Electric Power Steering Market by Component, Type (CEPS, PEPS, REPS), Mechanism (Collapsible, Rigid), Electric Motor Type, Application, Off-Highway (Construction, Agricultural), EV (BEV, PHEV, HEV), EV Gear Type and Region - Global Forecast to 2027

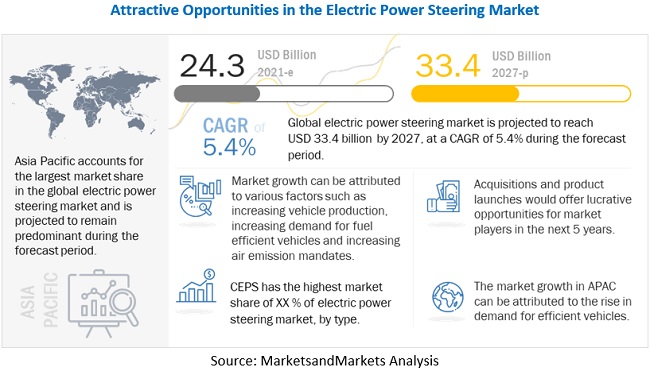

The global electric power steering market was valued at $24.3 billion in 2021 and is projected to reach $33.4 billion by 2027, growing at a CAGR of 5.4% from 2021 to 2027.

The key growth drivers for the market are the increasing number of government norms and mandates related to fuel-efficient technologies, measures taken by OEMs worldwide to reduce the weight and complexity of their vehicles, and the globally increasing vehicle production.

To know about the assumptions considered for the study, Request for Free Sample Report

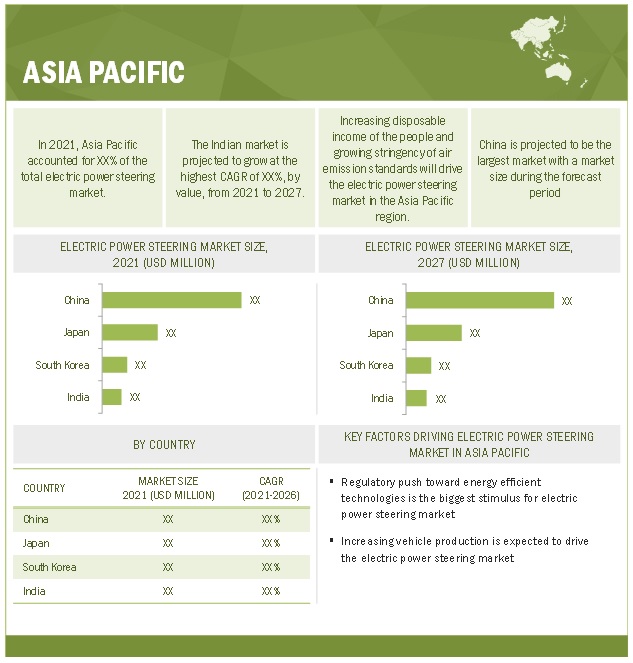

Asia Pacific is estimated to lead the electric power steering (EPS) market during the forecast period, followed by North America and Europe. The North American and European markets are set to attain maturity as the majority of the vehicles in these regions are equipped with electric power steering system. These markets are therefore expected to grow at a steady pace during the forecast period.

COVID-19 Impact on Electric Power Steering Market:

The COVID-19 pandemic had a severe impact on the entire automotive industry. The European automotive industry has been severely impacted by the pandemic and, according to the ACEA (European Automobile Manufacturers Association), the automotive sector in the EU suffered production losses amounting to 3.6 million vehicles worth around USD 110.6 billion, during the first half of 2020 alone. Considering the North American market, according to Boston Consulting Group (BCG), despite encouraging reports on vaccine development, numerous risks remain, and the US will not rebound to pre-COVID levels until 2023 at the earliest. This scenario is expected to affect electric power steering system market as the growth of this market is directly related to the production of vehicles.

Market Dynamics

Drivers of the Electric Power Steering Market: Global measures by OEMs to reduce complexity and weight of vehicles

Over the last few years, OEMs have shifted focus from hydraulic to electric power steering systems in the interests of reduced complexity and increased efficiency. EPS systems use an electric motor instead of a hydraulic pump to provide steering assistance and thus help to reduce the weight of the vehicle. Electronic sensors calculate the amount of steering force being applied by the driver and, with the help of an electric motor, the force is amplified to make steering easier

Restraints of the Electric Power Steering Market: High cost and lack of steering feel

Despite the high demand for electric power steering systems, this market still experiences certain obstacles. The higher cost of EPS as compared to traditional steering systems and lack of steering feel can hinder the growth of the market.

Opportunities for the Electric Power Steering Market: Penetration in commercial vehicles

Presently, the power steering market of commercial vehicles is dominated by hydraulic power steering (HPS), which has a complicated structure, consumes high power, leaks easily, and is difficult to control. EPS offers the advantages of adjustable power, good steering, low fuel consumption, and no pollution. Therefore, it would gradually be used in commercial vehicles.

Threats for the Electric Power Steering Market: Maintaining market against steer-by-wire technology

The steering market in the automotive industry is continuously evolving with the changing dynamics of this industry. With the advent of autonomous vehicles, OEMs are innovating their conventional steering system. Steer-by-wire technology is one such innovation that will replace the entire steering system in an autonomous vehicle. This type of steering system will remove the steering linkage of a traditional electric power steering system.

Rack EPS (R-EPS) is estimated to be the fastest-growing segment

An Electric Power Steering (EPS) system offers an alternative to traditional steering systems such as Hydraulic and Electro-Hydraulic. It deploys an electric motor to assist the driver of a vehicle. The global market is segmented by type into column EPS (C-EPS), rack EPS (R-EPS), and pinion EPS (P-EPS). The column EPS (C-EPS) is estimated to hold the largest share of the electric power steering market, by type.

Rack EPS (R-EPS) is estimated to be the fastest-growing segment of the automotive EPS market, by type. Factors contributing to the growth of this segment include the increasing installation rate of EPS in commercial vehicles. Rack EPS (R-EPS) is mostly used in heavy commercial vehicles. Hence, the growing popularity of EPS in heavy commercial vehicles would trigger the growth of R-EPS systems.

Collapsible electric power steering system to experience the highest growth during the forecast period

By mechanism, the market for collapsible electric power steering system is estimated to experience the highest growth during the forecast period. With the advent of the era of advanced technologies, the use of a collapsible electric power steering system has increased. The collapsible electric power steering systems are widely used in electric as well as conventional vehicles.

Stringent emission norms driving the sales of BEVs in turn increasing demand for EPS

By electric vehicle type, BEV is estimated to hold the largest share of the electric power steering market during the forecast period. The market growth can be attributed to the increased production of BEVs, particularly in the Asia Pacific region.

Asia Pacific is estimated to be the fastest growing EPS market

The electric power steering market for Asia Pacific is estimated to grow at the highest CAGR during the forecast period. The Asia Pacific market comprises India, China, Japan, and South Korea. While China has the highest penetration of EPS systems in its vehicles, other countries such as Japan, India, and South Korea are not far behind. JTEKT, which is headquartered in Japan, holds the largest market share of steering systems in the world. Also, Japan is home to many other leading manufacturers of steering systems, such as Mitsubishi Electric, NSK. The presence of leading manufacturers is a key factor driving the penetration of EPS systems in Japan. The EPS installation is directly proportional to the growth of vehicle production in the Asia Pacific region. The EPS systems would be mandated for all vehicle segments by 2025.

To know about the assumptions considered for the study, download the pdf brochure

Key Market Players

The market share analysis of the key industry players has been conducted based on factors such as the company’s overall revenue, segmental revenue, product portfolio, market presence, and recent developments. The chapter also highlights the key growth strategies adopted by market players from 2018 to 2020. The electric power steering market is dominated by a few globally established players such as JTEKT (Japan), Nexteer (US), Robert Bosch (Germany), ZF (Germany), and NSK (Japan). These companies develop new products, adopt expansion strategies, obtain supply contracts, establish joint ventures, and enter into agreements to gain traction in this market.

Scope of the Report

|

Report Metric |

Details |

|

Market size available for years |

2018–2027 |

|

Base year considered |

2020 |

|

Forecast period |

2022–2027 |

|

Forecast units |

Volume (Units) and Value (USD Million) |

|

Segments covered |

Electric Power Steering market By component, By type, By Mechanism, By electric motor type, By application, By off-highway vehicle, By Electric Vehicle, By region, EV Gear type (Worm Gear and Ball Screw) for BEV and PHEV Vehicles |

|

Geographies covered |

Asia Pacific, Europe, North America, and the Rest of the World (RoW) |

|

Companies covered |

JTEKT corporation (Japan), Nexteer (US), ZF Friedrichshafen AG (Germany), Robert Bosch (Germany), and Others |

The study segments the Electric Power Steering Market :

Electric Power Steering (EPS) Market, By Components

- Steering column

- Sensors

- Steering gear

- Mechanical rack and pinion

- Electronic control unit

- Electric motor

- Bearing

Electric Power Steering (EPS) Market, By Electric Motor

- Brush motor

- Brushless motor

Electric Power Steering (EPS) Market, By Application

- Passenger Cars (PC)

- Commercial Vehicles (CV)

Electric Power Steering (EPS) Market, By Off Highway Application

- Construction equipment

- Agricultural equipment

Electric Power Steering (EPS) Market, By Electric Vehicle

- BEV

- PHEV

- FCEV

Electric Power Steering (EPS) Market, By EV Gear Type

- Worm Gear

- Ball Screw

Electric Power Steering (EPS) Market, By Type

- Rack assist type (REPS)

- Colum assist type (CEPS)

- Pinion assist type (PEPS)

Electric Power Steering (EPS) Market, By Mechanism

- Rigid

- Collapsible

Electric Power Steering (EPS) Market, By Region

- Asia Pacific

- Europe

- North America

- Rest of the World

Recent Developments

- In October 2020, BorgWarner acquired Delphi Technologies in a USD 3.3 billion stock deal. The deal is expected to strengthen BorgWarner’s electronics and power electronics product portfolio, capabilities, and scale, creating a leader in electrified propulsion.

