Exhaust System Market by After-Treatment Device (DOC, DPF, LNT, SCR, GPF), Vehicle Type (LCV, Trucks, Buses, Tractor, Construction & Mining Equipment), Aftermarket, Component, Application, Fuel Type, Sales Channel and Region - Global Forecast to 2030

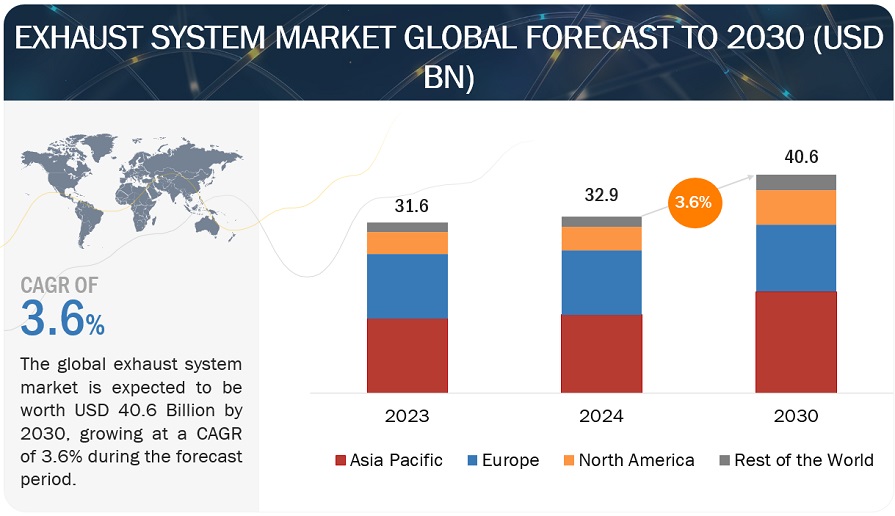

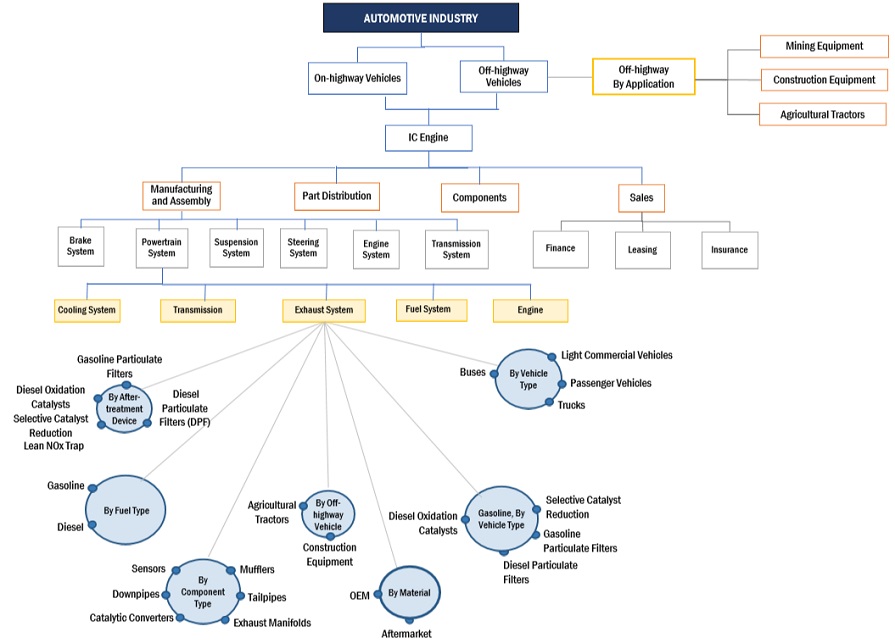

[339 Pages Report] The global exhaust system market size was valued at USD 32.9 billion in 2024 and is expected to reach USD 40.6 billion by 2030, growing at a CAGR of 3.6% during the forecast period. Exhaust gases released from engine cylinders are collected and cooled by the exhaust manifold before being directed to the catalytic converter via the downpipe. The catalytic converter and other after-treatment devices purify these gases by removing harmful pollutants. The gases then pass through the muffler, which reduces noise levels and finally emitted as cleansed exhaust through the tailpipe. The exhaust system comprises an exhaust manifold, downpipe, catalytic converter, various sensors (oxygen, temperature, etc.), mufflers, resonators, clamps, and tailpipes. Additionally, the exhaust system includes various after-treatment devices, alongside the catalytic converter, to eliminate harmful components such as carbon monoxide (CO), carbon dioxide (CO2), nitrogen oxides (NOX), and particulate matter (PM) from the exhaust gas. After-treatment devices installed in diesel engines include diesel particulate filters (DPF), diesel oxidation catalysts (DOC), lean NOX traps (LNT), and selective catalytic converters (SCR), while gasoline engines utilize gasoline particulate filters (GPF).

To know about the assumptions considered for the study, Request for Free Sample Report

To know about the assumptions considered for the study, download the pdf brochure

Market Dynamics

DRIVER: Increasing use of after-treatment device combination.

Reducing pollutants from diesel engines in the vehicle sector remains a significant scientific and technological challenge, especially with increasingly stringent regulations. Meeting strict limits on NOx and soot emissions requires complex catalytic systems that lead to the fitment of larger units, which consume more fuel. The combination of after-treatment devices enables automotive OEMs and exhaust system manufacturers to limit vehicle emissions within required regulatory restrictions. Therefore, effective after-treatment devices for diesel vehicles necessitate integrated catalyst technologies to reduce exhaust gas emissions individually. Selective catalytic reduction (SCR) and lean NOx trap (LNT) are key technologies for reducing NOx under lean-burn operation conditions, while soot removal primarily relies on filters (DPFs). These devices are typically used sequentially or in combinations to address the limitations of individual devices. One of the most commonly employed combinations of after-treatment devices consists of SCR and DPF. This pairing effectively eliminates over 70% of gaseous pollutants and particulate matter. In this system, SCR converts NOX into nitrogen and water using a reductant, while DPF filters out particulate matter.

In diesel vehicles, the focus is primarily on reducing PM and NOx emissions, typically addressed through a combination of DPFs and SCR systems. For example, BASF’s Catalysts division offers the combination of a Diesel Oxidation Catalyst (DOC) and a Lean NOx Trap (LNT). This DOC and LNT combination offers high HC and CO removal efficiency of a fully formulated DOC, with the ability of an LNT to trap and reduce NOx. Other possible combinations are SCR-on-Filter (SCRoF), series configurations like LNT/DPF and SCR/DPF, and hybrid systems like LNT/DPF and SCR/DPF. These combinations allow exhaust systems to control the emissions efficiently, which are set in Euro 6 standards for diesel engines. Further, in gasoline vehicles, the emphasis is often on reducing CO, HC, and NOx emissions; hence, catalytic converters are paired with advanced catalyst formulations. By integrating these technologies, automotive exhaust systems can achieve comprehensive emission control across different pollutants, resulting in cleaner exhaust emissions and improved air quality. Such combinations are expected to continue dominating in the coming years, leading to a high demand for after-treatment devices and subsequent growth of the automotive exhaust system market.

RESTRAINT: Increasing Sales of Cleaner Vehicles

Emission norms worldwide are becoming more stringent each year. Consequently, there is an increasing demand to reduce exhaust gas emissions. CNG and LPG-powered vehicles use simpler versions of exhaust systems without any after-treatment devices like DPF, DOC, SCR, LNT, or GPF. This decreases the revenue generation of the exhaust system industry compared to ICE-powered vehicles.

Unlike IC engines, which leverage automotive exhaust and after-treatment devices to reduce emissions and improve fuel efficiency, EVs draw power directly from batteries without requiring any form of forced induction. As consumers increasingly opt for EVs, there is a foreseeable decline in the demand for automotive exhaust systems. This trend is evident in the automotive industry, where leading manufacturers such as BMW, Volkswagen, GM, Stellantis, and Toyota are shifting focus toward EV development in response to stringent EU emission standards. BMW aims to achieve significant EV sales by 2030, with Volkswagen targeting a substantial portion of its European sales to be EVs by the same year. GM has committed to discontinuing polluting vehicle production by 2035, while Stellantis plans to pivot toward electric and hybrid vehicles, aiming for a majority of sales in that segment by 2030. Similarly, Toyota prioritizes hybrid sales and reduces reliance on traditional internal combustion engines, aiming for a substantial share of hybrid sales by 2025.

EVs emit fewer greenhouse gases than traditional internal combustion engines like gasoline and diesel cars. As the electric grid transitions to zero-carbon power sources, emissions from EVs are expected to decrease even further. The increase in sales is also due to lucrative subsidies and incentives provided by governments. As more consumers switch to EVs and governments implement stricter emissions regulations, the demand for automotive exhaust systems is likely to decline during the forecast period.

OPPORTUNITY:Increasing demand for lightweight and efficient exhaust systems to reduce vehicle weight

The demand for vehicle weight reduction is continuously growing to comply with stringent emission and fuel economy regulations and avoid heavy penalties imposed by government agencies. Reducing vehicle weight significantly lowers fuel consumption and CO2 emissions, as lighter cars require less fuel to overcome inertia, thus reducing the power needed to propel the vehicle. As per industry experts, reducing vehicle weight by 10% can boost its mileage by almost 6% to 8% and increase fuel economy.

Automotive OEMs are working on several aspects, like new and lightweight materials, aerodynamic design, and drive train (engine/transmission) efficiency, to reduce the overall vehicle weight. Conventional exhaust systems use materials like cast iron, stainless steel, mild steel/carbon steel, and others. However, several automotive OEMs and manufacturers focus on reducing the weight of exhaust systems and their components. One key material that has gained prominence is stainless steel, specifically high-grade stainless steel alloys such as 304 and 316. These alloys offer exceptional corrosion resistance, durability, and thermal stability, making them ideal for exhaust components exposed to high temperatures and harsh environments. Stainless steel also provides a balance between strength and weight, allowing for the creation of exhaust systems that are both robust and lightweight, thereby improving fuel efficiency and reducing emissions.

Exhaust system manufacturers worldwide are working toward lowering the weight of exhaust systems and increasing vehicle fuel economy. Hence, exhaust systems with lightweight materials would be a cost-effective choice in the coming years, as electric and hydrogen vehicles will take time to replace ICE vehicles.

CHALLENGE: Lack of uniformity in emission regulations across different regions

Automotive manufacturers operate in a global market but must adhere to varying emission standards set by different countries and regions. This lack of uniformity not only complicates the design and manufacturing process for exhaust systems but also increases costs associated with compliance. Engineers and designers must develop exhaust systems that meet the most stringent regulations worldwide, resulting in complex and often region-specific designs to ensure compliance. Moreover, the absence of standardized regulations makes it difficult for manufacturers to achieve economies of scale in production, as they may need to tailor exhaust systems for different markets, further driving up costs and complicating supply chains.

Furthermore, the lack of standardization in emission regulations hampers innovation and technological advancements in automotive exhaust systems. Manufacturers need help investing in R&D activities for new exhaust system technologies when regulatory requirements vary significantly between regions. This fragmentation in regulations restricts innovation as manufacturers focus on meeting existing standards rather than developing groundbreaking solutions for emissions reduction. Ultimately, achieving global standardization in emission regulations would streamline the design and manufacturing process for automotive exhaust systems, encourage innovation, and drive down costs, benefiting both manufacturers and consumers alike. However, once such standardization is realized, the automotive industry will continue to struggle with the challenges posed by disparate emission regulations across different regions.

Exhaust System Market Ecosystem.

The major manufacturers in the industrial exhaust system market have the latest technologies, diversified portfolios, and strong global distribution networks. The major players in the market are Tenneco Inc., , FORVIA Faurecia, Continental AG, Eberspacher, and Futaba Industrial Co., Ltd. The ecosystem analysis highlights various players in the market ecosystem, which component providers, exhaust system manufacturers, and automotive OEMs primarily represent.

The sensors segment holds the largest market share by component segment in the exhaust system market.

PM sensors are installed exclusively in diesel vehicles equipped with a DPF. Temperature, NOX, and oxygen sensors are used in both gasoline and diesel engines. In an exhaust system, one temperature sensor is used in gasoline engines, while diesel engines use two. Additionally, two oxygen sensors are employed for each catalytic converter in all vehicle types studied. Global emission reduction targets are anticipated to boost the use of exhaust sensors in vehicle exhaust systems to capture, monitor, and analyze emission gases and their quantities, thereby driving the demand for sensors during the forecast period.

The Asia Pacific region's large vehicle production, combined with recent emission norms such as BS 6 (India) and China 6 (China), is expected to drive the sensors (OE) market during the forecast period. Governments around the world are imposing more emission standards to reduce air pollution. This has compelled industries, especially the automotive sector, to implement advanced technologies for emissions control, resulting in a higher demand for NOx sensors. The advancement of high-performance exhaust technologies, such as gasoline particulate filters (GPF) and advanced exhaust heat recovery systems, is expected to drive market growth and demand additional sensors for optimization.

The GPF is estimated to be the fastest-growing after-treatment device segment during the forecast period.

