Automotive Safety System Market by Technology (Active (ABS, ESC, BSD, LDWS, TPMS) and Passive (Airbag, Pedestrian and Whiplash Protection)), On-highway (PC, LCV, Buses, Trucks), Off-highway, EV, Offering (Hardware, Software) - Global Forecast to 2025

The Automotive Safety System Market is estimated to be USD 76.50 Billion in 2016 and is projected to reach USD 169.46 Billion by 2025, at a CAGR of 9.36% during the forecast period. The report analyzes and forecasts the market size, in terms of volume (000’/million units) and value (USD million/ billion), of this market. The report segments the global market and forecasts its size, by volume and value, on the basis of region, technology (active and passive safety system), on-highway vehicle, off-highway vehicle, and electric vehicle, and in terms of value, by offering. The report also provides a detailed analysis of various forces acting in the market (drivers, restraints, opportunities, and challenges). It strategically profiles the key players and comprehensively analyzes their market shares and core competencies. It also tracks and analyzes competitive developments such as joint ventures, mergers & acquisitions, new product launches, expansions, and other activities carried out by key industry participants.

The research methodology used in the report involves various secondary sources such as China Association of Automobile Manufacturers (CAAM), European Automobile Manufacturers Association (EAMA), Environmental Protection Agency (EPA), Society of Indian Automobile Manufacturers (SIAM), Japan Automobile Manufacturers Association (JAMA), Canadian Automobile Association (CAA), and Korea Automobile Manufacturers Association (KAMA). Experts from related industries and suppliers have been interviewed to understand the future trends in the global market. Both top-down and bottom-up approaches have been used to estimate and validate the size of the global market. In the bottom-up approach, the market size, by volume, is derived by identifying the region-wise production volumes and analyzing the demand trends. The market size, by value, is derived by multiplying the average selling price of automotive safety systems of that region. The top-down approach has been used to estimate the offering type segment. The percentage split of global market has been done for estimating the offering type segment by value.

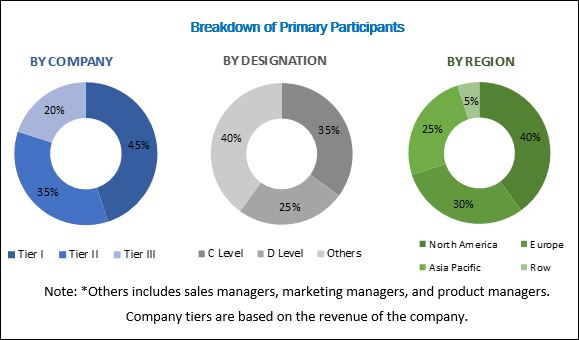

The figure given below illustrates the break-up of the profile of industry experts who participated in primary discussions.

To know about the assumptions considered for the study, download the pdf brochure

The ecosystem of the automotive safety system market consists tier I suppliers such as Robert Bosch (Germany), Continental (Germany), Denso (Japan), Infineon (Germany), and Delphi (UK).

Target Audience

- Automobile manufacturers

- Distributors and suppliers of automotive safety systems

- Industry associations and automotive experts

- Automotive safety feature manufacturers

- Automotive component manufacturers

- Autonomous vehicle software providers

- Electric vehicle manufacturers

- Automotive technology providers

- Tier 1, Tier 2, and Tier 3 suppliers

Scope of the Report

-

By Technology

-

Active Safety System:

- Anti-Lock Braking Systems (ABS)

- Automatic Emergency Breaking (AEB)

- Blind Spot Detection (BSD)

- Electronic Brake Force Distribution (EBD)

- Electronic Stability Control (ESC)

- Lane Departure Warning Systems (LDW)

- Tire Pressure monitoring system (TPMS)

- Traction Control System (TCS)

- Forward-Collision Warning (FCW)

-

Passive Safety System

- Seatbelts

- Airbags

- Active Hood Lifters

- Pedestrian Protection Airbag

- Whiplash Protection System

-

Active Safety System:

-

By On-Highway Vehicle

- Passenger Cars (PC)

- Light Commercial Vehicle (LCV)