- In May 2020, ZF Friedrichshafen AG acquired WABCO in a USD 7 billion deal. WABCO is now integrated into ZF as its Commercial Vehicle Control Systems Division, and ZF and WABCO will form global integrated systems for commercial vehicle technology. WABCO and ZF had earlier partnered for developing systems such as Evasive Maneuver Assist for collision mitigation in commercial vehicles. WABCO had also been a critical supplier of braking systems to ZF.

- In January 2020, JTEKT acquired shares of Yutaka Seimitsu Kogyo Ltd. from Toyota Motor Corporation (Toyota). Yutaka manufactures automotive parts and sells gears for general machines. The aim of the deal is to strengthen the competitiveness of Toyota and JTEKT’s core driveline operations. Going forward, all Yutaka operations related to drive components will be transferred from Toyota to JTEKT.

- In June 2019, Nexteer opened its new facility in liudong new district, Liuzhou, China. this new 12,000 square meter plant will provide customers with ceps (column-assist electric power steering) systems, related technologies, and services. the establishment of the new plant will boost Nexteer’s manufacturing capacity in the Asia pacific region to meet the growing demand for electric power steering systems in the Chinese and Asia pacific markets.

- In November 2018, NSK Ltd. joint venture, Rane NSK Steering Systems Pvt. Ltd., established a new plant in Gujarat (India) to produce electric power steering (EPS) systems. The plant is spread across 18,000 square meters of land size and has a floor space of 5,200 square meters. The investment is a part of the company’s strategic plan to achieve growth. The company will manufacture 250,000 units of electric power steering annually.

- In October 2018, Tenneco acquired Federal-Mogul LLC, a leading global supplier to original equipment manufacturers and the aftermarket. The transaction will result in the creation of two new product-focused companies with strong portfolios. The deal will create synergy between the companies and accelerates long-term value creation.

Frequently Asked Questions (FAQ):

What is the current size of the electric power steering market?

The overall electric power steering market is projected to grow from USD 24.3 billion in 2021 to USD 33.4 billion by 2027, at a CAGR of 5.4% during the forecast period.

Who are the STARS in the electric power steering market?

Some of the major market players are Robert Bosch (Germany), JTEKT Corporation (Japan), Nexteer Automotive (US), ZF TRW (Germany), NSK Ltd. (Japan).

What is the Covid-19 impact on electric power steering market OEMs?

The halt in vehicle production across the region has impacted the electric power steering market OEMs due to plunged auto manufacturing and sales on the backdrop of Covid-19. Despite this, owing to an increased installation of electric power steering (EPS) in passenger cars and light commercial vehicles and increasing demand for comfort features in vehicles, the market is expected to recover during the forecast period.

What are the new market trends impacting the growth of the electric power steering market?

Zero emission policies, incentive, subsidies and favorable policies are likely to drive electric power steering market along with greater adoption in commercial vehicles and initiatives by OEM’s to reduce complexity and weight of the vehicles.

Which countries are considered in the Asia Pacific region?

Asia Pacific region comprises countries such as China, Japan, India, and South Korea. .

To speak to our analyst for a discussion on the above findings, click Speak to Analyst

TABLE OF CONTENTS

1 INTRODUCTION (Page No. - 26)

1.1 OBJECTIVES

1.2 MARKET DEFINITION

1.2.1 INCLUSIONS & EXCLUSIONS

1.3 MARKET SCOPE

FIGURE 1 MARKET SEGMENTATION: ELECTRIC POWER STEERING MARKET

1.3.1 YEARS CONSIDERED FOR THE STUDY

1.4 CURRENCY

1.5 LIMITATIONS

1.6 STAKEHOLDERS

1.7 SUMMARY OF CHANGES

2 RESEARCH METHODOLOGY (Page No. - 31)

2.1 RESEARCH DATA

FIGURE 2 ELECTRIC POWER STEERING MARKET: RESEARCH DESIGN

FIGURE 3 RESEARCH DESIGN MODEL

2.1.1 SECONDARY DATA

2.1.1.1 Key secondary sources for vehicle production

2.1.1.2 Key secondary sources for market sizing

2.1.1.3 Key data from secondary sources

2.1.2 PRIMARY DATA

FIGURE 4 BREAKDOWN OF PRIMARY INTERVIEWS

2.1.3 PRIMARY PARTICIPANTS

2.2 MARKET ESTIMATION METHODOLOGY

FIGURE 5 RESEARCH METHODOLOGY: HYPOTHESIS BUILDING

2.3 MARKET SIZE ESTIMATION

2.3.1 BOTTOM-UP APPROACH

FIGURE 6 MARKET: BOTTOM-UP APPROACH

2.3.2 TOP-DOWN APPROACH

FIGURE 7 MARKET: TOP-DOWN APPROACH

2.3.3 RESEARCH DESIGN AND METHODOLOGY

FIGURE 8 RESEARCH APPROACH: MARKET

2.3.4 DEMAND-SIDE APPROACH

2.4 DATA TRIANGULATION

FIGURE 9 DATA TRIANGULATION

2.5 FACTOR ANALYSIS

2.5.1 FACTOR ANALYSIS FOR MARKET SIZING: DEMAND AND SUPPLY SIDES

2.6 RESEARCH ASSUMPTIONS

2.7 RESEARCH LIMITATIONS

3 EXECUTIVE SUMMARY (Page No. - 46)

3.1 PRE & POST-COVID-19 SCENARIO

FIGURE 10 PRE & POST-COVID-19 SCENARIO: ELECTRIC POWER STEERING MARKET, 2018–2027 (USD MILLION)

TABLE 1 MARKET: PRE VS. POST-COVID-19 SCENARIO, 2020–2027 (USD MILLION)

3.2 REPORT SUMMARY

FIGURE 11 MARKET: ASIA PACIFIC TO BE LARGEST MARKET DURING FORECAST PERIOD

4 PREMIUM INSIGHTS (Page No. - 51)

4.1 ATTRACTIVE OPPORTUNITIES IN ELECTRIC POWER STEERING MARKET

FIGURE 12 ATTRACTIVE OPPORTUNITIES IN MARKET

4.2 MARKET, BY REGION

FIGURE 13 ASIA PACIFIC PROJECTED TO LEAD MARKET DURING FORECAST PERIOD

4.3 MARKET, BY TYPE

FIGURE 14 BY TYPE, C-EPS SEGMENT PROJECTED TO LEAD MARKET DURING FORECAST PERIOD

4.4 MARKET, BY APPLICATION

FIGURE 15 BY APPLICATION, PASSENGER CAR SEGMENT PROJECTED TO LEAD MARKET DURING FORECAST PERIOD

4.5 MARKET, BY COMPONENT

FIGURE 16 BY COMPONENT, MECHANICAL RACK & PINION SEGMENT PROJECTED TO LEAD MARKET DURING FORECAST PERIOD

4.6 MARKET, BY MECHANISM

FIGURE 17 BY MECHANISM, COLLAPSIBLE EPS SEGMENT PROJECTED TO LEAD MARKET DURING FORECAST PERIOD

4.7 MARKET, BY ELECTRIC MOTOR TYPE

FIGURE 18 BY ELECTRIC MOTOR TYPE, BRUSHLESS DC MOTOR SEGMENT PROJECTED TO LEAD MARKET DURING FORECAST PERIOD

4.8 MARKET, BY ELECTRIC VEHICLE TYPE

FIGURE 19 BY ELECTRIC VEHICLE TYPE, BEV SEGMENT PROJECTED TO LEAD MARKET DURING FORECAST PERIOD

4.9 MARKET, BY OFF-HIGHWAY VEHICLE

FIGURE 20 BY OFF-HIGHWAY VEHICLE, AGRICULTURAL EQUIPMENT SEGMENT PROJECTED TO LEAD MARKET BY 2027

5 MARKET OVERVIEW (Page No. - 56)

5.1 INTRODUCTION

5.2 MARKET DYNAMICS

FIGURE 21 ELECTRIC POWER STEERING: MARKET DYNAMICS

5.2.1 DRIVERS

5.2.1.1 Regulatory push towards efficient technologies

FIGURE 22 GLOBAL EMISSION REGULATIONS FOR LIGHT-DUTY VEHICLES, BY COUNTRY, 2014–2025

5.2.1.2 Global measures by OEMs to reduce complexity and weight of vehicles

TABLE 2 MASS REDUCTION BY USE OF LIGHTWEIGHT MATERIAL

5.2.1.3 Increasing vehicle production

TABLE 3 GLOBAL LIGHT VEHICLE SALES FORECAST, BY REGION, 2020-2023 (MILLION UNITS)

