Exhaust Heat Recovery System Market by Technology (EGR, Turbocharger, ORC, TEG), Component (EGR Valve & Cooler, Turbine, Compressor, Evaporator, Condenser, TEG Module), Vehicle (PC, LCV, Truck, Bus, Hybrid, OHV) and Region - Global Forecast to 2025

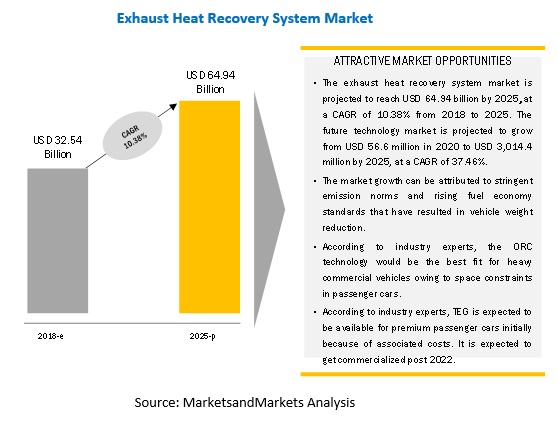

The global exhaust heat recovery system market size was valued to be USD 29.83 billion in 2017 and is expected to reach USD 64.94 billion by 2025, at a CAGR of 10.38%, during the forecast period. The market is primarily driven by the increasing stringency toward automotive emissions across the globe.

Years considered for this report:

- 2017 - Base Year

- 2018 - Estimated Year

- 2018–2025 - Forecast Period

Market Dynamics

Drivers

-

Introduction of stringent emission regulations

- Emission regulation for on-road vehicles

- Emission regulation for off-road vehicles

- Growing demand for diesel vehicles, especially in the commercial vehicle segment, to foster the growth of EHR systems

Restraints

- Shifting trend toward electric propulsion in light-duty vehicles in developed countries

Opportunities

- Use of exhaust heat for auxiliary applications like HVAC and oil cooling

- Rapid adoption of EGR and turbocharger in gasoline vehicles will boost the market for EHRS system

Challenges

- Commercialization, less cost-effectiveness, and low efficiency of future technologies such as TEG and ORC

- Harmonization of emission standards

Critical Questions:

- How would OEM see the exhaust heat recovery system technology as a product differentiator?

- How are the industry players addressing the challenge of EHRS technology?

- Does the addition of electric fleets impact EHRS sales?

- What are the top strategies adopted by key manufacturers to increase their revenues?

Objectives of the study:

- To analyze and forecast the exhaust heat recovery system market for automotive, in terms of value (USD million) and volume (’000 units), during 2017–2025

- To define, describe, and project the market for automotive based on technology (conventional technology EGR and turbocharger; and future technology ORC and TEG), component, vehicle type, off-highway vehicle, hybrid vehicle, and region

- To analyze and forecast the market for automotive across the 4 key regions, namely, Asia Pacific, Europe, North America, and the Rest of the World (RoW)

- To analyze the regional markets for growth trends, prospects, and their contribution to the total market

- To strategically profile key players in the market for automotive and comprehensively analyze their market share and core competencies

- To track and analyze competitive developments such as joint ventures, mergers & acquisitions, new product launches, expansions, and other industrial activities carried out by the key industry participants

- To define and analyze the stakeholders in the market for automotive and provide a detailed competitive landscape

- To analyze the opportunities offered by various segments of the market for automotive to the stakeholders

The country-wise share of diesel and gasoline vehicle is derived through secondary and primary research, which is applied to the total production, resulting in the country-level production of diesel vehicles. The installation rate of different EHRS technologies derived from primaries and secondary are applied to country-wise diesel vehicle production. This results in volume by technology, country, and vehicle type. The Average Selling Price (ASP) of each technology is derived from secondary and reconfirmed from primaries, and then multiplied with the country level derived volume resulting in the country-level market, in terms of value. The summation of countries’ market leads to global EHRS market for technology and vehicle type (diesel fuel type). The same methodology is used for gasoline vehicles. The integration cost of EHR technologies is observed higher in the case of gasoline vehicles; hence, the study considers the ASP of EHRS technologies higher in case of gasoline vehicles. The global market for ICE vehicles is derived from the summation of diesel and gasoline vehicles EHRS market.

Various secondary sources are used such as MarkLines, The International Council on Clean Transportation (ICCT), U.S. Environmental Protection Agency (U.S. EPA), Japan Land Engine Manufacturers Association (LEMA), and Indian Diesel Engine Manufacturers Association (IDEMA).

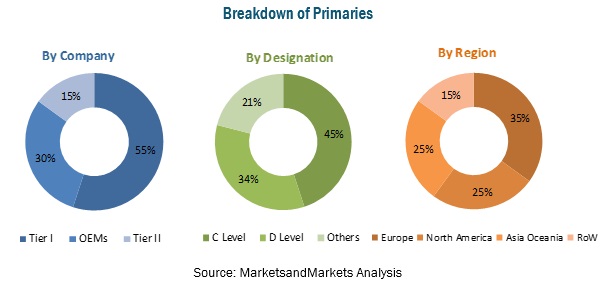

The figure below illustrates the break-up of the profile of industry experts who participated in primary discussions.