The GPF segment is projected to grow at the highest CAGR during the forecast period. The adoption rates of different after-treatment technologies vary across different fuel types. The market for after-treatment devices such as DOC, DPF, LNT, and SCR for diesel vehicles is reaching maturity. This is happening alongside a decreasing acceptance of diesel fuel due to strict laws and higher associated taxes, especially in developed regions like Europe and North America. Alternatively, the GDI engines have experienced rapid adoption in recent years across Europe, the US, and key Asia Pacific markets such as China and India. GDI engines offer key advantages such as improved fuel efficiency, higher power output, and reduced emissions compared to traditional port fuel injection systems. It is also cost-effective for OEMs in production, and consumer preferences are shifting towards more environmentally friendly and technologically advanced vehicles. However, the combustion characteristics of GDI engines also lead to increased production of particulate matter, compelling the fitment of Gasoline Particulate Filters (GPF) as after-treatment devices to mitigate harmful emissions effectively. The current adoption of GDI engines in Asia is significant, with a projected upward trend in the future as emission standards become stricter, and OEMs are compelled to integrate GDI engines into their vehicle line-ups to remain competitive in the market. As consumer demand for fuel-efficient vehicles grows, GDI engines and GPF technologies will notice an increased adoption in the coming years.

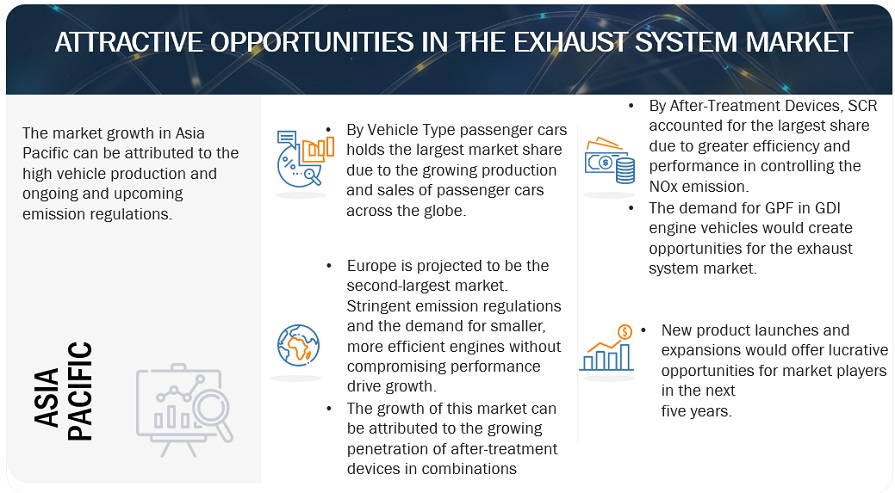

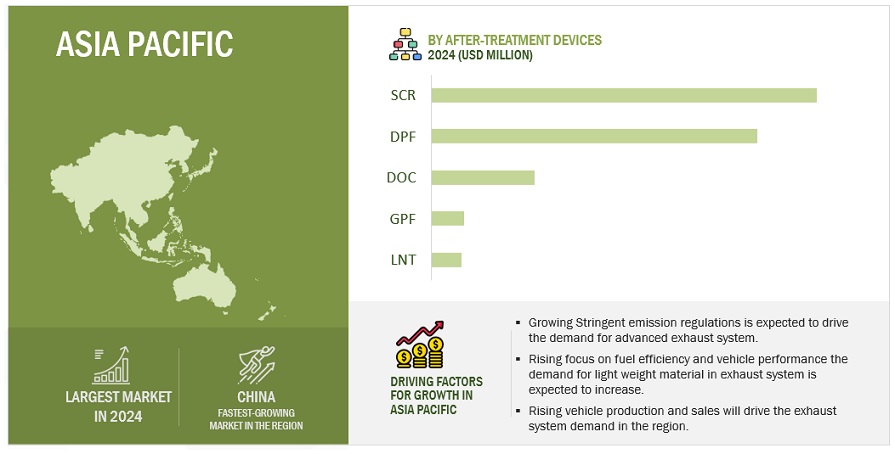

Asia Pacific holds the largest market for exhaust system in 2024.

Asia Pacific is expected to dominate the global exhaust market during the forecast period. This market dominance can be attributed to the growing production of vehicles. The increasing production volume of automobiles in recent years, combined with current emission regulations in countries like China (China VI) and India (BS-VI) and upcoming regulations like China VII and BS VII, is expected to fuel the growth of the automotive exhaust system market in the Asia Pacific during the forecast period.

In the Asia-Pacific region, China holds the largest market for exhaust systems due to its increased vehicle production. Since 2019, implementing China V emission norms has led to a 100% adoption rate of DOC and DPF across all vehicle types, although the adoption rate of SCR remains lower compared to European countries. The forthcoming China VI emission norms drive the anticipated growth in various after-treatment devices. Japan ranks as the second-largest market exhaust in the Asia-Pacific, adhering to its own stricter emission standards. Since 2018, Japan has achieved a 100% adoption rate of DOCs and DPFs for all vehicle types. It is projected that by 2025, the adoption rate of SCR will reach 100% for passenger cars and LCVs and by 2021 for buses and trucks. India is expected to be one of the fastest-growing markets in the Asia-Pacific. As of 2020, India's adoption rate for all after-treatment devices, such as SCR, LNT, and GPF, is lower than other countries in the region. However, the adoption rate for DPF and DOC increased to 100% across all vehicle types with the implementation of BS VI emission norms in 2020. The adoption rate for various after-treatment devices is anticipated to rise further in the coming years, driven by the introduction of more stringent emission regulations.

Major players in this market include Futaba Industrial Co., Ltd. (Japan), Sango Co. Ltd. (Japan), Yutaka Giken Company Limited (Japan), Sejong Industrial Co., Ltd. (South Korea), Hirotec Corporation (Japan), Sharada Motor Industries Limited (India), and Marelli Holdings Co. Ltd. (Japan).

Key Market Players

The key companies operating in the exhaust system market are Tenneco Inc.(US), Faurecia (France), Eberspächer (Germany), Friedrich Boysen GMBH & CO. KG (Germany), and BENTELER International (Austria).

These companies adopted new product launches, expansion, partnerships, and joint ventures to gain traction in the motorcycle exhaust system market

Scope of the Report

|

Report Metric |

Details |

|

Market size available for years |

2019–2030 |

|

Base year considered |

2023 |

|

Forecast period |

2024–2030 |

|

Forecast units |

Volume (Units) and Value (USD Million) |

|

Segments covered |

OE by after-treatment device, OE by component, OE by vehicle type, aftermarket by after-treatment device, OE by off-highway vehicle, off-highway by after-treatment device, OE by fuel type, By sales channel and By region |

|

Geographies covered |

Asia Pacific, North America, Europe, and the Rest of the World [RoW] |

|

Companies covered |

Forvia (France), Tenneco Inc. (US), Continental AG (Germany), Eberspächer (Germany), Futaba Industrial Co., Ltd. (Germany), Sango Co., Ltd. (Japan), Friedrich Boysen GmbH & Co. KG (Germany), Yutaka Giken (Japan), Sejong Industrial Co., Ltd. (South Korea), BOSAL (Belgium) |

Along with the given market data, MarketsandMarkets offers customizations in accordance with the company’s specific needs.

The study segments the exhaust system market:

OE Market, by after-treatment device

- DOC

- DPF

- SCR

- LNT

- GPF

OE Market, by component

- Manifolds

- Downpipes

- Catalytic Converter

- Mufflers

- Tailpipes

- Sensors

- Hangers

OE Market, By Vehicle type

- Passenger Cars

- LCVs

- Buses

- Trucks

By Fuel type

- Diesel

- Gasoline

By Sales Channel

- OEM

- Aftermarket

Aftermarket, by after-treatment device

- DOC

- DPF

- GPF

- SCR

Off-Highway (OE) market, by Equipment Type

- Agricultural tractor

- Construction Equipment

- Mining Equipment

Off-highway (OE) market, by after-treatment device

- DPF

- DOC

- SCR

By Region

- Asia Pacific

- North America

- Europe

- Rest of the World [RoW]

Recent Developments

- In January 2024, Continental AG revealed plans for a new hydraulic hose production plant in Mexico. The proposed investment is approximately USD 90 million, marking one of the company’s significant investments in 2024. This upcoming facility will serve industrial purposes and is poised to enhance Continental’s regional manufacturing capabilities. The plant is expected to create over 200 employment opportunities in its initial phase.

- In November 2023, Eberspächer’s facility, spanning over 7,000 square meters, will manufacture exhaust gas after-treatment systems for passenger cars and commercial vehicles intended for Chinese automotive brands. This encompasses hot-end systems comprising catalytic converters, particulate filters, and cold-end components such as mufflers and pipes.

- In October 2023, Purem AAPICO, a joint venture between Eberspaecher and AAPICO Hitech, inaugurated its new facility in Rayong, Thailand. Situated 100 km southeast of Bangkok, the production site will manufacture exhaust systems for a pickup truck model of a prominent US automotive company.

- In October 2023, Tenneco Inc.’s pioneering Cold Start Thermal Unit (CSTU) represents a groundbreaking heat source for after-treatment systems in passenger cars, light-duty vehicles, and commercial vehicles. This innovative technology empowers OEMs to adhere to ever-stringent emissions regulations effectively. Catering to gasoline and diesel applications, CSTU technology is tailored to meet upcoming Euro 7 standards by delivering thermal energy directly and efficiently. It ensures consistent catalyst performance throughout the engine’s operational spectrum, focusing on crucial phases like initial start-up and prolonged idling, which are significant sources of regulated emissions.

- In May 2023, FORVIA Faurecia (FORVIA) signed an agreement with Cummins to transfer two Faurecia manufacturing plants located in Roermond, the Netherlands, and Columbus, Indiana, the US, and their associated activities to Cummins. The agreement integrated these plants and their employees into Cummins’ worldwide operations, ensuring long-term viability.

- In November 2022, Continental AG inaugurated its Technical Center India campus in Bengaluru with an investment of Rs 1,000 Crore (approximately USD 128.1 million). This new campus has the capacity to accommodate over 6,500 employees. It will be a hub for consolidating India's growing engineering capabilities and teams, focusing on local and global markets' Automotive Research and Development (R&D) needs.

- In April 2022, Continental AG broadened its product portfolio to incorporate exhaust gas temperature sensors (EGT sensors) for Volkswagen Group’s VW, Audi, Skoda, and Seat brands.

Frequently Asked Questions (FAQ):

What is the current size of the global exhaust system market?

The global exhaust system market is projected to grow from USD 32.9 billion in 2024 to USD 40.6 billion by 2030, at a CAGR of 3.6%.

Which after-treatment device is currently in the exhaust system market?

SCR is the leading after-treatment device in the exhaust system market.

Many companies operate in the exhaust system market across the globe. Do you know who the front leaders are and what strategies they have adopted?

Tenneco Inc.(US), Faurecia (France), Eberspächer (Germany), Friedrich Boysen GMBH & CO. KG (Germany), and BENTELER International (Austria). These companies adopted new product launches and expansion strategies to gain traction in the exhaust system market.

How does the demand for an exhaust system vary by region?

Asia Pacific is estimated to be the largest OE market for exhaust systems and after-treatment devices during the forecast period, followed by Europe. The growth of the exhaust system market in Asia Pacific is mainly attributed to the increasing vehicle production and constant upgrades in emission norms, especially in countries such as China, Japan, and India.

What are the growth opportunities for the exhaust system supplier?

Lightweight emission systems, growing demand for gasoline particulate filters (GPF) in GDI engines, and advanced exhaust heat recovery systems are expected to offer promising future growth in the market for exhaust systems. .

