Automotive Power Electronics Market by Device Type (Power IC, Module & Discrete), Application, Component (Sensor & Microcontroller), Material, Vehicle Type (Passenger Vehicle, LCV & HCV), Electric Vehicle Type, and Region - Global Forecast to 2025

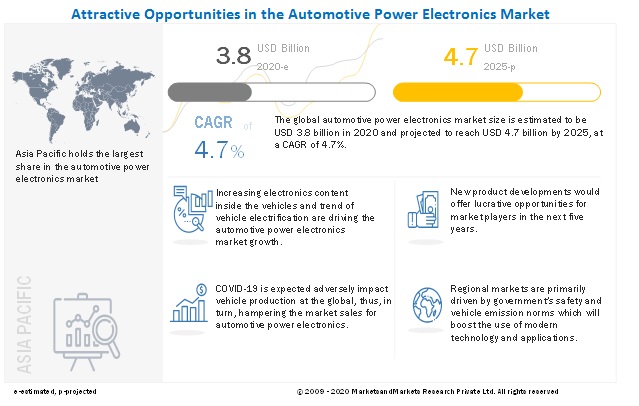

[271 Pages Report] The global automotive power electronics market size is projected to grow from USD 3.8 billion in 2020 to USD 4.7 billion by 2025, at a CAGR of 4.7%. Compliance with upcoming safety, vehicle emission mandates and increasing demand for vehicle connectivity, infotainment and powertrain electrification will drive the market for automotive power electronics.

The COVID-19 pandemic has led to the suspension of vehicle production and supply disruptions, which have brought the automotive industry to a halt. Lower vehicle sales will be a major concern for automotive OEMs for the next few quarters. According to experts, there is a slim chance of vehicle sale recovery in 2020. The automotive power electronics market, however, is expected to witness a significant boost in 2022 owing to the mandates by different countries. Before that, lower vehicle sales and abrupt stoppage in the development of new automotive technologies will result in sluggish growth of the automotive power electronics market in 2021.

To know about the assumptions considered for the study, Request for Free Sample Report

COVID-19 impact on automotive power electronics market:

major automotive power electronics solution providers such as Bosch and Continental have announced the suspension of production due to the lowered demand, supply chain bottlenecks, and to protect the safety of their employees in France, Germany, Italy, and Spain during the COVID-19 pandemic. As a result, the demand for automotive power electronics solutions is expected to decline in 2020. Manufacturers are likely to adjust production to prevent bottlenecks and plan production according to demand from OEMs and tier 1 manufacturers.

Major automotive power electronics solution providers lost revenue in Q1 2020. As the resumption of vehicle production is not likely in the immediate future due to the severity of the pandemic, especially in the US and major European countries, tier 1 players suspect a further decline in revenue in the remaining quarters of 2020. For instance, Aptiv’s advanced safety and user segment logged revenue of USD 902 million in Q1 2020 compared to USD 1,023 in Q1 2019, a decline of 13%. According to the company, the scenario could be worse in Q2 as global vehicle production is expected to fall by 50-60%. The company suspended production in China, followed by North America and Europe. Automotive power electronics providers are facing disruptions in supply chains as countries are in a state of lockdown to prevent the spread of the disease. Thus, the market for automotive power electronics is estimated to undergo a declining phase in 2020.

Market Dynamics:

Driver: Rising trend of vehicle electrification

The increasing manufacturing and sale of plug-in hybrid electric vehicles (PHEVs) are expected to create significant opportunities for the power electronics market in the transportation application. Besides, the increasing number of charging stations propels the use of power electronic components, such as power management integrated circuits (PMICs), intelligent power modules (IPMs), insulated gate bipolar transistors (IGBT), and standard & power integrated modules. The advent of electric vehicles (EVs) is one of the most important steps in environmental conservation. They require an electric power supply instead of fossil fuel to function and, thus, are eco-friendly. This factor has fueled the growth of the electric vehicles market. As these vehicles completely rely on the electrical power supply, the adoption of electronic devices in the manufacturing of these vehicles is high. The growth of the EVs market is projected to have a significant impact on the power electronics market in the coming years.

Restraint: Complex design and integration process for advanced applications

There is a shift in the automotive power electronics industry toward the integration of multiple functionalities on a single chip, which is ultimately resulting in complex designing. This shift reflects a drive in the industry for advanced and cost-optimized solutions that deliver reduced switching losses, reduction in the module size, and improved power efficiency. However, these advanced technology devices have a high switching frequency, which has its own set of design challenges. The complex design structure of control algorithms decreases the switching speed, and hence, affects the overall performance of the control structure. Some devices also present cooling challenges for design engineers.

Opportunity: Increasing use of SiC and GaN products in vehicle applications

The emergence of wide bandgap materials, such as GaN and SiC, have changed the landscape of the power electronics market. These new semiconductor materials offer better thermal conductivity, higher switching speeds, and are physically smaller devices than traditional silicon (Si) ones. The use of SiC and GaN has resulted in improvements in the existing semiconductor technologies, such as MOSFETs and isolated gate bipolar transistors (IGBTs). These materials can be leveraged by customers for a wide range of applications.

Challenge: Demand for compact devices with higher efficiency

For products fabricated with wafer-scale technologies, miniaturization and cost are strongly interdependent. The smaller the device surface area, the more the devices that could be placed on a wafer, and the lower is the processing cost per die. This principle has led to a continuous drive toward the miniaturization of power electronics products, which also helps to improve the performance of these devices. Moreover, as the current generation is moving toward compact and portable devices, the major challenge faced by power electronic device manufacturers is meeting the changing needs of the automotive OEMs. To cater to the demand for compact, portable, and multifunctional devices, the components and systems need to be downsized to reduce the size of the component.

The passenger vehicle segment is expected to be the largest during the forecast period

The passenger vehicle segment makes a major contribution to the automotive power electronics market. The increased demand for safety systems and fuel efficient technology associated with vehicle power train in emerging markets are fueling factor for the dominance of passenger vehicle. From past 5 or 10 years, passenger vehicles are getting installed with number of safety, comfort, entertainment and vehicle management features. This is because of factor such as changing preferences of vehicle buyer supported by government legislations. OEMs are also quite active in launching new variants and new models of vehicle that will fulfill the need of customers. Increasing population in developing economies also encourage OEMs to add specific features in new models of passenger vehicles. This is done to highlight own products among other products available in the market. OEMs, Tier I and Tier II also try to deploy new technology or features in the mass produced vehicle among vehicle category, i.e. passenger vehicles. These are some of the factor that are responsible for the dominance of passenger vehicle segment in the market.

Body control and comfort will have a major share in the automotive power electronics market during the forecast period

Body control and comfort application by application type segment dominates the automotive power electronics market. Body control and comfort comprise of sub-applications like TPMS, lighting, seat control, HVAC and start-stop module. Some of these are good to have applications/systems inside the vehicle. TPMS is a good to have feature for the safety of the vehicle. Lightings include both interior and exterior lightings. These are getting modern with the use of LED lights, Seat controls are getting advanced with the use of mechatronics actuators and control. HVAC is installed in almost every passenger vehicles now a days. Whereas, start-stop is growing rapidly specially in European and North American countries. Every sub-application of the body control and comfort segment is showing good growth. This because of most modern as well as customized features can be offered in these sub-applications. Customers across the globe like to have control of the vehicle interior and exterior features. These are some of the factors that fuel the market for body control and comfort and led this segment to hold maximum share in market.

Some leading manufacturers and suppliers of automotive power electronics are Robert Bosch (Germany), Continental (Germany), Infineon (Germany), STMicroelectronics (Switzerland), and ON Semiconductor (US). These Tier I and Tier II suppliers have adopted new product development as their key strategy to stay competitive in the automotive power electronics market. Their main focus for new product development was on use of GaN and SiC, innovation in transistor packaging material, on-board charger for electric vehicles, power converters for electric vehicles, etc.

To know about the assumptions considered for the study, download the pdf brochure

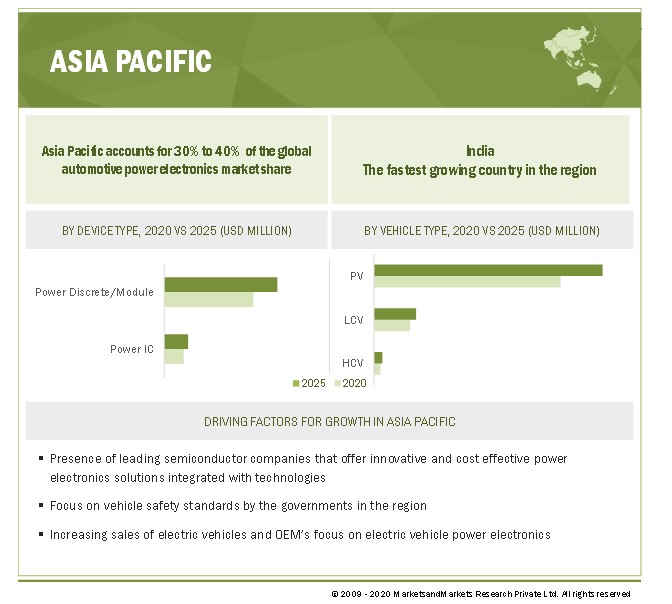

“The Asia pacific automotive power electronics market is projected to hold the largest share by 2025.”

China, South Korea, and Japan account for the largest share of the automotive power electronics market in the Asia Pacific region. The growth of the market in Asia Pacific can be attributed to the high vehicle production and increased use of advanced electronics in Japan, South Korea, and China. The governments of these countries have recognized the growth potential of the automotive industry and have consequently taken different initiatives to encourage major OEMs to enter their domestic markets. Several European and American automobile manufacturers such as Volkswagen (Germany), Mercedes Benz (Germany), and General Motors (US) have shifted their production plants to developing countries. Moreover, the region is a home of leading semiconductor suppliers. Easy availability of power electronics components and devices made the Asia Pacific the leading regional market for automotive power electronics.

Major automotive power electronics solution providers such as Robert Bosch (Germany), Continental (Germany), etc. have production facilities across the region. Despite the slowdown in vehicle sales due to the COVID-19 pandemic, existing safety mandates would surely boost the penetration of automotive power electronics features in upcoming vehicles. For instance, China mandated TPMS in vehicles from 2019. The country is also considering mandating automatic emergency braking during the forecast period. In addition, the Chinese government released multiple measures to boost economic recovery, including stabilizing domestic consumption, supporting new energy vehicle development, and other monetary and fiscal policies. As a result, the auto industry is projected to show significant improvement in the second quarter of 2020. Economic assistance, upcoming mandates, and the growth of Chinese OEMs would drive the demand for automotive power electronics in the country.

