Aircraft Exhaust System Market by End User (OEM, MRO), System (Engine Exhaust System, APU Exhaust System), Component (Exhaust Cone, Exhaust Pipe, Exhaust Nozzle, APU Exhaust Liner), Aviation Type, and Region (2017-2023)

[120 Pages] The aircraft exhaust system market was valued at USD 661.3 million in 2017 and projected to reach USD 987.4 million by 2023, at a CAGR of 7.78 % during the forecast period.

The objective of this study is to analyze the aircraft exhaust system market. It also aims to define, describe, and forecast the aircraft exhaust system market segmented on the basis of aviation type, system, component, end user, and region. 2017 has been considered the base year for this study, and 2018–2023 the forecast period.

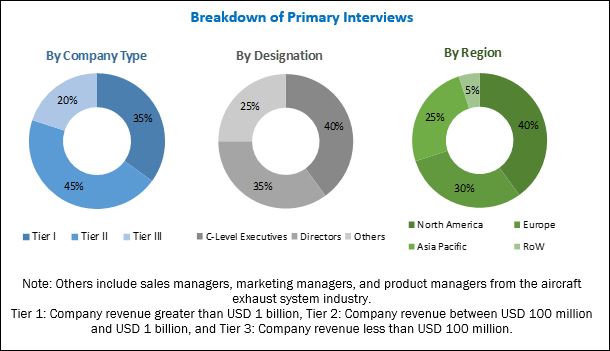

The research methodology that has been used to estimate and forecast the aircraft exhaust system market begins with capturing data on the revenues of the key aircraft exhaust system players through secondary sources, such as International Air Transport Association (IATA), Department of Defense (DoD), and paid databases. Aircraft exhaust system offerings are also taken into consideration to determine the market segmentation. The bottom-up procedure has been employed to arrive at the overall size of the aircraft exhaust system market from the revenues of key players in the market. After arriving at the overall market size, the total market has been split into several segments and subsegments, which have then been verified through primary research by conducting extensive interviews with key experts, such as Chief Executive Officers (CEOs), Vice Presidents (VPs), directors, and executives of the leading companies operating in the aircraft exhaust system market. Data triangulation and market breakdown procedures have been employed to complete the overall market engineering process and arrive at the exact statistics for all the segments and subsegments. The breakdown of profiles of primaries has been depicted in the figure below:

To know about the assumptions considered for the study, download the pdf brochure

Companies such as are Magellan Aerospace (Canada), Triumph Group (US), Ducommun (US), Nexcelle (US), Esterline Technologies (US), Nordam (US), Franke Industries (US), Senior Aerospace (UK) and GKN (UK), among others, are the major players in the aircraft exhaust systems market.

Target Audience for this Report:

- Manufacturers of Aircraft Exhaust Systems

- Providers or Suppliers of Aircraft Exhaust System Parts

- Manufacturers of Subcomponents

- Retailers, Distributors, and Wholesalers of Aircraft Exhaust System Components

- Technology Support Providers

- Manufacturers of Defense Components

- Manufacturers of Aerospace Components

- System Integrators

- Governmental Bodies

“This study on the aircraft exhaust systems market answers several questions for stakeholders, primarily which market segments they need to focus upon during the next 2 to 5 years to prioritize their efforts and investments.”

Scope of the Report

This research report categorizes the Aircraft Exhaust Systems Market into the following segments:

Aircraft Exhaust Systems Market, By End User

- OEM

- MRO

Aircraft Exhaust Systems Market, By Component

- Exhaust Cone

- Exhaust Pipe

- Exhaust Nozzle

- APU Exhaust Liner

- APU Exhaust Tube

- Turbochargers

- Others

Aircraft Exhaust Systems Market, By system

-

Engine Exhaust System

- Turbofan

- Turboprop

- Turboshaft

- Reciprocating Piston Type

- APU Exhaust System

Aircraft Exhaust Systems Market, By Aviation Type

- Commercial Aviation

- General Aviation

- Business Aviation

- Military Aviation

Aircraft Exhaust Systems Market, By Region

- North America

- Europe

- Asia Pacific

- Rest of the World

Available Customizations

Along with the market data, MarketsandMarkets offers customizations as per the specific needs of the companies. The following customization options are available for the report on the aircraft exhaust systems market:

