 2015–2025 (Million Units)

Table 59 Germany: Market, By Application, 2015–2025 (USD Million)

Table 60 Italy: Market, By Application, 2015–2025 (Million Units)

Table 61 Italy: Market, By Application, 2015–2025 (USD Million)

Table 62 Spain: Market, By Application, 2015–2025 (Million Units)

Table 63 Spain: Market, By Application, 2015–2025 (USD Million)

Table 64 UK: Market, By Application, 2015–2025 (Million Units)

Table 65 UK: Market, By Application, 2015–2025 (USD Million)

Table 66 North America: Market, By Country, 2015–2025 (Million Units)

Table 67 North America: Market, By Country, 2015–2025 (USD Million)

Table 68 Canada: Market, By Application, 2015–2025 (Million Units)

Table 69 Canada: Market, By Application, 2015–2025 (USD Million)

Table 70 Mexico: Market, By Application, 2015–2025 (Million Units)

Table 71 Mexico: Market, By Application, 2015–2025 (USD Million)

Table 72 US: Market, By Application, 2015–2025 (Million Units)

Table 73 US: Market, By Application, 2015–2025 (USD Million)

Table 74 RoW: Automotive Terminal Market, By Country, 2015–2025 (Million Units)

Table 75 RoW: Automotive Terminal Market, By Country, 2015–2025 (USD Million)

Table 76 Brazil: Market, By Application, 2015–2025 (Million Units)

Table 77 Brazil: Market, By Application, 2015–2025 (USD Million)

Table 78 Russia: Market, By Application, 2015–2025 (Million Units)

Table 79 Russia: Market, By Application, 2015–2025 (USD Million)

Table 80 Expansions, 2016-2018

Table 81 Partnerships/Joint Ventures/Supply Contracts/Collaborations, 2015–2018

Table 82 Mergers & Acquisitions, 2015–2018

Table 83 New Product Developments, 2016–2018

List of Figures (42 Figures)

Figure 1 Automotive Terminal : Market Segmentation

Figure 2 Automotive Terminal Market: Research Design

Figure 3 Research Design Model

Figure 4 Breakdown of Primary Interviews

Figure 5 Automotive Terminal Market: Bottom-Up Approach

Figure 6 Data Triangulation

Figure 7 Automotive Terminal Market Share (2017): Asia Pacific is Projected to Be the Largest Market

Figure 8 Cooling, Engine & Emission Control to Lead this Market Globally, 2017 vs 2025 (USD Billion)

Figure 9 Automotive Terminal Market Size, By Current Rating, 2017 vs 2025

Figure 10 Automotive Terminal Market Size, By On-Highway Vehicle, 2017 vs 2025

Figure 11 Automotive Terminal Market Size, By Electric Vehicle, 2017 vs 2025

Figure 12 Increasing Installation of Vehicle Electronics is Expected to Drive the Automotive Terminal Market, 2017–2025

Figure 13 Asia Pacific is Expected to Hold the Largest Share of the Automotive Terminal Market, By Value, 2017–2025

Figure 14 Battery System is Estimated to Be the Fastest Growing Market By Application, 2017 vs 2025 (USD Billion)

Figure 15 Below 40 Ampere Segment to Hold the Largest Market Share, 2017 vs 2025

Figure 16 Passenger Car is Estimated to Be the Largest Segment of the Automotive Terminal Market, By Value, 2017 vs 2025 (USD Billion)

Figure 17 Construction Vehicle Segment is Estimated to Be the Fastest Growing Market for Automotive Terminals, By Off-Highway Vehicle Type, 2017 vs 2025 (Million Units)

Figure 18 HEV Segment is Estimated to Be the Largest Market for Automotive Terminals, 2017 vs 2025 (USD Million)

Figure 19 Market Dynamics

Figure 20 Prominent Megatrends of Vehicle Electrification

Figure 21 Road Transportation Contributes Around 16% of Global Carbon Emission, 2016

Figure 22 Automotive Terminal Market: Cooling, Engine & Emission Control Segment to Account for the Largest Market Share, 2017–2025

Figure 23 Below 40 Ampere Segment to Account for the Largest Market Share During the Forecast Period

Figure 24 Automotive Terminal Market: Passenger Car (PC) Segment to Account for the Largest Market Share During the Forecast Period

Figure 25 Automotive Terminal Market for EV: HEV Segment to Account for the Largest Market Share During the Forecast Period

Figure 26 Automotive Terminal Market: Agricultural Vehicle to Account for the Largest Market Size in 2017

Figure 27 Asia Pacific to Dominate the Automotive Terminal Market, 2017 vs 2025 (USD Million)

Figure 28 The Automotive Terminal Market in the US is Estimated to Grow at the Highest Rate During the Forecast Period

Figure 29 Asia Pacific: Market Snapshot

Figure 30 North America: Market Snapshot

Figure 31 Automotive Terminal Market Ranking: 2017

Figure 32 TE Connectivity: Company Snapshot

Figure 33 TE Connectivity: SWOT Analysis

Figure 34 Sumitomo Electric: Company Snapshot

Figure 35 Sumitomo Electric: SWOT Analysis

Figure 36 Delphi: Company Snapshot

Figure 37 Delphi: SWOT Analysis

Figure 38 Lear: Company Snapshot

Figure 39 Lear: SWOT Analysis

Figure 40 Furukawa Electric: Company Snapshot

Figure 41 Furukawa Electric: SWOT Analysis

Figure 42 PKC Group: Company Snapshot

Growth opportunities and latent adjacency in Automotive Terminal Market