5.2.2 RESTRAINTS

5.2.2.1 Higher cost of EPS as compared to traditional steering systems

5.2.2.2 Lack of steering feel

5.2.2.3 Limited load-bearing capacity of EPS systems

TABLE 4 STEERING RACK FORCE LIMIT, BY PASSENGER CAR

5.2.3 OPPORTUNITIES

5.2.3.1 Adoption of steer-by-wire technology

FIGURE 23 WORKING OF STEER-BY-WIRE TECHNOLOGY

FIGURE 24 ADVANTAGES AND DISADVANTAGES OF STEER-BY-WIRE

FIGURE 25 PROS AND CONS OF STEER-BY-WIRE SYSTEMS

5.2.3.2 Penetration in commercial vehicles

5.2.3.3 Enabling ADAS features in EPS systems

5.2.4 CHALLENGES

5.2.4.1 Maintaining market against steer-by-wire technology

5.2.4.2 Autonomous vehicles without steering wheels

5.2.4.3 Failure of EPS system subcomponents

5.3 MACRO-INDICATOR ANALYSIS

5.3.1 INTRODUCTION

5.3.2 MACRO INDICATORS INFLUENCING THE MARKET FOR TOP 3 COUNTRIES

5.3.2.1 China

FIGURE 26 CHINA: RISING GDP PPP IS EXPECTED TO DRIVE THE MARKET DURING THE FORECAST PERIOD

5.3.2.2 US

FIGURE 27 US: GNI PER CAPITA IS EXPECTED TO PLAY A CRUCIAL ROLE OWING TO INCREASE IN MANUFACTURING EMPLOYMENT

5.3.2.3 Germany

FIGURE 28 GERMANY: PURCHASING POWER OF CUSTOMERS IS EXPECTED TO DRIVE THE MARKET

5.4 MARKET SCENARIO

FIGURE 29 MARKET SCENARIO, 2021–2027 (USD MILLION)

5.4.1 MOST LIKELY SCENARIO

TABLE 5 MOST LIKELY SCENARIO: MARKET, BY REGION, 2021–2027 (USD MILLION)

5.4.2 LOW COVID-19 IMPACT SCENARIO

TABLE 6 LOW IMPACT SCENARIO: MARKET, BY REGION, 2021–2027 (USD MILLION)

5.4.3 HIGH COVID-19 IMPACT SCENARIO

TABLE 7 HIGH IMPACT SCENARIO: MARKET, BY REGION, 2021–2027 (USD MILLION)

5.5 PORTER’S FIVE FORCES ANALYSIS

FIGURE 30 PORTER’S FIVE FORCES ANALYSIS: PRESENCE OF ESTABLISHED GLOBAL PLAYERS INCREASES THE DEGREE OF COMPETITION

5.5.1 THREAT OF SUBSTITUTES

5.5.2 THREAT OF NEW ENTRANTS

5.5.3 BARGAINING POWER OF BUYERS

5.5.4 BARGAINING POWER OF SUPPLIERS

5.5.5 RIVALRY AMONG EXISTING COMPETITORS

5.6 SUPPLY CHAIN ANALYSIS

FIGURE 31 SUPPLY CHAIN ANALYSIS OF ELECTRIC POWER STEERING MARKET

5.6.1 ELECTRIC POWER STEERING SYSTEM MARKET: SUPPLY CHAIN

5.7 EPS ECOSYSTEM

5.8 AVERAGE SELLING PRICE ANALYSIS OF ELECTRIC POWER STEERING, BY REGION & APPLICATION

5.8.1 PASSENGER CARS

TABLE 8 ELECTRIC POWER STEERING: AVERAGE PRICE ANALYSIS FOR PASSENGER CARS, 2021 (PER UNIT COST IN USD)

5.8.2 COMMERCIAL VEHICLES

TABLE 9 ELECTRIC POWER STEERING: AVERAGE PRICE ANALYSIS FOR COMMERCIAL VEHICLE, 2021 (PER UNIT COST IN USD)

5.9 TRADE ANALYSIS

TABLE 10 STEERING SYSTEM IMPORTS, SELECT COUNTRIES, 2020-2021 (USD)

5.10 PATENT ANALYSIS

TABLE 11 INNOVATION & PATENT REGISTRATIONS, 2019-2021

5.11 CASE STUDY ANALYSIS

5.11.1 CASE STUDY1

5.11.2 CASE STUDY 2

FIGURE 32 BLOCK DIAGRAM OF AN EPS MOTOR CONTROL UNIT

5.12 REGULATORY LANDSCAPE

TABLE 12 SAFETY REGULATIONS, BY COUNTRY/REGION

5.13 TECHNOLOGY OVERVIEW

FIGURE 33 EVOLUTION OF EPS SYSTEM (2005-2030)

5.13.1 ADAS FEATURES: AUTOMATED STEERING SYSTEM

FIGURE 34 ROADMAP OF ADAS FOR TOP 3 NATIONS (2013–2030)

5.13.2 STEER-BY-WIRE (SBW): CUTTING EDGE OF STEERING SYSTEM

FIGURE 35 REACH OF SBW IN AUTOMATED STEERING SYSTEM MARKET

5.13.3 TYPES OF SBW TECHNOLOGY

5.13.3.1 Type I

5.13.3.2 Type II

5.13.3.3 Type III

FIGURE 36 THREE TYPES OF STEER-BY-WIRE

5.13.4 FAIL-SAFE MECHANISM

TABLE 13 FAIL-SAFE MECHANISM OF EPS SYSTEM

5.14 KEY CONFERENCES & EVENTS IN 2022-2023

TABLE 14 MARKET: DETAILED LIST OF CONFERENCES & EVENTS

6 ELECTRIC POWER STEERING MARKET, BY COMPONENT (Page No. - 84)

6.1 INTRODUCTION

6.1.1 RESEARCH METHODOLOGY

6.1.2 PRIMARY INDUSTRY INSIGHTS

FIGURE 37 MARKET, BY COMPONENT, 2021 VS. 2027 (USD MILLION)

TABLE 15 MARKET, BY COMPONENT, 2018–2020 (USD MILLION)

TABLE 16 MARKET, BY COMPONENT, 2021–2027 (USD MILLION)

6.2 STEERING COLUMN

TABLE 17 STEERING COLUMN: MARKET, BY REGION, 2018–2020 (USD MILLION)

TABLE 18 STEERING COLUMN: MARKET, BY REGION, 2021–2027 (USD MILLION)

TABLE 19 STEERING COLUMN: MARKET, BY APPLICATION, 2018–2020 (USD MILLION)

TABLE 20 STEERING COLUMN: MARKET, BY APPLICATION, 2021–2027 (USD MILLION)

6.3 SENSOR

TABLE 21 SENSOR: MARKET, BY REGION, 2018–2020 (USD MILLION)

TABLE 22 SENSOR: MARKET, BY REGION, 2021–2027 (USD MILLION)

TABLE 23 SENSOR: MARKET, BY APPLICATION, 2018–2020 (USD MILLION)

TABLE 24 SENSOR: MARKET, BY APPLICATION, 2021–2027 (USD MILLION)

6.4 STEERING GEAR

TABLE 25 STEERING GEAR: MARKET, BY REGION, 2018–2020 (USD MILLION)

TABLE 26 STEERING GEAR: MARKET, BY REGION, 2021–2027 (USD MILLION)

TABLE 27 STEERING GEAR: MARKET, BY APPLICATION, 2018–2020 (USD MILLION)

TABLE 28 STEERING GEAR: MARKET, BY APPLICATION, 2021–2027 (USD MILLION)

6.5 MECHANICAL PINION & RACK

TABLE 29 MECHANICAL PINION AND RACK: MARKET, BY REGION, 2018–2020 (USD MILLION)

TABLE 30 MECHANICAL PINION AND RACK: MARKET, BY REGION, 2021–2027 (USD MILLION)

TABLE 31 MECHANICAL PINION AND RACK: MARKET, BY APPLICATION, 2018–2020 (USD MILLION)

TABLE 32 MECHANICAL PINION AND RACK: MARKET, BY APPLICATION, 2021–2027 (USD MILLION)

6.6 ELECTRONIC CONTROL UNIT (ECU)

TABLE 33 ELECTRONIC CONTROL UNIT: MARKET, BY REGION, 2018–2020 (USD MILLION)

TABLE 34 ELECTRONIC CONTROL UNIT: MARKET, BY REGION, 2021–2027 (USD MILLION)

TABLE 35 ELECTRONIC CONTROL UNIT: MARKET, BY APPLICATION, 2018–2020 (USD MILLION)

TABLE 36 ELECTRONIC CONTROL UNIT: MARKET, BY APPLICATION, 2021–2027 (USD MILLION)