Regional Analysis

- Further breakdown of the Rest of the World aircraft exhaust systems market

Company Information

- Detailed analysis and profiles of additional market players (up to 5)

The aircraft exhaust system market is projected to grow from an estimated USD 679.0 million in 2018 to USD 987.4 million by 2023, at a CAGR of 7.78% from 2018 to 2023. The factor that is expected to act as a major driver is the growing use of low drag, lightweight sound suppressant exhaust components. Aircraft exhaust systems are one of the significant contributors to the total aircraft nacelle weight and drag. The new low drag, lightweight exhaust components contribute in increasing the fuel efficiency of aircraft, and thus the demand for such components is increasing. The aircraft exhaust system market has been segmented based on component, system, aviation type, end user, and region.

Based on end user, the OEM segment of the aircraft exhaust systems market is projected to witness the highest growth during the forecast period. This is due to the increasing number of aircraft deliveries globally owing to the increasing global air passenger traffic. With increasing deliveries of new aircraft, the demand for aircraft exhaust systems is expected to increase.

Based on components, the exhaust nozzle segment is expected to lead the aircraft exhaust systems market during the forecast period. An exhaust nozzle is a part of any exhaust system which endures high temperature cycles and has to be repaired and replaced quite often, hence the exhaust nozzle is constantly in demand. Due to these factors, the exhaust nozzle segment is projected to lead the aircraft exhaust systems market during the forecast period.

Based on system, the engine exhaust system segment is projected to witness the highest growth during the forecast period. Engine exhaust components are one of the most complex parts of an engine exhaust system and contribute significantly to the total cost of aircraft exhaust system. Hence, due to the increasing demand for new aircraft deliveries globally, the engine exhaust system segment is projected to lead the aircraft exhaust systems market during the forecast period.

Based on aviation type, the commercial aviation segment is projected to witness the highest growth during the forecast period. In commercial aviation, which is the largest market within the overall aerospace industry, there is an increasing demand for commercial jet airliners due to the increasing air passenger traffic. Due to the increasing demand for commercial aviation jets globally, the commercial aviation segment is projected to lead the aircraft exhaust systems market during the forecast period. On the other hand, the military aviation segment is expected to witness the highest CAGR because of the increasing deliveries of fighter aircraft.

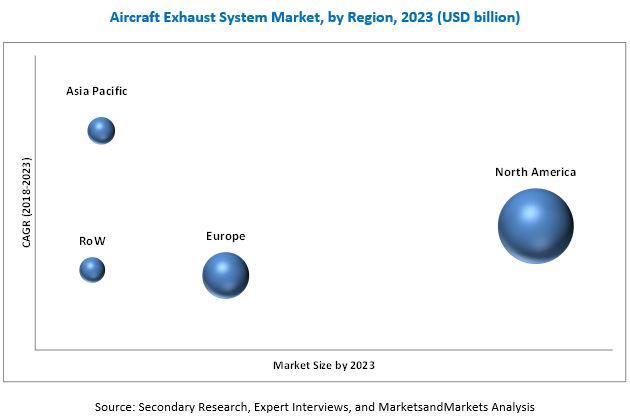

North America is expected to be a leading aircraft exhaust system market during the forecast period, due to the high demand for new aircraft and replacement of aging fleets. Asia Pacific is expected to be the fastest-growing market due to the increase in modernization programs in the Asia Pacific aviation industry, which is expected to lead to a high adoption of advanced aircraft exhaust systems. These factors are anticipated to further propel the demand for aircraft exhaust systems in the APAC region.

Significant investments required for the development of different types of aircraft exhaust systems is a major factor expected to restrain the growth of the aircraft exhaust system market across the globe.

Major players in the aircraft exhaust systems market are Magellan Aerospace (Canada), Triumph Group (US), Ducommun (US), Nexcelle (US), Esterline Technologies (US), Nordam (US), Franke Industries (US), Senior Aerospace (UK) and GKN (UK), among others. Products offered by various companies operating in the aircraft exhaust systems market have been listed in the report. The recent developments section of the report provides information on the strategies adopted by various companies to strengthen their positions in the aircraft exhaust systems market between November 2011 and October 2018.