Japan is a key market for advanced electrical and electronic components in the Asia Pacific region. The Ministry of Land, Infrastructure, Transport and Tourism (MLITT), announced plans to mandate AEB for all new passenger cars by November 2021. Existing models will have this feature by December 2025, while all imported vehicles will have AEB by June 2024. The Ministry for Road Transport and Highways (India) planned to adopt automotive power electronics features by 2022. Features such as electronic stability control and automatic emergency braking have been considered in the first phase. Tier 1 manufacturers such as Continental are collaborating with OEMs in India to support the implementation by 2022-2023.

Key Market Players

The global automotive power electronics market is dominated by major players such as Robert Bosch (Germany), Continental AG (Germany), Infineon (Germany), ON semiconductor (US), STMicroelectronics (Switzerland), Danfoss (Denmark). These companies have secure distribution networks at a global level and offer a wide range of power electronics products for traditional as well as electric vehicle. The key strategies adopted by these companies to sustain their market position are new product developments, acquisitions, etc.

Scope of the Report

|

Report Metric |

Details |

|

Market size available for years |

2017–2025 |

|

Base year considered |

2019 |

|

Forecast period |

2020–2025 |

|

Forecast units |

Volume (Million Units) and Value (USD Million) |

|

Segments covered |

Device type, Application Type Electric, Component Type, Material Type, Vehicle Type, Vehicle Type, and Region |

|

Geographies covered |

Asia Pacific, North America, Europe, South America and Rest of the World |

|

Companies Covered |

Robert Bosch (Germany), Continental AG (Germany), Infineon (Germany), STMicroelectronics (Switzerland), ON Semiconductor (US), NXP Semiconductor (Netherlands), Danfoss, (Denmark) and Vishay (US). |

This research report categorizes the automotive power electronics market based on device type, application type electric, component type, material type, vehicle type, vehicle type, and region

Based on device:

- Power IC

- Power Module/Discrete

Based on application:

- ADAS & safety

- Body control & comfort

- Infotainment

- Telematics

- Engine management & powertrain

- Battery management

Based on component

- Microcontroller

- Sensor

Based on material

- Silicon

- Silicon Carbide

- Gallium Nitride

- Others

Based on vehicle type:

- Passenger Vehicle

- Light Commercial Vehicle

- Heavy Commercial Vehicle

Based on electric vehicle:

- Battery Electric Vehicles (BEV)

- Plug-in Hybrid Electric Vehicle (PHEV)

Based on the region:

-

Asia Pacific

- China

- India

- Japan

- South Korea

- Thailand

- Rest of Asia Pacific

-

North America

- US

- Canada

- Mexico

-

Europe

- France

- Germany

- Russia

- Spain

- Turkey

- UK

- Rest of Europe

-

South America

- Brazil

- Argentina

- Rest of South America

-

Rest of the World

- Iran

- South Africa

- Others in RoW

Recent Developments

- In April 2020, Infineon Technologies launches its new product family: the CoolMOS™ CFD7A series. These silicon-based, high-performance products can be used in both the PFC and the DC-DC stage of on-board charger systems and HV-LV DC-DC converters specifically optimized for electric-vehicle applications.

- In April 2020, Infineon Technologies AG completes the acquisition of Cypress Semiconductor Corporation. Cypress adds a differentiated portfolio of microcontrollers, connectivity components, software ecosystems, and high-performance memories.

- In March 2020, Infineon Technologies launched new packages for its 80 V and 100 V MOSFETs with OptiMOS™ 5 technology to meet the different requirements of different 48 V applications.

- In January 2020, STMicroelectronics exhibits the latest solutions for automotive systems At Automotive World 2020. ST demonstrated electric traction for next-generation EVs using its industry-leading SiC (Silicon Carbide) power MOSFETs with cutting-edge small packages.

- In July 2019, At IAA 2019, Continental introduced the 48-volt high-power drive system with 30 kW. Continental Powertrain is mastering all variants of the electric drive, from 48-volt systems to hybrid technologies, right through to high-voltage components.

Frequently Asked Questions (FAQ):

Does this report cover forecasted data for power management devices?

Yes, the report covers power devices such as power module/discrete and power IC.

Which countries are considered in the European region?

The report includes the following European countries

- Germany

- France

- Spain

- Turkey

- Russia

- UK

- Rest of Europe

We are interested in the regional automotive power electronics market for electric vehicles. Does this report cover electric vehicles?

Yes, the automotive power electronics market for electric vehicles is covered at a global level. However, regional level markets can be provided as a separate customization.

Does this report include the impact of COVID-19 on power electronics?

Yes, the market includes qualitative insights on the COVID-19 impact and forecast.

Does this report contain the market size of automotive power electronics applications especially for electric vehicle?

Yes, the market size of automotive power electronics c applications like on-board charger, battery management, motor and AC-DC, DC-AC and DC-DC converters has been provided in terms of value. .

To speak to our analyst for a discussion on the above findings, click Speak to Analyst

TABLE OF CONTENTS

1 INTRODUCTION (Page No. - 43)

1.1 OBJECTIVES OF THE STUDY

1.2 PRODUCT DEFINITION

1.2.1 INCLUSIONS & EXCLUSIONS

TABLE 1 INCLUSIONS & EXCLUSIONS FOR THE AUTOMOTIVE POWER ELECTRONICS MARKET

1.3 MARKET SCOPE

FIGURE 1 MARKET SEGMENTATION

1.3.1 YEARS CONSIDERED FOR THE STUDY

1.4 PACKAGE SIZE

1.5 LIMITATIONS

1.6 STAKEHOLDERS

1.7 SUMMARY OF CHANGES

FIGURE 2 MARKETSANDMARKETS DOWNGRADES ITS FORECAST OF THE AUTOMOTIVE POWER ELECTRONICS MARKET

2 RESEARCH METHODOLOGY (Page No. - 50)

2.1 RESEARCH DATA

FIGURE 3 MARKET: RESEARCH DESIGN

FIGURE 4 RESEARCH DESIGN MODEL

2.2 SECONDARY DATA

2.2.1 KEY SECONDARY SOURCES

2.2.2 KEY DATA FROM SECONDARY SOURCES

2.3 PRIMARY DATA

FIGURE 5 BREAKDOWN OF PRIMARY INTERVIEWS

2.3.1 SAMPLING TECHNIQUES & DATA COLLECTION METHODS

2.3.2 PRIMARY PARTICIPANTS

2.4 FACTOR ANALYSIS

2.4.1 DEMAND-SIDE ANALYSIS

2.4.1.1 System topology dictates the size and functional requirements of the power electronics components

TABLE 2 REQUIRED FEATURES OF AN AUTOMOTIVE POWER ELECTRONICS COMPONENT

2.4.1.2 Emergence of new concepts of autonomous and connected cars

2.4.2 SUPPLY-SIDE ANALYSIS

2.4.2.1 Stringent safety regulations and demand for comfort & luxury influencing the automotive power electronics market

2.5 MARKET SIZE ESTIMATION

2.5.1 DEMAND-SIDE APPROACH

FIGURE 6 DEMAND-SIDE APPROACH: MARKET

2.5.2 PARENT MARKET TEAR DOWN APPROACH

FIGURE 7 PARENT MARKET TEAR DOWN APPROACH: MARKET

2.5.3 BOTTOM-UP APPROACH

FIGURE 8 BOTTOM-UP APPROACH: AUTOMOTIVE POWER ELECTRONICS MARKET

2.6 MARKET BREAKDOWN

FIGURE 9 DATA TRIANGULATION

2.7 ASSUMPTIONS/CONSIDERATIONS

2.8 LIMITATIONS

2.9 RISK ASSESSMENT & RANGES

TABLE 3 RISK ASSESSMENT & RANGES

3 EXECUTIVE SUMMARY (Page No. - 63)

FIGURE 10 MARKET OUTLOOK: AUTOMOTIVE POWER ELECTRONICS

TABLE 4 FOCUS OF AUTOMOTIVE POWER ELECTRONICS COMPANIES IN CONTEXT OF NEW PRODUCT DEVELOPMENTS

FIGURE 11 AUTOMOTIVE POWER ELECTRONICS MARKET: MARKET DYNAMICS

FIGURE 12 MARKET: REGIONAL OVERVIEW

FIGURE 13 MARKET, BY DEVICE TYPE, 2020 VS. 2025

FIGURE 14 MARKET FOR ELECTRIC VEHICLE, BY DEVICE TYPE, 2020 VS. 2025

FIGURE 15 COVID-19 IMPACT ON THE MARKET

4 PREMIUM INSIGHTS (Page No. - 68)

4.1 BRIEF OVERVIEW OF THE MARKET

FIGURE 16 INCREASING ELECTRONICS CONTENT PER VEHICLE IS EXPECTED TO DRIVE THE AUTOMOTIVE POWER ELECTRONICS MARKET

4.2 ASIA PACIFIC MARKET, BY VEHICLE TYPE AND COUNTRY

FIGURE 17 PASSENGER VEHICLE SEGMENT AND CHINA PROJECTED TO BE THE LARGEST IN THE MARKET, BY VEHICLE TYPE AND COUNTRY, IN TERMS OF VALUE

4.3 MARKET, BY COUNTRY

FIGURE 18 MEXICO AND BRAZIL EXPECTED TO WITNESS FAST GROWTH DURING 2020-2025 (VALUE)