6.7 ELECTRIC MOTOR

TABLE 37 ELECTRIC MOTOR: MARKET, BY REGION, 2018–2020 (USD MILLION)

TABLE 38 ELECTRIC MOTOR: MARKET, BY REGION, 2021–2027 (USD MILLION)

TABLE 39 ELECTRIC MOTOR: MARKET, BY APPLICATION, 2018–2020 (USD MILLION)

TABLE 40 ELECTRIC MOTOR: MARKET, BY APPLICATION, 2021–2027 (USD MILLION)

6.8 BEARING

TABLE 41 BEARING: MARKET, BY REGION, 2018–2020 (USD MILLION)

TABLE 42 BEARING: MARKET, BY REGION, 2021–2027 (USD MILLION)

TABLE 43 BEARING: MARKET, BY APPLICATION, 2018–2020 (USD MILLION)

TABLE 44 BEARING: MARKET, BY APPLICATION, 2021–2027 (USD MILLION)

7 ELECTRIC POWER STEERING MARKET, BY OFF-HIGHWAY VEHICLE (Page No. - 100)

7.1 INTRODUCTION

7.1.1 RESEARCH METHODOLOGY

7.1.2 PRIMARY INDUSTRY INSIGHTS

7.1.3 ASSUMPTIONS

FIGURE 38 MARKET, BY OFF-HIGHWAY VEHICLE, 2021 VS. 2027 (USD MILLION)

TABLE 45 MARKET, BY OFF-HIGHWAY VEHICLE, 2021–2027 (THOUSAND UNITS)

TABLE 46 MARKET, BY OFF-HIGHWAY VEHICLE, 2021–2027 (USD MILLION)

7.2 AGRICULTURAL TRACTORS

TABLE 47 AGRICULTURAL TRACTORS: MARKET, BY REGION, 2021–2027 (THOUSAND UNITS)

TABLE 48 AGRICULTURAL TRACTORS: MARKET, BY REGION, 2021–2027 (USD MILLION)

7.3 CONSTRUCTION EQUIPMENT

TABLE 49 CONSTRUCTION EQUIPMENT: MARKET, BY REGION, 2021–2027 (THOUSAND UNITS)

TABLE 50 CONSTRUCTION EQUIPMENT: MARKET, BY REGION, 2021–2027 (USD MILLION)

8 ELECTRIC POWER STEERING MARKET, BY ELECTRIC MOTOR TYPE (Page No. - 106)

8.1 INTRODUCTION

8.1.1 RESEARCH METHODOLOGY

8.1.2 PRIMARY INDUSTRY INSIGHTS

8.1.3 ASSUMPTIONS

FIGURE 39 MARKET, BY ELECTRIC MOTOR TYPE, 2021 VS. 2027 (USD MILLION)

TABLE 51 MARKET, BY ELECTRIC MOTOR TYPE, 2018–2020 (MILLION UNITS)

TABLE 52 MARKET, BY ELECTRIC MOTOR TYPE, 2021–2027 (MILLION UNITS)

TABLE 53 MARKET, BY ELECTRIC MOTOR TYPE, 2018–2020 (USD MILLION)

TABLE 54 MARKET, BY ELECTRIC MOTOR TYPE, 2021–2027 (USD MILLION)

8.2 BRUSHED DC MOTOR

TABLE 55 BRUSHED DC MOTOR: MARKET, BY REGION, 2018–2020 (MILLION UNITS)

TABLE 56 BRUSHED DC MOTOR: MARKET, BY REGION, 2021–2027 (MILLION UNITS)

TABLE 57 BRUSHED DC MOTOR: MARKET, BY REGION, 2018–2020 (USD MILLION)

TABLE 58 BRUSHED DC MOTOR: MARKET, BY REGION, 2021–2027 (USD MILLION)

8.3 BRUSHLESS DC MOTOR

TABLE 59 BRUSHLESS DC MOTOR: MARKET, BY REGION 2018–2020 (MILLION UNITS)

TABLE 60 BRUSHLESS DC MOTOR: MARKET, BY REGION, 2021–2027 (MILLION UNITS)

TABLE 61 BRUSHLESS DC MOTOR: MARKET, BY REGION, 2018–2020 (USD MILLION)

TABLE 62 BRUSHLESS DC MOTOR: MARKET, BY REGION, 2021–2027 (USD MILLION)

9 ELECTRIC POWER STEERING MARKET, BY APPLICATION (Page No. - 113)

9.1 INTRODUCTION

9.1.1 RESEARCH METHODOLOGY

9.1.2 PRIMARY INDUSTRY INSIGHTS

FIGURE 40 MARKET, BY APPLICATION, 2021 VS. 2027 (USD MILLION)

TABLE 63 MARKET, BY APPLICATION, 2018–2020 (MILLION UNITS)

TABLE 64 MARKET, BY APPLICATION, 2021–2027 (MILLION UNITS)

TABLE 65 MARKET, BY APPLICATION, 2018–2020 (USD MILLION)

TABLE 66 MARKET, BY APPLICATION, 2021–2027 (USD MILLION)

9.2 PASSENGER CAR

TABLE 67 PASSENGER CAR: MARKET, BY REGION, 2018–2020 (MILLION UNITS)

TABLE 68 PASSENGER CAR: MARKET, BY REGION, 2021–2027 (MILLION UNITS)

TABLE 69 PASSENGER CAR: MARKET, BY REGION, 2018–2020 (USD MILLION)

TABLE 70 PASSENGER CAR: MARKET, BY REGION, 2021–2027 (USD MILLION)

9.3 COMMERCIAL VEHICLE

TABLE 71 COMMERCIAL VEHICLE: MARKET, BY REGION, 2018–2020 (MILLION UNITS)

TABLE 72 COMMERCIAL VEHICLE: MARKET, BY REGION, 2021–2027 (MILLION UNITS)

TABLE 73 COMMERCIAL VEHICLE: MARKET, BY REGION, 2018–2020 (USD MILLION)

TABLE 74 COMMERCIAL VEHICLE: MARKET, BY REGION, 2021–2027 (USD MILLION)

10 ELECTRIC POWER STEERING MARKET, BY ELECTRIC VEHICLE TYPE (Page No. - 120)

10.1 INTRODUCTION

10.1.1 RESEARCH METHODOLOGY

10.1.2 PRIMARY INDUSTRY INSIGHTS

10.1.3 ASSUMPTIONS

10.2 ASIA PACIFIC

10.3 EUROPE

10.4 NORTH AMERICA

FIGURE 41 MARKET, BY ELECTRIC VEHICLE TYPE, 2021 VS. 2027 (USD MILLION)

TABLE 75 MARKET, BY ELECTRIC VEHICLE TYPE, 2018–2020 (THOUSAND UNITS)

TABLE 76 MARKET, BY ELECTRIC VEHICLE TYPE, 2021–2027 (THOUSAND UNITS)

TABLE 77 MARKET, BY ELECTRIC VEHICLE TYPE, 2018–2020 (USD MILLION)

TABLE 78 MARKET, BY ELECTRIC VEHICLE TYPE, 2021–2027 (USD MILLION)

10.5 BATTERY ELECTRIC VEHICLE (BEV)

TABLE 79 BATTERY ELECTRIC VEHICLE: MARKET, BY REGION 2018–2020 (THOUSAND UNITS)

TABLE 80 BATTERY ELECTRIC VEHICLE: MARKET, BY REGION, 2021–2027 (THOUSAND UNITS)

TABLE 81 BATTERY ELECTRIC VEHICLE: MARKET, BY REGION, 2018–2020 (USD MILLION)

TABLE 82 BATTERY ELECTRIC VEHICLE: MARKET, BY REGION, 2021–2027 (USD MILLION)

10.5.1 ASIA PACIFIC

TABLE 83 ASIA PACIFIC: MARKET, BY COUNTRY, 2018–2020 (THOUSAND UNITS)

TABLE 84 ASIA PACIFIC: MARKET, BY COUNTRY, 2021–2027 (THOUSAND UNITS)

TABLE 85 ASIA PACIFIC: MARKET, BY COUNTRY, 2018–2020 (USD MILLION)

TABLE 86 ASIA PACIFIC: MARKET, BY COUNTRY, 2021–2027 (USD MILLION)

10.5.2 EUROPE

TABLE 87 EUROPE: MARKET, BY COUNTRY, 2018–2020 (THOUSAND UNITS)

TABLE 88 EUROPE: MARKET, BY COUNTRY, 2021–2027 (THOUSAND UNITS)

TABLE 89 EUROPE: MARKET, BY COUNTRY, 2018–2020 (USD MILLION)

TABLE 90 EUROPE: MARKET, BY COUNTRY, 2021–2027 (USD MILLION)

10.5.3 NORTH AMERICA

TABLE 91 NORTH AMERICA: MARKET, BY COUNTRY, 2018–2020 (THOUSAND UNITS)

TABLE 92 NORTH AMERICA: MARKET, BY COUNTRY, 2021–2027 (THOUSAND UNITS)

TABLE 93 NORTH AMERICA: MARKET, BY COUNTRY, 2018–2020 (USD MILLION)

TABLE 94 NORTH AMERICA: MARKET, BY COUNTRY, 2021–2027 (USD MILLION)