- Buses

- Trucks

-

By Off-Highway Vehicle

- Agriculture Vehicle

- Construction Vehicle

-

By Electric Vehicle

- Battery Electric Vehicle (BEV)

- Hybrid Electric Vehicle (HEV)

- Plug-In Hybrid Electric Vehicle (PHEV)

- Fuel Cell Electric Vehicle (FCEV)

-

By Offering

- Hardware

- Software

-

By Region

- Asia Pacific

- Europe

- North America

- Rest of the World

Available Customizations

MarketsandMarkets offers the following customizations for this market report:

- Country level market for active and passive safety system markets (up to 3)

- Profiling of additional market players (Up to 3)

- Market sizing of additional safety systems (Up to 3)

The automotive safety system market is estimated to be USD 82.80 Billion in 2017 and is projected to grow to USD 169.46 Billion by 2025, at a CAGR of 9.36% during the forecast period. The increasing demand for a safe, efficient, and convenient driving experience and stringent safety regulations across the globe are driving the market for automotive safety system.

The global automotive safety system market has been segmented by technology, on-highway vehicle, off-highway vehicle, electric vehicle, offering, and region. The market has been segmented by technology into active and passive safety systems. Active safety systems are projected to be the fastest growing segment of this market, by technology. Continuously increasing demand for luxury vehicles will drive the growth of this segment. Also, the growing trend toward autonomous vehicles is expected to contribute to the growth of the active safety systems.

The global market has been segmented by on-highway vehicle into passenger cars, light commercial vehicles, buses, and trucks. Passenger car segment is estimated to be the fastest growing segment of the this market, by on-highway vehicle. The number of passenger cars is growing at a significant rate in the emerging economies of the Asia Pacific region. This can be attributed to the rise in GDP and the population of these countries, resulting in improved lifestyle, increased purchasing power of consumers, and development of infrastructure. Various active and passive safety systems such as airbags, seatbelts, tire pressure monitor (TPM), and electronic stability control (ESC) are provided in passenger cars for preventing accidents.

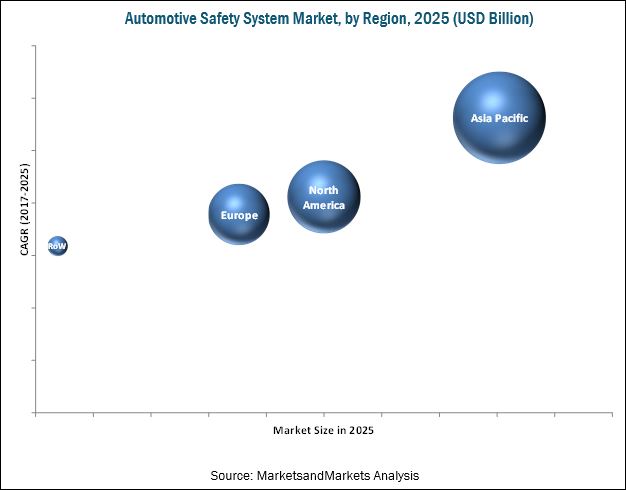

The Asia Pacific region is estimated to dominate the global automotive safety system market, in terms of value, in 2017. The rising consumer income levels, increased vehicle production in developing countries such as India and China, and increase in the number of luxury vehicles in countries such as Japan fuel the growth of this market in Asia Pacific region.

The complexity and the high cost of features are the key restraint for the growth of this market. These systems comprise micro-controller units, electronic control units, and various sensors such as ultrasonic, image, radio or laser sensors, and infrared sensors. These components increase the complexity of the safety features, thereby raising the cost. Currently, a limited class of buyers can afford driver assistance features. This could restrain the growth of this market.

Robert Bosch has a strong global footprint with an extensive channel of multiple manufacturing facilities and suppliers of various automobile parts and services. The company is focused on producing technologically advanced, efficient, and greener products for its customers. The company is looking to seize opportunities in the emerging markets by concentrating on electrification, connectivity, and automation. Robert Bosch is trying to develop new technologies for safety systems that can provide a safe and comfortable driving experience. Robert Bosch has also inorganically grown through strategic regional expansions. For instance, the company is expanding its manufacturing facilities in Thailand and China by investing USD 98.1 million and USD 122.7 million, respectively. This strategic move can provide the company a great advantage in the global automotive safety system market.