To speak to our analyst for a discussion on the above findings, click Speak to Analyst

Table of Contents

1 Introduction (Page No. - 14)

1.1 Objectives of the Study

1.2 Definition

1.3 Study Scope

1.3.1 Markets Covered

1.3.2 Regional Scope

1.3.3 Years Considered for the Study

1.4 Currency

1.5 Limitations

1.6 Stakeholders

2 Research Methodology (Page No. - 18)

2.1 Research Data

2.1.1 Secondary Data

2.1.1.1 Secondary Sources

2.1.2 Primary Data

2.1.2.1 Key Data From Primary Sources

2.1.2.2 Breakdown of Primaries

2.2 Market Size Estimation

2.2.1 Bottom-Up Approach

2.2.2 Top-Down Approach

2.3 Market Breakdown and Data Triangulation

2.4 Research Assumptions

3 Executive Summary (Page No. - 27)

4 Premium Insights (Page No. - 30)

4.1 Attractive Opportunities in Aircraft Exhaust System Market From 2018 to 2023

4.2 Aircraft Exhaust System Market, By System

4.3 Aircraft Exhaust System Market, By End User

4.4 Aircraft Exhaust System Market, By Aviation Type

4.5 Aircraft Exhaust System Market, By Region

5 Market Overview (Page No. - 33)

5.1 Introduction

5.2 Market Dynamics

5.2.1 Drivers

5.2.1.1 Increasing Number of Aircraft Deliveries

5.2.1.2 Growing Adoption of UAVS in Military & Commercial Applications

5.2.2 Opportunities

5.2.2.1 Reduction in Composite Material Costs

5.2.2.2 Adoption of Advanced Technology for Aircraft Exhaust System

5.2.3 Challenges

5.2.3.1 Complexity in Design Leading to Maintenance Difficulties

5.2.3.2 Failure of Exhaust System Components

6 Industry Trends (Page No. - 38)

6.1 Introduction

6.2 Emerging Trends

6.2.1 Additive Manufacturing (3D Printing) for Gas Turbine & Exhaust Components

6.2.2 Low Drag & Less Sound Nacelle Systems for Future Aircraft

6.2.3 Robotics for Smart Welding in Aircraft Exhaust Systems

6.2.4 Acoustically Treated Nozzles

6.2.5 Innovations & Patent Registrations

7 Aircraft Exhaust System Market, By End User (Page No. - 41)

7.1 Introduction

7.2 OEM

7.3 MRO

8 Aircraft Exhaust System Market, By Component (Page No. - 44)

8.1 Introduction

8.2 Exhaust Cone

8.3 Exhaust Pipe

8.4 Exhaust Nozzle

8.5 APU Exhaust Liner

8.6 APU Exhaust Tube

8.7 Turbocharger

8.8 Others

9 Aircraft Exhaust System Market, By Aviation Type (Page No. - 48)

9.1 Introduction

9.2 Commercial Aviation

9.3 General Aviation

9.4 Business Aviation

9.5 Military Aviation

10 Aircraft Exhaust System Market, By System (Page No. - 51)

10.1 Introduction

10.2 Engine Exhaust System

10.2.1 Turbofan

10.2.2 Turboprop

10.2.3 Turboshaft

10.2.4 Reciprocating (Piston-Based)

10.3 APU Exhaust System

11 Regional Analysis (Page No. - 55)

11.1 Introduction

11.2 North America

11.2.1 US

11.2.2 Canada

11.3 Europe

11.3.1 France

11.3.2 Russia

11.3.3 Germany

11.3.4 Italy

11.3.5 Switzerland

11.3.6 UK

11.3.7 Austria

11.3.8 Rest of Europe

11.4 Asia Pacific

11.4.1 China

11.4.2 India

11.4.3 Japan

11.4.4 New Zealand

11.4.5 Rest of Asia Pacific

11.5 Rest of the World

11.5.1 Latin America

11.5.2 Middle East

11.5.3 Africa

12 Competitive Landscape (Page No. - 86)

12.1 Introduction

12.2 Market Ranking Analysis

12.3 Competitive Scenario

12.3.1 Agreements and Joint Ventures

13 Company Profiles (Page No. - 90)

(Business Overview, Products Offered, Recent Developments, SWOT Analysis, and MnM View)*