10.6 PLUG-IN HYBRID ELECTRIC VEHICLE (PHEV)

TABLE 95 PLUG-IN HYBRID ELECTRIC VEHICLE: ELECTRIC POWER STEERING MARKET, BY REGION, 2018–2020 (THOUSAND UNITS)

TABLE 96 MARKET, BY REGION, 2021–2027 (THOUSAND UNITS)

TABLE 97 MARKET, BY REGION, 2018–2020 (USD MILLION)

TABLE 98 MARKET, BY REGION, 2021–2027 (USD MILLION)

10.6.1 ASIA PACIFIC

TABLE 99 ASIA PACIFIC: MARKET, BY COUNTRY, 2018–2020 (THOUSAND UNITS)

TABLE 100 ASIA PACIFIC: MARKET, BY COUNTRY, 2021–2027 (THOUSAND UNITS)

TABLE 101 ASIA PACIFIC: MARKET, BY COUNTRY, 2018–2020 (USD MILLION)

TABLE 102 ASIA PACIFIC: MARKET, BY COUNTRY, 2021–2027 (USD MILLION)

10.6.2 EUROPE

TABLE 103 EUROPE: MARKET, BY COUNTRY, 2018–2020 (THOUSAND UNITS)

TABLE 104 EUROPE: MARKET, BY COUNTRY, 2021–2027 (THOUSAND UNITS)

TABLE 105 EUROPE: MARKET, BY COUNTRY, 2018–2020 (USD MILLION)

TABLE 106 EUROPE: MARKET, BY COUNTRY, 2021–2027 (USD MILLION)

10.6.3 NORTH AMERICA

TABLE 107 NORTH AMERICA: MARKET, BY COUNTRY, 2018–2020 (THOUSAND UNITS)

TABLE 108 NORTH AMERICA: MARKET, BY COUNTRY, 2021–2027 (THOUSAND UNITS)

TABLE 109 NORTH AMERICA: MARKET, BY COUNTRY, 2018–2020 (USD MILLION)

TABLE 110 NORTH AMERICA: MARKET, BY COUNTRY, 2021–2027 (USD MILLION)

10.7 FUEL CELL ELECTRIC VEHICLE (FCEV)

TABLE 111 FUEL CELL ELECTRIC VEHICLE: ELECTRIC POWER STEERING MARKET, BY REGION, 2018–2020 (UNITS)

TABLE 112 MARKET, BY REGION, 2021–2027 (UNITS)

TABLE 113 MARKET, BY REGION, 2018–2020 (USD THOUSAND)

TABLE 114 MARKET, BY REGION, 2021–2027 (USD THOUSAND)

10.7.1 ASIA PACIFIC

TABLE 115 ASIA PACIFIC: MARKET, BY COUNTRY, 2018–2020 (UNITS)

TABLE 116 ASIA PACIFIC: MARKET, BY COUNTRY, 2021–2027 (UNITS)

TABLE 117 ASIA PACIFIC: MARKET, BY COUNTRY, 2018–2020 (USD THOUSAND)

TABLE 118 ASIA PACIFIC: MARKET, BY COUNTRY, 2021–2027 (USD THOUSAND)

10.7.2 EUROPE

TABLE 119 EUROPE: MARKET, BY COUNTRY, 2018–2020 (UNITS)

TABLE 120 EUROPE: MARKET, BY COUNTRY, 2021–2027 (UNITS)

TABLE 121 EUROPE: MARKET, BY COUNTRY, 2018–2020 (USD THOUSAND)

TABLE 122 EUROPE: MARKET, BY COUNTRY, 2021–2027 (USD THOUSAND)

10.7.3 NORTH AMERICA

TABLE 123 NORTH AMERICA: MARKET, BY COUNTRY, 2018–2020 (UNITS)

TABLE 124 NORTH AMERICA: MARKET, BY COUNTRY, 2021–2027 (UNITS)

TABLE 125 NORTH AMERICA: MARKET, BY COUNTRY, 2018–2020 (USD THOUSAND)

TABLE 126 NORTH AMERICA: MARKET, BY COUNTRY, 2021–2027 (USD THOUSAND)

11 ELECTRIC POWER STEERING MARKET, BY TYPE (Page No. - 146)

11.1 INTRODUCTION

11.1.1 RESEARCH METHODOLOGY

11.1.2 PRIMARY INDUSTRY INSIGHTS

11.1.3 ASSUMPTIONS

FIGURE 42 MARKET SIZE, BY TYPE, 2021 VS. 2027 (USD MILLION)

TABLE 127 MARKET, BY TYPE, 2018–2020 (MILLION UNITS)

TABLE 128 MARKET, BY TYPE, 2021–2027 (MILLION UNITS)

TABLE 129 MARKET, BY TYPE, 2018–2020 (USD MILLION)

TABLE 130 MARKET, BY TYPE, 2021–2027 (USD MILLION)

11.2 C-EPS

TABLE 131 C-EPS: ELECTRIC POWER STEERING MARKET, BY REGION, 2018–2020 (MILLION UNITS)

TABLE 132 MARKET, BY REGION, 2021–2027 (MILLION UNITS)

TABLE 133 MARKET, BY REGION, 2018–2020 (USD MILLION)

TABLE 134 MARKET, BY REGION, 2021–2027 (USD MILLION)

11.3 P-EPS

TABLE 135 P-EPS: ELECTRIC POWER STEERING MARKET, BY REGION, 2018–2020 (MILLION UNITS)

TABLE 136 MARKET, BY REGION, 2021–2027 (MILLION UNITS)

TABLE 137 MARKET, BY REGION, 2018–2020 (USD MILLION)

TABLE 138 MARKET, BY REGION, 2021–2027 (USD MILLION)

11.4 R-EPS

TABLE 139 R-EPS: ELECTRIC POWER STEERING MARKET, BY REGION, 2018–2020 (MILLION UNITS)

TABLE 140 MARKET, BY REGION, 2021–2027 (MILLION UNITS)

TABLE 141 MARKET, BY REGION, 2018–2020 (USD MILLION)

TABLE 142 MARKET, BY REGION, 2021–2027 (USD MILLION)

12 ELECTRIC POWER STEERING MARKET, BY MECHANISM (Page No. - 155)

12.1 INTRODUCTION

12.1.1 RESEARCH METHODOLOGY

12.1.2 PRIMARY INDUSTRY INSIGHTS

FIGURE 43 MARKET SIZE, BY MECHANISM, 2021 VS. 2027 (USD MILLION)

TABLE 143 MARKET SIZE, BY MECHANISM, 2018–2020 (MILLION UNITS)

TABLE 144 MARKET SIZE, BY MECHANISM, 2021–2027 (MILLION UNITS)

TABLE 145 MARKET SIZE, BY MECHANISM, 2018–2020 (USD MILLION)

TABLE 146 MARKET SIZE, BY MECHANISM, 2021–2027 (USD MILLION)

12.2 COLLAPSIBLE EPS

TABLE 147 COLLAPSIBLE EPS: ELECTRIC POWER STEERING MARKET, BY REGION, 2018–2020 (MILLION UNITS)

TABLE 148 MARKET, BY REGION, 2021–2027 (MILLION UNITS)

TABLE 149 MARKET, BY REGION, 2018–2020 (USD MILLION)

TABLE 150 MARKET, BY REGION, 2021–2027 (USD MILLION)

12.3 RIGID EPS

TABLE 151 RIGID EPS: ELECTRIC POWER STEERING MARKET, BY REGION, 2018–2020 (MILLION UNITS)

TABLE 152 MARKET, BY REGION, 2021–2027 (MILLION UNITS)

TABLE 153 MARKET, BY REGION, 2018–2020 (USD MILLION)

TABLE 154 MARKET, BY REGION, 2021–2027 (USD MILLION)

13 ELECTRIC POWER STEERING MARKET, BY EV GEAR TYPE (Page No. - 162)

13.1 INTRODUCTION

13.1.1 RESEARCH METHODOLOGY

13.2 BATTERY ELECTRIC VEHICLE (BEV)

TABLE 155 WORM GEAR: ELECTRIC POWER STEERING MARKET FOR BATTERY ELECTRIC VEHICLE, BY REGION, 2018–2020 (THOUSAND UNITS)

TABLE 156 MARKET FOR BATTERY ELECTRIC VEHICLE, BY REGION, 2021–2027 (THOUSAND UNITS)

TABLE 157 MARKET FOR BATTERY ELECTRIC VEHICLE, BY REGION, 2018–2020 (THOUSAND UNITS)

TABLE 158 MARKET FOR BATTERY ELECTRIC VEHICLE, BY REGION, 2021–2027 (THOUSAND UNITS)

13.3 PLUG-IN HYBRID ELECTRIC VEHICLE (PHEV)

TABLE 159 MARKET FOR PLUG-IN HYBRID ELECTRIC VEHICLE, BY REGION, 2018–2020 (THOUSAND UNITS)

TABLE 160 MARKET FOR PLUG-IN HYBRID ELECTRIC VEHICLE, BY REGION, 2021–2027 (THOUSAND UNITS)

TABLE 161 MARKET FOR PLUG-IN HYBRID ELECTRIC VEHICLE, BY REGION, 2018–2020 (THOUSAND UNITS)