To speak to our analyst for a discussion on the above findings, click Speak to Analyst

- 5.1 INTRODUCTION

-

5.2 MARKET DYNAMICSDRIVERS- Rising vehicle emissions and growing awareness of environmental sustainability- Increasing use of after-treatment device combinationsRESTRAINTS- Increasing sales of cleaner vehiclesOPPORTUNITIES- Increasing demand for lightweight and efficient exhaust systems to reduce vehicle weight- Growing demand for gasoline particulate filters (GPFs) in gasoline direct injection (GDI) enginesCHALLENGES- Lack of uniformity in emission regulations across different regions

-

5.3 TRENDS/DISRUPTIONS IMPACTING CUSTOMER BUSINESS

-

5.4 TECHNOLOGY ANALYSISKEY TECHNOLOGIES- Use of ammonia slip catalyst (ASC) and selective catalytic reduction (SCR)- Use of ultra-high filtration diesel particulate filtersCOMPLEMENTARY TECHNOLOGIES- Use of vanadium-based catalysts- Electric catalyst heatingADJACENT TECHNOLOGIES- Development of sensor-based exhaust systems

- 5.5 SUPPLY CHAIN ANALYSIS

-

5.6 ECOSYSTEM ANALYSISEXHAUST COMPONENT MANUFACTURERSEXHAUST SYSTEM AND AFTER-TREATMENT MANUFACTURERSOEMS

-

5.7 CASE STUDY ANALYSISANALYSIS OF EMISSIONS FROM GERMAN GASOLINE VEHICLESLEVERAGING CONNECTIVITY AND AUTONOMY FOR IMPROVED DIESEL PARTICULATE FILTER (DPF) MANAGEMENTEXPERIMENTAL STUDY ON RECIPROCATING FLOW REGENERATION OF DIESEL PARTICULATE FILTER (DPF) SYSTEMSASSESSMENT OF GASOLINE DIRECT INJECTION VEHICLE EMISSIONS WITH AND WITHOUT CATALYZED GASOLINE PARTICULATE FILTERSOPTIMIZATION OF THERMOELECTRIC GENERATOR PLACEMENT IN EXHAUST SYSTEMS FOR WASTE HEAT RECOVERY

-

5.8 PATENT ANALYSISINTRODUCTIONLEGAL STATUS OF PATENTSTOP PATENT APPLICANTS

-

5.9 REGULATORY LANDSCAPEON-ROAD VEHICLESOFF-ROAD VEHICLESREGULATORY BODIES, GOVERNMENT AGENCIES AND OTHER ORGANIZATIONS- North America- Europe- Asia Pacific- Rest of the World

-

5.10 FUEL ECONOMY NORMSUSEUROPECHINAINDIA

-

5.11 KEY STAKEHOLDERS AND BUYING CRITERIAKEY STAKEHOLDERS IN BUYING PROCESSBUYING CRITERIA

- 5.12 KEY CONFERENCES AND EVENTS

-

5.13 TRADE ANALYSISIMPORT DATAEXPORT DATA

- 5.14 INVESTMENT AND FUNDING SCENARIO

- 5.15 SUPPLIER ANALYSIS

-

5.16 PRICING ANALYSISBY AFTER-TREATMENT DEVICEBY REGION

- 5.17 IMPACT OF ELECTRIC VEHICLES ON EXHAUST SYSTEM MARKET

-

6.1 INTRODUCTIONINDUSTRY INSIGHTS

-

6.2 DIESEL OXIDATION CATALYST (DOC)STRINGENT EMISSION REGULATIONS FOR DIESEL VEHICLES TO DRIVE MARKET

-

6.3 DIESEL PARTICULATE FILTER (DPF)RISING EMISSION REGULATIONS FOR DIESEL VEHICLES TO DRIVE MARKET

-

6.4 LEAN NOX TRAP (LNT)STRINGENT REGULATION TO CONTAIN NOX EMISSIONS TO DRIVE MARKET

-

6.5 SELECTIVE CATALYTIC REDUCTION (SCR)ONGOING AND UPCOMING STRINGENT EMISSION NORMS IN EMERGING ECONOMIES TO DRIVE MARKET

-

6.6 GASOLINE PARTICULATE FILTER (GPF)RISING PRODUCTION OF GASOLINE VEHICLES TO DRIVE MARKET

-

7.1 INTRODUCTIONINDUSTRY INSIGHTS

-

7.2 SENSORSNOX SENSORS- Rising installation of SCR after-treatment devices to drive marketOXYGEN SENSORS- Increasing adoption of oxygen sensors to curb emissions to drive marketTEMPERATURE SENSORS- Adoption of temperature sensors for effective temperature management to drive marketPM SENSORS- increasing implementation of after-treatment devices to drive market

-

7.3 CATALYTIC CONVERTERSSTRINGENT EMISSION NORMS TO DRIVE MARKET

-

7.4 DOWNPIPESRISING DEMAND FOR AFTER-TREATMENT DEVICES TO DRIVE MARKET

-

7.5 MANIFOLDSRISING ADOPTION OF AFTER-TREATMENT DEVICES AND INCREASING SALES OF VEHICLES TO DRIVE MARKET

-

7.6 MUFFLERSGROWING ACCEPTANCE OF AFTER-TREATMENT DEVICES TO DRIVE MARKET

-

7.7 TAILPIPESGROWING FOCUS ON IMPROVED ENGINE ACOUSTICS AND PERFORMANCE TO DRIVE MARKET

-

7.8 HANGERSIMPLEMENTATION OF ADVANCED EXHAUST SYSTEMS TO DRIVE DEMAND

-

8.1 INTRODUCTIONINDUSTRY INSIGHTS

-

8.2 PASSENGER CARSRISING PRODUCTION AND SALES OF PASSENGER CARS TO DRIVE MARKET

-

8.3 LIGHT COMMERCIAL VEHICLESRISING PRODUCTION AND SALES OF LIGHT COMMERCIAL VEHICLES TO DRIVE MARKET

-

8.4 TRUCKSRISING ADOPTION OF TRUCKS FOR COMMERCIAL TRANSPORTATION TO DRIVE MARKET

-

8.5 BUSESINCREASING DEMAND FOR PUBLIC TRANSPORT TO DRIVE MARKET

-

9.1 INTRODUCTIONINDUSTRY INSIGHTS

-

9.2 GASOLINERISE IN GASOLINE-POWERED PASSENGER CARS TO DRIVE MARKET

-

9.3 DIESELINCREASING EFFICIENCY OF DIESEL EXHAUST SYSTEMS TO DRIVE MARKET

-

10.1 INTRODUCTIONINDUSTRY INSIGHTS

-

10.2 DIESEL OXIDATION CATALYST (DOC)INCREASING DEMAND FOR DIESEL VEHICLES TO DRIVE MARKET

-

10.3 DIESEL PARTICULATE FILTER (DPF)RISING DEMAND FOR DIESEL HEAVY-DUTY VEHICLES TO DRIVE MARKET

-

10.4 SELECTIVE CATALYTIC REDUCTION (SCR)STRINGENT EMISSION REGULATIONS TO DRIVE MARKET

-

11.1 INTRODUCTIONINDUSTRY INSIGHTS

-

11.2 AFTERMARKETINCREASING VEHICLE OWNERSHIP AND TECHNOLOGICAL IMPROVEMENTS TO DRIVE DEMAND FOR AFTERMARKET COMPONENTS

-

11.3 OEMRISE IS GLOBAL VEHICLE PRODUCTION TO DRIVE MARKET

-

12.1 INTRODUCTIONINDUSTRY INSIGHTS

-

12.2 AGRICULTURAL TRACTORSINCREASING ADOPTION OF AFTER-TREATMENT DEVICES IN AGRICULTURE INDUSTRY TO DRIVE MARKET

-

12.3 CONSTRUCTION EQUIPMENTINCREASING USE OF AFTER-TREATMENT DEVICES IN CONSTRUCTION EQUIPMENT TO DRIVE MARKET

-

12.4 MINING EQUIPMENTRISING DEMAND FOR MINERALS AND METALS ACROSS VARIOUS INDUSTRIES TO DRIVE MARKET

-

13.1 INTRODUCTIONINDUSTRY INSIGHTS

-

13.2 DIESEL PARTICULATE FILTER (DPF)STRINGENT EMISSION NORMS FOR DIESEL VEHICLES TO DRIVE MARKET

-

13.3 DIESEL OXIDATION CATALYST (DOC)STRINGENT NORMS TO CURB EMISSIONS TO DRIVE MARKET

-

13.4 SELECTIVE CATALYTIC REDUCTION (SCR)ONGOING AND UPCOMING STRINGENT EMISSION NORMS IN EMERGING ECONOMIES TO DRIVE MARKET

- 14.1 INTRODUCTION

-

14.2 ASIA PACIFICASIA PACIFIC: RECESSION IMPACTCHINA- Rising vehicle production and emission norms to drive marketINDIA- Growing focus on efficiency and sustainability to drive marketJAPAN- Stricter emission regulations to drive marketSOUTH KOREA- Sustainability and innovation to drive marketTHAILAND- Rising number of vehicles to drive marketREST OF ASIA PACIFIC

-

14.3 EUROPEEUROPE: RECESSION IMPACTGERMANY- Increased demand for premium cars to drive marketFRANCE- Stringent environmental laws and shift toward carbon neutrality to reduce demandUK- Rising sales of premium cars to drive marketSPAIN- Growing production of passenger cars to drive marketTURKEY- Growing demand for fuel-efficient vehicles to drive marketRUSSIA- Increasing sales of passenger cars to drive marketREST OF EUROPE

-

14.4 NORTH AMERICANORTH AMERICA: RECESSION IMPACTUS- Advancements in after-treatment technologies and stringency in emission regulations to drive marketMEXICO- Implementation of emission regulations to drive marketCANADA- Increasing vehicle production and stringent emission regulations to drive market

-

14.5 REST OF THE WORLDREST OF THE WORLD: RECESSION IMPACTBRAZIL- Rise in vehicle production and emission regulations to drive marketIRAN- Growing vehicle production and adoption of Euro 6 standards to drive marketOTHERS

- 15.1 OVERVIEW

- 15.2 MARKET SHARE ANALYSIS, 2023

- 15.3 EXHAUST SYSTEM MARKET: DEGREE OF COMPETITION, 2023

- 15.4 REVENUE ANALYSIS

- 15.5 KEY PLAYER STRATEGIES/RIGHT TO WIN, 2022–2024

-

15.6 COMPANY EVALUATION MATRIX: EXHAUST SYSTEM AND AFTER-TREATMENT DEVICE MANUFACTURERS, 2024STARSEMERGING LEADERSPERVASIVE PLAYERSPARTICIPANTSCOMPANY FOOTPRINTAPPLICATION FOOTPRINTREGION FOOTPRINT- Propulsion footprint

-

15.7 COMPANY EVALUATION MATRIX: EXHAUST SYSTEM COMPONENT MANUFACTURERS, 2024STARSEMERGING LEADERSPERVASIVE PLAYERSPARTICIPANTSCOMPANY FOOTPRINT- After-treatment device footprint- Application footprint- Region footprint

-

15.8 COMPETITIVE SCENARIO AND TRENDSPRODUCT LAUNCHESDEALSEXPANSIONS

- 15.9 COMPANY VALUATION AND FINANCIAL METRICS

- 15.10 PRODUCT COMPARISON

-

16.1 KEY PLAYERSFORVIA FAURECIA- Business overview- Products offered- Recent developments- MnM viewTENNECO INC.- Business overview- Products offered- Recent developments- MnM viewCONTINENTAL AG- Business overview- Products offered- Recent developments- MnM viewEBERSPÄCHER- Business overview- Products offered- Recent developments- MnM viewFUTABA INDUSTRIAL CO., LTD.- Business overview- Products offered- Recent developments- MnM viewSANGO CO., LTD.- Business overview- Products offered- Recent developmentsFRIEDRICH BOYSEN GMBH & CO. KG- Business overview- Products offeredYUTAKA GIKEN COMPANY LIMITED- Business overview- Products offered- Recent developmentsSEJONG INDUSTRIAL CO., LTD.- Business overview- Products offered- Recent developmentsBOSAL- Business overview- Products offered- Recent developments

-

16.2 OTHER PLAYERSMARELLI HOLDINGS CO., LTD.HIROTEC CORPORATIONBENTELER INTERNATIONAL AGKATCON GLOBALVIBRACOUSTIC SEASMETDINEX A/SMAGNAFLOWGRAND ROCK CO., INC.EMINOXEUROPEAN EXHAUST AND CATALYST LTD.CREFACT CORPORATIONSHARDA MOTOR INDUSTRIES LTD.EISENMANN EXHAUST SYSTEMSDENSOHARBIN AIRUI EMISSIONS CONTROL TECHNOLOGY CO., LTD.CHONGQING HEIGHT AUTOMOBILE EXHAUST SYSTEM CO., LTD.BOSCH MOBILITYJOHNSON MATTHEY

- 17.1 ASIA PACIFIC TO LEAD EXHAUST SYSTEM MARKET

- 17.2 KEY FOCUS AREAS: GROWING DEMAND FOR GDI ENGINES

- 17.3 CONCLUSION

- 18.1 INSIGHTS FROM INDUSTRY EXPERTS

- 18.2 DISCUSSION GUIDE

- 18.3 KNOWLEDGESTORE: MARKETSANDMARKETS’ SUBSCRIPTION PORTAL

-

18.4 CUSTOMIZATION OPTIONSEXHAUST SYSTEM MARKET, BY AFTER-TREATMENT DEVICES & VEHICLE TYPE- DOC- DPF- SCR- GPFEXHAUST SYSTEM COMPONENTS OE MARKET, BY VEHICLE TYPE- Passenger Cars- LCVs- Trucks- BusesHYBRID VEHICLE EXHAUST SYSTEM OE MARKET, BY AFTER-TREATMENT DEVICE- LNT- GPFTWO & THREE-WHEELER VEHICLE EXHAUST SYSTEM OE MARKET, BY REGION- Asia Pacific- Europe- North America- Rest of the WorldDETAILED ANALYSIS AND PROFILING OF ADDITIONAL MARKET PLAYERS (UP TO 3)