4.4 MARKET, BY APPLICATION TYPE

FIGURE 19 BODY CONTROL & COMFORT SEGMENT IS PROJECTED TO HAVE THE LARGEST MARKET SHARE BY 2025, IN TERMS OF VALUE

4.5 AUTOMOTIVE POWER ELECTRONICS MARKET, BY VEHICLE TYPE

FIGURE 20 PASSENGER VEHICLE SEGMENT IS ESTIMATED TO DOMINATE THE MARKET, IN TERMS OF VALUE

4.6 MARKET, BY DEVICE TYPE

FIGURE 21 POWER MODULE/DISCRETE SEGMENT IS ESTIMATED TO DOMINATE THE MARKET

4.7 MARKET FOR ELECTRIC VEHICLE, BY DEVICE TYPE

FIGURE 22 AC-DC, DC-AC & DC-DC CONVERTER SEGMENT IS ESTIMATED TO DOMINATE THE MARKET

5 MARKET OVERVIEW (Page No. - 73)

5.1 INTRODUCTION

5.2 MARKET DYNAMICS

FIGURE 23 AUTOMOTIVE POWER ELECTRONICS MARKET DYNAMICS

5.2.1 DRIVERS

5.2.1.1 Increasing modernization of vehicles to impact the power electronics market

5.2.1.2 Increasing demand for energy-efficient, battery-powered devices

5.2.1.3 Rising trend of vehicle electrification

5.2.2 RESTRAINTS

5.2.2.1 Increase in the overall cost of the vehicle

5.2.2.2 Complex design and integration process for advanced applications

5.2.3 OPPORTUNITIES

5.2.3.1 Growing demand for advanced safety, convenience, and comfort systems

5.2.3.2 Increasing use of SiC and GaN products in vehicle applications

5.2.4 CHALLENGES

5.2.4.1 Managing cost and quality of power electronic components

5.2.4.2 Demand for compact devices with high efficiency

5.2.5 IMPACT OF MARKET DYNAMICS

TABLE 5 AUTOMOTIVE POWER ELECTRONICS MARKET: IMPACT OF MARKET DYNAMICS

5.3 REVENUE SHIFT DRIVING MARKET GROWTH

FIGURE 24 REVENUE SHIFT DRIVING THE MARKET GROWTH

5.4 VALUE CHAIN ANALYSIS

FIGURE 25 VALUE CHAIN ANALYSIS: MARKET

5.5 AVERAGE SELLING PRICE TREND

FIGURE 26 AVERAGE SELLING PRICE TREND: MARKET

6 INDUSTRY TREND (Page No. - 83)

6.1 AUTOMOTIVE POWER ELECTRONICS LIFE CYCLE

FIGURE 27 AUTOMOTIVE POWER ELECTRONICS LIFECYCLE

6.2 TECHNOLOGY ANALYSIS

6.2.1 DOUBLE-SIDE COOLING OF POWER MODULE

FIGURE 28 CUSTOM POWER MODULE OF TOYOTA LS600

6.3 AUTOMOTIVE POWER ELECTRONICS MARKET TRENDS

6.3.1 USE OF GALLIUM NITRIDE TECHNOLOGY

6.3.2 USE OF MODERN INVERTERS FOR ELECTRIC VEHICLES

6.3.3 PACKAGING TREND OF POWER MODULES FOR ELECTRIC VEHICLES

6.4 PORTER’S FIVE FORCES

FIGURE 29 PORTER’S FIVE FORCES: MARKET

7 IMPACT ANALYSIS: COVID-19 (Page No. - 87)

7.1 INTRODUCTION TO COVID-19

7.2 COVID-19 HEALTH ASSESSMENT

FIGURE 30 COVID-19: THE GLOBAL PROPAGATION

FIGURE 31 COVID-19 PROPAGATION: SELECT COUNTRIES

7.3 COVID-19 ECONOMIC ASSESSMENT

FIGURE 32 REVISED GDP FORECASTS FOR SELECT G20 COUNTRIES IN 2020

7.3.1 SCENARIOS IN TERMS OF RECOVERY OF THE GLOBAL ECONOMY

FIGURE 33 CRITERIA IMPACTING THE GLOBAL ECONOMY

FIGURE 34 SCENARIOS IN TERMS OF RECOVERY OF THE GLOBAL ECONOMY

7.4 COVID-19 AND THE AUTOMOTIVE INDUSTRY

TABLE 6 IMPACT OF COVID-19 ON LARGE AUTOMOTIVE MARKETS

7.5 OEM ANNOUNCEMENTS

TABLE 7 OEM ANNOUNCEMENTS

7.6 IMPACT ON THE GLOBAL AUTOMOTIVE INDUSTRY AND VEHICLE PRODUCTION

7.7 IMPACT OF COVID-19 ON THE AUTOMOTIVE POWER ELECTRONICS MARKET

7.8 MARKET, SCENARIOS (2020–2025)

FIGURE 35 MARKET– FUTURE TRENDS & SCENARIO, 2020–2025 (USD MILLION)

7.8.1 MOST LIKELY SCENARIO

TABLE 8 MARKET (MOST LIKELY), BY REGION, 2017–2025 (USD MILLION)

7.8.2 OPTIMISTIC SCENARIO

TABLE 9 MARKET (OPTIMISTIC), BY REGION, 2017–2025 (USD MILLION)

7.8.3 PESSIMISTIC SCENARIO

TABLE 10 MARKET (PESSIMISTIC), BY REGION, 2017–2025 (USD MILLION)

8 AUTOMOTIVE POWER ELECTRONICS MARKET, BY MATERIAL TYPE (Page No. - 98)

8.1 INTRODUCTION

TABLE 11 SEMICONDUCTOR BANDWIDTH COMPARISON OF VARIOUS MATERIALS

8.2 SILICON (SI)

8.3 SILICON CARBIDE (SIC)

8.4 GALLIUM NITRIDE (GAN)

8.5 OTHERS

8.5.1 GALLIUM OXIDE (GA2O3)

8.5.2 DIAMOND (C)

9 AUTOMOTIVE POWER ELECTRONICS MARKET, BY DEVICE TYPE (Page No. - 101)

9.1 INTRODUCTION

FIGURE 36 POWER MODULE/DISCRETE DEVICE TYPE TO DOMINATE THE MARKET BY 2025 (USD MILLION)

TABLE 12 MARKET, BY DEVICE TYPE, 2017–2019 (MILLION UNITS)

TABLE 13 MARKET, BY DEVICE TYPE, 2020–2025 (MILLION UNITS)

TABLE 14 MARKET, BY DEVICE TYPE, 2017–2019 (USD MILLION)

TABLE 15 MARKET, BY DEVICE TYPE, 2020–2025 (USD MILLION)

9.1.1 ASSUMPTIONS

9.1.2 RESEARCH METHODOLOGY FOR DEVICE TYPE

9.2 DEVICE TYPE

9.2.1 POWER IC

TABLE 16 POWER IC: AUTOMOTIVE POWER ELECTRONICS MARKET, BY REGION, 2017–2019 (MILLION UNITS)

TABLE 17 POWER IC: MARKET, BY REGION, 2020–2025 (MILLION UNITS)

TABLE 18 POWER IC: MARKET, BY REGION, 2017–2019 (USD MILLION)

TABLE 19 POWER IC: MARKET, BY REGION, 2020–2025 (USD MILLION)

9.2.2 POWER MODULE

9.2.2.1 Intelligent Power Module (IPM)

9.2.2.2 Power Integrated Module (PIM)

9.2.3 POWER DISCRETE

9.2.3.1 Diode

9.2.3.2 Transistor

9.2.3.3 Thyristor

TABLE 20 POWER MODULE/DISCRETE: AUTOMOTIVE POWER ELECTRONICS MARKET, BY REGION, 2017–2019 (MILLION UNITS)

TABLE 21 POWER MODULE/DISCRETE: MARKET, BY REGION, 2020–2025 (MILLION UNITS)

TABLE 22 POWER MODULE/DISCRETE: MARKET, BY REGION, 2017–2019 (USD MILLION)

TABLE 23 POWER MODULE/DISCRETE: MARKET, BY REGION, 2020–2025 (USD MILLION)

9.3 KEY INDUSTRY INSIGHTS

10 AUTOMOTIVE POWER ELECTRONICS MARKET, BY APPLICATION TYPE (Page No. - 110)

10.1 INTRODUCTION

FIGURE 37 BODY CONTROL & COMFORT SEGMENT TO DOMINATE THE MARKET BY 2025 (USD MILLION)

TABLE 24 MARKET, BY APPLICATION TYPE, 2017–2019 (MILLION UNITS)

TABLE 25 MARKET, BY APPLICATION TYPE, 2020–2025 (MILLION UNITS)

TABLE 26 MARKET, BY APPLICATION TYPE, 2017–2019 (USD MILLION)

TABLE 27 MARKET, BY APPLICATION TYPE, 2020–2025 (USD MILLION)

10.1.1 ASSUMPTIONS

10.1.2 RESEARCH METHODOLOGY FOR APPLICATION TYPE

10.2 APPLICATION TYPE

10.2.1 ADAS & SAFETY

TABLE 28 ADAS & SAFETY: AUTOMOTIVE POWER ELECTRONICS MARKET, BY SUB-APPLICATION, 2017–2019 (MILLION UNITS)

TABLE 29 ADAS & SAFETY: MARKET, BY SUB-APPLICATION, 2020–2025 (MILLION UNITS)

TABLE 30 ADAS & SAFETY: MARKET, BY SUB-APPLICATION, 2017–2019 (USD MILLION)

TABLE 31 ADAS & SAFETY: MARKET, BY SUB-APPLICATION, 2020–2025 (USD MILLION)

10.2.1.1 ADAS

TABLE 32 ADAS: MARKET, BY REGION, 2017–2019 (MILLION UNITS)

TABLE 33 ADAS: MARKET, BY REGION, 2020–2025 (MILLION UNITS)

TABLE 34 ADAS: MARKET, BY REGION, 2017–2019 (USD MILLION)

TABLE 35 ADAS: MARKET, BY REGION, 2020–2025 (USD MILLION)

10.2.1.2 Electric power steering (EPS)

TABLE 36 ELECTRIC POWER STEERING: AUTOMOTIVE POWER ELECTRONICS MARKET, BY REGION, 2017–2019 (MILLION UNITS)

TABLE 37 ELECTRIC POWER STEERING: MARKET, BY REGION, 2020–2025 (MILLION UNITS)

TABLE 38 ELECTRIC POWER STEERING: MARKET, BY REGION, 2017–2019 (USD MILLION)

TABLE 39 ELECTRIC POWER STEERING: MARKET, BY REGION, 2020–2025 (USD MILLION)

10.2.1.3 Anti-lock braking system (ABS)

TABLE 40 ANTI-LOCK BRAKING SYSTEM: MARKET, BY REGION, 2017–2019 (MILLION UNITS)

TABLE 41 ANTI-LOCK BRAKING SYSTEM: AUTOMOTIVE POWER ELECTRONICS MARKET, BY REGION, 2020–2025 (MILLION UNITS)

TABLE 42 ANTI-LOCK BRAKING SYSTEM: MARKET, BY REGION, 2017–2019 (USD MILLION)

TABLE 43 ANTI-LOCK BRAKING SYSTEM: MARKET, BY REGION, 2020–2025 (USD MILLION)

10.2.2 BODY CONTROL & COMFORT

TABLE 44 BODY CONTROL & COMFORT: MARKET, BY SUB-APPLICATION, 2017–2019 (MILLION UNITS)

TABLE 45 BODY CONTROL & COMFORT: MARKET, BY SUB-APPLICATION, 2020–2025 (MILLION UNITS)