To speak to our analyst for a discussion on the above findings, click Speak to Analyst

Table of Contents

1 Introduction (Page No. - 17)

1.1 Objectives of the Study

1.2 Market Definition

1.3 Market Scope

1.3.1 Years Considered for the Study

1.4 Currency & Pricing

1.5 Package Size

1.6 Limitations

1.7 Stakeholders

2 Research Methodology (Page No. - 21)

2.1 Research Data

2.1.1 Secondary Data

2.1.1.1 Key Secondary Sources

2.1.1.2 Data From Secondary Sources

2.1.2 Primary Data

2.1.2.1 Sampling Techniques & Data Collection Methods

2.1.2.2 Primary Participants

2.2 Factor Analysis

2.2.1 Introduction

2.2.2 Demand-Side Analysis

2.2.2.1 Need for Safety and Security

2.2.3 Supply-Side Analysis

2.2.3.1 Technological Advancements in Vehicles

2.3 Market Size Estimation

2.3.1 Bottom-Up Approach

2.3.2 Top-Down Approach

2.4 Data Triangulation

2.5 Assumptions

3 Executive Summary (Page No. - 32)

4 Premium Insights (Page No. - 40)

4.1 Attractive Opportunities in Automotive Safety System Market

4.2 Market, By Region, 2017 & 2025

4.3 Market, By Technology, 2017 & 2025

4.4 Market, By On-Highway Vehicle, 2017 & 2025

4.5 Market, By Off-Highway Vehicle, 2017 & 2025

4.6 Market, By Electric Vehicle, 2017 & 2025

4.7 Market, By Offering, 2017 & 2025

5 Market Overview (Page No. - 45)

5.1 Introduction

5.2 Market Dynamics

5.2.1 Drivers

5.2.1.1 Government Regulations Pertaining to Vehicle Safety

5.2.1.2 Rise in the Demand for A Safe, Efficient, and Convenient Driving Experience

5.2.1.3 Increasing Demand for Luxury Cars

5.2.2 Restraints

5.2.2.1 Complex & Expensive Features

5.2.2.2 Software Failures in Applications

5.2.3 Opportunities

5.2.3.1 Advent of Autonomous Vehicles

5.2.3.2 Rising Demand for Electric Vehicles

5.2.4 Challenges

5.2.4.1 Security Threats

5.2.4.2 Maintaining A Balance Between Cost & Quality

6 Global Automotive Safety System Market, By Technology (Page No. - 54)

6.1 Introduction

6.2 Active Safety Systems

6.2.1 Anti-Lock Braking Systems (ABS)

6.2.2 Automatic Emergency Braking (AEB)

6.2.3 Blind Spot Detection (BSD)

6.2.4 Electronic Brake Force Distribution (EBD)

6.2.5 Electronic Stability Control (ESC)

6.2.6 Forward-Collision Warning (FCW)

6.2.7 Lane Departure Warning Systems (LDWS)

6.2.8 Traction Control System (TCS)

6.2.9 Tire Pressure Monitoring Systems (TPMS)

6.3 Passive Safety Systems

6.3.1 Occupant Protection

6.3.1.1 Seatbelts

6.3.1.2 Airbags

6.3.2 Pedestrian Protection Systems

6.3.2.1 Pedestrian Protection Airbag

6.3.2.2 Active Hood Lifters

6.3.3 Whiplash Protection System

7 Global Automotive Safety System Market, By On-Highway Vehicle Type (Page No. - 68)

7.1 Introduction

7.2 Buses

7.3 Light Commercial Vehicles

7.4 Passenger Cars

7.5 Trucks

8 Global Automotive Safety System Market, By Off-Highway Vehicle (Page No. - 76)

8.1 Introduction

8.2 Agriculture Vehicle

8.3 Construction Vehicle

9 Global Automotive Safety System Market, By Electric Vehicle (Page No. - 88)

9.1 Introduction

9.2 Battery Electric Vehicle (BEV)

9.3 Fuel Cell Electric Vehicle (FCEV)

9.4 Hybrid Electric Vehicle (HEV)

9.5 Plug-In Hybrid Electric Vehicle (PHEV)

10 Global Automotive Safety System Market, By Offering (Page No. - 101)

10.1 Introduction

10.2 Hardware

10.3 Software