TABLE 162 MARKET FOR PLUG-IN HYBRID ELECTRIC VEHICLE, BY REGION, 2021–2027 (THOUSAND UNITS)

14 ELECTRIC POWER STEERING MARKET, BY REGION (Page No. - 168)

14.1 INTRODUCTION

FIGURE 44 MARKET, BY REGION, 2021 VS. 2027 (USD MILLION)

TABLE 163 MARKET, BY REGION, 2018–2020 (MILLION UNITS)

TABLE 164 MARKET, BY REGION, 2021–2027 (MILLION UNITS)

TABLE 165 MARKET, BY REGION, 2018–2020 (USD MILLION)

TABLE 166 MARKET, BY REGION, 2021–2027 (USD MILLION)

14.2 ASIA PACIFIC

FIGURE 45 ASIA PACIFIC: MARKET SNAPSHOT

TABLE 167 ASIA PACIFIC: MARKET, BY COUNTRY, 2018–2020 (MILLION UNITS)

TABLE 168 ASIA PACIFIC: MARKET, BY COUNTRY, 2021–2027 (MILLION UNITS)

TABLE 169 ASIA PACIFIC: MARKET, BY COUNTRY, 2018–2020 (USD MILLION)

TABLE 170 ASIA PACIFIC: MARKET, BY COUNTRY, 2021–2027 (USD MILLION)

14.2.1 CHINA

TABLE 171 CHINA: VEHICLE PRODUCTION DATA, 2018-2020 (THOUSAND UNITS)

TABLE 172 CHINA: MARKET, BY APPLICATION, 2018–2020 (MILLION UNITS)

TABLE 173 CHINA: MARKET, BY APPLICATION, 2021–2027 (MILLION UNITS)

TABLE 174 CHINA: MARKET, BY APPLICATION, 2018–2020 (USD MILLION)

TABLE 175 CHINA: MARKET, BY APPLICATION, 2021–2027 (USD MILLION)

14.2.2 INDIA

TABLE 176 INDIA: VEHICLE PRODUCTION DATA, 2018-2020 (THOUSAND UNITS)

TABLE 177 INDIA: MARKET, BY APPLICATION, 2018–2020 (MILLION UNITS)

TABLE 178 INDIA: MARKET, BY APPLICATION, 2021–2027 (MILLION UNITS)

TABLE 179 INDIA: MARKET, BY APPLICATION, 2018–2020 (USD MILLION)

TABLE 180 INDIA: MARKET, BY APPLICATION, 2021–2027 (USD MILLION)

14.2.3 JAPAN

TABLE 181 JAPAN: VEHICLE PRODUCTION DATA, 2018-2020 (THOUSAND UNITS)

TABLE 182 JAPAN: MARKET, BY APPLICATION, 2018–2020 (MILLION UNITS)

TABLE 183 JAPAN: MARKET, BY APPLICATION, 2021–2027 (MILLION UNITS)

TABLE 184 JAPAN: MARKET, BY APPLICATION, 2018–2020 (USD MILLION)

TABLE 185 JAPAN: MARKET, BY APPLICATION, 2021–2027 (USD MILLION)

14.2.4 SOUTH KOREA

TABLE 186 SOUTH KOREA: VEHICLE PRODUCTION DATA, 2018-2020 (THOUSAND UNITS)

TABLE 187 SOUTH KOREA: MARKET, BY APPLICATION, 2018–2020 (MILLION UNITS)

TABLE 188 SOUTH KOREA: MARKET, BY APPLICATION, 2021–2027 (MILLION UNITS)

TABLE 189 SOUTH KOREA: MARKET, BY APPLICATION, 2018–2020 (USD MILLION)

TABLE 190 SOUTH KOREA: MARKET, BY APPLICATION, 2021–2027 (USD MILLION)

14.3 EUROPE

TABLE 191 EUROPE: MARKET, BY COUNTRY, 2018–2020 (MILLION UNITS)

TABLE 192 EUROPE: MARKET, BY COUNTRY, 2021–2027 (MILLION UNITS)

TABLE 193 EUROPE: MARKET, BY COUNTRY, 2018–2020 (USD MILLION)

TABLE 194 EUROPE: MARKET, BY COUNTRY, 2021–2027 (USD MILLION)

14.3.1 GERMANY

TABLE 195 GERMANY: VEHICLE PRODUCTION DATA, 2018-2020 (THOUSAND UNITS)

TABLE 196 GERMANY: MARKET, BY APPLICATION, 2018–2020 (MILLION UNITS)

TABLE 197 GERMANY: MARKET, BY APPLICATION, 2021–2027 (MILLION UNITS)

TABLE 198 GERMANY: MARKET, BY APPLICATION, 2018–2020 (USD MILLION)

TABLE 199 GERMANY: MARKET, BY APPLICATION, 2021–2027 (USD MILLION)

14.3.2 ITALY

TABLE 200 ITALY: VEHICLE PRODUCTION DATA, 2018-2020 (THOUSAND UNITS)

TABLE 201 ITALY: MARKET, BY APPLICATION, 2018–2020 (MILLION UNITS)

TABLE 202 ITALY: MARKET, BY APPLICATION, 2021–2027 (MILLION UNITS)

TABLE 203 ITALY: MARKET, BY APPLICATION, 2018–2020 (USD MILLION)

TABLE 204 ITALY: MARKET, BY APPLICATION, 2021–2027 (USD MILLION)

14.3.3 FRANCE

TABLE 205 FRANCE: VEHICLE PRODUCTION DATA, 2018-2020 (THOUSAND UNITS)

TABLE 206 FRANCE: MARKET, BY APPLICATION, 2018–2020 (MILLION UNITS)

TABLE 207 FRANCE: MARKET, BY APPLICATION, 2021–2027 (MILLION UNITS)

TABLE 208 FRANCE: MARKET, BY APPLICATION, 2018–2020 (USD MILLION)

TABLE 209 FRANCE: MARKET, BY APPLICATION, 2021–2027 (USD MILLION)

14.3.4 SPAIN

TABLE 210 SPAIN: VEHICLE PRODUCTION DATA, 2018-2020 (THOUSAND UNITS)

TABLE 211 SPAIN: MARKET, BY APPLICATION, 2018–2020 (MILLION UNITS)

TABLE 212 SPAIN: MARKET, BY APPLICATION, 2021–2027 (MILLION UNITS)

TABLE 213 SPAIN: MARKET, BY APPLICATION, 2018–2020 (USD MILLION)

TABLE 214 SPAIN: MARKET, BY APPLICATION, 2021–2027 (USD MILLION)

14.3.5 UK

TABLE 215 UK: VEHICLE PRODUCTION DATA, 2018–2020 (THOUSAND UNITS)

TABLE 216 UK: MARKET, BY APPLICATION, 2018–2020 (MILLION UNITS)

TABLE 217 UK: MARKET, BY APPLICATION, 2021–2027 (MILLION UNITS)

TABLE 218 UK: MARKET, BY APPLICATION, 2018–2020 (USD MILLION)

TABLE 219 UK: MARKET, BY APPLICATION, 2021–2027 (USD MILLION)

14.3.6 RUSSIA

TABLE 220 RUSSIA: VEHICLE PRODUCTION DATA, 2018–2020 (THOUSAND UNITS)

TABLE 221 RUSSIA: MARKET, BY APPLICATION, 2018–2020 (MILLION UNITS)

TABLE 222 RUSSIA: MARKET, BY APPLICATION, 2021–2027 (MILLION UNITS)

TABLE 223 RUSSIA: MARKET, BY APPLICATION, 2018–2020 (USD MILLION)

TABLE 224 RUSSIA: MARKET, BY APPLICATION, 2021–2027 (USD MILLION)

14.4 NORTH AMERICA

FIGURE 46 NORTH AMERICA: MARKET SNAPSHOT

TABLE 225 NORTH AMERICA: MARKET, BY COUNTRY, 2018–2020 (MILLION UNITS)

TABLE 226 NORTH AMERICA: MARKET, BY COUNTRY, 2021–2027 (MILLION UNITS)

TABLE 227 NORTH AMERICA: MARKET, BY COUNTRY, 2018–2020 (USD MILLION)

TABLE 228 NORTH AMERICA: MARKET, BY COUNTRY, 2021–2027 (USD MILLION)

14.4.1 US

TABLE 229 US: VEHICLE PRODUCTION DATA, 2018–2020 (THOUSAND UNITS)

TABLE 230 US: MARKET, BY APPLICATION, 2018–2020 (MILLION UNITS)

TABLE 231 US: MARKET, BY APPLICATION, 2021–2027 (MILLION UNITS)

TABLE 232 US: MARKET, BY APPLICATION, 2018–2020 (USD MILLION)

TABLE 233 US: MARKET, BY APPLICATION, 2021–2027 (USD MILLION)

14.4.2 CANADA

TABLE 234 CANADA: VEHICLE PRODUCTION DATA, 2018–2020 (THOUSAND UNITS)

TABLE 235 CANADA: MARKET, BY APPLICATION, 2018–2020 (MILLION UNITS)

TABLE 236 CANADA: MARKET, BY APPLICATION, 2021–2027 (MILLION UNITS)