To know about the assumptions considered for the study, download the pdf brochure

The exhaust heat recovery system market for automotive is dominated by a few globally established players such as BorgWarner (US), Continental (Germany), Faurecia (France), Denso (Japan), and MAHLE (Germany). These companies developed new products, adopted expansion strategies, obtained supply contracts, established collaborations & partnerships, and used mergers & acquisitions to gain traction in the market.

Target Audience

- Component suppliers for exhaust heat recovery system

- Dealers and distributors of exhaust heat recovery system

- Exhaust heat recovery system technology suppliers

- Government regulatory authorities

- Industry associations

- Raw material manufacturers of exhaust heat recovery system components (suppliers for tier I)

- Regional manufacturer associations

Scope of the Report

By Technology:

- EGR

- Turbocharger

- ORC

- TEG

By Component:

- EGR Valve

- EGR Cooler

- Turbine

- Compressor

- Evaporator

- Condenser

- Expander

- Pump

- Thermoelectric Module

- Heat exchanger

By Vehicle Type

- Passenger cars

- LCVs

- Truck

- Bus

By Hybrid Vehicles:

- HEVs

- PHEVs

By Off-Highway Vehicles

- Construction Equipment

- Agriculture Tractors

By Region

- Asia Oceania (China, India, Japan, South Korea, Thailand, Asia Oceania Others)

- Europe (Germany, France, Spain, Turkey, UK, Russia, Europe Others)

- North America ( US, Canada, and Mexico )

- RoW (Brazil, Iran, RoW Others)

Available Customizations

Exhaust Heat Recovery System Market For Hybrid And Plug-In Hybrid Vehicle, By Technology

-

Hybrid Vehicle

- EGR

- Turbocharger

- ORC

- TEG

-

Plug-In Hybrid Vehicle

- EGR

- Turbocharger

- ORC

- TEG

Exhaust Heat Recovery System Market For Off-Highway Vehicle, By Technology

-

Agricultural Tractor

- EGR

- Turbocharger

- ORC

- TEG

-

Construction Equipment

- EGR

- Turbocharger

- ORC

- TEG

Exhaust Heat Recovery System Market For On-Highway Vehicle, By Technology

-

Passenger Car

- EGR

- Turbocharger

- ORC

- TEG

-

LCV

- EGR

- Turbocharger

- ORC

- TEG

-

Truck

- EGR

- Turbocharger

- ORC

- TEG

-

Bus

- EGR

- Turbocharger

- ORC

- TEG

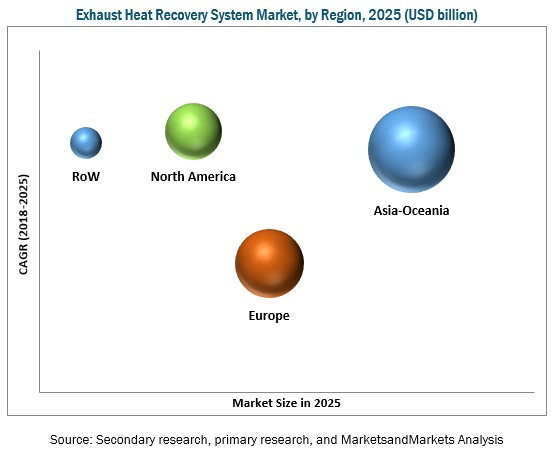

The global exhaust heat recovery system market, in terms of value, is expected to grow at a CAGR of 10.38% during the forecast period. It is estimated to be USD 32.54 billion in 2018 and is projected to reach USD 64.94 billion by 2025. The existing and upcoming stringent emission norms are driving the market. In addition to the above factors, the increasing production of commercial vehicles could be the potential market for EHRS technologies particularly for future technologies such as ORC and TEG. Even future technology like ORC is expected to get commercialized for commercial vehicles first. These factors are driving the EHRS market.

Due to stringent emission norms, the majority of diesel passenger cars are equipped with EHRS technologies such as EGR and turbocharger, and the trend for gasoline vehicles is also increasing. China and India are planning to implement emission norms named CHINA IV and BS IV respectively. The passenger car segment is estimated to be the largest and the fastest growing market for the exhaust heat recovery system market because of the higher production of passenger cars compared to commercial vehicles. With rapidly growing vehicle production and stringent emission norms, the passenger car segment is expected to be the largest market for the exhaust heat recovery system.

The exhaust heat recovery technologies considered are EGR, turbocharger, ORC, and TEG. The EGR and turbocharger are quite mature technologies as the majority of diesel vehicles are equipped with these technologies. Due to stringent emission norms, some gasoline vehicles are equipped with EHRS technologies and the trend is growing. In terms of conventional technologies, turbocharger is expected to be the fastest growing technology from 2018 to 2025 during the forecast period. Future technologies such as ORC and TEG are under development stage, and according to industry experts, these are expected to get commercialized by 2020. ORC is expected to be the fastest growing market from 2022 to 2025 during the forecast period.