- 18.5 RELATED REPORTS

- 18.6 AUTHOR DETAILS

- TABLE 1 CURRENCY EXCHANGE RATES

- TABLE 2 RESEARCH ASSUMPTIONS

- TABLE 3 HISTORICAL OVERVIEW OF ON-ROAD VEHICLE EMISSION REGULATIONS FOR PASSENGER VEHICLES, 2016–2024

- TABLE 4 FINANCIAL INCENTIVES FOR ELECTRIC VEHICLES, BY COUNTRY

- TABLE 5 OVERVIEW OF EMISSION REGULATION SPECIFICATIONS FOR PASSENGER CARS, 2016–2023

- TABLE 6 EMISSION NORMS FOR PASSENGER CARS, BY COUNTRY

- TABLE 7 EXHAUST SYSTEM MARKET: ECOSYSTEM

- TABLE 8 MARKET: KEY PATENTS, 2020–2024

- TABLE 9 EURO-5 VS. EURO-6 VEHICLE EMISSION STANDARDS ON NEW EUROPEAN DRIVING CYCLE

- TABLE 10 ON-ROAD VEHICLE EMISSION REGULATION OUTLOOK FOR PASSENGER CARS, 2016–2024

- TABLE 11 NORTH AMERICA: LIST OF REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- TABLE 12 EUROPE: LIST OF REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- TABLE 13 ASIA PACIFIC: LIST OF REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- TABLE 14 REST OF THE WORLD: LIST OF REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- TABLE 15 US: CAFE STANDARDS FOR EACH MODEL YEAR IN MILES PER GALLON, 2019–2025

- TABLE 16 CHINA: CHINA 6A AND 6B STANDARDS, 2021 ONWARDS

- TABLE 17 INFLUENCE OF STAKEHOLDERS ON BUYING PROCESS FOR AFTER- TREATMENT DEVICES

- TABLE 18 KEY BUYING CRITERIA FOR AFTER-TREATMENT DEVICES

- TABLE 19 EXHAUST SYSTEM MARKET: LIST OF KEY CONFERENCES AND EVENTS, 2024–2025

- TABLE 20 US: IMPORT SHARE, BY COUNTRY (VALUE USD)

- TABLE 21 CHINA: IMPORT SHARE, BY COUNTRY (VALUE USD)

- TABLE 22 JAPAN: IMPORT SHARE, BY COUNTRY (VALUE USD)

- TABLE 23 INDIA: IMPORT SHARE, BY COUNTRY (VALUE USD)

- TABLE 24 US: EXPORT SHARE, BY COUNTRY (VALUE USD)

- TABLE 25 CHINA: EXPORT SHARE, BY COUNTRY (VALUE USD)

- TABLE 26 JAPAN: EXPORT SHARE, BY COUNTRY (VALUE USD)

- TABLE 27 INDIA: EXPORT SHARE, BY COUNTRY (VALUE USD)

- TABLE 28 LIST OF FUNDING, 2023−2024

- TABLE 29 AVERAGE SELLING PRICE (ASP), BY AFTER-TREATMENT DEVICE

- TABLE 30 AVERAGE SELLING PRICE (ASP), BY REGION

- TABLE 31 EXHAUST SYSTEM (OE) MARKET, BY AFTER-TREATMENT DEVICE, 2019–2023 (THOUSAND UNITS)

- TABLE 32 EXHAUST SYSTEM (OE) MARKET, BY AFTER-TREATMENT DEVICE, 2024–2030 (THOUSAND UNITS)

- TABLE 33 EXHAUST SYSTEM (OE) MARKET, BY AFTER-TREATMENT DEVICE, 2019–2023 (USD MILLION)

- TABLE 34 EXHAUST SYSTEM (OE) MARKET, BY AFTER-TREATMENT DEVICE, 2024–2030 (USD MILLION)

- TABLE 35 DIESEL OXIDATION CATALYST (OE) MARKET, BY REGION, 2019–2023 (THOUSAND UNITS)

- TABLE 36 DIESEL OXIDATION CATALYST (OE) MARKET, BY REGION, 2024–2030 (THOUSAND UNITS)

- TABLE 37 DIESEL OXIDATION CATALYST (OE) MARKET, BY REGION, 2019–2023 (USD MILLION)

- TABLE 38 DIESEL OXIDATION CATALYST (OE) MARKET, BY REGION, 2024–2030 (USD MILLION)

- TABLE 39 DIESEL PARTICULATE FILTER (OE) MARKET, BY REGION, 2019–2023 (THOUSAND UNITS)

- TABLE 40 DIESEL PARTICULATE FILTER (OE) MARKET, BY REGION, 2024–2030 (THOUSAND UNITS)

- TABLE 41 DIESEL PARTICULATE FILTER (OE) MARKET, BY REGION, 2019–2023 (USD MILLION)

- TABLE 42 DIESEL PARTICULATE FILTER (OE) MARKET, BY REGION, 2024–2030 (USD MILLION)

- TABLE 43 LEAN NOX TRAP (OE) MARKET, BY REGION, 2019–2023 (THOUSAND UNITS)

- TABLE 44 LEAN NOX TRAP (OE) MARKET, BY REGION, 2024–2030 (THOUSAND UNITS)

- TABLE 45 LEAN NOX TRAP (OE) MARKET, BY REGION, 2019–2023 (USD MILLION)

- TABLE 46 LEAN NOX TRAP (OE) MARKET, BY REGION, 2024–2030 (USD MILLION)

- TABLE 47 SELECTIVE CATALYTIC REDUCTION (OE) MARKET, BY REGION, 2019–2023 (THOUSAND UNITS)

- TABLE 48 SELECTIVE CATALYTIC REDUCTION (OE) MARKET, BY REGION, 2024–2030 (THOUSAND UNITS)

- TABLE 49 SELECTIVE CATALYTIC REDUCTION (OE) MARKET, BY REGION, 2019–2023 (USD MILLION)

- TABLE 50 SELECTIVE CATALYTIC REDUCTION (OE) MARKET, BY REGION, 2024–2030 (USD MILLION)

- TABLE 51 GASOLINE PARTICULATE FILTER (OE) MARKET, BY REGION, 2019–2023 (THOUSAND UNITS)

- TABLE 52 GASOLINE PARTICULATE FILTER (OE) MARKET, BY REGION, 2024–2030 (THOUSAND UNITS)

- TABLE 53 GASOLINE PARTICULATE FILTER (OE) MARKET, BY REGION, 2019–2023 (USD MILLION)

- TABLE 54 GASOLINE PARTICULATE FILTER (OE) MARKET, BY REGION, 2024–2030 (USD MILLION)

- TABLE 55 EXHAUST SYSTEM (OE) MARKET, BY COMPONENT, 2019–2023 (THOUSAND UNITS)

- TABLE 56 EXHAUST SYSTEM (OE) MARKET, BY COMPONENT, 2024–2030 (THOUSAND UNITS)

- TABLE 57 EXHAUST SYSTEM (OE) MARKET, BY COMPONENT, 2019–2023 (USD MILLION)

- TABLE 58 EXHAUST SYSTEM (OE) MARKET, BY COMPONENT, 2024–2030 (USD MILLION)

- TABLE 59 SENSORS (OE) MARKET, BY TYPE, 2019–2023 (THOUSAND UNITS)

- TABLE 60 SENSORS (OE) MARKET, BY TYPE, 2024–2030 (THOUSAND UNITS)

- TABLE 61 SENSORS (OE) MARKET, BY TYPE, 2019–2023 (USD MILLION)

- TABLE 62 SENSORS (OE) MARKET, BY TYPE, 2024–2030 (USD MILLION)

- TABLE 63 NOX SENSORS (OE) MARKET, BY REGION, 2019–2023 (THOUSAND UNITS)

- TABLE 64 NOX SENSORS (OE) MARKET, BY REGION, 2024–2030 (THOUSAND UNITS)

- TABLE 65 NOX SENSORS (OE) MARKET, BY REGION, 2019–2023 (USD MILLION)

- TABLE 66 NOX SENSORS (OE) MARKET, BY REGION, 2024–2030 (USD MILLION)

- TABLE 67 OXYGEN SENSORS (OE) MARKET, BY REGION, 2019–2023 (THOUSAND UNITS)

- TABLE 68 OXYGEN SENSORS (OE) MARKET, BY REGION, 2024–2030 (THOUSAND UNITS)

- TABLE 69 OXYGEN SENSORS (OE) MARKET, BY REGION, 2019–2023 (USD MILLION)

- TABLE 70 OXYGEN SENSORS (OE) MARKET, BY REGION, 2024–2030 (USD MILLION)

- TABLE 71 TEMPERATURE SENSORS (OE) MARKET, BY REGION, 2019–2023 (THOUSAND UNITS)

- TABLE 72 TEMPERATURE SENSORS (OE) MARKET, BY REGION, 2024–2030 (THOUSAND UNITS)

- TABLE 73 TEMPERATURE SENSORS (OE) MARKET, BY REGION, 2019–2023 (USD MILLION)

- TABLE 74 TEMPERATURE SENSORS (OE) MARKET, BY REGION, 2024–2030 (USD MILLION)

- TABLE 75 PM SENSORS (OE) MARKET, BY REGION, 2019–2023 (THOUSAND UNITS)

- TABLE 76 PM SENSORS (OE) MARKET, BY REGION, 2024–2030 (THOUSAND UNITS)

- TABLE 77 PM SENSORS (OE) MARKET, BY REGION, 2019–2023 (USD MILLION)

- TABLE 78 PM SENSORS (OE) MARKET, BY REGION, 2024–2030 (USD MILLION)

- TABLE 79 CATALYTIC CONVERTERS (OE) MARKET, BY REGION, 2019–2023 (THOUSAND UNITS)

- TABLE 80 CATALYTIC CONVERTERS (OE) MARKET, BY REGION, 2024–2030 (THOUSAND UNITS)

- TABLE 81 CATALYTIC CONVERTERS (OE) MARKET, BY REGION, 2019–2023 (USD MILLION)

- TABLE 82 CATALYTIC CONVERTERS (OE) MARKET, BY REGION, 2024–2030 (USD MILLION)

- TABLE 83 DOWNPIPES (OE) MARKET, BY REGION, 2019–2023 (THOUSAND UNITS)

- TABLE 84 DOWNPIPES (OE) MARKET, BY REGION, 2024–2030 (THOUSAND UNITS)

- TABLE 85 DOWNPIPES (OE) MARKET, BY REGION, 2019–2023 (USD MILLION)

- TABLE 86 DOWNPIPES (OE) MARKET, BY REGION, 2024–2030 (USD MILLION)

- TABLE 87 MANIFOLDS (OE) MARKET, BY REGION, 2019–2023 (THOUSAND UNITS)

- TABLE 88 MANIFOLDS (OE) MARKET, BY REGION, 2024–2030 (THOUSAND UNITS)

- TABLE 89 MANIFOLDS (OE) MARKET, BY REGION, 2019–2023 (USD MILLION)

- TABLE 90 MANIFOLDS (OE) MARKET, BY REGION, 2024–2030 (USD MILLION)

- TABLE 91 MUFFLERS (OE) MARKET, BY REGION, 2019–2023 (THOUSAND UNITS)

- TABLE 92 MUFFLERS (OE) MARKET, BY REGION, 2024–2030 (THOUSAND UNITS)

- TABLE 93 MUFFLERS (OE) MARKET, BY REGION, 2019–2023 (USD MILLION)

- TABLE 94 MUFFLERS (OE) MARKET, BY REGION, 2024–2030 (USD MILLION)

- TABLE 95 TAILPIPES (OE) MARKET, BY REGION, 2019–2023 (THOUSAND UNITS)

- TABLE 96 TAILPIPES (OE) MARKET, BY REGION, 2024–2030 (THOUSAND UNITS)

- TABLE 97 TAILPIPES (OE) MARKET, BY REGION, 2019–2023 (USD MILLION)

- TABLE 98 TAILPIPES (OE) MARKET, BY REGION, 2024–2030 (USD MILLION)

- TABLE 99 HANGERS (OE) MARKET, BY REGION, 2019–2023 (THOUSAND UNITS)

- TABLE 100 HANGERS (OE) MARKET, BY REGION, 2024–2030 (THOUSAND UNITS)

- TABLE 101 HANGERS (OE) MARKET, BY REGION, 2019–2023 (USD MILLION)

- TABLE 102 HANGERS (OE) MARKET, BY REGION, 2024–2030 (USD MILLION)

- TABLE 103 EXHAUST SYSTEM (OE) MARKET, BY VEHICLE TYPE, 2019–2023 (THOUSAND UNITS)

- TABLE 104 EXHAUST SYSTEM (OE) MARKET, BY VEHICLE TYPE, 2024–2030 (THOUSAND UNITS)

- TABLE 105 EXHAUST SYSTEM (OE) MARKET, BY VEHICLE TYPE, 2019–2023 (USD MILLION)

- TABLE 106 EXHAUST SYSTEM (OE) MARKET, BY VEHICLE TYPE, 2024–2030 (USD MILLION)

- TABLE 107 PASSENGER CARS: EXHAUST SYSTEM (OE) MARKET, BY REGION, 2019–2023 (THOUSAND UNITS)

- TABLE 108 PASSENGER CARS: EXHAUST SYSTEM (OE) MARKET, BY REGION, 2024–2030 (THOUSAND UNITS)