11 Global Automotive Safety System Market, By Region (Page No. - 105)

11.1 Introduction

11.2 Asia Pacific

11.2.1 China

11.2.2 India

11.2.3 Japan

11.2.4 South Korea

11.3 Europe

11.3.1 France

11.3.2 Germany

11.3.3 Italy

11.3.4 Spain

11.3.5 UK

11.4 North America

11.4.1 Canada

11.4.2 Mexico

11.4.3 US

11.5 Rest of the World (RoW)

11.5.1 Brazil

11.5.2 Russia

12 Competitive Landscape (Page No. - 126)

12.1 Overview

12.2 Market Ranking Analysis

12.3 Competitive Situations & Trends

12.3.1 New Product Developments

12.3.2 Expansions

12.3.3 Mergers & Acquisitions

12.3.4 Joint Ventures/Partnerships/Collaborations/Agreements

13 Company Profiles (Page No. - 134)

(Business Overview, Products Offered, Recent Developments, SWOT Analysis, MnM View)*

13.1 Robert Bosch

13.2 Denso

13.3 Delphi Automotive

13.4 Infineon

13.5 ZF Friedrichshafen

13.6 Continental

13.7 Valeo

13.8 Magna

13.9 Autoliv

13.10 Mobileye

13.11 Hyundai Mobis

13.12 Takata

13.13 Knorr-Bremse

*Business Overview, Products Offered, Recent Developments, SWOT Analysis, MnM View Might Not Be Captured in Case of Unlisted Companies.

14 Appendix (Page No. - 173)

14.1 Key Insights of Industry Experts

14.2 Discussion Guide

14.3 Available Customizations

14.3.1 Country Level Market for Active and Passive Safety System Markets (Up to 3)

14.3.2 Profiling of Additional Market Players (Up to 3)

14.3.3 Market Sizing of Additional Safety Systems (Up to 3)

14.4 Related Reports

14.5 Author Details

List of Tables (112 Tables)

Table 1 Regulations for Safety Systems

Table 2 Automotive Safety System Market, By Technology, 2015–2025 (Million Units)

Table 3 Market, By Technology, 2015–2025 (USD Billion)

Table 4 Asia Pacific: Active Safety System Market, By Technology, 2015–2025 (’000 Units)

Table 5 Asia Pacific: Market, By Technology, 2015–2025 (USD Million)

Table 6 Asia Pacific: Passive Safety System Market, By Technology, 2015–2025 (’000 Units)

Table 7 Asia Pacific: Market, By Technology, 2015–2025 (USD Million)

Table 8 Europe: Active Safety System Market, By Technology, 2015–2025 (’000 Units)

Table 9 Europe: Market, By Technology, 2015–2025 (USD Million)

Table 10 Europe: Passive Safety System Market, By Technology, 2015–2025 (’000 Units)

Table 11 Europe: Market, By Technology, 2015–2025 (USD Million)

Table 12 North America: Active Safety System Market, By Technology, 2015–2025 (’000 Units)

Table 13 North America: Market, By Technology, 2015–2025 (USD Million)

Table 14 North America: Passive Safety System Market, By Technology, 2015–2025 (’000 Units)

Table 15 North America: Passive Safety System Market, By Technology, 2015–2025 (USD Million)

Table 16 RoW: Active Safety System Market, By Technology, 2015–2025 (’000 Units)

Table 17 RoW: Market, By Technology, 2015–2025 (USD Million)

Table 18 RoW: Passive Safety System Market, By Technology, 2015–2025 (’000 Units)

Table 19 RoW: Passive Safety System Market, By Technology, 2015–2025 (USD Million)

Table 20 Global Automotive Safety System Market, By On-Highway Vehicle, 2015–2025 (Million Units)

Table 21 Global Market, By On-Highway Vehicle, 2015–2025 (USD Billion)

Table 22 Buses: Market, By Region, 2015–2025 ('000 Units)

Table 23 Buses: Market, By Region, 2015–2025 (USD Million)