EGR cooler contributes a major share of the total EGR cost, which is higher than that of other components of EHRS technologies. EGR cooler reduces the temperature of exhaust gas, which helps in reducing the NOx. Due to these reasons, EGR cooler is expected to be the largest market for the exhaust heat recovery system.

Asia Oceania is the largest market for small passenger cars, and the majority of passenger cars in this region run on gasoline. Majority of diesel vehicles are equipped with conventional technologies such as EGR and turbocharger, however, at present, gasoline-powered vehicles have a very less installation rate of exhaust heat recovery technologies. To meet the upcoming strict emission norms, OEMs are also manufacturing exhaust heat recovery systems for gasoline cars, and this trend is expected to increase rapidly throughout the forecast period.

The hybrid electric vehicle segment is expected to be the largest market for the exhaust heat recovery system during the forecast period. The global eco-friendly vehicle market is booming because of the increasing concern over global warming and air pollution and the government support to reduce air pollution. Growth in the application of EGR and turbocharger in HEVs & PHEVs will be widely seen in North America and Europe due to their willingness to adopt state-of-the-art technology and strict emissions norms. The future technology like TEG could be the promising technology for hybrid vehicles as there is more scope to recover heat from the battery as well as the engine.

Rising stringency in emission regulations for on-highway as well as off-highway vehicles, especially in North America and Western Europe, is expected to drive the exhaust heat recovery system market. The governments of leading countries have started implementing regulations to curb air pollution. The increasing stringency of emission regulations creates an opportunity for the use of conventional exhaust heat recovery technologies such as Exhaust Gas Recirculation (EGR) and turbocharger. As per industry experts, future technologies such as Organic Rankine Cycle (ORC) and Thermoelectric Generator (TEG) are expected to get commercialized by 2020. OEM and tier 1 players can tap these future technologies as they have significant scope for revenue generation. Companies such as BorgWarner, Dana, and Denso can tap these future technologies as they have a large customer base across the globe. With the addition of future technologies to their product portfolio, these companies can tap future markets.

The exhaust heat recovery system market is dominated by manufacturers such as BorgWarner (US), Mahle (Germany), Denso (Japan), Faurecia (France), and Continental (Germany).

To speak to our analyst for a discussion on the above findings, click Speak to Analyst

Table of Contents

1 Introduction (Page No. - 20)

1.1 Objectives of the Study

1.2 Market Definition

1.3 Market Scope

1.3.1 Markets Covered

1.3.2 Years Considered for the Study

1.4 Currency

1.5 Package Size

1.6 Limitations

1.7 Stakeholders

2 Research Methodology (Page No. - 24)

2.1 Research Data

2.2 Secondary Data

2.2.1 Key Secondary Sources for Base Numbers

2.2.2 Key Secondary Sources for Market Sizing

2.2.3 Key Data From Secondary Sources

2.3 Primary Data

2.3.1 Sampling Techniques & Data Collection Methods

2.3.2 Primary Participants

2.4 Market Size Estimation

2.4.1 Bottom-Up Approach

2.5 Market Breakdown and Data Triangulation

2.6 Assumptions

3 Executive Summary (Page No. - 33)

4 Premium Insights (Page No. - 36)

4.1 Attractive Opportunities in the Future Exhaust Heat Recovery System Market

4.2 Market, By Technology

4.3 Market, By Component

4.4 Market, By Vehicle Type

4.5 Market, By Hybrid Vehicle

4.6 Market, By Off-Highway Vehicle

4.7 Market, By Region

5 Market Overview (Page No. - 42)

5.1 Introduction

5.1.1 Drivers

5.1.1.1 Introduction of Stringent Emission Regulations

5.1.1.1.1 Emission Regulation for On-Road Vehicles

5.1.1.1.2 Emission Regulation for Off-Road Vehicles

5.1.1.2 Growing Demand for Diesel Vehicles, Especially in Commercial Vehicle Segment, to Foster the Growth of EHR Systems