- TABLE 109 PASSENGER CARS: EXHAUST SYSTEM (OE) MARKET, BY REGION, 2019–2023 (USD MILLION)

- TABLE 110 PASSENGER CARS: EXHAUST SYSTEM (OE) MARKET, BY REGION, 2024–2030 (USD MILLION)

- TABLE 111 LIGHT COMMERCIAL VEHICLES: EXHAUST SYSTEM (OE) MARKET, BY REGION, 2019–2023 (THOUSAND UNITS)

- TABLE 112 LIGHT COMMERCIAL VEHICLES: EXHAUST SYSTEM (OE) MARKET, BY REGION, 2024–2030 (THOUSAND UNITS)

- TABLE 113 LIGHT COMMERCIAL VEHICLES: EXHAUST SYSTEM (OE) MARKET, BY REGION, 2019–2023 (USD MILLION)

- TABLE 114 LIGHT COMMERCIAL VEHICLES: EXHAUST SYSTEM (OE) MARKET, BY REGION, 2024–2030 (USD MILLION)

- TABLE 115 TRUCKS: EXHAUST SYSTEM (OE) MARKET, BY REGION, 2019–2023 (THOUSAND UNITS)

- TABLE 116 TRUCKS: EXHAUST SYSTEM (OE) MARKET, BY REGION, 2024–2030 (THOUSAND UNITS)

- TABLE 117 TRUCKS: EXHAUST SYSTEM (OE) MARKET, BY REGION, 2019–2023 (USD MILLION)

- TABLE 118 TRUCKS: EXHAUST SYSTEM (OE) MARKET, BY REGION, 2024–2030 (USD MILLION)

- TABLE 119 BUSES: EXHAUST SYSTEM (OE) MARKET, BY REGION, 2019–2023 (THOUSAND UNITS)

- TABLE 120 BUSES: EXHAUST SYSTEM (OE) MARKET, BY REGION, 2024–2030 (THOUSAND UNITS)

- TABLE 121 BUSES: EXHAUST SYSTEM (OE) MARKET, BY REGION, 2019–2023 (USD MILLION)

- TABLE 122 BUSES: EXHAUST SYSTEM (OE) MARKET, BY REGION, 2024–2030 (USD MILLION)

- TABLE 123 EXHAUST SYSTEM MARKET, BY FUEL TYPE, 2019–2023 (THOUSAND UNITS)

- TABLE 124 MARKET, BY FUEL, 2024–2030 (THOUSAND UNITS)

- TABLE 125 MARKET, BY FUEL TYPE, 2019–2023 (USD MILLION)

- TABLE 126 MARKET, BY FUEL TYPE, 2024–2030 (USD MILLION)

- TABLE 127 GASOLINE: MARKET, BY REGION, 2019–2023 (THOUSAND UNITS)

- TABLE 128 GASOLINE: MARKET, BY REGION, 2024–2030 (THOUSAND UNITS)

- TABLE 129 GASOLINE: MARKET, BY REGION, 2019–2023 (USD MILLION)

- TABLE 130 GASOLINE: MARKET, BY REGION, 2024–2030 (USD MILLION)

- TABLE 131 DIESEL: MARKET, BY REGION, 2019–2023 (THOUSAND UNITS)

- TABLE 132 DIESEL: MARKET, BY REGION, 2024–2030 (UNITS)

- TABLE 133 DIESEL: MARKET, BY REGION, 2019–2023 (USD MILLION)

- TABLE 134 DIESEL: MARKET, BY REGION, 2024–2030 (USD MILLION)

- TABLE 135 EXHAUST SYSTEM AFTERMARKET, BY AFTER-TREATMENT DEVICE, 2019–2023 (THOUSAND UNITS)

- TABLE 136 EXHAUST SYSTEM (OE) AFTERMARKET, BY AFTER-TREATMENT DEVICE, 2024–2030 (THOUSAND UNITS)

- TABLE 137 EXHAUST SYSTEM (OE) AFTERMARKET, BY AFTER-TREATMENT DEVICE, 2019–2023 (USD MILLION)

- TABLE 138 EXHAUST SYSTEM (OE) AFTERMARKET, BY AFTER-TREATMENT DEVICE, 2024–2030 (USD MILLION)

- TABLE 139 DIESEL OXIDATION CATALYST AFTERMARKET, BY REGION, 2019–2023 (THOUSAND UNITS)

- TABLE 140 DIESEL OXIDATION CATALYST AFTERMARKET, BY REGION, 2024–2030 (THOUSAND UNITS)

- TABLE 141 DIESEL OXIDATION CATALYST AFTERMARKET, BY REGION, 2019–2023 (USD MILLION)

- TABLE 142 DIESEL OXIDATION CATALYST AFTERMARKET, BY REGION, 2024–2030 (USD MILLION)

- TABLE 143 DIESEL PARTICULATE FILTER AFTERMARKET, BY REGION, 2019–2023 (THOUSAND UNITS)

- TABLE 144 DIESEL PARTICULATE FILTER AFTERMARKET, BY REGION, 2024–2030 (THOUSAND UNITS)

- TABLE 145 DIESEL PARTICULATE FILTER AFTERMARKET, BY REGION, 2019–2023 (USD MILLION)

- TABLE 146 DIESEL PARTICULATE FILTER AFTERMARKET, BY REGION, 2024–2030 (USD MILLION)

- TABLE 147 SELECTIVE CATALYTIC REDUCTION AFTERMARKET, BY REGION, 2019–2023 (THOUSAND UNITS)

- TABLE 148 SELECTIVE CATALYTIC REDUCTION AFTERMARKET, BY REGION, 2024–2030 (THOUSAND UNITS)

- TABLE 149 SELECTIVE CATALYTIC REDUCTION AFTERMARKET, BY REGION, 2019–2023 (USD MILLION)

- TABLE 150 SELECTIVE CATALYTIC REDUCTION AFTERMARKET, BY REGION, 2024–2030 (USD MILLION)

- TABLE 151 EXHAUST SYSTEM MARKET, BY SALES CHANNEL, 2019–2023 (THOUSAND UNITS)

- TABLE 152 MARKET, BY SALES CHANNEL, 2024–2030 (THOUSAND UNITS)

- TABLE 153 MARKET, BY SALES CHANNEL, 2019–2023 (USD MILLION)

- TABLE 154 MARKET, BY SALES CHANNEL, 2024–2030 (USD MILLION)

- TABLE 155 EXHAUST SYSTEM AFTERMARKET, BY REGION, 2019–2023 (THOUSAND UNITS)

- TABLE 156 EXHAUST SYSTEM AFTERMARKET, BY REGION, 2024–2030 (THOUSAND UNITS)

- TABLE 157 EXHAUST SYSTEM AFTERMARKET, BY REGION, 2019–2023 (USD MILLION)

- TABLE 158 EXHAUST SYSTEM AFTERMARKET, BY REGION, 2024–2030 (USD MILLION)

- TABLE 159 EXHAUST SYSTEM OEM MARKET, BY REGION, 2019–2023 (THOUSAND UNITS)

- TABLE 160 EXHAUST SYSTEM OEM MARKET, BY REGION, 2024–2030 (THOUSAND UNITS)

- TABLE 161 EXHAUST SYSTEM OEM MARKET, BY REGION, 2019–2023 (USD MILLION)

- TABLE 162 EXHAUST SYSTEM OEM MARKET, BY REGION, 2024–2030 (USD MILLION)

- TABLE 163 OFF-HIGHWAY VEHICLES EXHAUST SYSTEM (OE) MARKET, BY EQUIPMENT TYPE, 2019–2023 (THOUSAND UNITS)

- TABLE 164 OFF-HIGHWAY VEHICLES EXHAUST SYSTEM (OE) MARKET, BY EQUIPMENT TYPE, 2024–2030 (THOUSAND UNITS)

- TABLE 165 OFF-HIGHWAY VEHICLES EXHAUST SYSTEM (OE) MARKET, BY EQUIPMENT TYPE, 2019–2023 (USD MILLION)

- TABLE 166 OFF-HIGHWAY VEHICLES EXHAUST SYSTEM (OE) MARKET, BY EQUIPMENT TYPE, 2024–2030 (USD MILLION)

- TABLE 167 MARKET FOR AGRICULTURAL TRACTORS, BY REGION, 2019–2023 (THOUSAND UNITS)

- TABLE 168 MARKET FOR AGRICULTURAL TRACTORS, BY REGION, 2024–2030 (THOUSAND UNITS)

- TABLE 169 MARKET FOR AGRICULTURAL TRACTORS, BY REGION, 2019–2023 (USD MILLION)

- TABLE 170 MARKET FOR AGRICULTURAL TRACTORS, BY REGION, 2024–2030 (USD MILLION)

- TABLE 171 MARKET FOR CONSTRUCTION EQUIPMENT, BY REGION, 2019–2023 (THOUSAND UNITS)

- TABLE 172 MARKET FOR CONSTRUCTION EQUIPMENT, BY REGION, 2024–2030 (THOUSAND UNITS)

- TABLE 173 MARKET FOR CONSTRUCTION EQUIPMENT, BY REGION, 2019–2023 (USD MILLION)

- TABLE 174 MARKET FOR CONSTRUCTION EQUIPMENT, BY REGION, 2024–2030 (USD MILLION)

- TABLE 175 MARKET FOR MINING EQUIPMENT, BY REGION, 2019–2023 (THOUSAND UNITS)

- TABLE 176 MARKET FOR MINING EQUIPMENT, BY REGION, 2024–2030 (THOUSAND UNITS)

- TABLE 177 MARKET FOR MINING EQUIPMENT, BY REGION, 2019–2023 (USD MILLION)

- TABLE 178 MARKET FOR MINING EQUIPMENT, BY REGION, 2024–2030 (USD MILLION)

- TABLE 179 OFF-HIGHWAY VEHICLES EXHAUST SYSTEM (OE) MARKET, BY AFTER-TREATMENT DEVICE, 2019–2023 (THOUSAND UNITS)

- TABLE 180 OFF-HIGHWAY VEHICLES EXHAUST SYSTEM (OE) MARKET, BY AFTER-TREATMENT DEVICE, 2024–2030 (THOUSAND UNITS)

- TABLE 181 OFF-HIGHWAY VEHICLES EXHAUST SYSTEM (OE) MARKET, BY AFTER-TREATMENT DEVICE, 2019–2023 (USD MILLION)

- TABLE 182 OFF-HIGHWAY VEHICLES EXHAUST SYSTEM (OE) MARKET, BY AFTER-TREATMENT DEVICE, 2024–2030 (USD MILLION)

- TABLE 183 DPF MARKET FOR OFF-HIGHWAY VEHICLES (OE), BY REGION, 2019–2023 (THOUSAND UNITS)

- TABLE 184 DPF MARKET FOR OFF-HIGHWAY VEHICLES (OE), BY REGION, 2024–2030 (THOUSAND UNITS)

- TABLE 185 DPF MARKET FOR OFF-HIGHWAY VEHICLES (OE), BY REGION, 2019–2023 (USD MILLION)

- TABLE 186 DPF MARKET FOR OFF-HIGHWAY VEHICLES (OE), BY REGION, 2024–2030 (USD MILLION)

- TABLE 187 DOC MARKET FOR OFF-HIGHWAY VEHICLES (OE), BY REGION, 2019–2023 (THOUSAND UNITS)

- TABLE 188 DOC MARKET FOR OFF-HIGHWAY VEHICLES (OE), BY REGION, 2024–2030 (THOUSAND UNITS)

- TABLE 189 DOC MARKET FOR OFF-HIGHWAY VEHICLES (OE), BY REGION, 2019–2023 (USD MILLION)

- TABLE 190 DOC MARKET FOR OFF-HIGHWAY VEHICLES (OE), BY REGION, 2024–2030 (USD MILLION)

- TABLE 191 SCR MARKET FOR OFF-HIGHWAY VEHICLES (OE), BY REGION, 2019–2023 (THOUSAND UNITS)

- TABLE 192 SCR MARKET FOR OFF-HIGHWAY VEHICLES (OE), BY REGION, 2024–2030 (THOUSAND UNITS)

- TABLE 193 SCR MARKET FOR OFF-HIGHWAY VEHICLES (OE), BY REGION, 2019–2023 (USD MILLION)

- TABLE 194 SCR MARKET FOR OFF-HIGHWAY VEHICLES (OE), BY REGION, 2024–2030 (USD MILLION)

- TABLE 195 MARKET, BY REGION, 2019–2023 (THOUSAND UNITS)

- TABLE 196 MARKET, BY REGION, 2024–2030 (THOUSAND UNITS)

- TABLE 197 MARKET, BY REGION, 2019–2023 (USD MILLION)

- TABLE 198 MARKET, BY REGION, 2024–2030 (USD MILLION)

- TABLE 199 ASIA PACIFIC: MARKET, BY COUNTRY, 2019–2023 (THOUSAND UNITS)

- TABLE 200 ASIA PACIFIC: MARKET, BY COUNTRY, 2024–2030 (THOUSAND UNITS)

- TABLE 201 ASIA PACIFIC: MARKET, BY COUNTRY, 2019–2023 (USD MILLION)