13.1 GKN Aerospace

13.2 Magellan Aerospace

13.3 Triumph Group

13.4 Ducommun

13.5 Nordam

13.6 Nexcelle

13.7 Orbital ATK

13.8 Esterline Technologies

13.9 Franke Industrie

13.10 Senior Aerospace

13.11 Doncasters

13.12 Hellenic Aerospace Industry

13.13 Sky Dynamics Corporation

13.14 Industria De Turbo Propulsores

13.15 Exotic Metals

14 Appendix (Page No. - 114)

14.1 Discussion Guide

14.1 Knowledge Store: Marketsandmarkets’ Subscription Portal

14.2 Available Customization

14.3 Related Reports

14.4 Author Details

List of Tables (66 Tables)

Table 1 Innovations & Patent Registrations, 1994–2016

Table 2 Aircraft Exhaust System Industry, By End User, 2016–2023 (USD Million)

Table 3 Aircraft Exhaust System Industry, By Component, 2016–2023 (USD Million)

Table 4 Aircraft Exhaust System Industry, By Aviation Type, 2016–2023 (USD Million)

Table 5 Aircraft Exhaust System Market, By System, 2016–2023 (USD Million)

Table 6 Engine Exhaust System Industry, By Engine Type, 2016–2023 (USD Million)

Table 7 Aircraft Exhaust System Industry, By Region, 2016–2023 (USD Million)

Table 8 North America Market, By Aviation Type, 2016–2023 (USD Million)

Table 9 North America Market, By System, 2016–2023 (USD Million)

Table 10 North America Market, By Component, 2016–2023 (USD Million)

Table 11 North America Market, By End User, 2016–2023 (USD Million)

Table 12 North America Market, By Country, 2016–2023 (USD Million)

Table 13 US Market, By System, 2016–2023 (USD Million)

Table 14 US Market, By End User, 2016–2023 (USD Million)

Table 15 Canada Market, By System, 2016–2023 (USD Million)

Table 16 CanadaMarket, By End User, 2016–2023 (USD Million)

Table 17 Europe Market, By Aviation Type, 2016–2023 (USD Million)

Table 18 Europe Market, By System, 2016–2023 (USD Million)

Table 19 Europe Market, By Component, 2016–2023 (USD Million)

Table 20 Europe Market, By End User, 2016–2023 (USD Million)

Table 21 Europe Market, By Country, 2016–2023 (USD Million)

Table 22 France Market, By System, 2016–2023 (USD Million)

Table 23 France Market, By End User, 2016–2023 (USD Million)

Table 24 Russia Market, By System, 2016–2023 (USD Million)

Table 25 Russia Market, By End User, 2016–2023 (USD Million)

Table 26 Germany Market, By System, 2016–2023 (USD Million)

Table 27 Germany Market, By End User, 2016–2023 (USD Million)

Table 28 Italy Market, By System, 2016–2023 (USD Million)

Table 29 Italy Market, By End User, 2016–2023 (USD Million)

Table 30 Switzerland Market, By System, 2016–2023 (USD Million)

Table 31 Switzerland Market, By End User, 2016–2023 (USD Million)

Table 32 UK Market, By System, 2016–2023 (USD Million)

Table 33 UK Market, By End User, 2016–2023 (USD Million)

Table 34 Austria Aircraft Exhaust System Industry, By System, 2016–2023 (USD Million)

Table 35 Austria Aircraft Exhaust System Industry, By End User, 2016–2023 (USD Million)

Table 36 Rest of Europe Market, By System, 2016–2023 (USD Million)

Table 37 Rest of Europe Market, By End User, 2016–2023 (USD Million)

Table 38 Asia Pacific Market, By Aviation Type, 2016–2023 (USD Million)

Table 39 Asia Pacific Market, By System, 2016–2023 (USD Million)

Table 40 Asia Pacific Market, By Component, 2016–2023 (USD Million)

Table 41 Asia Pacific Market, By End User, 2016–2023 (USD Million)

Table 42 Asia Pacific Market, By Country, 2016–2023 (USD Million)

Table 43 China Market, By System, 2016–2023 (USD Million)

Table 44 China Market, By End User, 2016–2023 (USD Million)

Table 45 India Market, By System, 2016–2023 (USD Million)

Table 46 India Market, By End User, 2016–2023 (USD Million)

Table 47 Japan Market, By System, 2016–2023 (USD Million)

Table 48 Japan Market, By End User, 2016–2023 (USD Million)

Table 49 New Zealand Market, By System, 2016–2023 (USD Million)