Table 24 LCV: Global Market, By Region, 2015–2025 ('000 Units)

Table 25 LCV: Global Market, By Region, 2015–2025 (USD Million)

Table 26 Passenger Car: Market, By Region, 2015–2025 ('000 Units)

Table 27 Passenger Car: Market, By Region, 2015–2025 (USD Million)

Table 28 Trucks: Market, By Region, 2015–2025 ('000 Units)

Table 29 Trucks: Market, By Region, 2015–2025 (USD Million)

Table 30 Global Automotive Safety System Market, By Off-Highway Vehicle, 2015–2025 ('000 Units)

Table 31 Global Market, By Off-Highway Vehicle, 2015–2025 (USD Million)

Table 32 Agriculture Vehicle: Market Size, By Region, 2015–2025 ('000 Units)

Table 33 Agriculture Vehicle: Market Size, By Region, 2015–2025 (USD Million)

Table 34 Asia Pacific: Safety System Market for Agriculture Vehicles, By Technology, 2015–2025 ('000 Units)

Table 35 Asia Pacific: Safety System Market for Agriculture Vehicles, By Technology, 2015–2025 (USD Million)

Table 36 Europe: Safety System Market for Agriculture Vehicles, By Technology, 2015–2025 ('000 Units)

Table 37 Europe: Safety System Market for Agriculture Vehicles, By Technology, 2015–2025 (USD Million)

Table 38 North America: Safety System Market for Agriculture Vehicles, By Technology, 2015–2025 ('000 Units)

Table 39 North America: Safety System Market for Agriculture Vehicles, By Technology, 2015–2025 (USD Million)

Table 40 RoW: Safety System Market for Agriculture Vehicles, By Technology, 2015–2025 ('000 Units)

Table 41 RoW: Safety System Market for Agriculture Vehicles, By Technology, 2015–2025 (USD Million)

Table 42 Construction Vehicle: Global Market Size, By Region, 2015–2025 ('000 Units)

Table 43 Construction Vehicle: Global Market Size, By Region, 2015–2025 (USD Million)

Table 44 Asia Pacific: Safety System Market for Construction Vehicles, By Technology, 2015–2025 ('000 Units)

Table 45 Asia Pacific: Safety System Market for Construction Vehicles, By Technology, 2015–2025 (USD Million)

Table 46 Europe: Safety System Market for Construction Vehicles, By Technology, 2015–2025 ('000 Units)

Table 47 Europe: Safety System Market for Construction Vehicles, By Technology, 2015–2025 (USD Million)

Table 48 North America: Safety System Market for Construction Vehicles, By Technology, 2015–2025 ('000 Units)

Table 49 North America: Safety System Market for Construction Vehicles, By Technology, 2015–2025 (USD Million)

Table 50 RoW: Safety System Market for Construction Vehicles, By Technology, 2015–2025 ('000 Units)

Table 51 RoW: Safety System Market for Construction Vehicles, By Technology, 2015–2025 (USD Million)

Table 52 Global Automotive Safety System Market, By Electric Vehicle, 2015–2025 (’000 Units)

Table 53 Global Market, By Electric Vehicle, 2015–2025 (USD Million)

Table 54 Battery Electric Vehicle: Market, By Active Safety System, 2015–2025 (’000 Units)

Table 55 Battery Electric Vehicle: Market, By Active Safety System, 2015–2025 (USD Million)

Table 56 Battery Electric Vehicle: Market, By Passive Safety System, 2015–2025 (’000 Units)

Table 57 Battery Electric Vehicle: Market, By Passive Safety System, 2015–2025 (USD Million)

Table 58 Fuel Cell Electric Vehicle: Market, By Active Safety System, 2015–2025 (’000 Units)

Table 59 Fuel Cell Electric Vehicle: Market, By Active Safety System, 2015–2025 (USD Million)

Table 60 Fuel Cell Electric Vehicle: Market, By Passive Safety System, 2015–2025 (’000 Units)

Table 61 Fuel Cell Electric Vehicle: Market, By Passive Safety System, 2015–2025 (USD Million)

Table 62 Hybrid Electric Vehicle: Market, By Active Safety System, 2015–2025 (’000 Units)