- TABLE 202 ASIA PACIFIC: MARKET, BY COUNTRY, 2024–2030 (USD MILLION)

- TABLE 203 CHINA: MARKET, BY AFTER-TREATMENT DEVICE, 2019–2023 (THOUSAND UNITS)

- TABLE 204 CHINA: MARKET, BY AFTER-TREATMENT DEVICE, 2024–2030 (THOUSAND UNITS)

- TABLE 205 CHINA: MARKET, BY AFTER-TREATMENT DEVICE, 2019–2023 (USD MILLION)

- TABLE 206 CHINA: MARKET, BY AFTER-TREATMENT DEVICE, 2024–2030 (USD MILLION)

- TABLE 207 INDIA: MARKET, BY AFTER-TREATMENT DEVICE, 2019–2023 (THOUSAND UNITS)

- TABLE 208 INDIA: MARKET, BY AFTER-TREATMENT DEVICE, 2024–2030 (THOUSAND UNITS)

- TABLE 209 INDIA: MARKET, BY AFTER-TREATMENT DEVICE, 2019–2023 (USD MILLION)

- TABLE 210 INDIA: MARKET, BY AFTER-TREATMENT DEVICE, 2024–2030 (USD MILLION)

- TABLE 211 JAPAN: MARKET, BY AFTER-TREATMENT DEVICE, 2019–2023 (THOUSAND UNITS)

- TABLE 212 JAPAN: MARKET, BY AFTER-TREATMENT DEVICE, 2024–2030 (THOUSAND UNITS)

- TABLE 213 JAPAN: MARKET, BY AFTER-TREATMENT DEVICE, 2019–2023 (USD MILLION)

- TABLE 214 JAPAN: MARKET, BY AFTER-TREATMENT DEVICE, 2024–2030 (USD MILLION)

- TABLE 215 SOUTH KOREA: MARKET, BY AFTER-TREATMENT DEVICE, 2019–2023 (THOUSAND UNITS)

- TABLE 216 SOUTH KOREA: MARKET, BY AFTER-TREATMENT DEVICE, 2024–2030 (THOUSAND UNITS)

- TABLE 217 SOUTH KOREA: MARKET, BY AFTER-TREATMENT DEVICE, 2019–2023 (USD MILLION)

- TABLE 218 SOUTH KOREA: MARKET, BY AFTER-TREATMENT DEVICE, 2024–2030 (USD MILLION)

- TABLE 219 THAILAND: MARKET, BY AFTER-TREATMENT DEVICE, 2019–2023 (THOUSAND UNITS)

- TABLE 220 THAILAND: MARKET, BY AFTER-TREATMENT DEVICE, 2024–2030 (THOUSAND UNITS)

- TABLE 221 THAILAND: MARKET, BY AFTER-TREATMENT DEVICE, 2019–2023 (USD MILLION)

- TABLE 222 THAILAND: MARKET, BY AFTER-TREATMENT DEVICE, 2024–2030 (USD MILLION)

- TABLE 223 REST OF ASIA PACIFIC: MARKET, BY AFTER-TREATMENT DEVICE, 2019–2023 (THOUSAND UNITS)

- TABLE 224 REST OF ASIA PACIFIC: MARKET, BY AFTER-TREATMENT DEVICE, 2024–2030 (THOUSAND UNITS)

- TABLE 225 REST OF ASIA PACIFIC: MARKET, BY AFTER-TREATMENT DEVICE, 2019–2023 (USD MILLION)

- TABLE 226 REST OF ASIA PACIFIC: MARKET, BY AFTER-TREATMENT DEVICE, 2024–2030 (USD MILLION)

- TABLE 227 EUROPE: MARKET, BY COUNTRY, 2019–2023 (THOUSAND UNITS)

- TABLE 228 EUROPE: EXHAUST SYSTEM (OE) MARKET, BY COUNTRY, 2024–2030 (THOUSAND UNITS)

- TABLE 229 EUROPE: EXHAUST SYSTEM (OE) MARKET, BY COUNTRY, 2019–2023 (USD MILLION)

- TABLE 230 EUROPE: EXHAUST SYSTEM (OE) MARKET, BY COUNTRY, 2024–2030 (USD MILLION)

- TABLE 231 GERMANY: EXHAUST SYSTEM (OE) MARKET, BY AFTER-TREATMENT DEVICE, 2019–2023 (THOUSAND UNITS)

- TABLE 232 GERMANY: EXHAUST SYSTEM (OE) MARKET, BY AFTER-TREATMENT DEVICE, 2024–2030 (THOUSAND UNITS)

- TABLE 233 GERMANY: EXHAUST SYSTEM (OE) MARKET, BY AFTER-TREATMENT DEVICE, 2019–2023 (USD MILLION)

- TABLE 234 GERMANY: EXHAUST SYSTEM (OE) MARKET, BY AFTER-TREATMENT DEVICE, 2024–2030 (USD MILLION)

- TABLE 235 FRANCE: EXHAUST SYSTEM (OE) MARKET, BY AFTER-TREATMENT DEVICE, 2019–2023 (THOUSAND UNITS)

- TABLE 236 FRANCE: EXHAUST SYSTEM (OE) MARKET, BY AFTER-TREATMENT DEVICE, 2024–2030 (THOUSAND UNITS)

- TABLE 237 FRANCE: EXHAUST SYSTEM (OE) MARKET, BY AFTER-TREATMENT DEVICE, 2019–2023 (USD MILLION)

- TABLE 238 FRANCE: EXHAUST SYSTEM (OE) MARKET, BY AFTER-TREATMENT DEVICE, 2024–2030 (USD MILLION)

- TABLE 239 UK: EXHAUST SYSTEM (OE) MARKET, BY AFTER-TREATMENT DEVICE, 2019–2023 (THOUSAND UNITS)

- TABLE 240 UK: EXHAUST SYSTEM (OE) MARKET, BY AFTER-TREATMENT DEVICE, 2024–2030 (THOUSAND UNITS)

- TABLE 241 UK: EXHAUST SYSTEM (OE) MARKET, BY AFTER-TREATMENT DEVICE, 2019–2023 (USD MILLION)

- TABLE 242 UK: EXHAUST SYSTEM (OE) MARKET, BY AFTER-TREATMENT DEVICE, 2024–2030 (USD MILLION)

- TABLE 243 SPAIN: EXHAUST SYSTEM (OE) MARKET, BY AFTER-TREATMENT DEVICE, 2019–2023 (THOUSAND UNITS)

- TABLE 244 SPAIN: EXHAUST SYSTEM (OE) MARKET, BY AFTER-TREATMENT DEVICE, 2024–2030 (THOUSAND UNITS)

- TABLE 245 SPAIN: EXHAUST SYSTEM (OE) MARKET, BY AFTER-TREATMENT DEVICE, 2019–2023 (USD MILLION)

- TABLE 246 SPAIN: EXHAUST SYSTEM (OE) MARKET, BY AFTER-TREATMENT DEVICE, 2024–2030 (USD MILLION)

- TABLE 247 TURKEY: EXHAUST SYSTEM (OE) MARKET, BY AFTER-TREATMENT DEVICE, 2019–2023 (THOUSAND UNITS)

- TABLE 248 TURKEY: EXHAUST SYSTEM (OE) MARKET, BY AFTER-TREATMENT DEVICE, 2024–2030 (THOUSAND UNITS)

- TABLE 249 TURKEY: EXHAUST SYSTEM (OE) MARKET, BY AFTER-TREATMENT DEVICE, 2019–2023 (USD MILLION)

- TABLE 250 TURKEY: EXHAUST SYSTEM (OE) MARKET, BY AFTER-TREATMENT DEVICE, 2024–2030 (USD MILLION)

- TABLE 251 RUSSIA: EXHAUST SYSTEM (OE) MARKET, BY AFTER-TREATMENT DEVICE, 2019–2023 (THOUSAND UNITS)

- TABLE 252 RUSSIA: EXHAUST SYSTEM (OE) MARKET, BY AFTER-TREATMENT DEVICE, 2024–2030 (THOUSAND UNITS)

- TABLE 253 RUSSIA: EXHAUST SYSTEM (OE) MARKET, BY AFTER-TREATMENT DEVICE, 2019–2023 (USD MILLION)

- TABLE 254 RUSSIA: EXHAUST SYSTEM (OE) MARKET, BY AFTER-TREATMENT DEVICE, 2024–2030 (USD MILLION)

- TABLE 255 REST OF EUROPE: EXHAUST SYSTEM (OE) MARKET, BY AFTER-TREATMENT DEVICE, 2019–2023 (THOUSAND UNITS)

- TABLE 256 REST OF EUROPE: EXHAUST SYSTEM (OE) MARKET, BY AFTER-TREATMENT DEVICE, 2024–2030 (THOUSAND UNITS)

- TABLE 257 REST OF EUROPE: EXHAUST SYSTEM (OE) MARKET, BY AFTER-TREATMENT DEVICE, 2019–2023 (USD MILLION)

- TABLE 258 REST OF EUROPE: EXHAUST SYSTEM (OE) MARKET, BY AFTER-TREATMENT DEVICE, 2024–2030 (USD MILLION)

- TABLE 259 NORTH AMERICA: MARKET, BY COUNTRY, 2019–2023 (THOUSAND UNITS)

- TABLE 260 NORTH AMERICA: MARKET, BY COUNTRY, 2024–2030 (THOUSAND UNITS)

- TABLE 261 NORTH AMERICA: MARKET, BY COUNTRY, 2019–2023 (USD MILLION)

- TABLE 262 NORTH AMERICA: MARKET, BY COUNTRY, 2024–2030 (USD MILLION)

- TABLE 263 US: MARKET, BY AFTER-TREATMENT DEVICE, 2019–2023 (THOUSAND UNITS)

- TABLE 264 US: MARKET, BY AFTER-TREATMENT DEVICE, 2024–2030 (THOUSAND UNITS)

- TABLE 265 US: MARKET, BY AFTER-TREATMENT DEVICE, 2019–2023 (USD MILLION)

- TABLE 266 US: MARKET, BY AFTER-TREATMENT DEVICE, 2024–2030 (USD MILLION)

- TABLE 267 MEXICO: MARKET, BY AFTER-TREATMENT DEVICE, 2019–2023 (THOUSAND UNITS)

- TABLE 268 MEXICO: MARKET, BY AFTER-TREATMENT DEVICE, 2024–2030 (THOUSAND UNITS)

- TABLE 269 MEXICO: MARKET, BY AFTER-TREATMENT DEVICE, 2019–2023 (USD MILLION)

- TABLE 270 MEXICO: MARKET, BY AFTER-TREATMENT DEVICE, 2024–2030 (USD MILLION)

- TABLE 271 CANADA: MARKET, BY AFTER-TREATMENT DEVICE, 2019–2023 (THOUSAND UNITS)

- TABLE 272 CANADA: MARKET, BY AFTER-TREATMENT DEVICE, 2024–2030 (THOUSAND UNITS)

- TABLE 273 CANADA: MARKET, BY AFTER-TREATMENT DEVICE, 2019–2023 (USD MILLION)

- TABLE 274 CANADA: MARKET, BY AFTER-TREATMENT DEVICE, 2024–2030 (USD MILLION)

- TABLE 275 REST OF THE WORLD: MARKET, BY COUNTRY, 2019–2023 (THOUSAND UNITS)

- TABLE 276 REST OF THE WORLD: MARKET, BY COUNTRY, 2024–2030 (THOUSAND UNITS)

- TABLE 277 REST OF THE WORLD: MARKET, BY COUNTRY, 2019–2023 (USD MILLION)

- TABLE 278 REST OF THE WORLD: MARKET, BY COUNTRY, 2024–2030 (USD MILLION)

- TABLE 279 BRAZIL: MARKET, BY AFTER-TREATMENT DEVICE, 2019–2023 (THOUSAND UNITS)

- TABLE 280 BRAZIL: MARKET, BY AFTER-TREATMENT DEVICE, 2024–2030 (THOUSAND UNITS)

- TABLE 281 BRAZIL: MARKET, BY AFTER-TREATMENT DEVICE, 2019–2023 (USD MILLION)

- TABLE 282 BRAZIL: MARKET, BY AFTER-TREATMENT DEVICE, 2024–2030 (USD MILLION)

- TABLE 283 IRAN: MARKET, BY AFTER-TREATMENT DEVICE, 2019–2023 (THOUSAND UNITS)

- TABLE 284 IRAN: MARKET, BY AFTER-TREATMENT DEVICE, 2024–2030 (THOUSAND UNITS)

- TABLE 285 IRAN: MARKET, BY AFTER-TREATMENT DEVICE, 2019–2023 (USD MILLION)

- TABLE 286 IRAN: MARKET, BY AFTER-TREATMENT DEVICE, 2024–2030 (USD MILLION)

- TABLE 287 OTHERS: MARKET, BY AFTER-TREATMENT DEVICE, 2019–2023 (THOUSAND UNITS)

- TABLE 288 OTHERS: MARKET, BY AFTER-TREATMENT DEVICE, 2024–2030 (THOUSAND UNITS)