TABLE 46 BODY CONTROL & COMFORT: MARKET, BY SUB-APPLICATION, 2017–2019 (USD MILLION)

TABLE 47 BODY CONTROL & COMFORT: MARKET, BY SUB-APPLICATION, 2020–2025 (USD MILLION)

10.2.2.1 TPMS

TABLE 48 TPMS: AUTOMOTIVE POWER ELECTRONICS MARKET, BY REGION, 2017–2019 (MILLION UNITS)

TABLE 49 TPMS: MARKET, BY REGION, 2020–2025 (MILLION UNITS)

TABLE 50 TPMS: MARKET, BY REGION, 2017–2019 (USD MILLION)

TABLE 51 TPMS: MARKET, BY REGION, 2020–2025 (USD MILLION)

10.2.2.2 Lighting

10.2.2.2.1 Exterior Lighting

10.2.2.2.2 Interior Lighting

TABLE 52 LIGHTING: MARKET, BY REGION, 2017–2019 (MILLION UNITS)

TABLE 53 LIGHTING: MARKET, BY REGION, 2020–2025 (MILLION UNITS)

TABLE 54 LIGHTING: MARKET, BY REGION, 2017–2019 (USD MILLION)

TABLE 55 LIGHTING: MARKET, BY REGION, 2020–2025 (USD MILLION)

10.2.2.3 Seat control

10.2.2.3.1 Heated Seats

10.2.2.3.2 Seat Adjustment

TABLE 56 SEAT CONTROL: AUTOMOTIVE POWER ELECTRONICS MARKET, BY REGION, 2017–2019 (MILLION UNITS)

TABLE 57 SEAT CONTROL: MARKET, BY REGION, 2020–2025 (MILLION UNITS)

TABLE 58 SEAT CONTROL: MARKET, BY REGION, 2017–2019 (USD MILLION)

TABLE 59 SEAT CONTROL: MARKET, BY REGION, 2020–2025 (USD MILLION)

10.2.2.4 HVAC

TABLE 60 HVAC: MARKET, BY REGION, 2017–2019 (MILLION UNITS)

TABLE 61 HVAC: MARKET, BY REGION, 2020–2025 (MILLION UNITS)

TABLE 62 HVAC: MARKET, BY REGION, 2017–2019 (USD MILLION)

TABLE 63 HVAC: AUTOMOTIVE POWER ELECTRONICS MARKET, BY REGION, 2020–2025 (USD MILLION)

10.2.2.5 Start-stop module

TABLE 64 START-STOP MODULE: MARKET, BY REGION, 2017–2019 (MILLION UNITS)

TABLE 65 START-STOP MODULE: MARKET, BY REGION, 2020–2025 (MILLION UNITS)

TABLE 66 START-STOP MODULE: MARKET, BY REGION, 2017–2019 (USD MILLION)

TABLE 67 START-STOP MODULE: MARKET, BY REGION, 2020–2025 (USD MILLION)

10.2.3 INFOTAINMENT

TABLE 68 INFOTAINMENT: AUTOMOTIVE POWER ELECTRONICS MARKET, BY SUB-APPLICATION, 2017–2019 (MILLION UNITS)

TABLE 69 INFOTAINMENT: MARKET, BY SUB-APPLICATION, 2020–2025 (MILLION UNITS)

TABLE 70 INFOTAINMENT: MARKET, BY SUB-APPLICATION, 2017–2019 (USD MILLION)

TABLE 71 INFOTAINMENT: MARKET, BY SUB-APPLICATION, 2020–2025 (USD MILLION)

10.2.3.1 Instrument cluster

TABLE 72 INSTRUMENT CLUSTER: MARKET, BY REGION, 2017–2019 (MILLION UNITS)

TABLE 73 INSTRUMENT CLUSTER: MARKET, BY REGION, 2020–2025 (MILLION UNITS)

TABLE 74 INSTRUMENT CLUSTER: MARKET, BY REGION, 2017–2019 (USD MILLION)

TABLE 75 INSTRUMENT CLUSTER: AUTOMOTIVE POWER ELECTRONICS MARKET, BY REGION, 2020–2025 (USD MILLION)

10.2.3.2 Audio System

TABLE 76 AUDIO SYSTEM: MARKET, BY REGION, 2017–2019 (MILLION UNITS)

TABLE 77 AUDIO SYSTEM: MARKET, BY REGION, 2020–2025 (MILLION UNITS)

TABLE 78 AUDIO SYSTEM: MARKET, BY REGION, 2017–2019 (USD MILLION)

TABLE 79 AUDIO SYSTEM: MARKET, BY REGION, 2020–2025 (USD MILLION)

10.2.4 TELEMATICS

TABLE 80 TELEMATICS: MARKET, BY SUB-APPLICATION, 2017–2019 (MILLION UNITS)

TABLE 81 TELEMATICS: MARKET, BY SUB-APPLICATION, 2020–2025 (MILLION UNITS)

TABLE 82 TELEMATICS: MARKET, BY SUB-APPLICATION, 2017–2019 (USD MILLION)

TABLE 83 TELEMATICS: AUTOMOTIVE POWER ELECTRONICS MARKET, BY SUB-APPLICATION, 2020–2025 (USD MILLION)

10.2.4.1 Vehicle management

TABLE 84 VEHICLE MANAGEMENT: MARKET, BY REGION, 2017–2019 (MILLION UNITS)

TABLE 85 VEHICLE MANAGEMENT: MARKET, BY REGION, 2020–2025 (MILLION UNITS)

TABLE 86 VEHICLE MANAGEMENT: MARKET, BY REGION, 2017–2019 (USD MILLION)

TABLE 87 VEHICLE MANAGEMENT: MARKET, BY REGION, 2020–2025 (USD MILLION)

10.2.4.2 V2X

TABLE 88 V2X: AUTOMOTIVE POWER ELECTRONICS MARKET, BY REGION, 2017–2019 (MILLION UNITS)

TABLE 89 V2X: MARKET, BY REGION, 2020–2025 (MILLION UNITS)

TABLE 90 V2X: MARKET, BY REGION, 2017–2019 (USD MILLION)

TABLE 91 V2X: MARKET, BY REGION, 2020–2025 (USD MILLION)

10.2.5 ENGINE MANAGEMENT & POWERTRAIN

TABLE 92 ENGINE MANAGEMENT & POWERTRAIN: MARKET, BY SUB-APPLICATION, 2017–2019 (MILLION UNITS)

TABLE 93 ENGINE MANAGEMENT & POWERTRAIN: MARKET, BY SUB-APPLICATION, 2020–2025 (MILLION UNITS)

TABLE 94 ENGINE MANAGEMENT & POWERTRAIN: MARKET, BY SUB-APPLICATION, 2017–2019 (USD MILLION)

TABLE 95 ENGINE MANAGEMENT & POWERTRAIN: AUTOMOTIVE POWER ELECTRONICS MARKET, BY SUB-APPLICATION, 2020–2025 (USD MILLION)

10.2.5.1 Engine control

TABLE 96 ENGINE CONTROL: MARKET, BY REGION, 2017–2019 (MILLION UNITS)

TABLE 97 ENGINE CONTROL: MARKET, BY REGION, 2020–2025 (MILLION UNITS)

TABLE 98 ENGINE CONTROL: MARKET, BY REGION, 2017–2019 (USD MILLION)

TABLE 99 ENGINE CONTROL: MARKET, BY REGION, 2020–2025 (USD MILLION)

10.2.5.2 Transmission control

TABLE 100 TRANSMISSION CONTROL: AUTOMOTIVE POWER ELECTRONICS MARKET, BY REGION, 2017–2019 (MILLION UNITS)

TABLE 101 TRANSMISSION CONTROL: MARKET, BY REGION, 2020–2025 (MILLION UNITS)

TABLE 102 TRANSMISSION CONTROL: MARKET, BY REGION, 2017–2019 (USD MILLION)

TABLE 103 TRANSMISSION CONTROL: MARKET, BY REGION, 2020–2025 (USD MILLION)

10.2.6 BATTERY MANAGEMENT

TABLE 104 BATTERY MANAGEMENT: MARKET, BY REGION, 2017–2019 (MILLION UNITS)

TABLE 105 BATTERY MANAGEMENT: MARKET, BY REGION, 2020–2025 (MILLION UNITS)

TABLE 106 BATTERY MANAGEMENT: MARKET, BY REGION, 2017–2019 (USD MILLION)

TABLE 107 BATTERY MANAGEMENT: MARKET, BY REGION, 2020–2025 (USD MILLION)

10.3 KEY INDUSTRY INSIGHTS

11 AUTOMOTIVE POWER ELECTRONICS MARKET, BY COMPONENT TYPE (Page No. - 146)

11.1 INTRODUCTION

FIGURE 38 SYSTEM BLOCK DIAGRAM

FIGURE 39 SENSOR TO DOMINATE THE MARKET BY 2025 (USD MILLION)

TABLE 108 MARKET, BY COMPONENT TYPE, 2017–2019 (MILLION UNITS)

TABLE 109 MARKET, BY COMPONENT TYPE, 2020–2025 (MILLION UNITS)

TABLE 110 MARKET, BY COMPONENT TYPE, 2017–2019 (USD MILLION)

TABLE 111 MARKET, BY COMPONENT TYPE, 2020–2025 (USD MILLION)

11.1.1 ASSUMPTIONS

11.1.2 RESEARCH METHODOLOGY FOR COMPONENT TYPE

11.2 SENSOR

TABLE 112 SENSOR: AUTOMOTIVE POWER ELECTRONICS MARKET, BY REGION, 2017–2019 (MILLION UNITS)

TABLE 113 SENSOR: MARKET, BY REGION, 2020–2025 (MILLION UNITS)

TABLE 114 SENSOR: MARKET, BY REGION, 2017–2019 (USD MILLION)

TABLE 115 SENSOR: MARKET, BY REGION, 2020–2025 (USD MILLION)

11.3 MICROCONTROLLER

TABLE 116 MICROCONTROLLER: MARKET, BY REGION, 2017–2019 (MILLION UNITS)

TABLE 117 MICROCONTROLLER: MARKET, BY REGION, 2020–2025 (MILLION UNITS)

TABLE 118 MICROCONTROLLER: MARKET, BY REGION, 2017–2019 (USD MILLION)

TABLE 119 MICROCONTROLLER: MARKET, BY REGION, 2020–2025 (USD MILLION)

11.4 KEY INDUSTRY INSIGHTS

12 AUTOMOTIVE POWER ELECTRONICS MARKET, BY VEHICLE TYPE (Page No. - 154)

12.1 INTRODUCTION

FIGURE 40 PASSENGER VEHICLE SEGMENT TO DOMINATE THE MARKET BY 2025 (USD MILLION)