TABLE 237 CANADA: MARKET, BY APPLICATION, 2018–2020 (USD MILLION)

TABLE 238 CANADA: MARKET, BY APPLICATION, 2021–2027 (USD MILLION)

14.4.3 MEXICO

TABLE 239 MEXICO: VEHICLE PRODUCTION DATA, 2018–2020 (THOUSAND UNITS)

TABLE 240 MEXICO: MARKET, BY APPLICATION, 2018–2020 (MILLION UNITS)

TABLE 241 MEXICO: MARKET, BY APPLICATION, 2021–2027 (MILLION UNITS)

TABLE 242 MEXICO: MARKET, BY APPLICATION, 2018–2020 (USD MILLION)

TABLE 243 MEXICO: MARKET, BY APPLICATION, 2021–2027 (USD MILLION)

14.5 REST OF THE WORLD (ROW)

TABLE 244 REST OF THE WORLD: MARKET, BY COUNTRY, 2018–2020 (THOUSAND UNITS)

TABLE 245 REST OF THE WORLD: MARKET, BY COUNTRY, 2021–2027 (THOUSAND UNITS)

TABLE 246 REST OF THE WORLD: MARKET, BY COUNTRY, 2018–2020 (USD MILLION)

TABLE 247 REST OF THE WORLD: MARKET, BY COUNTRY, 2021–2027 (USD MILLION)

14.5.1 BRAZIL

TABLE 248 BRAZIL: VEHICLE PRODUCTION DATA, 2018-2020 (THOUSAND UNITS)

TABLE 249 BRAZIL: MARKET, BY APPLICATION, 2018–2020 (MILLION UNITS)

TABLE 250 BRAZIL: MARKET, BY APPLICATION, 2021–2027 (MILLION UNITS)

TABLE 251 BRAZIL: MARKET, BY APPLICATION, 2018–2020 (USD MILLION)

TABLE 252 BRAZIL: MARKET, BY APPLICATION, 2021–2027 (USD MILLION)

14.5.2 SOUTH AFRICA

TABLE 253 SOUTH AFRICA: VEHICLE PRODUCTION DATA, 2018–2020 (THOUSAND UNITS)

TABLE 254 SOUTH AFRICA: MARKET, BY APPLICATION, 2018–2020 (MILLION UNITS)

TABLE 255 SOUTH AFRICA: MARKET, BY APPLICATION, 2021–2027 (MILLION UNITS)

TABLE 256 SOUTH AFRICA: MARKET, BY APPLICATION, 2018–2020 (USD MILLION)

TABLE 257 SOUTH AFRICA: MARKET, BY APPLICATION, 2021–2027 (USD MILLION)

15 COMPETITIVE LANDSCAPE (Page No. - 201)

15.1 OVERVIEW

15.2 MARKET RANKING ANALYSIS

TABLE 258 ELECTRIC POWER STEERING MARKET RANKING: 2020

FIGURE 47 NORTH AMERICA: MARKET SHARE ANALYSIS, 2020

FIGURE 48 CHINA: MARKET SHARE ANALYSIS, 2020

15.3 REVENUE ANALYSIS OF TOP LISTED/PUBLIC PLAYERS

TABLE 259 MARKET: COMPANY PRODUCT FOOTPRINT, 2021

TABLE 260 MARKET: PRODUCT TYPE FOOTPRINT, 2021

TABLE 261 MARKET: COMPANY REGION FOOTPRINT, 2021

15.4 COMPETITIVE EVALUATION QUADRANT – ELECTRIC POWER STEERING MANUFACTURERS

15.4.1 STAR

15.4.2 EMERGING LEADERS

15.4.3 PERVASIVE

15.4.4 PARTICIPANTS

FIGURE 49 ELECTRIC POWER STEERING MANUFACTURERS: COMPETITIVE EVALUATION MATRIX, 2021

15.5 COMPETITIVE SCENARIO

15.5.1 NEW PRODUCT LAUNCHES

TABLE 262 PRODUCT LAUNCHES, 2018–2022

15.5.2 DEALS

TABLE 263 DEALS, 2018–2020

15.5.3 EXPANSIONS, 2018–2021

TABLE 264 EXPANSIONS, 2018–2021

15.6 KEY PLAYER STRATEGIES/RIGHT TO WIN, 2018–2021

FIGURE 50 COMPANIES ADOPTED NEW PRODUCT DEVELOPMENTS AND EXPANSIONS AS KEY GROWTH STRATEGIES, 2018–2021

16 COMPANY PROFILES (Page No. - 216)

(Business overview, Products offered, Recent developments & MnM View)*

16.1 KEY PLAYERS

16.1.1 JTEKT CORPORATION

TABLE 265 JTEKT CORPORATION: BUSINESS OVERVIEW

FIGURE 51 JTEKT CORPORATION: COMPANY SNAPSHOT

TABLE 266 JTEKT CORPORATION: PRODUCTS OFFERED

TABLE 267 JTEKT CORPORATION: DEALS

TABLE 268 JTEKT CORPORATION: OTHER DEVELOPMENTS

16.1.2 NEXTEER

TABLE 269 NEXTEER: BUSINESS OVERVIEW

FIGURE 52 NEXTEER: SNAPSHOT

TABLE 270 NEXTEER: PRODUCTS OFFERED

TABLE 271 NEXTEER: NEW PRODUCT DEVELOPMENTS

TABLE 272 NEXTEER: OTHER DEVELOPMENTS

16.1.3 ZF FRIEDRICHSHAFEN AG

TABLE 273 ZF FRIEDRICHSHAFEN AG: BUSINESS OVERVIEW

FIGURE 53 ZF FRIEDRICHSHAFEN AG: COMPANY SNAPSHOT

TABLE 274 ZF FRIEDRICHSHAFEN AG: PRODUCTS OFFERED

TABLE 275 ZF FRIEDRICHSHAFEN AG: NEW PRODUCT DEVELOPMENTS

TABLE 276 ZF FRIEDRICHSHAFEN AG: DEALS

16.1.4 ROBERT BOSCH

TABLE 277 ROBERT BOSCH: BUSINESS OVERVIEW

FIGURE 54 ROBERT BOSCH: COMPANY SNAPSHOT

TABLE 278 ROBERT BOSCH: PRODUCTS OFFERED

16.1.5 NSK LTD.

TABLE 279 NSK LTD.: BUSINESS OVERVIEW

FIGURE 55 NSK LTD.: COMPANY SNAPSHOT

TABLE 280 NSK LTD.: PRODUCTS OFFERED

TABLE 281 NSK LTD.: NEW PRODUCT DEVELOPMENTS

TABLE 282 NSK LTD.: DEALS

TABLE 283 NSK LTD.: OTHER DEVELOPMENTS

16.1.6 HYUNDAI MOBIS

TABLE 284 HYUNDAI MOBIS: BUSINESS OVERVIEW

FIGURE 56 HYUNDAI MOBIS: COMPANY SNAPSHOT

TABLE 285 HYUNDAI MOBIS: PRODUCTS OFFERED

TABLE 286 HYUNDAI MOBIS: DEALS

16.1.7 HITACHI ASTEMO, LTD.

TABLE 287 HITACHI ASTEMO, LTD.: BUSINESS OVERVIEW

FIGURE 57 HITACHI ASTEMO, LTD.: COMPANY SNAPSHOT

TABLE 288 HITACHI ASTEMO, LTD.: PRODUCTS OFFERED

16.1.8 THYSSENKRUPP

TABLE 289 THYSSENKRUPP: BUSINESS OVERVIEW

FIGURE 58 THYSSENKRUPP: COMPANY SNAPSHOT

TABLE 290 THYSSENKRUPP: PRODUCTS OFFERED

TABLE 291 THYSSENKRUPP: OTHER DEVELOPMENTS

16.1.9 MITSUBISHI ELECTRIC

TABLE 292 MITSUBISHI ELECTRIC: BUSINESS OVERVIEW

FIGURE 59 MITSUBISHI ELECTRIC: COMPANY SNAPSHOT

TABLE 293 MITSUBISHI ELECTRIC: PRODUCTS OFFERED

16.1.10 KYB CORPORATION

TABLE 294 KYB CORPORATION: BUSINESS OVERVIEW

FIGURE 60 KYB CORPORATION: COMPANY SNAPSHOT

TABLE 295 KYB CORPORATION: PRODUCTS OFFERED

16.1.11 MANDO CORPORATION

TABLE 296 MANDO CORPORATION: BUSINESS OVERVIEW

FIGURE 61 COMPANY SNAPSHOT: MANDO CORPORATION

TABLE 297 MANDO CORPORATION: PRODUCTS OFFERED

TABLE 298 MANDO CORPORATION: DEALS

TABLE 299 MANDO CORPORATION: OTHER DEVELOPMENTS

16.1.12 HYCET TECHNOLOGY CO., LTD

TABLE 300 HYCET TECHNOLOGY CO., LTD: BUSINESS OVERVIEW

TABLE 301 HYCET TECHNOLOGY CO., LTD: PRODUCTS OFFERED

*Details on Business overview, Products offered, Recent developments & MnM View might not be captured in case of unlisted companies.