5.1.2 Restraints

5.1.2.1 Shifting Trend Toward Electric Propulsion in Light-Duty Vehicles in Developed Countries

5.1.3 Opportunities

5.1.3.1 Use of Exhaust Heat for Auxiliary Applications Like Hvac and Oil Cooling

5.1.3.2 Rapid Adoption of EGR and Turbocharger in Gasoline Vehicle Will Boost the Market for EHRS

5.1.4 Challenges

5.1.4.1 Commercialization, Less Cost-Effectiveness and Low Efficiency of Future Technologies Like TEG & ORC

5.1.4.2 Harmonization of Emission Standards

6 Technological Overview (Page No. - 53)

6.1 Introduction

6.2 Engine Technologies vs Exhaust Heat Recovery System

6.3 Dana’s Thermal Management Solution (Eghr System)

6.4 Borgwarner’s Exhaust Heat Recovery System (EHRS)

6.4.1 EHRS for Hybrid Electric Vehicles (HEV) & Plug-In Hybrid Electric Vehicles (PHEV)

6.4.2 Flex Fuel Turbocharger

6.5 Tenneco Future Exhaust Heat Recovery System

6.5.1 Thermoelectric Generators (TEG) for Powering Electrical Accessories

6.5.2 Rankine Cycle

6.6 Sango Conventional and Future Exhaust Heat Recovery System

6.6.1 Heat Collectors

6.6.2 Thermoelectric Generation Technology

6.7 Avl Waste Heat Recovery System for Commercial Vehicles

6.8 Continental Thermoelectric Generation Technology

6.9 Faurecia Exhaust Heat Recovery System

6.9.1 Low-Pressure Exhaust Gas Recirculation (LP EGR)

6.9.2 Electrically-Heated Catalyst

6.9.3 Exhaust Heat Power Generation (EHPG) System

7 Exhaust Heat Recovery System Market, By Technology (Page No. - 58)

Note – The Chapter is Further Segmented at Regional Level and Considered Regions are Asia Oceania, Europe, North America, and RoW

7.1 Introduction

7.2 Conventional Technology

7.2.1 Exhaust Gas Recirculation (EGR)

7.2.1.1 Asia Oceania has the Largest EGR Installation Rate in Diesel Vehicles

7.2.2 Turbocharger

7.2.2.1 Expansions to Be the Key Strategy to Boost Turbocharger Market.

7.3 Future Technology

7.3.1 Organic Rankine Cycle (ORC)

7.3.1.1 ORC is Projected to Get First Commercialized for Heavy Duty Vehicles

7.3.2 Thermoelectric Generator (TEG)

7.3.2.1 TEG is Expected to Be First Commercialized in the Developed Countries

8 Exhaust Heat Recovery System Market, By Component (Page No. - 67)

Note – The Chapter is Further Segmented at Regional Level and Considered Regions are Asia Oceania, Europe, North America, and RoW

8.1 Introduction

8.2 EGR Component

8.2.1 EGR Valve

8.2.1.1 Asia Oceania is Expected to Be the Largest Market for EGR Valve.

8.2.2 EGR Cooler

8.2.2.1 With Increase in Gasoline Vehicle, North America is to Be the Largest Market for EGR Cooler

8.3 Turbocharger Component

8.3.1 Turbine

8.3.1.1 Asia Oceania is the Largest and Fastest Market for Turbocharger Turbine

8.3.2 Compressor

8.3.2.1 North America is the Fastest Growing Market for Compressor

8.4 Organic Rankine Cycle (ORC)

8.4.1 Evaporator

8.4.1.1 Asia Oceania is Expected to Be the Largest and Fastest Market for Evaporator

8.4.2 Condenser

8.4.2.1 During the Forecast Period Condenser Market is Expected to Follow the Same Trend as That of Evaporator

8.4.3 Expander

8.4.3.1 Asia Oceania is Projected to Be the Largest Market for Expander

8.4.4 Pump

8.4.4.1 Asia Oceania is Expected to Be the Largest and Fastest Market for Pump.

8.5 Thermoelectric Generator (TEG)

8.5.1 Thermoelectric Module

8.5.1.1 Asia Oceania is to Be the Fastest Growing Market for Thermoelectric Module

8.5.2 Heat Exchanger

8.5.2.1 Asia Oceania is Expected to Be the Largest Market for Heat Exchanger

9 Exhaust Heat Recovery System Market, By Vehicle Type (Page No. - 83)

Note – The Chapter is Further Segmented at Regional Level and Considered Regions are Asia Oceania, Europe, North America, and RoW

9.1 Introduction

9.2 Passenger Car

9.2.1 Owing to Largest Market for Passenger Cars, Asia Oceania is Expected to Be Fastest Growing Market

9.3 Light Commercial Vehicle (LCV)

9.3.1 Owing to Largest Share of LCV, North America is Expected to Be Fastest Growing Market

9.4 Truck

9.4.1 The Market is Estimated to Be Dominated By the Asia Oceania Region

9.5 Buses

9.5.1 EHRS Market for Buses is Expected to Be Dominated By the Asia Oceania Region

10 Exhaust Heat Recovery System Market, By Hybrid and Plug-In Hybrid Vehicle (Page No. - 91)

Note – The Chapter is Further Segmented at Regional Level and Considered Regions are Asia Oceania, Europe, North America, and RoW

10.1 Introduction

10.2 Hybrid Electric Vehicle (HEV)

10.2.1 in HEV, EHRS Will Greatly Be Seen in the North American and European Region

10.3 Plug-In Hybrid Electric Vehicle (PHEV)

10.3.1 The Sales of PHEV Vehicles are Likely to Increase By 2025

11 Exhaust Heat Recovery System Market, By Off Highway Vehicle (Page No. - 97)

Note – The Chapter is Further Segmented at Regional Level and Considered Regions are Asia Oceania, Europe, North America, and RoW