TABLE 120 MARKET, BY VEHICLE TYPE, 2017–2019 (MILLION UNITS)

TABLE 121 MARKET, BY VEHICLE TYPE, 2020–2025 (MILLION UNITS)

TABLE 122 MARKET, BY VEHICLE TYPE, 2017–2019 (USD MILLION)

TABLE 123 MARKET, BY VEHICLE TYPE, 2020–2025 (USD MILLION)

12.1.1 ASSUMPTIONS

12.1.2 RESEARCH METHODOLOGY FOR VEHICLE TYPE

12.2 VEHICLE TYPE

12.2.1 PASSENGER VEHICLE

TABLE 124 PASSENGER VEHICLE: AUTOMOTIVE POWER ELECTRONICS MARKET, BY REGION, 2017–2019 (MILLION UNITS)

TABLE 125 PASSENGER VEHICLE: MARKET, BY REGION, 2020–2025 (MILLION UNITS)

TABLE 126 PASSENGER VEHICLE: MARKET, BY REGION, 2017–2019 (USD MILLION)

TABLE 127 PASSENGER VEHICLE: MARKET, BY REGION, 2020–2025 (USD MILLION)

12.2.2 LIGHT COMMERCIAL VEHICLE

TABLE 128 LIGHT COMMERCIAL VEHICLE: AUTOMOTIVE POWER ELECTRONICS MARKET, BY REGION, 2017–2019 (MILLION UNITS)

TABLE 129 LIGHT COMMERCIAL VEHICLE: MARKET, BY REGION, 2020–2025 (MILLION UNITS)

TABLE 130 LIGHT COMMERCIAL VEHICLE: MARKET, BY REGION, 2017–2019 (USD MILLION)

TABLE 131 LIGHT COMMERCIAL VEHICLE: MARKET, BY REGION, 2020–2025 (USD MILLION)

12.2.3 HEAVY COMMERCIAL VEHICLE

TABLE 132 HEAVY COMMERCIAL VEHICLE: AUTOMOTIVE POWER ELECTRONICS MARKET, BY REGION, 2017–2019 (MILLION UNITS)

TABLE 133 HEAVY COMMERCIAL VEHICLE: MARKET, BY REGION, 2020–2025 (MILLION UNITS)

TABLE 134 HEAVY COMMERCIAL VEHICLE: MARKET, BY REGION, 2017–2019 (USD MILLION)

TABLE 135 HEAVY COMMERCIAL VEHICLE: MARKET, BY REGION, 2020–2025 (USD MILLION)

12.3 KEY INDUSTRY INSIGHTS

13 AUTOMOTIVE POWER ELECTRONICS MARKET, BY ELECTRIC VEHICLE TYPE (Page No. - 163)

13.1 INTRODUCTION

13.1.1 BATTERY MANAGEMENT SYSTEM (BMS)

13.1.2 ON-BOARD CHARGER (OBC)

13.1.3 MOTOR

13.1.4 AC-DC, DC-AC & DC-DC CONVERTER

13.1.5 ASSUMPTIONS

13.1.6 RESEARCH METHODOLOGY FOR ELECTRIC VEHICLE TYPE

FIGURE 41 MARKET FOR ELECTRIC VEHICLE, BY APPLICATION, 2020-2025 (USD MILLION)

TABLE 136 MARKET FOR ELECTRIC VEHICLE, BY APPLICATION, 2017–2019 (USD MILLION)

TABLE 137 MARKET FOR ELECTRIC VEHICLE, BY APPLICATION, 2020–2025 (USD MILLION)

13.2 BATTERY ELECTRIC VEHICLES

TABLE 138 BATTERY ELECTRIC VEHICLES: AUTOMOTIVE POWER ELECTRONICS MARKET, BY APPLICATION, 2017–2019 (USD MILLION)

TABLE 139 BATTERY ELECTRIC VEHICLES: MARKET, BY APPLICATION, 2020–2025 (USD MILLION)

13.3 HYBRID ELECTRIC VEHICLES

13.4 PLUG-IN HYBRID ELECTRIC VEHICLES

TABLE 140 PHEVS: MARKET, BY APPLICATION, 2017–2019 (USD MILLION)

TABLE 141 PHEVS: MARKET, BY APPLICATION, 2020–2025 (USD MILLION)

13.5 KEY INDUSTRY INSIGHTS

14 AUTOMOTIVE POWER ELECTRONICS MARKET, BY REGION (Page No. - 170)

14.1 INTRODUCTION

FIGURE 42 AVERAGE SELLING PRICE TREND FOR THE MARKET

FIGURE 43 ASIA PACIFIC TO DOMINATE THE MARKET

TABLE 142 MARKET, BY REGION, 2017–2019 (MILLION UNITS)

TABLE 143 MARKET, BY REGION, 2020–2025 (MILLION UNITS)

TABLE 144 MARKET, BY REGION, 2017–2019 (USD MILLION)

TABLE 145 MARKET, BY REGION, 2020–2025 (USD MILLION)

14.1.1 ASSUMPTIONS

14.1.2 RESEARCH METHODOLOGY FOR REGION

14.2 ASIA PACIFIC

FIGURE 44 ASIA PACIFIC: MARKET SNAPSHOT

TABLE 146 ASIA PACIFIC: MARKET, BY COUNTRY, 2017–2019 (MILLION UNITS)

TABLE 147 ASIA PACIFIC: MARKET, BY COUNTRY, 2020–2025 (MILLION UNITS)

TABLE 148 ASIA PACIFIC: MARKET, BY COUNTRY, 2017–2019 (USD MILLION)

TABLE 149 ASIA PACIFIC: MARKET, BY COUNTRY, 2020–2025 (USD MILLION)

14.2.1 IMPACT OF COVID-19 ON THE ASIA PACIFIC MARKET

14.2.2 CHINA

14.2.2.1 Increasing vehicle production will drive the Chinese market

14.2.2.2 China vehicle production data

14.2.2.3 China: Decline in vehicle production due to COVID-19

TABLE 150 CHINA: Q1 VEHICLE PRODUCTION DATA COMPARISON (UNITS), 2019 VS. 2020

14.2.2.4 China: Decline in vehicle sales due to COVID-19

TABLE 151 CHINA: Q1 VEHICLE SALES DATA COMPARISON (UNITS), 2019 VS. 2020

TABLE 152 CHINA: AUTOMOTIVE POWER ELECTRONICS MARKET, BY DEVICE TYPE, 2017–2019 (MILLION UNITS)

TABLE 153 CHINA: MARKET, BY DEVICE TYPE, 2020–2025 (MILLION UNITS)

TABLE 154 CHINA: MARKET, BY DEVICE TYPE, 2017–2019 (USD MILLION)

TABLE 155 CHINA: MARKET, BY DEVICE TYPE, 2020–2025 (USD MILLION)

14.2.3 JAPAN

14.2.3.1 Thriving semiconductors market to drive the demand for high-tech automotive power electronics in Japan

14.2.3.2 Japan: Decline in vehicle production due to COVID-19

TABLE 156 JAPAN: Q1 VEHICLE PRODUCTION DATA COMPARISON (UNITS), 2019 VS. 2020

14.2.3.3 Japan: Decline in vehicle sales due to COVID-19

TABLE 157 JAPAN: Q1 VEHICLE SALES DATA COMPARISON (UNITS), 2019 VS. 2020

TABLE 158 JAPAN: AUTOMOTIVE POWER ELECTRONICS MARKET, BY DEVICE TYPE, 2017–2019 (MILLION UNITS)

TABLE 159 JAPAN: MARKET, BY DEVICE TYPE, 2020–2025 (MILLION UNITS)

TABLE 160 JAPAN: MARKET, BY DEVICE TYPE, 2017–2019 (USD MILLION)

TABLE 161 JAPAN: MARKET, BY DEVICE TYPE, 2020–2025 (USD MILLION)

14.2.4 INDIA

14.2.4.1 Implementation of vehicle passive safety norms will drive the Indian market

14.2.4.2 India: Decline in vehicle production due to COVID-19

TABLE 162 INDIA: Q1 VEHICLE PRODUCTION DATA COMPARISON (UNITS), 2019 VS. 2020

14.2.4.3 India: Decline in vehicle sales due to COVID-19

TABLE 163 INDIA: Q1 VEHICLE SALES DATA COMPARISON (UNITS), 2019 VS. 2020

TABLE 164 INDIA: AUTOMOTIVE POWER ELECTRONICS MARKET, BY DEVICE TYPE, 2017–2019 (MILLION UNITS)

TABLE 165 INDIA: MARKET, BY DEVICE TYPE, 2020–2025 (MILLION UNITS)

TABLE 166 INDIA: MARKET, BY DEVICE TYPE, 2017–2019 (USD MILLION)

TABLE 167 INDIA: MARKET, BY DEVICE TYPE, 2020–2025 (USD MILLION)

14.2.5 SOUTH KOREA

14.2.5.1 Increasing sales of LCVs will drive the South Korean market

TABLE 168 SOUTH KOREA: MARKET, BY DEVICE TYPE, 2017–2019 (MILLION UNITS)

TABLE 169 SOUTH KOREA: MARKET, BY DEVICE TYPE, 2020–2025 (MILLION UNITS)

TABLE 170 SOUTH KOREA: MARKET, BY DEVICE TYPE, 2017–2019 (USD MILLION)

TABLE 171 SOUTH KOREA: MARKET, BY DEVICE TYPE, 2020–2025 (USD MILLION)

14.2.6 THAILAND

14.2.6.1 Improved tax exemption policies will drive the Thai market

TABLE 172 THAILAND: AUTOMOTIVE POWER ELECTRONICS MARKET, BY DEVICE TYPE, 2017–2019 (MILLION UNITS)

TABLE 173 THAILAND: MARKET, BY DEVICE TYPE, 2020–2025 (MILLION UNITS)

TABLE 174 THAILAND: MARKET, BY DEVICE TYPE, 2017–2019 (USD MILLION)

TABLE 175 THAILAND: MARKET, BY DEVICE TYPE, 2020–2025 (USD MILLION)

14.2.7 REST OF ASIA PACIFIC

14.2.7.1 Improving FDI policies in these countries will drive the Rest of Asia Pacific market

TABLE 176 REST OF ASIA PACIFIC: MARKET, BY DEVICE TYPE, 2017–2019 (MILLION UNITS)

TABLE 177 REST OF ASIA PACIFIC: MARKET, BY DEVICE TYPE, 2020–2025 (MILLION UNITS)