Table 50 New Zealand Market, By End User, 2016–2023 (USD Million)

Table 51 Rest of Asia Pacific Market, By System, 2016–2023 (USD Million)

Table 52 Rest of Asia Pacific Market, By End User, 2016–2023 (USD Million)

Table 53 Rest of the World Market, By Aviation Type, 2016–2023 (USD Million)

Table 54 Rest of the World Market, By System, 2016–2023 (USD Million)

Table 55 Rest of the World Market, By Component, 2016–2023 (USD Million)

Table 56 Rest of the World Market, By End User, 2016–2023 (USD Million)

Table 57 Rest of the World Market, By Region, 2016–2023 (USD Million)

Table 58 Latin America AES Market, By System, 2016–2023 (USD Million)

Table 59 Latin America AES Market, By End User, 2016–2023 (USD Million)

Table 60 Middle East Aircraft Exhaust System Industry, By System, 2016–2023 (USD Million)

Table 61 Middle East Aircraft Exhaust System Industry, By End User, 2016–2023 (USD Million)

Table 62 Africa Market, By System, 2016–2023 (USD Million)

Table 63 Africa Market, By End User, 2016–2023 (USD Million)

Table 64 Ranking of Players in the AES Market

Table 65 Contracts, February 2010–August 2018

Table 66 Agreements and Joint Ventures, February 2010–August 2018

List of Figures (40 Figures)

Figure 1 Research Flow

Figure 2 Research Design: AES Market

Figure 3 Breakdown of Primary Interviews: By Company Type, Designation, and Region

Figure 4 Market Size Estimation Methodology: Bottom-Up Approach

Figure 5 Market Size Estimation Methodology: Top-Down Approach

Figure 6 Data Triangulation

Figure 7 Exhaust Nozzle Segment Projected to Lead AES Market, By Component, From 2018 to 2023

Figure 8 OEM Segment Projected to Lead AES Market, By End User, From 2018 to 2023

Figure 9 North America Projected to Lead AES Market From 2018 to 2023

Figure 10 Increasing Use of 3D Printing Technology Expected to Lead to Growth of AES Market From 2018 to 2023

Figure 11 Engine Exhaust System Segment Projected to Lead AES Market From 2016 to 2023

Figure 12 OEM Segment Projected to Lead AES Market From 2016 to 2023

Figure 13 Commercial Aviation Segment to Lead AES Market From 2016 to 2023

Figure 14 North America Expected to Lead AES Market in 2018

Figure 15 AES Market Dynamics

Figure 16 Airbus and Boeing Aircraft Fleet Forecast Comparison By 2035, By Region

Figure 17 Increasing Demand for Uav for Military Applications

Figure 18 Reduction in the Cost of Composite Material

Figure 19 Aircraft Exhaust System - Evolution in the Use of Material

Figure 20 AES Market, By End User, 2018 & 2023 (USD Million)

Figure 21 Exhaust Nozzle Segment Expected to Lead AES Market From 2018 to 2023

Figure 22 Commercial Aviation Segment Projected to Lead AES Market From 2018 to 2023

Figure 23 AES Market, By System, 2018 & 2023 (USD Million)

Figure 24 Engine Exhaust System Market, By Engine Type, 2018 & 2023 (USD Million)

Figure 25 North America Estimated to Account for the Largest Share of AES Market in 2018

Figure 26 North America AES Market Snapshot

Figure 27 Europe AES Market Snapshot

Figure 28 Asia Pacific AES Market Snapshot

Figure 29 Companies Adopted Contracts as A Key Growth Strategy From February 2010 to August 2018

Figure 30 GKN Aerospace: Company Snapshot

Figure 31 GKN Aerospace: SWOT Analysis

Figure 32 Magellan Aerospace: Company Snapshot

Figure 33 Magellan Aerospace: SWOT Analysis

Figure 34 Triumph Group: Company Snapshot

Figure 35 Triumph Group: SWOT Analysis

Figure 36 Ducommun: Company Snapshot

Figure 37 Ducommun: SWOT Analysis

Figure 38 Orbital ATK: Company Snapshot

Figure 39 Esterline Technologies: Company Snapshot

Figure 40 Senior Aerospace: Company Snapshot

Growth opportunities and latent adjacency in Aircraft Exhaust System Market