11.1 Introduction

11.2 Agricultural Tractor

11.2.1 Increase in Mechanization to Drive the Agricultural Tractors Market

11.3 Construction Equipment

11.3.1 Turbochargers and EGR are Predominantly Used in Construction Equipment

12 Exhaust Heat Recovery System Market, By Region (Page No. - 102)

Note - The Chapter is Further Segmented By Technology Type and Considered Technologies are EGR, Turbocharger, ORC, and TEG

12.1 Introduction

12.2 Asia Oceania

12.2.1 Because of Heavy Vehicle Production, China is Expected to Be the Largest Market for EHRS

12.2.2 China

12.2.2.1 China has Higher Adoption Rate of Conventional as Well as Future EHRS Technologies

12.2.3 India

12.2.3.1 Rapidly Growing Demand for Commercial Vehicle, ORC Market Will Be Boosted

12.2.4 Japan

12.2.4.1 Future Technologies Like ORC & TEG are Expected to Show Significant Growth in Japan

12.2.5 South Korea

12.2.5.1 Turbocharger is Expected to Be the Largest Market for EHRS in South Korea.

12.2.6 Thailand

12.2.6.1 in Terms of Conventional Technologies, Turbocharger is Expected to Showcase Largest Market

12.2.7 Asia Oceania Others

12.2.7.1 Future Technology Like ORC and TEG are Expected to Have Low Market Share

12.3 Europe

12.3.1.1 EHRS Technologies Like EGR and Turbocharger are Expected to Show Promising Market for Gasoline Vehicle

12.3.2 Germany

12.3.2.1 ORC is Expected to Show Fastest EHRS Market

12.3.3 France

12.3.3.1 Turbocharger Market is Expected to Be the Fastest Growing Market

12.3.4 Spain

12.3.4.1 Growing Vehicle Production and Emission Norms Will Boost the Spain Market

12.3.5 Turkey

12.3.5.1 Turkey has the Significant Share in Diesel Cars, Hence EGR is Expected Have the Largest Share

12.3.6 UK

12.3.6.1 With Significant Investments, ORC is Expected to Be the Fastest Growing Market

12.3.7 Russia

12.3.7.1 Turbocharger Market is Expected to Be the Fastest Growing Market.

12.3.8 Europe Others

12.3.8.1 Low Technological Advancement to Hinder ORC and TEG Market Growth

12.4 North America

12.4.1 US is Expected to Have the Largest North American Market for Future Technologies Like TEG and ORC

12.4.2 US

12.4.2.1 Presence of EHRS Manufacturers and OEM’s, to Uplift the Market.

12.4.3 Canada

12.4.3.1 Presence of Few Tier 1 Players and OEM’s, Hinder the Market

12.4.4 Mexico

12.4.4.1 Mexico is the Fastest Growing EHRS Market as It is Second Largest Market in North America

12.5 RoW

12.5.1 Brazil is Expected to Be the Largest Market for EHRS in RoW Region

12.5.2 Brazil

12.5.2.1 Turbocharger is Expected to Have the Largest Market Share.

12.5.3 Iran

12.5.3.1 Low Technological Adoption to Hinder TEG and ORC Market Growth

12.5.4 RoW Others

12.5.4.1 Turbocharger is Expected to Have the Largest Market Over the Forecast Period.

13 Competitive Landscape (Page No. - 137)

13.1 Overview

13.2 Exhaust Heat Recovery System Market for Automotive: Market Share Analysis

13.3 Competitive Scenario

13.3.1 Expansions

13.3.2 Supply Contracts/Agreements

13.3.3 New Product Launches/Developments

13.3.4 Partnerships/Joint Ventures/Acquisition

14 Company Profiles (Page No. - 142)

(Business Overview, Products Offered, Recent Developments & SWOT Analysis)*

14.1 Faurecia

14.2 Mahle

14.3 Continental

14.4 Denso

14.5 Borgwarner

14.6 Valeo

14.7 Dana

14.8 Calsonic Kansei

14.9 Delphi Technologies

14.10 Mitsubishi Electric

14.11 Additional Company Profiles

14.11.1 North America

14.11.1.1 Clean Diesel Technologies

14.11.1.2 Katcon

14.11.1.3 Tenneco Inc.

14.11.2 Asia Oceania

14.11.2.1 Sankei Giken Kogyo Co., Ltd.

14.11.2.2 Hanon Systems

14.11.3 Europe

14.11.3.1 Bosal

14.11.3.2 Eberspaecher

14.11.3.3 Johnson Matthey

14.11.3.4 Schaeffler

14.11.3.5 Hella

*Details on Business Overview, Products Offered, Recent Developments & SWOT Analysis Might Not Be Captured in Case of Unlisted Companies.