Table 63 Hybrid Electric Vehicle: Market, By Active Safety System, 2015–2025 (USD Million)

Table 64 Hybrid Electric Vehicle: Market, By Passive Safety System, 2015–2025 (’000 Units)

Table 65 Hybrid Electric Vehicle: Market, By Passive Safety System, 2015–2025 (USD Million)

Table 66 Plug-In Hybrid Electric Vehicle: Market, By Active Safety System, 2015–2025 (’000 Units)

Table 67 Plug-In Hybrid Electric Vehicle: Market, By Active Safety System, 2015–2025 (USD Million)

Table 68 Plug-In Hybrid Electric Vehicle: Market, By Passive Safety System, 2015–2025 (’000 Units)

Table 69 Plug-In Hybrid Electric Vehicle:Market, By Passive Safety System, 2015–2025 (USD Million)

Table 70 Global Automotive Safety System Market, By Offering, 2015–2025 (USD Billion)

Table 71 Asia Pacific: Market, By Offering (USD Billion)

Table 72 Europe: Market, By Offering (USD Billion)

Table 73 North America: Market, By Offering (USD Billion)

Table 74 RoW: Market, By Offering (USD Billion)

Table 75 Global Market, By Region, 2015–2025 (Million Units)

Table 76 Global Market, By Region, 2015–2025 (USD Billion)

Table 77 Asia Pacific: Market, By Country, 2015–2025 (Million Units)

Table 78 Asia Pacific: Market, By Country, 2015–2025 (USD Billion)

Table 79 China: Market, By Technology, 2015–2025 (‘000 Units)

Table 80 China: Market, By Technology, 2015–2025 (USD Million)

Table 81 India: Market, By Technology, 2015–2025 (‘000 Units)

Table 82 India:Market, By Technology, 2015–2025 (USD Million)

Table 83 Japan: Market, By Technology, 2015–2025 (‘000 Units)

Table 84 Japan: Market, By Technology, 2015–2025 (USD Million)

Table 85 South Korea: Market, By Technology, 2015–2025 (‘000 Units)

Table 86 South Korea: Market, By Technology, 2015–2025 (USD Million)

Table 87 Europe: Market, By Country, 2015–2025 (Million Units)

Table 88 Europe: Market, By Country, 2015–2025 (USD Billion)

Table 89 France: Market, By Technology, 2015–2025 (‘000 Units)

Table 90 France: Market, By Technology, 2015–2025 (USD Million)

Table 91 Germany: Market, By Technology, 2015–2025 (‘000 Units)

Table 92 Germany: Market, By Technology, 2015–2025 (USD Million)

Table 93 Italy: Market, By Technology, 2015–2025 (‘000 Units)

Table 94 Italy: Market, By Technology, 2015–2025 (USD Million)

Table 95 Spain: Market, By Technology, 2015–2025 (‘000 Units)

Table 96 Spain: Market, By Technology, 2015–2025 (USD Million)

Table 97 UK: Market, By Technology, 2015–2025 (‘000 Units)

Table 98 UK: Market, By Technology, 2015–2025 (USD Million)

Table 99 North America: Market, By Country, 2015–2025 (Million Units)

Table 100 North America: Market, By Country, 2015–2025 (USD Billion)

Table 101 Canada: Market, By Technology, 2015–2025 (‘000 Units)

Table 102 Canada: Market, By Technology, 2015–2025 (USD Million)

Table 103 Mexico: Market, By Technology, 2015–2025 (‘000 Units)

Table 104 Mexico: Market, By Technology, 2015–2025 (USD Million)

Table 105 US: Market, By Technology, 2015–2025 (‘000 Units)

Table 106 US: Market, By Technology, 2015–2025 (USD Million)

Table 107 RoW: Market, By Country, 2015–2025 (Million Units)

Table 108 RoW: Market, By Country, 2015–2025 (USD Billion)

Table 109 Brazil: Market, By Technology, 2015–2025 (‘000 Units)

Table 110 Brazil: Market, By Technology, 2015–2025 (USD Million)

Table 111 Russia: Market, By Technology, 2015–2025 (‘000 Units)

Table 112 Russia: Market, By Technology, 2015–2025 (USD Million)