- TABLE 289 OTHERS: MARKET, BY AFTER-TREATMENT DEVICE, 2019–2023 (USD MILLION)

- TABLE 290 OTHERS: MARKET, BY AFTER-TREATMENT DEVICE, 2024–2030 (USD MILLION)

- TABLE 291 KEY GROWTH STRATEGIES, 2022–2024

- TABLE 292 MARKET: APPLICATION FOOTPRINT

- TABLE 293 MARKET: REGION FOOTPRINT

- TABLE 294 MARKET: PROPULSION FOOTPRINT

- TABLE 295 EXHAUST SYSTEM COMPONENT MANUFACTURERS: AFTER-TREATMENT DEVICE FOOTPRINT

- TABLE 296 EXHAUST SYSTEM COMPONENT MANUFACTURERS: APPLICATION FOOTPRINT

- TABLE 297 EXHAUST SYSTEM COMPONENT MANUFACTURERS: REGION FOOTPRINT

- TABLE 298 MARKET: PRODUCT LAUNCHES, JANUARY 2019–JANUARY 2024

- TABLE 299 MARKET: DEALS, JANUARY 2019–JANUARY 2024

- TABLE 300 MARKET: EXPANSIONS, JANUARY 2019–JANUARY 2024

- TABLE 301 FORVIA FAURECIA: COMPANY OVERVIEW

- TABLE 302 FORVIA FAURECIA: PRODUCTS OFFERED

- TABLE 303 FORVIA FAURECIA: DEALS

- TABLE 304 FORVIA FAURECIA: EXPANSIONS

- TABLE 305 TENNECO INC.: COMPANY OVERVIEW

- TABLE 306 TENNECO INC.: PRODUCTS OFFERED

- TABLE 307 TENNECO INC.: PRODUCT LAUNCHES/DEVELOPMENTS

- TABLE 308 TENNECO INC.: DEALS

- TABLE 309 CONTINENTAL AG: COMPANY OVERVIEW

- TABLE 310 CONTINENTAL AG: PRODUCTS OFFERED

- TABLE 311 CONTINENTAL AG: PRODUCT LAUNCHES/DEVELOPMENTS

- TABLE 312 CONTINENTAL AG: EXPANSIONS

- TABLE 313 EBERSPÄCHER: COMPANY OVERVIEW

- TABLE 314 EBERSPÄCHER: PRODUCTS OFFERED

- TABLE 315 EBERSPÄCHER: NEW PRODUCT DEVELOPMENTS

- TABLE 316 EBERSPÄCHER: DEALS

- TABLE 317 EBERSPÄCHER: EXPANSIONS

- TABLE 318 FUTABA INDUSTRIAL CO., LTD.: COMPANY OVERVIEW

- TABLE 319 FUTABA INDUSTRIAL CO., LTD.: PRODUCTS OFFERED

- TABLE 320 FUTABA INDUSTRIAL CO., LTD.: EXPANSIONS

- TABLE 321 FUTABA INDUSTRIAL CO., LTD.: OTHER DEVELOPMENTS

- TABLE 322 SANGO CO., LTD.: COMPANY OVERVIEW

- TABLE 323 SANGO CO., LTD.: PRODUCTS OFFERED

- TABLE 324 SANGO CO., LTD.: DEALS

- TABLE 325 FRIEDRICH BOYSEN GMBH & CO. KG: COMPANY OVERVIEW

- TABLE 326 FRIEDRICH BOYSEN GMBH & CO. KG: PRODUCTS OFFERED

- TABLE 327 YUTAKA GIKEN COMPANY LIMITED: COMPANY OVERVIEW

- TABLE 328 YUTAKA GIKEN COMPANY LIMITED: PRODUCTS OFFERED

- TABLE 329 YUTAKA GIKEN COMPANY LIMITED: DEALS

- TABLE 330 YUTAKA GIKEN COMPANY LIMITED: OTHER DEVELOPMENTS

- TABLE 331 SEJONG INDUSTRIAL CO., LTD.: COMPANY OVERVIEW

- TABLE 332 SEJONG INDUSTRIAL CO., LTD.: PRODUCTS OFFERED

- TABLE 333 SEJONG INDUSTRIAL CO., LTD.: OTHER DEVELOPMENTS

- TABLE 334 BOSAL: COMPANY OVERVIEW

- TABLE 335 BOSAL: PRODUCTS OFFERED

- TABLE 336 BOSAL: EXPANSIONS

- TABLE 337 MARELLI HOLDINGS CO., LTD.: COMPANY OVERVIEW

- TABLE 338 HIROTEC CORPORATION: COMPANY OVERVIEW

- TABLE 339 BENTELER INTERNATIONAL AG: COMPANY OVERVIEW

- TABLE 340 KATCON GLOBAL: COMPANY OVERVIEW

- TABLE 341 VIBRACOUSTIC SE: COMPANY OVERVIEW

- TABLE 342 ASMET: COMPANY OVERVIEW

- TABLE 343 DINEX A/S: COMPANY OVERVIEW

- TABLE 344 MAGNAFLOW: COMPANY OVERVIEW

- TABLE 345 GRAND ROCK CO., INC.: COMPANY OVERVIEW

- TABLE 346 EMINOX: COMPANY OVERVIEW

- TABLE 347 EUROPEAN EXHAUST AND CATALYST LTD.: COMPANY OVERVIEW

- TABLE 348 CREFACT CORPORATION: COMPANY OVERVIEW

- TABLE 349 SHARDA MOTOR INDUSTRIES LTD.: COMPANY OVERVIEW

- TABLE 350 EISENMANN EXHAUST SYSTEMS: COMPANY OVERVIEW

- TABLE 351 DENSO: COMPANY OVERVIEW

- TABLE 352 HARBIN AIRUI EMISSIONS CONTROL TECHNOLOGY CO., LTD.: COMPANY OVERVIEW

- TABLE 353 CHONGQING HEIGHT AUTOMOBILE EXHAUST SYSTEM CO., LTD.: COMPANY OVERVIEW

- TABLE 354 BOSCH: COMPANY OVERVIEW

- TABLE 355 JOHNSON MATTHEY: COMPANY OVERVIEW

- FIGURE 1 RESEARCH DESIGN

- FIGURE 2 RESEARCH METHODOLOGY MODEL

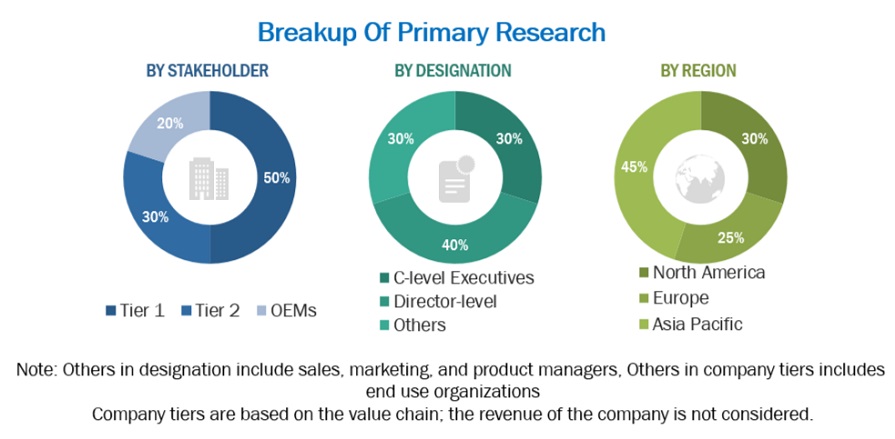

- FIGURE 3 BREAKDOWN OF PRIMARY INTERVIEWS: BY COMPANY TYPE, DESIGNATION, AND REGION

- FIGURE 4 RESEARCH METHODOLOGY: HYPOTHESIS BUILDING

- FIGURE 5 EXHAUST SYSTEM MARKET SIZE: BOTTOM-UP APPROACH (AFTER-TREATMENT DEVICE AND REGION)

- FIGURE 6 MARKET SIZE: BOTTOM-UP APPROACH (AFTERMARKET, BY VEHICLE TYPE)

- FIGURE 7 MARKET SIZE: TOP-DOWN APPROACH (COMPONENT)

- FIGURE 8 DATA TRIANGULATION METHODOLOGY

- FIGURE 9 MARKET, BY AFTER-TREATMENT DEVICE, 2024 VS. 2030

- FIGURE 10 RISING DEMAND FROM END USE APPLICATIONS AND GROWING PENETRATION OF GDI ENGINES TO DRIVE MARKET

- FIGURE 11 SCR SEGMENT TO LEAD MARKET FROM 2024 TO 2030

- FIGURE 12 SENSORS SEGMENT TO SECURE LEADING MARKET POSITION DURING FORECAST PERIOD

- FIGURE 13 PASSENGER CARS SEGMENT TO LEAD MARKET DURING FORECAST PERIOD

- FIGURE 14 GASOLINE SEGMENT TO WITNESS HIGHER CAGR THAN DIESEL SEGMENT DURING FORECAST PERIOD

- FIGURE 15 SCR SEGMENT TO REGISTER HIGHEST CAGR DURING FORECAST PERIOD

- FIGURE 16 AGRICULTURAL TRACTORS SEGMENT TO DOMINATE MARKET IN 2024

- FIGURE 17 SCR SEGMENT TO GROW AT HIGHEST RATE DURING FORECAST PERIOD

- FIGURE 18 AFTERMARKET SEGMENT TO DOMINATE MARKET DURING FORECAST PERIOD

- FIGURE 19 ASIA PACIFIC TO ACCOUNT FOR LARGEST MARKET SHARE IN 2024

- FIGURE 20 MARKET: DRIVERS, RESTRAINTS, OPPORTUNITIES, AND CHALLENGES

- FIGURE 21 GLOBAL ELECTRIC VEHICLE SALES, 2018–2030

- FIGURE 22 GLOBAL CNG AND LPG VEHICLE SALES, 2018–2030

- FIGURE 23 GASOLINE-POWERED PASSENGER CAR TRENDS IN EUROPE, 2023–2030 (VOLUME SHARE)

- FIGURE 24 EUROPE: CHANGE IN EMISSION LIMITS

- FIGURE 25 INDIA: CHANGE IN EMISSION LIMITS

- FIGURE 26 CHINA: CHANGE IN EMISSION LIMIT

- FIGURE 27 REVENUE SHIFT IMPACTING CONSUMER BUSINESS

- FIGURE 28 MARKET: SUPPLY CHAIN ANALYSIS

- FIGURE 29 MARKET: ECOSYSTEM ANALYSIS

- FIGURE 30 PATENT PUBLICATION TRENDS, 2014–2024

- FIGURE 31 LEGAL STATUS OF PATENTS FILED FOR EXHAUST SYSTEMS, 2014–2023

- FIGURE 32 EXHAUST SYSTEM PATENTS, BY OEM (2020–2024)

- FIGURE 33 ON-ROAD VEHICLE EMISSION REGULATION OUTLOOK, 2014–2025

- FIGURE 34 OFF-ROAD VEHICLE EMISSION REGULATION OUTLOOK, 2019–2025

- FIGURE 35 KEY BUYING CRITERIA FOR AFTER-TREATMENT DEVICES

- FIGURE 36 INVESTMENT SCENARIO

- FIGURE 37 EXHAUST SYSTEM (OE) MARKET, BY AFTER-TREATMENT DEVICE, 2024 VS. 2030 (USD MILLION)

- FIGURE 38 EXHAUST SYSTEM (OE) MARKET, BY COMPONENT, 2024 VS. 2030 (USD MILLION)

- FIGURE 39 EXHAUST SYSTEM (OE) MARKET, BY VEHICLE TYPE, 2024–2030 (USD MILLION)

- FIGURE 40 MARKET, BY FUEL TYPE, 2024 VS. 2030 (USD MILLION)

- FIGURE 41 EXHAUST SYSTEM AFTERMARKET, BY AFTER-TREATMENT DEVICE, 2024 VS. 2030 (USD MILLION)

- FIGURE 42 MARKET, BY SALES CHANNEL, 2024 VS. 2030 (USD MILLION)

- FIGURE 43 OFF-HIGHWAY VEHICLES EXHAUST SYSTEM (OE) MARKET, BY EQUIPMENT TYPE, 2024 VS. 2030 (USD MILLION)

- FIGURE 44 OFF-HIGHWAY VEHICLES EXHAUST SYSTEM (OE) MARKET, BY AFTER-TREATMENT DEVICE, 2024–2030 (USD MILLION)

- FIGURE 45 INDUSTRY INSIGHTS

- FIGURE 46 MARKET, BY REGION, 2024 VS. 2030 (USD MILLION)

- FIGURE 47 ASIA PACIFIC: MARKET SNAPSHOT

- FIGURE 48 EUROPE: MARKET SNAPSHOT

- FIGURE 49 NORTH AMERICA: MARKET SNAPSHOT

- FIGURE 50 REST OF THE WORLD: MARKET, BY COUNTRY, 2024 VS. 2030 (USD MILLION)