15 Appendix (Page No. - 169)

15.1 Insights of Industry Experts

15.2 Discussion Guide

15.3 Knowledge Store: Marketsandmarkets’ Subscription Portal

15.4 Available Customizations

15.4.1 Exhaust Heat Recovery System Market for Hybrid and Plug-In Hybrid Vehicle, By Technology

15.4.1.1 Hybrid Vehicle

15.4.1.1.1 EGR

15.4.1.1.2 Turbocharger

15.4.1.1.3 ORC

15.4.1.1.4 TEG

15.4.1.2 Plugin Hybrid Vehicle

15.4.1.2.1 EGR

15.4.1.2.2 Turbocharger

15.4.1.2.3 ORC

15.4.1.2.4 TEG

15.4.2 Exhaust Heat Recovery System Market for Off Highway Vehicle, By Technology

15.4.2.1 Agricultural Tractor

15.4.2.1.1 EGR

15.4.2.1.2 Turbocharger

15.4.2.1.3 ORC

15.4.2.1.4 TEG

15.4.2.2 Construction Equipment

15.4.2.2.1 EGR

15.4.2.2.2 Turbocharger

15.4.2.2.3 ORC

15.4.2.2.4 TEG

15.4.3 Exhaust Heat Recovery System Market for on Highway Vehicle, By Vehicle Type & Technology

15.4.3.1 Passenger Car

15.4.3.1.1 EGR

15.4.3.1.2 Turbocharger

15.4.3.1.3 ORC

15.4.3.1.4 TEG

15.4.3.2 LCV

15.4.3.2.1 EGR

15.4.3.2.2 Turbocharger

15.4.3.2.3 ORC

15.4.3.2.4 TEG

15.4.3.3 Truck

15.4.3.3.1 EGR

15.4.3.3.2 Turbocharger

15.4.3.3.3 ORC

15.4.3.3.4 TEG

15.4.3.4 Bus

15.4.3.4.1 EGR

15.4.3.4.2 Turbocharger

15.4.3.4.3 ORC

15.4.3.4.4 TEG

15.5 Related Report

15.6 Author Details

List of Tables (123 Tables)

Table 1 Currency Exchange Rates (Per USD)

Table 2 List of Assumptions Considered

Table 3 Exhaust Heat Recovery System Market: Market Dynamics Impact

Table 4 On-Road Vehicle Emission Regulation Outlook for Passenger Cars, 2016–2021

Table 5 Government Incentives for Electric Vehicles

Table 6 Average Cost of EHRS Technologies, 2018 (USD)

Table 7 Faurecia’s Supplies to Global Automotive Manufacturers: Exhaust & EHRS Systems

Table 8 Engine Technologies vs Aftertreatment Devices for on Highway Vehicles

Table 9 Engine Technologies vs Aftertreatment Devices for Off-Highway Vehicles

Table 10 Market, By Technology, 2016–2025 (Million Units)

Table 11 Market, By Technology, 2016–2025 (USD Billion)

Table 12 EGR: Market, By Region, 2016–2025 (Million Units)

Table 13 EGR: Market, By Region, 2016–2025 (USD Billion)

Table 14 Turbocharger: Market, By Region, 2016–2025 (Million Units)

Table 15 Turbocharger: Market, By Region, 2016–2025 (USD Billion)

Table 16 ORC: Market, By Region, 2016–2025 (Million Units)

Table 17 ORC: Market, By Region, 2016–2025 (USD Billion)

Table 18 TEG: Market, By Region, 2016–2025 (Million Units)

Table 19 TEG: Market, By Region, 2016–2025 (USD Billion)

Table 20 Market, By Component, 2016–2025 (Million Units)

Table 21 Market, By Component, 2016–2025 (USD Billion)

Table 22 EGR Component: Market, By Region, 2016–2025 (Million Units)

Table 23 EGR Component: Market, By Region, 2016–2025 (USD Billion)

Table 24 EGR Valve: Market, By Region, 2016–2025 (Million Units)

Table 25 EGR Valve: Market, By Region, 2016–2025 (USD Billion)

Table 26 EGR Cooler: Market, By Region, 2016–2025 (Million Units)

Table 27 EGR Cooler: Market, By Region, 2016–2025 (USD Billion)

Table 28 Turbocharger Component: Market, By Region, 2016–2025 (Million Units)

Table 29 Turbocharger Component: Market, By Region, 2016–2025 (USD Billion)

Table 30 Turbine: Market, By Region, 2016–2025 (Million Units)

Table 31 Turbine: Market, By Region, 2016–2025 (USD Billion)

Table 32 Compressor: Market, By Region, 2016–2025 (Million Units)

Table 33 Compressor: Market, By Region, 2016–2025 (USD Billion)

Table 34 ORC Component: Market, By Region, 2020–2025 (Million Units)

Table 35 ORC Component: Market, By Region, 2020–2025 (USD Billion)

Table 36 Evaporator: Market, By Region, 2020–2025 (Million Units)

Table 37 Evaporator: Market, By Region, 2020–2025 (USD Billion)

Table 38 Condenser: Market, By Region, 2020–2025 (Million Units)

Table 39 Condenser: Market, By Region, 2020–2025 (USD Billion)

Table 40 Expander: Market, By Region, 2020–2025 (Million Units)

Table 41 Expander: Market, By Region, 2020–2025 (USD Billion)

Table 42 Pump: Market, By Region, 2020–2025 (Million Units)