List of Figures (57 Figures)

Figure 1 Automotive Safety System Market Segmentation

Figure 2 Research Design

Figure 3 Research Methodology Model

Figure 4 Breakdown of Primary Interviews: By Company Type, Designation, & Region

Figure 5 Market Size Estimation Methodology: Bottom-Up Approach

Figure 6 Market Size Estimation Methodology: Top-Down Approach

Figure 7 Market, By Region, 2017 vs 2025 (USD Billion)

Figure 8 Market, By Technology, 2017 vs 2025 (USD Billion)

Figure 9 Market, By On-Highway Vehicle, 2017 vs 2025 (USD Billion)

Figure 10 Market, By Off-Highway Vehicle, 2017 vs 2025 (USD Million)

Figure 11 Market, By Electric Vehicle, 2017 vs 2025 (USD Million)

Figure 12 Market, By Offering, 2017 vs 2025 (USD Billion)

Figure 13 Government Regulations Pertaining to Vehicle Safety are Expected to Drive the Global Automotive Safety System Market, 2017–2025

Figure 14 Asia Pacific is Estimated to Witness the Highest Growth in this Market

Figure 15 Active Safety System is Expected to Be the Largest Market, 2017 & 2025

Figure 16 Passenger Car is Estimated to Be the Largest Market, 2017 & 2025

Figure 17 Agriculture Vehicle to Be the Largest Market, 2017 & 2025

Figure 18 Hybrid Electric Vehicle Projected to Be the Largest Market, 2017 & 2025

Figure 19 Hardware Expected to Be the Largest Market, 2017 & 2025

Figure 20 Automotive Safety System: Market Dynamics

Figure 21 Total Fatalities Due to Vehicle Crash in the Us, 1975–2016 (In Thousands)

Figure 22 Levels of Automation

Figure 23 BEV Sales in Major Regions, 2017 vs 2022 (Thousand Units)

Figure 24 Automotive Safety System Market, By Technology, 2017 vs 2025

Figure 25 Market, By On-Highway Vehicle, 2017 vs 2025 (USD Billion)

Figure 26 Market, By Off-Highway Vehicle, 2017 vs 2025

Figure 27 Market, By Electric Vehicle, 2017 vs 2025 (USD Million)

Figure 28 Market, By Offering, 2017 vs 2025

Figure 29 Asia Pacific to Be the Fastest Growing Market for Automotive Safety System During the Forecast Period (2017–2025)

Figure 30 Asia Pacific: Market Snapshot

Figure 31 Germany is Projected to Be the Largest Market for Automotive Safety System, 2017–2025

Figure 32 North America: Market Snapshot

Figure 33 Brazil is Projected to Be the Largest Market for Automotive Safety System, 2017–2025

Figure 34 Key Developments By Leading Players in the Automotive Safety System Market, 2015–2018

Figure 35 Automotive Safety Features Market Ranking: 2016

Figure 36 New Product Developments, 2015–2018

Figure 37 Expansions, 2016–2018

Figure 38 Mergers & Acquisitions, 2015–2017

Figure 39 Joint Ventures/Partnerships/Collaborations/Agreements, 2016–2017

Figure 40 Robert Bosch: Company Snapshot

Figure 41 Robert Bosch : SWOT Analysis

Figure 42 Denso: Company Snapshot

Figure 43 Denso: SWOT Analysis:

Figure 44 Delphi Automotive: Company Snapshot

Figure 45 Delphi: SWOT Analysis

Figure 46 Company Snapshot: Infineon

Figure 47 Infineon: SWOT Analysis

Figure 48 ZF Friedrichshafen: Company Snapshot

Figure 49 ZF Friedrichshafen: SWOT Analysis

Figure 50 Continental: Company Snapshot

Figure 51 Valeo: Company Snapshot

Figure 52 Magna: Company Snapshot

Figure 53 Autoliv: Company Snapshot

Figure 54 Mobileye: Company Snapshot

Figure 55 Hyundai Mobis: Company Snapshot

Figure 56 Takata: Company Snapshot

Figure 57 Knorr-Bremse: Company Snapshot

Growth opportunities and latent adjacency in Automotive Safety System Market