TABLE 178 REST OF ASIA PACIFIC: MARKET, BY DEVICE TYPE, 2017–2019 (USD MILLION)

TABLE 179 REST OF ASIA PACIFIC: MARKET, BY DEVICE TYPE, 2020–2025 (USD MILLION)

14.3 EUROPE

FIGURE 45 EUROPE: MARKET SNAPSHOT

TABLE 180 EUROPE: MARKET, BY COUNTRY, 2017–2019 (MILLION UNITS)

TABLE 181 EUROPE: MARKET, BY COUNTRY, 2020–2025 (MILLION UNITS)

TABLE 182 EUROPE: MARKET, BY COUNTRY, 2017–2019 (USD MILLION)

TABLE 183 EUROPE: AUTOMOTIVE POWER ELECTRONICS MARKET, BY COUNTRY, 2020–2025 (USD MILLION)

14.3.1 IMPACT OF COVID-19 ON THE EUROPEAN MARKET

14.3.2 GERMANY

14.3.2.1 Installation of automotive power electronics in mid-size and economy class vehicle will drive the German market

14.3.2.2 Germany: Decline in vehicle production due to COVID-19

TABLE 184 GERMANY: Q1 VEHICLE PRODUCTION DATA COMPARISON (UNITS), 2019 VS. 2020

14.3.2.3 Germany: Decline in vehicle sales due to COVID-19

TABLE 185 GERMANY: Q1 VEHICLE SALES DATA COMPARISON (UNITS), 2019 VS. 2020

TABLE 186 GERMANY: MARKET, BY DEVICE TYPE, 2017–2019 (MILLION UNITS)

TABLE 187 GERMANY: MARKET, BY DEVICE TYPE, 2020–2025 (MILLION UNITS)

TABLE 188 GERMANY: MARKET, BY DEVICE TYPE, 2017–2019 (USD MILLION)

TABLE 189 GERMANY: MARKET, BY DEVICE TYPE, 2020–2025 (USD MILLION)

14.3.3 FRANCE

14.3.3.1 Partnerships and collaborations among OEMs and Tier I suppliers will drive the French market

14.3.3.2 France: Decline in vehicle production due to COVID-19

TABLE 190 FRANCE: Q1 VEHICLE PRODUCTION DATA COMPARISON (UNITS), 2019 VS. 2020

14.3.3.3 France: Decline in vehicle sales due to COVID-19

TABLE 191 FRANCE: Q1 VEHICLE SALES DATA COMPARISON (UNITS), 2019 VS. 2020

TABLE 192 FRANCE: AUTOMOTIVE POWER ELECTRONICS MARKET, BY DEVICE TYPE, 2017–2019 (MILLION UNITS)

TABLE 193 FRANCE: MARKET, BY DEVICE TYPE, 2020–2025 (MILLION UNITS)

TABLE 194 FRANCE: MARKET, BY DEVICE TYPE, 2017–2019 (USD MILLION)

TABLE 195 FRANCE: MARKET, BY DEVICE TYPE, 2020–2025 (USD MILLION)

14.3.4 UK

14.3.4.1 Continuous R&D in vehicle electronics will drive the UK market

14.3.4.2 UK: Decline in vehicle production due to COVID-19

TABLE 196 UK: Q1 VEHICLE PRODUCTION DATA COMPARISON (UNITS), 2019 VS. 2020

14.3.4.3 UK: Decline in vehicle sales due to COVID-19

TABLE 197 UK: Q1 VEHICLE SALES DATA COMPARISON (UNITS), 2019 VS. 2020

TABLE 198 UK: AUTOMOTIVE POWER ELECTRONICS MARKET, BY DEVICE TYPE, 2017–2019 (MILLION UNITS)

TABLE 199 UK: MARKET, BY DEVICE TYPE, 2020–2025 (MILLION UNITS)

TABLE 200 UK: MARKET, BY DEVICE TYPE, 2017–2019 (USD MILLION)

TABLE 201 UK: MARKET, BY DEVICE TYPE, 2020–2025 (USD MILLION)

14.3.5 SPAIN

14.3.5.1 Continuous export of luxury vehicles will drive the Spanish market

14.3.5.2 Spain: Decline in vehicle production due to COVID-19

TABLE 202 SPAIN: Q1 VEHICLE PRODUCTION DATA COMPARISON (UNITS), 2019 VS. 2020

14.3.5.3 Spain: Decline in vehicle sales due to COVID-19

TABLE 203 SPAIN: Q1 VEHICLE SALES DATA COMPARISON (UNITS), 2019 VS. 2020

TABLE 204 SPAIN: AUTOMOTIVE POWER ELECTRONICS MARKET, BY DEVICE TYPE, 2017–2019 (MILLION UNITS)

TABLE 205 SPAIN: MARKET, BY DEVICE TYPE, 2020–2025 (MILLION UNITS)

TABLE 206 SPAIN: MARKET, BY DEVICE TYPE, 2017–2019 (USD MILLION)

TABLE 207 SPAIN: MARKET, BY DEVICE TYPE, 2020–2025 (USD MILLION)

14.3.6 RUSSIA

14.3.6.1 Investments in the automotive industry by major automobile manufacturers will drive the Russian market

14.3.6.2 Russia: Decline in vehicle production due to COVID-19

TABLE 208 RUSSIA: Q1 VEHICLE PRODUCTION DATA COMPARISON (UNITS), 2019 VS. 2020

TABLE 209 RUSSIA: AUTOMOTIVE POWER ELECTRONICS MARKET, BY DEVICE TYPE, 2017–2019 (MILLION UNITS)

TABLE 210 RUSSIA: MARKET, BY DEVICE TYPE, 2020–2025 (MILLION UNITS)

TABLE 211 RUSSIA: MARKET, BY DEVICE TYPE, 2017–2019 (USD MILLION)

TABLE 212 RUSSIA: MARKET, BY DEVICE TYPE, 2020–2025 (USD MILLION)

14.3.7 TURKEY

14.3.7.1 Improved business policies will drive the Turkish market

14.3.7.2 Turkey: Decline in vehicle production due to COVID-19

TABLE 213 TURKEY: Q1 VEHICLE PRODUCTION DATA COMPARISON (UNITS), 2019 VS. 2020

14.3.7.3 Turkey: Decline in vehicle sales due to COVID-19

TABLE 214 TURKEY: Q1 VEHICLE SALES DATA COMPARISON (UNITS), 2019 VS. 2020

TABLE 215 TURKEY: AUTOMOTIVE POWER ELECTRONICS MARKET, BY DEVICE TYPE, 2017–2019 (MILLION UNITS)

TABLE 216 TURKEY: MARKET, BY DEVICE TYPE, 2020–2025 (MILLION UNITS)

TABLE 217 TURKEY: MARKET, BY DEVICE TYPE, 2017–2019 (USD MILLION)

TABLE 218 TURKEY: MARKET, BY DEVICE TYPE, 2020–2025 (USD MILLION)

14.3.8 REST OF EUROPE

14.3.8.1 Flourishing Eastern European automotive industry will boost the market

TABLE 219 REST OF EUROPE: MARKET, BY DEVICE TYPE, 2017–2019 (MILLION UNITS)

TABLE 220 REST OF EUROPE: MARKET, BY DEVICE TYPE, 2020–2025 (MILLION UNITS)

TABLE 221 REST OF EUROPE: MARKET, BY DEVICE TYPE, 2017–2019 (USD MILLION)

TABLE 222 REST OF EUROPE: MARKET, BY DEVICE TYPE, 2020–2025 (USD MILLION)

14.4 NORTH AMERICA

14.4.1 IMPACT OF COVID-19 ON THE NORTH AMERICAN MARKET

TABLE 223 NORTH AMERICA: AUTOMOTIVE POWER ELECTRONICS MARKET, BY COUNTRY, 2017–2019 (MILLION UNITS)

TABLE 224 NORTH AMERICA: MARKET, BY COUNTRY, 2020–2025 (MILLION UNITS)

TABLE 225 NORTH AMERICA: MARKET, BY COUNTRY, 2017–2019 (USD MILLION)

TABLE 226 NORTH AMERICA: MARKET, BY COUNTRY, 2020–2025 (USD MILLION)

14.4.2 CANADA

14.4.2.1 Increasing sales of luxury class vehicles will boost the Canadian market

14.4.2.2 Canada: Decline in vehicle production due to COVID-19

TABLE 227 CANADA: Q1 VEHICLE PRODUCTION DATA COMPARISON (UNITS), 2019 VS. 2020

14.4.2.3 Canada: Decline in vehicle sales due to COVID-19

TABLE 228 CANADA: Q1 VEHICLE SALES DATA COMPARISON (UNITS), 2019 VS. 2020

TABLE 229 CANADA: AUTOMOTIVE POWER ELECTRONICS MARKET, BY DEVICE TYPE, 2017–2019 (MILLION UNITS)

TABLE 230 CANADA: MARKET, BY DEVICE TYPE, 2020–2025 (MILLION UNITS)

TABLE 231 CANADA: MARKET, BY DEVICE TYPE, 2017–2019 (USD MILLION)

TABLE 232 CANADA: MARKET, BY DEVICE TYPE, 2020–2025 (USD MILLION)

14.4.3 MEXICO

14.4.3.1 Increasing sales of LCVs will boost the Mexican market

14.4.3.2 Mexico: Decline in vehicle production due to COVID-19

TABLE 233 MEXICO: Q1 VEHICLE PRODUCTION DATA COMPARISON (UNITS), 2019 VS. 2020

14.4.3.3 Mexico: Decline in vehicle sales due to COVID-19

TABLE 234 MEXICO: Q1 VEHICLE SALES DATA COMPARISON (UNITS), 2019 VS. 2020

TABLE 235 MEXICO: AUTOMOTIVE POWER ELECTRONICS MARKET, BY DEVICE TYPE, 2017–2019 (MILLION UNITS)

TABLE 236 MEXICO: MARKET, BY DEVICE TYPE, 2020–2025 (MILLION UNITS)

TABLE 237 MEXICO: MARKET, BY DEVICE TYPE, 2017–2019 (USD MILLION)

TABLE 238 MEXICO: MARKET, BY DEVICE TYPE, 2020–2025 (USD MILLION)