Table 43 Pump: Market, By Region, 2020–2025 (USD Billion)

Table 44 TEG Component: Market, By Region, 2022–2025 (Million Units)

Table 45 TEG Component: Market, By Region, 2022–2025 (USD Billion)

Table 46 Thermoelectric Module: Market, By Region, 2022–2025 (Million Units)

Table 47 Thermoelectric Module: Market, By Region, 2022–2025 (USD Billion)

Table 48 Heat Exchanger: Market, By Region, 2022–2025 (Million Units)

Table 49 Heat Exchanger: Market, By Region, 2022–2025 (USD Billion)

Table 50 Exhaust Heat Recovery System Market, By Vehicle Type, 2016–2025 (Million Units)

Table 51 Market, By Vehicle Type, 2016–2025 (USD Billion)

Table 52 Passenger Car: Market, By Region, 2016–2025 (Million Units)

Table 53 Passenger Car: Market, By Region, 2016–2025 (USD Billion)

Table 54 LCV: Market, By Region, 2016–2025 (Million Units)

Table 55 LCV: Market, By Region, 2016–2025 (USD Billion)

Table 56 Truck: Market, By Region, 2018–2025 (Million Units)

Table 57 Truck: Market, By Region, 2016–2025 (USD Billion)

Table 58 Bus: Market, By Region, 2016–2025 (Million Units)

Table 59 Bus: Market, By Region, 2016–2025 (USD Billion)

Table 60 Market, By Hybrid & Plugin Hybrid Vehicle 2016–2025 (’000 Units)

Table 61 Market, By Hybrid & Plug-In Hybrid Vehicle 2016–2025 (USD Million)

Table 62 HEV: Market, 2016–2025 (’000 Units)

Table 63 HEV: Market, 2016–2025 (USD Million)

Table 64 PHEV: Market, 2016–2025 (’000 Units)

Table 65 PHEV: Market, 2016–2025 (USD Million)

Table 66 Market, By Off-Highway Vehicle, 2016–2025 (000’ Units)

Table 67 Market, By Off-Highway Vehicle, 2016–2025 (USD Million)

Table 68 Agricultural Tractor: Market, By Region, 2016–2025 (000’ Units)

Table 69 Agricultural Tractor: Market, By Region, 2016–2025 (USD Million)

Table 70 Construction Equipment: Market, By Region, 2016–2025 (000’ Units)

Table 71 Construction Equipment: Exhaust Heat Recovery System Market, By Region, 2016–2025 (USD Million)

Table 72 Market, By Region, 2016–2025 (Million Units)

Table 73 Market, By Region, 2016–2025 (USD Billion)

Table 74 Asia Oceania: Market, By Country, 2016–2025 (Million Units)

Table 75 Asia Oceania: Market, By Country, 2016–2025 (USD Billion)

Table 76 China: Market, By Technology, 2016–2025 (Million Units)

Table 77 China: Market, By Technology, 2016–2025 (USD Billion)

Table 78 India: Market, By Technology, 2016–2025 (Million Units)

Table 79 India: Market, By Technology, 2016–2025 (USD Billion)

Table 80 Japan: Market, By Technology, 2016–2025 (Million Units)

Table 81 Japan: Market, By Technology, 2016–2025 (USD Billion)

Table 82 South Korea: Market, By Technology, 2016–2025 (Million Units)

Table 83 South Korea: Market, By Technology, 2016–2025 (USD Billion)

Table 84 Thailand: Market, By Technology, 2016–2025 (Million Units)

Table 85 Thailand: Market, By Technology, 2016–2025 (USD Billion)

Table 86 Asia Oceania Others: Market, By Technology, 2016–2025 (Million Units)

Table 87 Asia Oceania Others: Market, By Technology, 2016–2025 (USD Billion)

Table 88 Europe: Market, By Country, 2016–2025 (Million Units)

Table 89 Europe: Market, By Country, 2016–2025 (USD Billion)

Table 90 Germany: Market, By Technology, 2016–2025 (Million Units)

Table 91 Germany: Market, By Technology, 2016–2025 (USD Billion)

Table 92 France: Market, By Technology, 2016–2025 (Million Units)

Table 93 France: Market, By Technology, 2016–2025 (USD Billion)

Table 94 Spain: Market, By Technology, 2016–2025 (Million Units)

Table 95 Spain: Market, By Technology, 2016–2025 (USD Billion)

Table 96 Turkey: Market, By Technology, 2016–2025 (Million Units)

Table 97 Turkey: Market, By Technology, 2016–2025 (USD Billion)

Table 98 UK: Market, By Technology, 2016–2025 (Million Units)

Table 99 UK: Market, By Technology, 2016–2025 (USD Billion)

Table 100 Russia: Market, By Technology, 2016–2025 (Million Units)

Table 101 Russia: Market, By Technology, 2016–2025 (USD Billion)

Table 102 Europe Others: Market, By Technology, 2016–2025 (Million Units)

Table 103 Europe Others: Market, By Technology, 2016–2025 (USD Billion)

Table 104 North America: Market, By Country, 2016–2025 (Million Units)