16.2 OTHER KEY PLAYERS

16.2.1 MAVAL INDUSTRIES

TABLE 302 MAVAL INDUSTRIES: BUSINESS OVERVIEW

16.2.2 TENNECO

TABLE 303 TENNECO: BUSINESS OVERVIEW

16.2.3 GSS STEERING SYSTEMS LLC

TABLE 304 GSS STEERING SYSTEMS LLC: BUSINESS OVERVIEW

16.2.4 HELLA GMBH & CO. KGAA

TABLE 305 HELLA GMBH & CO. KGAA: BUSINESS OVERVIEW

16.2.5 YUBEI POWER STEERING SYSTEM CO., LTD.

TABLE 306 YUBEI POWER STEERING SYSTEM CO., LTD: BUSINESS OVERVIEW

16.2.6 HUHEI HENGLONG AUTO SYSTEM GROUP

TABLE 307 HUHEI HENGLONG AUTO SYSTEM GROUP: BUSINESS OVERVIEW

16.2.7 BORGWARNER

TABLE 308 BORGWARNER: BUSINESS OVERVIEW

16.2.8 DENSO CORPORATION

TABLE 309 DENSO CORPORATION: BUSINESS OVERVIEW

17 APPENDIX (Page No. - 253)

17.1 INSIGHTS OF INDUSTRY EXPERTS

17.2 DISCUSSION GUIDE

17.3 KNOWLEDGE STORE: MARKETSANDMARKETS SUBSCRIPTION PORTAL

17.4 AVAILABLE CUSTOMIZATIONS

17.5 RELATED REPORTS

17.6 AUTHOR DETAILS

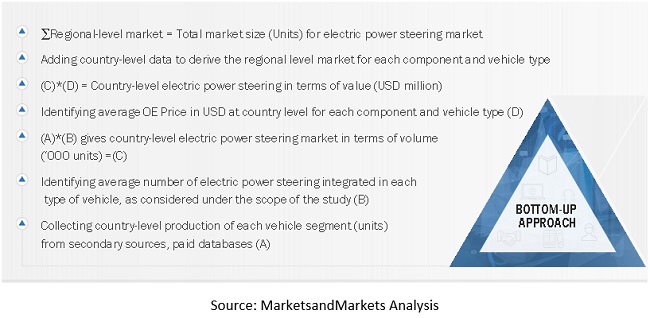

The study involves four main activities to estimate the current size of the electric power steering market.

- Exhaustive secondary research was done to collect information on the market, such as, electric power steering market by component, by off-highway vehicles, by electric motor type, by application, by type, by mechanism and by region

- The next step was to validate these findings, assumptions, and market analysis with industry experts across value chains through primary research.

- Bottom-up and top-down approaches were employed to estimate the complete market size for different segments considered under this study.

- Thereafter, market breakdown and data triangulation processes were used to estimate the market size of segments and subsegments.

Secondary Research

Secondary sources referred to in this research study include automotive industry organizations such as the Organization Internationale des Constructeurs d'Automobiles (OICA); corporate filings (such as annual reports, investor presentations, and financial statements); and trade, business, and automotive seats associations. The secondary data was collected and analyzed to arrive at the overall market size, which was further validated by primary research.

Primary Research

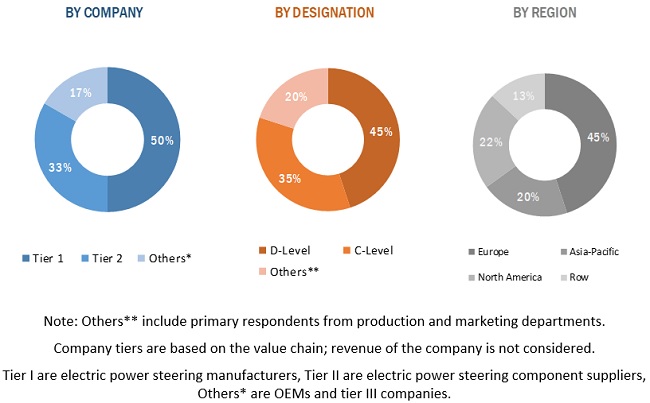

Extensive primary research was conducted after obtaining an understanding of the automotive seats market scenario through secondary research. Approximately 80% of the primary interviews were conducted from the electric power steering providers and component/system providers, and 20% from the end users across Americas, Europe, and Asia Oceania. The primary data was collected through questionnaires, emails, and telephonic interviews. Various departments within organizations, including sales, operations, and administrations, were contacted to provide a holistic viewpoint in the report while canvassing primaries.

After interacting with industry participants, some brief sessions were conducted with experienced independent consultants to reinforce the findings from the primaries. This, along with the opinions of in-house subject matter experts, led to the findings delineated in the report.

To know about the assumptions considered for the study, download the pdf brochure

Market Size Estimation

Bottom Up approach:

The bottom-up approach has been used to estimate and validate the size of the electric power steering market. In this approach, the vehicle production statistics for each application (passenger car and commercial vehicle) have been considered at a country and regional level.

To determine the market size, in terms of volume, the country-level vehicle production has been taken into consideration. The number of electric power steering employed in each application in each country, considered under the scope of the study, has been determined by secondary research and further validated by primary research. The average number of electric power steering is then multiplied by the production volumes of all applications to arrive at the market size, by volume, of key countries. The country-level market size, in terms of volume, is then multiplied by the country-level average OE Price of electric power steering for each application. This results in the country-level market size in terms of value. The summation of the country-level market gives the regional market, and further summation of the regional market provides the electric power steering market.

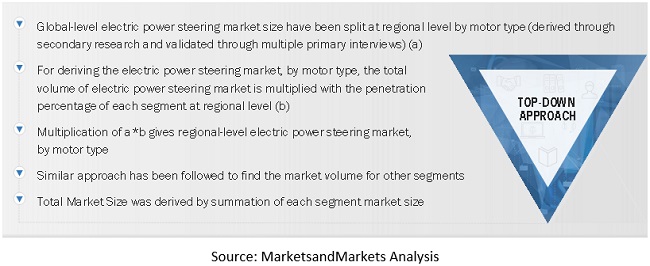

Top Down approach:

The market size of electric power steering, in terms of motor type and type, has been calculated using the top-down approach. Extensive secondary and primary research has been carried out to understand the global market scenario for the types of electric power steering used in the automotive industry. Several primary interviews have been conducted with key opinion leaders related to electric power steering development, including key OEMs and Tier-1 suppliers and applications. Qualitative aspects such as market drivers, restraints, opportunities, and challenges have been taken into consideration while calculating and forecasting the market size.

The research methodology used in the report involves various secondary sources such as Japan Automobile Manufacturers Association (JAMA), European Automobile Manufacturers Association (ACEA), Canadian Automobile Association (CAA), and Korea Automobile Manufacturers Association (KAMA). Experts from related industries and suppliers have been interviewed to understand the future trends of the electric power steering market. Both, bottom-up and top-down approaches have been used to estimate and validate the size of the global eps market. The market size, by volume, is derived by identifying the region-wise production volumes and analyzing the demand trends. The market size, by value, is derived by adding the average selling price of individual components of the electric power steering system and multiplying the same with the volume of electric power steering in that region.

Electric Power Steering Market Size: Bottom-Up Approach

To know about the assumptions considered for the study, Request for Free Sample Report

Electric Power Steering Market Size: Top-Down Approach

Report Objectives

- To define, describe, and project the electric power steering market based on Component (Steering Column, Sensors, Steering Gear, Mechanical Rack and Pinion), Electronic Control Unit (ECU), Electric Motor and Bearings)

- To define, describe, and project the market based on off-highway vehicles (Agricultural equipment and Construction equipment)

- To define, describe, and project the market based on electric motor type (Brushed DC Motors and Brushless DC Motors)

- To define, describe, and project the market based on Application (Passenger Cars and Commercial Vehicles)

-

To define, describe, and project the market based on Type (C-EPS,

P-EPS, R-EPS) - To define, describe, and project the market based on Mechanism (Collapsible EPS and Rigid EPS)

- To project the market for electric power steering across the four key regions, namely, Asia Pacific, Europe, North America, and the Rest of the World (RoW)

- To define, describe, and project the market based on EV Gear type (Worm Gear and Ball Screw) for BEV and PHEV Vehicles

- To define, describe, and project the market for electric power steering by electric vehicle type across the key regions, namely, Asia Pacific, Europe and North America for BEV, PHEV and FCEV Vehicles

- To provide detailed analysis regarding the various forces acting in the market (drivers, restraints, opportunities, and challenges)

- To analyze the regional markets for growth trends, future prospects, and their contribution to the total market

- To strategically profile key players and comprehensively analyze their market shares and core competencies

- To analyze and define the stakeholders in the market and provide a detailed competitive landscape

- To analyze the opportunities offered by various segments of the market to the stakeholders

Available Customizations

MarketsandMarkets offers the following customizations for this market report:

- Detailed analysis and profiling of additional regions (up to 3)

- Detailed analysis of an additional variant of electric power steering (only 1)

- Detailed analysis of component segment by country

- Detailed analysis of motor type segment by country

Generating Response ...

Generating Response ...

Growth opportunities and latent adjacency in Electric Power Steering Market