14.4.4 US

14.4.4.1 Launch of new vehicle models and changing import-export policies to drive the US market

14.4.4.2 US: Decline in vehicle production due to COVID-19

TABLE 239 US: Q1 VEHICLE PRODUCTION DATA COMPARISON (UNITS), 2019 VS. 2020

14.4.4.3 US: Decline in vehicle sales due to COVID-19

TABLE 240 US: Q1 VEHICLE SALES DATA COMPARISON (UNITS), 2019 VS. 2020

TABLE 241 US: AUTOMOTIVE POWER ELECTRONICS MARKET, BY DEVICE TYPE, 2017–2019 (MILLION UNITS)

TABLE 242 US: MARKET, BY DEVICE TYPE, 2020–2025 (MILLION UNITS)

TABLE 243 US: MARKET, BY DEVICE TYPE, 2017–2019 (USD MILLION)

TABLE 244 US: MARKET, BY DEVICE TYPE, 2020–2025 (USD MILLION)

14.5 SOUTH AMERICA

14.5.1 IMPACT OF COVID-19 ON THE SOUTH AMERICAN AUTOMOTIVE POWER ELECTRONICS MARKET

TABLE 245 SOUTH AMERICA: MARKET, BY COUNTRY, 2017–2019 (MILLION UNITS)

TABLE 246 SOUTH AMERICA: MARKET, BY COUNTRY, 2020–2025 (MILLION UNITS)

TABLE 247 SOUTH AMERICA: MARKET, BY COUNTRY, 2017–2019 (USD MILLION)

TABLE 248 SOUTH AMERICA: MARKET, BY COUNTRY, 2020–2025 (USD MILLION)

14.5.2 BRAZIL

14.5.2.1 Improving government policies to drive the Brazilian market

14.5.2.2 Brazil: Decline in vehicle production due to COVID-19

TABLE 249 BRAZIL: Q1 VEHICLE PRODUCTION DATA COMPARISON (UNITS), 2019 VS. 2020

14.5.2.3 Brazil: Decline in vehicle sales due to COVID-19

TABLE 250 BRAZIL: Q1 VEHICLE SALES DATA COMPARISON (UNITS), 2019 VS. 2020

TABLE 251 BRAZIL: AUTOMOTIVE POWER ELECTRONICS MARKET, BY DEVICE TYPE, 2017–2019 (MILLION UNITS)

TABLE 252 BRAZIL: MARKET, BY DEVICE TYPE, 2020–2025 (MILLION UNITS)

TABLE 253 BRAZIL: MARKET, BY DEVICE TYPE, 2017–2019 (USD MILLION)

TABLE 254 BRAZIL: MARKET, BY DEVICE TYPE, 2020–2025 (USD MILLION)

14.5.3 ARGENTINA

14.5.3.1 Increasing vehicle production will drive the Argentinian market

TABLE 255 ARGENTINA: MARKET, BY DEVICE TYPE, 2017–2019 (MILLION UNITS)

TABLE 256 ARGENTINA: MARKET, BY DEVICE TYPE, 2020–2025 (MILLION UNITS)

TABLE 257 ARGENTINA: MARKET, BY DEVICE TYPE, 2017–2019 (USD MILLION)

TABLE 258 ARGENTINA: MARKET, BY DEVICE TYPE, 2020–2025 (USD MILLION)

14.5.4 REST OF SOUTH AMERICA

14.5.4.1 Adoption of modern technologies related to active and passive safety will drive the Rest of South American market

TABLE 259 REST OF SOUTH AMERICA: AUTOMOTIVE POWER ELECTRONICS MARKET, BY DEVICE TYPE, 2017–2019 (MILLION UNITS)

TABLE 260 REST OF SOUTH AMERICA: MARKET, BY DEVICE TYPE, 2020–2025 (MILLION UNITS)

TABLE 261 REST OF SOUTH AMERICA: MARKET, BY DEVICE TYPE, 2017–2019 (USD MILLION)

TABLE 262 REST OF SOUTH AMERICA: MARKET, BY DEVICE TYPE, 2020–2025 (USD MILLION)

14.6 REST OF THE WORLD (ROW)

TABLE 263 ROW: AUTOMOTIVE POWER ELECTRONICS MARKET, BY COUNTRY, 2017–2019 (MILLION UNITS)

TABLE 264 ROW: MARKET, BY COUNTRY, 2020–2025 (MILLION UNITS)

TABLE 265 ROW: MARKET, BY COUNTRY, 2017–2019 (USD MILLION)

TABLE 266 ROW: MARKET, BY COUNTRY, 2020–2025 (USD MILLION)

14.6.1 IRAN

14.6.1.1 Increasing sales of luxury class vehicles will drive the Iranian market

TABLE 267 IRAN: MARKET, BY DEVICE TYPE, 2017–2019 (MILLION UNITS)

TABLE 268 IRAN: MARKET, BY DEVICE TYPE, 2020–2025 (MILLION UNITS)

TABLE 269 IRAN: MARKET, BY DEVICE TYPE, 2017–2019 (USD MILLION)

TABLE 270 IRAN: AUTOMOTIVE POWER ELECTRONICS MARKET, BY DEVICE TYPE, 2020–2025 (USD MILLION)

14.6.2 SOUTH AFRICA

14.6.2.1 Expansions of global OEMs and Tier I suppliers will drive the South African market

TABLE 271 SOUTH AFRICA: MARKET, BY DEVICE TYPE, 2017–2019 (MILLION UNITS)

TABLE 272 SOUTH AFRICA: MARKET, BY DEVICE TYPE, 2020–2025 (MILLION UNITS)

TABLE 273 SOUTH AFRICA: MARKET, BY DEVICE TYPE, 2017–2019 (USD MILLION)

TABLE 274 SOUTH AFRICA: MARKET, BY DEVICE TYPE, 2020–2025 (USD MILLION)

14.6.3 OTHERS IN ROW

14.6.3.1 Government initiatives related to vehicle passive safety to drive the market

TABLE 275 OTHERS IN ROW: MARKET, BY DEVICE TYPE, 2017–2019 (MILLION UNITS)

TABLE 276 OTHERS IN ROW: AUTOMOTIVE POWER ELECTRONICS MARKET, BY DEVICE TYPE, 2020–2025 (MILLION UNITS)

TABLE 277 OTHERS IN ROW: MARKET, BY DEVICE TYPE, 2017–2019 (USD MILLION)

TABLE 278 OTHERS IN ROW: MARKET, BY DEVICE TYPE, 2020–2025 (USD MILLION)

14.7 KEY INDUSTRY INSIGHTS

15 COMPETITIVE LANDSCAPE (Page No. - 222)

15.1 OVERVIEW

15.2 MARKET EVALUATION FRAMEWORK

FIGURE 46 MARKET EVALUATION FRAMEWORK: AUTOMOTIVE POWER ELECTRONICS MARKET

15.3 MARKET RANKING ANALYSIS

FIGURE 47 MARKET LEADERS AND MARKET SHARE ANALYSIS: MARKET

15.4 RIGHT TO WIN: AUTOMOTIVE POWER ELECTRONICS SUPPLIERS

TABLE 279 RIGHT TO WIN: AUTOMOTIVE POWER ELECTRONICS SUPPLIERS

15.5 COMPETITIVE LEADERSHIP MAPPING

15.5.1 STARS

15.5.2 EMERGING LEADERS

15.5.3 PERVASIVE

15.5.4 EMERGING COMPANIES

FIGURE 48 GLOBAL AUTOMOTIVE POWER ELECTRONICS MARKET: COMPETITIVE LEADERSHIP MAPPING, 2020

15.6 WINNERS VS. TAIL-ENDERS

FIGURE 49 KEY DEVELOPMENTS BY LEADING PLAYERS IN THE MARKET, 2018–2020

15.7 COMPETITIVE SCENARIO

15.7.1 NEW PRODUCT DEVELOPMENTS

TABLE 280 NEW PRODUCT DEVELOPMENTS, 2019–2020

15.7.2 EXPANSIONS

TABLE 281 EXPANSIONS, 2018-2020

15.7.3 MERGERS & ACQUISITIONS

TABLE 282 MERGERS & ACQUISITIONS, 2019-2020

15.7.4 PARTNERSHIPS/AGREEMENTS/COLLABORATIONS/ SUPPLY CONTRACTS

TABLE 283 PARTNERSHIPS/AGREEMENT/COLLABORATIONS/SUPPLY CONTRACTS, 2019

16 COMPANY PROFILES (Page No. - 232)

(Business overview, Products offered, Recent Developments, SWOT analysis, MNM view)*

16.1 ROBERT BOSCH

FIGURE 50 COMPANY SNAPSHOT: ROBERT BOSCH

TABLE 284 ROBERT BOSCH: KEY FINANCIALS

TABLE 285 PRODUCTS OFFERED: ROBERT BOSCH

FIGURE 51 ROBERT BOSCH: SWOT ANALYSIS

16.2 CONTINENTAL

FIGURE 52 CONTINENTAL: COMPANY SNAPSHOT

TABLE 286 CONTINENTAL: KEY FINANCIALS

TABLE 287 PRODUCTS OFFERED: CONTINENTAL

TABLE 288 CONTINENTAL: ORGANIC GROWTH STRATEGIES (NEW PRODUCT DEVELOPMENTS/EXPANSIONS)

TABLE 289 CONTINENTAL: INORGANIC GROWTH STRATEGIES (M&A/AGREEMENTS/ COLLABORATIONS/JOINT VENTURES/SUPPLY CONTRACTS)

FIGURE 53 CONTINENTAL: SWOT ANALYSIS

16.3 INFINEON

FIGURE 54 INFINEON: COMPANY SNAPSHOT

TABLE 290 INFINEON: KEY FINANCIALS

TABLE 291 PRODUCTS OFFERED: INFINEON

TABLE 292 INFINEON: ORGANIC GROWTH STRATEGIES (NEW PRODUCT DEVELOPMENTS/ EXPANSIONS)

TABLE 293 INFINEON: INORGANIC GROWTH STRATEGIES (M&A/AGREEMENTS/COLLABORATIONS/JOINT VENTURES/SUPPLY CONTRACTS)

FIGURE 55 INFINEON: SWOT ANALYSIS

16.4 STMICROELECTRONICS

FIGURE 56 COMPANY SNAPSHOT: STMICROELECTRONICS

TABLE 294 STMICROELECTRONICS: KEY FINANCIALS

TABLE 295 PRODUCTS OFFERED: STMICROELECTRONICS

TABLE 296 STMICROELECTRONICS: ORGANIC GROWTH STRATEGIES (NEW PRODUCT DEVELOPMENTS/EXPANSIONS)

TABLE 297 STMICROELECTRONICS: INORGANIC GROWTH STRATEGIES (M&A/AGREEMENTS/ COLLABORATIONS/JOINT VENTURES/SUPPLY CONTRACTS)