Table 105 North America: Market, By Country, 2016–2025 (USD Billion)

Table 106 US: Exhaust Heat Recovery System Market, By Technology, 2016–2025 (Million Units)

Table 107 US: Market, By Technology, 2016–2025 (USD Billion)

Table 108 Canada: Market, By Technology, 2016–2025 (Million Units)

Table 109 Canada: Market, By Technology, 2016–2025 (USD Billion)

Table 110 Mexico: Market, By Technology, 2016–2025 (Million Units)

Table 111 Mexico: Market, By Technology, 2016–2025 (USD Billion)

Table 112 RoW: Market, By Country, 2016–2025 (Million Units)

Table 113 RoW: Market, By Country, 2016–2025 (USD Billion)

Table 114 Brazil: Market, By Technology, 2016–2025 (Million Units)

Table 115 Brazil: Market, By Technology, 2016–2025 (USD Billion)

Table 116 Iran: Market, By Technology, 2016–2025 (Million Units)

Table 117 Iran: Market, By Technology, 2016–2025 (USD Billion)

Table 118 RoW Others: Market, By Technology, 2016–2025 (Million Units)

Table 119 RoW Others: Market, By Technology, 2016–2025 (USD Billion)

Table 120 Expansions

Table 121 Supply Contracts

Table 122 New Product Launches/Developments

Table 123 Partnerships/Joint Ventures

List of Figures (48 Figures)

Figure 1 Market Segmentation: Exhaust Heat Recovery System Market for Automotive

Figure 2 Research Design – Market

Figure 3 Research Methodology Model

Figure 4 Breakdown of Primary Interviews

Figure 5 Market: Bottom-Up Approach

Figure 6 Market: Market Outlook

Figure 7 Market, By Region, 2018 vs 2025 (USD Billion)

Figure 8 Stringent Emission Norms and Increasing Trend of Vehicle Light weighting to Fuel the EHRS Market During the Forecast Period

Figure 9 Turbocharger Technology is Expected to Hold the Largest Market Share By 2025 (USD Million)

Figure 10 EGR Cooler Segment is Expected to Hold the Largest Market Share By 2025 (USD Billion)

Figure 11 Passenger Car Segment to Be the Largest Market During the Forecast Period (USD Billion)

Figure 12 BEV Segment is Estimated to Be the Largest and Fastest Growing Market By 2025 (USD Million)

Figure 13 Construction Equipment to Be the Largest Market During the Forecast Period, 2018-2025 (USD Million)

Figure 14 Asia Oceania is Projected to Hold the Largest Share of the Market, By Value, During the Forecast Period

Figure 15 Market: Market Dynamics

Figure 16 On-Road Vehicle Emission Regulation Outlook for Heavy Duty Vehicles, 2014–2025

Figure 17 Off-Road Vehicle Emission Regulation Outlook, 2014–2025

Figure 18 Diesel Penetration in Commercial Vehicles, By Country, 2017 (%)

Figure 19 Diesel Penetration in Passenger Car, By Country, 2017 (%)

Figure 20 Market, By Technology, 2018 vs 2025 (USD Billion)

Figure 21 Market, By Component, 2018 vs 2025 (USD Billion)

Figure 22 Market, By Vehicle Type, 2018 vs 2025 (USD Billion)

Figure 23 Market, By Hybrid & Plug-In Hybrid Vehicle, 2018 vs 2025 (USD Million)

Figure 24 Off-Highway Market, 2018 vs 2025 (USD Million)

Figure 25 Market, By Region, 2018 vs 2025 (USD Billion)

Figure 26 Asia Oceania: Market Snapshot

Figure 27 Asia Oceania: Market, 2018 vs 2025 (USD Billion)

Figure 28 Europe: Market Snapshot

Figure 29 Europe: Market, 2018 vs 2025 (USD Billion)

Figure 30 North America: Market, 2018 vs 2025 (USD Billion)

Figure 31 RoW: Market, 2018 vs 2025 (USD Billion)

Figure 32 Companies Adopted Expansions as the Key Growth Strategy, 2016–2017

Figure 33 Exhaust Heat Recovery System Market for Automotive: OE Market Share Analysis, 2017

Figure 34 Faurecia: Company Snapshot

Figure 35 Faurecia: SWOT Analysis

Figure 36 Mahle: Company Snapshot

Figure 37 Mahle: SWOT Analysis

Figure 38 Continental: Company Snapshot

Figure 39 Continental: SWOT Analysis

Figure 40 Denso: Company Snapshot

Figure 41 Denso: SWOT Analysis

Figure 42 Borgwarner: Company Snapshot

Figure 43 Borgwarner: SWOT Analysis

Figure 44 Valeo: Company Snapshot

Figure 45 Dana: Company Snapshot

Figure 46 Calsonic Kansei: Company Snapshot

Figure 47 Delphi Technologies: Company Snapshot

Figure 48 Mitsubishi Electric: Company Snapshot

Growth opportunities and latent adjacency in Exhaust Heat Recovery System Market