- FIGURE 51 MARKET SHARE ANALYSIS OF KEY PLAYERS, 2023

- FIGURE 52 REVENUE ANALYSIS OF TOP LISTED/PUBLIC PLAYERS, 2019–2022

- FIGURE 53 MARKET: COMPANY FOOTPRINT

- FIGURE 54 MARKET: COMPANY EVALUATION MATRIX FOR EXHAUST SYSTEM AND AFTER-TREATMENT DEVICE MANUFACTURERS, 2023

- FIGURE 55 EXHAUST SYSTEM COMPONENT MANUFACTURERS: COMPANY FOOTPRINT

- FIGURE 56 MARKET: COMPANY EVALUATION MATRIX FOR EXHAUST SYSTEM COMPONENT MANUFACTURERS, 2023

- FIGURE 57 COMPANY VALUATION

- FIGURE 58 FINANCIAL METRICS

- FIGURE 59 FORVIA FAURECIA: COMPANY SNAPSHOT

- FIGURE 60 TENNECO INC.: COMPANY SNAPSHOT

- FIGURE 61 CONTINENTAL AG: COMPANY SNAPSHOT

- FIGURE 62 EBERSPÄCHER: COMPANY SNAPSHOT

- FIGURE 63 FUTABA INDUSTRIAL CO., LTD.: COMPANY SNAPSHOT

- FIGURE 64 SANGO CO., LTD.: COMPANY SNAPSHOT

- FIGURE 65 FRIEDRICH BOYSEN GMBH & CO. KG: COMPANY SNAPSHOT

- FIGURE 66 YUTAKA GIKEN COMPANY LIMITED: COMPANY SNAPSHOT

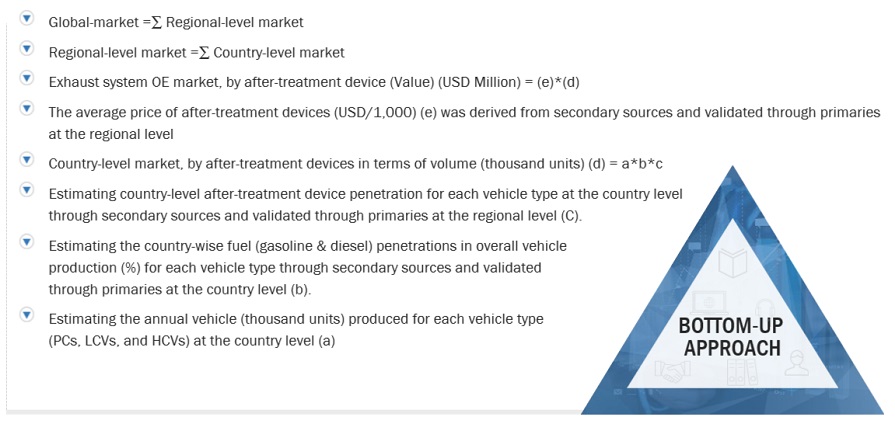

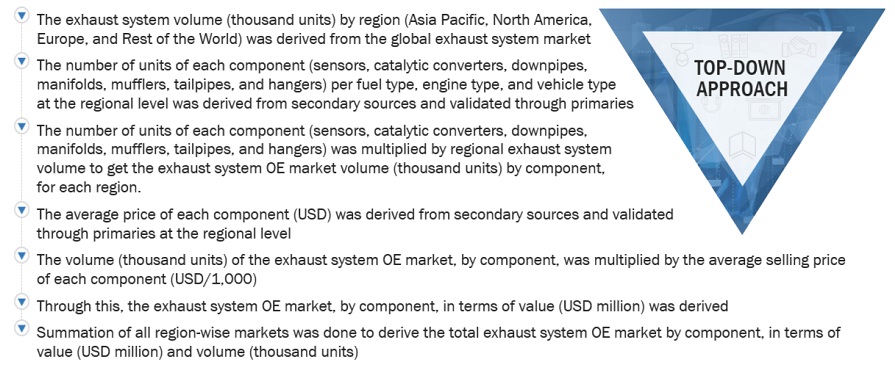

The study encompassed four primary tasks to determine the present scope of the exhaust system market. Initially, extensive secondary research was conducted to gather data on the market, its related sectors, and overarching industries. Subsequently, these findings, along with assumptions, were corroborated and validated through primary research involving industry experts across the value chain. Employing both bottom-up and top-down methodologies, the complete market size was estimated. Following this, a market breakdown and data triangulation approach were utilized to determine the size of specific segments and subsegments within the market.

Secondary Research

The secondary sources referred to for the study of the exhaust system market are directly dependent on end-use industry growth. Exhaust system sales and end-use industry demand are derived through secondary sources such as the International Council on Clean Transportation (ICCT), Organisation Internationale des Constructeurs d'Automobiles (OICA); the National Mobility Equipment Dealers Association (NMEDA), the Organization for Economic Co-operation and Development (OECD), World Bank, corporate filings such as annual reports, investor presentations, and financial statements, and paid repository. Historical production data has been collected and analyzed, and the industry trend is considered to arrive at the forecast, which is further validated by primary research.

Primary Research

In the primary research process, various primary sources from both the supply and demand sides were interviewed to obtain qualitative and quantitative information on the market. The primary sources from the supply side included various industry experts, such as CXOs, vice presidents, directors from business development, marketing, product development/innovation teams, and related key executives from various key companies. Various system integrators, industry associations, independent consultants/industry veterans, and key opinion leaders were also interviewed.

Primary interviews have been conducted to gather insights such as exhaust system market sizing estimation and forecast, future technology trends, and upcoming technologies in the exhaust systems. Data triangulation of all these points was done using the information gathered from secondary research and model mapping. Stakeholders from the demand and supply sides have been interviewed to understand their views on the aforementioned points.

Primary interviews have been conducted with market experts from the demand-side (end-use industries) and supply-side (exhaust system providers) across four regions, namely North America, Europe, Asia Pacific, and the Rest of the World. Approximately 60% and 40% of the primary interviews were conducted on the OEMs and component manufacturer sides, respectively. Primary data has been collected through questionnaires, emails, and telephonic interviews. After communicating with primaries, we have strived to cover various departments within organizations, such as sales and operations, to provide a holistic viewpoint in our report. After interacting with industry experts, we have also conducted brief sessions with highly experienced independent consultants to reinforce the findings from our primaries. This, along with the in-house subject matter experts’ opinions, has led us to the findings described in the remainder of this report.

To know about the assumptions considered for the study, download the pdf brochure

Market Size Estimation

A detailed market estimation approach was followed to estimate and validate the value of the exhaust system market and other dependent submarkets, as mentioned below.

- Key players in the exhaust system market were identified through secondary research, and their global market ranking was determined through primary and secondary research.

- The research methodology included a study of annual and quarterly financial reports and regulatory filings of major market players (public), as well as interviews with industry experts for detailed market insights.

- All vehicle level penetration rates, percentage shares, splits, and breakdowns for the market were determined using secondary sources and verified through primary sources.

- All key macro indicators affecting the revenue growth of the market segments and subsegments were accounted for, viewed in extensive detail, verified through primary research, and analyzed to obtain validated and verified quantitative and qualitative data.

- The gathered market data was consolidated, enhanced with detailed inputs, analyzed, and presented in this report.

Global Exhaust System Market Size: Bottom-Up Approach, By After-treatment device and Country

Global Exhaust System Market Size: Bottom-Up Approach, By Component Type

Data Triangulation

All percentage shares, splits, and breakdowns have been determined using secondary sources and verified by primary sources. All parameters that affect the markets covered in this research study have been accounted for, viewed in extensive detail, and analysed to obtain the final quantitative and qualitative data. This data has been consolidated and enhanced with detailed inputs and analysis from MarketsandMarkets and presented in the report.

Market Definition

Exhaust Systems: The key components of an exhaust system are the exhaust manifold, downpipe, and tailpipe. Exhaust gases released from engine cylinders are accumulated and cooled down by the exhaust manifold and passed on to the catalytic converter through the downpipe. The catalytic converter acts as an exhaust gas purifier and removes the harmful constituents from the gases. These gases travel through the muffler, which minimizes the noise level and finally emits the cleansed exhaust gases from the tailpipe.

After-treatment Devices: These devices remove harmful constituents such as carbon monoxide (CO), carbon dioxide (CO2), nitrogen oxide (NOX), and particulate matter (PM) from the exhaust gas. After-treatment devices considered under this study for diesel engines include a diesel particulate filter, a diesel oxidation catalyst, a lean NOx trap, and a selective catalytic converter, and for gasoline engines, a gasoline particulate filter (GPF).

Key Stakeholders

- Senior Management

- End User Finance/Procurement Department

- R&D Department

Report Objectives

-

To define, describe, and forecast the size of the exhaust system market in terms of value (USD million) and volume (units) between 2024 and 2030 based on the following segments:

- OE market, by after-treatment device (DOC, DPF, SCR, LNT, and GPF)

- OE market, by component (manifolds, downpipes, catalytic converters, mufflers, tailpipes, sensors, and Hangers)

- OE market, by vehicle type (passenger cars, LCVs, buses, and trucks)

- Aftermarket, by after-treatment device (DOC, DPF, GPF, and SCR)

- OE market, by off-highway vehicle (agricultural tractors, construction equipment and mining equipment)

- Off-highway vehicle, by after-treatment device (DPF, DOC, SCR)

- OE market, by fuel type (diesel and gasoline)

- By sales channel (OEM and aftermarket)

- By region (Asia Pacific, North America, Europe, and the Rest of the World)

- To identify and analyze key drivers, restraints, opportunities, and challenges influencing the market

- To analyze the market share of leading players in the exhaust system market and evaluate competitive leadership mapping.

- To strategically analyze key player strategies and company revenue analysis

-

To study the following with respect to the market

- Trends and Disruptions Impacting Customers’ Businesses

- Market Ecosystem

- Technology Analysis

- Supply Chain Analysis

- Patent Analysis

- Regulatory Landscape

- Case Study Analysis

- Key Stakeholders and Buying Criteria

- Key Conferences and Events

- Trade Analysis

- Investment and Funding Scenario

- Pricing Analysis

- To analyze recent developments, including product launches, partnerships, acquisitions, expansions, and other developments undertaken by key industry participants in the market

- To give a brief understanding of the exhaust system market in the recommendations chapter

Available Customizations

MarketsandMarkets offers the following customizations for this market report:

Exhaust System Market, By Aftertreatment Devices & Vehicle Type

- DOC

- DPF

- SCR

- GPF

Note: The after-treatment devices OE market can be offered for IC vehicle types - Passenger Cars, LCVs, Trucks, and Buses.

Exhaust System Components Oe Market, By Vehicle Type

- Passenger Cars

- LCVs

- Trucks

- Buses

Note: The component (exhaust manifolds, downpipes, catalytic converters, mufflers, tailpipes, and sensors) OE market can be offered for IC vehicle types - Passenger Cars, LCVs, Trucks, and Buses at the regional level- North America, Europe, Asia Pacific, and Rest of the World.

Hybrid Vehicle Exhaust System Oe Market, By After-Treatment Device

- LNT

- GPF

Note: The hybrid vehicle (HEV & PHEV) exhaust system OE market can be offered by after-treatment devices - LNT and GPF. The off-highway vehicle (construction equipment and agricultural tractors) market can be offered by after-treatment devices - DOC, DPF, and SCR at the regional level - North America, Europe, Asia Pacific, and the Rest of the World.

Two & Three-Wheeler Vehicle Exhaust System Oe Market, By Region

- Asia Pacific

- Europe

- North America

- Rest of the World

Note: The exhaust system OE market can be offered at the regional level - North America, Europe, Asia Pacific, and the Rest of the World.

Generating Response ...

Generating Response ...

Growth opportunities and latent adjacency in Exhaust System Market

Exhaust Systems report does cover the market size and growth forecast for Exhaust Systems in total for the Off-high way Applications, as provided below, at a regional level. 1) OE Market, by off-highway vehicle (agricultural tractor, mining equipment, and construction equipment) 2) By Application (on-highway vehicles and off-highway vehicles). Exhaust system market report covers the following segments, interms of Units and revenues at a regional level and country level, 1) OE Market, by after-treatment device (DOC, DPF, SCR, LNT, and GPF) 2) OE Market, by component (manifold, downpipe, catalytic converter, muffler, tailpipe, sensors, and hangers) 3) OE Market, by vehicle type (passenger cars, LCVs, buses, and trucks) 4) OE Market, by off-highway vehicle (agricultural tractor, mining equipment, and construction equipment) 5) By Application (on-highway vehicles and off-highway vehicles) 6) Aftermarket, By vehicle type (LDV and HDV) 7) By Sensor Type (temperature sensors, oxygen sensors, NOx sensors, and PM sensors) 8) By Sales Channel (OEM and aftermarket)

Which factors are majorly influencing the global growth of the Exhaust System Market?

I need detailed information on the exhaust system in India market. who supplies what – region wise and component-wise? who manufactures what?

I am planning to develop and market a low cost and low maintenance retro fit device for diesel vehicle tail pipe exhaust

I want to make retro fit for diesel engine vehicles, with low cost, low maintenance and least back pressure on the engine.