FIGURE 57 STMICROELECTRONICS: SWOT ANALYSIS

16.5 ON SEMICONDUCTOR

FIGURE 58 COMPANY SNAPSHOT: ON SEMICONDUCTOR

TABLE 298 ON SEMICONDUCTOR: KEY FINANCIALS

TABLE 299 PRODUCTS OFFERED: ON SEMICONDUCTOR

TABLE 300 ON SEMICONDUCTOR: ORGANIC GROWTH STRATEGIES (NEW PRODUCT DEVELOPMENTS/EXPANSIONS)

FIGURE 59 ON SEMICONDUCTOR: SWOT ANALYSIS

16.6 MITSUBISHI ELECTRIC

FIGURE 60 MITSUBISHI ELECTRIC: COMPANY SNAPSHOT

TABLE 301 MITSUBISHI ELECTRIC: KEY FINANCIALS

TABLE 302 MITSUBISHI ELECTRIC: ORGANIC GROWTH STRATEGIES (NEW PRODUCT DEVELOPMENTS/EXPANSIONS)

TABLE 303 PRODUCTS OFFERED: MITSUBISHI ELECTRIC

16.7 RENESAS

FIGURE 61 RENESAS: COMPANY SNAPSHOT

TABLE 304 RENESAS: KEY FINANCIALS

TABLE 305 PRODUCTS OFFERED: RENESAS

TABLE 306 RENESAS: ORGANIC GROWTH STRATEGIES (NEW PRODUCT DEVELOPMENTS/EXPANSIONS)

16.8 FUJI ELECTRIC

FIGURE 62 FUJI ELECTRIC: COMPANY SNAPSHOT

TABLE 307 FUJI ELECTRIC: KEY FINANCIALS

TABLE 308 PRODUCTS OFFERED: FUJI ELECTRIC

16.9 DELPHI TECHNOLOGIES

FIGURE 63 DELPHI TECHNOLOGIES: COMPANY SNAPSHOT

TABLE 309 DELPHI TECHNOLOGIES: KEY FINANCIALS

TABLE 310 PRODUCTS OFFERED: DELPHI TECHNOLOGIES

TABLE 311 DELPHI TECHNOLOGIES: ORGANIC GROWTH STRATEGIES (NEW PRODUCT DEVELOPMENTS/EXPANSIONS)

16.10 DANFOSS

FIGURE 64 DANFOSS: COMPANY SNAPSHOT

TABLE 312 DANFOSS: KEY FINANCIALS

TABLE 313 PRODUCTS OFFERED: DANFOSS

TABLE 314 DANFOSS: ORGANIC GROWTH STRATEGIES (NEW PRODUCT DEVELOPMENTS/EXPANSIONS)

*Details on Business overview, Products offered, Recent Developments, SWOT analysis, MNM view might not be captured in case of unlisted companies.

16.11 OTHER MAJOR PLAYERS

16.11.1 NORTH AMERICA

16.11.1.1 Vishay

16.11.1.2 Maxim Integrated

16.11.1.3 Microchip Technology

16.11.1.4 Littelfuse

16.11.1.5 Silicon Labs

16.11.1.6 BorgWarner

16.11.1.7 ABB

16.11.1.8 Analog Devices

16.11.1.9 Texas Instruments

16.11.1.10 Diodes Incorporated

16.11.1.11 Power Integrations

16.11.1.12 Vicor Power

16.11.2 EUROPE

16.11.2.1 NXP Semiconductor

16.11.2.2 Nexperia

16.11.2.3 Eaton

16.11.2.4 Valeo

16.11.2.5 Hella

16.11.2.6 Actia

16.11.2.7 SEMIKRON

16.11.2.8 Dialog Semiconductor

16.11.2.9 Marelli

16.11.2.10 Ascatron

16.11.3 ASIA PACIFIC

16.11.3.1 ROHM Semiconductor

16.11.3.2 Taiwan Semiconductor

16.11.3.3 Pulse

16.11.3.4 Delta

17 APPENDIX (Page No. - 265)

17.1 DISCUSSION GUIDE

17.2 KNOWLEDGE STORE: MARKETSANDMARKETS SUBSCRIPTION PORTAL

17.3 AVAILABLE CUSTOMIZATIONS

17.4 RELATED REPORTS

17.5 AUTHOR DETAILS

The research study involved the extensive use of secondary sources, such as company annual reports/presentations, industry association publications, magazine articles, directories, technical handbooks, World Economic Outlook, trade websites, technical articles, webinars and databases, to identify and collect information on the automotive power electronics market. The primary sources—experts from related industries, automobile OEMs, and suppliers—were interviewed to obtain and verify critical information, as well as assess the growth prospects and market estimations.

Secondary Research

The secondary sources referred to for this research study include corporate filings (such as annual reports, investor presentations, and financial statements), trade, business, and professional associations, whitepapers and automotive power electronics-related journals, certified publications, articles by recognized authors, directories, and databases. Secondary data was collected and analyzed to arrive at the overall market size, which was further validated by primary research.

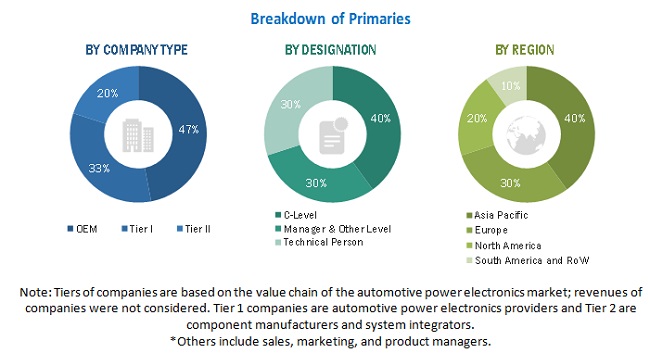

Primary Research

Extensive primary research was conducted after obtaining an understanding of the automotive power electronics market scenario through secondary research. Several primary interviews were conducted with market experts from both, the demand side (vehicle manufacturers, country-level government associations, and trade associations) and supply side (automotive power electronics manufacturers, and system integrators) across major regions, namely, Asia Pacific, North America, Europe, South America and the Rest of the World. Approximately 24% and 76% of primary interviews were conducted from the demand and supply side, respectively. Primary data was collected through questionnaires, emails, and telephonic interviews. In the canvassing of primaries, various departments within organizations, such as sales, operations, and marketing, were covered to provide a holistic viewpoint in this report.

After interacting with industry experts, brief sessions were conducted with highly experienced independent consultants to reinforce the findings from our primaries. This, along with the in-house subject matter expert opinions, led to the findings as described in the remainder of the report.

To know about the assumptions considered for the study, Download the PDF Brochure

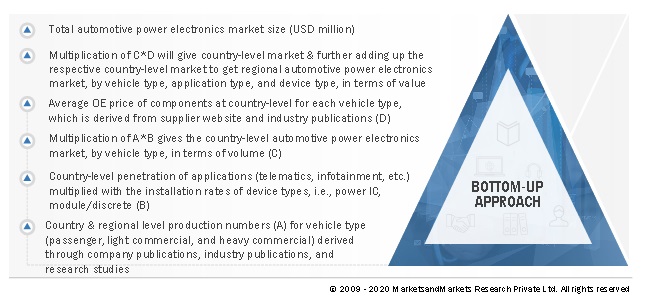

Market Size Estimation

The bottom-up approach was used to estimate and validate the size of the automotive power electronics market. In this approach, vehicle production statistics for each vehicle type were considered at the country and regional level. To arrive at the market size in terms of volume, the penetration of each applications and sub-applications for each vehicle type at the country level was identified through model mapping. Then, the penetration of each application at vehicle type for all countries was applied to obtain the number of vehicle that qualify for of the market. After this installation rates of devices type was multiplied with vehicle that qualified to arrive at the market in terms of volume. This volume was multiplied with average OE prices of device type to arrive at the market in terms of value.

Extensive secondary and primary research was carried out to understand the global market scenario for the types of automotive power electronics features used in the automotive industry. Several primary interviews were conducted with key opinion leaders related to automotive power electronics development, including key OEMs and Tier-1 suppliers. Qualitative aspects such as market drivers, restraints, opportunities, and challenges were taken into consideration while calculating and forecasting the market size.

The top-down methodology was followed to estimate the automotive power electronics market size, by component. To derive the market for automotive power electronics, by component, in terms of value, the cost break-up percentage of each component at the regional level was multiplied with the regional value of the market.

To know about the assumptions considered for the study, Request for Free Sample Report

Data Triangulation

All percentage shares, splits, and breakdowns were determined using secondary sources and verified by primary sources. All parameters that are said to affect the markets covered in this research study were accounted for, viewed in extensive detail, and analyzed to obtain the final quantitative and qualitative data. This data was consolidated, enhanced with detailed inputs and analysis from MarketsandMarkets, and presented in the report.

Report Objectives

-

To define, segment, analyze, and forecast the market size, in terms of value (USD million) and volume (million units)

- By device (power IC, power module/discrete) in terms of volume (million units) and value (USD million)

- By application type (ADAS & safety, body control & comfort, infotainment, telematics, engine management & powertrain, battery management) in terms of volume (million units) and value (USD million)

- By component type (microcontroller and sensor) in terms of volume (million units) and value (USD million)

- By vehicle type (passenger vehicle, light commercial vehicle, and heavy commercial vehicle) in terms of volume (million units) and value (USD million)

- By electric vehicle type (BEV, PHEV,) in terms of value (USD million)

- By region (Asia Pacific, Europe, North America, South America, and RoW) in terms of volume (million units) and value (USD million)

- To define, segment, and analyze the material type (silicon, silicon carbide, gallium nitride, sapphire, and others) segment

- To provide a detailed analysis of the factors influencing the automotive power electronics market (drivers, restraints, opportunities, and challenges)

- To analyze the regional markets for growth trends, prospects, and their contribution to the overall market

- To analyze the opportunities for stakeholders and provide details of the competitive landscape for market leaders

- To strategically shortlist and profile key players and comprehensively analyze their market shares and core competencies

- To analyze recent developments, alliances, joint ventures, product innovations, supply contracts, and mergers & acquisitions in the automotive power electronics market

Available Customizations

With the given market data, MarketsandMarkets offers customizations in accordance to the company’s specific needs.

- Automotive power electronics market, by electric vehicle for HEV and FCEV

- Automotive power electronics market, by electric vehicle at the country level

- Automotive power electronics market, by vehicle type at country level (for countries not covered in the report)

- Company Information

- Profiling of Additional Market Players (Up to 3)

Growth opportunities and latent adjacency in Automotive Power Electronics Market